Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STIFEL FINANCIAL CORP | d817351d8k.htm |

| EX-99.1 - EX-99.1 - STIFEL FINANCIAL CORP | d817351dex991.htm |

Exhibit 99.2

|

|

3rd Quarter 2014 Financial Results Presentation

Exhibit 99.2

November 6, 2014

|

|

Disclaimer

Forward Looking Statements

This presentation may contain “forward looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve significant risks, assumptions, and uncertainties, including statements relating to the market opportunity and future business prospects of Stifel Financial Corp., as well as Stifel, Nicolaus & Company, Incorporated and its subsidiaries (collectively, “SF” or the “Company”). These statements can be identified by the use of the words “may, “will,” “should,” “could,” “would,” “plan,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” and similar expressions. In particular, these statements may refer to our goals, intentions, and expectations, our business plans and growth strategies, our ability to integrate and manage our acquired businesses, estimates of our risks and future costs and benefits, and forecasted demographic and economic trends relating to our industry.

You should not place undue reliance on any forward looking statements, which speak only as of the date they were made. We will not update these forward looking statements, even though our situation may change in the future, unless we are obligated to do so under federal securities laws.

Actual results may differ materially and reported results should not be considered as an indication of future performance. Factors that could cause actual results to differ are included in the Company’s annual and quarterly reports and from time to time in other reports filed by the Company with the Securities and Exchange Commission and include, among other things, changes in general economic and business conditions, actions of competitors, regulatory and legal actions, changes in legislation, and technology changes.

Use of Non GAAP Financial Measures

The Company utilized non GAAP calculations of presented net revenues, compensation and benefits, non compensation operating expenses, income from continuing operations before income taxes, provision for income taxes, net income from continuing operations, net income, compensation and non compensation operating expense ratios, pre tax margin and diluted earnings per share as an additional measure to aid in understanding and analyzing the Company’s financial results for the three and nine months ended September 30, 2014. Specifically, the Company believes that the non GAAP measures provide useful information by excluding certain items that may not be indicative of the Company’ score operating results and business outlook. The Company believes that these non GAAP measures will allow for a better evaluation of the operating performance of the business and facilitate a meaningful comparison of the Company’s results in the current period to those in prior periods and future periods. Reference to these non GAAP measures should not be considered as a substitute for results that are presented in a manner consistent with GAAP. These non GAAP measures are provided to enhance investors’ overall understanding of the Company’s financial performance.

| 1 |

|

|

|

Chairman’s Comments

“In the third quarter, we had record results in Global Wealth Management and solid results in Investment Banking. Our equity and fixed income brokerage businesses were impacted in the quarter by lower volumes, particularly in the month of August. On the positive side, market volumes have strengthened in the month of October.

Our results reflect two months of our partnership with Oriel Securities, our U.K. investment bank. The initial integration is going well and we look forward to their future contributions. Looking ahead, we expect to close the acquisition of Legg Mason Investment Counsel in November, which will add $9 billion in client assets.”

2

|

|

Market Overview

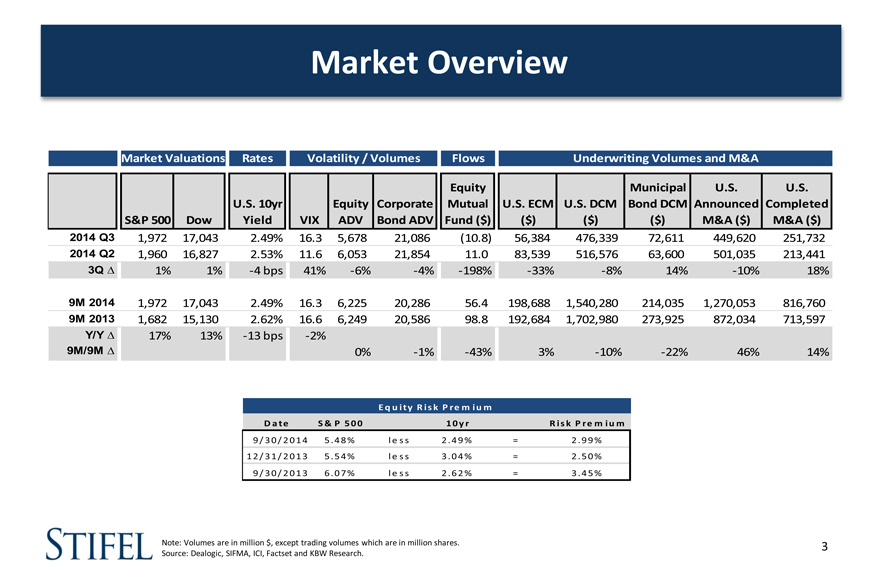

Market Valuations Rates Volatility / Volumes Flows Underwriting Volumes and M&A

Equity Municipal U.S. U.S.

U.S. 10yr Equity Corporate Mutual U.S. ECM U.S. DCM Bond DCM Announced Completed

S&P 500 Dow Yield VIX ADV Bond ADV Fund ($) ($) ($) ($) M&A ($) M&A ($)

2014 Q3 1,972 17,043 2.49% 16.3 5,678 21,086 (10.8) 56,384 476,339 72,611 449,620 251,732

2014 Q2 1,960 16,827 2.53% 11.6 6,053 21,854 11.0 83,539 516,576 63,600 501,035 213,441

3Q 1% 1% 4 bps 41% 6% 4% 198% 33% 8% 14% 10% 18%

9M 2014 1,972 17,043 2.49% 16.3 6,225 20,286 56.4 198,688 1,540,280 214,035 1,270,053 816,760

9M 2013 1,682 15,130 2.62% 16.6 6,249 20,586 98.8 192,684 1,702,980 273,925 872,034 713,597

Y/Y 17% 13% 13 bps 2%

9M/9M 0% 1% 43% 3% 10% 22% 46% 14%

Equity Risk Premium

Date S& P 500 10yr Risk Premium

9/30/2014 5.48% less 2.49% = 2.99%

12/31/2013 5.54% less 3.04% = 2.50%

9/30/2013 6.07% less 2.62% = 3.45%

Note: Volumes are in million $, except trading volumes which are in million shares. 3 Source: Dealogic, SIFMA, ICI, Factset and KBW Research.

