Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K RE BUSINESS UPDATE NOVEMBER 2014 - EDISON INTERNATIONAL | eix-sceform8xkrebusinessup.htm |

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 1 Business Update November 2014

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 2 Statements contained in this presentation about future performance, including, without limitation, operating results, asset and rate base growth, capital expenditures, San Onofre Nuclear Generating Station (SONGS), and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results are discussed under the headings “Risk Factors” and “Management’s Discussion and Analysis” in Edison International’s Form 10-K, most recent form 10-Q, and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation. Forward-Looking Statements

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 3 Table of Contents Page New (N) or Updated (U) Highlights & Regulatory Model 4-5 Historical Capital Expenditures, Rate Base, Core Earnings 6-7 Forecast Capital Expenditures, Rate Base 8-9 U System Investments, Growth Drivers Beyond 2017 10-11 California Climate Change Policy, New Technology Grid Impacts, Distribution Grid of the Future, Energy Storage, Electric Vehicles 12-16 16-N CPUC General Rate Case, Intervener Testimony 17-18 17-U CPUC and FERC Cost of Capital 19 Key Regulatory Events Calendar 20 U EIX 2014 Core and Basic Earnings Guidance 21 EIX Dividend Growth 22 EIX Responding to Industry Change, Creating Shareholder Value 23-24 Appendix Customer Demand Trends, Bundled Revenue Requirement, Rate and Bills Comparison 26-28 Residential Rate Design OIR, Net Metering Rate Structure, Energy Efficiency Programs 29-31 31-U Third Quarter and Year-to-Date Earnings Summary 32-33 U Non-GAAP Reconciliations, Results of Operations 34-36 San Onofre Nuclear Generation Station (SONGS) 37-39

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 4 • One of the nation’s largest electric utilities Nearly 14 million residents in service territory Approximately 5 million customer accounts 50,000 square-mile service area • Significant infrastructure investments: 1.4 million power poles 700,000 transformers 103,000 miles of distribution and transmission lines 3,200 MW owned generation • Above average annual rate base growth driven by: Infrastructure reliability investment California public policy Grid technology improvements SCE Highlights

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 5 SCE Decoupled Regulatory Model Decoupling of Regulated Revenues from Sales Major Balancing Accounts • Fuel • Purchased power • Energy efficiency • Pension-related contributions Advanced Long-Term Procurement Planning Forward-looking Ratemaking • SCE earnings are not affected by changes in retail electricity sales • Differences between amounts collected and authorized levels are either billed or refunded to customers • Promotes energy conservation • Stabilizes revenues during economic cycles • Trigger mechanism for fuel and purchased power adjustments at 5% variance level • Utility cost-recovery via balancing accounts represented over 50% of 2013 costs • Sets prudent upfront standards allowing greater certainty of cost recovery (subject to reasonableness review) • Three-year rate case and cost of capital cycles Regulatory Model Key Benefits

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 6 $2.4 $2.9 $3.8 $3.9 $3.9 $3.5 2008 2009 2010 2011 2012 2013 SCE Historical Capital Expenditures ($ billions) Note: 2013 distribution reliability spend up $300 million, offset by completion of SmartConnect in 2012 ($300 million); lower FERC ($300 million) and lower SONGS ($100 million)

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 7 $13.1 $15.0 $16.8 $18.8 $21.0 $21.12 2008 2009 2010 2011 2012 2013 Rate Base2 Core Earnings 10% 12% 2008 – 2013 CAGR Core Earnings $2.25 $2.68 $3.01 $3.33 $4.10 SCE Historical Rate Base and Core Earnings ($ billions) $3.88 1 Recorded rate base, year-end basis. See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix. 2 2013 rate base excludes San Onofre Generating Station (SONGS)

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 8 SCE Capital Expenditures Forecast ($ billions) 2014-17 Total Requested $4.1 $4.2 $4.6 $4.5 $17.4 Range $3.6 $3.7 $4.1 $4.0 $15.4 • Capital expenditures cumulative forecast increased $200 million primarily from new CPUC mobile home park meter conversion pilot program • Transmission includes Tehachapi scope changes for FAA requirements and $360 million estimate for Chino Hills undergrounding $15.4 – $17.4 billion forecasted capital program 2014 – 2017 $4.1 $4.2 $4.6 $4.5 2014 2015 2016 2017 Distribution Transmission Generation Note: Forecasted capital spending subject to timely receipt of permitting, licensing, and regulatory approvals. Forecast range reflects an average variability of 12%.

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 9 ($ billions) SCE Rate Base Forecast • Reflects 2015 GRC rebuttal testimony update for 2013 lower recorded Capex, offset by higher FERC transmission spend and CPUC mobile home park meter conversion pilot program • Growth driven by infrastructure replacement, reliability investments, and public policy requirements • FERC rate base includes CWIP and is approximately 22% of 2014 rate base forecast, increasing to 26% in 2017 • Excludes SONGS rate base 7 – 9% CAGR projected rate base 2014 – 2017 Requested Range $21.9 $23.0 $25.1 $27.2 $22.4 $24.0 $26.7 $29.3 2014 2015 2016 2017 Note: Weighted-average year basis, including forecasted 2014 FERC, 2015-2017 CPUC rate base requests, and consolidation of CWIP projects. Rate Base forecast range reflects capital expenditure forecast range.

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 10 Distribution ($ millions) SCE System Investments Transmission • Large transmission projects: Tehachapi – $3.2 billion total project cost; 2016-17 in service date Coolwater-Lugo – $0.7 billion total project cost; 2018 in service date West of Devers – $1.0 billion total project cost; 2019-20 in service date • Aging system reaching equilibrium replacement rate • 2015 GRC request includes ~120% increase in infrastructure replacement 2015 – 2017 Requested GRC Expenditures for Distribution Assets $9.2 Billion Load Growth New Service Connections Infrastructure Replacement General Plant1 Other Note: Total Project Costs are nominal direct expenditures, subject to CPUC and FERC cost recovery approval

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 11 SCE Growth Drivers Beyond 2017 Infrastructure Reliability Investment • Sustained level of infrastructure investment required until equilibrium replacement rates are achieved - includes underground cable, poles, switches, and transformers1 Grid Readiness • Accelerate automation and control technology at optimal locations to manage two-way power flows with more dynamic voltage control • Distribution Resource Plan required under AB 327 to identify optimal locations, additional spending, and barriers to deploying distributed energy resources – due to CPUC Q3 2015 Transmission • California ISO 2013-2014 Transmission Plan2 - approved Mesa Loop-in Project (system reliability post-SONGS and renewables integration) with target in-service date of December 31, 2020 • Two existing projects incorporated from prior Transmission Plans in service beyond 2017 include Coolwater-Lugo (2018) and West of Devers (2019-2020) Energy Storage • 290 MW utility owned investment opportunity 2015-2024 Other California Public Policy Requirements and Enabling Projects • Electric vehicle charging infrastructure • Transportation electrification • Renewables mandates beyond 33% 1 Source: A.13-11-0032015 GRC – SCE-01 Policy testimony; equilibrium replacement rate defined as equipment population divided by mean time to failure for type of equipment 2 Approved by the California ISO Board of Governors March 20, 2014

