Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Aevi Genomic Medicine, Inc. | v393988_ex99-1.htm |

| 8-K - CURRENT REPORT - Aevi Genomic Medicine, Inc. | v393988_8k.htm |

Exhibit 99.2

November 2014

Forward Looking Statement This presentation includes certain estimates and other forward - looking statements within the meaning of Section 21 E of the Securities Exchange Act of 1934 , as amended, including statements with respect to anticipated operating and financial performance, clinical results, potential partnerships, licensing opportunities and other statements of expectation . Words such as “ expects, ” “ anticipates, ” “ intends, ” “ plans, ” “ believes, ” “ assumes, ” “ seeks, ” “ estimates, ” “ should ” and variations of these words and similar expressions, are intended to identify these forward - looking statements . While we believe these statements are accurate, forward - looking statements are inherently uncertain and we cannot assure you that these expectations will occur and our actual results may be significantly different . These statements by the Company and its management are based on estimates, projections, beliefs and assumptions of management and are not guarantees of future performance . Important factors that could cause actual results to differ from those in the forward - looking statements include the factors described in the Company ’ s filings with the U . S . Securities and Exchange Commission . The Company disclaims any obligation to update or revise any forward - looking statement based on the occurrence of future events, the receipt of new information, or otherwise . 2

Investment Highlights • Rare and Orphan disease focused company • Proof of concept established with TARGT e x vivo gene therapy platform as evidenced by the positive initial data of ongoing TARGT EPO clinical trial • Multiple commercially attractive orphan indications for TARGT EPO identified; data from proof of concept studies expected in H 2 2015 • P latform expanded to include therapeutic peptides, as demonstrated by pre - clinical proof of concept with GLP - 2 , with potential utility in short bowel syndrome • Collaboration on rare and orphan disease R&D with Center for Applied Genomics (CAG) at Children’s Hospital of Philadelphia (CHOP) • Experienced management team 3

Management Team - Proven Track Record • President, Shire Specialty Pharmaceuticals - Responsible for all aspects of the $2.5 billion business e.g., commercial, R&D, manufacturing, etc. • President, Life Sciences, Safeguard Scientifics – Lead Life Sciences PE team, responsible for both investment and management of portfolio companies • Multiple senior operational leadership positions at Astra Merck/AstraZeneca Garry A Neil, MD Global Head of R&D • Group President, J&J Pharmaceutical R&D; Corporate VP, Science and Technology, J&J • Multiple senior R&D leadership positions at Astra Merck , Astra , Astra Zeneca and Merck KGaA • Industry R&D Thought Leader : Founder of Transcelerate ; Former Chair of PhRMA Science & Regulatory Committee; BOD of Reagan - Udall Foundation for FDA; BOD of Foundation for NIH • Directly contributed to >20 FDA approvals in multiple therapy areas • Vice - President Commercial Assessment for Shire Specialty Pharmaceuticals - Responsible for both corporate and business unit M&A and white space strategies • Principal, Devon Park Bioventures - Responsible for all aspects of venture investing e.g., negotiation, board governance, financing for $125M Life Sciences VC fund • Associate Principal, McKinsey & Company – Worked on strategic issues for multiple Top 25 pharmaceutical companies; specialized in BD/M&A, and payer/reimbursement issues Mike Cola CEO John H. Leaman, MD CFO 4

Medgenics Vision 5 Driven by our commitment to patients we strive to create the premier rare and orphan disease company by: x Developing first - to - market or best - in - class therapies that are transformative to patients suffering from life - altering rare genetic diseases x Having unparalleled understanding of the underlying science of rare diseases from phenotype to genotype x Pushing the boundaries of medicine and technology to develop unique and better therapies x Working with patient s, families and advocacy groups to increase awareness and commitment to research and improve access to therapies

Medgenics Pipeline Product Program Area Preclinical Phase 1/2 Phase 2/3 Status TARGT EPO MDGN - 201 Chronic Renal Diseases and Hematological Disorders Renal Anemia - ESRD Ongoing Hypo - Responders to ESA Initiate Q1 15 Anemic CKD Transplant Initiate H1 15 Peritoneal Dialysis Initiate H1 15 Beta Thalassemia Intermedia Initiate H1 15 Myelodysplastic Syndrome Initiate H2 15 TARGT Peptides MDGN - 205 GLP - 2 for Short Bowel Syndrome IND H2 2015 Early Pipeline MDGN - 204 Orphan Metabolic Disease MDGN - 206 Orphan Enzyme Replacement 6

