Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - OMEGA HEALTHCARE INVESTORS INC | ex99-1.htm |

| 8-K - FORM 8-K - OMEGA HEALTHCARE INVESTORS INC | t80626a_8-k.htm |

October 31, 2014 The Premier Skilled Nursing Facility REIT

2 Cautionary Language Regarding Forward-Looking Statements This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements regarding Omega Healthcare Investors, Inc. (“Omega”), Aviv REIT’s (“Aviv”) or their respective operators’or borrowers’expected future financial position, results of operations, cash flows, funds from operations, dividends and dividend plans, financing plans, business strategy, budgets, projected costs, operating metrics, capital expenditures, competitive positions, acquisitions, investment opportunities, merger integration, growth opportunities, dispositions, expected lease income, continued qualification as a real estate investment trust (“REIT”), plans and objectives of management for future operations and statements that include words such as “anticipate,”“if,”“believe,”“plan,” “estimate,”“expect,”“intend,”“may,”“could,”“should,”“will”and other similar expressions or the negative form of the same are forward-looking statements. Such forward-looking statements are inherently uncertain, and security holders must recognize that actual results may differ from the companies’expectations. Neither Omega nor Aviv undertakes a duty to update such forward-looking statements, which speak only as of the date on which they are made. Omega’s and Aviv’s actual future results and trends may differ materially depending on a variety of factors discussed in their filings with the Securities and Exchange Commission (“SEC”). These factors include without limitation: (a) the ability and willingness of each company’s operators, borrowers and other third parties to meet and/or perform their obligations under their respective contractual arrangements withthe company, including, in some cases, their obligations to indemnify, defend and hold harmless the company from and against various claims, litigation and liabilities; (b) the ability of each company’s operators and borrowers to maintain the financial strength andliquidity necessary to satisfy their respective obligations and liabilities to third parties, including without limitation obligations under their existing credit facilities and other indebtedness; (c) each company’s success in implementing its business strategy and its ability to identify, underwrite, finance, consummate and integrate diversifying acquisitions or investments, including those in different asset types; (d) the nature and extent of future competition; (e) the extent of future or pending healthcare reform and regulation, including cost containment measures and changes in reimbursement policies, procedures and rates; (f) increases in each company’s cost of borrowing as a result of changes in interest rates andother factors; (g) the ability of each company’s operators to deliver high quality services, to attract and retain qualified personnel and to attract residents and patients; (h)changes in general economic conditions and/or economic conditions in the markets in which each company may, from time to time, compete and the effect of those changes on the company’s revenues and its ability to access the capital markets or other sources of funds; (i) each company’s ability to pay down, refinance, restructure and/or extend its indebtedness as it becomes due; (j) each company’s ability and willingness to maintain its qualification as a REIT due to economic, market, legal, tax or other considerations; (k) the ability and willingness of each company’s operators to renew their leases with the company upon expiration of the leases and each company’s ability to reposition its properties on the same or better terms in the event such leases expire and are not renewed by the operators or in the event the company exercises its right to replace an existing operator upon default; (l) year-over-year changes in the Consumer Price Index and the effect of those changes on the rent escalators and each company’s earnings; (m) each company’s ability and the ability of its operators and borrowers to obtain and maintain adequate liability and other insurance from reputable and financially stable providers; (n) the impact of increased operating costs and uninsured professional liability claims on the liquidity, financial condition and results of operations on each company’s operators and borrowers, and the ability of those operators and borrowers to accurately estimate the magnitude of those claims; (o) the impact of market or issuer events on the liquidity or value of each company’s investments in marketable securities; (p) uncertainties relating to the business operations of the operators of each company’s properties, including those relating to reimbursement by third-party payors, regulatory matters and occupancy levels; (q) regulatory and other changes in the healthcare sector; (r) changes in the financial position of each company’s operators; (s) the ability of operators in bankruptcy to reject unexpired lease obligations, modify the terms of each company’s mortgages, and impede the ability of the company to collect unpaid rent or interest during the pendency of a bankruptcy proceeding and retain security deposits for the debtor's obligations; (t) changes in Omega’s credit ratings and the ratings of its debt securities; (u) competition in the financing of healthcare facilities; and (v) the impact of any financial, accounting, legal or regulatory issues or litigation that may affect either company or its major operators or borrowers. Many of these factors are beyond the control of the companies and their management.

