Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MICT, Inc. | zk1415748.htm |

| EX-99.1 - EXHIBIT 99.1 - MICT, Inc. | exhibit_99-1.htm |

Exhibit 99.2

3Q 14 Financial Results

Conference Call

Forward Looking Statement

This presentation contains express or implied forward-looking statements within the Private Securities Litigation

Reform Act of 1995 and other U.S. Federal securities laws. These forward-looking statements include, but are not

limited to, those statements regarding our continued growth, our strategy to become the major supplier of

rugged tablets to the multibillion MRM growing market, the growth of our aerospace and defense business, our

revenues expectation for 2015, and our expectations regarding future higher margins and profits. Such forward-

looking statements and their implications involve known and unknown risks, uncertainties and other factors that

may cause actual results or performance to differ materially from those projected. The forward-looking

statements contained in this presentation are subject to other risks and uncertainties, including those discussed

in the "Risk Factors" section and elsewhere in the company's annual report on Form 10-K for the year ended

December 31, 2013 and in subsequent filings with the Securities and Exchange Commission. Except as otherwise

required by law, the company is under no obligation to (and expressly disclaims any such obligation to) update or

alter its forward-looking statements whether as a result of new information, future events or otherwise.

Reform Act of 1995 and other U.S. Federal securities laws. These forward-looking statements include, but are not

limited to, those statements regarding our continued growth, our strategy to become the major supplier of

rugged tablets to the multibillion MRM growing market, the growth of our aerospace and defense business, our

revenues expectation for 2015, and our expectations regarding future higher margins and profits. Such forward-

looking statements and their implications involve known and unknown risks, uncertainties and other factors that

may cause actual results or performance to differ materially from those projected. The forward-looking

statements contained in this presentation are subject to other risks and uncertainties, including those discussed

in the "Risk Factors" section and elsewhere in the company's annual report on Form 10-K for the year ended

December 31, 2013 and in subsequent filings with the Securities and Exchange Commission. Except as otherwise

required by law, the company is under no obligation to (and expressly disclaims any such obligation to) update or

alter its forward-looking statements whether as a result of new information, future events or otherwise.

2

Presenters

3

Tali Dinar - Chief Financial Officer

David Lucatz - Chairman of the Board

and CEO

and CEO

Shai Lustgarten - CEO of Micronet Ltd.

4

Quarter Overview

■ Strong revenue growth for quarter

■ 43% increase over previous year

■ 73% sequential growth

■ Local fleet vertical becoming larger portion of sales

■ Significantly diversifying our customer base

■ EBITDA positive with clear path to enhanced

profitability

profitability

Recent Transformative Acquisition

Progressing Well

Progressing Well

5

■ In June, we consummated our acquisition of the U.S. Vehicle

operation

operation

■ Complementary product line with strong presence in local fleet

vertical

vertical

■ U.S.-based MRM Division of Micronet Inc.

