Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Pingtan Marine Enterprise Ltd. | v393300_ex31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - Pingtan Marine Enterprise Ltd. | v393300_ex23-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Pingtan Marine Enterprise Ltd. | v393300_ex31-2.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Pingtan Marine Enterprise Ltd. | Financial_Report.xls |

| EX-32.1 - EXHIBIT 32.1 - Pingtan Marine Enterprise Ltd. | v393300_ex32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Pingtan Marine Enterprise Ltd. | v393300_ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

Amendment No. 1 to

FORM 10-K

_____________________

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2013

Or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from: _____________ to _____________

_____________________

PINGTAN MARINE ENTERPRISE LTD.

(Exact name of registrant as specified in its charter)

_____________________

| Cayman Islands | 001-35192 | N/A |

| (State or Other Jurisdiction | (Commission | (I.R.S. Employer |

| of Incorporation or Organization) | File Number) | Identification No.) |

18/F, Zhongshan Building A,

No. 154 Hudong Road

Fuzhou, P.R.C. 350001

(Address of Principal Executive Office) (Zip Code)

(86) 591-8727-1266

(Registrant’s telephone number, including area code)

_____________________

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Ordinary Shares, $0.001 par value | The NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

_____________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer | ¨ | Accelerated filer | x | ||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant was approximately $127.3 million as of June 29, 2013, the last business day of the registrant’s most recently completed second fiscal quarter.

The number of shares of the registrant’s ordinary shares outstanding as of March 10, 2014 was 79,055,053.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference from the Proxy Statement relating to the 2014 Annual Meeting of Stockholders.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (this “Amendment”) of Pingtan Marine Enterprise Ltd. (“PME” or the “Company”) for the period ended December 31, 2013 is amending the Annual Report on Form 10-K originally filed with the U.S. Securities and Exchange Commission (“SEC”) on March 10, 2014 (the “Original Report”). We are filing this Amendment to reflect the restatement of our audited consolidated financial statements contained herein for the years ended December 31, 2013 and 2012. We incorrectly reflected certain balances of China Growth Equity Investments Ltd. in our consolidated financial statements that should have been reflected as part of the recapitalization of the Company on the effective date of the share exchange agreement dated February 25, 2013. Accordingly, we amended our consolidated financial statements for the years ended December 31, 2013 and 2012 to reflect the historical consolidated financial statements of China Dredging Group Co., Ltd. (”CDGC”) and Merchant Supreme jointly as the accounting acquirer prior to February 25, 2013 and the consolidated financial statements of PME, CDGC and Merchant Supreme and related subsidiaries for all periods subsequent to the effective date.

Additionally, we restated the following in our consolidated financial statements for the year ended December 31, 2013:

| a) | We incorrectly accounted for prepaid operating license rights for 20 vessels at its appraised fair value in Original Report. The management concluded that prepaid operating license rights should be considered a capital lease and recorded at the historical cost of the vessels to the related party which is under common control and considered a common control transaction in accordance with ASC 805-50. We restated prepaid operating license rights, property, plant and equipment, related depreciation and amortization expense, and reflected any excess amounts paid for the operating rights as a capital distribution; |

| b) | We further clarified certain disclosure related to the acquisition of 46 vessels from a related party in June 2013 and disclosure related to the acquisition of operating license rights of 20 vessels from a related party in December 2013; and |

| c) | We recorded other miscellaneous adjustments. |

Item 15. under Note 23 “Restatement” in the Notes to Consolidated Financial Statements of this Form 10-K/A provides a discussion of the full effects of the restatements to the Company’s previously reported Consolidated Balance Sheets, Consolidated Statements of Income and Comprehensive Income, and Consolidated Statement of Cash Flows.

In addition, this Amendment which replaces in its entirety Items 1 through 15 of the Original Filing, is in response to and to revise certain disclosures pursuant to the comment letters we received from the SEC, dated August 6, 2014 and September 10, 2014, respectively.

This Amendment also contains currently dated certifications as Exhibits 31.1, 31.2 and 32.1. No attempt has been made in this Amendment to modify or update the other disclosures presented in the report as previously filed, except as set forth herein. This Amendment does not reflect events occurring after the filing of the Original Report or modify or update those disclosures that may be affected by subsequent events. Accordingly, this Amendment should be read in conjunction with our other filings with the SEC made by the Company with the SEC pursuant to Section 13(a) or Section 15(d) of the Exchange Act subsequent to the filing of the Original Filing.

2013 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

| 2 |

CAUTIONARY STATEMENT FOR PURPOSES OF THE “SAFE HARBOR” STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

Statements in this report that are not historical facts or information are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “estimate,” “project,” “forecast,” “plan,” “believe,” “may,” “expect,” “anticipate,” “intend,” “planned,” “potential,” “can,” “expectation” and similar expressions, or the negative of those expressions, may identify forward-looking statements. Such forward-looking statements are based on management’s reasonable current assumptions and expectations. Such forward-looking statements involve risks, uncertainties and other factors, which may cause our actual results, levels of activity, performance or achievement to be materially different from any future results expressed or implied by such forward-looking statements, and there can be no assurance that actual results will not differ materially from management’s expectations. Such factors include, among others, the following:

| • | anticipated growth and growth strategies; |

| • | need for additional capital and the availability of financing; |

| • | our ability to successfully manage relationships with customers, distributors and other important relationships;; |

| • | technological changes; |

| • | competition; |

| • | demand for our products and services; |

| • | the deterioration of general economic conditions, whether internationally, nationally or in the local markets in which we operate; |

| • | legislative or regulatory changes that may adversely affect our business; and |

| • | other risks, including those described in the “Risk Factors” discussion of this annual report. |

We undertake no obligation to update any such forward looking statement, except as required by law.

| 3 |

Our Business

We are a marine enterprises group primarily engaging in ocean fishing through our wholly-owned PRC operating subsidiary and VIE, Fujian Provincial Pingtan County Ocean Fishing Group Co., Ltd., or Pingtan Fishing. We harvest a variety of fish species with our owned and licensed vessels operating within the Indian Exclusive Economic Zone and the Arafura Sea of Indonesia. We provide high quality seafood to a diverse group of customers including distributors, restaurant owners and exporters in the PRC.

In June 2013, we expanded our fleet from 40 to 86 through a purchase of 46 fishing trawlers from a related party for a total consideration of $410.1 million. We began operating the vessels in the third quarter of 2013 and since then we have been entitled to their operations and net profits. These vessels are fully licensed to fish in Indonesian waters. Each vessel carries crew of 10 to 15 persons. These vessels have resulted in additional carrying capacity of approximately 45,000 to 50,000 tons for us.

In September 2013, we further increased our fleet to 106 vessels with the addition of 20 newly-built fishing trawlers, which were initially ordered in September 2012. These vessels have an expected run-in period of 3 - 6 months, during which each is placed into the sea for testing prior to full operation. These vessels are fully licensed to fish in Indian and Indonesian waters. At full operation, each vessel is capable of harvesting 900 to 1,000 tons of fish. We expect that the expansions of our fleet will greatly increase our fish harvest volume and revenue.

