Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EXELON CORP | d815901d8k.htm |

Edison Electric Institute

Financial Conference

November 12 –

13, 2014

Exhibit 99.1

*

*

*

*

*

*

*

*

*

* |

1

2014 EEI Financial Conference

Cautionary Statements Regarding Forward-Looking Information

This presentation contains certain forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995, that are

subject to risks and uncertainties. The factors that could cause actual

results to differ materially from the forward-looking statements

made by Exelon Corporation, Commonwealth Edison Company, PECO Energy

Company, Baltimore Gas and Electric Company and Exelon

Generation Company, LLC (Registrants) include those factors discussed herein,

as well as the items discussed in (1) Exelon’s 2013 Annual

Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations and (c) ITEM 8. Financial Statements and

Supplementary Data: Note 22; (2) Exelon’s Third Quarter 2014 Quarterly

Report on Form 10-Q in (a) Part II, Other Information, ITEM 1A. Risk

Factors; (b) Part 1, Financial Information, ITEM 2. Management’s

Discussion and Analysis of Financial Condition and Results of Operations

and (c) Part I, Financial Information, ITEM 1. Financial Statements:

Note 18; and (3) other factors discussed in filings with the SEC by the

Registrants. Readers are cautioned not to place undue reliance on these

forward- looking statements, which apply only as of the date of this

presentation. None of the Registrants undertakes any obligation to

publicly release any revision to its forward- looking statements to

reflect events or circumstances after the date of this

presentation. |

2

2014 EEI Financial Conference

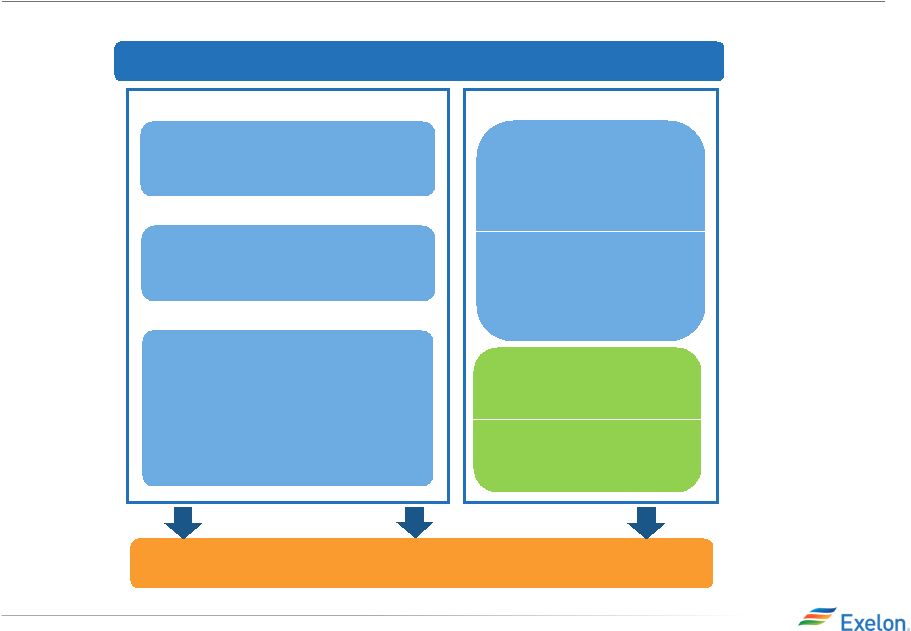

Our Strategy

Exelon

Corporation

Exelon Utilities

Exelon Generation

Attributes

Value Drivers

Guiding Principle

Corresponding Actions

•

Regulated growth

•

Dividend stability

•

Operational excellence

•

Earnings growth

•

Dividend yield

•

Public policy advocacy

General Characteristics

Role & Focus

•

Provide dividend coverage and

stable earnings growth platform

•

Invest in regulated growth

opportunities

•

Competitive growth

•

Commodity exposure

•

Operational excellence

•

Free cash flow growth

•

Power prices/volatility

•

Public policy advocacy

•

Diversify business to provide

growth and reduce earnings

volatility

•

Invest in existing and adjacent

markets and introduce new

products and services

Exelon’s Strategy

Leverage the integrated business model to create value and

diversify our business |

3

2014 EEI Financial Conference

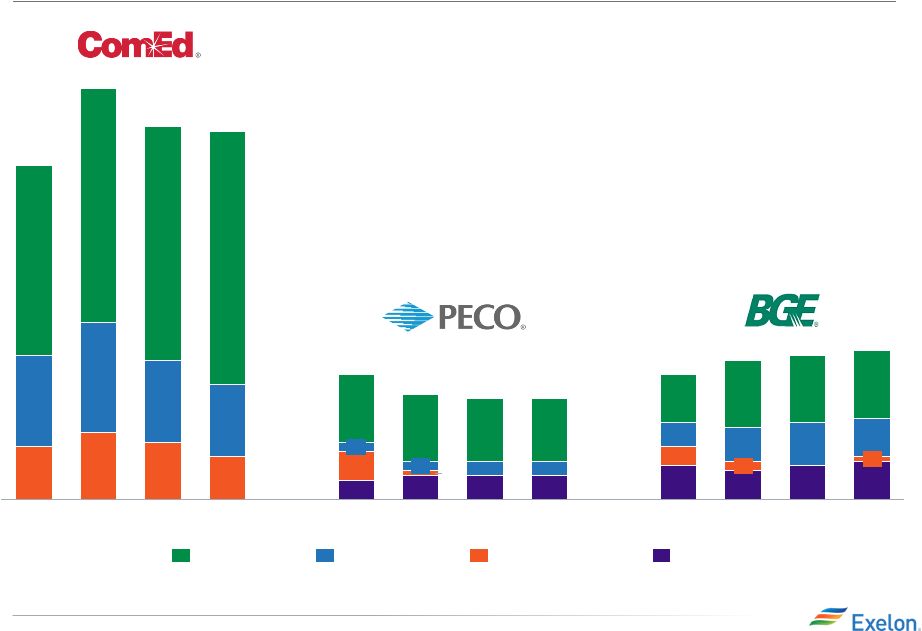

Driving Value at Exelon Utilities

Providing Material EPS Accretion

(1)

Significant Rate Base Growth

(2)

Operational Excellence

Creating

the Leading Mid-Atlantic Utility

•

Continue first quartile operating performance in

areas such as reliability and customer satisfaction

•

Achieve financial performance targets

•

Leverage standardization, common platforms and

best practices across operating companies

•

Improved operational performance at ComEd,

PECO and BGE since the merger

IL

Chicago

$0.00

$0.90

$1.70

$1.60

$1.40

$1.30

$1.20

$1.50

$1.10

$1.00

2017

$1.55

2016

2015

$1.40

2014

$1.25

$1.50

$1.20

$1.25

$0.95

$1.10

$21.8

$23.2

$24.7

$8.1

$8.8

$9.6

$20.1

$34.3

+15%

2017

2016

$32.0

2015

$29.9

2014

+49%

Exelon

PHI

(1)

Earnings guidance is for Exelon Utilities only and does not include PHI

utilities (2)

Denotes year end rate base

$20.1 |

4

2014 EEI Financial Conference

Driving Value at Exelon Generation

Capacity Prices

Capacity

Performance

Role of Demand

Response

Shift in Demand

Curve

Power Prices

Carbon

Heat Rates

Liquidity

Taking action to create value today while preparing for a different

future Guiding Principles:

Preserve the value of our core

business . . .

•

Operate the nuclear fleet safely and

reliably

•

Provide clean, reliable and affordable

energy

•

Manage portfolio through hedging and

generation to load matching

. . . while strategically growing and

diversifying the business

•

Leverage competencies for growth

•

Identify and capitalize on emerging

trends and technologies by being a first

mover

•

Invest in business diversification to

position the company for the future

•

Use full arsenal of financing tools |

5

2014 EEI Financial Conference

IL -

Market Based Solution

Possible Market Based Solutions

Benefits of Exelon’s Fleet to Illinois

Note: 2015 Legislative timeline is illustrative

•

•

•

•

•

•

Illinois could enact legislation to create a Clean Energy

Standard (CES)

A CES is a requirement that all customers purchase a

minimum percentage of “clean”

generation. The concept is

similar to a Renewable Portfolio Standard with the distinction

that the set of resources which qualify under the CES include

all zero or low CO

2

emission generators

Clean energy credits would be traded in a similar fashion to

how renewable energy credits (RECs) are traded today

Illinois could enact legislation to create a carbon trading

program or join an existing program like the Regional

Greenhouse Gas Initiative (RGGI)

