Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Cytosorbents Corp | v394161_8k.htm |

Exhibit 99.1

Cyto Sorbents Corporation OTCQB : CTSO An Emerging Leader in Critical Care Immunotherapy Q3 2014 Review – November 12, 2014

Safe Harbor Statement Statements in this presentation regarding CytoSorbents Corporation and its operating subsidiaries CytoSorbents, Inc (now known as CytoSorbents Medical Inc) and CytoSorbents Europe GmbH that are not historical facts are forward - looking statements and are subject to risks and uncertainties that could cause actual future events or results to differ materially from such statements . Any such forward - looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 . It is routine for our internal projections and expectations to change . Although these expectations may change, we are under no obligation to inform you if they do . Actual events or results may differ materially from those contained in the projections or forward - looking statements . The following factors, among others, could cause our actual results to differ materially from those described in a forward - looking statement : our history of losses ; potential fluctuations in our quarterly and annual results ; competition, inability to achieve regulatory approval for our device, technology systems beyond our control and technology - related defects that could affect the companies’ products or reputation ; risks related to adverse business conditions ; our dependence on key employees ; competition for qualified personnel ; the possible unavailability of financing as and if needed ; and risks related to protecting our intellectual property rights or potential infringement of the intellectual property rights of third parties . This list is intended to identify only certain of the principal factors that could cause actual results to differ from those discussed in the forward - looking statements . Readers are referred to a discussion of important risk factors detailed in the Company’s Form 10 - K filed with the Securities and Exchange Commission on March 31 , 2014 and other reports and documents filed from time to time by us, which are available online at www . sec . gov .

3 Conference Call Participants Dr . Phillip Chan, MD, PhD Chief Executive Officer and President Vincent Capponi, MS Chief Operating Officer Kathleen Bloch, MBA, CPA Chief Financial Officer Dr . Christian Steiner, MD Vice President of Sales and Marketing Christopher Cramer, MS, MBA Vice President of Business Development Moderator: Amy Vogel – CytoSorbents Corporation

4 Cyto Sorbents is an Emerging Leader in the $20B Critical Care Immunotherapy Space Leading the Prevention or Treatment of Life - Threatening Inflammation in the ICU

5 Inflammation Plays a Major Role in Nearly Every Known Disease • Life threatening conditions like sepsis & trauma • Autoimmune diseases like rheumatoid arthritis, inflammatory bowel, psoriasis, and lupus • Heart disease, peripheral artery disease • Cancer, cancer cachexia, graft vs host disease • Neurodegenerative diseases such as Alzheimer’s, multiple sclerosis (MS), Parkinson’s • Many others Uncontrolled inflammation wreaks havoc on the body and can be deadly

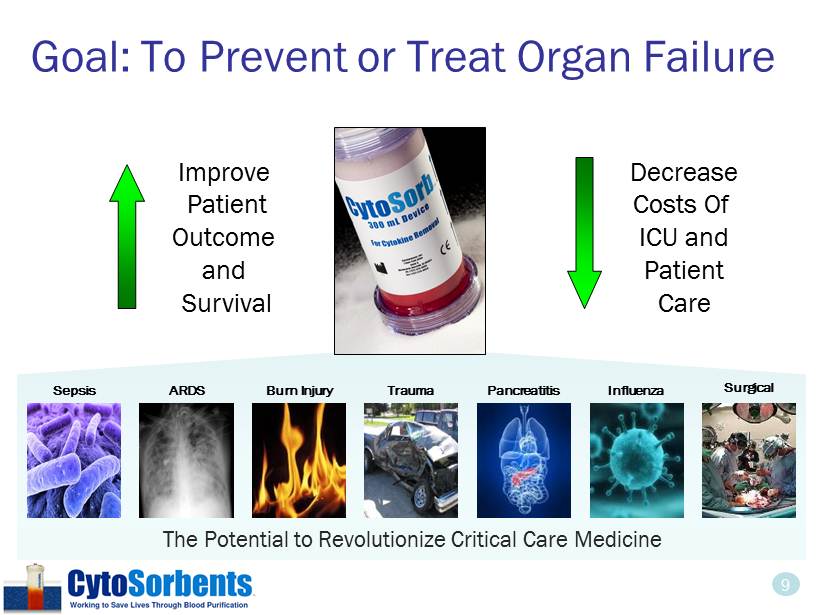

6 Severe Inflammation Drives Organ Failure Organ failure occurs when vital organs stop working, causing nearly half of all deaths in the ICU, but little can be done to treat or prevent it today

