Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Regency Energy Partners LP | d822390d8k.htm |

Regency Energy

Partners LP 2014 Investor Day

November 17, 2014

Exhibit 99.1 |

Forward-Looking Statements

2

Certain matters discussed in this report include “forward-looking” statements.

Forward-looking statements are identified as any statement that does not relate

strictly to historical or current facts. Statements using words such as “anticipate,” “believe,” “intend,” “will,” “project,” “plan,” “expect,”

“continue,” “estimate,” “goal,” “forecast,”

“may” or similar expressions help identify forward-looking statements. Although we believe our forward-

looking statements are based on reasonable assumptions and current expectations and

projections about future events, we cannot give assurances that such expectations will

prove to be correct. Forward-looking statements are subject to a variety of risks, uncertainties and assumptions including

the following risks: unexpected difficulties in integrating Regency’s operations as a

result of any significant acquisitions, including Regency's acquisition of Eagle Rock

Energy Partners, LP’s midstream business. Additional risks include, volatility in the price of oil, natural gas, condensate, and natural gas

liquids and coal; declines in the credit markets and the availability of credit for the

Partnership as well as for producers connected to the Partnership’s system and its

customers, the level of creditworthiness of, and performance by the Partnership’s counterparties and customers, the Partnership's

ability to access capital to fund organic growth projects and acquisitions, and the

Partnership’s ability to obtain debt and equity financing on satisfactory terms,

the Partnership's use of derivative financial instruments to hedge commodity and or enforcement practices risks, the amount of

collateral required to be posted from time-to-time in the Partnership's transactions,

changes in commodity prices, interest rates, and demand for the Partnership's services,

changes in laws and regulations impacting the use and development of renewable energy or limit use or development of fossil

fuels and the midstream sector of the natural gas industry, the oil industry and coal mining

industry, including those that relate to climate change and environmental protection

and safety, including with respect to emissions levels applicable to coal-burning power generators and permissible levels of

mining runoff, weather and other natural phenomena, industry changes including the impact of

consolidations and changes in competition, the regulation of transportation rates on

our natural gas, NGL, and oil pipelines, the Partnership’s ability to obtain indemnification related to clean up any

hazardous materials release on satisfactory , the Partnership's ability to obtain required

approvals for construction or modernization of the Partnership's facilities and the

timing of production from such facilities, and the effect of accounting pronouncements issued periodically by

accounting standard setting boards. The extent to which the amount and quality of actual

production of our coal differs from estimated recoverable coal reserves, the experience

and financial condition of our coal lessees, including our lesses’ ability to satisfy their royalty , environmental,

reclamation and other obligations to us and others, operating risks, including unanticipated

geological problems, incidental to our Gathering and Processing segment and Natural

Resources segment, the ability of our lesses to produce sufficient quantities of coal on an economic basis from our

reserves and obtain favorable contracts for such production, delays in anticipated

start-up dates of new development in our Gathering and Processing segment and our

lessees’ mining operation and related coal infrastructure projects, including the timing of receipt of necessary governmental permits

by us or our lessees; and uncertainties relating to the effects of regulatory guidance on

permitting under the Clean Water Act and the outcome of current and future litigation

regarding mine permitting. Therefore, actual results and outcomes may differ materially from those expressed in such

forward-looking information.

In light of these risks, uncertainties and assumptions, the events described in

the forward-looking statements might not occur or might occur to a different extent

or at a different time than the Partnership has described. The Partnership undertakes no obligation to update publicly or to revise any

forward-looking statements, whether as a result of new information, future events or

otherwise.

|

Agenda

3

1. Overview & Strategy

Mike Bradley, President & CEO

2. Natural Gas Transportation

and

Gathering & Processing Overviews

Jim Holotik, EVP & Chief Commercial Officer

3. Integration & Synergies Update

Jennifer Street, Vice President of Engineering

4. NGL Services Overview

Steve Spaulding, EVP of Lone Star NGL

5. Contract Services Overview

Chad Lenamon, President of Contract Services

6. Financial Review

Tom Long, EVP & CFO

7. Conclusion

Mike Bradley, President & CEO

8. Q&A |

Overview &

Strategy |

Major

Transformation Since Last Investor Day 5

Extensive

midstream

portfolio

and

strong

position

in

majority

of

high-growth

shale

plays

driving

expansion opportunities

•

Completed approximately $9 billion in strategic acquisitions

•

Combined synergies in excess of $85 million

•

Completed $1.5 billion in organic growth projects, primarily from the legacy Regency

assets •

Transformed into one of the largest and most diverse G&P MLPs

•

Achieved significant G&P scale in 5 prolific producing regions

•

Increased

organic

growth

opportunities

driven

by

strong

position

and

scale

•

Current backlog is approximately $2.6 billion, which provides visibility into future earnings

growth

•

High percentage of fee-based margins

•

Diversity of business mix, scale and strategic location of assets enhances stability of

cash flows

•

Quarterly distributions have increased 8% since Q2 2013

•

Well positioned for continued distribution growth as recently completed and new

projects

under

construction

ramp

up

from

2015

–

2017

Growth

Scale &

Diversity

Backlog

Stability of

Cash Flows

Distributions |

6

Highlights Since 2013 Investor Day

1. Includes FY 2013 and 9 months ended 2014 capex

Acquisitions -

$9 Billion

SUGS

PVR Partners

Hoover Energy

Midstream

EROC Energy

Midstream

Organic Growth -

$1.5 Billion¹

•

Eagle Ford Expansion

•

Dubach Processing Expansion

•

Dubberly Gathering Expansion

•

Contract Services Growth

•

Frac II

•

Tilden and ELG Treating Expansions

•

Red Bluff Processing Expansion

Adjusted EBITDA & DCF

Throughput & NGL Production

$155

$344

$101

$215

$0

$50

$100

$150

$200

$250

$300

$0

$100

$200

$300

$400

$500

Q2 2013

Q3 2014

Q2 2013

Q3 2014

Adjusted EBITDA

DCF

2.2

5.7

97

178

0

50

100

150

200

250

300

0

1

2

3

4

5

6

7

8

Q2 2013

Q3 2014

Q2 2013

Q3 2014

Throughput

NGL Production |

7

Substantially Increased Footprint

Transformed into a larger, more diverse G&P midstream provider with strong positions in 5

strategic basins Contract Services segment has expanded its existing positions and has

