Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LSB INDUSTRIES INC | d823926d8k.htm |

LSB Industries, Inc.

November 2014

NYSE: LXU

Exhibit 99.1 |

2

Safe Harbor Statement

The information contained in the presentation materials contain

certain forward-looking statements. All these statements,

other than statements of historical fact, are forward-looking

statements. Statements that include the words

“expect,” “intend,” “plan,” “believe,” “project,” “anticipate,” “estimate” and similar

statements of the future or of a forward-looking nature identify

forward-looking statements, including but not limited to, all

statements about or in references to the Architectural Building Index,

Dodge Construction Green Outlook, or any McGraw Hill forecast,

any references to future natural gas costs, ammonia costs, grain or corn demand or production, construction

trends and demand, and the outlook for the chemical or climate

control business. The forward-looking statements include

but are not limited to the following statements: major investments to reduce costs

and increase facility reliability; positioned to benefit from strong

agricultural market and economic recovery; product balance

options; production capacity; impact of capital expansion projects;

estimated completion and start up dates for new chemical

facilities and their cost and production capacity; planned capital

spending; outlook for Chemical and Climate Control; turnaround

at Cherokee; future maintenance activities; Pryor facility reliability; Climate Control’s product sales; sales growth

Q4 2014 and 2015; LEAN impact; future outlook.

You should not rely on the forward-looking statements because

actual events or results may differ materially from those

indicated by these forward-looking statements as a result of a

number of important factors. We incorporate the risks and

uncertainties discussed under the headings “Risk Factors”

and “A Special Note Regarding Forward-looking Statements” in

our Form 10-K for the fiscal year ended December 31, 2013 and Form

10-Q’s for the periods ending March 31, 2014, June 30,

2014, and September 30, 2014, which contain a discussion of a variety of factors which could cause the future outcome

to differ materially from the forward-looking statements discussed

in this investor presentation. We undertake no duty to update

the information contained in this investor presentation.

The term EBITDA, as used in this presentation, is net income plus

interest expense, depreciation, amortization, income taxes, and

certain non-cash charges, unless otherwise described. EBITDA is not a measurement of financial performance under

GAAP and should not be considered as an alternative to GAAP

measurement. The reconciliation of GAAP and any EBITDA numbers

discussed in this investor presentation are included in the appendix of this presentation.

|

3

Company Overview |

Business Overview

4

Diversified industrial manufacturer of chemicals and

HVAC products sold into a wide range of end

markets

Founded in 1968 and headquartered in Oklahoma

City, OK; publicly traded (NYSE: LXU)

Chemical Business operates 4 production facilities

El Dorado Chemical Company (“EDC”) (Arkansas)

Cherokee Nitrogen LLC (Alabama)

Pryor Chemical Company (Oklahoma)

El Dorado Nitric LLC (“Baytown”) (Texas)

Climate Control Business operates 7 facilities located

in Oklahoma City (over 1 million square feet)

Financial Snapshot:

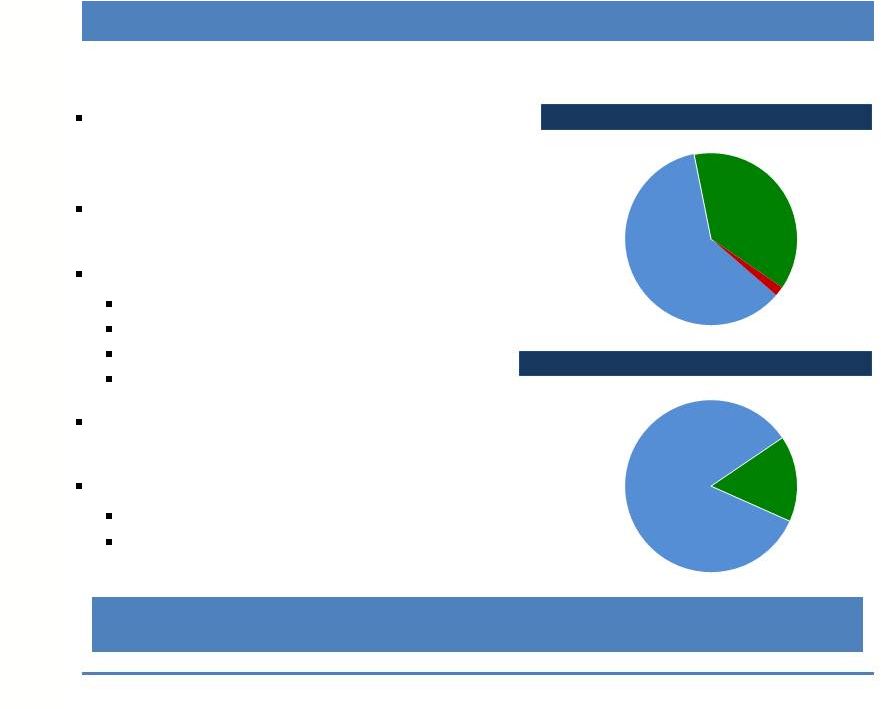

LTM 9/30/14 Net Sales of $700.3 million

LTM 9/30/14 Consolidated Adjusted EBITDA of

$154.0

million

Note: Excludes unallocated corporate expenses

Note (1): Includes insurance proceeds of $104.2 million

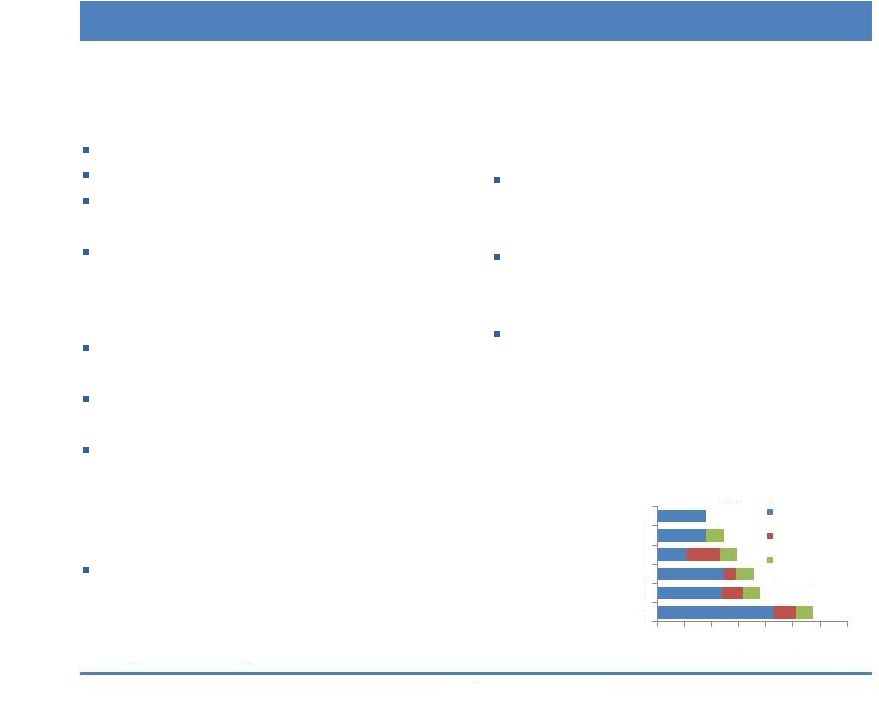

Climate

Control,

38%

Engineering

and other,

2%

Chemical

84%

Climate

Control,

16%

EBITDA by Business Segment – LTM 9/30/14

LSB operates a well-diversified business with differentiated market

positions across two distinct business segments (1)

