Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Wheeler Real Estate Investment Trust, Inc. | q3resultsofoperations8-k.htm |

| EX-99.3 - Q3 2014 EARNINGS CALL ANNOUNCEMENT - Wheeler Real Estate Investment Trust, Inc. | whlr-q3x2014ccannouncement.htm |

| EX-99.1 - THIRD QUARTER FINANCIAL RESULTS - Wheeler Real Estate Investment Trust, Inc. | whlr_q3-2014resultsxfinal.htm |

Supplemental Operating and Financial Data for the three months and nine months ended September 30, 2014

Wheeler Real Estate Investment Trust | Supplemental Operating and Financial Data 2 Table of Contents Page Company Overview 3 Financial and Portfolio Overview 4 Financial Summary Consolidated Balance Sheets 5 Consolidated Statements of Operations 6 Reconciliation of Non-GAAP Measures 7 Debt Summary 8 Portfolio Summary Property Summary 9 Top Ten Tenants by Annualized Base Rent 10 Leasing Summary 10 Definitions 11 Forward-Looking Statements This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of1933 and Section 21E of the Securities Act of 1934 that are based on current expectations, forecasts and assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ materially. These risks include, without limitation: adverse economic or real estate developments in the retail industry or the markets in which Wheeler Real Estate Investment Trust operates; defaults on or non-renewal of leases by tenants; increased interest rates and operating costs; decreased rental rates or increased vacancy rates; Wheeler Real Estate Investment Trust's failure to obtain necessary outside financing on favorable terms or at all; changes in the availability of additional acquisition opportunities; Wheeler Real Estate Investment Trust 's inability to successfully complete real estate acquisitions or successfully operate acquired properties and Wheeler Real Estate Investment Trust's failure to qualify or maintain its status as a REIT. For a further list and description of such risks and uncertainties that could impact Wheeler Real Estate Investment Trust's future results, performance or transactions, see the reports filed by Wheeler Real Estate Investment Trust with the Securities and Exchange Commission, including its quarterly reports on Form 10-Q and annual reports on Form 10-K. Wheeler Real Estate Investment Trust disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Wheeler Real Estate Investment Trust | Supplemental Operating and Financial Data 3 Company Overview Headquartered in Virginia Beach, VA, Wheeler Real Estate Investment Trust, Inc. (“Wheeler” or the “Company”) specializes in owning, acquiring, financing, developing, renovating, leasing and managing income producing assets, such as community centers, neighborhood centers, strip centers and free- standing retail properties. Wheeler’s portfolio contains strategically selected properties, primarily leased by nationally and regionally recognized retailers of consumer goods and located in the Northeastern, Mid-Atlantic, Southeast and Southwest regions of the United States. Wheeler’s common stock, Series B Convertible preferred stock and common stock warrants trade publicly on the Nasdaq under the symbols “WHLR”, “WHLRP” and “WHLRW”, respectively. Corporate Headquarters Wheeler Real Estate Investment Trust Inc. Riversedge North 2529 Virginia Beach Boulevard Virginia Beach, VA 23452 Phone: (757) 627-9088 Toll Free: (866) 203-4864 Email: info@whlr.us Website: www.whlr.us Executive Management Jon S. Wheeler - Chairman & CEO Steven M. Belote - CFO Robin A. Hanisch – Corporate Secretary Board of Directors Jon S. Wheeler, Chairman William W. King Christopher J. Ettel Carl B. McGowan, Jr. Warren D. Harris Ann L. McKinney David Kelly Jeffrey M. Zwerdling Investor Relations Contact Transfer Agent and Registrar The Equity Group Inc. 800 Third Avenue, 36th Floor New York, NY 10022 Adam Prior, Senior Vice President Phone: (212) 836-9606, aprior@equityny.com Terry Downs, Associate Phone: (212) 836-9615, tdowns@equityny.com Computershare Trust Company, N.A. 250 Royall Street Canton, MA 02021 www.computershare.com

