Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KEMET CORP | a8-kq2fy15.htm |

| EX-99.1 - NEWS RELEASE - KEMET CORP | kemex991fy15q2.htm |

Earnings Conference Call October 30, 2014 Quarter Ended September 30, 2014

Cautionary Statement Certain statements included herein contain forward-looking statements within the meaning of federal securities laws about KEMET Corporation's (the "Company") financial condition and results of operations that are based on management's current expectations, estimates and projections about the markets in which the Company operates, as well as management's beliefs and assumptions. Words such as "expects," "anticipates," "believes," "estimates," variations of such words and other similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions, which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in, or implied by, such forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management's judgment only as of the date hereof. The Company undertakes no obligation to update publicly any of these forward-looking statements to reflect new information, future events or otherwise. Factors that may cause actual outcome and results to differ materially from those expressed in, or implied by, these forward-looking statements include, but are not necessarily limited to the following: (i) adverse economic conditions could impact our ability to realize operating plans if the demand for our products declines, and such conditions could adversely affect our liquidity and ability to continue to operate; (ii) continued net losses could impact our ability to realize current operating plans and could materially adversely affect our liquidity and our ability to continue to operate; (iii) adverse economic conditions could cause the write down of long-lived assets or goodwill; (iv) an increase in the cost or a decrease in the availability of our principal or single-sourced purchased materials; (v) changes in the competitive environment; (vi) uncertainty of the timing of customer product qualifications in heavily regulated industries; (vii) economic, political, or regulatory changes in the countries in which we operate; (viii) difficulties, delays or unexpected costs in completing restructuring plans; (ix) equity method investment in NEC TOKIN expose us to a variety of risks; (x) acquisitions and other strategic transactions expose us to a variety of risks; (xi) inability to attract, train and retain effective employees and management; (xii) inability to develop innovative products to maintain customer relationships and offset potential price erosion in older products; (xiii) exposure to claims alleging product defects; (xiv) the impact of laws and regulations that apply to our business, including those relating to environmental matters; (xv) the impact of international laws relating to trade, export controls and foreign corrupt practices; (xvi) volatility of financial and credit markets affecting our access to capital; (xvii) the need to reduce the total costs of our products to remain competitive; (xviii) potential limitation on the use of net operating losses to offset possible future taxable income; (xix) restrictions in our debt agreements that limit our flexibility in operating our business; and (xx) additional exercise of the warrant by K Equity which could potentially result in the existence of a significant stockholder who could seek to influence our corporate decisions. 2

Income Statement Highlights U.S. GAAP 3 For the Quarters Ended (Amounts in thousands, except percentages and per share data) Sep 2014 Jun 2014 Sep 2013 Net sales $ 215,293 $ 212,881 $ 208,449 Gross margin $ 45,755 $ 32,957 $ 30,917 Gross margin as a percentage of net sales 21.3 % 15.5 % 14.8 % Selling, general and administrative $ 25,510 $ 24,779 $ 22,315 SG&A as a percentage of net sales 11.8 % 11.6 % 10.7 % Operating income (loss) $ 12,770 $ (606 ) $ 1,585 Net income (loss) from continuing operations $ 7,730 $ (10,483 ) $ (11,945 ) Net income (Ioss) from discontinued operations (1,400 ) 6,943 (1,151 ) Net income (loss) $ 6,330 $ (3,540 ) $ (13,096 ) Per share data: Net income (loss) from continuing operations - basic $ 0.17 $ (0.23 ) $ (0.26 ) Net income (loss) from discontinued operations - basic (0.03 ) 0.15 (0.03 ) Net income (loss) - basic 0.14 (0.08 ) (0.29 ) Net income (loss) from continuing operations - diluted 0.15 (0.23 ) (0.26 ) Net income (loss) from discontinued operations - diluted (0.03 ) 0.15 (0.03 ) Net income (loss) - diluted 0.12 (0.08 ) (0.29 ) Weighted avg. shares - basic 45,400 45,274 45,092 Weighted avg. shares - diluted 52,521 45,274 45,092

