Attached files

| file | filename |

|---|---|

| EX-5.2 - OPINION - Amrose Oil Co Inc. | aoci_ex52.htm |

| EX-5.1 - OPINION - Amrose Oil Co Inc. | aoci_ex51.htm |

| EX-23.1 - CONSENT - Amrose Oil Co Inc. | aoci_ex231.htm |

| EX-24.1 - POWER OF ATTORNEY - Amrose Oil Co Inc. | aoci_ex241.htm |

| EX-99.1 - MANAGEMENT REP LETTER - Amrose Oil Co Inc. | aoci_ex991.htm |

| EX-10.9 - DIRECTORS SERVICES AGREEMENT - Amrose Oil Co Inc. | aoci_ex109.htm |

| EX-23.2 - CONSENT - Amrose Oil Co Inc. | aoci_ex232.htm |

| EX-99.2 - SEC COMMENT LETTER RESPONSES - Amrose Oil Co Inc. | aoci_ex992.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

(Amendment No. 4)

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Amrose Oil Company Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

1300

|

45-3851452

|

||

|

(State of Incorporation)

|

(Primary Standard Industrial

|

(IRS Employer

|

||

|

Classification Number)

|

Identification Number)

|

Amrose Oil Company

3525 Sage Rd, Ste. 1416

Houston, TX 77056

713-280-5173

A Development Stage Company

Copies to:

Serpent Acquisitions LLC.

2217 N. IL. Route 83

Round Lake Beach IL 60073

847-548-2400

Approximate date of proposed sale to the public: As soon as practicable and from time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o |

Accelerated filer

|

o |

|

Non-accelerated filer

|

o |

Smaller reporting company

|

þ |

|

(Do not check if a smaller reporting company)

|

|||

CALCULATION OF REGISTRATION FEE

|

|

Proposed Maximum

|

Proposed Maximum

|

Amount of

|

|||||||||||||

|

Title of Each Class of

|

Amount to Be

|

Offering Price

|

Aggregate

|

Registration

|

||||||||||||

|

Securities to be Registered

|

Registered(3)

|

per Share

|

Offering Price

|

Fee (1)(2)

|

||||||||||||

|

Common Stock, par value $0.001 per share (3)

|

1,066,000 | $ | N/A | $ | N/A | N/A | ||||||||||

______________

(1) Estimated in accordance with Rule 457(a) of the Securities Act of 1933 solely for the purpose of computing the amount of the registration fee based on recent prices of private transactions.

(2) Calculated under Section 6(b) of the Securities Act of 1933 as .00011460 of the aggregate offering price.

(3) Represents shares of the registrant's common stock being registered for resale that have been issued to the selling shareholders named in this registration statement.

We hereby amend this registration statement on such date or dates as may be necessary to delay our effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission (the “Commission”), acting pursuant to Section 8(a) may determine.

2

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION

DATED OCTOBER 27, 2014

AMROSE OIL COMPANY

1,066,000 SHARES OF COMMON STOCK OFFERED BY SELLING SHAREHOLDERS

The selling shareholders are offering up to 1,066,000 shares of common stock. The selling shareholders will sell their shares at $.001 per share until our Shares are quoted on the OTC Bulletin Board and, assuming we secure quotation on the OTC Bulletin Board, thereafter at prevailing market price or privately negotiated prices. We will not receive any of the proceeds from the sale of the common shares by the selling shareholders.

There are no underwriting commissions involved in this offering. We have agreed to pay all the costs of this offering. The selling shareholders will pay no offering expenses.

Prior to this offering, there has been no market for our securities. Our common stock is not now listed on any national securities exchange, the NASDAQ stock market, or the OTC Bulletin Board. There is no guarantee that our securities will ever trade on the OTC Bulletin Board or other exchange.

This offering is highly speculative and these securities involve a high degree of risk and should be considered only by persons who can afford the loss of their entire investment. See “Risk Factors” beginning on page 8.

Neither the Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

3

The date of this prospectus is October 27, 2014.

The following table of contents has been designed to help you find information contained in this prospectus. We encourage you to read the entire prospectus.

|

PAGE

|

||||

|

Summary Information and Risk Factors

|

5 | |||

|

Risk Factors

|

8 | |||

|

Use of Proceeds

|

16 | |||

|

Determination of Offering Price

|

16 | |||

|

Dilution

|

16 | |||

|

Selling Shareholders

|

16 | |||

|

Plan of Distribution

|

20 | |||

|

Legal Proceedings

|

22 | |||

|

Directors, Executive Officers, Promoters, and Control Persons

|

22 | |||

|

Security Ownership of Certain Beneficial Owners and Management

|

24 | |||

|

Description of Securities

|

25 | |||

|

Interest of Named Experts and Counsel

|

26 | |||

|

Disclosure of Commission Position on Indemnification for Securities Liabilities

|

27 | |||

|

Description of Business

|

27 | |||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

33 | |||

|

Description of Property

|

||||

|

Certain Relationships and Related Transactions

|

38 | |||

|

Market for Common Equity and Related Stockholder Matters

|

40 | |||

|

Executive Compensation

|

42 | |||

|

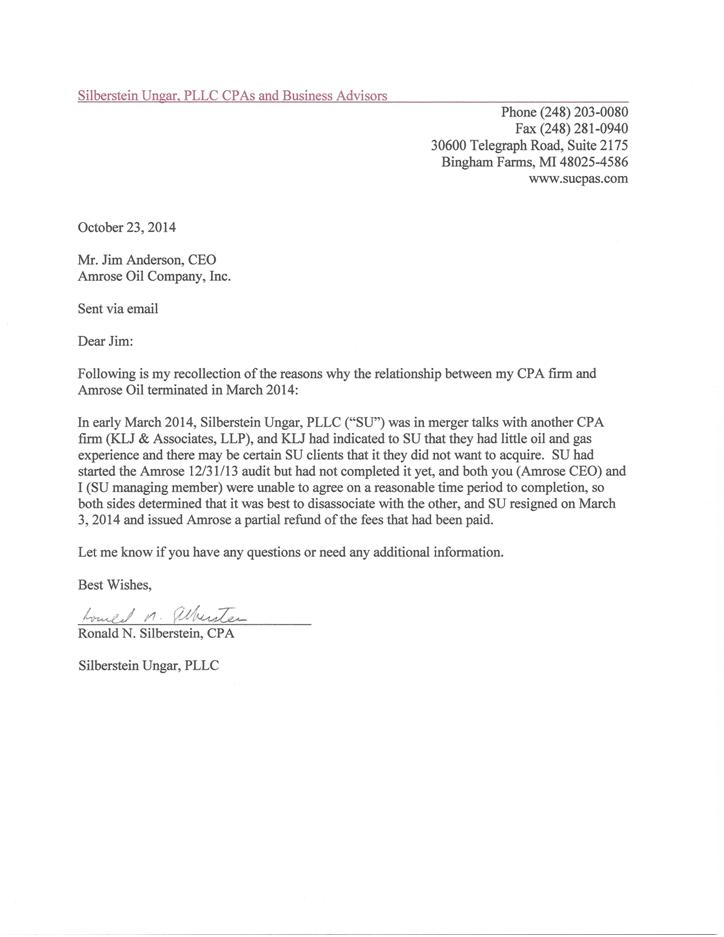

Changes In and Disagreements With Accountants on Accounting and Financial Disclosure

|

43 | |||

|

Legal Matters

|

44 | |||

|

Financial Statements

|

F-3-F-6

|

|||

|

Notes To Financial Statements

|

F7-F15

|

|||

4

SUMMARY INFORMATION AND RISK FACTORS

As used in this prospectus, references to the “Company,” “we,” “our”, “us” or “Amrose Oil Company” “AOC”, refer to Amrose Oil Company, a Nevada Corporation, unless the context otherwise indicates.

