Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Kearny Financial Corp. | d812254d8k.htm |

| EX-99.1 - EX-99.1 - Kearny Financial Corp. | d812254dex991.htm |

Exhibit 99.2 |

Forward-Looking Statements

2

This

presentation

may

include

certain

“forward-looking

statements,”

which

are

made

in

good

faith

by

Kearny

Financial

Corp.

(the

“Company”)

pursuant

to

the

“safe

harbor”

provisions

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

These forward-looking statements involve risks and uncertainties, such as

statements of the Company’s plans, objectives, expectations,

estimates and intentions that are subject to change based on various important factors (some of

which

are

beyond

the

Company’s

control).

In

addition

to

the

factors

described

under

Item

1A.

Risk

Factors

in

the

Company’s Annual Report on Form 10-K, the following factors, among

others, could cause the Company’s financial performance to differ

materially from the plans, objectives, expectations, estimates and intentions expressed in such

forward-looking statements:

•

the strength of the United States economy in general and the strength of the

local economy in which the Company conducts operations,

•

the effects of and changes in, trade, monetary and fiscal policies and laws,

including interest rate policies of the Board of Governors of the Federal

Reserve System, inflation, interest rates, market and monetary

fluctuations, •

the

impact

of

changes

in

financial

services

laws

and

regulations

(including

laws

concerning

taxation,

banking, securities and insurance),

•

changes in accounting policies and practices, as may be adopted by regulatory

agencies, the Financial Accounting Standards Board (“FASB”) or

the Public Company Accounting Oversight Board, •

technological changes.

•

•

the

success

of

the

Company

at

managing

the

risks

involved

in

the

foregoing

and

managing

its

business.

The Company cautions that the foregoing list of important factors is not

exclusive. The Company does not undertake to update any

forward-looking statement, whether written or oral, that may be made from time to time

by or on behalf of the Company.

competition among financial services providers and,

|

•

Kearny is committed to meeting the financial needs of the

individuals, businesses, and communities we serve throughout

Northern and Central New Jersey and the New York metro area.

•

By providing a superior level of service, we hope to earn long-

term loyalty and become a financial partner for many years to

come. Whether it is a loan request, information on a deposit

product or assistance with one of our other financial services, we

pledge to respond quickly, professionally and in a manner that

puts customers’

needs first.

•

We value and respect our customers and employees and will

strive to maintain an environment within which employees will

want to work and customers will want to bank.

Overview

3

Mission statement |

•

Founded in 1884

•

3

th

Largest

publicly

traded

mutual

holding

company

in the country

•

6

th

Largest

financial

institution

headquartered

in

New Jersey

•

Market capitalization ($896.1 million)

Company Overview

4

Note: Financial data as of June 30, 2014; Market data as of October 28, 2014

($ Millions)

Assets

$3,510

Net Loans

$1,729

Deposits

$2,480

Equity

$495

Tang. Common Equity/Tang. Assets

11.33%

Number of Branches

42

6/30/2014 |

Progressive community bank

Experienced management team

Seasoned acquirer and integrator

Best of breed technology platform

Stable financial condition

Well-capitalized balance sheet

Kearny Financial Corp. Background

5

Our Strengths |

Kearny Financial Corp. Background

6

Growth through strategic mergers & acquisitions

Seller

Completed

Type

Assets

($000)

Branches

1

st

Bergen Bancorp

3/31/1999

Thrift

300,755

4

Pulaski Bancorp, Inc. MHC

10/18/2002

Thrift

237,596

6

West Essex Bancorp

7/1/2003

Thrift

390,333

8

Central Jersey Bancorp

11/30/2010

Bank

571,295

13

Atlas Bank

6/30/2014

Thrift

110,480

2

Acquire niche talent

Expand geographic diversity

Grow market share

Acquire new business lines

Leverage capital

Source: SNL Financial |

Deposit Franchise

7

Strong deposit franchise

Source: SNL Financial

6 largest New

Jersey based

deposit

franchise

$59.0 million in

average

deposits per

branch

42 branch

locations across

11 counties

throughout

Northern and

Central New

Jersey, and the

greater New

York City area

$2.48 billion in

deposits as of

June 30, 2014

KRNY (42)

th |

Deposit Market Demographics

8

…with the ability to attract customers from across our footprint

(1)

Defined as the New York-Northern New Jersey-Long Island MSA.

Note: Deposit market share data as of June 30, 2014

Source: SNL Financial

Attractive

markets:

part

of

largest

MSA

in

the

U.S.

Weighted average median household income of Kearny franchise counties: $71,975 vs. $51,579 median

household income nationwide Household income poised to grow

Projected population growth in Kearny’s primary NJ counties of operation

2.36% vs. 1.64% for the entire state of New Jersey

Opportunities still exist for organic growth in existing branch footprint

1

Mkt.

