Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Hi-Crush Inc. | a93014-earningsrelease8xk.htm |

| EX-99.1 - EXHIBIT - Hi-Crush Inc. | exhibit991-earningsrelease.htm |

3RD QUARTER 2014 EARNINGS RELEASE NOVEMBER 4, 2014

Forward Looking Statements Some of the information included herein may contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements give our current expectations and may contain projections of results of operations or of financial condition, or forecasts of future events. Words such as “may,” “assume,” “forecast,” “position,” “predict,” “strategy,” “expect,” “intend,” “plan,” “estimate,” “anticipate,” “could,” “believe,” “project,” “budget,” “potential,” or “continue,” and similar expressions are used to identify forward-looking statements. They can be affected by assumptions used or by known or unknown risks or uncertainties. Consequently, no expected results of operations or financial condition or other forward-looking statements can be guaranteed. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in Hi-Crush Partners LP’s (“Hi-Crush”) reports filed with the Securities and Exchange Commission (“SEC”), including those described under Item 1A, “Risk Factors” of Hi-Crush’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013 and any subsequently filed Quarterly Report on Form 10-Q. Actual results may vary materially. You are cautioned not to place undue reliance on any forward-looking statements. You should also understand that it is not possible to predict or identify all such factors and should not consider the risk factors in our reports filed with the SEC or the following list to be a complete statement of all potential risks and uncertainties. Factors that could cause our actual results to differ materially from the results contemplated by such forward-looking statements include: the volume of frac sand we are able to sell; the price at which we are able to sell frac sand; the outcome of any pending litigation; changes in the price and availability of natural gas or electricity; changes in prevailing economic conditions; and difficulty collecting receivables. All forward-looking statements are expressly qualified in their entirety by the foregoing cautionary statements. Hi-Crush’s forward-looking statements speak only as of the date made and Hi-Crush undertakes no obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise. 2

A Portfolio of Opportunity 3 Wisconsin • 7.5 million tons of annual production capacity* • Over 30 years of reserves Marcellus & Utica • Exclusive rail access • Largest distribution network • Further expanding storage capabilities Permian • New facility in Big Spring, TX • Production from Permian expected to increase 20% from 2013-2015 Growth • Permitting underway by our Sponsor for fourth Wisconsin production facility • Expansion of distribution network through additional destination terminals Current Shale Plays Shale Basins Prospective Shale Plays Existing Terminals Planned Terminals * Includes 100 mesh and 2.6mm tons of 20/70 Whitehall capacity held by our Sponsor

Hi-Crush’s Competitive Advantages 4 • Long-Term Contracted Cash Flow • Visible Avenues to Growth • Low-Cost Producer • Long-Lived, High Quality Reserves • Prime Portfolio of Assets • Focused Strategy Focused Priorities Growth Meeting Our Customers’ Increasing Needs Returns and Value Acceleration

Delivering Outstanding Results 5 Predictable Cash Flow Visible Growth Best in Class Assets • Completed 2.6 million ton per year Whitehall facility, held by our sponsor • Expansion of distribution and storage capabilities • Developing fourth frac sand processing facility in Wisconsin • Lowest industry production cost per ton • 30+ years of premium Northern White frac sand reserves • 14 destination terminals, expanding to 100,000+ tons of silo storage capacity • 3.8 million tons of frac sand contracted in 2014; increasing to 6.6 million tons in 2015 • Long-term double-digit annual distribution growth

Our Business Model – Q3 2014 Operating Results 6 Sold FOB plant direct to customer (68%) Hi-Crush terminal Freight costs Hi-Crush plants Tons produced and delivered – 1,027,611 Production cost/ton – $13.89 Sold at the terminal to customer (32%) Sand delivered to Hi-Crush terminal via rail Tons sold – 1,180,602 Class-1 and short-line rail Customer truck delivers to well site

Logistics Flexibility Critical Augusta Facility Wyeville Facility Sandstone Formations • Access to all major U.S. oil and gas basins • Direct loading and unloading of unit trains • In-basin terminals across Marcellus and Utica shales, new location in Permian Basin • 6,000 railcars under management • Taking delivery of 700 additional cars in Q4 2014 • Strong relationships with multiple Class-1 and short-line railroads Current Shale Plays Shale Basins Prospective Shale Plays Existing Terminals Sponsor’s Whitehall Facility 7 Planned Terminals