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 12 California Climate Change Policy • Assembly Bill 32 (2006) – reduces State greenhouse gas (GHG) emissions to 1990 levels by 2020 (~16% reduction) • Cap and trade program basics: State-wide cap in 2013 – decreases over time Compliance met through allowances, offsets, or emissions reductions Excess allowances sold, or “banked” for future use January 2014 – merger with Quebec cap and trade program • SCE received 32.3 million 2013 allowances vs. 10.4 million metric tons 2012 GHG emissions • Allowances sold into quarterly auction and bought back for compliance SB 1018 (2012) – auction revenues used for rate relief for residential (~93%), small business, and large industrial customers AB32 Emissions Reduction Programs Cap & Trade 22% Other 23% Low Carbon Fuel Standard 19% RPS 14% Energy Efficiency 15% High GWP Gases 7%

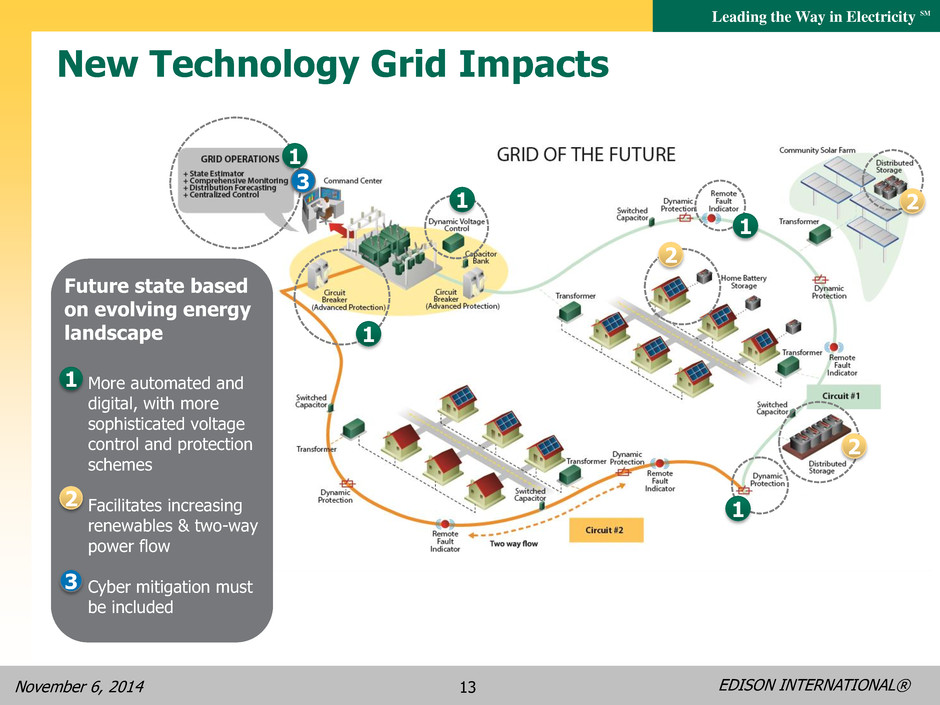

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 13 2 1 3 1 1 1 2 2 New Technology Grid Impacts Future state based on evolving energy landscape More automated and digital, with more sophisticated voltage control and protection schemes Facilitates increasing renewables & two-way power flow Cyber mitigation must be included 1 2 3 1

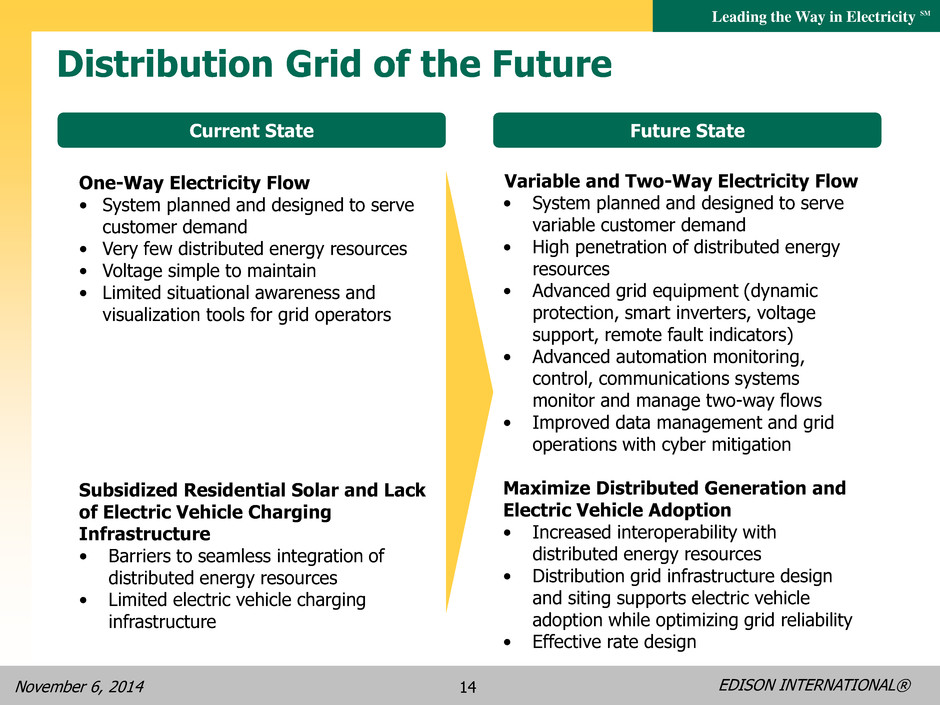

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 14 Distribution Grid of the Future One-Way Electricity Flow • System planned and designed to serve customer demand • Very few distributed energy resources • Voltage simple to maintain • Limited situational awareness and visualization tools for grid operators Subsidized Residential Solar and Lack of Electric Vehicle Charging Infrastructure • Barriers to seamless integration of distributed energy resources • Limited electric vehicle charging infrastructure Current State Future State Variable and Two-Way Electricity Flow • System planned and designed to serve variable customer demand • High penetration of distributed energy resources • Advanced grid equipment (dynamic protection, smart inverters, voltage support, remote fault indicators) • Advanced automation monitoring, control, communications systems monitor and manage two-way flows • Improved data management and grid operations with cyber mitigation Maximize Distributed Generation and Electric Vehicle Adoption • Increased interoperability with distributed energy resources • Distribution grid infrastructure design and siting supports electric vehicle adoption while optimizing grid reliability • Effective rate design

