Attached files

| file | filename |

|---|---|

| EX-10.48 - EX-10.48 - Peak Resorts Inc | a2222106zex-10_48.htm |

| EX-4.1 - EX-4.1 - Peak Resorts Inc | a2222106zex-4_1.htm |

| EX-5.1 - EX-5.1 - Peak Resorts Inc | a2222106zex-5_1.htm |

| EX-10.46 - EX-10.46 - Peak Resorts Inc | a2222106zex-10_46.htm |

| EX-10.49 - EX-10.49 - Peak Resorts Inc | a2222106zex-10_49.htm |

| EX-1.1 - EX-1.1 - Peak Resorts Inc | a2222106zex-1_1.htm |

| EX-10.47 - EX-10.47 - Peak Resorts Inc | a2222106zex-10_47.htm |

| EX-10.50 - EX-10.50 - Peak Resorts Inc | a2222106zex-10_50.htm |

| EX-23.2 - EX-23.2 - Peak Resorts Inc | a2222106zex-23_2.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on November 10, 2014

Registration No. 333-199488

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Peak Resorts, Inc.

(Exact name of registrant as specified in its charter)

| Missouri (State or other jurisdiction of incorporation or organization) |

7990 (Primary Standard Industrial Classification Code Number) |

43-1793922 (IRS Employer Identification No.) |

17409 Hidden Valley Drive

Wildwood, Missouri 63025

(636) 938-7474

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Timothy D. Boyd

17409 Hidden Valley Drive

Wildwood, Missouri 63025

(636) 549-0060

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| With copies to: | ||

David W. Braswell Armstrong Teasdale LLP 7700 Forsyth Boulevard, Suite 1800 St. Louis, Missouri 63105 (314) 552-6631 |

Carmelo M. Gordian Ted A. Gilman Michelle D. Kwan Andrews Kurth LLP 111 Congress Avenue, Suite 1700 Austin, Texas 78701 (512) 320-9290 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement is declared effective.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated November 10, 2014

PRELIMINARY PROSPECTUS

10,000,000 Shares

Peak Resorts, Inc.

Common Stock

This is the initial public offering of our common stock. We are offering 10,000,000 shares of our common stock. No public market currently exists for our common stock. We currently expect the initial public offering price to be between $9.00 and $11.00 per share. We have applied to list our common stock on the NASDAQ Global Market ("NASDAQ") under the symbol "SKIS". There is no assurance that this application will be approved.

Investing in our common stock involves risk. See "Risk Factors" beginning on page 19 to read about risks you should consider before buying our common stock.

Neither the Securities and Exchange Commission (the "SEC"), any state securities commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this registration statement. Any representation to the contrary is a criminal offense.

|

||||

| |

Per Share |

Total |

||

|---|---|---|---|---|

Initial public offering price |

$ | $ | ||

Underwriting discount and commissions |

$ | $ | ||

Proceeds, before expenses, to us |

$ | $ | ||

|

||||

The underwriters have an option exercisable within 45 days from the date of this Prospectus to purchase up to 1,500,000 additional shares of common stock from us at the initial public offering price, less the underwriting discount and commissions to cover over-allotments of shares. The shares of common stock issuable upon exercise of the underwriters' over-allotment option have been registered under the registration statement of which this Prospectus forms a part.

The underwriters expect to deliver the common stock against payment in U.S. dollars in New York, New York on or about • , 2014.

| FBR | Stifel | Baird |

| Janney Montgomery Scott | Oppenheimer & Co. |

Prospectus dated , 2014

No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this Prospectus. You must not rely on any unauthorized information or representations. This Prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this Prospectus is current only as of its date.

For investors outside the U.S.: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this Prospectus in any jurisdiction where action for that purpose is required, other than in the U.S. Persons outside the U.S. who come into possession of this Prospectus must inform themselves of, and observe, any restrictions relating to the offering of the shares of our common stock and the distribution of this Prospectus outside the U.S.

Dealer Prospectus Delivery Obligation

Through and including , 2014 (the 25th day after the date of this Prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a Prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Trademarks, Trade Names and Service Marks

Wildcat Mountain Ski AreaSM, Mount Snow®, Boston Mills Ski ResortSM, Hidden ValleySM, Crotched Mountain Ski AreaSM and Alpine Valley are trademarks, service marks and trade names owned by certain

i

subsidiaries of Peak Resorts, Inc. All other brand names, trademarks, trade names and service marks referred to in this Prospectus are the property of their respective owners.

Market data and certain industry forecasts used herein were obtained from internal surveys, market research, publicly available information and industry publications. For purposes of comparing market data with Company performance, the term EBITDA is calculated as net income before interest, depreciation and amortization. While we believe that the market research, publicly available information and industry publications we use are reliable, we have not independently verified market and industry data from third-party sources. Moreover, while we believe our internal surveys are reliable, they have not been verified by any independent source.

ii

This summary highlights information contained elsewhere in this Prospectus. Because this is only a summary, it does not contain all of the information that you should consider in making your investment decision. For a more complete understanding of us and this offering, you should read and consider the entire Prospectus, including the information set forth under "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the financial statements and related notes thereto before deciding whether to invest in our common stock.

Except as otherwise required by the context, references to "Company," "Peak," "we," "us" and "our" are to Peak Resorts, Inc. and its subsidiaries. The historical financial statements and financial data included in this Prospectus are those of Peak Resorts, Inc. and its consolidated subsidiaries. Unless otherwise indicated, we have derived industry data from publicly available sources that we believe are reliable.

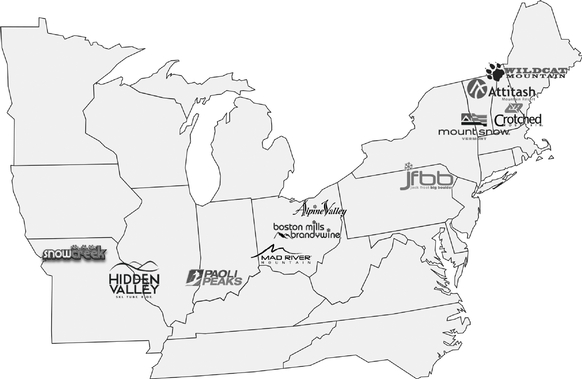

Our Company

We are a leading owner and operator of high-quality, individually branded ski resorts in the U.S. We currently operate 13 ski resorts primarily located in the Northeast and Midwest, 12 of which we own. The majority of our resorts are located within 100 miles of major metropolitan markets, including New York City, Boston, Philadelphia, Cleveland and St. Louis, enabling day and overnight drive accessibility. Our resorts are comprised of nearly 1,650 acres of skiable terrain that appeal to a wide range of ages and abilities. We offer a breadth of activities, services and amenities, including skiing, snowboarding, terrain parks, tubing, dining, lodging, equipment rentals and sales, ski and snowboard instruction and mountain biking and other summer activities. We believe that both the day and overnight drive segments of the ski industry are appealing given their stable revenue base, high margins and attractive risk-adjusted returns. We have successfully acquired and integrated ten ski resorts since our incorporation in 1997, and we expect to continue executing this strategy.

We have built an award-winning portfolio of individually branded entertainment properties, most of which are recognized as leading ski resorts in their respective markets. Our devotion to maintaining high quality standards across our portfolio through strategic investments and upgrades has created a loyal customer base that contributes to a significant number of repeat visits at each of our resorts. In particular, our investment over the last decade in the latest high-efficiency snowmaking equipment has earned us the reputation as an industry leader in snowmaking efficiency, capacity and quality, allowing us to consistently increase skier visits and revenue per skier. Since 2008, we have invested $49.7 million in capital expenditures and growth initiatives. Our strong branding reinforces customer loyalty and serves to attract new visitors through focused marketing campaigns and word of mouth.

