Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Wendy's Co | d817910d8k.htm |

Third-Quarter 2014

Conference Call

November 6, 2014

Exhibit 99.1

©

2013 Oldemark LLC |

DAVID

POPLAR Vice President

Investor Relations

2

©

2013 Oldemark LLC |

Today’s Agenda

CEO Overview

Emil Brolick

Financial Update

Todd Penegor

Q&A

3 |

4

Forward-Looking Statements and Non-GAAP Financial Measures

This presentation, and certain information that management may discuss in connection with

this presentation, contains certain statements that are not historical

facts, including information concerning possible or assumed future results of our

operations. Those statements constitute “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995 (The “Reform Act”). For

all forward-looking statements, we claim the protection of the safe harbor for

forward-looking statements contained in the Reform Act. Many important

factors could affect our future results and could cause those results to differ materially from

those expressed in or implied by our forward-looking statements. Such factors, all of

which are difficult or impossible to predict accurately, and many of which are

beyond our control, include but are not limited to those identified under the

caption “Forward-Looking Statements” in our news release issued on November 6,

2014 and in the “Special Note Regarding Forward-Looking Statements and

Projections” and “Risk Factors” sections of our most recent Form

10-K / Form 10-Qs.

In addition, this presentation and certain information management may discuss in

connection with this presentation reference non-GAAP financial measures, such

as adjusted earnings before interest, taxes, depreciation and amortization, or

adjusted EBITDA, and adjusted earnings per share. Adjusted EBITDA and adjusted

earnings per share exclude certain expenses, net of certain benefits. Reconciliations of non-GAAP

financial measures to the most directly comparable GAAP financial measures are provided

in the Appendix to this presentation, and are included in our news release issued

on November 6, 2014 and posted on www.aboutwendys.com. |

EMIL

BROLICK 5

©

2013 Oldemark LLC

President & CEO |

HOW WE

GROW BRAND RELEVANCE + ECONOMIC RELEVANCE = GROWTH

Shareholder

Value-Enhancing

Initiatives

Core Organic

Growth

Strategies

6

System

Optimization

Financial Management

Global Growth

Restaurant Utilization &

Brand Access

New Restaurant Growth

Image / Experience Activation

North America Same-Restaurant Sales Growth |

OPENED

600

IMAGE

ACTIVATION

RESTAURANT DURING OCTOBER

INCREASED DIVIDEND RATE 10% TO

$0.055 PER SHARE

7

REALIGNING RESOURCES TO FOCUS ON

GROWTH AND TECHNOLOGY INITIATIVES

REAFFIRMING 2014 ADJ. EPS OUTLOOK;