Carbon trading programs put a cap on carbon emissions

and each fossil fuel generator must submit a carbon

allowance for each tonne of carbon the plant emits

These allowances are traditionally auctioned with the

proceeds going to the state treasury. Some of the funds may

be provided to customers to offset any rate impacts or

dedicated to other energy-related programs |

6

2014 EEI Financial Conference

Exelon is positioned for a strong future

Operational Excellence

Financial Strength

Portfolio Optimization

Strategic Diversification

Strong

Integrated

Business

Model

We

operate

our

nuclear

fleet

at

world

class

levels,

and

deliver

first

quartile

performance

at

the

utilities

We

maintain

a

strong

balance

sheet

and

the

ability

to

raise

and

deploy

capital

for

growth

We

manage

commodity

market

volatility

and

optimize

earnings

through

our

hedging

strategy

We

diversify

our

business

to

capitalize

on

evolving

industry

trends

over

the

long

term

We

leverage

our

core

competencies

to

grow

our

regulated

and

competitive

business

while

expanding

to

adjacent

markets

Core Strength

Strategic Actions

Public Policy Advocacy

We

advocate

for

policies

that

strengthen

competitive

markets,

value

the

grid

and

enhance

the

value

of

clean,

reliable

generation |

Key Developments

*

*

*

*

* |

8

2014 EEI Financial Conference

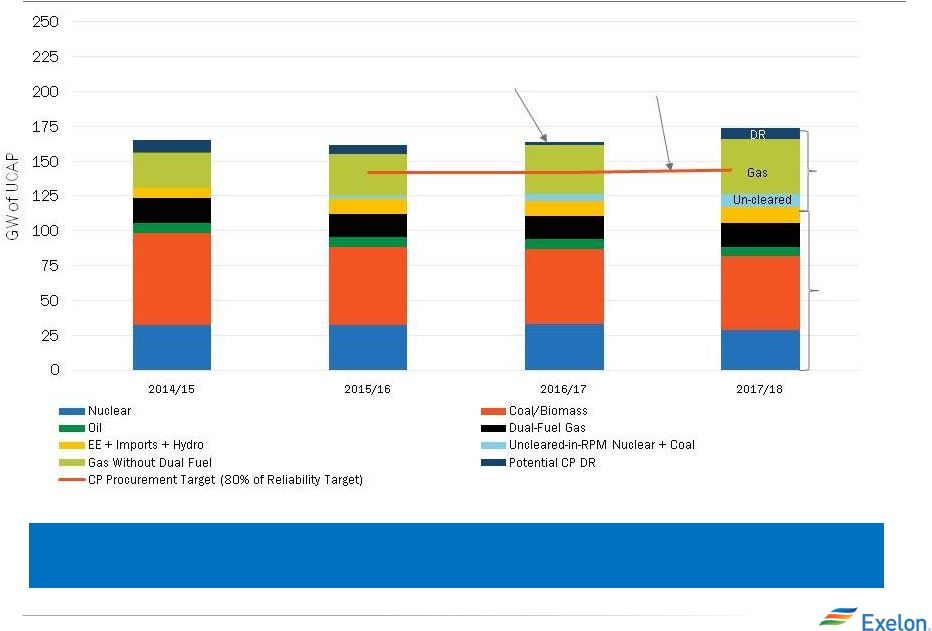

Capacity Performance (CP) Impact on PJM Fleet

Source: NorthBridge Analysis; includes FRR resources/Loads; PJM proposal is to

fully procure CP for 2016/17 and 2017/18 but to incrementally procure up to 10 GW of base

capacity for 2015/16. Potential 2015/16 all-in CP procurement

quantity shown for comparison purposes. Exelon’s fleet is well

positioned to benefit from Capacity Performance due to significant

investments in reliability |

9

2014 EEI Financial Conference

Asset Divestitures --

$ 1.4 Billion in Proceeds to Date

Retail

EXC Service Territory

PHI Service Territory

(1)

Represents EXC’s portion of the asset

Note: CF: Capacity Factor through September 2014; Safe Harbor capacity

factor through July 2014 Gas CT / 200 MW

2014 CF –

8%

Signed with Wayzata on

9/20

West Valley

Gas CT / 477 MW

2014 CF –

17%

Signed with Starwood

9/26

Quail Run

Gas / Oil CCGT / 688

MW

2014 CF –

61%

Signed with Calpine on

8/22

Fore River

Hydro / 277 MWZ

(1)

2014 CF –

38%

Transaction closed on

8/8 with Brookfield

Safe Harbor

Coal / 1245 MW

(1)

2014 CF –

74% / 82%

Signed with ArcLight on 10/24

Keystone / Conemaugh

Gas CCGT / 684 MW

2014 CF –

74%

Currently in sale

process

Hillabee

To date, Exelon has signed definitive agreements on five non-core

assets representing a total of nearly $1.4 billion of after-tax sales

proceeds upon closings; This excludes proceeds from Hillabee,

which is currently on the market |

10

2014 EEI Financial Conference

ExGen Disclosures -

Asset Sale Impacts

Gross

Margin

Category

($M)

2015

2016

2017

Open Gross Margin

(including South, West & Canada hedged GM)

6,750

6,500

6,650

Mark to Market of Hedges

-

150

150

Power New Business / To Go

400

550

750

Non-Power Margins Executed

100

50

50

Non-Power New Business / To Go

300

350

350

Total Gross Margin

(2,5)

7,550

7,600

7,950

Impact of Removing Keystone / Conemaugh

(150)

(100)

(100)

Pro-forma Total Gross Margin excluding Keystone / Conemaugh

7,400

7,500

7,850

Impact

of

Announced

Assets

Sales

During

2014

(1)

2015

2016

2017

OGM Impact Q2 (Safe Harbor)

(50)

(50)

(50)

OGM Impact Q3 (Fore River, Quail Run, West Valley)

(100)

(100)

(100)

OGM Impact Q4 (Keystone / Conemaugh)

(150)

(100)

(100)

Total Impact to OGM from Announced Asset Sales

(300)

(250)

(250)

O&M

100

100

100

D&A

100

100

100

EBIT

(100)

(50)

(50)

CapEx

(50)

(50)

(100)

EPS Reduction

(6)

($0.06-$0.08)

($0.02-$0.04)

($0.02-$0.04)

(1)

Rounded

to

nearest

$50M

(2)

Total

Gross

Margin

(Non-GAAP)

is

defined

as

operating

revenues

less

purchased

power

and

fuel

expense,

excluding

revenue

related

to

decommissioning,

gross

receipts

tax,

Exelon

Nuclear

Partners

and

variable

interest

entities.

Total

Gross

Margin

is

also

net

of

direct

cost

of

sales

for

certain

Constellation

businesses

(3)

Excludes

EDF’s

equity

ownership

share

of

the

CENG

Joint

Venture

(4)

Mark

to

Market

of

Hedges

assumes

mid-point

of

hedge

percentages

(5)

Reflects

the

divestiture

impact

of

Fore

River,

Quail

Run

and

West

Valley.

Does

not

include

divestiture

of

Keystone/Conemaugh

or

the

Integrys

Acquisition

(6)

EPS

impact

does

not

include

impact

of

investing

the

proceeds

from

the

sale.

As

a

reminder

these

sales

were

included

in

the

accretion

calculation

for

the

PHI

transaction

(3,4)

(3)

(1) |

11

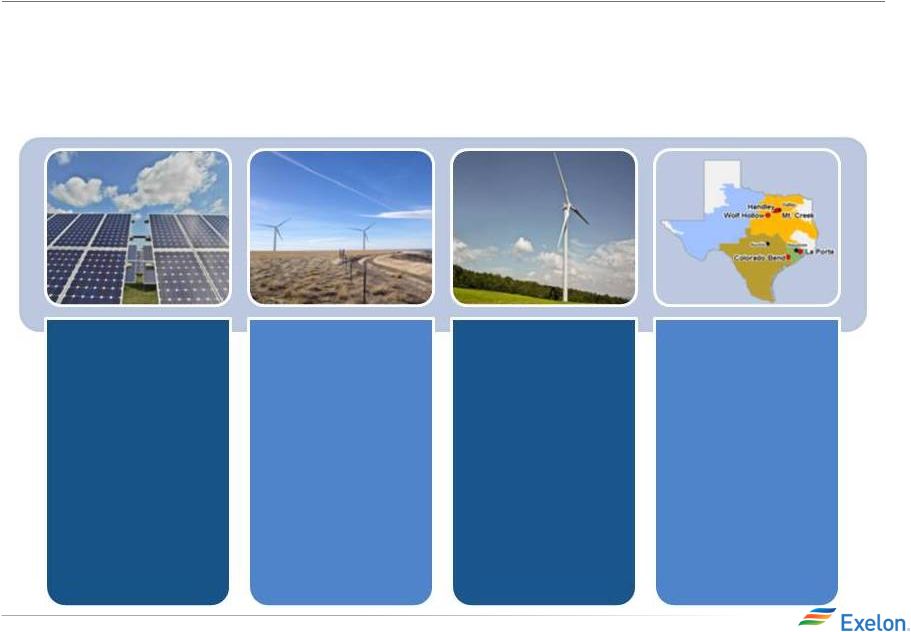

2014 EEI Financial Conference

2014 EEI Financial Conference

State of the Art Combined Cycles in ERCOT

•

Efficient:

Two of the cleanest, most efficient

Combined Cycle Gas Turbines (CCGT) in the

nation

•

Cost Effective:

Simplified design provides for

easier construction and maintenance, making

these units among the most predictable and

least costly to operate and maintain in the

industry

•

Environmental:

Plants

use

air

cooling

which

mitigates water constraint issues

•

Fast

Ramp:

100

MW/Minute

ramp

rate

(market

ramp rate ~50 MW/minute)

WEST

SOUTH

NORTH

HOUSTON

Wolf Hollow

Colorado Bend

Key Facts

Sites

Wharton County, TX

Granbury, TX

Total Capacity

~2,200MW

(Wolf Hollow: 1,085MW / Colorado

Bend: 1,104MW)

Construction Cost

~$700/kW

Heat Rate

~6,500 mmBtu/MWh

OEMs

GE and Alstom

EPC

Zachry

Cooling System

Air Cooled

Construction Start

2015

Commercial Operation

By Summer 2017

ERCOT Dispatch |

12

2014 EEI Financial Conference

2014 EEI Financial Conference

Distributed Energy Platform

Distributed Energy is a Fast Growing Business

•

On-site generation, including solar, quadrupled since 2006

(Wall Street Journal 2013)

•

US C&I customers are spending ~$5-6 billion per year on self-

generation and energy efficiency programs (Bloomberg 2013)

•

Revenues from Distributed Generation are expected to reach

$12.7 billion by 2018 (Pike Research, Navigant, 2012)

Distributed Energy

Supports Exelon’s

Strategy:

Grow

Organically &

Through M&A

Participate in

Emerging

Trends

& Technologies

Commercializing

emerging

and

potentially

disruptive

energy

technologies

to

diversify

existing

technology

base

Acquiring

long

term

retail

customers

through

a

PPA

or

other

long-term

agreement

Attract

and

acquire

new

customers

with

unique

offering

Provides

adaptive

growth

in

an

emerging

market

sector

Bolstering

existing

relationships

with

customers

to

help

achieve

reliability

or

sustainability

objectives

Integrating

supply

&

demand

side

solutions

Key Attributes of Financial Value

Backup

Generation

Battery

Storage

Co-Generation

Fuel

Cell

CNG

Solar

Energy

Efficiency

•

Provide equity financing for 21 MW of Bloom Energy fuel cell projects

at 75 commercial facilities including AT&T

•

Provides renewable energy value or credits, if applicable

•

Provides tax incentives, if applicable

•

Own and operate CNG facilities

•

Leverage retail gas supply and risk management expertise

•

Long-term customer off-take agreement(s)

•

~ 200 MW of Retail Solar Projects in operation or under construction

•

Long-term customer PPA (usually @ fixed price)

•

Provides renewable energy value or credits, if applicable

•

Provides tax incentives, if applicable

•

Over 1,000 energy saving projects implemented

•

~ 50 MW conserved by customers

•

More than $1 billion in projects 3rd party customer financed

•

Own and operate energy assets as a service to retail customers

•

Bundled service offering with long-term customer agreements

through grid power supply & LR programs

•

Load Response market -based value creation (e.g., LR Programs)

•

Own and operate energy assets as a service to retail customers

•

Bundled service offering with long-term customer agreements

through grid power supply & LR programs

•

Load Response market based value creation (e.g., ancillary services)

•

Design, build and operate energy assets

•

Provides renewable energy value or credits, if applicable

•

Long-term O&M agreements

Owned Assets –

additional attributes:

•

Long-term customer PPA (usually @ fixed price)

•

Provides tax incentives, if applicable

Invested

more

than

$1

billion

of

capital

with

projects

averaging

returns

of

8%

-

12%,

and

well

positioned

for

growth

Preserve

Value |

Financial Update |

14

2014 EEI Financial Conference

2014 EEI Financial Conference

Financing Strategy

•

Our financing strategy incorporates a broad range of financial products, from

the standard corporate-style products (such as corporate debt and

equity), to alternative structures such as project financing,

partnership structures and other arrangements

•

We employ a wide variety of financing tools that will enable us to access

capital to grow on both the regulated and unregulated sides of the

business Financing

Growth

Balance Sheet

Debt

Equity or Equity-

Like Products

Structured

Finance

On Balance Sheet Debt

supports core business and/or

strategic assets

•

Senior Unsecured Notes

•

Utility First Mortgage Bonds

Equity or Equity-Like Products

support growth projects (both

on-going and strategic M&A)

•

Mandatory Convertible Units

•

Marketed Follow-On Offerings

Structured Financing supports

non-core assets that generate

consistent cash flows

•

Project Financing

•

Asset Based Lending

•

Joint Venture/Equity Partner

Asset Sales

Proceeds from asset sales

support

•

Reinvestment of Free Cash Flow

•

Strategic Diversification |

15

2014 EEI Financial Conference

2014 EEI Financial Conference

Exelon’s Strategic and Financial Decisions Enable Growth

Across the Enterprise

Exelon has a proven ability to finance growth

A broad spectrum of financing alternatives beyond the

core financing options can be used to fund growth

o

Monetize assets in the portfolio via project

finance (Nearly $3B over past 3 years)

o

Sell assets which are worth more to others

($1.0-$1.5B after-tax in 2014-15)

o

Other financing structures (joint ventures,

minority partners, etc.) could be used based on

opportunity

Incremental Sources of Cash

750

750

750

775

775

550

425

675

300

625

275

2016

775

25

2015

2,650

1,900

2014

2018

1,200

2017

1,050

4,275

1,400

1,150

2013

1,175

Strategic and Diversified Deployment

Exelon

1.

Constellation

2.

BGE

3.

Utility Rate Base

4.

Retail Acquisitions

5.

Wind

6.

Annova LNG

7.

ERCOT New Build

8.

Pepco Holdings

9.

Distributed Energy

3

4

2/8

7

6

1

5

Contracted

Retail Regulated

Earnings Volatility

Higher

Lower

Merchant

Strategic Decisions

Dividend Reduction

Alternative Financings

Forward Equity Sale

Mandatory Converts

ExGen Texas Power, LLC

Asset Sales

(1)

EPU Cancellations

ExGen Renewables I

Continental Wind

(1)

Includes Safe Harbor, Fore River, Quail Run, West Valley and Keystone

Conemaugh. Does not include future Hillabee proceeds

9

Note: |

16

2014 EEI Financial Conference

2014 EEI Financial Conference

Over the Last Three Years, Exelon Has Raised Nearly $3 Billion

through Project Financing

•

Exelon uses project financing to:

•

Maintain upside reward of the project while mitigating the downside risk

•

Enhance corporate credit metrics and strengthen the balance sheet via

non-recourse financing vehicles •

Provide different and new sources of liquidity that Exelon would

not typically be able to access corporately

•

Maximize Exelon’s returns on its strategic investments

Antelope Valley

Solar Ranch

•230 MW photovoltaic

solar generating plant in

Lancaster, CA

•$646 MM

Senior

Secured Bond –

due

January 2037 with a DOE

Loan Guaranty

Continental Wind

•667 MW of wind spread

across 13 projects and five

wind regimes

•$613MM Senior Secured

144a Project Bond –

due

February 2033 and

$141MM Senior Secured LC

and Working Capital

Facilities –

due February

2021

•Deal of the Year

•Project Finance’s 2013

North American Portfolio

Power Deal of the Year

•Project Finance & Risk’s

2013 Project Finance

Renewable Deal of the Year

ExGen Renewables

I

•HoldCo financing of

Continental’s distributions

to further maximize our

returns on our wind

investments

•$300MM Senior Secured

Team Loan B –

due

February 2021

ExGen Texas Power

•3,476 MW ERCOT

conventional power

portfolio consisting of

CCGTs and Simple Cycles

•$675MM Senior Secured

Term Loan B –

due

September 2021

•One of the largest non-

corporate, single-tranche

term loan B issuances in

the power sector in 2014 |

17

2014 EEI Financial Conference

2014 Operating Earnings Guidance

2014 Original Guidance

$2.25 -

$2.55

(1)

$0.50 -

$0.60

$0.40 -

$0.50

$0.20 -

$0.30

ExGen

ComEd

PECO

BGE

2014 Revised Guidance (Disclosed

on 3Q2014 Earnings Call)

$2.30 -

$2.50

(1)

$1.25 -

$1.35

$0.45 -

$0.55

$0.35 -

$0.45

$0.15 -

$0.25

ExGen

ComEd

PECO

BGE

$1.10 -

$1.30

(1) Earnings guidance for OpCos may not add up to

consolidated EPS guidance. Refer to slide 24 for a list of adjustments from GAAP EPS to adjusted

(non-GAAP) operating EPS |

18

2014 EEI Financial Conference

2014 EEI Financial Conference

EPS Sensitivities

2015

2016

2017

Fully Open

Henry Hub Natural Gas

+$1/MMBtu

$0.10

$0.37

$0.66

$0.88

-$1/MMBtu

($0.05)

($0.34)

($0.59)

($0.87)

NiHub ATC Energy Price

+$5/MWh

$0.07

$0.22

$0.31

$0.36

-$5/MWh

($0.07)

($0.22)

($0.31)

($0.36)

PJM-W ATC Energy Price

+$5/MWh

$0.03

$0.14

$0.21

$0.27

-$5/MWh

($0.02)

($0.13)

($0.20)

($0.27)

PJM Capacity Market

+$10/MW-day

$0.05

-$10/MW-day

($0.05)

30 Year Treasury Rate

+25 basis points

$0.01

$0.01

$0.01

$0.01

-25 basis points

($0.01)

($0.01)

($0.01)

($0.01)

Share Count (millions)

870

872

892

910

(1)

Based

on

September

30,

2014

market

conditions

and

hedged

position.

