Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Great Western Bancorp, Inc. | d824862d8k.htm |

Exhibit 99.1

|

National Australia Bank Limited | |||

| ABN 12 004 044 937 | ||||

|

800 Bourke Street | ||||

| Docklands Victoria 3008 | ||||

| AUSTRALIA | ||||

|

www.nabgroup.com | ||||

|

Friday, 21 November 2014 |

Great Western’s FY14 and Q4 financial results

Great Western Bancorp, Inc. (GWB) reported its fiscal year 2014 fourth quarter (ended 30 September 2014) and full year financial results to the market in the United States on Thursday 20 November 2014.

Attached are the following relevant materials:

| • | GWB’s 30 September 2014 full and half year results under Australian Accounting Standards, including reconciliation to US GAAP |

| • | GWB’s earnings release to the New York Stock Exchange |

| • | GWB investor presentation. |

| For further information: | ||||

| Media | ||||

| Meaghan Telford | Emily Ritchie | |||

| M: +61 (0) 457 551 211 | M: +61 (0) 477 389 438 | |||

| Investor Relations | ||||

| Ross Brown | Belinda Bowman | |||

| M: +61 (0) 417 483 549 | M: +61 (0) 416 752 597 | |||

Australian Accounting Standards Full Year Results 2014 - Great Western Bank

Great Western Bancorp, Inc. (GWB), through its subsidiary Great Western Bank, provides a range of commercial, agribusiness, retail and wealth management banking services through 162 branches in seven states across the Midwestern United States. On 20 October 2014, an initial public offering was completed in respect of GWB, a US based subsidiary of the Group. The total offer comprised of 18.4 million shares or 31.8% of the outstanding common stock.

Results presented in local currency.

| Year to | Half Year to | |||||||||||||||

| Sep 14 | Sep 14 | Mar 14 | Sep 14 v | |||||||||||||

| US$m | US$m | US$m | Mar 14 % | |||||||||||||

| Net interest income |

300 | 150 | 150 | — | ||||||||||||

| Other operating income |

63 | 32 | 31 | 3.2 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net operating income |

363 | 182 | 181 | 0.6 | ||||||||||||

| Operating expenses |

(175 | ) | (90 | ) | (85 | ) | (5.9 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Underlying profit |

188 | 92 | 96 | (4.2 | ) | |||||||||||

| Charge to provide for bad and doubtful debts |

(8 | ) | (6 | ) | (2 | ) | large | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash earnings before tax |

180 | 86 | 94 | (8.5 | ) | |||||||||||

| Income tax expense |

(59 | ) | (28 | ) | (31 | ) | 9.7 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash earnings |

121 | 58 | 63 | (7.9 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Average Volumes (US$bn) |

||||||||||||||||

| Gross loans and acceptances |

6.6 | 6.7 | 6.5 | 3.1 | ||||||||||||

| Interest earning assets |

8.0 | 8.1 | 7.9 | 2.5 | ||||||||||||

| Customer deposits |

7.1 | 7.1 | 7.1 | — | ||||||||||||

| Performance Measures |

||||||||||||||||

| Net interest margin |

3.75 | % | 3.69 | % | 3.81 | % | (12 bps | ) | ||||||||

| Cost to income ratio |

48.2 | % | 49.5 | % | 47.0 | % | (250 bps | ) | ||||||||

Results presented in Australian dollars.

| Year to | Half Year to | |||||||||||||||

| Sep 14 | Sep 14 | Mar 14 | Sep 14 v | |||||||||||||

| A$m | A$m | A$m | Mar 14 % | |||||||||||||

| Net interest income |

326 | 161 | 165 | (2.4 | ) | |||||||||||

| Other operating income |

68 | 35 | 33 | 6.1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net operating income |

394 | 196 | 198 | (1.0 | ) | |||||||||||

| Operating expenses |

(190 | ) | (98 | ) | (92 | ) | (6.5 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Underlying profit |

204 | 98 | 106 | (7.5 | ) | |||||||||||

| Charge to provide for bad and doubtful debts |

(8 | ) | (5 | ) | (3 | ) | (66.7 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash earnings before tax |

196 | 93 | 103 | (9.7 | ) | |||||||||||

| Income tax expense |

(65 | ) | (31 | ) | (34 | ) | 8.8 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash earnings |

131 | 62 | 69 | (10.1 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Impact of foreign exchange rates movements

| Favourable/ (unfavourable) September 14 |

Half year since Mar 14 $m |

Sep 14 v Mar 14 Ex FX % |

||||||

| Net interest income |

(3 | ) | (0.6 | ) | ||||

| Other operating income |

(1 | ) | 9.1 | |||||

| Operating expenses |

2 | (8.7 | ) | |||||

| Charge to provide for bad and doubtful debts |

— | (66.7 | ) | |||||

| Income tax expense |

1 | 5.9 | ||||||

|

|

|

|

|

|||||

| Cash earnings |

(1 | ) | (8.7 | ) | ||||

|

|

|

|

|

|||||

Great Western Bancorp, Inc. US GAAP to Australian Accounting Standards (AAS)(1) Reconciliation (USD, Unaudited) for the year ended 30 September 2014

| US GAAP Consolidated(2) (US$‘000) |

Less: Holding Company(3) (US$‘000) |

Add: US GAAP / AAS Differences(4) (US$‘000) |

Income Statement Classification(5) (US$‘000) |

AAS GWB Net Income (US$‘000) |

Less: Non-cash items(6) (US$‘000) |

AAS GWB Cash Earnings (US$‘000) |

AAS GWB Cash Earnings (Rounded) (US$m) |

|||||||||||||||||||||||||

| Net interest income |

314,073 | (1,940 | ) | 6,189 | (21,282 | ) | 300,920 | (788 | ) | 300,132 | 300 | |||||||||||||||||||||

| Non interest income / other operating income |

58,054 | — | (66 | ) | 4,803 | 62,791 | — | 62,791 | 63 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total revenue / operating income |

372,127 | (1,940 | ) | 6,123 | (16,479 | ) | 363,711 | (788 | ) | 362,923 | 363 | |||||||||||||||||||||

| Non interest expense / other operating expense |

212,144 | 3,575 | (562 | ) | (17,029 | ) | 190,978 | (16,216 | ) | 174,762 | 175 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Underlying profit |

159,983 | (5,515 | ) | 6,685 | 550 | 172,733 | 15,428 | 188,161 | 188 | |||||||||||||||||||||||

| Provision for loan losses / charge to provide for bad and doubtful debts |

684 | — | 6,558 | 850 | 8,092 | — | 8,092 | 8 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Income before taxes |

159,299 | (5,515 | ) | 127 | (300 | ) | 164,641 | 15,428 | 180,069 | 180 | ||||||||||||||||||||||

| Provision for income tax / income tax expense |

54,347 | (1,992 | ) | 44 | (300 | ) | 56,083 | 3,384 | 59,467 | 59 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net income / Cash Earnings |

104,952 | (3,523 | ) | 83 | — | 108,558 | 12,044 | 120,602 | 121 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Average Volumes (US$m, Rounded US$b) |

||||||||||||||||||||||||||||||||

| Gross loans and acceptances |

6,557 | — | 18 | — | 6,575 | 6,575 | 6.6 | |||||||||||||||||||||||||

| Interest earning assets |

8,094 | — | (142 | ) | — | 7,952 | 7,952 | 8.0 | ||||||||||||||||||||||||

| Customer deposits |

7,104 | — | — | — | 7,104 | 7,104 | 7.1 | |||||||||||||||||||||||||

| Performance Measures |

||||||||||||||||||||||||||||||||

| Net interest margin |

3.88 | % | 3.75 | % | ||||||||||||||||||||||||||||

| Cost to income ratio |

48.2 | % | ||||||||||||||||||||||||||||||

| (1) | Australian Accounting Standards (AAS) as issued by the Australian Accounting Standards Board complying with International Financial Reporting Standards as issued by the International Accounting Standards Board. |

| (2) | Income statement has been reordered to the standard Australian presentation only affecting subtotals. |

| (3) | Represents the parent company only US GAAP results of Great Western Bancorp, Inc. or its predecessor, Great Western Bancorporation, Inc. |

| (4) | Represents differences in application of accounting standards between US GAAP and AAS, primarily related to the periodic revaluations of assets acquired from TierOne Bank in 2010. Within average volumes, amounts on deposit with other financial institutions are not included in interest earning assets in the AAS presentation. |

| (5) | Certain items are presented in different income statement line items under US GAAP compared to AAS. These items net to zero. |

| (6) | Non-cash items under the AAS basis include the amortisation of acquisition-related intangible assets, net of tax. |

Great Western Bancorp, Inc. US GAAP to Australian Accounting Standards (AAS)(1) Reconciliation (USD, Unaudited) for the six months ended 30 September 2014

| US GAAP Consolidated(2) (US$‘000) |

Less: Holding Company(3) (US$‘000) |

Add: US GAAP / AAS Differences(4) (US$‘000) |

Income Statement Classification(5) (US$‘000) |

AAS GWB Net Income (US$‘000) |

Less: Non-cash items(6) (US$‘000) |

AAS GWB Cash Earnings (US$‘000) |

AAS GWB Cash Earnings (Rounded) (US$m) |

|||||||||||||||||||||||||

| Net interest income |

166,032 | (898 | ) | 2,068 | (18,397 | ) | 150,601 | (322 | ) | 150,279 | 150 | |||||||||||||||||||||

| Non interest income / other operating income |

29,109 | — | (7 | ) | 2,666 | 31,768 | 31,768 | 32 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total revenue / operating income |

195,141 | (898 | ) | 2,061 | (15,731 | ) | 182,369 | (322 | ) | 182,047 | 182 | |||||||||||||||||||||

| Non interest expense / other operating expense |

115,597 | 1,869 | (318 | ) | (16,331 | ) | 97,079 | (6,837 | ) | 90,242 | 90 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Underlying profit |

79,544 | (2,767 | ) | 2,379 | 600 | 85,290 | 6,515 | 91,805 | 92 | |||||||||||||||||||||||

| Provision for loan losses / charge to provide for bad and doubtful debts |

4,249 | — | 685 | 850 | 5,784 | 5,784 | 6 | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Income before taxes |