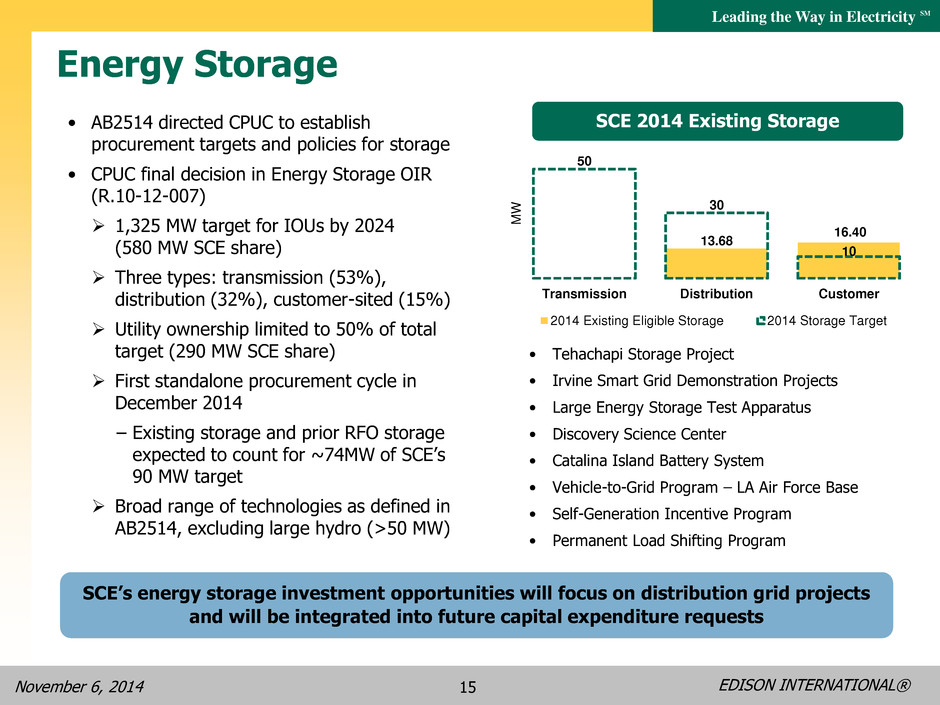

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 15 Energy Storage • AB2514 directed CPUC to establish procurement targets and policies for storage • CPUC final decision in Energy Storage OIR (R.10-12-007) 1,325 MW target for IOUs by 2024 (580 MW SCE share) Three types: transmission (53%), distribution (32%), customer-sited (15%) Utility ownership limited to 50% of total target (290 MW SCE share) First standalone procurement cycle in December 2014 − Existing storage and prior RFO storage expected to count for ~74MW of SCE’s 90 MW target Broad range of technologies as defined in AB2514, excluding large hydro (>50 MW) SCE 2014 Existing Storage SCE’s energy storage investment opportunities will focus on distribution grid projects and will be integrated into future capital expenditure requests • Tehachapi Storage Project • Irvine Smart Grid Demonstration Projects • Large Energy Storage Test Apparatus • Discovery Science Center • Catalina Island Battery System • Vehicle-to-Grid Program – LA Air Force Base • Self-Generation Incentive Program • Permanent Load Shifting Program 13.68 16.40 50 30 10 Transmission Distribution Customer M W 2014 Existing Eligible Storage 2014 Storage Target

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 16 Electric Vehicles (EV) • October 2014, electric vehicle Charge Ready Program application submitted to CPUC (A.14- 10-014) • Pro-active, two-phased program over five years to support installation of up to 30,000 EV charging stations to be included in rate base Phase 1: $22 million pilot program for 1,500 chargers and market education program (2015 – 2016) Phase 2: $333 million for 28,500 chargers (2016 – 2020) • Approval of Phase 1 requested by April 2015 • Addresses approximately 1/3 of forecast non- single family home charging demand in SCE territory in 2020 • Supports Governor’s 2012 zero-emission vehicle Executive Order – 1.5 million EVs by 2025 SCE’s electric vehicle Charge Ready program will help jump start the market to achieve State zero-emission vehicle goals • Level 1 (110V) and Level 2 (240V) chargers with Demand Response capability • 10 chargers per site minimum • Participants own / operate / maintain chargers • Capital cost per charging station: $11,400 • Rate base with rebate to participants

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 17 SCE 2015 CPUC General Rate Case • November 2013, 2015 GRC Application A.13-11-003 sets 2015 – 2017 base revenue requirement Includes operating costs and CPUC jurisdictional capital Excludes fuel and purchased power (and other utility cost-recovery activities), cost of capital, and FERC jurisdictional transmission • 2015 revenue requirement request of $5.775 billion (rebuttal update; excludes SONGS and Four Corners) $142 million increase over presently authorized base rates (excluding SONGS) Post test year requested increase of $301 million in 2016 and additional increase of $315 million in 2017 Customer advocates have recommended significant reductions to SCE request • Request consistent with SCE strategy to ramp up infrastructure investment consistent with capital plan while mitigating customer rate impacts through productivity and lower operating costs • Current CPUC schedule does not specify a proposed decision timeframe but will likely be in 2015 Nov 12 GRC Application Aug 18 Intervener Testimony Sept 29 Evidentiary Hearings 2013 2014 Feb 11 Prehearing Conference Jan 13-14 Update Hearing 2015 Aug 4 ORA Testimony Nov 25 Opening Briefs Dec 11 Reply Briefs Note: Schedule affirmed November 3, 2015, other than minor change in Update Hearing dates

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 18 SCE 2015 GRC – Intervenor Testimony • In August, Office of Ratepayer Advocate (ORA) and The Utility Reform Network (TURN) submitted 2015 GRC testimony Proposed $680 million 2015 test year decrease Proposed $356 million O&M expense reduction largely driven by compensation, and transmission and distribution expenses CPUC Revenue Requirement Total Company Capital Expenditures CPUC Rate Base Note: SCE summary interpretation of ORA and TURN testimony. Please refer to ORA and other intervener testimony for more information. SCE ORA/ TURN 2015 $5,775 $4,953 2015 increase $142 (2.52%) $(680) (-12.1%) 2016 increase $301 (5.21%) $94 (1.9%) 2017 increase $315 (5.18%) $116 (2.3%) • 2015 – $822 million intervenor reduction • Post test year ratemaking – CPI plus 0.5%, and other alternatives proposed $3,753 $2,855 $1,000 $2,000 $3,000 $4,000 2015 Capex SCE ORA ($ in millions) • 2015 – $898 million reduction • Mostly transmission and distribution reductions: Sales forecast and load growth differences Aged Pole program $18,206 $16,740 $16,000 $17,000 $18,000 $19,000 2015 Rate Base SCE ORA • 2015 – $1,466 million reduction • $0.9 billion plant reduction from reduced capex • $0.6 billion reduction in working cash, customer deposits M&S and deferred taxes

