Attached files

Exhibit 3.1

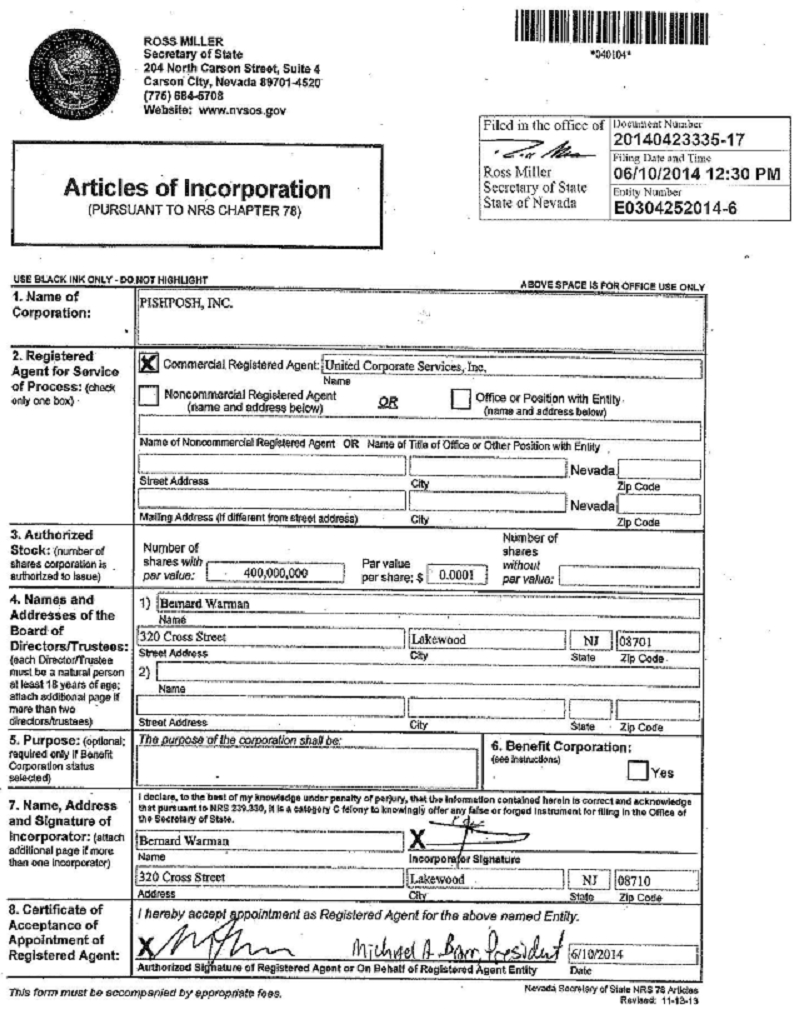

ARTICLES OF INCORPORATION

OF

PISIIPOSH, INC.

FIRST. The name of the corporation is PishPosh, Inc. (the "Corporation")

SECOND. The name of the commercial registered agent of the corporation is United Corporate Services, Inc. The corporation may maintain an office or offices in such other places within or without the State of Nevada as may be from time to time designated by the Board of Directors or the By-Laws of the corporation. The corporation may conduct all corporation business of every kind and nature outside the State of Nevada as well as within the State of Nevada.

THIRD. The objects for which this corporation is formed are to engage in any lawful activity, including, but not limited to the following:

(a) Shall have such rights, privileges and powers as may be conferred upon corporations by any existing law.

(b) May at any time exercise such rights, privileges and powers, when not inconsistent with the purposes and objects for which this corporation is organized.

(c) Shall have power to have succession by its corporate name for the period limited in its certificate or articles of incorporation, and when no period is limited, perpetually, or until dissolved and its affairs wound up according to law.

(d) Shall have power to sue and be sued in any court of law or equity.

(e) Shall have power to make contracts.

(f) Shall have power to hold, purchase and convey real estate with its franchise. The power to hold real and personal estate shall include the power to take the same by devise or bequest in the State of Nevada, or in any other state, territory or country.

(g) Shall have power to appoint such officers and agents as the affairs of the corporation shall require, and to allow them suitable compensation.

(h) Shall have power to make By-Laws not inconsistent with the constitution or laws of the United States, or .of the State of Nevada, for the management, regulation and government of its affairs and property, the transfer of its stock, the transaction of its business, and the calling and holding of meetings of its stockholders.

(i) Shall have power to wind up and dissolve itself, or be wound up or dissolved.

(i) Shall have power to adopt and use a common seal or stamp, and alter the same at pleasure. The use of a seal or stamp by the corporation on any corporate documents is not necessary. The corporation may use a seal or stamp, if it desires, but such use or nonuse shall not in any way affect the legality of the document.

| 1 |

(k) Shall have the power to borrow money and contract debts when necessary for the transaction of its business, or for the exercise of its corporate rights, privileges or franchises, or for any other lawful purpose of its incorporation: to issue bonds, promissory notes, bills of exchange, debentures, and other obligations and evidences of indebtedness, payable at a specified time or times, or payable upon the happening of a specified event or events, whether secured by mortgage, pledge or otherwise, or unsecured, for money borrowed, or in payment for property purchased, or acquired, or for any other lawful object.

(l) Shall have power to guarantee, purchase, hold, sell, assign, transfer, mortgage, pledge or otherwise dispose of the shares of the capital stock of, or any bonds, securities or evidences of the indebtedness created by, any other corporation or corporations of the State of Nevada, or any other state or government and while owners of such stock, bonds, securities or evidences of indebtedness, to exercise all rights, powers and privileges of ownership, including the right to vote, if any.

(m) Shall have power to purchase, hold, sell and transfer shares of its own capital stock, and use therefore its capital, capital surplus, surplus, or other property to fund.

(n) Shall have power to conduct business, have one or more offices, and conduct any legal activity in the State of Nevada, and in any of the several states, territories, possessions and dependencies of the United States, the District of Columbia, and any foreign countries.

(o) Shall have power to do all and everything necessary and proper for the accomplishment of the objects enumerated in its certificate or articles of incorporation, or any amendment thereof, or necessary or incidental to the protection and benefit of the corporation, and, in general, to carry on any lawful business necessary or incidental to the attainment of the objects of the corporation, whether or not such business is similar in nature to the objects set forth in the certificate' or articles of incorporation of the corporation, or any amendments thereof.

(p) Shall have power to make donations for the public welfare or for charitable, scientific or educational purposes.

(q) Shall have power to enter into partnerships, general or limited, or joint ventures, in connection with any lawful activities, as may be allowed by law.

FOURTH. That the total number of stock authorized that may be issued by the corporation is three hundred million (300,000,000) shares of Common Stock with a par value of one hundredth of one cent ($0.000l) per share and one hundred million (100,000,000) shares of unissued, blank check Preferred Stock with a par value of one hundredth of one cent ($0.0001) per share and no other class of stock shall be authorized. Said shares may be issued by the corporation from time to time for such considerations as may be fixed by the Board of Directors.

| 2 |

The following is a description of the different classes and a statement of the relative rights of the holder of the Preferred Stock and the Common Stock.

