Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - IBERIABANK CORP | d815024d8k.htm |

MAKING THE MOST OF IT

November 2014 |

| Safe

Harbor And Legend 2

Statements contained in this presentation which are not historical facts and which pertain to future

operating results of IBERIABANK Corporation and its subsidiaries constitute

“forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements involve significant risks and

uncertainties. Actual results may differ materially from the results discussed in these

forward-looking statements. Factors that might cause such a difference include, but are not

limited to, those discussed in IBERIABANK Corporation’s periodic filings with the SEC.

In connection with the proposed mergers, IBERIABANK Corporation will file Registration Statements

on Form S-4 that will contain proxy statement / prospectuses. INVESTORS AND SECURITY

HOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT/ PROSPECTUSES

REGARDING THE PROPOSED TRANSACTIONS WHEN THEY BECOME AVAILABLE, BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain a free

copy of the proxy statement / prospectuses and other documents containing information about

IBERIABANK Corporation, Florida Bank Group, Inc. and Old Florida Bancshares, Inc., without

charge, at the SEC’s website at http://www.sec.gov. Copies of the proxy statement / prospectuses

and the SEC filings that will be incorporated by reference in the proxy statement / prospectuses

may also be obtained for free from the IBERIABANK Corporation website, www.iberiabank.com, under

the heading “Investor Information”.

This communication is not a solicitation of any vote or approval, is not an offer to purchase shares

of Old Florida Bancshares, Inc. common stock or Florida Bank Group, Inc. common stock, nor is it

an offer to sell shares of IBERIABANK Corporation common stock which may be issued in the

proposed mergers with Florida Bank Group, Inc. and Old Florida Bancshares, Inc. The issuance of

IBERIABANK Corporation common stock in the proposed mergers with Florida Bank Group, Inc.

and Old Florida Bancshares, Inc. would have to be registered under the Securities Act of 1933, as

amended (the “Act”), and such IBERIABANK Corporation common stock would be offered only

by means of prospectuses complying with the Act. |

| INTRODUCTION

Summary

•

Headquartered in Lafayette, Louisiana

•

Since 1887 –

Oldest And Largest Louisiana-Based Bank

•

Diverse

US

Gulf

Coast

Presence

–

Texas

To

Florida

•

Pro Forma Assets Of Over $17 Billion

•

Pro Forma Market Capitalization Of Over $2.5 Billion

•

Strong Asset Quality Measures

•

Conservative And We Don’t Cut Corners

•

Limit Loan Concentrations

•

Asset Sensitive From An Interest Rate Risk Position

•

Large, Diverse Fee-Based Businesses

•

Completed Five FDIC-Assisted Transactions

•

Completed Five Live-Bank Transactions, With Two Pending

•

Executing Efficiency And Process Improvements

3 |

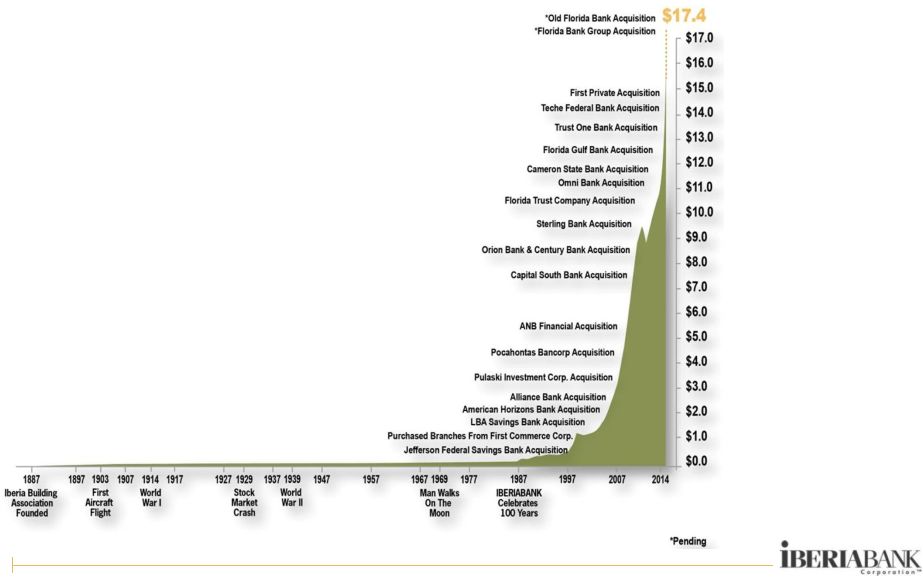

INTRODUCTION

Our Growth Path

4

ASSET GROWTH

1887-2014

•

Six-Fold Growth

Compared To The

Banking Industry

•

Asset Growth Is A

Function Of Both

Internal

(“Organic”) Growth

And Acquisitions

•

Averaged One Or

Two Acquisitions

Per Year

•

We Are Very

Selective

Regarding Our

Acquisition Targets |

INTRODUCTION

Results Compared To Peers

•

Very Difficult Period: Credit & Interest Rate Cycles, Bank Crisis,

Hurricanes •

Since Year-End 1999, We Have Outperformed Peers In Many Aspects

•

Peers Include Both All Publicly Traded U.S. Bank Holding Companies And

$10 To $30 Billion-Asset Publicly Traded Bank Holding Companies

5

Source: SNL Financial |

INTRODUCTION

Strategic Goals And Executive Compensation

•

Key Long-Term Financial Goals

Through 2016 Are As Follows:

Return on Average Tangible Equity

of 13% To 17%

Tangible Efficiency Ratio Of 60% Or

Less

Asset Quality In The Top 10% Of

Our Peers

Double-Digit Percentage Growth In

Fully-Diluted Operating EPS

•

Company Continues To Focus On

Improving Operating Efficiency And

Profitability

6

STRATEGIC GOALS

EXECUTIVE COMP CHANGES

•

Executive Compensation

Programs Were Redesigned To

Align With Strategic Goals,

Profitability Focus, And

Shareholder Value Creation

•

Short-Term Incentive Programs

Place Greater Emphasis On Pre-

Established Performance

Objectives (As Opposed To

Discretionary Objectives)

•

Long-Term Incentive Programs

Place Greater Emphasis On

Performance-Based Metrics (As

Opposed To Time-Based Metrics) |

PRIMARY FOCUS “

”

Things do not change, we do.

