Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Inventergy Global, Inc. | Financial_Report.xls |

| EX-10.4 - EXHIBIT 10.4 - Inventergy Global, Inc. | v392575_ex10-4.htm |

| EX-32.1 - EXHIBIT 32.1 - Inventergy Global, Inc. | v392575_ex32-1.htm |

| EX-10.3 - EXHIBIT 10.3 - Inventergy Global, Inc. | v392575_ex10-3.htm |

| EX-10.2 - EXHIBIT 10.2 - Inventergy Global, Inc. | v392575_ex10-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Inventergy Global, Inc. | v392575_ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Inventergy Global, Inc. | v392575_ex32-2.htm |

| EX-10.6 - EXHIBIT 10.6 - Inventergy Global, Inc. | v392575_ex10-6.htm |

| EX-31.2 - EXHIBIT 31.2 - Inventergy Global, Inc. | v392575_ex31-2.htm |

| EX-10.5 - EXHIBIT 10.5 - Inventergy Global, Inc. | v392575_ex10-5.htm |

| 10-Q - FORM 10-Q - Inventergy Global, Inc. | v392575_10q.htm |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

Exhibit 10.1

| ***CONFIDENTIAL TREATMENT REQUESTED*** |

| Note: Confidential treatment requested with respect to certain portions hereof denoted with “***” |

REVENUE SHARING AND NOTE PURCHASE AGREEMENT

(INVENTERGY)

Dated as of OCTOBER 1, 2014

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

TABLE OF CONTENTS

| ARTICLE I DEFINITIONS | 1 | |

| 1.1. | Certain Defined Terms | 1 |

| 1.2. | Other Interpretative Provisions | 2 |

| ARTICLE II CLOSING AND TERMS OF THE REVENUE STREAM AND NOTES | 2 | |

| 2.1. | The Revenue Stream | 2 |

| 2.2. | The Notes | 3 |

| 2.4. | Purchase Price Allocation | 5 |

| 2.5. | Taxes | 5 |

| 2.6. | Manner and Time of Payment | 5 |

| 2.7. | Patent License | 6 |

| ARTICLE III CONDITIONS PRECEDENT | 7 | |

| 3.1. | Conditions to Closing | 7 |

| ARTICLE IV REPRESENTATIONS AND WARRANTIES OF THE COMPANY | 9 | |

| 4.1. | Organization and Business | 9 |

| 4.2. | Qualification | 9 |

| 4.3. | Operations in Conformity with Law, etc. | 9 |

| 4.4. | Authorization and Non-Contravention | 9 |

| 4.5. | Intellectual Property | 10 |

| 4.6. | Material Agreements | 11 |

| 4.7. | Margin Regulations | 11 |

| 4.8. | Investment Company Act | 11 |

| 4.9. | USA PATRIOT Act, FCPA and OFAC | 11 |

| 4.10. | No Default | 12 |

| 4.11. | Binding Effect | 12 |

| 4.12. | Disclosure | 12 |

| ARTICLE V | 12 | |

| ARTICLE V REPRESENTATIONS AND WARRANTIES OF THE PURCHASERS AND COLLATERAL AGENT | 12 | |

| 5.1. | Authority | 12 |

| 5.2. | Binding Effect | 12 |

| 5.3. | Investment Intent | 13 |

| 5.4. | Experience of the Purchaser | 13 |

| 5.5. | Access to Information | 13 |

| 5.6 | Reliance on Exemptions | 13 |

| ARTICLE VI COVENANTS | 13 | |

| 6.1. | Taxes and Other Charges | 14 |

| -i- |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

| 6.2. | Conduct of Monetization Activities | 14 |

| 6.3. | Maintenance of Existence | 14 |

| 6.4. | Compliance with Legal Requirements | 14 |

| 6.5. | Notices; Reports | 15 |

| 6.6. | Information and Access Rights | 16 |

| 6.7. | Indebtedness | 16 |

| 6.8. | Liens | 17 |

| 6.9. | Management of Patents and Patent Licenses | 17 |

| 6.10. | Cash Collateral Account | 18 |

| 6.11. | Further Assurances | 19 |

| 6.12. | Confidentiality | 19 |

| ARTICLE VII EVENTS OF DEFAULT | 22 | |

| 7.1. | Events of Default | 22 |

| 7.2. | Remedies Following an Event of Default | 24 |

| 7.3. | Annulment of Defaults | 25 |

| 7.4. | Waivers | 25 |

| ARTICLE VIII COLLATERAL AGENT | 26 | |

| 8.1. | Appointment of Collateral Agent | 26 |

| 8.2. | Collateral | 26 |

| 8.3. | Collateral Agent’s Resignation | 26 |

| 8.4. | Concerning the Collateral Agent | 27 |

| ARTICLE IX GENERAL PROVISIONS | 28 | |

| 9.1. | Expenses | 28 |

| 9.2. | Indemnity | 29 |

| 9.3. | Notices | 30 |

| 9.4. | Amendments, Consents, Waivers, etc. | 30 |

| 9.5. | No Strict Construction | 31 |

| 9.6. | Certain Acknowledgments | 31 |

| 9.7. | Venue; Service of Process; Certain Waivers | 31 |

| 9.8. | WAIVER OF JURY TRIAL | 32 |

| 9.9. | Interpretation; Governing Law; etc. | 32 |

| 9.10. | Successors and Assigns | 32 |

| 9.11. | Tax Treatment | 34 |

APPENDICES, SCHEDULES AND EXHIBITS

| Appendix I | Definitions |

| Schedule 2.1 | Revenue Participants |

| Schedule 2.2 | Note Purchasers |

| Schedule 2.6 | Wire Transfer Instructions |

| -ii- |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

| Schedule 4.1 | Company Organization |

| Schedule 4.5(g) | Patent Litigation; Reissues and Oppositions |

| Schedule 4.6 | Material Agreements |

| Schedule 6.7 | Existing Indebtedness |

| Schedule 6.12.4 | *** |

| Schedule 9.3 | Notices |

| Schedule I(a) | Patents |

| Exhibit A | Form of Note |

| Exhibit B | Control Agreement |

| Exhibit C | Form of Certificate (Payments to Cash Collateral Account) |

| Exhibit D-1 | ☐Note Assignment and Acceptance Agreement |

| Exhibit D-2 | Revenue Stream Assignment and Acceptance Agreement |

| Exhibit E | Patent License Agreement |

| Exhibit F | Patent Security Agreement |

| Exhibit G | Security Agreement |

| Exhibit H | Subscription Agreement |

| Exhibit I | Newco LLC Agreement |

| -iii- |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

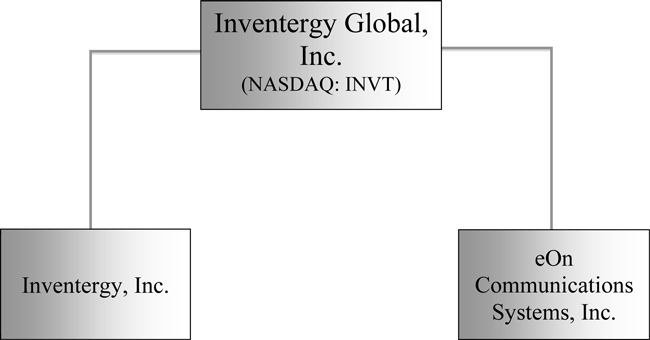

REVENUE SHARING AND NOTE PURCHASE AGREEMENT

This REVENUE SHARING AND NOTE PURCHASE AGREEMENT (this “Agreement”) is dated as of October 1, 2014 by and among Inventergy Global, Inc., a Delaware corporation (“Parent”) and Inventergy, Inc. (“Owner”, and, collectively, the “Company”), and DBD Credit Funding, LLC as collateral agent (the “Collateral Agent”), each Person listed on Schedule 2.1 hereto (the “Revenue Participants”) and each Person listed on Schedule 2.2 hereto (the “Note Purchasers” and, together with the Revenue Participants, the “Purchasers”).