3 Additional Information about the Proposed Transaction and Where to Find It This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any proxy, vote or approval. In connection with the proposed transaction, Omega and Aviv expect to prepare and file with the SEC a registration statement on Form S-4 containing a joint proxy statement/prospectus and other documents with respect to Omega’s proposed acquisition of Aviv. Investors are urged to read thejoint proxy statement/prospectus (including all amendments and supplements thereto) and other relevant documents filed with the SEC if and when theybecome available because they will contain important information about the proposed transaction. Investors may obtain free copies of the registration statement, the joint proxy statement/prospectus and other relevant documents filed by Omega and Aviv with the SEC (if and when they become available) through the website maintained by the SEC at www.sec.gov. Copies of the documents filedby Omega with the SEC will also be available free of charge on Omega’s website at www.omegahealthcare.com and copies of the documentsfiled by Aviv with the SEC are available free of charge on Aviv’s website at www.avivreit.com. Omega, Aviv and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Omega’s and Aviv’s shareholders in respect of the proposed transaction. Information regarding Omega’s directors and executive officers can be found in Omega’s definitive proxy statement filed with the SEC on April 29, 2014. Information regarding Aviv’s directors and executive officers can be found in Aviv’s definitive proxy statement filed with the SEC on April 15, 2014. Additional information regarding the interests of such potential participants will be included inthe joint proxy statement/prospectus and other relevant documents filed with the SEC in connection with the proposed transaction if and when they become available. These documents are available free of charge on the SEC’s website and from Omega and Aviv, as applicable, using the sources indicated above.

4 Transaction Summary Closing Conditions and Timing Board of Directors Overview Omega (NYSE: OHI) to merge with Aviv (NYSE: AVIV) in a stock-for-stock transaction Creates premier $10Bn SNF REIT and only pure-play SNF REIT Combined company uniquely positioned to consolidate highly attractive, highly fragmented industry Consideration Aviv shareholders and unitholders to receive 0.90 OHI shares foreach AVIV share or unit Aviv shareholders and unitholders to own 30% of combined company Represents Aviv total value of $3Bn including the assumption of debt Subject to Aviv and Omega shareholder votes -LG Aviv LP, an affiliate of Lindsay Goldberg LLC, has entered into a voting agreement in support of the transaction Expected to close Q1 2015 subject to other customary closing conditions Craig Bernfield and 2 other Aviv Directors to join Omega’s Board Omega’s long-tenured and experienced Board remains in place Omega shareholders to vote to de-classify Omega Board Management Team Taylor Pickett will be Chief Executive Officer of the combined company with HQ in Hunt Valley, MD Dan Booth and Bob Stephenson will retain current roles as COO and CFO, respectively Steven Insoft will lead the Chicago-based business development team, augmenting Omega’s investment capabilities Combines management teams with extensive industry knowledge, experience, and expertise

5 Transaction Rationale Positioned For Continued Sector Leading Growth Platforms With Superior Historical Track Records Management teams with strong track records of value creation forshareholders Omega is the top performing REIT over the last decade -total shareholder return of ~586% Aviv total shareholder return since IPO of ~64% High Quality and Complementary Portfolio Combined company has substantial scale Significant diversification with 83 operator relationships in 41states Long-term triple-net master leases with sector-leading rent coverage Commitment to high quality facilities Demonstrated track record of attractive acquisitions and development Consolidator in large, fragmented industry with attractive fundamentals Combined relationships will lead to ongoing pipeline of off-market transactions Over $900MM year-to-date combined investments Market data as of 30-Oct-2014 Attractive Financial Impact Accretive to Adjusted FFO and FAD – Significant cost synergies and meaningful interest savings opportunities – 9% -10% expected 2015 FAD per share growth over Omega 2014 guidance Expect positive ratings momentum from enhanced credit profile Strong balance sheet and lower cost of capital to drive future accretive growth Well positioned to continue to grow current, well-covered quarterly dividend

