Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Cooper-Standard Holdings Inc. | a8-kearningsxslidesxglenn.htm |

| EX-99.1 - RELEASE - Cooper-Standard Holdings Inc. | finalcooperstandard3q2014r.htm |

1 DRIVE FOR PROFITABLE GROWTH Third Quarter Earnings Call October 31, 2014

2 2 Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of U.S. federal securities laws, and we intend that such forward-looking statements be subject to the safe harbor created thereby. We make forward-looking statements in this presentation and may make such statements in future filings with the SEC. We may also make forward-looking statements in our press releases or other public or stockholder communications. These forward-looking statements include statements concerning our plans, objectives, goals, strategies, future events, future revenue or performance, capital expenditures, financing needs, plans or intentions relating to acquisitions, business trends, and other information that is not historical information. When used in this presentation, the words “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “forecasts,” or future or conditional verbs, such as “will,” “should,” “could,” or “may,” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking statements, including, without limitation, management’s examination of historical operating trends and data are based upon our current expectations and various assumptions. Our expectations, beliefs, and projections are expressed in good faith and we believe there is a reasonable basis for them. However, no assurances can be made that these expectations, beliefs and projections will be achieved. Forward-looking statements are not guarantees of future performance and are subject to significant risks and uncertainties that may cause actual results or achievements to be materially different from the future results or achievements expressed or implied by the forward-looking statements. There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained in this presentation. Important factors that could cause our actual results to differ materially from the forward-looking statements we make herein include, but are not limited to: cyclicality of the automotive industry with the possibility of further material contractions in automotive sales and production effecting the viability of our customers and financial condition of our customers; global economic uncertainty, particularly in Europe; loss of large customers or significant platforms; our ability to generate sufficient cash to service our indebtedness, and obtain future financing; operating and financial restrictions imposed on us by our credit agreements; our underfunded pension plans; supply shortages; escalating pricing pressures and decline of volume requirements from our customers; our ability to meet significant increases in demand; availability and increasing volatility in cost of raw materials or manufactured components; our ability to continue to compete successfully in the highly competitive automotive parts industry; risks associated with our non-U.S. operations; foreign currency exchange rate fluctuations; our ability to control the operations of joint ventures for our benefit; the effectiveness of our continuous improvement program and other cost savings plans; a disruption in our information technology systems; product liability and warranty and recall claims that may be brought against us; work stoppages or other labor conditions; natural disasters; our ability to meet our customers’ needs for new and improved products in a timely manner or cost-effective basis; the possibility that our acquisition strategy may not be successful; our legal rights to our intellectual property portfolio; environmental and other regulations; the possible volatility of our annual effective tax rate; significant changes in discount rates and the actual return on pension assets; the possibility of future impairment charges to our goodwill and long-lived assets; and the interests of our major stockholders may conflict with our interests. There may be other factors that may cause our actual results to differ materially from the forward-looking statements. All forward-looking statements attributable to us or persons acting on our behalf apply only as of the date of this presentation and are expressly qualified in their entirety by the cautionary statements included herein. We undertake no obligation to update or revise forward-looking statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events.

3 Jeff Edwards Chairman and Chief Executive Officer

4 4 Industry Overview • Global economy struggling to gain momentum • European vehicle production softening • Customers significantly reduced production in Brazil • Volume up in NA with a decline on key platforms

5 5 Cooper Standard Overview • Quarter impacted by: – Significant volume decline in Brazil – Foreign exchange fluctuations – Softening sales on key customer platforms • Strategic progress – Notable additions in Asia Pacific – Sale of thermal and emissions product line – Sold breakthrough technologies globally

