Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Apollo Residential Mortgage, Inc. | d817837d8k.htm |

| EX-99.1 - EX-99.1 - Apollo Residential Mortgage, Inc. | d817837dex991.htm |

| EX-99.3 - EX-99.3 - Apollo Residential Mortgage, Inc. | d817837dex993.htm |

November 4, 2014

Supplemental Financial Information Presentation

Information is as of September 30, 2014 except as otherwise noted.

It should not be assumed that investments made in the future will

be profitable or will equal the performance of investments in this document.

Exhibit 99.2

Q3 2014 |

2

APOLLO RESIDENTIAL MORTGAGE, INC. (“AMTG”)

Apollo Residential Mortgage, Inc.

Third Quarter 2014 Earnings Call

November 4, 2014

Michael A. Commaroto

Chief Executive Officer

Teresa D. Covello

Chief Financial Officer

Keith Rosenbloom

Agency Portfolio Manager

Paul Mangione

Non-Agency Portfolio Manager

Hilary Ginsberg

Investor Relations Manager |

3

APOLLO RESIDENTIAL MORTGAGE, INC. (“AMTG”)

Forward Looking Statements

This presentation may contain forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended, and such statements are intended to

be covered by the safe harbor provided by the same. Forward-looking statements are subject to

substantial risks and uncertainties, many of which are difficult

to predict and are generally beyond management’s control. These

forward-looking statements include information about

possible or assumed future results of Apollo Residential Mortgage, Inc.’s (“AMTG”

or the “Company”) business, financial condition, liquidity,

results of operations, plans and objectives, including

information about AMTG’s ability to generate attractive returns while attempting to mitigate risk. When used in this release, the

words "believe," "expect," "anticipate,"

"estimate," "plan," "continue," "intend," "should," "may" or similar expressions, are intended to identify forward-looking statements.

Statements regarding the following subjects, among others, may be

forward-looking: the return on equity; the yield on investments; the ability to borrow to finance assets;

and risks associated with investing in real estate assets, including

changes in business conditions and the general economy. The

forward-looking statements are based on management’s beliefs, assumptions and expectations of AMTG’s future performance, taking into account all information

currently available to management. Forward-looking statements are

not predictions of future events. These beliefs, assumptions and expectations can change as a result of

many possible events or factors, not all of which are known to AMTG.

Some of these factors are described in the Company's Annual

Report on Form 10-K for the year

ended December 31, 2013 and the Company’s other filings with the

Securities and Exchange Commission (“SEC”). If a change occurs, AMTG’s business, financial

condition, liquidity and results of operations may vary materially from

those expressed in AMTG’s forward-looking statements. Any forward-looking statement speaks only

as of the date on which it is made. New risks and uncertainties arise

over time, and it is not possible for management to predict those events or how they may affect AMTG.

Except as required by law, AMTG is not obligated to, and does not

intend to, update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise.

This presentation contains information regarding the Company’s

financial results that is calculated and presented on the basis of methodologies other than in accordance with

accounting principles generally accepted in the United States

(“GAAP”), including Operating Earnings and Operating Earnings per share.

Please refer to page 4 for a

definition of “Operating Earnings”

and the reconciliation of “Operating Earnings”

to the applicable GAAP financial measure set forth on pages 17 and

18. This presentation may contain statistics and other data that

in some cases has been obtained from or compiled from information made available by third-party service

providers. AMTG makes no representation or warranty, expressed or

implied, with respect to the accuracy, reasonableness or completeness of such information.

Past performance is not indicative nor a guarantee of future

returns. Index performance and yield data are shown for

illustrative purposes only and have limitations when used for comparison or for other purposes due to, among other matters,

volatility, credit or other factors (such as number and types of

securities). Indices are unmanaged, do not charge any fees or

expenses, assume reinvestment of income and do not

employ

special

investment

techniques

such

as

leveraging

or

short

selling.

No

such

index

is

indicative

of

the

future

results

of

any

investment

by

AMTG. |

4

APOLLO RESIDENTIAL MORTGAGE, INC. (“AMTG”)

Third Quarter 2014 Summary Highlights

Reported

Operating

Earnings

of

$16.4

million,

or

$0.51

per

share

of

common

stock

for

the

third

quarter

of

2014

(1)

Residential mortgage-backed securities (“RMBS”) portfolio

at September 30, 2014 consisted of Agency RMBS with an estimated

fair value of $2.1 billion and non-Agency RMBS with an estimated fair value of $1.5 billion

RMBS, securitized mortgage loans and other credit investment portfolio

had a 2.7% effective net interest spread and a 15.0%

effective

levered

asset

yield

at

September

30,

2014

(2)

Quarter-end leverage multiple of 3.9x at September 30, 2014

Estimated taxable income of $0.35 per share of common stock

Declared a $0.44 per share of common stock quarterly dividend for

stockholders of record as of September 30, 2014 Book value per

share of common stock of $19.27 at September 30, 2014 $23 million

outstanding on warehouse facility receivable associated with the Company’s Seller Financing Program to fund the

acquisition

and

rehabilitation

of

381

homes

and

earnest

money

deposits

for

45

homes

(3)