■ Enables MICT to establish strong U.S. sales and

operational base

■ Headquartered in Salt Lake City, UT

■ Immediately accretive; 2013 revenues of $11M

■ Significantly expands customer base

Q3 Was First Full Quarter Including The U.S. Vehicle Operation

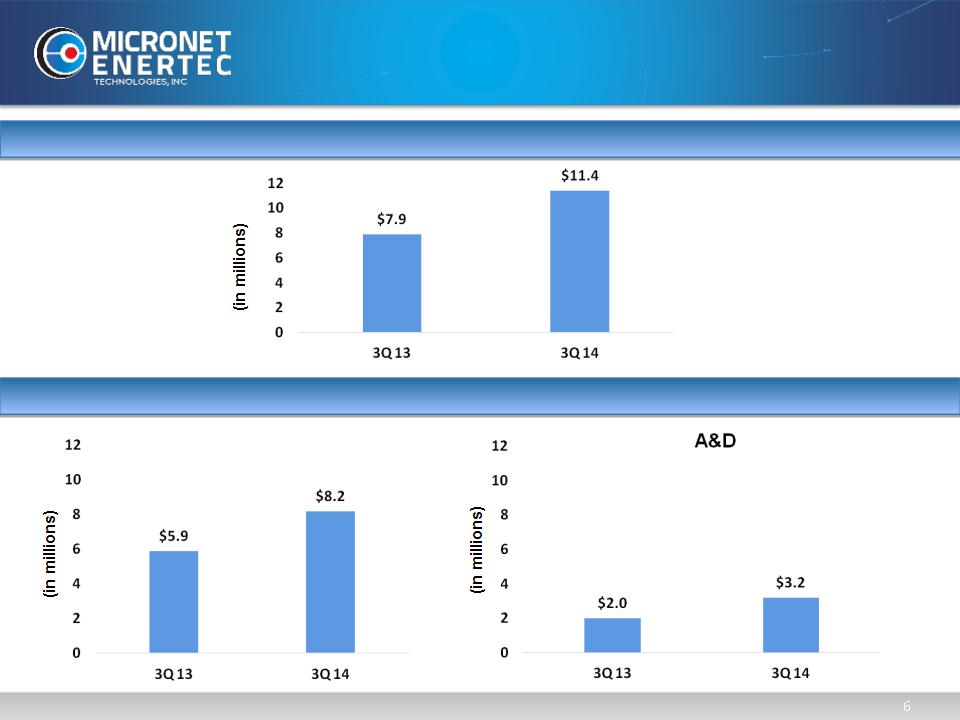

3Q 13 vs 3Q 14 Revenues

MRM

Driven by high growth in both divisions

Consolidated revenue grew 43.5% for the quarter

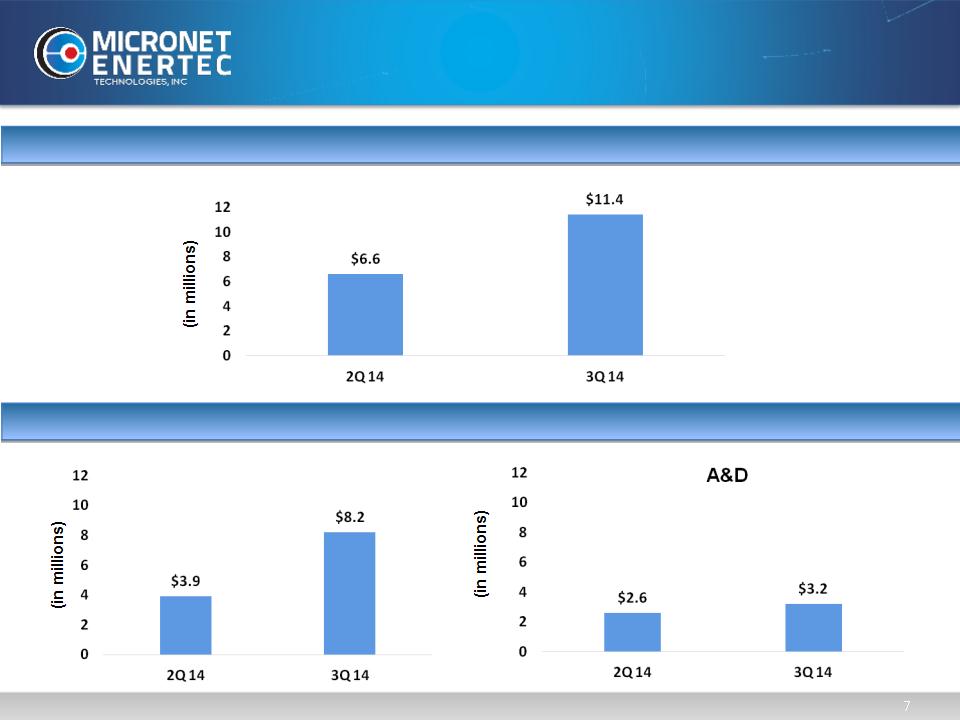

2Q 14 vs 3Q 14 Revenues

MRM

Also driven by high growth in both divisions

Consolidated revenue grew 73% from 2Q 14 to 3Q 14

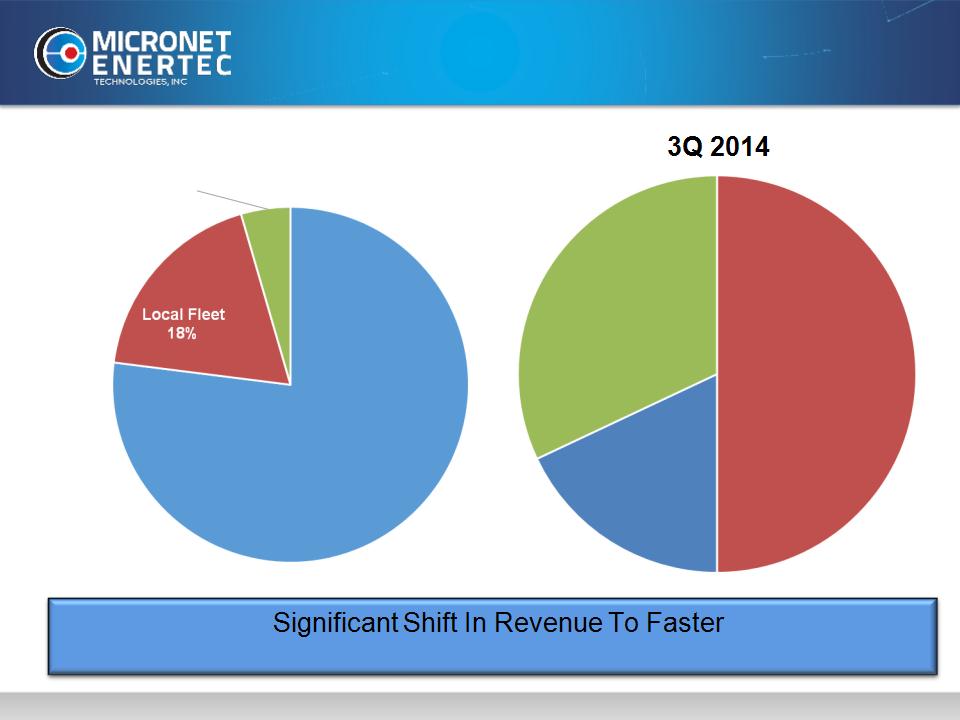

MRM Sales Mix by Vertical

8

Growing Local Fleet Revenues

FY 2013

Long Haul

77%

77%

Construction &

Heavy Equipment

Heavy Equipment

32%

Local

Fleet 50%

Fleet 50%

Long Haul

18%

18%

Construction &

Heavy Equipment

Heavy Equipment

5%

Broadening Customer Diversity

9

3Q 2014

FY 2013

One Customer Accounted for

83% of Sales

83% of Sales

Ten Customers Account for 83%

of Sales

of Sales

% of MRM Division

Customer A

83 %

83 %

Customer C

2 %

Customer B

3 %

Others

12%

10

Income Statement

|

|

Quarter Ended

September 30,

|

|

|

|

2014

|

2013

|

|

|

|

|

|

Revenues

|

$ 11,415

|

$ 7,956

|

|

Cost of revenues

|

8,546

|

4,366

|

|

Gross profit

