Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HYSTER-YALE MATERIALS HANDLING, INC. | d811877d8k.htm |

| EX-99.2 - EX-99.2 - HYSTER-YALE MATERIALS HANDLING, INC. | d811877dex992.htm |

1

Exhibit 99.1

Investor Presentation

October 30, 2014 |

1

Safe Harbor Statement

The following information includes forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Any and all statements regarding the Company’s

expected future financial position, results of operations, cash flows, business

strategy, budgets, projected costs, capital expenditures, products, competitive

positions, growth opportunities, plans, goals and objectives of management for future operations, as well as

statements that include words such as “anticipate,” “if,”

“believe,” “plan,” “estimate,” “expect,” “intend,” “may,” “could,” “should,” “will,” and

other similar expressions are forward-looking statements. Such forward-looking

statements are inherently uncertain, and readers must recognize that actual

results may differ materially from the expectations of the Company’s management. The Company does not

undertake a duty to update such forward-looking statements. Among the factors that

could cause plans, actions and results to differ materially from current

expectations include, without limitation, reduction in demand for lift trucks and related aftermarket parts and

service on a global basis, the ability of dealers, suppliers and end-users to

obtain financing at reasonable rates, or at all, as a result of current economic

and market conditions, the political and economic uncertainties in Eastern Europe and Brazil, customer acceptance of

pricing, delays in delivery or increases in costs, including transportation costs, of

raw materials or sourced products and labor or changes in or unavailability of

quality suppliers, exchange rate fluctuations, changes in foreign import tariffs and monetary policies and other

changes in the regulatory climate in the foreign countries in which the Company

operates and/or sells products, delays in manufacturing and delivery schedules,

bankruptcy of or loss of major dealers, retail customers or suppliers, customer acceptance of, changes in the

costs of, or delays in the development of new products, introduction of new products

by, or more favorable product pricing offered by, competitors, product liability

or other litigation, warranty claims or returns of products, the effectiveness of the cost reduction programs

implemented globally, including the successful implementation of procurement and

sourcing initiatives, changes mandated by federal, state and other regulation,

including health, safety or environmental legislation and delays in or increased costs associated with the Brazil

plant construction and other risks identified in the Company’s Annual Report on

Form 10-K and other filings with the Securities and Exchange

Commission. Many of these factors are outside of the Company’s control.

|

2

Hyster-Yale Snapshot

Hyster-Yale Materials Handling, Inc. (NYSE:HY)

Leading global designer, manufacturer and marketer of lift

trucks and provider of aftermarket parts and support

Headquartered in Cleveland, Ohio

Over 5,200 employees globally

LTM

9/30/14

Revenue

–

$2.8

billion

LTM 9/30/14 Net income

(1)

-

$109.1 million

LTM 9/30/14 EBITDA

(1)(2)

–

$183.1 million

9/30/14

Net

cash

–

$59.6

million

LTM 9/30/14 ROTCE

(1)(2)

of 28.6% (Net cash basis)

(1)

Net income, EBITDA and ROTCE for the LTM 9/30/14 include a $17.7 million pre-tax

gain on the sale of the Brazil land and facility.

(2)

EBITDA and ROTCE are non-GAAP measures and should not be considered in isolation or

as a substitute for GAAP measures. For discussion of non-GAAP items and the related

