Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ENDEAVOUR INTERNATIONAL CORP | d822735d8k.htm |

| EX-99.1 - EX-99.1 - ENDEAVOUR INTERNATIONAL CORP | d822735dex991.htm |

Exhibit 99.2

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

|

|

x | |||

| : | ||||

| In re: | : | Chapter 11 | ||

| : | ||||

| ENDEAVOUR OPERATING | : | |||

| CORPORATION, et al.,1 | : | Case No. 14–12308 (KJC) | ||

| : | ||||

| Debtors. |

: | (Jointly Administered) | ||

| : | ||||

|

|

x |

PROPOSED DISCLOSURE STATEMENT FOR THE DEBTORS’ JOINT

PLAN OF REORGANIZATION UNDER CHAPTER 11 OF THE BANKRUPTCY CODE

THIS IS NOT A SOLICITATION OF ACCEPTANCE OR REJECTION OF THE PLAN. ACCEPTANCES OR REJECTIONS MAY NOT BE SOLICITED UNTIL A DISCLOSURE STATEMENT HAS BEEN APPROVED BY THE BANKRUPTCY COURT. THE DISCLOSURE STATEMENT IS BEING SUBMITTED FOR APPROVAL BUT HAS NOT BEEN APPROVED BY THE BANKRUPTCY COURT TO DATE.

| WEIL, GOTSHAL & MANGES LLP | RICHARDS, LAYTON & FINGER, P.A. | |

| 767 Fifth Avenue | One Rodney Square | |

| New York, New York 10153 | 920 North King Street | |

| Telephone: (212) 310-8000 | Wilmington, Delaware 19801 | |

| Facsimile: (212) 310-8007 | Telephone: (302) 651-7700 | |

| Facsimile: (302) 651-7701 | ||

Attorneys for the Debtors

and Debtors in Possession

Dated: November 17, 2014

| 1 | The Debtors in these Chapter 11 Cases and the last four digits of each Debtor’s taxpayer identification number are as follows: Endeavour Operating Corporation (6552); Endeavour International Corporation (8389); Endeavour Colorado Corporation (0067); END Management Company (7578); Endeavour Energy New Ventures Inc. (7563); and Endeavour Energy Luxembourg S.à.r.l. (2113). The Debtors’ principal offices are located at 811 Main Street, Suite 2100, Houston, Texas 77002. |

TABLE OF CONTENTS

| I. INTRODUCTION TO THE DISCLOSURE STATEMENT |

1 | |||||

| A. |

Purpose of the Disclosure Statement |

1 | ||||

| B. |

Commencement of the Chapter 11 Cases |

2 | ||||

| C. |

Restructuring Support Agreement |

2 | ||||

| D. |

Plan Summary |

3 | ||||

| E. |

Representations and Disclaimers |

6 | ||||

| F. |

Summary of Voting Procedures |

7 | ||||

| G. |

Confirmation Hearing |

8 | ||||

| II. OVERVIEW OF THE DEBTORS’ OPERATIONS AND CAPITAL STRUCTURE |

9 | |||||

| A. |

Introduction |

9 | ||||

| B. |

Corporate Structure |

10 | ||||

| C. |

The Debtors’ Operations |

11 | ||||

| D. |

Prepetition Indebtedness and Capital Structure |

14 | ||||

| III. KEY EVENTS LEADING TO THE COMMENCEMENT OF CHAPTER 11 CASES |

19 | |||||

| A. |

Oil and Gas Exploration and Production Requires Significant Capital |

19 | ||||

| B. |

Unforeseen Negative Events Impacted the Debtors’ Revenues and Liquidity |

20 | ||||

| C. |

The Company’s Prepetition Efforts to Delever |

22 | ||||

| D. |

The Restructuring Support Agreement |

24 | ||||

| IV. THE CHAPTER 11 CASES |

25 | |||||

| V. THE PLAN |

30 | |||||

| A. |

Introduction |

30 | ||||

| B. |

Classification and Treatment of Claims and Interests Under the Bankruptcy Code |

30 | ||||

| C. |

Treatment of Unclassified Claims |

32 | ||||

| D. |

Classification of Claims and Interests |

33 | ||||

| E. |

Treatment of Claims and Interests |

35 | ||||

| F. |

Summaries of New Securities |

39 | ||||

| G. |

Means of Implementation |

45 | ||||

| H. |

Distributions Under the Plan |

52 | ||||

| I. |

Procedures for Objecting to Disputed Claims and Interests |

55 | ||||

i

| J. |

Executory Contracts and Unexpired Leases |

56 | ||||

| K. |

Conditions Precedent to the Effective Date |

60 | ||||

| L. |

Effect of Confirmation |

61 | ||||

| M. |

Jurisdiction and Governing Law |

65 | ||||

| VI. PROJECTIONS AND VALUATION ANALYSIS |

67 | |||||

| A. |

Assumed Valuation of the Reorganized Debtors |

67 | ||||

| B. |

Consolidated Projected Financial Statements |

68 | ||||

| C. |

Liquidation Analysis |

68 | ||||

| VII. SECURITIES LAW MATTERS |

68 | |||||

| A. |

New Notes, New Preferred Stock and New Common Stock |

68 | ||||

| B. |

Transfer and Securities Laws Restrictions |

68 | ||||

| VIII. CERTAIN RISK FACTORS TO BE CONSIDERED |

70 | |||||

| A. |

Certain Bankruptcy Law Considerations |

70 | ||||

| B. |

Risks in Connection with the Restructuring Support Agreement |

72 | ||||

| C. |

Risks Associated with the Debtors’ Business and Industry |

72 | ||||

| D. |

The Financial Projections are Based on Significant Assumptions |

73 | ||||

| E. |

Risks Related to an Investment in the New Notes |

74 | ||||

| F. |

Risks Related to Investment in the New Common Stock and the New Preferred Stock |

80 | ||||

| G. |

Unforeseen Events |

82 | ||||

| IX. VOTING PROCEDURES AND REQUIREMENTS |

82 | |||||

| X. CONFIRMATION OF THE PLAN |

83 | |||||

| A. |

Confirmation Hearing |

83 | ||||

| B. |

Objections to Confirmation |

83 | ||||

| C. |

Requirements for Confirmation of the Plan |

85 | ||||

| XI. ALTERNATIVES TO CONFIRMATION AND CONSUMMATION OF THE PLAN |

88 | |||||

| A. |

Alternative Plan |

88 | ||||

| B. |

Liquidation Under Chapter 7 |

88 | ||||

| XII. CERTAIN FEDERAL INCOME TAX CONSEQUENCES OF THE PLAN |

89 | |||||

| A. |

Consequences to the Debtors |

90 | ||||

| B. |

Consequences to Holders of Certain Claims |

93 | ||||

| XIII. CONCLUSION AND RECOMMENDATION |

105 | |||||

ii

EXHIBITS

| Exhibit A | The Plan | |

| Exhibit B | Restructuring Support Agreement | |

| Exhibit C | Voting Instructions | |

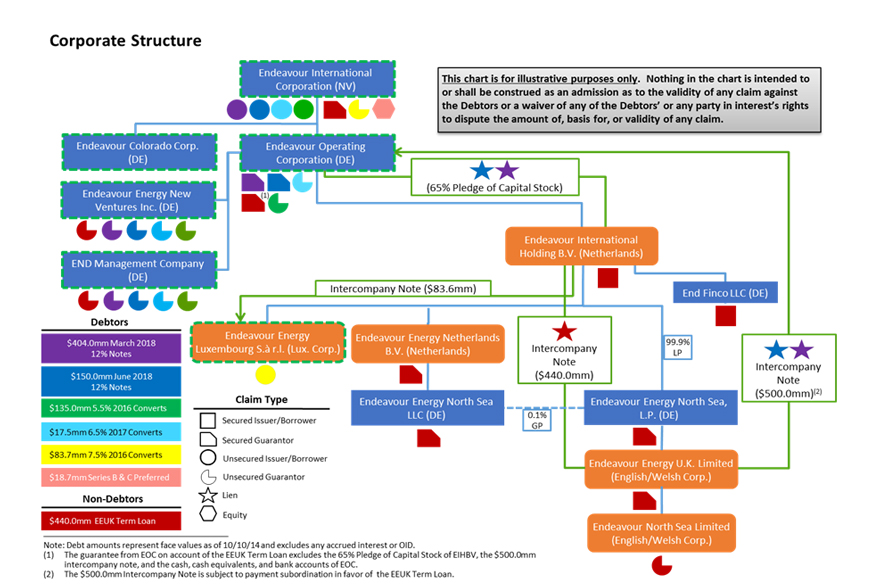

| Exhibit D | Corporate Structure Chart | |

| Exhibit E | Financial Projections | |

| Exhibit F | Liquidation Analysis | |

iii

THIS IS NOT A SOLICITATION OF ACCEPTANCE OR REJECTION OF THE PLAN. ACCEPTANCES OR REJECTIONS MAY NOT BE SOLICITED UNTIL A DISCLOSURE STATEMENT HAS BEEN APPROVED BY THE BANKRUPTCY COURT. THE DISCLOSURE STATEMENT IS BEING SUBMITTED FOR APPROVAL BUT HAS NOT BEEN APPROVED BY THE BANKRUPTCY COURT TO DATE.

i

THE VOTING DEADLINE TO ACCEPT OR REJECT THE PLAN IS 8:00 P.M. EASTERN TIME ON [JANUARY 20], 2015 UNLESS EXTENDED BY ORDER OF THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE.