-

Henry David Thoreau

7 |

QUARTERLY EFFICIENCY RATIOS

PRIMARY FOCUS

Operating Efficiency Initiative

•

In Early 2013, Projected

Pre-Tax Savings Of $21

Million On An

Annualized Run-Rate

Basis, Or $0.46 Per

Share After-Tax

Annually

•

During 2013, Achieved

More Than $24 Million

Annualized Pre-Tax

Run-Rate Savings

•

In 2014, Another

Initiative Is Projected To

Achieve An Additional

$10.7 Million In Run-

Rate Savings: Through

3Q14, 85% Of Savings

Achieved

8 |

PRIMARY FOCUS

Optimize Client Distribution Points

•

Enhanced Mobile

Banking And

Technological

Enhancements

9

•

Opened Two

Branches In 2Q14

And One Branch In

3Q14

•

Closed Three

Branches In 2Q14

•

Adding Two

Additional Branch

Openings By Year-

End 2014

•

Added 14 Branches

From Three

Acquisitions, Net Of

Consolidations, In

The First Half Of

2014 |

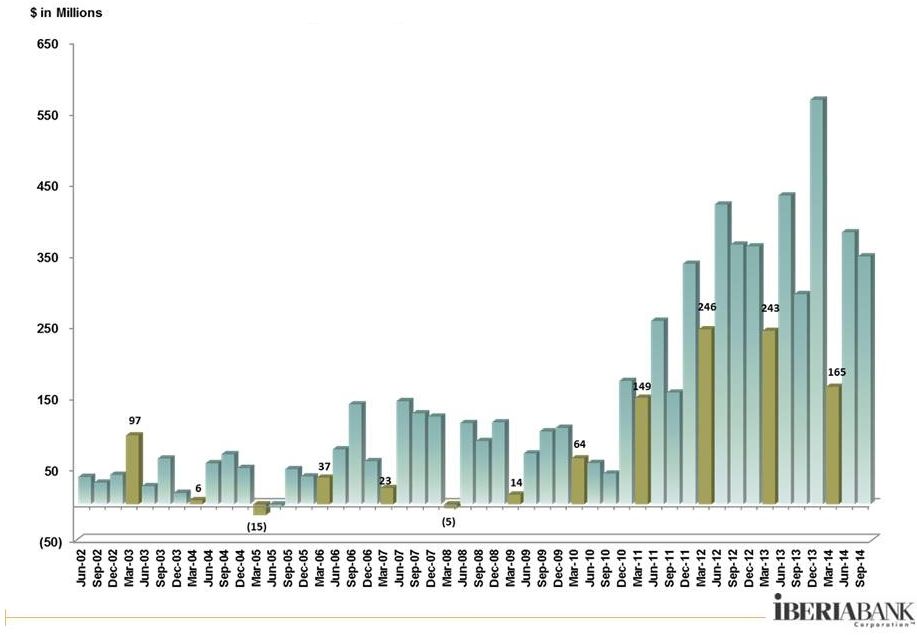

FDIC & NON-FDIC LOAN TRENDS

PRIMARY FOCUS

Continue FDIC Loan Resolution

•

Through The Third Quarter

Of 2014, FDIC-Covered

Loans Declined $270

Million, Or 29%

•

The FDIC Loss Share

Receivable Declined $67

Million, Or 42%

•

Certain FDIC Loss Share

Programs Will Begin To

Expire In 2014

•

To Date, Credit Results

Were Substantially Better

Than We Expected

10 |

COMMERCIAL COMMITMENT TRENDS

PRIMARY FOCUS

Grow High-Quality Client Base

•

Aggregate Year-To-Date

Loan Growth Of $1.6 Billion,

Or 17%, Through Third

Quarter Of 2014

•

Legacy Loan Growth Was

$892 million, Or 11% (14%

Annualized), Through Third

Quarter Of 2014

•

Notable Strength In:

Houston

Birmingham

New Orleans

Baton Rouge

Memphis

•

Unfunded Commitments And

Unused Lines Grew $241

Million, Or 8% Since Year-

End 2014

11

---------------------------Year

Ends ------------------------------ |

PRIMARY FOCUS

Execute Small Business & Retail Initiatives

•

In 2012, We Launched A

Restructuring Of The Small

Business Lending Process

•

Additional Bankers Were Added In

2013 To Increase Small Business

Loan Volume

•

We Host A Small Business

Website, Titled “Small Business

Insights”

At www.iberiabank.biz

•

Gaining Retail Branch Efficiency

•

In 2013, Deployed 23 Cash Teller

Recyclers (Gaining Speed Of

Transactions And Efficiencies)

•

Digital Banking Services Through

Mobile Apps For iPhone, Android,

And Our New iPad App

•

Recently Added Mobile Deposit

Capture Service –

Allows Clients

To Make Deposits By Scanning

Checks Quickly And Easily On

Their Smartphones

SMALL BUSINESS

RETAIL BANKING

12 |

PRIMARY FOCUS

Revenue Growth From Fee Income Businesses

13

Full Year

2013 vs.

2012

3Q

2014 vs.

3Q 2013

IBERIA Capital Partners

+63%

+64%

IBERIA Wealth Advisors

+26%

-3%

IBERIA Financial Services

-7%

+12%

Treasury Management

+31%

+22%

IBERIABANK Mortgage Company

-18%

-16%

Lenders Title Company

-2%

+2% |

STOCK PRICE TREND SINCE

YEAR-END 2012

PRIMARY FOCUS

Improve Shareholder Returns

•

After Many Poor Years, 2013 Was

An Outstanding Year For Many

Bank Stocks

•

In 1Q14, Adjustment In FDIC Loss

Share Accounting Resulted In A

Near-Term Negative Impact To

Share Price

•

In 2Q14, Subsequent Efficiency

Improvements Resulted In

Rebound In Market Price

•

From Year-End 2012 Through

October 29, 2014, Our Total

Shareholder Return Was 43%.

Since Year-End 1999, Our

Annualized Total Return was 15%

14

Indexed results through October 29, 2014

Source: Bloomberg |

L

O

N

G

-

T

E

R

M

P

E

R

S

P

E

C

T

I

V

E

“

”

15

Our favorite holding period is forever.

