Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - RCS Capital Corp | v394220_ex99-1.htm |

| 8-K - FORM 8-K - RCS Capital Corp | v394220_8k.htm |

Exhibit 99.2

American Realty Capital 1 November 2014 Pro Forma Third Quarter 2014 Financial & Operating Results 2:15AM ET 11/13/14

2 2 Forward - Looking Statements Certain statements made in this presentation are forward - looking statements . Those statements include statements regarding the intent, belief or current expectations of RCS Capital Corporation (“us,” “our,” “RCAP ” or the “Company”) and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions . Actual results may differ materially from those contemplated by such forward - looking statements . Further, forward - looking statements speak only as of the date they are made, and we undertake no obligation to update or revise forward - looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law . The following are some of the possible risks and uncertainties, although not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward - looking statements : the impact on our business of the events relating to the American Realty Capital Properties, Inc . announcement concerning errors in its financial statements our ability to integrate our recently acquired businesses into our existing businesses ; our ability to complete our pending acquisitions on the anticipated terms, in the anticipated timeframes or at all ; whether and when we will be able to realize the anticipated benefits from our recent and pending acquisitions ; significant dilution could result from future issuances of our Class A common stock ; future sales of our Class A common stock could lower the market price of our Class A common stock ; adverse developments in the direct investment program industry ; deterioration in the business environment in the specific sectors of the economy in which we focus or a decline in the market for securities of companies within these sectors ; substantial fluctuations in our financial results ; our ability to retain our senior professionals and key management personnel of our recently acquired businesses ; pricing and other competitive pressures ; changes in laws and regulations and industry practices that adversely affect our business ; incurrence of losses in the future ; competition from larger firms ; limitations on our access to capital ; malfunctioning or failure in our operations and infrastructure ; failure to achieve and maintain effective internal controls ; and the factors included in our most recent Annual Report on Form 10 - K and any subsequent Quarterly Reports on Form 10 - Q or Current Reports on Form 8 - K .

3 2 Disclaimer This presentation includes estimated projections of 2014 and 2015 operating results . These projections were not prepared in accordance with published guidelines of the SEC or the guidelines established by the American Institute of Certified Public Accountants for preparation and presentation of financial projections . This information is not fact and should not be relied upon as being necessarily indicative of future results ; the projections were prepared in good faith by management and are based on numerous assumptions that may prove to be wrong . Important factors that may affect actual results and cause the projections to not be achieved include, but are not limited to, risks and uncertainties relating to the company and other factors described under “Risk Factors” section of the Company’s Annual Report on Form 10 - K and any subsequent Quarterly Reports on Form 10 - Q or Current Reports on Form 8 - K and “Forward - Looking Statements . ” The projections also reflect assumptions as to certain business decisions that are subject to change . As a result, actual results may differ materially from those contained in the estimates . Accordingly, there can be no assurance that the estimates will be realized . This presentation also contains estimates and information concerning our industry, including market position, market size, and growth rates of the markets in which we participate, that are based on industry publications and reports . This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates . We have not independently verified the accuracy or completeness of the data contained in these industry publications and reports . The industry in which we operate is subject to a high degree of uncertainty and risk due to variety of factors, including those described in the “Risk Factors” section of the Company’s Annual Report on Form 10 - K and any subsequent Quarterly Reports on Form 10 - Q or Current Reports on Form 8 - K and “Forward Looking Statements” . These and other factors could cause results to differ materially from those expressed in these publications and reports .

4 RCS Capital: Third Quarter 2014 Financial & Operating Highlights (1) Excludes ($27.9) million non - cash revenue loss recognized from embedded derivative fair market value accounting Pro Forma Revenue: Revenue of $725.0 (1) million driven by higher Retail and Investment Management segment performance; 10% year over year growth Adjusted Net Income: Pro forma Adjusted Net Income of $35.5 million or $0.40 per fully diluted share Adjusted EBITDA: Pro forma Adjusted EBITDA of $57.8 million for the third quarter; Increase of 51% year - over - year Retail adjusted EBITDA margin grew 90 basis point sequential 7.4% from 6.5% Assets Under Administration: Assets Under Administration of $212.8 billion; Up 11.3% pro forma from the year - ago period, in - line with the prior quarter Recruitment: 196 financial advisors recruited in Q3, representing $15.2 million in Gross Dealer Concession (“GDC”); Net increase of $6.2 million in GDC; Average GDC from advisors recruited in third quarter 43% higher than average GDC of attrited advisors Solid Advisor Retention: 97.8% annualized advisor retention for the quarter based on trailing 12 - month GDC Advisor Base : 9,139 independent retail financial advisors servicing approximately 2.1 million clients, excluding advisors from announced acquisitions of VSR and Girard; Up 1.5% year over year; Robust recruiting pipeline Synergies: $57 - $65 million revenue synergies and cost savings in place for January 1, 2015; Incremental revenue and expense synergies expected for 2015 Balance Sheet & Cash Position: $315 million of cash and cash equivalents New Management Additions: Strategic Management changes and additions including Bill Dwyer, CEO of Realty Capital Securities; John Grady, Chief Strategy and Risk Officer of RCS Capital; and Sanjay Yodh , EVP of RCS Capital’s Liquid Alternative Investments 2014 Adjusted EBITDA Expectations: Expect $288 to $300 pro forma Adjusted EBITDA for 2014, including annualized impact of $57 to $65 million of operating synergies and $194 million Adjusted EBITDA year - to - date

