Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION (PURSUANT TO RULE 13A-14 OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED) - TUMBLEWEED HOLDINGS, INC. | dcdc10ka06302014ex31_1.htm |

| EX-32.1 - CERTIFICATION PURSUANT TO - TUMBLEWEED HOLDINGS, INC. | dcdc10ka06302014ex32_1.htm |

| EX-31.2 - CERTIFICATION (PURSUANT TO RULE 13A-14 OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED) - TUMBLEWEED HOLDINGS, INC. | dcdc10ka06302014ex31_2.htm |

| EX-32.2 - CERTIFICATION PURSUANT TO - TUMBLEWEED HOLDINGS, INC. | dcdc10ka06302014ex32_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

For the fiscal year ended June 30, 2014

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

For the transition period from: _____________ to _____________

Tumbleweed Holdings, Inc.

(Exact name of registrant as specified in its charter)

Commission file number:

000-22315

| Utah | 34-1413104 | |||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||

| 720 Fifth Avenue, 10th Floor, New York, NY | 10019 | |||

| (Address of Principal Executive Offices) | (Zip Code) | |||

Registrants telephone number, including area code:

(212) 247-0581

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class | Name of each exchange on which registered | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ ] No [X]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes [ ] No [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant s most recently completed second fiscal quarter.

Note. If a determination as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate market value of the common stock held by non-affiliates may be calculated on the basis of assumptions reasonable under the circumstances, provided that the assumptions are set forth in the Form.

| There were 143,420,667 outstanding shares of the registrant’s common stock as of October 10, 2014. |

TABLE OF CONTENTS

| Page | ||

| PART I |

| |

| Item 1. | Business. | 3 |

| Item 1A. | Risk Factors. | 5 |

| Item 1B. | Unresolved Staff Comments. | 5 |

| Item 2. | Properties | 5 |

| Item 3 | Legal Proceedings. | 5 |

| Item 4. | Mine Safety Disclosures. | 5 |

| PART II | ||

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | 6 |

| Item 6. | Selected Financial Data. | 7 |

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations. | 7 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | 9 |

| Item 8. | Financial Statements and Supplementary Data. | 10 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | 10 |

| Item 9A. . | Controls and Procedures. | 10 |

| Item 9B. | Other Information. | 11 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance. | 12 |

| Item 11. | Executive Compensation. | 12 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 13 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 14 |

| Item 14. | Principal Accounting Fees and Services. | 14 |

| PART IV | ||

| Item 15. | Exhibits, Financial Statement Schedules. | 15 |

| SIGNATURES | 16 | |

Forward-Looking Statements

This Current Report on Form 10-K (“Form 10-K”) and other reports filed by the Registrant from time to time with the SEC (collectively the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, the Registrant’s management as well as estimates and assumptions made by the Registrant’s management. When used in the filings the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan,” “may,” “will,” or the negative of these terms and similar expressions as they relate to the Registrant or the Registrant’s management identify forward-looking statements. Such statements reflect the current view of the Registrant with respect to future events and are subject to risks, uncertainties, assumptions and other factors relating to the Registrant’s industry, the Registrant’s operations and results of operations and any businesses that may be acquired by the Registrant. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although the Registrant believes that the expectations reflected in the forward-looking statements are reasonable, the Registrant cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, the Registrant does not intend to update any of the forward-looking statements to conform these statements to actual results.

PART I

Item 1. Business.

General

Tumbleweed Holdings, Inc. (the “Company”), formerly known as Digital Creative Development Corporation, was principally engaged in creating and providing media content to businesses and consumers as well as managing its ownership interest in Broadcaster, Inc. (“Broadcaster”). The Company changed its name to Tumbleweed Holdings, Inc. from Digital Creative Development Corporation in May 2014. Currently the Company does not have existing operations.

Plan of Business

The Company intends to locate and enter into a transaction with an existing, public or privately-held company that in management's view has growth potential (a "Target Business"). The Company has identified the agro-technology sector, including the legalized cannabis market and related lines of business, as a potential growth opportunity and a target industry. Presently, the Company is focused on reviewing potential transaction with several Target Businesses and searching for additional candidates for consideration to enter into a business combination or strategic transaction. A transaction with a Target Business may be structured as a merger, consolidation, exchange of the Company's common stock for stock or assets of the Target Business or any other form which will result in the combined enterprise remaining a publicly-held corporation. Acquisitions or business combinations may not be available at the times or on terms acceptable to us, or at all. In addition, acquiring, or combining with, a business involves many risks, including:

| · | difficulty integrating acquired technologies, operations, and personnel with the existing business; |

| · | diversion of management attention in connection with both negotiating the acquisitions and integrating the assets; |

| · | potential issuance of securities in connection with the acquisition, which securities dilute the holders of the Company’s currently outstanding securities; |

| · | the need to incur additional debt; |

| · | strain on managerial and operational resources as management tries to oversee larger operations; |

| · | exposure to unforeseen liabilities of acquired companies; |

| · | risks of entering markets in which we have little or no direct prior experience; |

| · | potential impairment of relationships with employees or customers as a result of changes in management; and |

| · | potential dilutive issuances of equity, large and immediate write-offs, the incurrence of debt, and amortization of goodwill or other intangible assets. |

The Company cannot make assurances that it will complete any acquisitions or business combinations or that it will be able to obtain financing for such acquisitions or combinations. If any acquisitions or combinations are completed, the Company cannot make assurances that it will be able to successfully integrate the acquired or combined business into operations or that the acquired or combined business will perform as expected. Furthermore, Federal and state tax laws and regulations have a significant impact upon the structuring of transactions. Management will evaluate the possible tax consequences of any prospective transaction and will endeavor to structure a transaction so as to achieve the most favorable tax treatment. There can be no assurance that the Internal Revenue Service or relevant state tax authorities will ultimately assent to the tax treatment of a particular consummated transaction. To the extent the Internal Revenue Service or any relevant state tax authorities ultimately prevail in recharacterizing the tax treatment of a transaction, there may be adverse tax consequences to us, a target business and their respective stockholders. Tax considerations as well as other relevant factors will be evaluated in determining the precise structure of a particular transaction, which could be effected through various forms by a merger, consolidation or stock or asset acquisition. Pending negotiation and consummation of a transaction, the Company anticipates that it will have, aside from carrying on its search for a transaction partner, no business activities, and, thus, no source of revenue. Should the Company incur any significant liabilities prior to a combination with a Target Business, it may not be able to satisfy, without additional financing, such liabilities as they are incurred.

Government Regulation

Currently, there are twenty-three states and the District of Columbia that have laws and/or regulations that recognize in one form or another legitimate medical uses for cannabis and consumer use of cannabis in connection with medical treatment. Currently, the policy and regulations of the Federal government and its agencies is that cannabis has no medical benefit and a range of activities including cultivation and use of cannabis for personal use is prohibited on the basis of federal law and may or may not be permitted on the basis of state law.

Employees

As of June 30, 2014 and through the present, the Company has no employees. Gary Herman, the Company’s Chairman, Chief Executive Officer, President and Secretary; and Skuli Thorvaldsson, the Company’s Interim Chief Financial Officer, serve on a management consulting basis.