Subsequent to our fleet expansions, in September 2013, the Ministry of Agriculture of the People’s Republic of China (“MOA”) issued a notification that it would suspend accepting shipbuilding applications for tuna harvesting vessels, squid harvesting vessels, Pacific saury harvesting vessels, trawlers operating on international waters, seine on international waters, and trawlers operating on the Arafura Sea, Indonesia. We believe the announcement is a positive indicator for long-term stability and balance in China’s fishing industry. We believe that this has helped to ensure our fishing productivity in international waters, while also serving as a major barrier to entry for competitors in our industry and strengthening our competitive position in the markets.

In December 2013, we further expanded our fleet to 126 vessels with the addition of the 25-year exclusive operating license rights for 20 new fishing drifters from a related party. Currently we operate 104 trawlers and 22 drifters (including 20 drifter vessels we operating pursuant to an operating license rights agreement) and our fleet has an average useful life of approximately 17 years. These vessels are fully licensed to fish in Indonesian or Indian waters. 114 of these vessels are operating in Arafura Sea in Indonesia, and the remaining 12 vessels are operating in the Bay of Bengal in India.

Currently we catch nearly 30 different species of fish including ribbon fish, Indian white shrimp, croaker fish, pomfret, Spanish mackerel, conger eel, squid and red snapper. All of our catch is shipped back to China. Our fishing vessels transport frozen catch to cold storage warehouse at nearby onshore fishing bases. We then arrange periodic charted transportation ships to deliver frozen stocks to our eight cold storage warehouses located in one of China’s largest seafood trading centers, Mawei Seafood Market in Fujian Province.

We derive our revenue primarily from the sales of frozen seafood products. We sell our products directly to customers including distributors, restaurant owners and exporters, and most of our customers have long-term and trustworthy cooperative relationship with us. Our existing customers also introduce new customers to us from time to time. Our operating results are subject to seasonal variations. Harvest volume is the highest in the fourth quarter of the year and harvest volumes in the second and third quarters are relatively low due to the spawning season of certain fish species, including ribbon fish, cuttlefish, butterfish, and calamari. Based on past experiences, demand for seafood products is the highest from December to January during Chinese New Year. We believe that our profitability and growth are dependent on our ability to expand the customer base. With the expansions of operating capacity and expected increasing harvest volume in the coming years, we will continue to develop new customers from existing and new territories in China.

Government Permits and Approvals

We are required to go through series of procedures to obtain all approvals necessary to fish in the dedicated fishing areas.

Step one: Obtaining Vessel Building Permits

| 4 |

First, we have to file a vessel building application to the relevant governmental authorities in Fujian to obtain the Fishing Vessel and Net Tools Building Permits. Governmental authorities in Fujian verify Pingtan Fishing’s qualifications for pelagic fishing and pass on the verified and approved application documents to affiliates of the Ministry of Agriculture for further confirmation. Once confirmed, the certificates are issued to Pingtan Fishing.

Step two: Vessels Building and Inspection

After obtaining the Fishing Vessel and Net Tools Building Permits, we start building the new vessels through contracting with third party vessel manufacturers. During the period of construction, inspection of the vessels is performed several times by the relevant governmental authorities. Once the construction is completed, a Vessel Inspection Certificate is issued, after which we can apply for certificates of ownership and certificates of nationality for new vessels.

Step three: Fishing Project Application

After obtaining all certificates in step two, we file applications to the relevant governmental authorities to obtain approvals for pelagic fishing projects in the specified fishing areas. Meanwhile, we start the application process for obtaining fishing permits from the relevant governmental authorities in the applicable fishing destination countries.

Step four: Preparations Before Departure

Once the approval for pelagic fishing projects is issued, we can complete all relevant departure procedures within six months from the time the notification of approval is issued. Departure procedures include obtaining visas for fishing vessels and crew members, submitting required certificates to the PRC customs in Fujian, and obtaining other relevant documents from governmental authorities, such as Vessel Departure Certificates.

Step five: Fishing Project Approval and Departure to Fishing Areas

After we have submitted all required documents to the relevant governmental authorities and completed all procedures required for departure, we receive confirmation of pelagic fishing project approval from affiliates of the Ministry of Agriculture. Once we obtain such confirmation, our vessels can departure to the applicable fishing destination country. Fish caught at the destination may then be shipped back and be declared at the PRC customs.

Operations

Harvesting Operations

The fishing vessels can carry up to one-month of supplies. The captains of the vessels utilize sophisticated technology to identify, among other things, fishing areas, time to cast and draw in the nets, vessel speed and sailing direction allowing the vessels to optimize the catch and resource value. Nearby fishing groups share real-time fishing information through wireless radio equipment. The catch is separated based on species and sizes, and is frozen immediately.

Once the storage of a fishing vessel is at capacity, it returns to the fishing base and transfers the catch to a transportation vessels docked at the fishing base port. We have entered into a contract with Avona Mina Lestari (“Avona”), which operates a fishing base owned by Mr. Xinrong Zhuo, our founder and chairman, to obtain access to the base and secure certain services including custom declaration and fishing permits registrations. We also use the fishing base to repair our vessels, if necessary.

Transportation

Transportation vessels are responsible for the shipment of fishing supplies and fish between the fishing areas and China. Pingtan Fishing ships its goods by contracting with three affiliate marine transportation firms and Avona. The transportation cycle takes no more than 30 days, depending mainly on the fishing seasons. There is always a transportation vessel anchored in the port of the fishing base.

Seasonality

The peak season for the fishing industry in Indonesia is from October to January, which is when harvesting is most productive. During the low season, from May to July, there are fewer fish as they migrate to different areas. There is no off season for fishing in Pingtan Fishing’s dedicated fishing zone in Indonesia.

| 5 |

In addition to seasonality, our annual catches are affected by a number of unpredictable factors, such as weather patterns and fish migration, which are likely to vary from year to year.

Cold Storage

Fish are stored separately according to different species and sizes for best practices of cold storage management, goods selectivity and delivery. When Pingtan Fishing unloads the fish, it places the fish on a wood pallet according to fishing vessel number, species and size. The cold storage administrator counts the number of bags on each pallet and weighs each pallet to record the weight. Pallets with bags of fish are then placed in specified positions within the cold storage facilities.

We have secured eight cold storages located in one of China’s largest seafood trading center, MaWei seafood market. The monthly rent for the cold storage is RMB80 ($13) per square meter and the leases are renewable annually. The following table sets forth information regarding the cold storages we currently rent as of December 31, 2013:

| Storage Capacity | ||||||||

| Cold Storage | (sq. meters) | Monthly rent | ||||||

| #301 | 1,045 | 13,613 | ||||||

| #302 | 717 | 9,340 | ||||||

| #602 | 717 | 9,340 | ||||||

| #103 | 776 | 10,109 | ||||||

| #303 | 1,045 | 13,613 | ||||||

| #401 | 1,045 | 13,613 | ||||||

| #402 | 717 | 9,340 | ||||||

| #403 | 1,045 | 13,613 | ||||||

| Total | 7,107 | 92,581 | ||||||

Sales, Marketing and Distribution

We market, sell and distribute products all over China, including the Guangdong, Fujian and Zhejiang provinces. Ribbon fish and shrimp were the main types of seafood sold for the year ended December 31, 2013, representing over 55% of the sales.

We have established long-term relationships with a number of customers, who send purchasing representatives to our cold storage facilities to select goods to purchase. The customer indicates the type, size and quantity as well as price and delivery schedules before the fish is moved into our cold storage facilities. Handling and transportation fees are borne by the customer when the goods are delivered. The proportion of these sales depends on the season and the nature of the catch including species, size and quality. Remaining products are sold out of cold storage within three months of landing.