added 4 new shale plays to its footprint Ark-La-Tex

•

EROC acquisition significantly

increased footprint in East

Texas, where drilling activity is

expected to increase, driving

expansion opportunities

•

Expanding legacy assets to

meet increased demand from

Cotton Valley drilling

Marcellus/Utica

•

PVR assets provide significant

position in core area of Appalachian

Shales, which are presenting

substantial growth opportunities

Midcontinent/Granite Wash

•

Acquisitions have created

stronger position, driving

significant synergy opportunities

and improved system efficiencies

Permian

•

A prominent position in most

active counties in Permian driving

processing, crude oil and water

gathering opportunities

South Texas

•

Positioned in the oil and liquids-

rich Eagle Ford, which is driving

increased treating opportunities

and possible further expansion of

the Eagle Ford Gathering System |

Permian

G&P NGL Services

Natural Resources

8

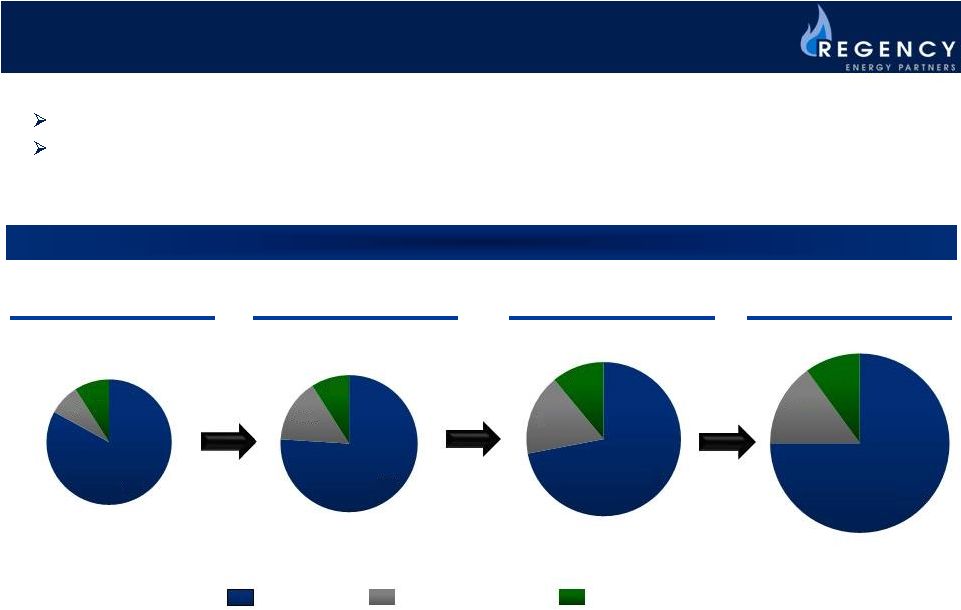

Margin By Business

Significant Portfolio Growth & Diversification

FY 2012

FY 2015E

Acquisitions and organic growth are driving a more balanced and diversified portfolio

NLa G&P

Eastern G&P

Natural Gas Transportation

Mid-Continent G&P

South Texas G&P

Contract Services

8%

6%

5%

17%

11%

25%

14%

8%

3%

17%

7%

15%

12%

13%

10%

28% |

9

Gathering & Processing Margin By Region

Significant Scale in 5 Prolific Producing Regions

FY 2012

FY 2015E

26%

11%

24%

18%

21%

23%

17%

13%

47%

Mid-Continent G&P

NLa G&P

Permian G&P

South Texas G&P

Eastern Region

PVR,

EROC

and

Hoover

acquisitions

provided

significant

scale

and

geographic

diversification

to

gathering and processing segment, and further diversified margins

|

SUGS Growth

Projects RGP Other Growth Projects

NGL Logistics Growth Projects

Contract Services Growth Projects

10

Scale & Position Driving Increased Organic Growth

Acquisition Growth Drivers

Organic Growth Backlog

Other Growth Drivers

PVR Growth Drivers

•

Utica Ohio River Gathering JV

•

Lycoming Expansion

•

East Clinton Expansion

•

Mi Vida Processing Plant

•

Permian Processing Expansion III

•

Frac III

•

Mariner South Pipeline

•

Lone Star Express Pipeline

•

Dubberly Cryo and NGL Pipeline

•

Eagle Ford Expansion

•

Permian oil gathering system

expansion

•

STX Treating Expansions

•

Revenue generating horsepower

$2,600

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

Contract

Services

Other G&P

NGL Logistics

SUGS

PVR

Total Backlog

Approximately 90% of project backlog is fee based |

Visibility for

Future Earnings & Distribution Growth 11

Mi Vida Processing Plant

2015

2016

2017

Dubberly Liquids Express Pipeline

Dubberly Cryo Processing Expansion

Eagle Ford Expansion

Utica Ohio River Gathering JV

Lycoming Expansion

Permian Processing Expansion III

Mariner South

Fractionator III

Major Announced Growth Projects

Lone Star Express Pipeline |

Assets

Strategically Located Source: Company data and Credit Suisse Energy Research. Futures

strip as of 11/10/2014 Year:

2014

2015

2016

2017

2018

2019

2020

2021+

WTI Oil:

$93.85

$80.17

$80.04

$79.93

$79.91

$80.12

$80.12

$80.12

NYMEX Gas:

$3.89

$3.62

$3.85

$4.03

$4.18

$4.32

$4.32

$4.32

IRR by Basin

12

No Footprint

RGP G&P Footprint |

2015

Objectives 13

Execution

Invest In Growth

Leverage Integrated

Midstream Platform

Maintain Stable

Cash Flows

•

Offer fully integrated

midstream services to

customers

•

Leverage expertise between

business segments

•

Package services utilizing all

business segments and

creating new growth

opportunities

•

Utilize integrated platform

of assets to capture

additional, creative

investment opportunities

•

Strategic acquisition

opportunities to expand

portfolio and diversify into

new plays

•

Focus on growing DCF/unit

•

Continue executing on

integration of PVR and EROC

assets

•

Achieve a minimum of $85

million in synergies

•

Successfully execute on

organic growth project

backlog of $2.6 billion

•

Maintain high percentage of

fee-based cash flows

•

Strategically target growth

opportunities backed by

fee-based commitments

•

Mitigate a substantial

portion of commodity risk

with a strategic hedging

program |

Transportation

and Gathering & Processing |

1 All

information as of September 30, 2014 15

Transportation and Gathering & Processing: Asset Overview

Gathering & Processing Asset

Summary¹

April 2013

September 2014

%

Growth

Total Processing Capacity (MMcf/d)

930

2,700

190%

Total Gas Treating Capacity (MMcf/d)

1,320

1,965

49%

Transportation Asset Summary¹

Total Intrastate Transportation

Capacity

2.1 Bcf/d

Total Interstate Transportation

Capacity

1.8 Bcf/d

Gathering & Processing Throughput

2,178

2,178

2,216

2,392

4,886

5,680

1,000

2,000

3,000

4,000

5,000

6,000

7,000

Q2 2013

Q3 2013

Q4 2013

Q1 2014

Q2 2014

Q3 2014

Mid-Con

South Texas

Ark-La-Tex

Permian

Eastern

- |

•

PVR provides a significant position in Appalachian Shales with extensive growth

opportunities •

Exceeded

2

Bcf/d

of

gathering

volumes

through

expansions

of

well

connects

•

Establishing

strong

position

in

Utica

with

2.1

Bcf/d

of

firm

commitments

on

the

36”

greenfield

Ohio River system pipeline

Accomplishments Since Investor Day 2013

16

Permian

South Texas

Mid-Continent

Eastern

Ark-La-Tex

•

Increased total treating capacity from 170 MMcf/d to 350 MMcf/d

•

Added 17,000 Bbls/d of oil stabilization capacity with 40,000 Bbls/d of pipeline

capacity •

Finalizing build out of 600 MMcf/d Eagle Ford Expansion Project

•

Acquired Hoover midstream assets, expanding gas, oil and water gathering capabilities

•

Increased cryogenic processing by 200 MMcf/d with new Red Bluff plant

•

Completed integration of SUGS assets and grew system volumes by 50%

•

PVR

and

EROC

acquisitions

increased

processing

capacity

from

50

MMcf/d

to

890

MMcf/d

•

Executing

>$15M

of

operational

synergies

with

the

integration

of

Midcon

assets

•

Connected over 200 wells year to date

•

Increased

processing

capacity

at

Dubach

facility

from

140

MMcf/d

to

210

MMcf/d

•

Completed construction of up to 400 MMcf/d additional gathering capacity in January

2014 •

Completed upgrades to north Louisiana complex to accommodate an additional 220 MMcf/d

