Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CINCINNATI BELL INC | a8-kearningsreleaseshellq3.htm |

| EX-99.1 - EARNINGS RELEASE - CINCINNATI BELL INC | earningsreleaseq32014.htm |

Cincinnati Bell Third Quarter 2014 Results November 5, 2014

Today’s Agenda Strategic Initiatives Ted Torbeck, President & Chief Executive Officer Financial Overview & Segment Results Leigh Fox, Chief Financial Officer Question & Answer 2

Safe Harbor This presentation and the documents incorporated by reference herein contain forward-looking statements regarding future events and our future results that are subject to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, are statements that could be deemed forward-looking statements. These statements are based on current expectations, estimates, forecasts, and projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,” “predicts,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “endeavors,” “strives,” “may,” variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of our future financial performance, our anticipated growth and trends in our businesses, and other characterizations of future events or circumstances are forward-looking statements. Readers are cautioned these forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially and adversely from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this release and those discussed in other documents we file with the Securities and Exchange Commission (SEC). More information on potential risks and uncertainties is available in our recent filings with the SEC, including Cincinnati Bell’s Form 10-K report, Form 10-Q reports and Form 8-K reports. Actual results may differ materially and adversely from those expressed in any forward-looking statements. We undertake no obligation to revise or update any forward-looking statements for any reason. 3

Non GAAP Financial Measures This presentation contains information about adjusted earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA), Adjusted EBITDA margin, net debt and free cash flow. These are non-GAAP financial measures used by Cincinnati Bell management when evaluating results of operations and cash flow. Management believes these measures also provide users of the financial statements with additional and useful comparisons of current results of operations and cash flows with past and future periods. Non- GAAP financial measures should not be construed as being more important than comparable GAAP measures. Detailed reconciliations of Adjusted EBITDA, net debt and free cash flow (including the Company’s definition of these terms) to comparable GAAP financial measures can be found in the earnings release on our website at www.cincinnatibell.com within the Investor Relations section. 4

Ted Torbeck President & Chief Executive Officer 5

2014 Key Objectives • Continue to invest in high demand strategic products • Evaluate opportunities to monetize CyrusOne investment • Manage wireless operations for profitability and cash flows as we consider strategic options for this business – Fioptics – Metro-Ethernet – VoIP – Managed & Professional Services 6

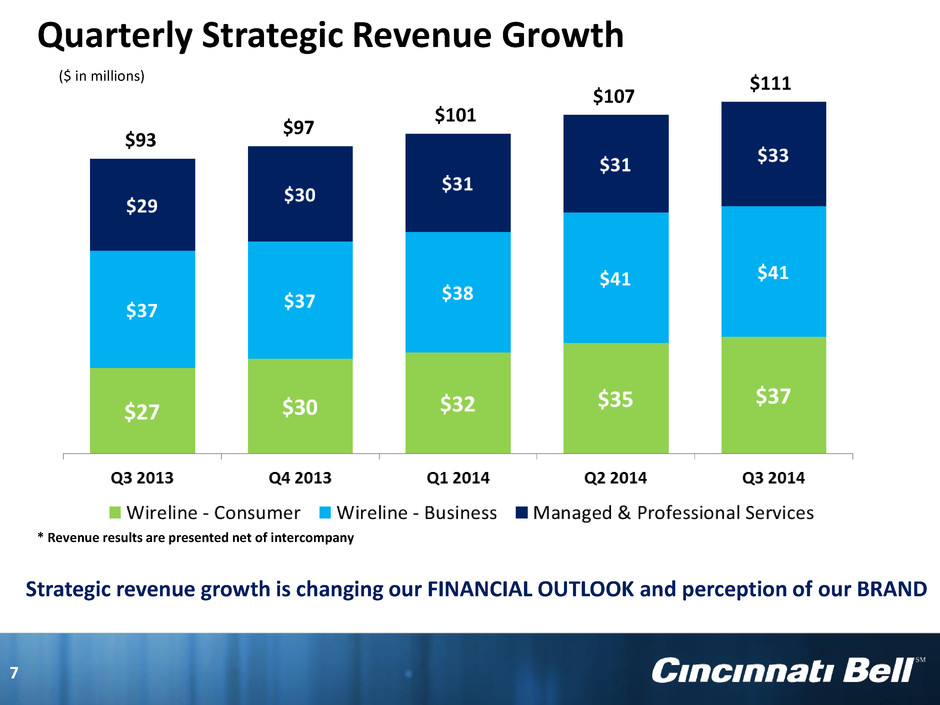

Quarterly Strategic Revenue Growth ($ in millions) * Revenue results are presented net of intercompany 7 $93 $97 $101 $107 $111 Strategic revenue growth is changing our FINANCIAL OUTLOOK and perception of our BRAND

CyrusOne Monetization 8 • Sold 16 million CyrusOne Partnership units with proceeds totaling $356 million – Proceeds used to repay a portion of our 8.75% Senior Subordinated Notes due 2018, reducing interest payments $28 million annually – Remaining 44% ownership currently valued at approximately $750 million – Tax gains from future monetization sheltered by $750 million of tax NOLs • Our strategy has not changed – Patient investor focused on a well-timed and thoughtfully developed monetization strategy to maximize shareholder value – CyrusOne reported outstanding third quarter results: o Revenue $85 million, up 26% year-over-year o Adjusted EBITDA $42 million, up 16% year-over-year

Wireless Sale Impact • Spectrum sale closed on September 30, 2014 – Cash proceeds of $194 million • Transfer of lease liabilities and other assets valued at approximately $16 million will occur once we no longer provide wireless service (later of 90 days after close of spectrum sale and April 6, 2015) • Broadens our relationship with Verizon – Expect increased foot traffic in Fioptics retail stores – Opportunity to provide additional carrier services 9

