Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - RAIT Financial Trust | d791093dex312.htm |

| EX-32.2 - EX-32.2 - RAIT Financial Trust | d791093dex322.htm |

| EX-32.1 - EX-32.1 - RAIT Financial Trust | d791093dex321.htm |

| EX-31.1 - EX-31.1 - RAIT Financial Trust | d791093dex311.htm |

| EX-12.1 - EX-12.1 - RAIT Financial Trust | d791093dex121.htm |

| EXCEL - IDEA: XBRL DOCUMENT - RAIT Financial Trust | Financial_Report.xls |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| x | Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended September 30, 2014

or

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number 1-14760

RAIT FINANCIAL TRUST

(Exact name of registrant as specified in its charter)

| Maryland | 23-2919819 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 2929 Arch Street, 17th Floor, Philadelphia, PA | 19104 | |

| (Address of principal executive offices) | (Zip Code) | |

(215) 243-9000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

A total of 82,511,313 common shares of beneficial interest, par value $0.03 per share, of the registrant were outstanding as of November 6, 2014.

Table of Contents

RAIT FINANCIAL TRUST

Table of Contents

PART I—FINANCIAL INFORMATION

| Item 1. | Financial Statements |

RAIT Financial Trust

(Unaudited and dollars in thousands, except share and per share information)

| As of September 30, 2014 |

As of December 31, 2013 |

|||||||

| Assets |

||||||||

| Investment in mortgages and loans, at amortized cost: |

||||||||

| Commercial mortgages, mezzanine loans, other loans and preferred equity interests |

$ | 1,369,782 | $ | 1,122,377 | ||||

| Allowance for losses |

(15,662 | ) | (22,955 | ) | ||||

|

|

|

|

|

|||||

| Total investment in mortgages and loans |

$ | 1,354,120 | 1,099,422 | |||||

| Investments in real estate, net of accumulated depreciation of $155,815 and $127,745, respectively |

1,400,715 | 1,004,186 | ||||||

| Investments in securities and security-related receivables, at fair value |

568,279 | 567,302 | ||||||

| Cash and cash equivalents |

116,767 | 88,847 | ||||||

| Restricted cash |

133,374 | 121,589 | ||||||

| Accrued interest receivable |

54,929 | 48,324 | ||||||

| Other assets |

78,948 | 57,081 | ||||||

| Deferred financing costs, net of accumulated amortization of $23,829 and $17,768, respectively |

25,141 | 18,932 | ||||||

| Intangible assets, net of accumulated amortization of $10,941 and $4,564, respectively |

23,944 | 21,554 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 3,756,217 | $ | 3,027,237 | ||||

|

|

|

|

|

|||||

| Liabilities and Equity |

||||||||

| Indebtedness ($444,190 and $389,146 at fair value, respectively) |

$ | 2,613,317 | $ | 2,086,401 | ||||

| Accrued interest payable |

34,164 | 26,936 | ||||||

| Accounts payable and accrued expenses |

58,579 | 32,447 | ||||||

| Derivative liabilities |

81,998 | 113,331 | ||||||

| Deferred taxes, borrowers’ escrows and other liabilities |

132,200 | 79,462 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

2,920,258 | 2,338,577 | ||||||

| Series D cumulative redeemable preferred shares, $0.01 par value per share, 4,000,000 shares authorized, 4,000,000 and 2,600,000 shares issued and outstanding, respectively |

76,176 | 52,970 | ||||||

| Equity: |

||||||||

| Shareholders’ equity: |

||||||||

| Preferred shares, $0.01 par value per share, 25,000,000 shares authorized; |

||||||||

| 7.75% Series A cumulative redeemable preferred shares, liquidation preference $25.00 per share, 8,069,288 and 4,760,000 shares authorized, respectively, 4,075,569 and 4,069,288 shares issued and outstanding |

41 | 41 | ||||||

| 8.375% Series B cumulative redeemable preferred shares, liquidation preference $25.00 per share, 4,300,000 shares authorized, 2,288,465 shares issued and outstanding |

23 | 23 | ||||||

| 8.875% Series C cumulative redeemable preferred shares, liquidation preference $25.00 per share, 3,600,000 shares authorized, 1,640,100 shares issued and outstanding |

17 | 17 | ||||||

| Series E cumulative redeemable preferred shares, $0.01 par value per share, 4,000,000 shares authorized |

— | — | ||||||

| Common shares, $0.03 par value per share, 200,000,000 shares authorized, 82,509,635 and 71,447,437 issued and outstanding, respectively, including 541,575 and 369,500 unvested restricted common share awards, respectively |

2,474 | 2,143 | ||||||

| Additional paid in capital |

2,008,814 | 1,920,455 | ||||||

| Accumulated other comprehensive income (loss) |

(43,039 | ) | (63,810 | ) | ||||

| Retained earnings (deficit) |

(1,364,168 | ) | (1,257,306 | ) | ||||

|

|

|

|

|

|||||

| Total shareholders’ equity |

604,162 | 601,563 | ||||||

| Noncontrolling interests |

155,621 | 34,127 | ||||||

|

|

|

|

|

|||||

| Total equity |

759,783 | 635,690 | ||||||

|

|

|

|

|

|||||

| Total liabilities and equity |

$ | 3,756,217 | $ | 3,027,237 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these consolidated financial statements.

1

Table of Contents

RAIT Financial Trust

Consolidated Statements of Operations

(Unaudited and dollars in thousands, except share and per share information)

| For the Three-Month Periods Ended September 30 |

For the Nine-Month Periods Ended September 30 |

|||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Revenue: |

||||||||||||||||

| Investment interest income |

$ | 33,273 | $ | 32,730 | $ | 102,882 | $ | 95,266 | ||||||||

| Investment interest expense |

(7,636 | ) | (8,235 | ) | (22,342 | ) | (22,996 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net interest margin |

25,637 | 24,495 | 80,540 | 72,270 | ||||||||||||

| Rental income |

41,814 | 29,233 | 116,204 | 84,260 | ||||||||||||

| Fee and other income |

7,842 | 8,667 | 19,113 | 22,738 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

75,293 | 62,395 | 215,857 | 179,268 | ||||||||||||

| Expenses: |

||||||||||||||||

| Interest expense |

13,910 | 10,052 | 38,756 | 29,696 | ||||||||||||

| Real estate operating expense |

20,882 | 15,521 | 58,655 | 44,842 | ||||||||||||

| Compensation expense |

7,187 | 6,565 | 23,118 | 19,849 | ||||||||||||

| General and administrative expense |

4,756 | 3,046 | 13,239 | 10,384 | ||||||||||||

| Acquisition expense |

816 | 199 | 1,408 | 199 | ||||||||||||

| Provision for losses |

1,500 | 500 | 3,500 | 1,500 | ||||||||||||

| Depreciation and amortization expense |

13,236 | 8,784 | 38,719 | 25,972 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total expenses |

62,287 | 44,667 | 177,395 | 132,442 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating Income |

13,006 | 17,728 | 38,462 | 46,826 | ||||||||||||

| Other income (expense) |

(21,464 | ) | (3,849 | ) | (21,449 | ) | (3,704 | ) | ||||||||

| Gain (losses) on assets |

25 | (191 | ) | (5,350 | ) | 30 | ||||||||||

| Gain (losses) on extinguishment of debt |

— | — | 2,421 | — | ||||||||||||

| Change in fair value of financial instruments |

(10,223 | ) | (24,659 | ) | (59,433 | ) | (200,436 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) before taxes |

(18,656 | ) | (10,971 | ) | (45,349 | ) | (157,284 | ) | ||||||||

| Income tax benefit (provision) |

2,194 | (164 | ) | 2,454 | 470 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

(16,462 | ) | (11,135 | ) | (42,895 | ) | (156,814 | ) | ||||||||

| (Income) loss allocated to preferred shares |

(7,407 | ) | (6,024 | ) | (20,628 | ) | (16,831 | ) | ||||||||

| (Income) loss allocated to noncontrolling interests |

603 | 53 | 20 | 130 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) allocable to common shares |

$ | (23,266 | ) | $ | (17,106 | ) | $ | (63,503 | ) | $ | (173,515 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings (loss) per share-Basic: |

||||||||||||||||

| Earnings (loss) per share-Basic |

$ | (0.28 | ) | $ | (0.24 | ) | $ | (0.78 | ) | $ | (2.60 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted-average shares outstanding-Basic |

81,967,806 | 70,192,918 | 81,111,796 | 66,807,299 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings (loss) per share-Diluted: |

||||||||||||||||

| Earnings (loss) per share-Diluted |

$ | (0.28 | ) | $ | (0.24 | ) | $ | (0.78 | ) | $ | (2.60 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average shares outstanding-Diluted |

81,967,806 | 70,192,918 | 81,111,796 | 66,807,299 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The accompanying notes are an integral part of these consolidated financial statements.