As of December 31, 2013, we sold our fish to over 200 distributors and retailers by acting as a wholesaler. We serve a wide customer base and no customer accounted for more than 10% of the sales.

Vessels

As of December 31, 2013, we owned 104 trawlers and 2 drifter vessels and have an operating license right to 20 drifter vessels. Our fleet has an average useful life of approximately 17 years. These vessels are fully licensed to fish in Indonesian or Indian waters. 114 of these vessels are operating in Arafura Sea in Indonesia, and the remaining 12 vessels are operating in the Bay of Bengal in India.

Single trawling vessels drag pocket-shaped nets and therefore force the fish into the nets. The trawl net on a trawling vessel is drawn by a winch on the deck of the vessel. Fish are sorted and stored in the cold storage on board the vessel. Single trawling vessels can catch species living in the upper layer of water. It has the advantage of catching multiple species of fish, which leads to a varied catch. Single trawling vessels are the majority of fishing vessels we currently use. As of December 31, 2013, we operated 104 trawling vessels. 92 of the trawling vessels were in operation in Indonesian waters and the others were in Indian waters.

| 6 |

Drifter vessels, as known as drifter netter vessels, have a gill net that is tied to the drift netter floats with weights attached to the net to keep it vertical, so that fish crossing the path of a drift net gets caught in it. Operations are generally carried out at night and the position of gill nets can be adjusted according to the water depth in which the fish move at any time. Drifter netter vessels are mainly used to catch dispersed fish or fish swimming in the upper layer of water. We operate 2 drifter vessels which are owned and 20 which we hold operating license rights to those vessels as of December 31, 2013 and all of them are fishing in Indonesian waters.

| 7 |

Business Strategy

We are committed to developing our business to become a global, integrated seafood company. We plan to enlarge our fishing fleet in the next few years through organic growth and acquisition opportunities of potential targets, domestically and abroad, which will significantly increase our fishing capability and our market share.

We are actively seeking opportunities to expand to other fishing grounds worldwide including North America, South America and the High Sea, which will further diversify the fish types we harvest as well as decrease our dependence on Indonesia. We are also planning to extend to fish processing business. If we operate fish processing plants, we will market processed food products throughout all of China and worldwide. At the same time, we will strengthen our brand recognition in the market, which will allow us to achieve forward integration of the industrial chain and hence increase its profitability.

| 8 |

Competition

We engage in the fishing business in the Arafura Sea in Indonesia and the Bay of Bengal in India. Competition within our dedicated fishing areas is not significant, as the region is not currently overfished.

Competition in the market in China is high as fish compete with other sources of protein. We compete with other fishing companies which offer similar and varied products. There is significant demand for fish in the Chinese market. Our catch appeals to a wide segment of consumers because of the low price points of our products. We have generally been able to sell our catch at market prices, which have been increasing over the past 3 years.

Employees

As of December 31, 2013, we had 1,535 employees. The following table sets forth the number of employees by function as of December 31, 2013:

| Number of Employees | % of Total | |||||||

| Management and administrative staff | 45 | 2.9 | % | |||||

| Crew members | 1,490 | 97.1 | % | |||||

| Total | 1,535 | 100.0 | % | |||||

We also use local Indonesian and Indian contract labor to supplement the Chinese crew, which varies based on seasons. In addition, we engage Avona as our agent to contract with third party labor companies to hire local crew members and we pay the hiring costs based on the actual fees incurred. The Company and Avona settle this payment on a quarterly basis. Welfare and benefit payments for such personnel are covered by the company supplying the crew members.

Company History

China Equity Growth Investment Ltd. (“CGEI”) was incorporated in the Cayman Islands as an exempted limited liability company, was incorporated as a blank check company on January 18, 2010 with the purpose of directly or indirectly acquiring, through a merger, share exchange, asset acquisition, plan of arrangement, recapitalization, reorganization or similar business combination, an operating business, or control of such operating business through contractual arrangements, that has its principal business and/or material operations located in the PRC. In connection with its initial business combination, CGEI changed its name to Pingtan Marine Enterprise Ltd. in February 2013.

China Dredging Group Co., Ltd (“CDGC” or “China Dredging”) and Merchant Supreme Co., Ltd (“Merchant Supreme”) are limited liability companies incorporated on April 14, 2010 and June 25, 2012, respectively, in the British Virgin Islands (“BVI”).

China Dredging, through its PRC Variable Interest Entity (“VIE”), Fujian Xinggang Port Service Co., Ltd (“Fujian Service”), provided specialized dredging services exclusively to the PRC marine infrastructure market and is, based on the number and capacity of the dredging vessels it operates, one of the leading independent (not state-owned) providers of such services in the PRC. Since its inception, China Dredging has functioned exclusively as a specialist subcontractor, performing dredging services for other companies licensed to function as general contractors. China Dredging engages in capital dredging (dredging carried out to create a new harbor, berth or waterway or to deepen existing facilities in order to allow larger ships access), maintenance dredging and reclamation dredging projects and primarily sources its projects by subcontracting projects from general contractors.

Merchant Supreme, through its PRC VIE, Fujian Provincial Pingtan County Ocean Fishing Group Co., Ltd. (“Pingtan Fishing”) engages in ocean fishery with its fleet of self- owned vessels and vessels with exclusive operating license rights within Indian EEZ and Arafura Sea of Indonesia. Pingtan Fishing is ranked highly as one of the leading private (not state-owned) supplier and trader of oceanic aquatic products in PRC.

CGEI and CDGC entered into the Merger Agreement dated October 24, 2012, providing for the combination of CGEI and CDGC. Pursuant to the Merger Agreement, CDGC would continue as the surviving company and a wholly-owned subsidiary of CGEI. CGEI also acquired all of the outstanding capital shares and other equity interests of Merchant Supreme as per Share Purchase Agreement dated October 24, 2012. Following the completion of the business combination on February 25, 2013, CDGC and Merchant Supreme became the wholly-owned subsidiaries of the Company (the “Business Combination”). The ordinary shares, par value $0.001 per share were listed on The NASDAQ Capital Market under the symbol “PME”.

| 9 |

On June 19, 2013, the Company entered into a master agreement (“Master Agreement”) with a related party, Fuzhou Honglong Ocean Fishery Co., Ltd (“Hong Long”) to acquire 46 fishing vessels with total consideration of $410.1 million. The major shareholder of Hong Long is Ms. Ping Lin, spouse of Xinrong Zhuo, the Company’s Chairman and CEO, who holds 66.5%. Mr. Zhuo currently holds about 56.2% of PME. On September 1, 2013, the Company further entered into a Memorandum with Hong Long to clarify the procedure of delivery of such 46 vessels to Pingtan Fishing. Due to additional time required prepare the vessels for operations, the parties agreed under the Memorandum to deliver the vessels for operation on September 1, 2013. Since June 2013, the Company has had full ownership of the vessels and the full right to operate the vessels and is in the process of registering the vessels under the name of the Company’s PRC operating company. Currently, 9 of the 46 vessels are formally registered to the Company. The vessels are in the process of being registered under the name of the Company’s PRC operating company and it will obtain the entire title registration document for the vessels, as required by Chinese laws and regulations according to the terms of the Master Agreement.