You should carefully read all information in the prospectus, including the financial statements and their explanatory notes beginning at page F12-1 prior to making an investment decision.

Organization

The purpose of the corporation will be to acquire and manage oil and gas properties in the United States with the goal of achieving a positive revenue stream and a solid asset base and then managing existing assets while acquiring selected additional assets in a manner that will achieve maximum growth and shareholder value while minimizing liabilities. Our Website is at: http://AmroseOil.com. The information on our website is not part of this prospectus.

CURRENT HOLDINGS

|

●

|

A 50% interest in various non-operated working interests in the wellbores of the Champion 320-1, 320-2 and 320-3 located in the Augustin Viesca Survey, A-77, Polk County, Texas. Operated by Old Pine Energy Corp. of Austin, Texas.

|

|

Currently these wells are not operating but the Company may decide to operate them in the future.

|

|

|

A 50% interest in a non-operated working interest of 17.71739% (NRI: 14.17391%) in the wellbore of the Cantey B #1 well located in the SW/4 of Section 30, Block 2, T&P RR Co. Survey, A-1881, Palo Pinto County, Texas. Operated by Dynamic Production, Inc. This well has been shut off and closed.

|

|

●

|

A 50% interest in a 0.03125% Overriding Royalty Interest in the Wohl 9-2 located in Section 9-T14N-R19W, Custer County, Oklahoma. Operated by Chesapeake Operating, Inc. of Oklahoma City, Oklahoma. This well has been shut off and closed.

|

The Company obtained a 50% interest in each of the above-described properties by purchasing half of the 50% interest from Wintree Energy Corporation (“Wintree”) and half of the 50% interest from Bri Ric Investments, Inc. The Company paid Wintree 40,000 shares of Company stock for its half of the 50% interest in the properties. The Company paid Bri Ric Investments, Inc., 40,000 shares of Company stock for its half of the 50% interest in the properties. Before the latest purchase agreements, each of the companies (Wintree & Bri Ric Investments) owned 25% of the interest in the described holdings. By the Company buying each companies’ interest, the Company now holds a full 50% interest in the properties. The current status of each of the wells is that they are all capped (shut off/plugged).

5

Plan of Business

The Company’s primary focus is crude oil production and our target acquisitions are onshore North American properties. The Company will set out to secure those opportunities that will produce revenues and positive cash flows within the shortest period of time. If the Company can't secure these opportunities and/or the Company is not able to secure funding then you could lose all of your investment. Today’s higher oil and gas prices have essentially made the acquisition of marginal oil wells a potentially valuable proposition.

The Company anticipates implementing multiple technologies to capitalize on the individual limitations and requirements of each well being treated. These advanced oil recovery technologies may include fracturing stimulation (fracking), surfactant-polymer technology (i.e., introduction of various gels and chemicals to mix with the oil and bring it out of the multiple layers of rock that it’s located in. Once the oil is free of the rock the Company can pump it to the surface to be sold.) and water-flooding methods (introduction of water into the oil well to increase pressure to bring the oil to the top to be pumped out). These methods have been used time and time again (with fracking and introduction of the latest gel based polymers being the latest developments) to obtain oil from working wells, capped wells, and wells that at one time were considered marginal and were abandoned due to costs involved and the small amounts of oil able to be recovered with the technology at that time. These methods have become standard operating procedure when it comes to oil recovery and no licensing or special contract for the use of equipment to implement the above procedures is necessary.

The mission of the Company is to acquire marginal oil wells, otherwise known as “Stripper Wells”, and apply enhanced oil recovery technologies to significantly increase existing production.

The Company’s vision is to create added value to existing marginal oil wells through the application of technologies used for developing untapped reserves and exploiting potentially undervalued oil properties. The Company is hoping to see marginally recoverable wells with extraction using oil industry standard extraction methodologies with the hope that these wells may contain part of the original oil reserves in place (OOIP). If the Company fails to locate and extract oil from these types of wells or there isn't enough oil left in place from the close of previous operations, you could lose your investment. This targeted market has marginal or non-producing wells due to:

● Neglect;

● Small, independent owners lacking resources

● Financial inability of owners to invest in rehabilitation;

● Lack of access or knowledge of new technologies;

● Desire to exit given current market price of oil;

● Other reasons specific to each lease.

For the above reasons, marginal oil wells and leases can and will be purchased at attractive discounts to market value, allowing investors the opportunity for significant returns.In addition to generating revenues from producing wells, management strongly believes that relevant incremental production can be generated from drilling a number of additional new wells.

6

The directive would be to reinvest a portion (up to 10%) of net cash flows from operations in these drilling programs, as determined by management, and expanded based upon the results generated.

Due to the massive fragmentation of the Marginal Oil Well market, our aggressive acquisition pace will afford the Company much efficiency and opportunities due to economies of scale. This strategy of consolidation will result in a more efficient operation.

The Company’s intent is to purchase drilling rights or ownership rights of various wells in the United States using cash and the issuance of restricted stock in private transactions. The Company also intends to approach well owners with the option for the Company to drill the well free of charge to the well owner for a percentage of any oil that the Company can pump out and bring to market. The Company also intends to drill the wells for the owners of same for a percentage ownership of the well providing the Company can pump out a predetermined amount of oil from the well (varies on each well on a case by case basis). We have no current agreements for any of the forgoing, however, and there can be no assurance that we will be successful in obtaining any of the foregoing.

We will also need access to additional financing, which may not be available to us on acceptable terms or at all. If we are unable to generate sufficient revenues or obtain debt or equity financing, we will not be able to earn profits and may not be able to continue operations. We have no current agreements or commitments for any additional financing, however, and there can be no assurance that we will be successful in obtaining any additional financing.

The Offering

As of the date of this prospectus, we had 1,066,000 shares of common stock outstanding. The selling shareholders are offering up to 1,066,000 shares of common stock. The selling shareholders will offer their shares at $.001 per share until our shares are quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. We will pay all expenses of registering the common shares held by the selling shareholders. We will not receive any proceeds of the sale of the common shares.

To be quoted on the OTC Bulletin Board, a market maker must file an application on our behalf in order to make a market for our common stock. The current absence of a public market for our common stock means that our shares should be considered totally illiquid, which inhibits investors’ ability to resell their shares.

