Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MRC GLOBAL INC. | d816466d8k.htm |

1

November 2014

November 2014

TM

Investor Presentation

Exhibit 99.1 |

2

November 2014

2

This

presentation

contains

forward-looking

statements

within

the

meaning

of

Section

27A

of

the

Securities

Act

and

Section

21E

of

the

Exchange

Act.

Words

such as “will,”

“expect,”

“expected”, “looking forward”, “guidance”

and similar expressions are intended to identify forward-looking statements.

Statements about the company’s business, including its strategy, its

industry, the company’s future profitability, the company’s guidance on its sales, adjusted EBITDA,

adjusted gross profit, tax rate, capital expenditures and cash flow, growth in the

company’s various markets and the company’s expectations, beliefs, plans,

strategies, objectives, prospects and assumptions are not guarantees of future

performance. These statements are based on management’s expectations

that involve a number of business risks and uncertainties, any of which could cause

actual results to differ materially from those expressed in or implied by

the forward-looking statements. These statements involve known and unknown

risks, uncertainties and other factors, most of which are difficult to predict

and many of which are beyond our control, including the factors described in the

company’s SEC filings that may cause our actual results and performance

to be materially different from any future results or performance expressed or

implied by these forward-looking statements. For a discussion of key risk

factors, please see the risk factors disclosed in the company’s SEC filings, which are available on the SEC’s website at

www.sec.gov

and

on

the

company’s

website,

www.mrcglobal.com.

Our

filings

and

other

important

information

are

also

available

on

the

Investor

Relations

page of our website at www.mrcglobal.com.

Undue reliance should not be placed on the company’s forward-looking

statements. Although forward-looking statements reflect the company’s good faith

beliefs,

reliance

should

not

be

placed

on

forward-looking

statements

because

they

involve

known

and

unknown

risks,

uncertainties

and

other

factors,

which

may

cause

the

company’s

actual

results,

performance

or

achievements

or

future

events

to

differ

materially

from

anticipated

future

results,

performance

or

achievements or future events expressed or implied by such forward-looking

statements. The company undertakes no obligation to publicly update or revise

any forward-looking statement, whether as a result of new information, future

events, changed circumstances or otherwise, except to the extent required by

law.

Statement Regarding Use of Non-GAAP Measures:

The Non-GAAP financial measures contained in this presentation (Adjusted

EBITDA and Adjusted Gross Profit) are not measures of financial

performance

calculated in accordance with U.S. Generally Accepted Accounting

Principles (GAAP) and should not be considered as alternatives to net income or

gross profit. They should be viewed in addition to, and not as a

substitute for, analysis of our results reported in accordance with GAAP. Management believes

that these non-GAAP financial measures provide investors a view to measures

similar to those used in evaluating our compliance with certain financial

covenants under our credit facilities and provide meaningful comparisons between

current and prior year period results. They are also used as a metric to

determine certain components of performance-based compensation. They are not

necessarily indicative of future results of operations that may be obtained

by the Company.

Forward Looking Statements and Non-GAAP Disclaimer |

3

November 2014

By the Numbers

Industry Sectors

Product Categories

2014 Guidance:

Sales

Adjusted EBITDA

$5.90B -

$5.97B

$430 -

$450M

Upstream

Line Pipe & OCTG

Employees

4,800+

Locations

400+

Midstream

Valves

Countries

•

Operations

•

Direct Sales

(>$100,000)

•

All countries

20

45+

90+

Customers

19,000+

Downstream/

Industrial

Fittings & Flanges

Suppliers

20,000+

SKU’s

230,000+

Company Snapshot

MRC

Global

is

the

largest

global

distributor

of

pipe,

valves

and

fittings

(PVF)

to the energy industry, by sales |

4

November 2014

Diversification by Industry Sector -

Revenue

Note: Percentage of sales for the twelve months ended September 30, 2014.

Upstream

47%

Downstream 25%

28% Midstream

Diversified Across All Three Major Energy Sectors |

5

November 2014

By Product Line

Revenue by Geography and Product Line

Note: Percentage of sales for the twelve months ended September 30, 2014.