Gas

price

sensitivities

are

based

on

an

assumed

gas-power

relationship

derived

from

an

internal

model

that

is

updated

periodically.

Power

prices

sensitivities

are

derived

by

adjusting

the

power

price

assumption

while

keeping

all

other

price

inputs

constant.

Due

to

correlation

of

the

various

assumptions,

the

EPS

impact

calculated

by

aggregating

individual

sensitivities

may

not

be

equal

to

the

EPS

impact

calculated

when

correlations

between

the

various

assumptions

are

also

considered.

(2)

Assumes

2017/2018

auction

cleared

volumes

(3)

Does

not

include

shares

assumed

to

be

issued

via

forward

equity

sale

in

connection

with

PHI

acquisition

(3)

(2) |

19

2014 EEI Financial Conference

2014 EEI Financial Conference

Capital Expenditure Expectations ($M)

Exelon Utilities

Exelon Generation

(1)

(1)

At Ownership

Note: Numbers rounded to nearest $25m

275

275

300

325

525

425

300

250

650

800

725

650

1,600

1,925

1,900

2,000

2016

3,225

2015

3,425

2014

3,050

2017

3,225

Gas Delivery

Smart Grid/Smart Meter

Electric Transmission

Electric Distribution

1,175

950

900

1,125

1,050

550

675

175

125

150

125

200

150

3,250

100

50

100

2014

2,775

75

1,025

1,000

950

100

75

2016

2,875

100

75

25

2015

2,200

2017

75

Wind

Base Capex

Nuclear Fuel

MD Commitments

TX New Build

Solar

Upstream

Nuclear Uprates |

20

2014 EEI Financial Conference

2014 Projected Sources and Uses of Cash

Key Messages

(1)

•

Cash from Operations is projected to be $7,475M vs. 2Q14E of

$6,975M for a $500M variance. This variance is driven by:

$625M Net proceeds from divestitures

$175M Income taxes and settlements

$125M Reclassification of PHI preferred stock purchase

($325M) Integrys acquisition, including working capital

($100M) Working capital at Utilities

•

Cash from Financing activities is projected to be $375M vs.

2Q14E of $250M for a $125M variance. This variance is driven

by:

$175M Incremental project financing at ExGen

($50M) Decreased ComEd long term debt requirements

($25M) Decrease in projected commercial paper financings

•

Cash from Investing activities is projected to be ($5,725M) vs.

2Q14E of ($5,450M) for a ($275M) variance. This variance is

driven by:

($125M) ExGen development

($125M) Reclassification of PHI preferred stock purchase

($25M) Upstream

Projected Sources & Uses

(1)

(1)

All amounts rounded to the nearest $25M.

(2)

Excludes counterparty collateral of $134 million at 12/31/2013. In addition, the

12/31/2014 ending cash balance does not include collateral.

(3)

Includes cash flow activity from Holding Company, eliminations, and other

corporate entities. CapEx for Exelon is shown net of $325M CPS early

lease termination fee, and ($125M) purchase of PHI preferred stock.

(4)

Adjusted Cash Flow from Operations (non-GAAP) primarily includes net cash

flows from operating activities and net cash flows from investing

activities excluding capital expenditures of $5.7B for 2014. (5)

Dividends are subject to declaration by the Board of Directors.

(6)

“Other Financing”

primarily includes CENG distribution to EDF, expected changes in short-term

debt, and proceeds from issuance of mandatory convertible units.

($ in millions)

BGE

ComEd

PECO

ExGen

Exelon

(3)

As of 2Q14

Variance

Beginning Cash Balance

1,475

1,475

--

Adjusted Cash Flow from Operations

675

1,600

650

4,550

7,475

6,975

500

CapEx (excluding other items below):

(550)

(1,475)

(500)

(1,275)

(3,700)

(3,450)

(250)

Nuclear Fuel

n/a

n/a

n/a

(1,000)

(1,000)

(1,000)

--

Dividend

(1,075)

(1,075)

--

Nuclear Uprates

n/a

n/a

n/a

(150)

(150)

(150)

--

Wind

n/a

n/a

n/a

(75)

(75)

(75)

--

Solar

n/a

n/a

n/a

(200)

(200)

(200)

--

Upstream

n/a

n/a

n/a

(75)

(75)

(50)

(25)

Utility Smart Grid/Smart Meter

(75)

(275)

(150)

n/a

(525)

(525)

--

Net Financing (excluding Dividend):

Debt Issuances

--

900

300

--

1,200

1,250

(50)

Debt Retirements

--

(625)

(250)

(525)

(1,375)

(1,375)

--

Project Finance/Federal Financing Bank

Loan

n/a

n/a

n/a

1,050

1,050

875

175

Other Financing

(75)

175

100

(375)

575

575

--

Ending Cash Balance

3,600

3,250

350

(2)

(4)

(2)

(6)

(5) |

21

2014 EEI Financial Conference

Pension and OPEB Contributions and Expense

2015

2016

(in $M)

Pre-tax Expense

(1)

Contributions

(2)

Pre-Tax Expense

(1)

Contributions

(2)

Pension

(3)(4)

$375

$515

$325

$565

OPEB

(3)(4)

$5

$30

$5

$35

Total

$380

$545

$330

$600

(1)

Pension and OPEB expenses assume a ~27% and ~28% capitalization rate in 2015

and 2016, respectively (2)

Contributions shown in the table above are based on the current contribution

policy, which for the pension includes a discretionary component of $250M

(3)

Expected return on assets for pension is 7.00% and for OPEB is 6.59%

(4)

Projected 12/31/14 pension and OPEB discount rates are 4.28% and 4.26%,

respectively, for the majority of plans |

22

2014 EEI Financial Conference

2015 Pension and OPEB Sensitivities

•

Tables below provide sensitivities for the combined company’s 2015 pension

and OPEB expense and contributions

(1)

under various discount rate and S&P 500 asset return scenarios

(1)

Contributions

shown

in

the

table

above

are

based

on

the

current

contribution

policy,

which

for

the

pension

includes

a

discretionary

component

of

$250M

(2)

Pension

and

OPEB

expenses

assume

an

~

27%

capitalization

rate

in

2015

(3)

Final

2014

asset

return

for

pension

and

OPEB

will

depend

in

part

on

overall

equity

market

returns

for

Q4

2014

as

proxied

by

the

S&P

500;

The

amounts

above

reflect

YTD

asset

returns

through

September

30,

2014

(4)

The

baseline

discount

rates

reflect

projected

12/31/14

pension

and

OPEB

discount

rates

of

4.28%

and

4.26%,

respectively,

for

the

majority

of

plans

2015 Pension Sensitivity

(2)

(in $M)

S&P Returns in Q4 2014

(3)

10%

0%

-10%

Discount Rate at

12/31/14

Pre-Tax

Expense

(1)

Contributions

(2)

Pre-Tax

Expense

(1)

Contributions

(2)

Pre-Tax

Expense

(1)

Contributions

(2)

Baseline

Discount

Rate

(4)

$365

$505

$375

$515

$390

$520

+50 bps

$345

$265

$345

$520

$355

$525

-

50bps

$400

$490

$410

$495

$425

$505

2015 OPEB Sensitivity

(2)

(in $M)

S&P Returns in Q4 2014

(3)

10%

0%

-10%

Discount Rate at

12/31/14

Pre-Tax

Expense

(1)

Contributions

(2)

Pre-Tax

Expense

(1)

Contributions

(2)

Pre-Tax

Expense

(1)

Contributions

(2)

Baseline

Discount

Rate

(4)

$0

$30

$5

$30

$25

$35

+50 bps

($10)

$30

$0

$30

$10

$30

-

50bps

$10

$30

$25

$35

$35

$50 |

23

2014 EEI Financial Conference

Exelon-PHI Debt Maturity Profile

(1)

250

250

325

260

1,275

425

1,350

300

500

650

600

550

700

600

1,100

525

100

125

100

75

200

250

800

2022

1,450

2016

1,575

2015

1,985

2014

2021

900

2020

1,600

2019

925

25

2018

1,600

2017

1,225

25

ExCorp

PHI Holdco

PHI Regulated

EXC Regulated

ExGen

(1)