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 19 CPUC and FERC Cost of Capital • CPUC – 48% common equity and Return on Equity (ROE) adjustment mechanism approved through 2015 Interest rates did not trigger change to ROE for 2015 – continues at 10.45% Weighted average authorized cost of capital – 7.90% ROE adjustment based on 12-month average of Moody’s Baa utility bond rates, measured from Oct. 1 to Sept. 30 If index exceeds 100 bps deadband from starting index value, authorized ROE changes by half the difference Starting index value based on trailing 12 months of Moody’s Baa index as of September 30, 2012 – 5.00% Applications due in April 2015 for 2016 Cost of Capital • FERC – November 2013 settlement 10.45% ROE comprised of: 9.30% base + 50 bps CAISO participation + 65 bps weighted average for project incentives Moratorium on filing ROE changes through June 30, 2015 FERC Formula recovery mechanism in effect through 2017 3 4 5 6 7 10/1/12 10/1/13 10/1/14 10/1/15 Ra te (% ) CPUC Adjustment Mechanism Moody’s Baa Utility Index Spot Rate Moving Average (10/1/14 – 10/10/14) = 4.69% 100 basis point +/- Deadband Starting Value – 5.00%

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 20 SCE Key CPUC Regulatory Events Calendar Rate Design OIR (R.12-06-013) 2015 GRC (A.13-11-003) 2H 2014 1H 2015 2H 2015 2016 SONGS Settlement (I.12-10-013) Other proceedings next steps: • CAISO 2013-2014 Transmission Plan – Board approval of Delaney-Colorado economic line; FERC Order 1000 competitive bid due November 19 • 2012 Long Term Procurement Plan (LTPP) Track 1 Local Capacity Requirements (LCR) – Track 1: 1,400 to 1,800 MW preferred resources, gas-fired, energy storage to replace Once-Through-Cooling units; Track 4: 500 to 700 MW online by 2022 to replace SONGS. Selected bidders notified October 24-27, final offers due to CPUC November 21. • Energy Storage OIR – First procurement cycle December 2014. SCE targeting net 14 MW storage capacity, excluding 74 MW existing and LCR storage. • Distributed Resources Plan OIR – required under AB 327 to identify optimal locations, additional spending, and barriers to deploying distributed energy resources – due to CPUC Q3 2015 July – Revised Scoping Memo Aug – ORA/TURN testimony Sept - Evidentiary Hearings Sept – NEM Scoping Memo Fall – NEM proposed decision Oct 9 – Proposed Decision Nov/Dec – Final Decision Cost of Capital April – Initial Filing New Cost of Capital takes effect Spring – Fixed charge and tiers proposed decision Jan – Update Hearing

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 21 2014 Core and Basic Earnings Guidance 2014 Earnings Guidance as of 10/28/14 2014 Earnings Guidance as of 4/29/14 Key Assumptions: • Midpoint rate base of $22.1 billion • Approved capital structure – 48% equity, 10.45% CPUC & FERC ROE • 325.8 million common shares outstanding (no change) • No significant transmission project delays Other Assumptions: • No change in tax policy • Energy efficiency earnings likely deferred to 2015 (previously $0.03) Low Mid High Low Mid High SCE $3.85 $4.43 EIX Parent & Other (0.15) (0.13) EIX Core EPS1 $3.60 $3.70 $3.80 $4.25 $4.30 $4.35 Non-core Items2 (0.36) 0.16 EIX Basic EPS $3.24 $3.34 $3.44 $4.41 $4.46 $4.51 1 See Use of Non-GAAP Financial Measures in Appendix 2 Represents non-core items recorded for the nine months ended September 30, 2014 $3.40 $(0.07) $1.10 $(0.13) $4.30 SCE 2014 EPS from Rate Base Forecast SONGS SCE 2014 Positive Variances EIX Parent & Other Updated 2014 Midpoint Guidance • Cost Savings / Other +$0.69 • Income Taxes +$0.41 • No Energy Efficiency Earnings • SONGS LT Debt & Preferred ($0.07) • Settlement +$0.03 • Philanthropic Contribution ($0.04) • Other +$0.01 No Change No Change Net Change +$0.58 Net Change +$0.02 Net Change +$0.60 (per share)

