Attached files

Exhibit 10.7

EARN-IN OPTION AGREEMENT

THIS EARN-IN OPTION AGREEMENT (this "Agreement") is made and entered into effective as of October 21, 2014 (the "Effective Date"), by and between Coeur Explorations, Inc., an Idaho corporation, authorized to conduct business in the state of Nevada ("Coeur"), and Idaho North Resources Corporation, an Idaho corporation ("IDAH"). Coeur and IDAH are sometimes collectively referred to herein as the "Parties" and individually as a "Party." Capitalized words used, but not otherwise defined, herein shall have the meanings given to such words in the Exploration Agreement (as defined below).

RECITALS

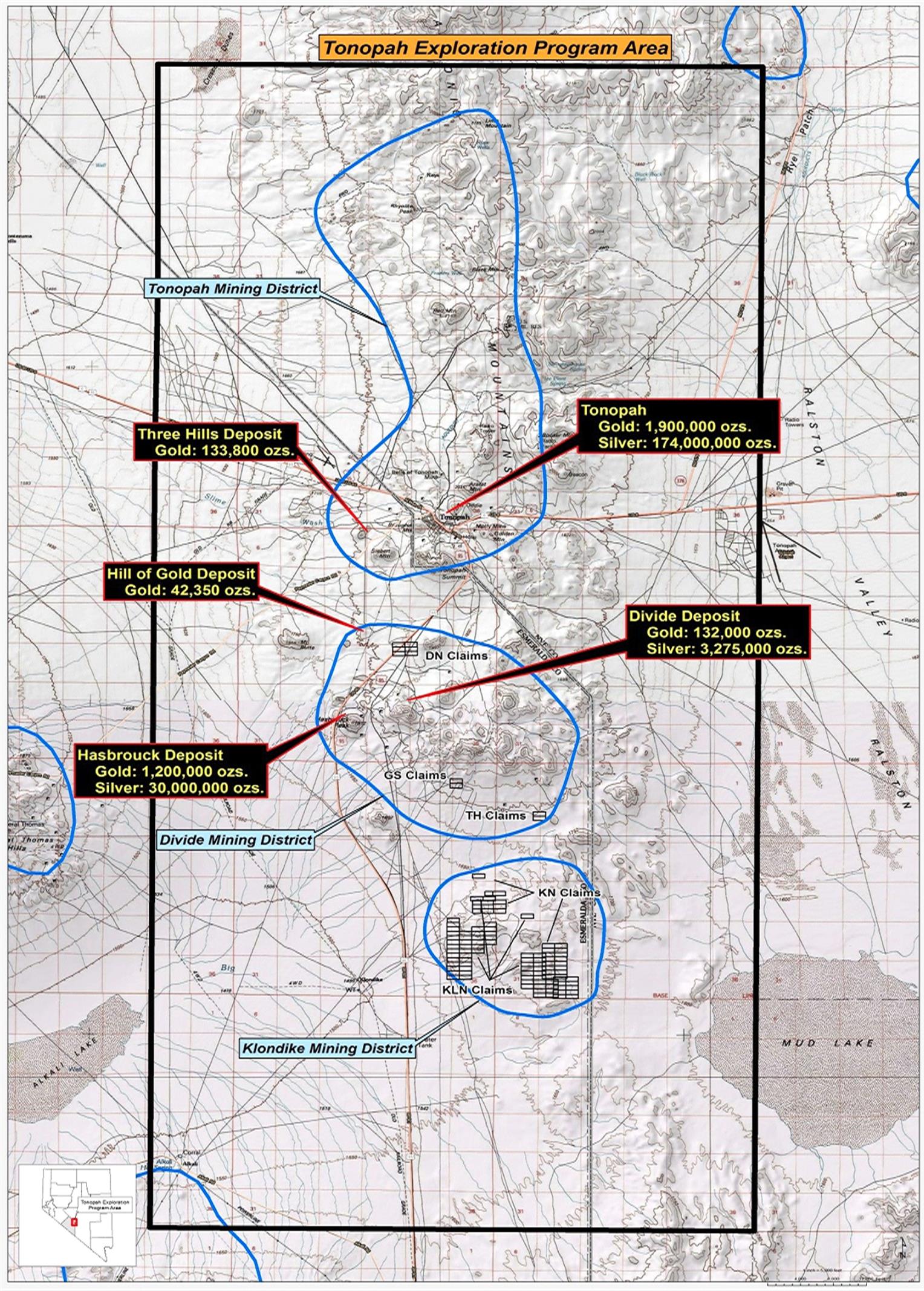

A. The Parties entered into that certain Exploration Program Agreement dated effective dated March 1, 2014 (the "Exploration Agreement") concerning the potential development of mining opportunities on lands in the State of Nevada within a defined area of interest in the Tonopah Mining District, Divide Mining District, and Klondike Mining District, as defined herein and on Exhibit A attached hereto (the "Exploration Program Area of Interest").

B. IDAH owns or controls certain unpatented mining claims identified on Exhibit B attached hereto, which are located within the Area of Interest (the "IDAH Property").

C. Pursuant to the Exploration Agreement, on October 15, 2014, IDAH identified and proposed a Target Property to Coeur, which is located within the Exploration Program Area of Interest and more particularly identified in Exhibit C attached hereto.

D. Pursuant to the Exploration Agreement, Coeur Selected IDAH's proposal for such Target Property, thereby exercising its right for the opportunity to acquire a sixty percent (60%) interest in and to the Target Property (now, the "Selected Property"), upon completing the Earn- In Requirements (as hereinafter defined) (the "Earn-In Option").

E. The Parties wish to formalize the Earn-In Option by entering into this Agreement.

AGREEMENT

NOW, THEREFORE, in consideration of the foregoing Recitals, which are incorporated herein, the mutual promises contained herein, and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties agree as follows:

1. Certain Definitions.

"Affiliate" means any person, partnership, Limited Liability Company, joint venture, corporation, or other form of enterprise, which Controls, is Controlled by, or is under common Control with a Party.

"Allowable Deductions" means the costs of transportation to point of sale and costs of any concentration of silver and gold prior to delivery to the smelter, refinery or other buyer,

EARN-IN OPTION AGREEMENT - 1

and less the deduction costs and expenses of smelting and refining, including without limitation, all costs of assaying, sampling, custom smelting, and refining, all independent representative and umpire charges, penalties, and other deductions, imposed or charged by the refinery or smelter, as the case may be. If smelting or refining is carried out in facilities owned or controlled by Coeur or its Affiliates, then the Allowable Deductions shall be the arm's-length amount Coeur would have incurred if such smelting or refining were carried out at facilities not owned or controlled by Coeur or its Affiliates then offering comparable services for comparable products on prevailing terms. If silver or gold is sold to any buyer other than a smelter, all costs incurred by Coeur after mining for processing or treating such substances, including refining, shall be Allowable Deductions.

"Selected Property Area of Interest" means all those lands and any and all interests therein, whatsoever, within the exterior boundaries of Sections 13, 14, 23, 24, 25, 26, 35, and 36 of Township 01 North, Range 42, East; Sections 16, 17, 18, 19, 20, 21, 28, 29, 30, 31, 32, and 33 of Township 01 North, Range 43 East; Sections 01 and 02 of Township 01 South, Range 42

East; Sections 04, 05, and 06 of Township 01 South, Range 43 East.