ExGen

debt

includes

legacy

CEG

debt;

EXC

Regulated

includes

capital

trust

securities;

Excludes

PHI

unregulated

debt,

which

totals

$25M;

Excludes

acquisition

debt

and

non-recourse

debt;

(2)

Current

senior

unsecured

ratings

for

Exelon,

Exelon

Generation

and

BGE

and

senior

secured

ratings

for

ComEd

and

PECO

(3)

All

ratings

are

“Stable”

outlook,

except

for

at

Fitch,

which

has

BGE

on

“Positive”

and

Exelon

and

ExGen,

on

“Ratings

Watch

Negative”

As of 10/31/14

Manageable debt maturity profile

Current

Ratings

(2)(3)

Moody’s

S&P

Fitch

Corp

Baa2

BBB-

BBB+

ComEd

A2

A-

A-

PECO

Aa3

A-

A

BGE

A3

A-

BBB+

Generation

Baa2

BBB

BBB+ |

24

2014 EEI Financial Conference

GAAP to Operating Adjustments

•

Exelon’s 2014 adjusted (non-GAAP) operating earnings excludes the

earnings effects of the following: -

Mark-to-market adjustments from economic hedging activities

-

Unrealized gains and losses from NDT fund investments to the extent not offset

by contractual accounting as described in the notes to the consolidated

financial statements -

Financial impacts associated with the increase and decrease in certain

decommissioning obligations -

Financial impacts associated with the sale of interests in generating

stations -

Non-cash charge to earnings related to the cancellation of previously

capitalized nuclear uprate projects and

the

impairment

of

certain

wind

generating

assets

and

certain

assets

held

for

sale

-

Gain recorded upon consolidation of CENG

-

Certain costs incurred associated with the Constellation, CENG merger, and

Pepco Holdings, Inc. merger and integration initiatives

-

Non-cash amortization of intangible assets, net, related to commodity

contracts recorded at fair value at the merger date for 2014

-

Favorable settlements of certain income tax positions on Constellation’s

2009-2012 tax returns -

CENG interest not owned by Generation, where applicable

|

Exelon Utilities

*

*

*

*

* |

26

2014 EEI Financial Conference

Exelon Utilities Strategy

Strategy

Increase Total Enterprise Value

Maintain

First Quartile

Operating Performance

Achieve Financial

Performance Targets

Leverage standardization,

common platforms, and

best practices across

operating companies,

building a value creation

platform for future scale

Optimize Existing

Infrastructure

(get full potential from

current businesses)

Invest in Traditional

Infrastructure

(delivery network investments)

Grow Emerging

Infrastructure

(transformative growth)

Innovate

Products & Services

(expand customer offering)

Operational Excellence

Growth |

27

2014 EEI Financial Conference

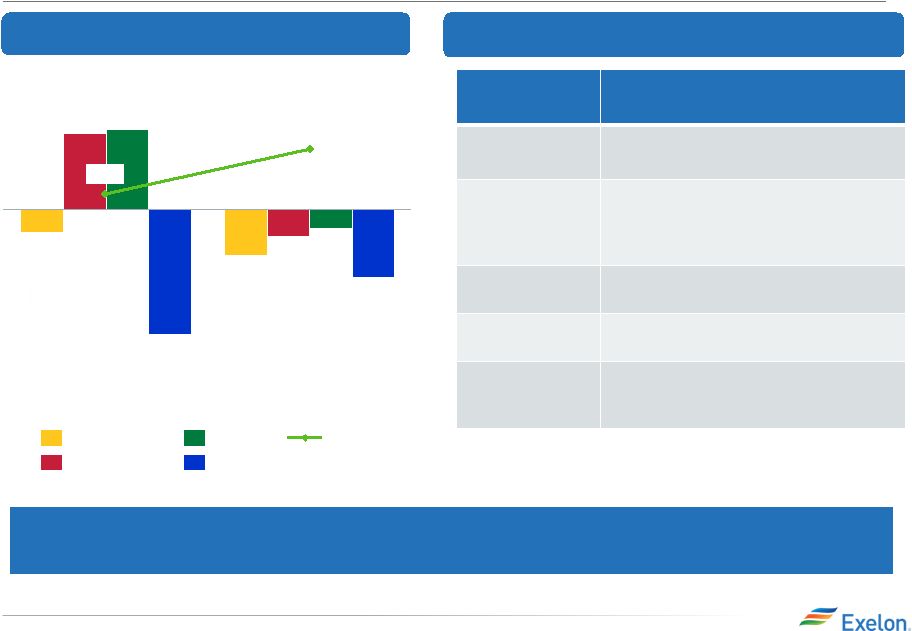

Leveraging Best Practices for Operational Excellence

Operations

Metric

At Merger (2012)

Post Merger (2014)

BGE

PECO

ComEd

BGE

PECO

ComEd

Electric

Operations

OSHA Recordable Rate

OSHA Severity Rate

2.5 Beta SAIFI

2.5 Beta CAIDI

Customer

Operations

Customer Satisfaction (MSI)

Service Level % of Calls Answered in

<30 Sec

Abandon Rate

Calls per Customer

Gas

Operations

Percent of Calls Responded to in

<=1 Hour

No

Gas

Operations

No

Gas

Operations

3rd Party Damages per 1,000 Gas

Locates

Q1

Q2

Q3

Q4

Performance

Quartiles

Exelon

Utilities

has

identified

and

transferred

best

practices

at

each

of

its

utilities

to

improve

operating

performance

in

areas

such

as:

•

System Performance

•

Emergency Preparedness

•

Corrective and Preventive Maintenance |

28

2014 EEI Financial Conference

Capital Expenditures

(1)

Smart

Meter/Smart

Grid

CapEx

net

of

proceeds

from

U.S.

Department

of

Energy

(DOE)

grant;

For

BGE,

includes

CapEx

from

Smart

Energy

Savers

program

of

~$10M

per

year

175

150

175

200

275

350

300

225

150

100

475

575

425

375

75

75

125

175

225

200

1,000

1,225

1,225

1,325

350

350

325

325

250

350

350

350

125

125

125

100

25

2017E

775

25

2016E

750

2015E

725

50

2014E

650

2017E

525

2016E

525

2015E

550

50

2014E

650

50

2017E

1,925

2016E

1,950

2015E

2,150

2014E

1,750

Gas Delivery

Electric Transmission

Smart Grid/Smart Meter

(1)

Electric Distribution

($ in millions) |

29

2014 EEI Financial Conference

Exelon

Utilities:

Rate

Base

(1)

and

ROE

Targets

2014E

Long-Term Target

Equity Ratio

52%

~53%

(4)

Earned ROE

7-8%

10%

Rate Case

2015

2014E

Long-Term Target

Equity Ratio

~46%

~53%

(2)

Earned ROE

8-9%

Based on 30-yr

US Treasury

(3)

Rate Case

Annual Formula Rate Filing

Continued investment in utilities will provide stable earnings growth

($ in billions)

(1)

ComEd,

PECO

and

BGE

rate

base

represents

end-of-year.

Numbers

may

not

add

due

to

rounding

(2)

Equity

component

for

distribution

rates

will

be

the

actual

capital

structure

adjusted

for

goodwill

(3)

Earned

ROE

will

reflect

the

weighted

average

of

11.5%

allowed

transmission

ROE

and

distribution

ROE

resulting

from

30-year

Treasury

plus

580

basis

points

for

each

calendar

year

(4)

Per

MDPSC

merger

commitment,

BGE

is

precluded

from

paying

dividends

through

2014

2014E

Long-Term Target

Equity Ratio

56%

~53%

Earned ROE

11-12%

10%

Rate Case

Possible 2015-2016

1.4

1.4

1.4

7.1

7.8

8.5

9.2

3.7

3.9

4.0

4.1

3.0

3.1

3.2

3.2

2.5

2.8

3.0

3.4

0.7

0.7

0.8

0.8

0.7

0.8

1.0

1.2

1.3

1.2

1.2

1.3

1.2

5.5

2015E

2017E

5.8

2016E

5.2

2014E

4.9

2017E

6.3

2014E

9.6

2016E

6.2

2015E

6.0

2014E

5.6

2017E

12.6

2016E

11.5

2015E

10.6

Gas

Distribution

Transmission |

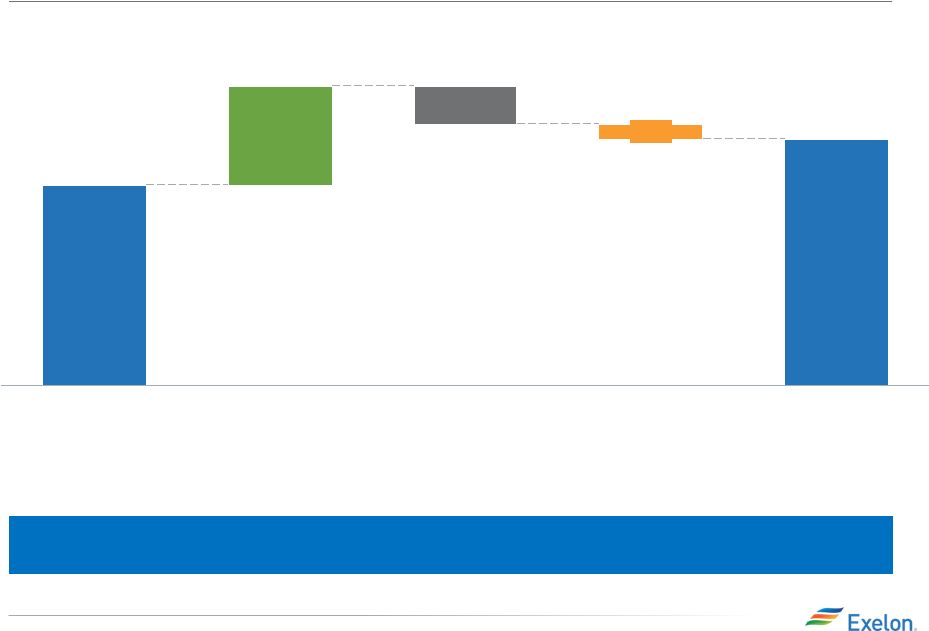

30

2014 EEI Financial Conference

9.9

2017 YE Rate Base

Other 2015-2017

$24.7B

(1.5)