Mr. Thorvaldsson became Interim Chief Financial Officer effective May 1, 2013, upon the sudden passing of the Company’s former Chief Financial Officer, Vincent De Lorenzo.

| -3- |

Acquisitions

The Company has never had plans or characterized itself as an investment company. Currently, the Company is targeting agricultural technology services and products, with a focus on businesses related to legalized cannabis. Its historical development had been focused almost exclusively on restaurant, software and digital entertainment businesses. Although the Company continues to search for candidates with which to enter into business combinations or strategic transactions, it does not have an operating business except for its ownership interest in Broadcaster, Inc. As of September 25, 2014, the Company owns approximately 2,806,000 shares of common stock of Broadcaster, or approximately 8.0% of the total outstanding shares. An additional 226,000 shares of common stock, or approximately 0.6% of Broadcaster, Inc. is beneficially owned by Gary Herman, the Company’s Chairman, and approximately 884,000 shares of common stock, or approximately 2.5% of Broadcaster, Inc. is beneficially owned by Bruce Galloway, the Company’s former chairman. Furthermore, approximately 372,000 shares of common stock, or approximately 1.1% are owned by Strategic Turnaround Equity Partners, LP (Cayman) an investment fund co-managed by the Company’s Chairman and Chief Executive Officer.

The Investment Company Act of 1940 (the “Act” ) was primarily meant to regulate investment companies, which generally include families of mutual funds of the type offered by the Fidelity and Vanguard organizations, to pick two of many, closed-end investment companies that are traded on the public stock markets, and certain non-managed pooled investment vehicles such as unit investment trusts. These entities are in the business of investing, reinvesting and trading in securities and generally own relatively diversified portfolios of publicly traded securities that are issued by companies not controlled by these entities. A company can, either deliberately or inadvertently, come to have the defining characteristics of an investment company within the meaning of the Act without proclaiming that fact or being willing to voluntarily submit itself to regulation as an acknowledged investment company. The Act and rules under it contain provisions to differentiate true operating companies from companies that may be considered to have sufficient investment-company-like characteristics to require regulation by the Act s complex procedural and substantive requirements. These provisions apply to companies that own or hold securities, as well as companies that invest, reinvest and trade in securities, and particularly focus on determining the primary nature of a Company’s activities, including whether an investing company controls and does business through the entities in which it invests or, instead, holds its securities investments passively and not as part of an operating business. For instance, under what is, for most purposes, the most liberal of the relevant tests, a company may become subject to the Act’s registration requirements if it either holds more than 45% of its assets in, or derives more than 45% of its income from, investments in companies that the investor does not primarily control or through which it does not actively do business. In making these determinations the Act generally requires that a Company’s assets be valued on a current fair market value basis, determined on the basis of securities public trading price or, in the case of illiquid securities and other assets, in good faith by the Company’s board of directors.

In February 2012, Broadcaster withdrew its registration of securities under the Securities Exchange Act of 1934 with the Securities and Exchange Commission (the “SEC”).

If the SEC takes the view that the Company has been operating and continues to operate as an unregistered investment company in violation of the Act, and does not provide the Company with a sufficient period to either register as an investment company or divest itself of investment securities and/or acquire non-investment securities, the Company may be subject to significant potential penalties.

In the absence of exemptions granted by the SEC (which are discretionary in nature and require the SEC to make certain findings), the Company would be required either to register as a closed-end investment company or a business development company under the Act. If the Company elects to register as a closed-end investment company under the Act, a number of significant requirements will be imposed upon the Company, including limits on the values of its investment securities as a percentage of its total assets, the make-up of its board of directors and transactions with affiliates. In order to comply with the Act, the Company may need to acquire additional operating assets that would have a material effect on the Company’s operations. There can be no assurance that the Company could identify such operating assets to acquire or could successfully acquire such assets. Any such acquisition could result in the Company issuing additional shares that may dilute the equity of the Company’s existing stockholders, and/or result in the Company incurring additional indebtedness, which could have a material impact on the Company’s balance sheet and results of operations. Any of the above risks could result in a material adverse effect on the Company’s results of operations and financial condition.

Going Concern

The Company has nominal assets and presently does not generate any revenues. The Company is dependent upon the receipt of capital investment and other financing to fund its ongoing operations and to execute its business plan. If continued funding and capital resources are unavailable at reasonable terms, the Company may not be able to implement its plan of operations. The Company may be required to obtain alternative or additional financing, from financial institutions or otherwise, in order to maintain and expand our existing operations. The failure by us to obtain such financing, if needed, would have a material adverse effect upon our business, financial condition and results of operations.

| -4- |

Our financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. Our independent registered public accounting firm has included an explanatory paragraph in their report in our audited financial statements for the period ended June 30, 2014 to the effect that our losses from operations and our negative cash flows from operations raise substantial doubt about our ability to continue as a going concern. Our financial statements do not include any adjustments that might be necessary should we be unable to continue as a going concern. We may be required to cease operations which could result in our stockholders losing all or almost all of their investment.

Recent Financings

On April 1, 2014, the Company entered into a securities purchase agreement with an accredited investor (the “Investor”), pursuant to which the Company agreed to issue the Investor 1,250,000 shares of its common stock for an aggregate purchase price of $25,000. As of the date of this Annual Report, the Company terminated the securities purchase agreement as a result of the Investor failing to make a timely payment in compliance with the terms of the agreement. No shares of common stock of the Company were issued to the Investor by the Company under such agreement.

On April 4 and 14, 2014, the Company entered into two separate securities purchase agreements with two accredited investors, pursuant to which the Company agreed to issue an aggregate of 16,250,000 Units (each, a “Unit”) at a purchase price per Unit of $0.02 for an aggregate purchase price of $325,000, with each Unit consisting of one common share in the capital of the Company (each, a “Share”) and one common share purchase warrant, each entitling the holder, at its option, to purchase one additional Share (each, a “Warrant”).

Item 1A. Risk Factors.

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide this information.

Item 1B. Unresolved Staff Comments.

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide this information.

Item 2. Properties.

The Company's principal executive offices are located at 720 Fifth Avenue, 10th Floor New York, NY 10019. The Company is utilizing office space and equipment of its management at no cost to the Company until an acquisition or business transaction is consummated. Management estimates such amounts to be immaterial.

Item 3. Legal Proceedings.

The Company and its subsidiaries are from time to time involved in ordinary and routine litigation.

On April 1, 2014, GrowBlox Sciences, Inc. (“Plaintiff” or “GrowBlox”) filed a lawsuit captioned GrowBlox Sciences, Inc. v. GCM Administrative Services, LLC et al, Docket No. 14-cv-02280-ER (the “Lawsuit”) in the United States District Court for the Southern District of New York (the “Court”) against Gary Herman, Seth Lukash, GCM Administrative Services, LLC, and Strategic Turnaround Equity Partners, L.P. (together, the “Defendants”). Mr. Herman serves as Chairman and CEO and Seth Lukash serves as a Director and Advisor of the Company. Both Mr. Herman and Mr. Lukash have fiduciary duties within GCM Administrative Services, LLC (“GCM”) and Strategic Turnaround Equity Partners, L.P. The Lawsuit requests that the Court issue a declaratory judgment that the Defendants are not entitled to receive stock in GrowBlox pursuant to conversion rights held under promissory notes given by an affiliate of GrowBlox to GCM. On May 9, 2014, the Defendants filed an answer with counter-claims and third-party claims against Plaintiff and certain individuals affiliated with Plaintiff seeking damages for breach of fiduciary duty, unjust enrichment, quantum meruit, and breach of contract. The Company’s management does not believe that a potential unfavorable ruling in the Lawsuit would have a material impact on the Company, as GrowBlox is not seeking monetary damages against the Defendants.

Item 4. Mine Safety Disclosures.