Income Statement Highlights Non-GAAP 4 For the Quarters Ended (Amounts in thousands, except percentages and per share data) Sep 2014 Jun 2014 Sep 2013 Net sales $ 215,293 $ 212,881 $ 208,449 Adjusted gross margin $ 46,389 $ 38,515 $ 32,196 Gross margin as a percentage of net sales 21.5 % 18.1 % 15.4 % Adjusted selling, general and administrative $ 24,119 $ 22,722 $ 20,743 SG&A as a percentage of net sales 11.2 % 10.7 % 10.0 % Adjusted operating income (loss) $ 16,054 $ 9,270 $ 5,895 Adjusted net income (loss) from continuing operations $ 3,465 $ (1,864 ) $ (4,569 ) Adjusted EBITDA 25,875 20,027 17,797 Per share data: Adjusted net income (loss) from continuing operations - basic $ 0.08 $ (0.04 ) $ (0.10 ) Adjusted net income (loss) from continuing operations - diluted $ 0.07 $ (0.04 ) $ (0.10 ) Weighted avg. shares - basic 45,400 45,274 45,092 Weighted avg. shares - diluted 52,521 45,274 45,092

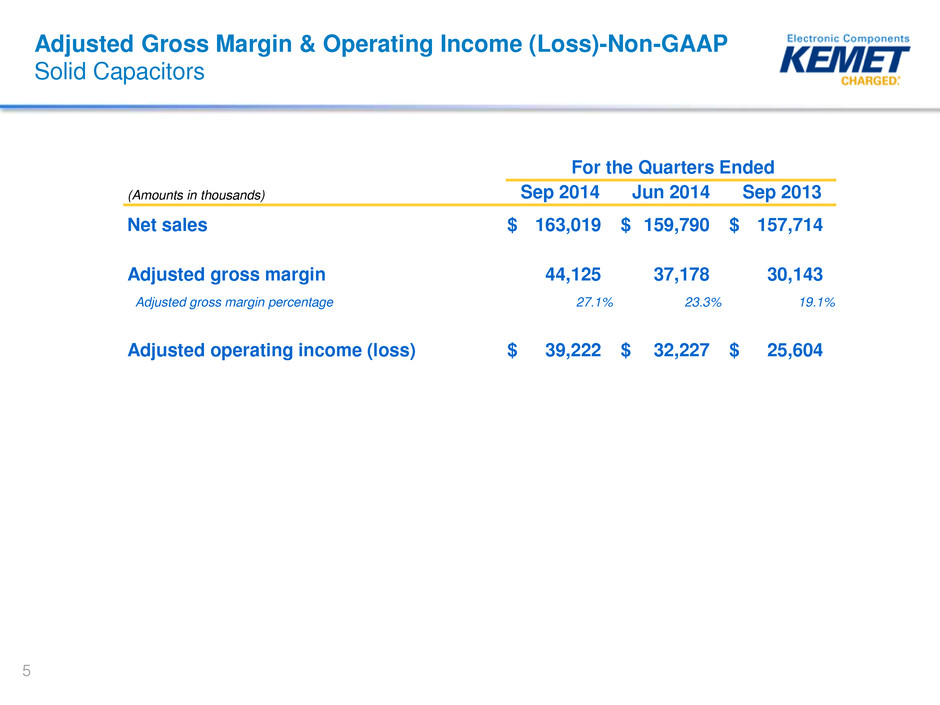

Adjusted Gross Margin & Operating Income (Loss)-Non-GAAP Solid Capacitors 5 For the Quarters Ended (Amounts in thousands) Sep 2014 Jun 2014 Sep 2013 Net sales $ 163,019 $ 159,790 $ 157,714 Adjusted gross margin 44,125 37,178 30,143 Adjusted gross margin percentage 27.1 % 23.3 % 19.1 % Adjusted operating income (loss) $ 39,222 $ 32,227 $ 25,604

