Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LOCAL Corp | d820172d8k.htm |

| EX-99.1 - EX-99.1 - LOCAL Corp | d820172dex991.htm |

Quarterly Earnings Summary

Quarterly Earnings Summary

Exhibit 99.2 |

2

Quarterly earnings summary: Q3 2014

statements. Those risks and uncertainties are detailed in the

company’s filings from time to time with the Securities and

Exchange Commission. The information contained in the

forward looking statements is provided as of the date first set

forth above and the company disclaims any obligation to

update such statements.

This document includes the non-GAAP financial measures of

“Adjusted EBITDA”

and “free cash flow”

.

See page 12 for a

note regarding the Company’s use of Non-GAAP financial

measures and slide 9 and 10 for a reconciliation of GAAP to

non-GAAP.

This Q3-2014 Quarterly Earnings Summary contains forward

looking statements which are made pursuant to the Safe Harbor

provisions of section 21-E of the Securities Exchange Act of

1934. Investors are cautioned that statements which are not

strictly historical statements, including statements concerning

future expected financial performance.

The forward looking statements include, but are not limited to,

any statements containing the words “expect”, “anticipate”,

“estimates”, “believes”, “should”,

“could”, “may”, “possibly”, and similar

expressions and the negatives thereof. These forward looking statements

involve a number of risks and uncertainties that could cause actual results

to differ materially from the forward looking |

3

Quarterly earnings summary: Q3 2014

Highlights

•

Q3 revenue of $18.1M

•

Q3 Adjusted EBITDA $407K, positive for

the seventh consecutive quarter

•

Q3 O&O revenue up 31 percent

from the prior year period

•

Q3 RKV of $201, compared to $180 in prior

year period

Financials

•

Ended Q3 with $4.3M in total cash

•

Reduced debt by $4.5M

•

Positive free cash flow $2.2M

•

Announced annual cost savings actions of

approximately $2.6M

•

Updated 2014 guidance: Revenue between

$87M and $90M, and Adjusted EBITDA

between $2M and $2.4M

Innovation

•

Expanding reach with the expected

launch of nQuery

TM

solution with a top

five global carrier

•

Launched our advanced traffic quality

solution nTegrity

TM

•

Building and monetizing our Local

audience with proprietary traffic quality

tools

Note: Since we cannot predict the valuation of the warrant liability and the

conversion option liability, we cannot reasonably project our GAAP net income (loss).

We, therefore, cannot provide GAAP guidance, but we do report GAAP results. An

explanation of the Company’s use of Non-GAAP measures is set forth on Slide 12 |

4

Quarterly earnings summary: Q3 2014

$ in Millions2

Q3-14

Q2-14

Q3-13

GAAP Revenue

$ 18.1

$ 22.5

$ 23.5

Adjusted EBITDA

$ 0.4

$ 1.0

$ 1.3

Net Loss

$ (1.3)

$ (1.3)

$ (1.7)

Diluted Adjusted EBITDA per share

$ 0.02

$ 0.04

$ 0.06

Diluted GAAP net loss per share

$ (0.06)

$ (0.06)

$ (0.08)

Diluted weighted avg shares used for Adj EBITDA per share

23,304

23,306

23,191

Diluted weighted avg shares used for GAAP net loss per share

23,230

23,228

22,962

Cash

$ 4.31

$ 6.68

$ 4.85

Ending Employees

84

87

89

Note: An explanation of the Company’s use of Non-GAAP measures is set forth on Slide