Amrose Relationship with Serpent Acquisitions LLC

On April 30, 2012 Serpent Acquisitions LLC, signed an agreement with Amrose Oil Corporation to provide services in the creation & filing of the Company’s registration statement (S-1) as well as to provide for all fees that may be required for same. For providing this service, Serpent Acquisitions LLC was given 490,000 shares of Amrose common shares representing 4.9% of the issued and outstanding common stock of the Issuer, the right to register the shares in any registration statement Amrose files with the Commission (as here), and a 3% share of gross profits of the Company. In addition, Serpent Acquisitions LLC is entitled to 3% of our gross profits, paid on a quarterly basis, subject to our right to repurchase half of such 3% interest for an amount not exceeding $200,000. The foregoing summary is qualified in its entirety by reference to the text of our agreement with Serpent Acquisitions, LLC, which is filed as Exhibit 10.1 to the registration statement of which this prospectus is a part.

7

Serpent Acquisitions is a private company hired by Amrose as a consultant to write the registration statement and nothing more. Serpent Acquisitions has no directors or management position in the Company and is nothing more than a private contractor hired by the Company. Serpent Acquisitions LLC is not part of any day to day operation or decision making of the Company.

Serpent Acquisitions LLC is not in the business of underwriting, nor does the Serpent Acquisitions LLC have any agreement or understanding to act as a statutory underwriter, as that term is defined in Section 2(a)(11) of the Securities Act of 1933. In addition, to the Company’s knowledge, Serpent Acquisitions LLC is not a broker-dealer or an affiliate of a broker-dealer and has not been licensed by any entity as such.

Summary Financial Information

We are in our third year of operations, but have yet to commence revenues. We have accumulated deficit of $46,950 as of June 30, 2014; and as of the date of this filing our cash flow has been provided by loans of $44,597, from officers and shareholders.

Because this is only a financial summary, it does not contain all the financial information that may be important to you. Therefore, you should carefully read all the information in this prospectus, including the financial statements and their explanatory notes before making an investment decision.

RISK FACTORS

In addition to the other information provided in this prospectus, you should carefully consider the following risk factors in evaluating our business before purchasing any of our common stock. All material risks are discussed in this section.

Risks Related To Our Business

Because our auditors have issued a going concern opinion and we may be unable to achieve our objectives, we may have to suspend our business operations should sufficient financial resources be unavailable.

Our auditors’ report in our December 31, 2013 and 2012 financial statements expressed an opinion that our capital resources as of December 31, 2013 are insufficient to sustain operations. These conditions raise substantial doubt about our ability to continue as a going concern.

We have minimal operations, no revenues and no current prospects for future revenues, and we expect losses to continue into the future.

Our operations to date have consisted primarily of acquiring interests in oil and gas leases, wells and pipelines. We have no revenue producing properties and we have not engaged in any drilling activities. We have no operating history upon which an evaluation of our potential success or failure can be made. As of our fiscal year ended December 31, 2013 and 2012, we had an accumulated deficit of $ 22,442 and $10,085, respectively.

8

As of June 30, 2014, we had an accumulated deficit of $46,950. Our ability to generate revenues and become profitable is dependent upon our ability to locate oil and gas and our ability to generate revenues from the sale of oil and gas we locate, if any. We expect to incur additional operating losses in the future due to exploration and drilling expenses associated with our existing properties.

We require a significant amount of capital for our operations; should we fail to raise sufficient capital we will have to cease our operations and you will lose your entire investment.

Oil and gas exploration requires significant outlays of capital and generally offers limited success probability. Our cash as of June 30, 2014 was $ 102. We need to raise a significant amount of capital to pay for our planned exploration and development activities. If we cannot raise the capital to fund our required expenditures, we will be unable to conduct drilling activities and our business will likely fail. Even assuming that we obtain the required capital for our operations, if we do not discover and produce commercial quantities of oil and natural gas, our business would fail, in which case you would lose your entire investment.

We will need access to additional financing, which may not be available to us on acceptable terms or at all.

If we cannot access additional financing when we need it and on acceptable terms, our business, prospects, financial condition, operating results and ability to continue as a going concern could be adversely affected. We may look to raise capital through the issuance of equity, equity-related or debt securities or by obtaining credit from government or financial institutions. This capital will be necessary to fund our ongoing operations, continue research & development, improve infrastructure and possibly introduce new or improved methods of oil & gas extraction.

We cannot be certain that additional financing will be available to us on favorable terms when required, or at all, particularly given that we do not now have a committed credit facility with any government or financial institution. If we cannot obtain additional financing when we need it and on terms acceptable to us, our business, prospects, financial condition, operating results and ability to continue as a going concern could be adversely affected.

Our limited operating history makes evaluating our business and future prospects difficult, and may increase the risk of losing your investment.

We may not discover commercial quantities of oil and gas, which could cause you to lose your investment.

Our ability to locate oil and gas is dependent upon successful drilling and development of our oil and gas wells and our ability to locate oil and gas in commercial quantities. We cannot predict in advance of drilling and testing whether any particular drilling location will yield gas or oil in sufficient quantities to recover drilling or completion costs or to be economically viable. The use of technologies will not enable us to know conclusively before drilling whether gas or oil will be present or, if present, whether gas or oil will be present in commercial quantities. The analysis that we perform may not be useful in predicting the characteristics and potential oil and gas in commercial quantities at our well locations. As a result, we may not find commercially viable quantities of gas and oil and you could lose your entire investment.

9

Drilling, exploring and producing gas and oil are high-risk activities with many uncertainties that could adversely affect our business, financial condition or results of operations.

Oil and gas activities involve numerous risks. Because we have not yet commenced drilling activities, we may be unable to anticipate all risks that we may encounter. We cannot anticipate with any degree of certainty the costs and time before we commence drilling activities, if ever, and whether our oil and gas wells will be commercially productive. Additionally, even if we do commence drilling, our drilling operations may be curtailed, delayed or canceled as a result of a variety of factors, including:

|

●

|

inability to obtain financing;

|

|

|

●

|

unexpected drilling conditions, pressure or irregularities in formations, equipment failures or accidents;

|

|

|

●

|

adverse weather conditions, including tornados;

|

|

|

●

|

unavailability or high cost of drilling rigs, equipment or labor;

|

|

|

●

|

mechanical difficulties;

|

|

|

●

|

reductions in gas and oil prices;

|

|

|

●

|

limitations in the market for gas and oil;

|

|

|

●

|

surface access restrictions;

|

|

|

●

|

title problems; and/or

|

|

|

●

|

compliance with governmental regulations.

|

In addition, higher gas and oil prices generally increase the demand for drilling rigs, equipment and crews and can lead to shortages of, and increasing costs for drilling equipment, services and personnel. Any such shortages could restrict our ability to commence drilling activities. Any delay in the drilling of our wells or significant increase in our expected drilling costs could adversely affect our ability to generate revenues.

Severe weather could have a material adverse impact on our business.

Our business could be materially and adversely affected by severe weather. Repercussions of severe weather conditions may include:

|

●

|

curtailment of services rendered to us;

|

|

|

●

|

weather-related damage to drilling rigs, resulting in suspension of operations;

|

|

|

●

|

weather-related damage to our facilities;

|

|

|

●

|

inability to deliver materials to jobsites in accordance with contract schedules; and

|

|

|

●

|

loss of productivity.

|

Oil and gas prices are volatile and an extended decline in prices can significantly affect our future financial results.