Adjusted Gross Margin & Operating Income (Loss) -Non-GAAP Film & Electrolytics 6 For the Quarters Ended (Amounts in thousands) Sep 2014 Jun 2014 Sep 2013 Net sales $ 52,274 $ 53,091 $ 50,735 Adjusted gross margin 2,264 1,337 2,053 Adjusted gross margin percentage 4.3 % 2.5 % 4.0 % Adjusted operating income (loss) $ 1 $ (933 ) $ 98

Financial Highlights (1) Calculated as accounts receivable, net, plus inventories, net, less accounts payable (2)Calculated by annualizing the current quarter’s Net sales and Cost of sales 7 (Amounts in millions, except DSO and DPO) Sep 2014 Jun 2014 FX Impact Cash, cash equivalents and restricted cash $ 64.5 $ 71.6 $ (1.1 ) Capital expenditures $ 6.8 $ 5.2 Short-term debt $ 25.8 $ 27.4 Long-term debt 373.6 373.7 Debt premium 2.7 2.7 Total debt $ 402.1 $ 403.8 $ — Equity $ 214.8 $ 218.3 $ 13.7 Net working capital (1) $ 211.8 $ 206.3 $ (4.6 ) Days in receivables (DSO)(2) 41 42 Days in payables (DPO)(2) 39 37

Sales Summary - Q2 FY2015 8

Appendix

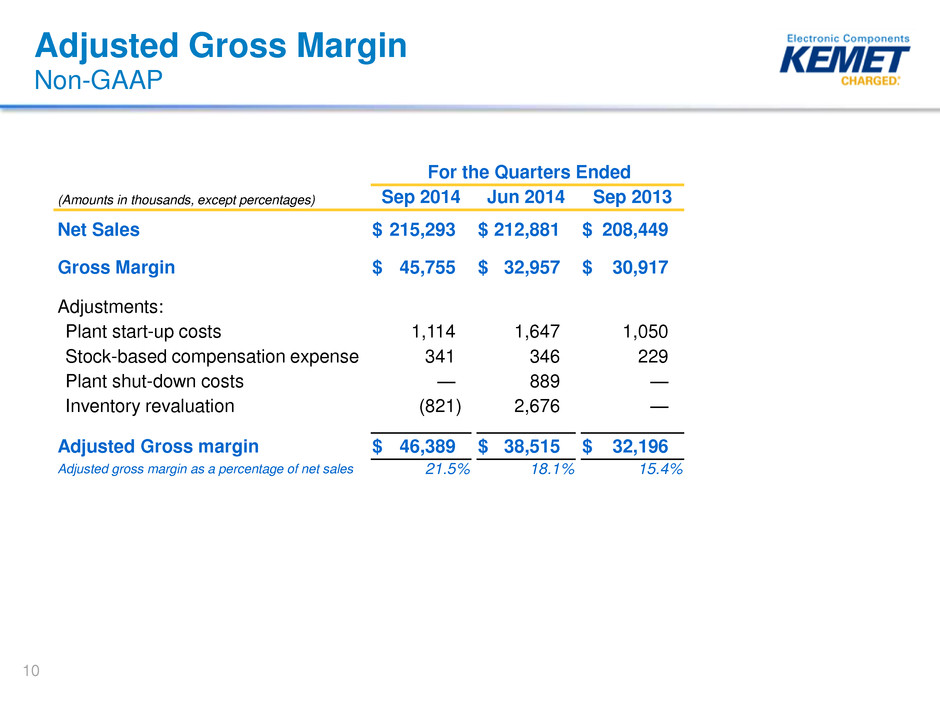

Adjusted Gross Margin Non-GAAP 10 For the Quarters Ended (Amounts in thousands, except percentages) Sep 2014 Jun 2014 Sep 2013 Net Sales $ 215,293 $ 212,881 $ 208,449 Gross Margin $ 45,755 $ 32,957 $ 30,917 Adjustments: Plant start-up costs 1,114 1,647 1,050 Stock-based compensation expense 341 346 229 Plant shut-down costs — 889 — Inventory revaluation (821 ) 2,676 — Adjusted Gross margin $ 46,389 $ 38,515 $ 32,196 Adjusted gross margin as a percentage of net sales 21.5 % 18.1 % 15.4 %

