Attached files

| file | filename |

|---|---|

| EX-14.1 - EXHIBIT 14.1 CODE OF ETHICS - Po Yuen Cultural Holdings (Hong Kong) Co., Ltd. | codeofethics14_1.htm |

| EX-23.1 - EXHIBIT 23.1 CONSENT OF TAAD, LLP - Po Yuen Cultural Holdings (Hong Kong) Co., Ltd. | consentofauditor23_1.htm |

| EX-10.1 - EXHIBIT 10.1 NOTE - Po Yuen Cultural Holdings (Hong Kong) Co., Ltd. | note10_1.htm |

| EX-99.1 - EXHIBIT 99.1 SUBSCRIPTION AGREEMENT - Po Yuen Cultural Holdings (Hong Kong) Co., Ltd. | subscriptionagreement99_1.htm |

| EX-3.2 - EXHIBIT 3.2 BY-LAWS - Po Yuen Cultural Holdings (Hong Kong) Co., Ltd. | bylaws3_2.htm |

| EX-3.1 - EXHIBIT 3.1 AMENDED AND RESTATED ARTICLES OF INCORPORATION - Po Yuen Cultural Holdings (Hong Kong) Co., Ltd. | articlesofincorporation3_1.htm |

| EX-5.1 - EXHIBIT 5.1 OPINION OF RONALD LOGAN, LOGAN LAW FIRM PLC - Po Yuen Cultural Holdings (Hong Kong) Co., Ltd. | legalopinion5_1.htm |

| UNITED STATES | |

| SECURITIES AND EXCHANGE COMMISSION | |

| WASHINGTON, D.C. 20549 | |

| FORM S-1 | |

| Amendment No. 2 | |

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | |

|

WeWearables, Inc. | |

| (Exact name of registrant as specified in its charter) | |

| NEVADA | |

| (State or other jurisdiction of incorporation or organization) | |

| 7310 | |

| (Primary Standard Industrial Classification Code Number) | |

| 47-1100063 | |

| (I.R.S. Employer Identification Number) | |

| 7 Whitford, Irvine, CA 92602, (714) 791-1305 | |

| (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) | |

| Incorp Services, Inc., 2360 CORPORATE CIRCLE STE 400, HENDERSON, NV, 89074 Telephone Number 1-702-866-2500 | |

| (Name, address, including zip code, and telephone number, including area code, of agent of service) | |

| From time to time after the effective date of this Registration Statement | |

| (Approximate date of commencement of proposed sale to the public) | |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [ X ]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ] .

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ] .

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ] .

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer," "accelerated filer,” and "smaller reporting company" in Rule 12b-2 of the Exchange Act (Check One):

| Large accelerated filer | . | Accelerated filer | . | |

| Non-accelerated filer | . (Do not check if a smaller reporting company) | Smaller reporting company | X . |

CALCULATION OF REGISTRATION FEE

|

Title of Each Class Of Securities To Be Registered |

Amount To Be Registered |

Proposed Maximum Offering Price Per Share 1 |

Proposed Maximum Aggregate Offering Price 1 |

Amount of Registration Fee | ||||

|

Common stock, $0.001 par value per share |

2,500,000 shares | $0.10 | $ 250,000 | $ 32.20 |

1 Estimated solely for purposed of calculating the registration fee under Rule 457(a) and (o) of the Securities Act. This registration statement shall also cover any additional shares of common stock which become issuable by reason of any stock split, stock dividend, anti-dilution provisions or similar transaction effected without the receipt of consideration which results in an increase in the number of the outstanding shares of common stock of the registrant.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING, PURSUANT TO SECTION 8(a), MAY DETERMINE.

| -2- |

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS DATED November 19, 2014

2,500,000 SHARES

COMMON STOCK

WeWearables, INC.

WeWearables, Inc. (“WeWearables,” “Company,” “we,” or “us.”) is offering for sale a maximum of 2,500,000 shares of its common stock at a fixed price of $0.10 per share. There is no minimum number of shares that must be sold by us for the offering to close, and we will retain the proceeds from the sale of any of the offered shares that are sold. The offering is being conducted on a self-underwritten, best efforts basis, which means our president and chief executive officer Mr. Thomas Chen, will attempt to sell the shares. This prospectus will permit our president and chief executive officer to sell the shares directly to the public, with no commission or other remuneration payable to him for any shares he may sell. Mr. Chen will sell the shares and intends to offer them to friends, family members and business acquaintances. In offering the securities on our behalf, he will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934. The intended methods of communication include, without limitations, telephone and personal contact. For more information, see the section of this prospectus entitled "Plan of Distribution".

The proceeds from the sale of the shares in this offering will be payable to the Company. All subscribed funds will be held in a noninterest-bearing account pending the completion of the offering of which there is no minimum number of shares that must be sold. The offering will be completed 180 days from the effective date of this prospectus, unless extended by our board of directors for an additional 180 days. All subscription agreements and checks for payment of shares are irrevocable (except as to any states that require a statutory cooling-off period or rescission right). For more information, see the section of this prospectus entitled "Plan of Distribution".

The Company is an development stage company with no financial resources or known source of equity or debt financing, and our independent registered auditors included an explanatory paragraph in their opinion on our financial statements as of and for the period ended September 30, 2014 that states that Company losses from operations raise substantial doubt about our ability to continue as a going concern. Because this offering is self-underwritten and there is no minimum amount of shares that must be sold, the Company may lose money from this offering if the proposed proceeds of this offering are substantially less than the estimated costs of this offering. There is currently no public or established market for our shares. Consequently, our shareholders will not be able to sell their shares in any organized market place and may be limited to selling their shares privately. Accordingly, an investment in our Company is an illiquid investment.

We are not a blank check company and our business plan does not include engaging in a merger or acquisition with an unidentified company, companies, entity, or person.

Since there is no minimum amount of shares that must be sold by the company, you may receive no proceeds or very minimal proceeds from the offering and potential investors may end up holding shares in a company that:

- Has not received enough proceeds from the offering to begin operations; and

- Has no market for its shares.

| -3- |

| THIS INVESTMENT INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE ONLY IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT. SEE "RISK FACTORS" BEGINNING ON PAGE 9 |

Number of Shares |

Offering Price |

Underwriting Discounts & Commissions |

Proceeds to the Company |

| Per Share | 1 | $0.10 | $0.00 | $0.10 |

| 10% of shares are sold | 250,000 | 25,000 | $0.00 | 25,000 |

| 50% of shares are sold | 1,250,000 | 125,000 | $0.00 | 125,000 |

| 75% of shares are sold | 1,875,000 | 187,500 | $0.00 | 187,500 |

| Maximum Offering | 2,500,000 | $250,000 | $0.00 | $250,000 |

This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

INVESTING IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE OUR SECURITIES ONLY IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT. SEE "RISK FACTORS" BEGINNING AT PAGE 9.