RECITALS

WHEREAS, the Revenue Participants wish to acquire, and the Company has agreed to grant, an interest in certain of the Company’s future revenues from its patent portfolio subject to payment of the purchase price and other conditions specified herein, which future revenues are inherently risky and uncertain as to both amount and timing; and

WHEREAS, the Note Purchasers have agreed to purchase from the Company, and the Company has agreed to issue and sell to the Purchasers, up to $11,000,000 in aggregate original principal amount of the Company’s senior secured notes (the “Notes”) in the form of Exhibit A hereto, subject to the terms of this Agreement,

WHEREAS, the Purchaser and the Company may agree in future to the issuance and sale of up to $5,000,000 in aggregate original principal amount of Notes and additional interests in the Company’s future revenues from its patent portfolio;

NOW THEREFORE, in consideration of the mutual agreements contained herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

ARTICLE I

DEFINITIONS

1.1. Certain Defined Terms. Capitalized terms used in this Agreement and not otherwise defined shall have the meanings set forth in Appendix I.

| 1 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

1.2. Other Interpretative Provisions. Unless otherwise specified, all references to “$”, “cash”, “dollars” or similar references shall mean U.S. dollars, paid in cash or other immediately available funds. The definitions set forth in this Agreement are equally applicable to both the singular and plural forms of the terms defined. The words “hereof”, “herein”, and “hereunder” and words of like import when used in this Agreement shall refer to this Agreement as a whole and not to any particular provision of this Agreement. All references to time of day herein are references to New York, New York time (daylight or standard, as applicable) unless otherwise specifically provided. Where the character or amount of any asset or liability or item of income or expense is required to be determined or any consolidation or other accounting computation is required to be made for the purposes of this Agreement, it shall be done in accordance with GAAP except where such principles are inconsistent with the specific provisions of this Agreement. References in this Agreement to an Appendix, Exhibit, Schedule, Article, Section, clause or subclause refer (A) to the appropriate Appendix, Exhibit or Schedule to, or Article, Section, clause or subclause in this Agreement or (B) to the extent such references are not present in this Agreement, to the Document in which such reference appears. The term “including” is by way of example and not limitation. The word “or” is not exclusive. In the computation of periods of time from a specified date to a later specified date, the word “from” means “from and including”; the words “to” and “until” each mean “to but excluding”; and the word “through” means “to and including.” The term “documents” includes any and all instruments, documents, agreements, certificates, notices, reports, financial statements and other writings, however evidenced, whether in physical or electronic form. All references to any Person shall be constructed to include such Person’s successors and assigns (subject to any restriction on assignment set forth herein). Unless otherwise expressly provided herein, references to any law shall include all statutory and regulatory provisions consolidating, amending, replacing, supplementing or interpreting such law.

ARTICLE II

CLOSING AND TERMS OF THE REVENUE STREAM AND NOTES

2.1. The Revenue Stream.

2.1.1. Purchase of the Revenue Stream. On the Closing Date, subject to the satisfaction of the conditions set forth in Section 3.1, and against the payment of an aggregate purchase price of *** allocated as set forth on Schedule 2.1, the Company hereby grants, and the Revenue Participants hereby acquire the Revenue Stream. The rights of the Revenue Participants to the Revenue Stream shall be secured pursuant to the Collateral Documents, junior in priority to the rights of the Note Purchasers.

2.1.2. Payments to Revenue Participants. Following payment in full of the Note Obligations, the Company shall pay to the Revenue Participants their proportionate share, in accordance with Schedule 2.1, of the Revenue Stream; provided, that the Company shall instruct any payors to deposit Monetization Revenues, per Section 6.11, directly into the Cash Collateral Account. Any applicable payments by the Company to Revenue Participants shall be made monthly on the last Business Day of each month with respect to any Monetization Revenues received through the last Business Day of the prior month. Except to the extent that the Collateral Agent is enjoined or stayed from distributing any such Monetization Revenues by action brought by the Company, such direct deposit in the Cash Collateral Account by payors shall constitute timely payment by the Company. For the avoidance of doubt, prior to the payment in full of the Note Obligations, all Monetization Net Revenues shall be applied by the Company or the Collateral Agent, as the case may be, in accordance with Section 2.2.4, including the payment of principal, interest and any applicable premiums or fees on the Note Obligations (inclusive of payments owed pursuant to Sections 9.1(ii)-(iv) or 9.2, and shall not be shared with any Revenue Participants as a payment in respect of the Revenue Stream.

| 2 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with respect to certain portions hereof denoted with

“***”

2.2. The Notes.

2.2.1. Purchase and Sale of the Notes. On the Closing Date, subject to satisfaction of the conditions set forth in Section 3.1, the Company agrees to issue and sell, and each Note Purchaser agrees to purchase, for the purchase price set forth on Schedule 2.2 and in accordance with the percentages set forth on Schedule 2.2, Notes in an aggregate original principal amount of $11,000,000.

2.2.2. Interest on the Notes. The unpaid principal amount of the Notes (including any PIK Interest) shall bear cash interest at a rate equal to LIBOR plus 7% per annum plus 3% per annum of PIK interest (defined below); provided that upon and during the continuance of an Event of Default under Section 7.1.1, the cash interest rate shall increase by an additional 2% per annum. Interest on the Notes shall be paid on the last Business Day of each calendar month (the “Interest Payment Date”), starting with the calendar month ending October 31, 2014. Such interest shall be paid in cash except that 3.00% per annum of the interest due on each Interest Payment Date shall be paid-in-kind, by increasing the principal amount of the Notes by the amount of such interest, effective as of the applicable Interest Payment Date (“PIK Interest”). PIK Interest shall be treated as principal of the Note for all purposes of interest accrual or calculation of any premium.

2.2.3. Fees; Prepayment Premium.

2.2.3.1. At the Closing Date, the Company shall pay to the Purchasers a structuring fee equal to $385,000 (consisting of 3.5% of the original principal amount of the Notes), which amount shall be netted out of the funding at the Closing Date.

2.2.3.2. Upon the earlier of the date on which the Note Obligations are paid in full, or become due (whether at the Maturity Date or upon acceleration), the Company shall pay to the Note Purchasers a termination fee equal to $770,000 (consisting of 7.0% of the original principal amount of the Notes).

2.2.4. Payment of the Notes.

2.2.4.1. Payment at Maturity. The principal of the Notes and all unpaid interest thereon or other amounts owing hereunder shall be paid in full in cash on September 30, 2017 (the “Maturity Date”). If the Maturity Date is not a Business Day, such payment shall be due on the next following Business Day.

| 3 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

2.2.4.2. Optional Prepayments. In addition to being required to make Mandatory Prepayments as required under Section 2.2.4.4, the Company may prepay the Notes from time to time in whole or in part, without penalty or premium, except that any optional prepayments of the Notes prior to the first anniversary of the Closing Date shall be accompanied by a prepayment premium equal to 5.00% of the principal amount prepaid. Any such prepayment shall include accrued and unpaid interest on the amount prepaid.

2.2.4.3. Amortization. Commencing on the last Business Day of October, 2015, the Company shall make monthly amortization payments on the Notes in an amount, as of the date of such payment, equal to (x) the then outstanding principal amount divided by (y) the number of months left until the Maturity Date. The amount of the monthly amortization payment shall be calculated by the Company, and provided to the Collateral Agent for review, initially prior to the first such payment and recalculated following any optional or mandatory prepayment.