Net Sales by Business Segment – LTM 9/30/14 Chemical

60% |

LSB’s Two Core Businesses

5

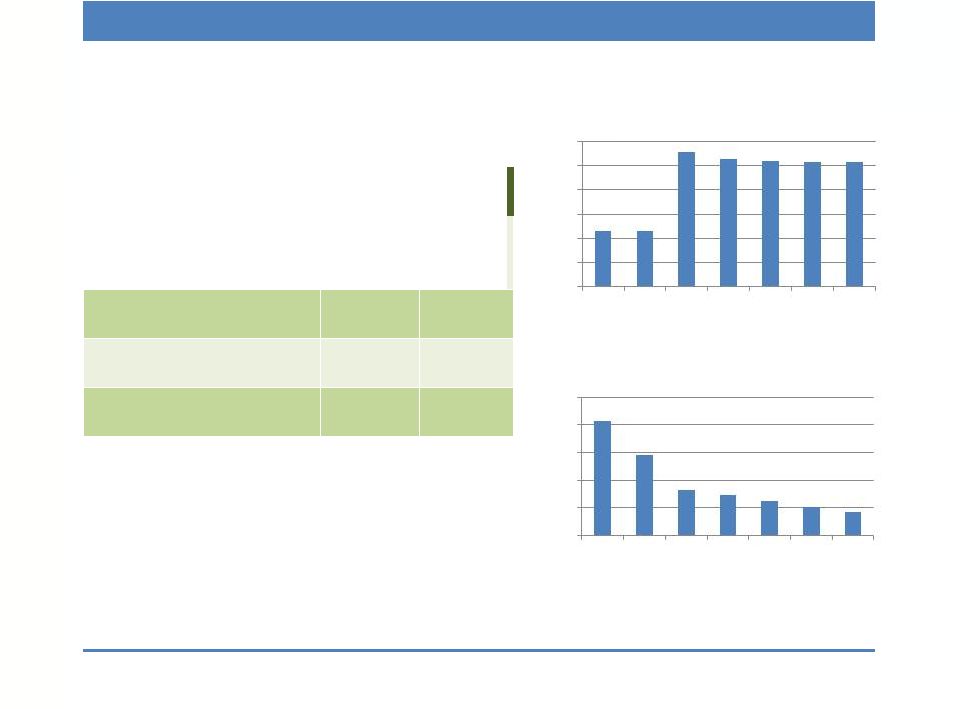

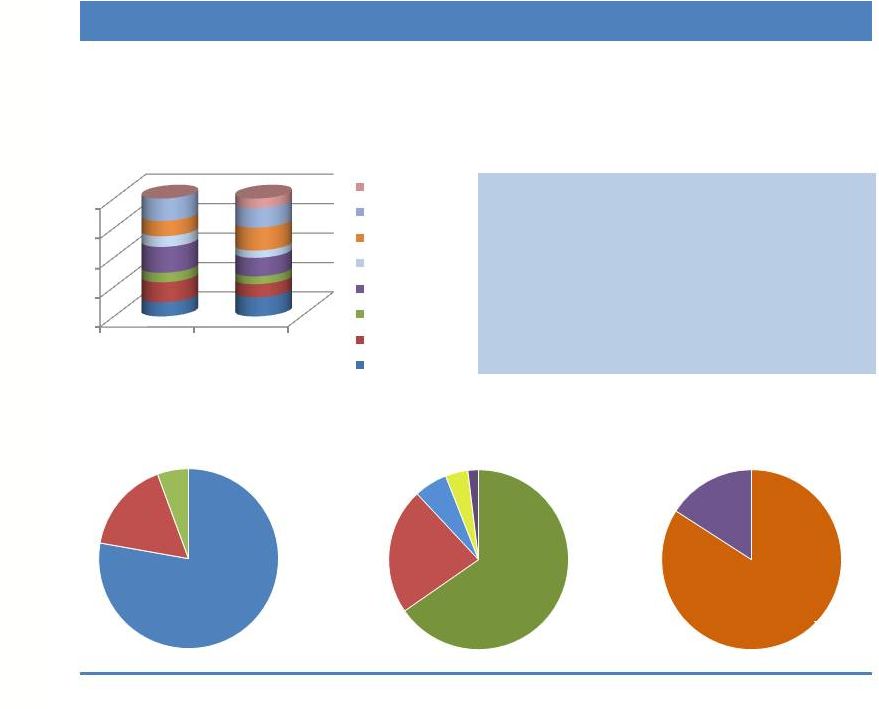

Consolidated Sales History

($’s in millions)

Chemical

Climate Control

Provides specialty HVAC products to

commercial, institutional and residential new

construction, renovation and replacement

markets, emphasis on green products

Market and technology leader for water

source and geothermal heat pumps, and

hydronic fan coils

Poised to benefit from the economic

recovery, long-term trend toward green

construction, and growth of emerging

products

28% Agriculture

22% Industrial

Acids & Ammonia

9%

Mining

2% Natural Gas

6% Single-family

Residential

31% Commercial

& Institutional

Buildings

2% Engineered

Products & Other

LTM 9/30/14 Sales Mix

492

586

749

532

610

805

759

679

700

$0

$300

$600

$900

2006

2007

2008

2009

2010

2011

2012

2013

LTM

9/30/14

Chemical

60%

($423 mil)

Climate

Control

38%

($264 mil)

Positioned to benefit from strong agricultural

market with favorable margins

Major investments underway to reduce costs

and increase facility reliability and capacity

Leading merchant marketer of nitric acid in

the U.S.

Provides nitrogen based agricultural, mining

and industrial chemicals to North American

market |

6

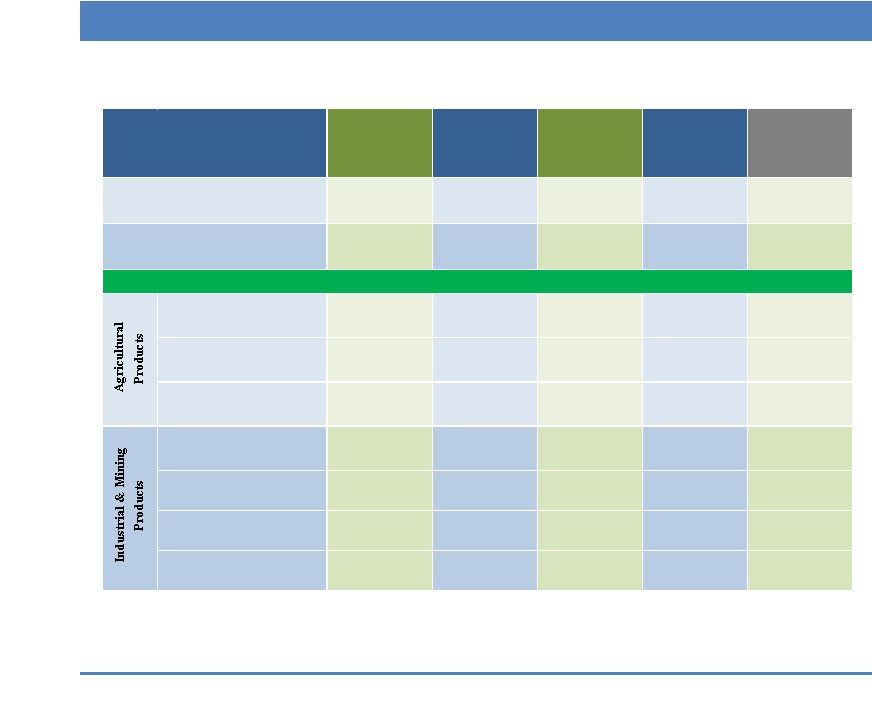

Business Segment

Overview |

Agro-

Chemical

(46% of sales)