5 • We have been taking and will continue to take prudent and decisive actions that we believe are in the best interests of RCS Capital’s stakeholders • Terminated definitive agreement to acquire Cole Capital Partners and Cole Capital Advisors • On October, 31, 2014, our audit committee retained independent external counsel to conduct a review in accordance with specified procedures that were determined prudent and appropriate by our audit committee, but that did not include email review. Counsel was assisted by an outside forensic accounting firm. Following counsel’s review as assisted by the outside forensic accounting firm, RCS Capital’s audit committee, board of directors and management team remain confident in the company’s reported historical financials, accounting, and internal controls for each of the three quarters i n the nine - month period ending September 30, 2013 • RCS Capital’s due diligence team has been working closely with the AR Capital Controls, Audit and Oversight committee, or CAO, which consists of executive management from multiple disciplines and departments within AR Capital, to review the financial controls, processes and systems of each product currently distributed by RCS Capital sponsored or advised by AR Capital • Review concluded that financial reporting and controls of the AR Capital - sponsored and advised public, non - listed products distributed on RCS Capital’s platform will file their 10Qs for the third quarter tomorrow with no delays • As we have in the past, we continue to evaluate all appropriate strategic actions to enhance the value of RCS Capital. We do not believe the events of the past two weeks limit our ability to pursue actions that the Board determines are in the best intere sts of the company and maximize long - term shareholder value RCS Capital Corporation Responds to Recent Events Takes Decisive Action

6 • Cetera Financial Group business, which represents 48% YTD pro forma adjusted EBITDA, performing very well • No material impact from recent events, including advisor retention and recruitment • Observed advisor retention 97.8% (1) on annualized basis • Strong recruitment pipeline • Expect 2015 Retail Adjusted EBITDA of $200 to $210 million • $2.3 billion total equity raised for third quarter; $8.2 billion through the end of October (2) • Well positioned to meet the continued long - term demand for alternative investment products with 30 - plus products on our platform, including Hatteras Funds • Anticipate that the majority of the temporarily suspended selling agreements will be reinstated through end of Q4 2014 to Q1 201 5 • Pipeline for investment banking remains strong, and capital markets environment remains favorable • Four deals representing more than $12 billion transaction value anticipated for fourth quarter 2014 and first quarter 2015 Bridging the Valuation Gap Retail Advice Wholesale Business Investment Banking (1) Retention rate based on annualized quarterly attrition by trailing 12 month GDC (excluding current quarter ) (2) Pro forma for Strategic Capital

American Realty Capital Operational Overview 7 2

8 2 Continue to Expand Leading Retail Investor Franchise Synergy Targets On - Track Balance Sheet • $ 57 to $ 65 million revenue synergies and cost savings in place for January 1 , 2015 ; Incremental synergies expected in 2015 • Engaged a leading third - party consulting firm to support management with synergy analysis and the integration of the Company’s broker - dealers • $ 315 million in cash and equivalents • $ 75 million available under lines of credit • Net debt/annualized Adjusted EBITDA less than 1 . 85 x Announced Three Strategic Acquisitions Closed Three Strategic Acquisitions

American Realty Capital Retail Advice 9 2

10 2 (1) Producing Advisors, excludes licensed home office advisors. Excludes VSR and Girard . (2) Reflects assets in internal advisory programs (3) Retention rate based on annualized attrition in the quarter divided by trailing 12 month GDC (excluding current quarter) (4) Trailing 12 - months (5) Represents funds from new accounts and additional funds deposited into existing advisory accounts that are custodied in our fee - based advisory platforms, less account attrition and funds withdrawn from advisory accounts Key Advisor Metrics Gross Recruited GDC (4) ($M): $15.2 Retention Rate (3) : 97.8% Total Advisors (1) : 9,139 9,000 AUA ($B): $212.8 $191.3 Retail Net New Advisory Assets (5) ($M): $969 Retail AUM (2 ) ($B) : $ 40.3 $32.8 Net Recruited GDC (4) ($M): $6.2 Q3 ‘14 Q3 ‘13 Change Retail Advice Adjusted EBITDA Margin Significant Margin Expansion Opportunities 5.1% 6.5% 7.4% >9.5 % 0.0% 2.5% 5.0% 7.5% 10.0% Q1 2014 Q2 2014 Q3 2014 Post Synergies • Cash sweep revenue • Rising interest rates • Transition to FDIC - based programs • Historically low levels of client assets held in cash • Greater advisory penetration • Incremental operating efficiencies • Operating leverage through scale • Natural margin expansion on organic revenue growth • Future acquisitions generating incremental EBITDA Fourth Quarter trends strong – Positive net advisor and net GDC growth 1.5% 11.3% 22.9% Retail Expansion Opportunities: Successful Recruiting & Retention Strategy and Margin Expansion