Not Applicable.

| -5- |

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The following table sets forth the high and low prices for the periods indicated as reported by the National Daily Quotation Service, Inc. between dealers and do not include retail mark-ups, mark-downs, or commissions and do not necessarily represent actual transactions, as reported by the National Association of Securities Dealers Composite Feed or other qualified inter-dealer quotation medium. On October 10, 2014 the closing price of the Company’s shares was $.03/share.

| High | Low | |||||||

| 2013 Fiscal Year | ||||||||

| First Quarter | $ | 0.02 | 0 | |||||

| Second Quarter | $ | 0.03 | 0.01 | |||||

| Third Quarter | $ | 0.02 | 0 | |||||

| Fourth Quarter | $ | 0.03 | 0 | |||||

| 2014 Fiscal Year | ||||||||

| First Quarter | $ | 0.02 | 0.01 | |||||

| Second Quarter | $ | 0.08 | 0.01 | |||||

| Third Quarter | $ | 0.10 | 0.01 | |||||

| Fourth Quarter | $ | 0.09 | 0.03 | |||||

Common Stock

Our Articles of Incorporation authorizes the issuance of up to 1,000,000,000 shares of common stock, par value $.01 per share. The common stock is eligible for trading on the Over-the-Counter Bulletin Board under the symbol “DCDC,” but a trading market has not developed to date. As of September 25, 2014, there were approximately 501 holders of record of the Company’s common stock.

The Company’s common stock is a “penny stock” as defined in Rule 3a51-1 under the Exchange Act. The penny stock rules require a broker-dealer, prior to a transaction in penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its sales person in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules require that the broker-dealer, not otherwise exempt from such rules, must make a special written determination that the penny stock is suitable for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure rules have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to the penny stock rules. So long as the common stock of the Company is subject to the penny stock rules, it may be more difficult to sell the Company’s common stock.

Dividends

The holders of the Series A Preferred Stock are entitled to a cumulative dividend of $0.10 per share per annum. Such dividends accrue annually but are payable if and when the Company declares a dividend. The Company has never paid any dividends with respect to the Series A Preferred Stock. The 2,200 outstanding shares of Series A Preferred Stock are convertible into 3,300 shares of Common Stock for no additional consideration at the option of the holder of the stock. The Series A Preferred Stock is entitled to a liquidation preference of $1.00 per share, plus any accrued and unpaid dividends. The Series A Preferred Stock may be redeemed by the Company at a redemption price of $1.00 per share plus all accrued and unpaid dividends. The amount of accumulated and unpaid dividends was approximately $26,900 and $26,600 as of June 30, 2014 and 2013, respectively.

In November and December 1997, the Company consummated a private placement with respect to equity units consisting of shares of its Series C Preferred Stock and warrants to purchase shares of common stock for aggregate proceeds of $990,000. The Company sold 9,900 shares of Series C Preferred Stock with warrants to purchase 148,500 shares of common stock attached. The preferred stock is not convertible, but may be redeemed at the option of the Company at a redemption price of $100/share plus accrued and unpaid dividends, at any time. The holders of the preferred stock are entitled to a cumulative dividend of 10% per annum, payable semi-annually, if and when the Board declares a dividend. On April 30, 2013, the holders of an aggregate of 9,400 shares of the Company’s Series C Preferred Stock, representing 95% of the total number of outstanding shares of Series C Preferred, converted their shares of Series C Preferred into an aggregate of 25,509,721 shares of the Company’s Common Stock. The Company declared a dividend payable of $66,113 for the remaining holders who had not converted their Series C Preferred Shares. As of June 30, 2014 and 2013, the Company had accumulated and unpaid dividends of approximately $14,700 and $9,700, respectively, on this series of preferred stock.

| -6- |

On September 28, 1998, the Company sold 4,000 shares of Series D Preferred Stock and Common Stock Purchase Warrants with gross proceeds of an aggregate amount of $400,000. The preferred stock is convertible into 400,000 shares of common stock. The holders of the preferred stock are entitled to a cumulative dividend of 15% per annum, payable semi-annually, if and when the Board declares a dividend. The Company never paid any dividend with respect to the Series D Preferred Stock. On April 30, 2013, the holders of an aggregate of 4,000 shares of the Company’s Series D Preferred Stock, representing 100% of the total number of outstanding shares of Series D Preferred, converted their shares of Series D Preferred Stock and accumulated and unpaid dividends of $875,000 into an aggregate of 14,899,747 shares of the Company’s Common Stock..

To date, the Company has not been current with dividends due to preferred shareholders of Series A and C Preferred Stock; the Company has not paid any dividends on its Common Stock. The payment of dividends, if any, in the future is within the discretion of the Board of Directors and will depend upon the Company's earnings, its capital requirements and financial condition, and other relevant factors. The Company does not intend to declare any dividends in the foreseeable future, but instead intends to retain all earnings, if any, for use in the Company's business operations. No dividends may be distributed with respect to the Common Stock so long as there are accrued and unpaid dividends on any Preferred Stock.

Securities Authorized for Issuance under Equity Compensation Plans

During fiscal 2014, the Company adopted the 2014 Stock-Based Incentive Compensation Plan, which provides for the issuance of equity awards to the Company’s officers, directors, employees and consultants.

Recent Sales of Unregistered Securities

On April 1, 2014, the Company entered into a securities purchase agreement with an investor (the “Investor”), pursuant to which the Company agreed to issue the Investor 1,250,000 shares of its common stock for an aggregate purchase price of $25,000. As of the date of this Annual Report, the Company terminated the securities purchase agreement as a result of the Investor failing to make a timely payment in compliance with the terms of the agreement. No shares of common stock of the Company were issued to the Investor by the Company under such agreement.

On April 4 and 14, 2014, the Company entered into two separate securities purchase agreements with two accredited investors, pursuant to which the Company agreed to issue an aggregate of 16,250,000 Units (each, a “Unit”) at a purchase price per Unit of $0.02 for an aggregate purchase price of $325,000, with each Unit consisting of one common share in the capital of the Company (each, a “Share”) and one common share purchase warrant, each entitling the holder, at its option, to purchase one additional Share (each, a “Warrant”).

The Warrants are exercisable for a period of five years from and after the closing at an exercise price of $0.05 per share. The transactions closed on April 4 and 18, 2014, respectively.

For each of the above, we relied on Section 4(2) of the Securities Act, as providing an exemption from registering the sale of these Units, Shares and Warrants under the Securities Act because, among other reasons, the offerees/issuees were accredited investors who were not subject to any general solicitation.

Issuer Purchases of Equity Securities

None.

Item 6. Selected Financial Data.

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide this information.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

This Management's Discussion and Analysis of Financial Condition and Results of Operations of the Company below provides information that the Company believes is relevant to an assessment and understanding of the Company's consolidated financial condition, changes in financial condition, and results of operations. This Management's Discussion and Analysis of Financial Condition and Results of Operations of the Company should be read in conjunction with the consolidated financial statements and related notes.

Plan of Operation

Our principal business objective for the next 12 months and beyond such time will be to achieve long-term growth potential through a combination with a business rather than immediate, short-term earnings. The Company intends to locate and enter into a transaction with an existing, public or privately-held company that in management's view has growth potential (a "Target Business"). The Company has identified several companies in the agro-technology sector, including the legalized cannabis market and related lines of business, as Target Businesses. Presently, the Company is focused on reviewing potential transactions with several identified Target Businesses and searching for additional candidates to consider entering into a business combination or strategic transaction with.

| -7- |

The Company currently does not engage in any business activities that provide cash flow. During the next twelve months we anticipate incurring costs related to:

(i) filing Exchange Act reports, and

(ii) investigating, analyzing and consummating an acquisition.

We believe we will be able to meet these costs through use of funds in our treasury and additional amounts, as necessary, to be loaned to or invested in us by our stockholders, management or other investors. There are no assurances that the Company will be able to secure any additional funding as needed. Currently, however our ability to continue as a going concern is dependent upon our ability to generate future profitable operations and/or to obtain the necessary financing to meet our obligations and repay our liabilities arising from normal business operations when they come due. Our ability to continue as a going concern is also dependent on our ability to find a suitable Target Business and enter into a possible reverse merger with such company. Management’s plan includes obtaining additional funds by equity financing through a reverse merger transaction, however there is no assurance of additional funding being available.