|

|

Financial Results

|

|

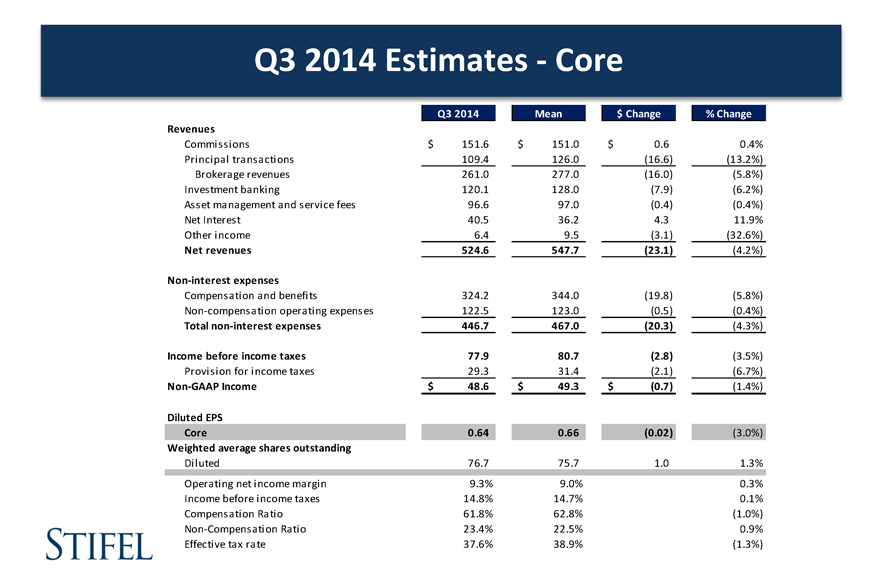

Q3 2014 Estimates - Core

Q3 2014 Mean $ Change % Change

Revenues

Commissions $ 151.6 $ 151.0 $ 0.6 0.4%

Principal transactions 109.4 126.0 (16.6) (13.2%)

Brokerage revenues 261.0 277.0 (16.0) (5.8%)

Investment banking 120.1 128.0 (7.9) (6.2%)

Asset management and service fees 96.6 97.0 (0.4) (0.4%)

Net Interest 40.5 36.2 4.3 11.9%

Other income 6.4 9.5 (3.1) (32.6%)

Net revenues 524.6 547.7 (23.1) (4.2%)

Non-interest expenses

Compensation and benefits 324.2 344.0 (19.8) (5.8%)

Non-compensation operating expenses 122.5 123.0 (0.5) (0.4%)

Total non-interest expenses 446.7 467.0 (20.3) (4.3%)

Income before income taxes 77.9 80.7 (2.8) (3.5%)

Provision for income taxes 29.3 31.4 (2.1) (6.7%)

Non-GAAP Income $ 48.6 $ 49.3 $ (0.7) (1.4%)

Diluted EPS

Core 0.64 0.66 (0.02) (3.0%)

Weighted average shares outstanding

Diluted 76.7 75.7 1.0 1.3%

Operating net income margin 9.3% 9.0% 0.3%

Income before income taxes 14.8% 14.7% 0.1%

Compensation Ratio 61.8% 62.8% (1.0%)

Non-Compensation Ratio 23.4% 22.5% 0.9%

Effective tax rate 37.6% 38.9% (1.3%)

|

|

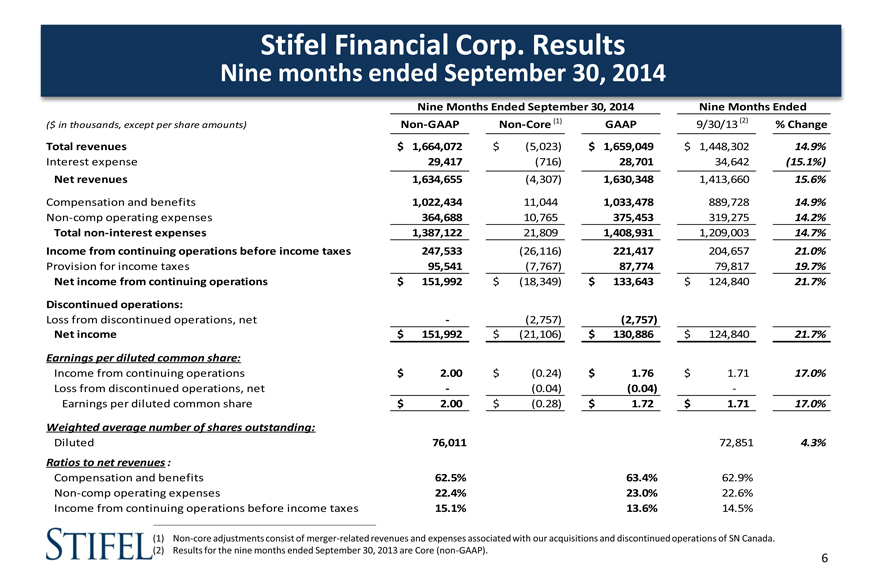

Stifel Financial Corp. Results

Nine months ended September 30, 2014

Nine Months Ended September 30, 2014 Nine Months Ended

($ in thousands, except per share amounts) Non-GAAP Non Core (1) GAAP 9/30/13 (2) % Change

Total revenues $ 1,664,072 $ (5,023) $ 1,659,049 $ 1,448,302 14.9%

Interest expense 29,417 (716) 28,701 34,642 (15.1%)

Net revenues 1,634,655 (4,307) 1,630,348 1,413,660 15.6%

Compensation and benefits 1,022,434 11,044 1,033,478 889,728 14.9%

Non comp operating expenses 364,688 10,765 375,453 319,275 14.2%

Total non-interest expenses 1,387,122 21,809 1,408,931 1,209,003 14.7%

Income from continuing operations before income taxes 247,533 (26,116) 221,417 204,657 21.0%

Provision for income taxes 95,541 (7,767) 87,774 79,817 19.7%

Net income from continuing operations $ 151,992 $ (18,349) $ 133,643 $ 124,840 21.7%

Discontinued operations:

Loss from discontinued operations, net - (2,757) (2,757)

Net income $ 151,992 $ (21,106) $ 130,886 $ 124,840 21.7%

Earnings per diluted common share:

Income from continuing operations $ 2.00 $ (0.24) $ 1.76 $ 1.71 17.0%

Loss from discontinued operations, net - (0.04) (0.04) -

Earnings per diluted common share $ 2.00 $ (0.28) $ 1.72 $ 1.71 17.0%

Weighted average number of shares outstanding:

Diluted 76,011 72,851 4.3%

Ratios to net revenues :

Compensation and benefits 62.5% 63.4% 62.9%

Non-comp operating expenses 22.4% 23.0% 22.6%

Income from continuing operations before income taxes 15.1% 13.6% 14.5%

(1) Non-core adjustments consist of merger-related revenues and expenses associated with our acquisitions and discontinued operations of SN Canada. (2) Results for the nine months ended September 30, 2013 are Core (non-GAAP).