7 Cyto Sorb ® Removes the Fuel to the Fire • CytoSorb ® represents a powerful immunotherapy to control inflammation • Approved in the European Union as the only specifically approved extracorporeal cytokine filter • Clinically proven to reduce key cytokines in blood in critically - ill patients • Approved for use in any situation where cytokines are elevated • Safe: More than 3,500 human treatments, with no serious device related adverse events reported

8 The Heart of the Technology The underlying blood purification technology is based on state - of - the - art biocompatible, highly porous polymer beads that act like tiny sponges to remove harmful substances from blood • Protected by 32 issued US patents and multiple applications pending • Manufactured at our ISO 13485 certified facility in New Jersey • One of the highest grade medical sorbents on the medical market today . Each bead is about the size of a grain of salt

9 Goal: To Prevent or Treat Organ Failure Sepsis ARDS Burn Injury Trauma Pancreatitis Influenza Surgical The Potential to Revolutionize Critical Care Medicine Improve Patient Outcome and Survival Decrease Costs Of ICU and Patient Care

10 Available for sale in all 28 countries in the EU. Sold direct in Germany, Austria, and Switzerland. Established distribution in the UK, Ireland, Netherlands, Turkey, Russia, India, Taiwan, and Middle East covering ~1.7 billion lives. Expanding to other EU countries and countries outside the EU that accept the CE Mark WMC Intensiv Med LLC Taiwan Cyto Sorb ® Marketed in 19 Countries We have now achieved registration of CytoSorb in Saudi Arabia and now await formal SFDA approval

11 • US Dept of Health and Human Services awarded $0.5M grant (2010) for therapies that can save lives and reduce costs under the QTDP Program • NIH grant awarded $7M five year (2006 - 2010) to University of Pittsburgh and Dr. John Kellum to research CytoSorb bead for treatment of sepsis • NIH/NHLBI awarded $0.2M Phase I SBIR to advance the HemoDefend purification technology intended to improve the quality and safety of blood transfusions (2013 - present) $15+ Million in US Government Support • DARPA awarded $3.8M five year (2012 - present) contract as part of “Dialysis - Like Therapeutics” program to treat sepsis by removing cytokines and pathogen - derived toxins • U.S. Army awarded $1.15M SBIR contracts for trauma and burn injury research (2011 - present) • U.S. Air Force is funding a 30 - patient human pilot study in trauma valued at $3M (2013 - present). FDA approved trial that has begun enrollment

12 Winner of the GREAT Tech Awards In October, CytoSorbents was awarded the UK GREAT Tech Awards for Health, sponsored by the United Kingdom Trade & Investment and the British Consulate in New York. GREAT Tech Awards selected one winner from one of 6 categories from a pool of m ore than 130 high growth companies from New York, New Jersey, Pennsylvania, and Connecticut CytoSorbents was recognized for its innovative and potentially revolutionary blood purification technology, CytoSorb ® , that may saves lives and reduce the high costs of ICU care. As part of the award, the company will receive assistance, access, and resources to expand into the U.K. further with its distributor LINC Medical. The UK is the third largest medical device market in the E.U.