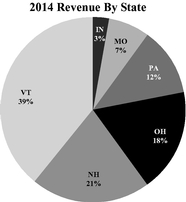

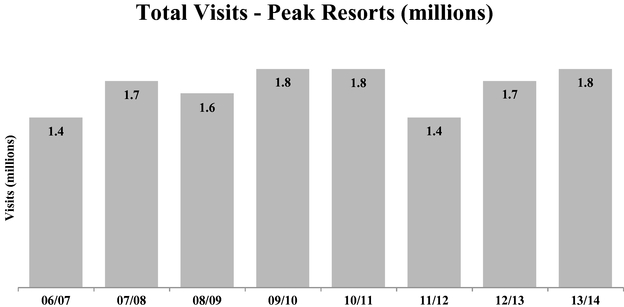

Combined, our ski resorts generated approximately 1.8 million visits in the 2013/2014 ski season, an increase of 4% from the prior ski season, which we believe puts us among the top U.S. ski resort operators in terms of number of visits during these seasons. We increased our revenue by 5.5%, from $99.7 million in fiscal 2013 to $105.2 million in fiscal 2014. As the U.S. economy continues to improve, our resorts are well-positioned to benefit from increased consumer spending on leisure activities, and we expect to continue to increase our lift ticket prices and drive more skier visits to our resorts. We believe we are better positioned to handle downturns in the economy than larger, overnight fly ski resorts because of our greater accessibility and lower overall costs to consumers.

The U.S. ski industry is highly fragmented, with less than 13% of the 470 ski resorts being owned by companies with four or more ski resorts. We believe that our proven ability to efficiently operate multiple resorts and our track record of successful acquisitions have created our reputation in the marketplace as a preferred buyer. We believe that our extensive experience in acquiring ski resorts and investing in snowmaking, lifts and other skier services, as well as the synergies we create by operating multiple resorts, drives increased revenues and profitability. Our capabilities serve as a competitive advantage in sourcing and executing investment opportunities as sellers will often provide us a "first

1

look" at opportunities outside of a broader marketing process, allowing us to expand both within our existing markets and into new markets.

Our Resorts

Our 13 ski resorts are located in geographically diverse areas and appeal to a wide range of visitors. All of our ski resorts employ high-capacity snowmaking capabilities on over 90% of their terrain as well as food and beverage services, equipment rental and retail outlets. All of our properties offer alternative snow activities, such as terrain parks and tubing, in addition to skiing and snowboarding. The diversity of our services and amenities allows us to capture a larger proportion of customer spending as well as ensure product and service quality at our resorts. The following table summarizes key statistics relating to each of our resorts as of September 10, 2014:

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Lifts | ||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

Acres | |

|

Trail Type(2) | |

Ancillary Outlets | ||||||||||||||||||||||||||||||||||||||||||||||||

| |

|

Developed/ Acquired | Vertical Drop (ft.) | |

|

|

|

|

Surface/ Rope Tow | |

|

|||||||||||||||||||||||||||||||||||||||||||||

Property

|

State | Total | Skiable | Snow Making(1) | Beg | Int | Adv | Terrain Park(s) | Rental/ Retail | Food/ Beverage | Tubing | Double | Triple | Quad | Conveyor Lifts | Total | ||||||||||||||||||||||||||||||||||||||||

Hidden Valley |

MO | 1982 | 250 | 60 | 310 | 100 | % | 30 | % | 60 | % | 10 | % | 1 | 2 | 1 | Yes | 1 | 2 | 2 | 2 | 3 | 10 | |||||||||||||||||||||||||||||||||

Snow Creek |

MO | 1985 | 460 | 40 | 300 | 100 | % | 30 | % | 60 | % | 10 | % | 1 | 2 | 1 | Yes | 1 | 2 | — | 2 | 1 | 6 | |||||||||||||||||||||||||||||||||

Paoli Peaks |

IN | 1997 | 65 | 65 | 300 | 100 | % | 25 | % | 55 | % | 20 | % | 1 | 2 | 1 | Yes | 1 | 3 | 1 | 1 | 2 | 8 | |||||||||||||||||||||||||||||||||

Mad River |

OH | 2001 | 324 | 60 | 300 | 100 | % | 34 | % | 36 | % | 30 | % | 4 | 2 | 1 | Yes | 3 | 2 | 1 | 3 | 3 | 12 | |||||||||||||||||||||||||||||||||

Boston Mills |

OH | 2002 | 100 | 40 | 264 | 100 | % | 30 | % | 45 | % | 25 | % | 4 | 2 | 2 | No | 2 | 4 | — | 2 | — | 8 | |||||||||||||||||||||||||||||||||

Brandywine |

OH | 2002 | 102 | 48 | 264 | 100 | % | 30 | % | 45 | % | 25 | % | 2 | 2 | 1 | Yes | — | 3 | 2 | 3 | 2 | 10 | |||||||||||||||||||||||||||||||||

Crotched Mountain |

NH | 2003 | 251 | 105 | 1,000 | 100 | % | 26 | % | 50 | % | 24 | % | 2 | 2 | 2 | No | 1 | 1 | 2 | — | 1 | 5 | |||||||||||||||||||||||||||||||||

Jack Frost(3) |

PA | 2005 | 201 | 80 | 600 | 100 | % | 25 | % | 40 | % | 35 | % | 1 | 2 | 2 | Yes | 6 | 2 | 1 | 2 | 1 | 12 | |||||||||||||||||||||||||||||||||

Big Boulder(3) |

PA | 2005 | 107 | 65 | 475 | 100 | % | 30 | % | 40 | % | 30 | % | 5 | 2 | 2 | Yes | 5 | 2 | — | 2 | 2 | 11 | |||||||||||||||||||||||||||||||||

Attitash |

NH | 2007 | 1,134 | 307 | 1,750 | 90 | % | 27 | % | 46 | % | 27 | % | 2 | 3 | 5 | Yes | 3 | 3 | 3 | 1 | 1 | 11 | |||||||||||||||||||||||||||||||||

Mount Snow |

VT | 2007 | 588 | 490 | 1,700 | 80 | % | 15 | % | 70 | % | 15 | % | 10 | 9 | 14 | Yes | 4 | 6 | 5 | (4) | 1 | 4 | 20 | ||||||||||||||||||||||||||||||||

Wildcat Mountain |

NH | 2010 | 225 | 225 | 2,112 | 90 | % | 25 | % | 45 | % | 30 | % | 1 | 2 | 2 | No | — | 3 | 1 | — | 1 | 5 | |||||||||||||||||||||||||||||||||

Alpine Valley |

OH | 2012 | 135 | 54 | 260 | 100 | % | 35 | % | 50 | % | 15 | % | 1 | 1 | 1 | Yes | 1 | 2 | 1 | 2 | 1 | 7 | |||||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/Weighted Avg |

3,942 | 1,639 | 9,635 | 91 | % | 24 | % | 54 | % | 22 | % | 35 | 33 | 35 | 28 | 35 | 19 | 21 | 22 | 125 | ||||||||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(revenues and visits in thousands)

| |

FY 2014 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Property

|

Revenues | % Revenues | Visits | |||||||

Hidden Valley |

$ | 4,072 | 3.9 | % | 97.8 | |||||

Snow Creek |

3,072 | 2.9 | % | 73.7 | ||||||

Paoli Peaks |

3,661 | 3.5 | % | 78.0 | ||||||

Mad River |

7,831 | 7.4 | % | 180.0 | ||||||

Boston Mills |

4,505 | 4.3 | % | 117.5 | ||||||

Brandywine |

4,808 | 4.6 | % | 132.1 | ||||||

Crotched Mountain |

4,398 | 4.2 | % | 94.6 | ||||||

Jack Frost |

6,570 | 6.2 | % | 134.1 | ||||||

Big Boulder |

5,967 | 5.7 | % | 102.2 | ||||||

Attitash(5) |

14,353 | 13.6 | % | 172.3 | ||||||

Mount Snow(5) |

41,350 | 39.3 | % | 468.9 | ||||||

Wildcat Mountain |

3,322 | 3.2 | % | 64.4 | ||||||

Alpine Valley |

1,297 | 1.2 | % | 36.0 | ||||||

| | | | | | | | | | | |

Total |

$ | 105,205 | 100.0 | % | 1,751.5 | |||||

| | | | | | | | | | | |

| | | | | | | | | | | |

- (1)

- Represents

the approximate percentage of skiable terrain covered by our snowmaking capabilities; total represents average of snowmaking coverage weighted by

the respective properties' skiable acres.

- (2)

- Total

figure represents the average weighted by skiable acres.