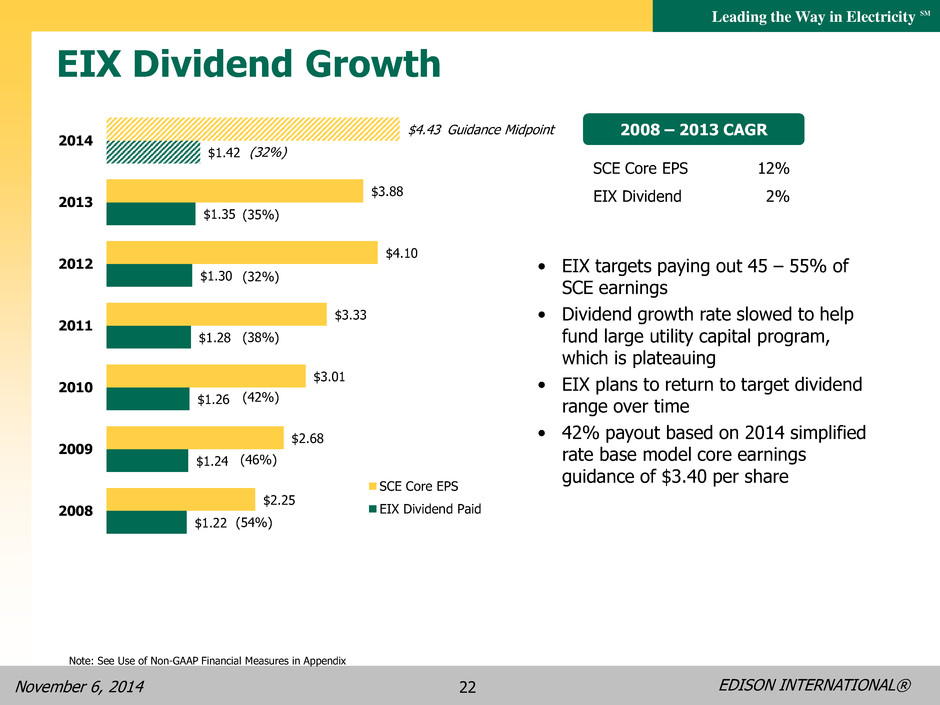

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 22 $1.22 $1.24 $1.26 $1.28 $1.30 $1.35 $1.42 $2.25 $2.68 $3.01 $3.33 $4.10 $3.88 $4.43 2008 2009 2010 2011 2012 2013 2014 SCE Core EPS EIX Dividend Paid EIX Dividend Growth • EIX targets paying out 45 – 55% of SCE earnings • Dividend growth rate slowed to help fund large utility capital program, which is plateauing • EIX plans to return to target dividend range over time • 42% payout based on 2014 simplified rate base model core earnings guidance of $3.40 per share SCE Core EPS EIX Dividend 12% 2% 2008 – 2013 CAGR (32%) (38%) (42%) (46%) (54%) (35%) Guidance Midpoint Note: See Use of Non-GAAP Financial Measures in Appendix (32%)

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 23 EIX is Responding to Industry Change • Public policy prioritizing environmental sustainability • Innovation facilitating conservation and self- generation • Regulation supporting new forms of competition • Flattening domestic demand for electricity • Grid of the future will be more complex and sophisticated to support increasing use of distributed resources and transportation electrification • SCE Strategy Invest in, build, and operate the next generation electric grid Operational and service excellence Enable California public policies • EIX Competitive Strategy – small, targeted investments in emerging technologies and markets to follow changes in the industry and better exploit opportunities as they arise Commercial and industrial distributed generation Energy optimization Energy efficiency and software Residential solar industry financial services and software Electric transportation Long-Term Industry Trends Strategy

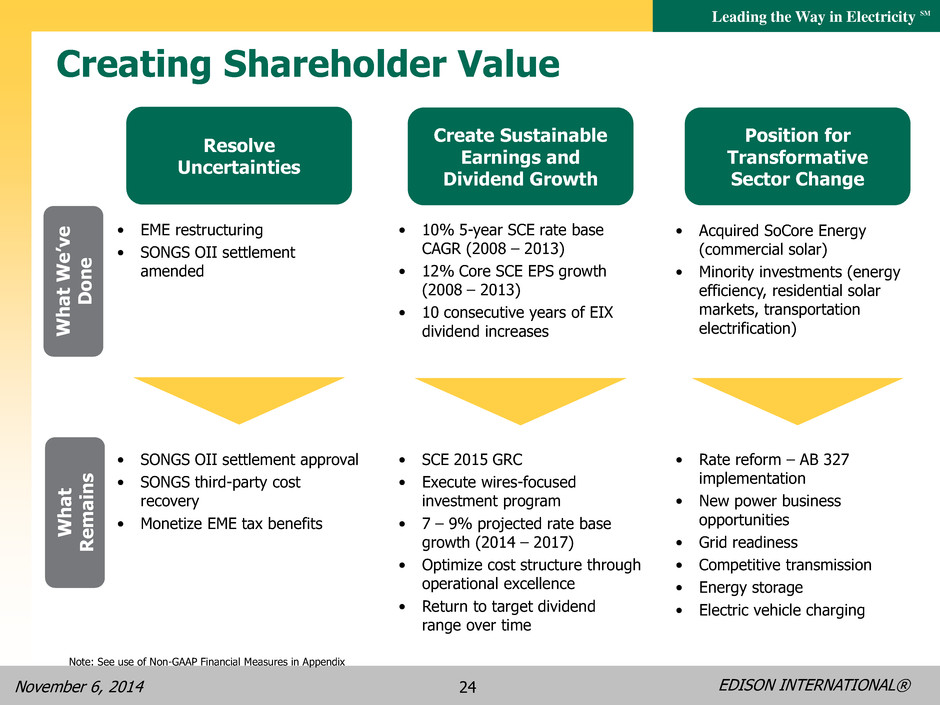

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 24 Creating Shareholder Value Resolve Uncertainties Create Sustainable Earnings and Dividend Growth Position for Transformative Sector Change • EME restructuring • SONGS OII settlement amended • 10% 5-year SCE rate base CAGR (2008 – 2013) • 12% Core SCE EPS growth (2008 – 2013) • 10 consecutive years of EIX dividend increases • Acquired SoCore Energy (commercial solar) • Minority investments (energy efficiency, residential solar markets, transportation electrification) • SONGS OII settlement approval • SONGS third-party cost recovery • Monetize EME tax benefits • SCE 2015 GRC • Execute wires-focused investment program • 7 – 9% projected rate base growth (2014 – 2017) • Optimize cost structure through operational excellence • Return to target dividend range over time • Rate reform – AB 327 implementation • New power business opportunities • Grid readiness • Competitive transmission • Energy storage • Electric vehicle charging What W e ’ve D on e What R e m a in s Note: See use of Non-GAAP Financial Measures in Appendix

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 25 Appendix

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 26 Kilowatt-Hour Sales (millions of kWh) Residential Commercial Industrial Public authorities Agricultural and other Subtotal Resale Total Kilowatt-Hour Sales Customers Residential Commercial Industrial Public authorities Agricultural Railroads and railways Interdepartmental Total Number of Customers Number of New Connections Area Peak Demand (MW) SCE Customer Demand Trends 2012 30,563 40,541 8,504 5,196 1,676 86,480 1,735 88,215 4,321,171 549,855 10,922 46,493 21,917 83 24 4,950,465 22,866 21,981 2011 29,631 39,622 8,490 5,206 1,318 84,267 3,071 87,338 4,301,969 546,936 11,370 46,684 22,086 82 22 4,929,149 19,829 22,374 2010 29,034 39,318 8,507 5,336 1,353 83,548 4,103 87,651 4,285,803 543,016 11,708 46,718 22,321 73 23 4,909,662 25,566 22,771 2009 30,078 40,076 8,522 5,686 1,499 85,861 5,869 91,730 4,262,966 539,270 12,244 46,902 22,315 67 23 4,883,787 32,145 22,112 2013 29,889 40,649 8,472 5,012 1,885 85,907 1,490 87,397 4,344,429 554,592 10,584 46,323 21,679 99 23 4,977,729 27,370 22,534 Note: See Edison International Financial and Statistical Reports for further information

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 27 SCE 2014 Bundled Revenue Requirement 2014 Bundled Revenue Requirement $millions ¢/kWh Fuel & Purchased Power – includes CDWR Bond Charge 5,071 6.9 Distribution – poles, wires, substations, service centers; Edison SmartConnect® 3,867 5.3 Generation – utility owned generation investment and O&M 2,048 2.8 Transmission – greater than 220kV 735 1.0 Other – CPUC and legislative public purpose programs, system reliability investments, nuclear decommissioning 539 0.7 Total Bundled Revenue Requirement ($millions) $12,260 Bundled kWh (millions) 73,249 = Bundled Systemwide Average Rate (¢/kWh) 16.7¢ Approximately 60% of SCE’s revenue requirement consists of utility earnings activities: distribution, generation, and transmission Fuel & Purchased Power (41%) Distribution (32%) Transmission (6%) Generation (17%) Other (4%) Note: Rates in effect as of July 7, 2014, based on forecast. Represents bundled service which excludes Direct Access customers that do not receive generation services.