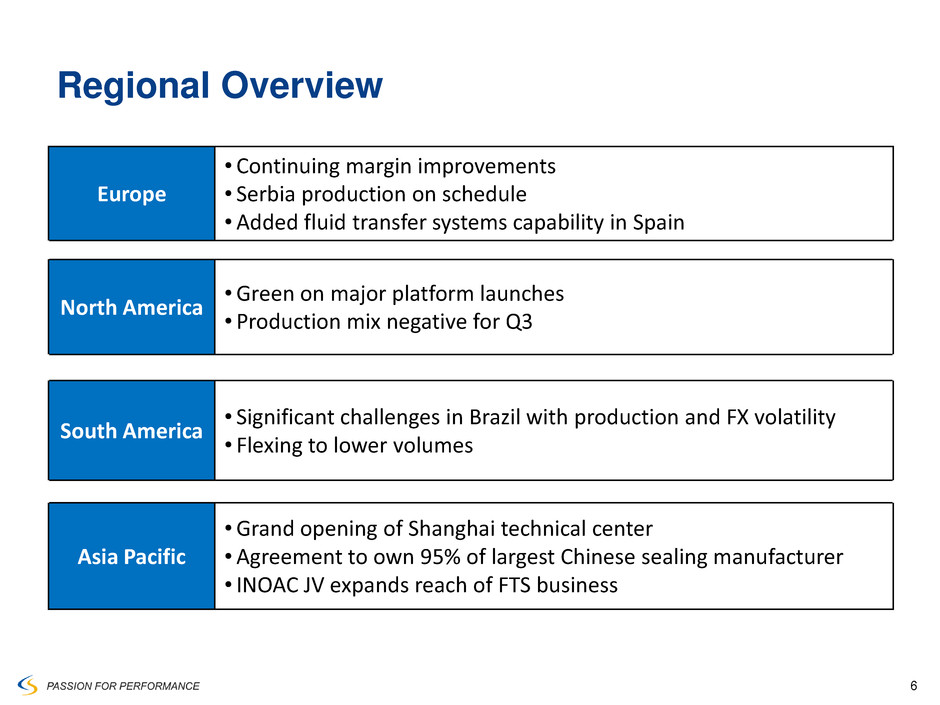

6 6 Regional Overview Europe • Continuing margin improvements • Serbia production on schedule • Added fluid transfer systems capability in Spain North America • Green on major platform launches • Production mix negative for Q3 South America • Significant challenges in Brazil with production and FX volatility • Flexing to lower volumes Asia Pacific • Grand opening of Shanghai technical center • Agreement to own 95% of largest Chinese sealing manufacturer • INOAC JV expands reach of FTS business

7 7 Cooper Standard / INOAC JV • Majority - owned JV with an Asian auto supplier provides opportunity for expanding Asia market • Expands our global reach and leadership position in Fluid Transfer Systems product line • Provides additional alignment with Japanese OEMs • Supports global programs Huayu-Cooper Standard JV • Cooper Standard to become majority (95%) owner of largest Chinese automotive sealing supplier • Accelerates company’s sealing and trim strategy in China • Provides growth opportunities with domestic Chinese automakers • Supports global platforms Changchun Chongqing Huai-an Jingzhou Kunshan Shanghai Current Locations Huayu-Cooper Standard Locations Wuhu Guangzhou Shenyang Qinpu Growing in China

8 8 Recap of the Quarter • Significant progress on strategic initiatives • Guidance reaffirmed • Continue to anticipate achieving double digit adjusted EBITDA for full year 2014

9 Allen Campbell Executive Vice President and Chief Financial Officer

10 10 Q3 2014 Performance Overview • Challenges in Brazil affecting results • North America sales impacted by vehicle mix and FX • Continuing margin improvement in Europe • Investing in Asia to support growth

11 Passion for Performance Q3 and Year-to-Date 2014 Revenue Note: Numbers subject to rounding Q3 2013 - $764 Q3 2014 - $781 YTD 2013 - $2,296 YTD 2014 - $2,476 $ USD Millions Third Quarter Year-to-Date $0 $100 $200 $300 $400 $500 North America Europe Asia Pacific South America $409 $258 $54 $43 $413 $265 $62 $40 $0 $250 $500 $750 $1,000 $1,250 $1,500 North America Europe Asia Pacific South America $1,192 $806 $160 $139 $1,298 $879 $178 $121

12 Passion for Performance Q3 and Year-to-Date 2014 Performance $ USD Millions, except EPS / % Note: Numbers subject to rounding EBITDA and Adjusted EBITDA are Non-GAAP measures. See appendix. Third Quarter Year-to-Date 2013 2014 2013 2014 $764.1 $781.0 Sales $2,296.3 $2,476.1 115.0 111.3 Gross Profit 367.6 391.6 15.1% 14.2% % Margin 16.0% 15.8% 73.0 67.4 SGA 220.8 228.6 36.4 53.5 Operating Profit 127.5 157.4 4.8% 6.9% % Margin 5.6% 6.4% $20.6 $22.7 Net Income $68.7 $55.6 $1.08 $1.23 Fully Diluted EPS $3.26 $3.07 $69.5 $66.6 Adjusted EBITDA $228.7 $239.4 9.1% 8.5% % Margin 10.0% 9.7%

13 Passion for Performance EBITDA and Adjusted EBITDA Reconciliation $ USD Millions 2014 Net income Income tax expense EBITDA Restructuring, net of noncontrolling interest Adjusted EBITDA Nine Months Ended Sep 30, Net interest expense Depreciation and amortization EBITDA and Adjusted EBITDA are Non-GAAP measures. See appendix. Note: Numbers subject to rounding Stock based compensation 2013 24.6 40.0 83.2 $ 216.5 6.9 $ 228.7 $ 68.7 4.3 35.4 35.3 84.7 $ 211.0 11.5 $ 239.4 $ 55.6 2.8 Loss on Debt Extinguishment - 30.5 Acquisition costs and Others 1.5 1.0 Gain on sales of Thermal and Emissions ( 17.9) -