The Company may consider acquiring a business which has recently commenced operations, is a developing company in need of additional funds for expansion into new products or markets, is seeking to develop a new product or service, or is an established business which may be experiencing financial or operating difficulties and is in need of additional capital. In the alternative, a business combination may involve the acquisition of, or merger with, a company which does not need substantial additional capital but which desires to establish a public trading market for its shares while avoiding, among other things, the time delays, significant expense, and loss of voting control which may occur in a public offering.

Any Target Business that is selected may be a financially unstable company or an entity in its early stages of development or growth, including entities without established records of sales or earnings. In that event, we will be subject to numerous risks inherent in the business and operations of financially unstable and early stage or potential emerging growth companies. In addition, we may effect a business combination with an entity in an industry characterized by a high level of risk, and, although our management will endeavor to evaluate the risks inherent in a particular Target Business, there can be no assurance that we will properly ascertain or assess all significant risks. Our management anticipates that it will likely be able to effect only one business combination, due primarily to our limited financing and the dilution of interest for present and prospective stockholders, which is likely to occur as a result of our management’s plan to offer a controlling interest to a Target Business in order to achieve a tax-free reorganization. This lack of diversification should be considered a substantial risk in investing in us, because it will not permit us to offset potential losses from one venture against gains from another.

The Company anticipates that the selection of a business combination will be complex and extremely risky. Because of general economic conditions, rapid technological advances being made in some industries and shortages of available capital, our management believes that there are numerous firms seeking even the limited additional capital which we will have and/or the perceived benefits of becoming a publicly traded corporation. Such perceived benefits of becoming a publicly traded corporation include, among other things, facilitating or improving the terms on which additional equity financing may be obtained, providing liquidity for the principals of and investors in a business, creating a means for providing incentive stock options or similar benefits to key employees, and offering greater flexibility in structuring acquisitions, joint ventures and the like through the issuance of stock. Potentially available business combinations may occur in many different industries and at various stages of development, all of which will make the task of comparative investigation and analysis of such business opportunities extremely difficult and complex.

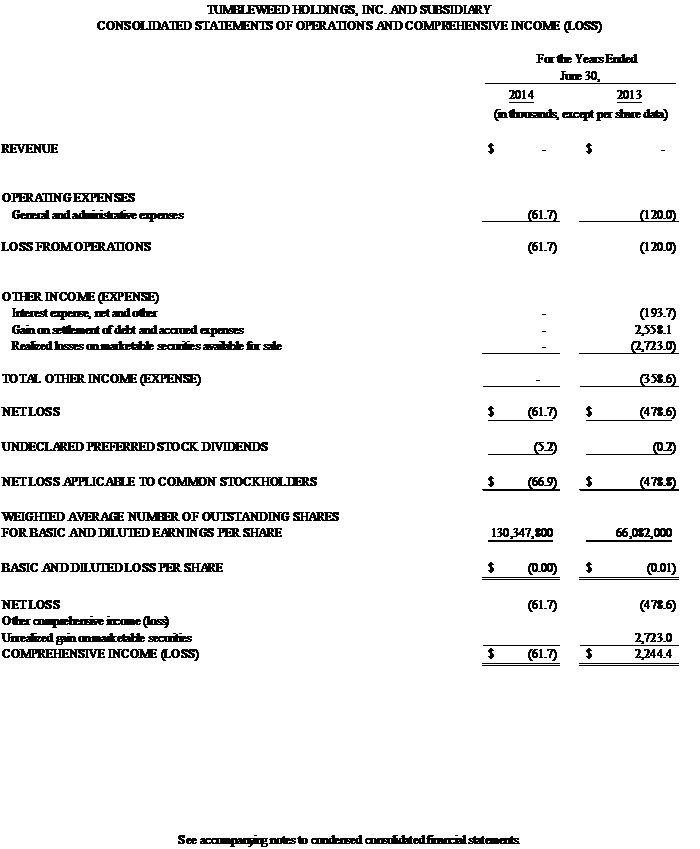

Results of Operations Fiscal 2014 and Fiscal 2013

The Company had no operating revenues in fiscal years 2014 or 2013. General and administrative expenses and were $61,700 and $120,000 for the fiscal years ended June 30, 2014 and 2013, respectively. Net loss for the fiscal years ended June 30, 2014 and 2013 was $61,700 and $478,600, respectively. The decrease in net loss is primarily due to the absence in the current fiscal year of interest expense and a realized loss on marketable securities available for sale, partially offset by a gain on settlement of debt and accrued expenses incurred in the prior fiscal year period. The Company continues to search for a business it deems suitable for acquisition or similar transaction.

New Accounting Standards

There are no recently issued accounting pronouncements that are not yet effective that are expected to have a material impact on the Company’s financial position, results of operations, or disclosures in the consolidated financial statements.

Liquidity and Capital Resources

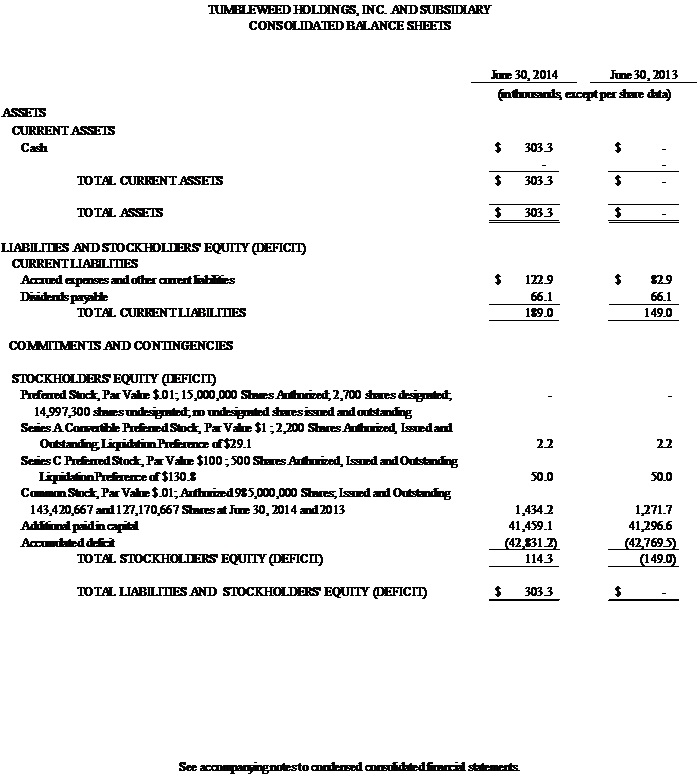

The Company’s current assets exceeded its current liabilities by $114,300 at June 30, 2014, compared to current liabilities exceeding its current assets by $149,000 at June 30, 2013. The change in working capital is primarily the result of proceeds, in the amount of $325,000, from the sale of the Company’s common stock. Current and total liabilities were $189,000 and $149,000 at June 30, 2014 and 2013, respectively.

| -8- |

In April 2003, the Company issued $345,000 of secured promissory notes with interest at 10% to a group of seven investors. On April 30, 2013, all of these notes and accrued and unpaid interest, which amounted to $1,260,836, were converted into 14,734,222 shares of the Company’s common stock which had a market value of $147,342. For the year ended June 30, 2013, the Company recognized a gain on the settlement of $1,113,494 from this transaction.

On September 18, 2003, the Company entered into a 15% one-year note (the “Note”) with IMSI (n/k/a “Broadcaster”) whereby the Company borrowed $350,000. On January 5, 2005, Broadcaster sold and assigned the Note, which then had a principal amount of $325,000, to Mag-Multi Corporation ("Mag-Multi"). On April 30, 2013, Mag-Multi converted the Note and accrued and unpaid interest, which amounted to $607,971 into 7,152,246 shares of the Company’s common stock which had a market value of $71,522. For the year ended June 30, 2013, the Company recognized a gain on the settlement of $536,449 from this transaction.