We are selling the shares without an underwriter and may not be able to sell all or any of the shares offered herein.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES, AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

The date of this prospectus is ____________, 2014.

TABLE OF CONTENTS

| Page | ||||

| SUMMARY FINANCIAL DATA | 8 | |||

| RISK FACTORS | 9 | |||

| USE OF PROCEEDS | 21 | |||

| THE OFFERING | 21 | |||

| DETERMINATION OF OFFERING PRICE | 23 | |||

| DILUTION | 23 | |||

| DIVIDEND POLICY | 23 | |||

| MARKET FOR SECURITIES | 24 | |||

| NOTE REGARDING FORWARD-LOOKING STATEMENTS | 26 | |||

| MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION | 27 | |||

| BUSINESS | 34 | |||

| DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS | 39 | |||

| PRINCIPAL SHAREHOLDERS | 42 | |||

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 42 | |||

| DESCRIPTION OF CAPITAL STOCK | 43 | |||

| PLAN OF DISTRIBUTION | 47 | |||

| LEGAL MATTERS | 51 | |||

| EXPERTS | 51 | |||

| WHERE YOU CAN FIND MORE INFORMATION | 51 |

| -4- |

PROSPECTUS SUMMARY

About WeWearables, Inc.

WeWearables, Inc. was incorporated under the laws of the State of Nevada on May 14, 2014. As of November 19, 2014, we had one employee, our president and chief executive officer Mr. Chen. During the period May 14, 2014 (date of inception) through September 30, 2014, Mr. Chen devoted between five (5) hours per week to over thirty (30) hours per week as necessary for the business to operate. For the calendar year 2014, Mr. Chen has committed to devote at least twenty (20) hours a week to us but may increase that number as necessary to further develop the business. As of this date and through calendar year 2014, Mr. Chen will continue to provide these services at no cost to the Company. In addition to his relationship with the Company, Mr. Chen provides his services to an unrelated business upon which he is compensated by as an employee.

The Company issued 17,000,000 shares of its common stock to Mr. Chen as founder’s shares. The cost incurred by Mr. Chen for the business plan and professional services in preparing it was approximately $85,000 which is the value placed upon the shares issued to pay Mr. Chen.

We are an early stage company and have limited financial resources. We are not a blank check company and our business plan does not include engaging in a merger or acquisition with an unidentified company, companies, entity, or person. As of today, we have raised $110,000 in debt financing through our president and chief executive officer Mr. Chen. Our auditors included an explanatory paragraph in their report on our financial statements that states that “the Company’s losses from operations raise substantial doubt about its ability to continue as a going concern.” We are at an early stage in development of our business plan. We have a significant amount of work that needs to be done and funds that need to be raised in order to compete within the marketplace. We believe that we may have an advantage with our president and chief executive officer’s industry relationships and soliciting the help of these relationships in growing our business model.

The Company plans to become a public company. The reason for becoming a public company is to attract capital to fund further development and expansion. Many investors prefer to invest in public companies because they deem their investment to have more liquidity in their investment. Another reason for becoming public is to increase public awareness of the Company. The negatives for being public are the cost of compliance with regulatory requirements, audits, and investor relations can be high. We believe the additional costs associated with being public will range up to $50,000 per year. This estimate could range dramatically depending on the level of our success. The Company, the Company’s officers and directors, any Company promoters, or any of their affiliates do not intend for the Company, once it is reporting, to be used as a vehicle for a private company to become a reporting company.

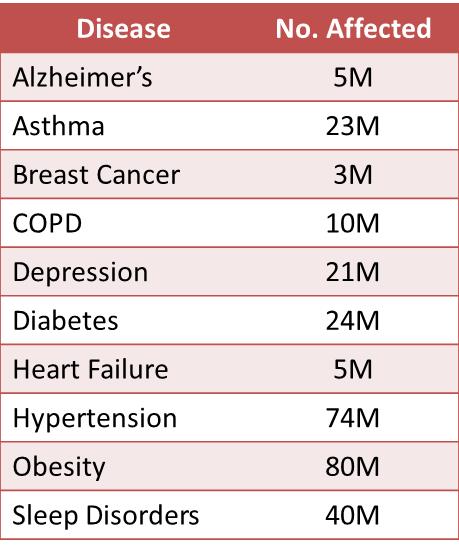

WeWearables focuses on marketing and distribution of the next generation of wearable health and wellness devices. WeWearables is targeting the next generation of devices which focus on smart, wearable products to help with specific diseases or solve direct healthcare issues.

WeWearables is focused on three business models:

WeWearables.com Market place – an online marketplace to shop, compare, review, rate and purchase the latest wearable technology. The marketplace will be modeled after zappos.com or casa.com, similar to how other e-commerce websites focus on specific products and target markets.

WeWearables Vending Machines – Vending machines can be placed in fitness centers, medical groups, doctors’ offices, airports and other locations where people with specific diseases or chronic conditions are visiting. The vending machines will be stocked with devices specific to the market they are placed in. A custom designed vending machine will be created with a large flat screen monitor to display ads and promote wearables products at each vending machine location.

WeWearables Retail Kiosks – Small retail kiosks inside malls will help promote the brand and online marketplace and also have direct retail sales. Kiosks will be designed to have interactive equipment that connects with people’s mobile phones and tablet devices. Kiosks can be owned directly by the company or franchised by territory.

| -5- |

The Offering

WeWearables is offering for sale a maximum of 2,500,000 shares of common stock at a fixed price of $0.10 per share. There is no minimum number of shares that must be sold by us for the offering to close, and we will retain the proceeds from the sale of any of the offered shares that are sold. The offering is being conducted on a self-underwritten, best efforts basis, which means our president and chief executive officer, Mr. Chen, will attempt to sell the shares himself. This prospectus will permit our president and chief executive officer to sell the shares directly to the public, with no commission or other remuneration payable to him for any shares he may sell. Mr. Chen will sell the shares himself and intends to offer them to friends, family members and business acquaintances. In offering the securities on our behalf, he will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934 (the "Exchange Act"). The intended methods of communication include, without limitation, telephone and personal contacts.

Since there is no minimum amount of shares that must be sold by the company, you may receive no proceeds or very minimal proceeds from the offering and potential investors may end up holding shares in a company that:

- Has not received enough proceeds from the offering to begin operations; and

- Has no market for its shares.

The proceeds from the sale of the shares in this offering will be payable to the Company. All subscription agreements and checks are irrevocable and should be delivered to the Company at the address provided in the Subscription Agreement (see Exhibit 99.1a).

All subscription funds will be held in a noninterest-bearing account subject to the completion of the offering. The offering will be completed 180 days from the effective date of this prospectus, unless extended by our board of directors for an additional 180 days. There is no minimum number of shares that must be sold. All subscription agreements and checks for payment of shares are irrevocable (except as to any states that require a statutory cooling-off period or rescission right).