2.2.4.4. Mandatory Prepayments. Upon receipt of any Monetization Revenues, the Company or the Collateral Agent, as the case may be, shall apply 85% of such Monetization Net Revenues to the payment of accrued and unpaid interest on, and then to repay outstanding principal of, and any fees with respect to, the Notes until all Note Obligations have been paid in full. Payments by the Company on the Notes shall be made monthly on the last Business Day of each month with respect to Monetization Revenues received through the last Business Day of the prior month. For the avoidance of doubt, mandatory prepayments are not subject to any prepayment premium.

2.2.4.5. Application of Payments. Payments on the Notes shall be applied in the following order, first to any then outstanding expenses or other amounts owing pursuant to Article 9; second, to accrued and unpaid interest (excluding PIK Interest); third to principal; fourth to any prepayment premium on the principal so repaid; and finally, after all principal of the Notes and any prepayment premium, has been paid in full, to the termination fee. Optional and mandatory repayments shall reduce required amortization payments pro rata.

2.3. Monetization Revenues. All Monetization Revenues received by the Company or deposited in the Cash Collateral Account shall be applied so that 86% of Monetization Net Revenues are applied to the Note Obligations until paid in full; provided, that 100% of the Monetization Net Revenues received since the last Business Day of the preceding month shall be applied to pay any past due Note Obligations, including in the event of acceleration of the Notes. Following payment in full of the Note Obligations, the Applicable Percentage of the Monetization Net Revenues received following the payment in full of the Note Obligations shall be paid to the Revenue Participants for application to the Revenue Stream, in accordance with Section 2.1.2 and Schedule 2.1, until fully satisfied; provided that in the event of an acceleration of the Revenue Stream, 100% of the Monetization Net Revenues received since the last Business Day of the preceding month shall be applied to pay the remaining balance of the Revenue Stream. The Company, after payment in full of the Note Obligations, may prepay any or all of the remaining balance of the Revenue Stream (as defined with respect to the applicable time of such payment in the definition of Revenue Stream). In the event of an ***, 100% of Net Revenues shall be applied to the payment of the Note Obligations and, following the payment in full of the Note Obligations, to the Revenue Stream, pending ***, which, if and to the extent that ***, then the Net Revenues applied after such determination to payment of the Note Obligations or the Revenue Stream shall revert to the Applicable Percentages per the terms of this Agreement as if *** had not occurred, and any amounts then due back to the Company will be treated as prepayments of the Note Obligations, or if the Note Obligations have been paid in full, of the Revenue Stream.

| 4 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

2.4. Purchase Price Allocation. The Company and the Purchasers agree that, for purposes of Sections 305 and 1271 through 1275 of the Code or any other jurisdiction, the aggregate purchase price of the Notes shall be *** and the aggregate purchase price of the Revenue Stream shall be ***, and that such purchase prices shall be used by the Company and each Purchaser for all financial reporting and income tax reporting purposes.

2.5. Taxes. Any and all payments by the Company with respect to any Notes or the Revenue Stream shall be made free and clear of and without deduction for any and all present or future taxes, levies, imposts, deductions, charges or withholdings in any such case imposed by the United States or any political subdivision thereof, excluding taxes imposed or based on the recipient Purchaser’s overall net income, and franchise or capital taxes imposed on it in lieu of net income taxes (all such non-excluded taxes, levies, imposts, deductions, charges, withholdings and liabilities in respect of payments hereunder being hereinafter referred to as “Taxes”). If the Company shall be required by law to deduct any Taxes from or in respect of any sum payable hereunder or under any Notes to any Purchaser, (i) the sum payable shall be increased as may be reasonably necessary so that after making all required deductions for taxes (including deductions for taxes applicable to additional sums payable under this Section 2.5) such Purchaser receives an amount equal to the sum it would have received had no such deductions been made, (ii) the Company shall make such deductions and (iii) the Company shall remit the full amount deducted to the relevant taxation authority or other authority in accordance with applicable law. Within 30 days after the date of any payment of such Taxes (or, if later, promptly upon a receipt becoming available), the Company shall furnish to the Purchasers the original or certified copy of a receipt evidencing payment thereof. If the Company or any Purchaser shall subsequently receive a refund or tax credit for any such Taxes withheld as to which the Purchaser has been made whole pursuant to the preceding procedure, any such refund or credit shall be for the sole account of the Company.

2.6. Manner and Time of Payment. All payments to the Note Purchasers or the Revenue Participants (or the Cash Collateral Account, as the case may be) shall be made by wire transfer or other same day funds, without set off, not later than 2:00 p.m. on the day such payment is due, in accordance with the payment instructions set forth on Schedule 2.6.

| 5 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

2.7. Patent License. Effective as of the earlier of (x) the date that is 365 days after the Closing Date or (y) the occurrence of an Event of Default, the Company shall grant to the Collateral Agent, for the benefit of the Secured Parties, a non-exclusive, royalty free, license (including the right to grant sublicenses) with respect to the Patents, which shall be evidenced by, and reflected in, the Patent License Agreement, which shall be delivered at Closing. The Patent License Agreement shall terminate upon payment in full of the Note Obligations and the Revenue Stream and as otherwise specified in the Patent License Agreement, but any sublicenses granted prior to any termination of this Agreement (except to Collateral Agent or its affiliates) shall survive according to the respective terms and conditions of such sublicenses. The Collateral Agent and the Secured Parties agree that the Collateral Agent shall only use such license following the occurrence and during the continuance of an Event of Default.

2.8. Additional Fundings

2.8.1. It is contemplated that the Company may subsequently request that the Purchasers acquire up to $5,000,000 in additional Notes, and further acquire additional interests in the Company’s Monetization Revenues. If the Company shall make such request, and if the Purchasers agree, in their sole discretion, to provide such additional funding to the Company, this Agreement shall be amended in a manner satisfactory to the Company and the Purchasers to reflect the economic and other terms and conditions of such additional funding, which terms and conditions shall be satisfactory to the Company and the Purchasers. In particular, it is contemplated that to the extent that such incremental funding occurs, the additional Notes and participation in the Monetization Revenues will have substantially the same economic terms as those issued as of the Closing Date (e.g., will contemplate the same rate, percentage fees, etc. and will provide for a proportional additional share of Monetization Net Revenues.)

2.8.2. In addition, if and to the extent that the Company breaches its obligations under Section 6.14 to timely pay amounts due under its Patent Purchase Agreements, the Purchasers shall have the option (but no obligation) to advance directly to the applicable seller under such Patent Purchase Agreement any such past due amounts. If and to the extent that the Purchasers elect to make such advances, this Agreement shall be amended in a manner satisfactory to the Purchasers (and the Company shall be deemed to have irrevocably consented to such amendment) so as to reflect the economics of such additional funding, which shall be on economic terms that are substantially the same as the Notes and Revenue Stream issued at Closing (but with a maturity date and return threshold deadlines that are consistent with the Notes and Revenue Stream issued at Closing).

| 6 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

ARTICLE III

CONDITIONS PRECEDENT

3.1. Conditions to Closing. The obligation of each Revenue Participant to purchase its respective pro rata share of the Revenue Stream and the obligation of each Note Purchaser to purchase its respective pro rata share of the Notes on the Closing Date is subject to the satisfaction of the conditions set forth in this Section 3.1:

3.1.1. Deliveries. The Company (and each of its Subsidiaries, as applicable) shall have delivered to each Purchaser and the Collateral Agent fully executed (where applicable) copies of the following:

3.1.1.1. this Agreement;

3.1.1.2. the Notes;

3.1.1.3. the Security Agreement;

3.1.1.4. the Patent License Agreement;

3.1.1.5. the Patent Security Agreement;

3.1.1.6. the Certificate of Designation;

3.1.1.7. the Proxy;