12 |

5

Quarterly earnings summary: Q3 2014

101.0

100.0

106.2

$276

$230

$215

93.4

$199.5

80.0

$180.3

80.4

$178

$189.3

71.6

$203.8

72.6

Local.com

$201.1

65.5 |

6

Quarterly earnings summary: Q3 2014

24.5

24%

25.4

31.9

33.7

32.0

31.0

23.1

20.6

16.6

25%

30%

36%

40%

39%

32%

28%

25% |

7

Quarterly earnings summary: Q3 2014

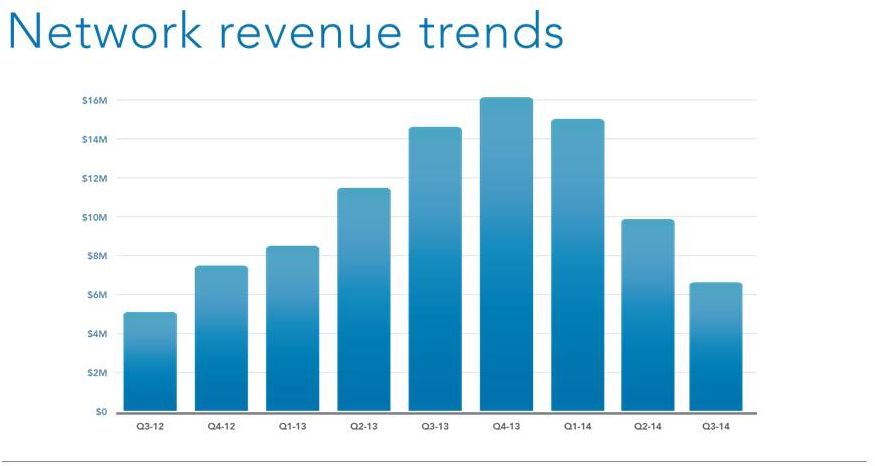

8.3

11.6

14.5

16.1

14.8

9.9

6.4

7.6

5.0 |

8

Quarterly earnings summary: Q3 2014

% of Total Revenue by Business Unit

20%

80%

37%

63%

39%

61%

51%

49%

Quarterly Revenues by Business Unit

$5.0

$19.4

$7.6

$12.9

$8.3

$13.2

$11.6

$11.1

$ in Millions

Q3-12

Q4-12

Q1-13

Q2-13

Q3-13

Q4-13

Q1-14

Q2-14

Q3-14

Network

$ 5.0

$ 7.6

$ 8.3

$ 11.6

$ 14.5

$ 16.1

$ 14.8

$ 9.9

$ 6.4

O&O

$ 19.4

$ 12.9

$ 13.2

$ 11.1

$ 8.9

$ 10.7

$ 11.4

$ 12.6

$ 11.7

Consolidated Revenue

$ 24.4

$ 20.6

$ 21.5

$ 22.7

$ 23.5

$ 26.8

$ 26.2

$ 22.5

$ 18.1

$14.5

$8.9

62%

38%

60%

40%

$16.1

$10.7

$24.4

$20.6

$21.5

$22.7

$23.5

$26.8

$14.8

$11.4

$26.2

56%

44%

$22.5

$9.9

$12.6

44%

56%

$18.1

$6.4

$11.7

36%

64% |

9

Quarterly earnings summary: Q3 2014

Description

FY-09

FY-10

FY-11

FY-12

FY-13

FY-14*

Adjusted EBITDA

$3,041

$13,775

$3,247

$777

$4,533

$2,200

Less interest and other income (expense), net

(27)

(275)

(413)

(425)

(2,321)

(2,100)

Less provision for income taxes

(158)

(102)

(178)

(111)

(139)

(100)

Less amortization of intangibles

(2,524)

(5,734)

(4,864)

(3,611)

(912)

(700)

Less depreciation

(734)

(1,418)

(3,182)

(3,658)

(3,896)

(4,000)

Less stock-based compensation

(2,364)

(2,911)

(3,442)

(2,533)

(1,619)

(800)

Less LEC receivable reserve

-

-

-

(1,407)

-

-

Less net loss from discontinued operations

-

-

(6,899)

(14,250)

(3,740)

-

Plus gain on sale of Rovion

-

-

-

1,458

-

-

Plus revaluation of warrants

(2,981)

887

2,633

202

1,100

-

Less Geo-Tag settlement

-

-

-

-

(550)

-

Less non-recurring charges

(520)

-

(1,461)

(684)

(2,829)

(1,800)

GAAP Net income (loss)

$(6,267)

$4,222

$(14,559)

$(24,242)

$(10,373)

$(7,300)

Note: Since we cannot predict the valuation of the warrant liability and the

conversion option liability, we cannot reasonably project our GAAP net income (loss).

We, therefore, cannot provide GAAP guidance, but we do report GAAP results. An

explanation of the Company’s use of Non-GAAP measures is set forth on Slide 12

*As of November 2014 |

10

Quarterly earnings summary: Q3 2014

Description

Q3-14

Net cash provided by operating activities

$3,012

Less capital expenditures

(830)

Free cash flow

$2,182

Net cash used in investing activities

$(830)

Net cash used in financing activities

$ (4,547)

Note: Since we cannot predict the valuation of the warrant liability and the

conversion option liability, we cannot reasonably project our GAAP net income (loss).