75,295 | (2,767 | ) | 1,694 | (250 | ) | 79,506 | 6,515 | 86,021 | 86 | ||||||||||||||||||||||

| Provision for income tax / income tax expense |

24,917 | (1,020 | ) | 592 | (250 | ) | 26,279 | 1,692 | 27,971 | 28 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net income / Cash Earnings |

50,378 | (1,747 | ) | 1,102 | — | 53,227 | 4,823 | 58,050 | 58 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Average Volumes (US$m, Rounded US$b) |

||||||||||||||||||||||||||||||||

| Gross loans and acceptances |

6,670 | — | 17 | — | 6,687 | 6,687 | 6.7 | |||||||||||||||||||||||||

| Interest earning assets |

8,140 | — | (76 | ) | — | 8,064 | 8,064 | 8.1 | ||||||||||||||||||||||||

| Customer deposits |

7,086 | — | — | — | 7,086 | 7,086 | 7.1 | |||||||||||||||||||||||||

| Performance Measures |

||||||||||||||||||||||||||||||||

| Net interest margin |

4.07 | % | 3.69 | % | ||||||||||||||||||||||||||||

| Cost to income ratio |

49.5 | % | ||||||||||||||||||||||||||||||

| (1) | Australian Accounting Standards (AAS) as issued by the Australian Accounting Standards Board complying with International Financial Reporting Standards as issued by the International Accounting Standards Board. |

| (2) | Income statement has been reordered to the standard Australian presentation only affecting subtotals. |

| (3) | Represents the parent company only US GAAP results of Great Western Bancorp, Inc. or its predecessor, Great Western Bancorporation, Inc. |

| (4) | Represents differences in application of accounting standards between US GAAP and AAS, primarily related to the periodic revaluations of assets acquired from TierOne Bank in 2010. Within average volumes, amounts on deposit with other financial institutions are not included in interest earning assets in the AAS presentation. |

| (5) | Certain items are presented in different income statement line items under US GAAP compared to AAS. These items net to zero. |

| (6) | Non-cash items under the AAS basis include the amortisation of acquisition-related intangible assets, net of tax. |

Great Western Bancorp, Inc. US GAAP to Australian Accounting Standards (AAS)(1) Reconciliation (USD, Unaudited) for the six months ended 31 March 2014

| US GAAP Consolidated(2) (US$‘000) |

Less: Holding Company(3) (US$‘000) |

Add: US GAAP / AAS Differences(4) (US$‘000) |

Income Statement Classification(5) (US$‘000) |

AAS GWB Net Income (US$‘000) |

Less: Non-cash items(6) (US$‘000) |

AAS GWB Cash Earnings (US$‘000) |

AAS GWB Cash Earnings (Rounded) (US$m) |

|||||||||||||||||||||||||

| Net interest income |

148,041 | (1,042 | ) | 4,121 | (2,885 | ) | 150,319 | (466 | ) | 149,853 | 150 | |||||||||||||||||||||

| Non interest income / other operating income |

28,945 | — | (59 | ) | 2,137 | 31,023 | 31,023 | 31 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total revenue / operating income |

176,986 | (1,042 | ) | 4,062 | (748 | ) | 181,342 | (466 | ) | 180,876 | 181 | |||||||||||||||||||||

| Non interest expense / other operating expense |

96,547 | 1,706 | (244 | ) | (698 | ) | 93,899 | (9,379 | ) | 84,520 | 85 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Underlying profit |

80,439 | (2,748 | ) | 4,306 | (50 | ) | 87,443 | 8,913 | 96,356 | 96 | ||||||||||||||||||||||

| Provision for loan losses / charge to provide for bad and doubtful debts |

(3,565 | ) | — | 5,873 | — | 2,308 | 2,308 | 2 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Income before taxes |

84,004 | (2,748 | ) | (1,567 | ) | (50 | ) | 85,135 | 8,913 | 94,048 | 94 | |||||||||||||||||||||

| Provision for income tax / income tax expense |

29,430 | (972 | ) | (548 | ) | (50 | ) | 29,804 | 1,692 | 31,496 | 31 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net income / Cash Earnings |

54,574 | (1,776 | ) | (1,019 | ) | — | 55,331 | 7,221 | 62,552 | 63 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Average Volumes (US$m, Rounded US$b) |

||||||||||||||||||||||||||||||||

| Gross loans and acceptances |

6,443 | — | 19 | — | 6,462 | 6,462 | 6.5 | |||||||||||||||||||||||||

| Interest earning assets |

8,049 | — | (198 | ) | — | 7,851 | 7,851 | 7.9 | ||||||||||||||||||||||||

| Customer deposits |

7,123 | — | — | — | 7,123 | 7,123 | 7.1 | |||||||||||||||||||||||||

| Performance Measures |

||||||||||||||||||||||||||||||||

| Net interest margin |

3.69 | % | 3.81 | % | ||||||||||||||||||||||||||||

| Cost to income ratio |

47.0 | % | ||||||||||||||||||||||||||||||

| (1) | Australian Accounting Standards (AAS) as issued by the Australian Accounting Standards Board complying with International Financial Reporting Standards as issued by the International Accounting Standards Board. |

| (2) | Income statement has been reordered to the standard Australian presentation only affecting subtotals. |

| (3) | Represents the parent company only US GAAP results of Great Western Bancorp, Inc. or its predecessor, Great Western Bancorporation, Inc. |

| (4) | Represents differences in application of accounting standards between US GAAP and AAS, primarily related to the periodic revaluations of assets acquired from TierOne Bank in 2010. Within average volumes, amounts on deposit with other financial institutions are not included in interest earning assets in the AAS presentation. |

| (5) | Certain items are presented in different income statement line items under US GAAP compared to AAS. These items net to zero. |

| (6) | Non-cash items under the AAS basis include the amortisation of acquisition-related intangible assets, net of tax. |

Great Western Bancorp, Inc. Announces Fiscal Year 2014 Fourth

Quarter and Full-Year Financial Results

Financial Highlights

| • | Fourth quarter net income rose 6% to $27.9 million, or $0.48 per share, compared to the same quarter in fiscal year 2013 |

| • | Noninterest expense management drove an adjusted efficiency ratio1 of 49.0% for the quarter |

| • | Asset quality continued to improve, with a $50.1 million reduction in nonperforming loans to $78.9 million and OREO down $7.8 million to $49.6 million over the last 12 months |

| • | Total loans grew 6.7% to $6.79 billion over the last 12 months targeted within the business and agribusiness segments of the portfolio |

| • | Full-year net income increased 9% to $105.0 million, or $1.81 per share, compared to fiscal year 2013 |

Great Western Bancorp, Inc. (NYSE: GWB) today reported net income of $27.9 million, or $0.48 per share, for the quarter ended September 30, 2014, an improvement of 6% from $26.3 million, or $0.46 per share, in the same quarter of fiscal year 2013. The higher net income was primarily due to targeted management of noninterest expense and improved net interest income, partially offset by provisions for loan losses and lower noninterest income.

“We are pleased with this strong finish to a successful fiscal year 2014. During the quarter, we preserved the momentum we carried throughout the fiscal year,” said Ken Karels, President and Chief Executive Officer of Great Western Bancorp, Inc. “The impact of our strategies drove positive results in fiscal year 2014. Asset quality continued to improve. The aggregate growth in our loan portfolio reflected our diversification and strengths in C&I, commercial real estate and agribusiness lending. We made additional progress managing our deposit portfolio toward the goal of lowering our cost of funds. We took important steps in fiscal year 2014 to further optimize our footprint, rationalizing our branch network in Nebraska and developing important growth markets such as Colorado and Arizona. Our brand promise of ‘big-bank capability with small-bank service,’ our commitment to efficiency and our disciplined focus on specific markets is ideally suited to our customers and creating a strong platform for long-term growth.”

Fiscal Year 2014 Results

For fiscal year 2014, net income rose 9% to $105.0 million, or $1.81 per share, from $96.2 million, or $1.66 per share, during fiscal year 2013. The increase was driven by management’s focus on noninterest expenses, other than expenses related to the fair value of derivatives, and continued improvements in overall asset quality. This led to a $5.3 million decline in adjusted noninterest expenses1 (total noninterest expenses were up 26% driven by changes in the fair value of derivative contracts fully offset in interest income) and a $10.9 million year-over-year reduction in provision for loan losses, partially offset by a significant decrease in noninterest income reflecting slower home mortgage originations.

| 1 | This is a non-GAAP measure management believes is helpful to understanding trends in the business that may not be fully apparent based only on the most comparable GAAP measure. Further information on this measure and a reconciliation to the most comparable GAAP measure is provided at the end of this document. |

1

Net Interest Income and Net Interest Margin

Net interest income increased $1.8 million, or 2%, from $74.9 million for the fourth quarter of fiscal year 2013 to $76.6 million for the fourth quarter of fiscal year 2014. Over the same period, adjusted net interest income1 increased $3.3 million, or 4%. Net interest income rose $59.0 million, or 23%, from $255.1 million for fiscal year 2013 to $314.1 million for fiscal year 2014. Over the same period, adjusted net interest income1 improved $6.8 million, or 2%. The difference between adjusted net interest income and net interest income reflects the amount of fair value adjustment related to interest rates on loans for which we have elected the fair value option, which is offset by corresponding changes in the fair value of the related interest rate swaps in noninterest expense. The increases in quarterly and annual adjusted net interest income were driven by loan portfolio growth through fiscal year 2014 and a reduction in total funding cost, primarily related to transition in the deposit portfolio away from time deposits toward more cost-effective transaction accounts, partially offset by reduced asset yields.