2

Table of Contents

RAIT Financial Trust

Consolidated Statements of Comprehensive Income (Loss)

(Unaudited and dollars in thousands)

| For the Three-Month Periods Ended September 30 |

For the Nine-Month Periods Ended September 30 |

|||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Net income (loss) |

$ | (16,462 | ) | $ | (11,135 | ) | $ | (42,895 | ) | $ | (156,814 | ) | ||||

| Other comprehensive income (loss): |

||||||||||||||||

| Change in fair value of interest rate hedges |

221 | (1,641 | ) | (975 | ) | (379 | ) | |||||||||

| Realized (gains) losses on interest rate hedges reclassified to earnings |

6,966 | 7,946 | 21,746 | 24,330 | ||||||||||||

| Change in fair value of available-for-sale securities |

— | 93 | — | 93 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other comprehensive income (loss) |

7,187 | 6,398 | 20,771 | 24,044 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive income (loss) before allocation to noncontrolling interests |

(9,275 | ) | (4,737 | ) | (22,124 | ) | (132,770 | ) | ||||||||

| Allocation to noncontrolling interests |

603 | 53 | 20 | 130 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive income (loss) |

$ | (8,672 | ) | $ | (4,684 | ) | $ | (22,104 | ) | $ | (132,640 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

The accompanying notes are an integral part of these consolidated financial statements.

3

Table of Contents

RAIT Financial Trust

Consolidated Statement of Changes in Equity

(Unaudited and dollars in thousands, except share information)

| Preferred Shares— Series A |

Par Value Preferred Shares— Series A |

Preferred Shares— Series B |

Par Value Preferred Shares— Series B |

Preferred Shares— Series C |

Par Value Preferred Shares— Series C |

Common Shares |

Par Value Common Shares |

Additional Paid In Capital |

Accumulated Other Comprehensive Income (Loss) |

Retained Earnings (Deficit) |

Total Shareholders’ Equity |

Noncontrolling Interests |

Total Equity |

|||||||||||||||||||||||||||||||||||||||||||

| Balance, January 1, 2014 |

4,069,288 | $ | 41 | 2,288,465 | $ | 23 | 1,640,100 | $ | 17 | 71,447,437 | $ | 2,143 | $ | 1,920,455 | $ | (63,810 | ) | $ | (1,257,306 | ) | $ | 601,563 | $ | 34,127 | $ | 635,690 | ||||||||||||||||||||||||||||||

| Net income (loss) |

0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (42,875 | ) | (42,875 | ) | (20 | ) | (42,895 | ) | ||||||||||||||||||||||||||||||||||||||

| Preferred dividends |

0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (20,628 | ) | (20,628 | ) | 0 | (20,628 | ) | |||||||||||||||||||||||||||||||||||||||

| Common dividends declared |

0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (43,359 | ) | (43,359 | ) | 0 | (43,359 | ) | |||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net |

0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 20,771 | 0 | 20,771 | 0 | 20,771 | ||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation |

0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (642 | ) | 0 | 0 | (642 | ) | 0 | (642 | ) | |||||||||||||||||||||||||||||||||||||||

| Issuance of noncontrolling interests |

0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 128,851 | 128,851 | ||||||||||||||||||||||||||||||||||||||||||

| Distribution to noncontrolling interests |

0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (7,337 | ) | (7,337 | ) | ||||||||||||||||||||||||||||||||||||||||

| Preferred shares issued, net |

6,281 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 85 | 0 | 0 | 85 | 0 | 85 | ||||||||||||||||||||||||||||||||||||||||||

| Common shares issued for equity compensation |

0 | 0 | 0 | 0 | 0 | 0 | 415,456 | 12 | 1,021 | 0 | 0 | 1,033 | 0 | 1,033 | ||||||||||||||||||||||||||||||||||||||||||

| Common shares issued, net |

0 | 0 | 0 | 0 | 0 | 0 | 10,646,742 | 319 | 88,194 | 0 | 0 | 88,513 | 0 | 88,513 | ||||||||||||||||||||||||||||||||||||||||||

| 4.0% convertible senior notes embedded conversion option |

0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1,182 | 0 | 0 | 1,182 | 0 | 1,182 | ||||||||||||||||||||||||||||||||||||||||||

| 4.0% convertible senior notes capped call |

0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | (1,481 | ) | 0 | 0 | (1,481 | ) | 0 | (1,481 | ) | |||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

| Balance, September 30, 2014 |

4,075,569 | $ | 41 | 2,288,465 | $ | 23 | 1,640,100 | $ | 17 | 82,509,635 | $ | 2,474 | $ | 2,008,814 | $ | (43,039 | ) | $ | (1,364,168 | ) | $ | 604,162 | $ | 155,621 | $ | 759,783 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

4

Table of Contents

RAIT Financial Trust

Consolidated Statements of Cash Flows

(Unaudited and dollars in thousands)

| For the Nine-Month Periods Ended September 30 |

||||||||

| 2014 | 2013 | |||||||

| Operating activities: |

||||||||

| Net income (loss) |

$ | (42,895 | ) | $ | (156,814 | ) | ||

| Adjustments to reconcile net income (loss) to cash flow from operating activities: |