Leigh Fox Chief Financial Officer 10

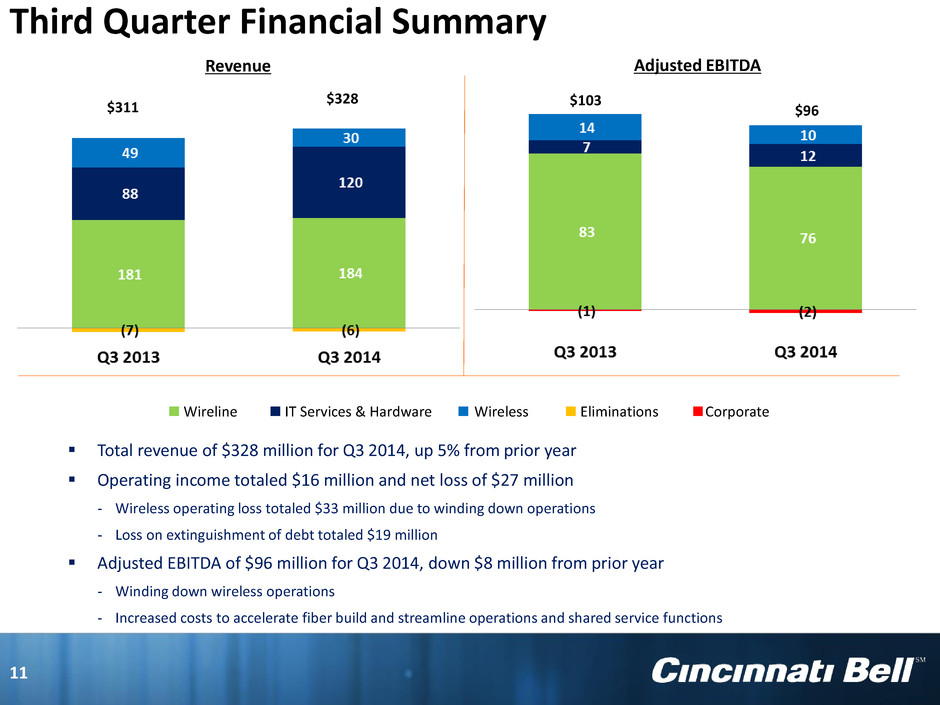

Third Quarter Financial Summary Revenue Adjusted EBITDA Total revenue of $328 million for Q3 2014, up 5% from prior year Operating income totaled $16 million and net loss of $27 million - Wireless operating loss totaled $33 million due to winding down operations - Loss on extinguishment of debt totaled $19 million Adjusted EBITDA of $96 million for Q3 2014, down $8 million from prior year - Winding down wireless operations - Increased costs to accelerate fiber build and streamline operations and shared service functions Wireline Wireless Corporate Eliminations $311 $328 $103 $96 IT Services & Hardware 11

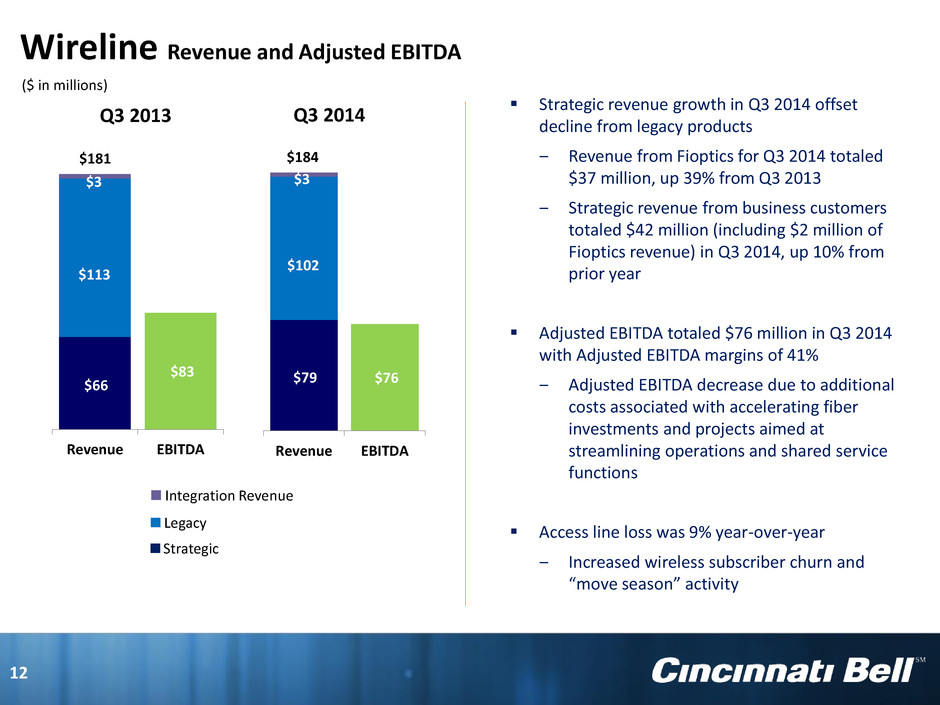

$66 $113 $3 $83 Revenue EBITDA $79 $102 $3 $76 Revenue EBITDA Strategic revenue growth in Q3 2014 offset decline from legacy products ‒ Revenue from Fioptics for Q3 2014 totaled $37 million, up 39% from Q3 2013 ‒ Strategic revenue from business customers totaled $42 million (including $2 million of Fioptics revenue) in Q3 2014, up 10% from prior year Adjusted EBITDA totaled $76 million in Q3 2014 with Adjusted EBITDA margins of 41% ‒ Adjusted EBITDA decrease due to additional costs associated with accelerating fiber investments and projects aimed at streamlining operations and shared service functions Access line loss was 9% year-over-year ‒ Increased wireless subscriber churn and “move season” activity ($ in millions) Wireline Revenue and Adjusted EBITDA Integration Revenue Strategic Legacy 12 Q3 2013 $184 Q3 2014 $181