reconciliations to GAAP measures, see pages starting on 20. |

3

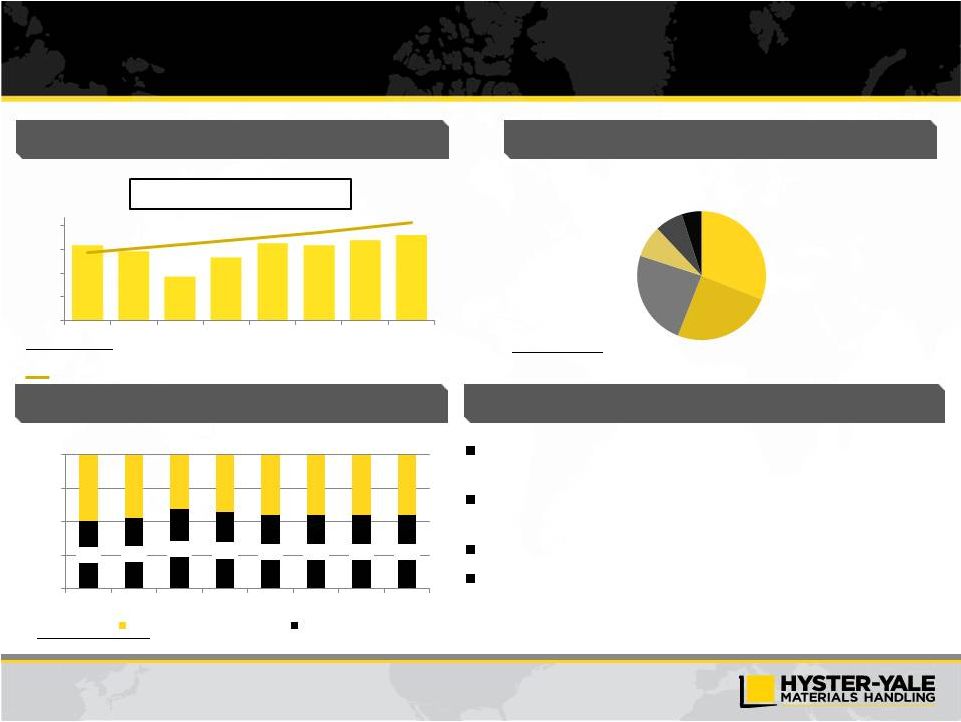

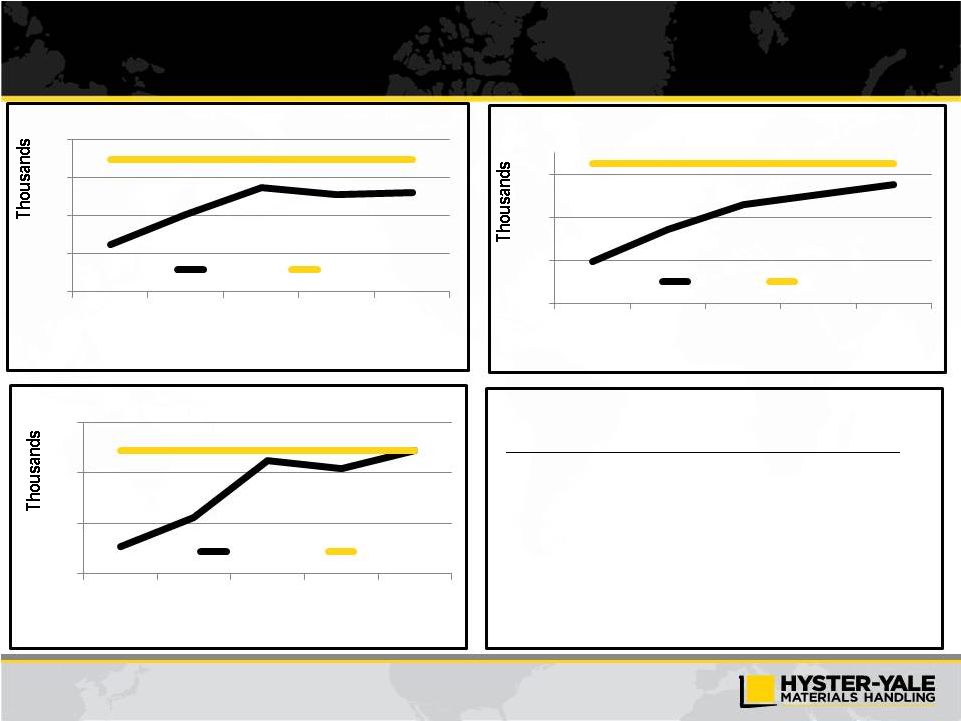

Growth similar to GDP levels in developed markets with emerging markets

driving expansion, particularly China.

Strong demand for warehouse and distribution industry applications in North

America and Western Europe

Increasing focus on electric truck technology development

Importance of total lifecycle cost of ownership

Key Themes

Industry Overview

(units in thousands)

Global Lift Truck Industry Size

Source: WITS. Represents order intake.

Global Lift Truck Industry Breakdown (Units)

Source: WITS. LTM 9/30/14 order intake.