||||||||

| Provision for losses |

3,500 | 1,500 | ||||||

| Share-based compensation expense |

3,777 | 2,562 | ||||||

| Depreciation and amortization |

38,719 | 25,972 | ||||||

| Amortization of deferred financing costs and debt discounts |

7,728 | 5,860 | ||||||

| Accretion of discounts on investments |

(4,719 | ) | (5,666 | ) | ||||

| (Gains) losses on assets |

5,350 | (30 | ) | |||||

| (Gains) losses on extinguishment of debt |

(2,421 | ) | — | |||||

| Change in fair value of financial instruments |

59,433 | 200,436 | ||||||

| Provision (benefit) for deferred taxes |

(2,634 | ) | — | |||||

| Changes in assets and liabilities: |

||||||||

| Accrued interest receivable |

(7,882 | ) | (4,311 | ) | ||||

| Other assets |

(15,626 | ) | (7,038 | ) | ||||

| Accrued interest payable |

(14,580 | ) | (20,998 | ) | ||||

| Accounts payable and accrued expenses |

21,611 | 8,118 | ||||||

| Deferred taxes, borrowers’ escrows and other liabilities |

14,918 | (4,920 | ) | |||||

|

|

|

|

|

|||||

| Cash flow from operating activities |

64,279 | 44,671 | ||||||

| Investing activities: |

||||||||

| Proceeds from sales of other securities |

8,973 | 96,991 | ||||||

| Purchase and origination of loans for investment |

(695,919 | ) | (419,661 | ) | ||||

| Principal repayments on loans |

134,521 | 50,851 | ||||||

| Sales of conduit loans |

238,988 | 281,959 | ||||||

| Investments in real estate |

(238,648 | ) | (46,725 | ) | ||||

| Proceeds from the disposition of real estate |

3,821 | 3,139 | ||||||

| (Increase) Decrease in restricted cash |

19,627 | (60,662 | ) | |||||

|

|

|

|

|

|||||

| Cash flow from investing activities |

(528,637 | ) | (94,108 | ) | ||||

| Financing activities: |

||||||||

| Repayments on secured credit facilities and loans payable on real estate |

(25,589 | ) | (9,268 | ) | ||||

| Proceeds from secured credit facilities and loans payable on real estate |

102,318 | — | ||||||

| Repayments and repurchase of CDO notes payable |

(174,397 | ) | (135,947 | ) | ||||

| Proceeds from issuance of senior notes from CMBS transaction |

155,001 | 101,250 | ||||||

| Proceeds from issuance of 4.0% convertible senior notes |

16,750 | — | ||||||

| Proceeds from issuance of senior unsecured notes |

131,905 | — | ||||||

| Proceeds from repurchase agreements |

357,550 | 156,781 | ||||||

| Repayments of repurchase agreements |

(236,129 | ) | (138,780 | ) | ||||

| Issuance (acquisition) of noncontrolling interests |

115,728 | 29,322 | ||||||

| Payments for deferred costs and convertible senior note hedges |

(12,313 | ) | (1,864 | ) | ||||

| Preferred share issuance, net of costs incurred |

33,639 | 21,879 | ||||||

| Common share issuance, net of costs incurred |

85,037 | 78,873 | ||||||

| Distributions paid to preferred shareholders |

(17,244 | ) | (12,843 | ) | ||||

| Distributions paid to common shareholders |

(39,978 | ) | (23,384 | ) | ||||

|

|

|

|

|

|||||

| Cash flow from financing activities |

492,278 | 66,019 | ||||||

|

|

|

|

|

|||||

| Net change in cash and cash equivalents |

27,920 | 16,582 | ||||||

| Cash and cash equivalents at the beginning of the period |

88,847 | 100,041 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at the end of the period |

$ | 116,767 | $ | 116,623 | ||||

|

|

|

|

|

|||||

| Supplemental cash flow information: |

||||||||

| Cash paid for interest |

$ | 29,129 | $ | 26,494 | ||||

| Cash paid (refunds received) for taxes |

191 | 509 | ||||||

| Non-cash increase in investments in real estate from conversion of loans |

35,180 | 51,974 | ||||||

| Non-cash increase in non-controlling interests from property acquisition |

3,362 | 1,618 | ||||||

| Non-cash decrease in indebtedness from debt extinguishments |

(2,421 | ) | — | |||||

| Non-cash increase in indebtedness from the assumption of debt from property acquisitions |

129,660 | — | ||||||

| Non-cash increase in other assets from business combination |

7,302 | — | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

5

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of September 30, 2014

(Unaudited and dollars in thousands, except share and per share amounts)

NOTE 1: THE COMPANY

RAIT Financial Trust invests in and manages a portfolio of real-estate related assets, including direct ownership of real estate properties, and provides a comprehensive set of debt financing options to the real estate industry. References to “RAIT”, “we”, “us”, and “our” refer to RAIT Financial Trust and its subsidiaries, unless the context otherwise requires. RAIT is a self-managed and self-advised Maryland real estate investment trust, or REIT.

We finance a substantial portion of our investments through borrowing and securitization strategies seeking to match the maturities and terms of our financings with the maturities and terms of those investments, and to mitigate interest rate risk through derivative instruments.

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

a. Basis of Presentation

The accompanying unaudited interim consolidated financial statements have been prepared by management in accordance with U.S. generally accepted accounting principles, or GAAP. Certain information and footnote disclosures normally included in annual consolidated financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations, although we believe that the included disclosures are adequate to make the information presented not misleading. The unaudited interim consolidated financial statements should be read in conjunction with our audited financial statements as of and for the year ended December 31, 2013 included in our Annual Report on Form 10-K. In the opinion of management, all adjustments, consisting only of normal recurring adjustments, necessary to present fairly our consolidated financial position and consolidated results of operations and cash flows are included. The results of operations for the interim periods presented are not necessarily indicative of the results for the full year.

For the nine-month period ended September 30, 2014, gains (losses) on assets in the accompanying consolidated statement of operations includes the write-off of assets totaling $3,001 that were associated with property transactions completed in a prior period.

b. Principles of Consolidation

The consolidated financial statements reflect our accounts and the accounts of our majority-owned and/or controlled subsidiaries. We also consolidate entities that are variable interest entities, or VIEs, where we have determined that we are the primary beneficiary of such entities. The portions of these entities that we do not own are presented as noncontrolling interests as of the dates and for the periods presented in the consolidated financial statements. All intercompany accounts and transactions have been eliminated in consolidation.

We expanded our third party property management platform and own a retail property management firm, which managed 62 properties representing 18,614,490 square feet in 26 states as of September 30, 2014. Upon acquisition in the fourth quarter of 2013, we recorded goodwill with a balance of $14,752 and identifiable intangible assets of $19,050.

Under Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 810, “Consolidation”, the determination of whether to consolidate a VIE is based on the power to direct the activities of the VIE that most significantly impact the VIE’s economic performance together with either the obligation to absorb losses or the right to receive benefits that could be significant to the VIE. We define the power to direct the activities that most significantly impact the VIE’s economic performance as the ability to buy, sell, refinance, or recapitalize assets or entities, and solely control other material operating events or items of the respective entity. For our commercial mortgages, mezzanine loans, and preferred equity investments, certain rights we hold are protective in nature and would preclude us from having the power to direct the activities that most significantly impact the VIE’s economic performance. Assuming both criteria are met, we would be considered the primary beneficiary and would consolidate the VIE. We will continually assess our involvement with VIEs and consolidate the VIEs when we are the primary beneficiary. See Note 9 for additional disclosures pertaining to VIEs.

6

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of September 30, 2014

(Unaudited and dollars in thousands, except share and per share amounts)

c. Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting periods. The items that include significant estimates are fair value of financial instruments and allowance for losses. Actual results could differ from those estimates.

d. Investments in Loans

We invest in commercial mortgages, mezzanine loans, preferred equity interests, debt securities and other loans. We account for our investments in commercial mortgages, mezzanine loans, preferred equity interests and other loans at amortized cost. The carrying value of these investments is adjusted for origination discounts/premiums, nonrefundable fees and direct costs for originating loans which are amortized into income on a level yield basis over the terms of the loans.

e. Allowance for Losses, Impaired Loans and Non-accrual Status

We maintain an allowance for losses on our investments in commercial mortgages, mezzanine loans and other loans. Management’s periodic evaluation of the adequacy of the allowance is based upon expected and inherent risks in the portfolio, the estimated value of underlying collateral, and current economic conditions. Management reviews loans for impairment and establishes specific reserves when a loss is probable under the provisions of FASB ASC Topic 310, “Receivables.” A loan is impaired when it is probable that we may not collect all principal and interest payments according to the contractual terms. As part of the detailed loan review, we consider many factors about the specific loan, including payment history, asset performance, borrower’s financial capability and other characteristics. If any trends or characteristics indicate that it is probable that other loans, with similar characteristics to those of impaired loans, have incurred a loss, we consider whether an allowance for loss is needed pursuant to FASB ASC Topic 450, “Contingencies.” Management evaluates loans for non-accrual status each reporting period. A loan is placed on non-accrual status when the loan payment deficiencies exceed 90 days. Payments received for non-accrual or impaired loans are applied to principal until the loan is removed from non-accrual status or no longer impaired. Past due interest is recognized on non-accrual loans when they are removed from non-accrual status and are making current interest payments. The allowance for losses is increased by charges to operations and decreased by charge-offs (net of recoveries). Management charges off loans when the investment is no longer realizable and legally discharged.

f. Investments in Real Estate

Investments in real estate are shown net of accumulated depreciation. We capitalize those costs that have been evaluated to improve the real property and depreciate those costs on a straight-line basis over the useful life of the asset. We depreciate real property using the following useful lives: buildings and improvements—30 to 40 years; furniture, fixtures, and equipment—5 to 10 years; and tenant improvements—shorter of the lease term or the life of the asset. Costs for ordinary maintenance and repairs are charged to expense as incurred.

Acquisitions of real estate assets and any related intangible assets are recorded initially at fair value under FASB ASC Topic 805, “Business Combinations.” Fair value is determined by appraisals obtained or by management based on market conditions and inputs at the time the asset is acquired. All expenses incurred to acquire a real estate asset are expensed as incurred.