The Company has nominal assets and presently does not generate any revenue. The Company is dependent upon the receipt of capital investment or other financing to fund its ongoing operations and to execute its business plan of seeking a combination with a private operating company. If continued funding and capital resources are unavailable at reasonable terms, the Company may not be able to implement its plan of operations. The failure by us to obtain such financing whether on acceptable terms or at all, if needed, would have a material adverse effect upon our business, financial condition and results of operations.

Cash provided by financing activities was $325,000 for the fiscal year ended June 30, 2014 which reflects proceeds from the sale of the Company’s common stock (see Recent Financing below).

Recent Financing

On April 1, 2014, the Company entered into a securities purchase agreement with an investor (the “Investor”), pursuant to which the Company agreed to issue the Investor 1,250,000 shares of its common stock for an aggregate purchase price of $25,000. As of the date of this Annual Report, the Company terminated the securities purchase agreement as a result of the Investor failing to make a timely payment in compliance with the terms of the agreement. No shares of common stock of the Company were issued to the Investor by the Company under such agreement.

On April 4 and 14, 2014, the Company entered into two separate securities purchase agreements with two accredited investors, pursuant to which the Company agreed to issue an aggregate of 16,250,000 Units (each, a “Unit”) at a purchase price per Unit of $0.02 for an aggregate purchase price of $325,000, with each Unit consisting of one common share in the capital of the Company (each, a “Share”) and one common share purchase warrant, each entitling the holder, at its option, to purchase one additional Share (each, a “Warrant”).

The Warrants are exercisable for a period of five years from and after the closing at an exercise price of $0.05 per share. The transactions closed on April 4 and 18, 2014, respectively.

Off-Balance Sheet Arrangements

The Company does not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on the Company’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Contractual Obligations

| As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide this information. |

Going Concern

Our financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. We have a history of losses that are likely to continue in the future. Our financial statements do not include any adjustments that might be necessary should we be unable to continue as a going concern. We may be required to cease operations which could result in our stockholders losing all or almost all of their investment.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

The Company’s equity investments are concentrated in Broadcaster, Inc. At June 30, 2014, 100% of the total fair value of equity investments was concentrated in Broadcaster, Inc. The Company’s present preferred strategy is to hold equity investments for trading purposes and for long-term strategic purposes. Thus, the Company’s management is not necessarily troubled by short term equity price volatility with respect to its investments provided that the underlying business, economic and management characteristics of the investees remain favorable. The carrying values of investments subject to equity price risks are based on quoted market prices or management s estimates of fair value as of the balance sheet dates. Market prices are subject to fluctuation and, consequently, the amount realized in the subsequent sale of an investment may significantly differ from the reported market value. Fluctuation in the market price of a security may result from perceived changes in the underlying economic characteristics of the investee, the relative price of alternative investments and general market conditions. Furthermore, amounts realized in the sale of a particular security may be affected by the relative quantity of the security being sold.

| -9- |

Item 8. Financial Statements and Supplementary Data.

The financial statements are filed as part of this Annual Report on Form 10-K.

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure.

None.

Item 9A. Controls and Procedures.

Disclosure Controls and Procedures

Our principal executive officer and principal financial officer performed an evaluation of the effectiveness of our disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) as of the end of the period covered by this Annual Report on Form 10-K. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms, and is accumulated and communicated to our management, including our principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure. Based on that evaluation, our principal executive officer and principal financial officer concluded that, as of June 30, 2014, our disclosure controls and procedures were effective for the year ended June 30, 2014, subject to the two material weaknesses described below.

Management’s Report on Internal Control Over Financial Reporting

Management is responsible for establishing and maintaining adequate internal controls over financial reporting for the Company. Internal control over financial reporting is defined in Rule 13a-15(f) and 15d-15(f) promulgated under the Exchange Act as a process designed by, or under the supervision of, the Company’s principal executive and principal financial officers and effected by the Company’s Board of Directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that:

| · | Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the company; |

| · | Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and |

| · | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the company’s assets that could have a material effect on the financial statements. |

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Internal control over financial reporting cannot provide absolute assurance of achieving financial reporting objectives because of its inherent limitations. Internal control over financial reporting is a process that involves human diligence and compliance and is subject to lapses in judgment and breakdowns resulting from human failure. Internal control over financial reporting can also be circumvented by collusion or improper management override. Because of such limitations, there is a risk that material misstatements may not be prevented or detected on a timely basis by internal control over financial reporting. However, these inherent limitations are known features of the financial reporting process. Therefore, it is possible to design into the process safeguards to reduce, though not eliminate, this risk.

We assessed the effectiveness of the Company’s internal control over financial reporting as of June 30, 2014. In making this assessment, the Company’s management used the criteria set forth by the Committee of Sponsoring Organizations (“COSO”) of the Treadway Commission’s Internal Control-Integrated Framework.

| -10- |

As a result of this assessment, we have determined that our internal control over financial reporting was ineffective as of June 30, 2014. We had neither the resources, nor the personnel, to provide an adequate control environment. The following two material weaknesses in our internal control over financial reporting existed at June 30, 2014:

(i) We do not have written documentation of our internal control policies and procedures. Written documentation of key internal controls over financial reporting is a requirement of Section 404 of the Sarbanes-Oxley Act which is applicable to us for the fiscal year ended June 30, 2014. Management evaluated the impact of our failure to have written documentation of our internal controls and procedures on our assessment of our disclosure controls and procedures and has concluded that the control deficiency that resulted represented a material weakness.

(ii) We do not have sufficient segregation of duties within accounting functions, which is a basic internal control. Due to our size and nature, segregation of all conflicting duties may not always be possible and may not be economically feasible. However, to the extent possible, the initiation of transactions, the custody of assets and the recording of transactions should be performed by separate individuals. Management evaluated the impact of our failure to have segregation of duties on our assessment of our disclosure controls and procedures, and concluded that the control deficiency that resulted represented a material weakness.

It should be noted that any system of controls, however well designed and operated, can provide only reasonable and not absolute assurance that the objectives of the system are met. In addition, the design of any control system is based in part upon certain assumptions about the likelihood of certain events. Because of these and other inherent limitations of control systems, there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions, regardless of how remote.

Attestation Report of the Independent Registered Public Accounting Firm

This annual report does not include an attestation report of our independent registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our independent registered public accounting firm pursuant to Section 404(c) of the Sarbanes-Oxley Act that permits us to provide only management’s report in this Annual Report.

Changes in Internal Control over Financial Reporting

There were no significant changes in the Company’s internal control over financial reporting that occurred during the fourth quarter of fiscal 2014 that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

Item 9B. Other Information.

None.

| -11- |

PART III

Item 10. Directors, Executive Officers, Promoters and Control Persons.

Name Age Position

| Gary Herman | 50 | Chairman of the Board, Chief Executive Officer, and Secretary | |

| Seth Lukash | 68 | Director |

| Skuli Thorvaldsson | 72 | Director and Interim Chief Financial Officer | |

Gary Herman

Mr. Herman was elected to the Board of Directors in May 2001 and became Chairman and Chief Executive officer in January 2002. Mr. Herman is a Managing Member of Galloway Capital Management, LLC as well as a Registered Representative with Arcadia Securities LLC, a FINRA registered broker-dealer based in New York. Prior to this, from 1997 to 2002, he was an investment banker with Burnham Securities, Inc. Prior to joining Burnham, he was the managing partner of Kingshill Group, Inc., a merchant banking and financial firm with offices in New York and Tokyo. Mr. Herman has a B.S. from the State University of New York at Albany.