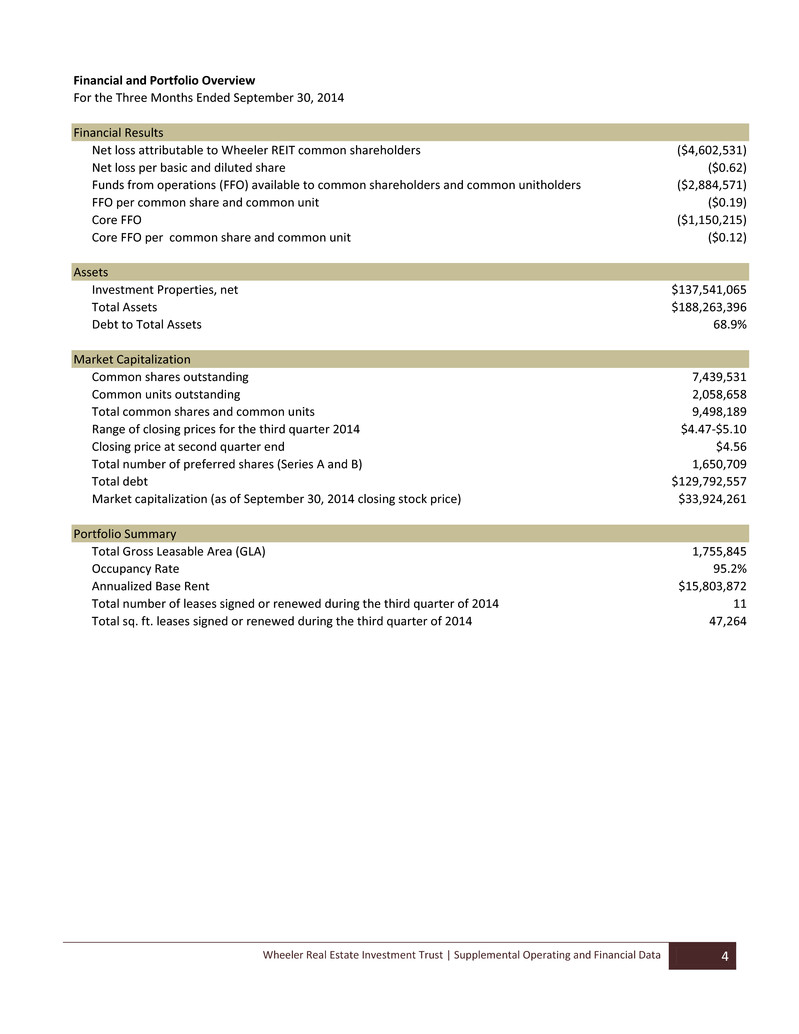

Wheeler Real Estate Investment Trust | Supplemental Operating and Financial Data 4 Financial and Portfolio Overview For the Three Months Ended September 30, 2014 Financial Results Net loss attributable to Wheeler REIT common shareholders ($4,602,531) Net loss per basic and diluted share ($0.62) Funds from operations (FFO) available to common shareholders and common unitholders ($2,884,571) FFO per common share and common unit ($0.19) Core FFO ($1,150,215) Core FFO per common share and common unit ($0.12) Assets Investment Properties, net $137,541,065 Total Assets $188,263,396 Debt to Total Assets 68.9% Market Capitalization Common shares outstanding 7,439,531 Common units outstanding 2,058,658 Total common shares and common units 9,498,189 Range of closing prices for the third quarter 2014 $4.47-$5.10 Closing price at second quarter end $4.56 Total number of preferred shares (Series A and B) 1,650,709 Total debt $129,792,557 Market capitalization (as of September 30, 2014 closing stock price) $33,924,261 Portfolio Summary Total Gross Leasable Area (GLA) 1,755,845 Occupancy Rate 95.2% Annualized Base Rent $15,803,872 Total number of leases signed or renewed during the third quarter of 2014 11 Total sq. ft. leases signed or renewed during the third quarter of 2014 47,264