-

Warren Buffett |

Data indexed at December 31, 1999

Organic loan growth excludes the impact of loan runoff on the FDIC

covered loan portfolio. LOAN GROWTH

1999 -

September 2014

LONG-TERM PERSPECTIVE

Loan Growth Compared To Industry

•

Between 2007 And

2012, We Tripled

Our Total Loans

•

Since 1999, Our

Organic Loan

Growth Was Four

Times Higher Than

The Banking Industry

•

Average Loans Up

13% In 2013 Versus

2012

•

Pending Florida

Bank Group And Old

Florida Bancshares

Acquisitions Will Add

Approximately $1.4

Billion in Total Loans

16

Source: Federal Reserve Board |

AVERAGE LOAN YIELD

1996 -

September 2014

LONG-TERM PERSPECTIVE

Loan Yield Trends Compared To Industry

•

Loan Yield Was

Consistent With

Industry Until 2010

•

Higher Yield After

That Period Due, In

Part, To FDIC Loss

Share Asset Yields

•

Favorable Loan

Yield Trend In The

Second Half Of

2013

17

Source: SNL Financial |

CORE DEPOSIT GROWTH

1999 -

September 2014

Core Deposit Growth Compared To Industry

LONG-TERM PERSPECTIVE

•

Between 2007 And

2012, We Tripled Our

Total Deposits

•

Five-Fold Growth In

Organic Core Deposits

Versus Industry

•

Average Total Deposits

Up 10% In 2013 Versus

2012

•

Strong Average Non-

Interest Bearing Deposit

Growth (Up 29%)

•

Pending Florida Bank

Group And Old Florida

Bancshares Acquisitions

Will Add Approximately

$1.4 Billion in Core

Deposits

18

Source: Federal Reserve Board |

AVERAGE COST OF DEPOSITS

1996 -

September 2014

LONG-TERM PERSPECTIVE

Deposit Cost Trends Compared To Industry

•

Our Deposit Costs

Have Generally

Kept Pace With

Industry Deposit

Cost Structure

•

In 2013, We Were

Approximately On

Par With Industry

•

Part Of Cost

Reduction Was

Due To Favorable

Deposit Mix

Improvement

(More Non-interest

Bearing Deposits)

19

Source: SNL Financial |

Loans By State

Deposits By State

LONG-TERM PERSPECTIVE

Geographic Diversification

•

Prior To 2007, 100% Of Loans And Deposits In Louisiana, Nearly All Of

Which Were Concentrated In Four Markets

•

On A Pro Forma Basis Louisiana Loans and Deposits Will Account For

Approximately 43% and 46, Of Total Franchise, Respectively

•

Pro Forma Of Pending Acquisitions Florida Will Account For 20% Of

Total Loans And 27% Of Total Deposits

•

Provides Significant Client Geographic Diversification

20

IBERIABANK loan and deposit information pro forma giving effect to pending acquisitions

of Florida Bank Group, Inc. and Old Florida Bancshares, Inc.

|

Summary Trends

LONG-TERM PERSPECTIVE

•

Doubled In Size Between

1999 And The Time Of

Hurricane Katrina

•

Four-Fold Increase In

Size Post-Katrina

•

More Geographic And

Client Diversification

•

Expansion Into

Significant Growth

Markets

•

Paid Quarterly Cash

Dividends For 76

Consecutive Quarters

Pre-Historic

Era

Hurricane

Katrina Era

Recent Time

Period

21

* trailing twelve months

Total Loans

$0.8

billion

$1.9

billion

$11.1

billion

Total Deposits

$1.1

$2.2

$12.4

Total Assets

$1.4

$2.9

$15.5

Market Capitalization

$86

million

$487

million

$2.1

billion

Mortgage Loan Production

< $50 million

$235

million

$1.6

billion *

Locations

43

44

278

MSAs Served

3

5

25

Associates (full-time equivalent)

535

686

2,703

Advisory Boards

None

5

13

Shareholders of Record

1,140

1,700

2,890

Analyst Coverage

2

10

11

Top 3 Shareholders

23.0%

14.0%

16.0%

Period-End Share Price

11.00

$

51.01

$

62.51

$

Tangible Book Value Per Share

9.95

$

17.07

$

37.41

$

Price to Tangible BVS

1.11

times

2.99

times

1.67

times

Operating Earnings Per Share

1.28

$

2.24

$

3.61

$

*

Annual Dividends Per Share

0.53

$

1.00

$

1.36

$

Dividend Payout Ratio

41%

45%

38%

Year-End

1999

Year-End

2005

September 30,

2014 |

PLANTING SEEDS

The difference between

ordinary and extraordinary is

that little extra.

-

Jimmy Johnson

“

”

22 |

PLANTING SEEDS

IBERIABANK Mortgage Company

Overall Industry Changes:

What We Are Doing:

QUARTERLY MORTGAGE LOAN ORIGINATION GROWTH

(% Change Since 1Q 2008)

23

Source: Mortgage Bankers Association 3Q14

•

Mortgage Market Is Smaller

From The Peak

•

Fewer Players

•

Regulatory Risk And Burden

Is Increasing

•

GSE Reform On The

Horizon

•

Digital And Internet Impact

•

Recruiting And Retaining

Experienced High Performing

Originators

•

Working Closer With

Branches

•

Improving Efficiency In

Processes And Staffing |

PLANTING SEEDS

IBERIA Capital Partners

ICP REVENUES AND EQUITY

RESEARCH COVERAGE

•

ICP Started in 4Q10

•

In 2013, ICP

Launched Coverage

On 39 Energy-

Related; By Year-

End, ICP Had

Research Coverage

On 100 Companies

•

In 2013, Completed

23 Equity And Fixed

Income Investment

Banking

Transactions

•

ICP Turned

Profitable in 2013

24 |

SMALL BUSINESS LOAN VOLUME TRENDS

PLANTING SEEDS

Small Business Initiative

•

Economy Is Improving,

Leading To An Increase In

Small Business Loan

Demand

•

Hired Additional Business

Bankers

•

Trained And Focused

Branch Managers On

Serving And Calling On

Small Businesses

•

Built Out Underwriting

Platform

•

Favorable Loan Growth

25

Acquired approximately $250

million in small business loans

from Teche in 2Q14 |

THE RIGHT

PARTNERS

“

”

Few men have the virtue to

withstand the highest bidder.