EXPECT ADJ. EBITDA OF ~ $390 MILLION

STRONG TWO-YEAR COMPANY-

OPERATED SRS OF 5.2 PERCENT

TH

©

2013 Oldemark LLC |

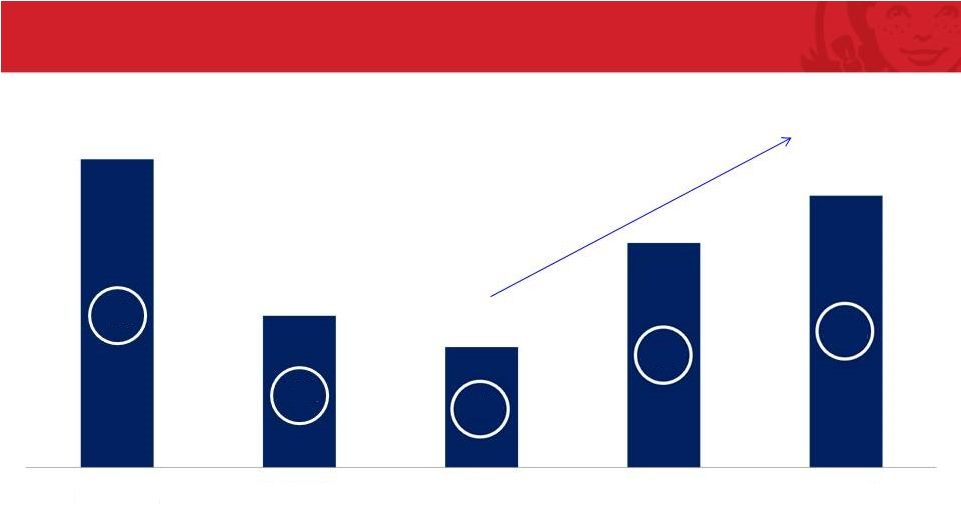

Five

Consecutive Quarters of SRS Growth 3.9%

8

Q3 2013

Q4 2013

Q1 2014

Q2 2014

Q3 2014

3.2%

3.1%

3.9%

2.0%

1.3%

First Half of Quarter: (1.3)%;

Second Half of Quarter: +4.4% |

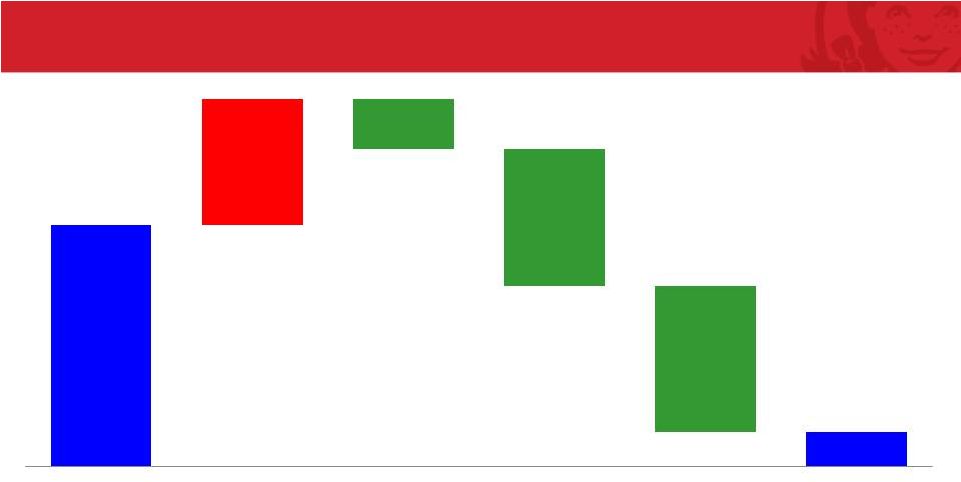

9

Five Consecutive Quarters of Solid Two-Year SRS Growth

5.9%

2.9%

2.3%

4.3%

5.2%

Q3 2013

Q4 2013

Q1 2014

Q2 2014

Q3 2014 |

Leadership Through Product Innovation

10 |

•

Ongoing evolution

Reducing Cost Structure & Driving Operational Efficiencies

11

•

Reduce G&A to ~$250 MM in 2015

•

Consumer-facing restaurant technology

•

Accelerated restaurant development

•

Beef-price inflation

•

Affordable Care Act

•

Expect cost headwinds to continue into 2015

•

U.S. system optimization

•

Canadian growth initiative

•

Realign and reinvest resources in:

•

Wage inflation – Minimum wage (state and local)

|

Investing

in Technology 12 |

©

2013 Oldemark LLC

TODD PENEGOR

Chief Financial Officer

13 |

14

*See reconciliation of Adjusted EBITDA in the appendix.

Q3 2014 Highlights

SALES

$409.1

$558.0

-26.7

FRANCHISE REVENUES

103.4

82.8

24.9

TOTAL REVENUES

$512.5

$640.8

-20.0

ADJUSTED EBITDA*

$94.1

$98.7

-4.7

Q3

2014

Q3

2013

%

Change

(Unaudited)

$ in millions |

Q3 2014

Highlights G&A

$65.8

$76.5

-14.0

N.A. CO. REST. MARGIN

15.5%

15.6%

(10) bps

OPERATING PROFIT

46.9

26.8

+75.0

ADJUSTED EPS*

0.08

0.08

--

REPORTED EPS

0.06

0.00

N/A

Q3

2014

Q3

2013

%

Change

(Unaudited)

$ in millions, except per-share amounts

15

* See reconciliation of Adjusted EPS in the appendix. |

Q3 2013

vs. Q3 2014: Adjusted EBITDA 16

(Unaudited)

$ in millions

* See reconciliation in appendix.