13 Launched International CytoSorb Registry • Available now in both English and German and is active with registrants

14 Established World Class U.S. Cardiac Surgery Advisory Board Dr. Joe Zwischenberger, M.D. - SAB Chair University of Kentucky Dr. Robert Bartlett, M.D. University of Michigan Dr. Paul Checchia, M.D. Texas Children’s Hospital in Houston Dr. Jonathan William Haft, M.D. University of Michigan Dr. Nicholas Smedira, M.D. Cleveland Clinic Foundation Dr. Craig Smith, M.D. Columbia University Dr. Peter Wearden, M.D., Ph.D. University of Pittsburgh Medical Center Intra - operative cardiac surgery protocol reviewed by SAB, IDE submission planned by end of 2014

15 Expansion of Biocon Partnership • According to Biocon , hundreds of patients have benefited from CytoSorb ® therapy and orders continue to increase • Expanded agreement beyond sepsis to all critical care applications and cardiac surgery with a focus on the systemic inflammatory response syndrome (SIRS) in India and select emerging countries • Negotiated a co - development agreement where Biocon has committed to conduct and publish results from multiple Investigator Initiated studies and patient case studies • Biocon will continue to market CytoSorb ® with their critical care antibiotics as the “most comprehensive treatment” of sepsis • Biocon has also agreed to an increase in annual minimum sales targets which should result in significantly increased sales over the life of the agreement

16 Cardiac Surgery Initial Partnership • CytoSorbents announced that following significant due diligence, it has entered into an initial partnership with a top - four global medical device company in cardiac surgery and other cardiovascular diseases, to use CytoSorb ® intra - operatively during cardiac surgery in France • The partnership has already begun and is expected to continue over a total 6 - month evaluation period to determine various market parameters, to obtain clinical data and to build KOL support in France • Following a successful evaluation, the two parties plan to jointly determine how to expand upon both the size and geographic footprint of its partnership • France is the second largest medical device market and one of the highest volume cardiac surgery markets in the EU • Medtronic, Sorin , Maquet and Terumo are top firms in the cardiac surgery space worldwide

17 Ebola, HemoDefend, Study Updates Ebola • CytoSorb ® is currently in 5 of 7 major hospitals in Germany that are prepared to accept Ebola patients. Have had communications with WHO, CDC, FDA, NIAID, USAMRIID, treatment hospitals in the US, and others. Ebola patients have undergone dialysis, a critical proof - of - concept for CytoSorb ® usage. CytoSorb ® has not been used to treat Ebola to date HemoDefend • Data from the RECESS trial giving ≤10 day old blood vs ≥21 day blood to patients undergoing complex cardiac surgery showed that the age of blood had no statistically significant impact on progression to organ dysfunction or death • Although not what we expected to see, we do not believe this diminishes the potential value of HemoDefend to improve the quality and safety of blood by removing contaminants that can cause transfusion reactions • We await subgroup analysis (e.g. those receiving more units of blood than average, different surgeries, etc ), the breakdown of the very high serious adverse event rate (~50%), and also await the results from the ABLE trial, giving “fresh” vs “standard issue” blood to critically - ill patients, likely released at ASH or SCCM. We continue HemoDefend development Cardiac Surgery Investigator Initiated Studies • Multiple studies at Hamburg, Vienna, Cologne are ongoing, some of which are expected to be completed in the next several months