Depreciation 2015-2017

(3.8)

CapEx 2015-2017

2014 YE Rate Base

$20.1B

Rate Base Growth

Utility CapEx spend outpaces depreciation, thereby growing rate base and

earnings |

31

2014 EEI Financial Conference

Exelon Utility 2014-17 Adjusted Operating EPS

Guidance

By investing $16B in capital and improving earned ROEs, Exelon Utilities will

provide average earnings growth of ~8% per year from

2014-2017 |

32

2014 EEI Financial Conference

Grand Prairie Gateway Transmission Line

Key Facts

•

Line:

60

mile,

345

kV

transmission

line

connecting

ComEd’s

Byron

and

Wayne

substations

alleviating

identified

congestion

and

enhancing

reliability

•

Cost:

$260

million

•

Customer

Savings:

$250

million

within

the

first

15

years

of

operation

–

net

of

all

costs

•

Recovery

Mechanism:

FERC-filed

transmission

rate

of

11.5%

and

construction

work

in

progress

and

abandonment

recovery

•

Construction:

Scheduled

to

begin

Q2

2015

•

In

Service

Date:

Q2

2017

•

Environmental

Benefits:

735,000

pounds

of

carbon

dioxide

(CO2)

reduced

over

the

first

15

years |

33

2014 EEI Financial Conference

ComEd April 2014 Distribution Formula Rate

Docket #

14-0312

Filing Year

2013

Calendar

Year

Actual

Costs

and

2014

Projected

Net

Plant

Additions

are

used

to

set

the

rates

for

calendar

year

2015.

Rates

currently

in

effect

(docket

13-0318)

for

calendar

year

2014

were

based

on

2012

actual

costs

and

2013

projected

net

plant

additions

Reconciliation Year

Reconciles

Revenue

Requirement

reflected

in

rates

during

2013

to

2013

Actual

Costs

Incurred.

Revenue

requirement

for

2013

is

based

on

docket

13-0386

filed

in

June

2013

and

reflect

the

impacts

of

PA

98-0015

(SB9)

Common Equity Ratio

~

46%

for

both

the

filing

and

reconciliation

year

ROE

9.25%

for

the

filing

year

(2013

30-yr

Treasury

Yield

of

3.45%

+

580

basis

point

risk

premium)

and

9.20%

for

the

reconciliation

year

(2013

30-yr

Treasury

Yield

of

3.45%

+

580

basis

point

risk

premium

–

5

basis

points

performance

metrics

penalty).

For

2014

and

2015,

the

actual

allowed

ROE

reflected

in

net

income

will

ultimately

be

based

on

the

average

of

the

30-year

Treasury

Yield

during

the

respective

years

plus

580

basis

point

spread,

absent

any

metric

penalties

Requested Rate of Return

~

7%

for

both

the

filing

and

reconciliation

years

Rate Base

(1)

$7,369

million–

Filing

year

(represents

projected

year-end

rate

base

using

2013

actual

plus

2014

projected

capital

additions).

2014

and

2015

earnings

will

reflect

2014

and

2015

year-end

rate

base

respectively.

$6,596

million

-

Reconciliation

year

(represents

year-end

rate

base

for

2013)

Revenue Requirement

Increase

(1)

$269M

($96M

is

due

to

the

2013

reconciliation,

$173M

relates

to

the

filing

year).

The

2013

reconciliation

impact

on

net

income

was

recorded

in

2013

as

a

regulatory

asset.

Timeline

•

04/16/14 Filing Date

•

240 Day Proceeding

•

ALJ Proposed Order issued on 10/15/14 proposes a $239M revenue requirement

increase •

ICC order expected by December 12, 2014

(1)

Amounts

represent

ComEd’s

position

filed

in

rebuttal

testimony

on

July

23,

2014

Note:

Disallowance

of

any

items

in

the

2014

distribution

formula

rate

filing

could

impact

2014

earnings

in

the

form

of

a

regulatory

asset

adjustment

Given

the

retroactive

ratemaking

provision

in

the

Energy

Infrastructure

Modernization

Act

(EIMA)

legislation,

ComEd

net

income

during

the

year

will

be

based

on

actual

costs

with

a

regulatory

asset/liability

recorded

to

reflect

any

under/over

recovery

reflected

in

rates.

Revenue

Requirement

in

rate

filings

impacts

cash

flow.

The

2014

distribution

formula

rate

filing

establishes

the

net

revenue

requirement

used

to

set

the

rates

that

will

take

effect

in

January

2015

after

the

Illinois

Commerce

Commission's

(ICC’s)

review.

There

are

two

components

to

the

annual

distribution

formula

rate

filing:

•

Filing

Year:

Based

on

prior

year

costs

(2013)

and

current

year

(2014)

projected

plant

additions.

•

Annual

Reconciliation:

For

the

prior

calendar

year

(2013),

this

amount

reconciles

the

revenue

requirement

reflected

in

rates

during

the

prior

year

(2013)

in

effect

to

the

actual

costs

for

that

year.

The

annual

reconciliation

impacts

cash

flow

in

the

following

year

(2015)

but

the

earnings

impact

has

been

recorded

in

the

prior

year

(2013)

as

a

regulatory

asset. |

34

2014 EEI Financial Conference

BGE Rate Case Settlement

Electric

Gas

Docket #

9355

Test Year

September 2013 -

August 2014

Common Equity Ratio

(1)(2)

52.3%

Authorized Returns

(1)(3)

ROE: 9.75%; ROR: 7.46%

ROE: 9.65%; ROR: 7.41%

Requested Rate of Return

7.93%

7.88%

Proposed Rate Base (adjusted)

(1)(4)

$2.9B

$1.2B

Revenue Requirement Increase

$22.0M

$38.0M

Distribution Increase as % of

overall bill

1%

5%

Timeline

•

07/02/14 BGE filed application with the MDPSC seeking increases in electric

& gas distribution base rates

•

210 Day Proceeding

•

7/08/14 –

Case delegated to the Public Utility Law Judge Division

•

10/17/14 –

BGE filed unanimous “black box”

settlement with MD PSC

•

Settlement must be approved by the MD PSC

•

If approved, new rates are expected to be effective no sooner than the middle

of December 2014

(1)

Due

to

the

“black

box”

nature

of

the

settlement,

the

Common

Equity

Ratio,

Authorized

Returns,

and

Proposed

Rate

Base

(adjusted)

were

not

agreed

upon

by

the

parties

in

determining

the

ultimate

revenue

requirement

increase

(2)

Reflects

BGE’s

actual

capital

structure

as

of

8/31/2014

(3)

ROE

and

ROR

stated

in

the

settlement

only

apply

to

AFUDC

and

carrying

costs

on

regulatory

assets

(4)

BGE’s

Proposed

Adjusted

rate

base

First BGE rate case settlement agreement since 1999

|

35

2014 EEI Financial Conference

ComEd Load

Weather-Normalized Load Growth

Economic Forecast of Drivers that Influence Load

2014E

0.6%

0.1%

1.4%

0.7%

1.7%

2013

-0.3%

-0.5%

0.0%

-0.2%

1.2%

GMP

Large C&I

Small C&I

Residential

All Customers

Driver or Indicator

2015 Outlook

Gross Metro

Product (GMP)

2.3% growth in real GMP reflects overall

better economic conditions than the slower

growth in 2014 (Manufacturing and

Professional Business Services employment

accelerate in 2015)