(1) Operating Earnings and Operating Earnings per share of common stock

are non-GAAP financial measures. Operating Earnings and Operating Earnings per share of common stock presented exclude, as applicable: (i) certain realized and unrealized gains and losses recognized through earnings;

(ii) non-cash equity compensation; (iii) one time events pursuant to

changes in GAAP; and (iv) certain other non-cash charges. Please see pages 17 and 18 for a reconciliation of Operating Earnings and Operating Earnings per common share to GAAP net income allocable to common stockholders

and GAAP net income allocable to common stockholders per share of common

stock. Operating Earnings represents the earnings, as adjusted, allocable to common stock.

(2) Effective net interest spread and effective levered asset yield are

non-GAAP financial measures, which include the cost of the Company’s Swaps as a component of its interest expense. Please see page 8.

(3) The “Seller Financing Program” refers to the

initiative whereby the Company provides funding through a warehouse line to a third-party to finance the acquisition and improvement of single-family homes. Once the homes are improved, they are marketed for sale, with the seller

providing financing to the buyer in the form of a mortgage loan

or a bond-for-title contract (“BFT Contract”). The Company may then purchase the mortgage loan or BFT Contract from the counterparty, at which time the associated balance on the warehouse line is repaid.

|

5

APOLLO RESIDENTIAL MORTGAGE, INC. (“AMTG”)

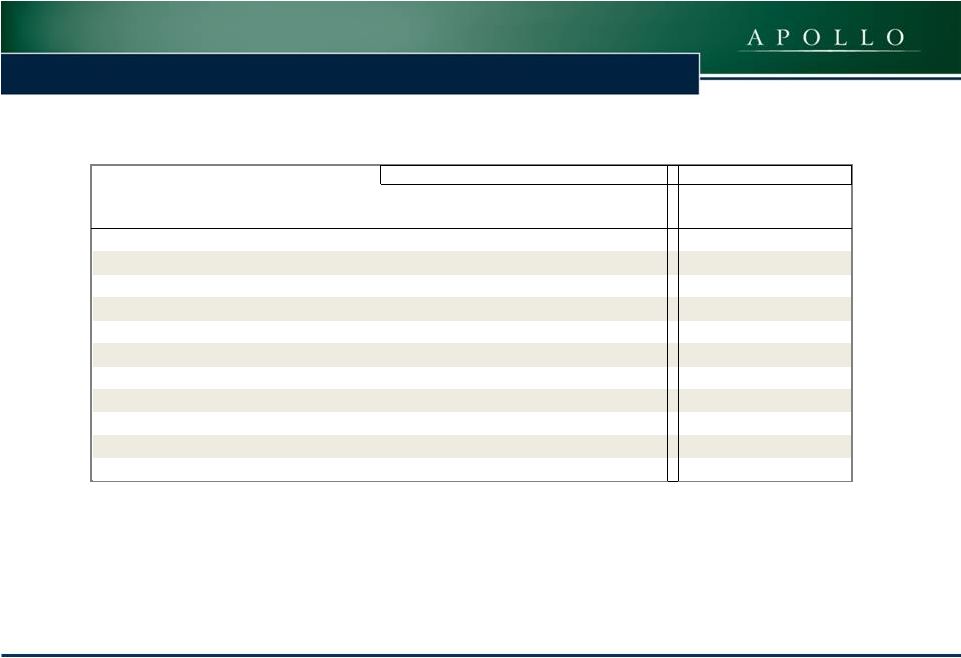

Financial Summary

($ amounts in thousands except per share data)

September 30,

2014

June 30, 2014

September 30,

2013

September 30,

2014

September 30,

2013

Interest Income

$38,542

$38,141

$34,416

$114,863

$113,992

Interest Expense

(7,708)

(7,510)

(6,789)

(22,486)

(20,243)

Net Interest Income

$30,834

$30,631

$27,627

$92,377

$93,749

Operating

Earnings

(1)

$16,372

$16,521

$11,386

$50,012

$49,377

Weighted

Average

Common

Shares

Outstanding

-

Basic

32,035

32,020

32,000

32,024

29,916

Operating Earnings per Common Share

(1)

$0.51

$0.52

$0.36

$1.56

$1.65

Leverage Multiple (Debt / Equity)

3.9x

3.8x

3.8x

3.9x

3.8x

Annualized

Return

on

Average

Assets

(2)

2.2%

2.3%

1.7%

2.3%

1.9%

Annualized

Return

on

Average

Equity

(3)

9.9%

10.2%

7.7%

10.2%

10.0%

Three Months Ended

Nine Months Ended

(1)

Operating Earnings and Operating Earnings per share of common stock are

non-GAAP financial measures. Operating Earnings and Operating Earnings per share of common stock presented exclude, as applicable: (i) certain

realized and unrealized gains and losses recognized through earnings;

(ii) non-cash equity compensation; (iii) one-time events pursuant to changes in GAAP; and (iv) certain other non-cash charges. Please see pages 17 and 18 for

a reconciliation of Operating Earnings and Operating Earnings per share

of common stock to GAAP net income allocable to common stockholders and GAAP net income allocable to common stockholders per share. Operating

Earnings represents the earnings, as adjusted, allocable to common

stock.