Rail Access Provides Direct Link from Mine to Basin 8 • Class-1 rail lines provide efficient and cost effective access to drilling activity • Majority of sand sold into leading areas of activity Q3 2014 – Shipping Destinations by Play/Region $26.9 $15.3 $11.5 $8.5 $6.6 $5.5 $5.4 $3.1 2014 Projected Capex by Play (1) ($ in billions) (1) Source: Wood Mackenzie 46% 39% 8% 5% 2% Permian / Eagle Ford Marcellus / Utica Colorado Oklahoma Other

Frac Sand Demand Remains Strong “… the appetite for more sand is really growing, particularly in the Permian as our customers stay in that experimentation mode… So the trend is there's going to be more sand.” Q2 2014 Earnings Call “If we look at our 2013 program we had pumped a lot of 40-70 mesh sand in the let's say, 300,000, 400,000 pound range. We've increased our proppant to 30-50 mesh and we've actually done some 20-40 mesh jobs now and we're pumping about 400,000 to 500,000 pounds per stage on those treatments.” Q2 2014 Earnings Call “You have operators out in the Permian Basin that, on average, spend $1 million more per well, but they're yielding an additional 400,000 barrels in ultimate estimated recovery. For me, that's a no-brainer.” Q2 2014 Earnings Call “We've seen sand costs generally go up about 10%. We've had 100 mesh go up as much 50% from some suppliers. But 20/40 white that we pump a lot of is really – we've seen 5% to 10% increases there, and we've been able to pass those on with really no pushback from our customers.” Q2 2014 Earnings Call “… on sand where we took some higher costs because there were some significant changes in sand size and volume for several of our customers… we had a very high growth rate and transportation availability became quite tight.” Q2 2014 Earnings Call • E&P operators are using fracture stimulation techniques, such as increased proppant per stage and increased frac stages per well, to drive well performance • These activities are driving premium Northern White frac sand demand growth 9 “Compared to the prior year…our stage count was up more than 30% and our average sand per well increased by more than 50%. …our customers are experimenting with larger completion volumes in almost every basin. This is a fundamental change in well design that we believe is part of a continuing trend.” Q3 2014 Earnings Call

Core E&P Acreage Offers Attractive Returns 10 • ~85% of our shipments go to basin with IRRs over 35% (1) Source: Credit Suisse Research (October 2014); based on oil and gas strip as of 10/27/14 Basin IRRs(1) 71% 59% 57% 51% 48% 47% 47% 37% – 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0%