Nitric Acid

Semi-conductor, nylon, polyurethane

intermediates, ammonium nitrate

CF Industries, PCS

Sulfuric Acid

Pulp and paper, alum, water treatment,

metals and vanadium processing

Cytec, Chemtrade Logistics

Anhydrous Ammonia

Power plant emissions abatement, water

treatment, refrigerants, metals processing

Various

Diesel Exhaust Fluid (DEF)

Exhaust

stream

additive

to

reduce

NO

x

emissions from diesel vehicles

Various

Market

Products Uses

Competitors

Industrial

Acids,

Ammonia &

DEF

(36% of sales)

Urea Ammonium Nitrate

Solutions (UAN)

Fertilizer for corn and other crops

CF Industries, PCS,

Koch Industries, Rentec,

Coffeeville Resources, imports

Ammonium Nitrate

-

high density prills (AN)

Primary nitrogen component in NPK

fertilizer blends

CF Industries, imports

Anhydrous Ammonia

High nitrogen content fertilizer primarily

used for corn

Various

Chemical Markets and Products

7

density prills (AN) and AN

solutions

Specialty emulsions for mining

applications

CF Industries, PCS,

Dyno Nobel America

Specialty E2 Ammonium

Nitrate

Surface mining, quarries, construction

Imports

Mining

Products

(15% of sales)

Ammonium Nitrate – low |

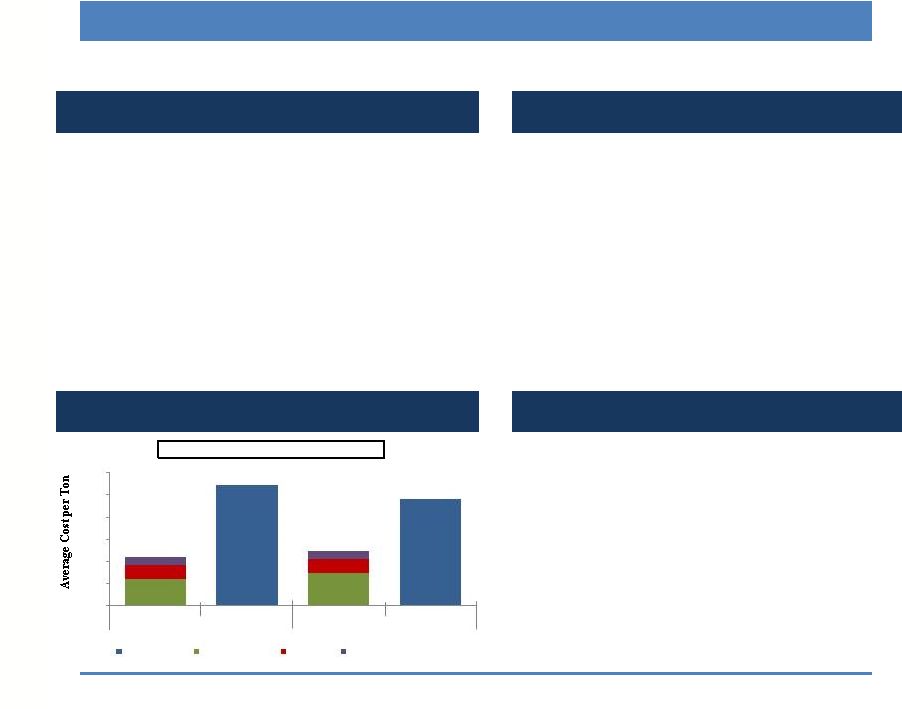

U.S. Midwest Delivered

Ammonia Cost Forecast

Source: Fertecon, Blue Johnson, PotashCorp (2014F)

Attractive Industry Fundamentals –

Agro Chemicals

8

World Situation:

North American Situation:

Result:

North America is Low

Cost Producer of

Nitrogen Fertilizers 0

100

200

300

400

500

600

700

Ukraine Port

Russia -

Yuzhnyy

Trinidad

Middle East

US Gulf Producers

US Midwest Producers

Cash Costs

Freight to US

Freight & Handling to US

Midwest

Natural gas is the primary feedstock for

anhydrous ammonia and all nitrogen

fertilizers.

Due to large shale gas reserves, U.S. has

relatively low natural gas prices vs. most

places worldwide.

Natural gas is expected to average

approximately $4.00 per MMBtu for the

remainder of 2014 and 2015.

Growing populations

Developing economies

Changing dietary habits (from grain to

meat)

Worldwide grain stock-to-use ratios at

10-year highs

World grain shortages positively impact

grain requirements in the U.S.

During last 3 years U.S. consumed more

grain than it produced.

U.S. grain stocks are at 10-year highs

leading to lower current and expected

corn prices.

High demand for grain expected in

2014 and 2015 despite low corn prices;

between 86 to 88 million acres of corn

expected to be planted in 2014/2015.

($US/ton) |

LSB’s Agricultural Distribution

9

Multiple distribution channels

Diverse geographic coverage

Longstanding customer relationships

Direct rail linkage to corn belt

Southern Plains,

South Central,

Midwest & West

Pryor,

OK

Cherokee,

AL

El Dorado,

AR

UAN

UAN

AN

Koch

Transammonia, The

Andersons, CHS,

Koch, et.al.

Eastern

Corn Belt

Ag Centers -

30%

Distributors &

Dealers -

70%

Southern

Plains &

Corn Belt |

Operational Dynamics

Diversification Strategy with Product Balance Options

10

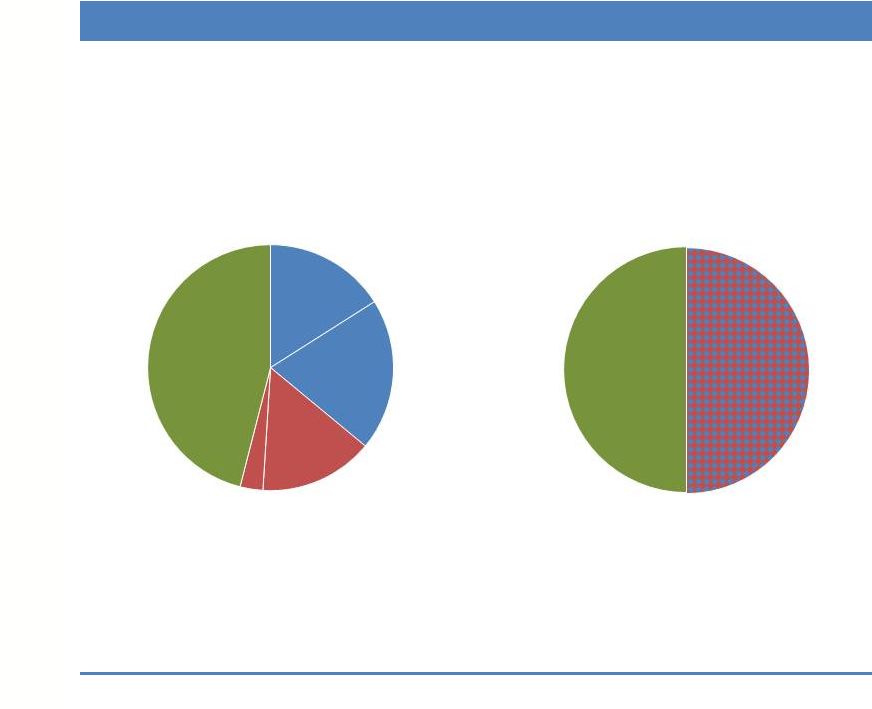

Sales by Market

Cost-Plus Agreements vs.