By Geography

9%

21%

19%

19%

32%

Houston, TX

Edmonton, AB

Bradford, UK

Singapore

Perth, AU

Stavanger, NO

Diversified Across Multiple Geographies -

Domestically (all shale plays) and Internationally |

6

November 2014

Global Footprint to Serve Customers -

North America

Munster, IN

Nitro, WV

Tulsa, OK

Houston, TX

Nisku, AB

Cheyenne, WY

Odessa, TX

Bakersfield, CA

San Antonio, TX

By the Numbers

As of 9/30/2014

Branches

170+

RDCs

9

VACs

14

Employees

3,400+

Regional Distribution Centers

Corporate Headquarters

Valve Automation Centers

Branch Locations |

7

November 2014

Global Footprint to Serve Customers -

Europe

Stavanger, NO

By the Numbers

As of 9/30/2014

Branches

34

RDCs

3

VACs

15

Countries

8

Employees

900+

Rotterdam, NL

Bradford, UK

Regional Distribution Centers

Valve Automation Centers

Branch Locations |

8

November 2014

Global Footprint to Serve Customers -

Asia Pacific & Middle East

Singapore

Perth, WA

Brisbane, QLD

Dubai, UAE

By the Numbers

As of 9/30/2014

Branches

29

RDCs

4

VACs

6

Countries

10

Employees

400+

Regional Distribution Centers

Valve Automation Centers

Branch Locations |

9

November 2014

Benefits of MRC Global

•

Supplier Registration / Preferred Supplier List

•

Global delivery footprint with 1.5 million + sq. ft. of

regional distribution centers

•

Approximately $1.1B in global inventory, net

•

Global sourcing from 45+ countries

Why Customers Choose MRC Global –

Well Positioned

Generating savings and efficiencies for our customers

while enabling them to focus on their core competencies

MRC Global is #7 on Industrial

Distribution magazine’s annual list of

the 50 largest industrial distributors¹,

“The Big 50”

1.

Wolseley

2.

Wurth Group

3.

W.W. Grainger

4.

HD Supply

5.

Wesco

6.

Anixter

7.

MRC Global

1. September/October 2014 edition, based on 2013 revenue.

|

10

November 2014

Integrated Supply Statistics

•

Supplying Integrated Supply services since

1988 •

Accounts for sales in excess of $800

million and

growing rapidly

•

Employ over 165 personnel at customer

sites •

Providing Integration Services on over 100 customer

sites

•

Managing

over 1.4 million customer part numbers

•

Consignment inventories in excess of $35 million at 700

locations

•

Manage customer-owned point of use materials at

over

800 locations

MRC Global is a leading provider of Integrated Supply

Services to the Energy Industry |

11

November 2014

Downstream

Midstream

Upstream

MRC Global plays a vital role in the complex, technical, global energy supply

chain Long-Term Supplier & Customer Relationships

CUSTOMERS

SUPPLIERS

IOCs

Phillips 66

Valero

DOW

DuPont

Marathon

Petroleum

Access

Midstream

AGL

Resources

Atmos

NiSource

PG&E

Williams

DCP

Midstream

Chesapeake

Energy

ConocoPhillips

Devon

Apache

Anadarko

CNRL

Hess

Husky

Energy

Marathon

Oil

Statoil

Energy Carbon Steel

Tubular Products

Valves

Fittings, Flanges and General

Use Products

Tenaris

TMK-

IPSCO

U.S.