Management reviews our investments in real estate for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be fully recoverable. The review of recoverability is based on an estimate of the future undiscounted cash flows (excluding interest charges) expected to result from the long-lived asset’s use and eventual disposition. These cash flows consider factors such as expected future operating income, trends and prospects, as well as the effects of leasing demand, competition and other factors. If impairment exists due to the inability to recover the carrying value of a long-lived asset, an impairment loss is recorded to the extent that the carrying value exceeds the estimated fair value of the property.

g. Investments in Securities

We account for our investments in securities under FASB ASC Topic 320, “Investments—Debt and Equity Securities”, and designate each investment security as a trading security, an available-for-sale security, or a held-to-maturity security based on our intent at the time of acquisition. Trading securities are recorded at their fair value each reporting period with fluctuations in fair value reported as a component of earnings. Available-for-sale securities are recorded at fair value with changes in fair value reported as a component of other comprehensive income (loss). We classify certain available-for-sale securities as trading securities when we elect to record them under the fair value option in accordance with FASB ASC Topic 825, “Financial Instruments.” See “m. Fair Value of Financial Instruments.” Upon the sale of an available-for-sale security, the realized gain or loss on the sale will be recorded as a component of earnings in the respective period. Held-to-maturity investments are carried at amortized cost at each reporting period.

7

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of September 30, 2014

(Unaudited and dollars in thousands, except share and per share amounts)

We account for investments in securities where the transfer meets the criteria as a financing under FASB ASC Topic 860, “Transfers and Servicing”, at fair value. Our investments in security-related receivables represent securities that were transferred to issuers of collateralized debt obligations, or CDOs, in which the transferors maintained some level of continuing involvement. We use our judgment to determine whether an investment in securities has sustained an other-than-temporary decline in value. If management determines that an available-for-sale security has sustained an other-than-temporary decline in its value, the investment is written down to its fair value by a charge to earnings, and we establish a new cost basis for the investment. Our evaluation of an other-than-temporary decline is dependent on the specific facts and circumstances. Factors that we consider in determining whether an other-than-temporary decline in value has occurred include: the estimated fair value of the investment in relation to our cost basis; the financial condition of the related entity; and the intent and ability to retain the investment for a sufficient period of time to allow for recovery of the fair value of the investment.

h. Revenue Recognition

| 1) | Interest income—We recognize interest income from investments in commercial mortgages, mezzanine loans, and other securities on a yield to maturity basis. Upon the acquisition of a loan at a discount, we assess the portions of the discount that constitute accretable yields and non-accretable differences. The accretable yield represents the excess of our expected cash flows from the loan over the amount we paid for the loan. That amount, the accretable yield, is accreted to interest income over the remaining life of the loan. Many of our commercial mortgages and mezzanine loans provide for the accrual of interest at specified rates which differ from current payment terms. Interest income is recognized on such loans at the accrual rate subject to management’s determination that accrued interest and outstanding principal are ultimately collectible. |

For investments that we did not elect to record at fair value under FASB ASC Topic 825, “Financial Instruments”, origination fees and direct loan origination costs are deferred and amortized to net investment income, using the effective interest method, over the contractual life of the underlying loan security or loan, in accordance with FASB ASC Topic 310, “Receivables.”

For investments that we elected to record at fair value under FASB ASC Topic 825, origination fees and direct loan costs are recorded in income and are not deferred.

We recognize interest income from interests in certain securitized financial assets on an estimated effective yield to maturity basis. Management estimates the current yield on the amortized cost of the investment based on estimated cash flows after considering prepayment and credit loss experience.

| 2) | Rental income—We generate rental income from tenant rent and other tenant-related activities at our consolidated real estate properties. For multi-family real estate properties, rental income is recorded when due from residents and recognized monthly as it is earned and realizable, under lease terms which are generally for periods of one year or less. For retail and office real estate properties, rental income is recognized on a straight-line basis from the later of the date of the commencement of the lease or the date of acquisition of the property subject to existing leases, which averages minimum rents over the terms of the leases. Leases also typically provide for tenant reimbursement of a portion of common area maintenance and other operating expenses to the extent that a tenant’s pro rata share of expenses exceeds a base year level set in the lease. |

| 3) | Fee and other income—We generate fee and other income through our various subsidiaries by (a) funding conduit loans for sale into unaffiliated CMBS securitizations, (b) providing or arranging to provide financing to our borrowers, (c) providing ongoing asset management services to investment portfolios under cancelable management agreements, and (d) providing property management services to third parties. We recognize revenue for these activities when the fees are fixed or determinable, are evidenced by an arrangement, collection is reasonably assured and the services under the arrangement have been provided. While we may receive asset management fees when they are earned, we eliminate earned asset management fee income from securitizations while such securitizations are consolidated. |

During the three-month periods ended September 30, 2014 and 2013, we received $681 and $1,143, respectively, of earned asset management fees, of which we eliminated $360 and $867, respectively, of management fee income associated with consolidated securitizations.

During the nine-month periods ended September 30, 2014 and 2013, we received $3,325 and $3,582, respectively, of earned asset management fees, of which we eliminated $2,381 and $2,612, respectively, of management fee income associated with consolidated CDOs.

8

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of September 30, 2014

(Unaudited and dollars in thousands, except share and per share amounts)

i. Fair Value of Financial Instruments

In accordance with FASB ASC Topic 820, “Fair Value Measurements and Disclosures”, fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Where available, fair value is based on observable market prices or parameters or derived from such prices or parameters. Where observable prices or inputs are not available, valuation models are applied. These valuation techniques involve management estimation and judgment, the degree of which is dependent on the price transparency for the instruments or market and the instruments’ complexity for disclosure purposes. Assets and liabilities recorded at fair value in the consolidated balance sheets are categorized based upon the level of judgment associated with the inputs used to measure their value. Hierarchical levels, as defined in FASB ASC Topic 820, “Fair Value Measurements and Disclosures” and directly related to the amount of subjectivity associated with the inputs to fair valuations of these assets and liabilities, are as follows:

| • | Level 1: Valuations are based on unadjusted, quoted prices in active markets for identical assets or liabilities at the measurement date. The types of assets carried at level 1 fair value generally are equity securities listed in active markets. As such, valuations of these investments do not entail a significant degree of judgment. |

| • | Level 2: Valuations are based on quoted prices for similar instruments in active markets or quoted prices for identical or similar instruments in markets that are not active or for which all significant inputs are observable, either directly or indirectly. |

Fair value assets and liabilities that are generally included in this category are unsecured REIT note receivables, CMBS receivables and certain financial instruments classified as derivatives where the fair value is based primarily on observable market inputs.

| • | Level 3: Inputs are unobservable inputs for the asset or liability, and include situations where there is little, if any, market activity for the asset or liability. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the level in the fair value hierarchy within which the fair value measurement in its entirety falls has been determined based on the lowest level input that is significant to the fair value measurement in its entirety. Our assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the asset. Generally, assets and liabilities carried at fair value and included in this category are trust preferred securities, or TruPS, and subordinated debentures, trust preferred obligations and CDO notes payable where significant observable market inputs do not exist. |

The availability of observable inputs can vary depending on the financial asset or liability and is affected by a wide variety of factors, including, for example, the type of investment, whether the investment is new, whether the investment is traded on an active exchange or in the secondary market, and the current market condition. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised by us in determining fair value is greatest for instruments categorized in level 3.

Fair value is a market-based measure considered from the perspective of a market participant who holds the asset or owes the liability rather than an entity-specific measure. Therefore, even when market assumptions are not readily available, our own assumptions are set to reflect those that management believes market participants would use in pricing the asset or liability at the measurement date. We use prices and inputs that management believes are current as of the measurement date, including during periods of market dislocation. In periods of market dislocation, the observability of prices and inputs may be reduced for many instruments. This condition could cause an instrument to be transferred from Level 1 to Level 2 or Level 2 to Level 3.

