Attached files

| file | filename |

|---|---|

| 8-K - 8-K - McGraw-Hill Global Education Intermediate Holdings, LLC | mhgeih8-kxq3callpresentati.htm |

final 1 McGraw-Hill Global Education Holdings Third Quarter 2014 Investor Update November 2014

All statements in this presentation and the oral remarks made in connection herewith that are not statements of historical fact are “forward-looking statements” within the meaning of securities laws. Forward-looking statements include any statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans, and objectives of management. The words ‘‘anticipate,’’ ‘‘believe,’’ ‘‘estimate,’’ ‘‘expect,’’ ‘‘intend,’’ ‘‘may,’’ ‘‘plan,’’ ‘‘predict,’’ ‘‘project,’’ ‘‘target,’’ ‘‘potential,’’ ‘‘will,’’ ‘‘would,’’ ‘‘could,’’ ‘‘should,’’ ‘‘continue,’’ and similar expressions commonly indicate a forward-looking statement, although not all forward-looking statements may contain these words. You should not put undue reliance on forward-looking statements. All forward-looking statements are subject to certain risks and uncertainties, and actual results or events could differ materially from the plans, intentions and expectations described therein. We undertake no obligation to revise forward-looking statements to reflect events or circumstances that arise after the statements are made. Important Notice 2

Meeting Participants 3 Patrick Milano Executive Vice President, Chief Financial Officer & Chief Administrative Officer David Levin President & Chief Executive Officer David Kraut Treasurer, Vice President – Investor Relations

4 Introduction and Business Review

Company Highlights • Third-quarter and year-to-date September 30 financial results in line with expectations • Higher Education selling season progressing well through early November • Strong, sustained user growth across digital platforms • Continue to strengthen internal e-commerce capabilities – New Higher Education e-commerce site launched November 8th www.mheducation.com/highered – Over 50% revenue growth in channel vs. prior year – New international multi-currency e-commerce sites launched early November • Cost savings initiatives and acquisition integrations continue according to plan 5

• Volume growth in digital offerings more than offsets traditional print volume declines and average selling price differential • Leadership in adaptive technologies continues to accelerate, with ALEKS, LearnSmart and SmartBook usage increasing - Since its introduction in May 2013, more than 400 SmartBook titles have been developed for the Higher Education market • Expanded digital R&D office in Boston; opened new digital office in Seattle • Business model moving to Digital/Subscription Strong Digital Adoption Growth Continues 6 Unique Users YTD Sept 2014 vs 2013 Connect 2.8 million +16% Instructor Assignments Created 6.0 million +55% Student Assignments Submitted 52.9 million +38% LearnSmart 1.8 million +40% ALEKS 1.6 million +28% MH Campus 364,000 +44% Business Mix Moving to Digital Traditional Print Digital Custom Print Rapid Growth in Digital Subscribers

7 Financial Update

Financial Highlights Higher Ed: • Higher cash revenues driven by growth in digital and custom print – YTD Digital revenue up from 35% of total cash revenue in 2013 to 39% in 2014 • Growth in cash EBITDA driven by higher revenue partially offset by higher operating expenses in selling and marketing for spring semester as well as impact of acquisition start-up costs • Potential timing impact in Q4 as digital sales shift between December and January when students purchase digital products closer to start of class – update to be provided on FY 2014 earnings call Professional: • Digital revenue increased from 40% to 43% of total cash revenue from YTD 2013 to 2014 – Digital revenue growth driven primarily by Access platforms; partially offsets traditional print decline – New partnership to offer online digital library of over 1,700 titles to libraries globally • YTD cash EBITDA higher but product mix driving lower cash EBITDA in Q3 2014 vs. Q3 2013 International: • Digital revenue up more than 50% YTD, representing 9% of total cash revenue – Largely driven by growth in emerging markets • Cash EBITDA being maintained through strong cost management and restructuring initiatives Cost Savings Program: • Initiatives continue as planned; approximately $68 million of run rate cost savings actioned since March 2013 8

Q3 & September YTD Financial Performance Overview ($ in Millions) Higher Education Professional International Other Note: All figures are unaudited. 9

September YTD Total Higher Education Cash Revenue Composition Strong Digital Adoption Growth Continues Notes: 1 Cash revenues exclude purchase accounting adjustments detailed in the Appendix. 2 Accrued returns are recorded in traditional revenue while actual returns are recorded by revenue stream YTD 2014: Digital Cash Revenue is Growing at a CAGR of 18.7% since 2012 10 Revenue = $582 Revenue = $584 Revenue = $612 $ in millions Digital Traditional Print Custom Print