14 14 YTD 2014 Cash Flow and Key Financial Ratios Note: Numbers subject to rounding $ USD Millions Liquidity Cash Balance as of December 31, 2013 $ 184.4 Cash generated 60.5 Cash Balance as of Sep 30, 2014 $ 244.9 ABL Revolver 180.0 Letters of Credit (35.6) Total Liquidity $ 389.3 Key Financial Ratios • Net Leverage $ 541.2 M • Net Leverage to Adjusted EBITDA 1.8 x • Interest Coverage Ratio 5.9 x EBITDA, Adjusted EBITDA and Financial Ratios are Non-GAAP measures. See appendix. $184.4 $118.8 $244.9 $172.2 $83.5 $154.3 $58.3 $44.9 $22.9 $0 $100 $200 $300 $400 Cash balance as of 12/31/2013 Cash from business Changes in operating assets and liabilities Capital expenditures Free cash flow Financing activities Proceeds from sale of T&E product line FX and others Cash balance as of 9/30/2014 (a) FX and others include FX of $11.9, warrant exercise of $8.5, and others (a)

15 15 2014 Guidance Key Assumptions: North American production 17.0 million European (including Russia) production 20.0 million Average full year exchange rate 1 EUR = $1.33 USD 1 CAD = $0.91 USD *G=Guidance Cash Balance as of March 31, 2012 296.0 Cash generated (43.9) Cash Balance as of June 30 , 2012 252.1 $1,945 $2,414 $2,854 $2,881 $3,091 2009A 2010A 2011A 2012A 2013A 2014G $3,250 - $3,350 $ USD Millions Cash Balance as of March 31, 2012 296.0 Cash generated (43.9) Cash Balance as of June 30 , 2012 252.1 $ USD Millions Cash Balance as of March 31, 2012 296.0 Cash generated (43.9) Cash Balance as of June 30 , 2012 252.1 $ USD Millions $42 $19 $26 $39 $21 $20-$30 2009A 2010A 2011A 2012A 2013A 2014G ($3) $13 $22 $21 $9 $25-$35 2009A 2010A 2011A 2012A 2013A 2014G Revenues Cash Taxes Cash Restructuring Cash Balance as of March 31, 2012 296.0 Cash generated (43.9) Cash Balance as of June 30 , 2012 252.1 $46 $77 $108 $131 $183 $195-$205 2009A 2010A 2011A 2012A 2013A 2014G $ USD Millions Capital Expenditures

16 Q&A

17 Appendix

18 18 Note: Numbers subject to rounding Adj. EBITDA % Margin - Nine Months Ended September 30, 2014 (1) Includes noncash restructuring and is net of noncontrolling interest (2) Non-cash stock amortization expense and non-cash stock option expense for grants issued at time of the Company’s 2010 reorganization (3) Loss on extinguishment of debt relating to the repurchase of our Senior Notes and Senior PIK Toggle Notes (4) Gain on sale of thermal and emissions product line Three Months Ended Nine Months Ended 31-Mar-14 30-Jun-14 30-Sep-14 30-Sep-14 Net income (loss) $19.7 $13.2 $22.7 $55.6 Income tax expense 12.1 4.4 18.9 35.4 Interest expense, net of interest income 15.0 10.9 9.4 35.3 Depreciation and amortization 28.3 28.5 28.0 84.7 EBITDA $75.1 $57.0 $79.0 $211.0 Restructuring (1) 3.0 3.8 4.7 11.5 Stock-based compensation (2) 2.1 0.7 - 2.8 Acquisition costs - - 0.4 0.4 Loss on extinguishment of debt (3) 0.2 30.3 - 30.5 Gain on divestiture (4) - - (17.9) (17.9) Other 0.2 0.4 0.4 1.1 Adjusted EBITDA $80.6 $92.2 $66.6 $239.4 Sales $837.6 $857.6 $781.0 $2,476.1 Adjusted EBITDA as a percent of Sales 9.6% 10.8% 8.5% 9.7%