American Realty Capital 11 2 Note: AUA table is for illustrative purposes only. Past performance and trends are not indicative of future results (1) RCS Independent Broker Dealers include Cetera, First Allied, Summit, ICH, and JP Turner VSR+ Girard Compelling AUA & Overall Retail Advice Growth $130 $154 $202 $208 $214 $212 $0 $40 $80 $120 $160 $200 $240 2011 2012 2013 Q1 2014 Q2 2014 Q3 2014 $22 $234 Pro Forma Historical AUA Growth – RCS Retail Advice Platform (1)

12 Rising Interest Rates Would Improve Annual EBITDA • Currently, less than 4% of AUA is in client cash sweep accounts earning approximately 10 basis points • As interest rates rise, money market allocations have the potential to increase to historic levels of approximately 8% of AUA • Revenue / EBITDA contribution for nine months ended September 30, 2014 from sweep income is approximately $ 7.5 million • We anticipate realizing between 60% and 80 % of the 100 basis point rate rise as incremental revenue / EBITDA (before any benefit from an increase in assets) A 100 Basis Point Increase in Interest Rates Would Result in Approximately $55 Million to $120 Million Annual EBITDA Improvement $ 7.5 $18.75 $ 30.0 $ 41.25 $52.5 $63.75 $ 15.0 $37.5 $ 60.0 $82.5 $ 105.0 $ 127.5 $0 $30 $60 $90 $120 $150 10 bps 30 bps 50 bps 70 bps 90 bps 110 bps 4% Cash Sweep / AUA 8% Cash Sweep / AUA Fed Funds Effective Rate Sweep Income ($mm) (current rate) (1) (1) Based on cash sweep assets as of September 30, 2014. Assumes realizing 75% of the 100 basis point rate rise as incremental r eve nue / EBITDA.

American Realty Capital Wholesale Distribution 13 2

14 2 Wholesale Distribution Achieved 45% Market Share in YTD Equity Sales (1) (1) According to Robert A. Stanger & Co. – October Market Pulse Report (2) Including Hatteras Funds (3) Acquisition completed on August 29 th , 2014 Equity Capital Raised 2Q’14 ($ millions) 3Q’14 31 (2) investment programs currently in distribution or registration offering approximately $ 41 billion in equity Distributes 15 (2) programs that are sponsored by AR Capital representing approximately 60% of total equity registered or in distribution No more than 7.4% of third quarter equity capital raised through one broker - dealer Achieved 45% market share among managing broker dealers based on year - to - date 2014 sales (1 ) Distributed more than three times the combined sales of the next two competitors (1) Distributed the top three non - traded REITs and four of the top five non - traded programs year - to - date 2014 through October (1 ) $3,420 $2,260 $ 2,650 $2,100 $ 770 $ 160 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 RCS Strat Cap (3)

15 • Capital preservation and current yield remains the focus of retail investor • Low correlation to broader equity market volatility • Alternatives currently represent just 2 - 3 % of Retail Investors Portfolios • Overall supply of direct investments remains low on all platforms • 33 direct investment programs, representing $37 billion in equity raised, have closed over the past 21 months • 19 closed in 2013 • 14 closed year - to - date September 2014 • Of these 33 closed programs, 7 liquidity events (1) , representing $5.9 billion in equity raised, occurred through September 2014 • Significant amount of capital invested and not yet recirculated • Traditional equity ramp up of next generation products approximately 3 – 12 months • Includes due diligence reviews and the reconstitution of selling groups Direct Investment Programs: Supply vs Demand Demand for Direct Investments Supply of Direct Investments We Believe That There is Pent Up Demand Caused by Recent Lack of Supply (1) Liquidity Events: HCT , NYRT, ARC V, UDF IV, Inland Diversified, Blue Rock, Independence Realty