Spot Market Sales

A key strategy is to

OPTIMIZE SALES MIX:

industrial vs. agricultural.

Approximately half our sales

are

NON-SEASONAL

and priced pursuant to

COST-PLUS

agreements.

LTM 9/30/14 Sales Mix

Bayer Nitric

Acid

16%

Industrial

Acids &

Ammonia

20%

Agricultural

46%

Mining

15%

Natural Gas

3%

Cost Plus

50%

Spot

Market

50% |

Major Chemical Customers

11

Bayer |

Chemical Facilities

12

El Dorado Nitric LLC

El Dorado Chemical Co.

Cherokee Nitrogen LLC

Pryor Chemical Co.

El Dorado

Chemical

Company

Cherokee

Nitrogen LLC

Pryor

Chemical

Company

El Dorado

Nitric LLC

El Dorado, AR

Cherokee, AL

Pryor, OK

Baytown, TX

1983

1999

2000

2000

Kellogg

Kellogg

Pritchard

-

150

160

47

2

1,400

1,300

104

Bayer site

ammonia

natural gas

natural gas

ammonia

UAN

x

x

High Density AN

x

Ammonia

x

x

Urea

x

x

Nitric Acid

x

x

x

x

Concentrated

Nitric Acid

x

Sulfuric Acid

x

Mixed Acid

x

Carbon Dioxide

x

x

Ammonia

x

x

DEF

x

Low Density AN

x

AN solutions

x

x

truck, rail

truck, rail,

pipeline,

truck, rail

truck, pipeline

Year Acquired/Built

Ammonia Design

Transportation to Market

Facility

Location

Plant Area (acres)

Site Area (acres)

Feedstock |

Annual Production Capacity of Products Available for Sale

(1,000’s of tons)

13

Red Font

= production capacities after the completion of the ammonia and

nitric acid expansion projects at El Dorado

Note (1): Represents amount of ammonia currently purchased

Note (2): Combined annual low density and high density AN production

capacity is limited to 330,000/TPY due to the loss in 2012 of 90,000/TPY of nitric acid production capacity

El Dorado

Chemical

Company

Cherokee

Nitrogen LLC

Pryor

Chemical

Company

El Dorado

Nitric LLC

Total

ammonia

natural gas

natural gas

ammonia

220

(1)

/375

175

215

-

610/765

UAN

215

300

515

High Density AN

(2)

110/300

110/300

Ammonia

125

30

85

115/240

Nitric Acid

45/200

30

410

485/640

DEF

15

15

Low Density AN

(2)

220

220

AN solutions

85

85

Feedstock

Ammonia Production Capacity

Products Available for Sale

Facility |

•

Cost of $275 million -

$300 million

•

Reduces production costs significantly vs.

purchased ammonia

•

Enhanced product balance opportunities

•

Increases plant capacity:

-

Currently use ~220,000 tons per year (TPY)

-

Additional capacity ~155,000 TPY

-

Total capacity ~375,000 TPY

•

Estimated completion Q4

2015/start-up Q1

2016 14

Capital Expansion Projects

El Dorado Ammonia Plant

•

Cost of $125 million -

$130 million

•

Improves operating characteristics

•

Enhanced product balance

•

Replaces lost acid capacity and adds

additional capacity for a total

of

370,000 TPY

•

Estimated completion and start-up

Q2 2015

El Dorado Nitric Acid Plant and Concentrator

•

Engineering, Procurement and

Construction (EPC) contractor secured

•

Installation of above ground structures

underway

•

Inspection and refurbish/rebuild of

equipment in process

Construction Process Well Underway

$545

$482

$220

$250

0

100

200

300

400

500

600

Approximate Cost to

Produce

Weighted Average Cost to

Purchase

Approximate Cost to

Produce

Weighted Average Cost to

Purchase

Produce vs. Purchase Spread at El Dorado

Delivered Cost

Natural Gas Cost

Fixed Cost

Other Variable Cost

2014 –

9 months Average

2013 Average

Ammonia Production Offers Attractive Economics

|

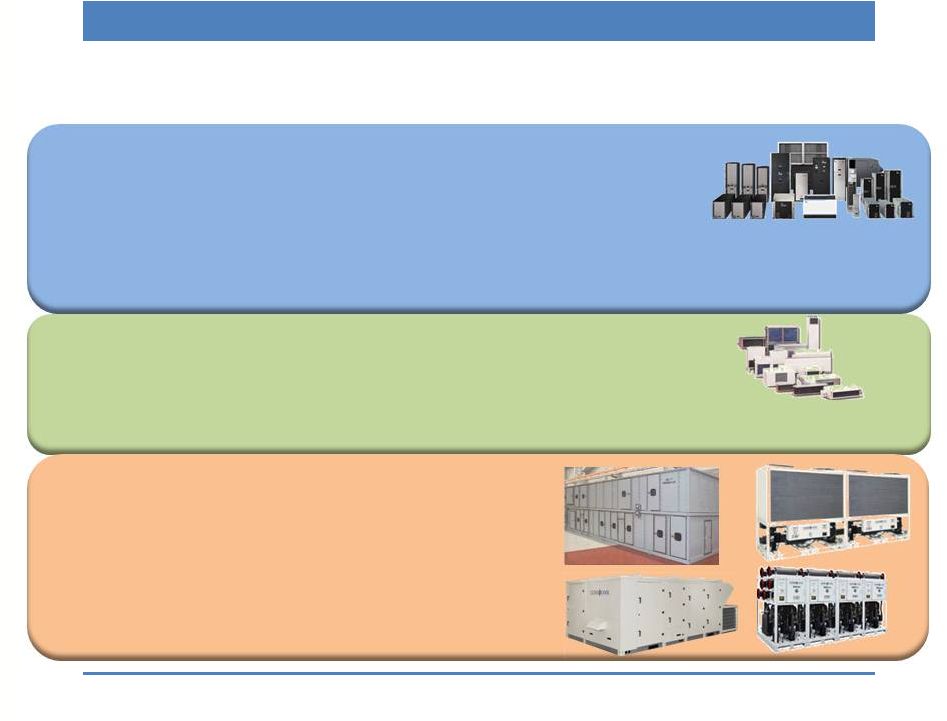

Climate Control Market and Products

Market

Products Uses 15

Geothermal &

Water Source

Heat Pumps

(65% of sales)

Water Source

Heat Pumps

Heating and cooling for commercial/institutional

as

well

as

single

family

residential

-

new

construction, renovation and replacements

Geothermal

Heat Pumps

Heating and cooling for commercial/institutional

as

well

as

single

family

residential

-

new

construction, renovation and replacements

Leading share in water

source and geothermal

heat pumps

Hydronic Fan

Coils

Heating and cooling for commercial/institutional

new construction, renovation and replacements

Leading share in hydronic

fan coils

Hydronic Fan

Coils

(23% of sales)

