Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Corindus Vascular Robotics, Inc. | cvrs-8k_111914.htm |

Corindus Vascular Robotics, Inc. 8-K

Exhibit 99.1

Precision Vascular Robotics Corindus Overview November, 2014 1

FORWARD LOOKING STATEMENTS THIS PRESENTATION CONTAINS “FORWARD - LOOKING STATEMENTS” (AS SUCH TERM IS DEFINED IN SECTION 27 A OF THE SECURITIES ACT OF 1933 , AS AMENDED, AND SECTION 21 E OF THE SECURITIES EXCHANGE ACT OF 1934 , AS AMENDED, AND INFORMATION RELATING TO THE COMPANY, THAT ARE BASED ON THE CURRENT BELIEFS OF, AND ASSUMPTIONS MADE BY OUR MANAGEMENT AND THE INFORMATION CURRENTLY AVAILABLE TO OUR MANAGEMENT . FORWARD - LOOKING STATEMENTS RELATE TO EXPECTATIONS CONCERNING MATTERS THAT ARE NOT HISTORICAL FACTS . WORDS SUCH AS "ANTICIPATE," "BELIEVE," "ESTIMATE," "EXPECT," "INTEND," "PLAN," "PREDICT," "OPINION," "WILL" AND SIMILAR EXPRESSIONS AND THEIR VARIANTS, ARE INTENDED TO IDENTIFY FORWARD - LOOKING STATEMENTS . THESE FORWARD - LOOKING STATEMENTS INCLUDE, BUT ARE NOT LIMITED TO STATEMENTS RELATED TO OUR EXPECTED BUSINESS, PRODUCTS, ADOPTION OF ROBOTIC MEDICAL PROCEDURES, RESULTS OF OPERATIONS, FUTURE FINANCIAL CONDITION, ABILITY TO INCREASE OUR REVENUES, FINANCING PLANS AND CAPITAL REQUIREMENTS, OR COSTS OF REVENUE, EXPENSES, POTENTIAL TAX ASSETS OR LIABILITIES, EFFECT OF RECENT ACCOUNTING PRONOUNCEMENTS, CASH FLOWS AND ABILITY TO FINANCE OPERATIONS FROM CASH FLOWS, AND SIMILAR MATTERS . THESE FORWARD - LOOKING STATEMENTS SHOULD BE CONSIDERED IN LIGHT OF VARIOUS IMPORTANT FACTORS, INCLUDING, WITHOUT LIMITATION, THE IMPACT OF GLOBAL AND REGIONAL ECONOMIC AND CREDIT MARKET CONDITIONS ON HEALTH CARE SPENDING ; HEALTH CARE REFORM LEGISLATION IN THE UNITED STATES AND ITS IMPACT ON HOSPITAL SPENDING, REIMBURSEMENT AND FEES WHICH WILL BE LEVIED ON CERTAIN MEDICAL DEVICE REVENUES, DECREASES IN HOSPITAL ADMISSIONS AND ACTIONS BY PAYERS TO LIMIT OR MANAGE SURGICAL PROCEDURES TIMING AND SUCCESS OF PRODUCT DEVELOPMENT AND MARKET ACCEPTANCE OF DEVELOPED PRODUCTS, PROCEDURE COUNTS ; REGULATORY APPROVALS, CLEARANCES AND RESTRICTIONS ; GUIDELINES AND RECOMMENDATIONS IN THE HEALTH CARE AND PATIENT COMMUNITIES, INTELLECTUAL PROPERTY POSITIONS AND LITIGATION, COMPETITION IN THE MEDICAL DEVICE INDUSTRY AND IN THE SPECIFIC MARKETS OF SURGERY IN WHICH WE OPERATE, THE INABILITY TO MEET DEMAND FOR PRODUCTS, THE RESULTS OF LEGAL PROCEEDINGS TO WHICH WE ARE OR MAY BECOME A PARTY, PRODUCT LIABILITY AND OTHER LITIGATION CLAIMS, ADVERSE PUBLICITY REGARDING OUR COMPANY AND SAFETY OF OUR PRODUCTS AND THE ADEQUACY OF TRAINING ; OUR ABILITY TO EXPAND IN FOREIGN MARKETS ; AND OTHER RISK FACTORS . READERS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD - LOOKING STATEMENTS, WHICH ARE BASED ON CURRENT EXPECTATION AND ARE SUBJECT TO RISKS, UNCERTAINTIES ; AND ASSUMPTIONS THAT ARE DIFFICULT TO PREDICT, INCLUDING THOSE RISK FACTORS DESCRIBED IN THE COMPANY’S CURRENT REPORT ON FORM 8 - K FILED ON AUGUST 15 , 2014 . OUR ACTUAL RESULTS MAY DIFFER MATERIALLY AND ADVERSELY FROM THOSE EXPRESSED IN ANY FORWARD - LOOKING STATEMENTS . WE UNDERTAKE NO OBLIGATION TO PUBLICLY UPDATE OR RELEASE ANY REVISIONS TO THESE FORWARD - LOOKING STATEMENTS EXCEPT AS REQUIRED BY LAW . NOT AN OFFER THIS PRESENTATION IS FOR INFORMATIONAL PURPOSES ONLY . THE MATERIALS DO NOT CONSTITUTE EITHER AN OFFER TO SELL SECURITIES OR THE SOLICITATION OF AN OFFER TO BUY SECURITIES . 2