Steel

CSI Tubular

JMC

Wheatland

Balon

Cameron

Flowserve

Kitz

Neway

Velan

Boltex

Bonney

Forge

Chevron

Phillips

Chemical

Tube

Forgings of

America

WL Plastics

Emerson |

12

November 2014

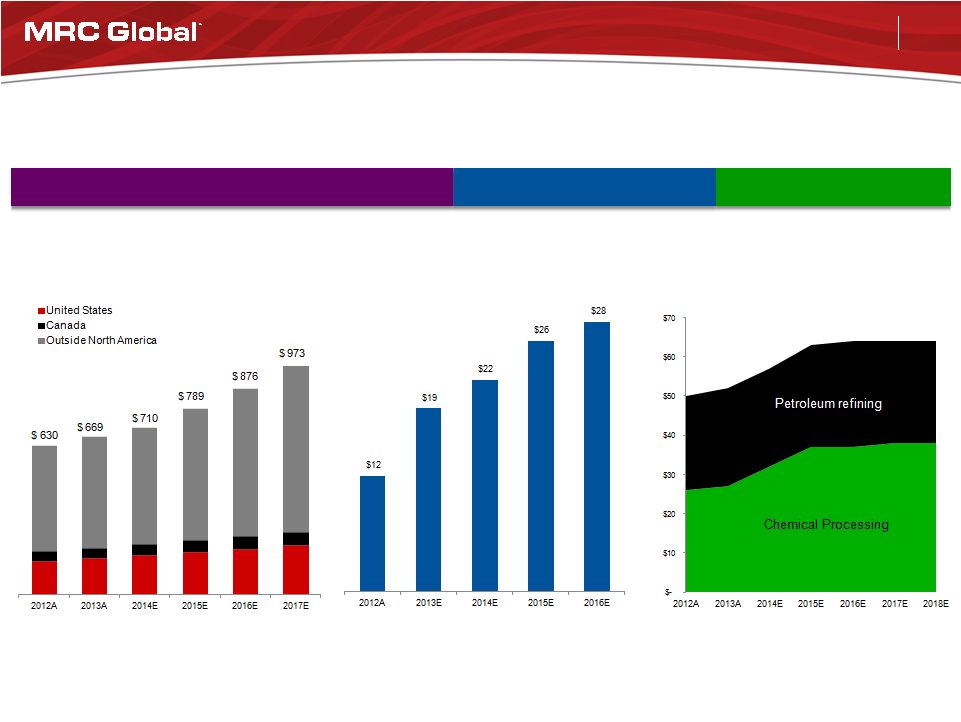

End Market Opportunities

Global E&P Spending²

1.

Percentage of sales for the twelve months ended September 30, 2014.

2.

Source: Barclays June 2014 E&P Spending Outlook.

3.

Source: Stifel “Pipelines: 2015 Spending & Awards Climb; Visibility into

Strength Through 2017”, September 15, 2014. 4.

Source: Industrial Info Resources: August 2014.

Petroleum Refining & Chemical

Processing Spending in North

America

4

$ Billions

Upstream 47%

Midstream 28%

Downstream 25%

MRC Global Revenue Mix by End Market¹

Large Project Pipeline Spending³

$ Billions

$ Billions |

13

November 2014

Strategic Objectives

Rebalance Product Mix to Higher Margin

Items

•

Focus on valve and valve automation

•

Strengthen offerings in stainless & alloy PFF

Growth from Mergers & Acquisitions

•

Add product lines to complete global PVF offerings

and geographies for scale and expertise

•

Stream AS –

Norway

•

NAWAH/MRC Global/US Steel Tubular

Products consortium –

Iraq

•

MSD Engineering –

Singapore and SE Asia

•

HypTeck

–

Norway

1.

Percentage of sales for the twelve months ended September 30, 2014.

Organic Growth

•

Targeted Growth Accounts: develop the

“next 75”

customers

Customer Mix -

Sales¹

•

Focus

on

multi-year

“Top

25”