|

2,869 |

3,590

|

|

Gross profit margin

|

25%

|

45%

|

|

Operating expenses:

|

|

|

|

Research and development

|

546

|

755

|

|

% of sales

|

4.7%

|

9.5%

|

|

Selling and marketing

|

449

|

276

|

|

% of sales

|

3.9%

|

3.5%

|

|

General and administrative

|

1,738

|

1,223

|

|

% of sales

|

15%

|

15.4%

|

|

Amortization of intangible assets

|

306

|

93

|

|

Total operating expenses

|

3,039

|

2,347

|

|

% of sales

|

27%

|

29%

|

|

|

|

|

|

Basic and diluted

|

(0.09)

|

0.01

|

|

Weighted average common shares outstanding:

|

5,831,246

|

5,831,246

|

Non-GAAP

11

|

Three Months Ended

September 30,

|

||||

|

2014

|

2013

|

|||

|

|

|

|

||

|

Net income

|

|

(506)

|

|

78

|

|

Amortization related to U.S. acquisition

|

|

213

|

|

-

|

|

Amortization related to Micronet acquisition

|

|

93

|

|

93

|

|

Total amortization of acquired intangible assets

|

|

306

|

|

93

|

|

Change in fair value of warrants

|

|

-

|

|

55

|

|

Amortization of UTA's note discount and related expenses

|

|

6

|

|

154

|

|

Stock-based compensation

|

|

6

|

|

7

|

|

Expenses relates to purchase of a business

|

|

79

|

|

-

|

|

Income tax-effect of above non-GAAP adjustments

|

|

(14)

|

|

(14)