Large Custom

Air Handlers

Commercial, institutional

and industrial

Modular

Chillers

Commercial, institutional

and industrial

Make-up Air

Units

Commercial, institutional

and industrial

Other HVAC

Products

(12% of sales) |

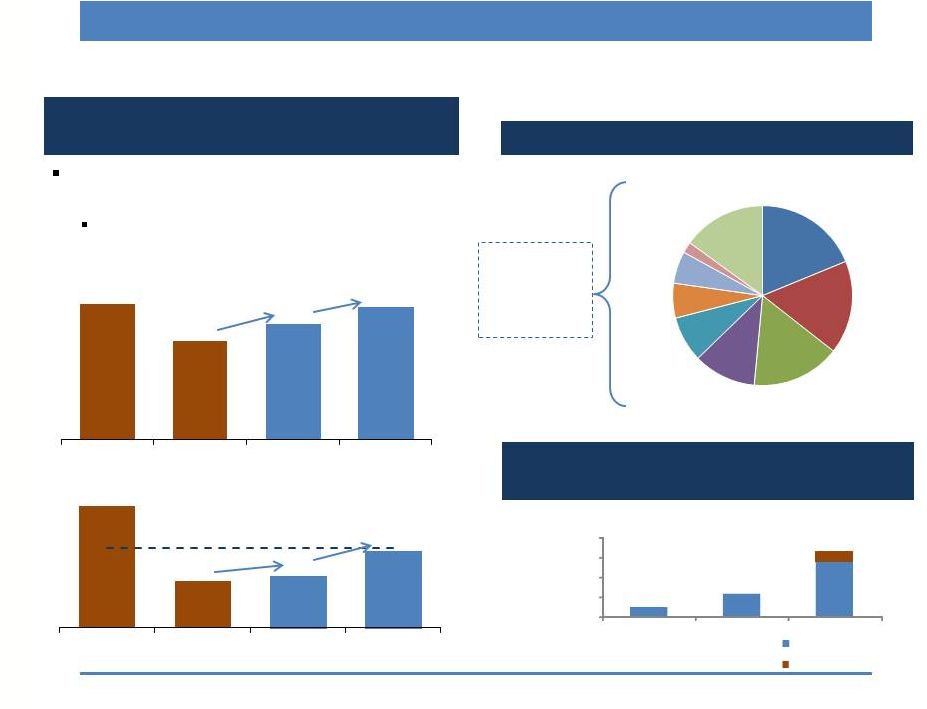

16

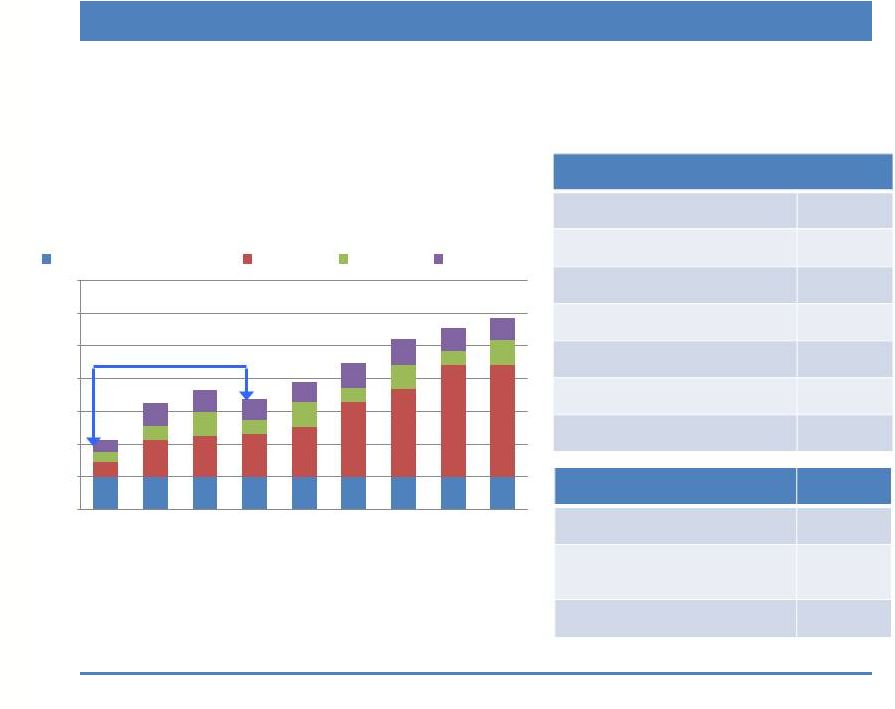

Attractive Industry Fundamentals: Climate Control

Significant upside as industry drivers return to

levels at/near historical norms

Driven by high energy efficiency

Climate Control LTM 9/30/14 Market Mix

Total

Commercial,

Institutional and

Multi-Family:

83%

($ in Billions)

$35.0

$85.0

$204.0

$248.0

$0

$75

$150

$225

$300

2008A

2012A

2016P

Low-end

High-end

Source: 2013 Dodge Construction Green Outlook

Construction markets are poised for a

recovery to pre-recession levels

Green building market spending expected

to

grow

~25%+

CAGR

from

‘12

–

‘16E

Commercial / Institutional / Multi-Family Starts

(MM Square Feet)

Single Family Residential Construction

(Starts in 000’s)

1,750

1,278

1,487

1,711

2008

2013

2015E

2017E

16%

15%

1,626

624

700

1,025

2005

2013

2015E

2017E

12%

50-Year Median: 1,070

46%

Education

19%

Single

Family

Residential

17%

Multi-

Family

16%

Lodging

11%

Retail

8%

Healthcare

6%

Office

6%

Industrial

2%

Other

15%

Sources: McGraw-Hill Construction Market Forecasting Service, Q4

2014; 50 Year Median – Census Bureau

|

Significant Installed Base of Climate Control Products

Millennium Towers, NYC

Bellagio, Las Vegas

Statue of Liberty

MGM Grand, Las Vegas

Trump Tower, NYC

World Financial Center, NYC

Chicago Hilton and Towers

Wynn Resort, Las Vegas

Disney’s Grand Floridian, Orlando

Atlantis, Bahamas

Rowes Wharf, Boston

Alta Condos, Washington DC

Peninsula, Hong Kong

Ritz Carlton, Pasadena, CA

Rockefeller Center, NYC

17

Thousands of premier installations and over 4 million units

|

18

Financial Overview |

Summary Statement of Operations

19

2013

2012

2011

2010

2014

2013

Sales

$679.3

$759.0

$805.3

$609.9

$551.2

$530.3

Sales Growth

(11)%

(6)%

32%

15%

4%

(9)%

Operating Income/(Loss)

$105.3

$95.7

$136.4

$55.9

$48.4

$35.1

Net Income/(Loss)