PREFERRED STOCK — See exhibit A

The Board of Directors of the Corporation is authorized at any time and from time to time to provide for the issuance of shares of Preferred Stock of the Corporation in one or more series with such voting power, full or limited, or without voting powers, and with such designations, preferences and relative, participating, optional or other special rights, and qualifications, limitations or restrictions thereof as are stated and expressed in these Articles of Incorporation, and to the extent not to stated or expressed, as may be stated and expressed in a resolution or resolutions establishing such series and providing for the issuance thereof adopted by the Board of Directors pursuant to the authority to do so which is hereby expressly vested in it, including, without limiting the generality of the foregoing, the following:

1. the designation and number of shares of each such series;

2. the dividend rate of each such series, the conditions and dates upon which such dividends shall be payable, the preferences or relation of such dividends to dividends payable on any other class or classes of capital stock of the Corporation, and whether such dividends shall be cumulative or noncumulative;

3. whether the shares of each such series shall be subject to redemption by the Corporation, and, if made subject to such redemption, the times, prices, rates, adjustments and other terms and conditions of such redemption;

4. the terms and amount of any sinking or similar fund provided for the purchase or redemption of the shares of each such series;

5. whether the shares of each such series shall be convertible into or exchangeable for shares of capital stock or other securities of the Corporation or of any other corporation, and, if provision be made for conversion or exchange, the times, prices, rates, adjustments and other terms and conditions of such conversion or exchange;

6. the extent, if any, to which the holders of the shares of any series shall be entitled to vote as a class or otherwise with respect to the election of directors or otherwise;

7. the restrictions and conditions, if any, upon the issue or release of any additional Preferred Stock ranking on a parity with or prior to such shares as to dividends or upon dissolution;

8. the rights of the holders of the shares of such series upon the dissolution of, or upon the distribution of assets of, the Corporation, which rights may be different in the case of voluntary dissolution that the case of involuntary dissolution; and

9. any other relative rights, preferences or limitations of shares of such series consistent with this Article FOURTH and applicable law.

The powers, preferences and relative, participating, optional and other special rights of each series of Preferred Stock of the Corporation, and the qualifications, limitations or restrictions thereof, if any, may differ from those of any and all other series at any time outstanding. All shares of any one series of Preferred Stock of the Corporation shall be identical in all respects with all other shares of such series, except that shares of any one series issued at different times may differ as to the dates from which dividends thereon shall accrue or shall be cumulative. Except as may otherwise be required by law or these Articles of Incorporation, the terms of any series of Preferred Stock may be amended without consent of the holders of any other series of Preferred Stock or of any class of capital stock of the Corporation. The rights and preferences of the Series A Preferred Stock are annexed hereto as Exhibit A.

COMMON STOCK

Voting Rights

(A) Each share of Common Stock shall entitle the holder thereof to one vote for each share held.

| 3 |

(B) No holder of Common Stock shall have the right to cumulate votes in the election of Directors of the Corporation or for any other purpose.

Dividends

Subject to the rights of holders of Preferred Stock of the Corporation, the holders of Common Stock shall be entitled to share, on a pro rata basis, in any and all dividends, payable in cash or otherwise, as may be declared in respect of their holdings by the Board of Directors from time to time out of assets or funds of the Corporation legally available therefor.

PROVISIONS APPLICABLE TO ALL CLASSES

Liquidation Rights

In the event of any dissolution, liquidation or winding up of the affairs of the Corporation, whether voluntary or involuntary, after payment or provision for payment of the debts and other liabilities of the Corporation, the holders of each series of Preferred Stock shall be entitled to receive, out of the net assets of the Corporation, an amount for each share of Preferred Stock equal to the amount fixed and determined in accordance with the respective rights and priorities established by the Board of Directors in any resolution or resolutions providing for the issuance of any particular series of Preferred Stock before any of the assets of the Corporation shall be distributed or paid over to holders of Common Stock After payment in full of said amounts to the holders of Preferred Stock of all series, any remaining assets shall be distributed to the holders of Common Stock. A merger or consolidation of the Corporation with or into any other corporation or a sale or conveyance of all or any material part of the assets of the Corporation (that does not in fact result in the liquidation of the Corporation and the distribution of assets to stockholders) shall not be deemed to be a voluntary or involuntary liquidation or dissolution or winding up of the Corporation within the meaning of this paragraph.

Pre-Emptive Rights

No stockholder of the Corporation, by reason of his holding any shares of any class of the Corporation, shall have any pre-emptive or preferential right to acquire or subscribe for any treasury or unissued shares of any class of the Corporation now or hereafter to be authorized, or any notes, debentures, bonds, or other securities convertible into or carrying any right, option or warrant to subscribe for or acquire shares of any class of the Corporation now or hereafter to be authorized, whether or not the issuance of any such shares, or such notes, debentures, bonds or other securities would adversely affect the dividends or voting rights of such stockholder, and the Board of Directors of the Corporation may issue shares of any class of this Corporation, or any notes, debentures, bonds or other securities convertible into or carrying rights, options or warrants to subscribe for or acquire shares of any class of the Corporation, without offering any such shares of any class of the Corporation, either in whole or in part, to the existing stockholders of any class of the Corporation.

Consideration For Shares

The Common Stock and Preferred Stock shall be issued for such consideration as shall be fixed from time to time by the Board of Directors. In the absence of fraud, the judgment of the Directors as to the value of any consideration for shares shall be conclusive. When such shares are issued upon payment of the consideration fixed by the Board of Directors, such shares shall be taken to be fully paid stock and shall be non-assessable. This provision shall not be amended in this particular.

| 4 |

Stock Rights And Options

The Corporation shall have the power to create and issue rights, wan-ants or options entitling the holders thereof to purchase from the Corporation any shares of its capital stock of any class or classes upon such terms and conditions and at such times and places as the Board of Directors may provide, which terms and conditions shall be incorporated in an instrument or instruments evidencing such rights. In the absence of fraud, the judgment of the Board of Directors as to the adequacy of consideration for the issuance of such rights or options and the sufficiency thereof shall be conclusive.

FIFTH. No capital stock of this Corporation, after the amount of the subscription price (which shall not be less than the par value thereof) has been fully paid in, shall be assessable for any purpose, and no stock issued as fully paid up shall ever be assessable or assessed. The holders of such stock shall not be individually responsible for the debts, contracts, or liabilities of the Corporation and shall not be liable for assessments to restore impairments in the capital of the Corporation.

SIXTH. The governing board of the Corporation shall be known as directors, and the number of directors may from time to time be increased or decreased in such manner as shall be provided by the By-Laws of this corporation, providing that the number of directors shall not be reduced to fewer than one (1).

SEVENTH. The Corporation shall have perpetual existence.

EIGHTH. The personal liability of a director or officer of the Corporation to the Corporation or the stockholders for damages for breach of fiduciary duty as a director or officer shall be limited to acts or omissions which involve intentional misconduct, fraud or a knowing violation of law, to the extent permissible under the Nevada Revised Statutes ("NRS").

NINTH. The Corporation shall indemnify its officers and directors to the greatest extent permitted by the laws of Nevada and may advance the cost of litigation to permitted persons to the extent permitted under Nevada law.

TENTH. The provisions of these Articles of Incorporation may be amended, altered or repealed from time to time to the extent and in the manner prescribed by the NRS, and additional provisions authorized by such laws as are then in force may be added. All rights herein conferred on the directors, officers and stockholders are granted subject to this reservation.

ELEVENTH. Subject to the by-laws, if any, adopted by the stockholders, the board of directors is expressly authorized to make, alter or amend the by-laws of the corporation. The directors, without restriction or limitation, shall have all of the powers and authorities expressly conferred upon them by the statutes of this State and this corporation may in its by-laws confer powers upon its directors in addition to the powers and authorities expressly conferred upon them by the statutes of this State.

TWELFTH. The corporation may enter into contracts or transact business with one or more of its directors, or with any firm of which one or more of its directors are members, or with any corporation or association in which any one of its directors is a stockholder, director or officer, and such contract or transaction shall not be invalidated or in any wise affected by the fact that such director or directors have or may have interests therein which are or might be adverse to the interests of the corporation, even though the vote of the director or directors having such adverse interest shall have been necessary to obligate the corporation upon such contract or transaction provided such adverse interest is either known or made known to the remaining directors; and no director or directors having such adverse interest shall be liable to the corporation or to any stockholder or creditor thereof, or to any other person, for any loss incurred by it under or by reason of any such contract or transaction; nor shall any such director or directors be accountable for any gains or profits realized thereon: Always provided, however, that such contract or transaction shall at the time at which it was entered into have been a reasonable one to have been entered into and shall have been upon terms that at the time were fair.

| 5 |

THIRTEENTH. Meetings of stockholders may be held without the State of Nevada, if the by-laws so provide. The books of this corporation may be kept (subject to the provision of the statutes) outside of the State of Nevada at such places as may be from time to time designated by the board of directors or in the by-laws of the corporation.