In December 2013, we completed the sale of CDGC, which has been reported as a discontinued operation since the third quarter of 2013, to Hong Long. In July 2013, we received an offer from Mr. Zhuo to acquire the business and operating assets of our wholly-owned dredging subsidiary, CDGC and its PRC operating subsidiaries in exchange for (i) offset of our current $155.2 million 4% promissory note due to Hong Long; (ii) the assignment of the 25-year exclusive operating license rights for 20 new fishing vessels, with such rights appraised at $216.1 million; and (iii) offset of PME’s current accounts due to CDGC with amount $172.5 million. These 20 fishing vessels received subsidies from China’s central government budget in 2012, and a recent notification from the Government prohibits the sale or transfer of ownership for a period of 10 years for fishing vessels that have received such subsidies.

The Board, excluding Mr. Zhuo and our Senior Officer, Mr. Bin Lin, retained our independent financial advisor to provide a fairness opinion on the transaction proposed by Mr. Zhuo. Subsequent to the receipt of the fairness opinion from our independent financial advisor on October 28, 2013, the Board agreed to evaluate any potential alternative proposals received during a 30 day period. After receiving no alternative proposals, on December 3, 2013, the Board, excluding Mr. Zhuo and Mr. Lin approved the completion of the transaction and executed and closed the Share Purchase Agreement. The total consideration of the transaction is approximately $543.8 million with a gain on sale of $117.5 million accounted for in stockholders equity as it was sold to a related party with common control.

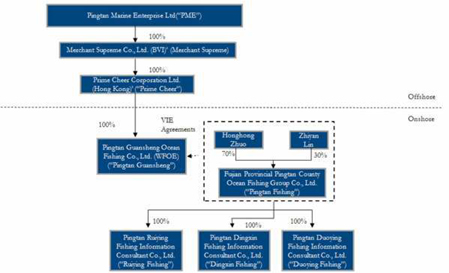

The PME/Pingtan Fishing VIE Relationship

Pingtan Fishing and WFOE, Pingtan Guansheng Ocean Fishing Co., Ltd., our wholly-owned subsidiary, has entered into a series of variable interest entity agreements (“VIE Agreements”). Under the VIE Agreements, we, among other things, fully control Pingtan Fishing’s business operations, policies and management, approve all matters requiring shareholders’ approval, and receive 100% of the annual net income earned Pingtan Fishing. Below is a summary of the Pingtan VIE Agreements.

The VIE Agreements

Our relationship with Pingtan Fishing and its shareholders are governed by a series of contractual arrangements, which agreements provide as follows.

Exclusive Purchase Right of Equity Interest. In October 2012, Pingtan Fishing, its shareholders and the WFOE entered into an exclusive option agreement, pursuant to which the shareholders of Pingtan Fishing irrevocably granted to the WFOE an exclusive right to purchase up to all of the equity interest in Pingtan Fishing, to the extent allowed under the current PRC laws. Accordingly, if and when the current limitations on direct ownership of Pingtan Fishing by the current shareholders are eased or ceased to apply under the PRC laws, WFOE may exercise its option to purchase and directly own the equity interests of Pingtan Fishing. The purchase price for the equity interest in Pingtan would be the minimum price as permitted by PRC laws at the time of the transfer. The term of the exclusive option agreement is 20 years, which term continuously renews unless the option is exercised in full or the agreement is otherwise terminated by the parties. The agreement also provides that upon consummation of the exercise of the option, the shareholders will contribute, without additional consideration, any funds actually received by it from the WFOE for the transfer of its equity interest in Pingtan Fishing to the WFOE. The agreement further provides that, as of the date of the agreement, the WFOE is entitled to all the future payments by Pingtan Fishing to the shareholders, together with all the profits of Pingtan Fishing.

| 10 |

Contracted Management Agreement. In October 2012, the WFOE, Pingtan Fishing and its shareholders entered into a management agreement pursuant to which the WFOE has the exclusive right to manage, operate and control the business operations of Pingtan Fishing, including, but not limited to, establishing and implementing policies for management, using all of the assets of Pingtan Fishing, appointing Pingtan Fishing directors and senior management, directing Pingtan Fishing to enter into loan agreement, making administrative decisions regarding employee wages or hiring and firing employees and other actions customarily associated with the Pingtan Fishing senior management and directors of Pingtan Fishing and its subsidiaries. As consideration for its business management services, the WFOE pays an annual fee to Pingtan Fishing, and Pingtan Fishing pays to the WFOE 100% of the net profits of Pingtan Fishing. The management agreement terminates upon the earlier of (i) the WFOE’s exercise in full of the option to purchase the equity interests of Pingtan Fishing, pursuant to the exclusive option agreement, and the WFOE and/or its designees individually or jointly own all of the equity interests in Pingtan Fishing, or (ii) 20 years after the effective date of the agreement subject to the right of the WFOE to renew the term of the management agreement for additional consecutive 20-year period.

The Contracted Management Agreement provides that the WFOE will pay an annual fee, which is currently RMB 1,000,000, to Pingtan Fishing as consideration for obtaining the operation and management rights of Pingtan Fishing, as well as 100% of its net profits. PRC law permits a company to manage and operate another company as an independent contractor. The amount of the consideration, which is customarily paid, may be agreed to by the parties and there is no statutory limit with regard to such compensation. In the Contracted Management Agreement executed between the WFOE and Pingtan Fishing, the consideration was agreed to by both parties in formalizing the contract.

Power of Attorney. In October 2012, the shareholders of Pingtan Fishing executed an irrevocable power of attorney granting to the WFOE or its designees the power to vote, pledge or dispose of all equity interests in Pingtan Fishing that the shareholders hold. Additionally, the power of attorney grants to the WFOE or its designees the power to appoint directors and senior management of Pingtan Fishing.

Equity Interest Pledge Agreement. In October 2012, the WFOE, Pingtan Fishing and it shareholders entered into an equity interest pledge agreement. To ensure that Pingtan Fishing and its shareholders perform their obligations under the exclusive call option agreement, the management agreement and the power of attorney, the shareholders have pledged their entire interest in Pingtan Fishing to the WFOE. The equity interest pledge agreement will terminate upon the earlier of (i) the purchase of the entire equity interest in Pingtan Fishing by the WFOE or (ii) 20 years after the effective date of the agreement, subject to the right of the WFOE to renew the term of the equity interest pledge agreement for additional consecutive 20 year periods in case of the WFOE or its designee’s failure to purchase the entire equity interest in Pingtan Fishing within the initial 20 year term. The Equity Interest Pledge Agreement was registered with Fuzhou AIC by Ms. Honghong Zhuo and Mr. Zhiyan Lin in December 2012, in order to legally pledge the entire equity interest of Pingtan Fishing as required by the agreement.

The following diagram illustrates our corporate structure as of the date of this annual report:

Available Information

Our website address is www.ptmarine.com. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (Exchange Act), are filed with the U.S. Securities and Exchange Commission (SEC). We are subject to the informational requirements of the Exchange Act and file or furnish reports, proxy statements, and other information with the SEC. Such reports and other information filed by the Company with the SEC are available free of charge on our website at ir.ptmarine.com when such reports are available on the SEC's website. We use our ir.ptmarine.com website as a means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor such portions of ir.ptmarine.com, in addition to following SEC filings and public conference calls and webcasts.