$55.0

$58.6

$83.8

$29.6

$19.0

$17.6

Diluted Earnings/(Loss) per Share

$2.33

$2.49

$3.58

$1.32

$0.80

$0.75

EBITDA

$132.9

$117.3

$155.7

$74.3

$75.4

$54.4

EBITDA Margin

20%

15%

19%

12%

14%

10%

$ in millions except EPS

9 Mos. Ended Sept. 30,

Calendar Year Ended Dec. 31,

*Free cash flow is defined as operating cash plus insurance proceeds

and debt and financing proceeds, less capital expenditures and

debt and financing payments |

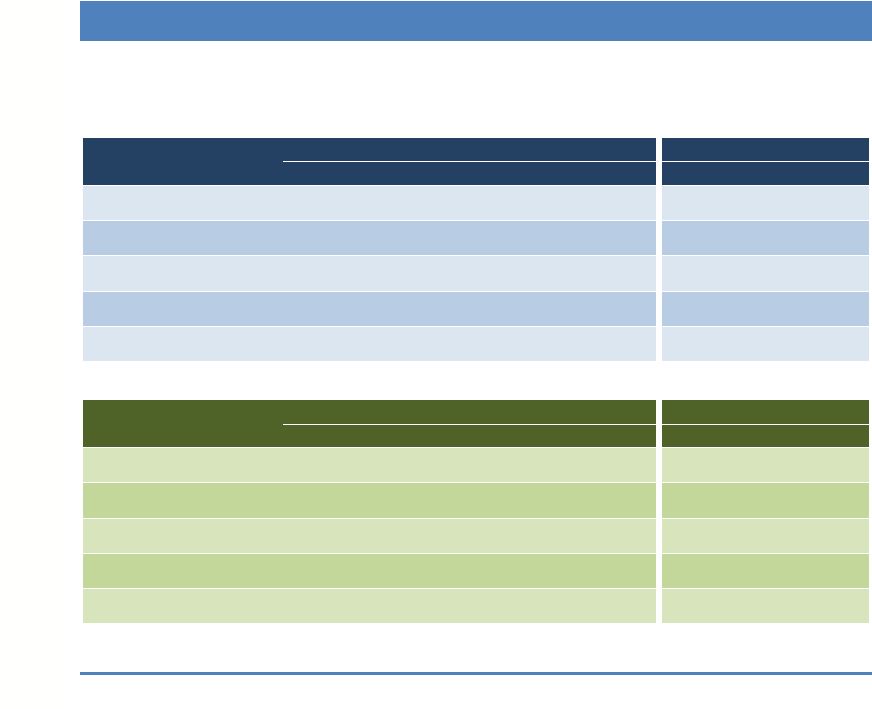

Segment Summary Statement of Operations

20

Chemical Business

$ in millions

2013

2012

2011

2010

2014

2013

Sales

$380.7

$477.8

$511.9

$351.1

$345.7

$303.0

Gross Profit

46.2

97.7

130.7

49.3

57.2

39.1

Gross Profit %

12.1%

20.4%

25.5%

14.0%

16.5%

12.9%

Operating Income

87.8

82.1

116.5

31.9

46.8

20.3

Segment EBITDA

$111.4

$98.5

$131.2

$45.0

$69.6

$36.9

Climate Control Business

$ in millions

2013

2012

2011

2010

2014

2013

Sales

$285.0

$266.2

$281.6

$250.5

$196.6

$217.5

Gross Profit

92.9

81.0

88.2

86.4

61.6

70.6

Gross Profit %

32.6%

30.4%

31.3%

34.5%

31.3%

32.4%

Operating Income

30.4

25.8

32.8

35.3

17.4

24.4

Segment EBITDA

$33.6

$29.0

$35.5

$38.8

$21.0

$26.9

9 Mos. Ended Sept. 30,

Calendar Year Ended Dec. 31,

Calendar Year Ended Dec. 31,

9 Mos. Ended Sept. 30, |

Solid Financial Position

Strong Balance Sheet

21

Note: As of September 30, 2014, total debt consisted

of $425 million 7.75% Senior Secured Notes due in

2019; a $24.5 million Secured Promissory Note due

in February 2016 and $9.9 million of equipment

loans and capital leases. Our availability under the

$100 million working capital revolver loan was

$74.2 million at September 30, 2014.

Sept. 30,

Dec. 31,

2014

2013

Cash and Investments

(including non-current)

$311.1

$434.7

Total Debt

$459.4

$463.0

Stockholders' Equity

$432.4

$411.7

Total Capitalization

$891.8

$874.7

$ in millions

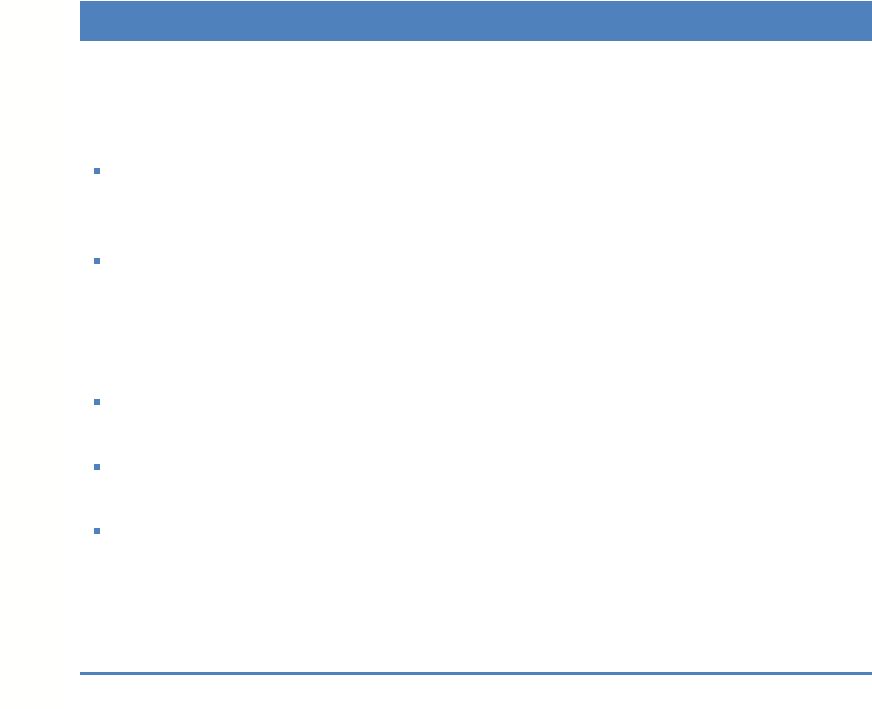

Debt to

Capital

EBITDA to Interest

Coverage*

* Calculated on a trailing twelve month basis using

total interest, including capitalized interest.

23.0%

22.9%

55.5%

52.9%

52.1%

51.4%

51.5%

0%

10%

20%

30%

40%

50%

60%

Mar.

31

2013

Jun.

30

2013

Sept.

30

2013

Dec.

31

2013

Mar.

31

2014

Jun.

30

2014

Sept.

30

2014

20.8x

14.6x

8.2x

7.4x

6.2x

5.2x

4.3x

0

5

10

15

20

25

Mar.

31

2013

Jun.

30

2013

Sept.

30

2013

Dec.

31

2013

Mar.

31

2014

Jun.

30

2014

Sept.

30

2014 |

Planned Capital Spending

22

Remainder of

2014

2015

Total

Chemical Business:

El Dorado Facility Expansion Projects

$80 - $93

$200 - $222

$280 - $315

Development of Natural Gas Leaseholds

1 - 3

14 - 18

15 - 21

Environmental Projects

5 - 7

5 - 7

10 - 14

Major Renewal and Improvement Projects

14 - 18

34 - 40

48 - 58

Other

4 - 8

13 - 16

17 - 24

Total Chemical

$104 - $129

$266 - $303

$370 - $432

Climate Control Business:

2 - 3

7 - 10

9 - 13

Corporate and Other:

2 - 3

7 - 10

9 - 13

Total Projects

$108 - $135

$280 - $323

$388 - $458

Expenditures

to Date

Remainder of

2014

2015

Project

Total

Ammonia Plant

$99

$50 - $60

$126 - $141

$275 - $300

Nitric Acid Plant and Concentrator

85

11 - 12

29 - 33

125 - 130

Other Support Infrastructure

21

19 - 21

45 - 48

85 - 90

Total El Dorado Projects

$205

$80 - $93

$200 - $222

$485 - $520

Planned Capital Expenditures

Planned Capital Expenditures

Total Projects

El Dorado

Expansion Projects

Note: The planned spending is presented as a range to provide for

engineering estimates, the status of bidding, variable material costs, unplanned delays in construction and

other contingencies.