(2)

Annualized Return on Average Assets is calculated as annualized

Operating Earning plus preferred dividend requirement for the period, as a percentage of average interest earning assets, excluding cash.

(3)

Annualized Return on Average Equity is calculated as annualized

Operating Earnings plus preferred dividend requirement for the period, as a percentage of average equity over the period.

|

6

APOLLO RESIDENTIAL MORTGAGE, INC. (“AMTG”)

Financial Summary

Operating Earnings per Share of Common Stock

(1)

Book Value per Share of Common Stock

Dividends per Share of Common Stock

(1)

$0.36

$0.61

$0.53

$0.52

$0.51

$0.00

$0.15

$0.30

$0.45

$0.60

$0.75

Q3 2013

Q4 2013

Q1 2014

Q2 2014

Q3 2014

$18.50

$18.26

$18.64

$19.49

$19.27

$0.00

$5.00

$10.00

$15.00

$20.00

$25.00

Q3 2013

Q4 2013

Q1 2014

Q2 2014

Q3 2014

$0.40

$0.40

$0.40

$0.42

$0.44

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

Q3 2013

Q4 2013

Q1 2014

Q2 2014

Q3 2014

Operating Earnings and Operating Earnings per share of common stock are

non-GAAP financial measures. Operating Earnings and Operating Earnings per share of common stock presented exclude, as applicable: (i) certain realized and unrealized gains and losses recognized through earnings; (ii) non-

cash equity compensation; (iii) one-time events pursuant to changes

in GAAP; and (iv) certain other non-cash charges. Please see pages 17 and 18 for a reconciliation of Operating Earnings and Operating Earnings per common share to GAAP net income allocable to common stockholders and GAAP net

income allocable to common stockholders per share of common stock.

Operating Earnings represents the earnings, as adjusted, allocable to common stock. |

7

APOLLO RESIDENTIAL MORTGAGE, INC. (“AMTG”)

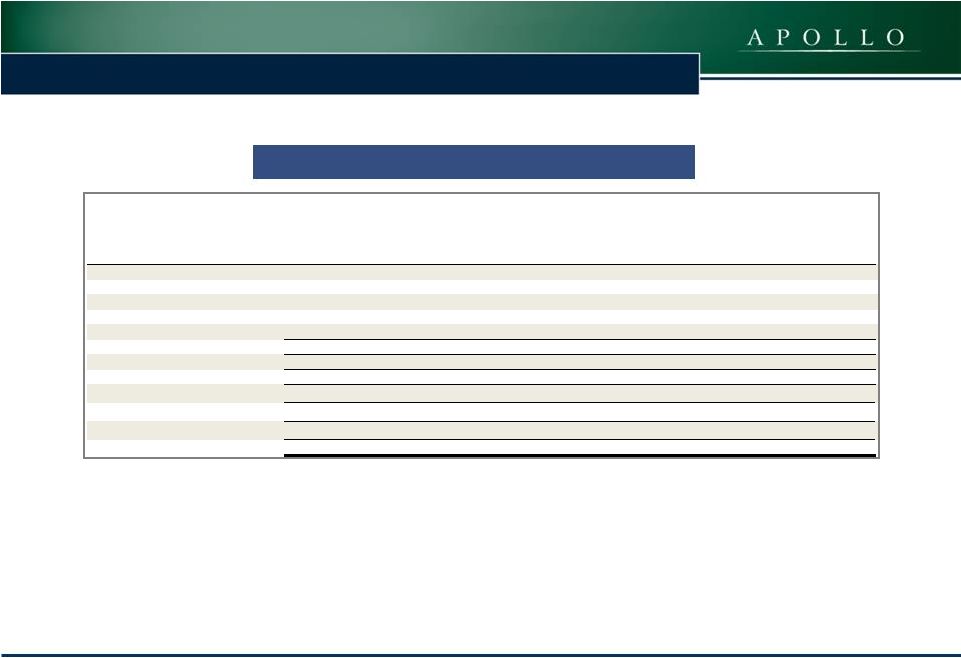

Book Value Roll-Forward

Book Value -

June 30, 2014 (unaudited)

19.49

$

Common stock dividend declared

(0.44)

Operating Earnings, net of preferred dividend

0.51

Non-Operating Items Impacting Net Income:

Unrealized loss on Agency RMBS, net

(0.29)

Unrealized loss on non-Agency RMBS, net

(0.24)

Unrealized loss on securitized mortgage loans, net

(0.02)