Many financial instruments have bid and ask prices that can be observed in the marketplace. Bid prices reflect the highest price that buyers in the market are willing to pay for an asset. Ask prices represent the lowest price that sellers in the market are willing to accept for an asset. For financial instruments whose inputs are based on bid-ask prices, we do not require that fair value always be a predetermined point in the bid-ask range. Our policy is to allow for mid-market pricing and adjusting to the point within the bid-ask range that results in our best estimate of fair value.

9

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of September 30, 2014

(Unaudited and dollars in thousands, except share and per share amounts)

Fair value for certain of our Level 3 financial instruments is derived using internal valuation models. These internal valuation models include discounted cash flow analyses developed by management using current interest rates, estimates of the term of the particular instrument, specific issuer information and other market data for securities without an active market. In accordance with FASB ASC Topic 820, “Fair Value Measurements and Disclosures”, the impact of our own credit spreads is also considered when measuring the fair value of financial assets or liabilities, including derivative contracts. Where appropriate, valuation adjustments are made to account for various factors, including bid-ask spreads, credit quality and market liquidity. These adjustments are applied on a consistent basis and are based on observable inputs where available. Management’s estimate of fair value requires significant management judgment and is subject to a high degree of variability based upon market conditions, the availability of specific issuer information and management’s assumptions.

j. Deferred Financing Costs and Intangible Assets

Costs incurred in connection with debt financing are capitalized as deferred financing costs and charged to interest expense over the terms of the related debt agreements, under the effective interest method.

Intangible assets on our consolidated balance sheets represent identifiable intangible assets acquired in business acquisitions. We amortize identified intangible assets to expense over their estimated lives using the straight-line method. We evaluate intangible assets for impairment as events and circumstances change, in accordance with FASB ASC Topic 360, “Property, Plant, and Equipment.” The gross carrying amount for our customer relationships was $21,726 as of September 30, 2014 and December 31, 2013. The gross carrying amount for our in-place leases was $11,659 and $2,892 as of September 30, 2014 and December 31, 2013, respectively. The gross carrying amount for our trade name was $1,500 as of September 30, 2014 and December 31, 2013, respectively. The accumulated amortization for our intangible assets was $10,941 and $4,564 as of September 30, 2014 and December 31, 2013, respectively. We recorded amortization expense of $1,980 and $228 for the three-month periods ended September 30, 2014 and 2013, respectively, and $6,376 and $1,318 for the nine-month periods ended September 30, 2014 and 2013, respectively. Based on the intangible assets identified above, we expect to record amortization expense of intangible assets of $1,758 for the remainder of 2014, $4,326 for 2015, $3,520 for 2016, $2,522 for 2017, $2,031 for 2018 and $9,788 thereafter.

k. Recent Accounting Pronouncements

In April 2014, the FASB issued an accounting standard classified under FASB ASC Topic 205, “Presentation of Financial Statements”. This accounting standard amends existing guidance to change reporting requirements for discontinued operations by requiring the disposal of an entity to be reported in discontinued operations if the disposal represents a strategic shift that has or will have a major effect on an entity’s operations and financial results. This standard is effective for interim and annual reporting periods beginning on or after December 15, 2014. Management is currently evaluating the impact that this standard may have on our consolidated financial statements.

In May 2014, the FASB issued an accounting standard classified under FASB ASC Topic 606, “Revenue from Contracts with Customers”. This accounting standard generally replaces existing guidance by requiring an entity to recognize the amount of revenue to which it expects to be entitled for the transfer of promised goods or services to customers. This standard is effective for annual reporting periods beginning after December 15, 2016. Management is currently evaluating the impact that this standard may have on our consolidated financial statements.

10

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of September 30, 2014

(Unaudited and dollars in thousands, except share and per share amounts)

NOTE 3: INVESTMENTS IN LOANS

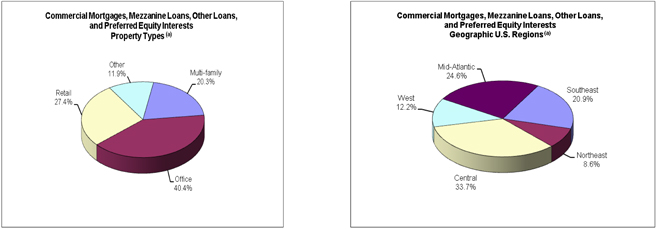

Investments in Commercial Mortgages, Mezzanine Loans, Other Loans and Preferred Equity Interests

The following table summarizes our investments in commercial mortgages, mezzanine loans, other loans and preferred equity interests as of September 30, 2014:

| Unpaid Principal Balance |

Unamortized (Discounts) Premiums |

Carrying Amount |

Number of Loans |

Weighted- Average Coupon (1) |

Range of Maturity Dates | |||||||||||||||||

| Commercial Real Estate (CRE) Loans |

||||||||||||||||||||||

| Commercial mortgages (2) |

$ | 1,068,977 | $ | (15,787 | ) | $ | 1,053,190 | 86 | 5.9 | % | Dec. 2014 to Jul. 2044 | |||||||||||

| Mezzanine loans |

257,553 | (2,576 | ) | 254,977 | 77 | 9.4 | % | Dec. 2014 to Jan. 2029 | ||||||||||||||

| Preferred equity interests |

42,608 | 0 | 42,608 | 10 | 7.7 | % | May 2015 to Aug. 2025 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total CRE Loans |

1,369,138 | (18,363 | ) | 1,350,775 | 173 | 6.6 | % | |||||||||||||||

| Other loans |

20,138 | 53 | 20,191 | 1 | 2.8 | % | Oct. 2016 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Loans |

$ | 1,389,276 | $ | (18,310 | ) | $ | 1,370,966 | 174 | 6.6 | % | ||||||||||||

|

|

|

|

|

|||||||||||||||||||

| Deferred fees |

(1,184 | ) | 0 | (1,184 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

| Total investments in loans |

$ | 1,388,092 | $ | (18,310 | ) | $ | 1,369,782 | |||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

| (1) | Weighted-average coupon is calculated on the unpaid principal amount of the underlying instruments, which does not necessarily correspond to the carrying amount. |

| (2) | Commercial mortgages includes 11 conduit loans with an unpaid principal balance and carrying amount of $107,164, a weighted-average coupon of 4.6% and maturity dates ranging from September 2021 through July 2044. These commercial mortgages are classified as loans held for sale. |

The following table summarizes our investments in commercial mortgages, mezzanine loans, other loans and preferred equity interests as of December 31, 2013:

| Unpaid Principal Balance |

Unamortized (Discounts) Premiums |

Carrying Amount |

Number of Loans |

Weighted- Average Coupon (1) |

Range of Maturity Dates | |||||||||||||||||

| Commercial Real Estate (CRE) Loans |

||||||||||||||||||||||

| Commercial mortgages (2) |

$ | 792,526 | $ | (19,257 | ) | $ | 773,269 | 59 | 6.4 | % | Mar. 2014 to Jan. 2029 | |||||||||||

| Mezzanine loans |

269,034 | (3,273 | ) | 265,761 | 81 | 9.6 | % | Mar. 2014 to Jan. 2029 | ||||||||||||||

| Preferred equity interests |

54,389 | (939 | ) | 53,450 | 11 | 8.6 | % | May 2015 to Aug. 2025 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total CRE Loans |

1,115,949 | (23,469 | ) | 1,092,480 | 151 | 7.3 | % | |||||||||||||||

| Other loans |

30,625 | 72 | 30,697 | 2 | 4.3 | % | Mar. 2014 to Oct. 2016 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Loans |

1,146,574 | (23,397 | ) | 1,123,177 | 153 | 7.2 | % | |||||||||||||||

|

|

|

|

|

|||||||||||||||||||

| Deferred fees |

(800 | ) | 0 | (800 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

| Total investments in loans |

$ | 1,145,774 | $ | (23,397 | ) | $ | 1,122,377 | |||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

| (1) | Weighted-average coupon is calculated on the unpaid principal amount of the underlying instruments, which does not necessarily correspond to the carrying amount. |

| (2) | Commercial mortgages includes six conduit loans with an unpaid principal balance and carrying amount of $61,825, a weighted-average coupon of 5.3% and maturity dates ranging from January 2024 through January 2029. These commercial mortgages are classified as loans held for sale. |

11

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of September 30, 2014

(Unaudited and dollars in thousands, except share and per share amounts)

During the nine-month period ended September 30, 2014, we completed the conversion of two commercial real estate loans with a carrying value of $35,404 to real estate owned property. We recorded a gain on asset of $136 on one property as the value of the real estate exceeded the carrying amount of the converted loan and charged off $360 to the allowance for losses as the carrying amount of the other loan exceeded the fair value of the real estate property. During the nine-month period ended September 30, 2013, we did not convert any commercial real estate loans to owned real estate property.