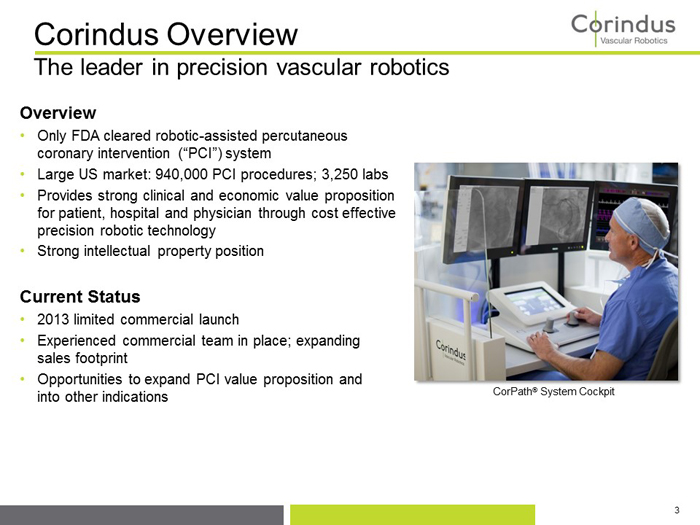

3 Corindus Overview The leader in precision vascular robotics Overview • Only FDA cleared robotic - assisted percutaneous coronary intervention (“PCI”) system • Large US market : 940,000 PCI procedures; 3,250 labs • Provides strong clinical and economic value proposition for patient, hospital and physician through cost effective precision robotic technology • Strong intellectual property position Current Status • 2013 limited commercial launch • Experienced commercial team in place; expanding sales footprint • Opportunities to expand PCI value proposition and into other indications CorPath ® System Cockpit

2014 CorPath Robotic PCI Largest Cath Lab Procedure Innovation CorPath Robotic - assisted PCI 1986 First Stent Procedure 2013 Procedure Unchanged >> 4 PCI procedure remains largely unchanged since introduction • Innovation historically focused on stents and delivery systems • PCI not optimized to required levels of complexity, dexterity and precision The CorPath System offers: • Physicians - robotic precision and control • Patients – potential to improve clinical outcomes • Hospitals - differentiation • Staff - safety and improved quality of life

Vascular Robotics Market CorPath platform potential to expand vascular indications Peripheral (1.5M Procedures) Coronary Peripheral Neuro Structural Corindus IP and Technology 5