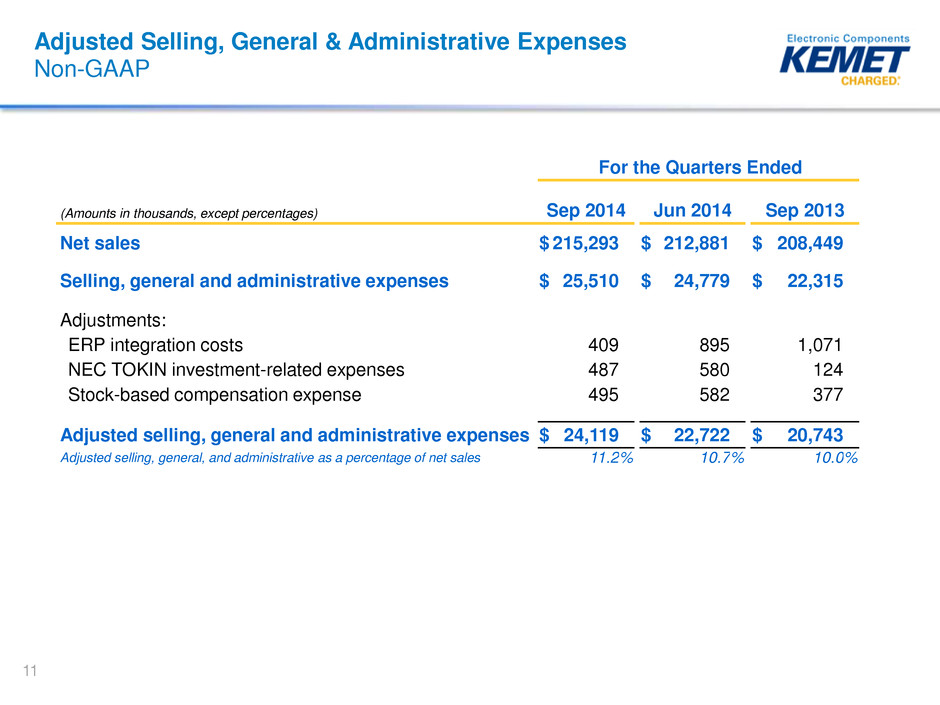

Adjusted Selling, General & Administrative Expenses Non-GAAP 11 For the Quarters Ended (Amounts in thousands, except percentages) Sep 2014 Jun 2014 Sep 2013 Net sales $ 215,293 $ 212,881 $ 208,449 Selling, general and administrative expenses $ 25,510 $ 24,779 $ 22,315 Adjustments: ERP integration costs 409 895 1,071 NEC TOKIN investment-related expenses 487 580 124 Stock-based compensation expense 495 582 377 Adjusted selling, general and administrative expenses $ 24,119 $ 22,722 $ 20,743 Adjusted selling, general, and administrative as a percentage of net sales 11.2 % 10.7 % 10.0 %

Adjusted Operating Income (Loss) Non-GAAP 12 For the Quarters Ended (Amounts in thousands) Sep 2014 Jun 2014 Sep 2013 Operating income (loss) $ 12,770 $ (606 ) $ 1,585 Adjustments: Restructuring charges 1,687 1,830 1,364 Stock-based compensation expense 958 994 659 ERP integration costs 409 895 1,071 Plant start-up costs 1,114 1,647 1,050 Plant shut-down costs — 889 — NEC TOKIN investment-related expenses 487 580 124 Net (gain) loss on sales and disposals of assets (550 ) 365 42 Inventory revaluation (821 ) 2,676 — Adjusted operating income (loss) $ 16,054 $ 9,270 $ 5,895