(as of September 30, 2014 - $ in millions)

|

Chemical Business Operating Metrics

23

(1) Gross cost excluding any hedging activity

Nine Months Ended September 30,

Agricultural:

2014

2013

% Change

Product (tons sold)

Urea ammonium nitrate (UAN)

231,153

200,549

15%

Ammonium nitrate (AN)

184,450

124,070

49%

Anhydrous ammonia

65,148

37,332

75%

Other

23,478

21,714

8%

504,229

383,665

31%

Average

Selling

Prices

(price

per

ton)

UAN

$259

$273

(5%)

AN

$332

$377

(12%)

Anhydrous ammonia

$481

$543

(11%)

Input Costs

Average purchased ammonia cost/ton

$482

$568

(15%)

Average natural gas cost/Mmbtu

(1)

$4.91

$3.86

27%

Industrial:

Product (tons sold)

Nitric acid

396,026

366,665

8%

AN and AN solution

126,256

116,827

8% |

Outlook

24

Chemical:

Favorable indicators for agricultural market

Expected 2014/2015 planting level of ~87 million acres of corn

Current nitrogen fertilizer prices approximately equal to or higher

than a year ago Natural gas feedstock cost relatively low

historically Corn pricing lower than recent past but stabilized

while yields per acre are increasing Continued high cost of

ammonia is unfavorable for our business El Dorado currently

purchases ammonia making the sale of HDAN uneconomical This is

expected to continue until the new ammonia plant is on-line in 2016

Successful turnaround moves Cherokee to a 2-year turnaround

cycle Translates into additional production days of between

10-15 days every 2 years Planned maintenance activity not

expected in Q4 2014 El

Dorado

will

cease

production

for

approximately

one

week

to

facilitate

“tie-ins”

required

for

expansion

projects

Climate Control:

Continued trend for increasing demand in the commercial and

institutional sectors September

ABI

was

positive

for

5

th

consecutive

month,

reaching

2007

levels

Long-stalled projects are re-activating, indicating credit is

easing and an increase in confidence in the economy Commercial and

institutional sectors we serve expected to increase in 2015 per Dodge data

Lodging (+17%), Retail (+11%), Office Buildings (+19%) and Education

(+9%) $75.5

million

backlog

at

10/31/14

highest

since

2008

translating

to

sales

growth

year-over-

year in Q4 2014 and into 2015 |

Key LSB Value Drivers

Comprehensive upgraded Chemical Business safety and plant reliability

systems

–

intended

to

improve

plant

up-time

and

reduce

risks

of

unplanned

downtime.

Pryor

facility

reliability

improvements

-

including

new

senior

management,

additional

engineering

support,

extensive

monitoring

and

control

equipment,

remanufacture of certain key pieces of equipment, and use of industry

expert consultants –

intended to improve plant up-time and reduce risks of unplanned

downtime.

Expansion

projects

at

El

Dorado

–

intended

to

reduce

costs,

increase

capacity,

and enhance product balance capabilities.

Growth

in

Climate

Control

Business

within

existing

plant

footprints

as

construction

cycle

recovers

to

achieve

increased

profits

through

operating

leverage.

LEAN

/

Operational

Excellence

initiatives

in

our

Climate

Control

Business

to

facilitate improved operational metrics and reduce costs.

25 |

26

Appendix |

27

EBITDA Reconciliations (in

millions) Reconciliation

of

Consolidated

Net

Income

and

Segment

Operating

Income

to

Non-GAAP

measurement

EBITDA.

Management

uses

operating

income

by business segment for purposes of making decisions that include

resource allocations and performance evaluations. Operating income by business segment

represents gross profit by business segment less selling, general and

administrative expenses incurred by each business segment plus other income and other

expense earned/incurred by each business segment before general

corporate expenses. The term EBITDA, as used in this

presentation, is net income plus interest expense, depreciation, amortization, income taxes, and certain non-cash charges, unless

otherwise described. EBITDA is not a measurement of financial

performance under GAAP and should not be considered as an alternative to GAAP measurement.

LSB Industries, Inc. Consolidated

2013

2012

2011

2010

2014

2013

Net income (loss)

55.0

$

58.6

$

83.8

$

29.6

$

19.0

$

17.6

$

Plus:

Interest expense

14.0

4.2

6.7

7.4

17.5

6.7

Depreciation and amortization

28.4

20.7

18.8

17.4

26.6

20.1

Provisions for income taxes

35.3

33.6

46.2

19.8

12.3

10.0

Loss from discontinued operations

0.2

0.2

0.2

0.1

-

-

EBITDA per conference call

132.9

$

117.3

$

155.7

$

74.3

$

75.4

$

54.4

$

Climate Control Business

Operating income (loss)

30.4

$

25.8

$

32.8

$

35.3

$

17.4

$

24.4

$

Plus:

Equity in earnings of affiliate

0.4

0.7

0.5

1.0

0.1

0.5

Depreciation and amortization

2.8

2.5

2.2

2.5

3.5

2.0

EBITDA per conference call

33.6

$

29.0

$

35.5

$

38.8

$

21.0

$

26.9

$

Chemical Business

Operating income (loss)

87.8

$

82.1

$

116.5

$

31.9

$

46.8

$

20.3

$

Plus:

Non-operating income

-

-

-

-

0.2

-

Depreciation and amortization

23.6

16.4

14.7

13.1

22.6

16.6

EBITDA per conference call

111.4

$

98.5

$

131.2

$

45.0

$

69.6

$

36.9

$

Nine months ended 9-30

Twelve months ended 12-31 |

What Our Chemical Products Are Used For:

28

Agrochemical Products

Uses

Urea Ammonium Nitrate Solutions (UAN) 28-32% N

Manufactured nitrogen content fertilizer

High nitrogen content fertilizer for corn and other crops with high

nitrogen demand (wheat, milo, cotton)

E2 Ammonium Nitrate Prill (solid) 34% N

High nitrogen content fertilizer

Nitrogen consuming crops, forage areas and citrus. The primary

nitrogen component in NPK (nitrogen, phosphorus, potassium)

fertilizer blends Fertilizer Blends

Custom blends with purchased phosphates, potassium, sulfur,

micronutrients with produced ammonium nitrate

Special application for agri-business products to supply growers

balanced fertility

Anhydrous Ammonia 82% N

Gas injected application

High

nitrogen

content

fertilizer

with

highest

percentage

use

for

corn.

Industrial Acids, Ammonia, DEF

Uses:

Concentrated Nitric Acid

Aqueous solution up to 99% concentration

Production of specialty fibers, nitrocellulose, gaskets, crop

chemicals, mining products, metal treatment, nitric acid

commercial blends Nitric Acid Commercial Blends

Aqueous solution up to 89% concentration

Semi-conductor industry, manufacture of nylon and polyurethane

intermediates, potassium nitrate compounds, ammonium nitrate

production Anhydrous Ammonia

Commercial grade and high purity refrigeration, metallurgical

grade Air emission abatement in power plants, water treatment,

refrigerants, metals processing, and a wide variety of

industrial uses Mixed Acids

Blends of concentrated nitric acid and sulfuric acid/oleum

Diesel fuel additives, ordnance, herbicides and pharmaceutical grade

nitroglycerine

Sulfuric Acid

98% and 93% concentrations, standard and low-iron grades

Pulp and paper manufacturing, alum, water treatment, metals

processing, vanadium processing, other industrial uses

DEF (diesel exhaust fluid)

Exhaust

stream

additive

to

reduce

NO

X

emissions

from

diesel

vehicles

Industrial Mining Products

Uses:

Ammonium Nitrate Solutions

54% and 83% concentrations

Specialty

emulsions

for

mining

applications,

other

miscellaneous

uses

Low Density Ammonium Nitrate Prills (solids)