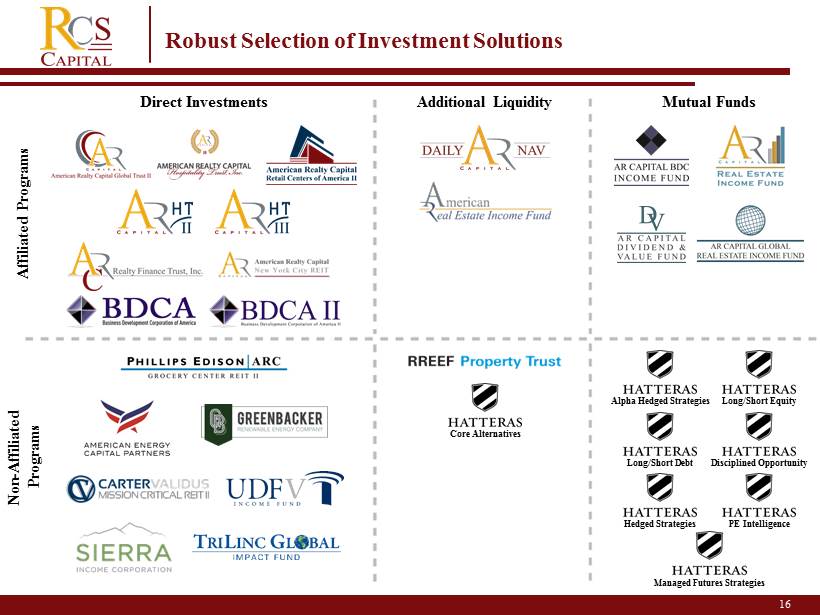

American Realty Capital 16 2 Direct Investments Additional Liquidity Mutual Funds Robust Selection of Investment Solutions Affiliated Programs Non - Affiliated Programs Core Alternatives Alpha Hedged Strategies Long/Short Equity Long/Short Debt Disciplined Opportunity Managed Futures Strategies PE Intelligence Hedged Strategies

American Realty Capital Investment Management 17 2

18 2 Investment Management Overview Hatteras Overview • Hatteras raised over $ 240 million in the third quarter ; Current AUM of $ 2 . 8 billion • Product portfolio includes seven open - end mutual funds and one closed - end fund as of September 30 , 2014 • Positioned to capitalize on investors’ growing interest in alternative mutual funds and demand for access to sophisticated investment approaches and superior portfolio management • Growth in demand for Hatteras’ liquid alternative programs expected to increase RCS Capital’s percentage of recurring revenues $ 368 B $ 1.2 T $0 $200 $400 $600 $800 $1,000 $1,200 2013 2014E 2015E 2016E 2017E 2018E Source: Citi Investor Services (1) Data represents U.S. Alternative Mutual Funds & ETFs Forecast on Assets Investment Management – Projected Growth of Liquid Alternative Funds (1) 44% 2% ($ in billions)

19 Investment Banking

20 Variable Quarter to Quarter, but 55% Growth Year Over Year ($ in millions) Investments Banking and Capital Markets Pro forma Adjusted EBITDA $54.2 YTD 2014 $78.9 Q4 Estimate $0 - $10.0 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 2013 2014E $88.9 #2 Ranked Real Estate M&A Advisor Through Q3 2014 (1) (1) Source: SNL. Announced and closed transactions.

21 Combined Operating Results

22 Revenue Q3’14 Q3’13 Retail $504.3 $433.4 • Driven by increased advisory revenues Wholesale $210.9 $227.3 • Lower equity raise due to product cycle Inv. Banking & Cap Mkts $28.3 $15.3 • Driven by completed advisory engagements Investment Management $17.0 $11.7 • Driven by increased demand for liquid alt funds Other (1) ($27) $0.0 • Fair value of derivative instrument accounting Intercompany Eliminations ($36.3) ($29.5) • Wholesale products sold through RCS Capital retail platform Total $697.1 $658.2 Pro forma Adjusted EBITDA Q3’14 Q3’13 Retail $37.2 $23.2 • M eaningful margin expansion potential Wholesale $1.4 $5.3 • Potential Strategic Capital Expense Synergies of ~$20 million Inv Banking & Cap Mkts $15.7 $7.9 • Investment Banking business variable due to transaction timing but 100% growth year over year Investment Management $3.4 $1.8 • 89% adjusted EBITDA growth year over year Other $0.1 $0.0 Total $57.8 $38.3 Operating Results Results ($ millions) Variance (1) ($ 27.9) million non - cash revenue loss recognized from embedded derivative fair market value accounting Comments

64.4% 2.4% 27.2% 5.9% Independent Retail Advice $37.2M Wholesale Distribution $1.4M Investment Banking $15.7M Investment Management $3.4M 23 Third Quarter Pro forma Revenue Pro forma Adjusted EBITDA Margin 3Q Margin YTD 7.4% 0.7% 55.5% 20.2% 6.4% 2.1% 68.1% 19.3% Segment Contribution to Revenue / Adjusted EBITDA 69.6% 29.1% 3.9% 2.3% Independent Retail Advice $504.3M Wholesale Distribution $210.9M Investment Banking $28.3M Investment Management $17.0M

24 Bridging EBITDA to Cash EPS – 3Q 2014 Pro Forma 1) EPS based on 88.7 million fully diluted shares 2) Adjustment for (non - cash) change in fair value attributable to derivative ($ in millions except per share data) Net Income Adjusted Net Income Pro forma 3Q 2014 Adjusted EBITDA $58 2014 3Q p ro forma Net Income ($25) ( - ) Non - cash equity compensation ($8) Plus: Share - based compensation (net of tax) $5 ( - ) Transaction costs ($7) Plus: Amortization of acquired intangibles $26 ( - ) Other ($39) Plus: Acquisition & integration expense (net of tax) $4 3Q 2014 Pro forma EBITDA $4 Plus: Other (2) (net of tax) $25 3Q 2014 Pro forma Adjusted Net Income $35 Less: D&A ($28) 3Q 2014 P ro forma Adjusted EPS (1) $0.40 Less: Interest ($18) 3Q 2014 Pro forma EBT ($42) Less: Taxes $17 3Q 2014 Pro forma Net Income ($25) 3Q 2014 Pro forma EPS (1) ($0.28)