TARGT TM (Transduced Autologous Restorative Gene Therapy) 1. H arvest Micro - Organs from abdominal dermis using the proprietary DermaVac device 2. Transduce fibroblasts in Micro - Organs via ex vivo gene therapy to create TARGT EPO 3. Wash out HDAd vector, measure production and choose TARGT EPO for re - implantation 4. Implant TARGT EPO into patient where it produces endogenous EPO ( eEPO ) 7 Micro - Organ (TARGT EPO ) Cryo - Bank Ex vivo gene therapy via HDAd vector #1 #2 # 4 DermaVac # 3 Cassette Bioreactor HDAd vector washed away Transduced Micro - Organ

Significant Improvements to Technology Platform 8 • Vector optimization • Culture conditions • Re - implantation technique • Engraftment The entire system was re - engineered to increase and stabilize secretion levels in vivo

TARGT Platform Mimics the Natural System • Autologous proteins and peptides • Continuous secretion • Physiologic levels – Avoids supratherapeutic spikes • Precise, individualized dosing • Safe – Simple, well - tolerated procedure – Avoids exposure to viral antigen – Avoids viral DNA integration – Interruptible therapy through excision/ablation 9

Phase 1/2 trial in ESRD Patients with Renal Anemia 10

MDGN - 201 Trial 11 Prospective, Open - label, Dose Escalation study, to evaluate Safety and Efficacy (control of Hb 9 - 11 and < 12 g/ d L ) of TARGT EPO in ESRD patients Study Summary Group Treatment N A Low dose eEPO 18 - 25 IU/kg/day 3 + 3 * B Mid dose eEPO 35 - 45 IU/kg/day 3 + 3 * C High dose eEPO 55 - 65 IU/kg/day 3 + 3 * MDGN - 201 Phase 1/2 Trial Design Enrollment and dose selection Screening Harvest procedure Ex vivo viral transduction 9 days Treatment and follow - up 12 months Safety follow - up 6 months Implantation procedure 4 weeks run - in * Initial cohort of 3 , expandable to 6 based on response Objective : determine dose for sustained secretion of eEPO levels sufficient to maintain target hemoglobin range for > 6 months

TARGT EPO Patient Profile • End Stage Renal Disease (ESRD) patients – CKD patients with renal failure and low baseline eEPO secretion – Hemodialysis patients with inability to regulate body fluid levels • rHuEPO dependent – Require 2 - 3 injections on a weekly basis to maintain hemoglobin in target range ( 9 - 11 and < 12 g/ dL ) and supplemental iron • Ongoing blood loss – Combination of disease state and hemodialysis ( 3 x weekly) significantly shortens red blood cell (RBC) lifespan and results in RBC loss – Frequent blood testing also results in significant RBC loss • Concomitant disease common – Diabetes – Hypertension 12

13 Patient One Run - in Period Supratherapeutic levels of rHuEPO required to maintain hemoglobin levels Days Pre-implantation -25 -20 -15 -10 -5 0 Serum rHuEPO, mIU/ml 0 200 400 600 800 1000 1200 Days Pre-implantation -25 -20 -15 -10 -5 0 Serum Hb, g/dL 8 9 10 11 12 13 Patient Description: Age: 70 Sex: Male Dialysis: 4 years Underlying disease: HTN & T 2 DM rHuEPO dependent: dose prior to enrollment 6 , 000 IU twice a week Target Hb 9 - 11 Safety Margin: Hb < 12