Solid pellets with good porosity and flowability

Surface mining, quarries, construction |

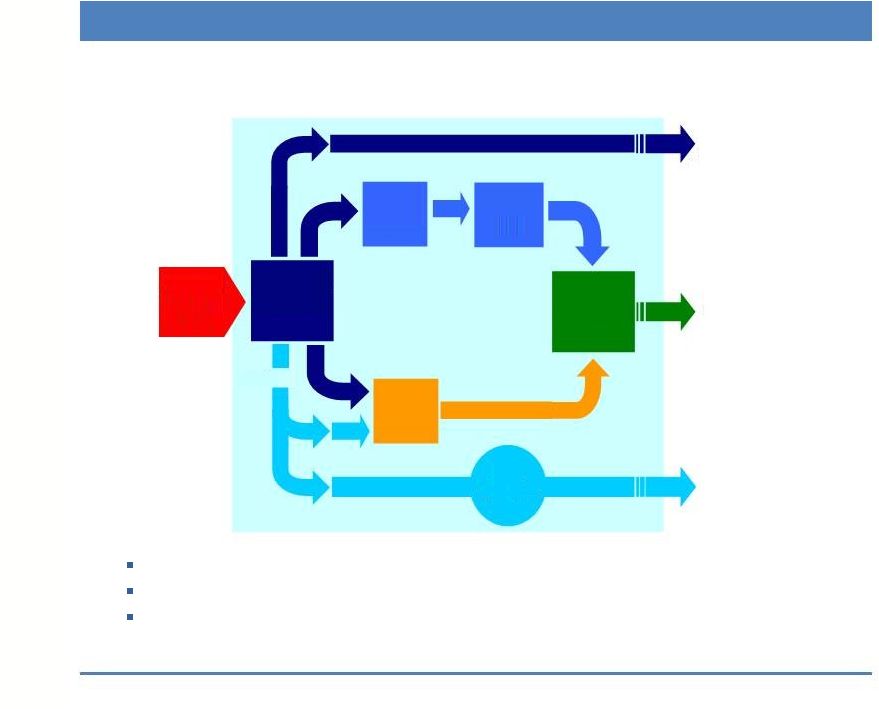

Typical

Facility

Process

Flow

(Pryor)

29

Products

are

marketable

at

every

intermediate

and

final

stage

of

production.

Pryor facility process flow is typical of plants with natural gas

feedstock. Pryor and Cherokee use natural gas feedstock.

El Dorado and Baytown use ammonia feedstock.

AN

Solution

CO

(storage,

trucks)

Nitric

Acid

Ammonia

Plant

UAN

Urea

CO

Liquification

Natural

Gas

(pipeline)

UAN

(storage,

trucks, rail)

NH

(storage,

trucks, rail)

CO

3

2

2

2 |

Climate Control Sales & Marketing Data

30

Diversified End Markets

Commercial:

•

•

Residential (Geothermal):

•

•

Plus: OEM distribution channels

Distribution Channels

Product

&

Market

Sales

Mix

–

Various

Perspectives

September 30, 2014 LTM Sales Mix Data

238 Commercial representative firms with

438 locations

2,200+ Sales Engineers

600 Residential distributor locations (approx.)

4,000 Residential contractor-dealers (approx.)

0%

25%

50%

75%

100%

2008

LTM

9/30/14

Retail

Single Family

Education

Healthcare

Multi Family

Office

Lodging

Other

Commercial

&

Institutional

78%

Residential

17%

Export

5%

Heat Pumps

65%

Fan Coils

23%

Air

Handlers

6%

Chillers

4%

Contracting

2%

Direct

84%

OEM

16% |

Focus on Geothermal Heat Pumps

How does a GHP system work?

31

The

Earth

absorbs

approximately

50%

of

all

solar

energy

and

remains at nearly a constant temperature year round (below a few

feet deep).

A

GHP

system

uses

a

sealed

in-ground

heat

exchanger

(loop)

filled

with

fluid

and

a

GHP

unit

to

exchange

energy

between

the

house

or

building and the earth.

In

winter,

fluid

in

the

loop

absorbs

energy

from

the

earth

and

carries

it

to the GHP where it is converted (compressed) to a higher temperature

and sent as warm air into the house or building.

In

summer

the

system

reverses,

transferring

heat

from

the

house

or

building into the earth.

GHP

systems

work

year

round

in

all

climates,

in

both

individual

residence and large commercial buildings, providing both conditioned

air

and

domestic

hot

water

(as

a

“free”

by-product).

Typical

Residential

Geothermal

System

Geothermal Benefits:

Energy Cost Reduction & Positive

Cash Flow

–

the most energy efficient HVAC

technology

available

–

up

to

80%

more

efficient than conventional systems.

Fed

Tax

Credits

-

30%

residential

&

10%

business

+

accelerated depreciation, + state/utility incentives

GHP’s

are

an

Alternative

form

of

Renewable

Energy

Green

Refrigerants

-

non-ozone

depleting

“Free”

Domestic Hot Water

Noise

Free

Operation

–

no noisy condensing unit

Extremely

Long

Lived

vs.

conventional systems (50 year

loops)

Residential Energy Usage

Conventional System Geothermal System

,

, |

32

Typical GHP Costs and Savings

For a GHP System in a 2,500 sq. ft. new house in St. Louis, MO

(typical middle America) Installed Cost of a 4 ton GHP System =

$6,000 per ton (12,000 Btu/ton). System Operating Cost

Comparison GHP vs. Conventional Systems

Note: System installed costs are different throughout the U.S due to

varying local conditions and labor costs. Savings vary

due to weather conditions, user preferences, and local utility

rates. Costs and savings in St. Louis are estimates and subject

to change.

Payback (GHP vs.

Hi-Eff Gas Furn+AC)

Installed cost of GHP

$24,000

Less: 30% Fed tax credit

(7,200)

GHP cost after credit

16,800

Cost for Hi-Eff Gas + AC

(12,000)

GHP premium cost

4,800

Annual Energy Savings

$1,248

Payback in Years

3.8

Positive Cash Flow

Annual Energy Savings

$1,248

Annual P&I on GHP

Premium

(6%

int.

–

10

yrs.)

(636)

Annual Cash Savings

$612

This analysis

compares these

systems:

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

Geothermal

Heat Pump

16 SEER

Standard

Heat Pump

10 SEER

Standard

Heat Pump

93% Efficient

Natural Gas

Furnace with

16 SEER A/C

80% Efficient 93% Efficient

Natural Gas

Furnace with

10 SEER A/C16 SEER A/C

Propane

Furnace with

80% Efficient 80% Efficient

Propane

Furnace with with 16 SEER with 10 SEER

10 SEER A/C

Oil Furnace

A/C

80% Efficient

Oil Furnace

A/C

Lighting & Appliance

Heating

Cooling

Hot Water |

Notes:

33

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

|

Notes:

34

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

|

Notes:

35

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

_________________________________________________________________

|

36

LSB Industries, Inc. is headquartered in

Oklahoma City and does business through

its subsidiaries, with seven HVAC manufacturing

and distribution facilities in Oklahoma City,

chemical plants in Texas, Arkansas, Alabama

and Oklahoma and an engineered products

distribution center in Oklahoma City.

Approximately 1,900 total employees.

Investor Relations:

Mark Behrman

Phone: 405-235-4546

Email: mbehrman@lsbindustries.com

The Equity Group, Inc.

Fred Buonocore

Phone: 212-836-9607

Email: fbuonocore@equityny.com

Linda Latman

Phone: 212-836-9609

Email: llatman@equityny.com

Fax: 212-421-1278

Corporate Offices:

16 South Pennsylvania Avenue

Oklahoma City, Oklahoma USA

Phone: 405-235-4546

Fax: 405-235-5067

Email: info@lsbindustries.com

Website: www.lsbindustries.com

Common Stock:

NYSE ticker symbol LXU

Auditor:

Ernst & Young LLP

Company Contact

: |