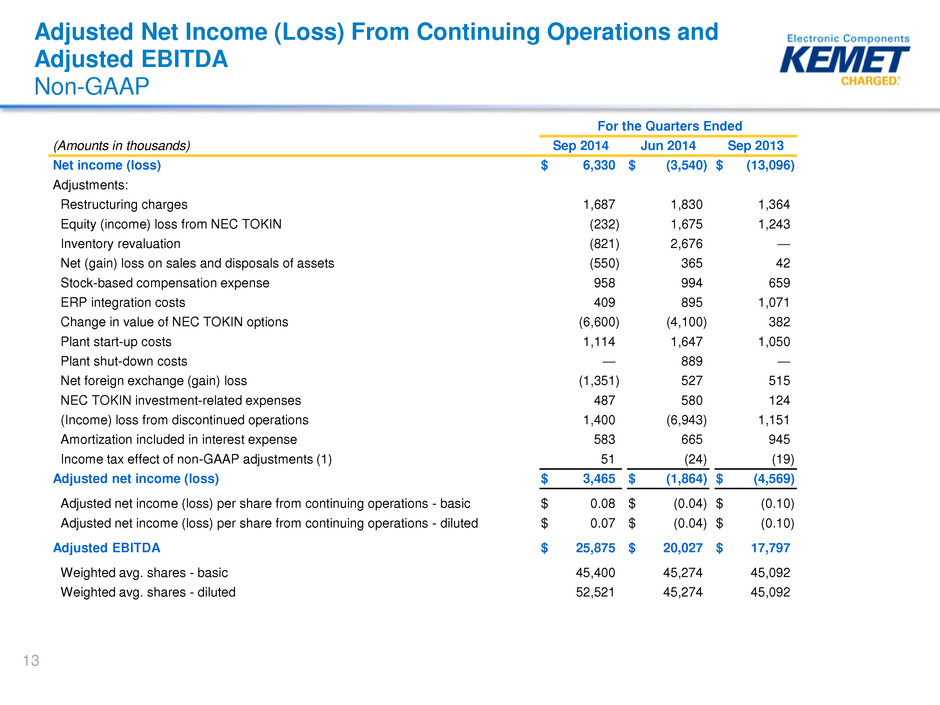

Adjusted Net Income (Loss) From Continuing Operations and Adjusted EBITDA Non-GAAP For the Quarters Ended (Amounts in thousands) Sep 2014 Jun 2014 Sep 2013 Net income (loss) $ 6,330 $ (3,540 ) $ (13,096 ) Adjustments: Restructuring charges 1,687 1,830 1,364 Equity (income) loss from NEC TOKIN (232 ) 1,675 1,243 Inventory revaluation (821 ) 2,676 — Net (gain) loss on sales and disposals of assets (550 ) 365 42 Stock-based compensation expense 958 994 659 ERP integration costs 409 895 1,071 Change in value of NEC TOKIN options (6,600 ) (4,100 ) 382 Plant start-up costs 1,114 1,647 1,050 Plant shut-down costs — 889 — Net foreign exchange (gain) loss (1,351 ) 527 515 NEC TOKIN investment-related expenses 487 580 124 (Income) loss from discontinued operations 1,400 (6,943 ) 1,151 Amortization included in interest expense 583 665 945 Income tax effect of non-GAAP adjustments (1) 51 (24 ) (19 ) Adjusted net income (loss) $ 3,465 $ (1,864 ) $ (4,569 ) Adjusted net income (loss) per share from continuing operations - basic $ 0.08 $ (0.04 ) $ (0.10 ) Adjusted net income (loss) per share from continuing operations - diluted $ 0.07 $ (0.04 ) $ (0.10 ) Adjusted EBITDA $ 25,875 $ 20,027 $ 17,797 Weighted avg. shares - basic 45,400 45,274 45,092 Weighted avg. shares - diluted 52,521 45,274 45,092 13