MRO

agreements

•

Chevron

•

Kazakhstan, Future Growth Project, PFF

•

Thailand & Australia, MRO, PVF

•

ConocoPhillips

•

Lower 48 states & Canada, MRO, PVF

Execute Global Preferred Supplier Contracts

All Other -

19,000+ customers

Targeted Growth Accounts

Top 1 -

25 |

14

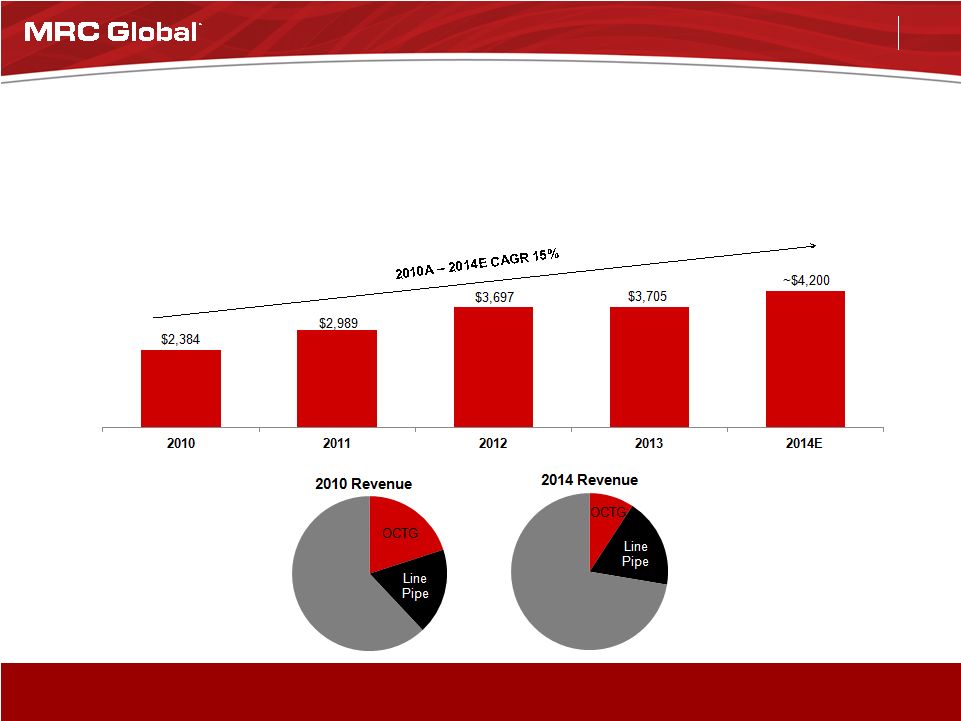

November 2014

Strategic Shift in Product Mix to Higher Margin Products

($ millions)

Total Revenue less Carbon Energy Tubulars (OCTG & Line Pipe)

15% CAGR Over Past 4 Years

Higher

Margin

Products

Higher

Margin

Products |

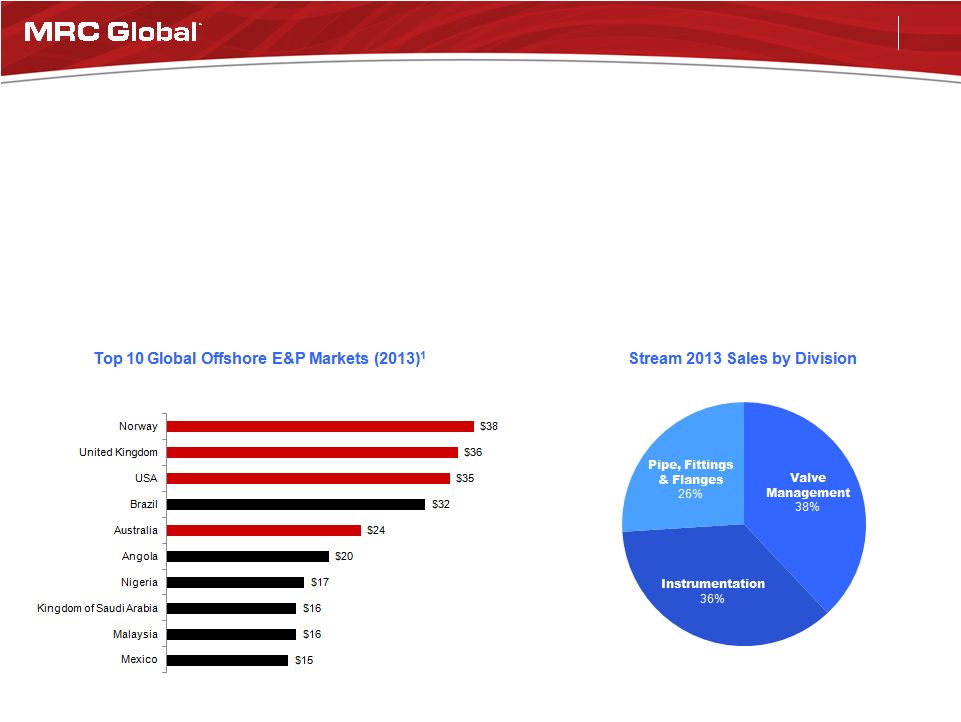

15

November 2014

Strategic Expansion into Offshore Production Platform MRO

•

Top 4 largest offshore markets ~$140 billion E&P spend

•

Norway is the largest –

we are now positioned in 4 of the 5 largest offshore markets

•

MRC Global revenue mix

•

Pre Stream

acquisition –

approx. 98% onshore, 2% offshore

•

Pro-forma post Stream

acquisition –

approx. 92% onshore, 8% offshore

1. Source: Rystad Energy, September 2014

($ billions) |

16

November 2014

1.