I. INTRODUCTION TO THE DISCLOSURE STATEMENT

| A. | PURPOSE OF THE DISCLOSURE STATEMENT2 |

Endeavour Operating Corporation (“EOC”), its parent, Endeavour International Corporation (“EIC”), and their above-captioned debtor affiliates (collectively, the “Debtors”) submit this disclosure statement (the “Disclosure Statement”) pursuant to section 1125 of title 11 of the United States Code (the “Bankruptcy Code”) in connection with the solicitation (the “Solicitation”) of acceptances of the Debtors’ Joint Plan of Reorganization Under Chapter 11 of the Bankruptcy Code (the “Plan”), attached hereto as Exhibit A, filed by the Debtors on November 17, 2014 (D.I. [ ]). This Solicitation is being conducted to obtain sufficient acceptances of the Plan.

On [DATE], 2014, the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”), pursuant to section 1125 of the Bankruptcy Code, approved this Disclosure Statement as containing adequate information to enable a hypothetical, reasonable investor – typical of the solicited classes of Claims and Interests – to make an informed judgment whether to vote to accept or reject the Plan. APPROVAL OF THIS DISCLOSURE STATEMENT BY THE BANKRUPTCY COURT DOES NOT CONSTITUTE A DETERMINATION OF THE FAIRNESS OR THE MERITS OF THE PLAN OR OF THE ACCURACY OR COMPLETENESS OF THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT.

Accompanying this Disclosure Statement is a ballot (the “Ballot”) (and return envelope) for voting to accept or reject the Plan. Holders of claims entitled to vote (collectively, the “Voting Claims”) must return a Ballot to the Debtors’ Solicitation Agent (as hereinafter defined) prior to January 20, 2015 (the “Voting Deadline”) for their Ballot to be counted. See Section IX of this Disclosure Statement for a more detailed description of voting procedures and deadline.

This Disclosure Statement contains important information and holders of Voting Claims are advised and encouraged to read this Disclosure Statement and the attached Plan in their entirety before voting to accept or reject the Plan, including, without limitation, the risk factors set forth in Section VIII of this Disclosure Statement.

The exhibits to this Disclosure Statement are incorporated as if fully set forth herein and are a part of this Disclosure Statement.

| 2 | Capitalized terms used in this Disclosure Statement but not defined herein shall have the meaning ascribed to them in the Plan unless otherwise noted. |

1

Documents filed with the United States Securities and Exchange Commission (the “SEC”) may contain additional information regarding the Debtors. Copies of any document filed by EIC with the SEC may be obtained by visiting the SEC’s website at http://www.sec.gov. Each of the following filings by EIC is incorporated as if fully set forth herein and is a part of this Disclosure Statement:

| • | Form 10-K for the fiscal year ended December 31, 2013, filed with the SEC on March 17, 2014 (including Form 10-K/A filed with the SEC on March 21, 2014); |

| • | Form 10-Q for the quarterly period ended September 30, 2014, filed with the SEC on November 12, 2014; |

| • | Form 10-Q for the quarterly period ended June 30, 2014, filed with the SEC on August 8, 2014; |

| • | Form 10-Q for the quarterly period ended March 31, 2014, filed with the SEC on May 9, 2014; and |

| • | Forms 8-K filed with the SEC on September 2, 2014, October 1, 2014, October 3, 2014, October 14, 2014, October 21, 2014, October 28, 2014 and November 13, 2014. |

Reports filed by EIC with the SEC on or after the date of this Disclosure Statement are also incorporated by reference herein.

In addition to being available on the SEC’s company search website, upon written request by any holder of a Voting Claim to Kurtzman Carson Consultants (“KCC” or the “Solicitation Agent”), the Debtors’ will provide copies of any of the above SEC filings.

| B. | COMMENCEMENT OF THE CHAPTER 11 CASES |

The Debtors filed voluntary cases (the “Chapter 11 Cases”) under chapter 11 of the Bankruptcy Code on October 10, 2014 (the “Petition Date”). The Debtors’ Chapter 11 Cases are currently pending before the Bankruptcy Court. The Debtors’ Chapter 11 Cases are being jointly administered for administrative purposes.

| C. | RESTRUCTURING SUPPORT AGREEMENT |

On October 10, 2014, prior to filing the voluntary petitions in these Chapter 11 Cases, the Debtors entered into an agreement (the “Restructuring Support Agreement”) with certain prepetition creditors, including certain of the March 2018 Noteholders, certain of the June 2018 Noteholders, certain of the 5.5% Convertible Noteholders, all of the 6.5% Convertible Noteholders and certain of the 7.5% Convertible Bondholders (all as hereinafter defined, and along with certain additional parties that thereafter signed joinders to the Restructuring Support Agreement, collectively, the “RSA Parties”) to recapitalize and restructure the Debtors, as set forth in the Plan. On November 10, 2014, the Bankruptcy Court approved an order authorizing the Debtors to assume the Restructuring Support Agreement pursuant to sections 105(a) and 365(a) of the Bankruptcy Code. The Restructuring Support Agreement is attached hereto as Exhibit B.

2

The Plan and Restructuring Support Agreement are supported by creditors throughout the Debtors’ capital structure and represent the culmination of extensive negotiations between the Debtors and the RSA Parties. The RSA Parties, who collectively hold approximately 75.41% of the March 2018 Notes Claims (Class 3), 69.88% of the June 2018 Notes Claims (Class 4), 99.75% of the 7.5% Convertible Bonds Claims (Class 5) and 69.08% of the Convertible Notes Claims (Class 6), have made substantial concessions to come to the Plan terms and have agreed to support and vote in favor of the Plan.

| D. | PLAN SUMMARY |

The Plan provides for the reduction of approximately $598 million3 of the Debtors’ existing debt, the reduction of approximately 43% of the Debtors annual interest burden, and freeing up of approximately $50 million in annual cash flow that can be used for reinvestment in the Debtors’ business. Among other things, the Plan further provides for (i) the cancellation of all of the Debtors’ existing debt and equity (other than any Claim against a Debtor held by another Debtor or an Affiliate of a Debtor (an “Intercompany Claim”) and any Interests in the Debtors other than EIC (the “Subsidiary Interests”)) and (ii) the issuance of $262.5 million in new notes bearing a 9.75% interest rate (the “New Notes”), new Series A convertible preferred stock (the “New Preferred Stock”) and new shares of common stock (the “New Common Stock”).

Pursuant to the Plan, the Voting Claims include all Allowed Claims that have been placed in Classes 3 through 7. The New Notes, New Preferred Stock and New Common Stock are being issued in full and final satisfaction of the Allowed Claims of the 2018 Noteholders (Classes 3 and 4), the 7.5% Convertible Bondholders (Class 5) and the Convertible Noteholders (Class 6) on the date on which all conditions to the effectiveness of the Plan have been satisfied or waived in accordance with the terms of the Plan (the “Effective Date”). The Plan provides that holders of Allowed General Unsecured Claims of a value greater than $10,000 (Class 7 - General Unsecured Claims) will receive a distribution of Cash equal to [15.0%] of the value of their Allowed Claim, in full and final satisfaction of such Claims on the Effective Date. Pursuant to section 1122(b) of the Bankruptcy Code, holders of Allowed General Unsecured Claims in the amount of $10,000 or less (Class 8 – Convenience Class Claims) will receive a distribution of Cash equal to 100% of the value of their Allowed Claim, in full and final satisfaction of such Claims on the Effective Date.

None of the indebtedness or other obligations of the Debtors’ non-debtor affiliates (collectively, the “Non-Debtor Affiliates”)—other than certain permitted reductions of, and other changes to, the intercompany note owed by Endeavour Energy UK Limited, an English/Welsh corporation (“EEUK”) to EOC—will be affected by the restructuring, including the $440 million in principal, plus interest and any other amounts outstanding, under the Restated EEUK Term Loan (as defined herein) entered into by EIC, certain of the Debtors’ Non-Debtor Affiliates, the

| 3 | Assumes debt balances through 10/10/14, and includes accrued interest through an assumed transaction date of 3/31/15 for the March 2018 Notes and through the Petition Date for all other debt balances. |

3

lenders party thereto (collectively, the “EEUK Term Loan Lenders”) and Credit Suisse AG, Cayman Island Branch (“Credit Suisse”) as administrative and collateral agent, dated September 30, 2014.