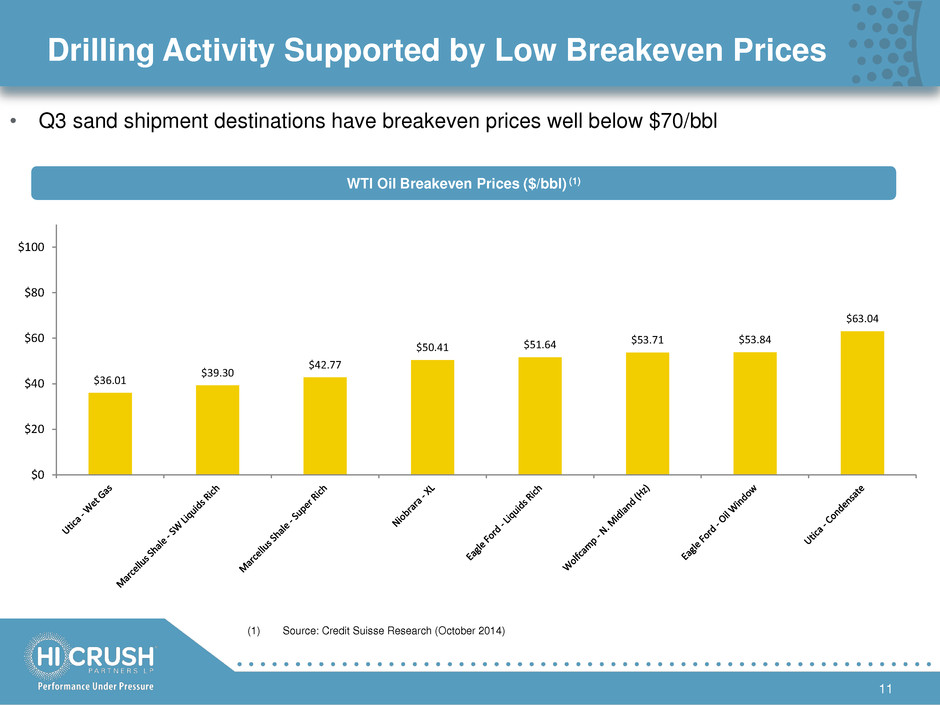

Drilling Activity Supported by Low Breakeven Prices 11 • Q3 sand shipment destinations have breakeven prices well below $70/bbl (1) Source: Credit Suisse Research (October 2014) WTI Oil Breakeven Prices ($/bbl) (1) $36.01 $39.30 $42.77 $50.41 $51.64 $53.71 $53.84 $63.04 $0 $20 $40 $60 $80 $100

68% 32% Tons Sold FOB Mine During the Quarter 12 FOB Mine Volume (1) Primarily sold in Marcellus and Utica shales (2) Tons sold FOB mine primarily comprised of volumes sold under contract to long-term, take or pay customers (3) FOB mine sales shipped to Marcellus and Utica exclude volumes sold FOB destination at Hi-Crush terminal locations (2) Q3 2014 – FOB Mine Sales Volume Sold at Terminals (1) 50% 33% 9% 6% 2% Permian / Eagle Ford Marcellus / Utica Colorado Oklahoma Other (3)

68% 32% Hi-Crush Terminals Addressing Customer Needs 13 Hi-Crush terminal Freight costs Sand delivered to Hi-Crush terminal via rail Class-1 and short-line rail Customer truck delivers to well site Volume Sold at Terminals Sand sourced from mine 1 1 2 3 4 Sand transported by rail to destination terminal 2 In-basin terminal locations provide convenient customer services 3 Customer trucks deliver sand to well site for completion 4 • Ability to source from Hi-Crush mines, the Sponsor’s Whitehall facility, and 3rd party suppliers • On-site rail access is significant logistical advantage; rail fleet creates flexibility • Hi-Crush earns margin for alleviating customers’ logistical challenges • Additional revenue generated via storage and transload services • Unit train capabilities key for asset utilization and inventory management • Mix of contract and spot sales • Terminals transfer product to customer or 3rd party trucking service via silo or portable conveyor Q3 2014 FOB Mine Volume

Committed to Growing Distribution Long-Term 14 • Pattern of raising distribution with quarterly increases — 28% increase from distribution paid Q4 2013 vs paid Q4 2014 • Delivered on guidance at high end of $2.30-$2.50 per unit distribution range • Long-term, double-digit annual distribution growth outlook intact Declared Distributions Per Unit (Annualized) * * $1.90 represents the Minimum Quarterly Distribution per unit at IPO $1.90 $1.96 $2.04 $2.10 $2.30 $2.50 Q3 '13 Q4 '13 Q1 '14 Q2 '14 Q3 '14 Q4 '14

Strong Coverage Provides Flexibility for Growth 15 • Strong coverage ratio averaging above target coverage of 1.20x — Average since 1/1/13 of 1.26x • Coverage supports step-change in distribution growth and organic expansion $0.475 Per Unit $0.475 Per Unit $0.490 Per Unit $0.510 Per Unit $0.525 Per Unit $0.575 Per Unit (1) Actual coverage ratio was 1.0x including $0.525 per unit distribution paid on 4.25 million units issued in April 2014 (2) Excludes impact of the August 15, 2014 conversion of Class B units to common units and related distribution paid upon conversion (3) Excludes the portion of DCF allocable to the Incentive Distribution Rights held by our Sponsor (1) (2) $0.625 Per Unit (3) (3) 1.12x 1.14x 1.24x 1.38x 1.15x 1.35x 1.40x – 0.20x 0.40x 0.60x 0.80x 1.00x 1.20x 1.40x 1.60x 1.80x $0 $5 $10 $15 $20 $25 $30 $35 $40 Q1 '13 Q2 '13 Q3 '13 Q4 '13 Q1 '14 Q2 '14 Q3 '14 $ in M ill io n s Distributions (Total $/Q) Coverage Coverage > 1.2x Target Coverage Ratio

