Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - MADRIGAL PHARMACEUTICALS, INC. | a14-19809_1ex31d1.htm |

| EX-31.2 - EX-31.2 - MADRIGAL PHARMACEUTICALS, INC. | a14-19809_1ex31d2.htm |

| EX-10.5 - EX-10.5 - MADRIGAL PHARMACEUTICALS, INC. | a14-19809_1ex10d5.htm |

| EX-10.4 - EX-10.4 - MADRIGAL PHARMACEUTICALS, INC. | a14-19809_1ex10d4.htm |

| EX-32.1 - EX-32.1 - MADRIGAL PHARMACEUTICALS, INC. | a14-19809_1ex32d1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - MADRIGAL PHARMACEUTICALS, INC. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2014

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-33277

SYNTA PHARMACEUTICALS CORP.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

04-3508648 |

|

(State or other jurisdiction |

|

(I.R.S. Employer Identification No.) |

|

of incorporation or organization) |

|

|

|

|

|

|

|

45 Hartwell Avenue |

|

|

|

Lexington, Massachusetts |

|

02421 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (781) 274-8200

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o |

|

Accelerated filer x |

|

|

|

|

|

Non-accelerated filer o |

|

Smaller reporting company o |

|

(Do not check if a smaller reporting company) |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of October 31, 2014, the registrant had 108,895,670 shares of common stock outstanding.

SYNTA PHARMACEUTICALS CORP.

PART I - FINANCIAL INFORMATION

SYNTA PHARMACEUTICALS CORP.

Condensed Consolidated Balance Sheets

(in thousands, except share and per share amounts)

(unaudited)

|

|

|

September 30, |

|

December 31, |

| ||

|

Assets |

|

|

|

|

| ||

|

Current assets: |

|

|

|

|

| ||

|

Cash and cash equivalents |

|

$ |

68,478 |

|

$ |

48,490 |

|

|

Marketable securities |

|

50,802 |

|

42,986 |

| ||

|

Prepaid expenses and other current assets |

|

2,911 |

|

765 |

| ||

|

Total current assets |

|

122,191 |

|

92,241 |

| ||

|

Property and equipment, net |

|

1,134 |

|

1,553 |

| ||

|

Other assets |

|

331 |

|

1,409 |

| ||

|

Total assets |

|

$ |

123,656 |

|

$ |

95,203 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

| ||

|

Current liabilities: |

|

|

|

|

| ||

|

Accounts payable |

|

$ |

4,442 |

|

$ |

6,589 |

|

|

Accrued contract research costs |

|

14,276 |

|

10,407 |

| ||

|

Other accrued liabilities |

|

4,994 |

|

5,718 |

| ||

|

Current portion of capital lease obligations |

|

42 |

|

42 |

| ||

|

Current portion of term loans |

|

9,207 |

|

9,451 |

| ||

|

Total current liabilities |

|

32,961 |

|

32,207 |

| ||

|

Long-term liabilities: |

|

|

|

|

| ||

|

Capital lease obligations, net of current portion |

|

54 |

|

85 |

| ||

|

Term loans, net of current portion |

|

6,913 |

|

13,820 |

| ||

|

Total long-term liabilities |

|

6,967 |

|

13,905 |

| ||

|

Total liabilities |

|

39,928 |

|

46,112 |

| ||

|

Stockholders’ equity: |

|

|

|

|

| ||

|

Preferred stock, par value $0.0001 per share Authorized: 5,000,000 shares at September 30, 2014 and December 31, 2013; no shares issued and outstanding at September 30, 2014 and December 31, 2013 |

|

— |

|

— |

| ||

|

Common stock, par value $0.0001 per share Authorized: 200,000,000 shares at September 30, 2014 and December 31, 2013; 108,895,670 and 85,232,506 shares issued and outstanding at September 30, 2014 and December 31, 2013, respectively |

|

11 |

|

9 |

| ||

|

Additional paid-in-capital |

|

700,927 |

|

600,477 |

| ||

|

Accumulated other comprehensive income |

|

11 |

|

17 |

| ||

|

Accumulated deficit |

|

(617,221 |

) |

(551,412 |

) | ||

|

Total stockholders’ equity |

|

83,728 |

|

49,091 |

| ||

|

Total liabilities and stockholders’ equity |

|

$ |

123,656 |

|

$ |

95,203 |

|

See accompanying notes to condensed consolidated financial statements.

SYNTA PHARMACEUTICALS CORP.

Condensed Consolidated Statements of Operations

(in thousands, except share and per share amounts)

(unaudited)

|

|

|

Three Months Ended |

|

Nine Months Ended |

| ||||||||

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

| ||||

|

Revenues: |

|

|

|

|

|

|

|

|

| ||||

|

Total revenues |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

| ||||

|

Research and development |

|

16,208 |

|

17,623 |

|

52,552 |

|

51,879 |

| ||||

|

General and administrative |

|

3,241 |

|

4,171 |

|

11,505 |

|

12,236 |

| ||||

|

Total operating expenses |

|

19,449 |

|

21,794 |

|

64,057 |

|

64,115 |

| ||||

|

Loss from operations |

|

(19,449 |

) |

(21,794 |

) |

(64,057 |

) |

(64,115 |

) | ||||

|

Interest expense, net |

|

(517 |

) |

(721 |

) |

(1,752 |

) |

(1,915 |

) | ||||

|

Net loss |

|

$ |

(19,966 |

) |

$ |

(22,515 |

) |

$ |

(65,809 |

) |

$ |

(66,030 |

) |

|

Net loss per common share: |

|

|

|

|

|

|

|

|

| ||||

|

Basic and diluted net loss per common share |

|

$ |

(0.19 |

) |

$ |

(0.33 |

) |

$ |

(0.69 |

) |

$ |

(0.96 |

) |

|

Basic and diluted weighted average number of common shares outstanding |

|

105,774,949 |

|

69,047,161 |

|

95,160,945 |

|

69,024,656 |

| ||||

See accompanying notes to condensed consolidated financial statements.

SYNTA PHARMACEUTICALS CORP.

Condensed Consolidated Statements of Comprehensive Loss

(in thousands)

(unaudited)

|

|

|

Three Months |

|

Nine Months |

| ||||||||

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

| ||||

|

Net loss |

|

$ |

(19,966 |

) |

$ |

(22,515 |

) |

$ |

(65,809 |

) |

$ |

(66,030 |

) |

|

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

| ||||

|

Unrealized gain (loss) on available-for-sale securities |

|

8 |

|

(3 |

) |

(6 |

) |

4 |

| ||||

|

Comprehensive loss |

|

$ |

(19,958 |

) |

$ |

(22,518 |

) |

$ |

(65,815 |

) |

$ |

(66,026 |

) |

See accompanying notes to condensed consolidated financial statements.

SYNTA PHARMACEUTICALS CORP.