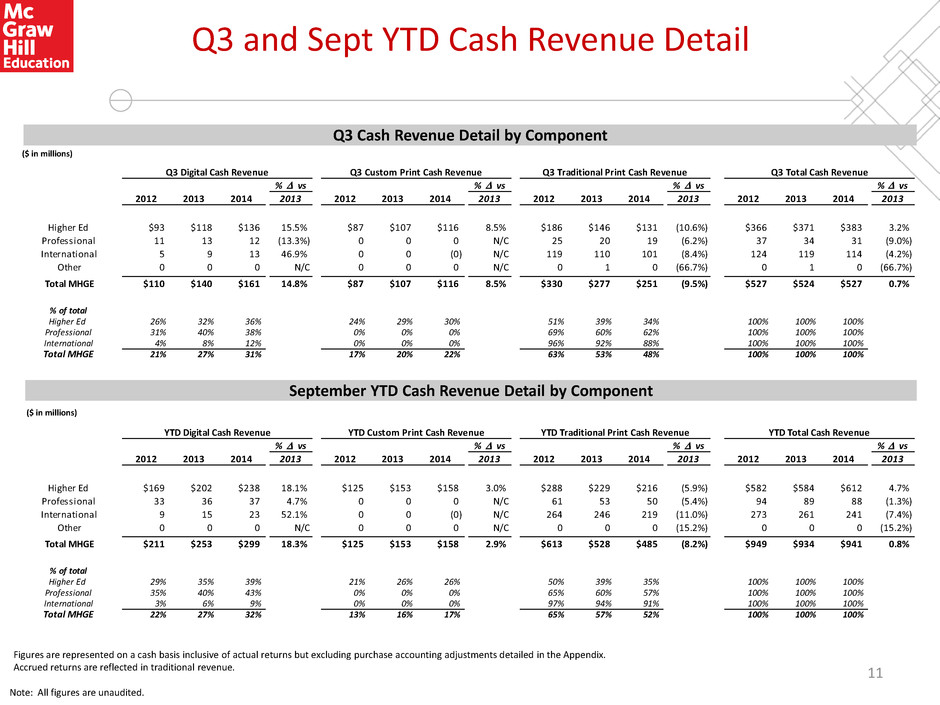

($ in millions) Q3 and Sept YTD Cash Revenue Detail Figures are represented on a cash basis inclusive of actual returns but excluding purchase accounting adjustments detailed in the Appendix. Accrued returns are reflected in traditional revenue. ($ in millions) Note: All figures are unaudited. Q3 Cash Revenue Detail by Component September YTD Cash Revenue Detail by Component Q3 Digital Cash Revenue Q3 Custom Print Cash Revenue Q3 Traditional Print Cash Revenue Q3 Total Cash Revenue 2012 2013 2014 2013 2012 2013 2014 2013 2012 2013 2014 2013 2012 2013 2014 2013 Higher Ed $93 $118 $136 15.5% $87 $107 $116 8.5% $186 $146 $131 (10.6%) $366 $371 $383 3.2% Professional 11 13 12 (13.3%) 0 0 0 N/C 25 20 19 (6.2%) 37 34 31 (9.0%) International 5 9 13 46.9% 0 0 (0) N/C 119 110 101 (8.4%) 124 119 114 (4.2%) Other 0 0 0 N/C 0 0 0 N/C 0 1 0 (66.7%) 0 1 0 (66.7%) Total MHGE $110 $140 $161 14.8% $87 $107 $116 8.5% $330 $277 $251 (9.5%) $527 $524 $527 0.7% % of total Higher Ed 26% 32% 36% 24% 29% 30% 51% 39% 34% 100% 100% 100% Professional 31% 40% 38% 0% 0% 0% 69% 60% 62% 100% 100% 100% International 4% 8% 12% 0% 0% 0% 96% 92% 88% 100% 100% 100% Total MHGE 21% 27% 31% 17% 20% 22% 63% 53% 48% 100% 100% 100% % D vs% D vs % D vs % D vs YTD Digital Cash Revenue YTD Custom Print Cash Revenue YTD Traditional Print Cash Revenue YTD Total Cash Revenue 2012 2013 2014 2013 2012 2013 2014 2013 2012 2013 2014 2013 2012 2013 2014 2013 i r Ed $1 9 $2 2 $238 18.1% $125 $153 $158 3.0% $288 $229 $216 (5.9%) $582 $584 $612 4.7% Pr fessi l 33 36 37 4.7% 0 0 0 N/C 1 53 50 (5.4%) 94 89 88 (1.3%) International 9 15 23 52.1% 0 0 (0) N/C 264 246 219 (11.0%) 273 261 241 (7.4%) Other 0 0 0 N/C 0 0 0 N/C 0 0 0 (15.2%) 0 0 0 (15.2%) Total MHGE $211 $253 $299 18.3% $125 $153 $158 2.9% $613 $528 $485 (8.2%) $949 $934 $941 0.8% % of total Higher Ed 29% 35% 39% 21% 26% 26% 50% 39% 35% 100% 100% 100% Professional 35% 40% 43% 0% 0% 0% 65% 60% 57% 100% 100% 100% International 3% 6% 9% 0% 0% 0% 97% 94% 91% 100% 100% 100% Total MHGE 22% 27% 32% 13% 16% 17% 65% 57% 52% 100% 100% 100% % D vs % D vs % D vs % D vs 11