3.1.1.8. the Voting Agreement; and

3.1.1.9. Series F Stock Certificate in Inventergy, Inc.

3.1.1.10. (i) a copy of the certificate or articles of incorporation, certificate of formation, limited liability company agreement or other constitutive document, including all amendments thereto, of the Company, certified as of a recent date by the Secretary of State of the state of its organization and a certificate as to the good standing of the Company as of a recent date, from such Secretary of State (or, in each case, a comparable governmental official, if available); (ii) a certificate of the Secretary or Assistant Secretary of the Company, dated the Closing Date and certifying (A) that attached thereto is a true and complete copy of the by-laws and any limited liability company agreement of the Company as in effect on the Closing Date and at all times since a date prior to the date of the resolutions described in clause (B) below, (B) that attached thereto is a true and complete copy of resolutions duly adopted by the board of directors or managers of the Company authorizing the execution, delivery and performance of the Documents, and that such resolutions and consents have not been modified, rescinded or amended and are in full force and effect, (C) that the certificate or articles of incorporation of the Company or the applicable subsidiary have not been amended since the date of the last amendment thereto shown on the certificate of good standing furnished pursuant to clause (i) above, and (D) as to the incumbency and specimen signature of each officer executing this Agreement or any other Document on behalf of the Company; and (iii) a certificate of another officer as to the incumbency and specimen signature of the Secretary or Assistant Secretary executing the certificate pursuant to clause (ii) above;

| 7 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

3.1.1.11. an opinion of counsel for the Company addressed to the Collateral Agent and each other party hereto in customary form and otherwise in form and substance reasonably satisfactory to the Collateral Agent;

3.1.1.12. an officer’s certificate from an Authorized Officer of the Company certifying that the condition set forth in Section 3.1.2 has been satisfied;

3.1.1.13. all documentation and other information about the Company requested by the Revenue Participants or the Note Purchasers or the Collateral Agent under applicable “know your customer” and anti-money laundering rules and regulations, including the USA PATRIOT Act; and

3.1.1.14. evidence satisfactory to the Purchasers that the Existing Notes has been fully repaid (or will be paid, by direct wire, with the proceeds of the Notes and Revenue Share) and all Liens securing such Indebtedness released (or agreed to be released by the Collateral Agent pursuant to a payoff letter acceptable in form and substance to the Purchasers.)

3.1.2. Representations and Warranties; No Default. The representations and warranties contained in this Agreement and the other Documents shall be true and correct in all material respects, and there shall exist no Default or Event of Default, including after giving effect to the transactions contemplated herein.

3.1.3. Consummation of Purchase of Common Stock. The Subscription Agreement shall have been executed and delivered and shares of Parent Common Stock sold to the Purchasers as contemplated thereby.

3.1.4. Fees and Expenses. The structuring fee and the expenses of the Purchasers and the Collateral Agent invoiced as of the Closing Date shall have been paid in full, in cash; which sums shall be acknowledged to have been received by the Company but applied by the Purchasers at Closing.

3.1.5. Due Diligence. The Purchasers shall have completed their due diligence, and shall be satisfied with the results thereof, in their sole judgment.

3.1.6. Senior Lien. The Purchasers shall be satisfied that, after giving effect to the Collateral Documents and to the making of any filings contemplated thereby, including, without limitation, UCC filings and filings in the United States Patent and Trademark Office, the Collateral Agent will have a first priority perfected lien in the Patents registered in the United States and on all other material assets of the Company and its Subsidiaries.

| 8 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

3.1.7. W-9. The Purchasers shall have delivered completed Forms W-9 (or applicable equivalent) to the Company.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF THE COMPANY

In order to induce the Revenue Participants to purchase the Revenue Stream and the Note Purchasers to purchase the Notes, the Company hereby represents and warrants to the Purchasers as of the Closing Date that:

4.1. Organization and Business. The Company is (a) a duly organized and validly existing corporation or limited liability company, (b) in good standing under the laws of the jurisdiction of its incorporation or organization, and (c) has the power and authority, corporate or otherwise, necessary (i) to enter into and perform this Agreement and the Documents to which it is a party, and (ii) to carry on the business now conducted or proposed to be conducted by it. Schedule 4.1 sets forth all of the Company’s Subsidiaries and each other entity in which the Company holds an interest, directly or indirectly, and sets forth the ownership of all equity securities of each such Subsidiary or other entity (including joint venture, membership or partnership interests, and including convertible securities, options or warrants).

4.2. Qualification. The Company and each of its Subsidiaries is duly and legally qualified to do business as a foreign corporation or limited liability company and is in good standing in each state or jurisdiction in which such qualification is required and is duly authorized, qualified and licensed under all laws, regulations, ordinances or orders of public authorities, or otherwise, to carry on its business in the places and in the manner in which it is conducted.

4.3. Operations in Conformity with Law, etc. The operations of the Company and each of its Subsidiaries as now conducted or proposed to be conducted are not in violation in any material respect of, nor is the Company or any of its Subsidiaries in default in any material respect under, any Legal Requirement.

4.4. Authorization and Non-Contravention. The Company and each of its Subsidiaries has taken all corporate, limited liability or other action required to execute, deliver and perform this Agreement and each other Document. All necessary consents, approvals and authorizations of any governmental or administrative agency or any other Person of any of the transactions contemplated hereby shall have been obtained and shall be in full force and effect. This Agreement and each other Document does not (i) contravene the terms of any of the Company’s Organization Documents, (ii) conflict with or result in any breach or contravention of, or the creation of any Lien under, or require any payment to be made under (x) any Contractual Obligation of the Company or its applicable Subsidiaries or (y) any material order, injunction, writ or decree of any Governmental Authority or any arbitral award to which the Company or any such Subsidiary is subject or (iii) violate any Legal Requirement.

| 9 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

4.5. Intellectual Property. As of the Closing Date,

(a) Owner is the entire, valid, sole and exclusive beneficial owner of all right, title and interest to all of the Patents, including the right to sue for past, present and future infringement of the Patents, with good and marketable title.

(b) The Patents are free and clear of any and all Liens other than any Existing Encumbrances that would not otherwise constitute a breach of Sections 4.5(c), (d) or (k).

(c) ***.

(d) ***.

(e) Owner is listed as record owner of all of the Patents in the United States Patent and Trademark Office ***.

(f) All of the granted Patents indicated are subsisting and have not been adjudged invalid or unenforceable, in whole or in part, and none of the Patents are at this time the subject to any challenge to their validity or enforceability. To the knowledge of the Company, the granted Patents are valid and enforceable.

(g) Except as set forth on Schedule 4.5(g), the Company has no notice of any lawsuits, actions or opposition, cancellation, revocation, re-examination or reissue proceedings commenced or threatened with reference to any of the Patents.

(h) There are no overdue amounts owed to Nokia Corporation under Section 4.1 of the Nokia PPA.

(i) There are no “Guaranteed Payments” outstanding whose payment is required to avoid triggering any re-purchase right of Panasonic Corporation under the Panasonic PPA.

(j) Except as set forth in Section 4.2 of the Panasonic PPA, there are no existing contracts, agreements, options, commitments, or rights with, to, or in any person to acquire any of the Patents.