The public may read and copy any materials filed by Pingtan Marine with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov.

The contents of the websites referred to above are not incorporated into this filing. Further, our references to the URLs for these websites are intended to be inactive textual references only.

| 11 |

You should carefully consider each of the following risks associated with an investment in our publicly traded securities and all of the other information in our 2013 Annual Report. Our business may also be adversely affected by risks and uncertainties not presently known to us or that we currently believe to be immaterial. If any of the events contemplated by the following discussion of risks should occur, our business, prospects, financial condition and results of operations may suffer.

Risks Relating to Our Business

We depend significantly on our Chief Executive Officer.

We are dependent on the principal members of our management staff, and in particular Xinrong Zhuo, our Chief Executive Officer. While we have entered into a three-year employment agreement with Mr. Zhuo, there are circumstances under the agreement in which Mr. Zhuo may elect to terminate his employment. Even if Mr. Zhuo were to terminate employment in breach of his agreement, we would have little or no practical recourse against Mr. Zhuo under PRC law. Mr. Zhuo may not continue to be employed by us for as long as we require his services. In addition, we rely on members of our senior management team with industry experience for important aspects of our operations, and we believe that losing the services of these executive officers could be detrimental to our operations, and our operations because they would be difficult to replace. We do not have key-man life insurance for any of our executive officers or other employees.

We will need additional financing in order to execute our business plan, which may not be available to us.

We will need to obtain additional capital in order to execute its business plan to expand our operations by enlarging the fishing vessel fleet, expanding fishing ground worldwide and extend its business to fishmeal processing. Such additional capital may be raised by issuing securities through various financing transactions or arrangements, including joint ventures of projects, debt financing, equity financing or other means. Additional financing may not be available when needed on commercially reasonable terms or at all. The inability to obtain additional capital may reduce our ability to continue to conduct our business operations as currently contemplated.

Regulation of the fishing industry may have an adverse impact on our business.

For years, the international community has been aware of and concerned with the worldwide problem of depletion of natural fish stocks. In the past, these concerns have resulted in the imposition of quotas that subject individual countries to strict limitations on the amount of fish they are allowed to catch. Environmental groups have been lobbying to have additional limitations on fishing imposed and have even made suggestions that would limit the activities of fish farms. If international organizations or national governments were to impose additional limitations on fishing, this could have a negative impact on our results of operations.

The growth of our business depends on our ability to secure fishing licenses directly or through third parties.

Fishing is a highly regulated industry. Our operations require licenses, permits and in some cases renewals of licenses and permits from various governmental authorities. For example, commercial fishing operations are subject to government license requirements that permit them to make their catch. Our ability to obtain, sustain or renew such licenses and permits on acceptable terms is subject to changes in regulations and policies and to the discretion of the applicable governments, among other factors. Our inability to obtain, or a loss or denial of extensions, to any of these licenses or permits could hamper our ability to produce revenues from fishing operations. We operate 20 of our fishing vessels under 25-year exclusive operating license rights from our affiliate Hong Long. The fishing licenses for such 20 leased fishing vessels are held in the name of Hong Long and are therefore renewed by Hong Long. If Hong Long for any reason fails to renew such licenses, it may have a negative impact on our business.

We are dependent on affiliates and third parties for our operations.

A large portion of our transportation operations are conducted by three of our related parties, Haifeng Dafu Enterprise Company Limited, Hai Yi Shipping Limited and Hong Fa Shipping Limited. If for any reason these three companies became unable or unwilling to continue to provide services to us, this would likely lead to a temporary interruption in transportation at least until we found another entity that could provide these services. Failure to find a suitable replacement, even on a temporary basis, may have an adverse effect on our results of operations.

A large portion of our operations are conducted from a base owned by our related party PT. Avona Mina Lestari, or Avona. We contract with Avona for the right to use the base. Avona also handles certain agency services, including customs applications and fees for Merchant Supreme. If for any reason Avona became unable or unwilling to continue to provide its services to us, this would likely lead to a temporary interruption in our operations, at least until we found another entity that could provide these services. Failure to find a suitable replacement for Avona, even on a temporary basis, may have an adverse effect on our results of operations.

| 12 |

We may be adversely affected by fluctuations in raw material prices and selling prices of products.

The products and raw materials we use may experience price volatility caused by events such as market fluctuations, weather conditions or changes in governmental programs. Raw materials consist primarily of bait, including sardines, anchovies, mackerel and other small fish. The market price of these raw materials may also experience significant upward adjustment, if, for instance, there is a material under-supply or over-demand in the market. These prices changes may ultimately result in increases in the selling prices of products, and may, in turn, adversely affect our sales volume, revenue and operating profit.

We may not be able to effectively manage our growth, which may harm our profitability.

Our strategy is to expand our business. If we fail to effectively manage this growth, our financial results could be adversely affected. Growth may place a strain on management systems and resources, including business development capabilities, systems and processes and access to financing sources. As we grow, we must continue to hire, train, supervise and manage new employees. In connection with our fishing business, we may not be able to:

· meet capital needs;

· expand systems effectively or efficiently, or in a timely manner;

· allocate human resources optimally;

· identify and hire qualified employees or retain valued employees; or

· incorporate effectively the components of any business that may be acquired in our effort to achieve growth.

If we are unable to manage growth, our operations and financial results could be adversely affected by inefficiency, which could diminish our profitability.

Our business requires talented personnel who we may not be able to attract and retain.

We depend in large measure on the abilities, expertise, judgment, discretion, integrity and good faith of our management and other personnel in conducting the business of the company. We have a small management team, and the loss of a key individual or inability to attract suitably qualified staff could materially adversely impact the fishing business.

The key personnel of our fishing business are Mr. Deming Chen, vice general manager, Mr. Dong Wang, general coordinator of the shipping department, Mr. Qing Lin, assistant of the chairman of the board of directors, Mr. Longhao Zhuo, chief supervisor of the sales department, who is mainly responsible for wholesale and fresh sea food retail business. Mr. Lin assists the chairman in dealing with daily operating matters, such as developing business plans and managing and supervising related projects.

Our success depends on the ability of our management and employees to interpret and respond to economic, market and environmental conditions in its operating areas correctly. Further, our key personnel may not continue their association or employment, which and replacement personnel with comparable skills may not be available, which may adversely affect our business.

Our insurance coverage may be inadequate to cover we may incur or to fully replace a significant loss of assets.

Our involvement in the fishing industry may result in liability for pollution, property damage, personal injury or other hazards. Although we believe we have obtained insurance in accordance with PRC industry standards to address such risks, such insurance has limitations on liability and/or deductible amounts that may not be sufficient to cover the full extent of such liabilities or losses. In addition, such risks may not, in all circumstances, be insurable or, in certain circumstances, we may choose not to obtain insurance to protect against specific risks due to the high premiums associated with such insurance or for other reasons. The payment of such uninsured liabilities would reduce the funds available to us. If we suffer a significant event or occurrence that is not fully insured, or if the insurer of such event is not solvent, we could be required to divert funds from capital investment or other uses towards covering any liability or loss for such events.

| 13 |

Earthquakes, tsunamis, adverse weather or oceanic conditions or other calamities may disrupt our operations and could adversely affect sales.