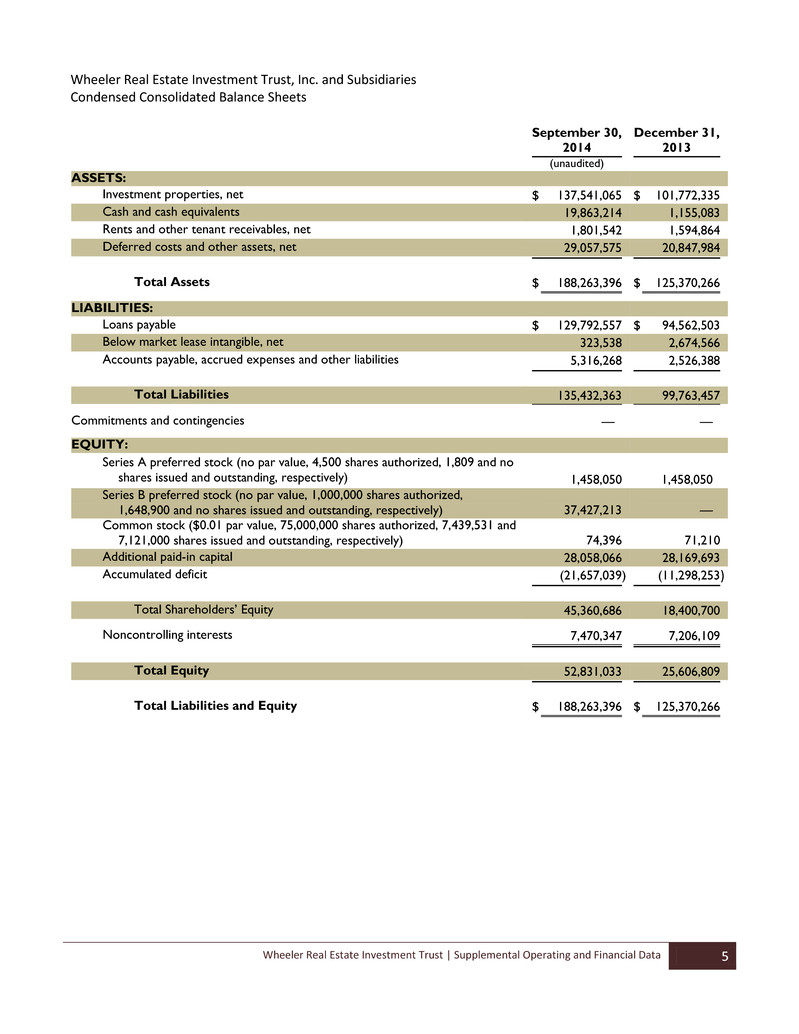

Wheeler Real Estate Investment Trust | Supplemental Operating and Financial Data 5 Wheeler Real Estate Investment Trust, Inc. and Subsidiaries Condensed Consolidated Balance Sheets September 30, 2014 December 31, 2013 (unaudited) ASSETS: Investment properties, net $ 137,541,065 $ 101,772,335 Cash and cash equivalents 19,863,214 1,155,083 Rents and other tenant receivables, net 1,801,542 1,594,864 Deferred costs and other assets, net 29,057,575 20,847,984 Total Assets $ 188,263,396 $ 125,370,266 LIABILITIES: Loans payable $ 129,792,557 $ 94,562,503 Below market lease intangible, net 323,538 2,674,566 Accounts payable, accrued expenses and other liabilities 5,316,268 2,526,388 Total Liabilities 135,432,363 99,763,457 Commitments and contingencies — — EQUITY: Series A preferred stock (no par value, 4,500 shares authorized, 1,809 and no shares issued and outstanding, respectively) 1,458,050 1,458,050 Series B preferred stock (no par value, 1,000,000 shares authorized, 1,648,900 and no shares issued and outstanding, respectively) 37,427,213 — Common stock ($0.01 par value, 75,000,000 shares authorized, 7,439,531 and 7,121,000 shares issued and outstanding, respectively) 74,396 71,210 Additional paid-in capital 28,058,066 28,169,693 Accumulated deficit (21,657,039 ) (11,298,253 ) Total Shareholders’ Equity 45,360,686 18,400,700 Noncontrolling interests 7,470,347 7,206,109 Total Equity 52,831,033 25,606,809 Total Liabilities and Equity $ 188,263,396 $ 125,370,266

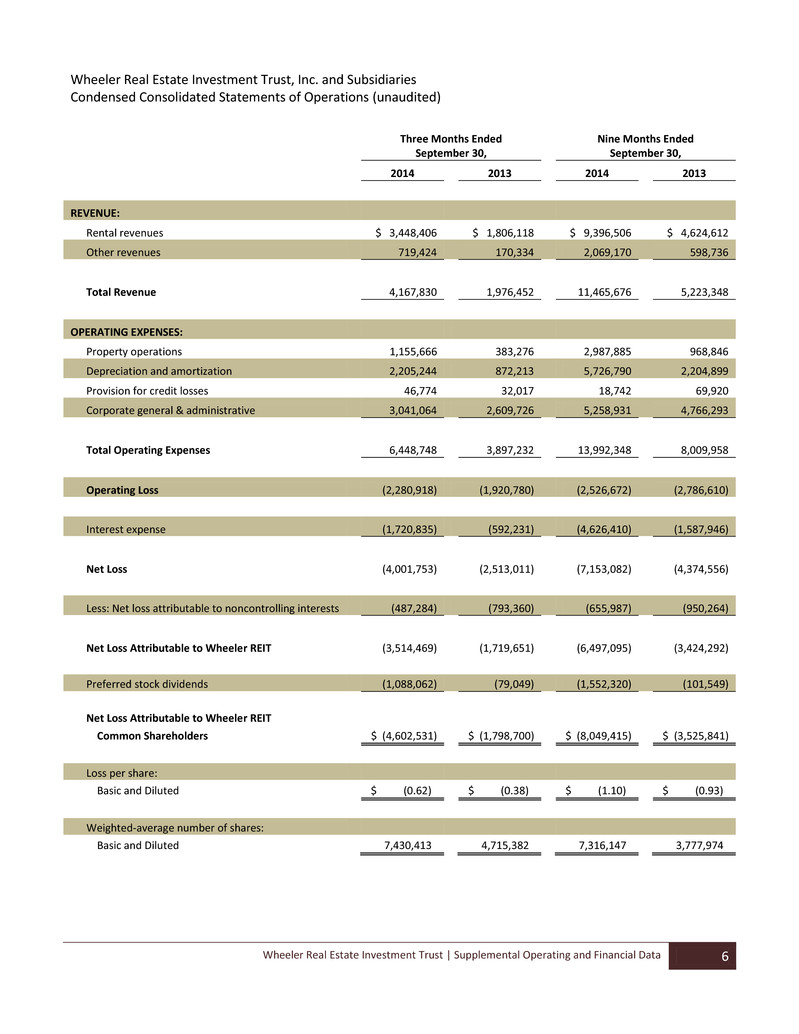

Wheeler Real Estate Investment Trust | Supplemental Operating and Financial Data 6 Wheeler Real Estate Investment Trust, Inc. and Subsidiaries Condensed Consolidated Statements of Operations (unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2014 2013 2014 2013 REVENUE: Rental revenues $ 3,448,406 $ 1,806,118 $ 9,396,506 $ 4,624,612 Other revenues 719,424 170,334 2,069,170 598,736 Total Revenue 4,167,830 1,976,452 11,465,676 5,223,348 OPERATING EXPENSES: Property operations 1,155,666 383,276 2,987,885 968,846 Depreciation and amortization 2,205,244 872,213 5,726,790 2,204,899 Provision for credit losses 46,774 32,017 18,742 69,920 Corporate general & administrative 3,041,064 2,609,726 5,258,931 4,766,293 Total Operating Expenses 6,448,748 3,897,232 13,992,348 8,009,958 Operating Loss (2,280,918) (1,920,780) (2,526,672) (2,786,610) Interest expense (1,720,835) (592,231) (4,626,410) (1,587,946) Net Loss (4,001,753) (2,513,011) (7,153,082) (4,374,556) Less: Net loss attributable to noncontrolling interests (487,284) (793,360) (655,987) (950,264) Net Loss Attributable to Wheeler REIT (3,514,469) (1,719,651) (6,497,095) (3,424,292) Preferred stock dividends (1,088,062) (79,049) (1,552,320) (101,549) Net Loss Attributable to Wheeler REIT Common Shareholders $ (4,602,531) $ (1,798,700) $ (8,049,415) $ (3,525,841) Loss per share: Basic and Diluted $ (0.62) $ (0.38) $ (1.10) $ (0.93) Weighted-average number of shares: Basic and Diluted 7,430,413 4,715,382 7,316,147 3,777,974