Total G&P throughput increased by 161% and NGL production by 100% since Q2 2013

|

Intrastate

Transportation: RIGS 17

RIGS Details

Capacity Pipeline

Length

2.1 Bcf/d

450 miles

Major Shippers

Petrohawk

Exco

BG

El Paso Corporation

Chesapeake

Louisiana Markets

Served

Union Power

Swepco

Louisiana Tech

Major Pipeline

Interconnections

Texas Gas

Tennessee

Trunkline

Southern Natural

ANR

Columbia Gulf

Tetco

Firm Transportation

Commitments

Expansion volumes fully

subscribed with ~85% demand

charges with ~6 years remaining

on contracts

~99% demand charges on Legacy

system with ~ 1-3 years

remaining

RIGS Haynesville Joint Venture Partnership Structure¹

50/50 Joint Venture with Alinda Capital Partners

Regency operates the assets on behalf of the Joint Venture

Interruptible volumes on RIGS associated with new Cotton Valley drilling around Terryville

gathering system have risen over the course of the year

1 Regency owns 49.99% of the Haynesville Joint Venture, GE Energy Financial Services owns

0.01% Legend

RGP Plant Facility

RIGS Pipeline |

Interstate

Transportation: MEP 18

MEP Details

Capacity /

Pipeline Length

1.8 Bcf/d

500 miles

Major Shippers

Chesapeake

Cross Timbers

EOG Resources

Newfield Exploration

Major Pipeline

Interconnections

Texas Gas

NGPL

ANR

Columbia Gulf

Southern Natural

CEGT

TETCO

Destin

Transco

Firm Transportation

Commitments

Primarily fee-based revenues

supported by long-term demand

agreements

Approximately 5 years remaining on

contracts

MEP Joint Venture Partnership Structure

50/50 Joint Venture with Kinder Morgan

Kinder Morgan operates the assets on behalf of the Joint Venture

|

Gathering and

Processing: South Texas Capacity

2014

Total Treating Capacity (MMcf/d)

350

Total Condensate Gathering Capacity

(Bbls/d)

37,000

19

Engineering expansion of the Eagle Ford Gathering System as producers increase production and

utilize longer laterals and new frac

techniques Phase

III

expansion

of

Edwards

Lime

JV

underway

with

new

100

gpm

treater and 17,000 Bbls/d stabilization capacity

Constructing

a

new

500

GPM

treater

at

Tilden

with

incremental

70

MMcf/d of treating capacity, expected in service Q2 2015

Growth Opportunities

South Texas Asset Map

Total South Texas gathering throughput increased 14% since Q2 2013

Accomplishments

Added 17,000 BPD of oil stabilization capacity with

approximately 40,000 BPD of takeaway capacity

Increased total treating capacity from 170 MMcf/d

to 350 MMcf/d at Tilden and Edwards Lime JV

plants

Nearing completion of total build out of 600

MMcf/d Eagle Ford gathering system

Increased Eagle Ford gathering system volumes by

15% and crude oil volumes by 14% since Q2 2013 |

Gathering and

Processing: Ark-La-Tex Capacity

2014

Total Processing Capacity (MMcf/d)

758

Total Treating Capacity (MMcf/d)

325

Constructing new 200 MMcf/d cryogenic processing facility at Dubberly, expected in service in

Q2 2015 Constructing new 47 mile, 10-inch Dubberly NGL pipeline, to provide ~40,000

Bbls/d of NGL takeaway Increase condensate gathering and stabilization capacity

Accomplishments

Ark-La-Tex Asset Map

Expanded Dubach cryogenic plant capacity to 210

MMcf/d in Q2 2013

Constructed 32 miles of 24-inch pipeline capable of

gathering up to 400 MMcf/d to north Louisiana complex

Completed 100 MMcf/d Dubberly refridge plant upgrade

Completed three processing projects and interconnects

to accommodate 120 MMcf/d of incremental volume

EROC system in position to gather Eaglebine and

Tuscaloosa Marine Shale volumes

Growth Opportunities

Increased Ark-La-Tex throughput volumes by 50% and NGL production by 74% since Q2

2013

20 |

Gathering and

Processing: Permian 21

Permian Asset Map

Increased gathering throughput by 50% and NGL production by 38% since Q2 2013

Capacity

2014

Total Processing Capacity (MMcf/d)

940

Total Treating Capacity (MMcf/d)

890

Constructing 200 MMcf/d Mi Vida cryogenic processing facility, expected online in Q2 2015,

with a second 200 MMcf/d cryogenic processing facility expected online in Q3 2015

Constructing incremental 110 MMcf/d treating capacity at Halley to increase gathering system

reliability Continuing expansion of oil gathering system, partnering with SXL for

takeaway options on their new Delaware Basin Extension Constructing >10,000 Bbls/d

of condensate stabilization in region to capture liquids upgrade Engineering a third 200

MMcf/d processing plant in key Permian producing area Growth Opportunities

Accomplishments

Successfully integrated SUGS and Hoover acquisitions

Increased total processing capacity from 250 MMcf/d

to 940 MMcf/d

Start-up of 200 MMcf/d Red Bluff cryogenic

processing facility in Q3 2013

Expansion of oil gathering from 25,000 Bbls/d to

100,000 Bbls/d expected online December 2014

Added over 400 miles of oil, gas and water pipelines |

22

Gathering and Processing: Eastern Region

Total Eastern region volumes grew 36% to 1.9 million MMbtu/d since Q2 2013

Accomplishments

Auburn/Korbin

Compressor

Station

adding

horsepower

to

increase

TGP

deliverability

by

200

MMcf/d,

expected

online

in

Q1

2015

Lycoming

System

Expansion

trunkline,

gathering

and

compression

will

expand

system

by

500

MMcf/d

,

expected

online

in

2015/2016

East Clinton Gathering Expansion trunkline, gathering and compression will expand delivery

into Transco by 300 MMcf/d, expected online in 2015/2016

Expanded Utica Project to over 2 Bcd/d of demand capacity

Capacity

2014

Total Interconnect Capacity (Bcf/d)

~2.2

East Texas Asset Map

Growth Opportunities

Expanded delivery into downstream transportation

markets by 730 MMcf/d

Exceeded 2 Bcf/d of actual gathered volume

Signed Utica Ohio River Valley Joint Venture

agreement, which included acreage dedication and

over 2 Bcf/d of firm commitments from shippers

Exercised option to construct Cadiz lateral |

Utica Ohio

River Project Commercial Highlights

•

Joint Venture between Regency and AE-MidCo

•

Over 2 Bcf/d of firm volume commitments

•

Provides interconnects with REX, TET, and

potentially others

•

Project cost at ~$500 million; Regency

contributing 75% and AE-MidCo 25%

Project Overview

•

52-mile, 36-inch trunkline with minimum 2.1

Bcf/d capacity, a northern tie-in would increase

capacity to 3.5 Bcf/d

•

Trunkline Phase I expected in service Q2 2015 and

Phase II expected in service 3Q15

•

1.125 Bcf/d booster station to REX, in service

3Q15

•

12 mile, 36-inch lateral initially connecting to the

tailgate of Cadiz processing plant and Harrison

County wellhead production

Utica Ohio River Joint Venture

Utica Ohio River Joint Venture creates a first-mover advantage, and will be a key