(k) The Patents acquired by Owner from Huawei Technologies Co., Ltd. under the Patent Rights Assignment Agreement, dated as of May 15, 2003 (“Huawei PRAA”), are subject only to the existing license agreements granted to the parties set forth on Exhibit C to the PRAA, and the terms of Sections 3.3, 3.4, 3.5, 3.6, 3.7, and 3.8 of the Huawei PRAA. Otherwise, such Patents are not subject to any license, sublicense, covenant not to sue, other immunity from suit under the Patents, or any other right of any kind that would materially restrict or impair the ability of Owner to pursue Monetization Activities. Other than as provided for by Sections 3.3, 3.4, 3.5, 3.6, 3.7, 3.8, and 5.5 of the Huawei PRAA, no prior owner of such Patents or other third party has the right to grant any license, sublicense, covenant not to sue, other immunity from suit under the Patents, or any other right of any kind that would materially restrict or impair the ability of Owner to pursue Monetization Activities.

| 10 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

4.6. Material Agreements. Schedule 4.6 sets forth each agreement relating to the purchase or other acquisition of any Patent, including seller notes issued in connection with such acquisition, and any other material agreement relating to any Patent (other than the Existing Encumbrances). Each such agreement is in full force and effect for the benefit of the Company and to the knowledge of the Company there are no material defaults under any such agreement except as listed in Schedule 4.6.

4.7. Margin Regulations. The Company is not engaged, nor will it engage, principally or as one of its important activities, in the business of purchasing or carrying Margin Stock, or extending credit for the purpose of purchasing or carrying Margin Stock, and the Notes will not be used for any purpose that violates Regulation U of the Board of Governors of the United States Federal Reserve System.

4.8. Investment Company Act. The Company is not, and is not required to be, registered as an “investment company” under the Investment Company Act of 1940.

4.9. USA PATRIOT Act, FCPA and OFAC.

4.9.1. To the extent applicable, the Company is in compliance, in all material respects, with (i) the Trading with the Enemy Act, as amended, and each of the foreign assets control regulations of the United States Treasury Department (31 CFR Subtitle B, Chapter V, as amended) and any other enabling legislation or executive order relating thereto and (ii) the USA Patriot Act.

4.9.2. No part of the proceeds of the Notes or the purchase price for the Revenue Stream will be used, directly or indirectly, for any payments to any governmental official or employee, political party, official of a political party, candidate for political office, or anyone else acting in an official capacity, in order to obtain, retain or direct business or obtain any improper advantage, in violation of the United States Foreign Corrupt Practices Act of 1977, as amended.

4.9.3. None of the Company nor, to the knowledge of the Company, any director, officer, agent, employee or controlled Affiliate of the Company, is currently the subject of any U.S. sanctions program administered by the Office of Foreign Assets Control of the United States Department of the Treasury (“OFAC”); and the Company will not directly or indirectly use the proceeds of the Notes or otherwise make available such proceeds to any Person, for the purpose of financing the activities of any Person currently the subject of any U.S. sanctions program administered by OFAC, except to the extent licensed or otherwise approved by OFAC.

| 11 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with respect to certain portions hereof denoted with

“***”

4.10. No Default. No Default or Event of Default exists or would result from the incurring of any Obligations by the Company or the grant or perfection of Liens on the Collateral. The Company is not in default under or with respect to any Contractual Obligation in any respect which, individually or together with all such defaults, would reasonably be expected to have a Material Adverse Effect.

4.11. Binding Effect. This Agreement and each other Document constitute the legal, valid and binding obligations of the Company, enforceable against the Company in accordance with their respective terms, except as enforceability may be limited by applicable bankruptcy, insolvency, or similar laws affecting the enforcement of creditors’ rights generally or by equitable principles relating to enforceability.

4.12. Disclosure. No report, financial statement, certificate or other written information furnished by or on behalf of the Company (other than projected financial information, pro forma financial information and information of a general economic or industry nature) to any Purchaser or the Collateral Agent in connection with the transactions contemplated hereby and the negotiation of this Agreement or delivered hereunder or any other Document (as modified or supplemented by other information so furnished) when taken as a whole contains any material misstatement of fact or omits to state any material fact necessary to make the statements therein (when taken as a whole), in the light of the circumstances under which they were made, not materially misleading. With respect to projected financial information and pro forma financial information, the Company represents that such information was prepared in good faith based upon assumptions believed to be reasonable at the time of preparation; it being understood that such projections may vary from actual results and that such variances may be material.

ARTICLE V

REPRESENTATIONS AND WARRANTIES OF THE PURCHASERS AND COLLATERAL AGENT

Each Purchaser, for itself and for no other Purchaser, and the Collateral Agent hereby represents and warrants to the Company as of the Closing Date:

5.1. Authority. The Purchaser and the Collateral Agent, as the case may be, has the power and authority, corporate or otherwise, necessary to enter into and perform this Agreement and the Documents to which it is a party.

5.2. Binding Effect. This Agreement and each other Document constitute the legal, valid and binding obligations of the Purchaser and the Collateral Agent, enforceable against the Purchaser or the Collateral Agent as the case may be in accordance with their respective terms, except as enforceability may be limited by applicable bankruptcy, insolvency, or similar laws affecting the enforcement of creditors’ rights generally or by equitable principles relating to enforceability.

| 12 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

5.3. Investment Intent. The Purchaser understands that the Note, to the extent constituting a security, is a “restricted security” and has not been registered under the Securities Act or any applicable state securities law and is acquiring the Note as principal for its own account and not with a view to or for distributing or reselling the Note or any part thereof in violation of the Securities Act or any applicable state securities laws. The Purchaser does not presently have any agreement, plan or understanding, directly or indirectly, with any Person to distribute or effect any distribution of the Note (or any securities which are derivatives thereof) to or through any person or entity, in each case, other than transfers or distributions to an Affiliate of such Purchaser.

5.4. Experience of the Purchaser. The Purchaser has such knowledge, sophistication and experience in business and financial matters so as to be capable of evaluating the merits and risks of the prospective investment in the Note, and has so evaluated the merits and risks of such investment. The Purchaser is able to bear the economic risk of an investment in the Note and, at the present time, is able to afford a complete loss of such investment. The Purchaser understands that its investment in the Note involves a significant degree of risk.

5.5. Access to Information. The Purchaser acknowledges that it has been afforded (i) the opportunity to ask such questions as it has deemed necessary of, and to receive answers from, representatives of the Company concerning the terms and conditions of the offering of the Note and the merits and risks of investing in the Note; (ii) access to information about the Company and its subsidiaries and their respective financial condition, results of operations, business, properties, management and prospects sufficient to enable it to evaluate its investment; and (iii) the opportunity to obtain such additional information that the Company possesses or can acquire without unreasonable effort or expense that is necessary to make an informed investment decision with respect to the investment. The Purchaser has sought such accounting, legal and tax advice as it has considered necessary to make an informed decision with respect to its acquisition of the Note.

5.6. Reliance on Exemptions. The Purchaser understands that the Notes are being offered and sold to it in reliance on specific exemptions from the registration requirements of U.S. federal and state securities laws and that the Company is relying in part upon the truth and accuracy of, and the Purchaser’s compliance with, the representations, warranties, agreements, acknowledgements and understandings of the Purchaser set forth herein in order to determine the availability of such exemptions and the eligibility of the Purchaser to acquire its Note.

ARTICLE VI

COVENANTS

Until all of the Company’s obligations with respect to the Notes and the Revenue Stream, have been paid in full in cash, the Company shall comply with the covenants set forth in this Article VI.

| 13 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

6.1. Taxes and Other Charges. The Company shall duly pay and discharge, or cause to be paid and discharged, before the same becomes in arrears, all taxes, assessments and other governmental charges imposed upon the Company and its properties, sales or activities, or upon the income or profits therefrom; provided, however, that any such tax, assessment, charge or claim need not be paid if the validity or amount thereof shall at* the time be contested in good faith by appropriate proceedings and if the Company shall, in accordance with GAAP, have set aside on its books adequate reserves with respect thereto; provided, further, that the Company shall pay or bond, or cause to be paid or bonded, all such taxes, assessments, charges or other governmental claims immediately upon the commencement of proceedings to foreclose any Lien which may have attached as security therefor (except to the extent such proceedings have been dismissed or stayed).