Positioned to Meet Demand Growth 16 • 3.8 million contracted take-or-pay tons in 2014 • Signed 11 new contracts or amendments to contracts YTD 2014 • 6.6 million contracted take-or-pay tons in 2015 • 88% of production capacity • Sponsor’s new Whitehall production facility • 2.6 million ton 20/70 annual capacity • Production began August 2014 • Currently cycling weekly unit trains • Permitting in process by our Sponsor for fourth Northern White frac sand processing facility in Wisconsin

Industry Backdrop

Proven Production Execution * Includes Augusta 1.0 million ton annual 20/70 capacity expansion to be completed in 2014 ** Whitehall 2.6 million ton annual 20/70 capacity facility held at Sponsor level completed in third quarter 2014 January 2014 April 2014 3rd Quarter 2014 End of Year 2014 18 Wyeville Wyeville + Augusta Wyeville + Augusta + Augusta Expansion* Wyeville + Augusta + Augusta Expansion* + Whitehall** 3.2 MM tons/yr 4.2 MM tons/yr 6.8 MM tons/yr 1.6 MM tons/yr 3.6 MM tons/yr 4.6 MM tons/yr 7.5 MM tons/yr Nameplate capacity of 20/70 sand 100 mesh

Capacity Increases Driven by Customer Demand YE 2012 YE 2013 November 2014 19 1.2 MM Tons Under Contract 2.4 MM Tons Under Contract 3.8 MM Tons Under Contract 6.6 MM Tons Under Contract 2.8 Year Average Life 4.5 Year Average Life 2.5 Year Average Life 4.2 Year Average Life YE 2014

Frac Sand Capacity 20 Frac Sand Market Structure (1) Top 10 Producers Hold > 75% of Tier-One Capacity (1) (2) Notes: (1) Based on internal estimated frac sand capacity estimates per 2014 Proppant Market Report, KELRIK LLC and Proptester, Inc. (Hi-Crush capacity includes Sponsor); Excludes sand used for other industrial applications (e.g., glass and foundry sand) (2) Tier One refers to Northern White Sand, specifically St. Peter, Jordan, Wonewoc, Mt. Simon and equivalent sandstones; excluding Canadian sources. (3) Excludes 100 mesh capacity. 15% 13% 11% 10% 10% 5% 3% 3% 3% 3% 24% Company A Hi-Crush Company B Company C Company D Company E Company F Company G Company H Company I All other tier one 6.8 Million Tons 20/70 Capacity (3) 28% 11% 9% 8% 8% 7% 29% 72% Non tier one Company A Hi-Crush Company B Company C Company D All other tier one

Low Cost Structure Essential 21 Hi-Crush Partners Production Costs per Ton Produced and Delivered Note: Recasted to include Augusta facility tons produced and delivered – 200,000 400,000 600,000 800,000 1,000,000 1,200,000 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 3Q 2014 Quarterly Production Costs / Ton Quarterly Tons Produced and Delivered

Levers for Further Performance 22

Appendix

Third Quarter 2014 Summary 24 Three Months Three Months Ended Ended September 30, 2014 September 30, 2013 Recasted Revenues $ 102,316 $ 53,158 Cost of goods sold (including depreciation, depletion, and amort.) 55,640 31,868 Gross profit 46,676 21,290 Operating costs and expenses: General and administrative 6,183 5,543 Exploration expense - - Accretion of asset retirement obligation 61 57 Income from operations 40,432 15,690 Other (income) expense: Interest expense 3,111 1,273 Net income 37,321 14,417 Income attributable to non-controlling interest (292) (62) Income attributable to Hi-Crush Partners LP $ 37,029 $ 14,355 Earnings per unit: Common and subordinated units - basic $ 0.86 $ 0.52 Common and subordinated units - diluted $ 0.83 $ 0.52 Weighted average limited partner units outstanding: Common and subordinated units - basic 35,077,527 28,865,171 Common and subordinated units - diluted 37,033,959 28,865,171