Pct. Of Kearny

Median HH

Projected HH

Projected

Deposits

Share

MHC Deposits

Income

Income Change

Population Change

County

Branches

($M)

(%)

(%)

($)

2014-2019 (%)

2014-2019 (%)

Bergen, NJ

9

766.9

1.78

30.80

79,746

3.45

2.77

Hudson, NJ

2

505.9

1.78

20.32

59,841

8.75

4.58

Monmouth, NJ

12

473.3

2.31

19.01

80,904

3.09

0.03

Ocean, NJ

6

182.5

1.26

7.33

57,972

2.57

1.39

Morris, NJ

3

145.2

0.64

5.83

91,208

(0.14)

2.10

Middlesex, NJ

3

128.4

0.45

5.16

75,361

3.47

3.02

Essex, NJ

3

128.2

0.53

5.15

52,919

3.52

1.03

Kings, NY

1

58.5

0.14

2.35

44,890

6.75

4.12

Union, NJ

1

46.6

0.20

1.87

68,442

4.59

2.69

Richmond, NY

1

27.6

0.26

1.11

70,814

4.72

0.84

Passaic, NJ

1

27.0

0.25

1.09

53,787

2.28

0.77

42

2,490.2

100.00

Kearny MHC - Deposit Market Share by County |

Kearny Financial Corp.

9

Deposit composition and strategies

Source: Company Filings, SNL Financial

•

Internal Strategies

Cultural transformation continued in 2014

Introduced Private Banker concept for high net-worth commercial and retail customers

Added small business bankers to improve volume

•

Results

Growth in core deposit balances continues

Increase in demand and NOW accounts

Retail Time

Deposits

47%

Jumbo Time

Deposits

14%

Demand

4%

NOW

7%

MMDA &

Savings

28%

Retail Time

Deposits

37%

Jumbo Time

Deposits

4%

Demand

9%

NOW

14%

MMDA &

Savings

36%

Deposits - June 30, 2007

Deposits - June 30, 2014

Retail

Banking

Group

training

leadership,

professionalism,

sales,

and

customer

service

: |

Kearny Financial Corp.

10

Composition of loan portfolio

•

Last

fiscal

year

net

loan

growth

of

28%

•

Loan portfolio mix continues to shift

•

Strong growth in CRE & Multifamily category

June

June

June

June

June

June

June

June

2007

2008

2009

2010

2011

2012

2013

2014

1-4 Family

64.5%

66.9%

65.9%

65.5%

48.2%

43.8%

36.8%

39.1%

CRE & Multifamily

18.4%

17.4%

18.9%

20.0%

30.3%

37.8%

49.0%

56.2%

Construction

1.3%

1.2%

1.3%

1.5%

1.7%

1.6%

0.8%

0.7%

Consumer

12.7%

10.7%

10.5%

10.8%

8.7%

8.5%

8.2%

0.2%

C&I

0.5%

0.8%

1.4%

1.4%

8.3%

6.9%

5.2%

3.8%

Other

2.6%

3.0%

2.0%

0.8%

2.9%

1.4%

0.0%

0.0%

(1) Note: Loan growth includes integration of loans of Atlas

Bank Source: Company Filings, SNL Financial

1 |

•

Expand upon expertise in commercial real estate, multifamily, and SBA

lending Continue to hire additional commercial lending personnel to

increase market share Business development officers continue to work

collaboratively with the retail branch network to further

develop/strengthen small business deposit, loan, and merchant business

relationships •

Rationale for commercial lending over residential lending

Commercial lending offers opportunity to lend at higher yields

Relationship based commercial lending requires borrower to establish meaningful

deposits

•

Recent developments

Entered NYC commercial real estate lending market

Focused on originating larger commercial real estate and multi-family

loans Launched new SBA product (discounted guarantee fees)

Kearny Financial Corp.

11

Organic loan growth strategies |

Kearny Financial Corp.

12

Commercial lending success continues |

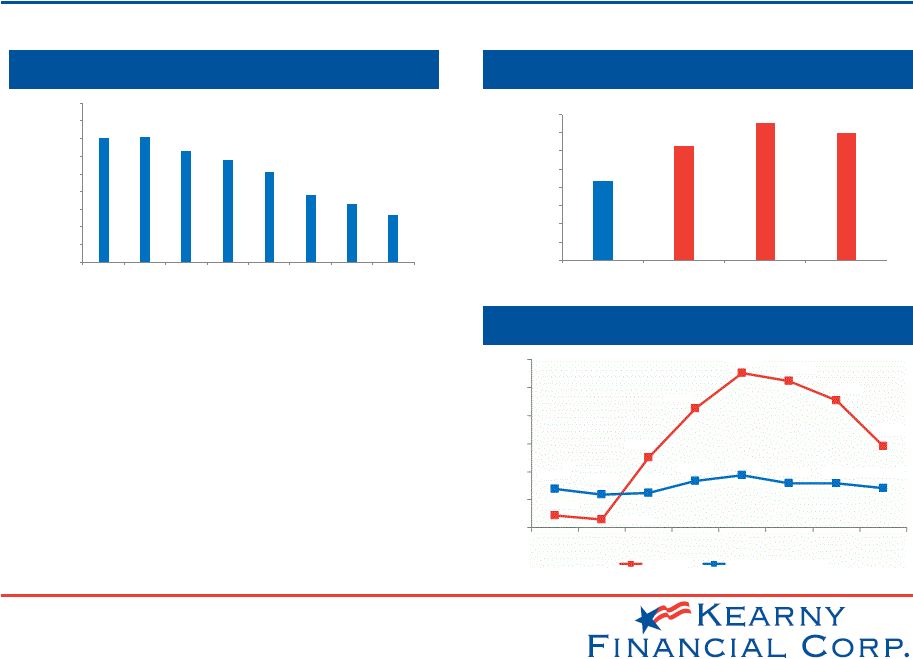

Kearny Financial Corp.