Condensed Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

|

|

|

Nine Months Ended |

| ||||

|

|

|

2014 |

|

2013 |

| ||

|

Cash flows from operating activities: |

|

|

|

|

| ||

|

Net loss |

|

$ |

(65,809 |

) |

$ |

(66,030 |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

| ||

|

Stock-based compensation expense |

|

5,665 |

|

4,490 |

| ||

|

Depreciation and amortization |

|

504 |

|

373 |

| ||

|

Changes in operating assets and liabilities: |

|

|

|

|

| ||

|

Prepaid expenses and other current assets |

|

(1,153 |

) |

(572 |

) | ||

|

Other assets |

|

85 |

|

25 |

| ||

|

Accounts payable |

|

(2,147 |

) |

32 |

| ||

|

Accrued contract research costs |

|

3,869 |

|

3,591 |

| ||

|

Other accrued liabilities |

|

(724 |

) |

(630 |

) | ||

|

Net cash used in operating activities |

|

(59,710 |

) |

(58,721 |

) | ||

|

Cash flows from investing activities: |

|

|

|

|

| ||

|

Purchases of marketable securities |

|

(68,510 |

) |

(71,183 |

) | ||

|

Maturities of marketable securities |

|

60,688 |

|

62,367 |

| ||

|

Purchases of property and equipment |

|

(85 |

) |

(687 |

) | ||

|

Net cash used in investing activities |

|

(7,907 |

) |

(9,503 |

) | ||

|

Cash flows from financing activities: |

|

|

|

|

| ||

|

Proceeds from issuance of common stock, net of transaction costs, and exercise of common stock options |

|

89,795 |

|

1,082 |

| ||

|

Proceeds from the sale of common stock to related parties, net of transaction costs |

|

4,992 |

|

— |

| ||

|

Proceeds from term loans |

|

— |

|

13,500 |

| ||

|

Payment of term loans |

|

(7,151 |

) |

(2,383 |

) | ||

|

Payment of capital lease obligations |

|

(31 |

) |

(10 |

) | ||

|

Net cash provided by financing activities |

|

87,605 |

|

12,189 |

| ||

|

Net increase (decrease) in cash and cash equivalents |

|

19,988 |

|

(56,035 |

) | ||

|

Cash and cash equivalents at beginning of period |

|

48,490 |

|

81,512 |

| ||

|

Cash and cash equivalents at end of period |

|

$ |

68,478 |

|

$ |

25,477 |

|

|

Supplemental disclosure of cash flow information: |

|

|

|

|

| ||

|

Cash paid for interest |

|

$ |

1,498 |

|

$ |

1,918 |

|

See accompanying notes to condensed consolidated financial statements.

SYNTA PHARMACEUTICALS CORP.

Notes to Condensed Consolidated Financial Statements

(unaudited)

(1) Nature of Business

Synta Pharmaceuticals Corp. (the Company) was incorporated in March 2000 and commenced operations in July 2001. The Company is a biopharmaceutical company focusing on discovering, developing and commercializing small molecule drugs to extend and enhance the lives of patients with severe medical conditions, including cancer and chronic inflammatory diseases.

The Company is subject to risks common to emerging companies in the drug development and pharmaceutical industry including, but not limited to, uncertainty of product development and commercialization, lack of marketing and sales history, dependence on key personnel, uncertainty of market acceptance of products, product liability, uncertain protection of proprietary technology, potential inability to raise additional financing and compliance with the U.S. Food and Drug Administration and other government regulations.

The Company may require significant additional funds earlier than it currently expects in order to conduct additional clinical trials and continue to fund its operations. There can be no assurances, however, that additional funding will be available on favorable terms, or at all. If adequate funds are not available, the Company may be required to delay, significantly modify or terminate its research and development programs or reduce its planned commercialization efforts.

(2) Summary of Significant Accounting Policies

The accompanying condensed consolidated financial statements are unaudited, have been prepared on the same basis as the annual financial statements and, in the opinion of management, reflect all adjustments, which include only normal recurring adjustments necessary to present fairly the Company’s financial position as of September 30, 2014 and the consolidated results of operations, comprehensive loss and cash flows for the three months and nine months ended September 30, 2014 and 2013. The preparation of financial statements in conformity with accounting principles generally accepted in the United States (GAAP) requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from these estimates. The results of operations for the three months and nine months ended September 30, 2014 are not necessarily indicative of the results to be expected for the year ending December 31, 2014 or for any other interim period or any other future year. For more complete financial information, these condensed consolidated financial statements, and the notes hereto, should be read in conjunction with the audited financial statements for the year ended December 31, 2013 included in the Company’s Annual Report on Form 10-K as filed with the Securities and Exchange Commission on March 11, 2014.

Principles of Consolidation

The condensed consolidated financial statements include the financial statements of the Company and its wholly owned subsidiaries. All significant intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect certain reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting periods. Significant items subject to such estimates and assumptions include contract research accruals, recoverability of long-lived assets, measurement of stock-based compensation, and the periods of performance under collaborative research and development agreements. The Company bases its estimates on historical experience and various other assumptions that management believes to be reasonable under the circumstances. Changes in estimates are recorded in the period in which they become known. Actual results could differ from those estimates.

Cash and Cash Equivalents

The Company considers all highly liquid investments with original maturities of three months or less at the date of purchase and an investment in a money market fund to be cash equivalents. Changes in the level of cash and cash equivalents may be affected by changes in investment portfolio maturities, as well as actual cash disbursements to fund operations.

The primary objective of the Company’s investment activities is to preserve its capital for the purpose of funding operations and the Company does not enter into investments for trading or speculative purposes. The Company invests in money market funds and high-grade, short-term commercial paper and corporate bonds, which are subject to minimal credit and market risk. The Company’s cash is deposited in a highly rated financial institution in the United States. Declines in interest rates, however, would reduce future investment income.

Marketable Securities

Marketable securities consist of investments in high-grade corporate obligations, and government and government agency obligations that are classified as available-for-sale. Since these securities are available to fund current operations they are classified as current assets on the consolidated balance sheets.

The Company adjusts the cost of available-for-sale debt securities for amortization of premiums and accretion of discounts to maturity. The Company includes such amortization and accretion as a component of interest expense, net. Realized gains and losses and declines in value, if any, that the Company judges to be other-than-temporary on available-for-sale securities are reported as a component of interest expense, net. To determine whether an other-than-temporary impairment exists, the Company considers whether it intends to sell the debt security and, if the Company does not intend to sell the debt security, it considers available evidence to assess whether it is more likely than not that it will be required to sell the security before the recovery of its amortized cost basis. During the three months and nine months ended September 30, 2014 and 2013, the Company determined it did not have any securities that were other-than-temporarily impaired.

Marketable securities are stated at fair value, including accrued interest, with their unrealized gains and losses included as a component of accumulated other comprehensive income or loss, which is a separate component of stockholders’ equity. The fair value of these securities is based on quoted prices and observable inputs on a recurring basis. Realized gains and losses are determined on the specific identification method. During the three months and nine months ended September 30, 2014 and 2013, the Company did not have any realized gains or losses on marketable securities.

Fair Value of Financial Instruments

The carrying amounts of the Company’s financial instruments, which include cash equivalents, marketable securities and term loan obligations, approximate their fair values. The fair value of the Company’s financial instruments reflects the amounts that would be received upon sale of an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value hierarchy has the following three levels:

Level 1—quoted prices in active markets for identical assets and liabilities.

Level 2—observable inputs other than Level 1 inputs. Examples of Level 2 inputs include quoted prices in active markets for similar assets or liabilities and quoted prices for identical assets or liabilities in markets that are not active.

Level 3—unobservable inputs that reflect the Company’s own assumptions about the assumptions market participants would use in pricing the asset or liability.