Reflects reported revenues for 2013.

Building an International Platform |

17

November 2014

Executive Management –

September 1, 2014

Over 30 years average individual experience

Andy Lane

Chairman, President & CEO

Jim Braun

Executive VP

& CFO

Dan Churay

Executive VP

Corporate Affairs,

General Counsel &

Corporate Secretary

Gary Ittner

Senior VP

SCM –

Valves,

Fittings, Flanges,

Alloys & Oilfield

Supply

Rory Isaac

Senior VP

Business

Development

Scott

Hutchinson

Senior VP

North America

Operations

Jim Dionisio

Senior VP

SCM –

Energy

Tubular Products

Steinar Aasland

Senior VP

Europe Region

John Bowhay

Senior VP

Asia Pacific &

Middle East Region |

18

November 2014

Financial Overview |

19

November 2014

3Q 2014 Highlights

•

New quarterly company records

•

Revenue $1.618 billion

•

Backlog $1.254 billion as of 9/30/14

•

Revenue from valves $531 million

•

19.0% Adjusted Gross Profit

•

$132 million Adjusted EBITDA (8.2%)

•

SG&A cost saving initiatives yield ~$17 million in annual savings

beginning in 4Q 2014

•

Early stages -

midstream customers pull-through occurring

•

Carbon energy tubular pricing improved throughout quarter

|

20

November 2014

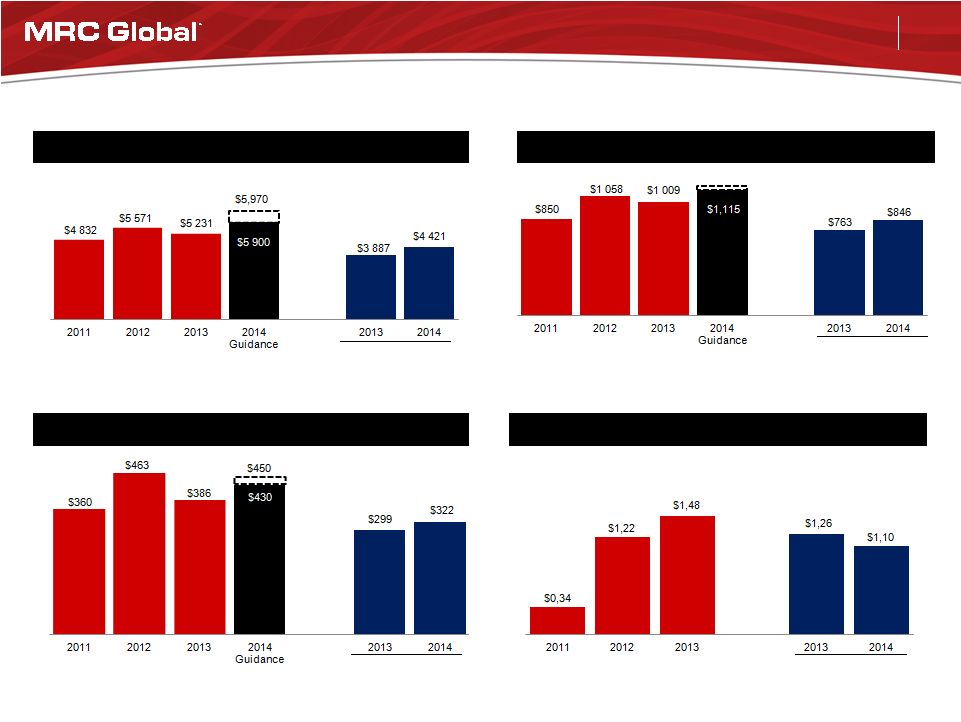

Financial Metrics

Sales

Adjusted Gross Profit and % Margin

Adjusted EBITDA and % Margin

7.0%

8.5%

($ millions, except per share data)

Y-o-Y

Growth

24%

(5%)

12%

Y-o-Y

Growth

29%

(17%)

14%

7.5%

8.3%

7.4%

7.5% -

7.3%

7.7%

7.3%

Y-o-Y

Growth

15%

(6%)