Adjusted net interest margin1 was 3.73%, 3.77% and 3.68%, respectively, for the quarters ended September 30, 2014, June 30, 2014, and September 30, 2013, while net interest margin fluctuated at 3.72%, 4.43% and 3.75%, respectively, for the same periods, again with volatility due to fair value changes. Loan yields continue to be pressured by pricing competition for high-quality credits. However, adjusted net interest margin has remained stable due to a six basis point reduction in cost of deposits between the fourth quarter of fiscal year 2013 and the fourth quarter of fiscal year 2014 and a change in asset mix. Adjusted net interest margin1 was 3.73% and 3.76%, respectively, for fiscal year 2014 and fiscal year 2013, while net interest margin was 3.88% and 3.24%, respectively.

Loan growth for the fiscal year ended September 30, 2014 was $424.8 million, or 6.7%, compared to September 30, 2013 and $109.0 million compared to June 30, 2014. The majority of the growth for the fiscal year occurred in targeted commercial real estate, commercial non-real estate (or C&I) and agribusiness segments of the portfolio, consistent with strategy. Deposits grew 1% compared to September 30, 2013, with certificates of deposit comprising 25% of average deposit balances for the fourth quarter of fiscal year 2014 compared to 32% for the fourth quarter of fiscal year 2013.

Provision for Loan Losses and Asset Quality

Provision for loan losses was $2.7 million for the quarter ended September 30, 2014, compared to a release of $2.5 million of provision for loan losses for the same quarter of fiscal year 2013. However, provision for loan losses was $0.7 million for fiscal year 2014, a decrease of 94% compared to $11.6 million for fiscal year 2013. The lower provision was driven by continued improvements in asset quality.

At September 30, 2014, nonperforming loans were $78.9 million compared to $129.0 million at September 30, 2013, a 39% improvement, with $35.0 million of the balance at September 30, 2014, covered by FDIC loss-sharing arrangements. OREO balances improved by approximately 14%, declining from $57.4 million at September 30, 2013 to $49.6 million at September 30, 2014, with $10.6 million of this balance covered by FDIC loss-sharing arrangements. Net charge-offs were $2.3 million for the fourth quarter of fiscal year 2014 compared to $11.9 million for the fourth quarter of fiscal year 2013 translating to net charge-offs to average loans of 0.14% for fiscal year 2014 compared to 0.44% for fiscal year 2013.

Noninterest Income

Noninterest income was $14.9 million for the quarter ended September 30, 2014, a 15% decrease compared to the same quarter in fiscal year 2013, reflecting lower mortgage volumes. Noninterest income

2

was $58.1 million for fiscal year 2014 compared to $74.9 million during fiscal year 2013, again reflecting lower mortgage volumes (primarily lower refinance volumes) and a reduction in recoveries realized on acquired assets shared with the FDIC under loss-sharing arrangements, consistent with the run-off of that portion of the portfolio.

Noninterest Expense

Total noninterest expense was $48.1 million for the quarter ended September 30, 2014, a reduction of 11% compared to $54.3 million for the same quarter in fiscal year 2013. Adjusted noninterest expense1 was $45.6 million for the fourth quarter of fiscal year 2014 compared to $48.3 million for the fourth quarter of fiscal year 2013, a reduction of 6%. In each case, the reduction was driven by lower salaries and employee benefits, occupancy expenses and professional fees, leading to an adjusted efficiency ratio1 of 49.0% for the quarter ended September 30, 2014, compared to 52.4% for the same quarter in fiscal year 2013.

Total noninterest expense for the fiscal year was $212.1 million, an increase of 26% compared to fiscal year 2013. Adjusted for changes in fair value of interest rate swaps offset in net interest income and amortization of intangible assets, adjusted noninterest expense1 for the full fiscal year was $184.0 million, a 3% decrease compared to $189.3 million for fiscal year 2013, driven primarily by a 6% reduction in salaries and employee benefits related to streamlining the retail management structure and right-sizing the branch footprint.

Capital

Great Western Bancorporation, Inc., the predecessor of Great Western Bancorp, Inc., declared and paid a dividend of $34.0 million to a subsidiary of National Australia Bank in September 2014 related to earnings for fiscal year 2014.

Tier 1 and total capital ratios were 11.8% and 12.9%, respectively, at September 30, 2014, compared to 12.4% and 13.8%, respectively, at September 30, 2013. In each case, the change reflects the timing of the dividend noted previously which was accelerated to be completed prior to the initial public offering on October 20, 2014.

Business Outlook

“The current business environment presents both opportunities and challenges as we move into fiscal year 2015,” added Karels. “Persistent lower interest rates continue to drive fierce competition for lending growth, and we expect the outstanding balance of our total loans to be relatively flat in the first quarter of fiscal year 2015. We also recorded a $0.9 million reversal of provision for loan losses in the first quarter of fiscal year 2014 and do not expect a similar reversal in the first quarter of fiscal year 2015. However, longer-term our loan portfolio diversification will be key to our strategy going forward and we believe we have the right exposure to the right sectors, supported by the right approach to serving customers, to create solid long-term growth opportunity. Our focus remains on efficiency, managing our cost of funds and optimizing our footprint for growth.”

Conference Call

Great Western Bancorp, Inc. will host a conference call to discuss its financial results for the fourth quarter and full-year fiscal year 2014 on Thursday, November 20, 2014 at 7:30 AM (CT). The call can be

3

accessed by dialing (888) 317-6016 approximately 10 minutes prior to the start time. Please ask to be joined into the Great Western Bancorp, Inc. (GWB) call. International callers should dial (412) 317-6016. The call will also be broadcast live over the Internet and can be accessed in the Investor Relations section of Great Western’s website at www.greatwesternbank.com. A replay will be available beginning one hour following the conference call and ending on December 03, 2014. To access the replay, dial (877) 344-7529 (U.S) and use conference ID #10055627. International callers should dial (412) 317-0088 and enter the same conference ID number.

About Great Western Bancorp, Inc.

Great Western Bancorp, Inc. is the holding company for Great Western Bank, a full-service regional bank focused on relationship-based business and agribusiness banking. Great Western Bank offers small and mid-sized businesses a focused suite of financial products and a range of deposit and loan products to retail customers through several channels, including the branch network, online banking system, mobile banking applications and customer care centers. The bank services its customers through 162 branches in seven states: South Dakota, Iowa, Nebraska, Colorado, Arizona, Kansas and Missouri. To learn more about Great Western Bank visit www.greatwesternbank.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements about Great Western’s expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipates,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends” and similar words or phrases. In particular, the statements included in this press release concerning Great Western’s expected performance and strategy, and the interest rate environment, in fiscal year 2015 are not historical facts and are forward-looking. Accordingly, the forward-looking statements in this press release are only predictions and involve estimates, known and unknown risks, assumptions and uncertainties that could cause actual results to differ materially from those expressed. All forward-looking statements are necessarily only estimates of future results, and there can be no assurance that actual results will not differ materially from expectations, and, therefore, you are cautioned not to place undue reliance on such statements. Any forward-looking statements are qualified in their entirety by reference to the factors discussed in the section titled “Risk Factors” in Great Western’s Prospectus, dated October 14, 2014, included as part of the Registration Statement on Form S-1 filed in connection with Great Western’s initial public offering. Further, any forward-looking statement speaks only as of the date on which it is made, and Great Western undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

4

GREAT WESTERN BANCORP, INC.

CONSOLIDATED FINANCIAL DATA (Unaudited)

| At and for the three months ended | At and for the fiscal year ended | |||||||||||||||||||

| Sept. 30, 2014 |

June 30, 2014 |

Sept. 30, 2013 |

Sept. 30, 2014 |

Sept. 30, 2013 |

||||||||||||||||

| (dollars in thousands except per share amounts) | ||||||||||||||||||||

| Operating Data: |

||||||||||||||||||||

| Interest and dividend income |

$ | 84,361 | $ | 97,164 | $ | 83,698 | $ | 346,125 | $ | 294,257 | ||||||||||

| Interest expense |

7,715 | 7,778 | 8,812 | 32,052 | 39,161 | |||||||||||||||

| Noninterest income |

14,884 | 14,225 | 17,526 | 58,054 | 74,904 | |||||||||||||||

| Noninterest expense |

48,121 | 67,476 | 54,333 | 212,144 | 168,285 | |||||||||||||||

| Provision for loan losses |

2,749 | 1,500 | (2,460 | ) | 684 | 11,574 | ||||||||||||||

| Net income |

27,875 | 22,503 | 26,323 | 104,952 | 96,243 | |||||||||||||||

| EPS |

$ | 0.48 | $ | 0.39 | $ | 0.46 | $ | 1.81 | $ | 1.66 | ||||||||||

| Performance Ratios: |

||||||||||||||||||||

| Net interest margin |

3.72 | % | 4.43 | % | 3.75 | % | 3.88 | % | 3.24 | % | ||||||||||

| Adjusted net interest margin(1) |

3.73 | % | 3.77 | % | 3.68 | % | 3.73 | % | 3.76 | % | ||||||||||

| Return on average total assets |

1.19 | % | 0.98 | % | 1.15 | % | 1.14 | % | 1.07 | % | ||||||||||

| Return on average common equity |

7.69 | % | 6.25 | % | 7.46 | % | 7.34 | % | 6.97 | % | ||||||||||

| Return on average tangible common equity(1) |

16.3 | % | 14.2 | % | 17.9 | % | 16.6 | % | 17.5 | % | ||||||||||

| Adjusted efficiency ratio(1) |

49.0 | % | 54.8 | % | 52.4 | % | 50.4 | % | 50.6 | % | ||||||||||

| Capital: |

||||||||||||||||||||

| Tier 1 capital ratio |

11.8 | % | 12.1 | % | 12.4 | % | 11.8 | % | 12.4 | % | ||||||||||

| Total capital ratio |

12.9 | % | 13.1 | % | 13.8 | % | 12.9 | % | 13.8 | % | ||||||||||

| Tier 1 leverage ratio |

9.1 | % | 9.3 | % | 9.2 | % | 9.1 | % | 9.2 | % | ||||||||||

| Tangible common equity / tangible assets(1) |

8.2 | % | 8.3 | % | 8.2 | % | 8.2 | % | 8.2 | % | ||||||||||

| Asset Quality: |

||||||||||||||||||||

| Nonperforming loans |

78,905 | 80,838 | 129,000 | 78,905 | 129,000 | |||||||||||||||

| OREO |

49,580 | 54,190 | 57,422 | 49,580 | 57,422 | |||||||||||||||

| Nonperforming loans / total loans |

1.16 | % | 1.21 | % | 2.03 | % | 1.16 | % | 2.03 | % | ||||||||||

| Net charge-offs |

2,269 | 1,615 | 11,927 | 9,030 | 27,588 | |||||||||||||||

| Net charge-offs / average total loans |

0.13 | % | 0.10 | % | 0.76 | % | 0.14 | % | 0.44 | % | ||||||||||

| Allowance for loan losses / total loans |

0.70 | % | 0.70 | % | 0.88 | % | 0.70 | % | 0.88 | % | ||||||||||

| (1) | This is a non-GAAP financial measure we believe is helpful to interpreting our financial results. See the table at the end of this document for the calculation of the measure and reconciliation to the most comparable GAAP measure. |

5

GREAT WESTERN BANCORP, INC.