Capital Structure 12 • Cash continues to build seasonally as expected – Remaining $54 million deferred acquisition payment for ALEKS made on August 1 – Cash balances exceeded $200 million by early November • Significant liquidity as $240 million bank revolver fully available as of September 30 with no plans to utilize for rest of 2014* • Net leverage below 3x as of September 30 – Net leverage including HoldCo debt below 4x as of September 30 *Excludes $30K outstanding letter of credit.

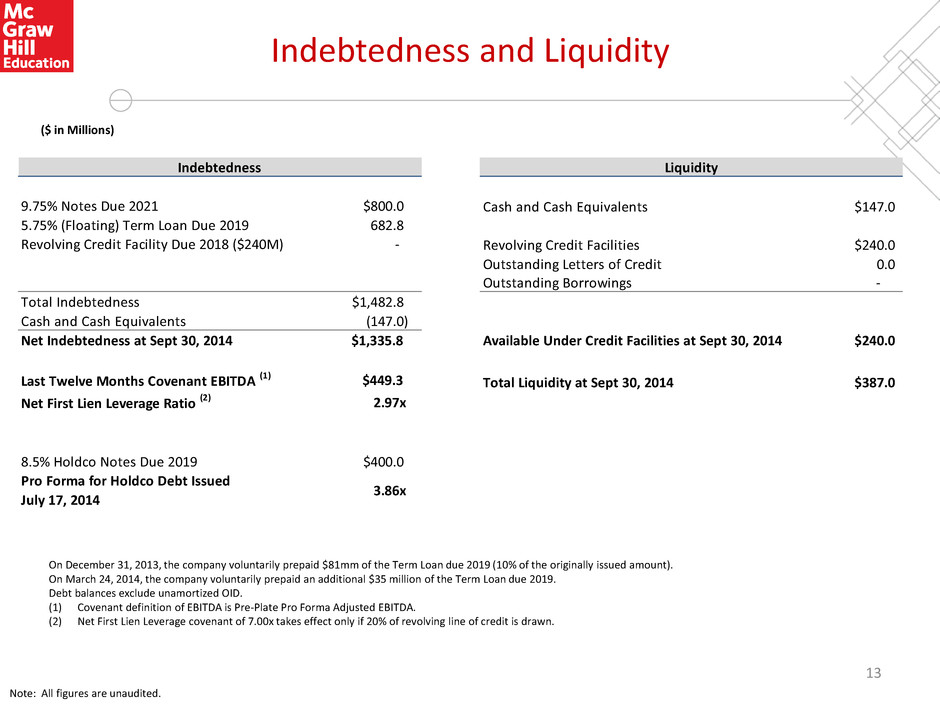

Indebtedness and Liquidity 13 On December 31, 2013, the company voluntarily prepaid $81mm of the Term Loan due 2019 (10% of the originally issued amount). On March 24, 2014, the company voluntarily prepaid an additional $35 million of the Term Loan due 2019. Debt balances exclude unamortized OID. (1) Covenant definition of EBITDA is Pre-Plate Pro Forma Adjusted EBITDA. (2) Net First Lien Leverage covenant of 7.00x takes effect only if 20% of revolving line of credit is drawn. ($ in Millions) Note: All figures are unaudited. 9.75% Notes Due 2021 $800.0 Cash and Cash Equivalents $147.0 5.75% (Floating) Term Loan Due 2019 682.8 Revolving Credit Facility Due 2018 ($240M) - Revolving Credit Facilities $240.0 Outstanding Letters of Credit 0.0 Outstanding Borrowings - Total Indebtedness $1,482.8 Cash and Cash Equivalents (147.0) Net Indebtedness at Sept 30, 2014 $1,335.8 Available Under Credit Facilities at Sept 30, 2014 $240.0 Last Twelve Months Covenant EBITDA (1) $449.3 Total Liquidity at Sept 30, 2014 $387.0 Net First Lien Leverage Ratio (2) 2.97x 8.5% Holdco Notes Due 2019 $400.0 Pro Forma for Holdco Debt Issued July 17, 2014 3.86x Indebtedness Liquidity