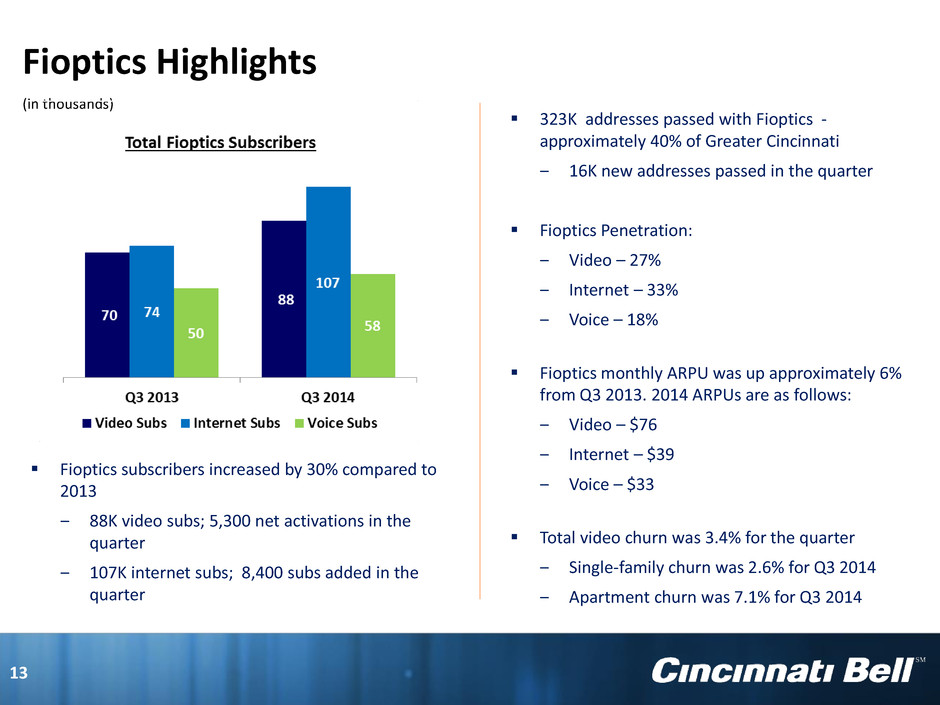

323K addresses passed with Fioptics - approximately 40% of Greater Cincinnati ‒ 16K new addresses passed in the quarter Fioptics Penetration: ‒ Video – 27% ‒ Internet – 33% ‒ Voice – 18% Fioptics monthly ARPU was up approximately 6% from Q3 2013. 2014 ARPUs are as follows: ‒ Video – $76 ‒ Internet – $39 ‒ Voice – $33 Total video churn was 3.4% for the quarter ‒ Single-family churn was 2.6% for Q3 2014 ‒ Apartment churn was 7.1% for Q3 2014 Fioptics Highlights (in thousands) Fioptics subscribers increased by 30% compared to 2013 ‒ 88K video subs; 5,300 net activations in the quarter ‒ 107K internet subs; 8,400 subs added in the quarter 13

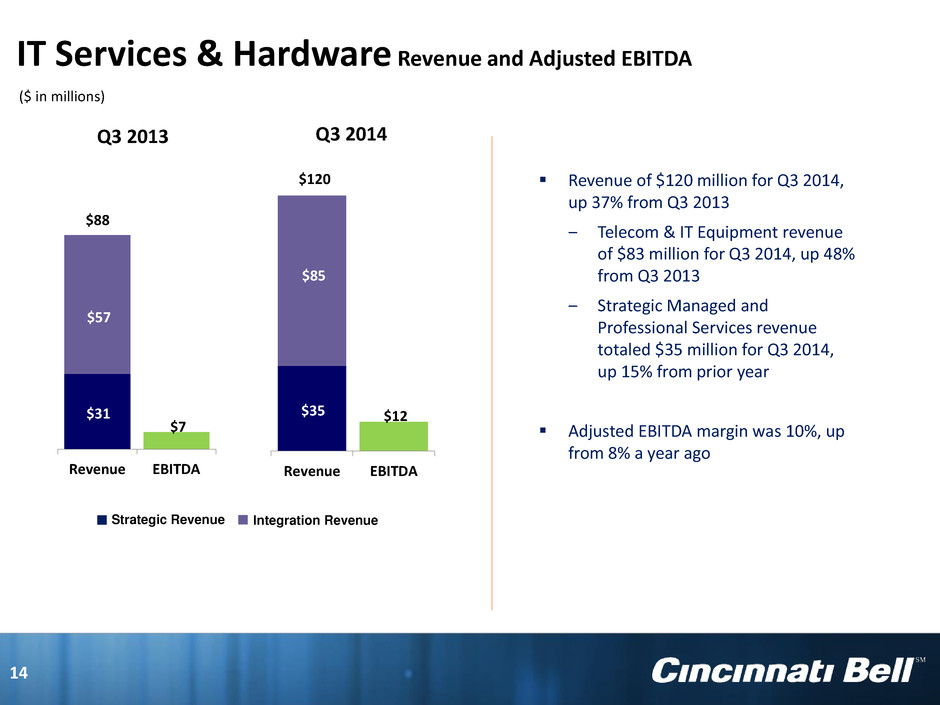

IT Services & Hardware Revenue and Adjusted EBITDA ($ in millions) Revenue of $120 million for Q3 2014, up 37% from Q3 2013 ‒ Telecom & IT Equipment revenue of $83 million for Q3 2014, up 48% from Q3 2013 ‒ Strategic Managed and Professional Services revenue totaled $35 million for Q3 2014, up 15% from prior year Adjusted EBITDA margin was 10%, up from 8% a year ago Integration Revenue Strategic Revenue 14 $31 $57 $7 Revenue EBITDA $35 $85 $12 Revenue EBITDA Q3 2013 Q3 2014 $120 $88