CONSOLIDATED FINANCIAL DATA (Unaudited)

| At and for the three months ended | At and for the fiscal year ended | |||||||||||||||||||

| Sept. 30, 2014 |

June 30, 2014 |

Sept. 30, 2013 |

Sept. 30, 2014 |

Sept. 30, 2013 |

||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||

| Income Statement |

||||||||||||||||||||

| Interest and dividend income |

$ | 84,361 | $ | 97,164 | $ | 83,698 | $ | 346,125 | $ | 294,257 | ||||||||||

| Interest expense |

7,715 | 7,778 | 8,812 | 32,052 | 39,161 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income |

76,646 | 89,386 | 74,886 | 314,073 | 255,096 | |||||||||||||||

| Provision for loan losses |

2,749 | 1,500 | (2,460 | ) | 684 | 11,574 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest income after provision for loan losses |

73,897 | 87,886 | 77,346 | 313,389 | 243,522 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Noninterest income |

||||||||||||||||||||

| Service charges and other fees |

10,477 | 9,695 | 10,765 | 40,204 | 41,692 | |||||||||||||||

| Net gain on sale of loans |

1,653 | 1,323 | 2,616 | 5,539 | 13,724 | |||||||||||||||

| Casualty insurance commissions |

196 | 321 | 472 | 1,073 | 1,426 | |||||||||||||||

| Investment center income |

660 | 577 | 1,087 | 2,417 | 3,137 | |||||||||||||||

| Net gain on sale of securities |

84 | — | (824 | ) | 90 | 917 | ||||||||||||||

| Trust department income |

891 | 942 | 944 | 3,738 | 3,545 | |||||||||||||||

| Other |

923 | 1,367 | 2,466 | 4,993 | 10,463 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total noninterest income |

14,884 | 14,225 | 17,526 | 58,054 | 74,904 | |||||||||||||||

| Noninterest expense |

||||||||||||||||||||

| Salaries and employee benefits |

$ | 23,928 | $ | 24,126 | $ | 24,536 | $ | 95,105 | $ | 100,660 | ||||||||||

| Occupancy expenses, net |

3,913 | 4,894 | 4,613 | 17,526 | 18,532 | |||||||||||||||

| Data processing |

5,442 | 4,354 | 5,231 | 19,548 | 18,980 | |||||||||||||||

| Equipment expenses |

1,251 | 1,077 | 1,158 | 4,350 | 4,518 | |||||||||||||||

| Advertising |

1,360 | 1,213 | 1,584 | 4,746 | 6,267 | |||||||||||||||

| Communication expenses |

1,108 | 1,046 | 1,024 | 4,510 | 4,609 | |||||||||||||||

| Professional fees |

2,609 | 3,620 | 3,692 | 12,233 | 12,547 | |||||||||||||||

| Derivatives, net (gain) loss |

(197 | ) | 13,197 | 1,330 | 11,922 | (40,305 | ) | |||||||||||||

| Net (gain) loss from sale of repossessed property and other assets |

(37 | ) | (1,564 | ) | (553 | ) | (2,451 | ) | (2,788 | ) | ||||||||||

| Amortization of core deposits and other intangibles |

2,768 | 4,069 | 4,690 | 16,216 | 19,290 | |||||||||||||||

| Other |

5,976 | 11,444 | 7,028 | 28,439 | 25,975 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total noninterest expense |

48,121 | 67,476 | 54,333 | 212,144 | 168,285 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income taxes |

40,660 | 34,635 | 40,539 | 159,299 | 150,141 | |||||||||||||||

| Provision for income taxes |

12,785 | 12,132 | 14,216 | 54,347 | 53,898 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 27,875 | $ | 22,503 | $ | 26,323 | $ | 104,952 | $ | 96,243 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

6

GREAT WESTERN BANCORP, INC.

CONSOLIDATED FINANCIAL DATA (Unaudited)

| Sept. 30, 2014 | June 30, 2014 | Sept. 30, 2013 | ||||||||||

| (dollars in thousands) | ||||||||||||

| Summarized Balance Sheet |

||||||||||||

| Assets |

||||||||||||

| Cash and due from banks |

$ | 256,639 | $ | 235,077 | $ | 282,157 | ||||||

| Securities |

1,341,242 | 1,395,768 | 1,480,449 | |||||||||

| Total loans |

6,787,467 | 6,678,501 | 6,362,673 | |||||||||

| Allowance for loan losses |

(47,518 | ) | (47,038 | ) | (55,864 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Loans, net |

6,739,949 | 6,631,463 | 6,306,809 | |||||||||

| Goodwill and other intangible assets |

712,036 | 714,803 | 728,251 | |||||||||

| Other assets |

321,563 | 315,172 | 336,592 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total assets |

$ | 9,371,429 | $ | 9,292,283 | $ | 9,134,258 | ||||||

|

|

|

|

|

|

|

|||||||

| Liabilities and stockholder’s equity |

||||||||||||

| Noninterest-bearing deposits |

$ | 1,303,015 | $ | 1,294,131 | $ | 1,199,427 | ||||||

| Interest-bearing deposits |

5,749,165 | 5,772,981 | 5,748,781 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total deposits |

7,052,180 | 7,067,112 | 6,948,208 | |||||||||

| Securities sold under agreements to repurchase |

161,687 | 185,620 | 217,562 | |||||||||

| FHLB advances and other borrowings |

575,094 | 435,097 | 390,607 | |||||||||

| Other liabilities |

161,378 | 173,490 | 160,667 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities |

7,950,339 | 7,861,319 | 7,717,044 | |||||||||

| Stockholder’s equity |

1,421,090 | 1,430,964 | 1,417,214 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities and stockholder’s equity |

$ | 9,371,429 | $ | 9,292,283 | $ | 9,134,258 | ||||||

|

|

|

|

|

|

|

|||||||

GREAT WESTERN BANCORP, INC.

CONSOLIDATED FINANCIAL DATA (Unaudited)

| Sept. 30, 2014 |

Sept. 30, 2013 |

Change ($) |

Change (%) |

|||||||||||||

| (dollars in thousands) | ||||||||||||||||

| Loan Portfolio Summary |

||||||||||||||||

| Commercial non-real estate |

$ | 1,571,122 | $ | 1,481,756 | $ | 89,366 | 6.0 | % | ||||||||

| Agriculture |

1,681,209 | 1,587,248 | 93,961 | 5.9 | % | |||||||||||

| Construction and development |

314,000 | 294,314 | 19,686 | 6.7 | % | |||||||||||

| Owner-occupied CRE |

1,151,868 | 1,010,159 | 141,709 | 14.0 | % | |||||||||||

| Non-owner-occupied CRE |

922,395 | 820,916 | 101,479 | 12.4 | % | |||||||||||

| Multifamily residential real estate |

152,931 | 186,585 | (33,654 | ) | 18.0 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Commercial real estate |

2,541,194 | 2,311,974 | 229,220 | 9.9 | % | |||||||||||

| Residential real estate |

902,918 | 906,469 | (3,551 | ) | (0.4 | %) | ||||||||||

| Consumer |

90,086 | 101,477 | (11,391 | ) | (11.2 | %) | ||||||||||

| Other(1) |

33,448 | 24,711 | 8,737 | 35.4 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total unpaid principal balance |

$ | 6,819,977 | $ | 6,413,635 | $ | 406,342 | 6.3 | % | ||||||||

| Less: Unamortized discount on acquired loans and unearned net deferred fees and costs and loans in process |

(32,510 | ) | (50,962 | ) | 18,452 | (35.2 | )% | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total unpaid principal balance |

$ | 6,787,467 | $ | 6,362,673 | $ | 424,794 | 6.7 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Other loans primarily include consumer and commercial credit cards and customer deposit account overdrafts. |

7

GREAT WESTERN BANCORP, INC.