- (3)

- We

purchased the Jack Frost and Big Boulder ski resorts in December 2011. Prior to that time, we operated these resorts pursuant to leases since 2005.

- (4)

- Quad

count includes one six-pack lift.

- (5)

- Includes lodging revenue.

2

Hidden Valley opened for business in 1982 as the first ski resort operated by our founder. In 2012, we

opened West Mountain, which expanded our skiable acreage by approximately 40%. Hidden Valley is located within the St. Louis MSA and is the only ski resort within a 250 mile radius. Hidden

Valley attracts skiers from as far away as Memphis, Tennessee and Jackson, Mississippi. The ski resort has 77 snowmaking machines to ensure snow quality throughout the season with a capacity of

up to 5,000 gallons of water per minute, or 12 inches of machine-made snow in a 24-hour period.

Hidden Valley opened for business in 1982 as the first ski resort operated by our founder. In 2012, we

opened West Mountain, which expanded our skiable acreage by approximately 40%. Hidden Valley is located within the St. Louis MSA and is the only ski resort within a 250 mile radius. Hidden

Valley attracts skiers from as far away as Memphis, Tennessee and Jackson, Mississippi. The ski resort has 77 snowmaking machines to ensure snow quality throughout the season with a capacity of

up to 5,000 gallons of water per minute, or 12 inches of machine-made snow in a 24-hour period.

- •

- Location: Wildwood, MO

- •

- Population Base: 3.9 million

- •

- Total Lifts: 10

- •

- Skiable Acreage: 60

![]() Snow Creek began operation in 1985 and is located 34 miles north of Kansas City. Snow Creek is the only ski resort in the Kansas City region,

and the next closest ski resort

is Hidden Valley in St. Louis. The ski resort also has 60 snowmaking machines to ensure snow quality throughout the season with a capacity of up to 3,000 gallons of water per minute, or 12

inches of machine-made snow in a 24-hour period.

Snow Creek began operation in 1985 and is located 34 miles north of Kansas City. Snow Creek is the only ski resort in the Kansas City region,

and the next closest ski resort

is Hidden Valley in St. Louis. The ski resort also has 60 snowmaking machines to ensure snow quality throughout the season with a capacity of up to 3,000 gallons of water per minute, or 12

inches of machine-made snow in a 24-hour period.

- •

- Location: Weston, MO

- •

- Population Base: 2.9 million

- •

- Total Lifts: 6

- •

- Skiable Acreage: 40

Paoli Peaks has been in operation since 1978 and has contributed several revolutionary concepts to the industry. Paoli Peaks has been

recognized as the first resort to utilize

snowmaking machines located on towers as well as introducing midnight skiing, an event that has become popular throughout the ski industry. Paoli Peaks' snowmaking machines can produce 12 inches of

machine-made snow in a 24-hour period.

Paoli Peaks has been in operation since 1978 and has contributed several revolutionary concepts to the industry. Paoli Peaks has been

recognized as the first resort to utilize

snowmaking machines located on towers as well as introducing midnight skiing, an event that has become popular throughout the ski industry. Paoli Peaks' snowmaking machines can produce 12 inches of

machine-made snow in a 24-hour period.

- •

- Location: Paoli, IN

- •

- Population Base: 3.0 million

- •

- Total Lifts: 8

- •

- Skiable Acreage: 65

3

![]() Mad River Mountain will mark its 53rd season of operation in 2014/2015 ski season. In addition to the most expansive skiable terrain in

Ohio, Mad River Mountain is home

to the state's largest snowmaking system. Mad River's snowmaking system is comprised of 133 fan guns that have the ability to pump over 7,000 gallons of water per minute and cover 100% of our terrain

in as little as 72 hours. The resort has four terrain parks, including Capital Park, which was voted the Midwest's best terrain park by OnTheSnow website in 2013. Over the years, the facility

has grown from a small commuter resort into the 324-acre winter playground that it is today.

Mad River Mountain will mark its 53rd season of operation in 2014/2015 ski season. In addition to the most expansive skiable terrain in

Ohio, Mad River Mountain is home

to the state's largest snowmaking system. Mad River's snowmaking system is comprised of 133 fan guns that have the ability to pump over 7,000 gallons of water per minute and cover 100% of our terrain

in as little as 72 hours. The resort has four terrain parks, including Capital Park, which was voted the Midwest's best terrain park by OnTheSnow website in 2013. Over the years, the facility

has grown from a small commuter resort into the 324-acre winter playground that it is today.

- •

- Location: Zanesfield, OH

- •

- Population Base: 2.8 million

- •

- Total Lifts: 12

- •

- Skiable Acreage: 60

Boston Mills and Brandywine Ski Resorts are a pair of sister ski resorts located within the Cleveland MSA and Cuyahoga Valley Park. The two

locations were developed

independently in the 1960's,

beginning with Boston Mills in 1963. Brandywine Resort was purchased by the previous owners of Boston Mills in 1990, forming the dual-resort complex that it is today. Boston Mills and Brandywine are

conveniently located approximately three miles apart and combined have over 18,000 season pass holders. All three of our Northeast Ohio ski resorts—Alpine Valley, Boston Mills and

Brandywine—are operated collectively, which provides us with revenue and cost synergies.

Boston Mills and Brandywine Ski Resorts are a pair of sister ski resorts located within the Cleveland MSA and Cuyahoga Valley Park. The two

locations were developed

independently in the 1960's,

beginning with Boston Mills in 1963. Brandywine Resort was purchased by the previous owners of Boston Mills in 1990, forming the dual-resort complex that it is today. Boston Mills and Brandywine are

conveniently located approximately three miles apart and combined have over 18,000 season pass holders. All three of our Northeast Ohio ski resorts—Alpine Valley, Boston Mills and

Brandywine—are operated collectively, which provides us with revenue and cost synergies.

- •

- Location: Sagamore Hills, OH

- •

- Population Base: 7.1 million

- •

- Total Lifts: 18

- •

- Skiable Acreage: 88

Crotched Mountain Ski & Ride is located approximately 70 miles from the Boston MSA. We acquired Crotched Mountain in 2003 and

reopened the ski resort during the

2003/2004 ski season, its first year of operation after a 13-year closure. Upon acquisition, we invested significant capital to increase snowmaking capabilities, add new lifts and build new skier

services facilities. In the 2013/2014 ski season, we achieved 94,600 skier visits and $4.4 million in revenues. Crotched Mountain's snowmaking system claims the highest snow production capacity

of any ski resort in New England. In the summer of 2012, we installed "The Rocket" at Crotched Mountain, which is Southern New Hampshire's only high-speed detachable quad chairlift. Crotched Mountain

is also the only resort within New England that offers midnight skiing.

Crotched Mountain Ski & Ride is located approximately 70 miles from the Boston MSA. We acquired Crotched Mountain in 2003 and

reopened the ski resort during the

2003/2004 ski season, its first year of operation after a 13-year closure. Upon acquisition, we invested significant capital to increase snowmaking capabilities, add new lifts and build new skier

services facilities. In the 2013/2014 ski season, we achieved 94,600 skier visits and $4.4 million in revenues. Crotched Mountain's snowmaking system claims the highest snow production capacity

of any ski resort in New England. In the summer of 2012, we installed "The Rocket" at Crotched Mountain, which is Southern New Hampshire's only high-speed detachable quad chairlift. Crotched Mountain

is also the only resort within New England that offers midnight skiing.

- •

- Location: Bennington, NH

- •

- Population Base: 10.5 million

- •

- Total Lifts: 5

- •

- Skiable Acreage: 105

4

Jack Frost Mountain and Big Boulder Ski Resorts are located in the Pocono Mountains of Pennsylvania near the Philadelphia and New York City

MSAs. Jack Frost and Big Boulder

are conveniently located five miles apart and are operated collectively, which provides us with revenue and cost synergies. Big Boulder first opened in 1949 and was the first commercial ski resort in

Pennsylvania. Both resorts are known for their powerful snowmaking systems, and Big Boulder has been the first ski resort in Pennsylvania to open during each of the last eight years. Big Boulder Ski

Resort devotes 50% of its acreage to freestyle terrain parks and it was ranked in the "Top 5 Parks in the East" by Transworld Snowboarding Magazine in 2009, 2010 and 2011.