Seth Lukash

Mr. Lukash has been a director of the Company since May 2014. He has 30 years of experience as a CEO of various technology companies. He was the Chairman and CEO of Tridex Corporation from 1983 to 1995. Under Mr. Lukash's leadership, Tridex grew its revenues from $6 million to over $100 million. Mr. Lukash then became CEO and Chairman of Progressive Software, a large provider of application software to the restaurant and hospitality market from 1995 to 2001. Between 2001 and 2003 he was CEO of Food Automation Services and Smart Commercial Kitchens, a group of privately held companies providing controls and technology to the food services industry. Mr. Lukash is a director of Strategic Turnaround Master Partnership, Ltd. (Cayman). He also serves as advisor to Strategic Turnaround Equity Partners, LP (Cayman), which is a fund focused on investments in public and private companies. He graduated from the University of Miami in 1968 with a B.A. in Finance.

Skuli Thorvaldsson

Mr. Thorvaldsson has been a member of the Board of Directors since May 1996. On May 1, 2013, Mr. Thorvaldsson was elected Interim Chief Financial Officer due to the sudden death of the Company’s former Chief Financial Officer. Previously, Mr. Thorvaldsson was the Company’s Chief Financial Officer from February 2002 to July 2007. Mr. Thorvaldsson is a private entrepreneur/investor. From 1980 to 2003, Mr. Thorvaldsson was the Chief Executive Officer of the Hotel Holt in Reykjavík, Iceland. He is a director of Holt Holdings S.A., a Luxembourg-based investment company. Mr. Thorvaldsson graduated from the Commercial College of Iceland and the University of Barcelona and holds a law degree from the University of Iceland.

Each Director is elected to serve until the Company's next annual meeting of shareholders and until his successor is duly elected and qualified.

There are no agreements with respect to the election of directors. Executive officers are appointed annually by the Board of Directors and each executive officer serves at the discretion of the Board of Directors.

The Company has adopted a Code of Ethics, which is administered by the Board of Directors. A copy is available upon request from the Company.

Section 16(a) of the Exchange Act requires the Company's officers, directors and persons who own more than ten percent of the Company's common shares to file reports of ownership with the SEC and to furnish the Company with copies of these reports. Based solely upon its review of reports received by it, or upon written representations from certain reporting persons that no reports were required, the Company believes that during fiscal year ended June 30, 2014 all filing requirements were met.

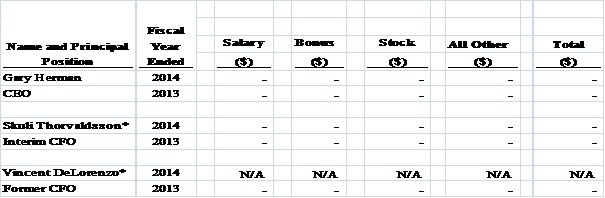

Item 11. Executive Compensation.

The following table provides certain summary information concerning the compensation paid or accrued by the Company to or on behalf of its Chief Executive Officer and the other named executive officers of the Company for services rendered in all capacities to the Company and its subsidiaries for the fiscal years ended June 30, 2014 and 2013.

| -12- |

(a) Summary Compensation

Table

*On May 1, 2013, the Company’s Board elected Mr. Thorvaldsson as the Company’s Interim Chief Financial Officer due to the sudden death of Mr. De Lorenzo.

Executive Compensation

GH Ventures LLC, an entity of which Gary Herman is the sole member, provides services as the Company's Chairman, Chief Executive Officer and Secretary. Due to the limited available working capital of the Company, he has received minor compensation since taking office in January 2002. Although Mr. Herman does not receive any recurring compensation, he is compensated from time to time for his services as funds are available.

Mr. Thorvaldsson is the Company's Interim Chief Financial Officer. He has not received any recurring compensation and is compensated from time to time for his services as funds are available.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

The following table sets forth information as of October 10, 2014 with respect to officers, directors and persons who are known by the Company to be beneficial owners of more than 5% of the Company's Common Stock. Except as otherwise indicated, the Company believes that the beneficial owners of the Common Stock listed below, based on information furnished by such owners, have sole investment and voting power with respect to such shares, subject to community property laws where applicable.

| Shareholder | Shares | Percentage |

| Charles Hallinan | 15,000,000 | 10.46% |

| Bruce R. Galloway (1) | 13,466,898 | 9.39% |

| Skuli Thorvaldsson (2) | 18,971,970 | 13.23% |

| Gary Herman (3) | 5,646,305 | 3.94% |

| James and Alexander Goren | 12,514,718 | 8.73% |

| Officers and Directors as a group | 24,618,275 | 17.17% |

| Total Outstanding shares | 143,420,667 | 100.00% |

| (1) | Consists of (i) 11,926,494 common shares owned directly by Mr. Galloway, (ii) 1,040,404 common shares owned by Jacombs Investments, Ltd. for which Mr. Galloway has the power to vote and dispose and (iii) 500,000 shares held by Mr. Galloway’s children for whom Mr. Galloway has the discretion to vote and dispose. |

| (2) | Consists of 1,250,000 common shares owned directly by Mr. Thorvaldsson and (ii) 17,721,970 common shares owned by NTS Financial Services for which Mr. Thorvaldsson is an advisor and has the power to vote and dispose. |

| (3) | Consists of (i) 80,000 shares owned directly by Mr. Herman, (ii) 1,045,412 common shares held by GH Ventures, LLC which Mr. Herman is sole owner and beneficiary, (iii) 220,302 common shares held by GCM Administrative Services LLC for which Mr. Herman has the discretion to vote and dispose, (iv) 980,216 common shares held by Galloway Capital Management, LLC for which Mr. Herman has the discretion to vote and dispose and (v) 3,320,375 common shares held by an investment fund Strategic Turnaround Equity Partners, LP (Cayman)(“STEP”) which is managed by Galloway Capital Management, LLC. Mr. Herman, a managing member of Galloway Capital Management, LLC disclaims beneficial ownership of the shares held by STEP except to the extent of being a limited partner in STEP for which Mr. Herman has the discretion to vote and dispose. |

| -13- |

Item 13. Certain Relationships and Related Transactions, and Director Independence.

During the fiscal year ended June 30, 2014, there has not been any transaction or series of similar transactions to which we were or are a party in which the amount involved exceeded or exceeds $120,000 and in which any of our directors or executive officers, any holder of more than 5% of any class of our voting securities or any member of the immediate family of any of the foregoing persons had or will have a direct or indirect material interest, other than the compensation arrangements described herein.

Item 14. Principal Accounting Fees and Services.

The following table presents fees for professional audit services rendered by Rosen Seymour Shapss Martin & Company LLP for the audit of our annual financial statements and fees for other services for the fiscal years ended June 30, 2014 and 2013. These fees are categorized as audit fees, audit related fees, tax fees and all other fees. The nature of the services provided in each category is described following the table.

| Fiscal | Fiscal | |||||||

| 2014 | 2013 | |||||||

| Fee Category | ||||||||

| Audit fees: (1) | $ | 45,000 | $ | 37,689 | ||||

| Audit related fees: (2) | None | None | ||||||

| Tax fees: (3) | None | None | ||||||

| All other fees: (4) | None | 2,650 | ||||||

| Total | $ | 45,000 | $ | 40,339 |

| 1. | Audit fees. These fees generally consist of professional services rendered for the audits of the financial statements of the Company and its internal control over financial reporting, quarterly reviews, consents, income tax provision procedures and assistance with and review of documents filed with the SEC. |

| 2. | Audit-related fees. These fees generally consist of assurance and other services related to the performance of the audit or review of the Company’s financial statements or that are traditionally performed by the independent registered public accounting firm, issuance of consents, due diligence related to acquisitions, internal control reviews, attest services that are not required by statute or regulation and consultations concerning financial accounting and reporting standards. |

| 3. | Tax fees. These fees generally relate primarily to tax compliance, including review and preparation of corporate tax returns, assistance with tax audits, review of the tax treatment for certain expenses and tax due diligence relating to acquisitions. They also include fees for state and local tax planning and consultations with respect to various tax matters. |

| 4. | All other fees. These fees generally consist of reviews for compliance with various government regulations, risk management and treasury reviews and assessments and audits of various contractual arrangements. |

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-audit Services of Independent Auditors

We do not currently have an Audit Committee and all actions that would otherwise be handled by the Audit Committee are undertaken by our full Board of Directors. If and when we find a suitable merger candidate and we successfully enter into a merger transaction whereby a company with assets and operations survives, we intend to establish an Audit Committee that fulfills the independent and other requirements promulgated by the SEC. However, recognizing the SEC policies regarding auditor independence, our Board of Directors has responsibility for appointing, setting compensation and overseeing the work of the independent auditor. In recognition of this responsibility, our Board of Directors has established a policy to pre-approve all audit and permissible non-audit services provided by the independent auditor.