13%

Diluted EPS

Y-o-Y

Growth

259%

21%

17.6%

19.0%

19.3%

19.3% -

18.9%

19.6%

19.1%

$1,150

Nine Months Ended

September 30

Nine Months Ended

September 30

Nine Months Ended

September 30

Nine Months Ended

September 30 |

21

November 2014

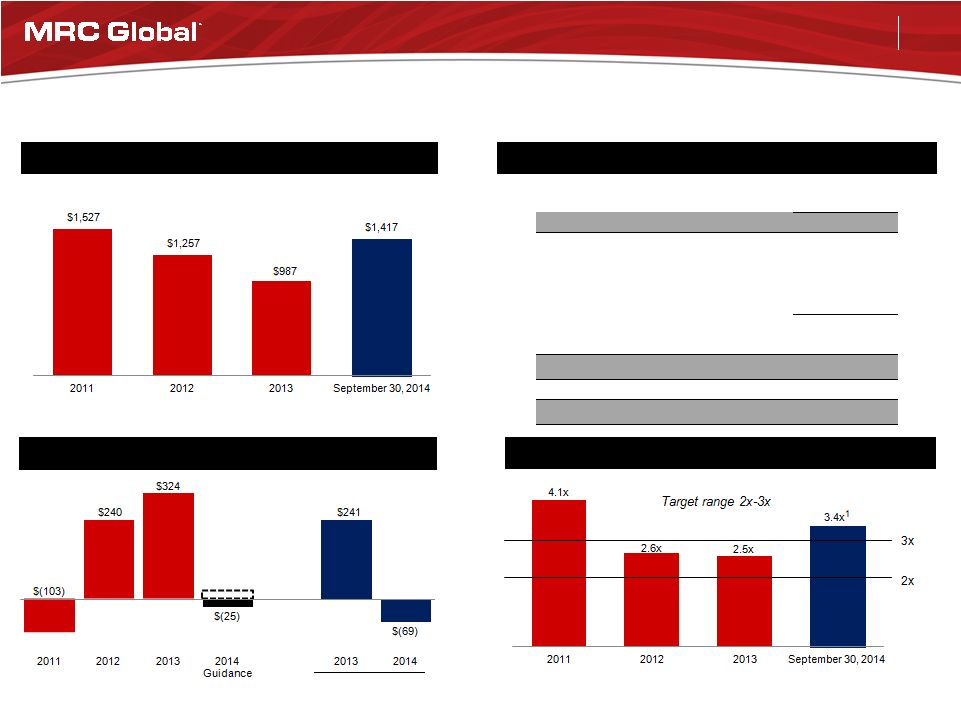

Balance Sheet Metrics

Total Debt

Capital Structure

Cash Flow from Operations

Net Leverage

($ millions)

September 30,

2014

Cash and Cash Equivalents

$ 31

Total Debt (including current portion):

Term Loan B due 2019, net of discount

782

Global ABL Facility due 2019

632

Other

3

Total Debt

$ 1,417

Total Equity

$ 1,425

Total Capitalization

$ 2,842

Liquidity

$ 307

Nine Months Ended

September 30

1.

The

net

leverage

ratio

is

3.25x

pro

forma

for

the

acquisition

of

Stream,

Flangefitt,

MSD and HypTeck.