Jack Frost Mountain and Big Boulder Ski Resorts are located in the Pocono Mountains of Pennsylvania near the Philadelphia and New York City

MSAs. Jack Frost and Big Boulder

are conveniently located five miles apart and are operated collectively, which provides us with revenue and cost synergies. Big Boulder first opened in 1949 and was the first commercial ski resort in

Pennsylvania. Both resorts are known for their powerful snowmaking systems, and Big Boulder has been the first ski resort in Pennsylvania to open during each of the last eight years. Big Boulder Ski

Resort devotes 50% of its acreage to freestyle terrain parks and it was ranked in the "Top 5 Parks in the East" by Transworld Snowboarding Magazine in 2009, 2010 and 2011.

- •

- Location: Blakeslee, PA

- •

- Population Base: 27.3 million

- •

- Total Lifts: 23

- •

- Skiable Acreage: 145

Attitash Mountain Resort is located within close proximity of Mt. Washington and approximately 150 miles from the Boston MSA.

Attitash was ranked among the

East's top ten ski resorts for snow, grooming, weather, dining, après ski, off-hill activities and family programs by readers of SKI Magazine in 2010. Attitash Mountain Resort is a

vacation destination for all seasons, offering a variety of summer attractions such as North America's longest Alpine Slide, the Nor'Easter Mountain Coaster and New England's longest zip line of 5,000

feet. Attitash features a 143-room Grand Summit Hotel, providing some of the only ski-in/ski-out accommodations in the area.

Attitash Mountain Resort is located within close proximity of Mt. Washington and approximately 150 miles from the Boston MSA.

Attitash was ranked among the

East's top ten ski resorts for snow, grooming, weather, dining, après ski, off-hill activities and family programs by readers of SKI Magazine in 2010. Attitash Mountain Resort is a

vacation destination for all seasons, offering a variety of summer attractions such as North America's longest Alpine Slide, the Nor'Easter Mountain Coaster and New England's longest zip line of 5,000

feet. Attitash features a 143-room Grand Summit Hotel, providing some of the only ski-in/ski-out accommodations in the area.

- •

- Location: Bartlett, NH

- •

- Population Base: 13.9 million

- •

- Total Lifts: 11

- •

- Skiable Acreage: 307

Mount Snow, a two-time host of the Winter X Games, is located in the Green Mountains of southern Vermont and is the state's closest major

resort to the Northeast's

largest metropolitan areas, making for a short drive to big mountain skiing. Mount Snow is approximately 200 miles from New York City, 130 miles from Boston, 65 miles from Albany and 100 miles from

Hartford. Founded in 1954 by National Ski & Snowboard Hall of Fame member Walter Schoenknecht, Mount Snow quickly became one of the most recognizable ski resorts in the world. We have invested

more than $20.0 million in capital enhancements since acquiring Mount Snow in the spring of 2007. The primary elements of those enhancements are the installation of more than 250 high output

fan guns, the most of any resort in North America, giving Mount Snow one of the most powerful and efficient snowmaking systems in the industry, and the $8.7 million Bluebird Express, which is

North America's only six passenger bubble lift. Transworld Snowboarding Magazine ranked Carinthia the "#1 Terrain Park in the East" for the 2013/2014 ski season and a "Top 5 Park in the East" for each

of the last five years. This all-freestyle terrain mountain face is home to ten different terrain parks, ranging from

Mount Snow, a two-time host of the Winter X Games, is located in the Green Mountains of southern Vermont and is the state's closest major

resort to the Northeast's

largest metropolitan areas, making for a short drive to big mountain skiing. Mount Snow is approximately 200 miles from New York City, 130 miles from Boston, 65 miles from Albany and 100 miles from

Hartford. Founded in 1954 by National Ski & Snowboard Hall of Fame member Walter Schoenknecht, Mount Snow quickly became one of the most recognizable ski resorts in the world. We have invested

more than $20.0 million in capital enhancements since acquiring Mount Snow in the spring of 2007. The primary elements of those enhancements are the installation of more than 250 high output

fan guns, the most of any resort in North America, giving Mount Snow one of the most powerful and efficient snowmaking systems in the industry, and the $8.7 million Bluebird Express, which is

North America's only six passenger bubble lift. Transworld Snowboarding Magazine ranked Carinthia the "#1 Terrain Park in the East" for the 2013/2014 ski season and a "Top 5 Park in the East" for each

of the last five years. This all-freestyle terrain mountain face is home to ten different terrain parks, ranging from

5

beginner features in Grommet to expert features in Inferno, as well as a 450-foot long super pipe with 18 foot walls. Mount Snow features a 196-room Grand Summit Hotel, providing some of the only ski-in/ski-out accommodations in the area.

- •

- Location: West Dover, VT

- •

- Population Base: 27.4 million

- •

- Total Lifts: 20

- •

- Skiable Acreage: 490

Wildcat Mountain Ski Resort is located in the White Mountains in the Mt. Washington region just 16 miles from its sister resort,

Attitash Mountain. The summit

elevation is 4,002 feet, and the base area elevation is 1,950 feet, which gives Wildcat a vertical drop of 2,112 feet. Wildcat is one of the best-known alpine skiing resorts in New England due

to its scenic views of Mt. Washington. It also contains the longest ski trail in New Hampshire and is home to one of the oldest ski-racing trails in the U.S. The original "Wildcat" trail was

cut in 1933 by the Civilian Conservation Corps and celebrated its 80th anniversary as a ski trail in 2013. Wildcat was the first ski resort to have a gondola lift in the U.S., which opened on

January 25, 1958. The resort hosted the U.S. downhill skiing championship in 1984, 1992, 1995 and 2007. Wildcat has garnered a reputation for strong spring skiing as it has had the latest

closing date of any lift-serviced ski resort in New Hampshire for the past eight seasons.

Wildcat Mountain Ski Resort is located in the White Mountains in the Mt. Washington region just 16 miles from its sister resort,

Attitash Mountain. The summit

elevation is 4,002 feet, and the base area elevation is 1,950 feet, which gives Wildcat a vertical drop of 2,112 feet. Wildcat is one of the best-known alpine skiing resorts in New England due

to its scenic views of Mt. Washington. It also contains the longest ski trail in New Hampshire and is home to one of the oldest ski-racing trails in the U.S. The original "Wildcat" trail was

cut in 1933 by the Civilian Conservation Corps and celebrated its 80th anniversary as a ski trail in 2013. Wildcat was the first ski resort to have a gondola lift in the U.S., which opened on

January 25, 1958. The resort hosted the U.S. downhill skiing championship in 1984, 1992, 1995 and 2007. Wildcat has garnered a reputation for strong spring skiing as it has had the latest

closing date of any lift-serviced ski resort in New Hampshire for the past eight seasons.

- •

- Location: Jackson, NH

- •

- Population Base: 13.9 million

- •

- Total Lifts: 5

- •

- Skiable Acreage: 225

One of Northeast Ohio's oldest public ski resort, Alpine Valley has been in operation since 1965 and is the most recent resort to join our

portfolio after our acquisition in

2012. It is located in Ohio's snow belt, allowing it to receive the most natural snowfall out of all of Ohio's ski resorts. All three of our Northeast Ohio ski resorts—Alpine Valley,

Boston Mills and Brandywine—are operated collectively, which provides us with revenue and cost synergies. Alpine Valley is 31 miles northeast of Boston Mills/Brandywine Resorts and is

located near the Cleveland MSA. In the summer of 2013, we installed two additional chairlifts, two additional tubing handle tows and a new beginner surface lift. Alpine Valley also boasts a

newly-installed, state-of-the-art snowmaking system equipped with 30 new tower and portable fan guns along with a new pump house and maintenance facility. The improvements and upgrades to Alpine

Valley constituted a total capital investment of over $2.5 million.