YTD 2014 Summary 25 Nine Months Nine Months Ended Ended September 30, 2014 September 30, 2013 Recasted Recasted Revenues $ 255,618 $ 114,995 Cost of goods sold (including depreciation, depletion, and amort.) 143,665 58,613 Gross profit 111,953 56,382 Operating costs and expenses: General and administrative 19,287 13,322 Exploration expense — 56 Accretion of asset retirement obligation 184 172 Income from operations 92,482 42,832 Other (income) expense: Interest expense 6,836 2,301 Net income 85,646 40,531 Income attributable to non-controlling interest (704) (150) Income attributable to Hi-Crush Partners LP $ 84,942 $ 40,381 Earnings per unit: Common and subordinated units - basic $ 2.24 $ 1.45 Common and subordinated units - diluted $ 2.15 $ 1.45 Weighted average limited partner units outstanding: Common and subordinated units - basic 32,162,763 27,933,411 Common and subordinated units - diluted 35,362,327 27,933,411

Third Quarter 2014 Summary (1) Maintenance and replacement capital expenditures, including accrual for reserve replacement, were determined based on an estimated reserve replacement cost of $1.35 per ton produced and delivered during the period. Such expenditures include those associated with the replacement of equipment and sand reserves, to the extent that such expenditures are made to maintain our long-term operating capacity. The amount presented does not represent an actual reserve account or requirement to spend the capital. (2) The Partnership's historical financial information has been recast to consolidate Augusta for all periods presented. For purposes of calculating distributable cash flow attributable to Hi-Crush Partners LP, the Partnership excludes the incremental amount of recasted distributable cash flow earned during the periods prior to the Augusta Contribution. 26 Three Months Three Months Ended Ended September 30, 2014 September 30, 2013 Recasted Reconciliation of distributable cash flow to net income: Net income $ 37,321 $ 14,417 Depreciation and depletion 2,677 2,189 Amortization expense 781 1,662 Interest expense 3,111 1,273 EBITDA $ 43,890 $ 19,541 Less: Cash interest paid (2,702) (1,178) Less: Maintenance and replacement capital expenditures, incl. accrual for reserve replacement (1) (1,387) (807) Less: Income attributable to noncontrolling interest (292) (62) Add: Accretion of asset retirement obligation 61 57 Add: Unit based compensation 569 - Distributable cash flow $ 40,139 $ 17,551 Adjusted for: Distributable cash flow attributable to Hi-Crush Augusta LLC, net of intercompany eliminations, prior to the Augusta Contribution (2) - 50 Less: Distributable cash flow attributable to holders of incentive distribution rights (7,791) - Distributable cash flow attributable to Hi-Crush Partners LP $ 32,348 $ 17,601

YTD 2014 Summary (1) Maintenance and replacement capital expenditures, including accrual for reserve replacement, were determined based on an estimated reserve replacement cost of $1.35 per ton produced and delivered during the period. Such expenditures include those associated with the replacement of equipment and sand reserves, to the extent that such expenditures are made to maintain our long-term operating capacity. The amount presented does not represent an actual reserve account or requirement to spend the capital. (2) The Partnership's historical financial information has been recast to consolidate Augusta for all periods presented. For purposes of calculating distributable cash flow attributable to Hi-Crush Partners LP, the Partnership excludes the incremental amount of recasted distributable cash flow earned during the periods prior to the Augusta Contribution. 27 Nine Months Nine Months Ended Ended September 30, 2014 September 30, 2013 Recasted Recasted Reconciliation of distributable cash flow to net income: Net income $ 85,646 $ 40,531 Depreciation and depletion 6,581 4,259 Amortization expense 4,385 2,025 Interest expense 6,836 2,301 EBITDA $ 103,448 $ 49,116 Less: Cash interest paid (5,984) (1,854) Less: Maintenance and replacement capital expenditures, incl. accrual for reserve replacement (1) (3,644) (2,117) Less: Income attributable to noncontrolling interest (704) (150) Add: Accretion of asset retirement obligation 184 172 Add: Unit based compensation 922 - Distributable cash flow $ 94,222 $ 45,167 Adjusted for: Distributable cash flow attributable to Hi-Crush Augusta LLC, net of intercompany eliminations, prior to the Augusta Contribution (2) (7,199) 2,511 Less: Distributable cash flow attributable to holders of incentive distribution rights (10,244) - Distributable cash flow attributable to Hi-Crush Partners LP $ 76,779 $ 47,678