Employment

1.3% increase in total employment is

expected for 2015, which is consistent with

the average growth for the past three years

Manufacturing

Manufacturing employment is expected to

grow 1.4% in 2015. This is a significant

improvement over the (0.4%) decline in

2013 and the (1.1%) decline in 2014

Households

Household formations are expected to

increase 0.7% in 2015 which is slightly

higher than the expected increase of 0.6% in

2014

Energy Efficiency

Continued expansion of EE program

expected to reduce usage in 2015 by

approximately 1.2%

Notes: 2013 data is not adjusted for leap year. Source of 2015 economic outlook

data is IHS Economics (September 2014). (C&I = Commercial and Industrial)

Improving economic conditions and energy efficiency initiatives will continue

to impact load growth |

36

2014 EEI Financial Conference

PECO Load

Weather-Normalized Load Growth

Economic Forecast of Drivers that Influence Load

2014E

-0.6%

0.0%

1.1%

0.3%

1.2%

2013

1.5%

-1.1%

0.0%

1.3%

GMP

Large C&I

Small C&I

Residential

All Customers

Driver or Indicator

2015 Outlook

Gross Metro

Product (GMP)

GMP projected to grow at 2.5% for 2015,

the same as prerecession levels

Resident

Employment

Resident employment outlook is 1.7% in

2015 vs. 1.3% in 2014

Manufacturing

Employment

Manufacturing employment is expected to

grow at 1.7%. Philadelphia has had

negative growth from 2000 to 2014

Households

Household growth is expected to be 0.7%,

strongest growth since 2008, and at the

same level as 2014

Energy Efficiency

Deemed Energy Efficiency impact

forecasted to be ~0.9% reduction in

usage in 2015

Moderately strong economic recovery will drive sales in 2015, partially offset

by on-going energy efficiency initiatives

0.3%

Notes: 2013 data is not adjusted for leap year. Source of 2015 economic outlook

data is IHS Economics (September 2014). (C&I = Commercial and Industrial) |

37

2014 EEI Financial Conference

BGE Load

Weather-Normalized Load Growth

Economic Forecast of Drivers that Influence Load

2014E

-1.8%

-0.5%

-0.7%

-1.2%

1.6%

2013

-3.2%

2.1%

2.0%

-0.6%

0.4%

GMP

Large C&I

Small C&I

Residential

All Customers

Moderately strong economic recovery will drive sales in 2015, partially offset

by energy efficiency initiatives

Driver or Indicator

2015 Outlook

Gross Metro

Product (GMP)

GMP is projected to grow at 2.6% for

2015

Employment

2.1% growth projected. BGE’s decoupled

non-rate case revenue growth is primarily

driven by customer growth. The main

driver for customer growth is employment

Manufacturing

Manufacturing employment is expected to

be fairly flat to 2014 levels in 2015

Households

Household growth is projected to be

0.8%, almost flat to 2014

Energy Efficiency

Continued expansion of EE programs will

partially offset growth seen due to

improvements in economic conditions

Notes: 2013 data is not adjusted for leap year. Source of 2015 economic outlook

data is IHS Economics (September 2014). (C&I = Commercial and Industrial) |

PHI Acquisition

*

*

*

*

* |

39

2014 EEI Financial Conference

Delivering Value to PHI’s Customers and Communities

|

40

2014 EEI Financial Conference

PHI Acquisition Will Create the Leading Mid-Atlantic Utility

Operating Statistics

Commonwealth Edison

Potomac Electric Power

Customers:

Service Territory:

Peak Load:

2013 Rate

Base:

3,800,000

11,400 sq.

miles

23,753 MW

$8.7 bn

Customers:

Service Territory:

Peak Load:

2013 Rate Base:

801,000

640 sq. miles

6,674 MW

$3.4 bn

PECO Energy

Atlantic City Electric

Customers:

Service Territory:

Peak Load:

2013 Rate

Base:

2,100,000

2,100 sq. miles

8,983 MW

$5.4 bn

Customers:

Service Territory:

Peak Load:

2013 Rate Base:

545,000

2,700 sq. miles

2,797

MW

$1.6 bn

Baltimore Gas & Electric

Delmarva Power & Light

Customers:

Service Territory:

Peak Load:

2013 Rate

Base:

1,900,000

2,300 sq. miles

7,236 MW

$4.6 bn

Customers:

Service Territory:

Peak Load:

2013 Rate Base:

632,000

5,000 sq. miles

4,121 MW

$2.0 bn

___________________________

Source: Company filings.

Note: Operational statistics as of 12/31/2013

Combined Service Territory

Potomac Electric Power Service Territory

Atlantic City Electric Service Territory

Delmarva Power & Light Service Territory

Baltimore Gas and Electric Service Territory

PECO Energy Service Territory

ComEd Service Territory |

41

2014 EEI Financial Conference

2014 EEI Financial Conference

Earnings Accretive First Full Year

(1)

Transaction Economics

Exelon Consolidated S&P FFO/Debt

24%

22%

2015

2016

(1) Assumes funding mix of assumed debt, new debt, asset sales and equity

issuance with appropriate discount to market price. (2) Reflects year end rate base

2016-2017 Operating Earnings

33%-39%

61%-67%

Pro Forma Business Mix

Regulated

Unregulated

Rate Base Growth ($B)

(2)

$21.8

$23.2

$24.7

$8.1

$8.8

$9.6

$20.1

$34.3

+15%

+49%

2017

2014

2015

2016

$29.9

$32.0

Exelon

PHI

2017

2016

$0.10 -

$0.15

$0.15 -

$0.20

Achieve run-rate

accretion of

$0.15-$0.20

starting in 2017

The transaction is EPS accretive, adds to rate base growth and further

strengthens our financials |

42

2014 EEI Financial Conference

2014 EEI Financial Conference

PHI: Capital Expenditures and Rate Base

$725

$675

$700

$725

$350

$350

$350

$350

$250

$275

$325

$325

$1,400

2017E

2016E

$1,375

2015E

$1,300

2014E

(2)

$1,325

(2)

Pepco

DPL

ACE

Rate Base ($B)

(1)(3)

Capital Expenditures ($M)

(1)

$4.0

$4.4

$4.8

$2.2

$2.4

$2.5

$2.7

$1.6

$1.7

$1.9

$2.1

$3.6

2016E

$8.8

2015E

$8.1

2014E

$7.5

2017E

$9.6

(1)

Source: PHI Third Quarter Earnings Materials 10/31/14

(2)

Source for 2014 CapEx is PHI 2014 Analyst Day Conference Presentation 03/21/14

and PHI First Quarter 2014 Earnings Materials 05/07/14 (3)

Denotes year end rate base

Note: CapEx numbers rounded to nearest $25M; totals might not add due to

rounding Strong rate base growth will provide stable utility earnings

growth |

43

2014 EEI Financial Conference

2014 EEI Financial Conference

Opportunity for ROE Improvement at PHI Utilities

Source: Pepco Holdings Inc. 2014 Analyst Conference Presentation,

3/21/14 |

44

2014 EEI Financial Conference

2014 EEI Financial Conference

Regulatory Approval Timeline Supports a Q2/Q3 2015 Close

Jurisdiction

Application

Filing

Key Regulatory Milestones

Approved

Virginia

(Case No. PUE-2014-00048)

3-Jun

Approved October 7, 2015

Federal Energy

Regulatory Commission

(FERC)

(Docket No. EC14-96-000)

30-May

Department of Justice

(DOJ)

6-Aug

Request for additional information received

October 9

Delaware

(Docket 14-193)

18-Jun

Pre-Hearing Briefs: Feb 11, 2015

Hearings: Feb 18 -

20, 2015

Final Order: Mar 10, 2015

New Jersey

(Docket No. EM14060581)

18-Jun

Hearings: Jan 12 -

16, 2015

Briefs: Feb 6, 2015

Reply Briefs: March 3, 2015

Maryland

(Case No 9361)

19-Aug

Hearings: Jan 26 -

Feb 6, 2015

Briefs: Feb 27, 2015

Reply Briefs: March 13, 2015

Statutory Deadline: April 1, 2015

District of Columbia

(Formal Case No. 1119)

18-Jun

Hearings: Feb 9 –

13, 2015

Briefs: March 12, 2015

Reply Briefs: March 26, 2015 |

|

46

2014 EEI Financial Conference

2014 EEI Financial Conference

Commercial Business Overview

Scale, Scope and Flexibility Across the Energy Value Chain

Development and

exploration of natural gas

and liquids properties

9 assets in

six states

~165 BCFe of proved

Reserves

(1)

Leading merchant power

generation portfolio in the

U.S.

~32 GW of owned

generation capacity

(2)

Clean portfolio, well

positioned for evolving

regulatory requirements

Industry-leading wholesale

and retail sales and

marketing platform

~150 TWh of load and

~500 BCF of retail gas

delivered

(3)

~ 1 million residential and

100,000 business and

public sector customers

One of the largest and most

experienced Energy

Management providers

Over 4,000 energy savings

projects implemented

across the U.S.

A growing Distributed

Energy platform with over

$1B of investment to date

Benefiting from scale, scope and flexibility across the value chain

(1) 12/31/13

year-end

reserves

based

upon

assets

owned

as

of

9/30/14.