-

George Washington

26 |

Florida Bank Group, Inc.

THE RIGHT PARTNERS

27

•

Announced October 3, 2014

•

In market and new-market acquisition of a Florida-based

commercial bank based in Tampa, Florida

•

As of September 30, 2014:

•

Total Loans:

$324 million

•

Total Assets:

$518 million

•

Total Deposits:

$393 million

•

Total Equity:

$37 million common stock and $25

million in convertible preferred equity

•

Combination cash and common stock with aggregate cash

consideration not to exceed 50% of total consideration

•

$7.81 in cash per Florida Bank Group common share, and

•

Fixed exchange ratio of 0.149 of a share of IBKC common

stock for each Florida Bank Group share within price collars

and

floating

exchange

ratios

outside

of

the

collars

(1)

,

•

$87 million

(1)

for common stock outstanding based on IBKC

closing price of $62.61 on October 2, 2014

•

$17.14

per

Florida

Bank

Group

share

outstanding

(1)

•

$3.5 million in cash liquidation value of options

•

Neutral to 2015 EPS and accretive thereafter

•

Slightly dilutive to TVBS (less than 1%)

•

IRR in excess of 20%

Shareholders’

With All Other

Equity

Adjustments

(2)

•

Price / Total Book:

142%

126%

•

Price / Tangible Book:

142%

126%

Adds 13 branches in Florida – eight offices in Tampa, three in

Jacksonville, one in Sarasota and one in Tallahassee

(1)

If the weighted average trading price of IBERIABANK common stock were to go below $56.79 per share, or

to exceed $76.83 per share, over a specified period, the value of the common stock portion of the

transaction would become fixed and the exchange ratio would float

(2)

Assumes the impact of cash liquidation for options, reversal of $23.4 million of deferred tax asset

valuation allowance, credit loss assumptions, interest rate adjustments and fair value marks to

facilities |

Notes:

(1)

The agreement provides for a fixed exchange ratio with pricing collars that fix the

value received by Old Florida’s shareholders if the weighted average

trading

price

of

IBERIABANK

Corporation’s

common

stock

were

to

decline

below

$57.31

per

share,

or

exceed

$70.05

per

share,

over

a

specified

period

(2)

Assumes

common

and

preferred

converted

shares

and

no

exercise

of

options

outstanding

(3)

Assumes all stock options outstanding are cashed out at consummation

•

Announced October 27, 2014

•

New-market acquisition of an Orlando, Florida-based

commercial bank

•

Adds

14

offices

in

Florida

–

12

offices

in

Orlando

and

two

offices north of Tampa

As of September 30, 2014:

•

Total Loans:

$1.1 billion

•

Total Assets:

$1.4 billion

•

Total Deposits:

$1.2 billion

•

Total Equity:

$146

million

total

shareholders’

equity

•

Tax-free, stock-for-stock exchange

•

Fixed exchange ratio of 0.34 share of IBKC common stock

for each Old Florida Bancshares, Inc. share within collars and

floating

exchange

rations

outside

of

collars

(1)

•

$238

million

for

total

equity

(2)

outstanding

based

on

IBKC’s

closing price of $64.13 on October 23, 2014

•

$21.80

per

Old

Florida

common

share

outstanding

(2)

•

Estimated $21 million in cash liquidation value of all options

outstanding

(3)

•

Approximately 2% accretive to EPS in 2016 and 3% accretive

in 2017

•

TBVS dilution of approximately 2% at consummation

•

TBVS breakeven in less than four years

•

IRR in excess of 20%

THE RIGHT PARTNERS

28

Old Florida

Bancshares, Inc.

Shareholders’

Aggregate Value

Equity

(2)

Including Options

(3)

•

Price / Total Book:

163%

178%

•

Price / Tangible Book:

170%

185% |

THIRD QUARTER 2014

We cannot direct the wind,

but

we

can

adjust

the

sails.

-

Bertha Calloway

“

”

29 |

SEASONAL INFLUENCES

Quarterly Organic Loan Growth

30

•

First quarter of each year tends to exhibit

slower loan growth than other quarters

•

3Q14 organic loan growth of $348 million,

down $34 million, or 10%, compared to

2Q14 growth |

THIRD

QUARTER

2014

–

OVERVIEW

Non-Performing Asset Trends

31

NPA determination based on regulatory guidance for Acquired portfolios

3Q14 includes $13 million of bank-related properties reclassified to OREO

|

THIRD

QUARTER

2014

–

OVERVIEW

Non-Interest Bearing Deposits

32

% of Total Deposits

•

$110 million of

incremental non-

interest-bearing

deposit growth or

+4% (+14%

annualized) in

3Q14

•

Top 3Q14 non-

interest-bearing

deposit growth

markets include

Houston, Baton

Rouge, New

Orleans,

Birmingham and

Sarasota

$ in billions

Non-interest-bearing deposits at period-end

|

SEASONAL INFLUENCES

Mortgage Income

33

•

Mortgage 3Q14 Non-Interest Income of $12.8

million is $5.1 million lower than 2Q14 driven by

•

$7.0 million lower market value adjustment

gains (-$4.5 million recognized in 3Q14

versus +$2.5 million in 2Q14)

•

$1.8 million higher gains on increased sales

volume (+24%) and higher sales margins

(+6%)

•

$62,000 higher servicing income

•

Loan originations were up $20 million in 3Q14 to

$456 million from $436 million in 2Q14 (+5%)

•

The Pipeline plus Loans HFS at September 30th

was 11% lower than at June 30, 2014 |

SEASONAL INFLUENCES

Capital Markets And Wealth Management

34

•

ICP revenues of

$2.7 million, or -9%,

compared to 2Q14

•

IWA revenues of

$1.5 million, or -4%,

compared to 2Q14

•

IFS revenues of $2.6

million, or +4%,

compared to 2Q14

•

ICP currently

provides research

coverage on 77

public energy

companies

•

IWA assets under

management

increased $5 million

to $1.2 billion on

September 30, 2014 |

| Summary

IBERIABANK Corporation

35

•

Longevity and Experience

•

Economically Vibrant Legacy Markets

•

Diversified Markets and Revenues

•

Multiple Growth Engines (Organic and M&A)

•

Disciplined, Yet Opportunistic

•

Exceptional Asset Quality

•

Outsized FDIC Loss Share Protection

•

Tremendous Capital Strength

•

Funded By Stable Core Deposits

•

Asset-Sensitive (Interest Rate Risk Position)

•

Unique Business Model

•

Favorable Risk/Return Trade-Off |

|

APPENDIX

I skate where the puck is going

to be, not where it has been.