FOURTEENTH. This corporation reserves the right to amend, alter, change or repeal any provision contained in these articles of incorporation, in the manner now or hereafter prescribed by statute, or by these articles of incorporation, and all rights conferred upon stockholders herein are granted subject to this reservation.

FIFTEENTH. No holder of shares of stock of the corporation shall be entitled as of right to purchase or subscribe for any part of any unissued stock of this corporation or of any new or additional authorized stock of the corporation of any class whatsoever, or of any issue of securities of the corporation convertible into stock, whether such stock or securities be issued for money or for a consideration other than money or by way of dividend, but any such unissued stock or such new or additional authorized stock or such securities convertible into stock may be issued and disposed of to such persons, firms, corporations and associations, and upon such terms as may be deemed advisable by the board of directors without offering to stockholders then of record or any class of stockholders any thereof upon the same terms or upon any terms.

SIXTEENTH. A director or officer of the corporation shall have no personal liability to the corporation or its stockholders for damages for breach of fiduciary duty as a director or officer, except for (a) acts or omissions which involve intentional misconduct, fraud or a knowing violation of law; or (b) the payment of dividends in violation of the applicable statutes of Nevada. If the Nevada General Corporation Law is amended after approval by the stockholders of this Article SIXTEENTH to authorize corporate action further eliminating or limiting the personal liability of directors or officers, the liability of a director or officer of the corporation shall be eliminated or limited to the fullest extent permitted by the Nevada General Corporation Law, as so amended from time to time. No repeal or modification of this Article SIXTEENTH by the stockholders shall adversely affect any right or protection of a director or officer of the corporation existing by virtue of this Article SIXTEENTH at the time of such repeal or modification.

SEVENTEENTH. (a) The corporation shall indemnify and hold harmless any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, by reason of the fact that he or she is or was or has agreed to become a director or officer of the corporation or is serving at the request of the corporation as a director or officer of another corporation, partnership, joint venture, trust, employee benefit plan or other enterprise or by reason of actions alleged to have been taken or omitted in such capacity or in any other capacity while serving as a director or officer. The indemnification of directors and officers by the corporation shall be to the fullest extent authorized or permitted by applicable law, as such law exists or may hereafter be amended (but only to the extent that such amendment permits the corporation to provide broader indemnification rights than permitted prior to the amendment). The indemnification of directors and officers shall be against all loss, liability and expense (including attorneys fees, costs, damages, judgments, fines, amounts paid in settlement and ERISA excise taxes or penalties) actually and reasonably incurred by or on behalf of a director or officer in connection with such action, suit or proceeding, including any appeal; provided, however, that with respect to any action, suit or proceeding initiated by a director or officer, the corporation shall indemnify such director or officer only if the action, suit or proceeding was authorized by the board of directors of the corporation, except with respect to a suit for the enforcement of rights to indemnification or advancement of expenses in accordance with Section (c) hereof.

| 6 |

(b) The expenses of directors and officers incurred as a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative shall be paid by the corporation as they are incurred and in advance of the final disposition of the action, suit or proceeding; provided, however, that if applicable law so requires, the advance payment of expenses shall be made only upon receipt by the corporation of an undertaking by or on behalf of the director or officer to repay all amounts:so advanced in the event that it is ultimately determined by a final decision, order or decree of a court of competent jurisdiction that the director or officer is not entitled to be indemnified for such expenses under this Article SEVENTEENTH.

(c) Any director or officer may enforce his or her rights to indemnification or advance payments for expenses in a suit brought against the corporation if his or her request for indemnification or advance payments for expenses is wholly or partially refused by the corporation or if there is no determination with respect to such request within 60 days from receipt by the corporation of a written notice from the director or officer for such a determination, If a director or officer is successful in establishing in a suit his or her entitlement to receive or recover an advancement of expenses or a right to indemnification, in whole or in part, he or she shall also be indemnified by the corporation for costs and expenses incurred in such suit. It shall be a defense to any such suit (other than a suit brought to enforce a claim for the advancement of expenses under Section (b) of this Article SEVENTEENTH where the required undertaking, if any, has been received by the corporation) that the claimant has not met the standard of conduct set forth in the Nevada General Corporation Law. Neither the failure of the corporation to have made a determination prior to the commencement of such suit that indemnification of the director or officer is proper in the circumstances because the director or officer has met the applicable standard of conduct nor a determination by the corporation that the director or officer has not met such applicable standard of conduct shall be a defense to the suit or create a presumption that the director or officer has not met the applicable standard of conduct. In a suit brought by a director or officer to enforce a right under this Section (c) or by the corporation to recover an advancement of expenses pursuant to the terms of an undertaking, the burden of proving that a director or officer is not entitled to be indemnified or is not entitled to an advancement of expenses under this Section (c) or otherwise, shall be on the corporation.

(d) The right to indemnification and to the payment of expenses as they are incurred and in advance of the final disposition of the action, suit or proceeding shall not be exclusive of any other right to which a person may be entitled under these articles of incorporation or any by-law, agreement, statute, vote of stockholders or disinterested directors or otherwise. The right to indemnification under Section (a) hereof shall continue for a person who has ceased to be a director or officer and shall inure to the benefit of his or her heirs, next of kin, executors, administrators and legal representatives.

(e) The corporation may maintain insurance, at its expense, to protect itself and any director, officer, employee or agent of the corporation or another corporation, partnership, joint venture, trust or other enterprise against any loss, liability or expense, whether or not the corporation would have the power to indemnify such person against such loss, liability or expense under the Nevada General Corporation Law.

| 7 |

(f) The corporation shall not be obligated to reimburse the amount of any settlement unless it has agreed to such settlement. if any person shall unreasonably fail to enter into a settlement of any action, suit or proceeding within the scope of Section (a) hereof, offered or assented to by the opposing party or parties and which is acceptable to the corporation, then, notwithstanding any other provision of this Article SEVENTEENTH, the indemnification obligation of the corporation in connection with such action, suit or proceeding shall be limited to the total of the amount at which settlement could have been made and the expenses incurred by such person prior to the time the settlement could reasonably have been effected.

The corporation may, to the extent authorized from time to time by the board of directors, grant rights to indemnification and to the advancement of expenses to any employee or agent of the corporation or to any director, officer, employee or agent of any of its subsidiaries to the fullest extent of the provisions of this Article SEVENTEENTH subject to the imposition of any conditions or limitations as the board of directors of the corporation may deem necessary or appropriate.

EIGHTEENTH. Pursuant to the authority granted in Section 78.378 of the NRS, the so-called "anti-takeover" statutes found in NRS Sections 78.3782 through 783793 inclusive, shall not be applicable to the Corporation.

NINETEENTH. Pursuant to the authority granted in NRS Section 78.434, the so-called "Combinations With Interested Stockholder" statutes found in NRS Sections 78.411 through 78.444 inclusive, shall not be applicable to the Corporation.

TWENTIETH. Bernard Warman is the sole director. His address is at 320 Cross Street Lakewood, N.108701.

I, the undersigned, being the incorporator hereinbefore named for the purpose of forming a corporation pursuant to General Corporation Law of the State of Nevada, do make and file these Articles of Incorporation, hereby declaring and certifying that the facts herein stated are true, and accordingly have hereunto set my hand this June 10, 2014.

| /s/ Bernard Warman | |

| Incorporator | |

| Bernard Warman | |

| 320 Cross Street | |

| Lakewood, NJ 08701 |

EXHIBIT A

PISHPOSH, INC.

The following are the voting powers, rights, preferences, limitations and restrictions of shares of Preferred Stock which have been designated as Series A Preferred Stock:

TERMS OF SERIES A PREFERRED STOCK

Section 1. Definitions. For the purposes of the Series A Preferred Stock, the following terms shall have the following meanings:

"Affiliate" means any Person that, directly or indirectly through one or more intermediaries, controls or is controlled by or is under common control with a Person, .as such terms are used in and construed under Rule 405 of the Securities Act.