14 Appendix: Financial Detail

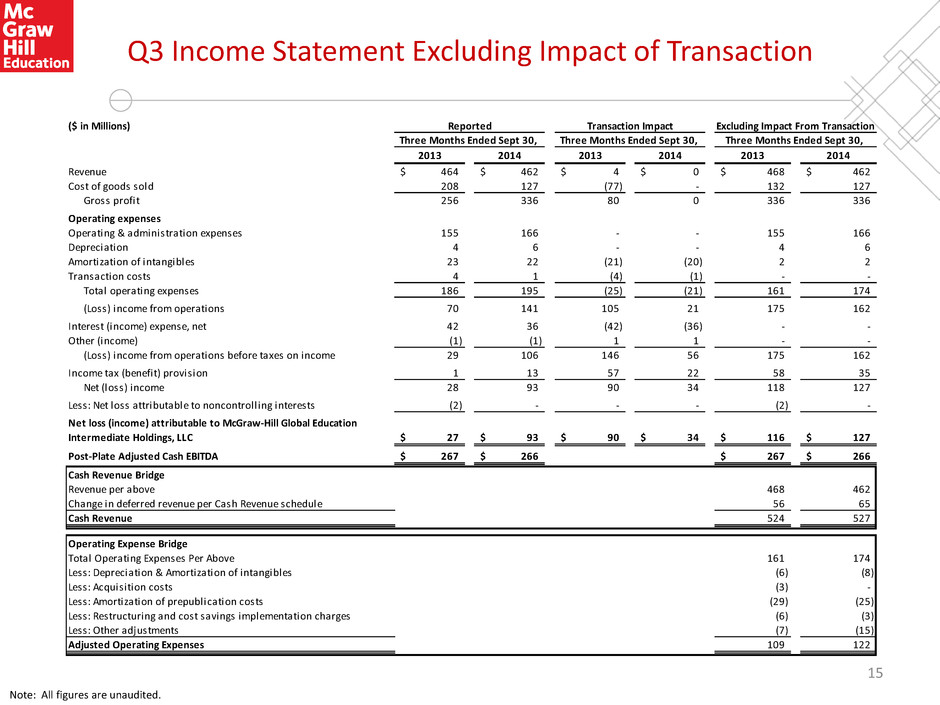

Q3 Income Statement Excluding Impact of Transaction Note: All figures are unaudited. ($ in Millions) 2013 2014 2013 2014 2013 2014 Revenue 464$ 462$ 4$ 0$ 468$ 462$ Cost of goods sold 208 127 (77) - 132 127 Gross profit 256 336 80 0 336 336 Operating expenses Operating & administration expenses 155 166 - - 155 166 Depreciation 4 6 - - 4 6 Amortization of intangibles 23 22 (21) (20) 2 2 Transaction costs 4 1 (4) (1) - - Total operating expenses 186 195 (25) (21) 161 174 (Loss) income from operations 70 141 105 21 175 162 Interest (income) expense, net 42 36 (42) (36) - - Other (income) (1) (1) 1 1 - - (Loss) income from operations before taxes on income 29 106 146 56 175 162 Income tax (benefit) provision 1 13 57 22 58 35 Net (loss) income 28 93 90 34 118 127 Less: Net loss attributable to noncontrolling interests (2) - - - (2) - Net loss (income) attributable to McGraw-Hill Global Education Intermediate Holdings, LLC 27$ 93$ 90$ 34$ 116$ 127$ Post-Plate Adjusted Cash EBITDA 267$ 266$ 267$ 266$ Cash Revenue Bridge Revenue per above 468 462 Change in deferred revenue per Cash Revenue schedule 56 65 Cash Revenue 524 527 Operating Expense Bridge Total Operating Expenses Per Above 161 174 Less: Depreciation & Amortization of intangibles (6) (8) Less: Acquisition costs (3) - Less: Amortization of prepublication costs (29) (25) Less: Restructuring and cost savings implementation charges (6) (3) Less: Other adjustments (7) (15) Adjusted Operating Expenses 109 122 Reported Transaction Impact Excluding Impact From Transaction Three Months Ended Sept 30, Three Months Ended Sept 30, Three Months Ended Sept 30, 15