Unrealized gain on derivatives, net

0.39

Realized gain on sales of Agency RMBS, net

0.06

Realized gain on sales of non-Agency RMBS, net

0.02

Realized loss on expirations of Swaptions

(0.20)

Other, net

(0.01)

Book Value -

September 30, 2014 (unaudited)

19.27

$ |

8

APOLLO RESIDENTIAL MORTGAGE, INC. (“AMTG”)

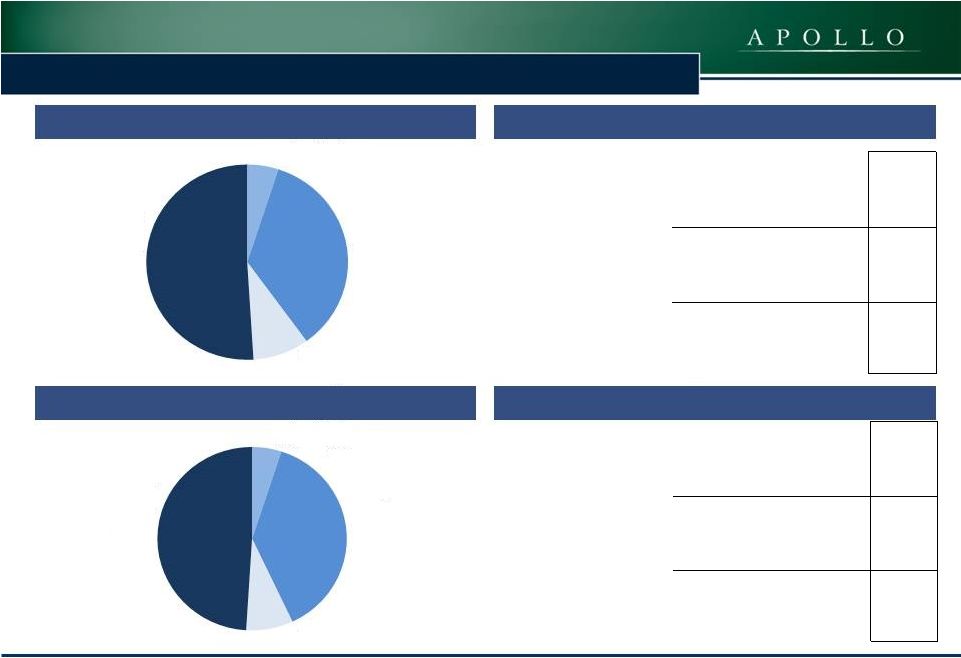

Portfolio Summary and Net Interest Spread

Allocation

of

Portfolio

Equity

at

September

30,

2014

(1)

Effective

Net

Interest

Spread

at

September

30,

2014

(2)

Allocation

of

Portfolio

Equity

at

June

30,

2014

(1)

Effective

Net

Interest

Spread

at

June

30,

2014

(2)

Securitized

Mortgage Loans

5%

Agency RMBS

35%

Cash and Other,

net

9%

Non

-Agency

RMBS and

Other Credit

Investments

51%

Securitized

Mortgage Loans

5%

Agency RMBS

38%

Cash and Other,

net

8%

Non-Agency

RMBS and

Other Credit

Investments

49%

Agency

RMBS

Non-Agency

RMBS and

Other

Credit

Investments

Securitized

Mortgage

Loans

Weighted

Average

Asset Yield

3.0%

6.1%

7.8%

4.3%

Interest Expense

0.3%

2.0%

3.0%

1.0%

Cost of Swaps

1.0%

-

1.9%

0.7%

Effective Net Interest Spread

1.7%

4.1%

2.9%

2.7%

Debt / Equity

(3)

7.1x

2.7x

1.5x

3.9x

Effective Levered Asset Yield

(2)

14.9%

17.4%

12.2%

15.0%

Agency

RMBS

Non-Agency

RMBS and

Other

Credit

Investments

Securitized

Mortgage

Loans

Weighted

Average

Asset Yield

2.9%

6.1%

7.8%

4.3%

Interest Expense

0.3%

2.0%

3.1%

1.0%

Cost of Swaps

1.0%

-

1.9%

0.7%

Effective Net Interest Spread

1.6%

4.1%

2.8%

2.6%

Debt / Equity

(3)

6.4x

2.7x

1.5x

3.8x

Effective Levered Asset Yield

(2)

12.9%

17.3%

12.2%

14.1%

(1)

Percentages reflect amount of equity allocated to Agency RMBS,

non-Agency RMBS and other credit investments and securitized mortgage loans, net of associated assets and liabilities, including the fair value of interest rate derivatives. Cash and

other net, represents cash and other assets and liabilities not

specifically allocable to Agency RMBS, non-Agency RMBS and other credit investments or securitized mortgage loans.

(2)

Effective net interest spread and effective levered asset yield are

non-GAAP financial measures, which include the cost of the Company’s Swaps as a component of its interest expense, as presented.