"Alternate Consideration" shall have the meaning set forth in Section 7(d).

"Bankruptcy Event" means any of the following events: (a) the Corporation or any material Subsidiary thereof commences a case or other proceeding under any bankruptcy, reorganization, arrangement, adjustment of debt, relief of debtors, dissolution, insolvency or liquidation or similar law of any jurisdiction relating to the Corporation or any material Subsidiary thereof, (6) there is commenced against the Corporation or any material Subsidiary thereof any such case or proceeding that is not dismissed within 60 days after commencement, (c) the Corporation or any material Subsidiary thereof is adjudicated insolvent or bankrupt or any order of relief or other order approving any such case -or proceeding is entered, (d) the Corporation or any material Subsidiary thereof suffers any appointment of any custodian or the like for it or any substantial part of its property that is not discharged or stayed within 90 calendar days after such appointment, (e) the Corporation or any material Subsidiary thereof makes a general assignment for the benefit of creditors, (1) the Corporation or any material Subsidiary thereof calls a meeting of its creditors with a view to arranging a composition, adjustment or restructuring of its debts, or (g) the Corporation or any material Subsidiary thereof, by any act or failure to act, expressly indicates its consent to, approval of or acquiescence in any of the foregoing or takes any corporate or other action for the purpose of effecting any of the foregoing.

"Beneficial Ownership Limitation" shall have the meaning set forth in Section 6(d).

"Business Day" means any day except any Saturday, any Sunday, any day which is a federal legal holiday in the United States or any day on which banking institutions in the State of New York are authorized or required by law or other governmental action to close.

"Commission" means the United States Securities and Exchange Commission.

"Common Stock" means the Corporation's common stock, par value $0.0001 per share, and stock of any other class of securities into which such securities may hereafter be reclassified or changed.

"Common Stock Equivalents" means any securities of the Corporation or the Subsidiaries including without limitation any other class of preferred stock other than the Series A Preferred Stock, which would entitle the holder thereof to acquire at any. time Common Stock, including, without limitation, any debt, preferred stock, rights, options, warrants or other instrument that is at any time convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock.

| 1 |

"Conversion Amount" means the sum of the Stated Value at issue.

"Conversion Date" shall have the meaning set forth in Section 6(a).

"Conversion Price" shall have the meaning set forth in Section 6(b).

"Conversion Shares" means, collectively, the shares of Common Stock issuable upon conversion of the Series A Preferred Stock in accordance with the terms hereof.

"Deemed Sale Event" shall mean a Fundamental Transaction described in subsection (b) and (c) of the definition of Fundamental Transaction.

"End Date" means the first to occur of: (i) a Going Public Event, (ii) the Holders of Series A Preferred Stock issued and outstanding as of the Initial Issue Date owning fewer than 25% of such Series A Preferred Stock, or (iii) two years after the Original Issue Date.

"Exchange Act" means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

"Exempt Issuance" means the issuance of (a) shares of Common Stock and options to officers, directors, employees, or consultants of the Corporation prior to and after the Closing Date in the amounts, (b) securities upon the exercise or exchange of or conversion of Securities issued hereunder (subject to adjustment for forward and reverse stock splits and the like that occur after the date hereof) and/or other securities exercisable or exchangeable for or convertible into shares of Common Stock issued and outstanding on the date of this Agreement, provided that such securities and any term thereof have not been amended since the date of this Agreement to increase the number of such securities or to decrease the issue price, exercise price, exchange price or conversion price of such securities, (e) securities issued pursuant to acquisitions or strategic transactions approved by a majority of the disinterested directors of the Corporation, provided that any such issuance shall only be to a Person (or to the equityholders of a Person) which is, itself or through its subsidiaries, an operating company or an owner of an asset in a business synergistic with the business of the Corporation and shall be intended to provide to the Corporation substantial additional benefits in addition to the investment of funds, but shall not include a transaction in which the Corporation is issuing. securities primarily for the purpose of raising capital or to an entity whose primary business is investing in securities, and (d) securities issued or issuable pursuant to this Agreement or the Articles of Incorporation, or upon exercise or conversion of any such securities, (e) securities issued pursuant to or in connection with a Going Public Event, (f) securities issued pursuant to the Stock Option Plan, and (g) securities issued in connection with Indebtedness.

"Fundamental Transaction" means after the occurrence of a Going Public Event and except in connection with an Exempt Issuance or Going Public Event, any of (a) an acquisition after the date hereof by an individual or legal entity or "group" (as described in Rule 13d 5(b)(I ) promulgated under the Exchange Act), other than a legal entity majority owned by, or a group the majority of which consists of, officers and directors of the Corporation and their Affiliates, of effective control (whether through legal or beneficial ownership of capital stock of the Corporation, by contract or otherwise) of in excess of 50% of the voting securities of the Corporation (other than by means of conversion or exercise of Preferred Stock and the Securities issued together with the Preferred Stock), (b) the Corporation merges into or consolidates with any other Person, or any Person merges into or consolidates with the Corporation and, after giving effect to such transaction, the stockholders of the Corporation immediately prior to such transaction own less than 50% of the aggregate voting power of the Corporation or the successor entity of such transaction, (c) the Corporation, directly or indirectly, effects any sale, lease, license, assignment, transfer, conveyance or other disposition of all or substantially all of its assets in one or a series of related transactions, or (d) the Corporation, directly or indirectly, in one or more related transactions effects any reclassification, reorganization or recapitalization of the Common Stock or any compulsory share exchange pursuant to which the Common Stock is effectively converted into or exchanged for other securities, cash or property and after giving effect to such transaction, the stockholders of the Corporation immediately prior to such transaction own less than 50% of the aggregate voting power of the Corporation or the successor entity of such transaction. A Fundamental Transaction shall not be deemed to have occurred in connection with any transaction brought about by the purchase or sale of any of the Corporation's securities by a holder of any Securities.

| 2 |

"GAAP" means United States generally accepted accounting principles.

"Going Public Event" means the Company has (a) consummated a merger or business combination with a public company and caused the Common Stock issuable upon conversion or exchange of the Preferred Stock to be such class of equity, (b) the Registration Statement has been declared effective by the Commission, and the effectiveness of the Registration Statement is maintained as described in the Registration Rights Agreement, or (c) the class of Common Stock issuable upon conversion of the Preferred Stock become subject to the reporting requirements of Section 13 or 15(d) under the Exchange Act.

"Holder" shall have the meaning given such term in Section 2.

"Indebtedness" means (a) any liabilities for borrowed money or amounts owed in excess of $400,000 other than debt financing from a licensed United States bank regularly engaged in such lending activity, and (b) all guaranties, endorsements and other contingent obligations in respect of indebtedness of others, whether or not the same are or should be reflected in the Corporation's balance sheet (or the notes thereto), except guaranties by endorsement of negotiable instruments for deposit or collection or similar transactions in the ordinary course of business, but in all cases excluding trade accounts payable incurred by the Corporation and its Subsidiaries in the ordinary course of business; and (z) the present value of any lease payments in excess of $400,000 due under leases required to be capitalized in accordance with GAAP.

"Initial Issue Date" means the first Business Day on which Series A Preferred Stock is issued pursuant to the Securities Purchase Agreement.

"Junior Securities" means the Common Stock and Common Stock Equivalents at any time outstanding or issuable.

"Liquidation" shall have the meaning set forth in Section 5.

"New York Courts" shall have the meaning set forth in Section 11(d).

"Notice of Conversion" shall have the meaning set forth in Section 6(a).

| 3 |

"Original Issue Date" means the date of the first issuance of any shares of the Series A Preferred Stock regardless of the number of transfers of any particular shares of Series A Preferred Stock and regardless of the number of certificates which may be issued to evidence such Series A Preferred Stock.