Financial assets and liabilities are classified in their entirety within the fair value hierarchy based on the lowest level of input that is significant to the fair value measurement. The Company measures the fair value of its marketable securities by taking into consideration valuations obtained from third-party pricing sources. The pricing services utilize industry standard valuation models, including both income and market based approaches, for which all significant inputs are observable, either directly or indirectly, to estimate fair value. These inputs include reported trades of and broker-dealer quotes on the same or similar securities, issuer credit spreads, benchmark securities and other observable inputs. As of September 30, 2014, the Company’s financial assets valued based on Level 1 inputs consisted of cash and cash equivalents in a money market fund and its financial assets valued based on Level 2 inputs consisted of high-grade corporate bonds and commercial paper. During the three months and nine months ended September 30, 2014 and 2013, the Company did not have any transfers of financials assets between Levels 1 and 2. As of September 30, 2014, the Company did not have any financial liabilities that were recorded at fair value on the balance sheet. The disclosed fair value of the Company’s term loan obligations is determined using current applicable rates for similar instruments as of the balance sheet date. The

carrying value of the Company’s term loan obligations approximates fair value as the Company’s interest rate yield is near current market rate yields. The disclosed fair value of the Company’s term loan obligations is based on Level 3 inputs.

Revenue Recognition

Collaboration and License Agreements

The Company’s principal source of revenue to date has been its former collaboration and license agreements, which included upfront license payments, development milestones, reimbursement of research and development costs, potential profit sharing payments, commercial and sales-based milestones and royalties. The accounting for collaboration and license agreements requires subjective analysis and requires management to make estimates and assumptions about whether deliverables within multiple-element arrangements are separable from the other aspects of the contractual arrangement into separate units of accounting and to determine the arrangement consideration to be allocated to each unit of accounting.

For multiple-element arrangements entered into or materially modified after January 1, 2011, the Company follows the provisions of Financial Accounting Standards Board (FASB) Accounting Standards Update (ASU) No. 2009-13— Multiple-deliverable Revenue Arrangements. ASU No. 2009-13 amended certain provisions of Accounting Standards Codification (ASC) Topic 605 — Revenue Recognition. This standard addresses the determination of the unit(s) of accounting for multiple-element arrangements and how an arrangement’s consideration should be allocated to each unit of accounting.

Pursuant to this standard, each required deliverable is evaluated to determine if it qualifies as a separate unit of accounting. For the Company this determination includes an assessment as to whether the deliverable has “stand-alone value” to the customer separate from the undelivered elements. The arrangement’s consideration is then allocated to each separate unit of accounting based on the relative selling price of each deliverable. The estimated selling price of each deliverable is determined using the following hierarchy of values: (i) vendor-specific objective evidence of fair value, (ii) third-party evidence of selling price, or (iii) the Company’s best estimate of the selling price (BESP). The BESP reflects the Company’s best estimate of what the selling price would be if the deliverable was regularly sold by it on a stand-alone basis. The Company expects, in general, to use BESP for allocating consideration to each deliverable in future collaboration agreements. In general, the consideration allocated to each unit of accounting is then recognized as the related goods or services are delivered limited to the consideration not contingent upon future deliverables.

The Company accounts for development milestones under collaboration and license agreements pursuant to ASU No. 2010-17 Milestone Method of Revenue Recognition (ASU No. 2010-17). ASU No. 2010-17 codified a method of revenue recognition that has been common practice. Under this method, contingent consideration from research and development activities that is earned upon the achievement of a substantive milestone is recognized in its entirety in the period in which the milestone is achieved. At the inception of each arrangement that includes milestone payments, the Company evaluates whether each milestone is substantive. This evaluation includes an assessment of whether (a) the consideration is commensurate with either (1) the entity’s performance to achieve the milestone, or (2) the enhancement of the value of the delivered item(s) as a result of a specific outcome resulting from the entity’s performance to achieve the milestone, (b) the consideration relates solely to past performance and (c) the consideration is reasonable relative to all of the deliverables and payment terms within the arrangement. The Company evaluates factors such as the scientific, clinical, regulatory, commercial and other risks that must be overcome to achieve the respective milestone, the level of effort and investment required and whether the milestone consideration is reasonable relative to all deliverables and payment terms in the arrangement in making this assessment. The Company does not have any ongoing collaboration and license agreements under which milestones may be achieved.

Royalty revenues are based upon a percentage of net sales. Royalties from the sales of products will be recorded on the accrual basis when results are reliably measurable, collectability is reasonably assured and all other revenue recognition criteria are met. Commercial and sales-based milestones, which are based upon the achievement of certain agreed-upon sales thresholds, will be recognized in the period in which the respective sales threshold is achieved and collectability is reasonably assured. The Company does not have any ongoing collaboration and license agreements under which royalties or commercial and sales-based milestones may be achieved.

Stock-Based Compensation

The Company recognizes stock-based compensation expense based on the grant date fair value of stock options granted to employees, officers and directors. The Company uses the Black-Scholes option pricing model to determine the grant date fair value as it is the most appropriate valuation method for its option grants. The Black-Scholes model requires inputs for risk-free interest rate, dividend yield, volatility and expected lives of the options. Expected volatility is based upon the weighted average historical volatility data of the Company’s common stock. The risk-free rate for periods within the expected life of the option is based on the U.S. Treasury

yield curve in effect at the time of the grant. The expected lives for options granted represent the period of time that options granted are expected to be outstanding. The Company uses the simplified method for determining the expected lives of options. The Company estimates the forfeiture rate based on historical data. This analysis is re-evaluated at least annually and the forfeiture rate is adjusted as necessary.

For awards with graded vesting, the Company allocates compensation costs on a straight-line basis over the requisite service period. The Company amortizes the fair value of each option over each option’s service period, which is generally the vesting period.

Certain of the employee stock options granted by the Company are structured to qualify as incentive stock options (ISOs). Under current tax regulations, the Company does not receive a tax deduction for the issuance, exercise or disposition of ISOs if the employee meets certain holding requirements. If the employee does not meet the holding requirements, a disqualifying disposition occurs, at which time the Company may receive a tax deduction. The Company does not record tax benefits related to ISOs unless and until a disqualifying disposition is reported. In the event of a disqualifying disposition, the entire tax benefit is recorded as a reduction of income tax expense. The Company has not recognized any income tax benefit for its share-based compensation arrangements due to the fact that the Company does not believe it is more likely than not it will realize the related deferred tax assets.

Comprehensive Loss

Comprehensive loss is defined as the change in equity of a business enterprise during a period from transactions and other events and circumstances from non-owner sources. Changes in unrealized gains and losses on marketable securities represent the only difference between the Company’s net loss and comprehensive loss.

Segment Reporting

Operating segments are determined based on the way management organizes its business for making operating decisions and assessing performance. The Company has a single operating segment, which is the discovery, development and commercialization of drug products.

Basic and Diluted Loss Per Common Share

Basic net loss per share is computed using the weighted average number of common shares outstanding during the period, excluding restricted stock that has been issued but is not yet vested. Diluted net loss per common share is computed using the weighted average number of common shares outstanding and the weighted average dilutive potential common shares outstanding using the treasury stock method. However, for the three months and nine months ended September 30, 2014 and 2013, diluted net loss per share is the same as basic net loss per share as the inclusion of weighted average shares of unvested restricted common stock and common stock issuable upon the exercise of stock options would be anti-dilutive.

The following table summarizes outstanding securities not included in the computation of diluted net loss per common share as their inclusion would be anti-dilutive:

|

|

|

September 30, |

| ||

|

|

|

2014 |

|

2013 |

|

|

Common stock options |

|

8,262,468 |

|

6,736,209 |

|

|

Unvested restricted common stock |

|

529,272 |

|

42,500 |

|

Recent Accounting Pronouncements

In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers (Topic 606), which amends the guidance for accounting for revenue from contracts with customers. This ASU supersedes the revenue recognition requirements in ASC Topic 605, and creates a new Topic 606, Revenue from Contracts with Customers. This guidance is effective for fiscal years beginning after December 15, 2016, with early adoption not permitted. Two adoption methods are permitted: retrospectively to all prior reporting periods presented, with certain practical expedients permitted; or retrospectively with the cumulative effect of initially adopting the ASU recognized at the date of initial application. The Company has not yet determined which adoption method it will utilize or the effect that the adoption of this guidance will have on its consolidated financial statements.