(3)

Debt/Equity multiples for each asset class are adjusted to reflect cash

held to meet margin calls and certain other assets and liabilities specifically allocable to Agency RMBS, non-Agency RMBS and other credit investments or securitized mortgage

loans.

|

9

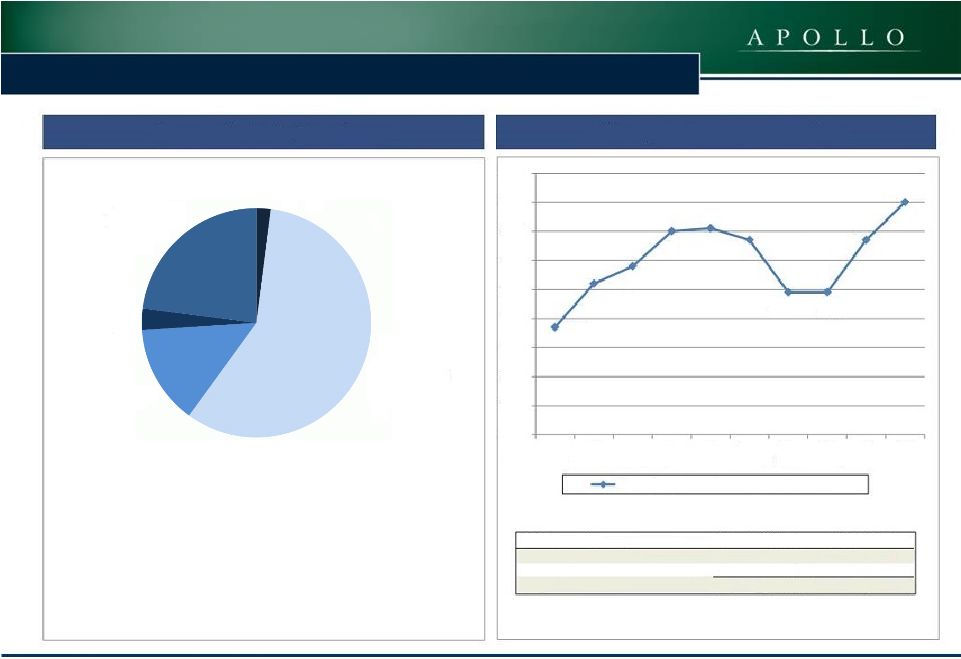

APOLLO RESIDENTIAL MORTGAGE, INC. (“AMTG”)

Agency RMBS Portfolio at September 30, 2014

Agency Portfolio Overview

Constant Prepayment Rates

(1)

Other includes Interest Only and Inverse Interest Only Securities

and Inverse Floaters. 3.7%

5.2%

5.8%

7.0%

7.1%

6.7%

4.9%

4.9%

6.7%

8.0%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

Q2

2012

Q3

2012

Q4

2012

Q1

2013

Q2

2013

Q3

2013

Q4

2013

Q1

2014

Q2

2014

Q3

2014

Total Agency Portfolio average one month CPR

Loan Balance 15

Year Pass-Throughs

2%

Loan Balance 30

Year Pass-Throughs

58%

Low Credit 30 Year

Pass-Throughs

14%

Other(1)

3%

HARP / MHA /

High LTV 30 Year

Pass-Throughs

23%

($ in thousands)

Estimated Fair Value

Q3 2014 CPR

Agency Pass-Throughs

2,084,678

$

7.9

%

Agency Inverse Floaters, IOs and IIOs

60,745

11.8

Total

2,145,423

$

8.0

% |

10

APOLLO RESIDENTIAL MORTGAGE, INC. (“AMTG”)

Agency RMBS Portfolio at September 30, 2014

Agency RMBS Portfolio Composition Summary

($ in thousands)

Principal Balance

Unamortized

Premium

Amortized Cost

(1)

Estimated Fair

Value

Weighted

Average

Coupon

Estimated

Weighted

Average

Yield

(2)

30-Year Mortgages

Fixed-rate coupons:

3.5%

149,142

$

6,878

156,020

152,392

3.50

%

2.80

4.0%

1,302,012

93,114

1,395,126

1,375,410

4.00

%

2.86

4.5%

466,745

35,394

502,139

506,427

4.50

%

3.05

1,917,899

135,386

2,053,285

2,034,229

4.08

%

2.90

15-Year Mortgages

3.0% Coupons

48,941

1,312

50,253

50,449

3.00

%

2.47

Agency Inverse Floaters

(3)

1,381

3,723

5,104

5,122

81.83

12.43

Agency IOs

(4)

-

-

24,471

25,255

4.02

%

0.41

Agency IIOs

(4)

-

-

30,445

30,368

6.22

%

12.81

Total Agency RMBS

1,968,221

$

140,421

$

2,163,558

$

2,145,423

$

4.23

%

3.02

(1)

Amortized cost is reduced by unrealized losses that are classified as

other-than-temporary impairments. (2)

Estimated weighted average yield at the date presented incorporates

prepayment assumptions and forward interest rate assumptions on Agency RMBS.