We will deliver stock certificates attributable to shares of common stock purchased directly to the purchasers approximately 30 days after the close of the offering or as soon thereafter as practicable.

The offering price of the common stock has been determined arbitrarily and bears no relationship to any objective criterion of value. The price does not bear any relationship to our assets, book value, historical earnings, if any, or net worth.

| Shares of common stock offered by us | A maximum of 2,500,000 shares. There is no minimum number of shares that must be sold by us for the offering to close. |

| Use of proceeds | WeWearables will use the proceeds from the offering to pay for professional fees and other general expenses, as well as fund the development of the Company’s operations. The total estimated costs of the offering ($55,000) may exceed the amount of offering proceeds. |

| Termination of the offering | The offering will conclude when all 2,500,000 shares of common stock have been sold, or 180 days after this registration statement becomes effective with the Securities and Exchange Commission. We may at our discretion extend the offering for an additional 180 days. |

| -6- |

| Risk factors | The purchase of our common stock involves a high degree of risk. The common stock offered in this prospectus is for investment purposes only and currently no market for our common stock exists. Please refer to the sections entitled "Risk Factors" and "Dilution" before making an investment in this stock. |

| Trading market |

None. While we plan to find a market maker to file a Rule 211 application with the Financial Industry Regulatory Authority (“FINRA”) in order to apply for the inclusion of our common stock in OTC Markets (“OTCQB”) or the Over-the-Counter Bulletin Board (“OTCBB”), such efforts may not be successful and our shares may never be quoted and owners of our common stock may not have a market in which to sell the shares. Also, no estimate may be given as to the time that this application process will require.

Even if WeWearables's common stock is quoted or granted a listing, a market for the common shares may not develop. |

| -7- |

SUMMARY FINANCIAL DATA

The following summary financial data should be read in conjunction with the financial statements and the notes thereto included elsewhere in this prospectus.

| Balance Sheet Data: | ||||

| As of September 30, 2014 | ||||

| (Audited) | ||||

| Current assets | $ | 106,888 | ||

| Current liabilities | $ | 156,406 | ||

| Stockholders’ deficit | $ | (49,518) |

| Operating Statement Data: | For the Period May 14, 2014 (inception) to September 30, 2014 | |||

| (Audited) | ||||

| Net revenues | $ | - | ||

| Operating expenses | $ | (69,518) | ||

| Net loss | $ | (69,518) | ||

| Net loss per common share basic and diluted | $ | (0.00) | ||

| Weighted average number of shares outstanding – basic and diluted | 20,010,145 |

| -8- |

RISK FACTORS

You should be aware that there are various risks to an investment in our common stock. You should carefully consider these risk factors, together with all of the other information included in this prospectus, before you decide to invest in shares of our common stock.

If any of the following risk were to occur, then our business, financial condition, results of operations and/or prospects could be materially adversely affected. If that happens, the market price of our common stock, if any, could decline, and investors may lose all or part of their investment.

Risks Related to the Business

| 1. | WeWearables has virtually no financial resources. Our independent registered auditors’ report includes an explanatory paragraph stating that there is substantial doubt about our ability to continue as a going concern. |

WeWearables is an early stage company and has virtually no financial resources. We had a cash balance of $106,888 as of September 30, 2014. We have working capital deficit of $49,518 and a stockholders’ deficit of $49,518 at September 30, 2014. Our independent registered auditors included an explanatory paragraph in their opinion on our financial statements as of and for the period ended September 30, 2014 that states that Company losses from operations raise substantial doubt about its ability to continue as a going concern. We may seek additional financing beyond the amounts that may be received from this offering. The financing sought may be in the form of equity or debt financing from various sources as yet unidentified. Until we have completed our offering most if not all of our efforts will be spent in our registration and development of our web portal. No assurances can be given that we will generate sufficient revenue or obtain the necessary financing to continue as a going concern.

Our current resources and source of funds, which primarily consist of officer debt are sufficient to keep our business operations functioning for the next three months. We do not have a formal agreement with our president and chief executive officer to fund the Company’s working capital needs; however our president and chief executive officer’s current plan is to do the majority of the work on his own without cash compensation while he seeks other sources of funding. The Company has started the development of an initial design and framework of its proposed portal platform, as well as through the efforts of a software development firm which the Company has been working with on an as “needed basis.” We currently spend between $2,500 and $10,000 per month in operational expenses not related to this offering. We have not generated any revenues from our business, and our expenses will be accrued and deferred until sufficient financing is obtained or our president and chief executive officer or others who know our president and chief executive officer loans the necessary funds to pay for these expenses. No assurances can be given that we will be able to receive funds from our president and chief executive officer or others to continue our operations beyond a month-to-month basis.

2. WeWearables is and will continue to be completely dependent on the services of our president and chief executive officer, Thomas Chen, the loss of whose services may cause our business operations to cease, and we will need to engage and retain qualified employees and consultants to further implement our strategy.

WeWearables’s operations and business strategy are completely dependent upon the knowledge and business connections of Mr. Chen our president and chief executive officer. He is under no contractual obligation to remain employed by us. If he should choose to leave us for any reason or becomes ill and is unable to work for an extended period of time before we have hired additional personnel, our operations will likely fail. Even if we are able to find additional personnel, it is uncertain whether we could find someone who could develop our business along the lines described in this prospectus. We will likely fail without the services of Mr. Chen or an appropriate replacement(s).

We intend to acquire key-man life insurance on the life of Mr. Chen naming us as the beneficiary when and if we obtain the resources to do so and if he is insurable. We have not yet procured such insurance, and there is no guarantee that we will be able to obtain such insurance in the future. Accordingly, it is important that we are able to attract, motivate and retain highly qualified and talented personnel and independent contractors.

| -9- |

Mr. Chen’s current employment does not limit or restrict him from being involved with our Company, and his employment allows him the flexibility to provide at least 20 hours per week to our Company.

3. Because we have only recently commenced business operations, we face a high risk of business failure.

The Company was formed in May 2014. All of our efforts to date have related to developing our business plan and beginning business activities. Through September 30, 2014, we had no operating revenues. We face a high risk of business failure. The likelihood of the success of the Company must be considered in light of the expenses, complications and delays frequently encountered in connection with the establishment and expansion of new businesses and the competitive environment in which the Company will operate. There can be no assurance that future revenues from sales of the Company’s products and services will occur or be significant enough or that we will be able to sell its products and services at a profit, if at all. Future revenues and/or profits, if any, will depend on many various factors, including, but not limited to both initial and continued market acceptance of the Company’s products and services and the successful implementation of its planned growth strategy.

The Company has commenced internally developing our website for products which we acquire from third parties. We may not be able to acquire or internally develop additional products in the future because of a lack of available funds or financing to do so. In order for us to acquire, we may need to secure the necessary financing, beyond just the proceeds of this offering. In the early stages of our operations, we will continue to keep costs to a minimum. The cost to develop our business plan as currently outlined may be in excess of $250,000. We will need additional funds to market the product. If we are unable to obtain adequate funding or financing, the Company faces the ultimate likelihood of business failure. There are no assurances that we will be able to raise any funds or establish any financing program for the Company’s growth.