6

|

|

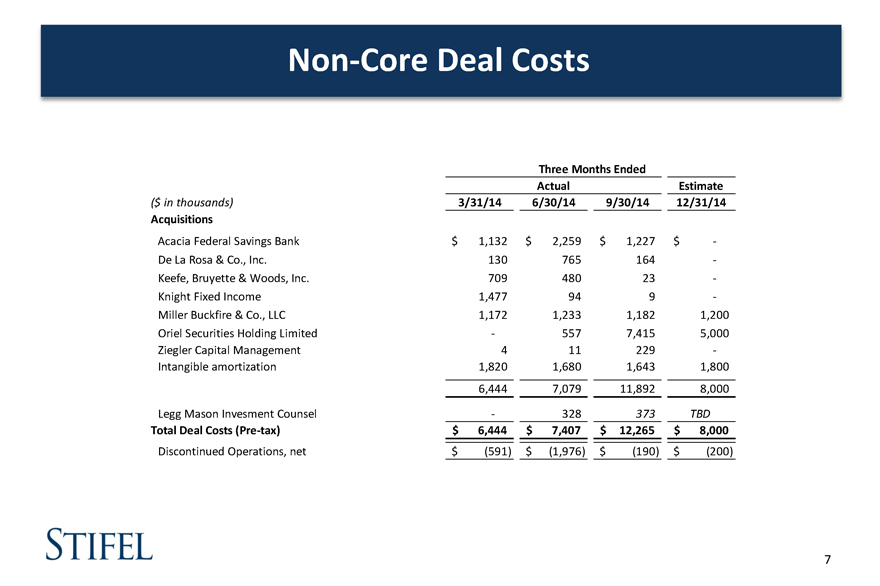

Non-Core Deal Costs

Three Months Ended

Actual Estimate

($ in thousands) 3/31/14 6/30/14 9/30/14 12/31/14

Acquisitions

Acacia Federal Savings Bank $ 1,132 $ 2,259 $ 1,227 $

De La Rosa & Co., Inc. 130 765 164

Keefe, Bruyette & Woods, Inc. 709 480 23

Knight Fixed Income 1,477 94 9

Miller Buckfire & Co., LLC 1,172 1,233 1,182 1,200

Oriel Securities Holding Limited 557 7,415 5,000

Ziegler Capital Management 4 11 229

Intangible amortization 1,820 1,680 1,643 1,800

6,444 7079 11,892 8,000

Legg Mason Investment Counsel - 328 373 TBD

Total Deal Costs (Pre-tax) $ 6,444 $ 7,407 $ 12,265 $ 8,000

Discontinued Operations, net $ (591) $ (1,976) $ (190) $ (200)

7

|

|

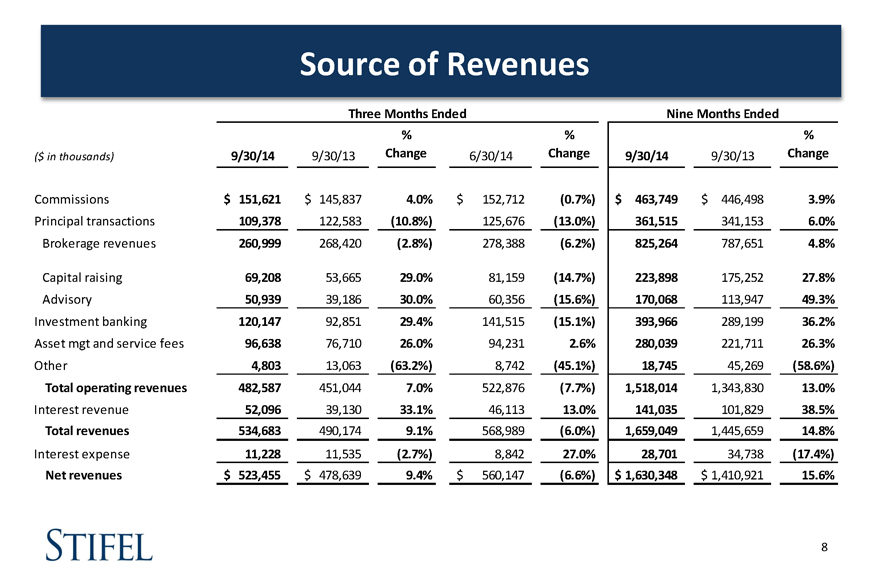

Source of Revenues

Three Months Ended Nine Months Ended

% % %

($ in thousands) 9/30/14 9/30/13 Change 6/30/14 Change 9/30/14 9/30/13 Change

Commissions $ 151,621 $ 145,837 4.0% $ 152,712 (0.7%) $ 463,749 $ 446,498 3.9%

Principal transactions 109,378 122,583 (10.8%) 125,676 (13.0%) 361,515 341,153 6.0%

Brokerage revenues 260,999 268,420 (2.8%) 278,388 (6.2%) 825,264 787,651 4.8%

Capital raising 69,208 53,665 29.0% 81,159 (14.7%) 223,898 175,252 27.8%

Advisory 50,939 39,186 30.0% 60,356 (15.6%) 170,068 113,947 49.3%

Investment banking 120,147 92,851 29.4% 141,515 (15.1%) 393,966 289,199 36.2%

Asset mgt and service fees 96,638 76,710 26.0% 94,231 2.6% 280,039 221,711 26.3%

Other 4,803 13,063 (63.2%) 8,742 (45.1%) 18,745 45,269 (58.6%)

Total operating revenues 482,587 451,044 7.0% 522,876 (7.7%) 1,518,014 1,343,830 13.0%

Interest revenue 52,096 39,130 33.1% 46,113 13.0% 141,035 101,829 38.5%

Total revenues 534,683 490,174 9.1% 568,989 (6.0%) 1,659,049 1,445,659 14.8%

Interest expense 11,228 11,535 (2.7%) 8,842 27.0% 28,701 34,738 (17.4%)

Net revenues $ 523,455 $ 478,639 9.4% $ 560,147 (6.6%) $ 1,630,348 $ 1,410,921 15.6%

