Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - US NUCLEAR CORP. | Financial_Report.xls |

| EX-10 - EXHIBIT 10.1 - US NUCLEAR CORP. | ex101.htm |

| EX-31 - EXHIBIT 31.2 - US NUCLEAR CORP. | ex312.htm |

| EX-31 - EXHIBIT 31.1 - US NUCLEAR CORP. | ex311.htm |

| EX-32 - EXHIBIT 32.2 - US NUCLEAR CORP. | ex322.htm |

| EX-32 - EXHIBIUT 32.1 - US NUCLEAR CORP. | ex321.htm |

| 10-Q - FORM 10-Q - US NUCLEAR CORP. | usnuclearq3.htm |

FORGIVENESS OF DEBT AND CONVERSION AGREEMENT

THIS FORGIVENESS OF DEBT AND CONVERSION AGREEMENT (this “Assignment”) is made as of this 30th day of September, 2014, by and between US Nuclear Corp., a Delaware corporation (“Debtor”), and Robert I. Goldstein (“Creditor”). The Debtor and Creditor may each be referred to herein as a “Party” and collectively as the “Parties.”

R E C I T A L S

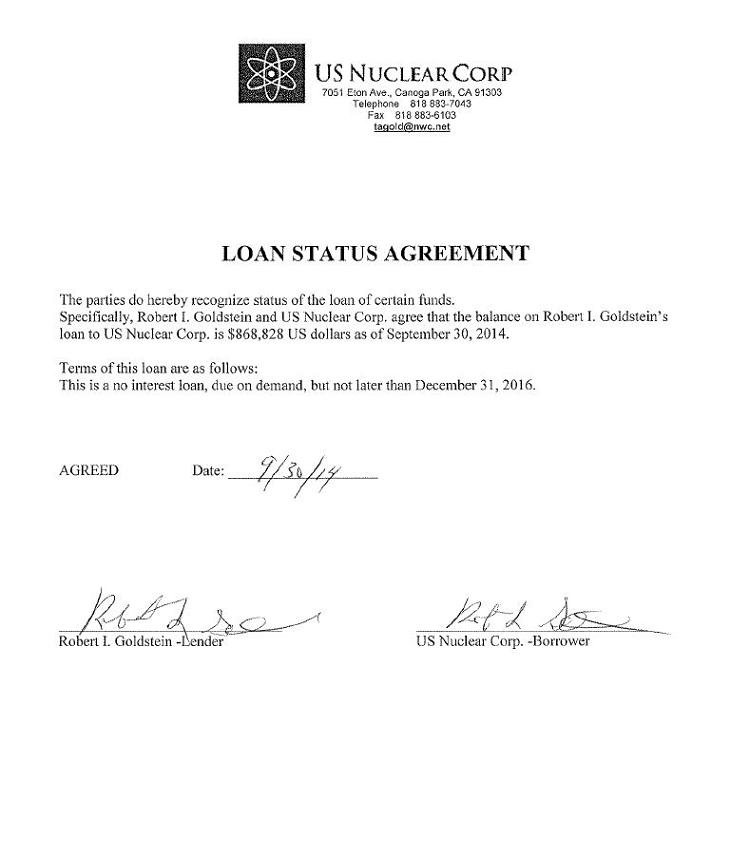

A. Debtor presently owes the Creditor as described in Exhibit A attached hereto and incorporated herein by this reference.

B. Pursuant to the Loan Status Agreement, with an Effective Date of September 30, 2014, between Debtor and Creditor, Creditor is, simultaneously with the execution of this Assignment, forgiving $668,828 (Six Hundred, Sixty Eight Thousand, Eight Hundred and Twenty Eight Dollars) of its $868,828 (Eight Hundred, Sixty Eight Thousand, Eight Hundred and Twenty Eight Dollars) outstanding loan to the Debtor which was a no interest loan, due on demand, no later than December 31, 2016, and under the terms and conditions more fully set forth in the Agreement.

C. In connection with the balance of the loan, the Creditor desires to convert $200,000 (Two Hundred Thousand Dollars), to the Debtor’s equity securities at a price of $0.20 cents per share or 1,000,000 (One Million) common shares of stock, as negotiated between Creditor and Debtor, and Debtor desires to convert the balance of the loan to Debtor’s equity security.

T E R M S A N D C O N D I T I O N S

NOW THEREFORE, for and in consideration of the mutual promises and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Debtor and Creditor hereby agree as follows:

1. Cancellation of Debt. Creditor hereby cancels his right, title and interest in the amount of $668,828, (Six Hundred, Sixty Eight Thousand, Eight Hundred and Twenty Eight Dollars).

2. Conversion. Debtor agrees to issue and conveys to Creditor, shares of common stock as approved by its Board of Directors and Majority shareholders, the right, title, and interest, in and to (i) 1,000,000 shares of restricted common stock of the Debtor, (ii) price of conversion of debt is hereby executed at $0.20 cents per share, (iii) Creditor hereby warrants full and complete ownership of and good title to the shares converted herein, that these shares are non-assessable and restricted common stock of the Debtor.

3. Binding Effect. This Assignment shall inure to the benefit of and be binding upon the parties hereto and their respective successors and assigns.

4. Construction; Definitions. This Assignment shall be construed according to Delaware law. Capitalized terms used and not otherwise defined herein shall have the meanings given to such terms in the Agreement.

5. Counterparts. This Assignment may be executed in any number of counterparts, each of which when executed and delivered shall be deemed to be an original, and all of which shall together constitute one and the same instrument.

| 1 |

IN WITNESS WHEREOF, the parties, intending to be legally bound, have caused this Agreement to be executed as of the day and year first written.

| DEBTOR: |

US Nuclear Corp. a Delaware corporation

By: Robert I. Goldstein Name: (print): Robert I. Goldstein Its: President & CEO

| |

| CREDITOR: |

Robert I. Goldstein

By: Robert I. Goldstein Name (print): Robert I. Goldstein Its (title): | |

| ||

|

|

|

| 2 |

EXHIBIT A

(Debt Owed To Creditor)