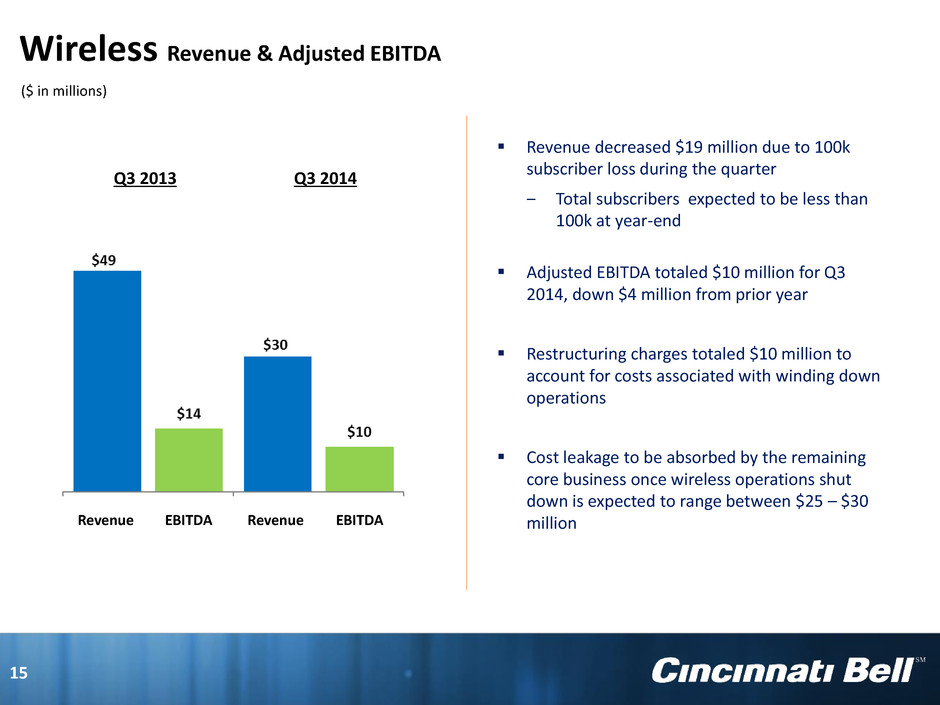

Wireless Revenue & Adjusted EBITDA ($ in millions) Revenue decreased $19 million due to 100k subscriber loss during the quarter ‒ Total subscribers expected to be less than 100k at year-end Adjusted EBITDA totaled $10 million for Q3 2014, down $4 million from prior year Restructuring charges totaled $10 million to account for costs associated with winding down operations Cost leakage to be absorbed by the remaining core business once wireless operations shut down is expected to range between $25 – $30 million Revenue EBITDA Revenue EBITDA Q3 2013 Q3 2014 15

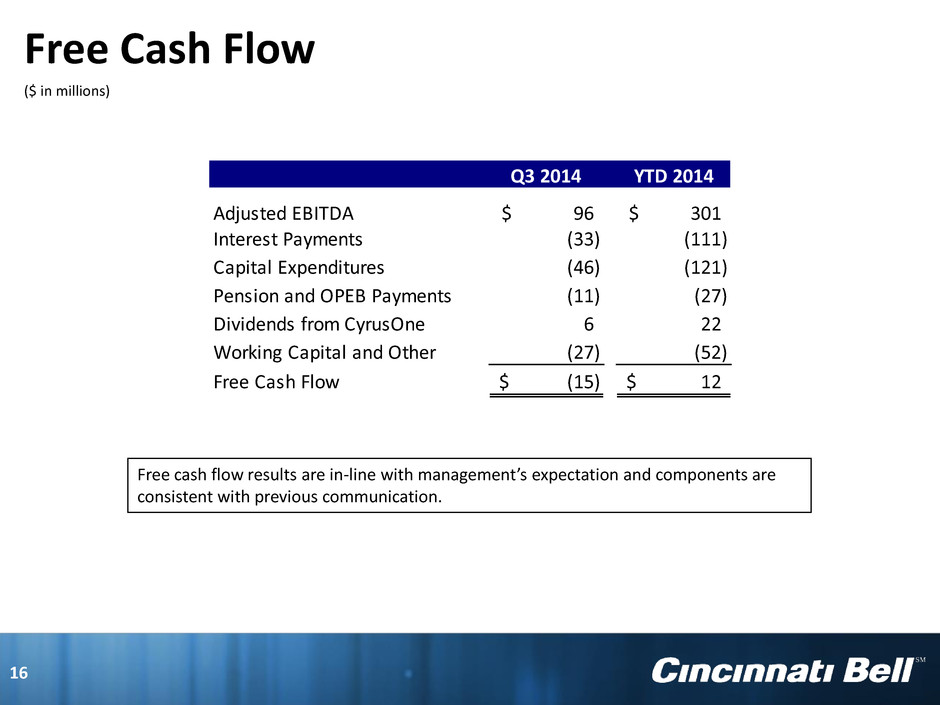

Free Cash Flow ($ in millions) Q3 2014 YTD 2014 Adjusted EBITDA 96$ 301$ Interest Payments (33) (111) Capital Expenditures (46) (121) Pension and OPEB Payments (11) (27) Dividends from CyrusOne 6 22 Working Capital and Other (27) (52) Free Cash Flow (15)$ 12$ Free cash flow results are in-line with management’s expectation and components are consistent with previous communication. 16

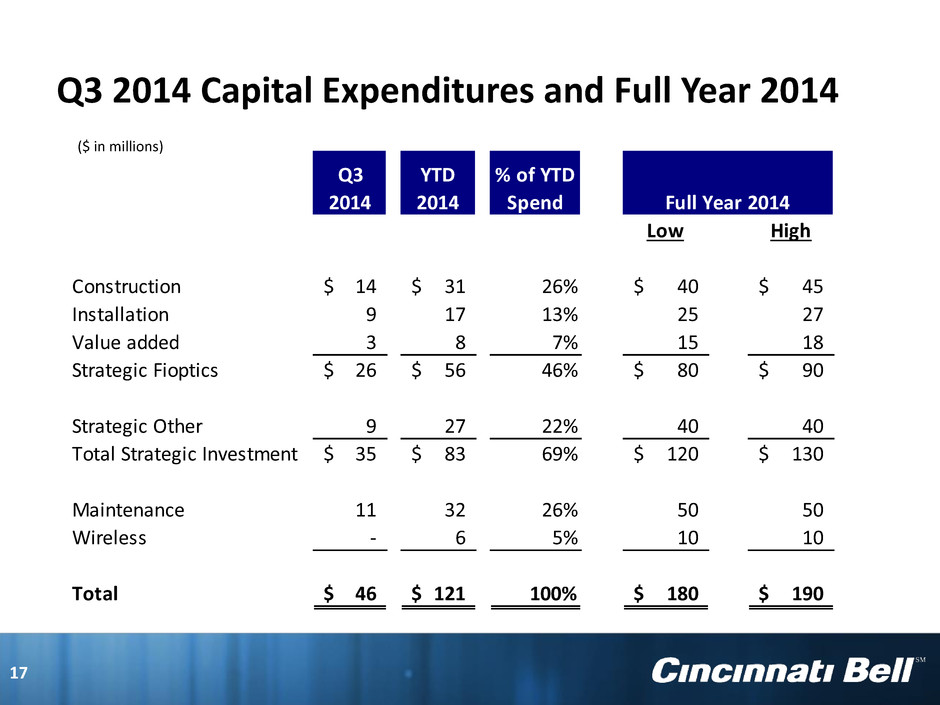

Q3 2014 YTD 2014 % of YTD Spend Low High Construction 14$ 31$ 26% 40$ 45$ Installation 9 17 13% 25 27 Value added 3 8 7% 15 18 Strategic Fioptics 26$ 56$ 46% 80$ 90$ Strategic Other 9 27 22% 40 40 Total Strategic Investment 35$ 83$ 69% 120$ 130$ Maintenance 11 32 26% 50 50 Wireless - 6 5% 10 10 Total 46$ 121$ 100% 180$ 190$ Full Year 2014 Q3 2014 Capital Expenditures and Full Year 2014 ($ in millions) 17