8

|

|

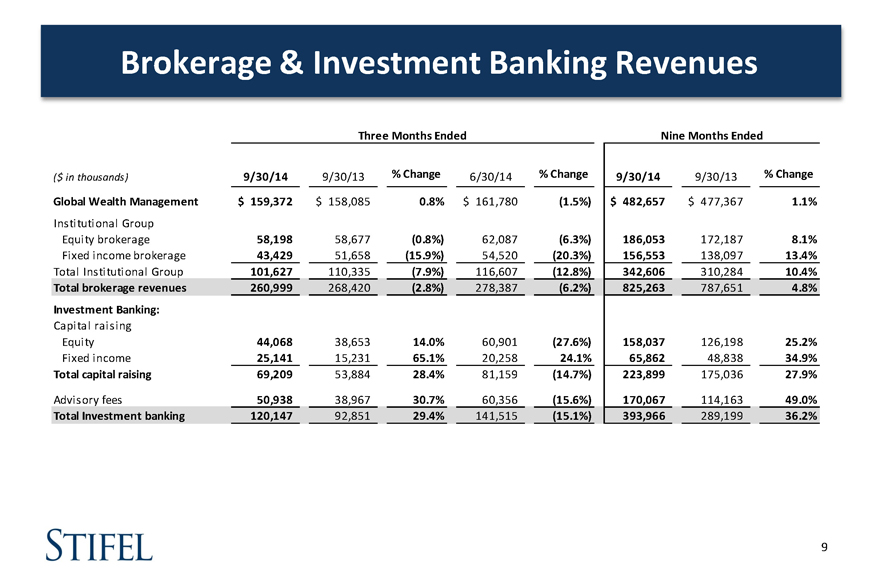

Brokerage & Investment Banking Revenues

Three Months Ended Nine Months Ended

($ in thousands) 9/30/14 9/30/13 % Change 6/30/14 % Change 9/30/14 9/30/13 % Change

Global Wealth Management $ 159,372 $ 158,085 0.8% $ 161,780 (1.5%) $ 482,657 $ 477,367 1.1%

Institutional Group

Equity brokerage 58,198 58,677 (0.8%) 62,087 (6.3%) 186,053 172,187 8.1%

Fixed income brokerage 43,429 51,658 (15.9%) 54,520 (20.3%) 156,553 138,097 13.4%

Total Institutional Group 101,627 110,335 (7.9%) 116,607 (12.8%) 342,606 310,284 10.4%

Total brokerage revenues 260,999 268,420 (2.8%) 278,387 (6.2%) 825,263 787,651 4.8%

Investment Banking:

Capital raising

Equity 44,068 38,653 14.0% 60,901 (27.6%) 158,037 126,198 25.2%

Fixed income 25,141 15,231 65.1% 20,258 24.1% 65,862 48,838 34.9%

Total capital raising 69,209 53,884 28.4% 81,159 (14.7%) 223,899 175,036 27.9%

Advisory fees 50,938 38,967 30.7% 60,356 (15.6%) 170,067 114,163 49.0%

Total Investment banking 120,147 92,851 29.4% 141,515 (15.1%) 393,966 289,199 36.2%

9

|

|

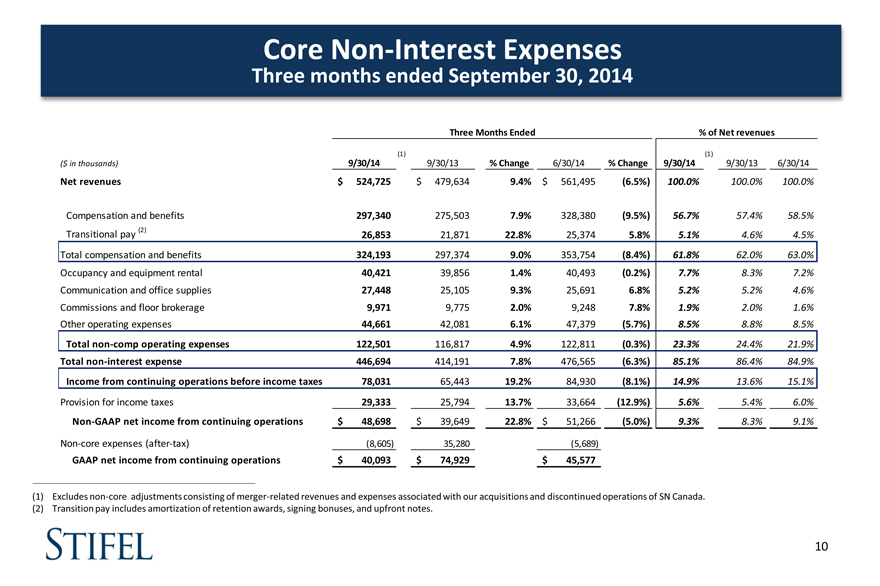

Core Non-Interest Expenses

Three months ended September 30, 2014

Three Months Ended % of Net revenues

(1) (1)

($ in thousands) 9/30/14 9/30/13 % Change 6/30/14 % Change 9/30/14 9/30/13 6/30/14

Net revenues $ 524,725 $ 479,634 9.4% $ 561,495 (6.5%) 100.0% 100.0% 100.0%

Compensation and benefits 297,340 275,503 7.9% 328,380 (9.5%) 56.7% 57.4% 58.5%

Transitional pay (2) 26,853 21,871 22.8% 25,374 5.8% 5.1% 4.6% 4.5%

Total compensation and benefits 324,193 297,374 9.0% 353,754 (8.4%) 61.8% 62.0% 63.0%

Occupancy and equipment rental 40,421 39,856 1.4% 40,493 (0.2%) 7.7% 8.3% 7.2%

Communication and office supplies 27,448 25,105 9.3% 25,691 6.8% 5.2% 5.2% 4.6%

Commissions and floor brokerage 9,971 9,775 2.0% 9,248 7.8% 1.9% 2.0% 1.6%

Other operating expenses 44,661 42,081 6.1% 47,379 (5.7%) 8.5% 8.8% 8.5%

Total non-comp operating expenses 122,501 116,817 4.9% 122,811 (0.3%) 23.3% 24.4% 21.9%

Total non-interest expense 446,694 414,191 7.8% 476,565 (6.3%) 85.1% 86.4% 84.9%

Income from continuing operations before income taxes 78,031 65,443 19.2% 84,930 (8.1%) 14.9% 13.6% 15.1%

Provision for income taxes 29,333 25,794 13.7% 33,664 (12.9%) 5.6% 5.4% 6.0%

Non-GAAP net income from continuing operations $ 48,698 $ 39,649 22.8% $ 51,266 (5.0%) 9.3% 8.3% 9.1%

Non-core expenses (after-tax) (8,605) 35,280 (5,689)

GAAP net income from continuing operations $ 40,093 $ 74,929 $ 45,577

(1) Excludes non-core adjustments consisting of merger-related revenues and expenses associated with our acquisitions and discontinued operations of SN Canada. (2) Transition pay includes amortization of retention awards, signing bonuses, and upfront notes.