Long-term CAGR (2003 –

2013) = 5.3%

(units in thousands)

Developed Market Warehouse Industry Growth

Source: WITS orders for North America and Western Europe

3

Europe

31%

China

25%

Americas

24%

Japan

8%

Asia Pacific

7%

Middle East & Africa

5%

951

872

547

794

975

944

1,009

1,071

0

300

600

900

1,200

2007

2008

2009

2010

2011

2012

2013

LTM Q3 14

50%

53%

59%

57%

55%

55%

55%

55%

0%

25%

50%

75%

100%

2007

2008

2009

2010

2011

2012

2013

LTM Q3 14

Counter Balanced

Warehouse

Trend line represents 5.3% CAGR from 2006-2008 Average Industry Size

|

4

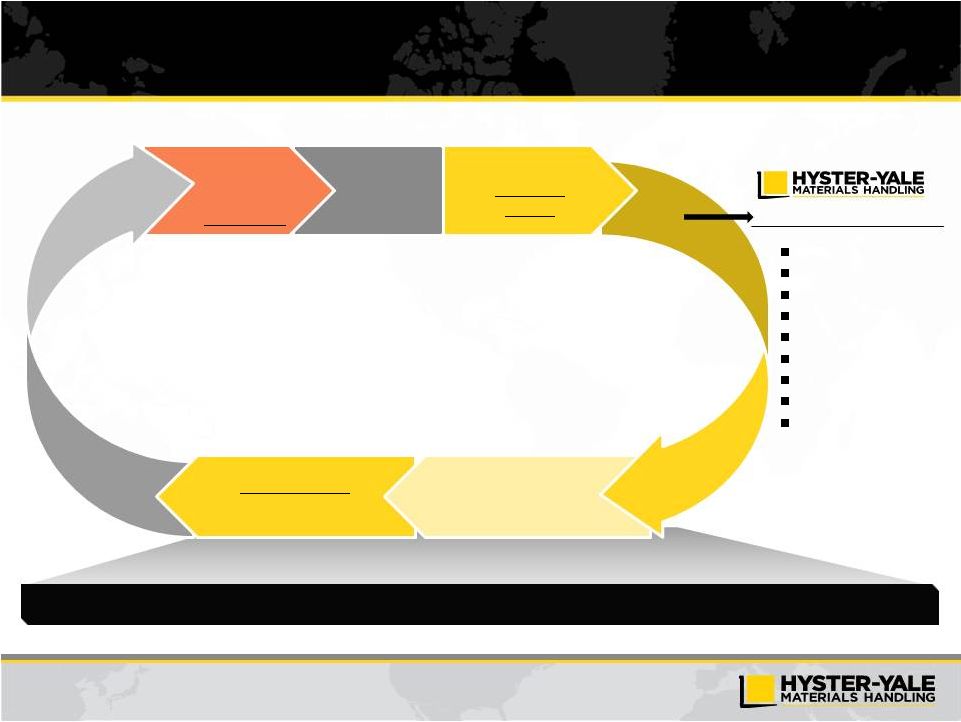

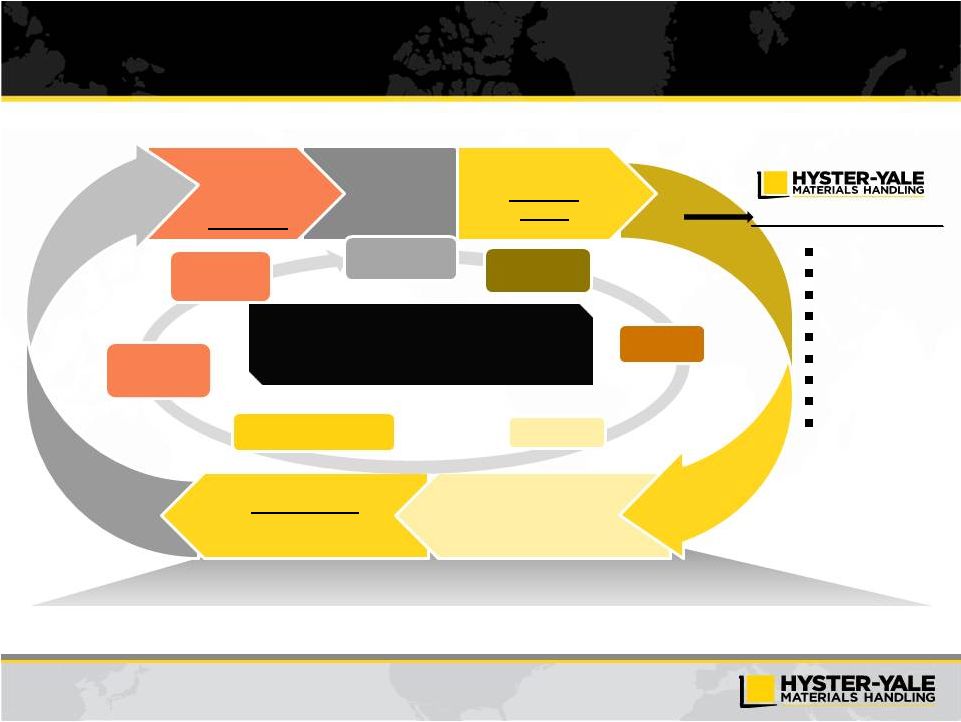

Economic Engine is Driven by Unit Volume

Geographic

and Product

Balance

Worldwide

Distribution

Strength to Drive

Market Share

Parts and Service

Volume

Large Lift Truck

Population in Service

Volume

Economies

of Scale

Design

Component Commonality

Supply Chain

Manufacturing

Quality

Marketing

Parts

Infrastructure

Capital Requirements

Drivers of long term competitive advantage

Basic Business Areas

A large lift truck population base drives parts and service volume resulting in enhanced

profitability for dealers and Hyster-Yale |