"Person" means an individual or corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability company, 'joint stock company, government (or an agency or subdivision thereof) or other entity of any kind.

"Principal Shareholder" means Bernard Warman.

"Registration Rights Agreement" means the Registration Rights Agreement, dated as of the date of the Securities Purchase Agreement, among the Corporation and the original Purchasers, in the form of Exhibit G attached to the Securities Purchase Agreement.

"Registration Statement" means a registration statement meeting the requirements set forth in the Registration Rights Agreement and covering the resale of the Common Stock issuable upon conversion of the Preferred Stock by each Purchaser as provided for and limited in the Registration Rights Agreement.

"Securities" means the Series A Preferred Stock and the Conversion Shares.

"Securities Act" means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

"Securities Purchase Agreement" means the agreement among the Corporation and some of the initial Holders in connection with which Series A Preferred Stock and Warrants will have been issued.

"Series A Preferred Stock" shall have the meaning set forth in Section 2.

"Share Delivery Date" shall have the meaning set forth in Section 6(c).

"Stated Value" shall have the meaning set forth in Section 2.

"Subsidiary" means with respect to any entity at any date, any direct or indirect corporation, limited or general partnership, limited liability company, trust, estate, association, joint venture or other business entity of which (A) more than 50% of (1) the outstanding capital stock having (in the absence of contingencies) ordinary voting power to elect a majority of the board of directors or other managing body of such entity, (ii) in the case of a partnership or limited liability company, the interest in the capital or profits of such partnership or limited liability company or (iii) in the case of a trust, estate, association, joint venture or other entity, the beneficial interest in such trust, estate, association or other entity business is, at the time of determination, owned or controlled directly or indirectly through one or more intermediaries, by such entity, or (B) is under the actual control of the Corporation.

"Successor Entity" shall have the meaning set forth in Section 7(d).

"Trading Market" means any of the following markets or exchanges: the NYSE MKT, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market, the New York Stock Exchange, the OTC Bulletin Board, the OTCQB or OTCQX or any markets or exchanges maintained by the OTC Markets Group, Inc. (or any successors to any of the foregoing).

| 4 |

"Transaction Documents" means the Securities Purchase Agreement, the Corporation's Articles of Incorporation, including the Certificate of Designation for the Series A Preferred Stock, Warrants, and all exhibits and schedules and other documents or agreements executed in connection with the transactions contemplated therunder.

"Transfer Agent" means the transfer agent for the Common Stock, and if so appointed, the Preferred Stock, and any successor transfer agent of the Corporation. As of the Closing Date, the Corporation is the Transfer Agent.

"Triggering Event" shall have the meaning set forth in Section 10(a).

"Triggering Redemption Amount" means, for each share of Preferred Stock 110% of the Stated Value.

"Triggering Redemption Payment Date" shall have the, meaning set forth in Section 10(b).

"Variable Rate Transaction" shall mean any Equity Line of Credit or similar agreement, nor issue nor agree to issue any common stock, floating or Variable Priced Equity Linked Instruments nor any of the foregoing or equity with price reset rights (subject to adjustment for stock splits, distributions, dividends, recapitalizations and the like).

"VWAP" means, for any date, the price determined by the first of the following clauses that applies: (a) if the Common Stock is then listed or quoted on a Trading Market, the daily volume weighted average price of the Common Stock for such date (or the nearest preceding date) on the Trading Market on which the Common Stock is then listed or quoted as reported by Bloomberg L.P. (based on a Trading Day from 9:30 a.m. (New York City time) to 4:02 p.m. (New York City time)), (b) if the Common Stock is not then listed or quoted for trading on a Trading Market and if prices for the Common Stock are then reported on the OTC Pink Marketplace maintained by OTC Markets Group Inc. (or a similar organization or agency succeeding to its functions of reporting prices), the most recent closing price per share of the Common Stock so reported, or (c) in all other cases, the fair market value of a share of Common Stock as determined by an independent appraiser selected in good faith by the Purchasers of a majority in interest of the Securities then outstanding and reasonably acceptable to the Corporation, the fees and expenses of which shall be paid by the Corporation.

"Warrants" means the Common Stock purchase warrants delivered to some of the initial Holders of Series A Preferred Stock pursuant to the Securities Purchase Agreement.

"Warrant Shares" means the shares of Common Stock issuable upon exercise of the Warrants.

Section 2. Designation. Amount and Par Value. The series of preferred stock shall be designated as its Series A Convertible Preferred Stock (the "Series A Preferred Stock") and the number of shares so designated shall be 5,000 (which shall not be subject to increase without the written consent of the holders of a majority of the then outstanding shares of Series A Preferred Stock (each, a "Holder" and collectively, the "Holders")). Each share of Series A Preferred Stock shall have a par value of $0.0001 per share and a stated value equal to $1,000 (the "Stated Value").

| 5 |

Section 3. Dividends.

a) Participating Dividends on As-Converted Basis. Holder shall not be entitled to receive any dividends except that the Corporation shall pay dividends on shares of Series A Preferred Stock equal to (on an as-if-converted-to-Common-Stock basis) and in the same form as dividends actually paid on shares of the Common Stock when,. as and if such dividends are paid on shares of the Common Stock. The Corporation shall pay no dividends on shares of the Common Stock unless it simultaneously complies with the previous sentence.

b) Other Securities. So long as at least 25% of the originally issued shares of Series A Preferred Stock shall remain outstanding, neither the Corporation nor any Subsidiary thereof shall redeem, purchase or otherwise acquire directly or indirectly any Junior Securities or other securities except from departing officers, directors or employees for not more than $100,000 per calendar year. So long as 25% of the originally issued shares of Series A Preferred Stock shall remain outstanding, neither the Corporation nor any Subsidiary thereof shall directly or indirectly pay or declare any dividend or make any distribution upon, nor shall any distribution be made in respect of, any Junior Securities, nor shall any monies be set aside for or applied to the purchase or redemption (through a sinking fund or otherwise) of any Junior Securities or shares pari passu with the Series A Preferred Stock.

Section 4. Voting Rights. Except as otherwise provided herein or as otherwise required by law, the Series A Preferred Stock shall have no voting rights. When entitled to vote on a matter as provided for herein, the holders of Series A Preferred Stock shall vote together with the holders of Common Stock on an as converted basis. In any event, and notwithstanding the foregoing limitation, as long as at least 20% of the originally issued shares of Series A Preferred Stock are outstanding, the Corporation shall not, without the affirmative vote of the Holders of a majority of the then outstanding shares of the holders of Series A Preferred Stock with respect to Series A Preferred Stock, (a) alter or change adversely the powers, preferences or rights given to the Series A Preferred Stock, (b) authorize or create any class of stock ranking as to dividends, redemption or distribution of assets upon a Liquidation (as defined in Section 5) senior to, or otherwise pari passu with, the Series A Preferred Stock, (0) amend its certificate of incorporation or other charter documents in any manner that materially adversely affects any rights of the Holders as holders of Series A Preferred Stock, (d) increase the number of authorized shares of Series A Preferred Stock, or (e) pay any dividends.