Our fishing expeditions are based out of the Arafura Sea, Indonesia, and Merchant Supreme has cold storages located in MaWei in the Fujian province on the southeast coast of China. In 2004, an undersea earthquake occurred off the west coast of Sumatra Indonesia. This earthquake triggered a series of devastating tsunamis along the costs of most landmasses boarding the Indian Ocean. More than 225,000 people in 11 countries were killed, and coastal communities were inundated with waves up to 100 feet. Due to the location of our business, it may be at risk of experiencing another tsunami, earthquake or other adverse weather or oceanic conditions. This may result in the breakdown of facilities, such as its cold storage facilities, which could lead to deterioration of products with the potential for spoilage. This could also adversely affect the ability to fulfill sales orders and, accordingly, adversely affect profitability. Adverse weather conditions affecting the fishing grounds where our fishing vessels operate, such as storms, cyclones and typhoons, or cataclysmic events such as tsunamis, may also decrease the volume of fish catches or hamper fishing operations. Our operations may also be adversely affected by major climatic disruptions such as El Nino which in the past has caused significant decreases in seafood catches worldwide.

We may be affected by global climate change or by legal, regulatory or market responses to such changes.

The growing political and scientific sentiment is that increased concentrations of carbon dioxide and other greenhouse gases in the atmosphere are influencing global weather patterns. Fresh products, including seafood products, are vulnerable to adverse weather conditions, including windstorms, floods, drought and temperature extremes, which are quite common but difficult to predict and may be influenced by global climate change. Similarly, changing weather patterns, along with the increased frequency or duration of extreme weather conditions, could impact the availability of the fish species we catch.

Concern over climate change, including global warming, has led to legislative and regulatory initiatives directed at limiting greenhouse gas, or GHG, emissions. For example, proposals that would impose mandatory requirements on GHG emissions may be considered by policy makers in the territories in which we operate. Laws enacted that directly or indirectly affect fishing, distribution, packaging, cost of raw materials, fuel, and water could all adversely impact our business and financial results.

A dramatic reduction in fish resources may adversely affect our business.

We are in the business of catching and selling marine catch. Due to over-fishing, the stocks of certain species of fish may be dwindling and to counteract such over-fishing, governments may take action that may be detrimental to our ability to conduct operations. If the solution proffered or imposed by the governments controlling the fishing grounds were to limit the types, quantities and species of fish that we are able to catch, our operations and prospects may be adversely affected.

Changes in the policies of the PRC government impacting the fishing industry may adversely affect our business.

The fishing industry in the PRC is subject to policies implemented by the PRC government. The PRC government may impose restrictions on aspects of our business such as regulations for the management and ownership of vessels. If the raw materials used by us or our products become subject to any form of government control, then depending on the nature and extent of the control and our ability to make corresponding adjustments, we may face a material adverse effect on our business and operating results.

Separately, our business and operating results also could be adversely affected by changes in policies of the Chinese government such as: changes in laws, regulations or the interpretation thereof; confiscatory taxation; restrictions on currency conversion, imports on sources of supplies; or the expropriation or nationalization of private enterprises. Although the Chinese government has been pursuing economic reform policies for approximately two decades to liberalize the economy and introduce free market aspects, the government may not continue to pursue such policies and such policies may be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting China’s political, economic and social life.

We have entered into certain pledge agreements pledging 22 fishing vessels as collateral to secure a loan to Hong Long, a fishing company controlled by spouse of Mr. Xinrong Zhuo. The pledge has no beneficial purpose for us and we could lose our fishing vessels if Hong Long were to default on the loans, which could be detrimental for our operations.

In October 2012, we entered into two pledge contracts with China Minsheng Banking Corp., Ltd. pursuant to which we pledged 10 fishing vessels with carrying amounts of approximately $9,500,000, as collateral to secure Hong Long’s $10,300,000 in long-term loans from the financial institution, which are due April 18, 2015. In September 2013, we entered into two additional pledge contracts with China Minsheng Banking Corp., Ltd. pursuant to which we pledged another 12 fishing vessels with carrying amounts of approximately $10,900,000, as collateral to secure Hong Long’s $9,911,300 in short-term loans from the financial institution, which are due June 25, 2014. Consequently, if Hong Long was to default on the loans and we would lose the vessels, it could be detrimental for our operations.

| 14 |

Risks Relating to Doing Business in the PRC

Certain political and economic considerations relating to PRC could adversely affect us.

The PRC is passing from a planned economy to a market economy. The Chinese government has confirmed that economic development will follow a model of market economy under socialism. While the PRC government has pursued economic reforms since its adoption of the open-door policy in 1978, a large portion of the PRC economy is still operating under five-year plans and annual state plans adopted by the government that set down national economic development goals. Through these plans and other economic measures, such as control on foreign exchange, taxation and restrictions on foreign participation in the domestic market of various industries, the PRC government exerts considerable direct and indirect influence on the economy. Many of the economic reforms are unprecedented or experimental for the PRC government, and are expected to be refined and improved. Other political, economic and social factors can also lead to further readjustment of such reforms. This refining and readjustment process may not necessarily have a positive effect on our operations or our business development. Our operating results may be adversely affected by changes in the PRC’s economic and social conditions as well as by changes in the policies of the PRC government, which we may not be able to foresee, such as changes in laws and regulations (or the official interpretation thereof), measures which may be introduced to control inflation, changes in the rate or method of taxation, and imposition of additional restrictions on currency conversion.

The recent nature and uncertain application of many PRC laws applicable to us create an uncertain environment for business operations and they could have a negative effect on us.

The PRC legal system is a civil law system. Unlike the common law system, such as the legal system used in the United States, the civil law system is based on written statutes in which decided legal cases have little value as precedents. In 1979, the PRC began to promulgate a comprehensive system of laws and has since introduced many laws and regulations to provide general guidance on economic and business practices in the PRC and to regulate foreign investment. Progress has been made in the promulgation of laws and regulations dealing with economic matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. The promulgation of new laws, changes of existing laws and the abrogation of local regulations by national laws could have a negative impact on our, business and prospects. In addition, as these laws, regulations and legal requirements are relatively recent, their interpretation and enforcement involve significant uncertainty.

The political and economic policies of the PRC government could affect our businesses and results of operations.

The economy of the PRC differs from the economies of most developed countries in a number of respects, including the degree of government involvement, control of capital investment, and the overall level of development. Before its adoption of reform and open up policies in 1978, China was primarily a planned economy. In recent years the PRC government has been reforming the PRC economic system and the government structure. These reforms have resulted in significant economic growth and social progress. Economic reform measures, however, may be adjusted, modified or applied inconsistently from industry to industry or across different regions of the country. As a result, we may not continue to benefit from all, or any, of these measures. In addition, it cannot be predicted whether changes in the PRC’s political, economic and social conditions, laws, regulations and policies will have any adverse effect on our business, financial condition and results of operations.

The PRC legal system is evolving and has inherent uncertainties regarding interpretation and enforcement of PRC laws and regulations that could limit the legal protections available to you.

Pingtan Fishing, our PRC operating company, is organized under the laws of the PRC. The PRC legal system is based on written statutes. Prior court decisions may be cited for reference but have limited weight as precedents. Since 1979, the PRC government has been developing a comprehensive system of commercial laws and considerable progress has been made in introducing laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited number and non-binding nature of published cases, the interpretation and enforcement of these laws and regulations involve uncertainties.

| 15 |

Our operations and assets in the PRC are subject to significant political and economic uncertainties.