4

The following table summarizes the treatment and estimated recovery for creditors and interest holders under the Plan. The classification of claims and interests described below will apply separately to each of the Debtors. For additional information, please refer to the discussion in Section V of this Disclosure Statement and the Plan itself:

| Class |

Description |

Entitled to Vote |

Estimated Recovery |

Pro Rata Form of Distribution | ||||||||

| 1 |

Priority Non-Tax Claims |

No– Deemed to Accept |

100 | % | • | Cash | ||||||

| 2 |

Other Secured Claims |

No– Deemed to Accept |

100 | % | •

•

• |

Cash

Reinstatement or

Such other recovery necessary to satisfy the Bankruptcy Code | ||||||

| 3 |

March 2018 Notes Claims |

Yes | See § VI.A | 4 | • | $262.5 million of New Notes due 2020 and | ||||||

|

• |

82.57% of New Preferred Stock ($196.1 million liquidation preference), convertible into 66.30% of New Common Stock | |||||||||||

| 4 |

June 2018 Notes Claims |

Yes | See § VI.A | 4 | • | 17.43% of New Preferred Stock ($41.4 million liquidation preference), convertible into 14.00% of New Common Stock and | ||||||

|

• |

2.74% of New Common Stock | |||||||||||

| 5 |

7.5% Convertible Bonds Claims |

Yes | See § VI.A | 4 | • | 8.72% of New Common Stock | ||||||

| 6 |

Convertible Notes Claims |

Yes | See § VI.A | 4 | • | 8.24% of New Common Stock | ||||||

| 7 |

General Unsecured Claims |

Yes | [15 | %] | • | Cash equal to 15% of amount of Allowed General Unsecured Claim | ||||||

| 8 |

Convenience Class Claims |

No – Deemed to Accept |

100 | % | • | Cash | ||||||

| 9 |

Series C Preferred Interests in EIC |

No – Deemed to Reject |

0 | % | • | No recovery | ||||||

| 10 |

Series B Preferred Interests in EIC |

No – Deemed to Reject |

0 | % | • | No recovery | ||||||

| 11 |

Interests in EIC |

No – Deemed to Reject |

0 | % | • | No recovery | ||||||

| 4 | As described in greater detail in Section V.E of this Disclosure Statement, the Plan contemplates distribution of fixed percentages of New Preferred Stock and/or New Common Stock on the Effective Date to each of the holders of Allowed Claims in Classes 3 through 6. Over the course of the negotiations that resulted in the Restructuring Support Agreement, the RSA Parties and the Debtors did not reach a consensus regarding a projected post-Effective Date total enterprise value of the Reorganized Debtors and their Non-Debtor Affiliates (the “Reorganized Company TEV”), and the Debtors understand that particular creditor groups determined to support the Restructuring Support Agreement based upon their own views of the Reorganized Company TEV. As discussed in Section V.G.3 of this Disclosure Statement, the Debtors submit that the allocation of distributions to creditors under the Plan (i) represents a good faith compromise of all Claims and controversies relating to the Reorganized Company TEV, the contractual, legal and subordination rights that a holder of a Claim may have with respect to any Allowed Claim or any distribution to be made on account of such Allowed Claim and (ii) satisfies the requirements of section 1129 of the Bankruptcy Code. |

5

| E. | REPRESENTATIONS AND DISCLAIMERS |

THIS SOLICITATION IS MADE ONLY TO HOLDERS OF CLAIMS AND INTERESTS FOR THE LIMITED PURPOSE OF SEEKING APPROVAL OF THE PLAN OF REORGANIZATION DESCRIBED HEREIN. THIS DISCLOSURE STATEMENT WAS PREPARED SOLELY IN CONNECTION WITH THE SOLICITATION OF VOTES ON THE PLAN BY THE HOLDERS OF THE VOTING CLAIMS. THE INFORMATION CONTAINED HEREIN IS NOT INTENDED TO BE USED OR RELIED ON BY ANY OTHER PERSON OR USED FOR ANY PURPOSE OTHER THAN THE CONSIDERATION OF THE PLAN BY HOLDERS OF VOTING CLAIMS.

HOLDERS OF VOTING CLAIMS SHOULD NOT CONSTRUE THE CONTENTS OF THE DISCLOSURE STATEMENT AS PROVIDING ANY LEGAL, BUSINESS, FINANCIAL OR TAX ADVICE AND SHOULD CONSULT WITH THEIR OWN ADVISORS BEFORE CASTING A VOTE WITH RESPECT TO THE PLAN.

THE NEW NOTES, NEW COMMON STOCK AND NEW PREFERRED STOCK HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR SIMILAR STATE SECURITIES OR “BLUE SKY” LAWS. THE ISSUANCE OF SUCH SECURITIES UNDER THE PLAN IS BEING EFFECTED PURSUANT TO THE EXEMPTION UNDER SECTION 1145 OF THE BANKRUPTCY CODE.

THE NEW NOTES, NEW COMMON STOCK AND NEW PREFERRED STOCK TO BE ISSUED ON THE EFFECTIVE DATE HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR BY ANY STATE SECURITIES COMMISSION OR SIMILAR PUBLIC, GOVERNMENTAL, OR REGULATORY AUTHORITY, AND NEITHER THE SEC NOR ANY SUCH AUTHORITY HAS PASSED UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT OR UPON THE MERITS OF THE PLAN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

CERTAIN STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT, INCLUDING PROJECTED FINANCIAL INFORMATION AND OTHER FORWARD-LOOKING STATEMENTS, ARE BASED ON ESTIMATES AND ASSUMPTIONS. THERE CAN BE NO ASSURANCE THAT SUCH STATEMENTS WILL BE REFLECTIVE OF ACTUAL OUTCOMES. FORWARD-LOOKING STATEMENTS ARE PROVIDED IN THIS DISCLOSURE STATEMENT PURSUANT TO THE SAFE HARBOR ESTABLISHED UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND SHOULD BE EVALUATED IN THE CONTEXT OF THE ESTIMATES, ASSUMPTIONS, UNCERTAINTIES, AND RISKS DESCRIBED HEREIN.

FURTHER, READERS ARE CAUTIONED THAT ANY FORWARD-LOOKING STATEMENTS HEREIN ARE BASED ON ASSUMPTIONS THAT ARE BELIEVED TO BE REASONABLE, BUT ARE SUBJECT TO A WIDE RANGE OF RISKS INCLUDING, BUT NOT LIMITED TO, RISKS ASSOCIATED WITH (I) FUTURE FINANCIAL RESULTS AND LIQUIDITY, INCLUDING THE ABILITY TO FINANCE OPERATIONS IN THE NORMAL COURSE, (II) VARIOUS FACTORS THAT MAY AFFECT THE VALUE OF THE NEW

6

NOTES, NEW COMMON STOCK AND NEW PREFERRED STOCK TO BE ISSUED UNDER THE PLAN, (III) UNANTICIPATED EVENTS THAT MAY AFFECT THE DEBTORS’ BUSINESSES, (IV) ADDITIONAL FINANCING REQUIREMENTS POST-RESTRUCTURING, (V) FUTURE DISPOSITIONS AND ACQUISITIONS, (VI) THE EFFECT OF COMPETITIVE PRODUCTS, SERVICES OR PRICING BY COMPETITORS, (VII) THE PROPOSED RESTRUCTURING AND COSTS ASSOCIATED THEREWITH, (VIII) THE CONFIRMATION AND CONSUMMATION OF THE PLAN, AND (IX) EACH OF THE OTHER RISKS IDENTIFIED IN THIS DISCLOSURE STATEMENT. DUE TO THESE UNCERTAINTIES, READERS CANNOT BE ASSURED THAT ANY FORWARD-LOOKING STATEMENTS WILL PROVE TO BE CORRECT. THE DEBTORS ARE UNDER NO OBLIGATION TO (AND EXPRESSLY DISCLAIM ANY OBLIGATION TO) UPDATE OR ALTER ANY FORWARD-LOOKING STATEMENTS WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS, OR OTHERWISE, UNLESS INSTRUCTED TO DO SO BY THE BANKRUPTCY COURT.

NO INDEPENDENT AUDITOR OR ACCOUNTANT HAS REVIEWED OR APPROVED THE FINANCIAL PROJECTIONS OR THE LIQUIDATION ANALYSIS HEREIN.

THE DEBTORS HAVE NOT AUTHORIZED ANY PERSON TO GIVE ANY INFORMATION OR ADVICE, OR TO MAKE ANY REPRESENTATION, IN CONNECTION WITH THE PLAN AND THIS DISCLOSURE STATEMENT.

THE STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT ARE MADE AS OF THE DATE HEREOF UNLESS OTHERWISE SPECIFIED. THE TERMS OF THE PLAN GOVERN IN THE EVENT OF ANY INCONSISTENCY WITH THE SUMMARIES PROVIDED IN THIS DISCLOSURE STATEMENT.

THE INFORMATION IN THIS DISCLOSURE STATEMENT IS BEING PROVIDED SOLELY TO HOLDERS OF VOTING CLAIMS FOR PURPOSES OF VOTING TO ACCEPT OR REJECT THE PLAN OR OBJECTING TO CONFIRMATION. NOTHING IN THIS DISCLOSURE STATEMENT MAY BE USED BY ANY PARTY FOR ANY OTHER PURPOSE.

ALL EXHIBITS TO THE DISCLOSURE STATEMENT ARE INCORPORATED INTO AND ARE A PART OF THIS DISCLOSURE STATEMENT AS IF SET FORTH IN FULL HEREIN.

TERMS USED BUT NOT DEFINED HEREIN SHALL HAVE THE MEANING ASCRIBED TO THEM IN THE PLAN.

| F. | SUMMARY OF VOTING PROCEDURES |

As set forth in more detail herein, classes 3 through 7 are “Impaired,” (as such term is defined in section 1124 of the Bankruptcy Code and the Plan) and holders of allowed Claims in such classes are entitled to receive distributions under the Plan. As such, holders of these “Voting Claims” are entitled to vote to accept or reject the Plan.

7

Pursuant to section 1126 of the Bankruptcy Code, only holders of allowed Voting Claims are entitled to vote to accept or reject the proposed Plan. Holders of claims in unimpaired classes under a chapter 11 plan are deemed to accept such a plan and are not entitled to vote. Additionally, holders of claims in impaired classes that do not receive a distribution under a chapter 11 plan are deemed to reject such a plan and are not entitled to vote. As no prepetition Interests will receive a distribution under the Plan, holders of Interests are not entitled to vote on the Plan. For a detailed description of the treatment of claims and interests under the Plan, see Sections V.C and V.E of this Disclosure Statement.