American Realty Capital 25 2014 Pro Forma Adjusted EBITDA Guidance ($ in millions) 2014 Pro forma Adjusted EBITDA expectation of $288 - $ 300 million including synergies associated with the integration of our retail platform (excluding any contribution from VSR & Girard) $194 $255 $288 $304 $41 ($8) - $4 0 50 100 150 200 250 300 350 September YTD Synergies Pro forma YTD Q4 Est Revised 2014 Guidance Original 2014 Guidance $300 $327 $57 - $65 Retail & Investment Management Banking & Wholesale

26 2 2015 Retail Advice Segment Guidance Pro forma Retail Advice Segment Adjusted EBITDA Strong Retail Advice Segment Growth Projected in 2015 (1) Pre - synergy: Pro forma for full year of all acquisitions other than VSR and Girard Securities. Estimated Pro - Forma Adjusted EBITDA for 2014 Anticipated Synergies 2015 Impact Additional Synergies, Organic Growth and Acquisition Impact (1) (1) $130 $200 $60 $210 $ 10 - $20 $0 $50 $100 $150 $200 $250 2014 E Synergies Other 2015 E

American Realty Capital Appendix 27 2

28 RCS Capital: Pro forma Consolidated Financial Results ($ in thousands) September 30, 2014 Proforma September 30, 2013 Proforma % Change Total Revenue $697,108 $658,243 5.9% Total Cost of Sales 510,600 482,829 5.8% Compensation and benefits 92,231 86,719 6.4% Non-comp operating expenses 108,557 91,119 19.1% Depreciation and Amoritization 27,780 27,809 0.1% Total expenses 228,568 205,647 11.1% Pre-tax net income / (loss) (42,060) (30,234) 39.1% Taxes (16,824) (12,093) 39.1% Net Income ($25,236) ($18,140) 39.1% Addbacks for EBITDA Provision for Income taxes (16,824) (12,093) 39.1% Interest 17,939 17,914 0.1% Depreciation & Amortization 27,780 27,809 0.1% EBITDA $3,659 $15,490 76.4% Acquisition and integration related expenses 7,197 12,204 41.0% Non-cash equity compensation 8,067 2,747 193.7% Capitalized advisor compensation 1,770 2,098 15.6% Change in contingent consideration 3,966 7 NM Other 33,095 5,705 480.1% Adjusted EBITDA $57,753 $38,250 51.0% Adjusted Net Income Proforma Net Income ($25,236) ($18,140) 39.1% Non-cash equity compensation (net of tax) 4,840 1,648 193.7% Acquisition and integration related expenses (net of tax) 4,318 7,322 41.0% Amortization of Intangibles 26,565 26,244 1.2% Capitalized advisor compensation 1,062 1,259 15.6% Change in contingent consideration 2,380 4 NM Other (net of tax) 21,607 5,174 317.6% Adjusted Net Income $35,536 $23,511 51.1% Three Months Ended

29 Consolidated Financial Condition & Key Metrics • Pro forma Adjusted Net Income $35.5 million or $0.40 per share; up 51% year over year • Adjusted EBITDA $57.8 million; up 51% year over year • Assets Under Administration $212.8 billion; up 11.3% year over year • 57.5% of revenue was recurring (3 ) ; 28.6% of total revenue was fee - based • 9,139 Independent Financial Advisors currently servicing approximately 2.1 million clients nationwide (2 ) • Three acquisitions completed during the quarter • Three strategic acquisitions announced • Firmly positioning company as second largest U.S. independent advice network • Revenue synergies and cost savings on track; Initial synergies recognized in 3Q • Additional synergies expected in 2015 (1) Includes Strategic Capital, Hatteras Funds, and programs in registration (2) Excluding advisors from VSR and Girard (3) Excludes deferred comp hedge revenues Financial Condition ($ millions) September 30, 2014 June 30, 2014 Cash & Cash Equivalents $315 $470 Assets 2,508 2,377 Debt 787 819 Stockholder's Equity - Primary 826 786 As of Three Months Ended Key Metrics - Pro Forma September 30, 2014 June 30, 2014% Change # of Advisors 9,139 9,200 -0.7% Payout Ratio 86.2% 86.0% 0.2% AUA ($ billions) $212.8 $214.2 -0.7% Net New Advisory Assets ($ millions) $969 $1,052 -7.9% Cash Sweep Balances ($ billions) $7.5 $7.6 -1.3% Recurring Revenue 57.5% 55.0% 4.5% Retention % 97.8% 97.0% 0.8% Net Recruitment ($ millions) $6.2 $6.3 -1.6% Headcount 1,537 1,467 4.8% # of Products (1) 31 31 0.0% New Products Offered (1) 4 3 33.3% Closed Products (1) 4 2 100.0% Adjusted EBITDA ($ millions) $57.8 $71.8 -19.5% Adjusted Net Income ($ millions) $35.5 $42.6 -16.7% As of Three Months Ended