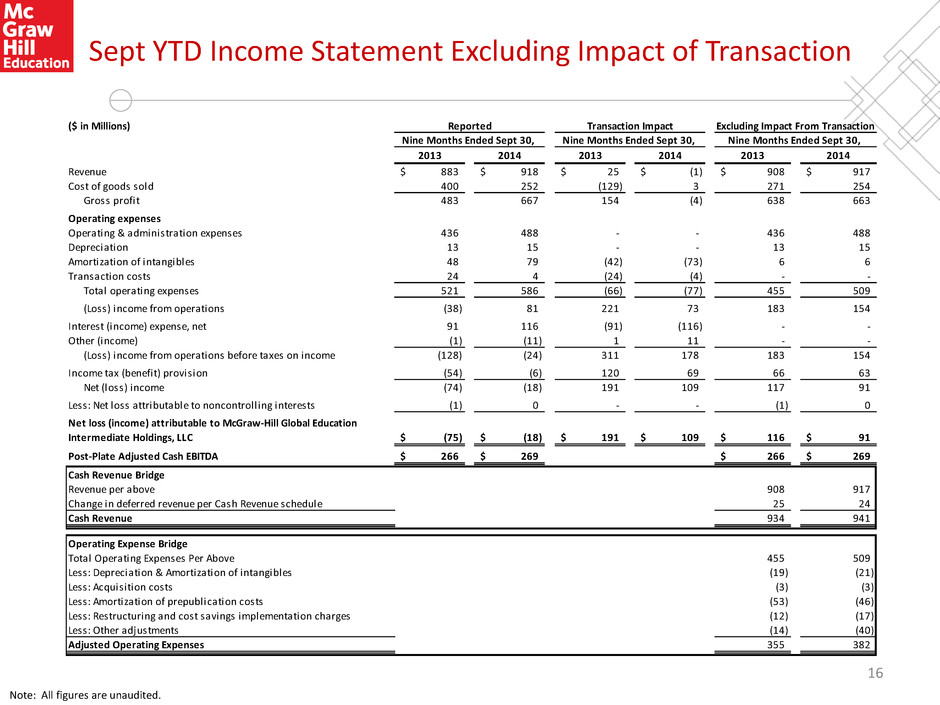

Sept YTD Income Statement Excluding Impact of Transaction Note: All figures are unaudited. ($ in Millions) 2013 2014 2013 2014 2013 2014 Revenue 883$ 918$ 25$ (1)$ 908$ 917$ Cost of goods sold 400 252 (129) 3 271 254 Gross profit 483 667 154 (4) 638 663 Operating expenses Operating & administration expenses 436 488 - - 436 488 Depreciation 13 15 - - 13 15 Amortization of intangibles 48 79 (42) (73) 6 6 Transaction costs 24 4 (24) (4) - - Total operating expenses 521 586 (66) (77) 455 509 (Loss) income from operations (38) 81 221 73 183 154 Interest (income) expense, net 91 116 (91) (116) - - Other (income) (1) (11) 1 11 - - (Loss) income from operations before taxes on income (128) (24) 311 178 183 154 Income tax (benefit) provision (54) (6) 120 69 66 63 Net (loss) income (74) (18) 191 109 117 91 Less: Net loss attributable to noncontrolling interests (1) 0 - - (1) 0 Net loss (income) attributable to McGraw-Hill Global Education Intermediate Holdings, LLC (75)$ (18)$ 191$ 109$ 116$ 91$ Post-Plate Adjusted Cash EBITDA 266$ 269$ 266$ 269$ Cash Revenue Bridge Revenue per above 908 917 Change in deferred revenue per Cash Revenue schedule 25 24 Cash Revenue 934 941 Operating Expense Bridge Total Operating Expenses Per Above 455 509 Less: Depreciation & Amortization of intangibles (19) (21) Less: Acquisition costs (3) (3) Less: Amortization of prepublication costs (53) (46) Less: Restructuring and cost savings implementation charges (12) (17) Less: Other adjustments (14) (40) Adjusted Operating Expenses 355 382 Reported Transaction Impact Excluding Impact From Transaction Nine Months Ended Sept 30, Nine Months Ended Sept 30, Nine Months Ended Sept 30, 16