|

|

Total non-GAAP net income

|

|

(123)

|

|

373

|

|

Non-GAAP net income per diluted share

|

|

(0.02)

|

|

0.06

|

|

Shares used in per share calculations

|

|

5,831,246

|

|

5,831,246

|

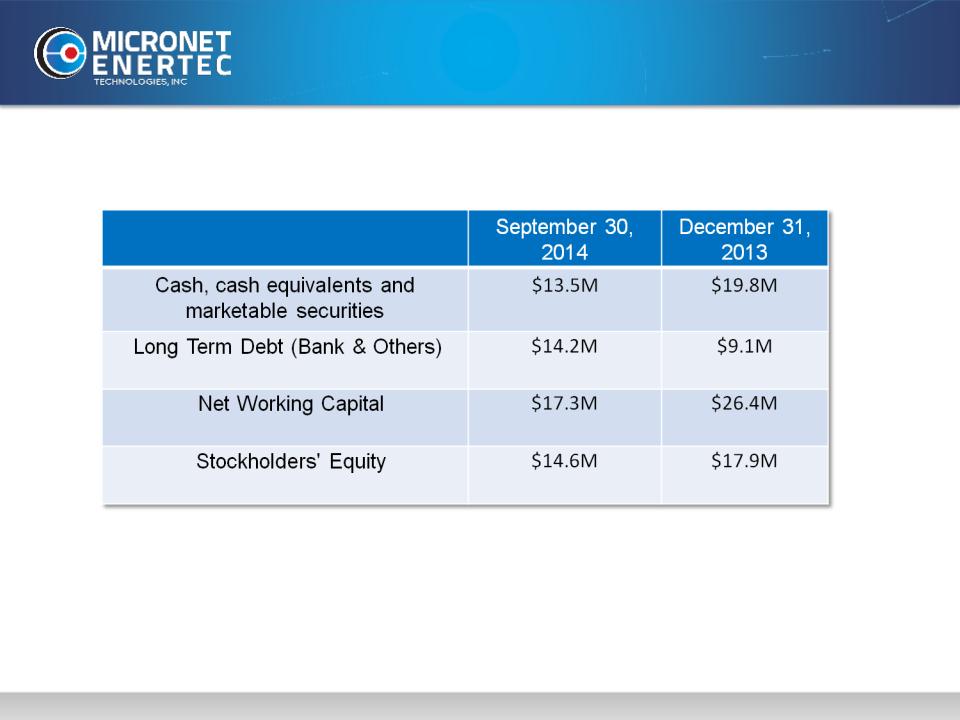

Strong Balance Sheet

12

MRM New Partnerships

13

Recent Contracts

XRS Corporation has certified Micronet

Enertec’s M-307 rugged computer tablet to

run the XRS solution.

Enertec’s M-307 rugged computer tablet to

run the XRS solution.

Partnership will enable Micronet to leverage

Verizon’s extensive ecosystem of MRM

partners, VARS, and systems integrators,

providing them with ready access to

Micronet’s full line of Android -based MDTs

and tablets.

Verizon’s extensive ecosystem of MRM

partners, VARS, and systems integrators,

providing them with ready access to

Micronet’s full line of Android -based MDTs

and tablets.

14

ELD Mandate Opportunity

§ Drivers are required to keep records of hours of service (HOS)

§ Cannot drive over 11 hours per day

§ Required rest periods

§ Electronic Logging Devices (ELDs) connect to engine and replace paper

logbooks

logbooks

§ Law being put in place requiring ELDs

Today 500,000 ELD equipped trucks

Jan ’15 ~2.6 Million trucks will require ELD

Passed by

congress

congress

Comment period

closed

closed

Law

enacted

enacted

Law

enforced

enforced

July ‘12

June ‘14

Jan. ‘15

Jan. ‘17

Background

Timeline

Market Opportunity

Looking Forward

MRM

§Local fleet market expected to grow 37% between 2014 and

20161

20161

Aerospace/Defense

§Increased missile strike threat support interest for our missile

systems

systems

§Strong performance continuing - 4Q expected to be of similar

magnitude as 3Q

magnitude as 3Q

§Profitability enhancement trend through growth and improved

product mix

product mix

1 Licht and Associates study (November 20, 2013)

*

Macro Trends

Near to Medium Term

16

Thank You

Q & A