"Confidential Information" means all non-public or proprietary information, Data, knowledge and know-how regarding the terms of this Agreement, the Selected Property, the Exploration, Development and Related Work, the business, interests and operations of either Party or its Affiliates and their respective Personnel (as the "Disclosing Party"), disclosed or made available to the other (as the "Receiving Party") or to any of its Personnel (collectively, "Representatives"), disclosed before, on, or after the Effective Date, whether disclosed orally or disclosed or accessed in written, electronic or other form or media, and whether or not marked, designated or otherwise identified as "confidential" or "proprietary" including, without limitation, the following: (a) all information concerning past, present and future commercial, legal and financial information and materials including, without limitation, strategic planning, financial condition, personnel information pertaining to a Party's employees or consultants, policies, procedures, methods, trade secrets, intellectual property, ideas, discoveries, facilities, products, plans, organizations, or suppliers; and a Party's own analyses, interpretations, studies and opinions in any way derived from any of the Confidential Information, forecasts, and other financial results, projections, records and budgets, and development; (b) all Data and information respecting the Selected Property existing and in possession of either Party as of the Effective Data and all Data and information developed under the terms of this Agreement or the Exploration Agreement including, without limitation, data regarding the quality and extent of mineralization; photographs; documents; interpretations; plans; drawings; writings; papers; materials and all other things related thereto; (c) any third-party confidential information included with, or incorporated in, any information; and (d) all notes, analyses, compilations, reports, forecasts, studies, statistics, summaries, interpretations and other materials ("Notes") that contain, reflect or are derived from, in whole or in part, any of the foregoing. Except as required by Law, Confidential Information shall not include information that, at the time of disclosure: (i) is, or thereafter becomes, generally available to and known by the public other than as a result of, directly or indirectly, any breach of this Agreement by either Party; (ii) is, or thereafter becomes, available to a Party on a non- confidential basis from a third-party source, provided that such third party is not and was not prohibited from disclosing such Confidential Information; (iii) was known by or in the possession of a Party or its Affiliates or their Personnel, as established by documentary evidence, prior to being

EARN-IN OPTION AGREEMENT - 2

disclosed; or (iv) was or is independently developed by a Party, as established by documentary evidence, without reference to or use of, in whole or in part, any of the Confidential Information.

"Control" used as a verb means, when used with respect to an entity, the ability, directly or indirectly through one or more intermediaries, to direct or cause the direction of the management and policies of such entity through (i) the legal or beneficial ownership of voting securities or membership interests; (ii) the right to appoint managers, directors or corporate management; (iii) contract; (iv) operating agreement; (v) voting trust; or otherwise; and, when used with respect to a person, means the actual or legal ability to control the actions of another, through family relationship, agency, contract or otherwise; and Control used as a noun means an interest which gives the holder the ability to exercise any of the foregoing powers.

"Data" means (a) all records, information and data relating to title to the Selected Property or environmental conditions at or pertaining to the Selected Property, and (b) all maps, assays, surveys, technical reports, drill logs, samples, mine, mill, processing and smelter records, and metallurgical, geological, geophysical, geochemical, magnetic, electromagnetic, radiometric and engineering data, and interpretive reports derived therefrom, relating to the Selected Property.

"Development" means all preparation for the removal and recovery of Products (other than Exploration), including construction and installation of a mill or any other improvements to be used for the mining, handling, milling, processing, or other beneficiation of Products, and all related Environmental Compliance.

"Encumbrance" or "Encumbrances" means mortgages, deeds of trust, security interests, pledges, liens, net profits interests, royalties or overriding royalty interests, other payments out of production, or other burdens of any and every nature.

"Environmental Compliance" means actions performed during or after Exploration, Development and Related Work to comply with the requirements of all Environmental Laws or contractual commitments related to reclamation of the Properties or other compliance with Environmental Laws.

"Environmental Laws" means Laws aimed at reclamation, remediation or restoration of the Selected Property; abatement of pollution; protection of the environment; protection of wildlife, including endangered species; ensuring public safety from environmental hazards; protection of cultural or historic resources; management, storage or control of hazardous materials and substances; releases or threatened releases of pollutants, contaminants, chemicals or industrial, toxic or hazardous substances as wastes into the environment, including without limitation, ambient air, surface water and groundwater; and all other Laws relating to the manufacturing, processing, distribution, use, treatment, storage, disposal, handling or transport of pollutants, contaminants, chemicals or industrial, toxic or hazardous substances or wastes.

"Environmental Liabilities" means any and all claims, actions, causes of action, damages, losses, liabilities, obligations, penalties, judgments, amounts paid in settlement, assessments, costs, disbursements, or expenses (including, without limitation, attorneys' fees and

EARN-IN OPTION AGREEMENT - 3

costs, experts' fees and costs, and consultants' fees and costs) of any kind or of any nature whatsoever that are asserted against either Party, by any person or entity other than the other Party, alleging liability (including, without limitation, liability for studies, testing or investigatory costs, cleanup costs, response costs, removal costs, remediation costs, containment costs, restoration costs, corrective action costs, closure costs, reclamation costs, natural resource damages, property damages, business losses, personal injuries, penalties or fines) arising out of, based on or resulting from (i) the presence, release, threatened release, discharge or emission into the environment of any hazardous materials or substances existing or arising on, beneath or above the Selected Property and/or emanating or migrating and/or threatening to emanate or migrate from the Selected Property to off-site properties; (ii) physical disturbance of the environment; or (iii) the violation or alleged violation of any Environmental Laws.

"Exploration" means all activities directed toward ascertaining or evaluating the existence, location, quantity, quality or commercial value of deposits of Products, including but not limited to additional drilling required after discovery of potentially commercial mineralization, and including related Environmental Compliance.

"Exploration, Development and Related Work" shall mean and include all Exploration and Development operations or activities of Coeur or IDAH on or relating to the Selected Property for purposes of determining ore reserves and mineralization, and for purposes of development of Products from the Selected Property including, without limitation, the right to enter upon the Selected Property for purposes of surveying, exploring, testing, sampling, trenching, bulk sampling, prospecting and drilling for Products, and to construct and use buildings, roads, power and communication lines, and to use so much of the surface of the Selected Property in such manner as Coeur deems necessary for the enjoyment of any rights and privileges to Coeur hereunder or otherwise necessary to effect the purposes of this Agreement.

"Exploration and Development Expenses" shall mean and include all costs or fees, expenses, liabilities and charges paid or incurred by Coeur or IDAH (and reimbursed by Coeur) which are related to Exploration, Development and Related Work conducted during the Option Period.

"Governmental Fees" means all location fees, mining claim rental fees, mining claim maintenance fees and similar fees or payments required by Law to locate and hold unpatented mining claims.

"Government Official" means any official, agent, or employee of the government, any political party or an official thereof, any candidate for political office, any official or employee of any public international organization, or any immediate relative (spouse, son, daughter, or parent) of any of the foregoing, including without limiting the generality of the foregoing any employee or official of any company which is majority-owned or controlled by the government, any employee or official of any company which is in the process of being privatized in whole or in part, and any person who is purporting to act in a private capacity, but who otherwise is a Government Official within the meaning of this definition.

EARN-IN OPTION AGREEMENT - 4

"Joint Operating Agreement" shall mean the Limited Liability Company Operating Agreement the Parties will enter into once Coeur has satisfied the Earn-In Requirement, in substantially the form attached here to as Exhibit D.

"Law" or "Laws" means all applicable federal, state and local laws (statutory or common), rules, ordinances, regulations, grants, concessions, franchises, licenses, orders, directives, judgments, decrees, and other governmental restrictions, including permits and other similar requirements, whether legislative, municipal, administrative or judicial in nature, as the same may be amended from time to time.

"Liabilities" means any and all liabilities, regardless of whether such liabilities are based upon contract, warranty, tort (including negligence of any nature), strict liability or other legal theory, damages, losses, liabilities, obligations, costs and expenses of every kind, including, without limitation, reasonable attorneys' fees (including legal expenses on a solicitor and client basis), expert witness fees, and other costs and expenses.

"Mined Materials" means materials located on the Selected Property and include, without limitation, any ores, metals, minerals, stockpiles, waste dumps, tailings, mineral products (including intermediate products) and materials of every nature or sort, or any other material present on the surface of the Selected Property, whether previously severed, or not.

"Minerals" means all minerals and mineral materials of any kind, character or quantity, including, without limitation, gold, silver, platinum group metals, base metals, antimony, chromium, cobalt, copper, lead, manganese, mercury, nickel, molybdenum, titanium, tungsten, zinc and barite, and all other metals and mineral materials and Mined Materials that are on, in or under the Selected Property.

"Mining" means the mining, extracting, producing, beneficiating, handling, milling or other processing of Products.

"Operations" means the activities carried out pursuant to the Exploration, Development and Related Work under this Agreement.

"Option Period" means the period commencing upon the Effective Date of this Agreement and continuing until Coeur: (i) incurs, in the aggregate, $2,000,000 in Exploration and Development Expenses and completes a Canadian NI 43-101 compliant Technical Report, within three (3) years of the Effective Date; or (ii) executes and delivers to IDAH a release of any interest that Coeur has in the Selected Property, pursuant to Section 6.2.