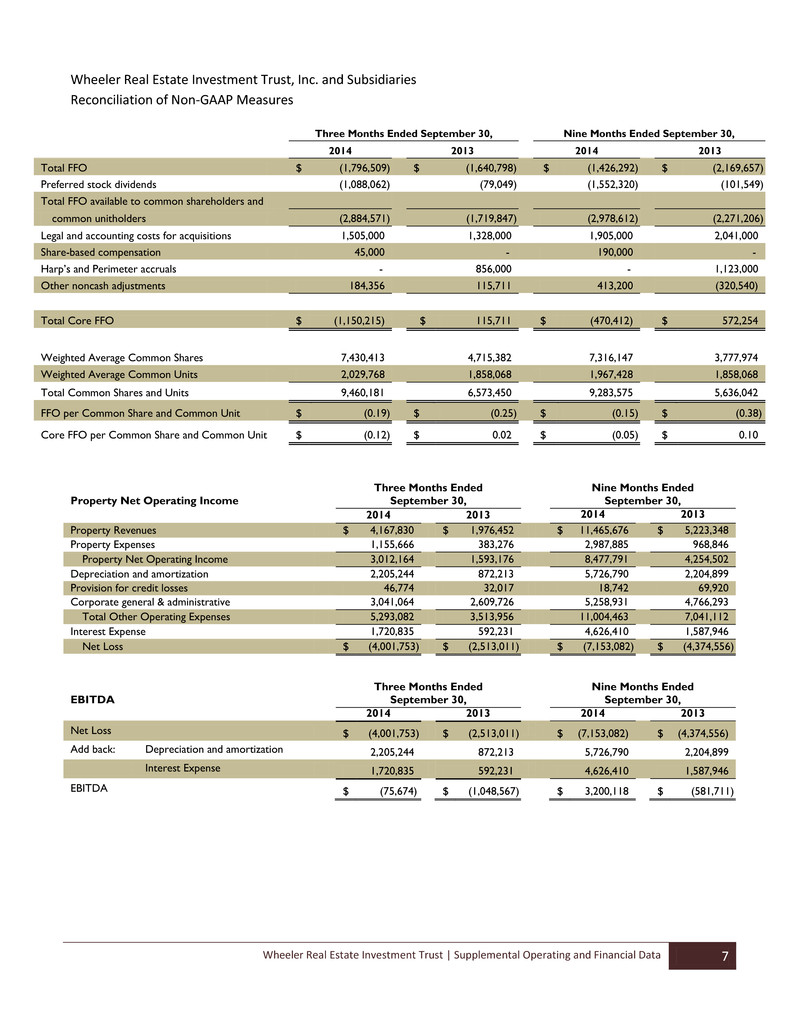

Wheeler Real Estate Investment Trust | Supplemental Operating and Financial Data 7 Wheeler Real Estate Investment Trust, Inc. and Subsidiaries Reconciliation of Non-GAAP Measures Three Months Ended September 30, Nine Months Ended September 30, 2014 2013 2014 2013 Total FFO $ (1,796,509) $ (1,640,798) $ (1,426,292) $ (2,169,657) Preferred stock dividends (1,088,062) (79,049) (1,552,320) (101,549) Total FFO available to common shareholders and common unitholders (2,884,571) (1,719,847) (2,978,612) (2,271,206) Legal and accounting costs for acquisitions 1,505,000 1,328,000 1,905,000 2,041,000 Share-based compensation 45,000 - 190,000 - Harp’s and Perimeter accruals - 856,000 - 1,123,000 Other noncash adjustments 184,356 115,711 413,200 (320,540) Total Core FFO $ (1,150,215) $ 115,711 $ (470,412) $ 572,254 Weighted Average Common Shares 7,430,413 4,715,382 7,316,147 3,777,974 Weighted Average Common Units 2,029,768 1,858,068 1,967,428 1,858,068 Total Common Shares and Units 9,460,181 6,573,450 9,283,575 5,636,042 FFO per Common Share and Common Unit $ (0.19) $ (0.25) $ (0.15) $ (0.38) Core FFO per Common Share and Common Unit $ (0.12) $ 0.02 $ (0.05) $ 0.10 Property Net Operating Income Three Months Ended September 30, Nine Months Ended September 30, 2014 2013 2014 2013 Property Revenues $ 4,167,830 $ 1,976,452 $ 11,465,676 $ 5,223,348 Property Expenses 1,155,666 383,276 2,987,885 968,846 Property Net Operating Income 3,012,164 1,593,176 8,477,791 4,254,502 Depreciation and amortization 2,205,244 872,213 5,726,790 2,204,899 Provision for credit losses 46,774 32,017 18,742 69,920 Corporate general & administrative 3,041,064 2,609,726 5,258,931 4,766,293 Total Other Operating Expenses 5,293,082 3,513,956 11,004,463 7,041,112 Interest Expense 1,720,835 592,231 4,626,410 1,587,946 Net Loss $ (4,001,753) $ (2,513,011) $ (7,153,082) $ (4,374,556) EBITDA Three Months Ended September 30, Nine Months Ended September 30, 2014 2013 2014 2013 Net Loss $ (4,001,753) $ (2,513,011) $ (7,153,082) $ (4,374,556) Add back: Depreciation and amortization 2,205,244 872,213 5,726,790 2,204,899 Interest Expense 1,720,835 592,231 4,626,410 1,587,946 EBITDA $ (75,674) $ (1,048,567) $ 3,200,118 $ (581,711)