Our Board of Directors may delegate pre-approval authority to one or more of its members. The member to whom such authority is delegated must report, for informational purposes only, any pre-approval decisions to our Board of Directors at its next scheduled meeting. Our Board has determined that the services rendered by Rosen Seymour Shapss Martin & Company, LLP are compatible with maintaining their independence as the Company’s principal accountants and independent auditors.

| -14- |

PART IV

Item 15. Exhibits, Financial Statement Schedules.

(a)

| (1) | Financial Statements: | Page Number from this Form 10-K | |

| Report of Independent Registered Public Accounting Firm | F-1 | ||

| Consolidated Balance Sheets - June 30, 2014 and 2013 | F-2 | ||

| Consolidated Statements of Operations and Comprehensive Income (Loss) - years ended June 30, 2014 and 2013 | F-3 | ||

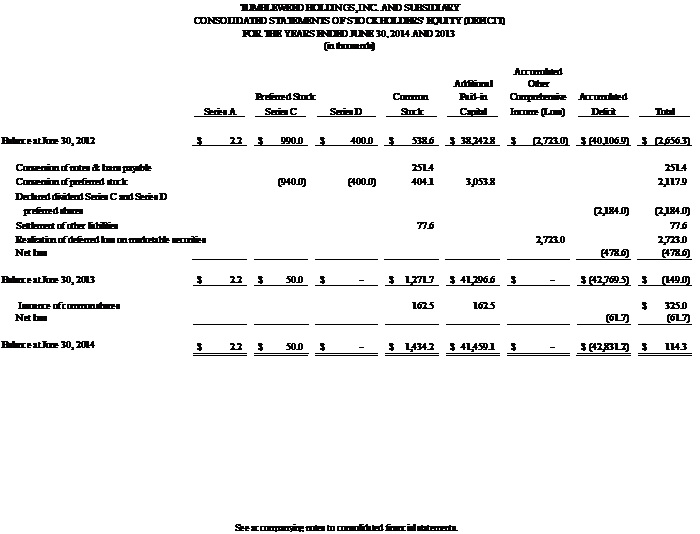

| Consolidated Statements of Stockholders’ Equity (Deficit) - years ended June 30, 2014 and 2013 | F-4 | ||

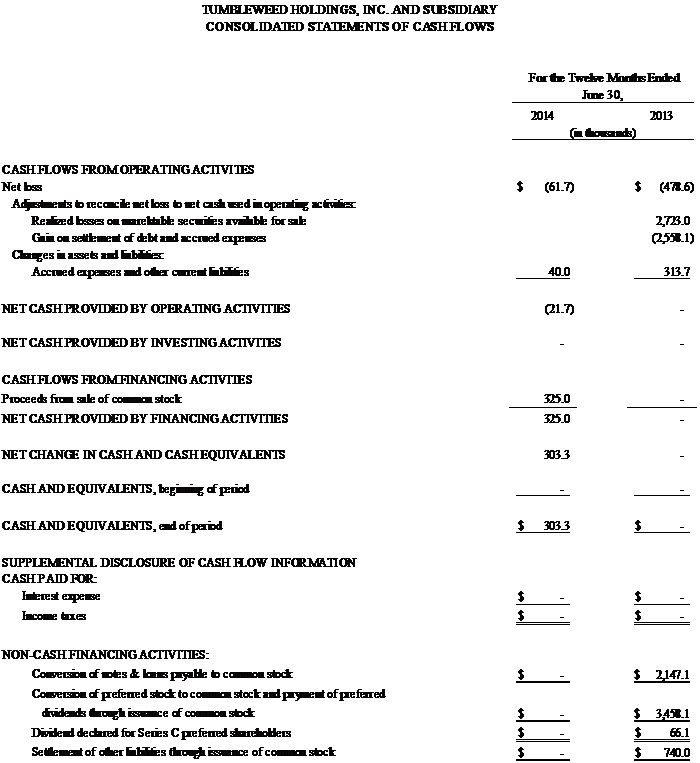

| Consolidated Statements of Cash Flows - years ended June 30, 2014 and 2013 | F-5 | ||

| Notes to Consolidated Financial Statements | F-6 | ||

| (2) | Consolidated Financial Statement Schedules: | ||

| None | |||

| (3) | Exhibits: | ||

|

A list of exhibits filed or furnished with this report on Form 10-K (or incorporated by reference to exhibits previously filed or furnished by us) is provided in the Exhibit Index on page 18 of this report.

|

| -15- |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this Annual

Report to be signed on our behalf by the undersigned, thereunto duly authorized.

| Date: October 13, 2014 | Tumbleweed Holdings, Inc. | ||

| By: /s/ Gary Herman | |||

| Gary Herman | |||

| Chief Executive Officer | |||

| Date: October 13, 2014 | Tumbleweed Holdings, Inc. | ||

| By: /s/ Skuli Thorvaldsson | |||

| Skuli Thorvaldsson | |||

| Interim Chief Financial Officer |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated:

| Signature | Title | Date | |||

| /s/ Gary Herman | Chairman of the Board | October 13, 2014 | |||

| Gary Herman | and Chief Executive Officer | ||||

| (Principal Executive Officer) | |||||

| /s/ Skuli Thorvaldsson | Director and Interim Chief Financial Officer | October 13, 2014 | |||

| Skuli Thorvaldsson | (Principal Accounting Officer) |

| -16- |

TUMBLEWEED

HOLDINGS, INC.

EXHIBIT INDEX

Exhibit

No. Exhibit Description

| 3.1.1 | Certificate of Incorporation. (1) |

| 3.1.2 | Agreement and Plan of Reorganization and First Addendum dated December 5, 1983. (1) |

| 3.1.3 | Certificate of Merger dated January 23, 1984. (1) |

| 3.1.4 | Articles of Merger dated January 27, 1984. (1) |

| 3.1.5 | Articles of Amendment to Articles of Incorporation dated January 27, 1984. (1) |

| 3.1.6 | Amendment to Articles of Incorporation dated January 27, 1986. (1) |

| 3.1.7 | Articles of Amendment to Articles of Incorporation dated June 28, 1996. (1) |

| 3.1.8 | Articles of Amendment to Articles of Incorporation dated July 31, 2000. (2) |

| 3.2 | Bylaws. (1) |

| 4.2 | Certificate of Designation of Series A Preferred Stock. (1) |

| 4.10 | Certificate of Designation of Series B Preferred Stock. (1) |

| 4.4 | Certificate of Designation of Series C Preferred Stock of Warrant to Burnham Securities Inc. (1) |

| 4.5 | Certificate of Designation of Series D Preferred Stock. (1) |

| 10.1 | Form of Stock Option to Employees. (1) |

| 10.2 | Form of agreement with holders of Series A Preferred Stock. (1) |

|

10.3

|

Assignment Agreement of the Promissory Note between the Company, International Microcomputer Software, Inc. and Mag-Multi Corporation dated as of February 3, 2005. (3) |

