Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MIDDLEFIELD BANC CORP | d822366d8k.htm |

Thomas G. Caldwell

President and CEO

Donald L. Stacy

Treasurer and CFO

Exhibit 99.1

Middlefield Banc Corp.

Investor Presentation

November 2014 |

Forward Looking Statements

This presentation contains forward-looking statements within the

meaning of the Securities Exchange Act of 1934 and the Private

Securities Litigation Reform Act of 1995 concerning Middlefield

Banc Corp.’s plans, strategies, objectives, expectations, intentions,

financial condition and results of operations. These

forward-looking statements reflect management’s current

views and intentions and are subject to known and unknown risks,

uncertainties, assumptions and other factors that could cause the

actual results to differ materially from those contemplated by

the statements. The significant risks and uncertainties

related to Middlefield Banc Corp. of which management is aware are

discussed in detail in the periodic reports that Middlefield Banc Corp.

files with the Securities and Exchange Commission (the

“SEC”), including in the “Risk Factors”

section

of its Annual Report on Form 10-K and its Quarterly Report on Form

10-Q. Investors are urged to review Middlefield Banc

Corp.’s periodic reports, which are available at no charge

through the SEC’s website at www.sec.gov

and through Middlefield Banc Corp.’s

website at www.middlefieldbank.com

on the “Investor Relations”

page. Middlefield Banc

Corp. assumes no obligation to update any of these forward-looking

statements to reflect a change in its views or events or

circumstances that occur after the date of this presentation.

2 |

Middlefield Banc Corp.

For over 100 years, Middlefield Banc

Corp. has supported its communities

by offering customers superior

financial products, exceptional

service, and modern banking

amenities

Company Snapshot

(1)(2)

NASDAQ:

MBCN

Stock Price:

$33.26

Market Cap:

$68.1 million

Dividend (yield):

$1.04 (3.1%)

Headquarters:

Middlefield, Ohio

Established:

Bank 1901/HC 1988

Branches:

10

Total Assets:

$680.3 million

Net Loans

$460.9 million

Total Deposits:

$600.0 million

(1)

Stock price, market cap and dividend yield as of October 31, 2014

(2)

Financial figures for the period ended September 30, 2014

3 |

Rankings and Awards

4

Sources:

(1)

SNL June 16, 2014

Disproving the naysayers, some banks under $1B thrive

By Kiah Lau Haslett and Marshall Schraibman

(2)

Independent Banker

http://independentbanker.org/2014/05/community-banks-with-assets-of-more-than-500-million-to-1-billion/

(3)

American Banker April 28, 2014

http://www.americanbanker.com/magazine/124_04/rising-tide-our-ranking-of-the-top-200-community-banks-1066820-1.html

SNL Financial

(1)

According to a June 16, 2014 article from SNL Financial, Middlefield

Banc Corp. had the 10

th

highest ROAE out of public community banks

with under $1 billion in assets.

American Banker

(3)

Middlefield Banc Corp. was ranked 63

rd

out of the top 200 community

banks and thrifts by 3-year Avg. ROE according to an April 28,

2014 American Banker article.

Independent Banker

(2)

According to May 30, 2014 study from Independent Banker,

Middlefield Banc Corp. had the 21

st

highest ROE of community banks

with assets of $500 million to $1 billion

|

Growing Banking Franchise

Profitable throughout the economic cycle and

never reported a quarterly loss

History of quarterly cash dividend payments

and maintained dividend amount during

recession

Excellent asset quality, strong liquidity

profile, and robust core deposit base

Strong Return on Average Equity

Expanded into Central Ohio with the April

2007 acquisition of Emerald Bank

Acquired Westerville branch in November

2008

Consolidated Emerald Bank into The

Middlefield Banking Company on

January 20, 2014

5 |

Middlefield Overview

6

Middlefield Banc Corp. is a community banking leader with

strong brand recognition in its markets

Favorable distribution network: 10 branches in five counties,

serving two distinct Ohio market areas

Northeastern Ohio market consists principally of:

–

Geauga County

–

Trumbull County

–

Ashtabula County

–

Portage County

Two central Ohio branches are located in Dublin and Westerville

in Franklin County, north of Columbus.