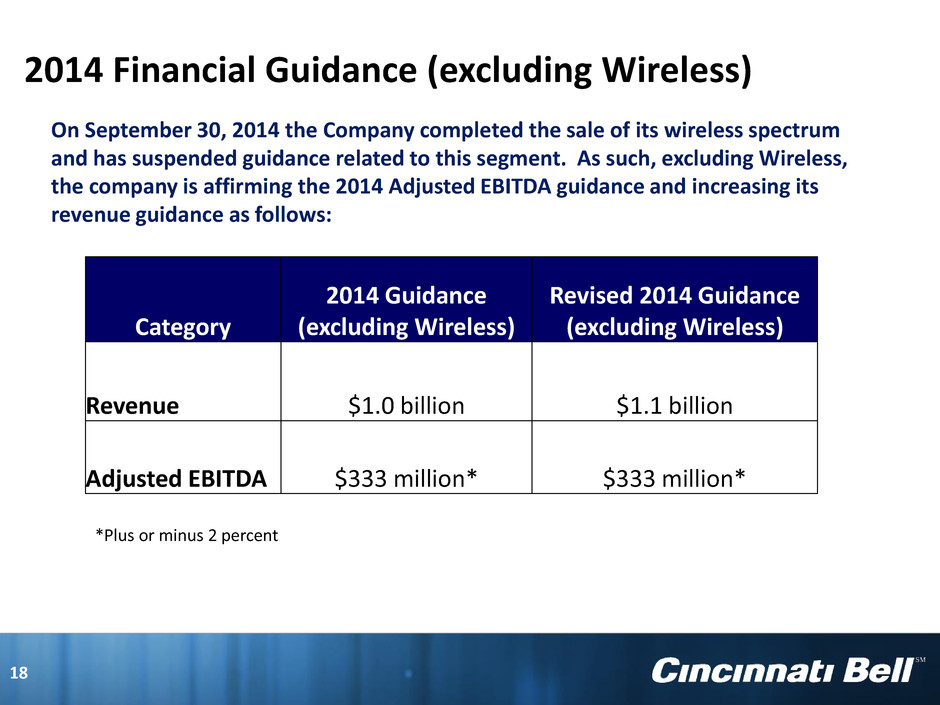

*Plus or minus 2 percent 2014 Financial Guidance (excluding Wireless) 18 On September 30, 2014 the Company completed the sale of its wireless spectrum and has suspended guidance related to this segment. As such, excluding Wireless, the company is affirming the 2014 Adjusted EBITDA guidance and increasing its revenue guidance as follows: Category 2014 Guidance (excluding Wireless) Revised 2014 Guidance (excluding Wireless) Revenue $1.0 billion $1.1 billion Adjusted EBITDA $333 million* $333 million*