4. We may not have or ever have the resources or ability to implement and manage growth strategy.

Although the Company expects to experience growth based on being able to implement its business plan, actual operations may never occur because the business plan may never be implemented because of lack of funds to do so. If the Company’s business plan and growth strategy are implemented, of which no assurances can be given, a significant strain on the Company’s management, operating systems and/or financial resources will be imposed. Failure by the Company’s management to manage this growth, if it occurs, or unexpected difficulties encountered during growth, could have a material adverse impact on the Company’s results of operations or financial condition.

The Company’s ability to operate profitable product lines (if we are able to establish any product or product lines at all) will depend upon a number of factors, including (i) identifying distribution channels, (ii) generating sufficient funds from our then existing operations or obtaining third-party financing or additional capital, (iii) the Company’s management team and its financial and accounting controls and (iv) staffing, training and retaining of skilled personnel, if any at all. Certain of these factors will be beyond the Company’s control and may be adversely affected by the economy or actions taken by competing companies. Moreover, potential products that may meet the Company’s product focus and other criteria for developing services, if we are able to acquire at all, are believed to be limited. There can be no assurance that the Company will be able to execute and manage a growth strategy effectively or at all.

5. We may not be successful in hiring technical personnel because of the competitive market for qualified technical people.

The Company's future success depends largely on its ability to attract, hire, train and retain highly qualified technical personnel to provide the Company's services. Competition for such personnel is intense. There can be no assurance that the Company will be successful in attracting and retaining the technical personnel it requires to conduct and expand its operations successfully and to differentiate itself from its competition. The Company's results of operations and growth prospects could be materially adversely affected if the Company were unable to attract, hire, train and retain such qualified technical personnel.

| -10- |

6. Our reliance on referrals from outside contacts to develop business may not be effective.

The Company initially will rely on our president and chief executive officer, Mr. Chen, for a majority of its leads and believes that independent outside sales reps will also be an important source of sales referrals in the foreseeable future. However, as is typical within the industry, there are no contractual requirements that an outside sales person use or recommend the Company's professional services in connection with product sales. We currently have no contracts or agreements in place with any outside sales professional. No assurances can be given that using independent outside sales reps will result in any meaningful numbers of sales leads or referrals.

7. We will face competition from companies with significantly greater resources and name recognition.

The markets in which the Company will operate are characterized by intense competition from several types of solution and technical service providers. The Company expects to face further competition from new market entrants and possible alliances among competitors in the future as the convergence of information processing and telecommunications continues. Many of the Company's current and potential competitors have significantly greater financial, technical, marketing and other resources than the Company. As a result, they may be better able to respond or adapt to new or emerging technologies and changes in client requirements or to devote greater resources to the development, marketing and sales of their services than the Company. There can be no assurance that the Company will be able to compete successfully. In addition, the Company will be faced with numerous competitors, both strategic and financial, in attempting to obtain competitive products. Many actual and potential competitors we believe are part of much larger companies with substantially greater financial, marketing and other resources than the Company, and there can be no assurance that the Company will be able to compete effectively against any of its future competitors.

8. There are significant potential conflicts of interest.

Our personnel will be required to commit substantial time to our affairs and, accordingly, these individual(s) (particularly our president and chief executive officer) may have conflicts of interest in allocating management time among various business activities. In the course of other business activities, certain key personnel (particularly our president and chief executive officer) may become aware of business opportunities which may be appropriate for presentation to us, as well as other entities with which they are affiliated. As such, there may be conflicts of interest in determining to which entity a particular business opportunity should be presented.

We cannot provide assurances that our efforts to eliminate the potential impact of conflicts of interest will be effective.

9. Following the effective date of our Registration Statement, of which this prospectus is a part, we will be subject to the periodic reporting requirements of Section 15(d) of the Exchange Act that will require us to incur audit fees and legal fees in connection with the preparation of such reports. These additional costs could reduce or eliminate our ability to earn a profit.

Following the effective date of our registration statement of which this prospectus is a part, we will be required to file periodic reports with the SEC pursuant to the Exchange Act and the rules and regulations promulgated thereunder. In order to comply with these requirements, our independent registered public accounting firm will have to review our financial statements on a quarterly basis and audit our financial statements on an annual basis. Moreover, our legal counsel will have to review and assist in the preparation of such reports. The costs charged by these professionals for such services cannot be accurately predicted at this time because factors such as the number and type of transactions that we engage in and the complexity of our reports cannot be determined at this time and will have a major effect on the amount of time to be spent by our auditors and attorneys. However, the incurrence of such costs will obviously be an expense to our operations and thus have a negative effect on our ability to meet our overhead requirements and earn a profit. We may be exposed to potential risks resulting from any new requirements under Section 404 of the Sarbanes-Oxley Act of 2002. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock, if a market ever develops, could drop significantly.

| -11- |

10. Our internal controls may be inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public.

Our management is responsible for establishing and maintaining adequate internal control over our financial reporting. As defined in Exchange Act Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial officer and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that:

| - | pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; |

| - | provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and/or directors of the Company; and |

| - | provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the financial statements. |

Our internal controls may be inadequate or ineffective, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public. Investors relying upon this misinformation may make an uninformed investment decision.

11. The costs of being a public company could result in us being unable to continue as a going concern.

As a public company, we will have to comply with numerous financial reporting and legal requirements, including those pertaining to audits, quarterly reporting and internal controls. The costs of this compliance could be significant. If our revenues are insufficient, and/or we cannot satisfy many of these costs through the issuance of our shares, we may be unable to satisfy these costs through the normal course of business which would result in our being unable to continue as a going concern.

12. Having only one director limits our ability to establish effective independent corporate governance procedures and increases the control of our president and chief executive officer.

We have only one director who also serves as our president and chief executive officer. Accordingly, we cannot establish board committees comprised of independent members to oversee functions like compensation or audit issues. In addition, currently a vote of board members is decided in favor of the chairman (who is our president, and chief executive officer), which gives him complete control over all corporate issues.

Until we have a larger board of directors that would include some independent members, if ever, there will be limited oversight of our president and chief executive officer’s decisions and activities and little ability for minority shareholders to challenge or reverse those activities and decisions, even if they are not in the best interests of minority shareholders.

13. Resources may limit the Company’s ability to get access to products and/or manufacturers of key products.

WeWearables will have limited access to products for sale on the e-Commerce, vending machine and retail locations. Until we build relationships or have access to vendors and vendor terms, it will be difficult to purchase and resale wearable technologies.

| -12- |

Larger retailers may also have exclusive relationships with wearables products that WeWearables will not have access to, limiting WeWearables catalogs and products.