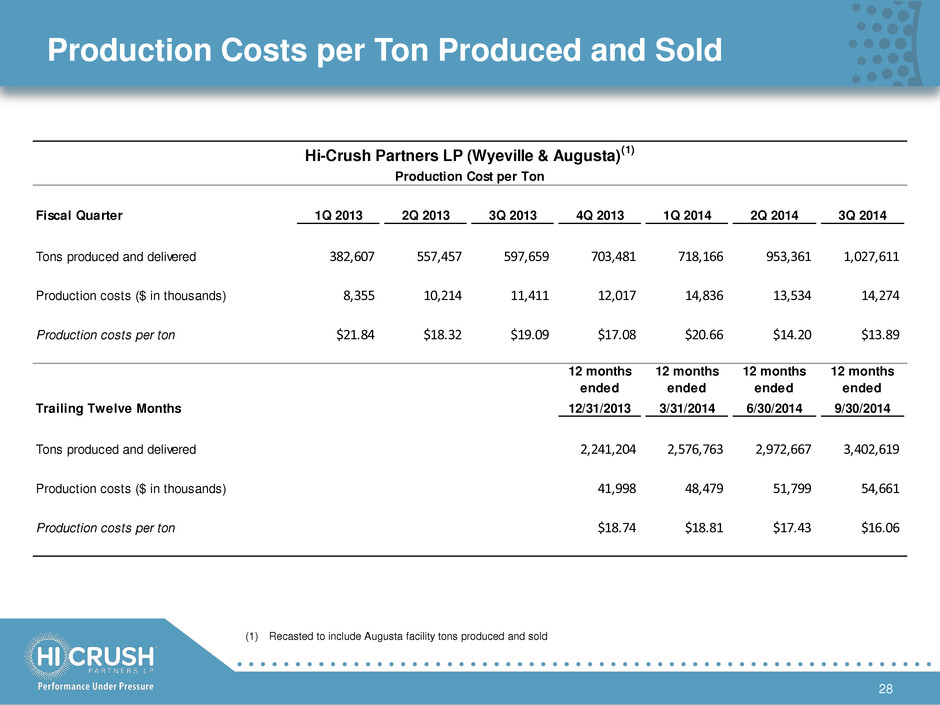

Production Costs per Ton Produced and Sold 28 (1) Recasted to include Augusta facility tons produced and sold Hi-Crush Partners LP (Wyeville & Augusta) (1) Production Cost per Ton Fiscal Quarter 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 3Q 2014 Tons produced and delivered 382,607 557,457 597,659 703,481 718,166 953,361 1,027,611 Production costs ($ in thousands) 8,355 10,214 11,411 12,017 14,836 13,534 14,274 Production costs per ton $21.84 $18.32 $19.09 $17.08 $20.66 $14.20 $13.89 12 months ended 12 months ended 12 months ended 12 months ended Trailing Twelve Months 12/31/2013 3/31/2014 6/30/2014 9/30/2014 Ton produced and delivered 2,241,204 2,576,763 2,972,667 3,402,619 Production costs ($ in thousands) 41,998 48,479 51,799 54,661 Production costs per ton $18.74 $18.81 $17.43 $16.06

Balance Sheet is Strong 29 (1) Revolving credit facility: $143.8mm available at L+3.25% ($150mm capacity less $6.2mm of LCs); includes accordion feature to increase to $200mm (2) Senior secured term loan: $200mm face value at L+3.75%; rated B2 and B+ by Moody's and Standard & Poor's, respectively (3) Denominator calculated as annualized recasted EBITDA for the nine months ended September 30, 2014 of $103.4mm As of September 30, 2014: ($ in 000s) Cash 20,625$ $150mm Revolver -$ 1 Term loan 197,118 2 Total debt 197,118$ Net debt 176,493$ Net debt / EBITDA 1.28x 3