Cleveland MSA and Columbus MSA have a combined population of more than

4.0 million people

Opportunities to “fill in”

gap between two operating geographies

According to FDIC statistics, Ohio insured financial institutions have

declined 25% from 304 institutions in 2003 to 227 at the end of

2013 In

terms

of

deposits,

out

of

249

banks

in

the

State

of

Ohio

Middlefield

was

the

33

rd

largest

bank in the state at June 30, 2014 |

Middlefield Serves Two Distinct Ohio Markets with Strong Demographics

Northeast Ohio

Northern Columbus

8 banking locations

Geauga County is 3

rd

in median

household income

(1)

out of 88 Ohio

counties

Geauga County is the center of the 4

th

largest Amish population in the world

–

This demographic provides a strong

borrowing and stable deposit base

Marcellus and Utica Shale opportunities

Improvements in manufacturing

2 banking locations

Columbus is the state capital and largest

city in Ohio

Franklin County is 2

nd

in population in

Ohio

Delaware County, immediately north of

Franklin, has the 2

nd

highest median

household income in Ohio

At June 30, 2014, 5 of the 34 banks in

Franklin County controlled 85% of total

deposits.

8 of the bank's 10 offices (and nearly 85% of deposits) are located in

counties that have stronger demographics than the State average

median household income, median value, value of

owner-occupied housing, and employment rates 7

(1) According to:

www.usa.com/rank/ohio-state--median-household-income--county-rank.htm?hl=Geauga&hlst=OH&yr=6000

|

Corporate Infrastructure and Experienced Management to Support Growth

Middlefield’s success is driven by a strong leadership team

dedicated to creating value for shareholders, while providing the

highest quality financial products and services within the

communities the Company serves

Experienced Management

2014 Investments in Infrastructure

Average tenure of 8 executive officers:

–

At MBCN is over 14 years

–

Within industry is over 25 years

Thomas Caldwell, CEO serves on the

Federal Delegate Board of the

Independent Community Bankers of

America, having been elected in June

2010. Mr. Caldwell previously served as

Chairman of the Community Bankers

Association of Ohio.

Sales-orientation culture

Community focused culture

Focused on expanding technology

–

Launched new website

–

Enhanced on-line banking

–

Developed mobile banking

capabilities

Hired Chief Information Officer and

Chief Credit Officer

Centralized operations center to a new

20,000 sq. foot facility

8 |

9

Personal Banking

Personal Banking

Products and Services

Strong brand recognition in core markets

–

#1 Market Share in Geauga County

–

#6 Market Share in Portage County

–

#3 overall within the primary

northeastern Ohio market

Focused on growth

–

Improved on-line banking offerings

–

Residential mortgage products

–

De novo expansion and strategic

acquisitions

Customers trust Middlefield Banc Corp. to be there for them in

day-to-day money management as well as for those milestone

events in their financial lives |

10

Market Share

Ashtabula, Geauga, Portage & Trumbull Counties

June 30, 2014

Rank

Institution

Branches

Deposits in

Market ($000)

Market

Share

1

Huntington National Bank

38

1,532,821

20.60

2

JP Morgan Chase

19

894,279

12.02

3

The Middlefield Banking Co.

8

528,765

7.11

4

KeyBank

15

522,389

7.02

5

PNC Bank

11

506,911

6.81

6

Talmer Bank and Trust

9

464,660

6.24

7

Cortland Savings & Banking

10

385,484

5.18

8

First Merit Bank

12

347,397

4.67

Total for institutions in market

190

7,441,520

Franklin County

June 30, 2014

Rank

Institution

Branches

Deposits in

Market ($000)

Market

Share

1

Huntington National Bank

68

14,035,079

31.14

2

JP Morgan Chase

53

10,503,465

23.30

3

PNC Bank

42

5,130,794

11.38

4

Nationwide Bank

2

4,415,679

9.80

5

Fifth Third Bank

47

4,145,568

9.20

25

The Middlefield Banking Co.