In August 2014, the FASB issued ASU No. 2014-15, Presentation of Financial Statements—Going Concern (Subtopic 205-40): Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern. This ASU is intended to define management’s responsibility to evaluate whether there is substantial doubt about an organization’s ability to continue as a going concern within one year of the date of issuance of the entity’s financial statements and to provide related footnote disclosures. This

guidance is effective for fiscal years beginning after December 15, 2016, with early application permitted. The Company has not yet determined the effect that the adoption of this guidance will have on the disclosures included in its consolidated financial statements.

(3) Cash, Cash Equivalents and Marketable Securities

A summary of cash, cash equivalents and available-for-sale marketable securities held by the Company as of September 30, 2014 and December 31, 2013 was as follows in thousands (see Note 2):

|

|

|

September 30, 2014 |

| ||||||||||

|

|

|

Cost |

|

Unrealized |

|

Unrealized |

|

Fair |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Cash and cash equivalents: |

|

|

|

|

|

|

|

|

| ||||

|

Cash and money market funds (Level 1) |

|

$ |

58,328 |

|

$ |

— |

|

$ |

— |

|

$ |

58,328 |

|

|

Corporate debt securities due within 3 months of date of purchase (Level 2) |

|

10,150 |

|

— |

|

— |

|

10,150 |

| ||||

|

Total cash and cash equivalents |

|

$ |

68,478 |

|

$ |

— |

|

$ |

— |

|

$ |

68,478 |

|

|

Marketable securities: |

|

|

|

|

|

|

|

|

| ||||

|

Corporate debt securities due within 1 year of date of purchase (Level 2) |

|

50,791 |

|

18 |

|

(7 |

) |

50,802 |

| ||||

|

Total cash, cash equivalents and marketable securities |

|

$ |

119,269 |

|

$ |

18 |

|

$ |

(7 |

) |

$ |

119,280 |

|

|

|

|

December 31, 2013 |

| ||||||||||

|

|

|

Cost |

|

Unrealized |

|

Unrealized |

|

Fair |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Cash and cash equivalents: |

|

|

|

|

|

|

|

|

| ||||

|

Cash and money market funds (Level 1) |

|

$ |

40,586 |

|

$ |

— |

|

$ |

— |

|

$ |

40,586 |

|

|

Corporate debt securities due within 3 months of date of purchase (Level 2) |

|

7,904 |

|

— |

|

— |

|

7,904 |

| ||||

|

Total cash and cash equivalents |

|

$ |

48,490 |

|

$ |

— |

|

$ |

— |

|

$ |

48,490 |

|

|

Marketable securities: |

|

|

|

|

|

|

|

|

| ||||

|

Corporate debt securities due within 1 year of date of purchase (Level 2) |

|

42,969 |

|

18 |

|

(1 |

) |

42,986 |

| ||||

|

Total cash, cash equivalents and marketable securities |

|

$ |

91,459 |

|

$ |

18 |

|

$ |

(1 |

) |

$ |

91,476 |

|

(4) Property and Equipment

Property and equipment as of September 30, 2014 and December 31, 2013 consisted of the following (in thousands):

|

|

|

September 30, |

|

December 31, |

| ||

|

|

|

|

|

|

| ||

|

Laboratory equipment |

|

$ |

12,207 |

|

$ |

12,681 |

|

|

Leasehold improvements |

|

4,988 |

|

4,958 |

| ||

|

Computers and software |

|

3,083 |

|

3,220 |

| ||

|

Furniture and fixtures |

|

1,170 |

|

1,170 |

| ||

|

|

|

21,448 |

|

22,029 |

| ||

|

Less accumulated depreciation and amortization |

|

(20,314 |

) |

(20,476 |

) | ||

|

|

|

$ |

1,134 |

|

$ |

1,553 |

|

Depreciation and amortization expenses of property and equipment, including equipment purchased under capital leases, were approximately $0.2 million and $0.1 million in the three months ended September 30, 2014 and 2013, respectively and $0.5 million and $0.4 million in the nine months ended September 30, 2014 and 2013, respectively.

(5) Stockholders’ Equity

Common Stock

Each common stockholder is entitled to one vote for each common share of stock held. The common stock will vote together with all other classes and series of stock of the Company as a single class on all actions to be taken by the Company’s stockholders. Each share of common stock is entitled to receive dividends, as and when declared by the Company’s board of directors.

The Company has never declared cash dividends on its common stock and does not expect to do so in the foreseeable future.

Registered Direct Offering

In April 2014, the Company sold 1,250,000 shares of its common stock at a purchase price of $4.01 per share in a registered direct offering to an affiliate of a director who is its largest stockholder. These shares were sold directly without a placement agent, underwriter, broker or dealer. The net proceeds to the Company were approximately $5.0 million after deducting offering expenses payable by the Company.

At-The-Market Issuance Sales Agreements

The Company entered into at-the-market issuance sales agreements (May 2012, May 2014 and July 2014 Sales Agreements) with MLV & Co. LLC (MLV), pursuant to which the Company may issue and sell shares of its common stock from time to time, at the Company’s option, through MLV as its sales agent. Sales of common stock through MLV may be made by any method that is deemed an “at-the-market” offering as defined in Rule 415 promulgated under the Securities Act of 1933, as amended, including by means of ordinary brokers’ transactions at market prices, in block transactions or as otherwise agreed by the Company and MLV. Subject to the terms and conditions of the Sales Agreements, MLV will use commercially reasonable efforts to sell the common stock based upon the Company’s instructions (including any price, time or size limits or other customary parameters or conditions the Company may impose). The Company is not obligated to make any sales of its common stock under the Sales Agreements. Any shares sold will be sold pursuant to an effective shelf registration statement on Form S-3. The Company will pay MLV a commission of up to 3% of the gross proceeds. The May 2012 and May 2014 Sales Agreements were terminated by the Company upon the sale of substantially all stock authorized for sale under each such agreement. The July 2014 Sales Agreement may be terminated by the Company at any time.

In March and April 2014, the Company sold an aggregate of 6,588,875 shares of common stock pursuant to the May 2012 Sales Agreement for an aggregate of approximately $28.0 million in gross proceeds at an average selling price of $4.25 per share. Net proceeds to the Company were approximately $27.3 million after deducting commissions and other transactions costs.

From May 2014 through July 2014, the Company sold an aggregate of 9,424,193 shares of common stock pursuant to the May 2014 Sales Agreement for an aggregate of approximately $40.0 million in gross proceeds at an average selling price of $4.24 per

share. Net proceeds to the Company were approximately $39.2 million after deducting commissions and other transactions costs, including approximately $33.6 million from the sale of 8,060,244 shares in the second quarter of 2014 and approximately $5.6 million from the sale of 1,363,949 shares in July 2014.

In July 2014, the Company reserved up to $50 million under its shelf registration statement for issuance under the July 2014 Sales Agreement. In the third quarter of 2014, the Company sold an aggregate of 5,679,685 shares of common stock pursuant to the July 2014 Sales Agreement for an aggregate of approximately $23.0 million in gross proceeds at an average selling price of $4.05 per share. Net proceeds to the Company were approximately $22.5 million after deducting commissions and other transactions costs. As of September 30, 2014, approximately $27.0 million remained reserved under the Company’s shelf registration statement and the applicable prospectus supplement for possible future issuance under the July 2014 Sales Agreement.