Revenue Excluding Impact of Purchase Accounting / Bridge from Reported Revenue to Cash Revenue 17 Note: All figures are unaudited. ($ in Millions) Sept 30, 2013 Sept 30, 2014 Sept 30, 2013 Sept 30, 2014 Reported Revenue 464$ 462$ 883$ 918$ Eliminate Impact of Purchase Accounting 4 0 25 (1) Total 468 462 908 917 Change in Deferred Revenues 56 65 25 24 Total Cash Revenues 524$ 527$ 934$ 941$ Segments Higher Ed 371$ 383$ 584$ 612$ Professional 34 31 89 88 International 119 114 261 241 Other 1 - (0) - Total 524$ 527$ 934$ 941$ Three Months Ended Nine Months Ended

EBITDA and Adjusted EBITDA 18 EBITDA, a measure used by management to assess operating performance, is defined as income from continuing operations plus interest, income taxes, depreciation and amortization, including amortization of prepublication costs (“plate investment”). Adjusted EBITDA is defined as EBITDA adjusted to exclude unusual items and other adjustments required or permitted in calculating covenant compliance under our new Asset-Based Revolving Credit Agreement. Post-Plate Adjusted Cash EBITDA reflects the impact of cash spent for plate investment. Plate investment costs, which include both the cost of developing education content and testing, scoring and assessment solution products, are capitalized and amortized. These costs are capitalized when the title is expected to generate probable future economic benefits and are amortized upon publication of the title over its estimated useful life of up to six years. Each of the above described EBITDA-based measures is not a recognized term under U.S. GAAP and does not purport to be an alternative to income from continuing operations as a measure of operating performance or to cash flows from operations as a measure of liquidity. Additionally, each such measure is not intended to be a measure of free cash flows available for management’s discretionary use, as it does not consider certain cash requirements such as interest payments, tax payments and debt service requirements. Such measures have limitations as analytical tools, and you should not consider any of such measures in isolation or as substitutes for our results as reported under U.S. GAAP. Management compensates for the limitations of using non-GAAP financial measures by using them to supplement U.S. GAAP results to provide a more complete understanding of the factors and trends affecting the business than U.S. GAAP results alone. Because not all companies use identical calculations, these EBITDA-based measures may not be comparable to other similarly titled measures of other companies. Note: All figures are unaudited.