2

61,079

0.14

26

Vinton County National Bank

1

57,354

0.13

27

First City Bank

1

44,764

0.10

Total for institutions in market

344

45,074,325

Strong Market Share in

Northeastern Ohio Market

Opportunities To Increase

Market Share in Central Ohio

Source: FDIC |

11

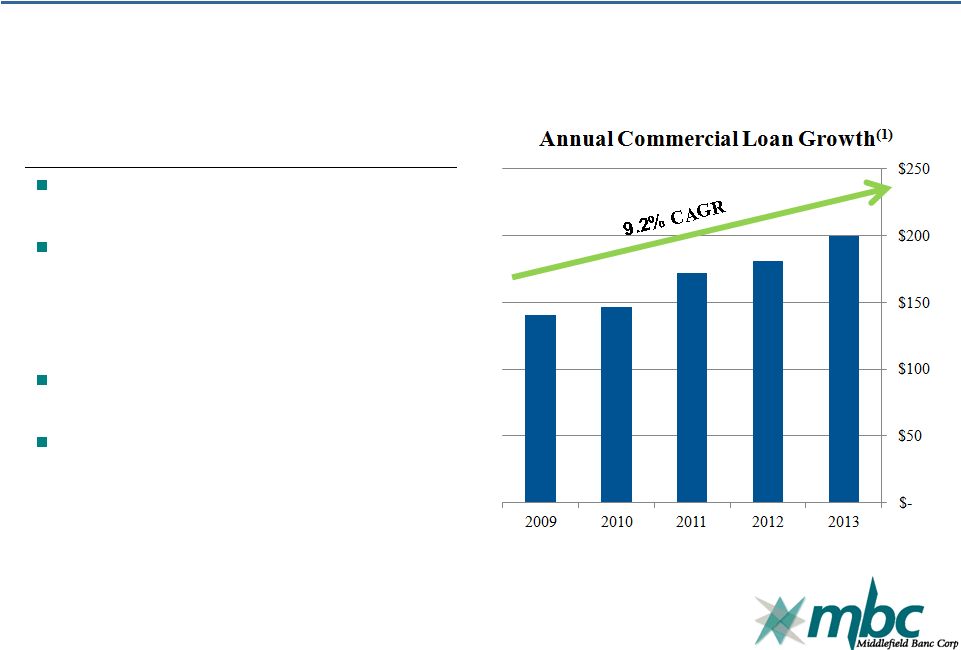

Commercial Banking

Commercial Banking

Products and Services

$208.4 million in commercial loans at

September 30, 2014

Enhanced commercial banking leadership

team in 2014 by adding:

–

Chief Credit Officer

–

SVP –

Commercial Lending

Expertise in niche commercial loan

products

Growth objectives include:

–

Branch expansions

–

Selective acquisitions

–

Increase market share

For over 100 years, Middlefield Banc Corp. has been helping businesses

grow (1) Dollars in millions |

History of Strong Financial Results

ROAA

0.36%

0.41%

0.65%

0.95%

1.06%

ROAE

4.90%

6.44%

10.24%

11.98%

13.17%

Return on Average Assets

Return on Average Equity

Managed cost of funding to increase net

interest margin

Anticipate continued pressure on margin

levels due to:

–

Higher regulatory costs

–

Continued low rate environment

–

Investments to support growth

Opportunities to offset margin pressures

and increase profitability by improvements

in fee based income

Nine Months Ended

September 30,

2014

2013

ROAA

(1)

1.06%

1.05%

ROAE

(1)

12.74%

12.74%

(1)

Annualized

Annual Return on Average Assets and Equity

12 |

2014 Third Quarter Highlights

2014 third quarter highlights include:

(on a year-over-year basis unless noted)

Net interest income increased 1.1% to $5.9 million.

Noninterest income grew 22.5% to $1.0 million.

Net income up 2.8% to $1.9 million, or $0.93 per

diluted share.

Tangible stockholders’

equity improved 4.3% from

2014 second quarter, and 16.6% from December 31,

2013.

Total net loans increased 12.1%.

Nonperforming assets declined to $13.1 million from

$16.3 million.

Tier 1 capital ratio strengthened to 9.50% from 8.70%.

