Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Premier, Inc. | d818966d8k.htm |

| EX-99.2 - EX-99.2 - Premier, Inc. | d818966dex992.htm |

| EX-99.1 - EX-99.1 - Premier, Inc. | d818966dex991.htm |

First Quarter Fiscal 2015

Financial Results and Update

November 10, 2014

Exhibit 99.3 |

1

Forward-looking statements and Non-GAAP financial

measures

Forward-looking

statements—

presentation, including, but not limited to, those related to our financial and

business outlook, strategy and growth drivers, acquisition activities and

pipeline, revenue available under contract, and financial guidance and

related

assumptions,

are

“forward-looking

statements.”

Forward-looking

statements

may

involve

known

and unknown risks, uncertainties and other factors that may cause the actual

results of Premier to be materially different from historical results or

from any future results or projections expressed or implied by such

forward-looking statements. Accordingly, readers should not place undue reliance on any forward

looking statements. Readers are urged to consider statements in the conditional or

future tenses or that include

terms

such

as

“believes,”

“belief,”

“expects,”

“estimates,”

“intends,”

“anticipates”

or

“plans”

to

be

uncertain and forward-looking.

Forward-looking statements may include comments as to Premier’s beliefs

and expectations as to future events and trends affecting its business and

are necessarily subject to uncertainties,

many

of

which

are

outside

Premier’s

control.

More

information

on

potential

risks

and

other

factors

that

could

affect

Premier’s

financial

results

is

included,

and

updated,

from

time

to

time,

in

Premier’s

periodic and current filings with the SEC and available on Premier’s website,

including Premier’s most recent

Form

10-K

for

the

year

ended

June

30,

2014.

Forward-looking

statements

speak

only

as

of

the

date

they are made. Premier undertakes no obligation to publicly update or revise any

forward-looking statements.

Certain

statements

made

during

this

conference

call

and

included

in this

Non-GAAP

financial

measures—

defined in Regulation G under the Securities Exchange Act of 1934. Schedules are

attached that reconcile the non-GAAP financial measures included in the

following presentation to the most directly comparable financial measures

calculated and presented in accordance with Generally Accepted Accounting Principles

in the United States. The press release attached as an Exhibit to our Form 8-K

filed with the SEC in connection with our earnings call, as well as our Form

10-Q for the quarter ended September 30, 2014 to be filed shortly

hereafter, provides further explanation and disclosure regarding our use of non-GAAP

financial measures and should be read in conjunction with these supplemental

slides. This

presentation

includes

certain

“non-GAAP

financial

measures”

as |

Susan DeVore, President & CEO

Overview and Business Update |

3

First-quarter highlights

1

(1) Comparisons are with year-ago pro forma information that reflects the

impact of the company’s reorganization and initial public offering. See Adjusted EBITDA,

Segment Adjusted EBITDA and Adjusted Fully Distributed Net Income reconciliations

to GAAP equivalents in Appendix. Acquired assets providing value and

growth Adjusted fully distributed net income per diluted

share of $0.33, increased 6% from prior year

Adjusted EBITDA rose 9% from prior year

SCS revenue exceeded and PS revenue in line with

company expectations

Net revenue up 15% from prior year, driven by double-

digit growth in both business segments

Strong start to fiscal 2015; affirming full-year guidance

|

4

Supply Chain Services revenue growth drivers

Solid GPO net administrative fees

revenue growth, up 4.1% year-over-year

on a pro forma basis

Products revenue up 45% year-over year |

5

Performance Services revenue growth drivers

11% revenue growth consistent with

first-quarter expectations, driven by:

•

SaaS-based subscription growth, particularly

from PremierConnect

®

Enterprise and

Population Health Management

•

Advisory services and performance

improvement collaborative growth

•

One month of revenue from TheraDoc and

Aperek acquisitions |

6

Member and

industry needs

Scale

Co-innovation

Intelligence to transform from the inside

Leadership in population health

Shared infrastructure

Premier strategic

differentiation

•

Total cost reduction

•

Quality improvement

across the continuum

•

Evolving delivery and

payment models

•

Actionable data and

information

Unique business model addresses industry challenges

Helping health systems manage challenges, optimize

the transition, and build for the future….