6 Combination of Market Leaders Total Market Cap. $7.3Bn $3.0Bn (1) $10.3Bn Equity Market Cap. $5.0Bn $2.2Bn (1) $7.2Bn Debt / Total Market Cap. 31.5% 28.0% (1) 30.5% # of Total Facilities (2) 562 312 874 EBITDAR Coverage (3) 1.4x 1.4x 1.4x Source: Company filings, Bloomberg and CapIQ. Market data as of 30-Oct-2014 1) Reflects 0.90 exchange ratio 2) Excludes 1 Omega HFS facility and 1 Aviv leasehold interest 3) TTM as of 30-Jun-2014 + Combination creates operating, growth and cost of capital efficiencies

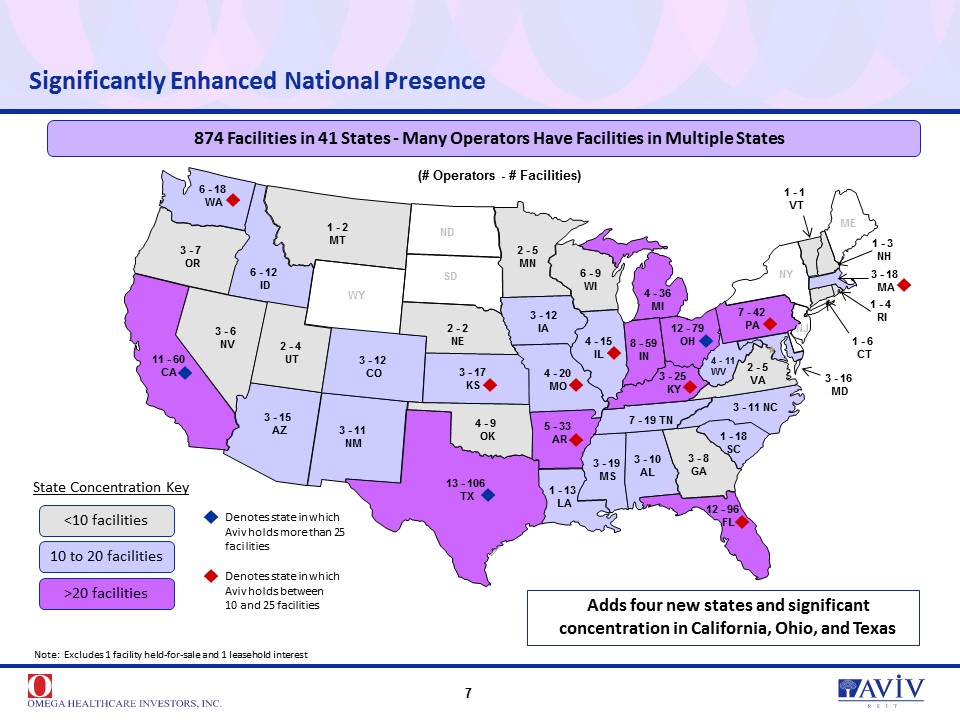

7 Significantly Enhanced National Presence 3 -19 MS 3 -11 NM 6 -9 WI 3 -6 NV 11 -60 CA 6 -18 WA 6 -12 ID 3 -15 AZ 13 -106 TX 3 -12 CO 3 -12 IA 4 -20 MO 5 -33 AR 1-13 LA 4-15 IL 8 -59 IN 12-79 OH 3 -25 KY 7 -19 TN 3 -10 AL 12 -96 FL 3 -8 GA 3 -11 NC 4 -11 WV 7 -42 PA 3 -18 MA 1-3 NH 1-1 VT 1-4 RI 3 -16 MD 3 -17 KS 4 -9 OK 4 -36 MI WY ND SD NY NJ ME 2 -4 UT 3 -7 OR 1 -18 SC 2 -5 VA 1 -6 CT 2 -5 MN 1 -2 MT 2 -2 NE 10 to 20 facilities <10 facilities >20 facilities Adds four new states and significant concentration in California, Ohio, and Texas State Concentration Key (# Operators -# Facilities) Note: Excludes 1 facility held-for-sale and 1 leasehold interest Denotes state in which Aviv holds more than 25 facilities 874 Facilities in 41 States -Many Operators Have Facilities in Multiple States Denotes state in which Aviv holds between 10 and 25 facilities