"Personnel" means any of the shareholders, directors, officers, employees, members, agents, contractors, subcontractors, advisors or representatives of a Party, and the respective successors and/or assigns of each.

"Product" or "Products" means all Minerals produced from, the Selected Property.

2. General. Coeur and IDAH hereby enter into this Agreement to effectuate the Earn-In Option. All of the rights and obligations of the Parties in connection with the Selected

EARN-IN OPTION AGREEMENT - 5

Property and the Exploration, Development, and Related Work shall be subject to and governed by this Agreement.

3. Purpose. This Agreement shall serve as the exclusive means by which the Parties accomplish the following purposes:

3.1 Conduct Exploration, Development, and Related Work in and to the Selected Property;

3.2 Allow Coeur to exercise the options set forth in Section 6 of this Agreement, in its sole discretion; and

the foregoing.

3.3 Perform any other activity necessary, appropriate, or incidental to any o

4. Exploration, Development and Related Work. During the Option Period:

4.1 IDAH (the "Operator") will conduct the Exploration, Development, and Related Work at the Selected Property and will be responsible for the Operations and the direct execution and administration of the Exploration, Development, and Related Work in accordance with this Agreement.

4.2 Notwithstanding Section 4.1, Coeur shall carry out all activities related to the completion of a Canadian NI 43-101 compliant Technical Report with respect to the Selected Property using the Data and information submitted to it by IDAH.

4.3 The Parties hereby agree that Coeur will fund the Exploration, Development, and Related Work during the Option Period, subject to the following terms and conditions:

(a) The Parties shall prepare a detailed estimate of all costs to be incurred, and a schedule of cash advances to be made, by Coeur with respect to the Exploration, Development, and Related Work and Exploration and Development Expenses in writing no later than January 1 of each year subject to Coeur's prior written approval, in its sole discretion (the "Project Budget"). The Project Budget for the calendar year ending December 31, 2014 is attached hereto as Exhibit G.

(b) Any Exploration and Development Expenses exceeding, or in addition to, the Project Budget shall be subject to Coeur's further prior written approval, in its sole discretion;

4.4 IDAH shall submit proposed Exploration, Development, and Related Work subcontractors' information to Coeur for Coeur's written pre-approval at least ten (10) calendar days prior to engaging a subcontractor. Coeur's approval of such subcontractor(s) shall be in Coeur's reasonable discretion. Notwithstanding the foregoing, Coeur reserves the right to designate subcontractors for the Exploration, Development, and Related Work, whether or not proposed by IDAH, in its sole and reasonable discretion.

EARN-IN OPTION AGREEMENT - 6

5. Project Program Operation.

5.1 Duties. The Operator shall:

(a) Conduct the Operations in a good and workmanlike manner in accordance applicable Laws and industry standards;

(b) Submit a quarterly work program on January 1, April 1, July 1, and October 1 of each calendar year of the Option Period for Coeur's written approval in Coeur's sole discretion, which quarterly work program shall set forth all planned Operations for the next three calendar months in accordance with the Project Budget;

(c) Pay any and all taxes, general, special, ordinary, and extraordinary, that may be levied or assessed against the Selected Property, that are the responsibility of IDAH under applicable Law or contact, before delinquency, and shall pay any and all Governmental Fees with respect to the Selected Property, complete all necessary assessment and other work, including, but in no way limited to, and all payment and bonding obligations, together with taking such other steps as may be required to record, file, and maintain mining claims and obtain and maintain in good standing any and all required permits under applicable Laws, together with preparing and filing, in a timely manner, any and all necessary reports concerning the permits and work thereon, as required by the applicable government authorities, providing copies to Coeur of evidence of all such payments, filings, records, permits, reports and correspondence regarding the foregoing;

(d) Complete and satisfy (a) all Environmental Compliance obligations during the Option Period and (b) any obligations or responsibilities that are reasonably expected to continue or that may arise after the Exploration, Development and Related Work on a Selected Property have ceased or are suspended, such as future monitoring, stabilization, or Environmental Compliance, affecting the Selected Property, unless the Parties enter into a subsequent agreement specifying otherwise;

(e) Immediately inform Coeur of any release or threatened release that could affect required permits and/or result in actual, or potential, Environmental Liabilities.

(f) Comply with all applicable Laws and all licenses, concessions, and other agreements of title under which the Selected Property is held.

(g) Keep the Selected Property free and clear from all Encumbrances other than those existing and disclosed to Coeur as of the Effective Date. IDAH shall immediately inform Coeur if it becomes aware of any occurrence or non-occurrence that may affect the title to, validity or good standing of any of the mineral rights comprising the Selected Property.

5.2 Title. If, in the opinion of Coeur, IDAH's title to all or any part of the Selected Property is defective or less than as represented in this Agreement, or IDAH's title is contested or questioned by any third party and IDAH is unable or unwilling to promptly correct the alleged defects, Coeur may, without obligation and without waiver of any remedies of Coeur provided herein, attempt to perfect or defend title. In that event, IDAH shall execute all documents and shall take such other actions as are reasonably necessary to assist Coeur in its

EARN-IN OPTION AGREEMENT - 7

efforts to perfect or defend title, time being of the essence. If title is less than represented by IDAH in this Agreement, then the costs and expenses of perfecting or defending title shall be a credit against subsequent payments to be made by Coeur to IDAH for Exploration and Development Expenses under this Agreement. Any improvements or perfection of title to the Selected Property shall inure to the benefit of Coeur in the same manner and to the same extent if such improvement or perfection had been made prior to execution of this Agreement.

6. Earn-In Option; Coeur NSR Option; Option to Acquire IDAH's Entire Interest; Repurchase of IDAH NSR; Selected Property Areas of Interest.

6.1 Earn-In Option. Coeur may exercise the Earn-In Option by completing the following requirements during the Option Period: (i) incurring in the aggregate at least two million dollars ($2,000,000) in Exploration and Development Expenses; and (ii) completing a Canadian NI 43-101 compliant Technical Report for the Selected Property (collectively, the "Earn-In Requirements"). Upon timely completion of the Earn-In Requirements during the Option Period, the Parties shall promptly, and in no event more than thirty (30) days after notice from Coeur to IDAH of its satisfaction of the Earn-In Requirements, (x) form a limited liability company for purposes of further Exploration, Development, and Mining of the Selected Property (the "JV"), and (y) in connection therewith, enter into the Joint Operating Agreement for the JV whereby Coeur's Exploration and Development Expenses shall be deemed capital contributions to the JV in exchange for sixty percent (60%) of the membership interests of the JV and IDAH shall contribute the Selected Property to the JV in exchange for forty percent (40%) of the membership interests of the JV.

6.2 Coeur NSR Option. If Coeur fails to meet the Earn-In Requirements during the Option Period, or if at any time during the Option Period Coeur determines, in its reasonable discretion, that further Exploration and Development Expenses are not reasonably likely to increase the value of the Selected Property, Coeur shall promptly execute and deliver to IDAH a release of any interest that Coeur has in the Selected Property, and Coeur shall retain and IDAH shall grant, bargain, sell, transfer, convey, and agree to pay Coeur a production royalty equal to two and one-half percent (2.5%) of the gross revenue, less Allowable Deductions, of all Minerals produced and sold from the Selected Property (the "Coeur NSR" or "Coeur Net Smelter Royalty") pursuant to terms of the Coeur Net Smelter Returns Royalty Agreement in the form attached hereto as Exhibit E (the "Coeur NSR Agreement"). For purposes of clarity, it is understood that Coeur will retain the Coeur NSR only after Coeur has incurred a minimum of one million dollars ($1,000,000) in Exploration and Development Expenses during the Option Period. Upon the delivery of such release, this Agreement shall be conclusively deemed terminated.

(a) If Coeur receives a bona fide written offer from a third-party, relating to the Coeur NSR, which Coeur desires to accept (each, a "Third Party Offer"), Coeur shall, within thirty (30) days following receipt of the Third Party Offer, notify IDAH in writing (the "Offer Notice") of the material financial and other terms and conditions of such Third-party Offer (the "Material Terms"). Each Offer Notice constitutes an offer made by Coeur to enter into an agreement with IDAH on the same Material Terms of such Third-party Offer (the "ROFR Offer") pursuant to the terms of the Coeur NSR Agreement.