The Debtors will seek confirmation of the Plan pursuant to section 1129(b) of the Bankruptcy Code over the deemed rejection of the Plan by Classes 9, 10, and 11, and any other class or classes of Claims that vote to reject the Plan. Section 1129(b) of the Bankruptcy Code permits the confirmation of a chapter 11 plan notwithstanding the rejection of such plan by one or more impaired classes of claims or equity interests. Under section 1129(b), a plan may be confirmed by a bankruptcy court if it does not “discriminate unfairly” and is “fair and equitable” with respect to each rejecting class. For a more detailed description of the requirements for confirmation of a nonconsensual plan, see Section X.C.2 of this Disclosure Statement.

Your Claims may be classified in multiple classes, in which case you will receive a separate Ballot for each class of Claim that is entitled to vote on the Plan. Please complete the information requested on each Ballot you receive; sign, date and indicate your vote on the Ballot; and return the completed Ballot in the enclosed pre-addressed postage-paid envelope so that it is actually received by the Solicitation Agent before the Voting Deadline. For detailed voting instructions, please refer to the voting instructions described in Section IX of this Disclosure Statement and attached hereto as Exhibit C.

The deadline to submit Ballots is January 20, 2015 at 8:00 p.m. (Prevailing Eastern Time). For a Ballot to be counted, the Debtors’ Solicitation Agent, KCC, must receive the Ballot by the Voting Deadline. The following do not constitute a vote to accept or reject the Plan: (i) the failure to submit a Ballot, (ii) the submission of a Ballot voting both for and against the Plan, and (iii) the submission of a Ballot voting neither for or against the Plan.

If you are a holder of a Voting Claim and you did not receive a Ballot, received a damaged Ballot, lost your Ballot, or if you have any questions concerning the procedures for voting on the Plan, please contact KCC at (866) 967-0263 in the United States, or +1 (310) 751-2663 for International callers.

THE DEBTORS BELIEVE THAT THE PLAN PROVIDES THE BEST POSSIBLE RECOVERIES TO THE HOLDERS OF VOTING CLAIMS. THE DEBTORS THEREFORE BELIEVE THAT ACCEPTANCE OF THE PLAN IS IN THE BEST INTERESTS OF EACH AND EVERY CLASS OF CREDITORS AND URGE ALL HOLDERS OF VOTING CLAIMS TO VOTE TO ACCEPT THE PLAN.

| G. | CONFIRMATION HEARING |

Pursuant to sections 1128 and 1129 of the Bankruptcy Code, the Bankruptcy Court has scheduled a hearing to consider confirmation of the Plan (the “Confirmation Hearing”). The Confirmation Hearing has been scheduled to be heard on [January 30], 2015 at [TIME]

8

(Prevailing Eastern Time) in Courtroom 5 of the United States Bankruptcy Court for the District of Delaware, located at 824 N. Market Street, Wilmington, Delaware 19801. The Confirmation Hearing may be adjourned from time-to-time without further notice except for the announcement of the adjournment date made at the Confirmation Hearing or at any subsequent adjourned Confirmation Hearing.

In addition, the Bankruptcy Court has set the deadline to object to the confirmation of the Plan as [January 20], 2015 at 4:00 p.m. (Prevailing Eastern Time) (the “Objection Deadline”). Section 1128(b) of the Bankruptcy Code provides that any party in interest may object to the confirmation of a plan. Objections and responses to the Plan, if any, must be served and filed as to be received on or before the Objection Deadline in the manner described in Section X.B of this Disclosure Statement. For the avoidance of doubt, an objection to the Plan filed with the Bankruptcy Court will not be considered a vote to reject the Plan.

II. OVERVIEW OF THE DEBTORS’

OPERATIONS AND CAPITAL STRUCTURE

| A. | INTRODUCTION |

EIC and its Debtor and Non-Debtor Affiliates (collectively, the “Company”) engage in the acquisition, exploration and development of oil and gas reserves and resources at properties on-shore in the United States and off-shore in the region of the North Sea under the control of the United Kingdom (each, an “Oil and Gas Property”). Through the acquisition of oil and gas leases in the United States and oil and gas licenses in the United Kingdom, the Company obtains “working interests” that entitle it to a pro rata share of the revenues generated from the sale of oil or gas produced at a particular Oil and Gas Property.

To manage its global businesses, the Company employs approximately 77 full-time employees and independent consultants across three offices. From its Houston headquarters, the Company conducts its domestic and overseas businesses with a staff of approximately 22 employees and independent contractors, including accountants, human resources managers, and legal and investor relations professionals. Many of these employees and independent contractors have extensive backgrounds in and experience with the oil and gas industry and international business.

In addition to its Houston-based employees and independent contractors, the Company employs geologists, geophysicists, engineers, information technologists and energy financial analysts who provide key technical support for its operations and work primarily out of the Company’s Denver, Colorado and Aberdeen, Scotland offices. The Company’s employees use their highly-specialized skills to help it identify potential new fields for acquisition and development and coordinate with regulatory authorities in the United States and United Kingdom to satisfy the Company’s licensing, permitting, tax and financial reporting obligations.

9

| B. | CORPORATE STRUCTURE5 |

EIC: EIC is a Nevada corporation and the ultimate parent of the Endeavour family of companies. Until it was de-listed on October 13, 2014, EIC was a publicly traded company on the New York Stock Exchange under the ticker symbol “END.” EIC’s common stock was also traded on the London Stock Exchange under the ticker symbol “ENDV” until its suspension on September 22, 2014. EIC has no operations and owns no material assets other than its direct and indirect interests in the Debtors and the Non-Debtor Affiliates.

EOC: EOC is a Delaware corporation. It is the domestic, wholly-owned direct subsidiary of EIC and provides the majority of the operational support required by the Company’s domestic and overseas enterprises from its Houston, Texas headquarters. EOC employs all of the Debtors’ U.S.-based employees and independent contractors and holds all of the Debtors’ interests in the domestic Oil and Gas Properties outside of Colorado. As of September 30, 2014, the Oil and Gas Properties held by EOC comprised approximately 33,800 gross acres and 16,400 net acres of oil and gas acreage under development predominantly in the Louisiana Haynesville and Pennsylvania Marcellus shale areas.

END Colorado: Endeavour Colorado Corporation (“END Colorado”) is a Delaware corporation and is the domestic, wholly-owned direct subsidiary of EIC. END Colorado holds the Company’s Colorado-based Oil and Gas Properties. As of September 30, 2014, the Oil and Gas Properties held by END Colorado comprised approximately 31,500 gross acres and 19,800 net acres of oil and gas acreage under development in the Niobrara oil and gas play.

Other Debtors: END Management Company, a Delaware company (“END Management”), Endeavour Energy New Ventures Inc., a Delaware corporation (“EENV”), and indirect subsidiary Endeavour Energy Luxembourg, S.à r.l. (“END LuxCo”), are all non-operating companies with no significant assets other than END LuxCo’s ownership of an intercompany note, as further described in Section II.D.10.b of this Disclosure Statement.

Non-Debtor Affiliates: EIC is also the ultimate parent of certain domestic and foreign Non-Debtor Affiliates that are not debtors in these Chapter 11 Cases. These entities include Endeavour International Holding B.V. (“EIHBV”), a besloten vennootschap organized under the laws of the Netherlands, and a direct, wholly-owned subsidiary of EOC; Endeavour Energy Netherlands B.V., a besloten vennootschap organized under the laws of the Netherlands; Endeavour Energy North Sea LLC and End Finco LLC, both Delaware limited liability companies; Endeavour Energy North Sea, L.P., a Delaware limited partnership; EEUK; and Endeavour North Sea Limited, an English/Welsh company and the direct, wholly-owned subsidiary of EEUK. Among the Non-Debtor Affiliates, only EEUK is an operating company with significant assets.

| 5 | The EIC corporate structure chart, attached to this Disclosure Statement as Exhibit D, provides an illustrative representation of the Company’s corporate structure discussed in this Section. |

10

| C. | THE DEBTORS’ OPERATIONS |

| 1. | U.S. Onshore Operations |

The Company’s primary U.S.-based assets are on-shore exploration leases and producing oil and gas properties located in Louisiana, Texas, New Mexico, Pennsylvania, Montana, and Colorado. Starting in 2009, the Company began acquiring domestic Oil and Gas Properties to complement its foreign Oil and Gas Properties in the North Sea. The Company’s U.S. acquisitions have focused on reserve and production growth in proven shale gas areas, including Louisiana’s Haynesville shale and Pennsylvania’s Marcellus shale areas. The Company has also targeted emerging oil-prone and liquids-rich areas, including Montana’s Heath oil and gas play and Colorado’s Niobrara oil and gas play.

As of year-end 2013, the Company had established working interests in approximately 442,600 gross acres and 109,000 net acres in the U.S. with exposure to both oil and gas. The Company’s U.S.-based revenues are primarily derived from its Oil and Gas Properties in Louisiana’s Haynesville shale and Pennsylvania’s Marcellus shale areas.

| a. | U.S. Oil and Gas Properties |

All of the Company’s domestic Oil and Gas Properties are assets of the Debtors. The Company’s assets located in Louisiana, Texas, New Mexico, Pennsylvania, and Montana are held by EOC, while the Colorado assets are held by END Colorado. However, the reserves of oil and gas in these domestic holdings comprise only 8% of the proven reserves owned by the Company’s entire enterprise. In total, as of December 31, 2013, the Debtors owned proved, developed reserves in the United States totaling 1.634 Million Barrels of Oil Equivalent (“MMBOE”).6 In addition, the Debtors owned 0.331 MMBOE of proven, undeveloped reserves, for total proven reserves of 1.965 MMBOE in the U.S. Oil and Gas Properties. Currently, these proven reserves are comprised entirely of natural gas.