8 The Largest Owner of SNF Properties And Only Pure-Play SNF REIT More than 2x the number of SNF properties as the next public competitor Number of SNF Properties + Source: Company filings 1) Excludes 1 Omega HFS facility and 1 Aviv leasehold interest

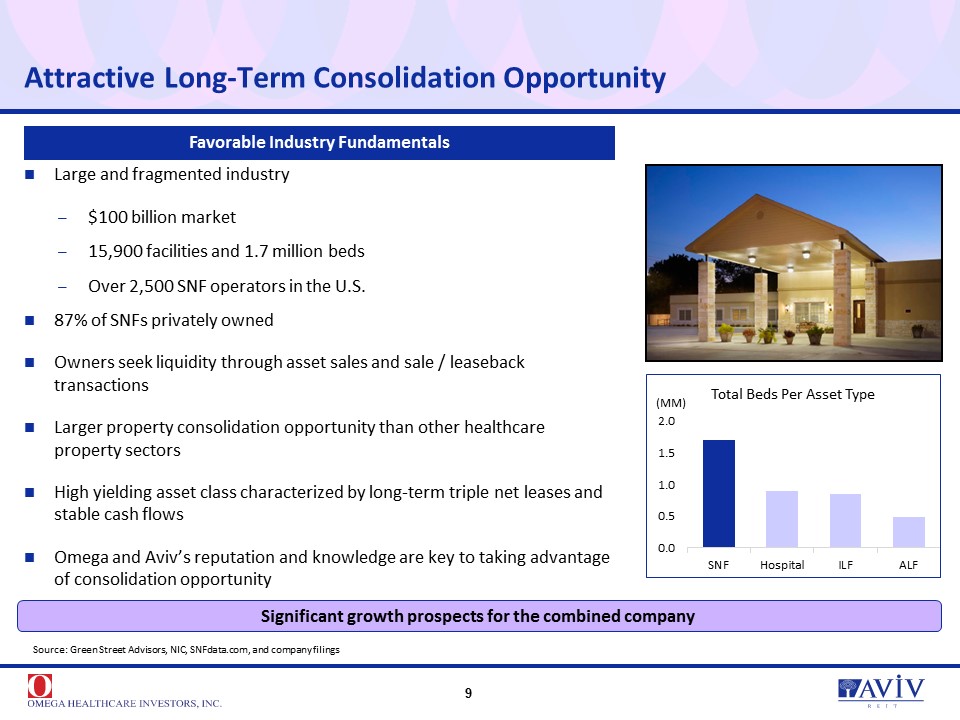

9 Attractive Long-Term Consolidation Opportunity Large and fragmented industry – $100 billion market – 15,900 facilities and 1.7 million beds – Over 2,500 SNF operators in the U.S. 87% of SNFs privately owned Owners seek liquidity through asset sales and sale / leaseback transactions Larger property consolidation opportunity than other healthcare property sectors High yielding asset class characterized by long-term triple net leases and stable cash flows Omega and Aviv’s reputation and knowledge are key to taking advantage of consolidation opportunity Favorable Industry Fundamentals Source: Green Street Advisors, NIC, SNFdata.com, and company filings Significant growth prospects for the combined company