37

-

Wayne Gretzky |

APPENDIX

Performance Metrics –

Quarterly Trends

38

•

Average earning

assets up $1.3

billion (+10%)

•

T/E net interest

income up $12

million (+11%)

•

Provision for loan

losses of $6 million:

•

Legacy net charge-

offs: $2.1 million

(0.09% annualized

rate)

•

Covered and

acquired net charge

offs: $0.1 million

(0.02% annualized

rate)

•

Legacy provision for

loan losses: $4.0

million

9/30/2013

12/31/2013

3/31/2014

6/30/2014

9/30/2014

Net Income ($ in thousands)

23,192

$

25,604

$

22,395

$

18,548

$

29,744

$

60%

Per Share Data:

Fully Diluted Earnings

0.78

$

0.86

$

0.75

$

0.60

$

0.89

$

48%

Operating Earnings (Non-GAAP)

0.83

0.87

0.73

0.96

1.00

4%

Pre-provision Operating Earnings (Non-GAAP)

0.89

0.97

0.78

1.06

1.11

5%

Tangible Book Value

37.00

37.17

37.59

37.41

37.91

1%

Key Ratios:

Return on Average Assets

0.71%

0.77%

0.68%

0.53%

0.76%

23

bps

Return on Average Common Equity

6.08%

6.62%

5.83%

4.56%

6.52%

196

bps

Return on Average Tangible Common Equity (Non-GAAP)

8.74%

9.43%

8.36%

6.62%

9.68%

306

bps

Net Interest Margin (TE)

(1)

3.37%

3.52%

3.54%

3.48%

3.47%

(1)

bps

Tangible Operating Efficiency Ratio (TE)

(1)

(Non-GAAP)

73.0%

69.9%

73.6%

68.3%

66.4%

(182)

bps

Tangible Common Equity Ratio (Non-GAAP)

8.64%

8.55%

8.61%

8.46%

8.47%

1

bps

Tier 1 Leverage Ratio

9.65%

9.70%

9.61%

10.03%

9.22%

(81)

bps

Tier 1 Common Ratio (Non-GAAP)

10.95%

10.55%

10.44%

10.33%

10.34%

1

bps

Total Risk Based Capital Ratio

13.28%

12.82%

12.69%

12.43%

12.42%

(1)

bps

Net Charge-Offs to Average Loans

(2)

0.02%

0.07%

0.05%

0.04%

0.09%

5

bps

Non-performing Assets to Total Assets

(2)

0.66%

0.61%

0.49%

0.53%

0.46%

(7)

bps

(1)

Fully taxable equivalent basis.

(2)

Excluding FDIC Covered Assets and Acquired Assets.

For Quarter Ended:

Linked Quarter

%/Basis Point

Change |

APPENDIX

Financial Summary –

3Q14

39

•

Reported EPS of $0.89 and non-GAAP operating EPS of $1.00

•

Tax equivalent net interest income increased $12.0 million, or 11% from 2Q14, while

average earning assets increased $1.3 billion, or 10%

•

Branch and systems conversion of First Private Bank completed over the weekend of

September 6-7, 2014

•

Legacy loan growth:

•

Legacy deposit growth:

•

Net

interest

margin

decreased

one

basis

point

to

3.47%

from

June

30,

2014,

due

mainly

to

a

one

basis

point increase in the yield on earning assets offset by a three basis point

increase in cost of funds -- within previously disclosed guidance

range of 3.45% to 3.50% •

Operating tangible efficiency ratio improved from 68.3% to 66.4%

•

Tax-equivalent operating revenues increased $9.1 million, or 6%, on a linked

quarter basis while operating expenses increased $3.4 million, or 3%,

resulting in improved operating leverage $348 million since June 30, 2014

(+16% annualized), including $146 million of Commercial and $202 million of

Small Business and Consumer

Growth in the loan portfolio was balanced with 58% Retail and Small

Business and 42% Commercial

$397 million since June 30, 2014 (+13% annualized)

$110 million increase in non-interest bearing deposits (+14%

annualized) |

APPENDIX

Non-Interest Income –

3Q14 Components

40

•

Operating non-interest income

decreased $2.9 million, or -6%,

on a linked quarter basis |

•

Deposit service charge income increased $2.0 million or 24%

•

ATM/Debit card fee income increased $0.4 million or 12%

•

Title revenue increased $0.3 million, or 6%

•

Mortgage income decreased $5.1 million or 29%

•

Decreased broker commissions income of $0.2 million or -3%

•

Gains on sale of investments increased $0.6 million

APPENDIX

Non-Interest Income Trends

41

3Q14 originations up 5% from 2Q14

Refinancings were 25% of production, up from

13% in 2Q14

Sales up 24% in 3Q14

Margins 6% higher in 3Q14

Pipeline of $170 million at quarter-end, down

6% as compared to June 30, 2014. At

October 10, 2014, the locked pipeline was

$194 million or +8% over September 30, 2014

Non-interest Income ($000s)

3Q13

4Q13

1Q14

2Q14

3Q14

$ Change

% Change

Service Charges on Deposit Accounts

7,512

$

7,455

$

7,012

$

8,203

$

10,205

$

2,002

$

24%

ATM / Debit Card Fee Income

2,476

2,493

2,467

2,937

3,287

350

12%

BOLI Proceeds and CSV Income

908

900

934

934

1,047

113

12%

Mortgage Income

15,202

12,356

10,133

17,957

12,814

(5,143)

-29%

Title Revenue

5,482

4,327

4,167

5,262

5,577

315

6%

Broker Commissions

3,950

4,986

4,048

5,479

5,297

(182)