take-away option for Utica lean-gas

23 |

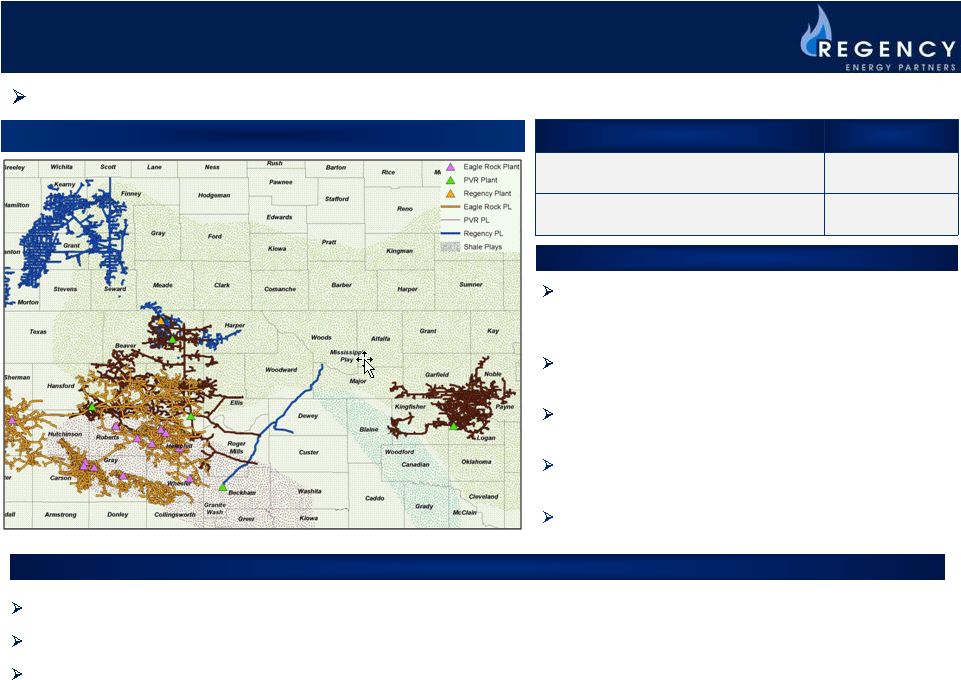

Gathering and

Processing: Mid-Continent Capacity

2014

Total Processing Capacity (MMcf/d)

900

Total Treating Capacity (MMcf/d)

400

24

Completed acquisitions of PVR and EROC’s midstream

businesses, positioned Regency as a major player in

region

Increased total processing capacity from 50 MMcf/d to

890 MMcf/d

Executing on >$15M in operating synergies with asset

integration plan

Connected over 200 wells on combined system year to

date

Rig count for area remains ~100 for stacked

production formations

Accomplishments

Mid-Continent Asset Map

Growth Opportunities

Capturing commercial opportunities with combined RGP, PVR and EROC systems through larger

footprint and asset integration Securing oil and water gathering opportunities in the

Woodford, Cleveland, Marmaton, Mississippi Lime and Granite Wash Reactivating

EROC

transloader

and

rail

service

to

provide

access

to

stronger

liquids

markets

Increased Mid-Continent throughput volumes over 400% since Q2 2013 with PVR and EROC

acquisitions |

Gathering

& Processing Opportunities Summary 25

Bone Spring/Permian

•

Additional 400 MMcf/d cryogenic

processing capacity coming online

in 2015. New capacity will utilize

NGL takeaway through Lone Star’s

NGL pipelines and fractionation

•

Expanding oil gathering system,

and utilize relationship with SXL for

takeaway options on their

announced Delaware Basin

Extension project

Ark-La-Tex

•

200 MMcf/d cryogenic processing

capacity coming online in Q2 2015

•

Complete 47 mile, 10% NGL Express line

•

Expand Dubach stabilization capacity by

4,000 Bbls/d

Eagle Ford Shale

•

Install 500 gpm of treating at Tilden to increase

treating capacity to 210 MMcf/d

•

Phase III Edwards Lime JV new 100 gpm treater,

providing incremental 25 MMcf/d capacity

Mid-Continent

•

Creating super system to increase

flexibility and capture new gas, oil

and water opportunities

•

Constructing storage and

reactivating transloader

Eastern

•

Completion of Lycoming Expansion adding

500 MMcf/d of throughput to Transco

•

Phase I of the Utica Ohio River project is

expected to be in service in Q2 2015 and

phase II to come online in 3Q15

Total Gathering and Processing volumes are expected to grow 18% year-over-year

|

Integration

& Synergies Update |

Combined EROC

and PVR Synergies Overview 27

Total Combined PVR and EROC Synergy Savings on an Annual Basis: $85M+ with Upside

Potential G&A Savings

Operating

Expense Savings

Gross Margin

Increase

Bond Refinance

Savings

Capital

Reduction &

Deferment

•

~15% in headcount consolidation

•

Elimination of corporate overhead costs

•

Benefits, insurance and office consolidation

•

IT systems and software consolidation

•

Lower OPEX with Midcon asset consolidation

•

Streamlined, flattened Midcon operations organization

•

Capture additional revenue with combined Midcon system flexibility

•

Increase system efficiencies through system optimization

•

Lower interest rates with PVR and EROC bonds refinance

•

Lower maintenance capital with new maintenance practices

•

Reduced capital from use of underutilized assets

2015

2016

2014

$0

$85

Year-Over-Year

Synergies Execution

Timeline

Upside

Potential |

Midcon Asset

Synergies Overview 28

Operating Expense Reduction

Maintenance & Growth Capital Reduction

Improve System Reliability

Increase Plant and Compression Efficiencies

Improved Processes

System Flexibility

Asset Consolidation

PVR, EROC & Regency Midcon System: Pre Close

Combined Midcon System: Post Close

Midcon Synergies Benefits

Midcon Synergies Strategy

Plant and compression consolidation

Two HP system & small interconnect pipelines

New maintenance and procurement practices

Streamline operations organization |

NGL

Services |

30

NGL Services: Highlights

Announced Projects

Lone Star Express NGL Pipeline

Conversion

of

existing

12”

NGL

line

to

crude

oil

service

Fractionator III

Mariner South expected in-service by year end

Volume Growth

Volumes transported are up over 25% year

over year

Fractionated volumes are up over 129% year

over year

Future Opportunities

Footprint for Fractionators IV, V & VI

Expansion of NGL export capacity

Continued development of Houston ship

channel NGL distribution system

Development of 8 additional NGL storage

caverns |

31

NGL Services: Assets

•

~53 Million barrels NGL storage

•

Permitted to drill additional 8 caverns

•

2,000+ miles of NGL Pipelines

•

~ 400 Mbpd of raw make transport

capacity

•

Expanding capacity to 700 Mbpd

•

210 Mbpd LPG export terminal

•

80 Mbpd of Diluent export capacity

•

Extensive Houston Ship Channel

pipeline network

•

Two 100,000 Bpd fractionator at Mont

Belvieu

•

Third Fractionator (Dec 2015)

•

Ability to build a total of 6 Mont Belvieu

fractionators on current footprint

•

Two cryogenic processing plants

•

25,000 Bpd fractionator at

Geismar, LA

•

Raw make truck rack

Godley

Baden

LaGrange/Chisholm

Mt Belvieu

Kenedy

Jackson

Sea Robin

Geismar

Sorrento

Chalmette

Hattiesburg

ETP Justice

Storage

Fractionation

Lone Star West Texas Gateway Expansion

ETP Spirit

ETP Freedom

Plant

Existing Lone Star

Approved Lone Star Express

ETP-Copano Liberty JV

Refinery Services

NGL Storage

Pipeline Transportation

Fractionation and Processing |

32

NGL Services: Integrated Assets Allow For Synergies Across

Family

ETP Justice NGL Line

ETP Freedom NGL

Lone Star West Texas Gateway

Lone Star West Texas NGL

ETP-Copano JV Liberty NGL

ETP Spirit NGL

Other Fractionators

Lone Star Fractionators

Connected Plants

Regency Plants

ETP Plants

ETP

Godley 1, 2, 3, 5

Lone Star

West Texas Pipeline 12”