We, therefore, cannot provide GAAP guidance, but we do report GAAP results. An

explanation of the Company’s use of Non-GAAP measures is set forth on Slide 12 |

11

Quarterly earnings summary: Q3 2014

$ in Millions

Q3-13

Q4-13

Q1-14

Q2-14

Q3-14

Assets

Cash & marketable debt securities

$ 4.8

$ 5.1

$ 3.7

$ 6.7

$ 4.3

Accounts receivable, net

14.9

17.3

18.2

12.8

8.1

Total Assets

51.4

51.6

50.7

47.7

40.1

Liabilities and Equity

Total Debt

13.1

13.2

14.0

13.6

9.2

Total Liabilities

29.7

31.3

33.1

31.2

24.7

Total Liabilities & Equity

$ 51.4

$ 51.6

$ 50.7

$ 47.7

$ 40.1 |

12

Quarterly earnings summary: Q3 2014

$ in Millions

FY-2014

Total Revenue

$87M –

90M

Adjusted EBITDA

$2.0M –

2.4M

Per Diluted Share

$0.09-$0.10

Diluted Weighted Avg. Shares

23,500

Projected as of November 12, 2014

Note: Since we cannot predict the valuation of the warrant liability and the

conversion option liability, we cannot reasonably project our GAAP net income (loss).

We, therefore, cannot provide GAAP guidance, but we do report GAAP results. An

explanation of the Company’s use of Non-GAAP measures is set forth on Slide 12 |

13

Quarterly earnings summary: Q3 2014

A

limitation

of

non-GAAP

Adjusted

EBITDA

is

that

it

excludes

items

that

often

have

a

material

effect on the company’s net income (loss) and earnings per common share

calculated in accordance

with

GAAP.

Therefore,

management

compensates

for

this

limitation

by

using

Adjusted EBITDA in conjunction with net income (loss) and net income (loss) per

share measures. The company believes that Adjusted EBITDA provides investors

with an additional tool for evaluating the company’s core performance,

which management uses in its own evaluation of overall performance, and as a

base-line for assessing the future earnings potential of the company.

A limitation of using free cash flow versus the GAAP measure of net cash

provided by operating activities as a means for evaluating the company is

that free cash flow does not represent the total increase or decrease in the

cash balance from operations for the period because it excludes cash used

for capital expenditures during the period. The company believes that free

cash flow provides investors with an additional tool in evaluating the

company’s liquidity. While

the

GAAP

results

are

more

complete,

the

company

prefers

to

allow

investors

to

have

this

supplemental metric since, with reconciliation to GAAP, it may provide greater

insight into the company’s financial results. The non-GAAP measures

should be viewed as a supplement to, and not as a substitute for, or

superior to the GAAP measures. This

press

release

includes

the

non-GAAP

financial

measures

of

“Adjusted

EBITDA”

and

“free

cash flow.”

Adjusted EBITDA is defined as net income (loss) excluding: provision for income

taxes; interest and other income (expense), net; depreciation; amortization;

stock based compensation

charges;

gain

or

loss

on

derivatives’

revaluation;

net

income

(loss)

from

discontinued operations; accrued lease liability/asset; and severance charges.

Adjusted EBITDA is reconciled to net income (loss) which we believe is the

most comparable GAAP measure. Free cash flow is defined as net cash provided

by operating activities less capital expenditures. Free cash flow is

reconciled to net cash provided by operating activities which we believe is

the most comparable GAAP measure. Adjusted EBITDA and free cash flow, as

defined

above,

are

not

measurements

under

GAAP.

A

reconciliation

of

net

income

(loss)

to

Adjusted EBITDA and free cash flow to net cash provided by operating activities is

set forth at the end of this press release.

Management believes that Adjusted EBITDA provides useful information to investors

about the company’s performance because it eliminates the effects of

period-to-period changes in income from interest on the

company’s cash, expense from the company’s financing transactions

and the costs associated with income tax expense, capital investments, stock-

based compensation expense, net income (loss) from discontinued operations,

derivatives’ revaluation charges; accrued lease liability/asset;

settlement accrual; and severance charges which are not directly attributable

to the underlying performance of the company’s business operations.

Management uses Adjusted EBITDA in evaluating the overall performance of the

company’s business operations.

Management also believes free cash flow to be a liquidity measure that provides

useful information

to

management

and

investors

about

the

amount

of

cash

generated

by

the

business that, after the acquisition of property and equipment, including

information technology infrastructure and land and buildings, can be used for

strategic opportunities, including investing in our business, making

strategic acquisitions, and strengthening the balance sheet. Analysis of free

cash flow also facilitates management's comparisons of our operating results

to competitors' operating results. |

Fred

Thiel Chairman & CEO

fred@local.com

Local

Corporation

|

7555

Irvine

Center

Drive

|

Irvine

CA

92618

|

949.784.0800

|

www.localcorporation.com

Ken Cragun

CFO

kcragun@local.com

Quarterly earnings summary: Q3 2014

14 |