10

|

|

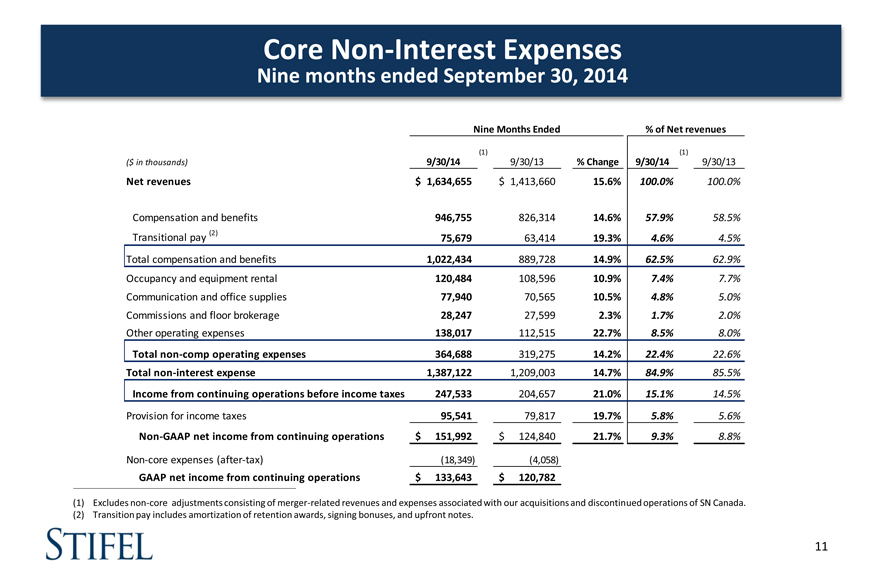

Core Non-Interest Expenses

Nine months ended September 30, 2014

Nine Months Ended % of Net revenues

| (1) |

|

(1) |

($ in thousands) 9/30/14 9/30/13 % Change 9/30/14 9/30/13

Net revenues $ 1,634,655 $ 1,413,660 15.6% 100.0% 100.0%

Compensation and benefits 946,755 826,314 14.6% 57.9% 58.5%

Transitional pay (2) 75,679 63,414 19.3% 4.6% 4.5%

Total compensation and benefits 1,022,434 889,728 14.9% 62.5% 62.9%

Occupancy and equipment rental 120,484 108,596 10.9% 7.4% 7.7%

Communication and office supplies 77,940 70,565 10.5% 4.8% 5.0%

Commissions and floor brokerage 28,247 27,599 2.3% 1.7% 2.0%

Other operating expenses 138,017 112,515 22.7% 85%. 80%.

Total non-comp operating expenses 364,688 319,275 14.2% 22.4% 22.6%

Total non-interest expense 1,387,122 1,209,003 14.7% 84.9% 85.5%

Income from continuing operations before income taxes 247,533 204,657 21.0% 15.1% 14.5%

Provision for income taxes 95,541 79,817 19.7% 5.8% 5.6%

Non-GAAP net income from continuing operations $ 151,992 $ 124,840 21.7% 9.3% 8.8%

Non-core expenses (after-tax) (18,349) (4,058)

GAAP net income from continuing operations $ 133,643 $ 120,782

(1) Excludes non-core adjustments consisting of merger-related revenues and expenses associated with our acquisitions and discontinued operations of SN Canada.

| (2) |

|

Transition pay includes amortization of retention awards, signing bonuses, and upfront notes. |

11

|

|

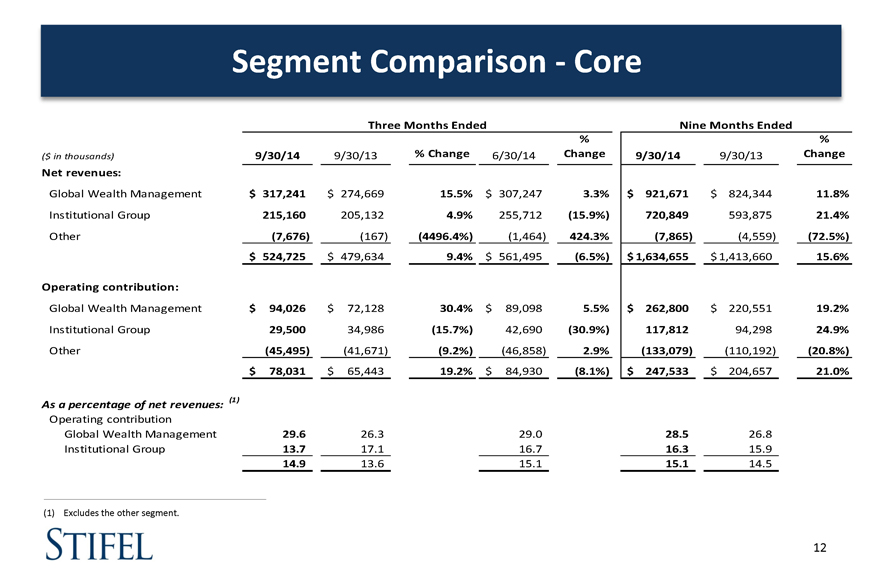

Segment Comparison Core

Three Months Ended Nine Months Ended

% % ($ in thousands) 9/30/14 9/30/13 % Change 6/30/14 Change 9/30/14 9/30/13 Change Net revenues:

Global Wealth Management $ 317,241 $ 274,669 15.5% $ 307,247 3.3% $ 921,671 $ 824,344 11.8%

Institutional Group 215,160 205,132 4.9% 255,712 (15.9%) 720,849 593,875 21.4%

Other (7,676) (167) (4496.4%) (1,464) 424.3% (7,865) (4,559) (72.5%)