Appendix 19

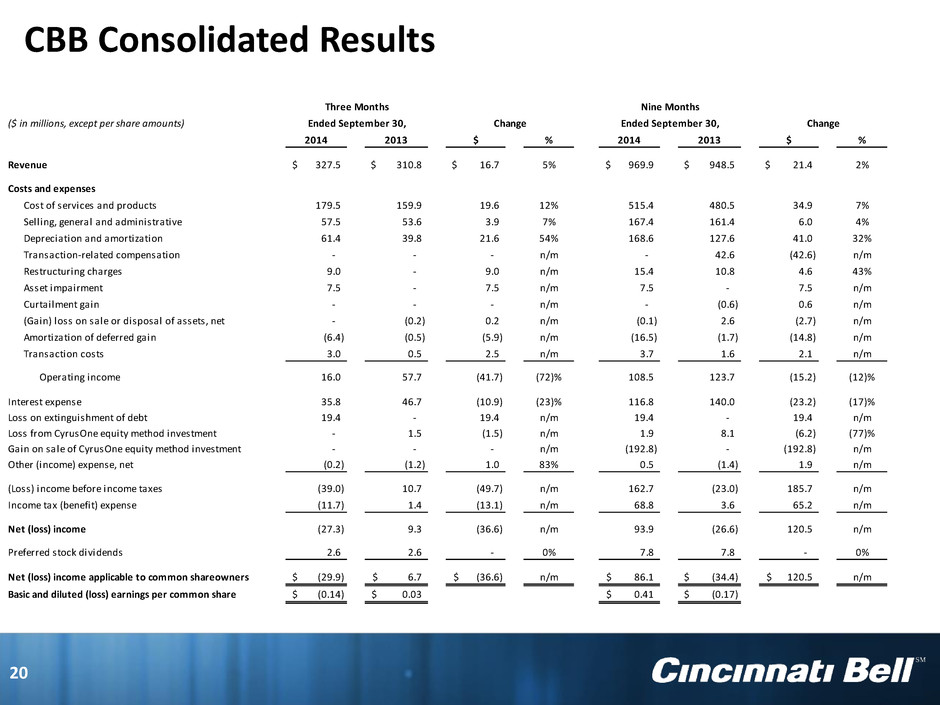

CBB Consolidated Results ($ in millions, except per share amounts) 2014 2013 $ % 2014 2013 $ % Revenue 327.5$ 310.8$ 16.7$ 5% 969.9$ 948.5$ 21.4$ 2% Costs and expenses Cost of services and products 179.5 159.9 19.6 12% 515.4 480.5 34.9 7% Selling, general and administrative 57.5 53.6 3.9 7% 167.4 161.4 6.0 4% Depreciation and amortization 61.4 39.8 21.6 54% 168.6 127.6 41.0 32% Transaction-related compensation - - - n/m - 42.6 (42.6) n/m Restructuring charges 9.0 - 9.0 n/m 15.4 10.8 4.6 43% Asset impairment 7.5 - 7.5 n/m 7.5 - 7.5 n/m Curtailment gain - - - n/m - (0.6) 0.6 n/m (Gain) loss on sale or disposal of assets, net - (0.2) 0.2 n/m (0.1) 2.6 (2.7) n/m Amortization of deferred gain (6.4) (0.5) (5.9) n/m (16.5) (1.7) (14.8) n/m Transaction costs 3.0 0.5 2.5 n/m 3.7 1.6 2.1 n/m Operating income 16.0 57.7 (41.7) (72)% 108.5 123.7 (15.2) (12)% Interest expense 35.8 46.7 (10.9) (23)% 116.8 140.0 (23.2) (17)% Loss on extinguishment of debt 19.4 - 19.4 n/m 19.4 - 19.4 n/m Loss from CyrusOne equity method investment - 1.5 (1.5) n/m 1.9 8.1 (6.2) (77)% Gain on sale of CyrusOne equity method investment - - - n/m (192.8) - (192.8) n/m Other (income) expense, net (0.2) (1.2) 1.0 83% 0.5 (1.4) 1.9 n/m (Loss) income before income taxes (39.0) 10.7 (49.7) n/m 162.7 (23.0) 185.7 n/m Income tax (benefit) expense (11.7) 1.4 (13.1) n/m 68.8 3.6 65.2 n/m Net (loss) income (27.3) 9.3 (36.6) n/m 93.9 (26.6) 120.5 n/m Preferred stock dividends 2.6 2.6 - 0% 7.8 7.8 - 0% Net (loss) income applicable to common shareowners (29.9)$ 6.7$ (36.6)$ n/m 86.1$ (34.4)$ 120.5$ n/m Basic and diluted (loss) earnings per common share (0.14)$ 0.03$ 0.41$ (0.17)$ Change Three Months Ended September 30, Change Nine Months Ended September 30, 20

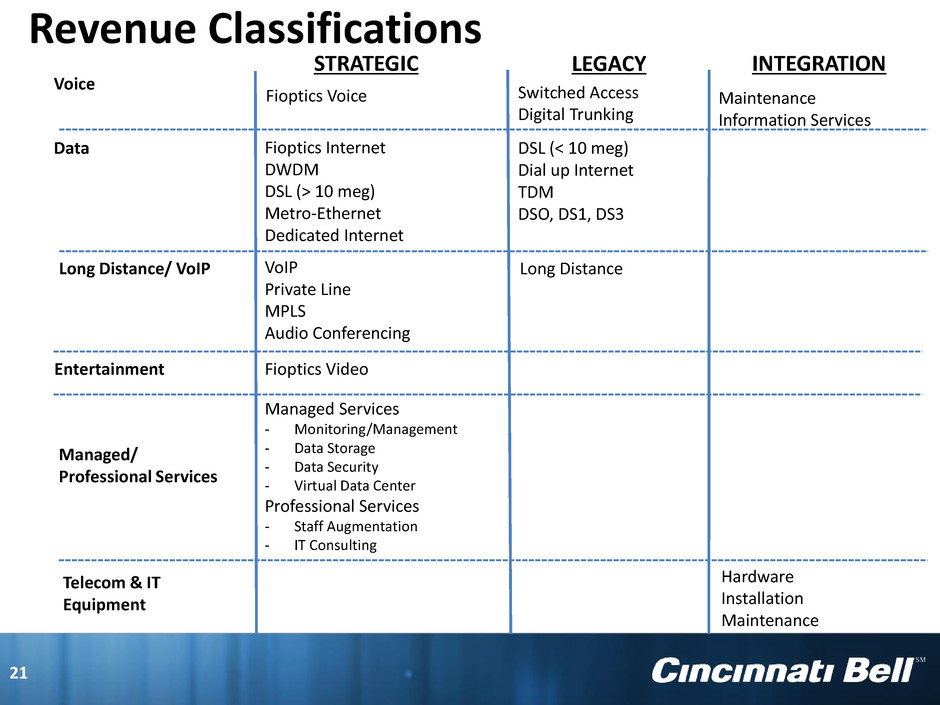

Revenue Classifications Voice STRATEGIC LEGACY INTEGRATION Fioptics Voice Switched Access Digital Trunking Data Fioptics Internet DWDM DSL (> 10 meg) Metro-Ethernet Dedicated Internet DSL (< 10 meg) Dial up Internet TDM DSO, DS1, DS3 Long Distance/ VoIP VoIP Private Line MPLS Audio Conferencing Managed/ Professional Services Managed Services - Monitoring/Management - Data Storage - Data Security - Virtual Data Center Professional Services - Staff Augmentation - IT Consulting Telecom & IT Equipment Hardware Installation Maintenance Maintenance Information Services Long Distance Entertainment Fioptics Video 21