Section 5. Liquidation. Upon any liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary (a "Liquidation"), the Holders shall be entitled to receive out of the assets, whether capital or surplus, of the Corporation an amount equal to the Stated Value, plus any accrued and unpaid dividends thereon and any other fees or liquidated damages then due and owing thereon under these Articles of Incorporation, for each share of Preferred Stock before any distribution or payment shall be made to the holders of any Junior Securities and if the assets of the Corporation shall be insufficient to pay in full such amounts, then the entire assets to be distributed to the Holders shall be ratably distributed among the Holders in accordance with the respective amounts that would be payable on such shares if all amounts payable thereon were paid in full. Upon occurrence of a Liquidation which is also a Fundamental Transaction, the Holder may elect to receive the rights and benefits of this section 5 and/or the rights and benefits set forth in Section 7(d) or any other rights set forth in these Articles of Incorporation. The Corporation shall mail written notice of any such Liquidation, not less than 10 days prior to the payment date stated therein, to each Holder.

| 6 |

Section 6. Conversion.

a) Conversions at Option of Holder. Each share of Series A Preferred Stock shall be convertible, at any time and from time to time from and after the Original Issue Date at the option of the Holder thereof, into that number of shares of Common Stock (subject to the limitations set forth in Section 6(d)) determined by dividing the Stated Value of such share of Series A Preferred Stock by the Conversion Price. Holders shall effect conversions by providing the Corporation with the form of conversion notice attached hereto as Annex A (a "Notice of Conversion"). Each Notice of Conversion shall specify the number of shares of Series A Preferred Stock to be converted, the number of shares of Series A Preferred Stock owned prior to the conversion at issue, the number of shares of Series A Preferred Stock owned subsequent to the conversion at issue and the date on which such conversion is to be effected, which date may not be prior to the date the applicable Holder delivers by facsimile such Notice of Conversion to the Corporation (such date, the "Conversion Date"). If no Conversion Date is specified in a Notice of Conversion, the Conversion Date shall be the date that such Notice of Conversion to the Corporation is deemed delivered hereunder. The calculations and entries set forth in the Notice of Conversion shall control in the absence of manifest or mathematical error. To effect conversions of shares of Series A Preferred Stock, a Holder shall not be required to surrender the certificate(s) representing the shares of Preferred Stock to the Corporation, (although the Holder may surrender the Preferred Stock certificate to, and receive a replacement certificate from the Corporation, at Holder's election) unless all of the shares of Preferred Stock represented thereby are so converted, in which case such Holder shall deliver the certificate representing such shares of Series A Preferred Stock promptly following the Conversion Date at issue. Shares of Series A Preferred Stock converted into Common Stock or redeemed in accordance with the terms hereof shall be canceled and shall not be reissued.

b) Conversion Price. The conversion price for the Preferred Stock shall equal $1.00, subject to adjustment herein (the "Conversion Price").

c) Mechanics of Conversion

i. Delivery of Certificate Upon Conversion. Not later than seven (7) Business Days after each Conversion Date (the "Share Delivery Date"), the Corporation shall deliver, or cause to be delivered, to the converting Holder (A) a certificate or certificates representing the Conversion Shares (however, the Corporation shall use reasonable commercial efforts to deliver such shares within five (5) Business Days).

ii. Failure to Deliver Certificates. 14 in the case of any Notice of Conversion, such certificate or certificates are not delivered to or as directed by the applicable Holder by the Share Delivery Date, the Holder shall be entitled to elect by written notice to the Corporation at any time on or before its receipt of such certificate or certificates, to rescind such Conversion, in which event the Corporation shall promptly return to the Holder any original Preferred Stock certificate delivered to the Corporation and the Holder shall promptly return to the Corporation the Common Stock certificates issued to such Holder pursuant to the rescinded Conversion Notice.

iii. Obligation Absolute: Partial Liquidated Damages. The Corporation's obligation to issue and deliver the Conversion Shares upon conversion of Preferred Stock in accordance with the terms hereof are absolute and unconditional, irrespective of any action or inaction by a Holder to enforce the same, any waiver or consent with respect to any provision hereof, the recovery of any judgment against any Person or any action to enforce the same, or any setoff, counterclaim, recoupment, limitation or termination, or any breach or alleged breach by such Holder or any other Person of any obligation to the Corporation or any violation or alleged violation of law by such Holder or any other person, and irrespective of any other circumstance which might otherwise limit such obligation of the Corporation to such Holder in connection with the issuance of such Conversion Shares; provided, however, that such delivery shall not operate as a waiver by the Corporation of any such action that the Corporation may have against such Holder.

| 7 |

iv. Reservation of Shares Issuable Upon Conversion. The Corporation covenants that it will at all times reserve and keep available out of its authorized and unissued shares of Common Stock for the sole purpose of issuance upon conversion of the Preferred Stock, free from preemptive rights or any other actual contingent purchase rights of Persons other than the Holder (and the other holders of the Preferred Stock), not less than such aggregate number' of shares of the Common Stock as shall be issuable upon the conversion of the then outstanding shares of Preferred Stock. The Corporation covenants that all shares of Common Stock that shall be so issuable shall, upon issue, be duly authorized, validly issued, fully paid and nonassessable, and, if the Registration Statement is then effective under the Securities Act, shall be registered for public resale in accordance with such Registration Statement (subject to such Holder's compliance with its obligations under the Registration Rights Agreement).

v. Fractional Shares. No fractional shares or scrip representing fractional shares shall he issued upon the conversion of the Preferred Stock. As to any fraction of a share which the Holder would otherwise be entitled to purchase upon such conversion, the Corporation shall at its election, either pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the Conversion Price or round up to the next whole share.

vi. Transfer Taxes and Expenses. The issuance of certificates for shares of the Common Stock on conversion of this Preferred Stock shall be made without charge to any Holder for any documentary stamp or similar taxes that may be payable in respect of the issue or delivery of such certificates, provided that the Corporation shall not be required to pay any tax that may be payable in respect of any transfer involved in the issuance and delivery of any such certificate upon conversion in a name other than that of the Holders of such shares of Preferred Stock and the Corporation shall not be required to issue or deliver such certificates unless or until the Person or Persons requesting the issuance thereof shall have paid to the Corporation the amount of such tax or shall have established to the satisfaction of the Corporation that such tax has been paid. The Corporation shall pay all Transfer Agent fees required for same-day processing of any Notice of Conversion.

| 8 |

d) Beneficial Ownership Limitation. The Corporation shall not effect any conversion of the Preferred Stock, and a Holder shall not have the right to convert any portion of the Preferred Stock, to the extent that, after giving effect to the conversion set forth on the applicable Notice of Conversion, such Holder (together with such Holder's Affiliates, and any Persons acting as a group together with such Holder or any of such Holder's Affiliates) would beneficially own in excess of the Beneficial Ownership Limitation (as defined below). For purposes of the foregoing sentence, the number of shares of Common Stock beneficially owned by such Holder and its Affiliates shall include the number of shares of Common Stock issuable upon conversion of the Preferred Stock with respect to which such determination is being made, but shall exclude the number of shares of Common Stock which are issuable upon (i) conversion of the remaining, unconverted Stated Value of Preferred Stock beneficially owned by such Holder or any of its Affiliates and (ii) exercise or conversion of the unexercised or unconverted portion of any other securities of the Corporation subject to a limitation on conversion or exercise analogous to the limitation contained herein (including, without limitation, the Preferred Stock or the Warrants) beneficially owned by such Holder or any of its Affiliates. Except as set forth in the preceding sentence, for purposes of this Section 6(d), beneficial ownership shall be calculated in accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder. To the extent that the limitation contained in this Section 6(d) applies, the determination of whether the Preferred Stock is convertible (in relation to other securities owned by such Holder together with any Affiliates) and of how many shares of Preferred Stock are convertible shall be in the sole discretion of such Holder, and the submission of a Notice of Conversion shall be deemed to be such Holder's determination of whether the shares of Preferred Stock may be convertible.(in relation to other securities owned by such Holder together with any Affiliates) and how many shares of the Preferred Stock are convertible, in each case subject to the Beneficial Ownership Limitation. To ensure compliance with this restriction, each Holder will be deemed to represent to the Corporation each time it delivers a Notice of Conversion that such Notice of Conversion has not violated the restrictions set forth in this paragraph and the Corporation shall have no obligation to verify or confirm the accuracy of such determination. In addition, a determination as to any group status as contemplated above shall be determined in accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder. For purposes of this Section 6(d), in determining the number of outstanding shares of Common Stock, a Holder may rely on the number of outstanding shares of Common Stock as stated in the most recent of the following: (i) the Corporation's most recent periodic or annual report filed with the Commission, as the case may be, (ii) a more recent public announcement by the Corporation or (iii) a more recent written notice by the Corporation or the Transfer Agent setting forth the number of shares of Common Stock outstanding. Upon the written or oral request of a Holder, the Corporation shall within two Business Days confirm orally and in writing to such Holder the number of shares of Common Stock then outstanding. In any case, the number of outstanding shares of Common Stock shall be determined after giving effect to the conversion or exercise of securities of the Corporation, including the Preferred Stock, by such Holder or its Affiliates since the date as of which such number of outstanding shares of Common Stock was reported. The "Beneficial Ownership Limitation" shall be 4.99% of the number of shares of the Common Stock outstanding immediately after giving effect to the issuance of shares of Common Stock issuable upon conversion of Preferred Stock held by the applicable Holder. A Holder, upon not less than 61 days' prior notice to the Corporation, may increase or decrease the Beneficial Ownership Limitation provisions of this Section 6(d) applicable to its Preferred Stock provided that the Beneficial Ownership Limitation in no event exceeds 9.99% of the number of shares of the Common Stock outstanding immediately after giving effect to the issuance of shares of Common Stock upon conversion of this Preferred Stock held by the Holder and the provisions of this Section 6(d) shall continue to apply. Any such increase or decrease will not be effective until the 61' day after such notice is delivered to the Corporation and shall only apply to such Holder and no other Holder. The provisions of this paragraph shall be construed and implemented in a manner otherwise than in strict conformity with the terms of this Section 6(d) to correct this paragraph (or any portion hereof) which may be defective or inconsistent with the intended Beneficial Ownership Limitation contained herein or to make changes or supplements necessary or desirable to properly give effect to such limitation. The limitations contained in this paragraph shall apply to a successor holder of Preferred Stock_ The foregoing conversion limitation shall only apply at a time when the Common Stock is subject to the reporting requirements under 13 or 15(d) under the Exchange Act. The Corporation will u cause the foregoing conversion limitation to apply with respect to any other class of equity to which the Series A Preferred Stock may be convertible (including equity of a successor entity or entity with which a Going Public Event is consummated) at such time as such other equity is subject to such reporting requirements.