EARN-IN OPTION AGREEMENT - 8

6.3 Option to Acquire IDAH's Entire Interest. During the Option Period, IDAH hereby irrevocably gives, grants, and extends to Coeur, its successors and assigns, the sole and exclusive option to acquire IDAH's entire interest in the Selected Property (the "Acquisition Option"). Coeur may exercise the Acquisition Option by giving IDAH written notice thereof at any time during the Option Period (the "Exercise Notice"). Upon exercise of the Acquisition Option by Coeur, IDAH shall be obligated to complete a transfer of title to the Selected Property to Coeur as provided herein and Coeur shall pay to IDAH at the time of transfer of title a purchase price equal to the value of such interest at the time of the purchase determination, as determined by a qualified third-party valuation firm, reasonably acceptable to both Coeur and IDAH. Upon payment of the purchase price by Coeur to IDAH, Coeur shall grant, bargain, sell, transfer convey and agree to pay IDAH a production royalty equal to two and one-half percent (2.5%) of the gross revenue, less Allowable Deductions, of all Minerals produced and sold from the Selected Property (the "IDAH NSR" or "IDAH Net Smelter Royalty"), pursuant to the terms of the IDAH Net Smelter Returns Royalty Agreement in the form attached hereto as Exhibit F (the "IDAH NSR Agreement").

(a) Acquisition Option Closing. The closing of the exercise of the Acquisition Option (the "Acquisition Option Closing") shall be held not more than sixty (60) days following the date of the Exercise Notice, at a time and place reasonably convenient to the Parties. Coeur shall pay the real property transfer taxes, if any, the costs of escrow and all recording costs incurred in connection with the Acquisition Option Closing. Payment of any and all state and local real property and personal property taxes levied on the Selected Property and not otherwise provided for in this Agreement shall be the responsibility of IDAH. At the Acquisition Option Closing, IDAH shall execute and deliver to Coeur a warranty deed, prepared by Coeur and reasonably acceptable to IDAH, in recordable form, in which IDAH will grant, bargain, sell, and convey to Coeur title in and to the Selected Property and Mined Materials free and clear of all Encumbrances, together with all of the lodes, ledges, veins and mineral-bearing rock, both known and unknown, intralimital and extralateral lying within or extending beyond the boundaries of the above claim, and all dips, spurs and angles, and all the ores, mineral bearing-quartz, rock and earth or other mineral deposits therein or thereon, and together with all water rights appurtenant thereto or used thereon, and all and singular tenements, hereditaments, appurtenances, fixtures, buildings, and improvements thereon or thereunto belonging to or in any way appertaining, the reversion and reversions, remainder and remainders, rents, issues, and profits thereof; and all of the estate, right, title, and interest in and to the mining claim, in law as well as in equity of IDAH relating to the Selected Property.

IDAH and Coeur shall execute and deliver such other written assurances and instruments as are reasonably necessary for the purpose of consummating Coeur's acquisition of the Selected Property (including, without limitation, a certification of IDAH as to the accuracy of the representations and warranties of IDAH contained herein and compliance with the covenants of IDAH contained herein, in each case as of the Acquisition Option Closing date).

6.4 Repurchase of IDAH NSR. Coeur shall have the irrevocable option, exercisable at any time from and after the Acquisition Option Closing, to repurchase IDAH's Net Smelter Royalty for a purchase price of one million dollars ($1,000,000), in accordance with the terms of the IDAH NSR Agreement.

EARN-IN OPTION AGREEMENT - 9

6.5 Selected Property Area of Interest. During the term of this Agreement, neither IDAH nor any of its affiliates shall acquire, directly or indirectly, any interest in real property, its hereditaments and appurtenances, including, but not limited to, fee simple, surface or mineral estates, unpatented or patented lode claims, unpatented or patented mill sites, permits, licenses, leases, grants, easements, rights-of-way, minerals, mineral tenures, personal property, or rights or options to acquire any such interests within the Selected Property Area of Interest (the "Acquired Interests") unless, within thirty (30) days of the date of such acquisition IDAH provides Coeur with notice thereof and the relevant acquisition terms. Coeur shall have the irrevocable right, at its sole option, within thirty (30) days of receipt of IDAH's notice, to elect, by written notice to IDAH, to elect for such Acquired Interests to be considered part of the Selected Property for purposes of this Agreement. If Coeur does not make such election within that period of thirty (30) days, the Acquired Interests shall not be considered part of the Selected Property for purposes of this Agreement and IDAH shall be solely entitled thereto.

7. Insurance. Without limiting any other obligation or liability of IDAH, under this Agreement, IDAH shall, at its own expense, procure and maintain in full force and effect at all times during the Option Period insurance coverage underwritten by a reputable insurer having an A.M. Best Company rating of at least A-/VII and on terms and conditions consistent with prudent risk management practice and in no event less than those specified in this Section 7.

|

TYPE

|

MINIMUM COVER/EACH CLAIM/MISC.

|

|

Comprehensive General Liability

|

$1.0 million per occurrence and $5.0 million

annual aggregate

|

|

Workers' Compensation

|

Per laws of states affected by the Agreement

|

|

Employer's Liability

|

$1.0 million per occurrence and in the

aggregate

|

|

Automobile Liability, for owned, non-owned,

hired and all other vehicles used by IDAH

|

$2.0 million per occurrence and annual

aggregate

|

7.1 Maintenance. IDAH will provide to Coeur a certificate of insurance as evidence of the insurance required pursuant to Section 7 upon the execution of this Agreement and each anniversary thereafter. All insurance arranged by IDAH pursuant to the terms of this Agreement shall not be varied to the detriment of Coeur, cancelled, or allowed to lapse unless thirty (30) days' notice of the intention to so vary, cancel, or lapse has been given to Coeur. The insurance maintained by IDAH pursuant to the terms of this Agreement will, unless prohibited by law, be endorsed to: (i) except in the case of Workers' Compensation, include Coeur and its Affiliates, together with their Personnel, as additional insureds, which shall be reflected in both the certificate of insurance and a separate endorsement; (ii) provide that IDAH's insurance coverage is primary to similar insurance, if any, that may be carried by Coeur or its Affiliates; and (iii) waive all express or implied rights of subrogation against Coeur and its Affiliates, together with their Personnel, which waiver shall be set forth in both the certificate of insurance and a separate endorsement. Any and all deductibles in the above-described insurance policies shall be assumed by, for the account of, and at IDAH's sole risk and expense.

EARN-IN OPTION AGREEMENT - 10

7.2 Subcontractor Insurance. If IDAH engages any subcontract to satisfy its obligations under this Agreement, IDAH will ensure that the subcontractor carries and maintains insurance in form and amounts consistent with this Agreement and any additional professional liability coverage that is required in the ordinary course of the subcontractors business, including without limitation an endorsement that lists Coeur, its Affiliates, and Personnel as additional insureds. Copies of the subcontractor's certificate of insurance and policy endorsements will be provided to Coeur prior to the subcontractor undertaking any such obligations.

8. Indemnification. IDAH shall indemnify, defend and hold harmless Coeur, its Affiliates, together with their respective Personnel, from and against any and all Liabilities, arising out of, resulting from, or in connection with: (i) IDAH's use and occupancy of the Selected Property or the Exploration, Development and Related Work conducted thereon, (ii) any negligent act or omission by IDAH or its Affiliates, together with their Personnel, (iii) any breach or default by IDAH in the performance or observance of its covenants or obligations under this Agreement, (iv) the personal or bodily injury or death of any person, including without limitation any third party, caused by IDAH, its Affiliates or Personnel, (v) damage to or loss of property caused by IDAH, its Affiliates or Personnel, or (vi) any Environmental Liabilities currently existing on the IDAH Property or caused by IDAH, its Affiliates or Personnel on the Selected Property except to the extent caused by the gross negligence or willful misconduct of Coeur. Coeur shall indemnify, defend and hold harmless IDAH, its Affiliates, together with their respective Personnel, from and against Liabilities suffered by or claimed against IDAH, directly based on, arising out of or resulting from any material breach by Coeur in the performance or observance of its covenants or obligations under this Agreement except to the extent caused by the negligent act, error or omission of IDAH.

8.1 Notice. If an indemnified Party receives notice of any event which triggers or may trigger any indemnity obligations under this Agreement, the indemnified Party shall give the indemnifying Party prompt notice of such event; provided, however, that a failure to give such notice shall not constitute a waiver of any of the indemnity obligations under this Agreement.