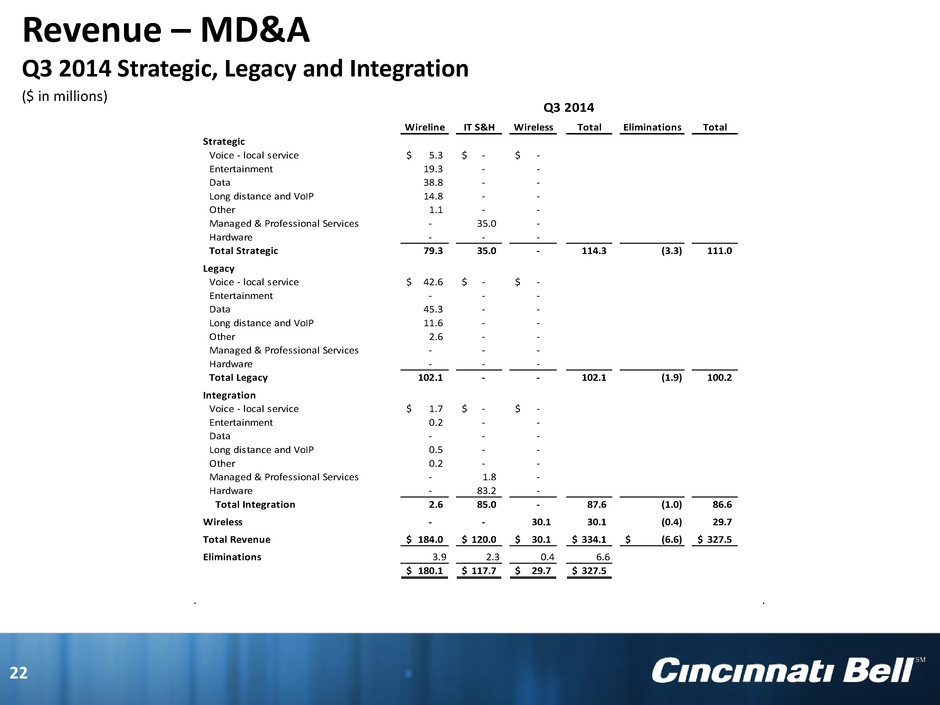

Revenue – MD&A Q3 2014 Strategic, Legacy and Integration ($ in millions) Wireline IT S&H Wireless Total Eliminations Total Strategic Voice - local service 5.3$ -$ -$ Entertainment 19.3 - - Data 38.8 - - Long distance and VoIP 14.8 - - Other 1.1 - - Managed & Professional Services - 35.0 - Hardware - - - Total Strategic 79.3 35.0 - 114.3 (3.3) 111.0 Legacy Voice - local service 42.6$ -$ -$ Entertainment - - - Data 45.3 - - Long distance and VoIP 11.6 - - Other 2.6 - - Managed & Professional Services - - - Hardware - - - Total Legacy 102.1 - - 102.1 (1.9) 100.2 Integration Voice - local service 1.7$ -$ -$ Entertainment 0.2 - - Data - - - Long distance and VoIP 0.5 - - Other 0.2 - - Managed & Professional Services - 1.8 - Hardware - 83.2 - Total Integration 2.6 85.0 - 87.6 (1.0) 86.6 Wireless - - 30.1 30.1 (0.4) 29.7 Total Revenue 184.0$ 120.0$ 30.1$ 334.1$ (6.6)$ 327.5$ Eliminations 3.9 2.3 0.4 6.6 180.1$ 117.7$ 29.7$ 327.5$ Q3 2014 22

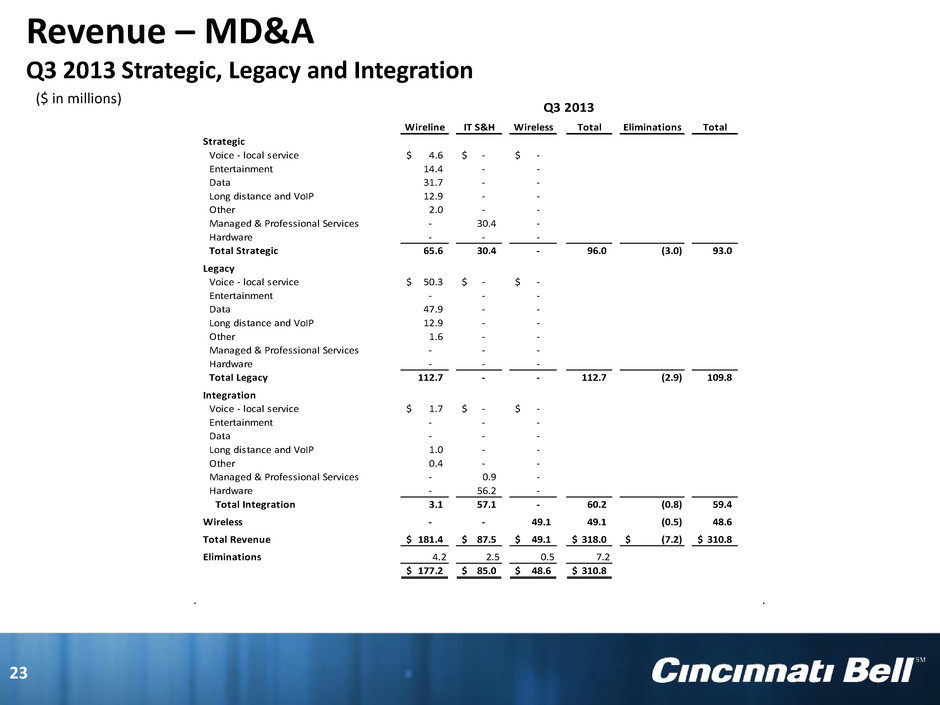

Revenue – MD&A Q3 2013 Strategic, Legacy and Integration ($ in millions) 23 Wireline IT S&H Wireless Total Eliminations Total Strategic Voice - local service 4.6$ -$ -$ Entertainment 14.4 - - Data 31.7 - - Long distance and VoIP 12.9 - - Other 2.0 - - Managed & Professional Services - 30.4 - Hardware - - - Total Strategic 65.6 30.4 - 96.0 (3.0) 93.0 Legacy Voice - local service 50.3$ -$ -$ Entertainment - - - Data 47.9 - - Long distance and VoIP 12.9 - - Other 1.6 - - Managed & Professional Services - - - Hardware - - - Total Legacy 112.7 - - 112.7 (2.9) 109.8 Integration Voice - local service 1.7$ -$ -$ Entertainment - - - Data - - - Long distance and VoIP 1.0 - - Other 0.4 - - Managed & Professional Services - 0.9 - Hardware - 56.2 - Total Integration 3.1 57.1 - 60.2 (0.8) 59.4 Wireless - - 49.1 49.1 (0.5) 48.6 Total Revenue 181.4$ 87.5$ 49.1$ 318.0$ (7.2)$ 310.8$ Eliminations 4.2 2.5 0.5 7.2 177.2$ 85.0$ 48.6$ 310.8$ Q3 2013