(6) Stock-Based Compensation

The Company’s 2006 Stock Plan provides for the grant of incentive stock options, non-statutory stock options and non-vested restricted stock to employees, officers, directors and consultants of the Company. In January 2014, the number of shares of common stock reserved for issuance under the 2006 Stock Plan was increased from 9,000,000 to 10,300,000 pursuant to an “evergreen” provision, which provides for an annual increase based on the lesser of 1,300,000 shares, 5% of the Company’s then outstanding shares of common stock, or such other amount as the board of directors may determine. This increase was approved by the board of directors in December 2013. The administration of the 2006 Stock Plan is under the general supervision of the compensation committee of the board of directors. The exercise price of the stock options is determined by the compensation committee of the board of directors, provided that incentive stock options are granted at not less than fair market value of the common stock on the date of grant and expire no later than ten years from the date the option is granted. Options generally vest over four years. As of September 30, 2014, the Company had options outstanding to purchase 8,262,468 shares of its common stock, which includes options outstanding under its 2001 Stock Plan that was terminated in March 2006. As of September 30, 2014, 1,279,397 shares were available for future issuance.

The following table summarizes stock option activity during the nine months ended September 30, 2014:

|

|

|

Shares |

|

Weighted average |

| |

|

Outstanding at January 1, 2014 |

|

6,814,417 |

|

$ |

6.90 |

|

|

Options granted |

|

2,593,627 |

|

5.44 |

| |

|

Options exercised |

|

(206,389 |

) |

4.14 |

| |

|

Options cancelled |

|

(939,187 |

) |

7.35 |

| |

|

Outstanding at September 30, 2014 |

|

8,262,468 |

|

$ |

6.46 |

|

|

Exercisable at September 30, 2014 |

|

4,724,718 |

|

$ |

6.67 |

|

The total cash received by the Company as a result of stock option exercises during the nine months ended September 30, 2014 and 2013 was $0.8 million and $1.1 million, respectively. The weighted-average grant date fair values of options granted during the three months ended September 30, 2014 and 2013 were $3.26 and $4.21 per share, respectively, and during the nine months ended September 30, 2014 and 2013 were $4.44 and $7.65 per share, respectively.

Non-Vested (“Restricted”) Stock Awards With Service Conditions

The Company’s share-based compensation plan provides for awards of restricted shares of common stock to employees, officers, directors and consultants to the Company. Restricted stock awards are subject to forfeiture if employment or service terminates during the prescribed retention period. Restricted shares vest over the service period. The total fair value of restricted stock that vested during the nine months ended September 30, 2014 and 2013 was $0.1 million and $0.2 million, respectively.

The following table summarizes unvested restricted share activity during the nine months ended September 30, 2014:

|

|

|

Shares |

|

Weighted |

| |

|

Outstanding at January 1, 2014 |

|

45,000 |

|

$ |

4.63 |

|

|

Vested |

|

(29,750 |

) |

4.70 |

| |

|

Granted |

|

539,022 |

|

4.01 |

| |

|

Forfeited |

|

(25,000 |

) |

4.34 |

| |

|

Outstanding at September 30, 2014 |

|

529,272 |

|

$ |

4.01 |

|

Stock-Based Compensation Expense

For the three months and nine months ended September 30, 2014 and 2013, the fair value of each employee stock option award was estimated on the date of grant based on the fair value method using the Black-Scholes option pricing valuation model with the following weighted average assumptions:

|

|

|

Three Months |

|

Nine Months |

| ||||

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

Risk-free interest rate |

|

1.96 |

% |

1.74 |

% |

1.88 |

% |

1.12 |

% |

|

Expected life in years |

|

6.25 |

|

6.25 |

|

6.25 |

|

6.25 |

|

|

Volatility |

|

104 |

% |

103 |

% |

104 |

% |

102 |

% |

|

Expected dividend yield |

|

— |

|

— |

|

— |

|

— |

|

Stock-based compensation expense during the three months and nine months ended September 30, 2014 and 2013 was as follows (in thousands):

|

|

|

Three Months |

|

Nine Months |

| ||||||||

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

| ||||

|

Stock-based compensation expense by type of award: |

|

|

|

|

|

|

|

|

| ||||

|

Employee stock options |

|

$ |

1,486 |

|

$ |

1,620 |

|

$ |

5,486 |

|

$ |

4,276 |

|

|

Restricted stock |

|

80 |

|

63 |

|

179 |

|

214 |

| ||||

|

Total stock-based compensation expense |

|

$ |

1,566 |

|

$ |

1,683 |

|

$ |

5,665 |

|

$ |

4,490 |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

Effect of stock-based compensation expense by line item: |

|

|

|

|

|

|

|

|

| ||||

|

Research and development |

|

$ |

1,066 |

|

$ |

902 |

|

$ |

3,329 |

|

$ |

2,363 |

|

|

General and administrative |

|

500 |

|

781 |

|

2,336 |

|

2,127 |

| ||||

|

Total stock-based compensation expense included in net loss |

|

$ |

1,566 |

|

$ |

1,683 |

|

$ |

5,665 |

|

$ |

4,490 |

|

Unrecognized stock-based compensation expense as of September 30, 2014 was as follows (dollars in thousands):

|

|

|

Unrecognized |

|

Weighted |

| |

|

Employee stock options |

|

$ |

14,082 |

|

2.82 |

|

|

Restricted stock |

|

2,080 |

|

3.74 |

| |

|

Total |

|

$ |

16,162 |

|

2.94 |

|

7) Other Accrued Liabilities

Other accrued liabilities as of September 30, 2014 and December 31, 2013 consisted of the following (in thousands):

|

|

|

September 30, |

|

December 31, |

| ||

|

|

|

|

|

|

| ||

|

Compensation and benefits |

|

$ |

2,776 |

|

$ |

3,137 |

|

|

Professional fees |

|

1,157 |

|

1,585 |

| ||

|

Other |

|

1,061 |

|

996 |

| ||

|

|

|

$ |

4,994 |

|

$ |

5,718 |

|

(8) Co-Development and License Agreements

Co-Development Agreement

In July 2011, the Company entered into a co-development agreement with a clinical research organization (CRO) for the conduct of certain company-sponsored clinical trials. Under the co-development agreement, this CRO was performing clinical research services under a reduced fee structure in exchange for a share of licensing payments and commercial revenues, if any, resulting from the product under development up to a specified maximum payment, which is defined as a multiple of the fee reduction realized. Research and development expenses were being recognized based on the reduced fee structure and expected payments will be recorded in the future if and when payment is probable. The maximum amount of the service fee discount was realized in the year ended December 31, 2013.

License Arrangement

In May 2014, the Company entered into a license arrangement for its CRACM program, including two lead candidates and the associated intellectual property portfolio, with PRCL Research Inc. (PRCL), a company funded by TVM Life Science Venture VII and the Fonds de Solidarité des Travailleurs du Québec, based in Montreal, Canada. PRCL plans to develop one of the two lead candidates licensed from us to proof-of-concept. Synta was granted a minority interest in PRCL in exchange for its contribution of know-how and intellectual property and will also hold a seat on PRCL’s Board of Directors. Synta will not be required to provide any research funding or capital contributions to PRCL. Synta will be reimbursed by PRCL for any ongoing intellectual property management costs in connection with the contributed intellectual property and may conduct preclinical research activities which would be reimbursed by PRCL. If and when proof-of-concept is reached with either drug candidate, Eli Lilly and Company, which is an investor in TVM, will manage the development program through one of its divisions and will have an option to acquire PRCL or its assets at the then fair value.