30 Retail Advice Segment Financial Results ▪ Retail Advice Revenue for the quarter was $ 504 . 3 million, up 16 . 4 % year over year ; primarily due to strong advisory revenues offset by seasonally lower commission based revenue ▪ Advisor Fee and Services Revenue : Which includes both client advisory fees and administrative fees, was $ 144 . 3 million for the quarter ; up 21 . 4 % year over year ▪ Commission - based Revenue : Which includes transactional commissions and “trails”, was $ 296 . 1 million for the quarter ; up 11 . 5 % year over year ▪ Asset - Based Revenue : Which includes strategic partner, cash sweep, and mutual fund networking fees, was $ 8 . 7 million for the third quarter ; down 34 % year over year ▪ Transaction - Based Revenue : Which includes ticket and other trading charges, advisor fees, other account fees (e . g . , IRA fees), and other revenues , was $ 55 . 2 million for the third quarter ; up 54 % year over year Note: Adjustments reflect the financial impact assuming all previously announced acquisitions were owned for the full period : Investors Capital closed 7/11/2014 ($ in thousands) September 30, 2014 Proforma September 30, 2013 Proforma % Change Total Revenue $504,349 $433,438 16.4% Total Cost of Sales 380,347 334,978 13.5% Compensation and benefits 44,795 47,774 6.2% Non-comp operating expenses 79,959 48,981 63.2% Depreciation and Amoritization 22,872 23,254 1.6% Total expenses 124,754 120,009 4.0% Pre-tax net income / (loss) (751) (21,548) 96.5% Taxes (301) (8,619) 96.5% Net Income ($451) ($12,929) 96.5% Addbacks for EBITDA Provision for Income taxes (301) (8,619) 96.5% Interest 156 91 71.7% Depreciation & Amortization 22,872 23,254 1.6% EBITDA $22,277 $1,797 1139.7% Acquisition and integration related expenses 4,845 11,198 56.7% Non-cash equity compensation 2,643 2,747 3.8% Capitalized advisor compensation 1,770 2,098 15.6% Change in contingent consideration 2,435 7 34269.4% Other 3,260 5,348 39.0% Adjusted EBITDA $37,230 $23,194 60.5% Adjusted Net Income Proforma Net Income ($451) ($12,929) 96.5% Non-cash equity compensation (net of tax) 1,586 1,648 3.8% Acquisition and integration related expenses (net of tax) 2,907 6,719 56.7% Amortization of Intangibles 21,766 21,766 0.0% Capitalized advisor compensation 1,062 1,259 15.6% Change in contingent consideration 1,461 4 NM Other (net of tax) 1,956 3,209 39.0% Adjusted Net Income $30,287 $21,676 39.7% Three Months Ended

31 Wholesale Distribution Segment Financial Results ▪ Wholesale Revenue for the quarter was $ 210 . 9 million ; down ( 7 . 2 % ) year over year ▪ Adjusted EBITDA for the quarter was $ 1 . 4 million ; down 74 % year over year ▪ RCS Capital/Strategic Capital Equity Raised : $ 2 . 3 billion equity capital raised in third quarter ; unchanged year over year ▪ Year - to - date October Capital Raise : $ 8 . 2 billion through October 2014 ▪ Third quarter wholesale expenses down 36 % sequentially given lower equity capital raised ▪ 31 investment programs currently in distribution or registration, including 8 programs distributed by the Hatteras Funds Group ; offering approximately $ 41 billion in equity ▪ RCS Capital distributes 15 programs that are sponsored by AR Capital representing approximately 60 % of total equity registered or in distribution ▪ No more than 7 . 4 % of third quarter equity capital raised through any one broker - dealer ▪ Achieved 45 % market share among managing broker dealers based on year - to - date 2014 sales ; more than three times the combined sales of the next two competitors ( 1 ) ▪ Distributed the top three non - traded REITs and four of the top five non - traded programs for period ending October 31 , 2014 ( 1 ) Note: Pro forma reflects the financial impact for the full quarter of the previously announced acquisition of Strategic Capital. (1) According to Robert A. Stanger & Co. – October Market Pulse. ($ in thousands) September 30, 2014 Proforma September 30, 2013 Proforma % Change Total Revenue $210,893 $227,274 7.2% Total Cost of Sales 164,907 176,919 6.8% Compensation and benefits 33,246 32,908 1.0% Non-comp operating expenses 15,200 12,291 23.7% Depreciation and Amoritization 3,537 3,521 0.5% Total expenses 51,983 48,720 6.7% Pre-tax net income / (loss) (5,997) 1,635 466.7% Taxes (2,399) 654 466.7% Net Income ($3,598) $981 466.7% Addbacks for EBITDA Provision for Income taxes (2,399) 654 466.7% Interest 0 1 74.5% Depreciation & Amortization 3,537 3,521 0.5% EBITDA ($2,460) $5,157 147.7% Acquisition and integration related expenses 775 - N/A Non-cash equity compensation 3,044 - N/A Capitalized advisor compensation - - N/A Change in contingent consideration - - N/A Other 22 126 82.9% Adjusted EBITDA $1,381 $5,283 73.9% Adjusted Net Income Proforma Net Income ($3,598) $981 466.7% Non-cash equity compensation (net of tax) 1,827 - N/A Acquisition and integration related expenses (net of tax) 465 - N/A Amortization of Intangibles 3,477 3,477 0.0% Capitalized advisor compensation - - N/A Change in contingent consideration - - N/A Other (net of tax) 13 76 82.9% Adjusted Net Income $2,183 $4,534 51.8% Three Months Ended