14 Patient One Interim Results • 3 Transduced Micro - Organs (TARG T EPO ) implanted • Patient stabilizes after approximately 30 days • Target Hb is reached with approx 100x lower C MAX than rHuEPO • Patient appears to have the ability to auto regulate Hb levels • *Possible hemoconcentration Five months post implantation renal anemia is well controlled * Patient Description: Age: 70 Sex: Male Dialysis: 4 years Underlying disease: HTN & T 2 DM rHuEPO dependent: dose prior to enrollment 6 , 000 IU twice a week Days from implantation 0 20 40 60 80 100 120 140 160 Serum eEPO, mIU/ml 0 5 10 15 20 Predicted eEPO baseline 4mU/ml Days from implantation 0 20 40 60 80 100 120 140 160 Serum Hb, g/dL 8 9 10 11 12 13 * Target Hb 9 - 11 Safety Margin: Hb < 12

15 Patient Two Interim Results • 2 Transduced Micro Organs (TARGT EPO ) implanted • Patient displays higher peak eEPO but stabilizes after 45 days • Target Hb is reached with approx 100 x lower C MAX than rHuEPO . Three months post implantation renal anemia is well controlled • Patient appears to have the ability to auto regulate Hb levels Days from implantation 0 10 20 30 40 50 60 70 80 90 100 110 120 Serum Hb, g/dL 8 9 10 11 12 13 Days from implantation 0 10 20 30 40 50 60 70 80 90 100 110 120 Serum eEPO, mIU/ml 0 2 4 6 8 10 20 40 Predicted eEPO baseline 2.8mU/ml Target Hb 9 - 11 Safety Margin: Hb < 12 Patient Description: Age: 26 Sex: Male Dialysis: 10 months Underlying disease: IgA Neph . rHuEPO dependent: dose prior to enrollment 4,000 IU three times a week

Patient Three Interim Results Two months post implantation patient required rHuEPO • 1 Transduced Micro - Organ (TARGT EPO ) implanted • O nly patient to receive 1 TMO 16 • * Patient surgery : (not product related) * Days from implantation 0 10 20 30 40 50 60 70 Serum eEPO, mIU/ml 0 5 10 15 20 Predicted eEPO baseline 2.4mU/ml Days from implantation 0 10 20 30 40 50 60 70 Serum Hb, g/dL 8 9 10 11 12 13 rHuEPO Patient Description: Age: 74 Sex: Female Dialysis: 1.4 years Underlying disease: HTN & T2DM rHuEPO Dependent : dose prior to enrollment 10,000 IU twice a week * Target Hb 9 - 11 Safety Margin: Hb < 12 • Est. blood loss: 1 unit (no transfusion required)

Potential Paradigm Shift in Treatment of Renal Anemia • Duration: – P atients 1 and 2 are meeting target secretion profile of continuously producing physiologic levels of endogenous EPO sufficient to maintain target Hb • After complications unrelated to therapy patient 3 required rHuEPO • Hemoglobin: – P atients 1 and 2 are meeting endpoint of hemoglobin ( 9 - 11 and < 12 g/ dL ) due to RBC production stimulated by eEPO • Sustainability: – A ppears to mimic the restoration of the natural erythropoietic function of the kidneys that has been lost to CKD • Safety: – C onsistent with the 23 patients treated with first generation system there have been no treatment related safety issues 17 These data presented herein are initial observations from an ongoing, non - randomized open - label trial. As such, no conclusions can be made about the safety and efficacy of TARGT EPO from these observations or the proposed hypotheses in this presentation.

Next Steps for MDGN - 201 Trial • Q 4 2014 – Complete enrollment in the low dose arm of trial ( 3 additional patients) • Q 1 2015 – Enroll 6 - patient cohort comparing single dose Depo - Medrol to multi - dose Depo - Medrol 18

Orphan Indications for TARGT EPO 19

Overview of Orphan Indications for TARGT EPO 20 • Renal Anemia/ESRD (3 indications) – Leverage current TARGT EPO IND for signal finding trials – Rapid route to market • Plan to de - risk programs through small signal finding studies (10 - 15 patients) – Interim results expected H2 2015 • Expect relatively small and single pivotal registration trial • Hematological disorders (2 indications) – Require new IND; expected to be filed H1 2015 – Rapid route to market • Plan to de - risk programs through small signal finding studies ( 5 - 10 patients) – Interim results expected H2 2015/H1 2016 • Expect relatively small and single pivotal registration trial >$ 500M potential market for each individual indication