CONSOLIDATED FINANCIAL DATA

(Unaudited)

| For the three months ended | ||||||||||||||||||||||||||||||||||||

| September 30, 2014 | June 30, 2014 | September 30, 2013 | ||||||||||||||||||||||||||||||||||

| Net Interest Margin (dollars in thousands) | Average Balance |

Interest | Yields /Rates |

Average Balance |

Interest | Yields /Rates |

Average Balance |

Interest | Yields /Rates |

|||||||||||||||||||||||||||

| Assets: |

||||||||||||||||||||||||||||||||||||

| Cash and due from banks |

$ | 80,815 | $ | 56 | 0.27 | % | $ | 119,970 | $ | 99 | 0.33 | % | $ | 75,073 | $ | 74 | 0.39 | % | ||||||||||||||||||

| Investment securities |

1,403,371 | 6,408 | 1.81 | % | 1,428,407 | 6,982 | 1.96 | % | 1,589,761 | 7,957 | 1.99 | % | ||||||||||||||||||||||||

| Loans, other than acquired with deteriorated credit quality, net |

6,527,721 | 76,388 | 4.64 | % | 6,362,850 | 88,531 | 5.58 | % | 6,024,403 | 74,453 | 4.90 | % | ||||||||||||||||||||||||

| Loans acquired with deteriorated credit quality, net |

169,287 | 1,509 | 3.54 | % | 186,825 | 1,552 | 3.33 | % | 241,630 | 1,214 | 1.99 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Loans, net |

6,697,008 | 77,897 | 4.61 | % | 6,549,675 | 90,083 | 5.52 | % | 6,266,033 | 75,667 | 4.79 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total interest-earning assets |

8,181,194 | 84,361 | 4.09 | % | 8,098,052 | 97,164 | 4.81 | % | 7,930,867 | 83,698 | 4.19 | % | ||||||||||||||||||||||||

| Other noninterest-earning assets |

1,125,205 | 1,146,314 | 1,171,020 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total Assets |

$ | 9,306,399 | $ | 84,361 | 3.60 | % | $ | 9,244,366 | $ | 97,164 | 4.22 | % | $ | 9,101,887 | $ | 83,698 | 3.65 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Liabilities and Equity: |

||||||||||||||||||||||||||||||||||||

| Non-interest demand deposits |

$ | 1,270,967 | $ | 1,232,316 | $ | 1,172,690 | ||||||||||||||||||||||||||||||

| NOW, MMDA and savings deposits |

3,980,578 | $ | 2,387 | 0.24 | % | 4,048,428 | $ | 2,376 | 0.24 | % | 3,494,212 | $ | 1,825 | 0.21 | % | |||||||||||||||||||||

| CDs |

1,779,503 | 3,749 | 0.84 | % | 1,860,094 | 3,943 | 0.85 | % | 2,211,758 | 5,317 | 0.95 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total deposits |

7,031,048 | 6,136 | 0.35 | % | 7,140,838 | 6,319 | 0.35 | % | 6,878,660 | 7,142 | 0.41 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Securities sold under agreements to repurchase |

$ | 186,477 | $ | 158 | 0.34 | % | $ | 192,579 | $ | 153 | 0.32 | % | $ | 231,476 | $ | 155 | 0.27 | % | ||||||||||||||||||

| FHLB advances and other borrowings |

490,360 | 860 | 0.70 | % | 311,430 | 752 | 0.97 | % | 427,028 | 946 | 0.88 | % | ||||||||||||||||||||||||

| Related party notes payable |

41,295 | 231 | 2.22 | % | 41,295 | 229 | 2.22 | % | 41,295 | 236 | 2.27 | % | ||||||||||||||||||||||||

| Subordinated debentures and other |

56,083 | 330 | 2.33 | % | 56,083 | 325 | 2.32 | % | 56,083 | 333 | 2.36 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total borrowings |

774,215 | 1,579 | 0.81 | % | 601,387 | 1,459 | 0.97 | % | 755,882 | 1,670 | 0.88 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Total interest-bearing liabilities |

7,805,263 | 7,715 | 0.39 | % | 7,742,225 | 7,778 | 0.40 | % | 7,634,542 | 8,812 | 0.46 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Noninterest-bearing other liabilities |

62,174 | 57,044 | 66,710 | |||||||||||||||||||||||||||||||||

| Equity |

1,438,962 | 1,445,097 | 1,400,635 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Total Liabilities and Equity |

$ | 9,306,399 | $ | 9,244,366 | $ | 9,101,887 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Net interest spread |

3.20 | % | 3.81 | % | 3.19 | % | ||||||||||||||||||||||||||||||

| Net interest income and net interest margin |

$ | 76,646 | 3.72 | % | $ | 89,386 | 4.43 | % | $ | 74,886 | 3.75 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Adjusted net interest income and adjusted net interest margin(1) |

$ | 76,843 | 3.73 | % | $ | 76,189 | 3.77 | % | $ | 73,556 | 3.68 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| Adjusted interest income and adjusted yield on Loans, other than acquired with deteriorated credit quality, net(1) |

$ | 76,585 | 4.65 | % | $ | 75,334 | 4.75 | % | $ | 73,123 | 4.82 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

| (1) | These are non-GAAP financial measures we believe are helpful to interpreting our financial results. See the table at the end of this document for the calculation of the measures and reconciliation to the most comparable GAAP measures. |

8

GREAT WESTERN BANCORP, INC.

CONSOLIDATED FINANCIAL DATA

(Unaudited)

| Fiscal year ended September 30, | ||||||||||||||||||||||||

| 2014 | 2013 | |||||||||||||||||||||||

| Net Interest Margin (dollars in thousands) | Average Balance |

Interest | Yields/ Rates |

Average Balance |

Interest | Yields/ Rates |

||||||||||||||||||

| Assets: |

||||||||||||||||||||||||

| Cash and due from banks |

$ | 167,982 | $ | 455 | 0.27 | % | $ | 132,517 | $ | 336 | 0.25 | % | ||||||||||||

| Investment securities |

1,419,354 | 27,411 | 1.93 | % | 1,575,343 | 29,588 | 1.88 | % | ||||||||||||||||

| Loans, other than acquired with deteriorated credit quality, net |

6,311,857 | 312,424 | 4.95 | % | 5,876,116 | 249,527 | 4.25 | % | ||||||||||||||||

| Loans acquired with deteriorated credit quality, net |

194,668 | 5,835 | 3.00 | % | 278,884 | 14,806 | 5.31 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Loans, net |

6,506,525 | 318,259 | 4.89 | % | 6,155,000 | 264,333 | 4.29 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total interest-earning assets |

8,093,861 | 346,125 | 4.28 | % | 7,862,860 | 294,257 | 3.74 | % | ||||||||||||||||

| Other noninterest-earning assets |

1,149,957 | 1,158,231 | ||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Total Assets |

$ | 9,243,818 | $ | 346,125 | 3.74 | % | $ | 9,021,091 | $ | 294,257 | 3.26 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Liabilities and Equity: |

||||||||||||||||||||||||

| Non-interest demand deposits |

$ | 1,242,097 | $ | 1,159,581 | ||||||||||||||||||||

| NOW, MMDA and savings deposits |

3,952,765 | $ | 9,329 | 0.24 | % | 3,296,745 | $ | 6,921 | 0.21 | % | ||||||||||||||

| CDs |

1,909,269 | 16,435 | 0.86 | % | 2,447,553 | 26,196 | 1.07 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total deposits |

7,104,131 | 25,764 | 0.36 | % | 6,903,879 | 33,117 | 0.48 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Securities sold under agreements to repurchase |

193,901 | 600 | 0.31 | % | 230,516 | 644 | 0.28 | % | ||||||||||||||||

| FHLB advances and other borrowings |

356,915 | 3,452 | 0.97 | % | 328,976 | 3,103 | 0.94 | % | ||||||||||||||||

| Related party notes payable |

41,295 | 921 | 2.23 | % | 41,295 | 950 | 2.30 | % | ||||||||||||||||

| Subordinated debentures and other |

56,083 | 1,315 | 2.34 | % | 56,083 | 1,347 | 2.40 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total borrowings |

648,194 | 6,288 | 0.97 | % | 656,870 | 6,044 | 0.92 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total interest-bearing liabilities |

7,752,325 | 32,052 | 0.41 | % | 7,560,749 | 39,161 | 0.52 | % | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Noninterest-bearing other liabilities |

60,721 | 80,047 | ||||||||||||||||||||||

| Equity |

1,430,772 | 1,380,295 | ||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Total Liabilities and Equity |

$ | 9,243,818 | $ | 9,021,091 | ||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Net interest spread |

3.33 | % | 2.74 | % | ||||||||||||||||||||

| Net interest income and net interest margin |

$ | 314,073 | 3.88 | % | $ | 255,096 | 3.24 | % | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Adjusted net interest income and adjusted net interest margin(1) |

$ | 302,151 | 3.73 | % | $ | 295,401 | 3.76 | % | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Adjusted interest income and adjusted yield on Loans, other than acquired with deteriorated credit quality, net(1) |

$ | 300,502 | 4.76 | % | $ | 289,832 | 4.93 | % | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| (1) | These are non-GAAP financial measures we believe are helpful to interpreting our financial results. See the table at the end of this document for the calculation of the measures and reconciliation to the most comparable GAAP measures. |

9

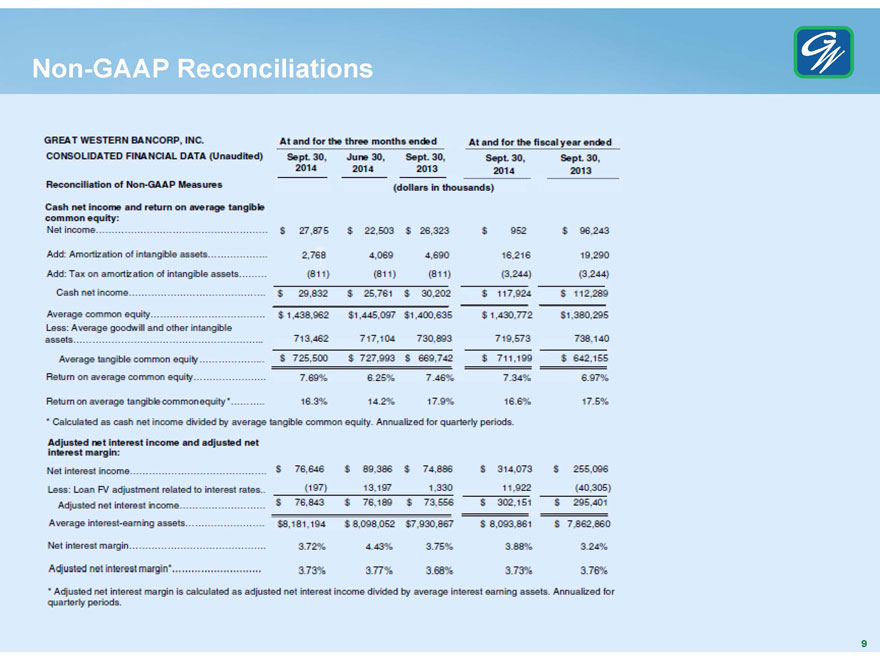

Non-GAAP Measures and Reconciliation

We rely on certain non-GAAP measures in making financial and operational decisions about our business which exclude certain items that we do not consider reflective of our business performance. We believe that each of the non-GAAP measures presented is helpful in highlighting trends in our business, financial condition and results of operations which might not otherwise be apparent when relying solely on our financial results calculated in accordance with U.S. generally accepted accounting principles, or GAAP.