-3%

Other Noninterest Income

7,720

6,179

5,129

7,182

6,854

(328)

-5%

Noninterest income excluding non-operating income

43,250

38,696

33,890

47,954

45,081

(2,873)

-6%

Gain (Loss) on Sale of Investments, Net

13

19

19

8

582

574

6797%

Other Non-operating income

-

-

1,772

1

-

(1)

-100%

Total Non-interest Income

43,263

$

38,715

$

35,681

$

47,963

$

45,663

$

(2,300)

$

-5%

3Q14 vs. 2Q14 |

APPENDIX

Non-Interest Expense –3Q14 Components

42

•

Non-operating

non-interest

expense of $6.4

million before-tax,

or $4.2 million

after-tax or $0.12

per share

•

Operating non-

interest expense

increased $3.4

million, or 3%, on

a linked-quarter

basis

•

$1.7 million of the

operating

expense increase

was due to the

full quarter impact

of Teche and

First Private |

APPENDIX

Non-Interest Expense Trends

43

Linked quarter increases/decreases of:

Salary and benefits expense

$0.4 mil

Credit/Loan related expense

1.5

Hospitalization expense

1.0

Other Incentives

(1.6)

Increased due to the timing and consummation of Teche and

First Private added approximately $1.7 million in operating

expenses in 3Q14

•

Non-interest expenses excluding non-operating items up

$3.4 million, or 3%, as compared to 2Q14

•

Total expenses down $7.3 million, or -6%, in 3Q14

•

Severance expense down $4.2 million, mostly related to

Teche acquisition

•

Impairment of long-lived assets up $3.0 million

•

Merger-related expense decreased $8.7 million

•

Operating Tangible Efficiency Ratio of 66.4%, down 190 bps

Non-interest Expense ($000s)

3Q13

4Q13

1Q14

2Q14

3Q14

$ Change

% Change

Mortgage Commissions

4,238

$

3,169

$

2,215

$

3,481

$

3,912

$

431

$

12%

Hospitalization Expense

4,303

3,899

3,944

3,661

4,611

950

26%

Other Salaries and Benefits

50,140

52,108

53,582

55,921

54,898

(1,023)

-2%

Salaries and Employee Benefits

58,681

$

59,176

$

59,741

$

63,063

$

63,421

$

358

$

1%

Credit/Loan Related

5,248

2,776

3,560

3,093

4,569

1,476

48%

Occupancy and Equipment

13,863

13,971

13,775

13,918

14,580

662

5%

Amortization of Acquisition Intangibles

1,179

1,177

1,218

1,244

1,493

249

20%

All Other Non-interest Expense

26,933

25,328

27,328

28,913

29,602

689

2%

Nonint. Exp. (Ex-Non-Operating Exp.)

105,904

$

102,428

$

105,622

$

110,231

$

113,666

$

3,435

$

3%

Severance

554

216

119

5,466

1,226

(4,240)

-78%

Occupancy and Branch Closure Costs

594

-

17

14

-

(14)

-100%

Storm-related expenses

-

-

184

4

1

(3)

-78%

Impairment of Long-lived Assets, net of gains on sales

977

(225)

541

1,241

4,213

2,972

239%

Provision for FDIC clawback liability

667

-

-

-

(797)

(797)

100%

Debt Prepayment

-

-

-

-

-

-

0%

Termination of Debit Card Rewards Program

-

(311)

(22)

-

-

-

0%

Consulting and Professional

(630)

-

-

-

-

-

0%

Merger-Related Expenses

85

566

967

10,419

1,752

(8,667)

-83%

Total Non-interest Expense

108,152

$

102,674

$

107,428

$

127,375

$

120,060

$

(7,315)

$

-6%

Tangible Efficiency Ratio - excl Nonop-Exp

73.0%

69.9%

73.6%

68.3%

66.4%

3Q14 vs. 2Q14 |

APPENDIX

Legacy Credit Portfolio

44

Asset Quality Summary

(Excludes FDIC covered assets and all acquired loans)

•

NPAs equated to

0.46% of total assets,

down 7 bps compared

to 2Q14. Includes

$13 million of bank-

related properties

•

$67 million in

classified assets

(down $0.3 million

from 2Q14)

•

Legacy net charge-

offs of $2.1 million, or

an annualized rate of

0.09% of average

loans

•

$4 million provision

for legacy franchise in

3Q14

($ thousands)

9/30/2013

6/30/2014

9/30/2014

Non-accrual Loans

43,838

$

34,187

$

38,060

$

-13%

11%

OREO

30,607

34,794

23,477

-23%

-33%

Accruing Loans 90+ Days Past Due

1,418

20

4

-100%

-78%

Non-performing Assets

75,863

69,001

61,542

-19%

-11%

Note: NPAs excluding Former Bank Properties

65,345

50,415

48,808

-25%

-3%

Past Due Loans

57,662

48,189

50,505

-12%

5%

Classified Loans

78,059

67,796

67,462

-14%

0%

Non-performing Assets/Assets

0.66%

0.53%

0.46%

(20)

bps

(7)

bps

NPAs/(Loans + OREO)

0.98%

0.78%

0.67%

(31)

bps

(11)

bps

Classified Assets/Total Assets

0.66%

0.52%

0.50%

(16)

bps

(2)

bps

(Past Dues & Nonaccruals)/Loans

0.75%

0.55%

0.55%

(20)

bps

0

bps

Provision For Loan Losses

2,868

$

3,004

$

4,022

$

40%

34%

Net Charge-Offs/(Recoveries)

303

759

2,131

604%

181%

Provision Less Net Charge-Offs

2,565

$

2,245

$

1,891

$

-26%

-16%

Net Charge-Offs/Average Loans

0.02%

0.04%

0.09%

7

bps

5

bps

Allowance For Loan Losses/Loans

0.83%

0.80%

0.79%

(4)

bps

(1)

bps

Allowance For Credit Losses/Loans

0.99%

0.93%

0.92%

(7)

bps

(1)

bps

For Quarter Ended:

% or Basis Point Change

Year/Year

Qtr/Qtr |

APPENDIX

Capital Ratios

45

•

The decline in Tier 1 leverage ratio in 3Q14 was due to the manner in which the

leverage ratio is calculated using capital in the numerator at

period-end and average total assets in the denominator

•

Commencing in 2015, the Company will experience a 50% phase-out of Tier 1

capital treatment for its trust preferred securities with no commensurate

change in total regulatory capital

•

In addition, by year-end 2014, the Company will experience the expiration of

FDIC loss share protection on non-single family loans associated with

three FDIC–assisted transactions •

Change in Tier 1

Leverage ratio due to

estimated impact of

acquisitions on average

total assets used in

calculations

Estimated Future Impacts:

•

Anticipated 50% phase-

out of trust preferred

securities beginning in

2015

•

Expiration of loss share

coverage on three FDIC-

assisted transactions

Q2 2014

Q3 2014

Well

Capitalized

Minimum

Tier 1 Leverage

10.03%

9.22%

(81)

bps

5.00%

Tier 1 Risk Based

11.23%

11.23%

0

bps

6.00%

Tier 1 Common Risk Based

10.33%

10.34%

1

bps

3.00%

Total Risk Based

12.43%

12.42%

(1)

bps

10.00%

Tangible Common Equity / Tangible Assets

8.46%

8.47%

1

bps

N/A

IBERIABANK Corporation Capital Ratios

Change

Estimated Proforma Impact on 3Q 2014 Capital Ratios

Phase out of Trust Preferred Securites (50% Phase Out)

(36)

bps

(45)

bps

-

bps

End of Loss Share -

certain covered assets

-

bps

(14)

bps

(17)

bps

Total Impact

(36)

bps

(59)

bps

(17)

bps

Total Risk Based

Tier 1 Risk Based

Tier 1 Leverage |

APPENDIX

Non-GAAP Cash Margin

46

•

Adjustments represent accounting

impacts of purchase discounts on

acquired loans and related accretion

as well as the I/A and related

amortization on the covered portfolio

Balances, as

Reported

Adjustments

As Adjusted

3Q13

Average Balance

11,674,648

(199,543.31)

11,475,104

Income

97,452

101

97,554

Rate

3.37%

-0.01%

3.35%

4Q13

Average Balance

11,853,895

(192,574.05)

11,661,322

Income

103,438

(2,061)

101,377

Rate

3.52%

-0.02%

3.49%

1Q14

Average Balance

12,088,182

(171,440.32)

11,916,741

Income

104,408

(2,517)

101,890

Rate

3.54%

-0.10%

3.44%

2Q14

Average Balance

12,693,217

(156,606)

12,536,611

Income

108,979

687

109,665

Rate

3.48%

0.01%

3.49%

3Q14

Average Balance

13,990,968

(157,213)

13,833,755

Income

121,041

(3,544)

117,497

Rate

3.47%

-0.12%

3.35% |

APPENDIX

Loan Growth Since Year-End 2008

47

December 31, 2008

$3.7 Billion

September 30, 2014

$11.1 Billion

Acquired loans, net of discount

+$4.0 billion

Acquired loan pay downs

($2.1 billion)

Legacy loan growth

+$5.4 billion

Total net growth

+$7.3 billion |

APPENDIX

Deposit Growth Since Year-End 2008

48

December

31,

2008

$4.0 Billion

•

$8.4 billion growth in total

deposits or +210% (+36%

annualized)

September

30,

2014

$12.4 Billion |

| APPENDIX

Small Business and Retail –

3Q14 Progress

49

•

Small Business loan growth of $87 million, or +12%, on a linked-quarter basis

•

Indirect loan growth of $3 million, or +1%, on a linked-quarter basis

•

Consumer Direct & Mortgage loan growth of $128 million, or +7%, on a linked

quarter basis

•

Credit Card loan growth of $3 million, or +5%, on a linked quarter basis

•

Checking account growth:

•

Small Business checking accounts increased 13% year-over-year and an

annualized 9% on a linked quarter basis

•

Consumer checking accounts increased slightly year-over-year but decreased

an annualized 6% on a linked quarter basis due to expected attrition from

recently converted Teche portfolio

•

Continued

focus

on

productivity

and

efficiency

of

the

delivery

network

–

opened

one

branch in 3Q14, did not close any branches in 3Q14, and two additional branch

openings targeted by year-end 2014

•

Acceptance and usage of digital delivery continues to increase among our client

base Excludes acquired loans and deposits |

| APPENDIX

Market Highlights For 3Q14

50

•

Competitive pressure remains strong for high quality commercial and business

banking clients in terms of both pricing and structure

•

Houston, New Orleans, Baton Rouge, Birmingham, and Huntsville showed

strong commercial loan originations

•

Total commitments originated during 3Q14 of $1.2 billion with 34% fixed rate

and 66% floating rate

•

Commercial loans originated and funded in 3Q14 totaled $445 million with a

mix of 23% fixed and 77% floating ($775 million in commercial loan

commitments during the quarter)

•

Strong commercial pipeline in excess of $629 million at quarter-end

•

Total Small Business loan growth of $66 million, or +6%, on a linked-quarter

basis

•

Period-end core deposit increase of $307 million, with non-interest bearing

deposits up $110 million (up $309 million linked quarter growth on an

average balance basis) –

mainly as a result of the Teche and First Private acquisitions

|

APPENDIX

Weekly Locked Mortgage Pipeline Trends

51

•

Significant pipeline

declines in winter

months

•

Seasonal rebound

commences at the

start of each year

through spring

months into early

summer

•

Most recent decline

was 40% since

start of October

2013

•

2014 trending is

consistent with

prior years

•

Weekly locked

pipeline was $194

million at October

10, 2014, up 8%

since September

30, 2014 |

APPENDIX

Payroll Taxes And Retirement Contributions

52

3Q14 includes full quarter of Teche and First Private results

|

APPENDIX

Checking NSF-Related Charges

53

3Q14 includes full quarter of Teche and First Private results

|

APPENDIX

Non-Operating Items (Non-GAAP)

54

For The Quarter Ended

September 30, 2013

June 30, 2014

September 30, 2014

Dollar Amount

Dollar Amount

Dollar Amount

Pre-tax

After-tax

(2)

Per share

Pre-tax

After-tax

(2)