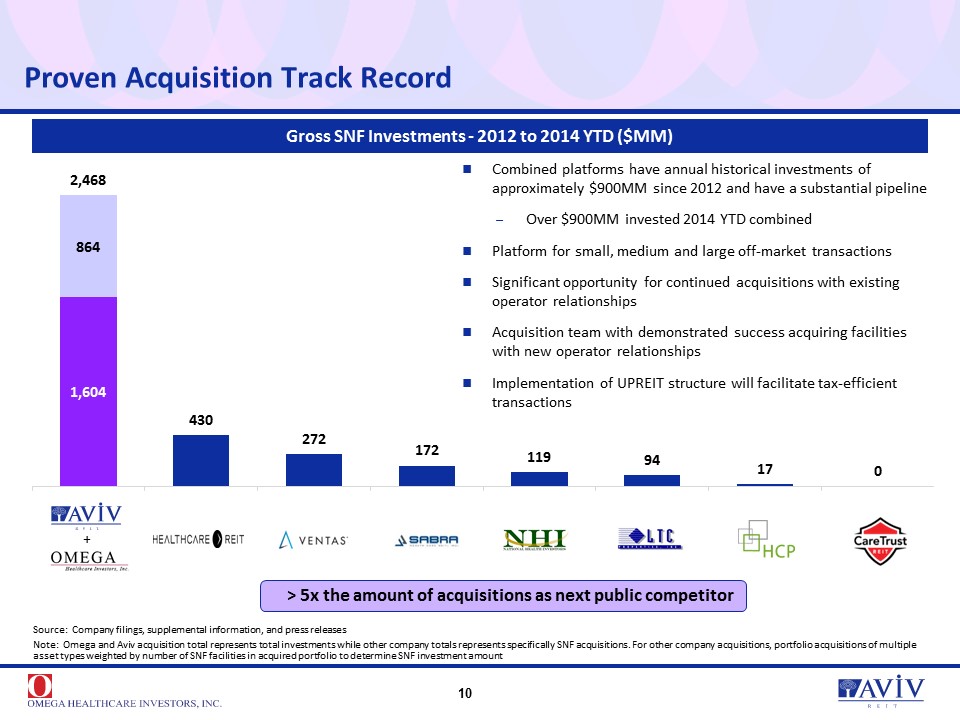

10 Proven Acquisition Track Record Gross SNF Investments -2012 to 2014 YTD ($MM) > 5x the amount of acquisitions as next public competitor + Source: Company filings, supplemental information, and press releases Note: Omega and Aviv acquisition total represents total investments while other company totals represents specifically SNF acquisitions. For other company acquisitions, portfolio acquisitionsof multiple asset types weighted by number of SNF facilities in acquired portfolio to determine SNF investment amount Combined platforms have annual historical investments of approximately $900MM since 2012 and have a substantial pipeline – Over $900MM invested 2014 YTD combined Platform for small, medium and large off-market transactions Significant opportunity for continued acquisitions with existing operator relationships Acquisition team with demonstrated success acquiring facilities with new operator relationships Implementation of UPREIT structure will facilitate tax-efficient transactions

11 Commitment to High-Quality Facilities Combined companies have invested approximately $316MM since 2009 for reinvestment and new construction – $55MM invested YTD as of 9/30/2014 Projects produce returns consistent with returns from acquisitions Projects help gain competitive advantage in markets, drive revenue and improve operator profitability Programmatic approach to investment – Market screening optimizes allocation of capital – Standardized finish packages – Interior enhancements: therapy gyms and specialty units – Exterior enhancements: lighting, signage and architectural features