8.2 Defense. At the request of any indemnified Party, the indemnifying Party shall defend the indemnified Party against any Liabilities for which the indemnifying Party is required to indemnify and hold harmless the indemnified Parties pursuant to the indemnity provisions set forth in this Agreement. Subject to the indemnified Party's approval, which shall not be unreasonably withheld, the indemnifying Party shall retain legal counsel for the purpose of defending any indemnified Party in such suit or action. The indemnified Party shall have the right to retain legal counsel at its expense to participate in the defense of any such suit or action. No such suit or action shall be settled, discontinued, nor shall judgment be permitted to be entered without the written consent of the indemnified Party, which consent shall not be unreasonably withheld.

9. Inspection. Coeur or Coeur's authorized representative may enter on the Selected Property at any reasonable time for the purpose of inspection.

10. Books and Records. During the Option Period and for a period of three (3) years following the termination of this Agreement, IDAH shall maintain complete and accurate books

EARN-IN OPTION AGREEMENT - 11

and records with respect to the Selected Property and the Exploration, Development and Related Work and the invoices submitted to Coeur for payment under this Agreement. Coeur may, at any reasonable time, audit such books and records of IDAH relating to the Selected Property; Exploration, Development, and Related Work; and invoices submitted to Coeur. Such audits shall not be performed more often than annually and shall not be performed in a manner which substantially impedes IDAH's business.

11. Representations and Warranties.

11.1 Representations and Warranties of IDAH. IDAH represents and warrants to Coeur as of the Effective Date:

(a) IDAH is an Idaho corporation duly incorporated, validly existing, and in good standing under the Laws of the State of Idaho.

(b) IDAH has the corporate power and authority to execute and deliver this Agreement and to perform its obligations hereunder. This Agreement constitutes the valid and legally binding obligation of IDAH, enforceable in accordance with its terms and conditions.

(c) IDAH has no liability to pay any fees or commissions to any broker, finder or agent with respect to the transactions contemplated by this Agreement.

(d) This Agreement and the transactions contemplated by this Agreement do not result in (1) a violation of IDAH's governance documents, (2) a material violation of any statute, rule or regulation of United States federal or state law applicable to IDAH, (3) a violation of any judgment or order applicable to IDAH, or (4) a breach or default by IDAH under any contractual obligation applicable to it.

(e) Subject to the paramount title of the U.S. Government in and to unpatented claims, IDAH warrants and will defend title to the IDAH Property against all persons whomsoever.

(f) IDAH is in exclusive possession of and owns or controls the IDAH Property free and clear of all Encumbrances (except liens for ad valorem property taxes and federal claim maintenance fees) or defects in title.

(g) No person, partnership, company, agency or entity, other than the IDAH, holds any right, title, royalty, interest, right of first refusal, back-in right, purchase option, joint development option or other analogous right, interest or benefit with respect to the IDAH Property.

(h) With respect to unpatented claims, which comprise portions of the IDAH Property and subject to the paramount title of the U.S. Government: (i) the unpatented claims were properly laid out and monumental; (ii) all required locations and validation work was properly performed; (iii) certificates of location and claim maps were properly drafted and were duly and timely recorded and filed with appropriate governmental entities; (iv) all Governmental Fees have been paid for the assessment year ending August 31, 2014; (v) all affidavits of payment of Governmental Fees or affidavits and notices of intent to hold and other

EARN-IN OPTION AGREEMENT - 12

filings, required to maintain such unpatented claims in good standing have been properly drafted and have been duly and timely recorded or filed with the appropriate governmental entities; (vi) IDAH has not received any notification of any unresolved violation or noncompliance with location and maintenance requirements for such unpatented claims; and (vii) IDAH has no knowledge of conflicting claims.

(i) There have been no past violations by it or, to IDAH's knowledge, by any of its predecessors in title of any Environmental Laws or other Law affecting or pertaining to the IDAH Property, nor any past creation of damage or threatened damage to the air, soil, surface waters, groundwater, flora, fauna, or other natural resources on, about or in the general vicinity of the IDAH Property ("Environmental Damage").

(j) IDAH has not received inquiry from or notice of a pending investigation from any governmental agency or of any administrative or judicial proceeding concerning the violation of any Law.

(k) To IDAH's knowledge, the IDAH Property has not been studied or proposed for study by the Environmental Protection Agency and/or any state regulatory agency.

(l) The IDAH Property has not been included or, to IDAH's knowledge, proposed for inclusion on the National Priorities List (40 C.F.R. Section 300).

11.2 Representations and Warranties of Coeur. Coeur represents and warrants to IDAH as of the Effective Date:

(a) Coeur is an Idaho corporation duly incorporated, validly existing, and in good standing under the applicable laws of the State of Idaho.

(b) Coeur has the corporate power and authority to execute and deliver this Agreement and to perform its obligations hereunder. This Agreement constitutes the valid and legally binding obligation of Coeur, enforceable in accordance with its terms and conditions.

(c) Coeur has no liability to pay any fees or commissions to any broker, finder or agent with respect to the transactions contemplated by this Agreement.

(d) This Agreement and the transactions contemplated by this Agreement do not result in (1) a violation of Coeur's governance documents, (2) a material violation of any statute, rule or regulation of United States federal or state law applicable to Coeur, (3) a violation of any judgment or order applicable to Coeur, or (4) a breach or default by Coeur under any material contractual obligation applicable to it.

11.3 No Improper Payments. Neither Party nor any person acting on behalf of any Party has made or committed to make nor shall they make or commit to make any payment of money or any gift of anything of value, directly or indirectly, to any Government Official for the purpose of securing or inducing the act, decision, influence, or omission of such Government Official to obtain, retain, or direct business or to secure any improper advantage for any person in connection with this Agreement. The prohibition on indirect payments or commitments includes any situation where the person making the payment

EARN-IN OPTION AGREEMENT - 13

knows, believes, or is aware of the high probability that the person receiving the payment will pass the payment through, in whole or in part, to a Government Official in the circumstances set forth above.

11.4 No Employment of Government Officials. Each Party represents and warrants that none of its officers, directors, shareholders, or employees is a Government Official.

11.5 Survival. The representations and warranties set forth herein are conditions on which the Parties have relied in entering into this Agreement and will survive execution and delivery of this Agreement and any termination or expiration hereof.

12. Notices. All notices, request, demands, waivers, payments and other required or permitted communications ("Notices") to either Party shall be in writing, and shall be addressed respectively as follows:

If intended for Coeur, to:

Coeur Explorations, Inc.

104 South Michigan Avenue, Suite 900

Chicago, Illinois 60603

Attention: Hans Rasmussen

With copies to (which shall not constitute notice):

Coeur Mining, Inc. Attn: General Counsel

104 South Michigan Avenue, Suite 900

Chicago, Illinois 60603

Coeur Mining, Inc. Attn: Land Manager

104 South Michigan Avenue, Suite 900

Chicago, Illinois 60603

If intended for IDAH, to:

Idaho North Resources Corp.

1220 Big Creek Road

Kellogg, Idaho 83837

Attention: Mark A. Fralich

All Notices shall be deemed to have been given: (a) when delivered by hand (with written confirmation of receipt); (b) when received by addressee if sent overnight or other express nationally recognized courier service (receipt requested); (c) on the date sent by facsimile or e-mail of a PDF document (with confirmation of transmission) if sent during normal business hours of the r eceiving Party, and on the next business day if sent after normal business hours of the receiving Party; or (d) on the third business day after the date mailed, by

EARN-IN OPTION AGREEMENT - 14

certified or registered mail, return receipt requested, postage prepaid. Either Party may change its address by Notice to the other Party.

13. Termination. If either Party fails to comply with the provisions of this Agreement, and if such defaulting Party does not initiate and diligently pursue steps to correct the default within thirty (30) days after notice has been given to it by the non-defaulting Party specifying with particularity the nature of the default, then upon the expiration of the thirty (30) day period, the non-defaulting Party may terminate this Agreement in its sole discretion by written notice to the defaulting Party.

13.1 Termination by Coeur. Coeur may at any time terminate this Agreement, by giving sixty (60) days advance written notice to IDAH.