(9) Term Loans

General Electric Capital Corporation

In March 2013, the Company amended its loan and security agreement entered into in September 2010 with General Electric Capital Corporation (GECC) and another lender (the GECC Term Loan) and obtained $12.9 million in additional loan funding and, as a result, increased the principal balance to $22.5 million at March 31, 2013. This amendment was accounted for as a loan modification. Interest on the borrowings under the GECC Term Loan remains at the annual rate of 9.75%. The Company made interest-only payments for the period from April 2013 through December 2013. In January 2014, the Company began making 30 equal monthly payments of principal plus accrued interest on the outstanding balance. During the period from July 2012 through March 2013, the Company made equal monthly payments of principal plus accrued interest on the outstanding balance. Prior to July 2012, the Company made interest-only payments.

The Company has paid various transaction fees and expenses in connection with the GECC Term Loan, which are deferred and are being amortized as interest expense over the remaining term of the GECC Term Loan. In addition, the Company is obligated to pay an exit fee of $788,000 at the time of the final principal payment which is being accreted and expensed as interest over the remaining term of the GECC Term Loan. In the three months ended September 30, 2014 and 2013, the Company recognized GECC Term Loan interest expense of $0.5 million and $0.7 million, respectively, of which $0.1 million was in connection with these transaction and exit

fees and expenses in each of the quarters. In the nine months ended September 30, 2014 and 2013, the Company recognized GECC Term Loan interest expense of $1.7 million and $1.8 million, respectively, of which $0.3 million and $0.4 million, respectively, was in connection with these transaction and exit fees and expenses. The Company may prepay the full amount of the GECC Term Loan, subject to prepayment premiums under certain circumstances. The Company did not issue any warrants in connection with the GECC Term Loan.

The GECC Term Loan is secured by substantially all of the Company’s assets, except its intellectual property. The Company has granted GECC a springing security interest in its intellectual property in the event the Company is not in compliance with certain cash usage covenants, as defined therein. The GECC Term Loan contains restrictive covenants, including the requirement for the Company to receive the prior written consent of GECC to enter into loans, other than up to $4.0 million of equipment financing, restrictions on the declaration or payment of dividends, restrictions on acquisitions, and customary default provisions that include material adverse events, as defined therein. The Company has determined that the risk of subjective acceleration under the material adverse events clause is remote and therefore has classified the outstanding principal in current and long-term liabilities based on the timing of scheduled principal payments.

Oxford Finance Corporation

In March 2011, the Company entered into a loan and security agreement with Oxford Finance Corporation (Oxford) and received $2.0 million in loan funding, and in December 2012, the Company entered into a loan modification agreement, as amended, under which the Company could elect to draw down up to an additional $0.6 million in equipment financing until June 30, 2013 that would be payable in 36 equal monthly payments of principal plus accrued interest on the outstanding balance (collectively, the Oxford Term Loan). As of June 30, 2013, the Company had fully utilized the $0.6 million in additional equipment financing. Interest on the borrowings under the Oxford Term Loan accrues at an annual rate of 13.35%. In May 2011, the Company began making 36 equal monthly payments of principal plus accrued interest on the initial $2.0 million outstanding balance that was fully paid in April 2014. The Company continues to make equal monthly payments of principal plus accrued interest on the $0.6 million in additional equipment financing. The Company recognized approximately $13,000 and $36,000 in interest expense in the three months ended September 30, 2014 and 2013, respectively, and $48,000 and $99,000 in interest expense in the nine months ended September 30, 2014 and 2013, respectively, related to the outstanding principal under the Oxford Term Loan. In addition to the interest payable under the Oxford Term Loan, the Company paid approximately $108,000 of administrative and legal fees and expenses in connection with the Oxford Term Loan. These expenses have been deferred and are being expensed over the term of the Oxford Term Loan. The Company did not issue any warrants in connection with the Oxford Term Loan. The Company may prepay the Oxford Term Loan, subject to prepayment premiums under certain circumstances. Oxford has the right to require the Company to prepay the Oxford Term Loan if the Company prepays the full amount of the GECC Term Loan under certain circumstances.

The Oxford Term Loan is secured by certain laboratory and office equipment, furniture and fixtures. In connection with the Oxford Term Loan, Oxford and GECC entered into a Lien Subordination Agreement, whereby GECC granted Oxford a first priority perfected security interest in the loan collateral. The Oxford Term Loan contains restrictive covenants, including the requirement for the Company to receive the prior written consent of Oxford to enter into acquisitions in which the Company incurs more than $2.0 million of related indebtedness, and customary default provisions that include material adverse events, as defined therein. The Company has determined that the risk of subjective acceleration under the material adverse events clause is remote and therefore has classified the outstanding principal in current and long-term liabilities based on the timing of scheduled principal payments.

Future principal payments under the GECC and Oxford Term Loans as of September 30, 2014 were approximately as follows (in thousands):

|

Years ending December 31, |

|

|

| |

|

2014 |

|

$ |

2,299 |

|

|

2015 |

|

9,214 |

| |

|

2016 |

|

4,607 |

| |

|

Total principal payments |

|

16,120 |

| |

|

Less current portion |

|

(9,207 |

) | |

|

Long term portion |

|

$ |

6,913 |

|

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

You should read this discussion together with the condensed consolidated financial statements, related notes and other financial information included elsewhere in this Quarterly Report on Form 10-Q. The following discussion may contain predictions, estimates and other forward-looking statements that involve a number of risks and uncertainties, including those discussed under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2013 filed with the Securities and Exchange Commission on March 11, 2014. These risks could cause our actual results to differ materially from any future performance suggested below.

Overview

Synta Pharmaceuticals Corp. is a biopharmaceutical company focused on discovering, developing, and commercializing small molecule drugs to extend and enhance the lives of patients with severe medical conditions, including cancer and chronic inflammatory diseases. We have two drug candidates in clinical trials for treating multiple types of cancer and a novel proprietary drug discovery platform. All of our drug candidates have been discovered and developed internally using our proprietary, unique chemical compound library and integrated discovery engine. We retain full ownership of all of our drug candidates.

We were incorporated in March 2000 and commenced operations in July 2001. Since that time, we have been principally engaged in the discovery and development of novel drug candidates. As of September 30, 2014, we have raised an aggregate of approximately $819.2 million in cash proceeds to fund operations, including $616.2 million in net proceeds from private and public offerings of our equity, $30.5 million in gross proceeds from term loans and $167.2 million in non-refundable payments from partnering activities under prior collaborations, as well as $5.3 million from the exercise of common stock warrants and options. We have also generated funds from government grants, equipment lease financings and investment income. We are engaged in preliminary partnership discussions for a number of our programs, which may provide us with additional financial resources if consummated.

During the three months and nine months ended September 30, 2014, we sold an aggregate of 7,043,634 and 21,692,753 shares of our common stock, respectively, for an aggregate of approximately $28.1 million and $89.0 million in net proceeds, respectively, pursuant to at-the-market issuance sales agreements with MLV & Co. LLC (MLV). See “—Liquidity and Capital Resources—At-The-Market Issuance Sales Agreements with MLV.”

In April 2014, we sold 1,250,000 shares of our common stock for approximately $5.0 million in net proceeds in a registered direct offering to an affiliate of a director who is our largest stockholder.