(3)

Agency inverse floaters are comprised of securities that have a floating

interest rate with coupons that reset periodically based on an index and which coupon varies inversely with changes in the index, which index is typically one-

month London Interbank Offer Rate, or LIBOR.

(4)

Agency IOs and Agency IIOs have no principal balance and bear interest

on a notional balance. The notional balance is used solely to determine interest distributions on interest-only classes of securities. At September 30, 2014,

Agency IOs had a notional balance of $293,345 and Agency Inverse IOs had

a notional balance of $143,983. |

11

APOLLO RESIDENTIAL MORTGAGE, INC. (“AMTG”)

Non-Agency

RMBS

Portfolio

Overview

(1)

Non-Agency RMBS Portfolio at September 30, 2014

Non-Agency

RMBS

Portfolio

Vintage

(1)

Non-Agency

RMBS

Cash-Flow

Profile

(1)

(1)

Includes $19,610 of small balance commercial mortgage backed

securities. Subprime

76%

Pay-Option

ARM

11%

Small

-Balance

Commercial

1%

Alt-A

12%

1998-2002

4%

2003

7%

2004

30%

2005

32%

2006

17%

2007

8%

2014

2%

Current-Pay

58%

Locked-Out

42% |

12

APOLLO RESIDENTIAL MORTGAGE, INC. (“AMTG”)

Non-Agency RMBS Portfolio at September 30, 2014

September 30, 2014

Portfolio Characteristics

Estimated Fair Value ($ in thousands)

$1,445,016

Amortized Cost to Par Value

81.5%

Net Weighted Average Security Coupon

1.2%

Collateral Attributes

Weighted Average Loan Age (months)

116

Weighted Average Original Loan-to-Value

79.8%

Weighted Average Original FICO Credit Score

642

Current Performance

60+ Day Delinquencies

29.2%

Average Credit Enhancement

(1)

33.3%

3 Month CRR

(2)

4.7%

(1) Credit enhancement is expressed as a percentage of all

outstanding mortgage loan collateral. The Company's non-Agency RMBS may incur losses if credit enhancement is reduced to zero.

(2) CRR represents conditional repayment rate. Information

is based on loans for individual groups owned by the Company. Amounts presented reflect the weighted average monthly performance for the three months ended

September 30, 2014.

|

13

APOLLO RESIDENTIAL MORTGAGE, INC. (“AMTG”)

Financing and Derivative Instruments Overview

Borrowings at September 30, 2014

Derivative Instruments at September 30, 2014

Swaps Overview at September 30, 2014

Swaptions Overview at September 30, 2014

($ in

thousands)

Notional Amount

Estimated Fair

Value

Swaps -

assets

957,000

$

22,429

$

Swaptions -

assets

1,100,000

2,593

Swaps -

(liabilities)

730,000

(5,018)

Total Derivative Instruments

2,787,000

$

20,004

$

($ in thousands)

Term to Maturity

Notional Amount

Average Fixed Pay

Rate

Average

Maturity

(Years)

Greater than 1 year up to 3 years

920,000

$

1.07%

2.7

Greater than 3 years up to 5 years

189,000

1.02%

3.5

Greater than 5 years

578,000

2.13%

8.2

Total

1,687,000

$

1.43%

4.6

($ in thousands)

Weighted

Average

Weighted

Months Until

Average

Fixed Pay Rate for

Option

Notional

Swap Terms

Fixed-Pay

Underlying Swap

Fair Value

Expiration

Amount

(Years)

Rate

2.50 -

3.00%

768

$

8

160,000

$

5.0

2.77%

3.00 -

3.50%

183

11

15,000

10.0

3.42%

3.50 -

4.00%

1,642

6

925,000

10.0

3.76%

2,593

$

6

1,100,000

$

9.3

3.61%

Option

Underlying Swap

($ in thousands)

Balance

Weighted

Average

Borrowing

Rate

Weighted

Average

Remaining

Maturity

Repurchase agreement borrowings:

Agency RMBS

1,934,669

$

0.33%

16 days

Non-Agency RMBS

(1)

1,116,411

1.97%

167 days

Other investment securities

25,728

1.74%

77 days

Total repurchase agreements

3,076,808

$

0.94%

71 days

Securitized debt

34,947

$

4.00%

53 months

(2)

Total Borrowings

3,111,755

$

0.97%

(1)

Includes $29,177 of repurchase borrowings collateralized by

non-Agency RMBS of $48,036 that were eliminated from the Company’s consolidated balance sheet in consolidation with the variable interest entity associated with our securitization transaction.