14. Other Business Opportunities. This Agreement is, and the rights and obligations of the Parties are, strictly limited to the matters set forth herein. The Parties shall have the free and unrestricted right to independently engage in and receive the full benefits of any and all business ventures of any sort whatever, whether or not competitive with the matters contemplated hereby without consulting the other or inviting or allowing the other to participate therein.

15. Confidentiality. The Receiving Party acknowledges and agrees that it may gain access to or become familiar with the Disclosing Party's Confidential Information. Except as required by Law, or otherwise as mutually agreed to in writing by the Parties, the Receiving Party shall: (i) protect and safeguard the confidentiality of the Disclosing Party's Confidential Information with at least the same degree of care as the Receiving Party would protect its own Confidential Information, but in no event with less than a commercially reasonable degree of care; (ii) not use the Disclosing Party's Confidential Information, or permit it to be accessed or used, for any purpose other than to perform its obligations under this Agreement; (iii) not disclose any such Confidential Information to any person or entity, except to the Receiving Party's Representatives who (a) need to know the Confidential Information to assist the Receiving Party, or act on its behalf, in exercising its rights or performing its obligations under this Agreement; (b) are informed by the Receiving Party of the confidential nature of the Confidential Information; and (c) are subject to confidentiality duties or obligations to the Receiving Party that are no less restrictive than the terms and conditions of this Agreement; (iv) promptly notify the Disclosing Party of any unauthorized disclosure of Confidential Information or other breaches of this Agreement by the Receiving Party or its Representatives of which the Receiving Party has knowledge; (v) fully cooperate with the Disclosing Party in any effort undertaken by the Disclosing Party to enforce its rights related to any such unauthorized disclosure; and (vi) be responsible for any breach of this Article caused by any of its Representatives, affiliates or third parties..

15.1 Required Disclosure. Any disclosure by the Receiving Party or its Representatives of any of the Disclosing Party's Confidential Information pursuant to Law or valid court order issued by a court or governmental agency of competent jurisdiction (a "Legal Order") shall be subject to the terms of this Article. Prior to making any such disclosure, the Receiving Party shall provide the Disclosing Party with: (i) prompt written notice of such requirement so that the Disclosing Party may seek a protective order or other remedy; and

EARN-IN OPTION AGREEMENT - 15

(ii) reasonable assistance in opposing such disclosure or seeking a protective order or other limitations on disclosure. If, after providing such notice and assistance as required herein, the Receiving Party remains subject to a Legal Order to disclose any Confidential Information, the Receiving Party shall disclose no more than that portion of the Confidential Information which such Legal Order specifically requires the Receiving Party to disclose and shall use commercially reasonable efforts to obtain assurances from the applicable court or agency that such Confidential Information will be afforded confidential treatment. To the extent permitted under Law, the Receiving Party shall provide the Disclosing Party with a copy of any written disclosure made by the Receiving Party as soon as practicable thereafter.

15.2 Ownership and Return or Destruction of Confidential Information. Subject to Section 15, the Receiving Party acknowledges and agrees that any and all Confidential Information disclosed by the Disclosing Party under this Agreement, is and shall remain the exclusive property of the Disclosing Party, until such time as: (i) the Acquisition Option Closing occurs at which point all Confidential Information relating in any way to the Selected Property shall become the exclusive property of Coeur; or (ii) completion of the Earn-in Option by Coeur , at which point all Confidential Information relating in any way to the Selected Property shall become the exclusive property of the limited liability company formed under the Limited Liability Company Operating Agreement. At any time during or after the Option Period of this Agreement, at the Disclosing Party's request, the Receiving Party and its Representatives shall promptly return to the Disclosing Party all originals and copies, whether in written, electronic or other form or media, of the Disclosing Party's Confidential Information, or destroy all such copies and certify in writing to the Disclosing Party that such Confidential Information has been destroyed. In addition, the Receiving Party shall also destroy all copies of any Notes created by the Receiving Party or its Representatives and certify in writing to the Disclosing Party that such copies have been destroyed. Notwithstanding the return or destruction of the Information, Receiving Party and its Representatives will continue to be bound by the obligations under this Section 15. Notwithstanding the foregoing, the Receiving Party may retain any copies of Confidential Information, regardless of whether such copies are in original form: (a) included in any materials that document a decision not to proceed with a transaction with the Disclosing Party, or otherwise to cease discussions or negotiations with the Disclosing Party; (b) as may be required to comply with any applicable federal, state or local law, regulation or regulatory authority to which the Receiving Party is subject; or (c) that are maintained as archive copies on the Receiving Party's disaster recovery and/or information technology backup systems. Such copies will be destroyed upon the normal expiration of the Receiving Party's backup files. The Receiving Party shall continue to be bound by the terms and conditions of this Agreement with respect to any such Confidential Information retained in accordance with this Section 15.

16. Information. Each Party, subject to the confidentiality provisions of Section 15, will have free access to geological Data, assays, plans, etc. acquired during the Option Period, and shall be entitled to receive, upon request, copies of the Data and results.

17. Public Announcements. Prior to making or issuing any press release or other public announcement or disclosure regarding the Selected Property, this Agreement or the Exploration, Development or Related Work, IDAH shall first consult with Coeur as to the content and timing of such announcement or disclosure, unless in the good faith judgment of IDAH, there is

EARN-IN OPTION AGREEMENT - 16

not sufficient time to consult with Coeur before such announcement or disclosure must be made under applicable Laws; but in such event, IDAH shall notify Coeur, as soon as possible, of the pendency of such announcement or disclosure, and it shall notify Coeur before such announcement or disclosure is made if at all reasonably possible.

18. Assignability; Successors and Assigns. Neither Party shall have the right to assign its interest in the Agreement without the prior written consent of the non-assigning party, provided that, Coeur may assign its rights, interests and obligations to an Affiliate. Any assignment of this Agreement shall be binding upon and inure to the benefit of the respective successors and permitted assigns of the Parties.

19. Headings. The subject headings of the Sections and Subsections of this Agreement and the Paragraphs and Subparagraphs of the Exhibits to this Agreement are included for purposes of convenience only, and shall not affect the construction or interpretation of any of its provisions.

20. Waiver. The failure of either Party to insist on the strict performance of any provision of this Agreement or to exercise any right, power or remedy upon a breach hereof shall not constitute a waiver of any provision of this Agreement or limit such Party's right thereafter to enforce any provision or exercise any right.

21. Modification. No modification of this Agreement shall be valid unless made in writing and duly executed by both Parties.

22. Severability. If one of the provisions herein is declared null or invalid for execution, for any reason, such invalidity shall not affect the validity of the Agreement unless the provision in question is not separable.

23. Further Assurances. Each of the Parties shall take, from time to time and without additional consideration, such further actions and execute such additional instruments as may be reasonably necessary or convenient to implement and carry out the intent and purpose of this Agreement.

24. Entire Agreement. This Agreement and all Exhibits referenced herein and incorporated by any such reference contains the entire understanding of the Parties and supersedes all prior agreements and understandings between the Parties relating to the subject matter hereof.

25. No Third-Party Rights. Nothing in this Agreement is intended, nor shall be construed, to confer upon any person other than the Parties any right or remedy under or by reason of this Agreement.

26. Counterparts. This Agreement may be executed in any number of counterparts, and it shall not be necessary that the signatures of both Parties be contained on any counterpart. Each counterpart shall be deemed an original, but all counterparts together shall constitute one and the same instrument.

EARN-IN OPTION AGREEMENT - 17

27. Governing Law. This Agreement shall be governed by, and construed in accordance, with the laws of the State of Nevada as though made and to be fully performed in that State without giving effect to any choice or conflict of law provision or rule (whether of the State of Nevada or any other jurisdiction) that would cause the application of Laws of any jurisdiction other than those of the State of Nevada. EACH PARTY IRREVOCABLY AND UNCONDITIONALLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL ACTION, PROCEEDING, CAUSE OF ACTION OR COUNTERCLAIM ARISING OUT OF OR RELATING TO THIS AGREEMENT, INCLUDING ANY EXHIBITS ATTACHED TO THIS AGREEMENT, OR THE TRANSACTIONS CONTEMPLATED HEREBY. .