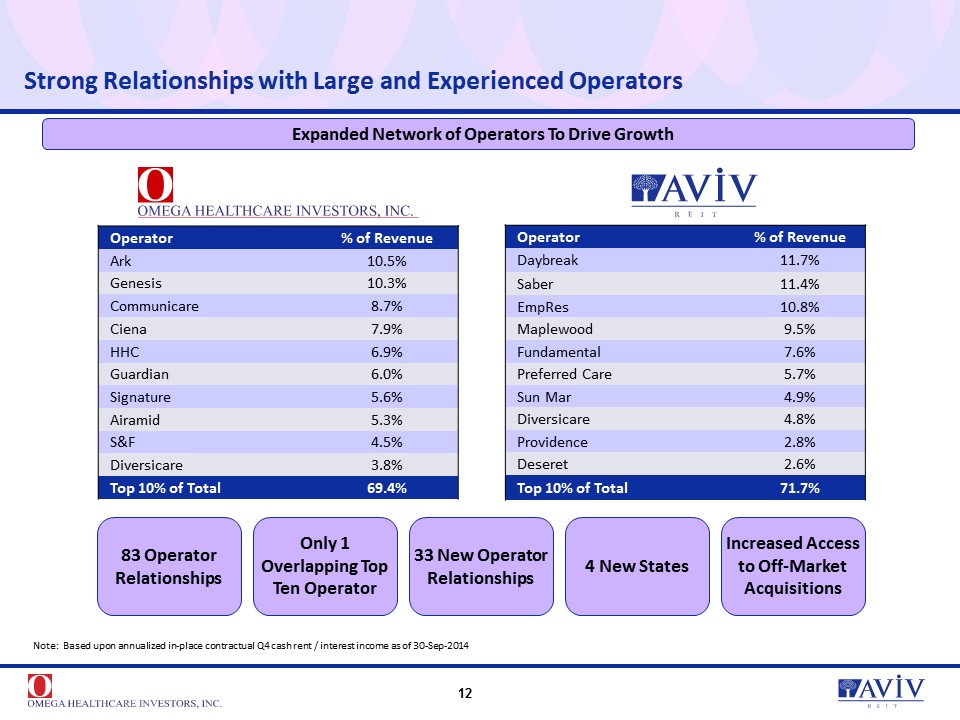

12 Operator % of Revenue Ark 10.5% Genesis 10.3% Communicare 8.7% Ciena 7.9% HHC 6.9% Guardian 6.0% Signature 5.6% Airamid 5.3% S&F 4.5% Diversicare 3.8% Top 10% of Total 69.4% Strong Relationships with Large and Experienced Operators Operator % of Revenue Daybreak 11.7% Saber 11.4% EmpRes 10.8% Maplewood 9.5% Fundamental 7.6% Preferred Care 5.7% Sun Mar 4.9% Diversicare 4.8% Providence 2.8% Deseret 2.6% Top 10% of Total 71.7% Only 1 Overlapping Top Ten Operator 33 New Operator Relationships 83 Operator Relationships Note: Based upon annualized in-place contractual Q4 cash rent / interest income as of 30-Sep-2014 4 New States Increased Access to Off-Market Acquisitions Expanded Network of Operators To Drive Growth

13 Significant Increase in Diversification Operator Diversification Note: Based upon annualized in-place contractual rent / interest State Diversification 83 Operators Strategic increase of operators in individual states Substantial scale and concentration in multiple states Reduces concentration of Top 10 Operators from 69% to 52% Reduces concentration of Top 3 Operators from 29% to 22% 41 States

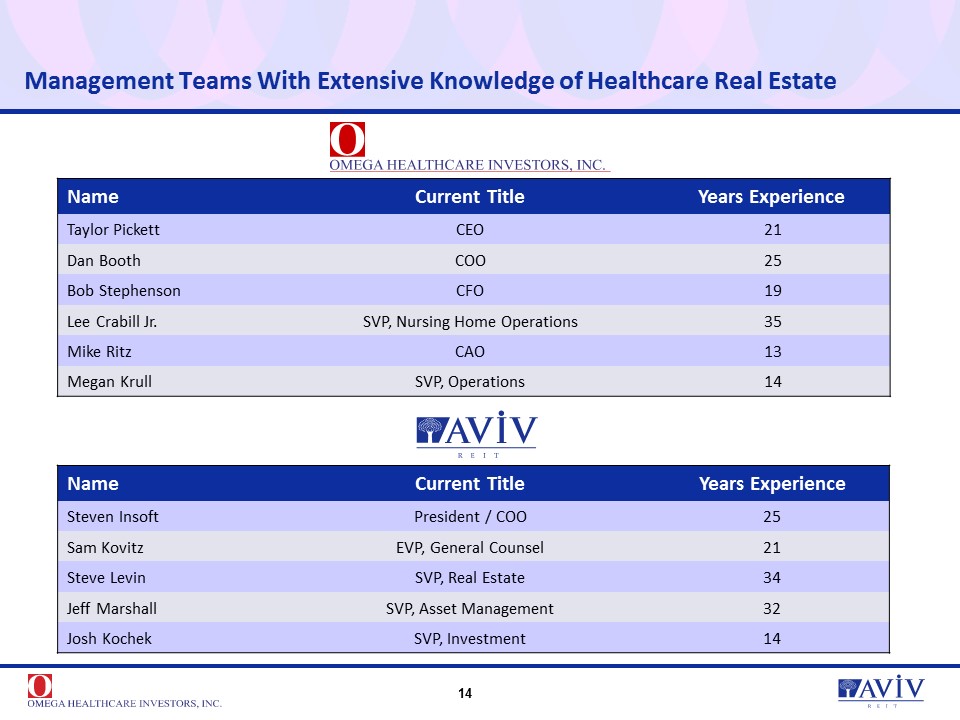

14 Name Current Title Years Experience Steven Insoft President / COO 25 Sam Kovitz EVP, General Counsel 21 Steve Levin SVP, Real Estate 34 Jeff Marshall SVP, Asset Management 32 Josh Kochek SVP, Investment 14 Management Teams With Extensive Knowledge of Healthcare Real Estate Name Current Title Years Experience Taylor Pickett CEO 21 Dan Booth COO 25 Bob Stephenson CFO 19 Lee Crabill Jr. SVP, Nursing Home Operations 35 Mike Ritz CAO 13 Megan Krull SVP, Operations 14