One of Northeast Ohio's oldest public ski resort, Alpine Valley has been in operation since 1965 and is the most recent resort to join our

portfolio after our acquisition in

2012. It is located in Ohio's snow belt, allowing it to receive the most natural snowfall out of all of Ohio's ski resorts. All three of our Northeast Ohio ski resorts—Alpine Valley,

Boston Mills and Brandywine—are operated collectively, which provides us with revenue and cost synergies. Alpine Valley is 31 miles northeast of Boston Mills/Brandywine Resorts and is

located near the Cleveland MSA. In the summer of 2013, we installed two additional chairlifts, two additional tubing handle tows and a new beginner surface lift. Alpine Valley also boasts a

newly-installed, state-of-the-art snowmaking system equipped with 30 new tower and portable fan guns along with a new pump house and maintenance facility. The improvements and upgrades to Alpine

Valley constituted a total capital investment of over $2.5 million.

- •

- Location: Chesterland, OH

- •

- Population Base: 7.1 million

- •

- Total Lifts: 7

- •

- Skiable Acreage: 54

6

Competitive Strengths

We believe our strengths are as follows:

- •

- We own a high-quality branded portfolio. We own

12 and operate 13 high-quality ski resorts, each of which is individually branded and recognized to be a leading ski resort in its respective regional market. Our devotion to maintaining high

quality standards through strategic investments and upgrades has created a loyal customer base at each of our resorts. Our strong branding reinforces customer loyalty and serves to attract new guests

through focused marketing campaigns and word of mouth.

- •

- We have a history of investing in targeted capital projects to increase

profitability. We are continuously evaluating our property-level performance and are committed to increasing our profitability. Many ski

resort operators are unwilling to invest in improvements due to capital constraints and the perceived risk of such investments. Since 2008, we have invested $49.7 million throughout our

portfolio in an effort to improve the profitability of our ski resorts through energy-efficient snowmaking machinery, high-speed/high-capacity lifts and additional features such as terrain parks and

various other infrastructure investments. The costs of these improvements are significantly outweighed by the benefits realized, which include higher quality and less costly snow, shorter lift lines,

terrain expansion and customer appreciation. We have found that the ability to transport customers up the mountain on high-speed chairlifts and to reduce lift lines not only attracts skiers and

promotes a better skiing experience but also leads to higher restaurant and retail sales and increased customer satisfaction.

- •

- We are an experienced and successful acquirer and

integrator. We have grown our Company significantly since inception by acquiring strategically located ski resorts with the potential

for increased revenue growth and margin expansion. We have successfully acquired and integrated ten ski resorts since 1997. We adhere to a disciplined acquisition strategy by pursuing opportunities at

attractive acquisition prices that can create additional value through operational improvements and efficiencies. After acquiring a ski resort, we implement a strategic repositioning program designed

during the underwriting process and integrate the resort into our portfolio. We believe that our track record for acquiring and integrating ski resorts makes us an industry leader and gives us a

competitive advantage over other buyers. Our ski resorts have, on average, achieved compound annual EBITDA growth of 34.4% within two years of our ownership or operation.

- •

- Our experienced senior management team is dedicated to providing a reliable and enjoyable ski

experience. Our three senior executives have almost 60 years of combined experience owning, operating and acquiring ski resorts

in the U.S. Since 1982, it has been our vision to offer a reliable and enjoyable skiing experience to our customers. As a result of this vision, our management team constantly strives to enhance and

improve our snowmaking capabilities to ensure our ski resorts maintain high-quality snow throughout the season. In addition, our management team strives to provide our ski resorts with a full range of

amenities to augment our customers' overall skiing experience.

- •

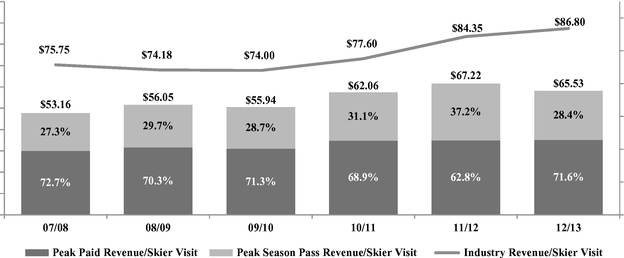

- Overnight drive and day ski resorts experience lower sensitivity to the economy. We believe our portfolio provides more attractive risk-adjusted returns than overnight fly resorts due to the stability in our visits. Furthermore, we believe that customers are more likely to visit overnight drive and day ski resorts during an economic downturn as compared to other higher cost overnight fly ski resorts, resulting in less sensitivity to downturns in the economy. The revenue per skier visit of our resorts from the 2007/2008 ski season (the first season subsequent to the Mount Snow and Attitash acquisitions) to the 2012/2013 ski season increased at a compounded annual growth rate of 4.3% compared to an increase of 2.8% for the U.S. ski industry for the same period.

7

- •

- The ski industry possesses high barriers to entry. A

limited number of ski resorts have been developed in the past 30 years. Skiable land is scarce and demanding to develop due to the difficulty in aggregating suitable terrain, obtaining

government permitting, resolving accessibility issues and addressing heightened environmental concerns. Operating a ski resort requires a high level of expertise and strict regulatory and

environmental compliance. Additionally, many resorts have built significant customer loyalty and brand awareness over multiple generations, which can be difficult for a new entrant to overcome. These

factors have contributed to the number of ski resorts decreasing 36%, from 735 in 1984 to 470 in 2014 as smaller, poorly capitalized resorts have been unable to compete effectively. With our large

existing portfolio, proven capital investment strategy and strong customer loyalty, we believe our Company is competitively well-positioned.

- •

- Our ski resort portfolio is diverse. Our portfolio of 13

ski resorts consists of five overnight drive ski resorts and eight day ski resorts located across six states ranging from Missouri to New Hampshire. We believe that our portfolio mix enables us

to reach a large customer base seeking high-quality ski resorts within driving distance of major metropolitan areas. Each of our ski resorts is located within reasonable drive times from major

metropolitan areas such as New York City, Boston, Philadelphia, Cleveland and St. Louis, which we believe provides us with a consistent repeat customer base and increases our new customer

outreach potential. We believe that the size and geographic diversity of our portfolio helps insulate the Company's financial performance against adverse economic and weather conditions.

- •

- We are a proven operator of ski resorts. We have operated

numerous ski resorts since our incorporation in 1997. Due to our extensive operating expertise, we believe we have a profitable and efficient platform that positions us to take advantage of growth

initiatives and cost controls. Our revenue growth and EBITDA margins were 22% and 26%, respectively, for fiscal 2013, whereas the industry experienced revenue growth of 13% and EBITDA margins of 16%

over the same time period.

- •

- Alignment of interests between management and new stockholders. Subsequent to this transaction, our management team will own approximately 16.1% of our outstanding shares. We believe that this substantial ownership position aligns the interest of our operating team with that of our new stockholders.

- •

- Increase visits. We have invested significant capital in

our snowmaking capabilities, terrain parks, year-round activities and skier facilities as an important component in increasing visits and revenue per skier visit, as well as developing and maintaining

our brand and market reputation. Our continuous investment in the latest high-efficiency snowmaking equipment across our resorts provides our guests with consistent and high-quality skiing surfaces as

well as a longer skiable season. By maintaining high-quality snow conditions across a longer ski season, we are able to drive repeat visits among our current clients and attract new clients from other

resorts. Over the last decade, we have met the demand for quality terrain parks in the Northeast and Midwest with terrain park developments that include award-winning parks such as Carinthia Park at

Mount Snow, Big Boulder Park at Big Boulder and Capital Park at Mad River. Our terrain parks are located where few substitutes exist, creating strong loyalty amongst our guests and driving increased

skier visits. We intend to continue diversifying our winter activities to include additional terrain parks and tubing hills and adding summer activities such as mountain biking, zip lines and

horseback riding.

- •

- Drive revenue per skier visit. We believe that several of our resorts are considered to be premier ski resorts in their respective metropolitan areas, providing us with enhanced pricing power. We

Growth Strategies

8

- •

- Improve operating efficiency through technology and

scale. We continue to focus on driving operational synergies and margin expansion via investment in technology and increasing economies

of scale. Through continued investment in energy-efficient snowmaking machines, we have decreased our energy costs while creating a superior skiing experience for our guests. For example, we are

currently under contract to purchase 645 new high-efficiency snowmaking machines to be deployed at Mount Snow through a partnership with Efficiency Vermont, which will fund 75% of the acquisition

cost. We expect to achieve payback of our entire investment within one year. As an operator of 13 ski resorts, we benefit from our scale of procurement, insurance and technology. As we continue to

invest in technology and grow through acquisitions, we expect to realize further efficiencies and economies of scale, driving higher margins than many of our competitors.