28. Recordation. Contemporaneously herewith, the Parties shall execute and deliver a Memorandum of Earn-In Option Agreement (the "Memorandum"), which shall be promptly recorded by Coeur in the County Recorder's Office of Nye County, Nevada, or any other office determined, in the sole discretion of Coeur, as necessary. The execution and recording of the Memorandum shall not limit, increase or in any manner affect the terms of this Agreement, or any rights, interests or obligations of the Parties. In Coeur's discretion, this Agreement may be recorded by Coeur, but not by IDAH, in lieu of the Memorandum.

EARN-IN OPTION AGREEMENT - 18

IN WITNESS WHEREOF, this Earn-In Option Agreement is executed by Coeur and IDAH as of the date of the acknowledgment of their respective signature, hereinbelow, but shall be effective as of the Effective Date written hereinabove.

|

COEUR EXPLORATIONS, INC.

|

||

|

By:

|

HANS RASMUSSEN

|

|

|

Name:

|

Hans Rasmussen

|

|

|

Title:

|

Vice President

|

|

Illinois Short Form Corporate Acknowledgment

STATE OF ILLINOIS )

SS.

COUNTY OF COOK )

The foregoing instrument was acknowledged before me this 21st day of October 2014 by Hans Rasmussen, as Vice President of Coeur Explorations, Inc., an Idaho corporation, on behalf of the corporation.

WITNESS my hand and seal, this 21 day of October 2014.

|

[SEAL]

|

ALMA MIRANDA

|

|

NOTARY PUBLIC:

|

|

|

Serial Number, if any:

|

My Commission Expires: 1-24-2016 in and for the County of Cook State of Illinois

765 ILCS 30/7

EARN-IN OPTION AGREEMENT - SIGNATURE PAGE

|

IDAHO NORTH RESOURCES CORPORATION

|

||

|

By:

|

ERIK PANKE

|

|

|

Name:

|

Erik Panke

|

|

|

Title:

|

CFO

|

|

STATE OF IDAHO )

)ss.

COUNTY OF SHOSHONE )

On this 21st day of Oct, in the year 2014, before me, personally appeared Erik Panke, known or identified to me to be the Chief Financial Officer, of the corporation that executed the instrument or the person who executed the instrument on behalf of said corporation, and acknowledged to me that such corporation executed the same.

WITNESS my hand and official seal.

|

[SEAL]

|

RENEE TENEYCK

|

|

NOTARY PUBLIC:

|

|

|

Printed Name: Renee TenEyck

|

|

|

My Commission expires: 5-27-17

|

EARN-IN OPTION AGREEMENT - SIGNATURE PAGE

EXHIBIT A

EXPLORATION PROGRAM AREA OF INTEREST

EXHIBIT A

EXHIBIT B

IDAH PROPERTY

Schedule of Unpatented Mining Claims Controlled by IDAH

Esmeralda County, Nevada

|

Claim

|

Name

|

BLM (NMC)