14. Product liability

Although WeWearables will be a reseller of wearable technology, we may be subject to product liability claims if people or properties are harmed by the products we sell. This liability may be mitigated by manufacturer. A significant product liability judgment or a widespread product recall may negatively impact on sales and profitability of the affected brand or all brands for a period of time depending on product availability, competitive reaction and consumer attitudes.

Risks Related to Our Common Stock

15. The Company is selling the shares offered in this prospectus without an underwriter and may not be able to sell all or any of the shares offered herein.

The common shares are being offered on our behalf by Mr. Chen, our president and chief executive officer, on a best-effort basis. No broker-dealer has been retained as an underwriter and no broker-dealer is under any obligation to purchase any common shares. There are no firm commitments to purchase any of the shares in this offering. Consequently, there is no guarantee that the Company, through its president and chief executive officer, is capable of selling all, or any, of the common shares offered hereby. The sale of only a small number of shares increases the likelihood of no market ever developing for our shares.

16. Since there is no minimum for our offering, if only a few persons purchase shares they will lose their money without us being even able to develop a market for our shares.

Since there is no minimum with respect to the number of shares to be sold directly by the Company in its offering, if only a few shares are sold, we will be unable to even attempt to create a public market of any kind for our shares. In such an event, it is highly likely that the entire investment of shareowners would be lost. Even if all of the shares are purchased, we could have the same result.

17. The offering price of our common stock has been determined arbitrarily.

The price of our common stock in this offering has not been determined by any independent financial evaluation, market mechanism or by our auditors, and is therefore, to a large extent, arbitrary. Our audit firm has not reviewed management's valuation and, therefore, expresses no opinion as to the fairness of the offering price as determined by our management. As a result, the price of the common stock in this offering may not reflect the value perceived by the market. There can be no assurance that the shares offered hereby are worth the price for which they are offered and investors may, therefore, lose a portion or all of their investment.

18. Shareholders may be diluted significantly through our efforts to obtain financing and satisfy obligations through issuance of additional shares of our common stock.

We have no committed source of financing. Wherever possible, our board of directors will attempt to use non-cash consideration to satisfy obligations. In many instances, we believe that the non-cash consideration will consist of restricted shares of our common stock. Our board of directors has authority, without action or vote of the shareholders, to issue all or part of the authorized (150,000,000) shares but unissued (130,450,000) shares assuming the sale of 2,500,000 shares in this offering. In addition, if a trading market develops for our common stock, we may attempt to raise capital by selling shares of our common stock, possibly at a discount to market. These actions will result in dilution of the ownership interests of existing shareholders, further dilute common stock book value, and that dilution may be material.

| -13- |

19. The interests of shareholders may be hurt because we can issue shares of our common stock to individuals or entities that support existing management with such issuances serving to enhance existing management’s ability to maintain control of our company.

Our board of directors has authority, without action or vote of the shareholders, to issue all or part of the authorized but unissued common shares. Such issuances may be issued to parties or entities committed to supporting existing management and the interests of existing management which may not be the same as the interests of other shareholders. Our ability to issue shares without shareholder approval serves to enhance existing management’s ability to maintain control of our company.

20. Our articles of incorporation provide for indemnification of officers and directors at our expense and limit their liability that may result in a major cost to us and hurt the interests of our shareholders because corporate resources may be expended for the benefit of officers and/or directors.

Our Articles of Incorporation at Article X provide for indemnification as follows: "No director or officer of the Corporation shall be personally liable to the Corporation or any of its stockholders for damages for breach of fiduciary duty as a director or officer; provided, however, that the foregoing provision shall not eliminate or limit the liability of a director or officer: (i) for acts or omissions which involve intentional misconduct, fraud or knowing violation of law; or (ii) the payment of dividends in violation of Section 78.300 of the Nevada Revised Statutes. Any repeal or modification of an Article by the stockholders of the Corporation shall be prospective only, and shall not adversely affect any limitation of the personal liability of a director or officer of the Corporation for acts or omissions prior to such repeal or modification."

We have been advised that, in the opinion of the SEC, indemnification for liabilities arising under federal securities laws is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification for liabilities arising under federal securities laws, other than the payment by us of expenses incurred or paid by a director, officer or controlling person in the successful defense of any action, suit or proceeding, is asserted by a director, officer or controlling person in connection with our activities, we will (unless in the opinion of our counsel, the matter has been settled by controlling precedent) submit to a court of appropriate jurisdiction, the question whether indemnification by us is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue. The legal process relating to this matter if it were to occur is likely to be very costly and may result in us receiving negative publicity, either of which factors is likely to materially reduce the market and price for our shares, if such a market ever develops.

21. Currently, there is no established public market for our securities, and there can be no assurances that any established public market will ever develop or that our common stock will be quoted for trading and, even if quoted, it is likely to be subject to significant price fluctuations.

Prior to the date of this prospectus, there has not been any established trading market for our common stock, and there is currently no established public market whatsoever for our securities. We have not found a market maker. There can be no assurance that we will find a market maker willing to file an application with FINRA on our behalf and if we do that the market maker’s application will be accepted by FINRA nor can we estimate as to the time period that the application will require. We are not permitted to file such application on our own behalf. If the application is accepted, there can be no assurances as to whether

| (i) | any market for our shares will develop; |

| (ii) | the prices at which our common stock will trade; or |

| (iii) | the extent to which investor interest in us will lead to the development of an active, liquid trading market. Active trading markets generally result in lower price volatility and more efficient execution of buy and sell orders for investors. |

| -14- |

If we become able to have our shares of common stock quoted on the OTCQB and/or OTCBB, we will then try, through a broker-dealer and its clearing firm, to become eligible with the Depository Trust Company ("DTC") to permit our shares to trade electronically. If an issuer is not “DTC-eligible,” then its shares cannot be electronically transferred between brokerage accounts, which, based on the realities of the marketplace as it exists today (especially the OTCQB/OTCBB), means that shares of a company will not be traded (technically the shares can be traded manually between accounts, but this takes days and is not a realistic option for companies relying on broker dealers for stock transactions - like all companies on the OTCQB and OTCBB. What this boils down to is that while DTC-eligibility is not a requirement to trade on the OTCQB or OTCBB, it is a necessity to process trades on the OTCBB if a company’s stock is going to trade with any volume. There are no assurances that our shares will ever become DTC-eligible or, if they do, how long it will take.

In addition, our common stock is unlikely to be followed by any market analysts, and there may be few institutions acting as market makers for our common stock. Either of these factors could adversely affect the liquidity and trading price of our common stock. Until our common stock is fully distributed and an orderly market develops in our common stock, if ever, the price at which it trades is likely to fluctuate significantly. Prices for our common stock will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity of the market for shares of our common stock, developments affecting our business, including the impact of the factors referred to elsewhere in these Risk Factors, investor perception of the Company and general economic and market conditions. No assurances can be given that an orderly or liquid market will ever develop for the shares of our common stock.