18 Q3 2014 Operating and Financial Highlights

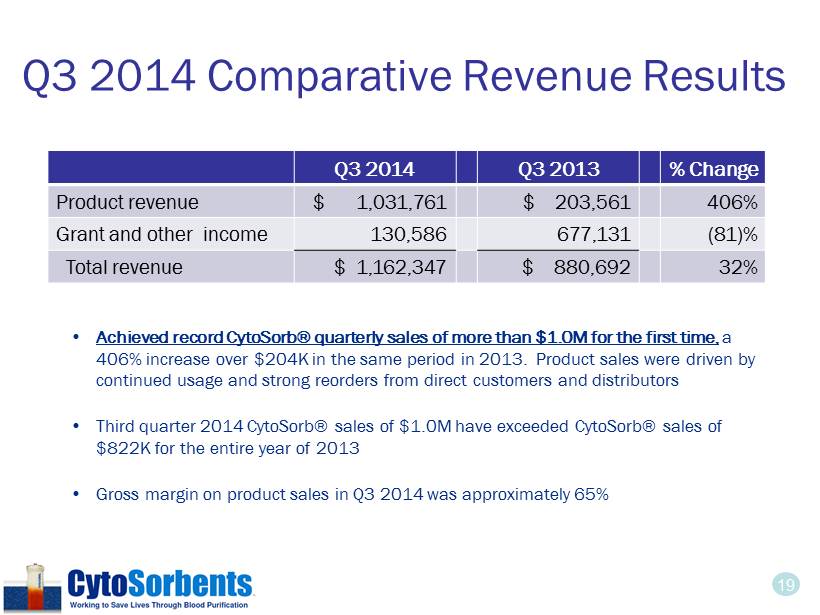

19 Q3 2014 Comparative Revenue Results • Achieved record CytoSorb® quarterly sales of more than $1.0M for the first time, a 406% increase over $204K in the same period in 2013. Product sales were driven by continued usage and strong reorders from direct customers and distributors • Third quarter 2014 CytoSorb® sales of $1.0M have exceeded CytoSorb® sales of $822K for the entire year of 2013 • Gross margin on product sales in Q3 2014 was approximately 65% Q3 2014 Q3 2013 % Change Product revenue $ 1,031 ,761 $ 203,561 406% Grant and other income 130,586 677,131 (81)% Total revenue $ 1,162,347 $ 880,692 32%

20 Nine Months Comparative Revenue • Total nine month revenue (ended 9/30/14) was ~$3.2M, a 111% increase over $1.5M in total revenue for the same period in 2013 • CytoSorb ® product sales fueled the increase in total revenues, with $2.3M in sales in the first nine months of 2014, a 346% increase from $508K in CytoSorb ® revenue in the first nine months of 2013 • Grant income for the nine months of 2014 was approximately $985K, a slight decrease as compared to grant income of approximately $1.0M for the first nine months of 2013 • Product gross margins were approximately 66% Nine Months Ended 9/30/14 Nine Months Ended 9/30/13 % Change Product revenue $ 2,264 ,237 $ 507,628 346% Grant and other income 984,937 1,035,877 (5)% Total revenue $ 3,249,174 $ 1,543,505 111%

21 Continuing Strong Product Growth $13,679 $87,960 $176,098 $127,969 $203,561 $314,159 $569,243 $663,233 $1,031,761 $0 $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 CytoSorb ® Product Sales 21 Q3 2014 is the fifth consecutive quarter of double digit quarter over quarter growth

22 Product Sales (TTM) $151,574 $310,779 $405,706 $595,588 $821,787 $1,214,932 $1,750,196 $2,578,396 $- $500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 $3,000,000 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Trailing Twelve Month Product Sales Trend Line Trailing 12 - month CytoSorb sales are $2.6M

23 Update on Up - listing to the NASDAQ Capital Market

24 Potential Benefits of Up - listing • Increased visibility • We believe most institutional investors would no longer be restricted from owning our shares • We believe there our analyst coverage and news releases will be more impactful • Increased liquidity for investors • Average daily trading volume increased by 3X in the three months following a NASDAQ national market up - listing * • Median stock appreciation of 2013 Up - listed NASDAQ companies was 69% in 2013 * Median stock appreciation of 2014 Up - listed NASDAQ companies was 15% in 2014 * • Much easier transfer of stock certificates to brokers • Increased credibility • Amongst investors, strategic partners, journalists, customers • Rigorous governance standards, SEC reporting and Sarbanes Oxley compliance • Eliminate the perceived stigma of being a “penny stock” • Potential for lower cost of capital and less shareholder dilution • More options to raise capital at attractive rates * Source: NASDAQ. These are based on historical data. Past results do not predict future performance. We cannot predict the performance of our stock post - split or post up - listing. We can provide no assurances that our application for listing to the NASDAQ Capital Market will be accepted.