Serial №

|

Date of Location

|

|

DN

|

1

|

1058054

|

9/1/11

|

|

DN

|

2

|

1058055

|

9/1/11

|

|

DN

|

3

|

1058056

|

9/1/11

|

|

DN

|

4

|

1058057

|

9/1/11

|

|

DN

|

5

|

1058058

|

9/1/11

|

|

DN

|

6

|

1058059

|

9/1/11

|

|

GS

|

1

|

1058062

|

9/1/11

|

|

GS

|

3

|

1058063

|

9/1/11

|

|

TH-

|

1

|

1058060

|

9/1/11

|

|

TH-

|

2

|

1058061

|

9/1/11

|

|

KN

|

1

|

1104351

|

9/2/14

|

|

KN

|

2

|

1104352

|

9/2/14

|

|

KN

|

3

|

1104353

|

9/2/14

|

|

KN

|

4

|

1104354

|

9/2/14

|

|

KN

|

5

|

1104355

|

9/2/14

|

|

KN

|

6

|

1104356

|

9/2/14

|

|

KN

|

14

|

1104357

|

9/2/14

|

|

KN

|

15

|

1104358

|

9/2/14

|

|

KN

|

16

|

1104359

|

9/2/14

|

|

KN

|

25

|

1104360

|

9/2/14

|

|

KN

|

41

|

1104362

|

9/2/14

|

|

KN

|

59

|

1104361

|

9/2/14

|

|

KN

|

100

|

1066359

|

11/16/11

|

|

KN

|

101

|

1066360

|

11/16/11

|

|

KN

|

102

|

1066361

|

11/16/11

|

|

KN

|

103

|

1066362

|

11/16/11

|

|

KN

|

104

|

1066363

|

11/16/11

|

|

KN

|

105

|

1066364

|

11/16/11

|

|

KN

|

106

|

1066365

|

11/16/11

|

EXHIBIT B

|

KN

|

107

|

1066366

|

11/16/11

|

|

KN

|

108

|

1066367

|

11/16/11

|

|

KN

|

109

|

1066368

|

11/16/11

|

|

KN

|

147

|

1066369

|

11/16/11

|

|

KN

|

148

|

1066370

|

11/16/11

|

|

KN

|

149

|

1066371

|

11/16/11

|

|

KN

|

150

|

1066372

|

11/16/11

|

|

KN

|

151

|

1066373

|

11/16/11

|

|

KN

|

152

|

1066374

|

11/16/11

|

|

KN

|

153

|

1066375

|

11/16/11

|

|

KN

|

154

|

1066376

|

11/16/11

|

|

KN

|

155

|

1066377

|

11/16/11

|

|

KN

|

156

|

1066378

|

11/16/11

|

|

KN

|

157

|

1066379

|

11/16/11

|

|

KN

|

158

|

1066380

|

11/16/11

|

|

KN

|

159

|

1066381

|

11/16/11

|

|

KN

|

160

|

1066382

|

11/16/11

|

|

KN

|

161

|

1066383

|

11/16/11

|

|

KN

|

162

|

1066384

|

11/16/11

|

|

KLN

|

1

|

1103345

|

5/2/14

|

|

KLN

|

2

|

1103346

|

5/2/14

|

|

KLN

|

3

|

1103347

|

5/2/14

|

|

KLN

|

4

|

1103348

|

5/2/14

|

|

KLN

|

5

|

1103349

|

5/2/14

|

|

KLN

|

6

|

1103350

|

5/2/14

|

|

KLN

|

7

|

1103351

|

5/2/14

|

|

KLN

|

8

|

1103352

|

5/2/14

|

|

KLN

|

9

|

1103353

|

5/2/14

|

|

KLN

|

10

|

1103354

|

5/2/14

|

|

KLN

|

11

|

1103355

|

5/2/14

|

|

KLN

|

12

|

1103356

|

5/2/14

|

|

KLN

|

13

|

1103357

|

5/2/14

|

|

KLN

|

14

|

1103358

|

5/2/14

|

|

KLN

|

15

|

1103359

|

5/2/14

|

|

KLN

|

16

|

1103360

|

5/2/14

|

|

KLN

|

17

|

1103361

|

5/2/14

|

|

KLN

|

18

|

1103362

|

5/2/14

|

|

KLN

|

19

|

1103363

|

5/2/14

|

EXHIBIT B

|

KLN

|

20

|

1103364

|

5/2/14

|

|

KLN

|

21

|

1103365

|

5/2/14

|

|

KLN

|

22

|

1103366

|

5/2/14

|

|

KLN

|

23

|

1103367

|

5/2/14

|

|

KLN

|

24

|

1103368

|

5/2/14

|

|

KLN

|

25

|

1103369

|

5/2/14

|

|

KLN

|

26

|

1103370

|

5/2/14

|

|

KLN

|

27

|

1103371

|

5/2/14

|

|

KLN

|

28

|

1103372

|

5/2/14

|

|

KLN

|

29

|

1103373

|

5/2/14

|

|

KLN

|

30

|

1103374

|

5/2/14

|

|

KLN

|

31

|

1103375

|

5/2/14

|

|

KLN

|

32

|

1103376

|

5/2/14

|

|

KLN

|

33

|

1103377

|

5/2/14

|

|

KLN

|

34

|

1103378

|

5/2/14

|

|

KLN

|

35

|

1103379

|

5/2/14

|

|

KLN

|

36

|

1103380

|

5/2/14

|

|

KLN

|

37

|

1103381

|

5/3/14

|

|

KLN

|

38

|

1103382

|

5/3/14

|

|

KLN

|

39

|

1103383

|

5/3/14

|

|

KLN

|

40

|

1103384

|

5/3/14

|

|

KLN

|

41

|

1103385

|

5/3/14

|

|

KLN

|

42

|

1103386

|

5/3/14

|

|

KLN

|

43

|

1103387

|

5/3/14

|

|

KLN

|

44

|

1103388

|

5/3/14

|

|

KLN

|

45

|

1103389

|

5/3/14

|

|

KLN

|

46

|

1103390

|

5/3/14

|

|

KLN

|

47

|

1103391

|

5/3/14

|

|

KLN

|

48

|

1103392

|

5/3/14

|

|

KLN

|

49

|

1103393

|

5/3/14

|

|

KLN

|

50

|

1103394

|

5/3/14

|

|

KLN

|

51

|

1103395

|

5/3/14

|

|

KLN

|

52

|

1103396

|

5/3/14

|

|

KLN

|

53

|

1103397

|

5/3/14

|

|

KLN

|

54

|

1103398

|

5/3/14

|

|

KLN

|

55

|

1103399

|

5/3/14

|

|

KLN

|

56

|

1103400

|

5/3/14

|

|

KLN

|

57

|

1103401

|

5/3/14

|

EXHIBIT B

|

KLN

|

58

|

1103402

|

5/3/14

|

|

KLN

|

59

|

1103403

|

5/2/14

|

|

KLN

|

60

|

1103404

|

5/2/14

|

|

KLN

|

61

|

1103405

|

5/2/14

|

EXHIBIT B

EXHIBIT C

SELECTED PROPERTY

|

Claim

|

Name

|

BLM (NMC)

Serial №

|

Date of Location

|

|

KN

|

1

|

1104351

|

9/2/14

|

|

KN

|

2

|

1104352

|

9/2/14

|

|

KN

|

3

|

1104353

|

9/2/14

|

|

KN

|

4

|

1104354

|

9/2/14

|

|

KN

|

5

|

1104355

|

9/2/14

|

|

KN

|

6

|

1104356

|

9/2/14

|

|

KN

|

14

|

1104357

|

9/2/14

|

|

KN

|

15

|

1104358

|

9/2/14

|

|

KN

|

16

|

1104359

|

9/2/14

|

|

KN

|

25

|

1104360

|

9/2/14

|

|

KN

|

41

|

1104362

|

9/2/14

|

|

KN

|

59

|

1104361

|

9/2/14

|

|

KN

|

100

|

1066359

|

11/16/11

|

|

KN

|

101

|

1066360

|

11/16/11

|

|

KN

|

102

|

1066361

|

11/16/11

|

|

KN

|

103

|

1066362

|

11/16/11

|

|

KN

|

104

|

1066363

|

11/16/11

|

|

KN

|

105

|

1066364

|

11/16/11

|

|

KN

|

106

|

1066365

|

11/16/11

|

|

KN

|

107

|

1066366

|

11/16/11

|

|

KN

|

108

|

1066367

|

11/16/11

|

|

KN

|

109

|

1066368

|

11/16/11

|

|

KN

|

147

|

1066369

|

11/16/11

|

|

KN

|

148

|

1066370

|

11/16/11

|

|

KN

|

149

|

1066371

|

11/16/11

|

|

KN

|

150

|

1066372

|

11/16/11

|

|

KN

|

151

|

1066373

|

11/16/11

|

|

KN

|

152

|

1066374

|

11/16/11

|

|

KN

|

153

|

1066375

|

11/16/11

|

|

KN

|

154

|

1066376

|

11/16/11

|

|

KN

|

155

|

1066377

|

11/16/11

|

|

KN

|

156

|

1066378

|

11/16/11

|

|

KN

|

157

|

1066379

|

11/16/11

|

EXHIBIT C

|

KN

|

158

|

1066380

|

11/16/11

|

|

KN

|

159

|

1066381

|

11/16/11

|

|

KN

|

160

|

1066382

|

11/16/11

|

|

KN

|

161

|

1066383

|

11/16/11

|

|

KN

|

162

|

1066384

|

11/16/11

|

|

KLN

|

1

|

1103345

|

5/2/14

|

|

KLN

|

2

|

1103346

|

5/2/14

|

|

KLN

|

3

|

1103347

|

5/2/14

|

|

KLN

|

4

|

1103348

|

5/2/14

|

|

KLN

|

5

|

1103349

|

5/2/14

|

|

KLN

|

6

|

1103350

|

5/2/14

|

|

KLN

|

7

|

1103351

|

5/2/14

|

|

KLN

|

8

|

1103352

|

5/2/14

|

|

KLN

|

9

|

1103353

|

5/2/14

|

|

KLN

|

10

|

1103354

|

5/2/14

|

|

KLN

|

11

|

1103355

|

5/2/14

|

|

KLN

|

12

|

1103356

|

5/2/14

|

|

KLN

|

13

|

1103357

|

5/2/14

|

|

KLN

|

14

|

1103358

|

5/2/14

|

|

KLN

|

15

|

1103359

|

5/2/14

|

|

KLN

|

16

|

1103360

|

5/2/14

|

|

KLN

|

17

|

1103361

|

5/2/14

|

|

KLN

|

18

|

1103362

|

5/2/14

|

|

KLN

|

19

|

1103363

|

5/2/14

|

|

KLN

|

20

|

1103364

|

5/2/14

|

|

KLN

|

21

|

1103365

|

5/2/14

|

|

KLN

|

22

|

1103366

|

5/2/14

|

|

KLN

|

23

|

1103367

|

5/2/14

|

|

KLN

|

24

|

1103368

|

5/2/14

|

|

KLN

|

25

|

1103369

|

5/2/14

|

|

KLN

|

26

|

1103370

|

5/2/14

|

|

KLN

|

27

|

1103371

|

5/2/14

|

|

KLN

|

28

|

1103372

|

5/2/14

|

|

KLN

|

29

|

1103373

|

5/2/14

|

|

KLN

|

30

|

1103374

|

5/2/14

|

|

KLN

|

31

|

1103375

|

5/2/14

|

|

KLN

|

32

|

1103376

|

5/2/14

|

|

KLN

|

33

|

1103377

|

5/2/14

|

|

EXHIBIT C

|

|

KLN

|

34

|

1103378

|

5/2/14

|

|

KLN

|

35

|

1103379

|

5/2/14

|

|

KLN

|

36

|

1103380

|

5/2/14

|

|

KLN

|

37

|

1103381

|

5/3/14

|

|

KLN

|

38

|

1103382

|

5/3/14

|

|

KLN

|

39

|

1103383

|

5/3/14

|

|

KLN

|

40

|

1103384

|

5/3/14

|

|

KLN

|

41

|

1103385

|

5/3/14

|

|

KLN

|

42

|

1103386

|

5/3/14

|

|

KLN

|

43

|

1103387

|

5/3/14

|

|

KLN

|

44

|

1103388

|

5/3/14

|

|

KLN

|

45

|

1103389

|

5/3/14

|

|

KLN

|

46

|

1103390

|

5/3/14

|

|

KLN

|

47

|

1103391

|

5/3/14

|

|

KLN

|

48

|

1103392

|

5/3/14

|

|

KLN

|

49

|

1103393

|

5/3/14

|

|

KLN

|

50

|

1103394

|

5/3/14

|

|

KLN

|

51

|

1103395

|

5/3/14

|

|

KLN

|

52

|

1103396

|

5/3/14

|

|

KLN

|

53

|

1103397

|

5/3/14

|

|

KLN

|

54

|

1103398

|

5/3/14

|

|

KLN

|

55

|

1103399

|

5/3/14

|

|

KLN

|

56

|

1103400

|

5/3/14

|

|

KLN

|

57

|

1103401

|

5/3/14

|

|

KLN

|

58

|

1103402

|

5/3/14

|

|

KLN

|

59

|

1103403

|

5/2/14

|

|

KLN

|

60

|

1103404

|

5/2/14

|

|

KLN

|

61

|

1103405

|

5/2/14

|

|

EXHIBIT C

|

EXHIBIT D

JOINT OPERATING AGREEMENT

|

EXHIBIT D

|

EXHIBIT E

COEUR NET SMELTER RETURNS ROYALTY AGREEMENT

EXHIBIT E

EXHIBIT F

IDAH NET SMELTER RETURNS ROYALTY AGREEMENT

EXHIBIT F

EXHIBIT G

PROJECT BUDGET FOR FY2014

EXHIBIT G