(2)

Securitized debt, which represents non-recourse senior securities

sold to third parties in connection with a securitization transaction, has a final contractual maturity of May 2047. Weighted average remaining maturity represents the underwritten final maturity of the security

based on the projected final repayment of principal. The actual

maturity of the securitized debt may differ significantly given that actual interest collections, mortgage prepayments and/or losses on liquidation of mortgages may differ significantly from those expected.

|

14

APOLLO RESIDENTIAL MORTGAGE, INC. (“AMTG”)

Financials |

15

APOLLO RESIDENTIAL MORTGAGE, INC. (“AMTG”)

Balance Sheet

(in thousands—except share and per share data)

September 30, 2014

December 31, 2013

Assets:

(unaudited)

Cash

105,904

$

127,959

$

Restricted cash

66,399

67,458

RMBS, at fair value (of which $3,424,933 and $3,317,060 were pledged

as collateral, respectively) 3,590,439

3,503,326

Securitized mortgage loans (transferred to a consolidated VIE), at

fair value 106,947

110,984

30,688

11,515

Other investments

25,512

-

Investment related receivable (of which $0 and $21,959 were pledged as

collateral, respectively) 6,095

24,887

Interest receivable

10,020

10,396

Deferred financing costs, net

773

882

Derivative instruments, at fair value

25,022

53,315

Other assets

1,072

854

Total Assets

3,968,871

$

3,911,576

$

Liabilities and Stockholders' Equity

Liabilities:

Borrowings under repurchase agreements

3,076,808

$

3,034,058

$

Non-recourse securitized debt, at fair value

36,188

43,354

Investment related payable

11,505

-

Obligation to return cash held as collateral

14,656

38,654

Accrued interest payable

10,332

8,708

Derivative instruments, at fair value

5,018

4,610

Payable to related party

5,036

5,444

Dividends payable

17,558

16,812

Accounts payable and accrued expenses

1,336

2,335

Other liabilities

6

-

Total Liabilities

3,178,443

$

3,153,975

$

Stockholders' Equity:

Preferred stock, $0.01 par value, 50,000,000 shares authorized,

6,900,000 shares issued and outstanding ($172,500 aggregate

liquidation preference) 69

$

69

$

Common stock, $0.01 par value, 450,000,000 shares authorized,

32,063,141 and 32,038,970 shares issued and outstanding,

respectively 321

320

Additional paid-in-capital

793,021

792,010

Accumulated deficit

(2,983)

(34,798)

Total Stockholders' Equity

790,428

$

757,601

$

Total Liabilities and Stockholders'

Equity 3,968,871

$

3,911,576

$

Other investment securities, at fair value (of

which $30,688 and $11,515 were pledged as collateral, respectively) |

16

APOLLO RESIDENTIAL MORTGAGE, INC. (“AMTG”)

Income Statement

(in thousands—except per share data)

2014

2013

2014

2013

Interest Income:

RMBS

36,277

$

32,013

$

108,093

$

107,959

$

Securitized mortgage loans

1,871

2,324

6,044

5,954

Other

394

79

726

79

Total Interest Income

38,542

34,416

114,863

113,992

Interest Expense:

Repurchase agreements

(7,310)

(6,299)

(21,214)

(18,935)

Securitized debt

(398)

(490)

(1,272)

(1,308)

Total Interest Expense

(7,708)

(6,789)

(22,486)

(20,243)

Net Interest Income

30,834

$

27,627

$

92,377

$

93,749

$

Other Income/(Loss):

Realized gain/(loss) on sale of RMBS, net

2,581

$

(16,596)

$

(16,301)

$

(48,309)

$

Gain/(loss) on derivative instruments, net (includes

$12,434, ($27,572), ($20,751) and $50,547 of unrealized

gains/(losses), net, respectively)

801

(21,687)

(63,522)

55,884

Unrealized gain/(loss) on RMBS, net

(16,971)

28,143

85,266

(139,727)

Unrealized gain/(loss) on securitized debt

67

(428)

(287)

(413)

Unrealized gain/(loss) on securitized mortgage loans, net

(650)

537

2,440

(88)

Unrealized gain/(loss) on other investment securities

(101)

116

75

116

Other, net

39

4

14

72

Other Income/(Loss), net

(14,234)

$

(9,911)

$

7,685

$

(132,465)

$

Operating Expenses:

General and administrative (includes ($144), ($207), ($1,011) and

($752) of non-cash stock based compensation,

respectively) (2,925)

$

(3,089)

$

(8,941)

$

(8,374)

$

Management

fee

-

related

party

(2,800)

(2,941)

(8,360)

(8,651)

Total Operating Expenses

(5,725)

$

(6,030)

$

(17,301)

$

(17,025)

$

Net Income/(Loss)

10,875

$

11,686

$

82,761

$

(55,741)

$

Preferred Stock Dividends Declared

(3,450)

(3,450)

(10,350)

(10,350)

Net Income/(Loss) Allocable to Common Stock and

Participating Securities

7,425

$

8,236

$

72,411

$

(66,091)

$

Earnings/(Loss)

per

Share

of

Common

Stock

-

Basic

and

Diluted

0.23

$

0.25

$

2.25

$

(2.22)

$

Dividends Declared per Share of Common

Stock 0.44

$

0.40

$

1.26

$

1.80

$

Three Months Ended

September 30,

NineMonths Ended

September 30,

(Unaudited)