$ 524,725 $ 479,634 9.4% $ 561,495 (6.5%) $1,634,655 $1,413,660 15.6%

Operating contribution:

Global Wealth Management $ 94,026 $ 72,128 30.4% $ 89,098 5.5% $ 262,800 $ 220,551 19.2%

Institutional Group 29,500 34,986 (15.7%) 42,690 (30.9%) 117,812 94,298 24.9%

Other (45,495) (41,671) (9.2%) (46,858) 2.9% (133,079) (110,192) (20.8%)

$ 78,031 $ 65,443 19.2% $ 84,930 (8.1%) $ 247,533 $ 204,657 21.0%

As a percentage of net revenues: (1)

Operating contribution

Global Wealth Management 29.6 26.3 29.0 28.5 26.8 Institutional Group 13.7 17.1 16.7 16.3 15.9 14.9 13.6 15.1 15.1 14.5

| (1) |

|

Excludes the other segment. |

12

|

|

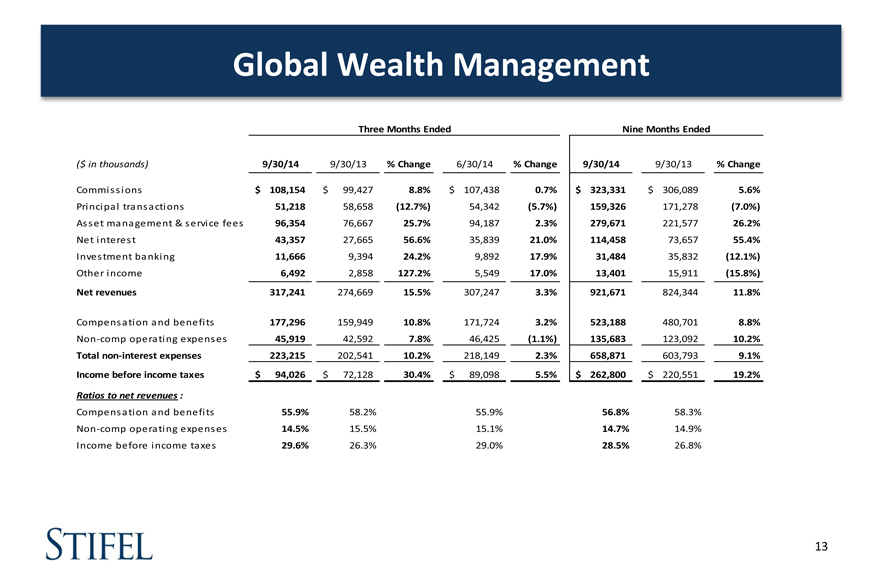

Global Wealth Management

Three Months Ended Nine Months Ended

($ in thousands) 9/30/14 9/30/13 % Change 6/30/14 % Change 9/30/14 9/30/13 % Change

Commissions $ 108,154 $ 99,427 8.8% $ 107,438 0.7% $ 323,331 $ 306,089 5.6% Principal transactions 51,218 58,658 (12.7%) 54,342 (5.7%) 159,326 171,278 (7.0%) Asset management & service fees 96,354 76,667 25.7% 94,187 2.3% 279,671 221,577 26.2% Net interest 43,357 27,665 56.6% 35,839 21.0% 114,458 73,657 55.4% Investment banking 11,666 9,394 24.2% 9,892 17.9% 31,484 35,832 (12.1%)

Other income 6,492 2,858 127.2% 5,549 17.0% 13,401 15,911 (15.8%)

Net revenues 317,241 274,669 15.5% 307,247 3.3% 921,671 824,344 11.8%

Compensation and benefits 177,296 159,949 10.8% 171,724 3.2% 523,188 480,701 8.8% Non-comp operating expenses 45,919 42,592 7.8% 46,425 (1.1%) 135,683 123,092 10.2% Total non-interest expenses 223,215 202,541 10.2% 218,149 2.3% 658,871 603,793 9.1%

Income before income taxes $ 94,026 $ 72,128 30.4% $ 89,098 5.5% $ 262,800 $ 220,551 19.2%

Ratios to net revenues :

Compensation and benefits 55.9% 58.2% 55.9% 56.8% 58.3% Non-comp operating expenses 14.5% 15.5% 15.1% 14.7% 14.9% Income before income taxes 29.6% 26.3% 29.0% 28.5% 26.8%

13

|

|

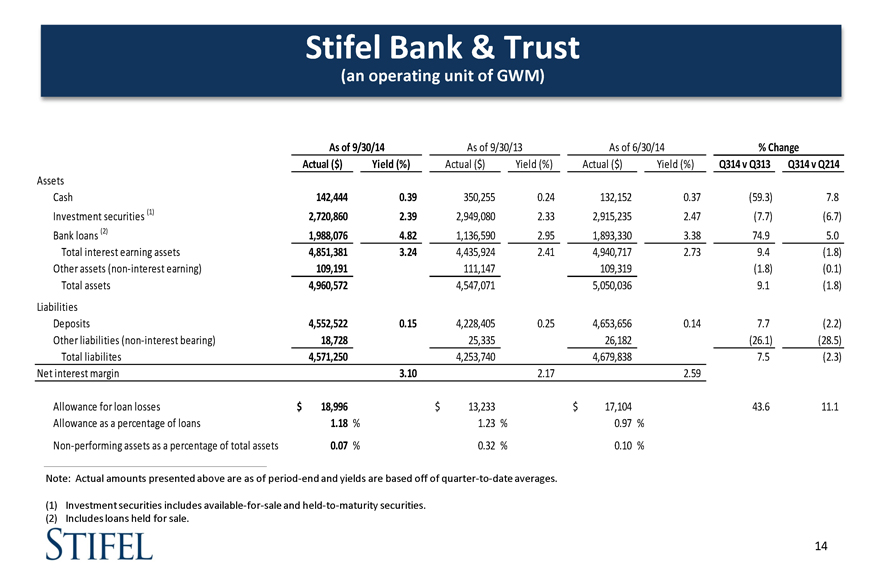

Stifel Bank & Trust

(an operating unit of GWM)

As of 9/30/14 As of 9/30/13 As of 6/30/14 % Change

Actual ($) Yield (%) Actual ($) Yield (%) Actual ($) Yield (%) Q314 v Q313 Q314 v Q214