We have devoted substantially all of our capital resources to the research and development of our drug candidates. Since our inception, we have had no revenues from product sales. As of September 30, 2014, we had an accumulated deficit of $617.2 million. We expect to incur significant operating losses for the foreseeable future as we advance our drug candidates from discovery through preclinical development and clinical trials, and seek regulatory approval and eventual commercialization. We will need to generate significant revenues from product sales to achieve future profitability and may never do so.

Oncology Programs

We have two clinical-stage programs in oncology (ganetespib and elesclomol) and a novel, proprietary small molecule cancer drug development program (the HDC platform).

Ganetespib (Hsp90 Inhibitor)

Summary

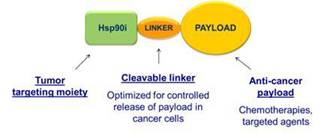

Ganetespib is a novel, potent, small molecule inhibitor of Hsp90, a molecular chaperone which is required for the proper folding and activation of many cancer-promoting proteins. Inhibition of Hsp90 by ganetespib leads to the simultaneous degradation of many of these client proteins and the subsequent death or cell cycle arrest of cancer cells dependent on those proteins. A number of Hsp90 client proteins are also involved in the resistance of cancer cells to other anti-cancer treatments, such as chemotherapy. The ability to reduce cancer-cell drug resistance suggests that the combination of ganetespib with chemotherapies or other anti-cancer agents may provide greater benefit than those agents administered alone. In preclinical studies, ganetespib has shown potent anti-cancer activity against a broad range of solid and hematologic cancers, both as a monotherapy and in combination with certain widely used anti-cancer agents.

Ganetespib is currently being evaluated in a broad range of cancer clinical trials including our GALAXY NSCLC program (GALAXY-1 and GALAXY-2) in combination with docetaxel chemotherapy, and as monotherapy in certain genetically-defined targeted patient populations. A favorable safety profile has been consistently observed across clinical trials, involving over 1,200 patients treated with ganetespib to date. Ganetespib has not shown the serious liver or common ocular toxicities reported with other

Hsp90 inhibitors, or the neurotoxicity, bone marrow toxicities, and alopecia characteristic of many chemotherapies. The most common adverse event reported with ganetespib has been transient, mild or moderate diarrhea, which can be prevented or effectively managed with standard supportive care. In the clinical trials conducted to date, ganetespib has shown promising activity both in combination with chemotherapy and as a monotherapy.

The results observed to date in our GALAXY program suggest a significant potential commercial opportunity for use of ganetespib in patients with advanced non-small cell lung adenocarcinoma. Lung cancer is the leading cause of cancer death worldwide in both men and women, estimated to be responsible for about 1.6 million deaths or approximately 20% of global cancer deaths in 2012. Non-small cell lung cancer (NSCLC) is the most common form of lung cancer, making up approximately 85% to 90% of all lung cancers. Adenocarcinoma is the most common subtype of NSCLC.

Ganetespib in lung cancer: The GALAXY program

GALAXY-1 Phase 2b Trial

In 2011, we initiated the GALAXY-1 trial in patients with advanced NSCLC who received one prior treatment for advanced disease, i.e., a second-line treatment setting. GALAXY-1 compares treatment with docetaxel alone, which is approved for second-line treatment, vs. treatment with ganetespib plus docetaxel. The aims of this study were to:

· evaluate clinical benefit and establish the safety profile of ganetespib in combination with docetaxel relative to docetaxel alone;

· identify the patient populations, by biomarker or other disease characteristics, which may be most responsive to combination treatment; and

· build the clinical and operational experience needed to optimize the design and execution of the pivotal GALAXY-2 Phase 3 trial.

Patients in both arms of GALAXY-1 receive a standard regimen of docetaxel 75 mg/m2 on day 1 of a 21-day treatment cycle. Patients in the combination arm also receive ganetespib 150 mg/m2 on days 1 and 15. Treatment continues until disease progression or until treatment intolerance. To ensure balance of prognostic factors between the two arms, patients were stratified by ECOG performance status, baseline LDH level, smoking status, and time since diagnosis of advanced disease (greater than 6 months vs. less than 6 months).

Rate of disease progression during or following first line chemotherapy is a common stratification factor in salvage-setting (after first-line treatment) lung cancer clinical trials to ensure balance and evaluate any difference in treatment benefit between refractory and chemosensitive patients. Commonly used measures include time since completion of first line chemotherapy, best response to first line therapy, time since initiation of first line therapy, as well as time since diagnosis of advanced disease. The latter was chosen for GALAXY-1 in order to reduce ambiguity introduced by the recent approvals of maintenance therapy following first line treatment, as well as to avoid possible subjectivity in assessment of tumor response in the first-line setting.

GALAXY-1 was originally designed to enroll 240 second-line advanced NSCLC patients of all histologies in order to evaluate several hypotheses on which patients might be most responsive to combination treatment. Co-primary endpoints were PFS in all patients (the ITT population) and OS in patients with elevated baseline level of serum LDH (eLDH). During the course of the trial, the co-primary endpoints were changed to PFS in patients with eLDH and PFS in patients with mutant KRAS (mKRAS). Key secondary endpoints are OS and PFS in the adenocarcinoma patient population.

In early 2012, enrollment of patients with non-adenocarcinoma histologies (which consists primarily of squamous cell carcinoma) was terminated based on possible safety concerns, including risk of bleeding and a trend towards inferior survival. The trial was amended at that time to enroll 240 patients with adenocarcinoma histology only. To ensure the specified number of eLDH and mKRAS patients were included, a total of 385 patients were enrolled in GALAXY-1. Enrollment in GALAXY-1 was completed in May 2013.

The final analysis of GALAXY-1 data was conducted in early May 2014. Publication of the final data from GALAXY-1 is expected in the first half of 2015. A summary of key efficacy data is presented in the tables and figures below:

|

|

|

Hazard Ratio |

|

eLDH |

|

mKRAS |

|

Dg > 6 months* |

|

Adenocarcinoma |

|

|

|

|

|

|

|

|

|

|

|

|

|

OS |

|

Unadjusted |

|

0.88 |

|

1.18 |

|

0.71 |

|

0.87 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted |

|

0.75 |

|

1.23 |

|

0.69 |

|

0.84 |

|

|

|

|

|

|

|

|

|

|

|

|

|

PFS |

|

Unadjusted |

|

1.06 |

|

0.93 |

|

0.75 |

|

0.85 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted |

|

0.88 |

|

1.11 |

|

0.74 |

|

0.82 |

* The Dg > 6 months population selected for the Phase 3 GALAXY-2 trial consists of patients having a time since diagnosis of advanced disease of greater than 6 months (a stratification factor in the Phase 2b GALAXY-1 trial).

P-values are 1-sided

Hazard ratios were calculated using Cox proportional hazards model

Unadjusted: univariate analysis

Adjusted: pre-specified analysis adjusting for multiple prognostic variables such as gender, smoking status, LDH, ECOG performance status, interval since diagnosis of advanced disease, age, total baseline target lesion size, and geographic region

|

G+D vs. D |

|

|

|

eLDH |

|

mKRAS |

|

Dg > 6 months* |

|

Adenocarcinoma |

|

|

|

|

|

|

|

|

|

|

|

|

|

OS |

|

Median (months) |

|

6.0 vs. 5.1 |

|

7.6 vs. 6.4 |

|

11.0 vs. 7.4 |

|

10.2 vs. 8.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Events |

|

72 (83)% |

|

68 (76)% |

|

132 (75)% |

|

190 (75)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

PFS |

|

Median (months) |

|

2.8 vs. 2.7 |

|

3.9 vs. 3.0 |

|

5.3 vs. 3.4 |

|

4.5 vs. 3.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Events |

|

70 (80)% |

|

73 (82)% |

|

142 (80)% |

|

205 (81)% |

* The Dg > 6 months population selected for the Phase 3 GALAXY-2 trial consists of patients having a time since diagnosis of advanced disease of greater than 6 months (a stratification factor in the Phase 2b GALAXY-1 trial).