(Unaudited) |

17

APOLLO RESIDENTIAL MORTGAGE, INC. (“AMTG”)

Reconciliation

of

Operating

Earnings

(1)

(in thousands—except share and per share data)

September 30, 2014

Per Share

Amount

(2)

September 30, 2013

Per Share

Amount

(2)

Operating Earnings:

Net income/(loss) allocable to common stockholders

7,344

$

0.23

$

8,158

$

0.25

$

Adjustments:

Non-cash stock-based compensation expense

144

-

207

0.01

Unrealized (gain)/loss on RMBS, net

16,971

0.53

(28,143)

(0.88)

Unrealized (gain)/loss on derivatives, net

(12,434)

(0.39)

27,572

0.86

Unrealized (gain)/loss on securitized mortgage loans, net

650

0.02

(537)

(0.02)

Unrealized (gain)/loss on securitized debt

(67)

-

428

0.01

Unrealized (gain)/loss on other investment securities

101

-

(116)

-

Realized (gain)/loss on sale of RMBS, net

(2,581)

(0.08)

16,596

0.52

Realized (gain) on Short TBA Contracts

-

-

(281)

(0.01)

Realized (gain)/loss on Swaps/Swaption terminations and

expirations, net

6,505

0.20

(12,498)

(0.38)

Tax amortization of (loss) on Swaption terminations and

expirations, net

(250)

-

-

-

Other, net

(11)

-

-

-

Total adjustments to arrive at operating earnings:

9,028

0.28

3,228

0.11

Operating Earnings

16,372

$

0.51

$

11,386

$

0.36

$

Weighted average common shares

32,035,376

31,999,792

Three Months Ended

Three Months Ended

(1)

Operating Earnings and Operating Earnings per share of common stock are

non-GAAP financial measures. Operating Earnings and Operating Earnings per hare of common stock presented exclude, as applicable: (i) certain realized and unrealized gains and losses recognized

through earnings; (ii) non-cash equity compensation; (iii) one time

events pursuant to changes in GAAP; and (iv) certain other non-cash charges. Operating Earnings represents the earnings, as adjusted, allocable to common stock.

(2)

Reflects per share amount for each component presented.

|

18

APOLLO RESIDENTIAL MORTGAGE, INC. (“AMTG”)

Reconciliation of Operating Earnings

(1)

and Effective Cost of Funds

(2)

Effective Cost of Funds

($ in thousands)

Reconciliation

Cost of Funds/Effective

Cost of Funds

Interest expense

7,708

$

0.99%

Adjustment:

Net-interest paid for Swaps

5,128

0.66%

Effective interest expense/effective cost of funds

12,836

$

1.65%

Weighted average balance of borrowings

3,304,970

$

September 30, 2014

Three Months Ended

(in thousands—except share and per share data)

September 30, 2014

Per Share

Amount

(3)

September 30, 2013

Per Share

Amount

(3)

Operating Earnings:

Net income/(loss) allocable to common stockholders

71,960

$

2.25

$

(66,442)

$

(2.22)

$

Adjustments:

Non-cash stock-based compensation expense

1,011

0.03

752

0.03

Unrealized (gain)/loss on RMBS, net

(85,266)

(2.66)

139,727

4.67

Unrealized (gain)/loss on derivatives, net

20,751

0.65

(50,547)

(1.69)

Unrealized (gain)/loss on securitized mortgage loans, net

(2,440)

(0.08)

88

-

Unrealized loss on securitized debt

287

0.01

413

0.01

Unrealized (gain) on other investment securities

(75)

-

(116)

-

Realized loss on sale of RMBS, net

16,301

0.51

48,309

1.61

Realized (gain)/ loss on Short TBA Contracts

7,156

0.22

(281)

(0.01)

Realized (gain)/loss on Swaps/Swaption terminations and

expirations, net

20,617

0.64

(22,526)

(0.75)

Tax amortization of gain/(loss) on Swaption terminations and

expirations, net

(342)

(0.01)

-

-

Other

52

-

-

-

Total adjustments to arrive at operating earnings:

(21,948)

(0.69)

115,819

3.87

Operating Earnings

50,012

$

1.56

$

49,377

$

1.65

$

Weighted average common shares

32,023,617

29,916,932

Nine Months Ended

Nine Months Ended

(1)

Operating Earnings and Operating Earnings per common share are

non-GAAP financial measures. Operating Earnings and Operating Earnings per common share presented exclude, as applicable: (i) certain realized and unrealized gains and losses recognized through

earnings; (ii) non-cash equity compensation; (iii) one time events

pursuant to changes in GAAP; and (iv) certain other non-cash charges. Operating Earnings represents the earnings, as adjusted, allocable to common stock.

(2)

Effective cost of funds reflects interest expense adjusted to include

the net interest component related to Swaps. (3) Reflects per share amount for

each component presented. |

19

APOLLO RESIDENTIAL MORTGAGE, INC. (“AMTG”)

Contact Information

Hilary Ginsberg

Investor Relations Manager

212-822-0767 |