25 NASDAQ Volume and Price Data

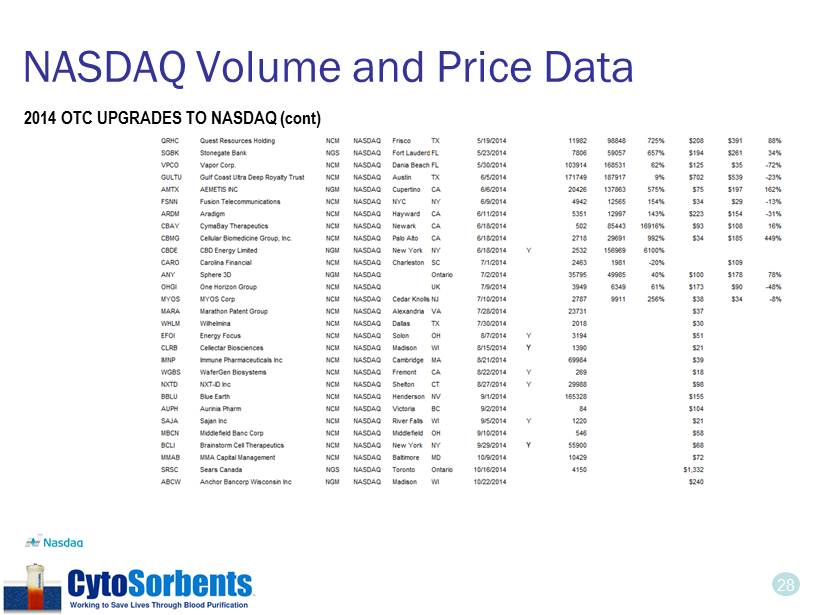

26 NASDAQ Volume and Price Data According to NASDAQ, the median stock appreciation for all 2013 OTC Upgrades was 69% in 2013 2013 OTC UPGRADES TO NASDAQ

27 NASDAQ Volume and Price Data 2014 OTC UPGRADES TO NASDAQ According to NASDAQ, the median stock appreciation for all 2014 OTC upgrades was 15% through October 17, 2014 2013 OTC UPGRADES TO NASDAQ (cont)

28 NASDAQ Volume and Price Data 2014 OTC UPGRADES TO NASDAQ (cont)

29 Why Up - list Now? CytoSorbents is an evolving company, whose fundamentals continue to improve. We believe our profile compares favorably to other recent up - listed healthcare companies • CytoSorb ® is approved in the EU, with direct sales and distribution in 19 countries worldwide • Massive multi - billion dollar market opportunity addressing major unmet medical need • Strong growth with total revenues ( ttm ) of $4.1M, of which $2.6M are CytoSorb ® sales • 5 quarters of double digit increases in CytoSorb® sales and first $1M sales quarter in Q3 ‘14 • Solid product gross margins of 65% and cash and short term investments of $7.8M • 45 employees across the US corporation and subsidiary in Berlin, Germany • Vertically integrated, ISO 13485 certified medical device manufacturer • Strategic partnership with Biocon in India and select emerging countries and initial partnership with major cardiac surgery device company in France • 40 + investigator initiated studies being planned with many enrolling, 150+ KOLs • US Cardiac surgery pivotal trial IDE application to be filed soon, trauma trial enrolling • $15M in technology validation by DARPA, US Army, US Air Force, NHLBI, NIH • World class trauma, cardiac surgery, and sepsis advisory boards • Analyst coverage by Brean Capital, H.C. Wainwright, Merriman Capital, and Zacks Our major goal was to have the fundamentals and progress in place to warrant and maintain NASDAQ listing and to be able to attract institutional investors

30 The Path to Up - listing Completed: x Met with NYSE and NASDAQ and evaluated listing requirements x Transitioned to DLA Piper as SEC and corporate counsel to guide up - list process x Adopted Code of Business Conduct and Ethics, updated Insider Trading Policy, clean - up of internal documentation, and formation of NASDAQ compliant committees of the BOD x Strengthen system of internal controls & formation of independent audit committee x Simplification of our capital structure with conversion of Series A and B preferred x Proxy sent to shareholders for consent to various corporate actions needed including reverse split and conversion to Delaware C - corp x Cultivate analyst coverage ( Brean , HCW, Merriman, Zacks ) x Significant operating progress led by increasing CytoSorb ® sales x Application filed with NASDAQ In Process: □ D ocumentation and testing of system of internal controls by third party □ Continued institutional investor outreach