The markets for oil and gas are volatile. Any substantial or extended decline in the price of oil or gas could:

|

●

|

have a material adverse effect on our planned operations;

|

|

|

●

|

limit our ability to attract capital;

|

|

|

●

|

reduce our ability to borrow funds needed for our operations; and

|

|

|

●

|

reduce the value and the amount of oil and gas we discover, if any.

|

10

Our exploration and development activities are subject to operational risks, which may lead to, increased costs and decreased production.

The marketability of oil and gas we discover and produce, if any, will depend in part upon the availability, location and capacity of our gas gathering systems, pipelines and processing facilities. Even if we locate oil and gas in commercial quantities, reservoir and operational risks may lead to increased costs and decreased production. These risks include the inability to sustain deliverability at commercially productive levels as a result of decreased reservoir pressures, large amounts of water, or flawed drilling operations. Operational risks include hazards such as fires, explosions, craterings, blowouts, uncontrollable flows of oil, gas or well fluids, pollution, releases of toxic gas and encountering formations with abnormal pressures. The occurrence of any one of these significant events, if not fully insured against, could have a material adverse effect on our financial condition and results of operations.

We face title risks related to our leases or those that we enter into that may result in additional costs and negatively affect our operating results.

It is customary in the oil and gas industry to acquire a leasehold interest in a property based upon a preliminary title investigation. To date, we have acquired 3 oil and gas leases. If the title to the leases acquired is defective, we could lose funds already spent on acquisition and development, or incur substantial costs to cure the title defect, including any necessary litigation. If a title defect cannot be cured, we will not have the right to participate in the development of or production from the leased properties, which will negatively affect our potential profitability.

Competition in the oil and gas industry is intense, and most of our competitors have greater financial and operational resources then we do.

We operate in a highly competitive environment for marketing gas and oil and securing equipment and trained personnel. Many of our competitors are major and large independent oil and gas companies that possess and employ financial, technical and personnel resources substantially greater than ours. Those companies may be able to develop properties more efficiently than our financial or personnel resources permit. Also, there is substantial competition for capital available for investment in the oil and gas industry. Larger competitors will likely be better able to withstand sustained periods of unsuccessful drilling and absorb the burden of changes in laws and regulations more easily than we can, which would adversely affect our competitive position. We may be unable to compete successfully in the future in developing our oil and gas wells, marketing any oil and gas we discover, attracting and retaining quality personnel and/or raising capital to commence drilling activities.

We are subject to complex governmental laws and regulations that may adversely affect the cost, manner or feasibility of doing business.

Our operations and facilities are subject to extensive federal, state and local laws and regulations relating to the exploration for, and the development, production and transportation of, gas and oil, and operating safety, and protection of the environment, including those relating to air emissions, wastewater discharges, land use, storage and disposal of wastes and remediation of contaminated soil and groundwater. Future laws or regulations, any adverse changes in the interpretation of existing laws and regulations or our failure to comply with existing legal requirements may negatively affect our business, results of operations and financial condition. We may encounter unanticipated capital expenditures to comply with governmental laws and regulations, such as:

11

|

●

|

price control;

|

|

|

●

|

taxation;

|

|

|

●

|

lease permit restrictions;

|

|

|

●

|

drilling bonds and other financial responsibility requirements, such as plug and abandonment bonds;

|

|

|

●

|

spacing of wells;

|

|

|

●

|

unitization and pooling of properties;

|

|

|

●

|

safety precautions; and

|

|

|

●

|

permitting requirements.

|

Under these laws and regulations, we could be liable for:

|

●

|

personal injuries;

|

|

|

●

|

property and natural resource damages;

|

|

|

●

|

well reclamation costs, soil and groundwater remediation costs; and

|

|

|

●

|

governmental sanctions, such as fines and penalties.

|

Our operations could be significantly delayed or curtailed, and our cost of operations could significantly increase as a result of environmental safety and other regulatory requirements or restrictions. We are unable to predict the ultimate cost of compliance with these requirements or their effect on our operations. We may be unable to obtain all necessary licenses, permits, approvals and certificates for proposed projects. Intricate and changing environmental and other regulatory requirements may require substantial expenditures to obtain and maintain permits. If a project fails to function as planned, for example, due to costly or changing requirements or local opposition, it may create expensive delays, extended periods of non-operation or significant loss of value in a project.

Environmental liabilities may expose us to significant costs and liabilities.

There is inherent risk of incurring significant environmental costs and liabilities in our gas and oil operations due to the potential handling of oil and gas and generated wastes, the occurrence of air emissions and water discharges from work-related activities and the legacy of pollution from historical industry operations and waste disposal practices. We may incur joint and several or strict liability under these environmental laws and regulations in connection with spills, leaks or releases of oil and gas wastes on, under or from our properties and facilities, many of which have been used for exploration, production or development activities for many years, oftentimes by third parties not under our control. Private parties, including the owners of properties upon which we conduct drilling and production activities as well as facilities where our oil and gas or wastes are taken for reclamation or disposal, may also have the right to pursue legal actions to enforce compliance as well as to seek damages for non-compliance with environmental laws and regulations or for personal injury or property damage. In addition, changes in environmental laws and regulations occur frequently, and may result in more stringent and costly waste handling, storage, transport, disposal or remediation requirements that could have a material adverse effect on our operations or financial position. We may be unable to recover some or any of these costs from insurance.

Risks Related To Our Management

We depend heavily on our management and we may be unable to replace them if we lose their services.

The loss of the services of one or more members of our management or our inability to attract, retain and maintain additional management could harm our business, financial condition, results of operations and future prospects.

12

Our operations and prospects depend in large part on the performance of our President, James Anderson, and our management team. We may be unable to find qualified replacements for them if their services are no longer available.

Because members of our management have other business interests, they may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

Our directors and officers have other business interests that take up a portion of their individual and professional time from our business. Currently, each director who is not an officer intends but is not obligated to devote a minimum of approximately ten (10) hours per week to the management of the Company. Each of our officers are required to devote a minimum of thirty-five (35) hours per week to the management and operation of the Company. Accordingly, the personal interests of our officers and directors and those of the companies that they are affiliated with may come into conflict with our interests and those of our minority stockholders. We, as well as the other companies that our officers and directors are affiliated with, may present them with business opportunities, which are simultaneously desired. Additionally, we may compete with these other companies for investment capital, technical resources, key personnel and other things. You should carefully consider these potential conflicts of interest before deciding whether to invest in our shares of our common stock. We have not yet adopted a policy for resolving such conflicts of interests.

Risks Related to Our Common Stock

Our current management holds significant control over our common stock, which will prevent our minority shareholders from having the ability to control any of our corporate actions.

Our management has significant control over our voting stock, which may make it difficult to complete some corporate transactions without their support and may prevent a change in our control. Our officers, directors, and majority shareholder have employment contracts and board minutes calling for the issuance of 41,250,000 shares, of which 1,250,000 shares is for contractual compensation to the CEO Jim Anderson and 40,000,000 is for repayment of loans from the board of directors, with 41,250,000 of these approved shares currently issued, or approximately 16% of our outstanding common stock. As a result of this substantial control of our common stock, our management will have considerable influence over the outcome of all matters submitted to our stockholders for approval, including the election of directors. In addition, this ownership could discourage the acquisition of our common stock by potential investors and could have an anti-takeover effect, possibly depressing the trading price of our common stock.