15 Expected to be accretive to run rate Adjusted FFO and FAD per diluted share – $9MM cost synergies – Opportunistically decrease cost of Aviv debt 2015 FAD guidance of $2.81 to $2.87 per diluted share as compared to Omega’s 2014 FAD guidance of $2.58 to $2.61 per diluted share – 9% -10% growth Continue to grow current, well-covered quarterly dividend – Conservative 78% FAD payout ratio – 11% dividend CAGR since 2004 Combined platform and lower cost of capital will drive future growth and accretion Attractive Financial Impact OHI RMZ OHI 10-Year Total Shareholder Return OHI Historical Dividend Growth (Indexed Total Returns) ($ Per Share) 586% 131% Source: SNL Financial Market data as of 30-Oct-2014

16 Market data as of 30-Oct-2014 Conservative Credit Profile and Balance Sheet Strength Combined Capital Structure at 9/30/2014 Combined Debt Maturity Schedule Conservative combined capitalization – Less than 35% Funded Debt / Total Market Cap. – Less than 5.0x Funded Debt / Adj. EBITDA (Q3 Annualized) – Less than 5.0% Secured Debt / GAV – Greater than 3.5x Adj. EBITDA / Interest Significant liquidity with well-laddered debt maturities – As of 9/30/14, Omega had $997MM available on its $1Bn credit facility, plus potential for an incremental $550MM via accordion – Opportunity to refinance $650MM of Aviv debt and $775MM of Omega debt with optional early redemptions in 2015 Financial flexibility and access to capital markets Strong and Flexible Balance Sheet ($MM) 600 Sub-Note Aviv Callable Notes Omega Callable Notes Credit Facilities Omega Non-Callable Notes Hud Debt

17 Vision for Success Leverage our unique consolidation strategy, our management knowledge and expertise and operator relationships to continue owning, acquiring and developing SNFs Leverage our disciplined approach and cost of capital advantage to fund accretive transactions Continue to strengthen the credit quality of our tenant relationships Continue to improve the quality of our properties and overall portfolio Continue to maintain our strong balance sheet with minimal maturity and interest rate risk Continue to deliver meaningful dividend growth and total shareholder returns

18 Certain Non-GAAP Information Funds From Operations (“FFO”), Adjusted FFO and Adjusted Funds Available for Distribution (“FAD”) are not financial measures calculated or presented in accordance with generally accepted accounting principles in the United States (“GAAP”). The Company calculates and reports FFO in accordance with the definition and interpretive guidelines issued by the National Association of Real Estate Investment Trusts ("NAREIT"), and consequently, FFO is defined as net income available to common stockholders, adjusted for the effects of asset dispositions and certain non-cash items, primarily depreciation and amortization and impairments on real estate assets. The Company references FFO, Adjusted FFO and FAD as important supplemental measures of its operating performance and not as measures of liquidity or cash flow. FFO, Adjusted FFO and FAD are not measures of financial performance under GAAP and should not be considered measures of liquidity, alternatives to net income or indicators of any other performance measure determined in accordance with GAAP. Investors and potential investors in the Company’s securities should not rely on these measures as a substitute for any GAAP measure, including net income. Adjusted FFO is calculated as FFO available to common stockholders excluding the impact of non-cash stock-based compensation and certain revenue and expense items identified above. FAD is calculated as Adjusted FFO less non-cash interest expense and non-cash revenue, such as straight-line rent. The Company believes these measures provide an enhanced measure of the operating performance of the Company’s core portfolio as a REIT. The Company’s computation of adjusted FFO and FAD are not comparable to the NAREIT definition of FFO or to similar measures reported by other REITs, but the Company believes that they are appropriate measures for this Company.