The Debtors own an approximately 50% working interest in their producing Marcellus Oil and Gas Properties in Pennsylvania. Samson Exploration, LLC, which is unaffiliated with the Debtors, owns the remaining 50% of the working interest in these Oil and Gas Properties and is the party responsible for the day-to-day operation (the “Operator”) of the on-site wells. As of December 31, 2013, the Debtors held approximately 27,200 gross acres and 13,400 net acres in the Pennsylvania Marcellus area.

Similarly, the Debtors own various percentages of working interests, ranging from less than 1% to upwards of 43.75%, in their producing Haynesville Oil and Gas Properties, but do not act as Operator at any such properties. As of December 31, 2013, the Debtors held approximately 7,250 gross acres and 3,300 net acres, and had working interest in 19 Haynesville Oil and Gas Properties held by production, with an additional 80 or more gross locations that are currently undeveloped.

| 6 | The term “barrels of oil equivalent” is an industry term of art used to convert quantities of hydrocarbons, including crude oil, natural gas and natural gas liquids, into a standard metric based on energetic output that provides a basis for comparing the production or reserves of different oil and gas companies with different types of reserves. |

11

The Debtors’ operations are largely focused on strategic positioning for future growth and development of oil and gas opportunities in the U.S. With minimal spending, the Debtors have maintained their natural gas acreage in Pennsylvania, Louisiana, Montana, Texas and New Mexico and expanded their liquids-rich acreage positions in Colorado.

| b. | U.S.-Based Revenue and Expenses |

Physical production in the U.S. for the 2013 fiscal year was approximately 1,257 Barrels of Oil Equivalent (“BOE”) per day. The Company’s total U.S. revenue in 2013, which consisted of the entirety of the Company’s U.S. gas production, was $8.4 million, against expenses related to operations of $16.1 million, for a net loss from U.S. operations of $7.7 million. The Company’s U.S. revenue for the first nine months of 2014 was $5.1 million, against expenses related to operations of $4.6 million, for a net gain from U.S. operations of $489,000. As of September 30, 2014, the Debtors held cash and cash equivalents of approximately $41.5 million.

| 2. | North Sea Operations |

The Company was originally founded in 2004 to find and develop oil and gas resources in the North Sea, one of the most prolific energy basins in the world. The Company’s focus was on offshore U.K and Norway fields in the North Sea, but it later reduced its focus to the U.K Central North Sea region, where it is one of only a select group of small independents to find, develop and produce new oil and gas reserves in the region.

Today, the Company’s primary operations are associated with the exploration, appraisal, development and production of oil and gas reserves in the North Sea region under the control of the United Kingdom. The Company’s wholly-owned Non-Debtor Affiliate EEUK holds working interests in a variety of Oil and Gas Properties in the North Sea. None of the Debtors directly hold any interest in the Oil and Gas Properties located in the North Sea.

| a. | North Sea Producing Assets |

At present, EEUK has interests in five producing Oil and Gas Properties in the North Sea—Alba, Bacchus, Bittern, Enoch, and Rochelle (the “U.K. Producing Fields”). The reserves at these U.K. Producing Fields account for approximately 92% of the Company’s proven reserves. EEUK’s working interests in each of these Oil and Gas Properties are derived from oil and gas licenses granted by the Department of Energy and Climate Change (the “DECC”), a department of the British government that oversees a bidding process whereby companies bid for the right to explore or produce oil and gas from specific fields in the North Sea.

EEUK is not the Operator at any of its U.K. Producing Fields. As such, EEUK’s revenue from the U.K. Producing Fields is generated pursuant to the terms of various joint operating agreements (each, a “JOA”) among itself and the other working interest holders for each particular U.K. Producing Field.

Alba. The Alba field, which first produced oil in 1994, is one of the most significant generators of revenue for EEUK. The field includes 35 total platform and subsea wells, which are operated by Chevron. Following the acquisition of an additional 23.43% interest in the Alba field in 2012, EEUK now owns a 25.68% working interest in the field, the largest percentage of any Alba working interest owner. Other working interest holders include third-parties Chevron (23.37%), Statoil (17%), Mitsui (13%), Centrica (12.65%) and Enquest (8%).

12

In 2013, the average daily production at Alba attributable to EEUK’s working interest was 4,163 BOE, representing 48.0% of the total daily physical production from all of EEUK’s North Sea Oil and Gas Properties. As of December 31, 2013, Alba had estimated proved reserves attributable to EEUK’s interest of approximately 9.200 MMBOE, of which approximately 97% is oil. Further, it is estimated that only 40% of the proved oil and gas in the Alba lease has been developed.

Bacchus. The Bacchus field, which first produced oil in April 2012, is another significant revenue-generating field for EEUK. Apache Corporation is the Operator and owns a 50% working interest in Bacchus, while EEUK owns a 30% working interest and First Oil owns the remaining 20%. In 2013, the average daily production at Bacchus attributable to EEUK’s working interest was 3,527 BOE, representing 40.7% of the total daily physical production from all of EEUK’s North Sea Oil and Gas Properties. As of December 31, 2013, Bacchus had estimated proved reserves attributable to EEUK’s interest of approximately 1.100 MMBOE, of which 94% is oil.

Rochelle. The Rochelle field, which came online in October 2013, is another significant source of revenue for EEUK. EEUK owns a 44% working interest in the field, while Nexen (the Operator) and Premier Oil own 41% and 15% working interests, respectively. As of December 31, 2013, Rochelle had estimated proved reserves attributable to EEUK’s interest of approximately 8900 MMBOE, of which 17% is oil. Based on the Debtors’ most recent reserve reports, it is estimated that only 38% of the proved oil and gas in the Rochelle lease has been developed.

Bittern and Enoch. EEUK holds smaller working interests of 2.42% and 8.0%, respectively, in the Bittern and Enoch fields. Shell is the operator at Bittern, and Talisman is the operator at Enoch. In 2013, the average daily production at the two fields attributable to EEUK’s working interests was 220 BOE. As of December 31, 2013, the two fields had estimated proved reserves attributable to EEUK’s interest of approximately 2.400 MMBOE, of which 57% is oil. It is estimated that only 23% of the proved oil and gas in the Bittern and Enoch leases have been developed.

| b. | North Sea Development Projects and Exploratory Assets |

Columbus. EEUK owns a 25% working interest in the Columbus field, which as of the Petition Date was finalizing a Field Development Plan (a “FDP”). Serica Energy is the operator of the field and has a 50% working interest. EOG owns the remaining 25%. The DECC has extended the Columbus license through December 2015.

Other North Sea Fields. In its exploration portfolio, EEUK holds working interests in twenty-eight (28) North Sea Oil and Gas Properties licensed by the DECC. Of these licenses, twelve (12) are operated by EEUK. EEUK has focused on acquiring high-quality acreage in close proximity to infrastructure necessary to bring oil and gas to market. Included in these numerous prospects are the Buffalo, Mabry, Mostyn, Rogers and Rossini prospects.

13

| c. | U.K.-Based Revenue and Expenses |

Physical production in the U.K. for the 2013 fiscal year was approximately 8,665 BOE per day, up significantly from 5,494 BOE per day in 2012. EEUK’s revenue in 2013 was $329.3 million against expenses related to operations of $245.6 million, for a net gain from U.K. operations of $83.7 million. EEUK’s revenue for the first nine months of 2014 was $220.4 million, against expenses related to operations of $195.6 million, excluding goodwill impairment, for a net gain from U.K. operations of $24.8 million before goodwill impairment of $259.2 million. Revenues in 2014 were down primarily because of unexpected downtime at certain of the U.K. Producing Fields, as discussed in Section III.B of this Disclosure Statement.

| D. | PREPETITION INDEBTEDNESS AND CAPITAL STRUCTURE |

As of the Petition Date, the Company had approximately $1.2 billion in debt outstanding. This amount excludes accrued interest, fees and other amounts through the Petition Date, as well as open but undrawn letters of credit and hedging obligations.

| 1. | The 2018 Notes |

On February 23, 2012, EIC closed on the private placement of $350 million in aggregate principal amount of 12% notes due March 2018 (collectively, the “March 2018 Notes”). The March 2018 Notes are governed by an indenture (the “March 2018 Indenture”), under which EIC is the primary obligor, EOC, END Management and EENV are guarantors (collectively, the “2018 Notes Guarantors”), and Wells Fargo Bank, National Association (“Wells Fargo”) is the indenture trustee on behalf of the noteholders (the “March 2018 Noteholders”).

Concurrently, on February 23, 2012, EIC closed on the private placement of $150 million in aggregate principal amount of 12% notes due June 2018 (the “June 2018 Notes,” and, together with the March 2018 Notes, the “2018 Notes”). The June 2018 Notes are governed by an indenture (the “June 2018 Indenture” and together with the March 2018 Indenture, the “2018 Indentures”), under which EIC is the primary obligor, the 2018 Notes Guarantors are guarantors, and Wilmington Trust, National Association (“Wilmington Trust”), is trustee on behalf of the noteholders (the “June 2018 Noteholders” and together with the March 2018 Noteholders, the “2018 Noteholders”). The 2018 Notes are secured by a pledge of 65% of the stock of EIHBV and all indebtedness owed to EOC by any foreign subsidiary, including the EOC-EEUK Intercompany Note (the “2018 Notes Collateral”).