Investors may have difficulty in reselling their shares due to the lack of market or state Blue Sky laws.

Our common stock is currently not quoted on any market. No market may ever develop for our common stock, or if developed, may not be sustained in the future. The holders of our shares of common stock and persons who desire to purchase them in any trading market that might develop in the future should be aware that there might be significant state law restrictions upon the ability of investors to resell our shares. Accordingly, even if we are successful in having the Shares available for trading on the OTC Bulletin Board, investors should consider any secondary market for our securities to be a limited one.

13

We intend to seek coverage and publication of information regarding the Company in an accepted publication, which permits a "manual exemption." This manual exemption permits a security to be distributed in a particular state without being registered if the Company issuing the security has a listing for that security in a securities manual recognized by the state. However, it is not enough for the security to be listed in a recognized manual. The listing entry must contain (1) the names of issuers, officers, and directors, (2) an issuer's balance sheet, and (3) a profit and loss statement for either the fiscal year preceding the balance sheet or for the most recent fiscal year of operations. We may not be able to secure a listing containing all of this information. Furthermore, the manual exemption is a non-issuer exemption restricted to secondary trading transactions, making it unavailable for issuers selling newly issued securities. Most of the accepted manuals are those published in Standard and Poor's, Moody's Investor Service, Fitch's Investment Service, and Best's Insurance Reports, and many states expressly recognize these manuals. A smaller number of states declare that they “recognize securities manuals” but do not specify the recognized manuals. The following states do not have any provisions and therefore do not expressly recognize the manual exemption: Alabama, Georgia, Illinois, Kentucky, Louisiana, Montana, South Dakota, Tennessee, Vermont and Wisconsin. Accordingly, our shares should be considered totally illiquid, which inhibits investors’ ability to resell their shares.

We will be subject to penny stock regulations and restrictions and you may have difficulty selling shares of our common stock.

The SEC has adopted regulations which generally define so-called “penny stocks” to be an equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. We anticipate that our common stock will become a “penny stock”, and we will become subject to Rule 15g-9 under the Exchange Act, or the “Penny Stock Rule”. This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers. For transactions covered by Rule 15g-9, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our securities and may affect the ability of purchasers to sell any of our securities in the secondary market.

For any transaction involving a penny stock, unless exempt, the rules require delivery, prior to any transaction in a penny stock, of a disclosure schedule prepared by the SEC relating to the penny stock market. Disclosure is also required to be made about sales commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

We do not anticipate that our common stock will qualify for exemption from the Penny Stock Rule. In any event, even if our common stock were exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock, if the SEC finds that such a restriction would be in the public interest.

Sales of our common stock under Rule 144 could reduce the price of our stock.

None of our outstanding common shares are currently eligible for resale under Rule 144.

14

In general, persons holding restricted securities in a Securities & Exchange Commission reporting company, including affiliates, must hold their shares for a period of at least six months, may not sell more than one percent of the total issued and outstanding shares in any 90-day period, and must resell the shares in an unsolicited brokerage transaction at the market price. If substantial amounts of our common stock become available for resale under Rule 144, prevailing market prices for our common stock will be reduced.

If in the future we are not required to continue filing reports under Section 15(d) of the 1934 Act, for example because we have less than three hundred shareholders of record at the end of the first fiscal year in which this registration statement is declared effective, and we do not file a Registration Statement on Form 8-A upon the occurrence of such an event, our securities can no longer be quoted on the OTC Bulletin Board, which could reduce the value of your investment.

As a result of this offering as required under Section 15(d) of the Securities Exchange Act of 1934, we will file periodic reports with the Commission as required under Section 15(d). However, if in the future we are not required to continue filing reports under Section 15(d), for example because we have less than three hundred shareholders of record at the end of the first fiscal year in which this registration statement is declared effective, and we do not file a Registration Statement on Form 8-A upon the occurrence of such an event, our securities can no longer be quoted on the OTC Bulletin Board, which could reduce the value of your investment. Of course, there is no guarantee that we will be able to meet the requirements to be able to cease filing reports under Section 15(d), in which case we will continue filing those reports in the years after the fiscal year in which this registration statement is declared effective. Filing a registration statement on Form 8-A will require us to continue to file quarterly and annual reports with the SEC and will also subject us to the proxy rules of the SEC. In addition, our officers, directors and 10% stockholders will be required to submit reports to the SEC on their stock ownership and stock trading activity. Thus the filing of a Form 8-A in such event will enable our securities to continue to be quoted on the OTC Bulletin Board.

We may, in the future, issue additional securities, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorize us to issue 250,000,000 shares of common stock. As of the date of this prospectus, we had 1,066,000 shares of common stock outstanding. Accordingly, we may issue up to an additional 248,934,000 shares of common stock. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis including for services or acquisitions or other corporate actions that may have the effect of diluting the value of the shares held by our stockholders, and might have an adverse effect on any trading market for our common stock. Our board of directors may designate the rights terms and preferences at its discretion including conversion and voting preferences without notice to our shareholders.

Special Information Regarding Forward Looking Statements

Some of the statements in this prospectus are “forward-looking statements.” These forward-looking statements involve certain known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

15

These factors include, among others, the factors set forth above under “Risk Factors.” The words “believe,” “expect,” “anticipate,” “intend,” “plan,” and similar expressions identify forward-looking statements. We caution you not to place undue reliance on these forward-looking statements. We undertake no obligation to update and revise any forward-looking statements or to publicly announce the result of any revisions to any of the forward-looking statements in this document to reflect any future developments. However, the Private Securities Litigation Reform Act of 1995 is not available to us as a non-reporting issuer. Further, Section 27A(b)(2)(D) of the Securities Act and Section 21E(b)(2)(D) of the Securities Exchange Act expressly state that the safe harbor for forward looking statements does not apply to statements made in connection with an initial public offering.

USE OF PROCEEDS

Not applicable. We will not receive any proceeds from the sale of shares offered by the selling shareholders.

DETERMINATION OF OFFERING PRICE

The offering price has been arbitrarily determined and does not bear any relationship to our assets, results of operations, or book value, or to any other generally accepted criteria of valuation. Prior to this offering, there has been no market for our securities.

DILUTION

Not applicable. We are not offering any shares in this registration statement. All shares are being registered on behalf of our selling shareholders.

SELLING SHAREHOLDERS

This prospectus covers the offering of up to 1,066,000 shares of the Company’s common stock by the selling shareholders. The Company has not entered into any agreement with any underwriter or market maker for the establishment of an active trading market for the securities subject to this registration statement, but may do so in the future. However, subsequent to this registration statement becoming effective (if at all), selling shareholders whose securities have been registered pursuant to this registration statement may sell some or all of their securities.

None of the selling shareholders have held any position or office or had a material relationship with the company and/or its predecessors and/or affiliates in any way in the three years preceding the filing of this registration statement, except for: Serpent Acquisitions LLC, which has performed consulting services for the Company pursuant to a consulting agreement filed as Exhibit 10.1 to the registration statement of which this prospectus is a part.

The Company believes, but cannot assure that the selling shareholders have sole voting and investment powers with respect to the securities indicated. The Company will not receive any proceeds from the sale (if any) of the securities by the selling shareholders.