In June 2014, we sold all of the remaining interests, held by Taberna VIII and Taberna IX, in one of our other investments with an unpaid principal balance of $10,488 for $2,850. We recorded a loss on sale of asset of $7,638 due to the illiquid nature of the investment.

The following table summarizes the delinquency statistics of our commercial real estate loans as of September 30, 2014 and December 31, 2013:

| Delinquency Status |

As of September 30, 2014 |

As of December 31, 2013 |

||||||

| 30 to 59 days |

$ | 0 | $ | 0 | ||||

| 60 to 89 days |

0 | 6,441 | ||||||

| 90 days or more |

32,811 | 13,603 | ||||||

| In foreclosure or bankruptcy proceedings |

7,930 | 23,470 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 40,741 | $ | 43,514 | ||||

|

|

|

|

|

|||||

As of September 30, 2014 and December 31, 2013, approximately $40,741 and $37,073, respectively, of our commercial real estate loans were on non-accrual status and had a weighted-average interest rate of 7.3% and 6.3%, respectively.

During the nine-month period ended September 30, 2014, we removed a loan with an unpaid principal balance of $5,500 from non-accrual status. The carrying amount of this loan is $4,330 as it was acquired at a discount. We recorded $882 of accrued interest which represents the interest during the time the loan was on non-accrual status. Management believes the entire unpaid principal balance and all accrued interest is collectible.

Allowance For Losses And Impaired Loans

The following table provides a roll-forward of our allowance for losses for our commercial mortgages, mezzanine loans and other loans for the three-month periods ended September 30, 2014 and 2013:

| For the Three-Month Period Ended September 30, 2014 |

For the Three-Month Period Ended September 30, 2013 |

|||||||

| Beginning balance |

$ | 15,336 | $ | 24,222 | ||||

| Provision |

1,500 | 500 | ||||||

| Charge-offs, net of recoveries |

(1,174 | ) | (1,405 | ) | ||||

|

|

|

|

|

|||||

| Ending balance |

$ | 15,662 | $ | 23,317 | ||||

|

|

|

|

|

|||||

The following table provides a roll-forward of our allowance for losses for our commercial mortgages, mezzanine loans and other loans for the nine-month periods ended September 30, 2014 and 2013:

| For the Nine-Month Period Ended September 30, 2014 |

For the Nine-Month Period Ended September 30, 2013 |

|||||||

| Beginning balance |

$ | 22,955 | $ | 30,400 | ||||

| Provision |

3,500 | 1,500 | ||||||

| Charge-offs, net of recoveries |

(10,793 | ) | (8,583 | ) | ||||

|

|

|

|

|

|||||

| Ending balance |

$ | 15,662 | $ | 23,317 | ||||

|

|

|

|

|

|||||

12

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of September 30, 2014

(Unaudited and dollars in thousands, except share and per share amounts)

As of September 30, 2014 and December 31, 2013, we identified 14 commercial mortgages and mezzanine loans with unpaid principal balances and recorded investment of $64,741 and $55,573, respectively, as impaired.

The average unpaid principal balance and recorded investment of total impaired loans was $65,129 and $65,199 during the three-month periods ended September 30, 2014 and 2013, respectively, and $58,088 and $67,315 during the nine-month periods ended September 30, 2014 and 2013, respectively. As of September 30, 2014, there are four impaired loans with unpaid principal balances of $20,180 for which there is no allowance. We recorded interest income from impaired loans of $53 and $23 for the three-month periods ended September 30, 2014 and 2013, respectively. We recorded interest income from impaired loans of $938 and $229 for the nine-month periods ended September 30, 2014 and 2013, respectively.

We have evaluated modifications to our commercial real estate loans to determine if the modification constitutes a troubled debt restructuring (TDR) under FASB ASC Topic 310, “Receivables”. During the nine-month period ended September 30, 2014, we have determined that a modification to one commercial real estate loan constituted a TDR as the borrower was experiencing financial difficulties and we, as the lender, granted a concession to the borrower by deferring principal payments to future periods. The outstanding recorded investment was $11,140 both before and after the modification. As of September 30, 2014, there were no TDRs that subsequently defaulted for modifications within the previous 12 months.

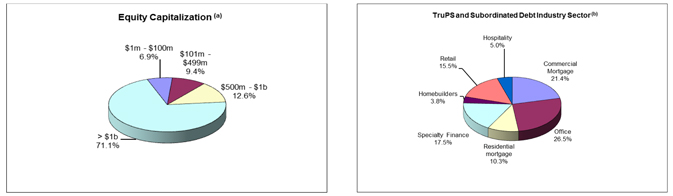

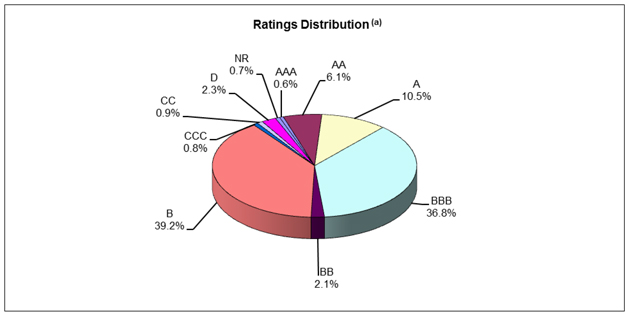

NOTE 4: INVESTMENTS IN SECURITIES

Our investments in securities and security-related receivables are accounted for at fair value. The following table summarizes our investments in securities as of September 30, 2014:

| Investment Description |

Amortized Cost |

Gross Unrealized Gains |

Gross Unrealized Losses |

Estimated Fair Value |

Weighted Average Coupon (1) |

Weighted Average Years to Maturity |

||||||||||||||||||

| Trading securities |

||||||||||||||||||||||||

| TruPS and subordinated debentures |

$ | 602,376 | $ | 0 | $ | (112,438 | ) | $ | 489,938 | 3.8 | % | 20.2 | ||||||||||||

| Other securities |

12,604 | 0 | (12,604 | ) | 0 | 4.7 | % | 38.1 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total trading securities |

614,980 | 0 | (125,042 | ) | 489,938 | 3.8 | % | 20.5 | ||||||||||||||||

| Available-for-sale securities |

3,600 | 0 | (2,970 | ) | 630 | 2.0 | % | 28.1 | ||||||||||||||||

| Security-related receivables |

||||||||||||||||||||||||

| TruPS and subordinated debenture receivables |

32,900 | 0 | (25,217 | ) | 7,683 | 3.4 | % | 17.5 | ||||||||||||||||

| Unsecured REIT note receivables |

30,000 | 2,532 | 0 | 32,532 | 6.7 | % | 2.4 | |||||||||||||||||

| CMBS receivables (2) |

53,383 | 1,656 | (18,604 | ) | 36,435 | 5.8 | % | 32.0 | ||||||||||||||||

| Other securities |

28,328 | 0 | (27,267 | ) | 1,061 | 2.3 | % | 35.6 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total security-related receivables |

144,611 | 4,188 | (71,088 | ) | 77,711 | 4.7 | % | 23.3 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total investments in securities |

$ | 763,191 | $ | 4,188 | $ | (199,100 | ) | $ | 568,279 | 4.0 | % | 21.2 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | Weighted-average coupon is calculated on the unpaid principal amount of the underlying instruments, which does not necessarily correspond to the carrying amount. |

| (2) | CMBS receivables include securities with a fair value totaling $12,122 that are rated between “AAA” and “A-” by Standard & Poor’s, securities with a fair value totaling $22,667 that are rated “BBB+” and “B-” by Standard & Poor’s and securities with a fair value totaling $1,646 that are rated “D” by Standard & Poor’s. |

All of our gross unrealized losses at September 30, 2014 were greater than 12 months.