(140 Mbpd)

ETP

Freedom/Liberty

(75 Mbpd)

ETP

Justice 20”

(340 Mbpd)

Lone Star

Mt. Belvieu Frac

(200 Mbpd)

NGL Storage Capacity (50

MMbbl)

ETP

Kenedy

ETP

Jackson 1, 2, 3, 4

ETP

LaGrange/Chisholm

Lone Star

West Texas Gateway 16”

(210 Mbpd)

RGP

Jal

RGP

Haley

RGP

Coyanosa

RGP

Tippett

RGP

Waha

RGP

Bone Spring

RGP

Mivida

RGP

Red Bluff

RGP

Keystone

Mariner South

Batching C2 & C4

Capacity

(200 Mbpd)

ETP Rebel |

33

NGL Services: Performance

1

Represents 100% of Lone Star adjusted EBITDA

2013

Adjusted

EBITDA

by

Segment

2014

Estimated

Adjusted

EBITDA

by

Segment

1

1

NGL Storage

NGL Pipeline Transportation

Refinery Services

Fractionation

Other |

34

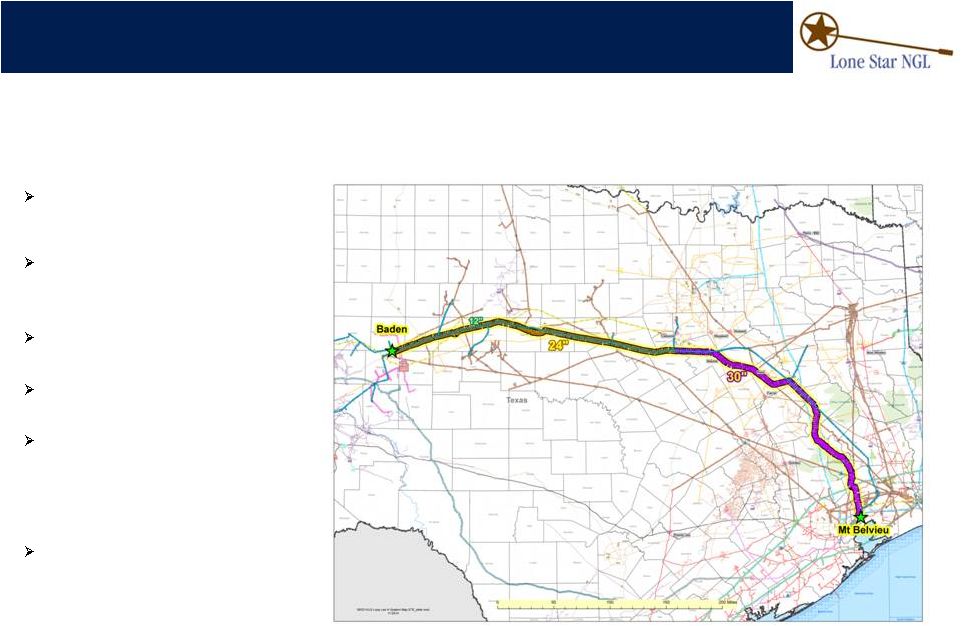

NGL Services: Lone Star Express Pipeline

533 miles of new 24”

and 30”

NGL

pipelines from the Permian Basin to

Mont Belvieu

Capacity

•

Initial scope of 375 MBPD

•

Expandable up to 495 MBPD

Contracted volumes in excess of 200

MBPD

Conversion of LST’s West Texas NGL

line to crude oil service

Expected In-Service

•

Phase I –

24”

Q1 2016

•

Phase II –

30”

Q3 2016

•

Phase III –

Crude Oil Conversion Q1

2017

Estimated cost -

$1.5 to $1.8 billion |

35

NGL Services: Lone Star’s Mont Belvieu Complex

Frac I 100 Mbpd

Dec ‘12

Frac II 100 Mbpd

Oct ‘13

Frac IV , V , IV

Frac III 100 Mbpd Dec

‘15

De-C2 100 Mbpd

Nov ‘14 |

36

NGL Services: Mariner South |

Contract

Services |

Contract

Services: Asset Offerings 38

CDM Resource

Management

Zephyr Gas

Services

Merged Into

CDM

Resource

Management

Contract

Compression

•

Gas compression packages ranging

from 75 HP to 3,550 HP

Amine

Treating

Fuel Gas

Conditioning

Condensate

Stabilization

•

Separate and stabilize condensate

project for sale or transportation

Gas Cooling

•

Liquids extraction

•

Cool gas to spec

Turnkey

Construction

& Installation

•

Design, engineer and construct

standard or custom facilities

•

Provide all equipment and contract

services

•

Removal

of

CO

2

and/or

H

2

S

•

5 GPM to 400 GPM

•

Reduce high BTU for natural gas

engine fuel in rich gas areas |

Contract

Compression: Asset Overview Growth since April 2013

Horsepower Growth

Footprint as of April 2013

39

CDM is well positioned to provide fee-based, turn-key services in the majority of all

shale plays and equipped to capitalize on those that are currently experiencing

increased drilling activity Revenue generating HP is currently at an all-time

high; seen net horsepower growth in all five regions

Expanded into Mississippi Lime in 2014, and continued

to grow footprint in three newest plays (Niobrara,

Utica, Avalon)

Current fleet utilization is approximately 96%

Opportunities for turnkey installations continue to

increase and have become a good source of margin

diversification

Recent Developments

Geographic Diversification

853

897

973

1,005

1,072

1,140

1,216

-

200

400

600

800

1,000

1,200

Q1 2013

Q2 2013

Q3 2013

Q4 2013

Q1 2014

Q2 2014

Q3 2014

Revenue Generating Horsepower

Permian/Avalon/

Bone Spring/Wolfcamp/

Wolfberry/Cline

Niobrara

Granite Wash /

Mississippi Lime

Marcellus/

Utica |

40

Horsepower By Shale Play

Target Shale Plays for Expansion

2015 Opportunities and Growth Strategy

Contract Services: 2015 Outlook

Larger gas-lift and turn-key facility installation opportunities

expected to drive growth in Eagle Ford and Permian

Expect additional growth in Niobrara Shale as customers

finalize expansion plans

Increasing customer demand driving new Gulf Coast

opportunities

Approximately 100,000 HP is booked and scheduled to be

set the remainder of 2014 and projected to reach 1.3 million

HP by year-end 2014

2015 focus will be on filling in gaps within specific

customers’

established operating regions

Significant increase in demand for compression in shale plays, which is expected to continue

throughout 2015 |

Production

Services: Asset Overview Treating business is well positioned in several rapidly growing

shale plays, which is expected to allow CDM to capitalize on increased activity and

production 41

Growth since April 2013

Footprint as of April 2013

Marcellus/

Utica

Niobrara

Granite Wash /

Mississippi Lime

Barnett

Permian/Avalon/

Bone Spring/Wolfcamp/

Wolfberry/Cline

Fayetteville

Gulf Coast

Eagle Ford Shale

10%

20%

30%

40%

50%

60%

70%

80%

90%

50

100

150

200

250

300

350

400

2012 YE

2013 YE

2014 FYE

Revenue Generating Assets

Idle

Utilization %

Asset Utilization

71

311

242

59

95

191

0

0%

Recent Developments

Smaller Refrigeration Plants

Continued focus on full, turn-key installations

Liquids-rich shale plays continue to drive improved

asset utilization (current utilization is 82%)