Adjusted EBITDA Reconciliation Non-GAAP 14 For the Quarters Ended (Amounts in thousands) Sep 2014 Jun 2014 Sep 2013 U.S. GAAP Net income (loss) $ 6,330 $ (3,540 ) $ (13,096 ) Interest expense, net 10,284 10,453 9,897 Income tax expense 2,583 1,282 1,444 Depreciation and amortization 10,177 10,797 11,951 EBITDA 29,374 18,992 10,196 Excluding the following items (non-GAAP): Restructuring charges 1,687 1,830 1,364 Equity (income) loss from NEC TOKIN (232 ) 1,675 1,243 Inventory revaluation (821 ) 2,676 — Net (gain) loss on sales and disposals of assets (550 ) 365 42 Stock-based compensation expense 958 994 659 ERP integration costs 409 895 1,071 Change in value of NEC TOKIN options (6,600 ) (4,100 ) 382 Plant start-up costs 1,114 1,647 1,050 Plant shut-down costs — 889 — Net foreign exchange (gain) loss (1,351 ) 527 515 NEC TOKIN investment-related expenses 487 580 124 (Income) loss from discontinued operations 1,400 (6,943 ) 1,151 Adjusted EBITDA $ 25,875 $ 20,027 $ 17,797

Adjusted Gross Margin-Non-GAAP Solid Capacitors 15 For the Quarters Ended (Amounts in thousands) Sep 2014 Jun 2014 Sep 2013 Net sales $ 163,019 $ 159,790 $ 157,714 Gross margin 43,460 36,020 30,104 Gross margin percentage 26.7 % 22.5 % 19.1 % Adjustments: Inventory revaluation (238 ) 715 — Stock-based compensation expense 190 166 39 Plant start-up costs 713 277 — Adjusted gross margin $ 44,125 $ 37,178 $ 30,143 Adjusted gross margin percentage 27.1 % 23.3 % 19.1 %

Adjusted Gross Margin-Non-GAAP Film & Electrolytics 16 For the Quarters Ended (Amounts in thousands) Sep 2014 Jun 2014 Sep 2013 Net sales $ 52,274 $ 53,091 $ 50,735 Gross margin 2,295 (3,063 ) 813 Gross margin percentage 4.4 % (5.8 )% 1.6 % Adjustments: Inventory revaluation (583 ) 1,961 — Stock-based compensation expense 151 180 190 Plant start-up costs 401 1,370 1,050 Plant shut-down costs — 889 — Adjusted gross margin $ 2,264 $ 1,337 $ 2,053 Adjusted gross margin percentage 4.3 % 2.5 % 4.0 %

Adjusted Operating Income (Loss)-Non-GAAP Solid Capacitors 17 For the Quarters Ended (Amounts in thousands) Sep 2014 Jun 2014 Sep 2013 Net sales $ 163,019 $ 159,790 $ 157,714 Operating income (loss) 38,386 29,734 25,386 Adjustments: Inventory revaluation (238 ) 715 — Restructuring charges 169 1,230 99 Stock-based compensation expense 190 166 39 Plant start-up costs 713 277 — ERP integration expenses — — 18 (Gain) loss on sales and disposals of assets 4 105 60 Adjusted operating income (loss) $ 39,224 $ 32,227 $ 25,602

Adjusted Operating Income (Loss)-Non-GAAP Film & Electrolytics 18 For the Quarters Ended (Amounts in thousands) Sep 2014 Jun 2014 Sep 2013 Net sales $ 52,274 $ 53,091 $ 50,735 Operating income (loss) (917 ) (6,076 ) (2,211 ) Adjustments: Inventory revaluation (583 ) 1,961 — Restructuring charges 1,500 489 1,062 Stock-based compensation expense 151 180 190 Plant start-up costs 401 1,370 1,050 Plant shut-down costs — 889 — ERP integration expenses — — 74 (Gain) loss on sales and disposals of assets (551 ) 254 (66 ) Adjusted operating income (loss) $ 1 $ (933 ) $ 99