16

All the selling shareholders purchased their shares in the Company from March 2012 through June 2014 except for Serpent Acquisitions LLC which obtained theirs are payment for the writing of the Company’s registration statement and of which are bring presented for registration in this registration statement. These selling shareholders purchased their shares from the Company pursuant to the private placement safe-harbor afforded by Rule 504 of Regulation D of the Securities Act of 1933, as amended. As of the date of this filing, although listed on the Company’s shareholder list, none of the selling shareholders have taken physical possession of their certificates nor had any shares electronically deposited in any brokerage or bank accounts. However, such selling shareholders may do so in the future. To the Company’s knowledge, No selling shareholders are in the business of underwriting, nor does the Company and/or any selling shareholder have any agreement or understanding, or otherwise to act as a statutory underwriter, as that term is defined in Section 2 (11) of the Securities Act of 1933. In addition, to the Company’s knowledge, none of the shareholders are broker-dealers or affiliates of broker-dealers.

|

Shares Owned Before Offering

|

Percentage of Shares Owned

|

Shares Owned After Offering

|

Percentage of Shares Owned

|

|||||||||||||

|

1. JUDITH CAROLE GRANT *

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

2. JOHN STABLE *

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

3. SAM ALEXANDER *

|

180,000 | 0.0179 | 180,000 | 16.89 | % | |||||||||||

|

4. JENNIFER ALEXANDER *

|

186,000 | 0.0185 | 186,000 | 17.45 | % | |||||||||||

|

5. PETER MOORE *

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

6. ANDREW GRANT *

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

7. ROBERT GRANT *

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

8. ROBERT STARKY *

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

9. TONY ALEXANDER *

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

10. TRUDI MAYFIELD *

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

11. MICHAEL CHIERO

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

12. MATTHEW FRY

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

13. TINA CHIERO

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

14. RICHARD CHIERO

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

15. NICOLE BUEROSSE

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

16. MATTHEW SYMONDS SR.

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

17. MATTHEW SYMONDS JR.

|

1,000 | 0.00005 | 1,000 | 0.09 | % | |||||||||||

|

18. LAURA SYMONDS

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

|

||||||||||||||||

|

19. LARRY GLASSMAN

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

17

|

20. JOSHUA GLASSMAN

|

1,000 | 0.00005 | 1,000 | 0.09 | % | |||||||||||

|

21. DANIEL GLASSMAN

|

1,000 | 0.00005 | 1,000 | 0.09 | % | |||||||||||

|

22. JULIA GLASSMAN

|

1,000 | 0.00005 | 1,000 | 0.09 | % | |||||||||||

|

23. SHELLY CONRAD

|

4,000 | 0.0002 | 4,000 | 0.38 | % | |||||||||||

|

24. JUDITH GOLDSTEIN

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

25. GARY GOLDSTEIN

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

|

||||||||||||||||

|

26. SCOTT GOLDSTEIN

|

60,000 | 0.006 | 60,000 | 5.63 | % | |||||||||||

|

27. DR. THOMAS FRY

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

28. CHRISTOPHER FRY

|

1,000 | 0.00005 | 1,000 | 0.09 | % | |||||||||||

|

29. VANESSA FRY ESQ.

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

30. DR. RICHARD MARGOLIN

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

31. DAN GLEASON

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

32. GAYLE ESKAMP

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

33. JILLIAN WARE

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

34. EYDIE GLASSMAN

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

35. JOSEPH FORRESTER

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

36. RYAN FORRESTER

|

1,000 | 0.00005 | 1,000 | 0.09 | % | |||||||||||

|

37. LEAH FORRESTER

|

1,000 | 0.00005 | 1,000 | 0.09 | % | |||||||||||

|

38. LANA FORRESTER

|

1,000 | 0.00005 | 1,000 | 0.09 | % | |||||||||||

|

39. RACHEL DOLAN

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

40. SHAUN DOLAN SR.

|

2,000 | 0.0001 | 2,000 | 0.19 | % | |||||||||||

|

41. SHAUN DOLAN JR.

|

1,000 | 0.00005 | 1,000 | 0.09 | % | |||||||||||

|

42. AIDAN DOLAN

|

1,000 | 0.00005 | 1,000 | 0.09 | % | |||||||||||

|

43. Certificate Voided

|

0 | 0 | 0 | |||||||||||||

|

44. SERPENT ACQUISITIONS LLC

|

490,000 | 4.9000 | 490,000 | 45.97 | % | |||||||||||

|

45.FRANK MANZO

|

40,000 | 0.002 | 40,000 | 3.75 | % |

18

|

46. RICHARD LUCCHESI

|

40,000 | 0.002 | 40,000 | 3.75 | % |

Notes:

|

●

|

* Are residents of Australia

|

|

●

|

Selling shareholders sharing the last name Alexander are related by blood and marriage

|

|

●

|

Selling shareholders sharing the last name Grant are related by blood and marriage.

|

|

●

|

Selling shareholders sharing the last name Glassman are the same family

|

|

●

|

Selling shareholders sharing the last name Goldstein are the same family

|

|

●

|

Selling shareholders sharing the last name Dolan are the same family

|

|

●

|

Selling shareholders sharing the last name Fry are the same family

|

|

●

|

Selling shareholders sharing the last name Symonds are the same family

|

|

●

|

Selling shareholders sharing the last name Chiero are the same family

|

Blue Sky

The holders of our shares of common stock and persons who desire to purchase them in any trading market that might develop in the future should be aware that there may be significant state law restrictions upon the ability of investors to resell our shares. Accordingly, even if we are successful in having the Shares available for trading on the OTC Bulletin Board, investors should consider any secondary market for our common stock to be a limited one. We intend to seek coverage and publication of information regarding us in an accepted publication, which permits a “manual exemption.” This manual exemption permits a security to be distributed in a particular state without being registered if the company issuing the security has a listing for that security in a securities manual recognized by the state. However, it is insufficient for the security to be listed in a recognized manual alone. The listing entry must contain (1) the names of our officers and directors, (2) our balance sheet, and (3) a profit and loss statement for either the fiscal year preceding the balance sheet or for the most recent fiscal year of operations. We may be unable to secure a listing containing all of this information. Furthermore, the manual exemption is a non-issuer exemption restricted to secondary trading transactions, making it unavailable for issuers selling newly issued securities. Most of the accepted manuals are those published in Standard and Poor’s, Moody’s Investor Service, Fitch’s Investment Service, and Best’s Insurance Reports, and many states expressly recognize these manuals. A smaller number of states declare that they “recognize securities manuals” but do not specify the recognized manuals. The following states do not have any provisions and therefore do not expressly recognize the manual exemption: Alabama, Georgia, Illinois, Kentucky, Louisiana, Montana, South Dakota, Tennessee, Vermont and Wisconsin.

19

We currently do not intend to and may be unable to qualify securities for resale in other states, which require shares to be qualified before they can be resold by our shareholders.

PLAN OF DISTRIBUTION

Our common shares are currently not quoted on any market. No market may ever develop for our common shares, or if developed, may not be sustained in the future. Accordingly, our shares should be considered totally illiquid, which inhibits our shareholders’ ability to resell their common shares.