Includes

Natural

Gas

(NG),

NG

Liquids

(NGL)

and

Oil.

NGL

and

Oil

are

converted

to

BCFe

at

a

ratio

of

6:1.

(2)

Total

owned

generation

capacity

as

of

9/30/2014,

less

capacity

for

announced

divestitures

of

Fore

River,

Quail

Run,

West

Valley,

and

Keystone

Conemaugh

(3)

Expected

for

2014

as

of

9/30/2014.

Electric

load

and

gas

includes

fixed

price

and

indexed

products

Note:

Does

not

include

the

impact

of

Integrys

acquisition |

47

2014 EEI Financial Conference

2014 EEI Financial Conference

10

15

5

9

18

7

15

16

49

71

27

97

25

ERCOT

38

Mid-Atlantic

108

Canada

Midwest

111

23

South/West/

New York

10

New England

Generation to Load Match

Industry-leading platform with regional diversification of the

generation fleet and

customer-facing load business

Generation Capacity, Expected Generation and Expected Load

2015 in TWh

(1,2)

(1)

Owned

and

contracted

generation

capacity

converted

from

MW

to

MWh

assuming

100%

capacity

factor

(CF)

for

all

technology

types,

except

for

renewable

capacity

which

is

shown

at

estimated

CF

(2)

Expected

generation

and

load

shown

in

the

chart

above

will

not

tie

out

with

load

volume

and

ExGen

disclosures;

Load

shown

above

does

not

include

indexed

products

and

generation

reflects

a

net

owned and

contracted

position;

Estimates

as

of

9/30/2014

Note:

Includes

divestitures

for

Safe

Harbor,

Fore

River,

Quail

Run,

and

West

Valley;

Does

not

include

impact

of

Keystone

/Conemaugh

divestiture

or

the

Integrys

acquisition

Expected Load

Expected

Generation

Baseload

Intermediate

Peaking

Renewables

Generation to Load match provides

portfolio management benefits in

differing volatility and price

environments

•

During the first quarter, our

nuclear baseload generation fleet,

in combination with our

dispatchable fleet, allowed us to

take advantage of the high

volatility/price environment while

managing load obligations

•

During the third quarter, we were

able to realize lower costs to serve

our load due to the low

volatility/price environment |

48

2014 EEI Financial Conference

2014 EEI Financial Conference

Electric Load Serving Business: Growth Targets

(1)

0

20

40

60

80

100

120

140

160

180

2015E

2017E

2016E

2014E

165

70-80%

20-30%

165

60-70%

30-40%

150

60-70%

30-40%

165

70-80%

20-30%

Retail Load

(2)

Wholesale Load

Total Contracted

Commercial Load

2014 –

2017 TWh

8%

Load Split by Customer Class

(2014 TWh)

Expected growth in volumes and margins on the

back of a sustainable platform

A diverse set of customers enhances portfolio

management opportunities

Note: Index load expected to be 20% to 30% of total forecasted retail

load Customer Type

Load Size

Mass Markets

<1,000 MWhs per year

Small C&I

1,001-5,000 MWhs per year

Medium C&I

5,001-25,000 MWhs per year

Large C&I

>25,000 MWhs per year

Medium C&I

Large C&I

35%

15%

Small C&I

10%

Mass Markets

5%

Wholesale

35%

C&I = Commercial & Industrial

(1) Does not include Integrys acquisition |

49

2014 EEI Financial Conference

2014 EEI Financial Conference

Electric Load Serving Business: Market Landscape

Total U.S. Power Market 2014 (~3,700 TWh load)

(2)

Eligible Non-

Switched

Eligible

Switched

Muni/Co-Op Market

Other

Ineligible

Constellation Active Retail Electric Markets

(1)

Competitive Retail Market Expected to Grow Faster Than Overall

Market 2014-2017

•

Underlying 1% load growth across the U.S.

•

C&I switched market to grow by about 8%

•

Residential switched market to grow by about 7%

Retail Mergers & Acquisitions Activity has Increased

•

EXC has been active in evaluating opportunities, and acquired

Integrys Energy Services earlier this year

•

34 deals announced 2014 YTD, compared to 27 deals in 2013,

and 23 deals in 2012

Conditions have improved in many markets as impacts of the

Polar Vortex have played out

•

During 2014, we have experienced improved margins, contract

tenors, and renewal rates

Existing suppliers continue to expand market footprint and

product portfolio

•

Existing suppliers entered 23 new markets in 2014 YTD

•

Energy efficiency among most popular for cross-selling

opportunities

Market Landscape

(2)

(1)

Does

not

include

Integrys

acquisition

(2)

Sources

are

EIA,

DNV

GL,

and

internal

estimates

Improving market driving higher margins and better contract terms

|

50

2014 EEI Financial Conference

2014 EEI Financial Conference

Natural Gas Serving Business: Marketing Platform

Constellation Active Natural Gas Markets

Supply

~4-6 Bcf per day delivered in competitive markets

Transportation

Active shipper on more than 45 interstate pipelines on a daily basis

Trading

Active participant in all major supply basins, markets, and trading

points in North America

Volume

Management

Schedule, nominate and balance behind more than 100 LDCs

Nature

Gas

markets

continue

to

grow

on

both

the

consumption

and

supply

side

•

Lead by the industrial section, gas consumption is expected

to increase by 1.6% in 2014

•

EXC expanded it’s gas marketing presence through the

Integyrs and ETC ProLiance acquisitions

Growing domestic production impacting imports

•

Continued downward pressure on natural gas imports from

Canada

•

Mexican exports, specifically from Eagle Ford, are expected to

increase due to growing demand in the electric power sector

The

Polar

Vortex

provided

multiple

supply

opportunities

across

the

US

for

natural

gas

LNG imports and exports

•

Higher prices in Europe and Asia more attractive to sellers

than low US prices

•

LNG exports are still a very small part of the total picture;

however, the United States will remain a net importer of

natural gas because of pipeline imports from Canada

Gas Storage and Pipeline Investment

•

Gas inventories continue to drop year over year. Currently

373 BCF lower than last year driving storage opportunities

•

Investment in new pipelines supporting key production

areas continue grow supported by multiple parties (Equity,

LDCs)

(1) Source: EIA and internal estimates

Market Landscape 2014 -

2015

(1)

Top 10 US Gas Marketer with a growing presence |

51

2014 EEI Financial Conference

Integrys Energy Services Acquisition

Natural Gas

Electric

Electric and Natural

Gas

•

Significantly

increases

natural

gas

portfolio

by

150

bcf

annually

•

Increases

power

load

by

15

TWh

•

Many

of

the

power

customers

served

by

Integrys

are

in

regions

where

Exelon

owns

significant

generation,

providing

generation

to

load

match

benefit

•

Mitigates

risk

of

hedging

in

illiquid

markets

•

Adds

1.2

million

customers,

bringing

the

total

Constellation

customer

base

to

approximately

2.5

million

homes

and

businesses |

52

2014 EEI Financial Conference

(1) 12/31/13 year-end reserves based upon assets owned

as-of 9/30/14. Upstream E&P Assets

Estimated Net Proved

Reserves

(as of 12/31/13)

(1)

Average Net Daily

Production

(as of Q2 2014)

165 Bcfe

55 MMcfe

Investment Thesis

•

Our Upstream Gas business achieves strong returns

(>16% after-tax IRR)

•

$110m (~70% utilized) Reserve Based Lending (RBL)

facility in place

Non-recourse treatment at S&P

•

Provides valuable market intelligence in complex

natural gas markets

Forecasted Production

2014

2015

2016

2017

Net Daily Prod

(MMcfe / day)

50-55

40-55

35-50

40-55

Current Portfolio Of Investments

Mississippi Lime (OK)

Hunton Dewatering (OK)

Woodford Shale (OK)

Fayetteville Shale (AR)

Haynesville Shale (LA)

Floyd Shale (AL)

Woodbine Shale (TX)

Trenton Black River (MI)

Barnett Shale (TX) |

53

2014 EEI Financial Conference

Pipeline capacity expansions and regional demand should balance higher gas

production starting in mid-2017, improving Mid-Atlantic gas

basis Mid-Atlantic Gas Basis: Improves Starting 2017

•

Northeastern U.S. gas production is projected to approach 25 bcf/day by 2018,

up from 19 bcf/day in 2015 •

Regional demand is projected to reach 18 bcf/day by 2018, up from 15 bcf/day in

2015 •

Based upon public announcements, we expect 19 bcf/day of pipeline takeaway

capacity by 2018 •

Pipeline

projects

are

underway

adding

takeaway

capacity.

2017

is

a

transition

year

where

timing

of

pipeline

expansions

(~9

bcf/day)

will

play

a role in determining local gas prices, but should be more balanced than

in prior years. This is consistent with the current forward market

which indicates an improving Mid-Atlantic natural gas basis

•

Additional pipeline capacity and regional demand will stabilize basis discounts

in non winter months and reduce price spikes in the winter Notes:

Values represent annual averages; Demand includes storage