31 After the Up - list We have several goals post up - listing: • Continue to drive growth in CytoSorb ® sales • Continue to build key opinion leader support • Drive deep into accounts, expand to multiple indications in multiple ICUs within each hospital • Geographic expansion with new distributors and strategic partners • Drive country by country product registrations • Invest in the support infrastructure of both direct and distributor sales • Continue to pursue strategic partnerships for CytoSorb and for our pipeline • Prioritize clinical data with build - out of clinical trial capability, start of a US pivotal cardiac surgery trial, data from investigator initiated studies, US Air Force funded Trauma Pilot and other funded studies, CytoSorb registry • Continue to aggressively “spread the word” on CytoSorbents via meetings with institutional investors, additional analyst coverage, and an upgraded PR strategy • Aggressive research grant program and new product development

32 Consent Solicitation You have been sent a consent solicitation statement seeking your approval of five proposals needed to up - list. Your vote is required before December 1, 2014. 1. A 25 to 1 reverse split of our Common Stock 2. To reduce authorized common stock from 800,000,000 to 50,000,000 shares 3. To reduce authorized preferred stock from 100,000,000 to 5,000,000 shares 4. To approve the 2014 Long - Term Incentive Plan 5. To change the domicile of the Company from the State of Nevada to the State of Delaware

33 Share Structure Explained There is considerable misperception on the effect of decreasing the authorized common stock share count from 800 million to 50 million shares Definitions: 1) Total authorized shares - T he total number of shares authorized (voted for) by shareholders that a company can issue and sell. All companies have an authorized share number 2) Total outstanding shares - The total number of issued and outstanding shares after giving effect to the reverse split held by shareholders, which now also includes common shares from the conversion of the Series A and B preferred shares. These are often reflected in the stock float, or shares that are available for trading 3) Fully - diluted share count - Includes the total outstanding shares plus shares underlying outstanding warrants, options, etc . 4) Authorized, but unissued shares – These shares are currently authorized by shareholders, but are currently not issued or otherwise allocated. They can be issued and sold by the Company to raise needed capital to grow the business, to run clinical studies, to expand manufacturing, or for general working capital, or can be used to attract or retain key talent that is necessary for the success of the company. Without available shares, companies cannot raise capital, and run the risk of bankruptcy or illiquidity, to the peril of all shareholders Management believes that a strategy of careful investment to drive growth, while limiting shareholder dilution, is the correct strategy to pursue now to enhance the return on investment to all shareholders

34 FAQ on Authorized Shares After giving effect to a 25 to 1 reverse split, our capital structure will approximately look as follows: Shares Outstanding ~23 million Warrants, Options, others ~4 million* Authorized but unissued shares ~23 million Total Authorized shares 50 million NOTE: The reverse split does not automatically decrease the authorized share count. We are therefore reducing the number of shares that the company can issue to 50 million. Otherwise the Company would have had the ability to issue up to 700 million shares on a post - reverse split basis. Setting the authorized share count to 50 million does NOT mean that shareholders incur immediate dilution. If we never issue or sell, or only issue or sell part of the authorized but unissued shares, shareholders will not incur, or only partially incur, dilution of their ownership. However, the authorized but unissued shares gives the company the flexibility to fund and grow the business that would benefit all shareholders If we do sell authorized but unissued shares to raise capital, the fully diluted share count would increase and shareholders would incur a proportional level of dilution. However, this dilution is offset, in part, by the increase in net value of the company through the cash raised and hopefully by the growth achieved by the infusion of new capital Fully Diluted Share Count * Does not include 2.4 million of unallocated shares under the 2014 Option Plan, assuming stockholder approval