The selling shareholders are offering up to 1,066,000 shares of common stock. The selling shareholders will offer their shares at $.001 per share until our shares are quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. We will not receive any proceeds of the sale of these securities. We will pay all expenses of registering the securities.

The securities offered by this prospectus will be sold by the selling shareholders without underwriters and without underwriter commissions. The distribution of the securities by the selling shareholders may be effected in one or more transactions that may take place in the over-the-counter market or privately negotiated transactions.

The selling shareholders may pledge all or a portion of the securities owned as collateral for margin accounts or in loan transactions, and the securities may be resold pursuant to the terms of such pledges, margin accounts or loan transactions. Upon default by such selling shareholders, the pledge in such loan transaction would have the same rights of sale as the selling shareholders under this prospectus. The selling shareholders may also enter into exchange traded listed option transactions, which require the delivery of the securities listed under this prospectus. After our securities are qualified for quotation on the OTC Bulletin Board, the selling shareholders may also transfer securities owned in other ways not involving market makers or established trading markets, including directly by gift, distribution, or other transfer without consideration, and upon any such transfer the transferee would have the same rights of sale as such selling shareholders under this prospectus.

In addition to the above, each of the selling shareholders will be affected by the applicable provisions of the Securities Exchange Act of 1934, including, without limitation, Regulation M, which may limit the timing of purchases and sales of any of the securities by the selling shareholders or any such other person. We have instructed our selling shareholders that they may not purchase any of our securities while they are selling shares under this registration statement. We have advised them that we will monitor our stock transfer records on a regular basis and will void any transaction they undertake in violation of this restriction.

Upon this registration statement being declared effective, the selling shareholders may offer and sell their shares from time to time until all of the shares registered are sold; however, this offering may not extend beyond two years from the initial effective date of this registration statement.

There can be no assurances that the selling shareholders will sell any or all of the securities. In various states, the securities may not be sold unless these securities have been registered or qualified for sale in such state or an exemption from registration or qualification is available and is complied with.

All of the foregoing may affect the marketability of our securities. Pursuant to oral promises we made to the selling shareholders, we will pay the entire fees and expenses incident to the registration of the securities.

20

Should any substantial change occur regarding the status or other matters concerning the selling shareholders or us, we will file a post-effective amendment disclosing such matters.

OTC Bulletin Board Considerations

To be quoted on the OTC Bulletin Board, a market maker must file an application on our behalf in order to make a market for our common stock. We have engaged in preliminary discussions with a Market Maker to file our application on Form 211 with the FINRA, but as of the date of this prospectus, no filing has been made. We anticipate that after this registration statement is declared effective, it will take approximately 2 – 8 weeks for the FINRA to issue a trading symbol.

The OTC Bulletin Board is separate and distinct from the NASDAQ stock market. NASDAQ has no business relationship with issuers of securities quoted on the OTC Bulletin Board. The SEC’s order handling rules, which apply to NASDAQ-listed securities, do not apply to securities quoted on the OTC Bulletin Board.

Although the NASDAQ stock market has rigorous listing standards to ensure the high quality of our issuers, and can delist issuers for not meeting those standards, the OTC Bulletin Board has no listing standards. Rather, it is the market maker who chooses to quote a security on the system, files the application, and is obligated to comply with keeping information about the issuer in our files. FINRA cannot deny an application by a market maker to quote the stock of a company. The only requirement for inclusion in the OTC Bulletin Board is that the issuer be current in our reporting requirements with the SEC.

Although we anticipate listing on the OTC Bulletin Board will increase liquidity for our stock, investors may have greater difficulty in getting orders filled because it is anticipated that if our stock trades on a public market, it initially will trade on the OTC Bulletin Board rather than on NASDAQ. Investors’ orders may be filled at a price much different than expected when an order is placed. Trading activity in general is not conducted as efficiently and effectively as with NASDAQ-listed securities.

Investors must contact a broker-dealer to trade OTC Bulletin Board securities. Investors do not have direct access to the OTC Bulletin Board service. For OTC Bulletin Board securities, there only has to be one market maker.

OTC Bulletin Board transactions are conducted almost entirely manually. Because there are no automated systems for negotiating trades on the OTC Bulletin Board, they are conducted via telephone. In times of heavy market volume, the limitations of this process may result in a significant increase in the time it takes to execute investor orders. Therefore, when an investor places a market order to buy or sell a specific number of shares at the current market price, it is possible for the stock price to go up or down significantly during the lapse of time between placing a market order and getting execution.

Because OTC Bulletin Board stocks are usually not followed by analysts, there may be lower trading volume than for NASDAQ-listed securities. We intend to have our common stock be quoted on the OTC Bulletin Board. If our securities are not quoted on the OTC Bulletin Board, a security holder may find it more difficult to dispose of, or to obtain accurate quotations as to the market value of our securities. The OTC Bulletin Board differs from national and regional stock exchanges in that it1) is not situated in a single location but operates through communication of bids, offers and confirmations between broker-dealers, and (2) securities admitted to quotation are offered by one or more Broker-dealers rather than the “specialist” common to stock exchanges.

21

TRANSFER AGENT

Vintage Filing System

We are not currently a party to any legal proceedings, and we are not aware of any pending or potential legal actions.

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS, AND INSIDERS

The board of directors elects our executive officers annually. A majority vote of the directors who are in office is required to fill vacancies. Each director shall be elected for the term of one year, and until his successor is elected and qualified, or until his earlier resignation or removal. Our directors and executive officers are:

|

Name

|

Age

|

Position Held

|

||

|

James Anderson

|

61

|

CEO/Chairman of the Board of Directors

|

||

|

Vic Devlaeminck

|

65

|

CFO/ Chief Legal Counsel/ Member of the Board of Directors

|

||

|

J. Michael Hadwin

|

59

|

Member of the Board of Directors

|

||

|

Gerald Schiano

|

57

|

Member of the Board of Directors

|

||

|

Greg Smith

|

65

|

Founder/Insider & Consultant

|

Family Relationships and Other Matters

None.

Jim Anderson, CEO and Chairman of the Board (July 2011-Current) - Mr. Anderson graduated from University of Oregon in 1985 with a double degree in Business Management and Marketing. He worked for Sacred Heart Hospital in Eugene for 10 years (1976 to 1985) gradually moving up to Project Manager. Mr. Anderson created the Physician Services department in 1985. He started managing physician offices in 1986 until 1990. Mr. Anderson started consulting in 1990 with Jim Meador (a founding member of the Society of Professional Business Consultants) until he retired in 1995. Mr. Anderson took over the Company and worked as a consultant for the past 21 years. He has done several turnaround projects where Mr. Anderson took over an organization that was in distress and cleaned them up and hired a CEO or General Manager to take over. In the past 5 years, Mr. Anderson has had 3 larger projects that started with Universal Pain Management in Palmdale, California and then to two other projects Alpha Healthcare in New Jersey and Northstar Neurology in Bend, Oregon. Mr. Anderson has worked with Hospital Chains (Columbia/HCA, Tenet, Community Health Systems) and other national entities.