…all at the same time |

7

Delivering practical insights to facilitate and inform future

healthcare decision making

Premier establishes Ebola rapid response

center

Premier and CDC research reveals potential

safety and cost implications of unnecessary

and duplicative antibiotic use in hospitals

Premier blood utilization analysis reveals

significant cost and quality improvement

opportunities for hospitals

Premier and eHealth Initiative survey shows

threat to ACOs from poor interoperability

across technology systems |

8

Population health management initiatives

Building and piloting the first perioperative

surgical home collaborative with 43 hospitals

across the country

Co-developing a system-wide population

health collaborative, including up to 20

Medicare Shared Savings Program sites

Constructing new models to create greater

physician alignment

Major Catholic

integrated delivery

network

Large midwest

health system

Florida Medicare

Shared Savings

program

Building a care management platform to

manage high-risk patients |

Michael Alkire, Chief Operating Officer

Operations Update |

10

Integrated solutions to complex challenges

Unified

sales/field

SUPPLY CHAIN SERVICES

PERFORMANCE SERVICES

Group purchasing, serving both

acute and alternate site

•

Physician preference

•

Capital equipment

Direct sourcing

Specialty pharmacy

Real-time demand aggregation

and purchasing

SaaS-based analytic products

in cost, quality, safety &

population health

Enterprise data analytics

platform

Collaboratives

Advisory services

Change the game in supply chain,

uncover unmatched savings and value,

and lead the disruption in this industry

Become the data analytics “backbone”

with wrap-around services for cost and

quality improvement over the short-term,

and for population health management

over the long-term |

11

Select first-quarter healthcare system new business

•

GPO

•

PremierConnect Quality, Operations & Supply Chain

•

Provider of Choice

•

QUEST & PACT collaboratives

•

GPO

•

Yankee Alliance Supply Chain Solutions

•

PremierConnect Quality & Supply Chain

•

GPO

•

PremierConnect

•

ASCEND collaborative |

12

Strategic acquisition integration

Clinical & Physician

Preference Solution

Data Management

Expanded Cost

Reduction

Supply Chain

Technology

Enablement

Total Quality

Management

Physician preference contract management and data services

•

Closed July 2013

•

14 new customers signed in fiscal first quarter

•

72 current customers representing 284% growth over 14 months

•

Product continues to deliver double digit cost savings

Strategic Need

Company

Data acquisition and integration as-a-service

•

Closed October 2013

•

Delivering revenue and decreasing operating expenses while improving

integration capabilities across all products

•

Instrumental to implementation of real-time analytics for PremierConnect

Quality

Capital equipment planning, sourcing, analytics

•

Closed April 2014

•

Added 11 engagements since acquisition, including 3 in FYQ1

•

Member savings from 10%-18% off of best member negotiated price

Supply chain workflow and analytics

•

Closed August 2014

•

Key asset in current recruiting efforts

•

Full retention of customers

•

Key asset for evolution of Supply Chain model

Clinical surveillance software

•

Closed September 2014

•

Significant impact to market share with ~600 installs, ~400 new customers

•

Penetration of academic health system market

•

Instrumental in planned migration to next-generation safety surveillance

solution

•

Full retention of existing accounts and achieving additional sales since

acquisition

Details and Progress |

13

Expanding and deploying Premier capabilities

PremierConnect

®

Enterprise &

Data Alliance Collaborative

Leading developer of cloud-based

predictive analytics platform

Innovation in ambulatory data integration

Data integration project with major health

system underway, using Meddius technology

PremierConnect integrating ambulatory data

across diverse EMR systems

Health system will have actionable data across

both acute care locations and network clinics |

Craig McKasson, Chief Financial Officer

Financial Review |

15

First-quarter consolidated and segment highlights

1

Consolidated

Net revenue (millions)

Supply Chain Services

Net revenue (millions)

Performance Services

Net revenue (millions)