On May 31, 2012, the net proceeds obtained from the placement of the 2018 Notes were used to fund the acquisition of an additional working interest in the Alba field and repay all outstanding amounts under a senior term loan.

On October 15, 2012, EIC completed the private placement of an additional $54 million aggregate principal amount of March 2018 Notes. The March 2018 Notes issued in October 2012 and the March 2018 Notes issued in February 2012 are treated as a single class of debt securities under the March 2018 Indenture. Net proceeds from this additional placement were used to: (i) repay certain indebtedness of EIC, (ii) pay certain general and administrative expenses and other operating expenses of EIC and its U.S. subsidiaries, (iii) pay certain payroll expenses of EIC and its U.S. subsidiaries, and (iv) fund certain capital expenditures at EEUK.7

14

Interest on the 2018 Notes is payable semiannually, on March 1 and September 1. As of the Petition Date, $404.0 million in principal was outstanding under the March 2018 Notes, plus accrued interest of approximately $30 million (including interest related to the Missed Interest Payment, as defined below). Additionally, as of the Petition Date, approximately $150.0 million in principal was outstanding under the June 2018 Notes, plus accrued interest of approximately $11.1 million (including interest related to the Missed Interest Payment).

| 2. | The 5.5% Convertible Notes |

Pursuant to that certain convertible notes indenture, dated as of July 22, 2011 (the “5.5% Convertible Notes Indenture”), EIC, as primary obligor, and EOC, END Management and EENV, as guarantors (collectively, the “5.5% Convertible Notes Guarantors”), issued $135 million aggregate principal amount of unsecured 5.5% Convertible Senior Notes due July 15, 2016 (as amended or otherwise modified from time to time, the “5.5% Convertible Notes”) with Wilmington Savings Fund Society, FSB, as successor trustee, on behalf of the noteholders (the “5.5% Convertible Noteholders”). The 5.5% Convertible Notes are convertible into shares of Common Stock (as defined below) at an initial conversion rate of 54.019 shares per $1,000 principal amount of the 5.5% Convertible Notes.

Interest on the unsecured 5.5% Convertible Notes is payable semiannually. As of the Petition Date, $135.0 million in principal was outstanding under the 5.5% Convertible Notes, plus accrued interest of approximately $1.8 million.

| 3. | The 6.5% Convertible Notes |

Pursuant to that certain convertible notes indenture, dated as of March 3, 2014 (the “6.5% Convertible Notes Indenture”), EIC, as primary obligor, and EOC, END Management and EENV, as guarantors (collectively, the “6.5% Convertible Notes Guarantors”), issued $17.5 million aggregate principal amount of unsecured 6.5% Convertible Notes due December 1, 2017 (as amended or otherwise modified from time to time, the “6.5% Convertible Notes” and together with the 5.5% Convertible Notes, the “Convertible Notes”) with Wilmington Savings Fund Society, FSB, as trustee on behalf of the noteholders (the “6.5% Convertible Noteholders” and together with the 5.5% Convertible Noteholders, the “Convertible Noteholders”). The 6.5% Convertible Notes are convertible into shares of Common Stock (as defined below) at an initial conversion rate of 214.5002 shares per $1,000 principal amount of the 6.5% Convertible Notes.

Proceeds from the issuance of the 6.5% Convertible Notes were used to pay a portion of the March 2014 interest payment due with respect to the 2018 Notes. Interest on the unsecured 6.5% Convertible Notes is payable quarterly, beginning June 1, 2014. As of the Petition Date, $17.5 million in principal was outstanding under the 6.5% Convertible Notes, plus accrued interest of approximately $400,000.

| 7 | The March 2018 Noteholders believe that the net proceeds from this additional placement may have been used in a different manner. |

15

| 4. | The 7.5% Convertible Bonds |

Pursuant to that certain Trust Deed, dated as of January 24, 2008 (the “7.5% Convertible Bonds Trust Deed”), END LuxCo, as primary obligor, issued $40.0 million aggregate principal amount of unsecured convertible bonds due March 31, 2014 (as amended or otherwise modified from time to time, the “7.5% Convertible Bonds”) with EIC as guarantor. Delaware Trust Company serves as successor trustee (in such capacity, the “7.5% Convertible Bonds Trustee,” and together with the indenture trustees for the 2018 Notes and the Convertible Notes, the “Indenture Trustees”) on behalf of the bondholders (the “7.5% Convertible Bondholders”). The 7.5% Convertible Bonds bore an interest rate of 11.5% per annum until an amendment to the 7.5% Convertible Bonds Trust Deed was entered into on March 11, 2011, pursuant to which the interest rate associated with the 7.5% Convertible Bonds was reduced to 7.5% and the maturity date was extended to January 24, 2016. As of the Petition Date, 99.75% of the 7.5% Convertible Notes were held by Smedvig Funds Plc, and the remaining 0.25% were held by John Hewett, CEO of Smedvig Capital. The 7.5% Convertible Bonds are convertible into shares of Common Stock (as defined below).

Interest on the unsecured 7.5% Convertible Bonds accrues quarterly, however, under the terms of the 7.5% Convertible Bonds Trust Deed, this accrued interest has been capitalized and added to the outstanding principal amount of the 7.5% Convertible Bonds. Therefore, as of the Petition Date, approximately $83.9 million in principal is outstanding under the 7.5% Convertible Bonds.

| 5. | Old EEUK Term Loan and LC Procurement Guarantees |

Pursuant to (i) that certain credit agreement for the benefit of EEUK among EIHBV, END Finco LLC and certain lenders thereto, dated January 24, 2014 (as amended or otherwise modified from time to time, the “Old EEUK Term Loan”), (ii) that certain LC Procurement Agreement among EEUK, LC Finco S.à r.l. and Credit Suisse, dated January 24, 2014 (as amended or otherwise modified from time to time, the “LC Procurement Agreement”), and (iii) that certain U.S. Security Agreement dated January 24, 2014 among EIC, EOC, EIHBV and certain of its subsidiaries, and Credit Suisse as collateral agent on behalf of certain lenders under the Old EEUK Term Loan and LC Procurement Agreement (as amended or otherwise modified from time to time, the “Old EEUK Loan Security Agreement”), EIC and EOC guaranteed certain obligations of EIHBV and other foreign subsidiaries with a pledge of substantially all of the assets of EIC and EOC (other than the 2018 Notes Collateral), as well as the equity of EOC, END Management, EENV and END Colorado. The Old EEUK Term Loan and LC Procurement Agreement were also secured by the assets and equity holdings of several Non-Debtor Affiliates, including EEUK.

Prior to the closing of the Refinancing Transaction (as defined below), $124.5 million in principal was outstanding under the Old EEUK Term Loan, plus accrued interest, and approximately $89.5 million in principal was outstanding under the LC Procurement Agreement.

16

| 6. | The Refinancing Transaction and the Restated EEUK Term Loan |

On September 30, 2014, EIC, EIHBV and End Finco LLC entered into that certain credit agreement amending and restating the Old EEUK Term Loan (the “Restated EEUK Term Loan”). The Restated EEUK Term Loan provides for a $440.0 million aggregate face value (the proceeds thereof, the “EEUK Term Loan Proceeds”) senior secured term loan facility, with Credit Suisse as Administrative Agent on behalf of the EEUK Term Loan Lenders. Under the terms of the Restated EEUK Term Loan, the EEUK Term Loan Lenders provided the EEUK Term Loan Proceeds (i) to repay in full the Old EEUK Term Loan, the MPPs (as defined below) and all reimbursement obligations outstanding relating to the LC Procurement Agreement, (ii) to provide cash collateral to support a new letter of credit issuance agreement and pay related fees and expenses, and (iii) for general corporate purposes (the “Refinancing Transaction”). The Restated EEUK Term Loan also allows certain non-debtor entities during the first twelve months following the effectiveness of the Restated EEUK Term Loan to make intercompany transfers in the amount of up to $55 million to the Debtors to finance cash needs during these Chapter 11 Cases.

The Restated EEUK Term Loan’s primary purpose was to aid the Company in its restructuring efforts and protect its U.K. assets through the replacement of the Old EEUK Term Loan and certain monetary production payments (the “MPPs”).8 Under the Old EEUK Term Loan, either the commencement of these Chapter 11 Cases or a payment default under the Debtors’ other primary debt obligations would have constituted an event of default, threatening the loss of the Company’s valuable portfolio of Oil and Gas Properties in the North Sea. Under the Restated EEUK Term Loan, the Debtors’ chapter 11 filings do not result in a default or cross-default of that agreement. The Restated EEUK Term Loan also provided approximately $36 million in additional liquidity to the Company and addressed significant near term maturities under the MPPs.