In particular, we evaluate our profitability and performance based on our cash net income and return on average tangible common equity, each of which excludes the effects of amortization expense relating to intangible assets and related tax effects from the acquisition of us by National Australia Bank Limited and our acquisitions of other institutions. We believe these measures help highlight trends associated with our financial condition and results of operations by providing net income and return information based on our cash payments and receipts during the applicable period.

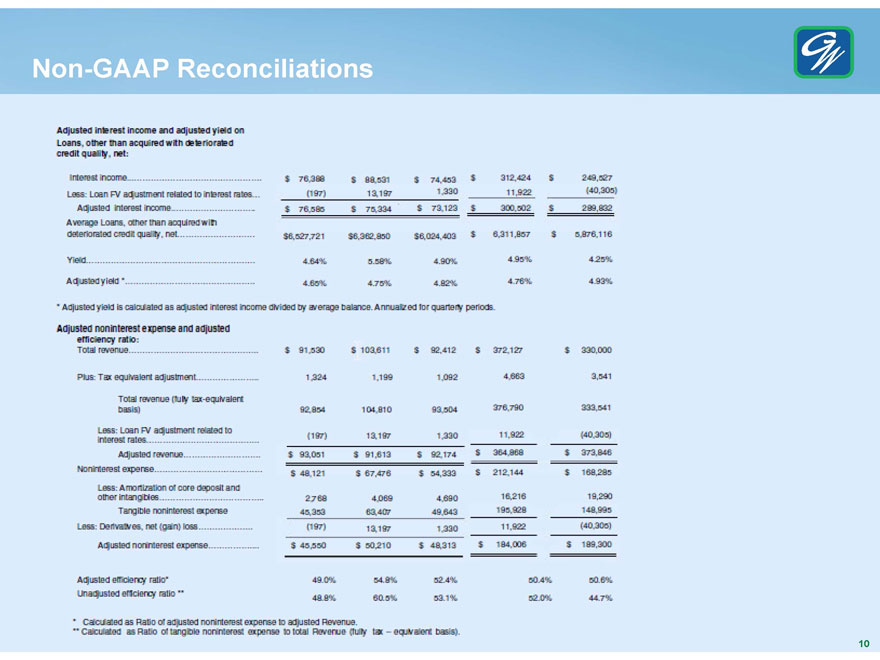

We also evaluate our profitability and performance based on our adjusted net interest income, adjusted interest income on loans other than acquired with deteriorated credit quality, adjusted noninterest expense, adjusted net interest margin and adjusted yield on loans other than acquired with deteriorated credit quality. Each of these measures excludes changes in fair value related to interest rates associated with certain of our fixed-rate loans measured at fair value and the matching fixed-to-floating interest rate swaps. We believe that these measures help highlight trends associated with our financial condition and results of operations by eliminating these matching and offsetting changes in fair value which, on a net basis, have no effect on our GAAP net income. Similarly, we evaluate our operational efficiency based on our adjusted efficiency ratio, which excludes the effects of changes in fair value discussed above as well as adjusted to exclude the effect of amortization of core deposit and other intangibles (a non-cash expense item) and to include the tax benefit associated with our tax-advantaged loans and investments.

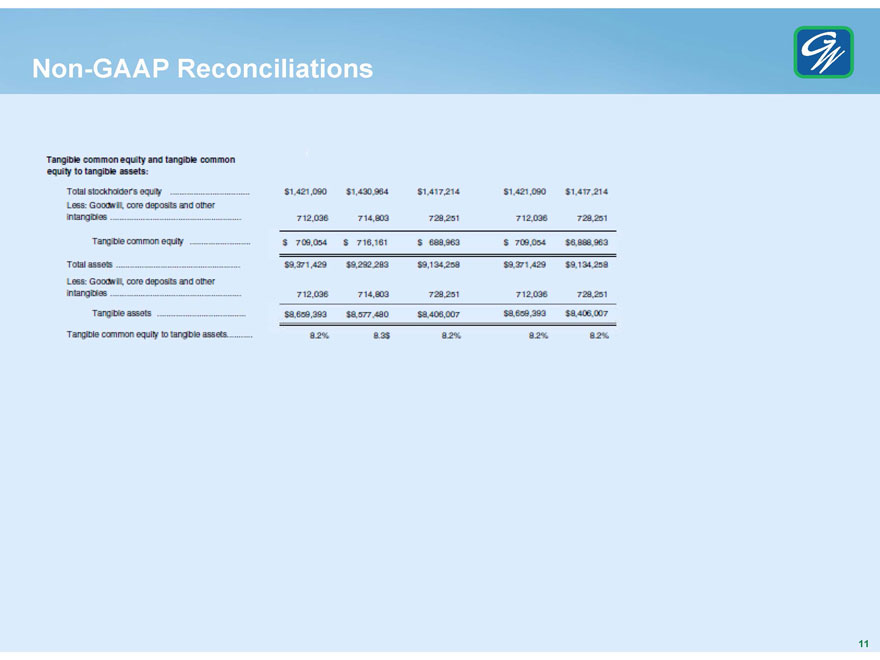

We evaluate our financial condition based on the ratio of our tangible common equity to our tangible assets. Our calculation of this ratio excludes the effect of our goodwill and other intangible assets. We believe this measure is helpful in highlighting the common equity component of our capital and because of its focus by federal bank regulators when reviewing the health and strength of financial institutions in recent years and when considering regulatory approvals for certain actions, including capital actions.

Reconciliations for each of these non-GAAP financial measures to the closest GAAP financial measures are included in the tables below. Each of the non-GAAP measures presented should be considered in context with our GAAP financial results included in this release.

GREAT WESTERN BANCORP, INC.

CONSOLIDATED FINANCIAL DATA (Unaudited)

| At and for the three months ended | At and for the fiscal year ended | |||||||||||||||||||

| Sept. 30, 2014 |

June 30, 2014 |

Sept. 30, 2013 |

Sept. 30, 2014 |

Sept. 30, 2013 |

||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||

| Reconciliation of Non-GAAP Measures |

||||||||||||||||||||

| Cash net income and return on average tangible common equity: |

||||||||||||||||||||

| Net income |

$ | 27,875 | $ | 22,503 | $ | 26,323 | $ | 952 | $ | 96,243 | ||||||||||

| Add: Amortization of intangible assets |

2,768 | 4,069 | 4,690 | 16,216 | 19,290 | |||||||||||||||

| Add: Tax on amortization of intangible assets |

(811 | ) | (811 | ) | (811 | ) | (3,244 | ) | (3,244 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash net income |

$ | 29,832 | $ | 25,761 | $ | 30,202 | $ | 117,924 | $ | 112,289 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average common equity |

$ | 1,438,962 | $ | 1,445,097 | $ | 1,400,635 | $ | 1,430,772 | $ | 1,380,295 | ||||||||||

| Less: Average goodwill and other intangible assets |

713,462 | 717,104 | 730,893 | 719,573 | 738,140 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average tangible common equity |

$ | 725,500 | $ | 727,993 | $ | 669,742 | $ | 711,199 | $ | 642,155 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Return on average common equity |

7.69 | % | 6.25 | % | 7.46 | % | 7.34 | % | 6.97 | % | ||||||||||

| Return on average tangible common equity * |

16.3 | % | 14.2 | % | 17.9 | % | 16.6 | % | 17.5 | % | ||||||||||

| * Calculated as cash net income divided by average tangible common equity. Annualized for quarterly periods. |

| |||||||||||||||||||

10

| Adjusted net interest income and adjusted net interest margin: |

||||||||||||||||||||

| Net interest income |

$ | 76,646 | $ | 89,386 | $ | 74,886 | $ | 314,073 | $ | 255,096 | ||||||||||

| Less: Loan FV adjustment related to interest rates |

(197 | ) | 13,197 | 1,330 | 11,922 | (40,305 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted net interest income |

$ | 76,843 | $ | 76,189 | $ | 73,556 | $ | 302,151 | $ | 295,401 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average interest-earning assets |

$ | 8,181,194 | $ | 8,098,052 | $ | 7,930,867 | $ | 8,093,861 | $ | 7,862,860 | ||||||||||

| Net interest margin |

3.72 | % | 4.43 | % | 3.75 | % | 3.88 | % | 3.24 | % | ||||||||||

| Adjusted net interest margin * |

3.73 | % | 3.77 | % | 3.68 | % | 3.73 | % | 3.76 | % | ||||||||||

| * Adjusted net interest margin is calculated as adjusted net interest income divided by average interest earning assets. Annualized for quarterly periods. |

| |||||||||||||||||||

| Adjusted interest income and adjusted yield on Loans, other than acquired with deteriorated credit quality, net: |

||||||||||||||||||||

| Interest income |

$ | 76,388 | $ | 88,531 | $ | 74,453 | $ | 312,424 | $ | 249,527 | ||||||||||

| Less: Loan FV adjustment related to interest rates |

(197 | ) | 13,197 | 1,330 | 11,922 | (40,305 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted interest income |

$ | 76,585 | $ | 75,334 | $ | 73,123 | $ | 300,502 | $ | 289,832 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Average Loans, other than acquired with deteriorated credit quality, net |

$ | 6,527,721 | $ | 6,362,850 | $ | 6,024,403 | $ | 6,311,857 | $ | 5,876,116 | ||||||||||

| Yield |

4.64 | % | 5.58 | % | 4.90 | % | 4.95 | % | 4.25 | % | ||||||||||

| Adjusted yield * |

4.65 | % | 4.75 | % | 4.82 | % | 4.76 | % | 4.93 | % | ||||||||||

| * Adjusted yield is calculated as adjusted interest income divided by average balance. Annualized for quarterly periods. | ||||||||||||||||||||

| Adjusted noninterest expense and adjusted efficiency ratio: |

||||||||||||||||||||

| Total revenue |

$ | 91,530 | $ | 103,611 | $ | 92,412 | $ | 372,127 | $ | 330,000 | ||||||||||

| Plus: Tax equivalent adjustment |

1,324 | 1,199 | 1,092 | 4,663 | 3,541 | |||||||||||||||

| Total revenue (fully tax-equivalent basis) |

92,854 | 104,810 | 93,504 | 376,790 | 333,541 | |||||||||||||||

| Less: Loan FV adjustment related to interest rates |

(197 | ) | 13,197 | 1,330 | 11,922 | (40,305 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted revenue |