Corindus Market Opportunity FY2018 market estimate 2 6 • New System Sales annual opportunity based on 5 - year replacement cycle in 5,750 US labs and 7,540 OUS labs, at a blended average price per system of $350,000. Prices vary by procedure type and geography. • Non - PCI procedure types are Peripheral Vascular 1 , Neurointerventional and Structural Heart. • Consumables annual sales based on year 2018 estimated PCI annual procedure volume of 940,000 in the US and 1,405,000 OUS, and non - PCI annual procedure volumes of 1,265,000 in the US and 1,885,000 OUS, at an average selling price of $530 per CorPath cassette. 2 • The annual service revenue opportunity of $475mm is based on blended average price of $44,600 per annual service contract. • Includes both PCI and future potential vascular indications • Model does not account for custom Corindus catheter devices, which could significantly expand market opportunity 1 Peripheral Vascular includes lower limb, carotid, renal, iliac and AAA (abdominal aortic aneurysm) procedures 2 Corindus market size estimates based on industry data sources New Systems ($, mm) Consumables ($, mm) Service ($, mm) Total Revenue Opportunity ($, mm) PCI $240 $520 $120 $880 Non-PCI $260 $940 $130 $1,330 US Subtotal $500 $1,460 $250 $2,210 PCI $260 $640 $130 $1,030 Non-PCI $190 $990 $95 $1,275 OUS Subtotal $450 $1,630 $225 $2,305 $950 $3,090 $475 $4,515 US OUS Worldwide

Product Overview 7

CorPath Robotic - Assisted PCI System 8

Today’s Cath Lab Challenges Staff Safety and Health is at Risk • The cath lab is a dangerous environment for workers » Radiation exposure cancer and cataract risk » Ergonomic Strain orthopedic injury and pain Procedure Outcomes Not Optimal • Difficulty viewing angiography standing at bedside • Inconsistent visual assessment of length and location • Variations in manual skill limits deployment accuracy Hospital Economics Are Inefficient • Above factors lead to: » I ncreased stent usage » Costly complications • Highly competitive market for PCI procedures Foreshortened coronary angiogram Traditional angioplasty 9

• Lab ergonomics create awkward working positions • Lead protection exacerbates stress loading – pressures up to 300 psi on discs propagating “interventionalist disc disease” • Radiation exposure – increased risk of brain tumor, leukemia/lymphoma, cataracts Safety in a Hazardous Environment Reduce radiation exposure, orthopedic injury and pain • Radiation shielded work station reduces exposure from head to toe • Improved ergonomics - work from a seated position • No need to wear lead while in cockpit - reduced stress and fatigue. • PRECISE study demonstrated 95.2% median reduction in physician radiation exposure 10

Enhanced procedure may i mprove outcomes , economics and safety Traditional PCI vs. CorPath ® Robotic PCI 11 Struggle to see angiography Assess Anatomy Close proximity ergonomic visualization Trial & error, wire spinning Navigate Precise ‘Point & Shoot’ predictability ‘Eyeball’ estimate Measure Anatomy Robotic - assisted sub - mm Measurement Manual adjustment Position Stent 1mm precise positioning Devices loose during inflation Deploy Stent Fixated devices during deployment Traditional PCI PCI steps CorPath Robotic PCI Assess Anatomy Navigate Measure Anatomy Position Stent Deploy Stent

Stent Deployment Procedural Factors – STLLR Trial • 1,557 patients, 41 US hospitals • Published Journal American College of Cardiology 1 Longitudinal Geographic Miss (LGM) • Independent Core Lab identified LGM • 47.6 % * of patients had LGM stent placements 12 STLLR Trial patients evaluated for LGM at 1 year LGM = (47.6%) No LGM = (52.4%) 6.1% TVR 2.6% TVR 1 Costa M., et al. Impact of Stent Deployment Procedural Factors on Long - Term Effectiveness and Safety of Sirolimus - Eluting Stents. Am J Cardiol , 101(12):1704 - 11 2008 *Analyzable data set included 1419 patients (required LGM and AGM data) Precision Matters in PCI How does LGM impact patients? Target Vessel Revascularization (“TVR”) = Repeat PCI or worse! (increased patient risk and cost implications) LGM Leads to 2.3x Incidence of TVR