6.2. Conduct of Monetization Activities; Reporting and Consultation.

6.2.1. The Company shall undertake its best efforts to diligently pursue the monetization of the Patents, and shall provide reasonable regular updates to the Purchasers and their advisors, and shall consult with Purchasers and their advisors on request, as to its Monetization Activities, including providing the Purchasers with a summary of any material litigation relating to the Patents or the Monetization Activities, copies of material correspondence, pleadings, judgments, orders, licenses, settlement agreements or other documents reasonably requested by the Majority Purchasers, and, no later than the 15th day of every month, a report calculating in detail its Monetization Revenues for the prior month, in each case in form and substance reasonably satisfactory to the Majority Purchasers. Subject to the preservation of any privilege and confidentiality requirements, the Company shall authorize and direct any legal counsel or consultant engaged by it to discuss the status of the Company’s Monetization Activities with the Purchasers and the Collateral Agent, provided that the Company has the reasonable opportunity to have at least one Company representative present, in person or by telephone, for any such discussions.

6.2.2. Notwithstanding Section 6.2.1, Section 6.5 or Section 6.6, but subject to compliance with Section 6.9.3, the Company shall not be required to breach any contractual obligation of confidentiality or to jeopardize any legal privilege.

6.3. Maintenance of Existence. The Company shall do all things necessary to preserve, renew and keep in full force and effect and in good standing its legal existence and authority necessary to continue its business.

6.4. Compliance with Legal Requirements. The Company shall comply in all material respects with all valid then existing Legal Requirements applicable to it, except where compliance therewith shall at the time be contested in good faith by appropriate proceedings.

| 14 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

6.5. Notices; Reports.

6.5.1. Certain Notices; Reports. The Company shall furnish to each of the Note Purchasers and Revenue Participants:

6.5.1.1. Promptly, notice of any dispute, litigation, investigation, suspension or any administrative or arbitration proceeding by or against the Company for an amount in excess of $500,000 or affecting the Company’s ownership rights with respect to the Patents;

6.5.1.2. promptly upon acquiring knowledge thereof, the existence of any Default or Event of Default, specifying the nature thereof and what action the Company has taken, is taking or proposes to take with respect thereto; and

6.5.1.3. promptly, and in any event within 10 Business Days, such additional business, financial, corporate affairs and other information as the Majority Purchasers may reasonably request.

Each notice pursuant to this Section shall be accompanied by a statement by an Authorized Officer of the Company, on behalf of the Company, setting forth details of the occurrence referred to therein (including, if applicable, describing with particularity any and all clauses of this Agreement or the Other Documents that may have been breached), and, subject to any requirement of privilege, stating what action the Company or other Person proposes to take with respect thereto and at what time.

6.5.2. In the event that the Company receives notice, or becomes aware, of *** would constitute a *** contained in ***, in addition to the remedies set forth in any Document, the Company shall give immediate notice thereof to the Purchasers and the Collateral Agent, with reasonable detail concerning the basis for ***, of the Company’s intended approach to addressing such ***. The Company shall provide periodic updates of its progress in resolving *** to the Purchasers. Upon the final resolution or withdrawal of any such ***, the Company shall provide notice of such resolution or withdrawal, with supporting documentation, to the Purchasers. ***.

| 15 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

6.6. Information and Access Rights.

6.6.1. Upon reasonable request of the Majority Purchasers (and requests made not more often than quarterly shall be deemed reasonable), the Company shall permit any Purchaser and any Purchaser’s duly authorized representatives and agents to visit and inspect any of its property, corporate books, and financial records related to the Patents, to examine and make copies of its books of accounts and other financial records related to the Patents and its Monetization Activities and Monetization Revenues, and to discuss its affairs, finances, and accounts with, and to be advised as to the same by, its managers, officers, employees and independent public accountants (and by this provision the Company hereby authorizes such accountants to discuss with the Purchasers the finances and affairs of the Company so long as (i) an officer or manager of the Company has been afforded a reasonable opportunity to be present for such discussion and (ii) such accountants shall be bound by standard confidentiality obligations), in each case related to the Patents and the Monetization Activities and Monetization Revenues. In addition, upon request of the Majority Purchasers from time to time, and subject to any claims of privilege, the Company shall provide the Purchasers with a status update of any material development in any litigations or any administrative or arbitration proceeding related to the Patents. All costs and expenses reasonably incurred by the Purchasers and their duly authorized representatives and agents in connection with the exercise of the Purchasers’ rights pursuant to this Section 6.6 shall be paid by the Company.

6.6.2. The Purchasers acknowledge that in connection with their information and access rights under this Agreement, the Company may be required to provide information that may be deemed to be material non public information; provided that the Company agrees to clearly identify any such information prior to delivery and to request and obtain Purchaser confirmation prior to such delivery that the Purchasers wish to receive such information notwithstanding that it may constitute material non public information. The Purchasers and the Company agree to work together in good faith to establish procedures for the handling of information that may constitute material non public information, including procedures that enable the Purchasers to evaluate from time to time the extent to which they are prepared to receive material non public information by the Company and as to which of such information will be subject to periodic “cleansing disclosure” and/or the establishment of “trading windows” in order to achieve the Purchasers’ objectives of remaining reasonably informed of the Company’s Monetization Activities and available to consult with the Company regarding such activities, while not being unreasonably restricted in public trading of common stock of the Company. For the avoidance of doubt, subject to the Company not providing the Purchasers with any information that it is not prepared to disclose to the public without first providing a written notice to the Purchasers identifying, with specificity, which information is subject to such restriction, the Company shall have no obligation to any Purchaser to disclose information to the public, whether by press release or SEC filing, that it is not otherwise obligated to disclose at such time pursuant to the Securities Exchange Act of 1934 and the regulations of the SEC promulgated thereunder.

6.7. Indebtedness. The Company shall not create, incur, assume or otherwise become or remain liable with respect to any Indebtedness that is secured by the Patents or any rights related thereto (other than the obligations to vendors of the Patents that are set forth on Schedule 4.5. The Company shall not incur any other Indebtedness, except for:

6.7.1. Indebtedness in respect of the Obligations;

6.7.2. unsecured trade payables that are not evidenced by a promissory note and are incurred in the Ordinary Course of Business;

| 16 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

6.7.3. the existing Indebtedness set forth on Schedule 6.7;

6.7.4. additional unsecured Indebtedness that is subordinated to the rights of the Purchasers under this Agreement pursuant to an agreement in form and substance satisfactory to the Majority Purchasers; and

6.7.5. additional Indebtedness secured solely by patent assets purchased after the Closing Date that is subordinated to the rights of the Purchasers under this Agreement pursuant to an agreement in form and substance satisfactory to the Majority Purchasers (“New Secured Indebtedness”); provided that the Purchasers shall have been provided a right of first refusal to provide such New Secured Indebtedness and shall have either waived such right or shall have provided such New Secured Indebtedness; provided that the Purchasers shall use commercially reasonable efforts to respond promptly to any such offered right of first refusal.

6.8. Liens. The Company shall not create, incur, assume or suffer to exist any Lien upon any Patent or any Monetization Revenues other than the following (“Permitted Liens”):

6.8.1. Liens securing the Obligations,

6.8.2. the Existing Encumbrances and other non-exclusive licenses that are entered into pursuant to the Company’s Monetization Activities and otherwise in compliance with this Agreement;

6.8.3. Liens securing New Secured Indebtedness; and

6.8.4. Tax and other statutory or involuntary Liens, in each case arising in the Ordinary Course of Business for amounts not yet due or that are being contested in good faith and, in the case of Liens in favor of attorneys or consultants, are not securing claims in excess of amounts that the Company is retaining under this Agreement (i.e., that the Company is not required to apply to the Note Obligations or the Revenue Stream).