32 Investment Banking, Capital Markets, and Transaction Management Services Segment Financial Results ▪ Investment Banking & Capital Markets Revenue for the third quarter was $ 28 . 3 million ; up 84 . 6 % year over year ; driven by completed advisory engagements ▪ Investment Banking : Revenue was $ 12 . 9 million for the third quarter ; up 70 . 0 % year over year ▪ Transaction Management : Revenue was $ 9 . 7 million for the third quarter ; up 128 . 4 % year over year ▪ Transfer Agent : Revenue was $ 5 . 7 million for the quarter ; up 63 . 2 % year over year ($ in thousands) September 30, 2014 Proforma September 30, 2013 Proforma % Change Total Revenue $28,259 $15,305 84.6% Total Cost of Sales - - N/A Compensation and benefits 5,880 2,916 101.6% Non-comp operating expenses 7,622 5,677 34.3% Depreciation and Amoritization 3 2 39.1% Total expenses 13,505 8,595 57.1% Pre-tax net income / (loss) 14,754 6,710 119.9% Taxes 5,902 2,684 119.9% Net Income $8,852 $4,026 119.9% Addbacks for EBITDA Provision for Income taxes 5,902 2,684 119.9% Interest - 0 100.0% Depreciation & Amortization 3 2 59.0% EBITDA $14,757 $6,712 119.9% Acquisition and integration related expenses - 1,006 100.0% Non-cash equity compensation 632 - N/A Capitalized advisor compensation 291 - N/A Change in contingent consideration - - N/A Other - 231 100.0% Adjusted EBITDA $15,680 $7,950 97.2% Adjusted Net Income Proforma Net Income $8,852 $4,026 119.9% Non-cash equity compensation (net of tax) 379 - N/A Acquisition and integration related expenses (net of tax) - 604 100.0% Amortization of Intangibles - - N/A Capitalized advisor compensation 174 - N/A Change in contingent consideration - - N/A Other (net of tax) - 139 100.0% Adjusted Net Income $9,406 $4,769 97.2% Three Months Ended

33 Investment Management Segment Financial Results • Investment Management revenue for the third quarter was $ 17 . 0 million ; up 45 . 0 % year over year • Pro forma Adjusted EBITDA for the third quarter was $ 3 . 4 million ; up 88 . 1 % • Hatteras Assets Under Management grew to $ 2 . 8 billion in the third quarter, up 28 . 8 % year over year • Investment Management platform currently providing eleven open - end mutual funds and two closed - end fund as of the third quarter ($ in thousands) September 30, 2014 Proforma September 30, 2013 Proforma % Change Total Revenue $16,972 $11,704 45.0% Total Cost of Sales - - 0.0% Compensation and benefits 3,904 3,120 25.1% Non-comp operating expenses 9,747 6,803 43.3% Depreciation and Amoritization 1,038 1,033 0.5% Total expenses 14,689 10,956 34.1% Pre-tax net income / (loss) 2,283 749 204.9% Taxes 913 299 204.9% Net Income $1,370 $449 204.9% Addbacks for EBITDA Provision for Income taxes 913 299 204.9% Interest - 39 100.0% Depreciation & Amortization 1,038 1,033 0.5% EBITDA $3,321 $1,821 82.4% Acquisition and integration related expenses 103 - N/A Non-cash equity compensation - - N/A Capitalized advisor compensation - - N/A Change in contingent consideration - - N/A Other - - N/A Adjusted EBITDA $3,424 $1,821 88.1% Adjusted Net Income Proforma Net Income $1,370 $449 204.9% Non-cash equity compensation (net of tax) - - N/A Acquisition and integration related expenses (net of tax) 62 - N/A Amortization of Intangibles 1,000 1,000 0.0% Capitalized advisor compensation - - N/A Change in contingent consideration - - N/A Other (net of tax) - - N/A Adjusted Net Income $2,432 $1,449 67.8% Three Months Ended