Diversified product mix to match market demand

Smaller Amine Plants

H2S removal

equipment Successful design and engineering of liquids-rich

products

Fuel Gas Conditioning Skid

Cotton Valley |

42

Assets by Shale Play

Bookings of 720 GPM in 2014 year-to-date

Targeting new turn-key projects in Eagle Ford & Permian

Basin shale plays for 2015

Further diversify customer base and product mix in

Mississippi Lime and Permian Basin shale plays

Segregated sales focus on Production Services opportunities

3

rd

Party Operations & Maintenance

2015 Opportunities and Growth Strategies

Revenue by Asset

2013 YE

2015 FYE

28%

61%

11%

52%

37%

11%

38%

40%

2%

11%

9%

2%

Diversified Equipment

Amine

Gas Coolers

Haynesville

Eagle Ford

Fayetteville

Tuscaloosa Marine / Eaglebine

Permian Basin / Bone Spring

Barnett / Granite Wash

Niobrara

Marcellus/Utica

20%

41%

4%

4%

17%

1%

6%

8%

2015 FYE

2013 YE

Production Services: 2015 Outlook

In 2014, have experienced an increase in sales coverage and diversified customer base as a

result of the successful integration of the treating and compression sales teams |

43

Contract Services: Where We Are Going

In summary, the contract services segment presents tremendous opportunities and upside

potential driven by demand from existing and developing shale plays

Opportunities Summary

Basins

Continue to focus on liquids-rich basins: Eagle Ford, Permian and Woodbine

Execute in newer shale plays: Niobrara, Utica, and Mississippi Lime

Dry-gas basin activity remains stable in the Haynesville Shale

Focus

Continue to focus on cross-selling ability

–

Leverage

both

companies’

traditional

customer

base

–

Move gas from the wellhead to the pipeline via compression, treating and production

services –

Increased ability to focus on developing new customers

Fill in geographical voids by targeting specific customers and/or opportunities

Organization Structure

–

Continue to maintain segregated operations organization

Fleet/Product Mix

Compression: Staged and sized appropriately

Fuel Skids: Condition rich fuel gas commonly found in majority of shale plays

Amine

Plants:

H

2

S

and

CO

2

common

in

numerous

shale

plays

and

focus

on

smaller

opportunities

Gas Coolers: Enhances economics of wellhead gas stream and adding additional assets to

fleet Other

fleet

additions

to

meet

market

demand:

H

2

S

Removal

and

Refrigeration

Plants

With these synergies, and the appropriate product mix, CDM is well positioned for growth and

poised to capture future opportunities as they arise |

Financial

Review

Review |

Financial

Objectives 45

Distribution Growth

Q3 2014 marked Regency’s sixth consecutive increase in quarterly distributions,

representing 9% distribution growth over the period

Distribution Coverage

LTM distribution coverage through Q3 2014 was 1.00x

Goal is to maintain coverage between 1.0x and 1.1x

Credit Ratings and

Leverage

Debt/

Pro

Forma

EBITDA

was

4.74x

as

of

September

30,

2014

1

Leverage target is 4.0x to 4.25x

Interest Rate

Management

Indebtedness

is

substantially

fixed

rate,

with

approximately

10%

floating

today

Comfortable with up to 20-25% floating rate debt

Strong Balance Sheet

Upsizing of credit facility to add additional liquidity

Issued/acquired

roughly

$3.9

billion

of

debt

and

$5.0

billion

of

equity

this

year

Risk Management

Strong mix of fee-based cash flow (75% for 2015)

Target entering 2015 with approximately two-thirds of exposure hedged

1

Based on compliance calculations

Achieve Investment Grade Metrics |

Distributions

46

Since Q2 2013, RGP has delivered 6 consecutive distribution increases, including the

$0.0125/unit increase in Q3 2014, which represents $2.01 per unit on an annual

basis $0.465

$0.47

$0.475

$0.48

$0.49

$0.5025

$0.44

$0.46

$0.48

$0.50

Q2 2013

Q3 2013

Q4 2013

Q1 2014

Q2 2014

Q3 2014

Distribution ($/LP unit) |

Capital

Markets Update 47

Revolving Credit Facility

•

Launched amendment early this month

•

Increased size by $500 million up to $2 billion

•

Improved pricing and terms

•

Extended maturity to 5 years

•

Expected to close on November 21, 2014

•

Provides an efficient source of liquidity for growth capital funding

•

Completed approximately 65% of the program to date

Called Senior Notes

•

Called

$600

million

of

6.875%

outstanding

notes

(redemption

December

2

nd

)

$400 million ATM Program

Additional

near

term

debt

and/or

equity

offerings

will

be

driven

by

organic

growth

spend,

opportunistic M&A

transactions, and liability management opportunities |

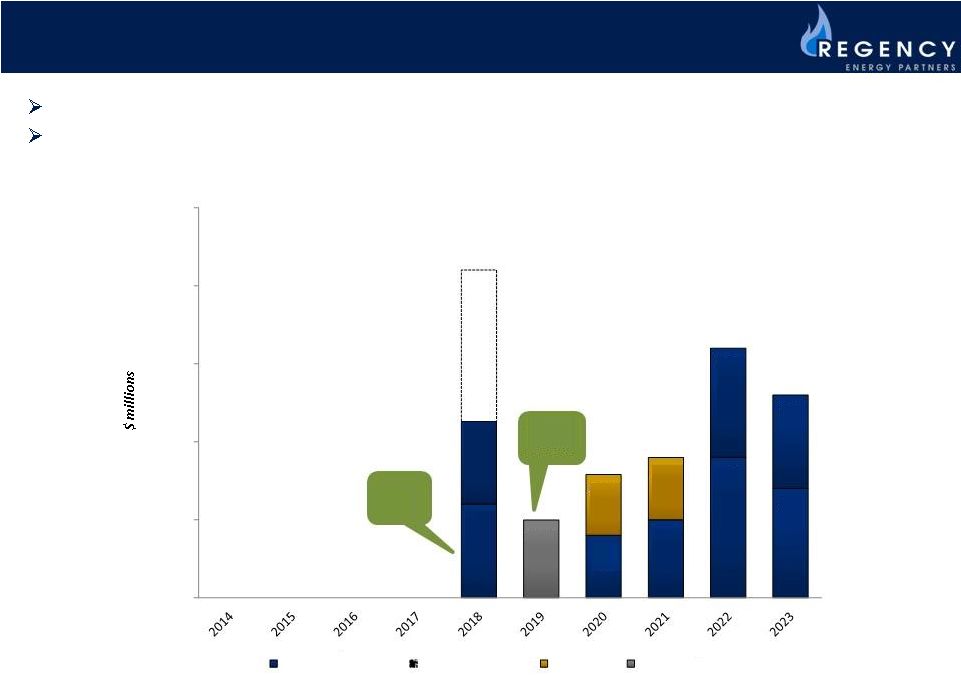

Debt complex

is well-balanced, with no maturities in the next 3 years Weighted average interest

rate will be 5.74% after 6.875% notes are redeemed next month Debt Maturity Profile

48

6.875

5.75

6.50

5.875

5.50

2.53

5.00

4.50

8.375

6.50

8.375

-

500

1,000

1,500

2,000

2,500

Called

Nov ‘14

Callable

June ‘15

RGP Notes/Revolver

Undrawn Revolver

PVR Notes

EROC Notes |

Organic Growth

Project Backlog 49

Major Projects

($ in Millions)