Because of the anticipated low price of the securities being registered, many brokerage firms may not be willing to effect transactions in these securities. Purchasers of our securities should be aware that any market that develops in our stock will be subject to the penny stock restrictions. See “Plan of Distribution” and Risk Factor #22 below.

22. If we were designated a shell your ability to resell your shares would be limited.

All of the presently outstanding shares of our common stock are "restricted securities" as defined under Rule 144 promulgated under the Securities Act and may only be sold pursuant to an effective registration statement or an exemption from registration, if available. The SEC has adopted final rules amending Rule 144 which have become effective on August 15, 2008. Pursuant to the new Rule 144, one year must elapse from the time a “shell company,” as defined in Rule 405 of the Securities Act and Rule 12b-2 of the Exchange Act, ceases to be a “shell company” and files a Form 8-K addressing Item 5.06 with such information as may be required in a Form 10 Registration Statement with the SEC, before a restricted shareholder can resell their holdings in reliance on Rule 144. The Form 10 information or disclosure is equivalent to the information that a company would be required to file if it were registering a class of securities on Form 10 under the Exchange Act. Under amended Rule 144, restricted or unrestricted securities that were initially issued by a reporting or non-reporting shell company or a company that was at anytime previously a reporting or non-reporting shell company, can only be resold in reliance on Rule 144 if the following conditions are met:

1) the issuer of the securities that was formerly a reporting or non-reporting shell company has ceased to be a shell company;

2) the issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act;

3) the issuer of the securities has filed all reports and material required to be filed under Section 13 or 15(d) of the Exchange Act, as applicable, during the preceding twelve months (or shorter period that the Issuer was required to file such reports and materials), other than Form 8-K reports; and

4) at least one year has elapsed from the time the issuer filed the current Form 10 type information with the SEC reflecting its status as an entity that is not a shell company.

At the present time, we are not classified as a “shell company” under Rule 405 of the Securities Act Rule 12b-2 of the Exchange Act. To the extent the Company is designated a shell, you would be unable to sell your shares under Rule 144.

| -15- |

23. Any market that develops in shares of our common stock will be subject to the penny stock regulations and restrictions pertaining to low priced stocks that will create a lack of liquidity and make trading difficult or impossible.

The trading of our securities, if any, will be in the over-the-counter market which is commonly referred to as the OTCBB as maintained by FINRA. As a result, an investor may find it difficult to dispose of, or to obtain accurate quotations as to the price of our securities.

Rule 3a51-1 of the Exchange Act establishes the definition of a "penny stock," for purposes relevant to us, as any equity security that has a minimum bid price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to a limited number of exceptions which are not available to us. It is likely that our shares will be considered to be penny stocks for the immediately foreseeable future. This classification severely and adversely affects any market liquidity for our common stock.

For any transaction involving a penny stock, unless exempt, the penny stock rules require that a broker or dealer approve a person's account for transactions in penny stocks and the broker or dealer receive from the investor a written agreement to the transaction setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person's account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience and objectives of the person and make a reasonable determination that the transactions in penny stocks are suitable for that person and that that person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, which, in highlight form, sets forth:

| - | the basis on which the broker or dealer made the suitability determination, and |

| - | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Disclosure also has to be made about the risks of investing in penny stock in both public offerings and in secondary trading and commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Additionally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Because of these regulations, broker-dealers may not wish to engage in the above-referenced necessary paperwork and disclosures and/or may encounter difficulties in their attempt to sell shares of our common stock, which may affect the ability of selling shareholders or other holders to sell their shares in any secondary market and have the effect of reducing the level of trading activity in any secondary market. These additional sales practice and disclosure requirements could impede the sale of our securities, if and when our securities become publicly traded. In addition, the liquidity for our securities may decrease, with a corresponding decrease in the price of our securities. Our shares, in all probability, will be subject to such penny stock rules for the foreseeable future and our shareholders will, in all likelihood, find it difficult to sell their securities.

| -16- |

24. The market for penny stocks has experienced numerous frauds and abuses that could adversely impact investors in our stock.

Company management believes that the market for penny stocks has suffered from patterns of fraud and abuse. Such patterns include:

| - | Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; |

| - | Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; |

| - | "Boiler room" practices involving high pressure sales tactics and unrealistic price projections by sales persons; |

| - | Excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and |

| - | Wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses. |

25. Any trading market that may develop may be restricted by virtue of state securities “Blue Sky” laws that prohibit trading absent compliance with individual state laws. These restrictions may make it difficult or impossible to sell shares in those states.

There is currently no established public market for our common stock, and there can be no assurance that any established public market will develop in the foreseeable future. Transfer of our common stock may also be restricted under the securities or securities regulations laws promulgated by various states and foreign jurisdictions, commonly referred to as “Blue Sky” laws. Absent compliance with such individual state laws, our common stock may not be traded in such jurisdictions. Because the securities registered hereunder have not been registered for resale under the blue sky laws of any state, the holders of such shares and persons who desire to purchase them in any trading market that might develop in the future, should be aware that there may be significant state blue sky law restrictions upon the ability of investors to sell the securities and of purchasers to purchase the securities. These restrictions prohibit the secondary trading of our common stock. We currently do not intend to and may not be able to qualify securities for resale in at least 17 states which do not offer manual exemptions (or may offer manual exemptions but may not to offer one to us if we are considered to be a shell company at the time of application) and require shares to be qualified before they can be resold by our shareholders. Accordingly, investors should consider the secondary market for our securities to be a limited one. See also “Plan of Distribution-State Securities-Blue Sky Laws.”

26. Our board of directors (consisting of one person, our president and chief executive officer) has the authority, without stockholder approval, to issue preferred stock with terms that may not be beneficial to common stockholders and with the ability to affect adversely stockholder voting power and perpetuate their control over us.

Our articles of incorporation allow us to issue shares of preferred stock without any vote or further action by our stockholders. Our board of directors has the authority to fix and determine the relative rights and preferences of preferred stock. Our board of directors also has the authority to issue preferred stock without further stockholder approval, including large blocks of preferred stock. As a result, our board of directors could authorize the issuance of a series of preferred stock that would grant to holders the preferred right to our assets upon liquidation, the right to receive dividend payments before dividends are distributed to the holders of common stock and the right to the redemption of the shares, together with a premium, prior to the redemption of our common stock.

| -17- |

27. The ability of our president, and chief executive officer to control our business may limit or eliminate minority shareholders’ ability to influence corporate affairs.