- •

- Monetize developable real estate. We own developable land

at Mount Snow that is entitled for up to 900 residential units, including ski-in and ski-out condos, and 200,000 square feet of resort amenities, including restaurants, ski rental and retail shops,

guest services and other functions. Given recent improvements in the second home and vacation home markets, we believe that we can generate significant profits from the further development of the

Mount Snow land. In addition to sales of residential units, we believe that the mixed-use property development, including updated skier services, additional amenities and added occupancy capability,

will create a significant opportunity for us to maximize Mount Snow's operational profitability. We are currently in the process of raising up to $52.0 million of debt capital under an EB-5

program to capitalize the first stage of development, including a new lodge, snowmaking infrastructure, including a new water reservoir, and related skier services. We intend to commence development

of these projects in the second half of calendar year 2015. Additionally, we own developable land at Attitash. While we do not have imminent plans to develop the Attitash real estate, we could benefit

from the sale or development of that land at some point in the future.

- •

- Pursue strategic acquisitions. As an operator of 13 ski resorts benefiting from economies of scale and investment in technology, we believe we can generate substantial revenue and cost synergies through strategic acquisitions. The U.S. ski industry, consisting of 470 resorts, is highly fragmented with less than 13% of ski resorts being owned by companies with four or more ski resorts. We estimate that there are approximately 250 day ski and 180 overnight drive ski resorts in the U.S. providing us with numerous acquisition opportunities. We believe that our proven ability to efficiently operate multiple resorts as well as our track record of successful acquisitions have established our reputation in the marketplace as a preferred buyer and will provide us the opportunity to acquire additional complementary ski resorts at attractive valuations. Our targeted acquisition strategy is to identify and purchase ski resorts where we can introduce many of the initiatives currently in place at our existing resorts, such as superior quality and efficiency snowmaking, high-speed detachable chair lifts and upgraded skier service and hospitality facilities, in order to drive increased skier visits, price increases and enhanced profitability.

increased our season pass price and rack rates for the 2013/14 season over those in effect for the 2012/13 season. We were able to increase our revenue 5.5% from $99.7 million in fiscal 2013 to $105.2 million in fiscal 2014. We anticipate our previous and planned investments in snowmaking and facilities will allow us to continue to raise our quality level and prices for lift tickets, lodging, food and beverage, equipment rentals and other activities at our resorts.

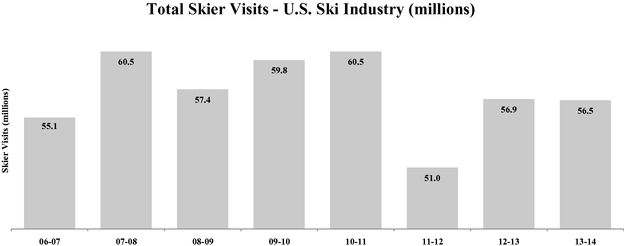

Ski Industry

The U.S. ski industry was estimated to total approximately 56.5 million skier visits in the 2013/2014 ski season. The National Ski Areas Association Kottke National End of Season Survey reported that there were 470 ski resorts operating during the 2013/2014 ski season in the U.S. Given the consistency

9

and strength of annual skier visits over the last 30 years as well as the state of the recovering economy, we believe that skier participation will remain strong in the coming years.

The ski industry divides ski resorts into three distinct categories: overnight fly, overnight drive and day ski resorts. Overnight fly ski resorts are defined as ski resorts which primarily serve skiers who fly or drive considerable distances and stay for multiple nights. These resorts depend, in large part, on long-distance travel by their visitors and on the development of adjacent real estate for housing, hospitality and retail uses. Overnight drive ski resorts are ski resorts which primarily serve skiers from the regional drive market who stay overnight. Day ski resorts are typically located within 50 miles of a major MSA and do not generally offer dedicated lodging.

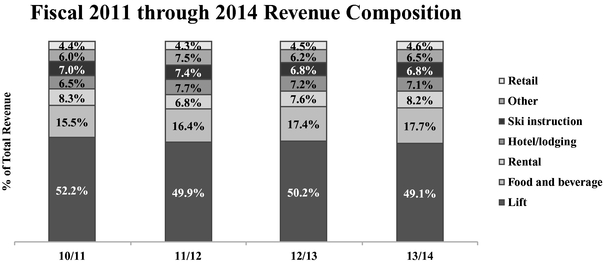

Day and overnight drive ski resorts tend to be smaller in size and are usually located near metropolitan areas. As an owner and operator of primarily day and overnight drive ski resorts, we focus on selling lift tickets, renting ski equipment, selling ski lessons, offering food and beverage services and catering to the targeted local market. We target skiers of all levels from beginners who are skiing for the first time to intermediate and advanced skiers who are honing their skills.

An important statistic used to gauge the performance of companies operating within the ski industry is revenue per skier visit. The revenue per skier visit of our resorts for the 2007/2008 ski season (the first season subsequent to the Mount Snow and Attitash acquisitions) to the 2012/2013 ski season increased at a compounded annual growth rate of 4.3% compared to an increase of 2.8% for the U.S. ski industry for the same period. Revenue per skier visit is calculated as total resort revenue divided by skier visits.

The ski industry statistics stated in the foregoing sections have been derived from data published by the Kottke National End of Season Survey 2013/2014 and other industry publications, including those of the National Ski Areas Association.

Recent Developments

On November 10, 2014, the Company and certain of its subsidiaries entered into a Restructure Agreement with certain affiliates of the Company's primary lender, EPR Properties ("EPR"), providing for the prepayment of certain formerly non-prepayable notes in the event that the Company's net proceeds from this offering exceed approximately $44.9 million plus closing and transaction costs (such transaction hereinafter referred to as the "Debt Restructure").

The Debt Restructure allows the Company to pre-pay up to approximately $76.2 million in debt secured by the Crotched Mountain, Attitash, Paoli Peaks, Hidden Valley and Snow Creek properties and to retire one of the notes associated with the future development of Mount Snow, with the closing of such transaction to occur three business days following closing of the offering and to be contingent upon the Company's receipt of net proceeds from this offering sufficient to pre-pay the Mount Snow Development Debt of approximately $42.9 million, a Defeasance Fee not to exceed $5 million (which amount adjusts based on the actual amount of the prepayment but which will in no event be less than $2 million), and certain closing and transaction costs. In the event that the net proceeds exceed the sum of such amounts, various notes and mortgages will be paid down in the following order: Crotched Mountain, Attitash, Snow Creek, Paoli Peaks and Hidden Valley.

In exchange for such prepayment right, the Debt Restructure provides that EPR shall be granted a purchase option on the Boston Mills, Brandywine, Jack Frost, Big Boulder and Alpine Valley properties, which will be exercisable as to any one or more of such properties on the maturity date of the notes and mortgages for such properties by the delivery of written notice by EPR to the Company at least one (1) year prior to such maturity date and upon payment of a purchase price for each such property calculated by multiplying the previous fiscal year's EBITDAR (defined as earnings before interest, taxes, debt service and rent) applicable to such property by fifty percent (50%) and dividing

10

the product by the applicable initial interest rate payable under the note associated with such property, with a minimum purchase price of not less than the outstanding balance of the applicable loan on the closing date. Upon the closing of the sale under the option, EPR will enter into an agreement with the Company or one of its subsidiaries for the lease of each such acquired property for an initial term of 20 years, plus options to extend the lease for two additional periods of 10 years each. All current option agreements between the Company and/or its subsidiaries and EPR shall be terminated at the time of the closing of the Debt Restructure. In addition, the Company has agreed to extend the maturity dates on all non-prepayable notes and mortgages secured by the Mount Snow, Boston Mills, Brandywine, Jack Frost, Big Boulder and Alpine Valley properties remaining after the closing of this offering by seven years to a period of 20 years from the date of the closing of the transactions contemplated by the Debt Restructure and to extend the lease for the Mad River property, previously terminating in 2026, until December 31, 2034.