2015 Growth Capital

Total Backlog

Gathering & Processing

Mi

Vida

Processing

Facility

1

Dubberly Liquid Express Pipeline

Dubberly Processing Expansion

Eagle Ford Expansion

Ohio

River

Gathering

Joint

Venture

1

Lycoming Expansion

Permian Processing Facility

Other

$800

$1,600

Contract Services

$300

$400

NGL Services

1

Mariner South

Fractionator III

Lone Star Express Pipeline

Other

$390

$630

Total Growth Capital

$1,490

$2,630

1

Represents Regency’s proportionate JV interest Major growth projects

expected to support distribution growth as projects come online |

Diverse

Portfolio 50

In the past 3 years, Regency has grown EBITDA by over 300%, driven by strategic acquisitions

and accretive organic growth projects

Recent acquisitions have significantly increased Regency’s gathering and processing

activity FY 2012

Estimated 2015

1

Excludes segment EBITDA from the Corporate and Others Segment

Adjusted EBITDA

1

Gathering & Processing

Transportation

Natural

Resources

Contract Services

NGL Services

32%

34%

21%

12%

63%

10%

3%

13%

11% |

Strong

Fee-based Cash Flows 51

FY 2014 Estimated

FY 2013

FY 2015 Target

FY 2012

Fee-based

Hedged Commodity

Un-hedged Commodity

Currently, over one-third of 2015 commodity exposure is hedged

Adjusted Total Segment Margin

83%

8%

9%

76%

15%

9%

72%

17%

11%

75%

15%

10%

Target having two-thirds of commodity hedged for 2015 |

DCF

Sensitivities 52

A $5.00/bbl movement in crude prices would result in a $7M change to Regency’s forecasted

DCF for 2015 A $0.25/MMbtu movement in natural gas would result in an $7M change to

Regency’s forecasted DCF for 2015 A $0.05/gallon move in NGL prices would result in

a $5 million change to Regency’s forecasted DCF for 2015 Regency is currently

hedged 49% on natural gas/ethane, 37% on natural gasoline/condensate and 29% on propane

and butane Commodity

$/Move

$ Impact

Natural Gas

+/-

$0.25/MMbtu

+/-

$7M

NGLs

+/-

$0.05/gallon

+/-

$5M

Condensate

+/-

$5/barrel

+/-

$7M

DCF Sensitivity to Commodity Price Changes – Full Year 2015 |

Conclusion

|

Conclusion

54

•

Completed more than $10.5 billion in organic growth and acquisitions in the last two

years •

Project backlog of approximately $2.6 billion expected to increase

•

Assets strategically located in majority of the most prolific shale plays and basins

•

Strong position in key producing plays driving significant organic growth program

•

Comprehensive midstream service provider with significant presence across the midstream value

chain •

Oil and water gathering opportunities will expand overall service offerings

•

High percentage of fee-based margins increasing with organic backlog

•

Diversity of business mix, scale and strategic location of assets enhances stability of

cash flows

•

Scale and backlog provide visibility for continued distribution growth

Strong

Visibility for

Growth

High-Quality

Assets

Integrated

Midstream

Platform

Stability &

Diversity of

Cash Flows

Distribution

Growth |

Appendix

Appendix |

Maintain

Stable Cash Flows: Comprehensive Hedging Program 56

1

As of September 30, 2014. Based on exposures as of Q3 2014

Executed Hedges by Product

1

Balance of

2014

Full Year 2015

Full Year 2016

Natural Gas/Ethane

73%

49%

-

C

3

to C

4

60%

29%

-

C

5

+/Condensate

88%

37%

23% |

Maintain

Stable Cash Flows: Comprehensive Hedging Program 57

Note: WTI prices in $/bbl; WTI Natural Gas prices in $/MMbtu; all other prices in

$/gallon 1

As of September 30, 2014. Based on exposures as of Q3 2014

Executed Hedges by Product

1

Balance of 2014

Full Year 2015

Full Year 2016

Bbls/d

Price

($/gal)

Bbls/d

Price

($/gal)

Bbls/d

Price

($/gal)

Propane

3,989

$1.05

1,900

$1.05

-

-

Normal Butane

1,600

$1.34

800

$1.19

-

-

Bbls/d

Price

($/Bbl)

Bbls/d

Price

($/Bbl)

WTI

5,036

$95.72

2,115

$90.10

$1,311

$84.48

Cushing to

Midland Basis

-

-

1,000

$(3.00)

-

-

MMbtu/d

Price

($/MMbtu)

MMbtu/d

Price

($/MMbtu)

Natural Gas

(Henry Hub)

45,043

$4.00

45,000

$3.89

-

-

Natural Gas

(Permian)

40,000

$4.10

24,932

$3.95

-

-

Natural Gas

(Panhandle)

20,000

$4.35

-

-

-

- |

Eastern

FY 2015E Margin by Type

58

Mid-Continent

South Texas

Ark-La-Tex

Permian

19%

39%

41%

1%

Gas

NGL

Condensate

Fee

Helium

100%

Fee

36%

12%

23%

29%

0%

Gas

NGL

Condensate

Fee

6%

5%

5%

84%

Gas

NGL

Condensate

Fee

8%

4%

0%

88%

0%

Gas

NGL

Condensate

Fee |

September 30, 2014

June 30, 2014

March 31, 2014

December 31, 2013

September 30, 2013

June 30, 2013

Net income (loss)

107

$

(4)

$

12

$

3

$

42

$

11

$

Add (deduct):

Operation and maintenance

129

93

78

76

78

73

General and administrative

36

54

33

24

13

18

Loss (gain) on asset sales, net

1

-

(2)

1

(1)

1

Depreciation and amortization

122

168

94

80

74

68

Income from unconsolidated affiliates

(53)

(47)

(43)

(32)

(37)

(31)

Interest expense, net

86

78

56

45

41

41

Loss on debt refinancing, net

(2)

-

-

-

-

7

Other income and deductions, net

2

7

(2)

(4)

(24)

7

Income tax benefit

4

1

(1)

-

2

(1)

Total Segment Margin

432

350

225

193

188

194

Non-cash (gain) loss from commodity derivatives

(17)

1

3

7

9

(12)

Segment margin related to the noncontrolling interest

(7)

(6)

(6)

(5)

(4)

(2)

Segment margin related to our ownership percentage in

Ranch JV

4

3

3

2

1

1

Adjusted Total Segment Margin

412

$

348

$

225

$

197

$

194

$

181

$

Gathering and Processing Segment Margin

349

$

269

$

166

$

137

$

136

$

145

$

Non-cash loss (gain) from commodity

derivatives (17)

1

3

7

9

(12)

Segment margin related to the noncontrolling interest

(7)

(6)

(6)

(5)

(4)

(2)

Segment margin related to our ownership percentage in

Ranch JV

4

3

3

2

1

1

Adjusted Gathering and Processing Segment Margin

329

267

166

141

142

132

Natural Gas Transportation Segment Margin

-

-

-

-

-

-

Contract Services Segment Margin

66

63

56

55

52

49

Natural Resources

18

20

2

-

-

-

Corporate Segment Margin

2

2

5

4

4

4

Inter-segment Eliminations

(3)

(4)

(4)

(4)

(4)

(4)

Adjusted Total Segment Margin

412

$

348

$

225

$

196

$

194

$

181

$

($ in millions)

Three Months Ended

Non-GAAP Reconciliations

59 |

Non-GAAP

Reconciliations 60

September 2014

June 30, 2014

March 31, 2014

December 31, 2013

September 30, 2013

June 30, 2013

Net income (loss)

107

$

(4)

$

12

$

2

$

42

11

Add:

Interest expense, net

86

78

56

45

41

41

Depreciation and amortization

122

168

94

80

74

68

Income tax

expense (benefit) 4

1

(1)

-

2

-

EBITDA (1)

319

$

243

$

161

$

127

$

159

$

120

$

Add (deduct):

Partnership's ownership interest in unconsolidated affiliates' adjusted

EBITDA (2)(3)(4)(5)(6)(7) 86

79

75

62

66

60

Income from

unconsolidated affiliates (53)

(47)

(43)

(32)

(37)

(31)

Non-cash (gain) loss

from commodity and embedded derivatives (16)

9

4

3

(14)

(4)

Other income,

net 8

23

8

5

(2)

10

Adjusted

EBITDA 344

$

307

$

205

$

165

$

172

$

155

$

(1) Earnings before interest, taxes,

depreciation and amortization. (2) 100% of Haynesville Joint

Venture's Adjusted EBITDA and the Partnership's interest are calculated as follows:

Net income

19

16

15

16

$

18

$

18

$

Add (deduct):

Depreciation and amortization

8

10

10

9

9

9

Interest expense, net

4

3

3

3

1

-

Loss

on sale of asset, net -

-

-

(1)

-

-

Impairment of property, plant and equipment

-

-

-

-

-

-

Other expense, net

-

-

-

-

-

-

Adjusted EBITDA

31

$

29

$

28

$

27

$

28

$

27

$

Ownership

interest 49.99%

49.99%

49.99%

49.99%

49.99%

49.99%

Partnership's interest in Adjusted EBITDA

15

$

14

$

14

$

13

$

14

$

13

$

(3) 100% of MEP Joint

Venture's Adjusted EBITDA and the Partnership's interest are calculated as follows:

Net income

21

$

22

$

21

$

17

$

21

$

21

$

Add:

Depreciation and amortization

17

17

17

17

17

17

Interest

expense, net 12

13

13

13

13

13

Adjusted

EBITDA 50

$

52

$

51

$

47

$

51

$

51

$

Ownership

interest 50%

50%

50%

50%

50%

50%

Partnership's interest in Adjusted EBITDA

25

$

26

$

26

$

24

$

26

$

26

$

We acquired a 49.9%

interest in MEP Joint Venture in May 2010. (4) 100% of Lone Star

Joint Venture's Adjusted EBITDA and the Partnership's interest are calculated as follows:

Net income

104

$

89

$

83

$

53

$

60

$

44

$

Add (deduct):

Depreciation and amortization

27

26

25

24

21

20

Other (income)

expense, net 2

-

1

-

1

1

Adjusted EBITDA

133

$

115

$

109

$

77

$

82

$

65

$

Ownership

interest 30%

30%

30%

30%

30%

30%

Partnership's interest in Adjusted EBITDA

40

$

35

$

33

$

23

$

25

$

20

$

We acquired a 30%

interest in Lone Star Joint Venture in May 2011. (5) 100% of

Ranch Joint Venture's Adjusted EBITDA and the Partnership's interest are calculated as follows:

Net loss

7

$

7

$

6

$

2

$

1

$

1

$

Add

(deduct): Depreciation and amortization

1

3

1

1

1

1

Other income, net

1

-

-

-

-

-

Adjusted EBITDA

9

$

10

$

7

$

3

$

2

$

2

$

Ownership

interest 33%

33%

33%

33%

33%

33%

Partnership's interest in Adjusted EBITDA

3

$

3

$

2

$

1

$

1

$

1

$

We

acquired a 33.33% interest in Ranch Joint Venture in December 2011.

(6) 100% of Aqua JV's Adjusted EBITDA and the Partnership's interest

are calculated as follows: Net loss

(2)

$

(3)

$

-

$

-

$

-

$

-

$

Add

(deduct): Depreciation and amortization

4

3

-

-

-

-

Other income, net

-

-

-

-

-

-

Adjusted EBITDA

2

$

-

$

-

$

-

$

-

$

-

$

Ownership

interest 51%

51%

51%

51%

51%

51%

Partnership's interest in Adjusted EBITDA

1

$

-

$

-

$

-

$

-

$

-

$

We acquired a 51% interest in Aqua

JV in March 2014. (7) 100% of Coal Handling JV's Adjusted EBITDA

and the Partnership's interest are calculated as follows:

Net income

2

$

1

$

-

$

-

$

-

$

-

$

Add

(deduct): Depreciation and amortization

1

1

-

-

-

-

Other income, net

-

-

-

-

-

-

Adjusted EBITDA

3

$

2

$

-

$

-

$

-

$

-

$

Ownership

interest 50%

50%

50%

50%

50%

50%

Partnership's interest in Adjusted EBITDA

2

$

1

$

-

$

-

$

-

$

-

$

We acquired a 50% interest in Coal

Handling JV in March 2014. ($ in millions)

Three Months Ended |

Non-GAAP

Reconciliations 61

September 30, 2014

June 30, 2014

March 31, 2014

December 31, 2013

September 30, 2013

June 30, 2013

Net cash flows provided by operating activities

293

$

90

$

187

$

59

$

183

$

112

$

Add (deduct):

Depreciation, depletion and amortization, including debt

issuance cost amortization and bond premium write-off and

amortization

(99)

(167) (97)

(82)

(75)

(68)

Income from unconsolidated

affiliates

53

47 43

32

37

31

Derivative valuation

change

16

4

(17)

(3)

14

1

Loss on asset

sales, net

(1)

-

2

(1)

2

(1)

Unit-based

compensation expenses

(3)

(3) (2)

(2)

(2)

(1)

Cash flow changes in

current assets and liabilities: Trade accounts receivables,

accrued revenues, and related party receivables

28

(4) 21

23

32

27

Other current assets and

other current liabilities

(26)

9

(35)

28

(25)

137

Trade accounts payable, accrued

cost of gas and liquids, related party payables and deferred

revenues

(109)

84 (48)

(20)

(89)

(57)

Distributions of earnings received

from unconsolidated affiliates

(51)

(53) (43)

(33)

(37)

(35)

Other assets and liabilities

6

(11) 1

1

2

(135)

Net (Loss) Income

107

$

(4)

$

12

$

2

$

42

$

11

$

Add:

Interest expense, net

86

78 56

45

41

41

Depreciation and

amortization

122

168 94

80

74

68

Income tax expense

(benefit)

4

1

(1)

-

2

-

EBITDA

319

$

243

$

161

$

127

$

159

$

120

$

Add (deduct):

Partnership's interest in unconsolidated affiliates' adjusted

EBITDA

86

79 75

62

66

60

Income from unconsolidated

affiliates

(53)

(47) (43)

(32)

(37)

(31)

Non-cash loss (gain) from

commodity and embedded derivatives

(16)

9 4

3

(14)

(4)

Other income,

net

8

23 8

5

(2)

10

Adjusted EBITDA

344

$

307

$

205

$

165

$

172

$

155

$

Add (deduct):

Interest expense, excluding capitalized interest

(97)

(87) (86)

(51)

(40)

(46)

Maintenance capital

expenditures

(24)

(15) (25)

(18)

(9)

(13)

SUGS Contribution Agreement

adjustment *

-

-

-

-

9

PVR DCF

contribution

-

-

83

-

-

-

Proceeds from asset sales

1

2 5

2

-

5

Other

adjustments

(9)

-

-

(4)

(8)

(9)

Distributable cash

flow 215

$

207

$

182

$

94

$

115

$

101

$

* Includes an adjustment to DCF related to the historical

SUGS operations for the time period prior to the Partnership's acquisition.

($ in millions)

Three Months Ended |