$98.7

$94.1

($18.5)

($3.9)

($4.2)

$22.4

$2.0

2013 Q3

Adj. EBITDA*

Lost EBITDA From

Restaurants Sold

Image

Activation

Gain/Loss on

Sale of Assets

Rental Income (net),

Royalties, &

G&A Savings

Restaurant

Income

& Other

2014 Q3

Adj. EBITDA* |

17

Q3 2013 vs. Q3 2014: G&A

(Unaudited)

$ in millions

(Unaudited)

$ in millions

* Amounts are net of Sys Ops savings which are included in “Sys Ops Savings &

G&A Management” $76.5

$65.8

($6.6)

$2.6

$7.1

$7.6

2013 Q3

G&A

Stock Comp *

Franchise

Incentives

Sys. Ops. Savings &

G&A Management

Incentive Comp *

2014 Q3

G&A |

18

Cash Flow Highlights

Cash Flow from Operations

$182.6

Capital Expenditures

197.9

Beginning Cash Balance

$580.2

Change In Cash

(237.8)

Ending Cash Balance

$342.4

YTD 2014

(Unaudited)

$ in millions

Returned nearly $350 million to shareholders in dividends and share repurchases in 2014

YTD |

Ended

2014 Q3 with

$342M

of Cash

CASH PRIORITIES

19

•

Image Activation Reimages, including

Increasing Scrape & Rebuilds

Invest in our

Business

•

Announced divided rate increase of

10 percent

Dividend

Growth

•

Offset ongoing equity award dilution

beyond 2014

Share

Repurchase |

2014

Outlook 20

•

Full-year Company-operated SRS growth of ~ 2.5%

•

Reduction in interest expense of approximately $15 million

•

Capital expenditures of $280 to $290 million, including approximately $215

million for Company-operated Image Activation restaurants

•

Company-operated restaurant margin outlook of 15.5 to 15.7 percent

•

Reflects significantly higher beef costs

•

Reported effective tax rate of 38 to 40%

Adjusted EBITDA of ~$390 million

Adjusted EPS of $0.34 to $0.36 |

2015

2016

2017

SRS

3%+

3%+

3%+

Adjusted EBITDA

Mid to High

Single digits

High Single

Digits

Low Double

Digits

Adjusted EPS

Mid-Teens

Mid -

Teens

Mid -

Teens

Outlook: 2015 to 2017

21 |

Image

Activation Franchise Adoption Accelerating 2011A

2012A

2013A

2014E

22

TOTAL SYSTEM ANNUAL

REIMAGES AND NEW BUILDS

TOTAL SYSTEM CUMULATIVE

REIMAGES AND NEW BUILDS

236

59

10

435-460

200 Company reimages

15 Company new

175-200 Franchise reimages

45 Franchise new

10

69

305

740-765

2011A

2012A

2013A

2014E |

•

Market planning

•

Joint capital planning

•

Multi-Year Investment Plan

•

Construction support

•

Turnkey services

•

Incentives

•

Canadian Build-to-Suit program

Facilitating Franchisee Commitments for Reimages and New Builds

23 |

24

2013 Actual to 2015 Forecast: G&A

~ $30 Million of

Cost

Savings

(Unaudited)

$ in millions

$294

$267

$265

$250

$2

($7)

($5)

$20

$8

$4

($5)

2013 Actual

G&A

2014 G&A

Pre

-

G&A

Initiative

G&A Cost

Initiative

2014 Current

Forecast G&A

Merit,

53rd wk

& Other

Incentive

Comp

to 100%

G&A Cost

Initiative

Sale of

Canadian

Restaurants

Franchise

Incentives

Investment

Initiatives

(Primarily IT &

Development)