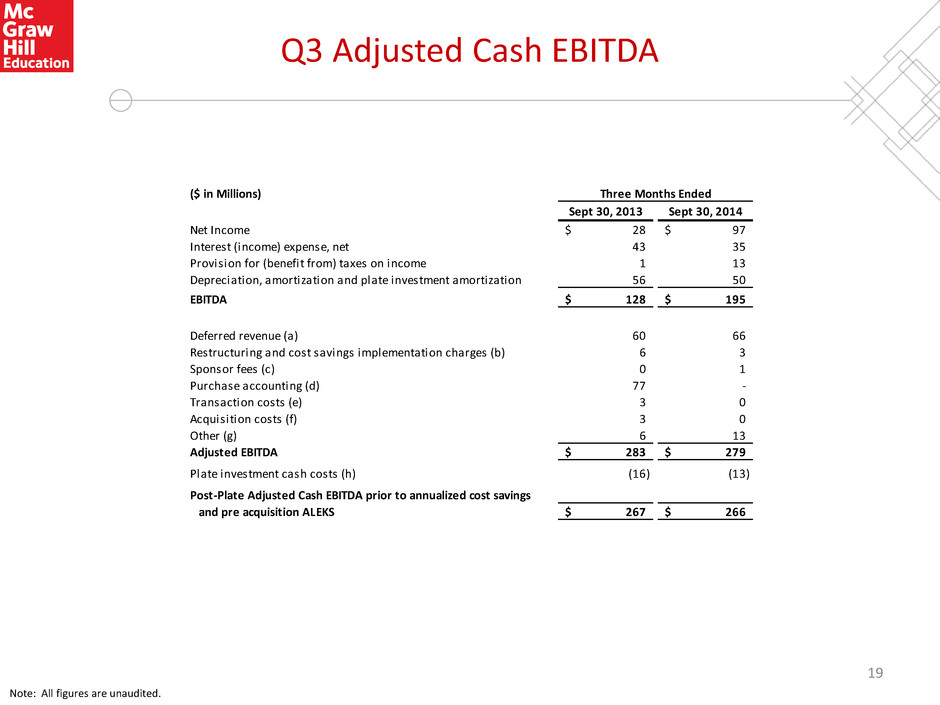

Q3 Adjusted Cash EBITDA Note: All figures are unaudited. ($ in Millions) Sept 30, 2013 Sept 30, 2014 Net Income 28$ 97$ Interest (income) expense, net 43 35 Provision for (benefit from) taxes on income 1 13 Depreciation, amortization and plate investment amortization 56 50 EBITDA 128$ 195$ Deferred revenue (a) 60 66 Restructuring and cost savings implementation charges (b) 6 3 Sponsor fees (c) 0 1 Purchase accounting (d) 77 - Transaction costs (e) 3 0 Acquisition costs (f) 3 0 Other (g) 6 13 Adjusted EBITDA 283$ 279$ Plate investment cash costs (h) (16) (13) Post-Plate Adjusted Cash EBITDA prior to annualized cost savings and pre acquisition ALEKS 267$ 266$ Three Months Ended 19

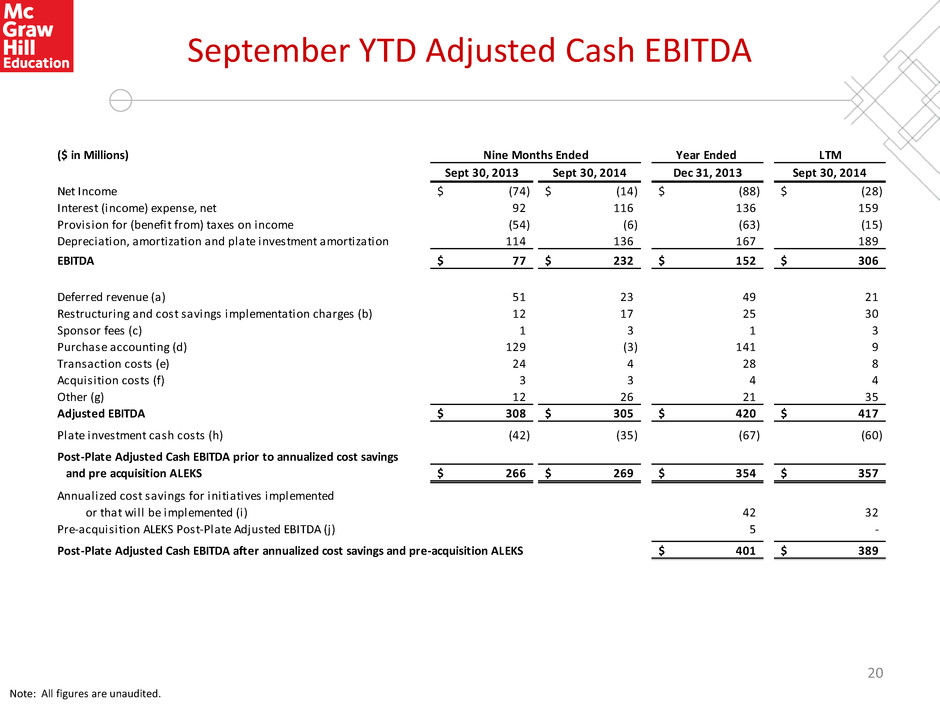

September YTD Adjusted Cash EBITDA Note: All figures are unaudited. ($ in Millions) Year Ended LTM Sept 30, 2013 Sept 30, 2014 Dec 31, 2013 Sept 30, 2014 Net Income (74)$ (14)$ (88)$ (28)$ Interest (income) expense, net 92 116 136 159 Provision for (benefit from) taxes on income (54) (6) (63) (15) Depreciation, amortization and plate investment amortization 114 136 167 189 EBITDA 77$ 232$ 152$ 306$ Deferred revenue (a) 51 23 49 21 Restructuring and cost savings implementation charges (b) 12 17 25 30 Sponsor fees (c) 1 3 1 3 Purchase accounting (d) 129 (3) 141 9 Transaction costs (e) 24 4 28 8 Acquisition costs (f) 3 3 4 4 Other (g) 12 26 21 35 Adjusted EBITDA 308$ 305$ 420$ 417$ Plate investment cash costs (h) (42) (35) (67) (60) Post-Plate Adjusted Cash EBITDA prior to annualized cost savings and pre acquisition ALEKS 266$ 269$ 354$ 357$ Annualized cost savings for initiatives implemented or that will be implemented (i) 42 32 Pre-acquisition ALEKS Post-Plate Adjusted EBITDA (j) 5 - Post-Plate Adjusted Cash EBITDA after annualized cost savings and pre-acquisition ALEKS 401$ 389$ Nine Months Ended 20