Upon the completion of this offering, our president, and chief executive officer, Mr. Chen will beneficially own an aggregate of 75.56% of our outstanding common stock assuming the sale of all shares being registered. Because of their beneficial stock ownership, our president, and chief executive officer will be in a position to continue to elect our board of directors, decide all matters requiring stockholder approval and determine our policies. The interests of our president, and chief executive officer may differ from the interests of other shareholders with respect to the issuance of shares, business transactions with or sales to other companies, selection of officers and directors and other business decisions. The minority shareholders would have no way of overriding decisions made by our president and chief executive officer. This level of control may also have an adverse impact on the market value of our shares because our president and chief executive officer may institute or undertake transactions, policies or programs that may result in losses, may not take any steps to increase our visibility in the financial community and/or may sell sufficient numbers of shares to significantly decrease our price per share.

28. All of our presently issued and outstanding common shares are restricted under Rule 144 of the Securities Act, as amended. When the restriction on any or all of these shares is lifted, and the shares are sold in the open market, the price of our common stock could be adversely affected.

All of the presently outstanding shares of common stock (20,050,000 shares) are "restricted securities" as defined under Rule 144 promulgated under the Securities Act and may only be sold pursuant to an effective registration statement or an exemption from registration, if available. Rule 144 provides in essence that a person who is not an affiliate and has held restricted securities for a prescribed period of at least six (6) months if purchased from a reporting issuer or twelve (12) months (as is the case herein) if purchased from a non-reporting Company, may, under certain conditions, sell all or any of his shares without volume limitation, in brokerage transactions. Affiliates, however, may not sell shares in excess of 1% of the Company’s outstanding common stock every three months. As a result of revisions to Rule 144 which became effective on August 15, 2008, there is no limit on the amount of restricted securities that may be sold by a non-affiliate (i.e., a stockholder who has not been an officer, director or control person for at least 90 consecutive days) after the restricted securities have been held by the owner for the aforementioned prescribed period of time. A sale under Rule 144 or under any other exemption from the Act, if available, or pursuant to registration of shares of common stock of present stockholders, may have a depressive effect upon the price of the common stock in any market that may develop.

29. We do not expect to pay cash dividends in the foreseeable future.

We have never paid cash dividends on our common stock. We do not expect to pay cash dividends on our common stock at any time in the foreseeable future. The future payment of dividends directly depends upon our future earnings, capital requirements, financial requirements and other factors that our board of directors will consider. Since we do not anticipate paying cash dividends on our common stock, return on your investment, if any, will depend solely on an increase, if any, in the market value of our common stock.

30. Because we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our stockholders have limited protection against interested director transactions, conflicts of interest and similar matters.

The Sarbanes-Oxley Act of 2002, as well as rule changes proposed and enacted by the SEC, the New York and American Stock Exchanges and the Nasdaq Stock Market, as a result of Sarbanes-Oxley, require the implementation of various measures relating to corporate governance. These measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities that are listed on those exchanges or the Nasdaq Stock Market. Because we are not presently required to comply with many of the corporate governance provisions and because we chose to avoid incurring the substantial additional costs associated with such compliance any sooner than legally required, we have not yet adopted these measures.

| -18- |

Because none of our directors (currently one person) are independent directors, we do not currently have independent audit or compensation committees. As a result, these directors have the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our stockholders without protections against interested director transactions, conflicts of interest, if any, and similar matters and investors may be reluctant to provide us with funds necessary to expand our operations.

We intend to comply with all corporate governance measures relating to director independence as and when required. However, we may find it very difficult or be unable to attract and retain qualified officers, directors and members of board committees required to provide for our effective management as a result of Sarbanes-Oxley Act of 2002. The enactment of the Sarbanes-Oxley Act of 2002 has resulted in a series of rules and regulations by the SEC that increase responsibilities and liabilities of directors and executive officers. The perceived increased personal risk associated with these recent changes may make it more costly or deter qualified individuals from accepting these roles.

31. You may have limited access to information regarding our business because our obligations to file periodic reports with the SEC could be automatically suspended under certain circumstances.

As of the effective date of our registration statement of which this prospectus is a part, we will become subject to certain informational requirements of the Exchange Act, as amended and we will be required to file periodic reports (i.e., annual, quarterly and material events) with the SEC which will be immediately available to the public for inspection and copying. In the event during the year that our registration statement becomes effective, these reporting obligations may be automatically suspended under Section 15(d) of the Exchange Act if we have less than 300 shareholders and do not file a registration statement on Form 8-A (of which we have no current plans to file). If this occurs after the year in which our registration statement becomes effective, we will no longer be obligated to file such periodic reports with the SEC and access to our business information would then be even more restricted. After this registration statement on Form S-1 becomes effective, we may be required to deliver periodic reports to security holders as proscribed by the Exchange Act, as amended. However, we will not be required to furnish proxy statements to security holders and our directors, officers and principal beneficial owners will not be required to report their beneficial ownership of securities to the SEC pursuant to Section 16 of the Exchange Act until we have both 500 or more security holders and greater than $10 million in assets. This means that access to information regarding our business and operations will be limited. However, we plan to voluntarily continue reporting in the absence of an SEC reporting obligation.

32. We are an emerging growth company within the meaning of the Securities Act, and as a consequence of taking advantage of certain exemptions from reporting requirements that are available to emerging growth companies, our financial statements may not be comparable to companies that comply with public company effective dates.

We are an emerging growth company as defined in Section 2(a)(19) of the Securities Act of 1933, as amended (the “Securities Act”). Pursuant to Section 107 of the Jumpstart Our Business Startups Act, we may take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards, meaning that we can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have chosen to take advantage of the extended transition period for complying with new or revised accounting standards applicable to public companies to delay adoption of such standards until such standards are made applicable to private companies. Accordingly, our financial statements may not be comparable to the financial statements of public companies that comply with such new or revised accounting standards.

| -19- |

33. You may receive no proceeds or very minimal proceeds from the offering.

Since there is no minimum amount of shares that must be sold by the company, you may receive no proceeds or very minimal proceeds from the offering and potential investors may end up holding shares in a company that:

- Has not received enough proceeds from the offering to begin operations; and

- Has no market for its shares.

For all of the foregoing reasons and others set forth herein, an investment in our securities in any market that may develop in the future involves a high degree of risk.

| -20- |

USE OF PROCEEDS

WeWearables will apply the proceeds from the offering to pay for accounting fees, legal and professional fees associated with the offering. The total estimated costs of the offering ($55,000) do not exceed the maximum amount of offering proceeds ($250,000). The estimated costs of the offering, which principally relate to professional costs, are estimated to consist of:

| SEC Registration fee | $ | 32.20 |

| NASD filing fee | 100.00 | |

| Accounting fees and expenses | 5,000.00 | |

| Legal fees and expenses (relating to the preparation of our registration statement from inception to effective date and related documents) | 40,000.00 | |

| Transfer agent fees | 2,500.00 | |

| Blue Sky fees and expenses | 5,000.00 | |

| Miscellaneous expenses | 2,367.80 | |

| Total | $ | 55,000.00 |

WeWearables will pay all costs related to this offering. If the amount of offering costs exceed the amount raised, this amount in excess of the offering proceeds will be paid when necessary or otherwise accrued on the books and records of WeWearables until we are able to pay the full amounts due either from revenues or loans from our president and chief executive officer, related or unrelated parties that we may approach. A significant portion of the estimated costs of the offering ($55,000) are legal fees and expenses ($40,000). Absent sufficient revenues to pay these amounts, we will seek financial assistance either from our president and chief executive officer, or shareholders or possibly third party business associates of our president and chief executive officer who may agree to loan us the funds necessary to cover the balance of outstanding professional and related fees related to our prospectus to the extent that such liabilities cannot be extended or satisfied in other ways and the professional service providers insist upon payment. Absent the above, Mr. Chen will attempt to seek sufficient funding personally for the amounts due and, if successful in obtaining these funds, to lend it to the Company on an interest-free basis. No formal written arrangement exists, with respect to Mr. Chen or anyone’s commitment outside of the Company, to loan funds for this purpose.