As of the Petition Date, approximately $440.0 million in principal is outstanding under the Restated EEUK Term Loan. EOC, EIC and certain Non-Debtor Affiliates granted secured guarantees of the EEUK Term Loan obligations, pledging substantially all of the assets of EIC and EOC (the “EEUK Term Loan Collateral”), other than certain excluded assets (the “Excluded Assets”). The Excluded Assets include, among other things, the 2018 Notes Collateral and the Debtors’ cash, cash equivalents and deposit accounts. The Restated EEUK Term Loan is also secured by the assets and equity holdings of certain Non-Debtor Affiliates, including the assets and equity holdings of EEUK.

| 7. | Series B Preferred Stock |

In February 2004, in conjunction with its merger with publicly-traded Continental Southern Resources, Inc., EIC authorized and designated 500,000 shares of its 10,000,000 shares of preferred stock as Series B preferred stock (as amended or otherwise modified from time to time, the “Series B Preferred Stock”), with a par value of $0.001 per share. As of the Petition Date, there were 19,714 shares of Series B Preferred Stock outstanding.

| 8 | The aggregate face value of the MPPs at the time the Company entered into the Restated EEUK Term Loan was approximately $161.6 million. |

17

The Series B Preferred Stock is entitled to dividends of 8.0% of the original issuing price per share per annum. The holders of each share of Series B Preferred Stock are entitled to be paid out of available funds prior to any distributions to holders of Common Stock (as defined below) in the amount of $100.00 per outstanding share plus all accrued dividends. As of the Petition Date, approximately $1.9 million in accrued dividends was due and owing to holders of Series B Preferred Stock, and the outstanding Series B Preferred Stock had an aggregate liquidation preference of approximately $3.9 million, inclusive of accrued and unpaid dividends.

| 8. | Series C Convertible Preferred Stock |

On October 30, 2006, EIC authorized and designated 125,000 shares of its 10,000,000 shares of preferred stock as Series C convertible preferred stock (as amended or otherwise modified from time to time, the “Series C Convertible Preferred Stock), with a par value of $0.001 per share. As of the Petition Date, there were 14,800 shares of Series C Convertible Preferred Stock outstanding with an aggregate liquidation preference of $14.8 million, inclusive of accrued and unpaid dividends.

The Series C Convertible Preferred Stock is entitled to dividends payable in cash or common stock, at 4.5% or 4.722%, respectively. Further, the shares of Series C Convertible Preferred Stock are convertible into Common Stock (as defined below) at any time at the option of the holders of the Series C Convertible Preferred Stock, at a conversion price of $8.75, plus accrued and unpaid dividends. As of the Petition Date, approximately $10,000 in accrued dividends was due and owing to holders of Series C Convertible Preferred Stock.

| 9. | Common Stock |

EIC has authorized 125,000,000 shares of $0.001 par value common stock (the “Common Stock”). Until it was de-listed on October 13, 2014, EIC was a publicly traded company on the New York Stock Exchange under the ticker symbol “END.” EIC’s common stock was also traded on the London Stock Exchange under the ticker symbol “ENDV” until its suspension on September 22, 2014. As of the Petition Date, EIC has approximately 53.0 million shares of Common Stock outstanding.

| 10. | Intercompany Notes9 |

| a. | The EOC-EEUK Intercompany Note |

EOC is the beneficiary of an intercompany note issued pursuant to that certain Inter-Company Loan Agreement, dated May 31, 2012 between EOC and EEUK (the “EOC-EEUK Intercompany Note”). Pursuant to the EEOC-EEUK Intercompany Note, EOC provided a loan facility to Non-Debtor Affiliate EEUK, under which EEUK may borrow up to $550 million from EOC at an interest rate calculated as the weighted average cost of funds of EIC and its subsidiaries. As of the Petition Date, $500 million in principal was outstanding under the EOC-EEUK Intercompany Note. The EOC-EEUK Intercompany Note is pledged to the 2018

| 9 | Each of the RSA Parties reserves its respective rights and remedies with respect to the foregoing statements in this Section II.D.10. |

18

Noteholders to secure EOC’s guaranty of the 2018 Notes. As of August 31, 2014, EEUK held a separate intercompany claim against EOC for approximately $40.2 million as a result of ordinary course intercompany transactions.

| b. | The END LuxCo-EIHBV Intercompany Note |

END LuxCo is the beneficiary of an intercompany note issued pursuant to that certain Revolving Loan Facility agreement, dated January 23, 2008, between END LuxCo and EIHBV (the “END LuxCo-EIHBV Intercompany Note”). The END LuxCo-EIHBV Intercompany Note provides that EIHBV may borrow up to $100 million from END LuxCo at an interest rate calculated at 7.59%, which interest accrues quarterly and is capitalized and added to the outstanding principal from time to time. As of the Petition Date, approximately $83.6 million in principal was outstanding under the END LuxCo-EIHBV Intercompany Note.

III. KEY EVENTS LEADING TO THE

COMMENCEMENT OF CHAPTER 11 CASES

The Company has not always been so significantly leveraged. Over $500 million of its current debt obligations are the result of unexpected events that occurred in the last three years. Natural disasters, adverse and unforeseen operating issues, delays in new production coming online and operating difficulties particular to the North Sea all gave rise to unanticipated costs and delayed cash flows that directly contributed to the Debtors’ prepetition capital structure and the associated liquidity constraints and ultimately to the commencement of these Chapter 11 Cases.

From 2012-2014, when the Company was heavily investing in the development of its offshore Oil and Gas Properties in the North Sea, certain negative events – combined with less-than-expected operating performance at the Alba Field and economic and geopolitical issues in the North Sea oil and gas industry contributed to a rapid increase in the Company’s debt levels and the cost of capital. As further detailed in the Declaration of William L. Transier in Support of the Debtors’ Chapter 11 Petitions and Request for First Day Relief (D.I. 12) and described below, the nature of the Debtors’ businesses, coupled with these unexpected, negative events, conspired to force the Debtors to seek outside sources of capital to maintain the liquidity needed to continue operations. As its cost of capital increased and the leverage on the Company became unmanageable, the Company was forced to explore certain strategic alternatives before eventually determining to commence these Chapter 11 Cases.

| A. | OIL AND GAS EXPLORATION AND PRODUCTION REQUIRES SIGNIFICANT CAPITAL |

| 1. | The Company Operates in a Highly Volatile and Competitive Industry |

The Company’s revenue, profitability and cash flow depend substantially upon the prices and demand for oil and liquid natural gas. The markets for these commodities are volatile, and even relatively modest drops in prices can significantly impact the Company’s financial results. For example, the U.S. natural gas market in particular has seen depressed natural gas prices following the dramatic increase in supply associated with fracking. This influx of supply has made engaging in production from U.S.-based Oil and Gas Properties unviable for the Company from an economic standpoint.

19

Additionally, the Debtors and their Non-Debtor Affiliates encounter intense competition from other oil and gas production companies in all areas of their operations, including the acquisition of producing properties and undeveloped acreage. The Company’s competitors include many large, well-established, multi-national companies with substantially more personnel, superior operating leverage and greater capital resources. In addition to this competition with other oil and gas producers, the Company must increasingly compete with suppliers of alternative energy sources (such as wind, solar and hydrothermal) to industrial, commercial and residential end-users.

| 2. | The Company Must Continue to Make Significant Capital Outlays for Exploration and Development of New Fields |

Producing oil and gas fields are, by their very nature, depleting assets that must be replaced with new producing assets in order for an oil and gas exploration and production company to maintain its revenue stream. As such, exploration and development of new producing assets is almost as important to oil and gas companies as maintaining and monetizing their current producing assets. However, such exploration and development is costly, time consuming and risky, as there is no guarantee that any given exploration effort will result in the discovery of or efficient production of the difficult-to-reach resources.

Further, many of the Debtors’ Oil and Gas Properties, as well as all of EEUK’s North Sea Oil and Gas Properties, require the Company to demonstrate progress towards commercial production of oil and gas. Failure to conduct exploration and development operations on as-yet unproducing Oil and Gas Properties can result in the revocation of critical licenses by the mineral interest owners (which, in the case of the North Sea assets, is the British Government). In this regard, if the Debtors and their Non-Debtor Affiliates fail to continue their capital intensive efforts to explore and develop their leases, they can lose potentially valuable future revenue streams.

In 2014, the Company expected that total capital expenditures would be approximately $70 million, of which $45 million was to be spent in the U.K., primarily on drilling at Alba. The remainder of 2014 capital expenditures was to be spent in the U.S. to maintain acreage positions and fulfill minor drilling commitments. Failure to make those expenditures in the U.S. could have resulted in the loss of access to valuable U.S. Oil and Gas Properties.

| B. | UNFORESEEN NEGATIVE EVENTS IMPACTED THE DEBTORS’ REVENUES AND LIQUIDITY |

The Company is primarily dependent on its U.K. Producing Fields to produce the revenue required to fund its operations. However, as discussed in Section II.A of this Disclosure Statement, neither EEUK nor any of the other Affiliates of the Company are Operators of the U.K. Producing Fields, meaning that problems occurring with production at the U.K. Producing Fields are largely beyond the Debtors’ control. In addition, despite its rich hydrocarbon deposits, the North Sea is a particularly difficult environment in which to operate, as it features volatile weather conditions that can negatively impact production and make exploration and development of fields more costly.

20

| 1. | The Company’s Cost of Capital Increased Due to Unfavorable Changes in the Economic and Political Climate |

Since the Company’s inception, certain economic events and government actions have contributed to the Company’s increased leverage and its cost of capital. New technical regulations, significantly higher oilfield services costs and the ripple effect on regulations around the world as a result of the 2010 Macondo well disaster in the Gulf of Mexico all resulted in a steep increase in the Company’s decommissioning costs. For example, the Company’s Ivanhoe, Rob Roy, Hamish, Renee and Ruby fields were originally estimated in 2006 to cost approximately $30 million to decommission. The most recent estimates place the actual decommissioning costs at approximately $150 million, which have been or will be, largely incurred during the period of 2012 to 2015.