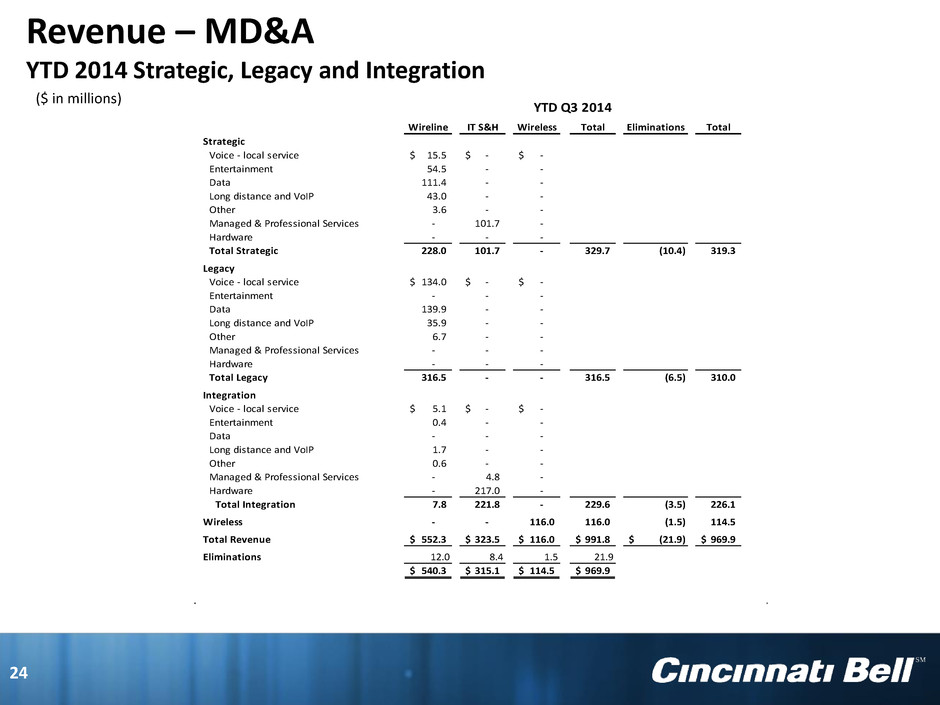

Revenue – MD&A YTD 2014 Strategic, Legacy and Integration ($ in millions) 24 Wireline IT S&H Wireless Total Eliminations Total Strategic Voice - local service 15.5$ -$ -$ Entertainment 54.5 - - Data 111.4 - - Long distance and VoIP 43.0 - - Other 3.6 - - Managed & Professional Services - 101.7 - Hardware - - - Total Strategic 228.0 101.7 - 329.7 (10.4) 319.3 Legacy Voice - local service 134.0$ -$ -$ Entertainment - - - Data 139.9 - - Long distance and VoIP 35.9 - - Other 6.7 - - Managed & Professional Services - - - Hardware - - - Total Legacy 316.5 - - 316.5 (6.5) 310.0 Integration Voice - local service 5.1$ -$ -$ Entertainment 0.4 - - Data - - - Long distance and VoIP 1.7 - - Other 0.6 - - Managed & Professional Services - 4.8 - Hardware - 217.0 - Total Integration 7.8 221.8 - 229.6 (3.5) 226.1 Wireless - - 116.0 116.0 (1.5) 114.5 Total Revenue 552.3$ 323.5$ 116.0$ 991.8$ (21.9)$ 969.9$ Eliminations 12.0 8.4 1.5 21.9 540.3$ 315.1$ 114.5$ 969.9$ YTD Q3 2014

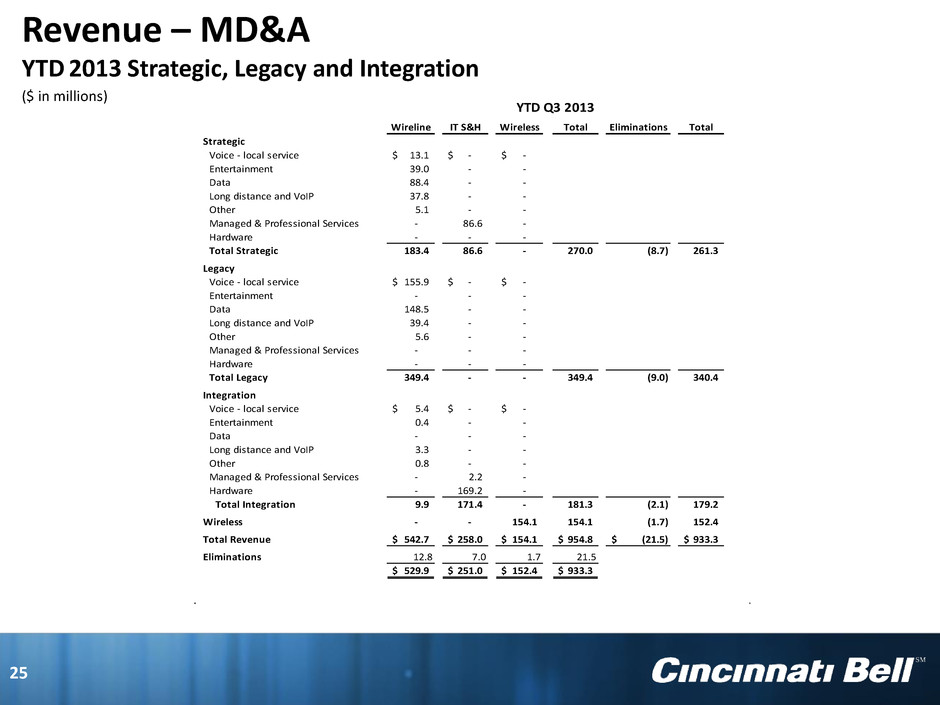

Revenue – MD&A YTD 2013 Strategic, Legacy and Integration ($ in millions) 25 Wireline IT S&H Wireless Total Eliminations Total Strategic Voice - local service 13.1$ -$ -$ Entertainment 39.0 - - Data 88.4 - - Long distance and VoIP 37.8 - - Other 5.1 - - Managed & Professional Services - 86.6 - Hardware - - - Total Strategic 183.4 86.6 - 270.0 (8.7) 261.3 Legacy Voice - local service 155.9$ -$ -$ Entertainment - - - Data 148.5 - - Long distance and VoIP 39.4 - - Other 5.6 - - Managed & Professional Services - - - Hardware - - - Total Legacy 349.4 - - 349.4 (9.0) 340.4 Integration Voice - local service 5.4$ -$ -$ Entertainment 0.4 - - Data - - - Long distance and VoIP 3.3 - - Other 0.8 - - Managed & Professional Services - 2.2 - Hardware - 169.2 - Total Integration 9.9 171.4 - 181.3 (2.1) 179.2 Wireless - - 154.1 154.1 (1.7) 152.4 Total Revenue 542.7$ 258.0$ 154.1$ 954.8$ (21.5)$ 933.3$ Eliminations 12.8 7.0 1.7 21.5 529.9$ 251.0$ 152.4$ 933.3$ YTD Q3 2013