Our offering is being made on a best efforts basis: no minimum number of shares must be sold in order for the offering to proceed. The offering price per share is $0.10. The following table sets forth the uses of proceeds assuming the sale 100%, 75%, 50% and 10% respectively, of the securities offered for sale by the Company. There is no assurance that we will raise the full $250,000 as anticipated. The following scenarios are for illustrative purposes only and the actual amounts of proceeds, if any, may differ.

| $ | 250,000 | $ | 187,500 | $ | 125,000 | $ | 25,000 | |||||||||

| Offering Costs | $ | 55,000 | $ | 55,000 | $ | 55,000 | $ | 25,000 | ||||||||

| Net Proceeds | $ | 195,000 | $ | 132,500 | $ | 70,000 | $ | 0 | ||||||||

| Website development | $ | 45,000 | $ | 45,000 | $ | 45,000 | $ | 0 | ||||||||

| Kiosk development | $ | 30,000 | $ | 30,000 | $ | 0 | $ | 0 | ||||||||

| Vending machine development | $ | 30,000 | $ | 0 | $ | 0 | $ | 0 | ||||||||

| Advertising & search engine optimization | $ | 40,000 | $ | 40,000 | $ | 20,000 | $ | 0 | ||||||||

| Rent | $ | 12,000 | $ | 0 | $ | 0 | $ | 0 | ||||||||

| Inventory | $ | 38,000 | $ | 17,500 | $ | 5,000 | $ | 0 | ||||||||

| Total | $ | 195,000 | $ | 132,500 | $ | 70,000 | $ | 0 |

Our plans will not change regardless of whether the maximum proceeds are raised, except to the extent indicated in MD&A “Liquidity” section, first paragraph.

THE OFFERING

The Company will have substantial costs relating to this offering. We will also incur ongoing continuous costs to meet the reporting requirements of a public company. These costs may very well exceed our current or anticipated revenues, significantly. However, the Company believes that the risks are worth taking because management believes, based on its own observations which are not based on any formal studies, that potential future vendors, consultants and manufacturers will have a higher regard in providing services for a public company than a small, privately-held startup company. Management’s belief is based solely on the advice and informal consultation with various business and legal professionals who are known to us and have public company experience. These discussions have led us to believe that being a public company may afford the business (management and its shareholders) with a higher degree of recognition than would be typically attained as a small private (or non-public) company and may increase its ability and/or options to obtain financing for its growth. In addition, by being a public company we believe increases the visibility of our future opportunities to raise funds or to pay vendors by issuing restricted common stock rather than cash. We cannot predict the likelihood that our observations and conclusions about the benefits of being a public company will prove accurate or beneficial to us.

| -21- |

We are offering for sale a maximum of 2,500,000 shares of common stock at a fixed price of $0.10 per share. There is no minimum number of shares that must be sold by us for the offering to close, and we will retain the proceeds from the sale of any of the offered shares that are sold. The offering is being conducted on a self-underwritten, best efforts basis, which means our president, and chief executive officer, Mr. Chen, will attempt to sell the shares. This prospectus will permit our president and chief executive officer to sell the shares directly to the public, with no commission or other remuneration payable to him for any shares that he may sell. Mr. Chen will sell the shares and intends to offer them to friends, family members and business acquaintances. In offering the securities on our behalf, Mr. Chen will rely primarily on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934. The intended methods of communication include, without limitation, telephone and personal contacts.

As discussed above in connection with WeWearables’s selling efforts in the offering, Mr. Chen will not register as a broker-dealer pursuant to Section 15 of the Exchange Act, as amended, but rather will rely upon the “safe harbor” provisions of Rule 3a4-1, promulgated under the Exchange Act, as amended. Generally speaking, Rule 3a4-1 provides an exemption from the broker-dealer registration requirements of the Exchange Act for persons associated with an issuer that participate in an offering of the issuer’s securities. Mr. Chen is not subject to any statutory disqualification, as that term is defined in Section 3(a) (39) of the Exchange Act. Mr. Chen will not be compensated in connection with his participation in the offering by the payment of commissions or other remuneration based either directly or indirectly on transactions in our securities. Mr. Chen is not, nor has he been within the past 12 months, a broker or dealer, and he is not, nor has he been within the past 12 months, an associated person of a broker or dealer. At the end of the offering, Mr. Chen will continue to primarily perform duties for the Company or on its behalf otherwise than in connection with transactions in securities. Mr. Chen will not participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on Exchange Act Rule 3a4-1(a)(4)(i) or (iii).

The proceeds from the sale of the shares in this offering will be made payable to the Company. All subscription agreements and checks are irrevocable and should be delivered to the Company at the address provided on the Subscription Agreement.

We will receive all proceeds from the sale of up to 2,500,000 shares being offered. No proceeds will be received by any other entity other than the Company. The price per share is fixed at $0.10 for the duration of this offering.

All subscribed funds will be held in a noninterest-bearing account. Any subscribed funds may be immediately utilized by the Company prior to the completion of the offering. The offering will be completed 180 days from the effective date of this prospectus (or such earlier date when all 2,500,000 shares are sold), unless extended by our board of directors for an additional 180 days. There is no minimum number of shares that must be sold in this offering. All subscription agreements and checks for payment of shares are irrevocable (except as to any states that require a statutory cooling-off period or rescission right).

The Company will deliver stock certificates attributable to shares of common stock purchased directly by the purchasers within 30 days of the close of this offering or as soon thereafter as practicable.

We have the right to accept or reject subscriptions in whole or in part, for any reason or for no reason. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions. Subscriptions for securities will be accepted or rejected within 48 hours after we receive them.

The offering may terminate on the earlier of:

| i. | the date when the sale of all 2,500,000 shares is completed, or |

| ii. | 180 days from the effective date of this document or any extension thereto. |

| -22- |

The offering price of the common stock has been determined arbitrarily and bears no relationship to any objective criterion of value. The price does not bear any relationship to our assets, book value, historical earnings or net worth.