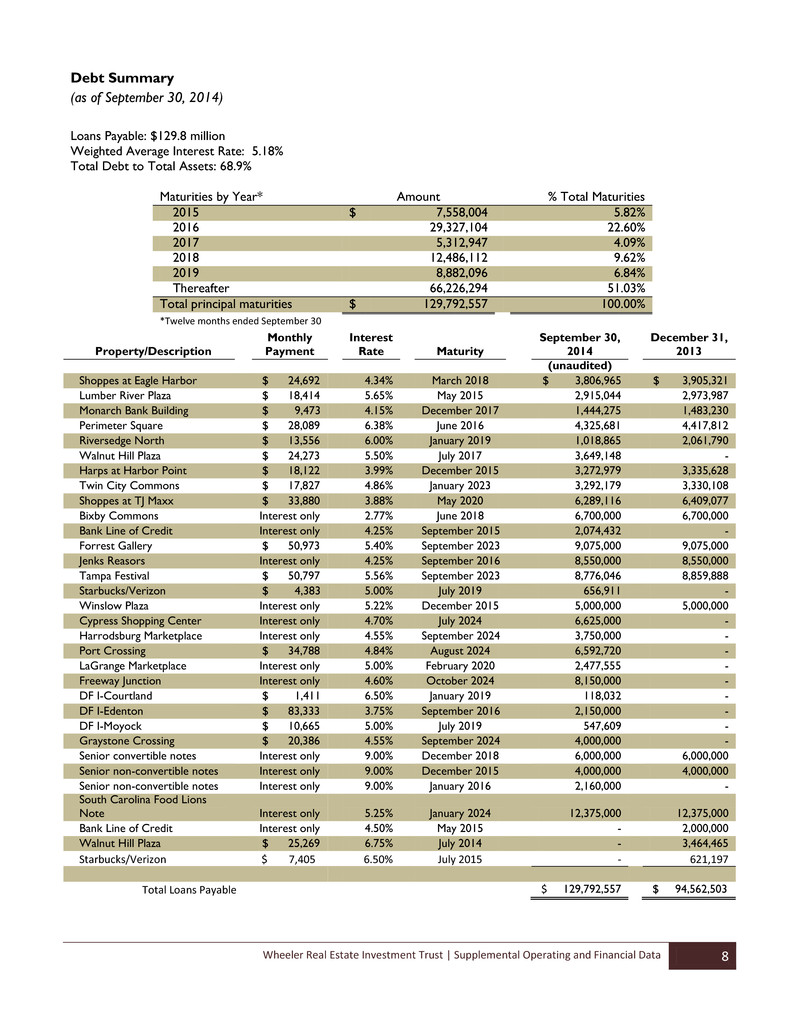

Wheeler Real Estate Investment Trust | Supplemental Operating and Financial Data 8 Debt Summary (as of September 30, 2014) Loans Payable: $129.8 million Weighted Average Interest Rate: 5.18% Total Debt to Total Assets: 68.9% Maturities by Year* Amount % Total Maturities 2015 $ 7,558,004 5.82% 2016 29,327,104 22.60% 2017 5,312,947 4.09% 2018 12,486,112 9.62% 2019 8,882,096 6.84% Thereafter 66,226,294 51.03% Total principal maturities $ 129,792,557 100.00% *Twelve months ended September 30 Monthly Interest September 30, December 31, Property/Description Payment Rate Maturity 2014 2013 (unaudited) Shoppes at Eagle Harbor $ 24,692 4.34% March 2018 $ 3,806,965 $ 3,905,321 Lumber River Plaza $ 18,414 5.65% May 2015 2,915,044 2,973,987 Monarch Bank Building $ 9,473 4.15% December 2017 1,444,275 1,483,230 Perimeter Square $ 28,089 6.38% June 2016 4,325,681 4,417,812 Riversedge North $ 13,556 6.00% January 2019 1,018,865 2,061,790 Walnut Hill Plaza $ 24,273 5.50% July 2017 3,649,148 - Harps at Harbor Point $ 18,122 3.99% December 2015 3,272,979 3,335,628 Twin City Commons $ 17,827 4.86% January 2023 3,292,179 3,330,108 Shoppes at TJ Maxx $ 33,880 3.88% May 2020 6,289,116 6,409,077 Bixby Commons Interest only 2.77% June 2018 6,700,000 6,700,000 Bank Line of Credit Interest only 4.25% September 2015 2,074,432 - Forrest Gallery $ 50,973 5.40% September 2023 9,075,000 9,075,000 Jenks Reasors Interest only 4.25% September 2016 8,550,000 8,550,000 Tampa Festival $ 50,797 5.56% September 2023 8,776,046 8,859,888 Starbucks/Verizon $ 4,383 5.00% July 2019 656,911 - Winslow Plaza Interest only 5.22% December 2015 5,000,000 5,000,000 Cypress Shopping Center Interest only 4.70% July 2024 6,625,000 - Harrodsburg Marketplace Interest only 4.55% September 2024 3,750,000 - Port Crossing $ 34,788 4.84% August 2024 6,592,720 - LaGrange Marketplace Interest only 5.00% February 2020 2,477,555 - Freeway Junction Interest only 4.60% October 2024 8,150,000 - DF I-Courtland $ 1,411 6.50% January 2019 118,032 - DF I-Edenton $ 83,333 3.75% September 2016 2,150,000 - DF I-Moyock $ 10,665 5.00% July 2019 547,609 - Graystone Crossing $ 20,386 4.55% September 2024 4,000,000 - Senior convertible notes Interest only 9.00% December 2018 6,000,000 6,000,000 Senior non-convertible notes Interest only 9.00% December 2015 4,000,000 4,000,000 Senior non-convertible notes Interest only 9.00% January 2016 2,160,000 - South Carolina Food Lions Note Interest only 5.25% January 2024 12,375,000 12,375,000 Bank Line of Credit Interest only 4.50% May 2015 - 2,000,000 Walnut Hill Plaza $ 25,269 6.75% July 2014 - 3,464,465 Starbucks/Verizon $ 7,405 6.50% July 2015 - 621,197 Total Loans Payable $ 129,792,557 $ 94,562,503