Non-GAAP Financial Measures Non-GAAP Financial Measures Included in this presentation are certain non-GAAP financial measures designed to complement the financial information presented in accordance with generally accepted accounting principles in the United States of America because management believes such measures are useful to investors. Adjusted gross margin Adjusted gross margin represents net sales less cost of sales excluding adjustments which are outlined in the quantitative reconciliation provided earlier in this presentation. Management uses Adjusted gross margin to facilitate our analysis and understanding of our business operations and believes that Adjusted gross margin is useful to investors because it provides a supplemental way to understand the underlying operating performance of the Company. Adjusted gross margin should not be considered as an alternative to gross margin or any other performance measure derived in accordance with GAAP. Adjusted selling, general and administrative expenses Adjusted selling, general and administrative expenses represents selling, general and administrative expenses excluding adjustments which are outlined in the quantitative reconciliation provided earlier in this presentation. Management uses Adjusted selling, general and administrative expenses to facilitate our analysis and understanding of our business operations and believes that Adjusted selling, general and administrative expenses is useful to investors because it provides a supplemental way to understand the underlying operating performance of the Company. Adjusted selling, general and administrative expenses should not be considered as an alternative to selling, general and administrative expenses or any other performance measure derived in accordance with GAAP. Adjusted operating income (loss) Adjusted operating income (loss) represents operating income (loss), excluding adjustments which are outlined in the quantitative reconciliation provided earlier in this presentation. Management uses Adjusted operating income to facilitate our analysis and understanding of our business operations and believes that Adjusted operating income is useful to investors because it provides a supplemental way to understand the underlying operating performance of the Company. Adjusted operating income should not be considered as an alternative to operating loss or any other performance measure derived in accordance with GAAP. 19

Non-GAAP Financial Measures Continued Adjusted net income (loss) and Adjusted EPS Adjusted net income (loss) and Adjusted EPS represent net income (loss) and EPS, excluding adjustments which are more specifically outlined in the quantitative reconciliation provided earlier in this presentation. Management uses Adjusted net income (loss) and Adjusted EPS to evaluate the Company's operating performance and believes that Adjusted net income (loss) and Adjusted EPS are useful to investors because they provide a supplemental way to possibly better understand the underlying operating performance of the Company. Adjusted net income (loss) and Adjusted EPS should not be considered as alternatives to net income, operating income or any other performance measures derived in accordance with GAAP. Adjusted EBITDA Adjusted EBITDA represents net loss before income tax expense (benefit), interest expense, net, and depreciation and amortization expense, excluding adjustments which are more specifically outlined in the quantitative reconciliation provided earlier in this presentation. We present Adjusted EBITDA as a supplemental measure of our performance and ability to service debt. We also present Adjusted EBITDA because we believe such measure is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. We believe Adjusted EBITDA is an appropriate supplemental measure of debt service capacity, because cash expenditures on interest are, by definition, available to pay interest, and tax expense is inversely correlated to interest expense because tax expense goes down as deductible interest expense goes up; depreciation and amortization are non-cash charges. The other items excluded from Adjusted EBITDA are excluded in order to better reflect our continuing operations. In evaluating Adjusted EBITDA, you should be aware that in the future we may incur expenses similar to the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these types of adjustments. Adjusted EBITDA is not a measurement of our financial performance under GAAP and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP or as an alternative to cash flow from operating activities as a measure of our liquidity. 20

Non-GAAP Financial Measures Continued Our Adjusted EBITDA measure has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: • it does not reflect our cash expenditures, future requirements for capital expenditures or contractual commitments; • it does not reflect changes in, or cash requirements for, our working capital needs; • it does not reflect the significant interest expense or the cash requirements necessary to service interest or principal payment on our debt; • although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and our Adjusted EBITDA measure does not reflect any cash requirements for such replacements; • it is not adjusted for all non-cash income or expense items that are reflected in our statements of cash flows; • it does not reflect the impact of earnings or charges resulting from matters we consider not to be indicative of our ongoing operations; • it does not reflect limitations on or costs related to transferring earnings from our subsidiaries to us; and • other companies in our industry may calculate this measure differently than we do, limiting its usefulness as a comparative measure. Because of these limitations, Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business or as a measure of cash that will be available to us to meet our obligations. You should compensate for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA only supplementally. 21