(1) See Adjusted EBITDA and Segment Adjusted EBITDA reconciliations to GAAP

equivalents in Appendix; financial information for the fiscal 2014 first quarter is

pro forma and has been adjusted to reflect the impact of the company’s

reorganization and IPO. Consolidated |

16

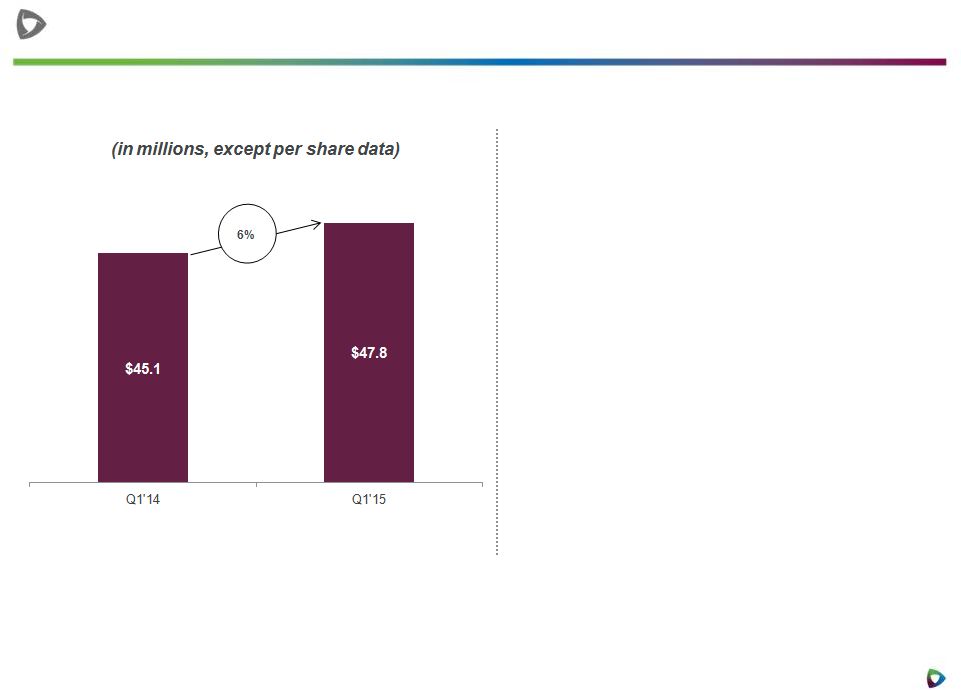

First-quarter non-GAAP adjusted fully distributed net

income

•

Calculates income taxes at 40%

on pre-tax income, assuming

taxable C corporate structure

•

Calculates adjusted fully

distributed earnings per share,

assuming total Class A and B

common shares held by public

$0.31

$0.33

Non-GAAP earnings per share on fully distributed

net income

(1) See non-GAAP adjusted fully distributed net income and non-GAAP

earnings per share on fully distributed net income reconciliations to GAAP equivalents in

Appendix; financial information for the fiscal 2014 first quarter is pro forma and

has been adjusted to reflect the impact of the company’s reorganization and IPO.

1 |

17

Cash flow and capital structure at September 30, 2014

Cash, cash equivalents and marketable

securities of $398.2 million

No outstanding borrowings on $750 million

five-year unsecured revolving credit facility

Cash flow from operations of $45.9 million |

18

Fiscal 2015 annual guidance

1

Premier, Inc. affirms full-year fiscal 2015 financial guidance:

(in millions, except per share data)

Pro Forma

FY 2015

YoY Change

Net Revenue:

Supply Chain Services segment

$688 -

$707

8% -

11%

Performance Services segment

$281 -

$288

21% -

24%

Total Net Revenue

$969 -

$995

11% -

14%

Non-GAAP adjusted EBITDA

$379 -

$390

8% -

11%

Non-GAAP adjusted fully

distributed EPS

$1.39 -

$1.44

7% -

11%

(1) As of fiscal 2015 first-quarter conference call, 11/10/2014. Guidance measures are

“forward-looking statements.” For information regarding the use and

limitations of non-GAAP financial measures and forward-looking statements, see

“Forward-looking statements and Non-GAAP financial measures” at the

front of this presentation. Guidance is based on comparisons with prior-year non-GAAP pro

forma results, which have been adjusted to reflect the impact of the company’s

reorganization and IPO. |

19

Fiscal 2015 guidance assumptions

Supply Chain Services growth driven by:

•

Low to mid-single-digit growth in net

administrative fee revenue

•

Continuation of high GPO retention rates

•

15% -

20% product revenue growth

Performance Services growth driven by:

•

Demand for integrated offerings of SaaS-based products,

advisory services and collaboratives

•

Continuation of high SaaS institutional renewal rates

•

TheraDoc and Aperek full revenue contributions in

second, third and fourth quarters |

20

Exchange update

Approximately 4.7 million Class B shares

exchanged for Class A shares on 1-for-1 basis

on Oct. 31, 2014

•

~16 million shares eligible for exchange

•

Outcome provides additional liquidity and float for

public markets

Premier will conduct underwritten company

directed offering

•

Approximately 3.8 million shares in the offering

•

Approximately 900,000 exchanged shares not

participating in the offering and cannot be sold until 60

days following the completion of the offering |

Questions

21 |

Contact Investor Relations

Jim Storey

Vice President, Investor Relations

jim_storey@premierinc.com

Thank you

22 |

Appendix

23 |

24

Premier, Inc. supplemental financial information

(Unaudited, in thousands)

2014*

2013

Reconciliation of Non-GAAP Pro Forma Net Revenue to Net

Revenue: Non-GAAP Pro Forma Net Revenue

229,308

$

199,313

$

Non-GAAP pro forma adjustment for revenue share post-IPO

—

41,263

Net Revenue

229,308

$

240,576

$

Net income

64,887

$

112,528

$

Non-GAAP pro forma adjustment for revenue share post-IPO

—

(41,263)

Interest and investment income, net

(191)

(220)

Income tax expense

5,811

764

Depreciation and amortization

10,308

8,356

Amortization of purchased intangible assets

903

601

EBITDA

81,718

80,766

Stock-based compensation

6,439

325

Acquisition related expenses

1,278

142

Strategic and financial restructuring expenses

96

1,842

Adjustment to tax receivable agreement liability

(1,073)

—

Acquisition related adjustment - deferred revenue

2,065

—

Other (income) expense, net

(5)

(4)

Adjusted EBITDA

90,518

$

83,071

$

Segment Adjusted EBITDA:

Supply Chain Services

91,268

$

125,480

$

Non-GAAP pro forma adjustment for revenue share post-IPO

—

(41,263)

Supply Chain Services

(including non-GAAP pro forma adjustment)

91,268

$

84,217

$

Performance Services

18,362

16,329

Corporate

(19,112)

(17,475)

Adjusted EBITDA

90,518

$

83,071

$

Depreciation and amortization

(10,308)

(8,356)

Amortization of purchased intangible assets

(903)

(601)

Stock-based compensation

(6,439)

(325)

Acquisition related expenses

(1,278)

(142)

Strategic and financial restructuring expenses

(96)

(1,842)

Adjustment to tax receivable agreement liability

1,073

—

Acquisition related adjustment - deferred revenue

(2,065)

—

Equity in net income of unconsolidated affiliates

(4,866)

(4,114)

Deferred compensation plan expense

509

—

66,145

67,691

Non-GAAP pro forma adjustment for revenue share post-IPO

—

41,263

Operating income

66,145

$

108,954

$

Equity in net income of unconsolidated affiliates

4,866

4,114

Interest and investment income, net

191

220

Other (expense) income, net

(504)

4

Income before income taxes

70,698

$

113,292

$

* Note that no pro forma adjustments were made for the three months

ended September 30, 2014; as such, actual results are presented for the three months ended September 30, 2014.

Three Months Ended

September 30,

Supplemental Financial Information - Reporting of Non-GAAP Pro

Forma Adjusted EBITDA and Non-GAAP Adjusted Fully Distributed Net Income

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

Reconciliation of Net Income to Adjusted EBITDA and Reconciliation of

Segment Adjusted EBITDA to Income Before Income Taxes: |

25

Premier, Inc. supplemental financial information

(Unaudited, in thousands)

2014*

2013

Reconciliation of Non-GAAP Pro Forma Adjusted Fully Distributed Net

Income: Net income (loss) attributable to shareholders

9,273

$

(476)