Orphan Indications – Renal Anemia/ESRD • Hypo - responders to rHuEPO – Patients unable to manage anemia on maximal dose of rHuEPO – Continuous physiologic levels of eEPO will stimulate bone marrow more effectively and safely than intermittent IV dosing 1 – Estimated US prevalence: ~ 40 , 000 - 70 , 000 patients 2 • Anemic CKD transplant candidates – Reducing transfusions would prevent increased immunogenicity, shortening “wait - times” and improving transplant outcomes – Estimated US prevalence: ~ 10 , 000 patients 2 • Peritoneal Dialysis (PD ) – 20 % cost reduction over patients with hemodialysis 2 – Potential for TARGT EPO to improve compliance, outcomes, and cost for patients on PD – Estimated US prevalence: ~ 20 , 000 patients 2 21 1. Source : Besarab , A. Semin Nephrol . 2000 ; 20 ( 4 ): 364 2. U.S . Renal Data System, USRDS 2013 Annual Data Report and primary company research

Orphan Indications – Hematological Disorders • Beta Thalassemia Intermedia – Milder form of symptomatic beta thalassemia patients (e.g.,~12 transfusions/year) – rHuEPO has shown ability to reduce anemia and raise hemoglobin in beta thalassemia 1 ; safety issues have limited use – Estimated US/EU prevalence: ~15,000 patients 2 • Myelodysplastic Syndrome (MDS) – 20 - 55% of MDS patients respond to rHuEPO but use is limited due to safety concerns 3 – Reducing transfusions would limit iron overload – Target population: mild to intermediate patients, EPO levels < 150 – Estimated US prevalence: ~60,000 patients 4 22 1. Oliveri NF et al. Blood 1992, 80:3258 - 60 2. Weatherall , D.J. and Clegg, J.B. Bulletin of the World Health Organization , 2001, 79: 704 – 712. 3. Giraldo , P. et al Cancer : 107 - 2807 - 14 4. Am Journal Med. 2012, Jul:125(7 Suppl ):S2 - 5

Additional Pipeline Opportunities 23

Novel Peptide Production Capability • TARGT system has demonstrated the unique ability to produce native peptides in vivo • Native peptides have been difficult to develop into drugs – Short half - life: poor metabolic stability and rapid clearance – Delicate: often require a complex manufacturing process – Frequently require structural modification and long - acting formulations, which can lead to off - target effects 24

Glucagon - like peptide 2 (GLP - 2) • 33 amino acid naturally occurring peptide, t 1/2 = 6 - 7 min • Produced by L cells of small intestine • Several important functions: – Increases intestinal absorption – Stimulates intestinal growth – Reduces bone breakdown • Improves intestinal absorption in humans with short bowel syndrome and reduce need for total parenteral nutrition (TPN) – Gattex ® ( teduglutide ) approved in 2012 for this indication • Impacts gastric and intestinal motility and causes dose - related nausea and vomiting in some patients 1 25 1 . O’Keefe, S.J.D. et al. Clin . Gastroenterol . Hepatol . 11 : 815 - 23 2013

• TARGT GLP - 2 should provide a more favorable PK profile – physiologic levels of continuous GLP - 2 – lower peak dose and continuous coverage • Indications include short bowel syndrome and IBD • Pre - IND meeting in H 1 2015 MDGN TARGT GLP - 2 vs teduglutide 26 Source NPS briefing book, Gattex Advisory Committee meeting, 2012

MDGN GLP - 2 Program • We adapted the TARGT platform for expression of peptides < 40 amino acids including GLP - 2 • Program has advanced to in vivo stage in SCID mice (n=5) 27 0 5 10 15 20 25 30 7 18 27 39 49 60 Serum GLP - 2 ng/ml Days from Implantation

Collaboration with Center for Applied Genomics (CAG) 28

Collaboration Structure • MDGN – E xclusive license to use the rare and orphan disease samples at the Center for Applied Genomics (CAG) at the Children’s Hospital of Philadelphia (CHOP) biobank for the purpose of developing and commercializing therapeutic treatments and diagnostic targets for rare and orphan diseases • CHOP – $5M funding from Medgenics to perform r are and orphan research/translation – Low single - digit royalties and development milestones for products discovered under the collaboration 29