6.9. Management of Patents and Patent Licenses.

6.9.1. Dispositions. The Company shall not make any Disposition of any Patents or of any equity interests in Owner other than (i) entering into settlement agreements or non-exclusive licensing arrangements with respect to the Patents in pursuit of the Monetization Activities, (ii) sales of the Company’s proprietary hardware and software products in the ordinary course of business provided, for the avoidance of doubt, that no such arrangements shall permit the use of any Patents other than as required for the sale of such products; (iii) the entry into exclusive license agreements or sales of Patents with the written consent of the Majority Purchasers, such consent not to be unreasonably withheld, conditioned or delayed; and (iv) the entry into contingency, revenue sharing or profit sharing arrangements with additional law firms, consultants or other professionals to the extent such arrangements are not inconsistent with the Purchasers’ rights in respect of the Monetization Revenues hereunder. For the avoidance of doubt, nothing in the foregoing shall be construed to prohibit Company from replacing or dividing existing agreements under substantially equivalent, or more favorable to the Company, financial and other terms than the Existing Encumbrances or such existing agreements. For the avoidance of doubt, proceeds of any Disposition of any Patents, or of any equity interest in Owner, shall constitute Monetization Revenues.

| 17 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

6.9.2. Preservation of Patents. Except to the extent consented to by the Collateral Agent (such consent not to be unreasonably withheld, conditioned or delayed), (a) the Company shall, at its own expense, take all reasonable steps to pursue the registration and maintenance of each Patent and shall take all reasonably necessary steps to preserve and protect each Patent and (b) the Company shall not do or permit any act or knowingly omit to do any act whereby any of the Patents may lapse, be terminated, or become invalid or unenforceable or placed in the public domain. At its option, the Collateral Agent or the Majority Purchasers may, at the Company’s expense, take all reasonable steps to pursue the registration and maintenance of each Patent and take all reasonably necessary steps to preserve and protect each Patent and the Company hereby grants the Collateral Agent a power-of-attorney to take all steps in the Company’s name in furtherance of the foregoing; provided that the foregoing shall not be interpreted as excusing the Company from the performance of, or imposing any obligation on the Collateral Agent or the Majority Purchasers to cure or perform any obligation of the Company; provided further that the Collateral Agent shall give the Company prompt written notice following any action taken by the Collateral Agent under this Section 6.9.2, and shall endeavor to give the Company advance written notice where feasible.

6.9.3. Entry into Agreements. Neither the Company nor any Affiliate of the Company shall enter into any contract or other agreement with respect to the Patents that contains confidentiality provisions prohibiting or otherwise restricting the Company or such Affiliate from disclosing the existence and content of such contract or other agreement to the Note Purchasers and their counsel; provided that, with respect to any contract that provides for at least $500,000 in payments to the Company, the Company shall not be precluded from entering into confidentiality provisions so long as it has first made commercially reasonable efforts to exclude or limit the scope of such provisions or, to the extent unable to exclude them, to permit disclosure to investors in the Company, including the Purchasers, that agree to maintain the confidentiality of such contracts.

6.10. Minimum Liquidity. The Company shall maintain not less than One Million Dollars ($1,000,000) in unrestricted cash and Cash Equivalents (“Liquidity”) (not including amounts on deposit in the Cash Collateral Account except to the extent the Company is entitled to such amounts), and shall provide weekly certifications demonstrating the Company’s Liquidity.

| 18 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

6.11. Cash Collateral Account. Within 30 days following the Closing Date, the Company shall open a depository account (the “Cash Collateral Account”) with an institution reasonably acceptable to the Collateral Agent, which Cash Collateral Account shall be subject to a control agreement, substantially in the form of Exhibit B (and with such other changes as may be approved by the Collateral Agent and the Company), between the Company, such institution and the Collateral Agent. The Company shall cause all Monetization Revenues to be deposited into such Cash Collateral Account, shall provide instructions to each payor of Monetization Revenues to directly deposit any Monetization Revenues into the Cash Collateral Account, and the Company hereby authorizes the Majority Purchasers to inform any payor of Monetization Revenues of the Company’s obligation to direct all Monetization Revenues to the Cash Collateral Account as required hereunder. On each deposit of Monetization Revenues to the Cash Collateral Account, the Company shall deliver an officer’s certificate in the form of Exhibit C to the Collateral Agent detailing the source and nature of such Monetization Revenues, the amount of any related Monetization Expenses (including specifying any Monetization Expenses that have been already deducted from such Monetization Revenues), and setting forth the Company’s calculation of the required application of the resulting Monetization Net Revenues. On a monthly basis on and after the Closing Date, but no later than the 15th day of each month, the Collateral Agent shall deliver to the Company a written statement (each a “Collateral Agent Statement”) with reasonable detail showing the amounts applied by the Collateral Agent in the Cash Collateral Account for the prior month to the payment of the Note or, after the payment in full of the Notes, the payments made to Revenue Participants, and payments to the Company in respect of the Monetization Revenues. The Cash Collateral Account shall be under the sole control of the Collateral Agent and the Company may not have withdrawal rights with respect to, or otherwise control of, the Cash Collateral Account; provided that the Collateral Agent shall make withdrawals from the Cash Collateral Account promptly following the deposit of any Monetization Revenues, and will apply such Monetization Net Revenues to amounts due hereunder in accordance with this Agreement, and will release amounts to pay any Monetization Expenses to appropriate third parties, along with any remaining excess Monetization Revenues to the Company within three (3) Business Days of delivery of the Collateral Agent Statement. The Company shall have access to account statements from the depositary bank concerning the Cash Collateral Account. ***.

6.12. Further Assurances.

6.12.1. Upon the reasonable request of the Majority Purchasers or the Collateral Agent, the Company shall (i) correct any material defect or error that may be discovered in the execution, acknowledgment, filing or recordation of any Document or other document or instrument relating to any Collateral, and (ii) do, execute, acknowledge, deliver, record, re-record, file, re-file, register and re-register any and all such further acts, deeds, certificates, assurances and other instruments, subject to Section 3.1.7, as the Collateral Agent or Majority Purchasers may reasonably request from time to time in order to carry out the purposes of the Documents.

| 19 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

6.12.2. Within ninety 90 days after the Closing Date, and at Owner’s expense, Owner shall cause to be filed in the applicable foreign filing offices any filings required to perfect Collateral Agent’s first priority lien in the Patents in Canada, China, France, Germany and the United Kingdom. For any other foreign jurisdiction, at the Purchasers’ expense, the Collateral Agent may cause any other filings required to perfect a first priority lien in the Patents in such other jurisdictions and Owner will take any actions reasonably requested by the Collateral Agent from time to time in order to carry out such filings.

6.12.3. Within 60 days after the Closing Date, Parent agrees to take all necessary actions to either, at the Purchasers’ option, (x) effect the conversion of Owner from a Delaware corporation to a Delaware limited liability company or (y) contribute all of its interests in Owner to a newly created Delaware limited liability company and, in either case, to enter into a limited liability company operating agreement for such newly formed limited liability company substantially in the form attached hereto as Exhibit I and to cause such entity to execute a joinder of the Documents.

6.12.4. Within one hundred eighty (180) days after the Closing Date, and at Owner’s expense, Owner shall use reasonable best efforts to ***. If Owner is not able to ***, Owner will provide Collateral Agent with a written description of how Owner attempted to ***.