13

NPA / Assets trend

(1)

All MHCs that are publicly traded

(2)

The group is comprised of publicly traded banks and thrifts

Source: SNL Financial

•

Asset quality continues to improve

•

Level

of

“classified

assets”

declined

by

18.5%

year

over year

•

Minimal level of NPAs as compared to the industry

NPAs / Assets

Industry Comparison: NPAs / Assets

0.87%

1.26%

1.51%

1.40%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

1.60%

KRNY

All MHC

New Jersey

Publicly Traded

Nationwide

Publicly Traded

1.30

1.31

1.23

1.18

1.11

0.98

0.93

0.87

0.60

0.70

0.80

0.90

1.00

1.10

1.20

1.30

1.40

1.50

Sep

2012

Dec

2012

Mar

2013

Jun

2013

Sep

2013

Dec

2013

Mar

2014

Jun

2014

ALL vs. NPLs

0.22%

0.15%

1.26%

2.13%

2.76%

2.61%

2.27%

1.45%

0.70%

0.59%

0.62%

0.84%

0.93%

0.79%

0.80%

0.71%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

2007

2008

2009

2010

2011

2012

2013

2014

NPLs/Loans

Reserves/Loans |

Kearny Financial Corp.

14

Summary income statement

(1)

Related to a one-time

nonrecurring debt extinguishment expense in March 2013 (2)

Resulting from system conversion and merger-related expenses

Source: Company Financial Statements

(dollars in thousands, except EPS)

FY 2012

FY 2013

FY 2014

Net Interest Income

$70,180

$66,257

$73,821

Provision for Loan Losses

5,750

4,464

3,381

Loss on sale and write down of REO

(3,330)

(775)

(441)

Gain on Sale of Securities

47

10,427

1,517

Other Non-Interest Income

5,428

6,736

7,047

Restructuring, Conversion and Merger Charges

--

8,688

2,331

Other Non-Interest Expense

58,721

60,737

61,827

Income Tax Expense

2,776

2,250

4,217

Net Income

5,078

6,506

10,188

Diluted EPS

$0.08

$0.10

$0.16

1

1

2 |

Kearny Financial Corp.

15

Net Interest Margin

(1)

NJ Peers includes all public banks and thrifts headquartered in New Jersey

Source: SNL Financial

1

2.43%

2.54%

2.81%

2.83%

2.79%

2.65%

2.50%

2.44%

3.34%

3.40%

3.24%

3.65%

3.75%

3.59%

3.44%

3.38%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

2007

2008

2009

2010

2011

2012

2013

2014

KRNY

NJ Peers |

•

Completed Bank technology platform conversions Q3 2014

•

Restructured SBA Lending group

•

Closed Atlas Bank acquisition June 30, 2014

•

Developed Executive & Employee Compensation programs to align with

company strategic goals, probability focus, and long term shareholder

value creation

•

Continue to evaluate fee income based business lines such as the

acquisition of an insurance agency

Kearny Financial Corp.

16

Strategic review -

2014 |

Second Step Summary

On September 5, 2014 Kearny filed a registration statement in connection

with

its

second

step

conversion

from

a

mutual

holding

company

to

a

stock

holding company

Reasons for the offering

Support growth

Eliminate uncertainties associated with the mutual holding company

structure Transition to a more familiar and flexible form of

ownership Facilitate additional mergers and acquisitions

In connection with the conversion a new charitable foundation will be

established by the new stock holding company with a $10.0 million

contribution

consisting

of

$5.0

million

of

common

stock

and

$5.0

million

in

cash

Kearny Financial Corp.

17

Strategic Focus -

2015 |

•

Close second step offering

•

C&I business team build-out

expected to occur over the next three quarters

•

Continue to expand the commercial lending team in NYC via LPO

•

Develop

regional

advisory

board

of

COIs

to

help

with

loan

growth

and

relationship building

•

Continued reallocation of earning assets from investments into loans

•

Refresh current company brand with new logo & tag line

Kearny Financial Corp.

18

Strategic Focus -

2015 |

Kearny Financial Corp.

19

Strategic Focus -

2015 |

•

Enhance current product offerings and business services utilizing the

Bank’s new technology platforms

–

“Mobiliti”

-

a new mobile banking /payment services application

–

“Popmoney”

–

a quick and secure way for customers to send and receive money

–

“OpenNow/FundNow”

–

online account origination system

Kearny Financial Corp.

20

Strategic Focus -

2015 |

Kearny Financial Corp.

21

Strategic Focus -

2015 |