In addition, the Debt Restructure provides for a right of first refusal on the part of EPR to provide all or a portion of the financing associated with any purchase, ground lease, sale/leaseback, management or financing transaction contemplated by the Company or any of its subsidiaries with respect to any new or existing ski resort property for a period of seven years after the closing of the transactions contemplated by the Debt Restructure. Proposed financings from certain types of institutional lenders providing a loan to value ratio of less than 60% (as relates to the applicable property being financed) are excluded from the right of first refusal. An additional right of first refusal will be granted to EPR with respect to any sale or transfer of Attitash.

The Restructure Agreement also contemplates that the Company and certain of its subsidiaries will enter into a Master Credit and Security Agreement ("Master Credit Agreement") with EPR containing additional terms and conditions governing the restructured loans, including restrictions on certain transactions including mergers, acquisitions, leases, asset sales, loans to third parties, and the incurrence of additional debt and liens. Financial covenants set forth in the Master Credit Agreement consist of a maximum Leverage Ratio (as defined in the Master Credit Agreement) of 65%, above which the Company and certain of its subsidiaries are prohibited from incurring additional indebtedness, and a Consolidated Fixed Charge Coverage Ratio (as defined in the Master Credit Agreement) covenant, which (a) requires the Company to increase the balance of its debt service reserve account if the Company's Consolidated Fixed Charge Coverage Ratio falls below 1.50:1.00, and (b) prohibits the Company from paying dividends if the ratio is below 1.25:1.00. The payment of dividends is also prohibited during default situations. The Master Credit Agreement also provides for additional interest payments under certain circumstances. Specifically, if the gross receipts of the properties securing the loans during any fiscal year exceed an amount determined by dividing the amount of interest otherwise due during that period by 10%, and additional interest payment equal to 10% of such excess is required.

At the closing of the transactions contemplated by the Debt Restructure, the personal guarantees of Messrs. Boyd, Mueller and Deutsch with respect to all obligations of the Company to EPR will be released, and all obligations of the Company to EPR will be guaranteed by certain of the Company's subsidiaries.

Risk Factors

Before you invest in our common stock, you should be aware that there are various risks related to, among other things:

- •

- weather, including climate change;

- •

- seasonality;

- •

- competition with other indoor and outdoor winter leisure activities and ski resorts;

11

- •

- the leases and permits for property underlying certain of our ski resorts;

- •

- ability to integrate new acquisitions;

- •

- environmental laws and regulations;

- •

- our dependence on key personnel;

- •

- the security of our guest information;

- •

- funds for capital expenditures, including funds raised under the EB-5 program;

- •

- the effect of declining revenues on margins;

- •

- the future development and continued success of our Mount Snow ski resort;

- •

- our reliance on information technology;

- •

- our current dependence on a single lender and the lender's option to purchase certain of our ski resorts;

- •

- our dependence on a seasonal workforce; and

- •

- the securities markets.

For more information about these and other risks, please read the section titled "Risk Factors." You should carefully consider these risk factors together with all of the other information in this Prospectus.

Corporate History and Additional Information

Peak Resorts, Inc. was incorporated in Missouri on September 24, 1997 as a holding company to own or lease and operate day ski and overnight drive ski resorts through its wholly owned subsidiaries. Throughout the history of the Company, including the development of the Hidden Valley and Snow Creek ski resorts before the incorporation of Peak Resorts, Inc., the Company has acquired or developed a total of 13 ski resorts.

Our principal executive offices are located at 17409 Hidden Valley Drive, Wildwood, Missouri 63025, telephone (636) 938-7474. We maintain a website at www.peakresorts.com. We will make available on our website, free of charge, the Company's future annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K as soon as practicable after we file these reports with the SEC. The information contained on our website or that can be accessed through our website neither constitutes part of this Prospectus nor is incorporated by reference herein.

Emerging Growth Company Status

We are an "emerging growth company," as defined in Section 2(a)(19) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"). As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not "emerging growth companies" including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the "Sarbanes-Oxley Act"), reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We have not made a decision whether to take advantage of any or all of these exemptions.

In addition, Section 107 of the JOBS Act also provides that an "emerging growth company" can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act

12

for complying with new or revised accounting standards, and delay compliance with new or revised accounting standards until those standards are applicable to private companies. We have elected to use the extended transition period for complying with new or revised accounting standards. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

Although we are still evaluating our options under the JOBS Act, we may take advantage of some or all of the reduced regulatory and reporting requirements that will be available to us so long as we qualify as an "emerging growth company" and thus the level of information we provide may be different than that of other public companies. If we do take advantage of any of these exemptions, some investors may find our securities less attractive, which could result in a less active trading market for our common stock, and our stock price may be more volatile.

We could be an emerging growth company until the last day of the first fiscal year following the fifth anniversary of our first common equity offering, although circumstances could cause us to lose that status earlier if our annual revenues exceed $1.0 billion, if we issue more than $1.0 billion in non-convertible debt in any three-year period or if we become a "large accelerated filer" as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the "Exchange Act").

13

Summary of the Offering

Common stock offered by us |

10,000,000 shares (or 11,500,000 shares if the underwriters exercise their over-allotment option in full). We are not registering any shares of common stock held by our stockholders. | |

Common stock to be outstanding after the offering |

13,982,400 shares (or 15,482,400 shares if the underwriters exercise their over-allotment option in full). |

|

Proposed trading symbol on NASDAQ Global Market |

"SKIS" |

|

Use of proceeds |

We estimate that we will receive net proceeds of approximately $91.6 million from our offering of our common stock, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, assuming the shares are offered at $10.00 per share, which is the midpoint of the estimated offering price range shown on the front cover page of this Prospectus. We will use the net proceeds from this offering as follows: approximately $42.9 million to repay a portion of the outstanding balance due under a promissory note in favor of our lender for the redevelopment of our Mount Snow ski area; approximately $12.5 million to repay a portion of the outstanding balance under a promissory note in favor of our lender for the acquisition of our Attitash ski area; approximately $11.4 million to repay a portion of the outstanding balance under a promissory note in favor of our lender made principally to pay outstanding debt secured by Crotched Mountain, of which approximately $0.4 million will be used to acquire the portion of the land underlying Crotched Mountain that we lease; approximately $9.5 million to repay a portion of the outstanding debt due pursuant to the Amended and Restated Credit and Security Agreement with our lender; and up to $5.0 million to pay a defeasance fee to our lender in connection with the prepayment of this debt. We intend to use the remaining proceeds for working capital and general corporate purposes, including future acquisitions. See "Use of Proceeds" for additional details. |

14

Dividend policy |

We intend to pay quarterly cash dividends on our common stock at an initial quarterly rate of $0.1375 per share. We intend to pay the first dividend in February 2015, which will include an amount on a pro-rated basis for the period from the effective date of this offering to January 31, 2015 and, thereafter, to pay dividends on a quarterly basis. There can be no guarantee that we will be able to pay dividends at this rate, or at all, in the future. The declaration and payment of future dividends to holders of our common stock will be at the sole discretion of our board of directors and will depend upon many factors, including our actual operating results financial condition, capital requirements, contractual restrictions, restrictions in our debt agreements, including the Master Credit Agreement, and other factors deemed relevant by our board of directors. Distributions treated as dividends that are received by individual holders of our common stock that are United States persons currently will be subject to a reduced maximum income tax rate of 20% if such dividends are treated as "qualified dividend income" for U.S. federal income tax purposes. See "Dividend Policy" for additional details. |

|

Risk factors |

Investment in our common stock involves a high degree of risk. You should read and consider the information set forth under the heading "Risk Factors" and all other information included in this Prospectus before deciding to invest in our common stock. |

Except as otherwise indicated, all of the information in this Prospectus:

- •

- gives effect to an assumed 100 for 1 stock split which we intend to effect prior to the consummation of this offering;

- •

- assumes no exercise of the underwriters' option to purchase up to 1,500,000 additional shares of common stock; and

- •

- excludes 559,296 shares eligible for issuance in connection with the Company's equity plan.