Moreover, the U.K. government’s reduction in the tax deductions available to oil and gas companies for decommissioning liabilities also contributed to the Company’s increased cost of capital. After unsuccessfully attempting to disallow corporate tax deductions associated with decommissioning, the U.K. government eventually settled for an absolute deduction of 50%, down from 62%, thus reducing the deductibility of decommissioning costs by one-fifth. As a result, industry standards have evolved to require companies without an “A” credit rating, like the Company, to post a letter of credit for decommissioning security as calculated by formulas under decommissioning security agreements. Unfortunately, after the credit crisis of 2008-2009, letters of credit were not as readily available, and when available, the cost of capital to obtain a letter of credit increased dramatically. As a result, the Company was required to source capital and post letters of credit or lose its ownership interest in its assets.

| 2. | The Company’s Expenses Increased and Revenues Decreased Due to Unexpected and Costly Delays in Production |

The offshore oil and gas business requires large, up-front commitments of capital and resources, usually many years before the costs of a development project can be fully quantified and many more years before revenue can be realized from the oil and gas field. In the U.K., oil and gas development projects are generally determined by a joint venture operating group (comprised of joint interest partners) to be commercially viable after many years of geological and geophysical technical analysis and, usually, some level of appraisal drilling. Upon this determination, the operator, on behalf of the joint interest partners, will submit a FDP to the DECC for approval. Once the FDP is approved, each of the joint interest partners will “sanction” the project, or, in other words, commit to pay their share of the estimated costs under the FDP.

As a project is developed, actual costs and timing can vary significantly from original projections. But this does not relieve each joint interest partner from paying its committed share of the development expenditures. In fact, nonpayment could result in the joint interest partner losing its ownership interest in the asset. This means that between the time capital is expended and cash flow is generated, many factors, including changes in commodity prices and the cost and timeline of the development project, can radically change the timing of cash flow from the oil and gas field. A delay in cash flow from the field could then negatively impact a joint interest owner’s financial condition.

21

The Company has experienced expensive unexpected delays and cost overruns for certain of the committed development projects in which it holds non-operating working interests. For example, at Bacchus, the Company committed to an FDP that estimated first production would occur in mid-2011. First production occurred eight months late due to mechanical issues and a crane incident on the rig drilling the development well. The delay in production cost the Company approximately $125 million in additional expenses and delayed oil and gas revenue. At Rochelle, the Company committed to an FDP that estimated first production would occur in 2010, which was later amended to the first quarter of 2013. As the first development well was nearing completion in January 2013, a severe storm damaged the well, forcing the well to be abandoned because of health and safety concerns. The abandonment and replacement of the well cost approximately $50 million. The interruption in production delayed the receipt of expected oil and gas revenues and caused the incurrence of additional cost in the amount of $125 million. At Alba, recurring water handling, water injection and emulsions issues caused lower overall production than estimated by the operator and increased operating costs, resulting in an aggregate loss to the Company of approximately $40 million. Lastly, at Alba, a damaged water injection pipeline has caused property damage and loss of revenues estimated in the range of $50 million to $80 million.

Furthermore, as a consequence of the unanticipated downtime and maintenance required by the Company’s U.K. Producing Fields, the Company failed to generate sufficient cash flow to support the entire enterprise, including its U.S. businesses. Thus, the Company was forced to intentionally slow or stop investing in its U.S.-based operations, resulting in a steep decline in U.S. production.

As the holder of non-operating working interests, the Company does not control the operation of the U.K. Producing Fields and, therefore, could not avoid the recurring issues in the North Sea. These events, however, illustrate the risks faced by a small, independent exploration and production company like the Company—including, natural disasters, operational challenges, poor reservoir performance, volatile commodity prices and an unfavorable regulatory or geopolitical climate, all of which are largely outside of the Company’s control.

In an effort to protect the Company’s entire business enterprise, management implemented strategies to address the unanticipated cost hurdles caused by each of these risks. Those strategies, however, required incurring additional obligations and committing cash flow that would otherwise have been used to maintain its businesses. For example, in 2013, the Company entered into two MPPs to provide approximately $175 million in incremental liquidity and, in early 2014, issued approximately $17.5 million in 6.5% Convertible Notes.

| C. | THE COMPANY’S PREPETITION EFFORTS TO DELEVER |

| 1. | The Strategic Review |

In May of 2013, the Company conducted a strategic review to consider the potential sale of either its U.K. business or the entire Company in an attempt to reduce its exposure to uncontrollable events in the U.K. North Sea and to capture the value it had created in its business. The Company engaged financial and legal advisors to analyze a broad range of options relating to the Company’s capital structure and later retained financial and legal advisors to further assist in its exploration of possible restructuring alternatives.

22

In October 2013, upon the conclusion of the strategic review, the Company determined it would retain and exploit its existing asset base while implementing several cost-cutting initiatives and organizational restructuring efforts to help reduce overhead. The Company consolidated its U.K. offices and reduced headcount, successfully lowering its general and administrative expenses by approximately $15 million annually.

Notwithstanding these cost-cutting efforts, the Company’s cash position continued to rapidly deteriorate. Compounding problems, the Company continued to encounter unforeseen production delays and suffer cost overruns related to its Rochelle field, where each problem resulted in months of lost production and cash flow from one of the Company’s most significant revenue sources.

| 2. | Discussions with Creditors Regarding Deleveraging |

In late June 2014, the Company and its advisors began discussions with the Company’s major creditors in an attempt to broker a restructuring transaction that would significantly delever the Company and reduce its untenable debt obligations. The Company and its advisors first engaged certain of the 2018 Noteholders (collectively, the “Ad Hoc Prepetition Noteholder Group”) and its legal and financial advisors. The discussions stalled when the parties failed to reach agreement on several key issues that would determine the foundation of a proposed restructuring transaction. Around that time, the Company contacted other creditor groups in an effort to canvass the full range of restructuring options available to it. The Company next initiated discussions with certain of the Convertible Noteholders (collectively, the “Ad Hoc Convertible Noteholder Group”) and the 7.5% Convertible Bondholders and their legal and financial advisors.

As the Company faced an interest payment of approximately $33.5 million on the 2018 Notes and the 6.5% Convertible Notes due on September 2, 2014, the Company’s restructuring efforts took on greater urgency. Failure to make the interest payment on September 2 would result in the Company entering a 30-day grace-period before an event of default would be triggered under the 2018 Notes and 6.5% Convertible Notes. If the Company failed to make the interest payment after the expiration of the 30-day grace period, the default under the 2018 Notes and 6.5% Convertible Notes would have triggered a cascade of cross-defaults on the Old EEUK Term Loan and its 7.5% Convertible Bonds. An event of default under the Old EEUK Term Loan would have permitted the lenders to that agreement to exercise remedies against the Company’s U.K. assets, which comprised the bulk of the Company’s value.

| 3. | The Refinancing Transaction and Insulation of the Company’s U.K.-Based Assets |

Prior to the commencement of these Chapter 11 Cases, the Company prepared for the contingency that no consensual restructuring transaction would be reached before the 30-day grace period under the 2018 Notes and 6.5% Convertible Notes ended.

The Company determined that its primary strategy would be to first preserve the value of its interests at its core revenue-generating Oil and Gas Properties. This required protecting the U.K. assets from the effects of a payment default on its U.S. debt and a bankruptcy default

23

resulting from a chapter 11 filing of its U.S. entities. Throughout late summer and early fall of 2014, the Company and its advisors aggressively pursued a waiver of the U.K. cross-defaults from its lenders under the Old EEUK Term Loan, while simultaneously exploring the possibility of refinancing the existing U.K. debt with new debt that would eliminate the specter of the U.K. cross-defaults. Concurrently, the Company prepared for the chapter 11 filing of its U.S. businesses to accomplish a comprehensive debt reduction.

On September 2, EIC’s board of directors determined not to pay the approximately $33.5 million interest payment due on its 2018 Notes and its 6.5% Convertible Notes (the “Missed Interest Payment”), and to conserve its cash and take advantage of the permitted 30-day grace period to continue earnest negotiations with its key creditors.

In connection with a possible refinancing transaction, the Company’s advisors contacted more than twenty-five (25) potential lenders. Over the course of a few short weeks, the Company’s management and advisors engaged in intensive discussions and negotiations with multiple parties concurrently. These discussions yielded the Refinancing Transaction, which closed on September 30, 2014. Under the Refinancing Transaction, the newly-issued Restated EEUK Term Loan proceeds were used to repay the outstanding Old EEUK Term Loan, thus diffusing the possibility that the Missed Interest Payment would lead to a cross-default on Endeavour’s U.K. debt and potentially cause it to lose its most valuable oil and gas licenses. The Restated EEUK Term Loan also provided approximately $36 million in additional incremental liquidity to help fund operations, restructuring costs and a known requirement to fund an additional letter of credit for the Alba field before the end of 2014.

| D. | THE RESTRUCTURING SUPPORT AGREEMENT |

| 1. | Overview |

Having successfully addressed the potential defaults and cross-defaults under the Old EEUK Term Loan and thereby insulating its U.K. assets from the risks associated with a restructuring of its U.S. businesses, the Company resumed negotiations with the 2018 Noteholders. As before, the Company’s primary goal was to obtain a much-needed debt restructuring in a controlled and comprehensive manner through a chapter 11 proceeding.