Assets

Cash 142,444 0.39 350,255 0.24 132,152 0.37 (59.3) 7.8

| (1) |

|

Investment securities 2,720,860 2.39 2,949,080 2.33 2,915,235 2.47 (7.7) (6.7)

| (2) |

|

Bank loans 1,988,076 4.82 1,136,590 2.95 1,893,330 3.38 74.9 5.0 Total interest earning assets 4,851,381 3.24 4,435,924 2.41 4,940,717 2.73 9.4 (1.8) Other assets (non-interest earning) 109,191 111,147 109,319 (1.8) (0.1) Total assets 4,960,572 4,547,071 5,050,036 9.1 (1.8)

Liabilities

Deposits 4,552,522 0.15 4,228,405 0.25 4,653,656 0.14 7.7 (2.2) Other liabilities (non-interest bearing) 18,728 25,335 26,182 (26.1) (28.5) Total liabilites 4,571,250 4,253,740 4,679,838 7.5 (2.3) Net interest margin 3.10 2.17 2.59

Allowance for loan losses $ 18,996 $ 13,233 $ 17,104 43.6 11.1 Allowance as a percentage of loans 1.18 % 1.23 % 0.97 %

Non-performing assets as a percentage of total assets 0.07 % 0.32 % 0.10 %

Note: Actual amounts presented above are as of period-end and yields are based off of quarter-to-date averages.

(1) Investment securities includes available-for-sale and held-to-maturity securities. (2) Includes loans held for sale.

14

|

|

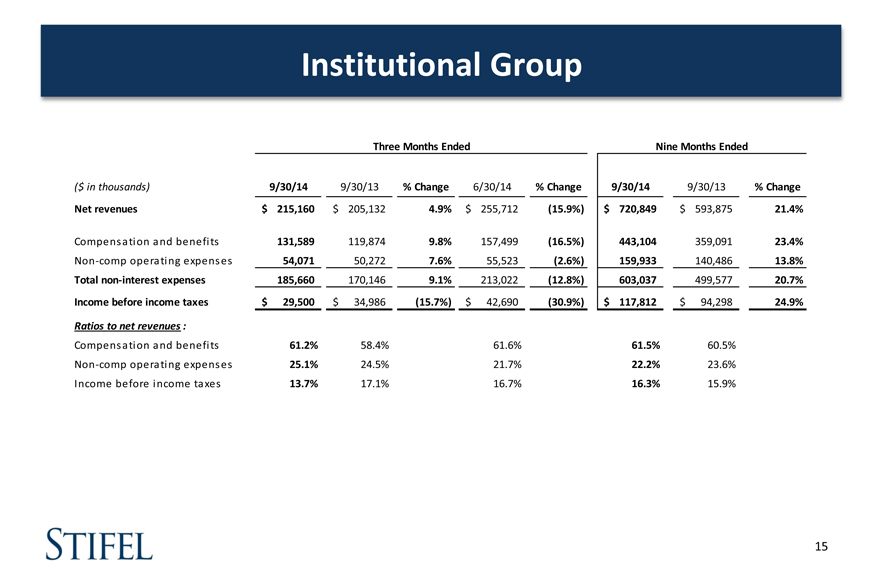

Institutional Group

Three Months Ended Nine Months Ended

($ in thousands) 9/30/14 9/30/13 % Change 6/30/14 % Change 9/30/14 9/30/13 % Change

Net revenues $ 215,160 $ 205,132 4.9% $ 255,712 (15.9%) $ 720,849 $ 593,875 21.4%

Compensation and benefits 131,589 119,874 9.8% 157,499 (16.5%) 443,104 359,091 23.4% Non-comp operating expenses 54,071 50,272 7.6% 55,523 (2.6%) 159,933 140,486 13.8% Total non-interest expenses 185,660 170,146 9.1% 213,022 (12.8%) 603,037 499,577 20.7%

Income before income taxes $ 29,500 $ 34,986 (15.7%) $ 42,690 (30.9%) $ 117,812 $ 94,298 24.9%

Ratios to net revenues :

Compensation and benefits 61.2% 58.4% 61.6% 61.5% 60.5% Non-comp operating expenses 25.1% 24.5% 21.7% 22.2% 23.6% Income before income taxes 13.7% 17.1% 16.7% 16.3% 15.9%

15

|

|

Financial Condition

|

|

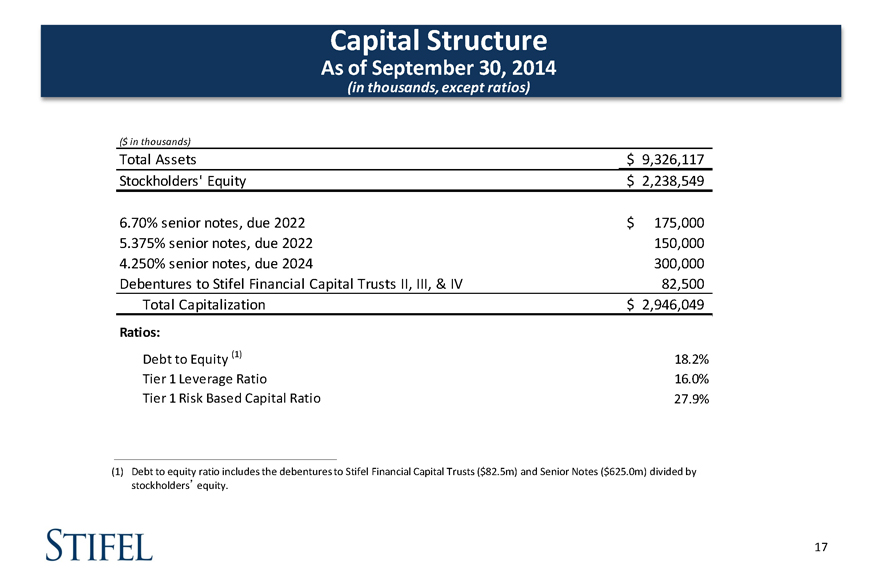

Capital Structure

As of September 30, 2014

(in thousands, except ratios)

($ in thousands)

Total Assets $ 9,326,117 Stockholders’ Equity $ 2,238,549

6.70% senior notes, due 2022 $ 175,000 5.375% senior notes, due 2022 150,000 4.250% senior notes, due 2024 300,000 Debentures to Stifel Financial Capital Trusts II, III, & IV 82,500 Total Capitalization $ 2,946,049

Ratios:

| (1) |

|

Debt to Equity 18.2% Tier 1 Leverage Ratio 16.0% Tier 1 Risk Based Capital Ratio 27.9%

(1) Debt to equity ratio includes the debentures to Stifel Financial Capital Trusts ($82.5m) and Senior Notes ($625.0m) divided by stockholders’equity.