Per share

Pre-tax

After-tax

(2)

Per share

Net Income (Loss) (GAAP)

$ 30,549

$ 23,192

$ 0.78

$ 24,819

$ 18,548

$ 0.60

$ 40,930

$ 29,744

$ 0.89

Non-interest income adjustments

Gain on sale of investments and other non-interest income

(13)

(8)

(0.00)

(9)

(6)

(0.00)

(582)

(378)

(0.01)

Non-interest expense adjustments

Merger-related expenses

85

55

0.00

10,419

6,840

0.22

1,752

1,139

0.04

Severance expenses

554

360

0.01

5,466

3,553

0.11

1,226

797

0.02

(Gain) Loss on sale of long-lived assets, net of impairment

977

635

0.02

1,241

807

0.03

4,213

2,738

0.08

(Reversal of) Provision for FDIC clawback liability

667

434

0.01

-

-

-

(797)

(518)

(0.02)

Other non-operating non-interest expense

(36)

(23)

(0.00)

18

12

0.00

1

1

(0.00)

Operating

earnings

(Non-GAAP)

(3)

32,783

24,644

0.83

41,954

29,754

0.96

46,743

33,523

1.00

Covered and acquired impaired (reversal of) provision for loan losses

(854)

(555)

(0.02)

1,744

1,134

0.04

1,692

1,100

0.03

Other (reversal of) provision for loan losses

2,868

1,864

0.07

3,004

1,953

0.06

4,022

2,614

0.08

Pre-provision

operating

earnings

(Non-GAAP)

(3)

$ 34,797

$ 25,954

$ 0.89

$ 46,702

$ 32,841

$ 1.06

$ 52,457

$ 37,237

$ 1.11

(dollars in thousands)

Non-operating adjustments equal to $5.8 million pre-tax or $0.11 EPS after-tax:

•

3Q14 Merger related expense of $1.8 million pre-tax or $0.04 EPS after-tax

•

3Q14 Severance expense of $1.2 million pre-tax or $0.02 EPS after-tax

•

Net impairment expense of $4.2 million pre-tax or $0.08 EPS after-tax

(1) Per share amounts may not appear to foot due to rounding.

(2) After-tax amounts estimated based on a 35% marginal tax rate.

•

Reversal of provisioning for FDIC clawback liability of $0.7 million pre-tax or $0.02 after

tax RECONCILIATION

OF NON-GAAP FINANCIAL MEASURES

(1) |

APPENDIX

Expected Quarterly Re-Pricing Schedule

55

Excludes FDIC loans and receivable, non-accrual loans and market value adjustments

$ in millions

Note: Amounts exclude re-pricing of assets and liabilities from prior

quarters 4Q14

1Q15

2Q15

3Q15

4Q15

Cash Equivalents

Balance

481.1

$

-

$

-

$

-

$

-

$

Rate

0.69%

0.00%

0.00%

0.00%

0.00%

Investments

Balance

68.6

$

60.9

$

77.1

$

84.1

$

82.9

$

Rate

3.02%

2.97%

2.92%

2.75%

2.82%

Fixed Rate Loans

Balance

200.2

$

145.0

$

158.9

$

177.3

$

150.6

$

Rate

4.94%

4.95%

5.05%

4.96%

4.91%

Variable Rate Loans

Balance

4,840.3

$

35.4

$

40.4

$

44.4

$

17.5

$

Rate

3.28%

3.02%

3.11%

3.54%

3.36%

Held for Sale Loans

Balance

148.5

$

-

$

-

$

-

$

-

$

Rate

3.52%

0.00%

0.00%

0.00%

0.00%

Time Deposits

Balance

702.8

$

314.2

$

321.9

$

256.4

$

104.6

$

Rate

0.38%

0.62%

0.70%

0.80%

0.84%

Repos/ST Debt

Balance

504.8

$

180.0

$

125.0

$

-

$

-

$

Rate

0.15%

0.19%

0.20%

0.00%

0.00%

Borrowed Funds

Balance

126.5

$

2.1

$

10.1

$

3.3

$

1.9

$

Rate

3.11%

3.20%

3.49%

3.95%

3.60% |

APPENDIX

Interest Rate Simulation

56

•

Asset sensitive from an interest rate risk position

•

The degree of asset sensitivity is a function of the reaction of

competitors to changes in deposit pricing

•

Forward curve has a positive impact over 12 months

Source: Bancware model, as of September 30, 2014

* Assumes instantaneous and parallel shift in interest rates based on static

balance sheet Base

Blue

Forward

Change In:

-200 bp*

-100 bp*

Case

+100 bp*

+200 bp*

Chip

Curve

Net Interest

Income

-4.6%

-2.0%

0.0%

4.9%

9.8%

1.1%

1.0%

Economic

Value of

Equity

-12.1%

-17.7%

0.0%

2.7%

7.8%

-0.1%

-0.1% |

APPENDIX

Expected Amortization

57

Projected average balance includes the balance of the Indemnification Asset

$ in Millions

Q1 2013

Revenues

Amortization

41.6

$

30.3

$

$

13.9

$

Q2 2013

Q3 2013

Q4 2013

2013

Q1 2014

Q2 2014

Q3 2014

Q4 2014

2014

Q1 2015

(17.0)

(25.1)

$

$

$

$

11.9

(27.7)

(18.1)

$

(29.1)

(97.8)

$

(8.7)

(70.1)

$

Net covered Income

$

12.2

Balance

1,424

$

1,224

$

$

$

$

23.0

$

$

93.1

$

$

(22.9)

$

(4.0)

$

42.1

$

5.1

$

$

23.0

1,100

$

941

$

1,171

$

846

$

756

$

670

$

573

$

711

504

30.9

$

139.9

25.9

30.2

13.9

$

6.7

$

6.0

5.3

$

7.9

$

$

$

8.0

37.1

$

8.0

(19.3)

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

8.00%

$0

$300

$600

$900

$1,200

$1,500

Q1 2013

Q2 2013

Q3 2013

Q4 2013

Q1 2014

Q2 2014

Q3 2014

Q4 2014

Q1 2015

Projected Average Balance

Projected Net Yield

$

$

$

$

Projected Average Balances and Net Yields |