Changes in PRC laws and regulations, or their interpretation, or the imposition of confiscatory taxation, restrictions on currency conversion, imports and sources of supply, devaluations of currency or the nationalization or other expropriation of private enterprises could have a material adverse effect on our business, results of operations and financial condition. The PRC government has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. The PRC government may continue to pursue these policies, and it may significantly alter these policies from time to time without notice.

The consummation of the acquisition by the Pingtan Fishing share purchase agreement and the reorganization plan carried out by Pingtan Fishing may require prior approval from MOFCOM or the CSRC, which may subject us to sanctions or adversely affect our business, results of operations, reputation and prospects.

On August 8, 2006, six PRC regulatory authorities, including the Ministry of Commerce, or MOFCOM, the State Assets Supervision and Administration Commission, the State Administration for Taxation, the State Administration for Industry and Commerce, the China Securities Regulatory Commission, or the CSRC, and the State Administration of Foreign Exchange, or SAFE, jointly issued the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, which became effective on September 8, 2006 and was amended on June 22, 2009 by the MOFCOM, or the M&A Regulations. The M&A Regulations, among other things, require that the approval from MOFCOM be obtained for acquisitions of affiliated domestic entities by foreign entities established or controlled by domestic natural persons or enterprises, and also require that an offshore special purpose vehicle, or SPV, formed for purposes of overseas listing of equity interests in PRC companies and controlled directly or indirectly by PRC companies or individuals, obtain the approval of the CSRC prior to the listing and trading of such SPV’s securities on an overseas stock exchange. On September 21, 2006, the CSRC published on its official website procedures regarding its approval of overseas listings by SPVs. The CSRC approval procedures require the filing of a number of documents with the CSRC.

The application of the M&A Regulations remains unclear as of the date of this 10-K/A submission, with no consensus among leading PRC law firms regarding the scope and applicability of the CSRC approval requirement. Pingtan Fishing’s PRC legal counsel has advised, based on its understanding of current PRC laws, regulations and rules, that the M&A Regulations are not applicable to the consummation of the acquisition by the Pingtan Fishing share purchase agreement and the reorganization plan carried out by Pingtan Fishing because Merchant Supreme’s founder and controlling shareholder, Mr. Xinrong Zhuo, is not a mainland PRC natural person. However, the relevant PRC government authorities, including MOFCOM and the CSRC, may reach a different conclusion. If it is decided that the prior approval from MOFCOM or the CSRC is required, we may face sanctions by MOFCOM, the CSRC or other PRC regulatory agencies. Consequently, it is possible that MOFCOM, the CSRC or other PRC regulatory agencies may impose fines and penalties on our operations in the PRC, limit such operations, or take other actions that could have a material adverse effect on our business, financial condition, results of operations, reputation and prospects.

The Circular of Security Review and the Regulations of Security Review provide that any foreign investor should file an application with MOFCOM for the merger and acquisition of domestic enterprises in sensitive sectors or industries. Further, MOFCOM has, for its inner review process, stipulated a range of the business operation items which are required to be reviewed. With reference to such business items, Pingtan Fishing believes that the Regulations of Security Review do not apply to the business operations of Pingtan Fishing. However, the relevant PRC regulatory authorities may have a different view or interpretation in this regard when implementing the Regulations of Security Review. If it is decided that the acquisition by the Pingtan Fishing share purchase agreement may materially affect the state security of the PRC, we may be ordered to restore the shareholding structure to the status before the consummation of the said acquisition, which could have a material adverse effect on our business, financial condition, results of operations, reputation and prospects.

If SAFE determines that its foreign exchange regulations concerning “round-trip” investment apply to our shareholding structure, a failure by our shareholders or beneficial owners to comply with these regulations may restrict our ability to distribute profits, restrict our overseas and cross-border investment activities or subject us to liability under PRC laws, which may materially and adversely affect our business and prospects.

SAFE Circular No. 75 provides that those domestic individuals who hold a PRC identity card, passport or other legal identity supporting document, or who have no such legal identity in mainland PRC but are habitually residing in PRC for the sake of economic interest, whether they hold a PRC identity supporting document or not, should register with the local SAFE branch prior to their establishment or control of an offshore SPV. In addition, any PRC citizen, resident, or entity which is a direct or indirect shareholder of an SPV is required to update the previously filed registration with the local branch of SAFE, with respect to that SPV, to reflect any material change. Moreover, a PRC subsidiary of an SPV is required to urge its shareholders who are PRC citizens, residents, or entities to update their registration with the local branch of SAFE. If a PRC shareholder with a direct or indirect equity interest in an offshore parent company fails to make the required SAFE registration, the PRC subsidiaries of such offshore parent company may be prohibited from paying the offshore parent proceeds from any reduction in capital, share transfer or liquidation in respect of the PRC subsidiaries. Failure to comply with the SAFE Circular No. 75 could result in liability under PRC law for violation of the relevant rules relating to transfers of foreign exchange.

| 16 |

Our founder and controlling shareholder, Mr. Xinrong Zhuo, obtained his Hong Kong identity card in 2005 and surrendered his PRC identity card subsequently thereto. SAFE Circular No. 75 provides that individuals without PRC identities that habitually reside in mainland China for the sake of economic interest should be considered PRC residents, who are required to register their direct or indirect investments in offshore SPVs with the local branch of SAFE. SAFE Circular No. 75 further provides that individuals who have their permanent domicile in mainland China and have been permanently residing in mainland China after temporary departure should be considered PRC residents, no matter whether they have a PRC identity or not. Although he leaves the PRC from time to time and maintains his Hong Kong identity card, Mr. Xinrong Zhuo has been residing in mainland China for most of the time since the SAFE Circular No. 75 became effective. Accordingly, it is possible that PRC authorities may consider Mr. Zhuo to be PRC resident. As of the date of this10-K/A submission, Mr. Zhuo has not made registrations or filings according to SAFE Circular No. 75. Due to uncertainty over how SAFE Circular No. 75 will be interpreted and implemented, we cannot predict how SAFE Circular No. 75 will affect our business operations or future strategies following the business combination. If SAFE Circular No. 75 is determined to apply to us or any of our PRC resident shareholders, none of whom to our knowledge has made registrations or filings according to SAFE Circular No. 75, a failure by any such shareholders or beneficial owners to comply with SAFE Circular No. 75 may subject the relevant shareholders or beneficial owners to penalties under PRC foreign exchange administrative regulations, and may subject us to fines or legal sanctions, restrict our overseas or cross-border investment activities, limit our subsidiaries’ ability to make distributions or pay dividends or affect our ownership structure and capital inflow from the offshore entity, which would have a material adverse effect on our business, financial condition, results of operations and liquidity. In addition, we may not be informed of the identities of our beneficial owners and our Chinese resident beneficial owners, if any, may not comply with SAFE Circular No. 75. The failure or inability of our beneficial owners who are PRC citizens, residents or entities to make or amend any required registrations may subject these PRC residents or our PRC subsidiary to fines and legal sanctions, and may also limit our ability to contribute additional capital into our PRC subsidiary and limit our PRC subsidiary’s ability to make distributions or pay dividends to us, as a result of which our business operations and our ability to distribute profits to its shareholders may be materially and adversely affected.