17

|

|

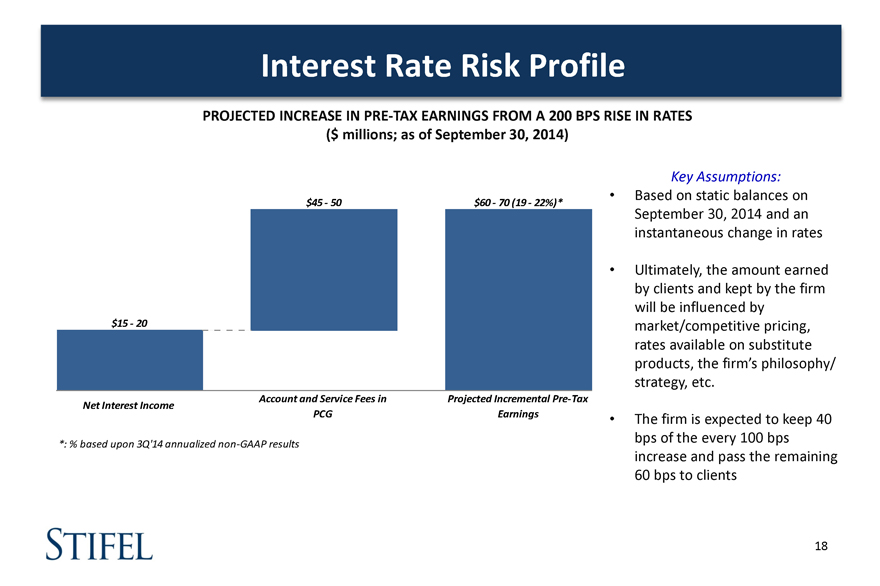

Interest Rate Risk Profile

PROJECTED INCREASE IN PRE-TAX EARNINGS FROM A 200 BPS RISE IN RATES ($ millions; as of September 30, 2014)

$45 - 50 $60 - 70 (19 - 22%)*

$15 - 20

Account and Service Fees in Projected Incremental Pre-Tax

Net Interest Income

PCG Earnings

*: % based upon 3Q’14 annualized non-GAAP results

Key Assumptions:

Based on static balances on September 30, 2014 and an instantaneous change in rates

Ultimately, the amount earned by clients and kept by the firm will be influenced by market/competitive pricing, rates available on substitute products, the firm’s philosophy/ strategy, etc.

The firm is expected to keep 40 bps of the every 100 bps increase and pass the remaining 60 bps to clients

18

|

|

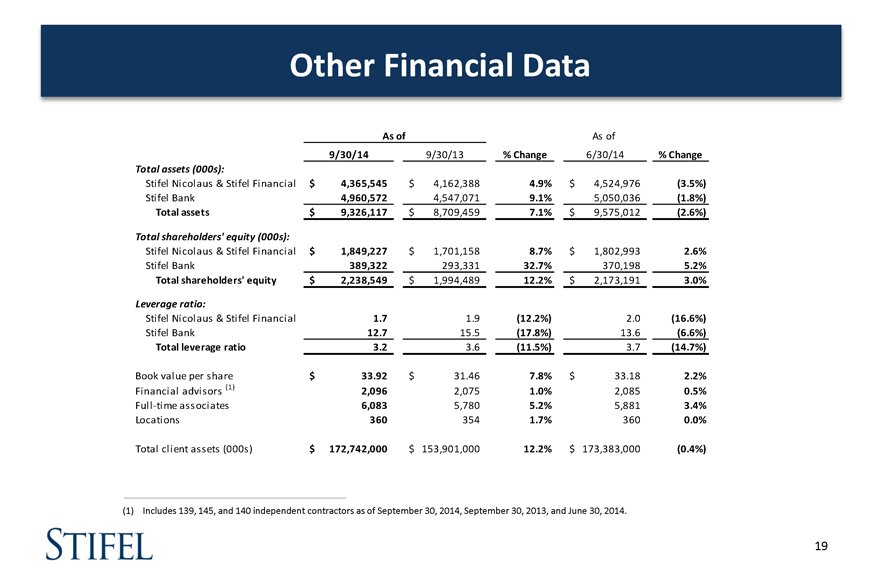

Other Financial Data

As of As of

9/30/14 9/30/13 % Change 6/30/14 % Change

Total assets (000s):

Stifel Nicolaus & Stifel Financial $ 4,365,545 $ 4,162,388 4.9% $ 4,524,976 (3.5%) Stifel Bank 4,960,572 4,547,071 9.1% 5,050,036 (1.8%) Total assets $ 9,326,117 $ 8,709,459 7.1% $ 9,575,012 (2.6%)

Total shareholders’ equity (000s):

Stifel Nicolaus & Stifel Financial $ 1,849,227 $ 1,701,158 8.7% $ 1,802,993 2.6%

Stifel Bank 389,322 293,331 32.7% 370,198 5.2% Total shareholders’ equity $ 2,238,549 $ 1,994,489 12.2% $ 2,173,191 3.0%

Leverage ratio:

Stifel Nicolaus & Stifel Financial 1.7 1.9 (12.2%) 2.0 (16.6%) Stifel Bank 12.7 15.5 (17.8%) 13.6 (6.6%) Total leverage ratio 3.2 3.6 (11.5%) 3.7 (14.7%)

Book value per share $ 33.92 $ 31.46 7.8% $ 33.18 2.2%

| (1) |

|

Financial advisors 2,096 2,075 1.0% 2,085 0.5% Full-time associates 6,083 5,780 5.2% 5,881 3.4% Locations 360 354 1.7% 360 0.0%

Total client assets (000s) $ 172,742,000 $ 153,901,000 12.2% $ 173,383,000 (0.4%)

(1) Includes 139, 145, and 140 independent contractors as of September 30, 2014, September 30, 2013, and June 30, 2014.

19

|

|

Acquisition Updates

Closed July 31, 2014

Full-service broker-dealer based in London- Research, sales, trading and investment banking

23 analysts covering more than 260 UK companies in 9 industries - Integration and conversion efforts scheduled for Q1 2015- Added approximately $4 million in incremental non-compensation expenses in the third quarter

Expected to close in November

Expected to add approximately $9 billion in client assets

Investment Counsel

20

|

|

Q & A