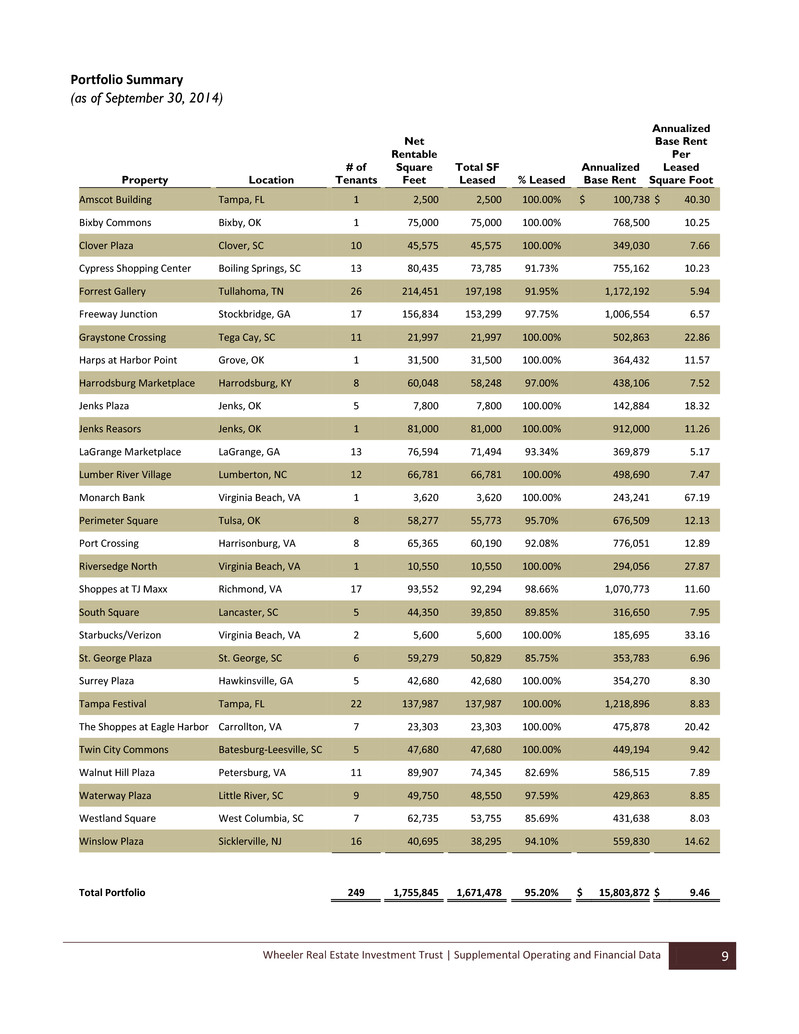

Wheeler Real Estate Investment Trust | Supplemental Operating and Financial Data 9 Portfolio Summary (as of September 30, 2014) Property Location # of Tenants Net Rentable Square Feet Total SF Leased % Leased Annualized Base Rent Annualized Base Rent Per Leased Square Foot Amscot Building Tampa, FL 1 2,500 2,500 100.00% $ 100,738 $ 40.30 Bixby Commons Bixby, OK 1 75,000 75,000 100.00% 768,500 10.25 Clover Plaza Clover, SC 10 45,575 45,575 100.00% 349,030 7.66 Cypress Shopping Center Boiling Springs, SC 13 80,435 73,785 91.73% 755,162 10.23 Forrest Gallery Tullahoma, TN 26 214,451 197,198 91.95% 1,172,192 5.94 Freeway Junction Stockbridge, GA 17 156,834 153,299 97.75% 1,006,554 6.57 Graystone Crossing Tega Cay, SC 11 21,997 21,997 100.00% 502,863 22.86 Harps at Harbor Point Grove, OK 1 31,500 31,500 100.00% 364,432 11.57 Harrodsburg Marketplace Harrodsburg, KY 8 60,048 58,248 97.00% 438,106 7.52 Jenks Plaza Jenks, OK 5 7,800 7,800 100.00% 142,884 18.32 Jenks Reasors Jenks, OK 1 81,000 81,000 100.00% 912,000 11.26 LaGrange Marketplace LaGrange, GA 13 76,594 71,494 93.34% 369,879 5.17 Lumber River Village Lumberton, NC 12 66,781 66,781 100.00% 498,690 7.47 Monarch Bank Virginia Beach, VA 1 3,620 3,620 100.00% 243,241 67.19 Perimeter Square Tulsa, OK 8 58,277 55,773 95.70% 676,509 12.13 Port Crossing Harrisonburg, VA 8 65,365 60,190 92.08% 776,051 12.89 Riversedge North Virginia Beach, VA 1 10,550 10,550 100.00% 294,056 27.87 Shoppes at TJ Maxx Richmond, VA 17 93,552 92,294 98.66% 1,070,773 11.60 South Square Lancaster, SC 5 44,350 39,850 89.85% 316,650 7.95 Starbucks/Verizon Virginia Beach, VA 2 5,600 5,600 100.00% 185,695 33.16 St. George Plaza St. George, SC 6 59,279 50,829 85.75% 353,783 6.96 Surrey Plaza Hawkinsville, GA 5 42,680 42,680 100.00% 354,270 8.30 Tampa Festival Tampa, FL 22 137,987 137,987 100.00% 1,218,896 8.83 The Shoppes at Eagle Harbor Carrollton, VA 7 23,303 23,303 100.00% 475,878 20.42 Twin City Commons Batesburg-Leesville, SC 5 47,680 47,680 100.00% 449,194 9.42 Walnut Hill Plaza Petersburg, VA 11 89,907 74,345 82.69% 586,515 7.89 Waterway Plaza Little River, SC 9 49,750 48,550 97.59% 429,863 8.85 Westland Square West Columbia, SC 7 62,735 53,755 85.69% 431,638 8.03 Winslow Plaza Sicklerville, NJ 16 40,695 38,295 94.10% 559,830 14.62 Total Portfolio 249 1,755,845 1,671,478 95.20% $ 15,803,872 $ 9.46