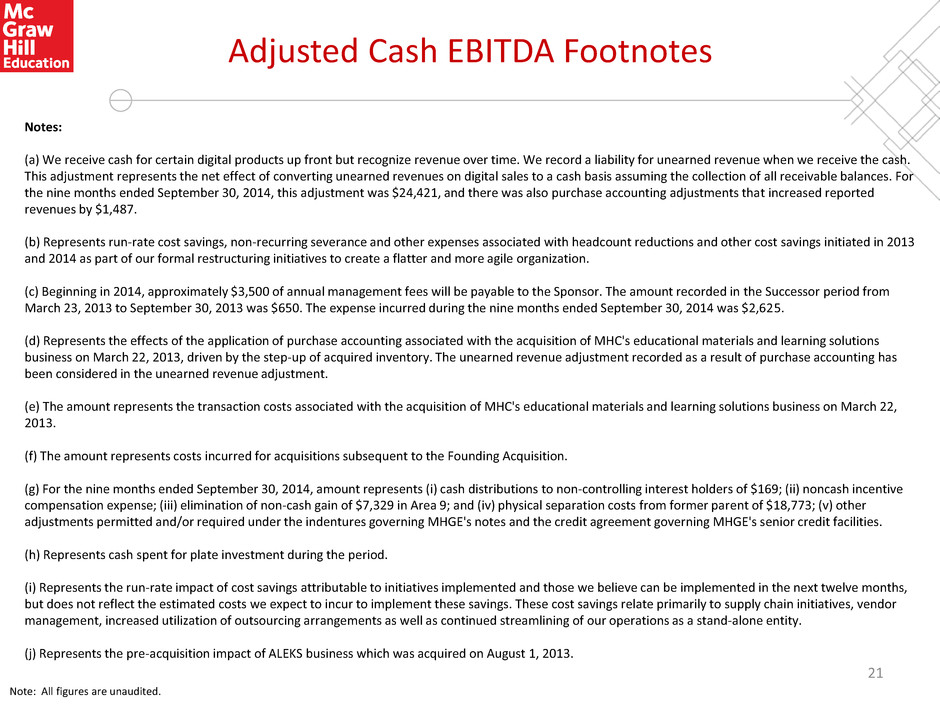

Adjusted Cash EBITDA Footnotes 21 Note: All figures are unaudited. Notes: (a) We receive cash for certain digital products up front but recognize revenue over time. We record a liability for unearned revenue when we receive the cash. This adjustment represents the net effect of converting unearned revenues on digital sales to a cash basis assuming the collection of all receivable balances. For the nine months ended September 30, 2014, this adjustment was $24,421, and there was also purchase accounting adjustments that increased reported revenues by $1,487. (b) Represents run-rate cost savings, non-recurring severance and other expenses associated with headcount reductions and other cost savings initiated in 2013 and 2014 as part of our formal restructuring initiatives to create a flatter and more agile organization. (c) Beginning in 2014, approximately $3,500 of annual management fees will be payable to the Sponsor. The amount recorded in the Successor period from March 23, 2013 to September 30, 2013 was $650. The expense incurred during the nine months ended September 30, 2014 was $2,625. (d) Represents the effects of the application of purchase accounting associated with the acquisition of MHC's educational materials and learning solutions business on March 22, 2013, driven by the step-up of acquired inventory. The unearned revenue adjustment recorded as a result of purchase accounting has been considered in the unearned revenue adjustment. (e) The amount represents the transaction costs associated with the acquisition of MHC's educational materials and learning solutions business on March 22, 2013. (f) The amount represents costs incurred for acquisitions subsequent to the Founding Acquisition. (g) For the nine months ended September 30, 2014, amount represents (i) cash distributions to non-controlling interest holders of $169; (ii) noncash incentive compensation expense; (iii) elimination of non-cash gain of $7,329 in Area 9; and (iv) physical separation costs from former parent of $18,773; (v) other adjustments permitted and/or required under the indentures governing MHGE's notes and the credit agreement governing MHGE's senior credit facilities. (h) Represents cash spent for plate investment during the period. (i) Represents the run-rate impact of cost savings attributable to initiatives implemented and those we believe can be implemented in the next twelve months, but does not reflect the estimated costs we expect to incur to implement these savings. These cost savings relate primarily to supply chain initiatives, vendor management, increased utilization of outsourcing arrangements as well as continued streamlining of our operations as a stand-alone entity. (j) Represents the pre-acquisition impact of ALEKS business which was acquired on August 1, 2013.