| 10.4 | Amendment No.2 to the Promissory Note in favor of Mag-Multi dated June 5, 2005. (3) |

| 10.5 | Code of Ethics. (4) |

| 10.6 | Amendment No. 3 to the Promissory Note in favor of Mag-Multi dated December 14, 2005. (5) |

| 10.7 | Amendment No. 4 to the Promissory Note in favor of Mag-Multi dated May 31, 2006. (5) |

| 10.8 | Amendment No. 5 to the Promissory Note in favor of Mag-Multi dated May 30, 2007. (5) |

|

10.9

|

Form of Conversion Agreement and General Release dated April 30, 2013, between Digital Creative Development Corporation and Goren Bros, LP. (6) |

| 10.10 | Form of Conversion Agreement and General Release dated April 30, 2013, between Digital Creative Development Corporation and GCM Administrative Services. (6) |

| 10.11 | Form of Conversion Agreement and General Release dated April 30, 2013, between Digital Creative Development Corporation and Lieyrissjodurinn Hlif. (6) |

|

10.12

|

Form of Conversion Agreement and General Release dated April 30, 2013, between Digital Creative Development Corporation and Mag-Multi Corporation. (6) |

| 21 | List of Subsidiaries. (2) |

| 31.1 | Certifications Pursuant to Rule 13(a)-14(a)/15(d)-14(a). (7) |

| 31.2 | Certifications Pursuant to Rule 13(a)-14(a)/15(d)-14(a). (7) |

| 32.1 | Section 1350 Certifications. (7) |

| 32.2 | Section 1350 Certifications. (7) |

| (1) | Previously Filed with Form 10-SB Declared Effective on August 12, 1997. |

| (2) | Previously filed with Form 10-KSB for the fiscal year ended June 30, 2000. |

| (3) | Previously filed with Form 10-KSB for the fiscal year ended June 30, 2002. |

| (4) | Previously filed with Form 10-KSB for the fiscal year ended June 30, 2004. |

| (5) | Previously filed with Form 10-KSB for the fiscal year ended June 30, 2005. |

| (6) | Previously filed with Form 10-K for the fiscal year ended June 30, 2013. |

| (7) | Filed herewith. |

| -17- |

TUMBLEWEED HOLDINGS, INC.

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

| Report of Independent Registered Public Accounting Firm | F-1 |

| Consolidated Balance Sheets | F-2 |

| Consolidated Statements of Operations and Comprehensive Income (Loss) | F-3 |

| Consolidated Statements of Stockholders’ Equity (Deficit) | F-4 |

| Consolidated Statements of Cash Flows | F-5 |

| Notes to Consolidated Financial Statements | F-6 - F11 |

| -18- |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Stockholders Tumbleweed Holdings, Inc. and Subsidiary

We have audited the accompanying consolidated balance sheets of Tumbleweed Holdings, Inc. and Subsidiary as of June 30, 2014 and 2013, and the related consolidated statements of operations and comprehensive income (loss), stockholders’ equity (deficit) and cash flows for the years then ended. The consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were to engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for determining audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Tumbleweed Holdings, Inc. and Subsidiary as of June 30, 2014 and 2013, and the result of their operations and their cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has recurring losses from operations and a negative cash flow from operating activities¬ that raise substantial doubt about the Company’s ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

| October 13, 2014 | Tumbleweed Holdings, Inc. | ||

| By: /s/ Rosen Seymour Shapss Martin & Company LLP | |||

| Rosen Seymour Shapss Martin & Company LLP | |||

| Certified Public Accountants |

F-1

F-2

F-3

F-4

F-5

TUMBLEWEED HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2014 and 2013

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

PRINCIPLES OF CONSOLIDATION

The consolidated financial statements include the accounts of Tumbleweed Holdings, Inc. and its wholly owned subsidiary, (collectively the "Company"), Digital Creative Development Corporation (Delaware). All significant inter-company accounts and transactions have been eliminated in consolidation.

ORGANIZATION

Tumbleweed Holdings, Inc. (the "Company") was originally founded in 1969 as Arthur Treacher's Fish & Chips, Inc., a Delaware corporation. Since then, the Company has purchased several businesses and has changed its corporate identity by merging into other corporate entities.

The Company sold its interest in Arthur Treacher's Fish & Chips, Inc. in 2002 and currently has no active business. In 2001 and 2002, the Company acquired a controlling interest in International Microcomputer Software, Inc. ("IMSI"), (n/k/a Broadcaster, Inc. (“Broadcaster”) which had been a developer and publisher of productivity software in precision design, graphics design and other related business applications, as well as graphics and CAD (Computer Aided Design) software and internet technology. On June 2, 2006, Broadcaster closed on its acquisition of AccessMedia Networks, Inc. Broadcaster operated an Internet entertainment network under the name Broadcaster. Since its original investment, the Company's ownership interest in Broadcaster has decreased to approximately 8% as of September 25, 2014. During the fourth quarter of fiscal 2014, the Company changed its name to Tumbleweed Holdings, Inc. and disclosed that it is reviewing potential corporate transactions in the legalized cannabis market and within the broader agro-technology sector.

STOCK-BASED COMPENSATION

The Company measures for stock-based compensation using a fair value based method, whereby the grant date fair value of the share-based awards is charged to expenses over their vesting period.

USE OF ESTIMATES

The preparation of financial statements in conformity with generally accepted accounting principles in the United States (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant estimates include the allowance for impairment of investment assets and the valuation allowance against deferred tax assets.

INVESTMENTS

Investments in marketable securities are carried at fair market value and classified as available for sale. Investments in nonmarketable debt securities are carried at cost or fair value as determined by management.

During the year ended June 30, 2012, the Company valued the securities down to $0 but believed the decrease to be temporary and recorded an unrealized loss in other comprehensive income. In fiscal 2013, the Company deemed the decrease to be other than temporary and recognized the loss by reclassifying the other comprehensive loss to the statement of operations.

INCOME TAXES

The Company utilizes the asset and liability method of accounting for income taxes. Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. In addition, the method requires the recognition of future tax benefits, such as net operating loss carry forwards, to the extent that realization of such benefits is more likely than not. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

F-6

TUMBLEWEED HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2014 and 2013

PER SHARE DATA

Net income or loss per share of common stock is computed based upon the weighted-average number of common shares and potential common shares outstanding during the year.

2. DOUBT AS TO CONTINUING AS A GOING CONCERN

Our consolidated financial statements were prepared on the assumption that we will continue as a going concern. We currently have working capital and equity of $101,000. Our ability to obtain resources sufficient to continue to meet our obligations as they come due is dependent on raising cash through issuance of additional equity or borrowings. We intend to use our cash as well as other funds in the event that they shall be available on commercially reasonable terms, to finance our activities, although we can provide no assurance that these additional funds will be available in the amounts or at the times we may require.

The Company is dependent upon the receipt of capital investment or other financing to fund its ongoing operations and to execute its business plan of seeking a combination with a private operating company. If continued funding and capital resources are unavailable at reasonable terms, the Company may not be able to implement its plan of operations. The failure by us to obtain such financing whether on acceptable terms or at all, if needed, would have a material adverse effect upon our business, financial condition and results of operations.

3. INVESTMENTS IN MARKETABLE SECURITIES AND NONMARKETABLE SECURITIES

The Company had investments and advances in certain marketable and non-marketable securities at June 30, 2014 and 2013, as follows:

| 2014 | 2013 | |||||||

| Broadcaster, Inc. at cost | $ | 2,723.0 | $ | 2,723.0 | ||||

| Realized losses on marketable securities | (2,723.0 | ) | (2,723.0 | ) | ||||