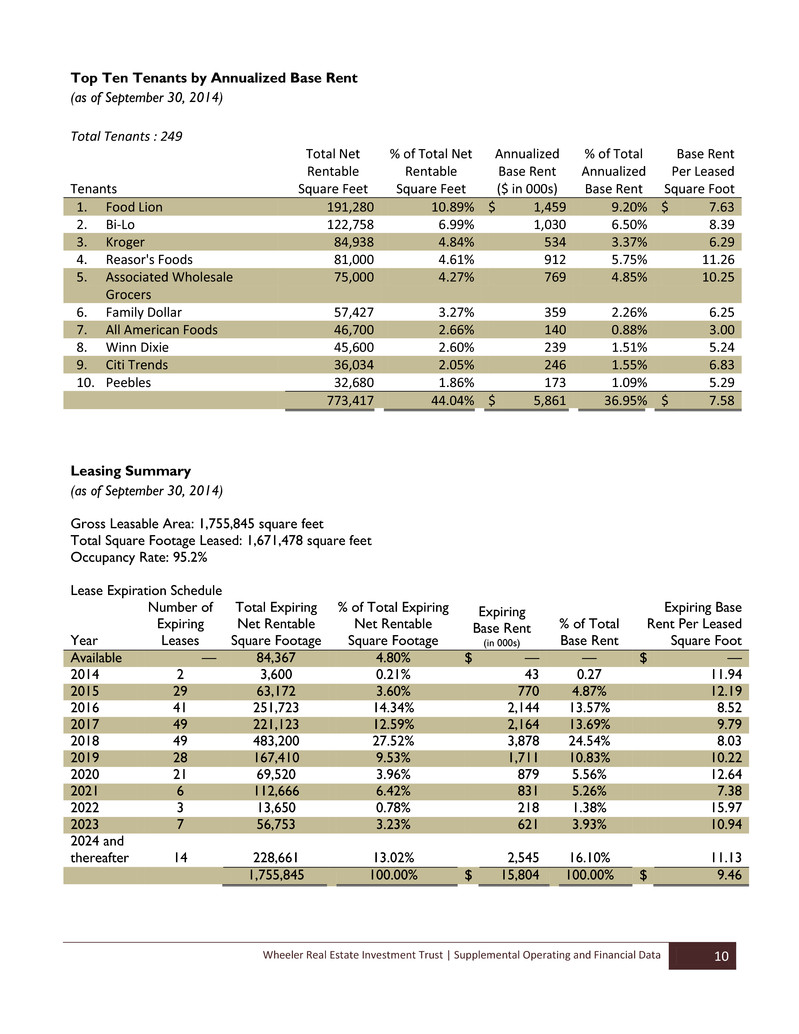

Wheeler Real Estate Investment Trust | Supplemental Operating and Financial Data 10 Top Ten Tenants by Annualized Base Rent (as of September 30, 2014) Total Tenants : 249 Tenants Total Net Rentable Square Feet % of Total Net Rentable Square Feet Annualized Base Rent ($ in 000s) % of Total Annualized Base Rent Base Rent Per Leased Square Foot 1. Food Lion 191,280 10.89% $ 1,459 9.20% $ 7.63 2. Bi-Lo 122,758 6.99% 1,030 6.50% 8.39 3. Kroger 84,938 4.84% 534 3.37% 6.29 4. Reasor's Foods 81,000 4.61% 912 5.75% 11.26 5. Associated Wholesale Grocers 75,000 4.27% 769 4.85% 10.25 6. Family Dollar 57,427 3.27% 359 2.26% 6.25 7. All American Foods 46,700 2.66% 140 0.88% 3.00 8. Winn Dixie 45,600 2.60% 239 1.51% 5.24 9. Citi Trends 36,034 2.05% 246 1.55% 6.83 10. Peebles 32,680 1.86% 173 1.09% 5.29 773,417 44.04% $ 5,861 36.95% $ 7.58 Leasing Summary (as of September 30, 2014) Gross Leasable Area: 1,755,845 square feet Total Square Footage Leased: 1,671,478 square feet Occupancy Rate: 95.2% Lease Expiration Schedule Year Number of Expiring Leases Total Expiring Net Rentable Square Footage % of Total Expiring Net Rentable Square Footage Expiring Base Rent (in 000s) % of Total Base Rent Expiring Base Rent Per Leased Square Foot Available — 84,367 4.80% $ — — $ — 2014 2 3,600 0.21% 43 0.27 11.94 2015 29 63,172 3.60% 770 4.87% 12.19 2016 41 251,723 14.34% 2,144 13.57% 8.52 2017 49 221,123 12.59% 2,164 13.69% 9.79 2018 49 483,200 27.52% 3,878 24.54% 8.03 2019 28 167,410 9.53% 1,711 10.83% 10.22 2020 21 69,520 3.96% 879 5.56% 12.64 2021 6 112,666 6.42% 831 5.26% 7.38 2022 3 13,650 0.78% 218 1.38% 15.97 2023 7 56,753 3.23% 621 3.93% 10.94 2024 and thereafter 14 228,661 13.02% 2,545 16.10% 11.13 1,755,845 100.00% $ 15,804 100.00% $ 9.46

Wheeler Real Estate Investment Trust | Supplemental Operating and Financial Data 11 Definitions Funds from Operations (FFO): an alternative measure of a REITs operating performance, specifically as it relates to results of operations and liquidity. FFO is a measurement that is not in accordance with accounting principles generally accepted in the United States (“GAAP”). Wheeler computes FFO in accordance with standards established by the Board of Governors of NAREIT in its March 1995 White Paper (as amended in November 1999 and April 2002). As defined by NAREIT, FFO represents net income (computed in accordance with GAAP), excluding gains (or losses) from sales of property, plus real estate related depreciation and amortization (excluding amortization of loan origination costs) and after adjustments for unconsolidated partnerships and joint ventures. Most industry analysts and equity REITs, including Wheeler, consider FFO to be an appropriate supplemental measure of operating performance because, by excluding gains or losses on dispositions and excluding depreciation, FFO is a helpful tool that can assist in the comparison of the operating performance of a company’s real estate between periods, or as compared to different companies. Management uses FFO as a supplemental measure to conduct and evaluate the business because there are certain limitations associated with using GAAP net income alone as the primary measure of our operating performance. Historical cost accounting for real estate assets in accordance with GAAP implicitly assumes that the value of real estate assets diminishes predictably over time, while historically real estate values