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 28 12.6 16.6 US Average SCE 33% Higher SCE Rates and Bills Comparison • SCE’s residential rates are above national average due, in part, to a cleaner fuel mix – cost for renewables are higher than high carbon sources • Average monthly residential bills are lower than national average – higher rate levels offset by lower usage 55% lower SCE residential customer usage than national average, from mild climate and higher energy efficiency building standards • Public policy mandates (33% RPS, AB32 GHG, Once-through Cooling) and electric system requirements will drive rates and bills higher 2014 Average Residential Rates (¢/kWh) 2014 Average Residential Bills ($ per Month) Key Factors ¢ ¢ SCE’s average residential rates are above national average, but residential bills are below national average due to lower energy usage $126 $75 US Average SCE 40% Lower Source: EIA's Form 826 Data Monthly Electric Utility Sales and Revenue Data for the Data 12 Months Ending April 2014

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 29 Residential Rate Design OIR 14.85 19.28 28.10 32.10 0 5 10 15 20 25 30 35 0 200 400 600 800 1,000 1,200 1,400 ¢ / k W h kWh/month SCE Proposed 2018 Tiers: • Two tiers: Tier 1 – 16.4¢/kWh Tier 2 – 19.7¢/kWh • June 2012, CPUC opened Order Instituting Ratemaking (OIR) R.12-06-013: Comprehensive review of residential rate structure Transition to Time of Use (TOU) rates AB327 rate design • Phase 2 (Summer 2014): simple tiered rate adjustments Settlement approved in June; rates implemented in July – 12% increase to Tier 1 rate, 17% increase to Tier 2 rate • Phase 1 (2015 – 2018): longer-term rates 2 tiers (2017); TOU rates (2018) Fixed charge or minimum bill (2015) Proposed Decision expected March 2015 • Net Energy Metering: successor tariff Q4 2015 20-year NEM grandfathering for existing customers and new installations up to 5% cap (2,240 MW for SCE) NEM grandfathered customers still subject to new tier structure Tier 1 Tier 2 Tier 3 Tier 4 OIR Phase 2 Settlement Summary Fixed Monthly Charge Current: $0.94/month SCE Proposed: $10/month Note: Rates in effect as of July 7, 2014, based on forecast

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 30 SCE Residential Net Metering Rate Structure 8.7¢ 30.6¢ 21.9¢ 0 5 10 15 20 25 30 35 ¢ / k W h Solar Subsidies (Illustrative) Generation Rate Subsidy Paid by Other Ratepayers Equivalent Solar Rate Current rate design results in residential solar customers receiving a subsidy funded by all other non-solar customers in higher tiers • Residential solar customer generation offsets total retail rate • Average retail rate of 30.6¢/kWh vs. actual generation cost of 8.7¢/kWh • Resulting 21.9¢/kWh is a subsidy funded by all other non-solar customers in Tiers 3 and 4 SCE 2013 Net Energy Metering Statistics: • 76,400 combined residential and non- residential customers – 697 MW installed 99.5% solar 73,300 residential – 361 MW 3,100 non-residential – 336 MW • Approximately 1,000,000 mWh / year generated, or 1% of total sales Note: Based on average home usage of 1,150 kWh/month, a 4-tier rate structure, and a 4.8kW solar system with a 18% capacity factor that generates 631 kWh per month

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 31 SCE Energy Efficiency Programs Energy efficiency programs updated for 2013 – 2014 • SCE is a national leader – 2012 energy savings = 1.8% of retail sales • 2014 budget of $352 million • Target 0.9 billion kWh average annual savings for 2013-14 cycle – Reduced goals reflect CPUC-identified market potential for energy efficiency Energy efficiency earnings incentive mechanism modified • New earnings mechanism for 2010-12 – 5% management fee + up to 1% performance bonus • CPUC approved new incentive mechanism for 2013 – 2015 activities comprised of performance rewards and management fees Note: Additional program year 2013 award request expected to be submitted in 2015 SCE Energy Efficiency Earnings Summary Progra m Year Total Requested Received Pending CPUC Approval 2010 $15.1 million $0.03/share $15.1 million $0.03/share (2012) 2011 $18.6 million $0.04/share $13.6 million $0.03/share (2013) $5.0 million $0.01/share 2012 $16.2 million $0.03/share $16.2 million $0.03/share 2013 $14.2 million $0.03/share $14.2 million $0.03/share

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 32 Third Quarter Earnings Summary Q3 2014 Q3 2013 Variance Core EPS1 SCE $1.54 $1.46 $0.08 EIX Parent & Other (0.02) (0.04) 0.02 Core EPS1 $1.52 $1.42 $0.10 Non-Core Items SCE $– $– $– EIX Parent & Other – – – Discontinued Operations (0.05) (0.08) 0.03 Total Non-Core $(0.05) $(0.08) $0.03 Basic EPS $1.47 $1.34 $0.13 Diluted EPS $1.46 $1.34 $0.12 SCE Key Core Earnings Drivers Higher revenue $0.20 SONGS impact (0.03) Higher depreciation (0.04) Income taxes and other (0.05) - Lower income tax benefits (0.04) - Other (0.01) Total $0.08 EIX Key Core Earnings Drivers Higher income from affordable housing projects $0.03 Higher income tax benefits 0.01 Higher corporate expenses and costs of new businesses (0.02) Total $0.02 1 See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix

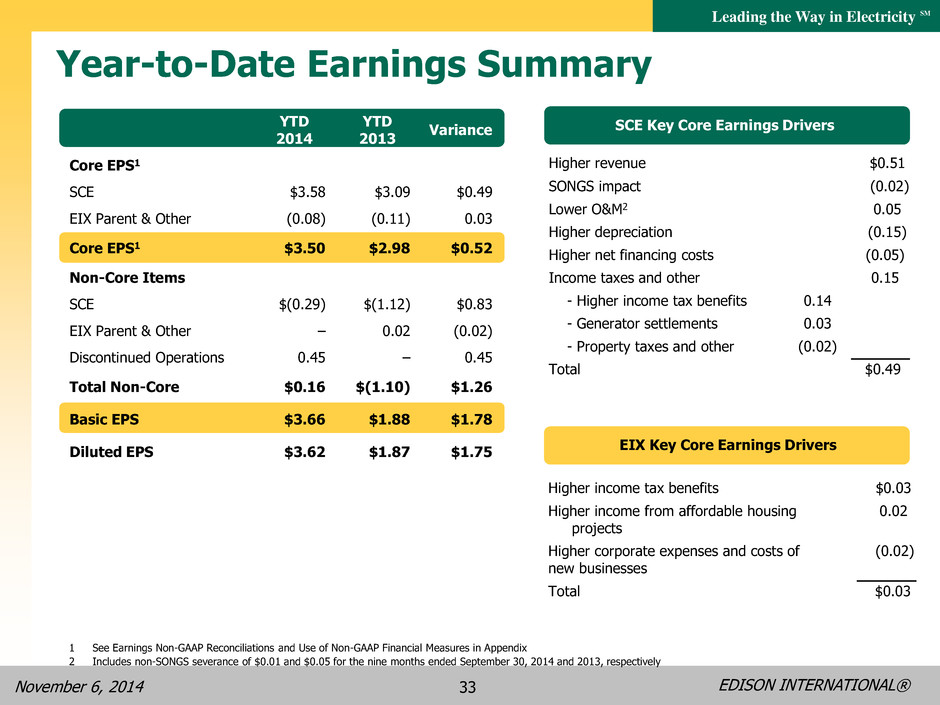

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 33 Year-to-Date Earnings Summary YTD 2014 YTD 2013 Variance Core EPS1 SCE $3.58 $3.09 $0.49 EIX Parent & Other (0.08) (0.11) 0.03 Core EPS1 $3.50 $2.98 $0.52 Non-Core Items SCE $(0.29) $(1.12) $0.83 EIX Parent & Other – 0.02 (0.02) Discontinued Operations 0.45 – 0.45 Total Non-Core $0.16 $(1.10) $1.26 Basic EPS $3.66 $1.88 $1.78 Diluted EPS $3.62 $1.87 $1.75 EIX Key Core Earnings Drivers Higher income tax benefits $0.03 Higher income from affordable housing projects 0.02 Higher corporate expenses and costs of new businesses (0.02) Total $0.03 SCE Key Core Earnings Drivers Higher revenue $0.51 SONGS impact (0.02) Lower O&M2 0.05 Higher depreciation (0.15) Higher net financing costs (0.05) Income taxes and other 0.15 - Higher income tax benefits 0.14 - Generator settlements 0.03 - Property taxes and other (0.02) Total $0.49 1 See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix 2 Includes non-SONGS severance of $0.01 and $0.05 for the nine months ended September 30, 2014 and 2013, respectively

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 34 Earnings Non-GAAP Reconciliations ($ millions) Reconciliation of EIX Core Earnings to EIX GAAP Earnings Earnings Attributable to Edison International Core Earnings SCE EIX Parent & Other Core Earnings Non-Core Items SCE EIX Parent & Other Discontinued operations Total Non-Core Basic Earnings Q3 2013 $477 (14) $463 $– – (25) (25) $438 Q3 2014 $503 (7) $496 $– – (16) (16) $480 YTD 2013 $1,007 (34) $973 $(365) 7 (1) (359) $614 YTD 2014 $1,168 (26) $1,142 $(96) – 146 50 $1,192 Note: See Use of Non-GAAP Financial Measures in Appendix

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 35 Earnings Per Share Attributable to SCE Core EPS Non-Core Items Tax settlement Health care legislation Regulatory and tax items Asset impairment Total Non-Core Items Basic EPS SCE Core EPS Non-GAAP Reconciliations Reconciliation of SCE Core Earnings Per Share to SCE Basic Earnings Per Share 2008 $2.25 — — (0.15) — (0.15) $2.10 2009 $2.68 0.94 — 0.14 — 1.08 $3.76 2010 $3.01 0.30 (0.12) — — 0.18 $3.19 CAGR 12% 6% 2011 $3.33 — — — — — $3.33 2012 $4.10 — — 0.71 — 0.71 $4.81 2013 $3.88 — — — (1.12) (1.12) $2.76 Note: See Use of Non-GAAP Financial Measures in Appendix

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 36 $6,682 — 2,518 1,562 296 32 4,408 2,274 94 (494) 1,874 214 1,660 91 $1,569 $5,169 4,139 1,026 — (1) — 5,164 5 — (5) — — — — $— $6,602 — 2,348 1,622 307 575 4,852 1,750 48 (519) 1,279 279 1,000 100 $900 $5,960 4,891 1,068 — — — 5,959 1 — (1) — — — — $— $12,562 4,891 3,416 1,622 307 575 10,811 1,751 48 (520) 1,279 279 1,000 100 $900 $1,265 (365) $900 SCE Results of Operations ($ millions) Utility Earning Activities Utility Cost- Recovery Activities Total Consolidated 2013 Utility Earning Activities Utility Cost- Recovery Activities Total Consolidated 2012 Operating revenue Fuel and purchased power Operation and maintenance Depreciation, decommissioning and amortization Property and other taxes Asset impairment and disallowances Total operating expenses Operating income Interest income and other Interest expense Income before income taxes Income tax expense Net income Preferred and preference stock requirements Net income available for common stock Core earnings Non-core earnings Total SCE GAAP earnings $11,851 4,139 3,544 1,562 295 32 9,572 2,279 94 (499) 1,874 214 1,660 91 $1,569 $1,338 231 $1,569 • Utility earning activities – revenue authorized by CPUC and FERC to provide reasonable cost recovery and return on investment • Utility cost-recovery activities – CPUC- and FERC-authorized balancing accounts to recover specific project or program costs, subject to reasonableness review or compliance with upfront standards Note: See Use of Non-GAAP Financial Measures in Appendix