Inaccurate Lesion Assessment Visual estimation impacts proper stent selection • >65% physicians select stent length based on visual estimation alone 1 – Physician visual estimation is inconsistent 2 • Inaccurate estimates lead to sub - optimal PCI procedure 13 1 65% according to an online survey, Junicon market research 2012 – 113 interventional cardiologists. Study s ponsored by Corindus Inc. 2 Campbell, et al. Prospective, Online, Interactive Survey Comparing Visual Lesion Estimation to Quantitative Coronary Angiogra phy , Poster, TCT 2014, Study sponsored by Corindus Inc. Decrease in accuracy in the evening v. morning 14mm 18mm 70% • 25 Image sets (20 unique images) • 5 images repeated twice during the survey • Images were provided by angiography core lab and pre - reviewed by an interventional cardiologist • 40 Physicians estimated lesion length and selected stent size for each case Visual Assessment Study Selected a stent that is shorter than the lesion Underestimated lesion length Estimated different lesion length the 2 nd time 51% 24% 20%

1 Nikolsky E, Pucelikova T, Mehran R, et al. An Evaluation of fluoroscopy time and correlation with outcomes after percutaneous coronary intervention. J Invasive Cardiol, 2007, 19: 208 - 213 2 Weisz G, et al. Safety and Feasibility of Robotic Percutaneous Coronary Intervention. J American College of Cardiol, 2013, V ol 61, No. 15: 1596 - 1600 PRECISE study demonstrated: x 9% fewer stents x 16% reduction in fluoro time x 40% less contrast used x 12% LGM Nikolsky et al, 2007 [1] Fluoro time ≤23 min (N=7,242 pts ) PRECISE study [2] (N=164 pts) Age 63.9 ± 11.8 64.1 ± 10.0 Lesion length (mm) 12.8 ± 6.7 13.4 ± 4.0 Number of Stents 1.20 ± 0.83 1.1 ± 0.34 Fluoroscopy time (min) 12.7 ± 5.1 10.6 ± 6.2 Contrast Volume (ml) 242 ± 100 144.2 ± 70 PRECISE vs. Historical Data Compares CorPath robotic vs. historical PCI procedure 14

15 Clinical Evidence – Precision Matters Peer reviewed publication highlights Continued Investment in Clinical Data • Post PRECISE sub - analysis • PRECISION registry post market data collection and analysis vs. manual procedures • Concurrent studies to prove procedure benefits of CorPath robotic precision vs. manual procedures » Reduced LGM » Measurement accuracy » Visualization » Stent utilization » Contrast utilization » Radiation exposure

Commercial Strategy 16

Sales Strategy Dedicated system and cassette sales teams 17 System Sales Team • Experienced medical technology sales professionals – System ‘hunters’ • Leveraging both capital and usage models to accelerate sales • Increasing field team • Focused on largest market areas Cassette Sales Team • Experienced interventional procedure/device sales – procedure ‘builders’ • Initial site training and program launch • Drive procedures and cassette sales, in depth account focus • Continuous use and adoption of new users Two sales teams working together to provide experienced interventional cardiology leadership.

Intellectual Property 18

Intellectual Property Overview Expanding on a strong f oundation Continuous “Ring - fencing” all vascular robotics applications: • 30 issued global patents • 54 patents pending: broad application coverage • Continuously building IP portfolio • Pursuing the entire vascular space 19 The only company allowed to remotely control two or more co - axial devices - a requirement for PCI and most vascular procedures

Summary 20

Key Financial Information 21 Key Metrics* Cash, Cash Equivalents and Marketable Securities $6.9 million Private Placements in Q3 2014 $27.5 million Debt** $5.0 million Basic Weighted Average Shares Outstanding 73,360,273 Warrants Outstanding 5,029,865 Stock Options Outstanding 9,046,549 Closing Share Price (as of 11/13/14) $4.10 * As of June 30, 2014, except Private Placements in Q3 2014 ** Outstanding principal balance

• PCI is a very large volume medical robotics procedure opportunity; long growth runway • Established initial installed base during 2013 limited launch • PCI commercial foundation and regional show sites in place • Sales team expansion and funnel building across US • Building technology and clinical experience for next application growth markets: Peripheral, Neuro, Structural Heart 22 Corindus Growth Platform Interventional robotics leadership

Precision Vascular Robotics The New Standard of Care in Vascular Procedures 23 About Corindus Vascular Robotics Corindus Vascular Robotics is a global technology leader in robotic - assisted percutaneous coronary interventions. The company’s CorPath System is the first medical device that offers interventional cardiologists PCI procedure control from an interventional cockpit. Visit us at www.corindus.com