34 Weighted Average Shares Outstanding Reconciliation Note: Adjustments are estimated on the market price as of 9/30/2014 (Share count in thousands) Cash & Debt ($ millions) Cash $315 Debt (Par Value) First Lien Debt (L+550) $575 Second Lien Debt (L+950) $150 Convertible Notes (5.0%) $120 Preferred Stock Convertible Preferred $270 Common Stock Reconciliation Date Issued Shares Issued RCAP Historical 1/1/2014 2,500 RCAP Historical 2/11/2014 23,999 RCAP Historical 3/17/2014 RCAP Historical 3/31/2014 Equity Issuance Shares Issued in Public Offering 6/6/2014 21,469 Greenshoe follow on offering 6/18/2014 870 Acquisition Consideration Various 14,530 RSU & Stock Plan Various 1,279 Primary Shares Outstanding 66,463 Trupoly-contingent consideration Various 31 JP Turner-contingent consideration Various 144 Warrants Various 242 LTIPs Various 311 Luxor Put Option Various 2,495 Convertible Notes (1) Various 5,666 Convertible Preferred Stock (1) Various 13,327 - Fully Diluted Shares Outstanding 9/30/2104 88,678 1,816 ( 1 ) The certificate of designation relating to the convertible preferred stock provides that, without the advance approval of FINRA, the aggregate number of shares of common stock held by the holders of the convertible preferreds (including shares of common stock obtained upon conversion of the convertible preferred stock, the convertible notes or issued pursuant to the June 10 , 2014 private offering of our common stock) cannot exceed 24 . 9 % of the number of common shares outstanding on the trading day immediately preceding the date of issuance of such common stock, or approximately 20 , 209 , 591 shares as of September 30 , 2014 . On June 10 , 2014 , the Company issued 2 , 469 , 136 shares of Class A common stock at the public offering price of $ 20 . 25 per share in a private offering . As a result, as of September 30 , 2014 , the holders of the convertible preferred stock can hold no more than 17 , 740 , 455 additional shares of Class A common stock without prior approval of FINRA . As such, fully diluted class A shares outstanding without prior approval of FINRA is approximately 87 , 426 , 346 and pro forma adjusted net income per share of $ 0 . 40 .

35 2 Non - GAAP Measure Disclosure We use earnings before interest, taxes, depreciation and amortization, or EBITDA, adjusted EBITDA and adjusted net income, which are non - GAAP measures, as supplemental measures of our performance that are not required by, or presented in accordance with GAAP. None of the non - GAAP measures should be considered as an alternative to any other performance measure derived in accordance with GAAP. We use EBITDA, adjusted EBITDA and adjusted net income as an integral part of our report and planning processes and as one of the primary measures to, among other things: • our ability to integrate the acquired businesses into our existing businesses; • monitor and evaluate the performance of our business operations; • facilitate management’s internal comparisons of the historical operating performance of our business operations; • facilitate management’s external comparisons of the results of our overall business to the historical operating performance o f o ther companies that may have different capital structures and debt levels; • analyze and evaluate financial and strategic planning decisions regarding future operating investments; • provide useful information to investors regarding financial and business trends related to our results of operations; and • plan for and prepare future annual operating budgets and determine appropriate levels of operating investments. Pro forma Adjusted EBITDA represents earnings on a pro forma basis before interest, taxes, depreciation and amortization, sha re - based compensation, acquisition and integration related costs (including integration - related employee compensation and related costs) and other non - recurring charge s. Pro forma Adjusted Net Income represents net operating income before non - controlling interest, share - based compensation, acquisition related costs, and non - recurring cos ts. We define adjusted net income as net income attributable to the Company (using a 40% tax rate to illustrate the tax impact for comparative purposes) and adjusted to excl ude acquisition related expenses and equity - based compensation and other items. We believe similarly titled measures are frequently used by securities analysts, investors and other interested parties in th e e valuation of companies in our industry, many of which present EBITDA, adjusted EBITDA, adjusted net income and other similar metrics when rep orting their financial results. Our presentation of EBITDA, adjusted EBITDA and adjusted net income should not be construed to imply that our future results will be unaffected by unusual or nonrecurring items. The non - GAAP measures have limitations as analytical tools, and you should not consider any of these measures in isolation or as a s ubstitute for analyses of our income or cash flows as reported under GAAP. Some of these limitations are : • they do not reflect our cash expenditures, or future requirements for capital expenditures, or contractual commitments; • they do not reflect changes in, or cash requirements for, our working capital needs; • they do not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments , o n our debt; and • depreciation and amortization are non - cash expense items that are reflected in our statements of cash flows. In addition, other companies in our industry may calculate these measures differently than we do, limiting their usefulness a s a comparative measure. We compensate for these limitations by relying primarily on our GAAP results and using the non - GAAP measures only for supplemental purposes. Please see our financial statements and the related notes thereto.