2015 G&A

Target |

25

Restaurant Ownership Optimization

Selective Buying and

Selling of Restaurants

Declining Company ownership over time

Canadian Growth Initiative

Focused on Building a Stronger Wendy’s

Commitment to Growth

Image Activation and new restaurant development

Improved Economic Models for Company and Franchisees

Strengthening of Franchise Base |

©

2013 Oldemark LLC

DAVID POPLAR

Vice President

Investor Relations

26 |

Year-End Investor Relations Calendar

FEBRUARY 24, 2015

Issue Final 2014 Earnings Release

10-K Filing

27

FEBRUARY 3, 2015

Preliminary 2014 Earnings Release and Investor Day

Dublin, Ohio |

Q&A

28 |

Appendix

29 |

Reconciliation of Adjusted EBITDA to Net Income

30

2014

2013

2014

2013

Adjusted EBITDA

94,125

$

98,737

$

285,691

$

278,122

$

(Less) plus:

Depreciation and amortization

(36,274)

(44,325)

(117,790)

(134,841)

Facilities action charges (income), net

(7,520)

(22,275)

35,630

(31,690)

Impairment of long-lived assets

(3,408)

(5,327)

(3,740)

(5,327)

Operating profit

46,923

26,810

199,791

106,264

Interest expense

(13,204)

(15,620)

(39,328)

(55,548)

Loss on early extinguishment of debt

-

-

-

(21,019)

Other income, net

373

2,273

1,753

50

Income before income taxes and noncontrolling interests

34,092

13,463

162,216

29,747

Provision for income taxes

(11,262)

(15,625)

(64,076)

(17,774)

Net income (loss)

22,830

(2,162)

98,140

11,973

Net loss attributable to noncontrolling interests

-

223

-

445

Net income (loss) attributable to The Wendy's Company

22,830

$

(1,939)

$

98,140

$

12,418

$

Three Months

Nine Months

Reconciliation of Adjusted EBITDA to Net Income (Loss)

Attributable to The Wendy's Company

(In Thousands)

(Unaudited) |

31

Reconciliation of Adjusted Income and Adjusted Earnings Per Share

to Net Income and Earnings Per Share

Per share

Per share

(a)

Per share

Per share

Adjusted income and adjusted earnings per share

29,617

$

0.08

$

30,254

$

0.08

$

90,083

$

0.24

$

75,132

$

0.19

$

(Less) plus:

Facilities action charges (income), net

(4,077)

(0.01)

(24,990)

(0.06)

20,238

0.05

(30,875)

(0.08)

Depreciation of assets that will be replaced as part of the Image Activation

initiative (728)

(0.00)

(3,591)

(0.01)

(9,994)

(0.03)

(15,312)

(0.04)

Impairment of long-lived assets

(2,103)

(0.01)

(3,332)

(0.01)

(2,308)

(0.00)

(3,332)

(0.01)

Gain (loss) on sale of investment, net

121

0.00

(503)

(0.00)

121

0.00

(503)

(0.00)

Loss on early extinguishment of debt

-

-

-

-

-

-

(13,137)

(0.03)

Total adjustments

(6,787)

(0.02)

(32,416)

(0.08)

8,057

0.02

(63,159)

(0.16)

Net income (loss)

22,830

0.06

(2,162)

(0.00)

98,140

0.26

11,973

0.03

Net loss attributable to noncontrolling interests

-

-

223

0.00

-

-

445

0.00

Net income (loss) and earnings per share attributable to The Wendy's Company

22,830

$

0.06

$

(1,939)

$

(0.00)

$

98,140

$

0.26

$

12,418

$

0.03

$

Reported number of shares used to calculate diluted income (loss) per share

372,152

392,579

377,892

398,101

Plus: Dilutive effect of stock options and restricted shares

-

8,145

-

-

Adjusted number of shares used to calculate adjusted earnings per share

372,152

400,724

377,892

398,101

(a)

Adjusted earnings per share amounts for the three months ended September 29, 2013

include the dilutive effect of stock options and restricted shares, which were excluded from the reported number of shares used to calculate

basic and diluted loss per share, as the impact would have been

anti-dilutive. Included above is a reconciliation of the number of shares used to calculate adjusted earning per share amounts.

Reconciliation of Adjusted Income and Adjusted Earnings Per Share to Net Income

(Loss) and Earnings Per Share Attributable to The Wendy's Company

(In Thousands Except Per Share Amounts)

(Unaudited)

2014

2013

Three Months

Nine Months

2014

2013 |

32 |