| 9 |

Section 7. Certain Adjustments.

a) Stock Dividends and Stock Splits. If the Corporation, at any time while this Preferred Stock is outstanding: (i) pays a stock dividend or otherwise makes a distribution or distributions payable in shares of Common Stock on shares of Common Stock or any other Common Stock Equivalents (which, for avoidance of doubt, did not include a corresponding distribution to the holders of Series A Preferred Stock on an as converted basis), (ii) subdivides outstanding shares of Common Stock into a larger number of shares, (iii) combines (including by way of a reverse stock split) outstanding shares of Common Stock into a smaller number of shares, or (iv) issues, in the event of a reclassification of shares of the Common Stock, any shares of capital stock of the Corporation (which, for avoidance of doubt, did not include a corresponding distribution to the holders of Series A Preferred Stock on an as converted basis), then the Conversion Price shall be multiplied by a fraction of which the numerator shall be the number of shares of Common Stock (excluding any treasury shares of the Corporation) outstanding immediately before such event, and of which the denominator shall be the number of shares of Common Stock outstanding immediately after such event. Any adjustment made pursuant to this Section 7(a) shall become effective immediately after the record date for the determination of stockholders entitled to receive such dividend or distribution and shall become effective immediately after the effective date in the case of a subdivision, combination or re-classification.

b) Subsequent Rights Offerings. In addition to any adjustments pursuant to Section 7(a) above, if at any time the Corporation grants, issues or sells any Common Stock Equivalents or rights to purchase stock, warrants, securities or other property pro rata to the record holders of any class of shares of Common Stock (the "Purchase Rights"), then the Holder of will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which the Holder could have acquired if the Holder had held the number of shares of Common Stock acquirable upon complete conversion of such Holder's Preferred Stock (without regard to any limitations on exercise hereof, including without limitation, the Beneficial Ownership Limitation) immediately before the date on which a record is taken for the grant, issuance or sale of such Purchase Rights, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the grant, issue or sale of such Purchase Rights (provided, however, to the extent that the Holder's right to participate in any such Purchase Right would result in the Holder exceeding the Beneficial Ownership Limitation, then the Holder shall not be entitled to participate in such Purchase Right to such extent (or beneficial ownership of such shares of Common Stock as a result of such Purchase Right to such extent) and such Purchase Right to such extent shall be held in abeyance for the Holder until such time, if ever, as its right thereto would not result in the Holder exceeding the Beneficial Ownership Limitation).

c) Pro Rata Distributions. The Corporation, at any time while this Preferred Stock is outstanding, shall include Holders, on an as converted basis, in all distributions of any kind (including cash and cash dividends) issued to all holders of Common Stock.

| 10 |

d) Fundamental Transaction. If, at any time while this Preferred Stock is outstanding, a Fundamental Transaction occurs, then, upon any subsequent conversion of this Preferred Stock, the Holder shall have the right to receive, for each Conversion Share that would have been issuable upon such conversion immediately prior to the occurrence of such Fundamental Transaction (without regard to any limitation in Section 6(d) on the conversion of this Preferred Stock), the number of shares of Common Stock of the successor or acquiring corporation or of the Corporation, if it is the surviving corporation, and any additional consideration (the "Alternate Consideration") receivable as a result of such Fundamental Transaction by a holder of the number of shares of Common Stock for which this Preferred Stock is convertible immediately prior to such Fundamental Transaction (without regard to any limitation in Section 6(d) on the conversion of this Preferred Stock). For purposes of any such conversion, the determination of the Conversion Price shall be appropriately adjusted to apply to such Alternate Consideration based on the amount of Alternate Consideration issuable in respect of one share of Common Stock in such Fundamental Transaction, and the Corporation shall apportion the Conversion Price among the Alternate Consideration in a reasonable manner reflecting the relative value of any different components of the Alternate Consideration. If holders of Common Stock are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the Holder shall be given the same choice as to the Alternate Consideration it receives upon any conversion of this Preferred Stock following such Fundamental Transaction. To the extent necessary to effectuate the foregoing provisions, any successor to the Corporation or surviving entity in such Fundamental Transaction shall file an amended Articles of Incorporation with the same terms and conditions and issue to the Holders new preferred stock consistent with the foregoing provisions and evidencing the Holders' right to convert such preferred stock into Alternate Consideration. The Corporation shall cause any successor entity in a Fundamental Transaction in which the Corporation is not the survivor (the "Successor Entity") to assume in writing all of the obligations of the Corporation under these Articles of Incorporation with respect to the Series A Preferred Stock in accordance with the provisions of this Section 7(d) pursuant to written agreements in form and substance reasonably satisfactory to the Holder and approved by the Holder (without unreasonable delay) prior to such Fundamental Transaction and shall, at the option of the holder of this Preferred Stock, deliver to the Holder in exchange for this Preferred Stock a security of the Successor Entity evidenced by a written instrument substantially similar in form and substance to this Preferred Stock which is convertible fox% corresponding number of shares of capital stock of such Successor Entity (or its parent entity) equivalent to the shares of Common Stock acquirable and receivable upon conversion of this Preferred Stock (without regard to any limitations on the conversion of this Preferred Stock) prior to such Fundamental Transaction, and with a conversion price which applies the conversion price hereunder to such shares of capital stock (but taking into account the relative value of the shares of Common Stock pursuant to such Fundamental Transaction and the value of such shares of capital stock, such number of shares of capital stock and such conversion price being for the purpose of protecting the economic value of this Preferred Stock immediately prior to the consummation of such Fundamental Transaction), and which is reasonably satisfactory in form and substance to the Holder. Upon the occurrence of any such Fundamental Transaction, the Successor Entity shall succeed to, and be substituted for (so that from and after the date of such Fundamental Transaction, the provisions of these Articles of Incorporation referring to the "Corporation" shall refer instead to the Successor Entity), arid may exercise every right and power of the Corporation and shall assume all of the obligations of the Corporation under these Articles of Incorporation with the same effect as if such Successor Entity had been named as the Corporation herein. A Going Public Event is not a Fundamental Transaction. Subject to this Section 7(d), each Holder must convert or accept in exchange for Series A Preferred Stock the securities or other preferred stock issuable in connection with such Fundamental Transaction provided a majority of the Holders of Series A Preferred Stock, have consented to such Fundamental Transaction. The Corporation is designated the attorney-in-fact by each Holder to effectuate the provisions of this Section 7(d) including the authority to deem shares of Series A Preferred Stock to have been surrendered, cancelled or exchanged, as the case may be.