have risen or fallen with market conditions. Core FFO: Management believes that the computation of FFO in accordance with NAREIT’s definition includes certain items that are not indicative of the operating performance of the Company’s real estate assets. These items include, but are not limited to, non-recurring expenses, legal settlements and acquisition costs. Management uses Core FFO, which is a non-GAAP financial measure, to exclude such items. Management believes that reporting Core FFO in addition to FFO is a useful supplemental measure for the investment community to use when evaluating the operating performance of the Company on a comparative basis. Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA): another widely-recognized non- GAAP financial measure that the Company believes, when considered with financial statements prepared in accordance with GAAP, is useful to investors and lenders in understanding financial performance and providing a relevant basis for comparison among other companies, including REITs. While EBITDA should not be considered as a substitute for net income attributable to the Company’s common shareholders, net operating income, cash flow from operating activities, or other income or cash flow data prepared in accordance with GAAP, the Company believes that EBITDA may provide additional information with respect to the Company’s performance or ability to meet its future debt service requirements, capital expenditures and working capital requirements. The Company computes EBITDA by excluding interest expense, net loss attributable to noncontrolling interest, and depreciation and amortization, from income from continuing operations. Net Operating Income (NOI): Wheeler believes that NOI is a useful measure of the Company's property operating performance. The Company defines NOI as property revenues (rental and other revenues) less property and related expenses (property operation and maintenance and real estate taxes). Because NOI excludes general and administrative expenses, depreciation and amortization, interest expense, interest income, provision for income taxes, gain or loss on sale or capital expenditures and leasing costs, it provides a performance measure, that when compared year over year, reflects the revenues and expenses directly associated with owning and operating commercial real estate properties and the impact to operations from trends in occupancy rates, rental rates and operating costs, providing perspective not immediately

Wheeler Real Estate Investment Trust | Supplemental Operating and Financial Data 12 apparent from net income. The Company uses NOI to evaluate its operating performance since NOI allows the Company to evaluate the impact of factors, such as occupancy levels, lease structure, lease rates and tenant base, have on the Company's results, margins and returns. NOI should not be viewed as a measure of the Company's overall financial performance since it does not reflect general and administrative expenses, depreciation and amortization, involuntary conversion, interest expense, interest income, provision for income taxes, gain or loss on sale or disposition of assets, and the level of capital expenditures and leasing costs necessary to maintain the operating performance of the Company's properties. Other REITs may use different methodologies for calculating NOI, and accordingly, the Company's NOI may not be comparable to that of other REITs.