15

Summary Historical Consolidated Financial Data

The following summary consolidated financial information for each of the years in the five-year period ended April 30, 2014 is primarily based on our audited consolidated financial statements. The audited consolidated financial statements for fiscal 2014 and 2013 are included elsewhere in this Prospectus. The summary consolidated financial information for the three months ended July 31, 2014 and 2013 is based on our unaudited consolidated financial statements. In the opinion of our management, the interim financial information includes all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of our financial condition, results of operations and cash flows. The results for interim periods set forth below are not indicative of the results to be expected for the full year. The information set forth below should be read together with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated historical financial statements and the notes to our consolidated financial statements included elsewhere in this Prospectus.

| |

Three Months Ended July 31, |

Year Ended April 30, | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2014 | 2013 | 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||

| |

(In thousands, except share and ski resorts owned/leased and operated) |

|||||||||||||||||||||

Income Statement Information: |

||||||||||||||||||||||

Revenues |

$ | 5,596 | $ | 5,020 | $ | 105,205 | $ | 99,689 | $ | 82,044 | $ | 97,586 | $ | 89,846 | ||||||||

Operating expenses |

14,672 | 13,694 | 90,204 | 82,768 | 78,524 | 80,817 | 76,074 | |||||||||||||||

(Loss) income from operations |

(9,076 | ) | (8,674 | ) | 15,001 | 16,921 | 3,520 | 16,769 | 13,772 | |||||||||||||

Other Balance Sheet Data: |

||||||||||||||||||||||

Cash (end of period) |

5,996 | 9,286 | 13,186 | 11,971 | 6,179 | 16,463 | 19,508 | |||||||||||||||

Restricted cash (end of period)(1) |

10,956 | 7,616 | 13,063 | 12,141 | 11,036 | 11,271 | 11,139 | |||||||||||||||

Total debt (end of period)(2) |

175,727 | 172,586 | 175,902 | 172,322 | 161,499 | 144,058 | 138,621 | |||||||||||||||

Other Financial Information (unaudited): |

||||||||||||||||||||||

Reported EBITDA(3) |

$ | (6,445 | ) | $ | (6,347 | ) | $ | 25,366 | $ | 25,939 | $ | 13,081 | $ | 24,822 | $ | 21,317 | ||||||

Capital expenditures(4) |

3,043 | 1,718 | 10,028 | 14,900 | 21,817 | 19,116 | 6,009 | |||||||||||||||

Operating Data (unaudited): |

||||||||||||||||||||||

Total visits |

N/A | N/A | 1,752 | 1,686 | 1,346 | 1,752 | 1,776 | |||||||||||||||

Skier visits |

N/A | N/A | 1,570 | 1,521 | 1,221 | 1,572 | 1,606 | |||||||||||||||

Ski resorts owned/leased and operated(5)(6) |

13 | 13 | 13 | 13 | 12 | 12 | 11 | |||||||||||||||

16

The following table presents a summary of our balance sheet as of July 31, 2014 on an actual basis and on a pro forma basis to reflect the sale in this offering of 10,000,000 shares of common stock at an assumed initial public offering price of $10.00 per share, which is the midpoint of the range listed on the cover of this Prospectus, and no exercise of the underwriters' over-allotment option, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

| |

As of July 31, 2014 |

||||||

|---|---|---|---|---|---|---|---|

| |

Actual | Pro Forma | |||||

| |

(In thousands) |

||||||

Balance Sheet Information: |

|||||||

Cash |

$ | 5,996 | $ | 16,424 | |||

Restricted cash(1) |

10,956 | 10,956 | |||||

Total assets |

204,360 | 215,192 | |||||

Net property and equipment |

137,466 | 137,466 | |||||

Debt (including current portion)(2) |

175,727 | 99,931 | |||||

Stockholders' equity |

(4,671 | ) | 83,907 | ||||

- (1)

- As

of April 30 of each year, the end of our fiscal year, we are required to include, in restricted cash, interest due on our outstanding debt with

EPR and rent under the lease for the Mad River resort for the 10 months following April 30.

- (2)

- Total

debt includes $1.1 million in current obligations and $174.8 million in long-term debt and capital lease obligations. At the time of the

closing, the Company intends to reduce long-term debt from $174.8 million to approximately $99.0 million by repaying certain of its outstanding borrowings with a portion of the offering

proceeds. See "Use of Proceeds" and "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources" for further discussion.

- (3)

- We

have chosen to specifically include Reported EBITDA (defined as net income before interest, income taxes, depreciation and amortization, gain on sale

leaseback, investment income, other income or expense and other non-recurring items) as a measurement of our results of operations because we consider this measurement to be a significant indication

of our financial performance and available capital resources. Reported EBITDA is not a measure of financial performance under U.S. generally accepted accounting principles ("GAAP"). We provide a

reconciliation of Reported EBITDA to net income, the most directly-comparable GAAP measurement, below.

- Management

considers Reported EBITDA to be a significant indication of our financial performance and available capital resources. Because of

large depreciation and other charges relating to our ski resorts, it is difficult for management to fully and accurately evaluate our financial results and available capital resources using net

income. Management believes that by providing investors with Reported EBITDA, investors will have a clearer understanding of our financial performance and cash flow because Reported EBITDA:

(i) is widely used in the ski industry to measure a company's operating performance without regard to items excluded from the calculation of such measure, which can vary by company primarily

based upon the structure or existence of their financing; (ii) helps investors to more meaningfully evaluate and compare the results of our operations from period to period by removing the

effect of our capital structure and asset base from our operating structure; and (iii) is used by our management for various purposes, including as a measure of performance of our operating

entities and as a basis for planning.

- Items excluded from Reported EBITDA are significant components in understanding and assessing financial performance or liquidity. Reported EBITDA should not be considered in isolation or as alternative to, or substitute for, net income, net change in cash and cash equivalents or other financial statement data presented in the consolidated financial statements as indicators of

17

financial performance or liquidity. Because Reported EBITDA is not a measurement determined in accordance with GAAP and is susceptible to varying calculations, Reported EBITDA as presented may not be comparable to other similarly titled measures of other companies.

- The following table includes a reconciliation of Reported EBITDA to net income (loss) (in thousands):

| |

Three Months Ended July 31, |

Year Ended April 30, | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2014 | 2013 | 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||

Net (loss) income |

$ | (8,160 | ) | $ | (7,880 | ) | $ | (1,501 | ) | $ | 2,707 | $ | (5,295 | ) | $ | (4,006 | ) | $ | 2,833 | |||

Income tax (benefit) provision |

(5,172 | ) | (4,981 | ) | (461 | ) | 1,823 | (3,462 | ) | 10,410 | — | |||||||||||

Interest expense, net |

4,342 | 4,274 | 17,307 | 12,733 | 11,465 | 11,338 | 11,370 | |||||||||||||||

Depreciation and amortization |

2,306 | 2,287 | 9,207 | 8,902 | 9,561 | 8,054 | 7,545 | |||||||||||||||

Investment income |

(3 | ) | (4 | ) | (10 | ) | (10 | ) | (23 | ) | (241 | ) | (98 | ) | ||||||||

Gain on sale/leaseback |

(83 | ) | (83 | ) | (333 | ) | (333 | ) | (333 | ) | (333 | ) | (333 | ) | ||||||||

Gain on acquisition |

— | — | — | — | — | (400 | ) | — | ||||||||||||||

Non-routine legal fees and lawsuit settlement |

325 | 40 | 1,157 | 117 | — | — | — | |||||||||||||||

Write off of prepaid incremental stock issuance cost |

— | — | — | — | 1,168 | — | — | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Reported EBITDA |

$ | (6,445 | ) | $ | (6,347 | ) | $ | 25,366 | $ | 25,939 | $ | 13,081 | $ | 24,822 | $ | 21,317 | ||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

- (4)

- Capital

expenditures for the year ended April 30, 2011 include the Wildcat Mountain acquisition, which was financed with a seller note. Capital

expenditures for the year ended April 30, 2014 exclude land financed for $1.0 million.

- (5)

- Effective

in October 2010, we acquired substantially all of the business of Wildcat Mountain ski resort. We have included Wildcat Mountain's results of

operations in our financial statements since the date of acquisition.

- (6)

- Effective in October 2012, we acquired all of the business of Alpine Valley ski resort. We have included Alpine Valley's results of operations in our financial statements since the date of acquisition.

18