$ | 93,051 | $ | 91,613 | $ | 92,174 | $ | 364,868 | $ | 373,846 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Noninterest expense |

$ | 48,121 | $ | 67,476 | $ | 54,333 | $ | 212,144 | $ | 168,285 | ||||||||||

| Less: Amortization of core deposit and other intangibles |

2,768 | 4,069 | 4,690 | 16,216 | 19,290 | |||||||||||||||

| Tangible noninterest expense |

45,353 | 63,407 | 49,643 | 195,928 | 148,995 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Less: Derivatives, net (gain) loss |

(197 | ) | 13,197 | 1,330 | 11,922 | (40,305 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted noninterest expense |

$ | 45,550 | $ | 50,210 | $ | 48,313 | $ | 184,006 | $ | 189,300 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted efficiency ratio * |

49.0 | % | 54.8 | % | 52.4 | % | 50.4 | % | 50.6 | % | ||||||||||

| Unadjusted efficiency ratio ** |

48.8 | % | 60.5 | % | 53.1 | % | 52.0 | % | 44.7 | % | ||||||||||

| * Calculated as ratio of adjusted noninterest expense to adjusted revenue. |

| |||||||||||||||||||

| ** Calculated as ratio of tangible noninterest expense to total revenue (fully tax-equivalent basis). |

| |||||||||||||||||||

11

| Tangible common equity and tangible common equity to tangible assets: |

||||||||||||||||||||

| Total stockholder’s equity |

$ | 1,421,090 | $ | 1,430,964 | $ | 1,417,214 | $ | 1,421,090 | $ | 1,417,214 | ||||||||||

| Less: Goodwill, core deposits and other intangibles |

712,036 | 714,803 | 728,251 | 712,036 | 728,251 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Tangible common equity |

$ | 709,054 | $ | 716,161 | $ | 688,963 | $ | 709,054 | $ | 6,888,963 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 9,371,429 | $ | 9,292,283 | $ | 9,134,258 | $ | 9,371,429 | $ | 9,134,258 | ||||||||||

| Less: Goodwill, core deposits and other intangibles |

712,036 | 714,803 | 728,251 | 712,036 | 728,251 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Tangible assets |

$ | 8,659,393 | $ | 8,577,480 | $ | 8,406,007 | $ | 8,659,393 | $ | 8,406,007 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Tangible common equity to tangible assets |

8.2 | % | 8.3 | % | 8.2 | % | 8.2 | % | 8.2 | % | ||||||||||

12

Great Western Bank

Member

FDIC

Making Life Great

BIG BANK

SMALL BANK

Earnings Release November 20, 2014

Bank where

Big enough & small enough meet.

Disclosures

Forward-Looking Statements: This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

Statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use

of words or phrases such as “anticipates,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,”

“plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends” and similar words or phrases. Accordingly, these statements are only predictions and involve estimates, known and unknown

risks, assumptions and uncertainties that could cause actual results to differ materially from those expressed. All forward-looking statements are necessarily only estimates of future results, and there can be no assurance that actual results will

not differ materially from expectations, and, therefore, you are cautioned not to place undue reliance on such statements. Any forward-looking statements are qualified in their entirety by reference to the factors discussed in the section titled

“Risk Factors” in our Prospectus, dated October 14, 2014, included as part of the Registration Statement on Form S-1 filed in connection with our initial public offering. Further, any forward-looking statement speaks only as of the date on

which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

Non-GAAP Financial Measures: This presentation contains non-GAAP measures which our management relies on in making financial and operational decisions about our business and which

exclude certain items that we do not consider reflective of our business performance. We believe that the presentation of these measures provides investors with greater transparency and supplemental data relating to our financial condition and

results of operations. These non-GAAP measures should be considered in context with our GAAP results. A reconciliation of these non-GAAP measures appears in our earnings release dated November 20, 2014 and in the appendix to this presentation. Our

earnings release and this presentation are available in the Investor Relations section of our website at www.greatwesternbank.com. Our earnings release and this presentation are also available as part of our Current Report on Form 8-K filed with the

SEC on November 20, 2014.

Explanatory Note: In this presentation, all financial information presented refers to the financial results of Great Western Bancorp,

Inc. combined with those of its predecessor, Great Western Bancorporation, Inc.

2

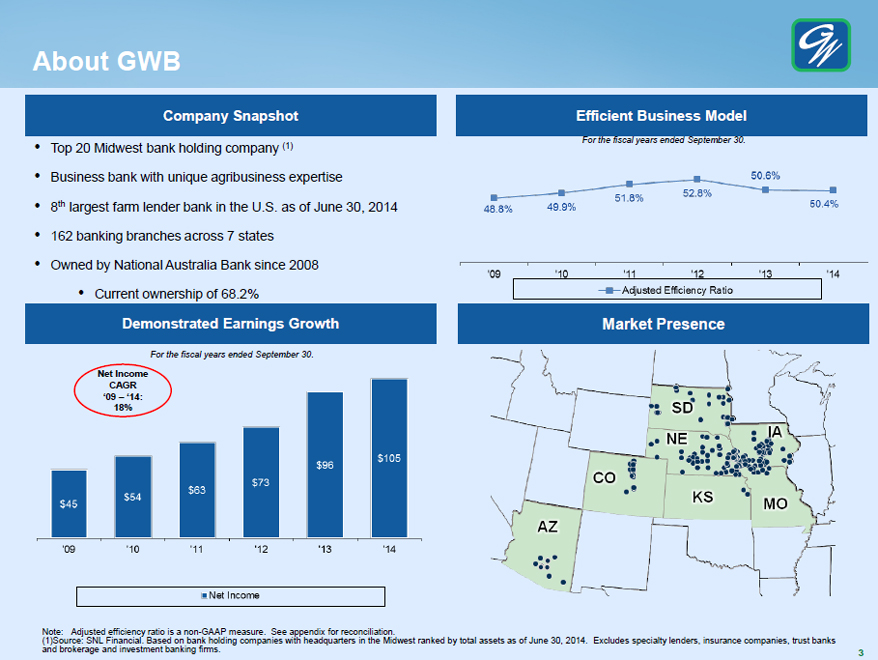

About GWB

Company

Snapshot

Top 20 Midwest bank holding company (1)

Business bank with unique

agribusiness expertise

8th largest farm lender bank in the U.S. as of June 30, 2014

162 banking branches across 7 states

Owned by National Australia Bank since 2008

Current ownership of 68.2%

Efficient Business Model

For the fiscal years ended September 30.

48.8%

49.9%

51.8%

52.8%

50.6%

50.4%

‘09

‘10

‘11

‘12

‘13

‘14

Adjusted Efficiency Ratio

Demonstrated Earnings Growth

For the fiscal years ended September 30.

Net Income

CAGR

‘09 – ‘14:

18%

$45 $54 $63 $73 $96 $105

‘09 ‘10 ‘11 ‘12 ‘13 ‘14

Net Income

Market Presence

Note: Adjusted efficiency ratio is a non-GAAP measure. See appendix for reconciliation.

(1)Source: SNL Financial. Based on bank holding companies with headquarters in the Midwest ranked by total assets as of June 30, 2014. Excludes specialty lenders,

insurance companies, trust banks and brokerage and investment banking firms.

3

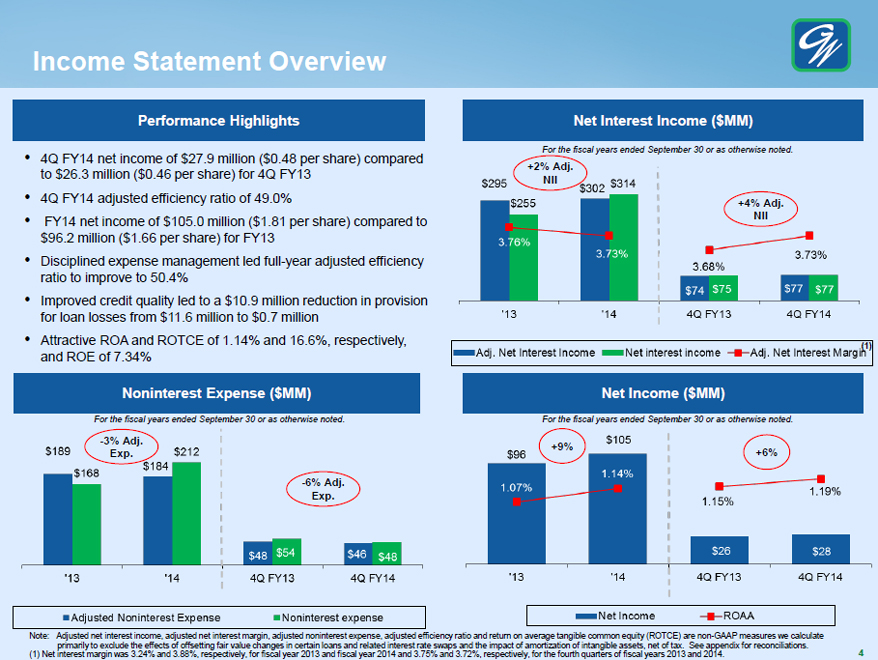

Income Statement Overview

Performance Highlights

4Q FY14 net income of $27.9 million ($0.48 per share)

compared to $26.3 million ($0.46 per share) for 4Q FY13

4Q FY14 adjusted efficiency ratio of 49.0%

FY14 net income of $105.0 million ($1.81 per share) compared to $96.2 million ($1.66 per share) for FY13

Disciplined expense management led full-year adjusted efficiency ratio to improve to 50.4%

Improved credit quality led to a $10.9 million reduction in provision for loan losses from $11.6 million to $0.7 million

Attractive ROA and ROTCE of 1.14% and 16.6%, respectively, and ROE of 7.34%

Net Interest

Income ($MM)

For the fiscal years ended September 30 or as otherwise noted.