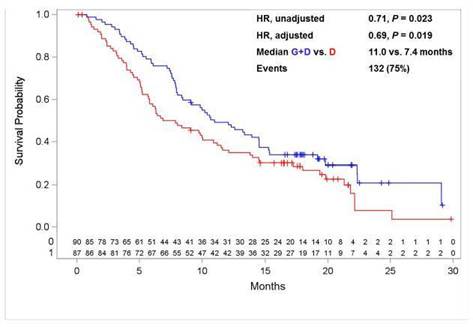

Figure 1: OS Kaplan Meier plot for the Dg > 6 months patient population of GALAXY-1 selected for evaluation in the GALAXY-2 Phase 3 trial

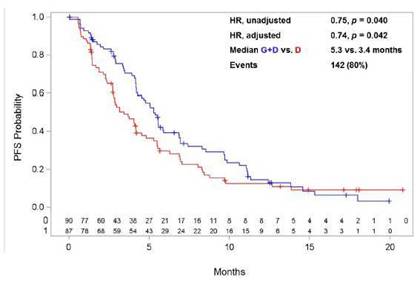

Figure 2: PFS Kaplan Meier plot for the Dg > 6 months patient population of GALAXY-1 selected for evaluation in the GALAXY-2 Phase 3 trial

Safety

The safety profile of adenocarcinoma patients treated with the combination of ganetespib (G) and docetaxel (D) was favorable, consistent with previously reported results. The most common adverse events (AEs), all grades, were neutropenia (46% vs. 45%), diarrhea (50% vs. 17%) and fatigue (35% vs. 24%), for G+D vs. D, respectively. Diarrhea was effectively prevented or managed with standard supportive care; the incidence of grade 3 or 4 diarrhea was 4% (G+D) vs. 0% (D). Fatigue was predominantly grade 1 and grade 2; grade 3 or 4 fatigue was 6% (G+D) vs. 4% (D). The most common grade 3 or 4 AEs were neutropenia (41% vs. 42%), leukopenia (10% vs 6%) and febrile neutropenia (9% vs. 5%). Only one case of visual impairment was reported in this study, which was mild (Grade 1) and transient. The safety profile of patients in the Dg > 6 months population being evaluated in Phase 3 was comparable to the profile in the adenocarcinoma population.

GALAXY-2 Phase 3 Trial

In early 2013, we initiated the GALAXY-2 trial, a global, randomized, multi-center study comparing the same treatments as in GALAXY-1 in the 2nd-line non-small cell adenocarcinoma patient population, with overall survival as the primary endpoint. Patients are required to have an interval since diagnosis of advanced disease of at least 6 months and have tumors that are negative for both EGFR mutation and ALK translocation.

Patients on both arms receive docetaxel generally for four to six 21-day cycles, according to standard practice at their treatment center. After completion of docetaxel treatment, patients on the ganetespib arm are eligible to continue to receive ganetespib monotherapy as maintenance treatment.

The GALAXY-2 trial is expected to enroll a total of approximately 850 patients. Assuming a median overall survival of 7 months in the control arm and 9.3 months in the combination arm (a hazard ratio of 0.75), 5 months of follow up, and a two-sided overall Type I error rate of 0.05, GALAXY-2 has an 92% or higher power to detect a statistically significant treatment difference at the final analysis. Following agreement with the FDA on the statistical analysis plan, the primary endpoint analysis will be based on an evaluation of overall survival in the intent-to-treat population, and a pre-specified analysis of overall survival in ALK- and EGFR-negative patients will be conducted as a supportive analysis. Two event-driven interim analyses of the overall survival primary endpoint of GALAXY-2 have been pre-specified.

Based on current projections and statistical assumptions, we expect that the two GALAXY-2 interim overall survival analyses will be conducted in the second half of 2015, and we expect that the final overall survival analysis will be conducted in the first half of 2016.

Clinical trial of ganetespib and crizotinib combination in ALK positive, crizotinib-naïve NSCLC patients

This clinical trial is sponsored by Memorial Sloan Kettering Cancer Center in NYC. In the first stage, initiated in 2012, the safety profile of escalating doses of the combination was successfully evaluated. The study physician has decided not to proceed into Phase 2 due to the availability of new ALK inhibitor drugs.

Ganetespib in breast cancer

I-SPY 2 Trial

Ganetespib has been selected for study in the I-SPY 2 TRIAL (Investigation of Serial Studies to Predict Your Therapeutic Response with Imaging And moLecular Analysis 2). I-SPY 2 is a standing phase 2 randomized, controlled, multicenter trial for women with newly diagnosed, locally advanced breast cancer (Stage 2 or higher) that is designed to test whether adding investigational drugs to standard chemotherapy is better than standard chemotherapy alone in the neo-adjuvant setting (prior to surgery).

I-SPY 2 employs a unique adaptive trial design to match experimental therapies with patients. Genetic or biological markers (“biomarkers”) from individual patients’ tumors are used to screen promising new treatments, identifying which treatments are most effective in specific patient subgroups. Regimens that have a high Bayesian predictive probability of showing superiority in a 300 patient Phase 3 confirmatory trial in at least one of 10 predefined signatures may “graduate” from I-SPY 2. A regimen can graduate early and at any time after having 60 patients assigned to it, and exits the trial after a maximum of 120 patients. This high efficacy bar and rapid turnaround time allows the trial to match the most promising drug with the right patient in the most expeditious fashion.

I-SPY 2 was created as a pre-competitive consortium that brings together the Food and Drug Administration (FDA), National Cancer Institute (NCI), pharmaceutical companies, leading academic medical centers, and patient advocacy groups under its umbrella. I-SPY 2 is sponsored by QuantumLeap Healthcare Collaborative (QLHC), a non-profit 501(c)(3) foundation dedicated to accelerating healthcare solutions. QLHC shares a unique partnership with the Foundation for the National Institutes of Health Biomarkers Consortium, who manages intellectual property that emerges from the trial. The trial was developed by principal investigators, Laura J. Esserman, M.D., M.B.A., Professor of Surgery and Radiology and Director of the Carol Frank Buck Breast Care Center at UCSF Helen Diller Family Comprehensive Cancer Center in San Francisco, and Donald A. Berry, Ph.D., Professor in the Department of Biostatistics at The University of Texas MD Anderson Cancer Center, and founder of Berry Consultants.

As we announced on October 29, 2014, the arm evaluating ganetespib in the I-SPY 2 TRIAL has been initiated and is open to enrolling patients. Ganetespib will initially be available to patients with HER2-negative disease with the intent to expand its eligibility to all biomarker subtypes after safety testing with trastuzumab is completed.

Clinical trial of ganetespib and fulvestrant in patients with hormone receptor positive metastatic breast cancer

This randomized Phase 2 trial is evaluating safety and activity of the fulvestrant and ganetespib combination in patients with hormone receptor positive metastatic breast cancer who are experiencing progression after initial treatment with hormonal therapy. At present, patient recruitment is ongoing. The trial is sponsored by Dana Farber Cancer Institute in Boston.

Ganetespib in Acute Myeloid Leukemia (AML) and Myelodysplastic Syndrome (MDS)