19 19 Note: Numbers subject to rounding Adj. EBITDA % Margin - Nine Months Ended September 30, 2013 (1) Includes noncash restructuring. (2) Proportionate share of restructuring costs related to Cooper Standard France joint venture. (3) Non-cash stock amortization expense and non-cash stock option expense for grants issued at time of the Company’s 2010 reorganization. (4) Write-up of inventory to fair value for the Jyco acquisition (5) Costs incurred in relation to the Jyco acquisition ($ USD Millions) Three Months Ended Nine Months Ended Mar 31, Jun 31, Sep 30, Sep 30, 2013 2013 2013 2013 Net income $ 20.7 $ 27.4 $ 20.6 $ 68.7 Income tax expense 7.9 12.2 4.5 24.6 Interest expense, net of interest income 11.2 13.6 15.2 40.0 Depreciation and amortization 29.8 28.2 25.2 83.2 EBITDA $ 69.6 $ 81.4 $ 65.5 $ 216.5 Restructuring (1) 4.8 1.0 1.9 7.7 Noncontrolling interest restructuring (2) (0.7) (0.1) - (0.8) Stock-based compensation (3) 2.7 0.5 1.1 4.3 Inventory write-up (4) - - 0.3 0.3 Acquisition costs (5) - - 0.7 0.7 Others 0.3 (0.3) - - Adjusted EBITDA $ 76.7 $ 82.5 $ 69.5 $ 228.7 Sales 747.6 784.7 764.1 2,296.3 Adjusted EBITDA as a percent of Sales 10.3% 10.5% 9.1% 10.0%

20 20 Net Leverage Ratio and Adj. EBITDA % Margin as of September 30, 2014 Note: Numbers subject to rounding ($ USD Millions) Three Months Ended Twelve Months Ended Dec 31, 2013 Mar 31, 2014 Jun 30, 2014 Sep 30, 2014 Sep 30, 2014 Net income (loss) $ (20.8) $ 19.7 $ 13.2 $ 22.7 $ 34.8 Income tax expense 21.0 12.1 4.4 18.9 56.4 Interest expense, net of interest income 14.9 15.0 10.9 9.4 50.2 Depreciation and amortization 27.9 28.3 28.5 28.0 112.7 EBITDA $ 43.0 $ 75.1 $ 57.0 $ 79.0 $ 254.1 Restructuring (1) 14.3 3.0 3.8 4.7 25.6 Stock-based compensation (2) 0.9 2.1 0.7 - 3.7 Acquisition costs 0.2 - - 0.4 0.6 Loss on extinguishment of debt (3) - 0.2 30.3 - 30.5 Gain on divestiture (4) - - - (17.9) (17.9) Other 0.3 0.2 0.4 0.4 1.4 Adjusted EBITDA $ 58.7 $ 80.6 $ 92.2 $ 66.6 $ 298.0 Net Leverage Debt payable within one year $ 26.1 Long-term debt 760.0 Less: cash and cash equivalents (244.9) Net Leverage $ 541.2 Net Leverage Ratio 1.82 Interest coverage ratio 5.93 Sales $ 794.2 $ 837.6 $ 857.6 $ 781.0 $ 3,270.4 Adjusted EBITDA as a percent of Sales 7.4% 9.6% 10.8% 8.5% 9.1% (1) Includes noncash restructuring and is net of noncontrolling interest (2) Non-cash stock amortization expense and non-cash stock option expense for grants issued at time of the Company’s 2010 reorganization (3) Loss on extinguishment of debt relating to the repurchase of our Senior Notes and Senior PIK Toggle Notes (4) Gain on sale of thermal and emissions product line

21 21 Non-GAAP Financial Measures EBITDA and adjusted EBITDA are measures not recognized under Generally Accepted Accounting Principles (GAAP) which exclude certain non-cash and non-recurring items. Management considers EBITDA and adjusted EBITDA as key indicators of the Company's operating performance and believes that these and similar measures are widely used by investors, securities analysts and other interested parties in evaluating the Company's performance. Adjusted EBITDA is defined as net income adjusted to reflect income tax expense, interest expense net of interest income, depreciation and amortization, and certain non-recurring items that management does not consider to be reflective of the Company's core operating performance. When analyzing the company’s operating performance, investors should use EBITDA and adjusted EBITDA in addition to, and not as alternatives for, net income (loss), operating income, or any other performance measure derived in accordance with GAAP, or as an alternative to cash flow from operating activities as a measure of the company’s performance. EBITDA and adjusted EBITDA have limitations as analytical tools and should not be considered in isolation or as substitutes for analysis of the company’s results of operations as reported under GAAP. Other companies may report EBITDA and adjusted EBITDA differently and therefore Cooper Standard’s results may not be comparable to other similarly titled measures of other companies. In addition, in evaluating adjusted EBITDA, it should be noted that in the future Cooper Standard may incur expenses similar to or in excess of the adjustments in the above presentation. This presentation of adjusted EBITDA should not be construed as an inference that Cooper Standard's future results will be unaffected by unusual or non- recurring items.