+2% Adj.

NII

$295 $255 $302 $314 3.68% 3.73% +4% Adj. NII 3.76% 3.73% $74 $75 $77 $77 ‘13 ‘14 4Q FY 13 4Q FY 14

Adj. Net Interest Income

Net Interest income

Adj. Net Interest Margin(1)

Noninterest Expense ($MM)

For the fiscal years ended September 30 or as otherwise noted.

-3% Adj.

Exp.

$189 $168

$184 $212

$48 $54

$46 $48

-6% Adj.

Exp.

‘13

‘14

4Q FY 13

4Q FY 14

Adjusted Noninterest Expense

Noninterest expense

Net Income ($MM)

For the fiscal years ended September 30 or as otherwise noted.

+9% +6% $96 $105 1.15%

1.19% 1.07% 1.14% $26 $28

‘13

‘14

4Q FY 13

4Q FY 14

Net Income

ROAA

Note: Adjusted net interest income, adjusted net interest margin, adjusted noninterest expense, adjusted efficiency ratio and return on average tangible common equity (ROTCE) are

non-GAAP measures we calculate primarily to exclude the effects of offsetting fair value changes in certain loans and related interest rate swaps and the impact of amortization of intangible assets, net of tax. See appendix for reconciliations.

(1) Net interest margin was 3.24% and 3.88%, respectively, for fiscal year 2013 and fiscal year 2014 and 3.75% and 3.72%, respectively, for the fourth quarters of

fiscal years 2013 and 2014.

4

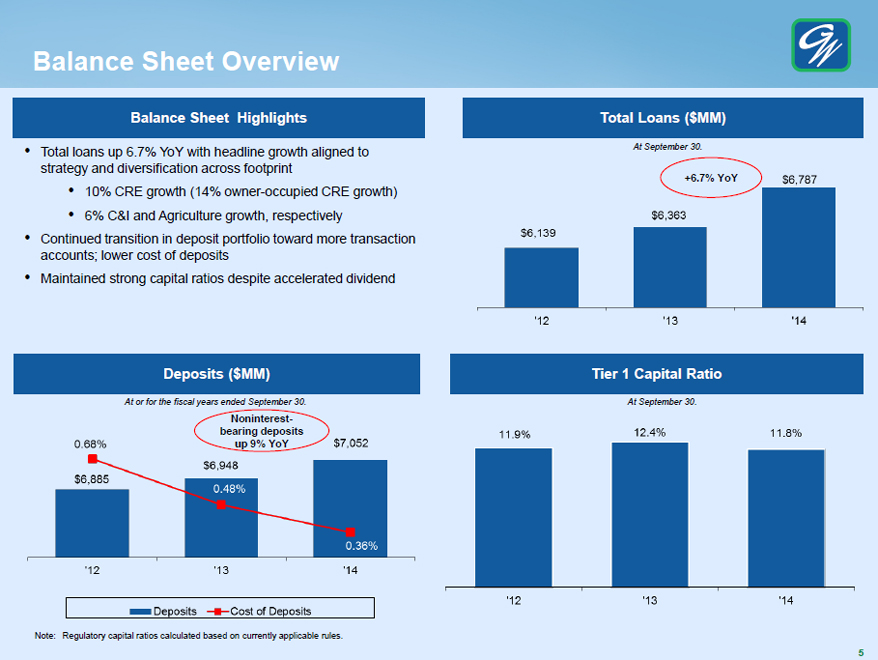

Balance Sheet Overview

Balance Sheet Highlights

Total loans up 6.7% YoY with headline growth aligned

to strategy and diversification across footprint

10% CRE growth (14% owner-occupied CRE growth)

6% C&I and Agriculture growth, respectively

Continued transition in deposit portfolio

toward more transaction accounts; lower cost of deposits

Maintained strong capital ratios despite accelerated dividend

Total Loans ($MM)

At September 30.

+6.7% YoY

$6,139 $6,363 $6,787

‘12 ‘13 ‘14

Deposits ($MM)

At or for the fiscal years ended September 30.

Noninterest-bearing deposits

up 9% YoY

0.68%

$6,948

$7,052

$6,885

0.48%

0.36%

‘12

‘13

‘14

Deposits Cost of Deposits

Tier 1 Capital Ratio

At September 30.

11.9%

12.4%

11.8%

‘12

‘13

‘14

Note: Regulatory capital ratios calculated based on currently applicable rules.

5

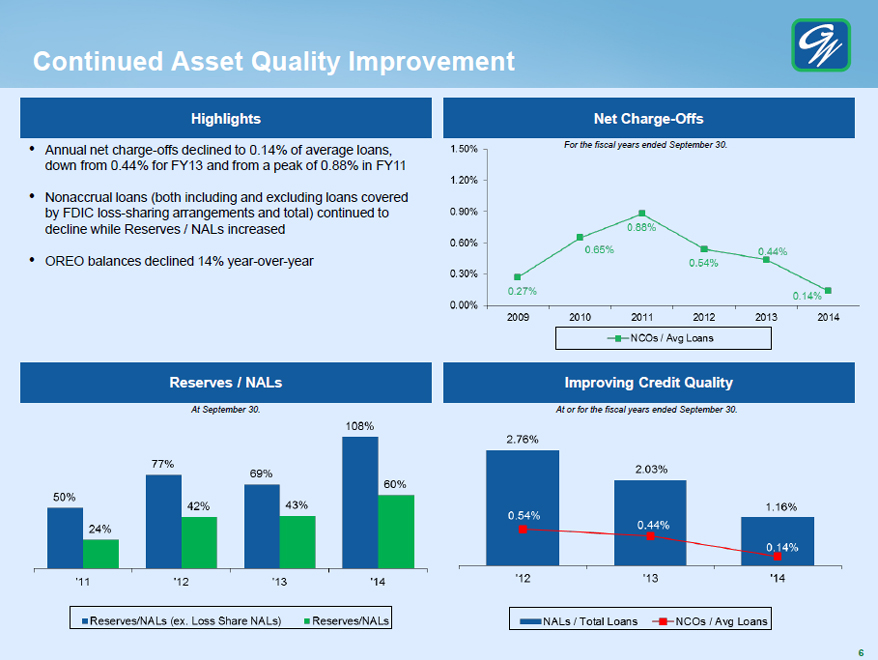

Continued Asset Quality Improvement

Highlights

Annual net charge-offs declined to 0.14% of average loans, down from 0.44% for FY13

and from a peak of 0.88% in FY11

Nonaccrual loans (both including and excluding loans covered by FDIC loss-sharing arrangements and total) continued to decline

while Reserves / NALs increased

OREO balances declined 14% year-over-year

Net

Charge-Offs

For the fiscal years ended September 30.

1.50%

1.20%

0.90%

0.60%

0.30%

0.00%

0.27% 0.65% 0.88% 0.54% 0.44% 0.14%

2009 2010 2011 2012 2013 2014

NCOs / Avg Loans

Reserves / NALs

At September 30.

50% 24% 77% 42% 69% 43% 108% 60%

‘11 ‘12 ‘13 ‘14

Reserves/NALs (ex. Loss Share NALs) Reserves/NALs

Improving Credit Quality

At or for the fiscal years ended September 30.

2.76%

0.54%

2.03%

0.44%

1.16%

0.14%

‘12 ‘13 ‘14

NALs/Total Loans

NCOs / Avg Loans

6

Proven Business Strategy

Focused Business Banking Franchise with Agribusiness Expertise

Attract and

Retain High-Quality Relationship Bankers

Prioritize Organic Growth While Optimizing Footprint

Deepen Customer Relationships

Strong Profitability and Growth Driven by a Highly Efficient

Operating Model

Strong Capital Generation and Attractive Dividend

Risk

Management Driving Superior Credit Quality Relative to Peers

7

Great Western Bank

Member

FDIC

Making Life Great

BIG BANK

SMALL BANK

Appendix

Non-GAAP Reconciliations

GREAT WESTERN BANCORP, INC.

At and for the three months ended

At and for the fiscal year ended

CONSOLIDATED FINANCIAL DATA

(Unaudited)

Sept. 30, 2014

June 30, 2014

Sept. 30, 2013

Sept. 30, 2014

Sept. 30, 2013

Reconciliation of Non-GAAP Measures

(dollars in thousands)

Cash net income and return on average tangible common equity:

Net income

$27,875 $22,503 $26,323 $952 $96,243

Add: Amortization of intangible assets

2,768 4,069 4,690 16,216 19,290

Add: Tax on amortization of intangible assets

(811) (811) (811) (3,244) (3,244)

Cash net income

$29,832 $25,761 $30,202 $117,924 $112,289

Average common equity

$1,438,962 $1,445,097 $1,400,635 $1,430,772 $1,380,295

Less: Average goodwill and other intangible assets

713,462 717,104 730,893 719,573 738,140

Average tangible common equity

$725,500 $727,993 $669,742 $711,199 $642,155

Return on average common equity

7.69% 6.25% 7.46% 7.34% 6.97%

Return on average tangible common equity *

16.3% 14.2% 17.9% 16.6% 17.5%

* Calculated as cash net income divided by average tangible common equity. Annualized for quarterly periods.

Adjusted net interest income and adjusted net interest margin:

Net interest income

$76,646 $89,386 $74,886 $314,073 $255,096

Less: Loan FV adjustment related to interest rates

(197) 13,197 1,330 11,922 (40,305)

Adjusted net interest income

$76,843 $76,189 $73,556 $302,151 $295,401

Average interest-earning assets

$8,181,194 $8,098,052 $7,930,867 $8,093,861 $7,862,860

Net interest margin

3.72% 4.43% 3.75% 3.88% 3.24%

Adjusted net interest margin *

3.73% 3.77% 3.68% 3.73% 3.76%

* Adjusted net interest margin is calculated as adjusted net

interest income divided by average interest earning assets. Annualized for quarterly periods.

9