13

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of September 30, 2014

(Unaudited and dollars in thousands, except share and per share amounts)

The following table summarizes our investments in securities as of December 31, 2013:

| Investment Description |

Amortized Cost |

Gross Unrealized Gains |

Gross Unrealized Losses |

Estimated Fair Value |

Weighted Average Coupon (1) |

Weighted Average Years to Maturity |

||||||||||||||||||

| Trading securities |

||||||||||||||||||||||||

| TruPS and subordinated debentures |

$ | 620,376 | $ | 0 | $ | (139,531 | ) | $ | 480,845 | 3.7 | % | 20.4 | ||||||||||||

| Other securities |

12,312 | 0 | (12,312 | ) | 0 | 4.7 | % | 38.9 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total trading securities |

632,688 | 0 | (151,843 | ) | 480,845 | 3.8 | % | 20.8 | ||||||||||||||||

| Available-for-sale securities |

3,600 | 0 | (3,598 | ) | 2 | 2.0 | % | 28.9 | ||||||||||||||||

| Security-related receivables |

||||||||||||||||||||||||

| TruPS and subordinated debenture receivables |

32,900 | 0 | (24,689 | ) | 8,211 | 3.4 | % | 18.3 | ||||||||||||||||

| Unsecured REIT note receivables |

30,000 | 3,046 | 0 | 33,046 | 6.7 | % | 3.1 | |||||||||||||||||

| CMBS receivables (2) |

69,905 | 1,722 | (27,509 | ) | 44,118 | 5.6 | % | 30.6 | ||||||||||||||||

| Other securities |

33,144 | 0 | (32,064 | ) | 1,080 | 2.2 | % | 36.5 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total security-related receivables |

165,949 | 4,768 | (84,262 | ) | 86,455 | 4.7 | % | 24.4 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total investments in securities |

$ | 802,237 | $ | 4,768 | $ | (239,703 | ) | $ | 567,302 | 3.9 | % | 21.7 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | Weighted-average coupon is calculated on the unpaid principal amount of the underlying instruments, which does not necessarily correspond to the carrying amount. |

| (2) | CMBS receivables include securities with a fair value totaling $8,228 that are rated between “AAA” and “A-” by Standard & Poor’s, securities with a fair value totaling $26,594 that are rated between “BBB+” and “B-” by Standard & Poor’s, securities with a fair value totaling $8,164 that are rated “CCC” by Standard & Poor’s, and securities with a fair value totaling $1,132 that are rated “D” by Standard & Poor’s. |

All of our gross unrealized losses at December 31, 2013 were greater than 12 months.

TruPS included above as trading securities include (a) investments in TruPS issued by VIEs of which we are not the primary beneficiary and which we do not consolidate and (b) transfers of investments in TruPS securities to us that were accounted for as a sale pursuant to FASB ASC Topic 860, “Transfers and Servicing.”

The following table summarizes the non-accrual status of our investments in securities:

| As of September 30, 2014 | As of December 31, 2013 | |||||||||||||||||||||||

| Principal /Par Amount on Non-accrual |

Weighted Average Coupon |

Fair Value | Principal /Par Amount on Non-accrual |

Weighted Average Coupon |

Fair Value | |||||||||||||||||||

| TruPS and TruPS receivables |

$ | 65,557 | 2.0 | % | $ | 650 | $ | 83,557 | 1.8 | % | $ | 5,678 | ||||||||||||

| Other securities |

36,842 | 3.2 | % | 630 | 41,019 | 3.1 | % | 11 | ||||||||||||||||

| CMBS receivables |

15,250 | 5.9 | % | 328 | 22,772 | 5.9 | % | 447 | ||||||||||||||||

The assets of our consolidated CDOs collateralize the debt of such entities and are not available to our creditors. As of September 30, 2014 and December 31, 2013, investment in securities of $635,276 and $653,276, respectively, in principal amount of TruPS and subordinated debentures, and $78,383 and $91,383, respectively, in principal amount of unsecured REIT note receivables and CMBS receivables, collateralized the consolidated CDO notes payable of such entities.

14

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of September 30, 2014

(Unaudited and dollars in thousands, except share and per share amounts)

NOTE 5: INVESTMENTS IN REAL ESTATE

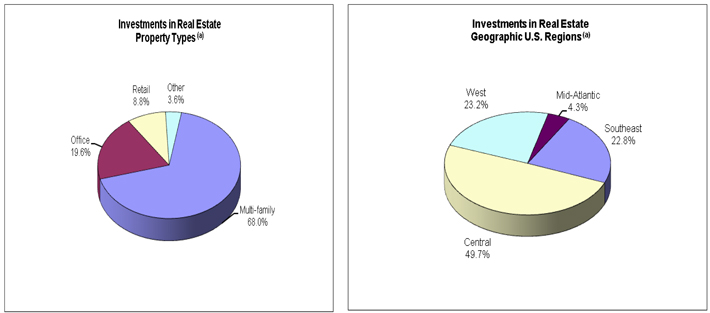

The table below summarizes our investments in real estate:

| As of September 30, 2014 | As of December 31, 2013 | |||||||||||||||

| Book Value | Number of Properties |

Book Value | Number of Properties |

|||||||||||||

| Multi-family real estate properties (a) |

$ | 1,040,808 | 50 | $ | 716,708 | 37 | ||||||||||

| Office real estate properties |

330,725 | 14 | 282,371 | 11 | ||||||||||||

| Retail real estate properties |

134,341 | 6 | 83,653 | 4 | ||||||||||||

| Parcels of land |

50,656 | 10 | 49,199 | 10 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Subtotal |

1,556,530 | 80 | 1,131,931 | 62 | ||||||||||||

| Less: Accumulated depreciation and amortization (a) |

(155,815 | ) | (127,745 | ) | ||||||||||||

|

|

|

|

|

|||||||||||||

| Investments in real estate |

$ | 1,400,715 | $ | 1,004,186 | ||||||||||||

|

|

|

|

|

|||||||||||||

| (a) | As of September 30, 2014, includes 22 apartment properties owned by Independence Realty Trust, Inc., with 6,470 units and a book value of $444,050 and accumulated depreciation of $20,848. As of December 31, 2013, includes 10 apartment properties owned by Independence Realty Trust, Inc., with 2,790 units and a book value of $190,096 and accumulated depreciation of $15,775. |

As of September 30, 2014, our investments in real estate of $1,400,715 were financed through $379,242 of mortgages held by third parties and $944,662 of mortgages held by our RAIT I and RAIT II CDO securitizations. As of December 31, 2013, our investments in real estate of $1,004,186 were financed through $171,223 of mortgages held by third parties and $864,689 of mortgages held by our RAIT I and RAIT II CDO securitizations. Together, along with commercial real estate loans held by RAIT I and RAIT II, these mortgages serve as collateral for the CDO notes payable issued by the RAIT I and RAIT II CDO securitizations. All intercompany balances and interest charges are eliminated in consolidation.

Acquisitions:

During the nine-month period ended September 30, 2014, we acquired 14 multi-family properties, two retail properties and three office properties with a combined purchase price of $421,879. We assumed first mortgages on some of these properties. Upon acquisition, we recorded the investment in real estate, including any related working capital and intangible assets, at fair value of $427,194 and recorded a gain on assets of $5,675. Of these acquisitions, Independence Realty Trust, Inc., or IRT, acquired 12 multi-family properties at a fair value of $255,831. We consolidate IRT as it is a VIE and we are the primary beneficiary. See Note 9 for additional disclosures pertaining to VIEs.