CHOP Center for Applied Genomics 30 • Founded by Dr. Hakon Hakonarson in 2006 • Highly regarded knowledge base and expertise – More than 3 5 0 publications in leading journals • Enriched database for Rare and Orphan diseases – 10 % of rare disease patients in North America treated at CHOP – Largest pediatric genotypic/phenotypic biobank in the world • 60 , 000 pediatric patients; 10 - 12 , 000 rare and orphan patients – Greater than 85 % of donors consented for future studies

Leveraging the CAG Biobank • Realizes Medgenics vision of having unparalleled understanding of the underlying science of rare diseases from phenotype to genotype – It is estimated that 80 % of Rare and Orphan diseases have a genetic origin • TARGT platform enables rapid prototyping of therapy • Effectively de - risks and streamlines R&D – Identification of targets based on Next Generation Sequencing – Reduction of clinical trial size and duration – Expedited development timeframes 31

Conclusion • Proof of concept established with TARGT ex vivo gene therapy platform as evidenced by the positive initial data of ongoing TARGT EPO clinical trial • Multiple commercially attractive orphan indications for TARGT EPO identified; data from proof of concept studies expected in H2 2015 • Platform expanded to include therapeutic peptides, as demonstrated by pre - clinical proof of concept with GLP - 2, with potential utility in short bowel syndrome • Unique R&D collaboration formed with CHOP to leverage CAG biobank for the purpose of developing and commercializing therapeutic treatments and diagnostic targets for rare and orphan diseases 32

Company Development Timeline 33 Long term ( 2018 ) ▪ Multiple late - stage clinical programs ▪ First commercial product launch (TARGT EPO ) Mid term ( 2016 - 2017 ) ▪ P ivotal trials for multiple TARGT EPO indications ▪ Proof of concept for GLP - 2 ▪ INDs for 4 early pipeline programs Short term (2014 - 2015) ▪ Proof of concept in up to 5 TARGT EPO programs ▪ Pre - IND meeting for GLP - 2 ▪ Strategic collaborations that further expand the platform ▪ Initiate CHOP/CAG collaboration

Upcoming Catalysts 34 TIMING Complete enrollment in MDGN - 201 study Q4 14 Initiate Phase 2 study in Hypo - Responders Q1 15 Initiate Phase 2 study in Anemic CKD Transplant H1 15 Initiate Phase 2 study in Peritoneal Dialysis H1 15 Initiate Phase 2 study in Beta Thalassemia Intermedia H1 15 Initiate Phase 2 study in Myelodysplastic Syndrome H2 15 Pre - IND meeting for GLP - 2 H1 15

Financial Summary • NYSE - MKT: MDGN • Basic shares outstanding – 18.9 M • Warrants and options – 9 M warrants – 7 M options • Cash runway – $ 15 M at September 2014 – Cash burn of ~ $ 1 M per month 35

APPENDIX 36

0 5 10 15 20 25 30 -10 0 10 20 30 40 50 60 70 Serum e EPO , mU /ml Days from implantation Gen 1 System: eEPO Production Drops O ff Rapidly • Excellent safety and tolerability profile • One month of erythropoietin production translates into 4 – 5 months of anemia treatment given lifespan of red blood cells ( 90 - 110 days) Average Serum eEPO in 20 Chronic Kidney Disease (CKD) Patients 37

Bulk of Diagnosed CKD Patients in Stage III - V (ESRD) - 2.0 4.0 6.0 8.0 10.0 12.0 14.0 I II III IV V- ESRD Patients MM Stage US CKD Population 38 - 400 800 1,200 1,600 I II III IV V - ESRD Patients 000 ’s Stage Diagnosed Population • The US CKD patient population is approximately 26 million • The majority of the Stage I - II population (96.5%) is undiagnosed • 90% of Stage V patients ( 540,000 ) have renal anemia Source: National Kidney Disease Outcomes Quality Initiative