6.13. Confidentiality. Subject to the Company’s routine compliance with the requirements of the Securities Exchange Act of 1934, as amended and the regulations promulgated thereunder, each party hereto will hold, and will cause its respective Affiliates and its and their respective directors, officers, employees, agents, members, investors, auditors, attorneys, financial advisors, other consultants and advisors and assignees to hold, in strict confidence, unless disclosure to a regulatory authority is necessary in connection with any necessary regulatory approval, examination or inspection or unless disclosure is required by judicial or administrative process or, in the written opinion of its counsel, by other requirement of law or the applicable requirements of any regulatory agency or relevant stock exchange, all non-public records, books, contracts, instruments, computer data and other data and information (collectively, “Information”) concerning the other party hereto furnished to it by or on behalf of such other party or its representatives pursuant to this Agreement (except to the extent that such information can be shown to have been (1) previously known by such party on a non-confidential basis or becomes available to such party on a non-confidential basis, (2) publicly available through no fault of such party (3) later lawfully acquired from other sources by such party or (4) disclosed to a prospective investor), and neither party hereto shall release or disclose such Information to any other person, except on a confidential basis to its officers, directors, employees, agents, members, investors, Affiliates, auditors, attorneys, financial advisors, other consultants and advisors and except in connection with any proposed assignment or participation of the rights of a Purchaser under this Agreement made in accordance with Section 9.10.2, provided such prospective assignee or participant has agreed to be bound by the confidentiality provisions consistent with those set forth herein.

| 20 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

6.14. Obligations Under Patent Purchase Agreements.

(a) Owner will pay all amounts due to Nokia Corporation under Section 4.1 of the Nokia PPA on or before thirty (30) days prior to the due date thereof (other than the payment due October 1, 2014 which shall be made within 2 Business Days of Closing), and shall provide the Purchasers with prompt written notice of Owner’s having made such payment (with supporting documentation, e.g. a receipt, cancelled check or wire confirmation) (a “Payment Confirmation”). If the Purchasers do not receive a Payment Confirmation by thirty (30) days’ prior to the applicable payment due date, the Purchasers shall have the option, at their sole discretion, to pay the amount due to Nokia Corporation on Owner’s behalf. For the avoidance of doubt, any failure by Owner to timely make such payment shall constitute an immediate Event of Default hereunder, unless and to the extent that the Purchasers elect (x) to fund such amounts and (y) to treat such funding as an advance under Section 2.8.2.

(b) Owner will timely pay all amounts due *** under Section 4.2 of the Panasonic PPA on or before thirty (30) days prior to the due date thereof, and shall provide the Purchasers with a Payment Confirmation with respect to such payment. If the Purchasers do not receive a Payment Confirmation by thirty (30) days’ prior to the applicable payment due date, the Purchasers the option, at their sole discretion, to pay the amount due to Panasonic Corporation on Owner’s behalf. For the avoidance of doubt, any failure by Owner to timely make such payment shall constitute an immediate Event of Default hereunder, unless and to the extent that the Purchasers elect (x) to fund such amounts and (y) to treat such funding as an advance under Section 2.8.2.

(c) If the Purchasers fund any amounts under this Section 6.14, they shall have the option to either (x) treat any such funding as an additional purchase of Notes and participation in the Monetization Net Revenues pursuant to Section 2.8.2 or (y) treat such funding as a protective advance to protect their interests, in which event, such funding shall bear interest at a rate equal to the rate applicable to the Notes on an Event of Default and the failure of Owner to advance such funding shall constitute a continuing Event of Default unless and until such advance is repaid with interest. For the avoidance of doubt, pending such payment in full with interest, the Purchasers shall have a right of acceleration on account of such continuing Event of Default and following such acceleration, the Notes and the Revenue Stream shall be fully due and payable as specified in Article VII.

| 21 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

ARTICLE VII

EVENTS OF DEFAULT

7.1. Events of Default. Each of the following events is referred to as an “Event of Default”:

7.1.1. Payment. The Company shall fail to make any payment due hereunder within 3 Business Days of when such payment is due and payable.

7.1.2. Other Covenants. The Company shall (x) fail to perform or observe any of the covenants or agreements contained in Section 6.2, Section 6.6, Section 6.10 or 6.14 or (y) fail to perform or observe any of the covenants or agreements in Article VI or elsewhere in this Agreement or in any other Document (other than those covenants or agreements specified in clause (x) above) such failure continues for thirty days after the earlier of (i) written notice to the Company by the Collateral Agent or any Purchaser of such failure or (ii) knowledge of the Company of such failure; provided, that no such cure period shall apply to breaches of any of Sections 6.7 through Section 6.9 or to Section 6.11 that either are intentional by the Company or where, in the reasonable judgment of the Majority Purchasers, a material delay in the exercise of remedies or the taking of curative action is reasonably likely to result in material harm to the value of the Patents or the success of the monetization efforts.

7.1.3. Representations and Warranties.

7.1.3.1. Any representation or warranty of or with respect to the Company made in this Agreement (other than under Section 4.5) or pursuant to or in connection with any Document, or in any financial statement, report, notice, mortgage, assignment or certificate delivered by the Company so representing to the other parties hereto in connection herewith or therewith, shall be false in any material respect on the date as of which it was made.

7.1.3.2. ***

7.1.4. Cross Default. Prior to the Maturity Date, any event of default, after giving effect to any applicable grace or cure period, with respect to any Indebtedness in excess of $500,000 of the Company that is on account of a default in any payment under such Indebtedness shall occur and be continuing if such event of default continues for thirty days after the earlier of (i) written notice to the Company by the Collateral Agent or any Purchaser of such failure or (ii) knowledge of the Company of such event of default.

7.1.5. Liquidation; etc. The Company shall initiate any action to dissolve, liquidate or otherwise terminate its existence.

7.1.6. Change of Control. A Change of Control shall have occurred.

| 22 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”

7.1.7. Judgments. A final judgment (a) which, with other outstanding final judgments against the Company, exceeds an aggregate of $500,000 shall be rendered against the Company or (b) which grants injunctive relief that results, or creates a material risk of resulting, in a Material Adverse Effect and in either case if (i) within 30 days after entry thereof (or such longer period permitted under the terms of such judgment), such judgment shall not have been discharged or execution thereof stayed pending appeal or (ii) within 30 days after the expiration of any such stay, such judgment shall not have been discharged.

7.1.8. Bankruptcy, etc. The Company shall:

7.1.8.1. commence a voluntary case under the Bankruptcy Code or authorize, by appropriate proceedings of its board of directors or other governing body, the commencement of such a voluntary case;

7.1.8.2. (i) have filed against it a petition commencing an involuntary case under the Bankruptcy Code that shall not have been dismissed within 60 days after the date on which such petition is filed or (ii) file an answer or other pleading within such 60-day period admitting or failing to deny the material allegations of such a petition or seeking, consenting to or acquiescing in the relief therein provided or (iii) have entered against it an order for relief in any involuntary case commenced under the Bankruptcy Code;

7.1.8.3. seek relief as a debtor under any applicable law, other than the Bankruptcy Code, of any jurisdiction relating to the liquidation or reorganization of debtors or to the modification or alteration of the rights of creditors, or consent to or acquiesce in such relief;

7.1.8.4. have entered against it an order by a court of competent jurisdiction (i) finding it to be bankrupt or insolvent, (ii) ordering or approving its liquidation or reorganization as a debtor or any modification or alteration of the rights of its creditors or (iii) assuming custody of, or appointing a receiver or other custodian for, all or a substantial portion of its property; or

7.1.8.5. make an assignment for the benefit of, or enter into a composition with, its creditors, or appoint, or consent to the appointment of, or suffer to exist a receiver or other custodian for, all or a substantial portion of its property.

| 23 |

FOIA CONFIDENTIAL TREATMENT REQUEST BY

INVENTERGY GLOBAL, INC.

IRS EMPLOYER IDENTIFICATION NUMBER 62-1482176

Confidential treatment requested with

respect to certain portions hereof denoted with

“***”