35 Frequently Asked Questions on Reverse Split Why do we need a reverse split? • To meet the minimum $4 per share price requirement to be a NASDAQ Capital Markets company • To make the total number of shares in the company a manageable and practical number that is acceptable to institutional investors Why is the reverse split ratio 25 to 1? • The ratio is arbitrary but was selected because it achieved the goals above • T he size of the ratio does not change your % ownership or share value, and is not dilutive Would waiting until we are further along be better? • As we have stated, there are many benefits of up - listing that we cannot access in any other way. We believe that we are ready and that any delay to up - listing is counter - productive to the short and long - term goals of the company and is a disservice to our shareholders • There is a lack of purchase power in the current shareholder base. This can be witnessed by the muted effect of positive new releases, and the drifting average daily trading volume • Up - listing is intended to bring in new, long - term institutional shareholders with deep pockets who can potentially take large positions in our stock and in doing so, potentially shift the supply - demand curve of our stock

36 Frequently Asked Questions on Reverse Split Is a Reverse Split a Good Thing or Bad Thing? • It depends on why the reverse split is being done. Consider these scenarios: • Company “X” fundamentals are deteriorating with a drop in the stock price. In order to maintain a national exchange listing, they need to meet the minimum share price requirement and enact a reverse split. In many cases, this is generally unsuccessful, as the stock price continues to deteriorate as the business deteriorates • Company “Y” has stagnant growth and fundamentals but wants a higher share price because of the stigma of being a penny stock. It does a reverse split solely for the purpose of increasing the share price • Company “C” is growing rapidly and seeks to up - list to the NASDAQ Capital Markets to target a significantly larger investor base that includes institutional investors. The fundamentals of this company are increasing, and the goal of the up - listing is to improve visibility, credibility, liquidity, reduce the cost of capital, and increase interest in the company and its stock. We believe CytoSorbents is an example of Company “C”. Although there can be no guarantees about post - split stock performance, NASDAQ has summarized their historical data as follows: The median stock appreciation for all 2013 OTC Upgrades was 69% in 2013. The median stock appreciation for all 2014 OTC upgrades was 15% in 2014 .

37 Frequently Asked Questions on Reverse Split Where did the rest of my shares go ? Have I been diluted by 25X? Have I been cheated? • No. No ownership percentage was taken from you. No dilution has been incurred solely by the reverse split • Think of your ownership as a percentage ownership of the company rather than in share numbers • Below is a simple example of how a reverse or forward split affects a shareholder’s ownership and value of his/her shares. This is only an illustrative example, but in principle is similar to the reverse split we are proposing. There is NO change in % ownership of value of your shares. Scenario Ratio of split Your Shares Price per share Fully diluted Shares % Ownership Value Pre - split None 100,000 $0.25 10,000,000 1.0% $25,000 Reverse Split 25 to 1 4,000 $6.25 400,000 1.0% $25,000 10 to 1 10,000 $2.50 1,000,000 1.0% $25,000 5 to 1 20,000 $1.25 2,000,000 1.0% $25,000 Forward Split 1 to 5 500,000 $0.05 50,000,000 1.0% $25,000 1 to 10 1,000,000 $0.025 100,000,000 1.0% $25,000 1 to 25 2,500,000 $0.0125 250,000,000 1.0% $25,000

38 Frequently Asked Questions on Reverse Split Wouldn’t I make more money if the reverse split were at a lower ratio and I had more shares? • Just as with your other stock holdings, you must look at the % increase in the share price, not the absolute dollar increase. There is no difference with a lower RS ratio Scenario Ratio of split Your Shares Price per share (PPS) % Owner Ship Value % Stock Increase New PPS % Ownership Value Fully diluted Shares Pre - split None 100,000 $0.25 1.0% $25,000 50% $0.375 1.0% $37,500 10,000,000 Reverse Split 25 to 1 4,000 $6.25 1.0% $25,000 50% $9.375 1.0% $37,500 400,000 10 to 1 10,000 $2.50 1.0% $25,000 50% $3.75 1.0% $37,500 1,000,000 5 to 1 20,000 $1.25 1.0% $25,000 50% $1.875 1.0% $37,500 2,000,000 Pre - split None 100,000 $0.25 1.0% $25,000 300% $0.75 1.0% $75,000 10,000,000 Reverse Split 1 to 25 4,000 $6.25 1.0% $25,000 300% $18.75 1.0% $75,000 400,000 1 to 10 10,000 $2.50 1.0% $25,000 300% $7.50 1.0% $75,000 1,000,000 1 to 5 20,000 $1.25 1.0% $25,000 300% $3.75 1.0% $75,000 2,000,000