$

Non-GAAP pro forma adjustment for revenue share

post-IPO —

(41,263)

Income tax expense

5,811

764

Stock-based compensation

6,439

325

Acquisition related expenses

1,278

142

Strategic and financial restructuring expenses

96

1,842

Adjustment to tax receivable agreement liability

(1,073)

—

Acquisition related adjustment - deferred revenue

2,065

—

Amortization of purchased intangible assets

903

601

Net income attributable to noncontrolling interest in Premier LP

54,816

113,214

Non-GAAP pro forma adjusted fully distributed income before income

taxes 79,608

75,149

Income tax expense on fully distributed income before income

taxes 31,843

30,060

Non-GAAP Pro Forma Adjusted Fully Distributed Net Income

47,765

$

45,089

$

* Note that no pro forma adjustments were made for the three months

ended September 30, 2014; as such, actual results are presented for the three months ended September 30, 2014.

Three Months Ended

September 30,

Supplemental Financial Information - Reporting of Non-GAAP Pro

Forma Adjusted EBITDA and Non-GAAP Adjusted Fully Distributed Net Income

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

|

26

Premier, Inc. supplemental financial information

(Unaudited, in thousands, except per share data)

2014*

2013

Reconciliation of numerator for GAAP EPS to Non-GAAP EPS on Adjusted

Fully Distributed Net Income Net loss attributable to

shareholders after adjustment of redeemable limited partners' capital to redemption amount

(373,384)

$

(476)

$

Adjustment of redeemable limited partners' capital to

redemption amount 382,657

—

Net income (loss) attributable to shareholders

9,273

(476) Non-GAAP pro forma adjustment for

revenue share post-IPO —

(41,263)

Income tax expense

5,811

764

Stock-based compensation

6,439

325

Acquisition related expenses

1,278

142

Strategic and financial restructuring expenses

96

1,842

Adjustment to tax receivable agreement liability

(1,073)

—

Acquisition related adjustment - deferred revenue

2,065

—

Amortization of purchased intangible assets

903

601

Net income attributable to noncontrolling interest in Premier LP

54,816

113,214

Non-GAAP pro forma adjusted fully distributed income before income

taxes 79,608

75,149

Income tax expense on fully distributed income before income

taxes 31,843

30,060

Non-GAAP pro forma adjusted fully distributed net income

47,765

$

45,089

$

Reconciliation of denominator for GAAP EPS to Non-GAAP Adjusted Fully

Distributed Net Income Weighted Average:

Common shares used for basic and diluted earnings per share

32,376

5,627 Potentially dilutive shares

253

25 Class A common shares

outstanding

-

26,749 Conversion of Class B common units

112,083

112,608

Weighted average fully distributed shares outstanding - diluted

144,712

145,009

Reconciliation of GAAP EPS to Adjusted Fully Distributed EPS

GAAP loss per share

$ (11.53)

$

(0.08) Impact of adjustment of redeemable limited partners'

capital to redemption amount

$ 11.82

$ -

Impact of additions:

Non-GAAP pro forma adjustment for revenue share post-IPO

$ -

$

(7.33) Income tax expense

$ 0.18

$ 0.14

Stock-based compensation

$ 0.20

$ 0.06

Acquisition related expenses

$ 0.04

$ 0.03

Strategic and financial restructuring expenses

$ 0.00

$ 0.33

Adjustment to tax receivable agreement liability

$

(0.03)

$ -

Acquisition related adjustment - deferred revenue

$ 0.06

$ -

Amortization of purchased intangible assets

$ 0.03

$ 0.11

Net income attributable to noncontrolling interest in Premier LP

$ 1.69

$ 20.12

Impact of corporation taxes

$

(0.98)

$ (5.34)

Impact of increased share count

$

(1.15)

$ (7.70)

Non-GAAP earnings per share on adjusted fully distributed net income

- diluted

$ 0.33

$ 0.31

* Note that no pro forma adjustments were made for the three

months ended September 30, 2014; as such, actual results are presented for the three months ended September 30, 2014.

Three Months Ended

September 30,

Supplemental Financial Information - Reporting of Net Income and

Earnings Per Share Reconciliation of Selected Non-GAAP Measures

to GAAP Measures |