15

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of September 30, 2014

(Unaudited and dollars in thousands, except share and per share amounts)

The following table summarizes the aggregate estimated fair value of the assets and liabilities associated with the 19 properties acquired during the nine-month period ended September 30, 2014, on the respective date of each acquisition, for the real estate accounted for under FASB ASC Topic 805.

| Description |

Estimated Fair Value |

|||

| Assets acquired: |

||||

| Investments in real estate |

$ | 418,427 | ||

| Cash and cash equivalents |

308 | |||

| Restricted cash |

3,094 | |||

| Other assets |

2,590 | |||

| Deferred financing costs |

993 | |||

| Intangible assets |

8,767 | |||

|

|

|

|||

| Total assets acquired |

434,179 | |||

| Liabilities assumed: |

||||

| Loans payable on real estate |

127,755 | |||

| Accounts payable and accrued expenses |

5,480 | |||

| Other liabilities |

710 | |||

|

|

|

|||

| Total liabilities assumed |

133,945 | |||

| Noncontrolling interests assumed: |

3,000 | |||

|

|

|

|||

| Estimated fair value of net assets acquired |

$ | 297,234 | ||

|

|

|

|||

The following table summarizes the consideration transferred to acquire the real estate properties and the amounts of identified assets acquired and liabilities assumed at the respective conversion date:

| Description |

Estimated Fair Value |

|||

| Fair value of consideration transferred: |

||||

| Commercial real estate loans and cash |

$ | 297,407 | ||

| Other considerations |

(173 | ) | ||

|

|

|

|||

| Total fair value of consideration transferred |

$ | 297,234 | ||

|

|

|

|||

During the nine-month period ended September 30, 2014, these investments contributed revenue of $22,042 and a net income allocable to common shares of $1,813. During the nine-month period ended September 30, 2014, we incurred $1,127 of third-party acquisition-related costs, which is included in general and administrative expense in the accompanying consolidated statements of operations.

16

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of September 30, 2014

(Unaudited and dollars in thousands, except share and per share amounts)

The tables below present the revenue, net income and earnings per share effect of the acquired properties, as reported in our consolidated financial statements and on a pro forma basis as if the acquisitions occurred on January 1, 2013. These pro forma results are not necessarily indicative of the results which actually would have occurred if the acquisition had occurred on the first day of the periods presented, nor does the pro forma financial information purport to represent the results of operations for future periods.

| Description |

For the Three-Month Period Ended September 30, 2014 |

For the Three-Month Period Ended September 30, 2013 |

||||||

| Total revenue of real estate properties acquired, as reported |

$ | 10,039 | $ | 0 | ||||

| Pro forma rental income |

45,347 | 42,260 | ||||||

| Net income (loss) allocable to common shares of real estate properties acquired, as reported |

846 | 0 | ||||||

| Pro forma net income (loss) allocable to common shares |

(22,393 | ) | (14,912 | ) | ||||

| Earnings (loss) per share attributable to common shareholders of real estate properties acquired |

||||||||

| Basic and diluted—as reported |

0.01 | 0.00 | ||||||

| Basic and diluted—as pro forma |

(0.27 | ) | (0.21 | ) | ||||

| Description |

For the Nine-Month Period Ended September 30, 2014 |

For the Nine-Month Period Ended September 30, 2013 |

||||||

| Total revenue of real estate properties acquired, as reported |

$ | 22,042 | $ | 0 | ||||

| Pro forma rental income |

133,861 | 122,776 | ||||||

| Net income (loss) allocable to common shares of real estate properties acquired, as reported |

1,813 | 0 | ||||||

| Pro forma net income (loss) allocable to common shares |

(59,458 | ) | (166,797 | ) | ||||

| Earnings (loss) per share attributable to common shareholders of real estate properties acquired |

||||||||

| Basic and diluted—as reported |

0.02 | 0.00 | ||||||

| Basic and diluted—as pro forma |

(0.73 | ) | (2.50 | ) | ||||

We have not yet completed the process of estimating the fair value of assets acquired and liabilities assumed. Accordingly, our preliminary estimates and the allocation of the purchase price to the assets acquired and liabilities assumed may change as we complete the process. In accordance with FASB ASC Topic 805, changes, if any, to the preliminary estimates and allocation will be reported in our financial statements retrospectively. During the nine-month period ended September 30, 2014, we have not recorded any adjustments for prior period real estate acquisitions.

Dispositions:

During the nine-month period ended September 30, 2014, we disposed of one multi-family real estate property for a total sale price of $4,250. We recorded a loss on the sale of this asset of $2,526, of which $319 is included in the accompanying consolidated statements of operations during the nine-month period ended September 30, 2014.

17

Table of Contents

RAIT Financial Trust

Notes to Consolidated Financial Statements

As of September 30, 2014

(Unaudited and dollars in thousands, except share and per share amounts)

NOTE 6: INDEBTEDNESS

We maintain various forms of short-term and long-term financing arrangements. Generally, these financing agreements are collateralized by assets within securitizations. The following table summarizes our total recourse and non-recourse indebtedness as of September 30, 2014:

| Description |

Unpaid Principal Balance |

Carrying Amount |

Weighted- Average Interest Rate |

Contractual Maturity | ||||||||||

| Recourse indebtedness: |

||||||||||||||

| 7.0% convertible senior notes (1) |

$ | 34,066 | $ | 33,297 | 7.0 | % | Apr. 2031 | |||||||

| 4.0% convertible senior notes (2) |

141,750 | 133,752 | 4.0 | % | Oct. 2033 | |||||||||

| 7.625% senior notes |

60,000 | 60,000 | 7.6 | % | Apr. 2024 | |||||||||

| 7.125% senior notes |

71,905 | 71,905 | 7.1 | % | Aug. 2019 | |||||||||

| Secured credit facilities |

5,000 | 5,000 | 2.7 | % | Oct. 2016 | |||||||||

| Junior subordinated notes, at fair value (3) |

18,671 | 13,048 | 0.5 | % | Mar. 2035 | |||||||||

| Junior subordinated notes, at amortized cost |

25,100 | 25,100 | 2.7 | % | Apr. 2037 | |||||||||

| CMBS facilities |

159,171 | 159,171 | 2.4 | % | Nov. 2014 to Jul. 2016 | |||||||||

|

|

|

|

|

|

|

|||||||||

| Total recourse indebtedness (4) |

515,663 | 501,273 | 4.4 | % | ||||||||||

| Non-recourse indebtedness: |

||||||||||||||

| CDO notes payable, at amortized |

1,086,038 | 1,084,289 | 0.6 | % | 2045 to 2046 | |||||||||

| CDO notes payable, at fair value (3)(5)(7) |

846,941 | 431,142 | 1.0 | % | 2037 to 2038 | |||||||||

| CMBS securitizations (8) |

215,518 | 215,518 | 1.9 | % | Jan. 2029 to May 2031 | |||||||||

| Loans payable on real estate (9) |

379,259 | 381,095 | 4.7 | % | Sep. 2015 to Aug. 2024 | |||||||||

|

|

|

|

|

|

|

|||||||||

| Total non-recourse indebtedness |

2,527,756 | 2,112,044 | 1.4 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||

| Total indebtedness |

$ | 3,043,419 | $ | 2,613,317 | 1.9 | % | ||||||||

|

|

|

|

|

|

|

|||||||||

| (1) | Our 7.0% convertible senior notes are redeemable at par, at the option of the holder, in April 2016, April 2021, and April 2026. |

| (2) | Our 4.0% convertible senior notes are redeemable at par, at the option of the holder, in October 2018, October 2023, and October 2028. |

| (3) | Relates to liabilities which we elected to record at fair value under FASB ASC Topic 825. |

| (4) | Excludes senior secured notes issued by us with an aggregate principal amount equal to $80,000 with a weighted average coupon of 7.0%, which are eliminated in consolidation. |

| (5) | Excludes CDO notes payable purchased by us which are eliminated in consolidation. |

| (6) | Collateralized by $1,573,559 principal amount of commercial mortgages, mezzanine loans, other loans and preferred equity interests. These obligations were issued by separate legal entities and consequently the assets of the special purpose entities that collateralize these obligations are not available to our creditors. |