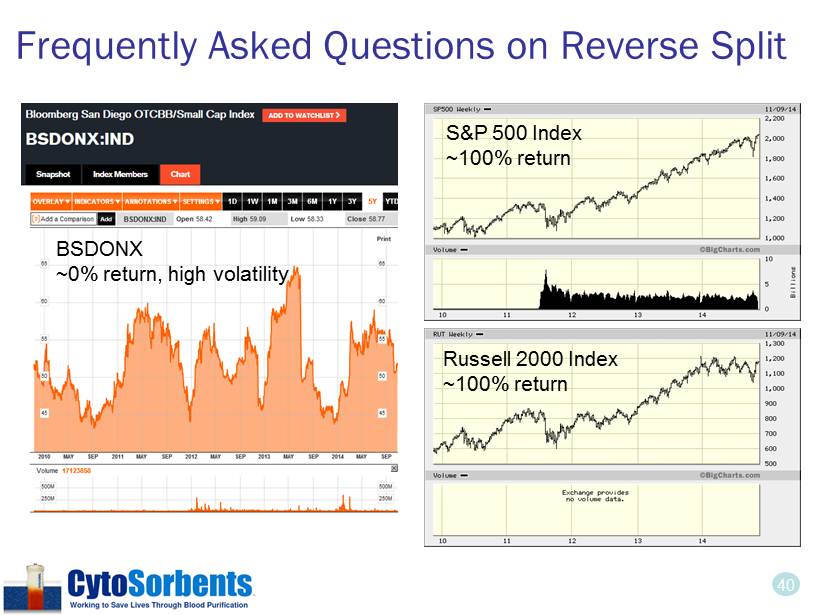

39 Frequently Asked Questions on Reverse Split Isn’t it easier for a $0.25 stock to go to $1 (four - fold) on the OTCQB than a $6.25 stock to go to $25 (four - fold) on the NASDAQ? • The stock price of any company is simply a matter of supply and demand. If supply exceeds demand, then the stock price will fall. If demand exceeds supply, then the stock price will rise. • We believe that making the stock available to a vast pool of investment capital held by institutional investors that cannot buy our stock today on the OTCQB, combined with good news can improve demand for our stock • Although it is true that low float penny stocks have been known to be very volatile and can increase by significant percentages, these are often not sustainable increases in market cap value. For investors, this can be fraught with danger, depending when the stock is bought and sold • Although no guarantee can be made about post - split or post - up - listing performance, our goal with up - listing is to build increased liquidity and a sustainable increase in share price that would benefit all shareholders. You are encouraged to read the consent solicitation statement for more details.

40 Frequently Asked Questions on Reverse Split S&P 500 Index ~100% return Russell 2000 Index ~100% return BSDONX ~0% return, high volatility

41 Consent Solicitation We again recommend that you review the consent solicitation statement and vote in favor of the following 5 proposals before December 1, 2014. This is a key step towards up - listing to NASDAQ. 1. A 25 to 1 reverse split of our Common Stock 2. To reduce authorized common stock from 800,000,000 to 50,000,000 shares 3. To reduce authorized preferred stock from 100,000,000 to 5,000,000 shares 4. To approve the 2014 Long - Term Incentive Plan 5. To change the domicile of the Company from the State of Nevada to the State of Delaware

42 Dedicated to our Co - Founder and Board Director Joseph Rubin (1938 - 2014)

43 Phillip P. Chan, MD, PhD - CEO 7 Deer Park Drive, Suite K Monmouth Junction, NJ 08852 pchan@cytosorbents.com Cyto Sorbents Corporation OTCBB: CTSO The Rise of An Emerging Critical Care Immunotherapy Company Q&A Session