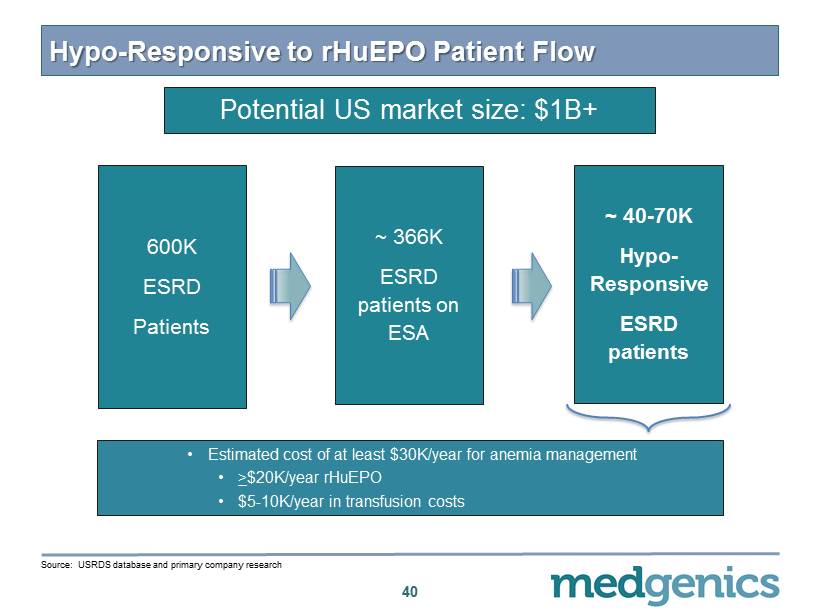

TARGT EPO in Hypo - responders to rHuEPO 39 • Clinical Rationale – Continuous physiologic levels of eEPO will stimulate bone marrow more effectively and safely than intermittent IV dosing 1 • Commercial Rationale: – Identified orphan population of high unmet need – Reduction of overall patient costs ( rHuEPO , iron management and transfusion) 2 – Rapid route to market ▪ Ability to do a small signal finding study ( 10 – 15 patients ), significantly de - risking the program; interim results H 2 2015 ▪ Relatively small, single pivotal trial similar to other orphan development programs for registration 1 . Source: Besarab , A. Semin Nephrol . 2000 ; 20 ( 4 ): 364 2 . Source : USRDS data analysis and primary company research

Hypo - Responsive to rHuEPO Patient Flow 40 600K ESRD Patients ~ 40 - 70K Hypo - Responsive ESRD patients ~ 366 K ESRD patients on ESA • Estimated cost of at least $ 30 K/year for anemia management • > $ 20 K/year rHuEPO • $ 5 - 10 K/year in transfusion costs Source: USRDS database and primary company research Potential US market size: $ 1 B+

Beta Thalassemia 41 • Beta Thalassemia is the most common genetic disease worldwide – Yet, it represents an Orphan disorder with significant unmet need • Characteristics in symptomatic patients include 1 : – Severe anemia – Iron overload – Splenomegaly • Patients generally require transfusions and/or bone marrow transplant to alleviate anemia ( Hb < 7gms/dl) 1. Weatherall , D.J. and Clegg, J.B. Bulletin of the World Health Organization , 2001, 79: 704 – 712.

TARGT EPO in Beta Thalassemia Intermedia 42 • Clinical Rationale: – eEPO levels are lower than expected in Beta Thalassemia patients ▪ rHuEPO has shown the ability to reduce transfusions and increase hemoglobin levels in Beta Thalassemia patients 1 ▪ Safety concerns have limited usage of rHuEPO – Continuous physiologic levels of eEPO should stimulate bone marrow more effectively and safely than intermittent IV dosing ▪ May increase fetal hemoglobin levels • Commercial Rationale: – Rapid route to market ▪ Ability to do a small signal finding study ( 5 - 10 patients), significantly de - risking the program; interim results H 2 2015 ▪ Relatively small, single pivotal trial similar to other orphan development programs for registration – Potential to expand into other hemoglobinopathies

Beta Thalassemia Intermedia Patient Flow 43 ~100,000 Symptomatic Beta Thalassemia patients W.W. ~ 50,000 Beta Thalassemia Intermedia patients W.W. ~ 15,500 Beta Thalassemia Intermedia Patients US/EU • Avg. cost of ~$ 100 K/year* • ~$ 60 K/year in transfusion costs • (> 12 units of blood per year) • ~$ 40 K/year in iron chelation costs *Primary research Potential US/EU market size: $ 1.5 B+