Throughout 2014 Middlefield will be making investments in its business by

enhancing the company’s operations, products, and services,

and adding senior managers to assist with

its growth objectives

13

Net Income

Total Noninterest Income

Net Interest Income

(1) Dollars in thousands |

Stable and Growing Loan Portfolio

Net loans at September 30, 2014 were

$460.9 million, up from $411.2 million in

the same period last year

Loan policy goal is to achieve a

composition mix of:

–

40 –

50% residential real estate loans

–

35 –

45% commercial loans

–

5 –

15% consumer loans

–

5% credit card accounts

Adding secondary mortgage market will

enhance residential product

–

Especially in Columbus market

No national or sub-prime lending

Lending within market area

Participation loans with banks that have

similar credit quality standards and

cultures

Loan Portfolio at September 30, 2014

14

(1) Dollars in millions |

Excellent Asset Quality

Dollars in thousands

2011

2012

2013

Q314

Q313

Nonperforming Loans

$24,546

$14,224

$12,290

$10,438

$13,608

Real Estate Owned

2,196

1,846

2,698

2,674

2,719

Nonperforming Assets (NPAs)

$26,742

$16,070

$14,988

$13,112

$16,327

NPAs/Total Assets (%)

4.09%

2.40%

2.32%

1.93%

2.48%

Allowance for Loan Losses

$6,819

$7,779

$7,046

$7,288

$7,821

Allowance/Total Loans (%)

1.70%

1.90%

1.62%

1.56%

1.87%

Net Charge-off Ratio –

Annualized (%)

0.65%

0.30%

0.22%

(0.08)%

0.08%

Strong reserve coverage provides flexibility in managing potential losses

with reduced impact on net income

Problem assets peaked in 2011,

primarily driven by non-owner

occupied 1 -

4 family in Central

Ohio market

Net charge-offs returned to

normalized levels in 2012

15 |

Supplemental Information

16 |

Strong Capital Levels

Capital Levels at September 30, 2014

Middlefield Banc Corp.

(Dollars in thousands)

Amount

Ratio

Total Capital (to Risk-weighted Assets)

Actual

$

69,449

13.93%

For Capital Adequacy Purposes

39,874

8.00

To Be Well Capitalized

49,843

10.00

Tier I Capital (to Risk-weighted Assets)

Actual

$

63,206

12.68%

For Capital Adequacy Purposes

19,937

4.00

To Be Well Capitalized

29,906

6.00

Tier I Capital (to Average Assets)

Actual

$

63,206

9.50%

For Capital Adequacy Purposes

26,610

4.00

To Be Well Capitalized

33,262

5.00

17 |

Quarterly and Nine-Month Financial Summary

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

Dollars in thousands

2014

2013

2014

2013

Net interest income

5,912

5,846

17,754

17,021

Provision for loan losses

70

153

370

766

Noninterest income

990

808

2,562

2,495

Noninterest expense

4,385

4,115

13,212

12,064

Income before income taxes

2,447

2,386

6,734

6,686

Income taxes

529

521

1,442

1,479

Net income

1,918

1,865

5,292

5,207

Net interest margin

3.99%

4.05%

4.08%

4.03%

Total assets

680,262

658,141

Loans outstanding, net

460,920

411,239

Deposits

600,020

579,222

Equity capital

61,515

52,529

Earnings per share

0.93

0.92

2.59

2.58

Cash dividend (per share)

0.26

0.26

0.78

0.78

Dividend pay-out ratio

27.58%

27.99%

30.01%

30.13%

Return on average assets

1.13%

1.12%

1.06%

1.05%

Return on average equity

13.55%

13.66%

12.74%

12.74%

18 |

Annual Financial Summary

Dollars in thousands

2009

2010

2011

2012

2013

Net interest income

14,268

18,149

21,075

22,299

22,928

Provision for loan losses

2,578

3,580

3,085

2,168

196

Noninterest income

2,668

2,623

2,237

3,451

3,145

Noninterest expense

12,650

14,763

15,501

15,639

16,870

Income before income taxes

1,708

2,429

4,726

7,943

9,007

Income taxes

(73)

(88)

596

1,662

1,979

Net income

1,781

2,517

4,130

6,281

7,028

Net interest margin

3.30%

3.41%

3.65%

3.74%

3.85%

Total assets

558,658

632,197

654,551

670,288

647,090

Loans outstanding, net

348,660

366,277

395,061

400,654

428,679

Deposits

487,106

565,251

580,962

593,335

568,836

Equity capital

36,707

38,022

47,253

55,437

53,473

Earnings per share

1.15

1.60

2.45

3.29

3.49

Cash dividend (per share)

1.04

1.04

1.04

1.04

1.04

Dividend pay-out ratio

90.28%

65.04%

42.71%

31.87%

29.14%

Return on average assets

0.36%

0.41%

0.65%

0.95%

1.06%

Return on average equity

4.90%

6.44%

10.24%

11.98%

13.17%

19 |