| 11 |

e) Subsequent Equity Sales. From the date hereof until two years after the date of occurrence of a Going Public Event and while the Series A Preferred Stock is outstanding, the Corporation or any Subsidiary, as applicable, sells or grants any option to purchase or sells or grants any right to reprice, or otherwise disposes of or issues (or announces any sale, grant or any option to purchase or other disposition), any Common Stock or Common Stock Equivalents entitling any Person to acquire shares of Common Stock at an effective price per share that is lower than the then Conversion Price (such lower price, the "Base Conversion Price" and such issuances, collectively, a "Dilutive Issuance") (if the holder of the Common Stock or Common Stock Equivalents so issued shall at any time, whether by operation of purchase price adjustments, reset provisions, floating conversion, exercise or exchange prices or otherwise, or due to warrants, options or rights per share which are issued in connection with such issuance, be entitled to receive shares of Common Stock at an effective price per share that is lower than the Conversion Price, such issuance shall be deemed to have occurred for less than the Conversion Price on such date of the Dilutive Issuance), then the Conversion Price shall be reduced to equal the Base Conversion Price. Such adjustment shall be made whenever such Common Stock or Common Stock Equivalents are issued. Notwithstanding the foregoing, no adjustment will be made under this Section 7(e) in respect of an Exempt issuance nor in connection with a Going Public Company in connection with which the requirements of Section 7(d) are applicable. If the Corporation enters into a Variable Rate Transaction, despite the prohibition set forth in these Articles of Incorporation, the Corporation shall be deemed to have issued Common Stock or Common Stock Equivalents at the lowest possible conversion price at which such securities may be converted or exercised. For purposes of clarification, whether or not the Corporation provides such notice pursuant to this Section 7(e), upon the occurrence of any Dilutive Issuance, the Holders are entitled to receive a number of Conversion Shares based upon the Base Conversion Price on or after the date of such Dilutive Issuance, regardless of whether a Holder accurately refers to the Base Conversion Price in the Notice of Conversion.

f) Calculations. All calculations under this Section 7 shall be made to the nearest cent or the nearest /100th of a share, as the case may be. For purposes of this Section 7, the number of shares of Common Stock deemed to be issued and outstanding as of a given date shall be the sum of the number of shares of Common Stock (excluding any treasury shares of the Corporation) issued and outstanding.

g) Notice to the Holders.

i. Adjustment to Conversion Price. Whenever the Conversion Price is adjusted pursuant to any provision of this Section 7, the Corporation shall promptly deliver to each Holder a notice setting forth the Conversion Price after such adjustment and setting forth a brief statement of the facts requiring such adjustment.

| 12 |

ii. Notice to Allow Conversion by Holder. If (A) the Corporation shall declare a dividend (or any other distribution in whatever form) on the Common Stock, (B) the Corporation shall declare a special nonrecurring cash dividend on or a redemption of the Common Stock, (C) the Corporation shall authorize the granting to all holders of the Common Stock of rights or warrants to subscribe for or purchase any shares of capital stock of any class or of any rights, (D) the approval of any stockholders of the Corporation shall be required in connection with any reclassification of the Common Stock, any consolidation or merger to which the Corporation is a party, any sale or transfer of all or substantially all of the assets of the Corporation, or any compulsory share exchange whereby the Common Stock is converted into other securities, cash or property or (E) the Corporation shall authorize the voluntary or involuntary dissolution, liquidation or winding up of the affairs of the Corporation, then, in each case, the Corporation shall cause to be filed at each office or agency maintained for the purpose of conversion of this Preferred Stock, and shall cause to be delivered to each Holder at its last address as it shall appear upon the stock books of the Corporation, at least ten (10) calendar days prior to the applicable record or effective date hereinafter specified, a notice stating (x) the date on which A record is to be taken for the purpose of such dividend, distribution, redemption, rights or warrants, or if a record is not to be taken, the date as of which the holders of the Common Stock of record to be entitled to such dividend, distributions, redemption, rights or warrants arc to be determined or (y) the date on which such reclassification, consolidation, merger, sale, transfer or share exchange is expected to become effective or close, and the date as of which it is expected that holders of the Common Stock of record shall be entitled to exchange their shares of the Common Stock for securities, cash or other property deliverable upon such reclassification, consolidation, merger, sale, transfer or share exchange, provided that the failure to deliver such notice or any defect therein or in tilt 'delivery thereof shall not affect the validity of the corporate action required to be specified in such notice. The Holder shall remain entitled to convert the Conversion Amount of the Series A Preferred Stock (or any part hereof) during the -20-day period commencing on the date of such notice through the effective date of the event triggering such notice except as may otherwise be expressly set forth herein.

Section 8. Redemption and Drag Along Rights.

(a) Redemption. The Corporation shall have no right to require Holders to surrender Series A Preferred Stock for redemption, cancellation, conversion or exchange, except in connection with a Fundamental Transaction of which a majority of the Holders have approved.

(b) Drag Along Right. If, and only if, the Completion of a Going Public Event has not occurred on or before one year after the Closing Date, then subject to Section 8(c) below, a majority of the Holders shall have the right, exercisable prior to the twenty-fourth month after the Closing Date, to require the Corporation to enter into a Deemed Sale Event (as defined below) on terms approved by the Holders. The Principal Shareholder and the Holders agree to vote (in person, by proxy or by action by written consent, as applicable) and shall be deemed to have voted such Holder's Common Stock, Preferred Stock and Common Stock Equivalents owned by them in favor of, and adopt, such Deemed Sale Event and to execute and deliver all related documentation and take such other action in support of the Deemed Sale Event as shall reasonably be requested by the Corporation in order to carry out the terms and provision of this Section 8, including without limitation executing and delivering instruments of conveyance and transfer, and any purchase agreement, merger agreement, indemnity agreement, escrow agreement, consent, waiver, governmental filing, share certificates duly endorsed for transfer (free and clear of impermissible liens, claims and encumbrances), and any similar or related documents. The obligation of any party to take the actions required by this Section 8 shall not apply to a Deemed Sale Event where the other party together with its Affiliates, involved in such Deemed Sale Event is an affiliate or stockholder of the Corporation holding more than 30% of the voting power of the Corporation or a holder of 30% of the Common Stock on an as converted basis.

| 13 |

(c) Exceptions to Drag Along Right. Notwithstanding the foregoing, a Holder will not be required to comply with Section 8(b) above in connection with any proposed Deemed Sale Event unless:

(i) any representations and warranties to be made by such Holder in connection with the Deemed Sale are limited to representations and warranties related to authority, ownership and the ability to convey title to such Restricted Securities, including but not limited to representations and warranties that (A) the Holder holds all right, title and interest in and to the Restricted Securities such Holder purports to hold, free and clear of all liens and encumbrances, (B) the obligations of the Holder in connection with the transaction have been duly authorized, if applicable, (C) the documents to be entered into by the Holder have been duly executed by the Holder and delivered to the acquirer and are enforceable against the Holder in accordance with their respective terms and (D) neither the execution and delivery of documents to be entered into in connection with the transaction, nor the performance of the Holder's obligations thereunder, will cause a breach or violation of the terms of any agreement, law or judgment, order or decree of any court or governmental agency;

(ii) the Holder shall not be liable for the inaccuracy of any representation or warranty made by any other Person in connection with the Proposed Sale;