Vic Devlaeminck, CFO and Member of the Board of Directors (September 2012 – Current) - Mr. Devlaeminck has over 35 years of experience in accounting and tax compliance as well as nearly 30 years practicing tax and business law. Since 1993 he has maintained a dual private law and accounting practice specializing in tax and business matters under his own name.

22

He is a member of the Oregon and Washington State Bar Associations, Oregon Society of Certified Public Accountants and the American Association of Attorney-Certified Public Accountants. In addition to being admitted to practice in the state courts of Oregon and Washington State, he is also admitted to practice before the U.S. Tax Court and the U.S. District Court (Oregon) and is a licensed CPA in Oregon. Vic is focused on the corporate structuring, tax benefits and securities transactions within the scope of the oil & gas sector.

J. Michael Hadwin, Member of the Board Of Directors (October 2011 – Current) – Mr. Hadwin is an energy broker with Classic Energy LLC and highly regarded as a natural gas industry professional with over 20 years of experience in identifying trading risk exposure. Mr. Hadwin provides his skills and expertise to large producers, marketers, and hedge funds to help facilitate and implement the right trading strategy and trading vehicles for his clients. Some of his current clients include JP Morgan Ventures, Conoco Phillips Co., Chevron Natural Gas, Shell Natural Gas Corp., and Apache Corp. Mr. Hadwin’s vast knowledge base was obtained while holding various portfolio management and trading positions with TPC Corp, Associated Natural Gas (Duke), and NGC (Dynegy) along with various brokering positions throughout his career. Mr. Hadwin is a graduate of Louisiana Tech University with a bachelor in Business Management Psychology. He also holds a Masters in Human Resource Management from Louisiana Tech University. Michael lives in Spring, Texas with his wife and two sons’.

Gerald L. Schiano, Member of the Board of Directors (September 2012 – Current) - After graduating from Rhode Island College, Gerald began his career as an accountant in the construction industry. The rigors of construction accounting trained Gerald well for his next positions as cost accountant and then controller in the high technology sector. Gerald was later hired as Chief Financial Officer and then Chief Executive of a construction company involved in large public works projects. Later Gerald formed his own construction company that serviced similar projects. Gerald then used his entrepreneurial talent to develop oil fields in the Mid-West, eventually leveraging the experience into a publicly traded organization where Gerald served as the Chief Financial Officer. After merging that entity into a green solutions company Gerald began serving as the Managing Director of Liberty Hill Ventures. Within the venture community Gerald finds opportunities where his skill sets are best served.

Greg Smith, Consultant & Insider/Founder (August 2011 – Current) – Mr. Greg Smith is a private investor with 40 years business experience in the steel fabrication, telecommunications, and transportation industries. He spent six years as QA Manager for a Nuclear Power Plant supplier originating and implementing quality control procedures, eight years in telecomm inventory management, and eight years controlling costs, inventory delivery, and quality control compliance in the food services industry. As a private investor he has pursued collaborative efforts in the oil and gas industry, seeking to match owners and capital investments.

Currently each member of the board of directors intends but is not obligated to devote a minimum of approximately ten (10) hours per week to the management of the Company. Officers are required to devote a minimum of thirty-five (35) hours per week to the management and operation of the Company. If an officer is a director as well then the higher amount of thirty-five (35) hours per week is required.

Legal Proceedings

No officer, director, or persons nominated for such positions, promoter or significant employee has been involved in the last ten years in any of the following:

23

|

●

|

Any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time;

|

|

●

|

Any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses);

|

|

●

|

Being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities;

|

|

●

|

Being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated;

|

|

●

|

Having any government agency, administrative agency, or administrative court impose an administrative finding, order, decree, or sanction against them as a result of their involvement in any type of business, securities, or banking activity;

|

|

●

|

Being the subject of a pending administrative proceeding related to their involvement in any type of business, securities, or banking activity; and/or

|

|

●

|

Having any administrative proceeding been threatened against you related to their involvement in any type of business, securities, or banking activity.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership, as of the date of this prospectus, of our common stock by (i) each person known by us to be the beneficial owner of more than 5% of our outstanding common stock, and (ii) each of our directors, each of our executive officers, and of our executive officers and directors as a group. To the best of our knowledge, the persons named have sole voting and investment power with respect to such shares, except as otherwise noted. No one on the shareholder list has stock exceeding 4.9% of the shares. Only the table below with the name of beneficial owners that are also Company directors and officers have more than 5% of the outstanding common shares.

The information presented below regarding beneficial ownership of our voting securities has been presented in accordance with the rules of the Commission and is not necessarily indicative of ownership for any other purpose. Under these rules, a person is deemed to be a "beneficial owner" of a security if that person has or shares the power to vote or direct the voting of the security or the power to dispose or direct the disposition of the security. A person is deemed to own beneficially any security as to which such person has the right to acquire sole or shared voting or investment power within 60 days through the conversion or exercise of any convertible security, warrant, option or other right. More than one person may be deemed to be a beneficial owner of the same securities. The percentage of beneficial ownership by any person as of a particular date is calculated by dividing the number of shares beneficially owned by such person, which includes the number of shares as to which such person has the right to acquire voting or investment power within 60 days, by the sum of the number of shares outstanding as of such date plus the number of shares as to which such person has the right to acquire voting or investment power within 60 days. Consequently, the denominator used for calculating such percentage may be different for each beneficial owner.

24

Except as otherwise indicated below and under applicable community property laws, we believe that the beneficial owners of our common stock listed below have sole voting and investment power with respect to the shares shown. The business address for these shareholders is 3525 Sage Street, Suite 1416, Houston, Texas 77056.

|

Name of beneficial Owner

|

Amount of Beneficial Ownership

|

Percent of class

|

||||||

|

Jim Anderson-CEO/Director

|

1,250,000 | 12.6 | % | |||||

|

Vic Devlaeminck-CFO/Director

|

2,000,000 | 20.2 | % | |||||

|

Mike Hadwin-Director

|

40,000 | * | ||||||

|

Jerry Schiano-Director

|

40,000 | * | ||||||

|

All Directors and Executive Officers as a group (four persons)

|

3,330,000 | 32.9 | % | |||||

|

Greg Smith

|

5,500,000 | 55.7 | % | |||||

* Less than 1%.

We are not registering common shares held by any stockholder who holds more than 5% of outstanding common shares and we are not registering shares held by our officers and directors.

This table is based upon information derived from our stock records. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, each of the shareholders named in this table has sole or shared voting and investment power with respect to the shares indicated as beneficially owned. Except as set forth above, applicable percentages are based upon 1,066,000 shares of common stock outstanding as of the date of this prospectus.

DESCRIPTION OF SECURITIES

The following description is a summary of the material terms of the provisions of our Articles of Incorporation and Bylaws. Our Articles of Incorporation and Bylaws have been filed as exhibits to the registration statement of which this prospectus is a part.

Common Stock

We are authorized to issue 250,000,000 shares of common stock, $0.001 par value per share. As of the date of this prospectus there are 1,066,000 shares of our common stock issued and outstanding held by 45 selling stockholders, including five Company affiliates and two individuals that received shares in exchange for their interests in the oil properties as contained in this registration statement and one shareholder that received shares in exchange for creating this registration statement.

Preferred Stock

None

Warrants

None

25

Nevada Anti-Takeover Laws