$25 |

22

November 2014

Macro drivers

•

Growth in global energy consumption

driving investment

•

Increased global production

•

Need for additional energy infrastructure

•

Expansion of downstream energy

conversion businesses

Investment Thesis Highlights

Leading global PVF distributor to the energy sector

MRC Global attributes

•

Market leader

•

Exposed to all sectors of global energy

•

Long term global customer & supplier

relationships

•

Generates strong cash flow from operations

over the cycle |

23

November 2014

Appendix |

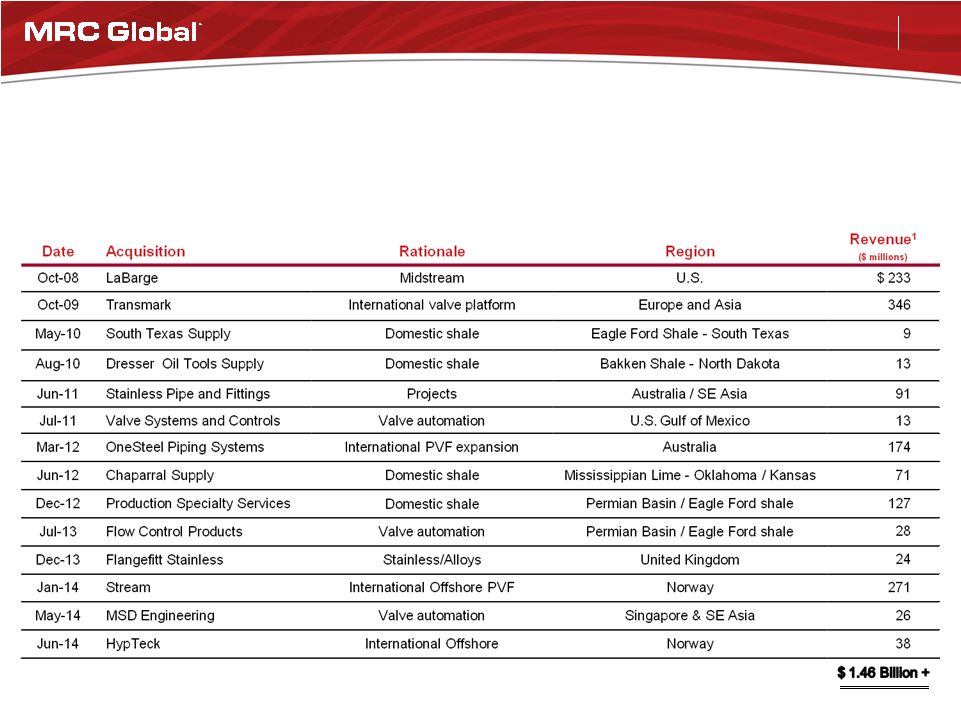

24

November 2014

1.

Reflects reported revenues for the year of acquisition or 2013 for Stream, MSD and

HypTeck. M&A -

Track Record of Strategic Acquisitions

•

International branch platform for “super majors”

E&P spend

•

Branch platforms/infrastructure for North American shale plays

•

Global valve and valve automation

•

Global stainless/alloys

Acquisition Priorities |

25

November 2014

Nine Months Ended

September 30

Year Ended December 31

($ millions)

2014

2013

2013

2012

2011

Net income

$ 113.0

$ 128.8

$ 152.1

$ 118.0

$ 29.0

Income tax expense

60.1

65.5

84.8

63.7

26.8

Interest expense

45.4

46.0

60.7

112.5

136.8

Depreciation and amortization

17.1

16.8

22.3

18.6

17.0

Amortization of intangibles

53.2

39.1

52.1

49.5

50.7

Increase (decrease) in LIFO reserve

5.9

(21.2)

(20.2)

(24.1)

73.7

Expenses associated with refinancing

-

-

5.1

1.7

9.5

Loss on early extinguishment of debt

-

-

-

114.0

-

Change in fair value of derivative instruments

1.7

(0.6)

(4.7)

(2.2)

(7.0)

Equity-based compensation expense

7.4

8.6

15.5

8.5

8.4

Loss on sale of Canadian progressive cavity pump business

6.2

-

-

-

-

Severance & related costs

7.5

0.8

0.8

-

-

Cancellation of executive employment agreement (cash portion)

3.2

-

-

-

-

Insurance charge

-

2.0

2.0

-

-

Foreign currency losses (gains)

1.8

12.0

12.9

(0.8)

(0.6)

Pension settlement

-

-

-

4.4

-

Legal and consulting expenses

-

-

-

-

9.9

Joint venture termination

-

-

-

-

1.7

Other expense (income)

-

1.4

3.0

(0.6)

4.6

Adjusted EBITDA

$ 322.5

$ 299.2

$ 386.4

$ 463.2

$ 360.5

Adjusted EBITDA Reconciliation |

26

November 2014

Nine Months Ended

September 30

Year Ended December 31

($ millions)

2014

2013

2013

2012

2011

Gross profit

$ 769.6

$ 728.8

$ 954.8

$ 1,013.7

$ 708.2

Depreciation and amortization

17.1

16.8

22.3

18.6

17.0

Amortization of intangibles

53.2

39.1

52.1

49.5

50.7

Increase (decrease) in LIFO reserve

5.9

(21.2)

(20.2)

(24.1)

73.7

Adjusted Gross Profit

$ 845.8

$ 763.5

$1,009.0

$ 1,057.7

$ 849.6

Adjusted Gross Profit Reconciliation |