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 37 SONGS Settlement – Summary Term Description Steam Generators • Steam Generator Replacement Project (“SGRP”) removed from rates as of February 1, 2012, with book value balance disallowed. Revenues related to the SGRP collected after February 1, 2012, refunded to customers. Power Costs • Full recovery of replacement power costs Regulatory Asset Recovery • Non SGRP plant costs are recovered in rates over 10 years from February 1, 2012 • Weighted average return equal to authorized cost on debt and 50% of authorized cost on preferred; no return on equity. Results in current weighted average return of 2.62%. • Construction Work in Progress (CWIP) and materials and supplies are recovered with same return over same period • Nuclear Fuel amortized over same period; return at customary commercial paper rate • 5% of proceeds of any sales / dispositions of materials, supplies, and nuclear fuel accrue to shareholders, as well as 5% reduction in nuclear fuel commitments • Regulatory Asset can be removed from ratemaking capital structure, thus reducing equity requirement in excess of $300 million Operations & Maintenance Costs • Recorded O&M for 2013 recovered, including incremental inspection and repair costs • O&M recovery for 2012 limited to CPUC authorized amounts • Leaves $99 million incremental inspection and repair costs not recovered in rates (these costs were previously expensed) Sharing of Third Party Recoveries • NEIL: 95% ratepayers / 5% shareholders (outage coverage); 82.5% ratepayers / 17.5% shareholders (property damage) • MHI: 50% ratepayers / 50% shareholders • Litigation costs recovered before sharing starts Other • $20 million (SCE share) philanthropic contribution over five years to fund University of California greenhouse gas emissions research

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 38 SONGS Settlement – Third-Party Recoveries CPUC SONGS OII Settlement • SCE’s share of recoveries from NEIL and MHI will be reported in non-core earnings • Customer share of recoveries from NEIL and MHI will be credited to balancing accounts and reduce SONGS regulatory asset • Litigation fees recovered prior to SCE / customer sharing • Different recovery allocations apply to claims under the NEIL outage and property damage coverages MHI Warranty • $138 million liability limit and exclusion for consequential damages (e.g. replacement power) Limits subject to applicable exceptions in the contract and under law • 7 invoices submitted totaling $149 million for repair costs through April 30, 2013 • October 2013, Request for Arbitration filed with the International Chamber of Commerce per MHI contract • MHI responded in December 2013 countering SCE’s claims and asserting $41 million in counterclaims NEIL Insurance • Accidental property damage and accidental outage insurance through Nuclear Electric Insurance Limited (“NEIL”) • Separate proofs of loss have been filed for Unit 2 and Unit 3 under NEIL accidental outage policy totaling $427 million ($334 million SCE share) for amounts through June 28, 2014 • It is possible that the NEIL Board of Directors will make a coverage determination by the end of 2014, but it may take longer

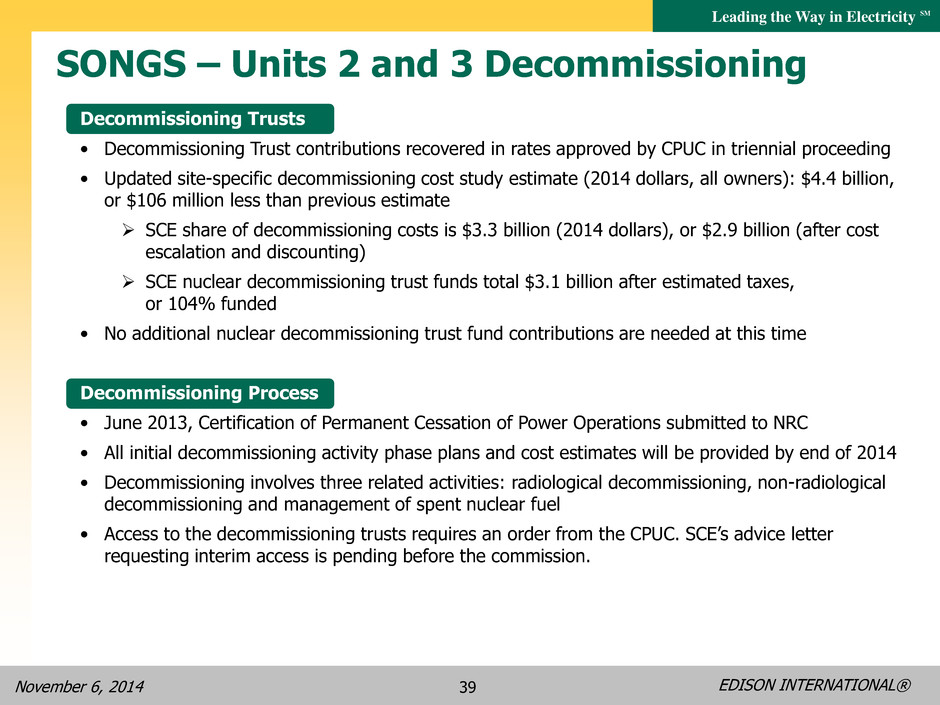

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 39 SONGS – Units 2 and 3 Decommissioning Decommissioning Trusts • Decommissioning Trust contributions recovered in rates approved by CPUC in triennial proceeding • Updated site-specific decommissioning cost study estimate (2014 dollars, all owners): $4.4 billion, or $106 million less than previous estimate SCE share of decommissioning costs is $3.3 billion (2014 dollars), or $2.9 billion (after cost escalation and discounting) SCE nuclear decommissioning trust funds total $3.1 billion after estimated taxes, or 104% funded • No additional nuclear decommissioning trust fund contributions are needed at this time Decommissioning Process • June 2013, Certification of Permanent Cessation of Power Operations submitted to NRC • All initial decommissioning activity phase plans and cost estimates will be provided by end of 2014 • Decommissioning involves three related activities: radiological decommissioning, non-radiological decommissioning and management of spent nuclear fuel • Access to the decommissioning trusts requires an order from the CPUC. SCE’s advice letter requesting interim access is pending before the commission.

EDISON INTERNATIONAL® Leading the Way in Electricity SM November 6, 2014 40 Edison International's earnings are prepared in accordance with generally accepted accounting principles used in the United States. Management uses core earnings internally for financial planning and for analysis of performance. Core earnings are also used when communicating with investors and analysts regarding Edison International's earnings results to facilitate comparisons of the Company's performance from period to period. Core earnings are a non-GAAP financial measure and may not be comparable to those of other companies. Core earnings (or losses) are defined as earnings or losses attributable to Edison International shareholders less income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings, such as: exit activities, including sale of certain assets, and other activities that are no longer continuing; asset impairments and certain tax, regulatory or legal settlements or proceedings. A reconciliation of Non-GAAP information to GAAP information is included either on the slide where the information appears or on another slide referenced in this presentation. Use of Non-GAAP Financial Measures EIX Investor Relations Contacts Scott Cunningham, Vice President (626) 302-2540 scott.cunningham@edisonintl.com Felicia Williams, Senior Manager (626) 302-5493 felicia.williams@edisonintl.com