In December 2009, the PRC State Administration for Taxation issued a notice, known as “Circular 698,” addressing PRC income tax issues in connection with transfers of equity by a non-PRC resident enterprise that directly or indirectly holds an interest in a PRC resident enterprise. Circular 698 requires certain tax filings with, and the submission of comprehensive information to, the applicable tax authorities regarding transfers of equity by a non-PRC resident enterprise that directly or indirectly holds an interest in a PRC resident enterprise. The filings and submissions are designed to assist the taxing authorities in evaluating whether the transfer has a reasonable business purpose. If the transfer does not have a reasonable business purpose, Circular 698 provides that the seller is subject to PRC income tax on the gains received from the transfer of the PRC resident enterprise. Although the tax obligations generally apply to the seller, the PRC resident enterprise that is transferred is also subject to certain requirements to assist the PRC tax authorities in collecting the taxes, potentially including withholding agent obligations. Circular 698 is relatively new with limited implementation guidance, and it is uncertain how it will be interpreted, implemented or enforced. For example, there is no clear guidance regarding what constitutes a “reasonable business purpose” or the assistance obligation applicable to the transferred PRC resident enterprise. We cannot predict how Circular 698 will apply to current or future acquisition strategies and business operations. For example, if our affiliated PRC entities are deemed to have been sold through an offshore holding company, we may face comprehensive filing obligations that could result in significant taxes, potential sanctions or other enforcement action, or other adverse considerations, which could have an adverse impact on our ability to consummate such a transaction or expand our business and market share.

| 17 |

We may be classified as a PRC “resident enterprise” under the PRC enterprise income tax law, which could result in unfavorable tax consequences for us and our shareholders and have a material adverse effect on our results of operations.

Under the Enterprise Income Tax Law of the PRC, or the EIT Law, dividends, interests, rent, royalties and gains on transfers of property payable by a foreign-invested enterprise in China to its foreign investor who is a non-resident enterprise will be subject to a 10% withholding tax, unless such non-resident enterprise’s jurisdiction of incorporation has a tax treaty with China that provides for a reduced rate of withholding tax. Under the arrangement for avoidance of double taxation between mainland China and Hong Kong, the effective withholding tax applicable to a Hong Kong non-resident company is 5% if it directly owns no less than a 25% stake in the Chinese foreign-invested enterprise.

Under the EIT Law, an enterprise established outside China with its “de facto management body” within China is considered a “resident enterprise” in China and is subject to the Chinese enterprise income tax at the rate of 25% on its worldwide income. We may be deemed to be a PRC resident enterprise under the EIT Law and be subject to the PRC enterprise income tax at the rate of 25% on its worldwide income. If the Chinese tax authorities determine that we should be classified as a resident enterprise, foreign securities holders will be subject to a 10% withholding tax upon dividends payable by us and subject to income tax upon gains on the sale of securities under the EIT Law.

Due to various restrictions under PRC laws on the distribution of dividends by PRC operating companies, we may not be able to pay dividends to our shareholders.

The Wholly-Foreign Owned Enterprise Law (1986), as amended, The Wholly-Foreign Owned Enterprise Law Implementing Rules (1990), as amended, and the Company Law of the PRC (2006) contain the principal regulations governing dividend distributions by Wholly-Foreign Owned Enterprises, or WFOEs. Under these regulations, WFOEs may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. Additionally, they are required to set aside each year 10% of its net profits, if any, based on PRC accounting standards, to fund a statutory surplus reserve until the accumulated amount of such reserve reaches 50% of their respective registered capital. These reserves are not distributable as cash dividends except in the event of liquidation and cannot be used for working capital purposes. The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. We may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from the profits of our WFOE.

Furthermore, if our subsidiaries in the PRC incur debt on their own in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments. If we or our subsidiaries are unable to receive all of the economic value from the operations of our PRC subsidiary through contractual or dividend arrangements, we may be unable to pay dividends on our ordinary shares.

Because our principal assets are located outside of the United States and our directors and officers reside outside of the United States, it may be difficult for you to enforce your rights based on the United States federal securities laws against us and our officers and directors in the United States or to enforce foreign judgments or bring original actions in the PRC against us or our management.

All of our officers and directors reside outside of the United States. In addition, our operating subsidiaries are located in the PRC and all of their assets are located outside of the United States. The PRC does not have a treaty with United States providing for the reciprocal recognition and enforcement of judgments of courts. Therefore, it may be difficult for investors in the United States to enforce their legal rights based on the civil liability provisions of the United States federal securities laws against us in the courts of either the United States or the PRC and, even if civil judgments are obtained in courts of the United States, to enforce such judgments in PRC courts.

In addition, since we are incorporated under the laws of the Cayman Islands and our corporate affairs are governed by the laws of the Cayman Islands, it may not be possible for investors to originate actions against us or our directors or officers based upon PRC laws, and it may be difficult, if possible at all, to bring actions based upon Cayman Islands laws in the PRC in the event that you believe that your rights as a shareholder have been infringed.

Our employment practices may be adversely impacted under the labor contract law of the PRC.

The PRC National People’s Congress promulgated the Labor Contract Law, which became effective on January 1, 2008. Compared to previous labor laws, the Labor Contract Law provides stronger protection for employees and imposes more obligations on employers. According to the Labor Contract Law, employers have the obligation to enter into written labor contracts with employees to specify the key terms of the employment relationship. The law also stipulates, among other things, (i) that all written labor contracts shall contain certain requisite terms; (ii) that the length of trial employment periods must be in proportion to the terms of the relevant labor contracts, which in any event may not be longer than six months; (iii) that in certain circumstances, a labor contract is deemed to be without a fixed term and thus an employee can only be terminated with cause; and (iv) that there are certain restrictions on the circumstances under which employers may terminate labor contracts as well as the economic compensations to employees upon termination of the employee’s employment.

| 18 |

In addition, if we decide to significantly change or downsize our workforce, the Labor Contract Law could restrict our ability to terminate employee contracts and adversely affect our ability to make such changes to our work force in a manner that is most favorable to our business or in a timely and cost effective manner, which in turn may materially and adversely affect our financial condition and results of operations. If we are subject to severe penalties or incur significant legal fees in connection with labor law disputes or investigations, our business, financial condition and results of operations may be adversely affected.

Investors will have limited access to corporate records filed with the relevant PRC government authorities by the PRC operating entities.

All our PRC subsidiaries are companies registered in Fujian Province. The PRC State Administration for Industry and Commerce and its local counterparts, or collectively SAIC, is the PRC government authority governing the market supervision and administrative enforcement of various business licensing laws. According to the relevant SAIC regulations, certain corporate records of a company should be filed with SAIC, for example, the annual financial report, shareholder changes, amendments of articles of association, registered capital changes, capital verification reports and equity interest pledge registration. In Fujian Province, an individual can gain access to information filed with SAIC only with the authorization of the company for which such information is filed. Alternatively, access to information can be granted by an order of a PRC people’s court, provided that the individual requesting the information is a party to litigation involving the company in question. Due to such restrictions, investors will have limited access to corporate records filed with the SAIC by our PRC affiliates.

Currency fluctuations and restrictions on currency exchange may adversely affect our business, including limiting our ability to convert Renminbi into foreign currencies and, if Renminbi were to decline in value, reducing our revenue in U.S. dollar terms.