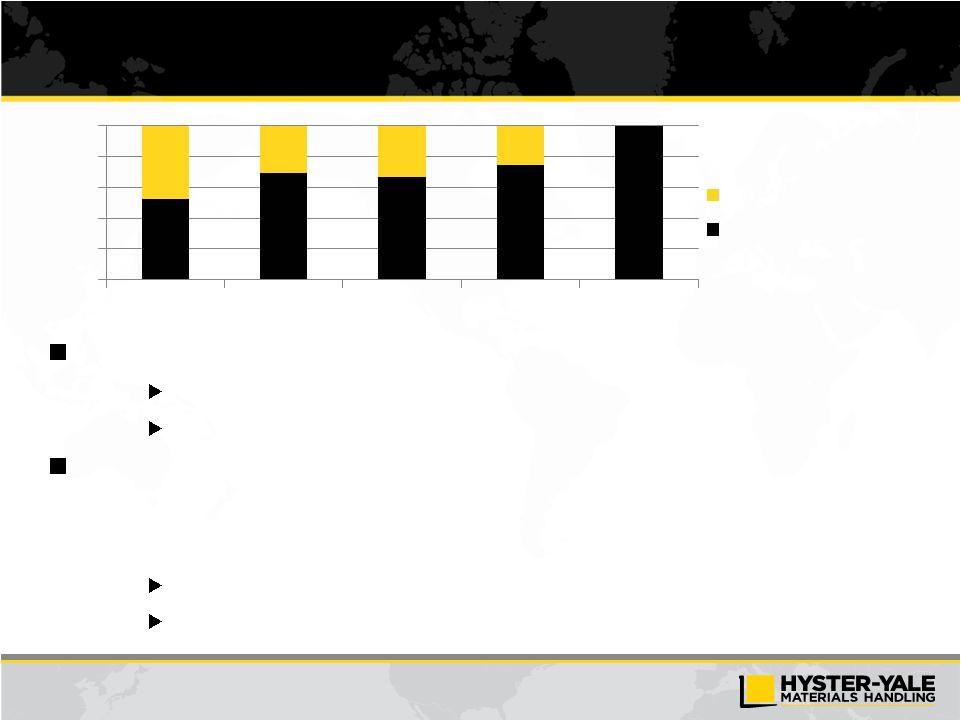

5

Target Economics Goal and Gap to Target

Goal

is

to

achieve

minimum

operating

profit

margin

of

7%

at

mid-cycle

and

to

achieve

7%

operating

profit margin at the peak of the current market cycle

9/30/14 LTM Gap to Target Economics

Actual Operating Profit Margin: 5.4%

Margin variances:

(0.2%)

–

Unit margin

(0.9%)

–

Parts/other

+0.7%

Volume variances:

–

Manufacturing variances/other

(1.0%)

–

Operating Expenses

(1.0%)

Brazil gain:

+0.6%

Operating Profit % Gap

(1.6%)

Gap Excluding Brazil Gain

(1)

(2.2%)

Operating Profit $ Opportunity

(1)

$61m

Target Economics gap closure can be

achieved by:

1.

Increased margin on ICE trucks

-

Segmentation

-

Low cost of ownership

2.

Unit volume

-

Share growth

-

Stronger industry

-

Volume leverage

(1)

Gap excluding Brazil Gain of 0.6% is a non-GAAP measure and should not be considered

in isolation or as a substitute for the GAAP measure. Management believes that this measure assists the investor in understanding the results of operations.

|

6

Leverage Gained from Moving Volume to Full

Manufacturing Capacity

Objective of minimum 25,000 unit volume increase from 2013 levels

$600m additional revenue

$70m+ incremental operating profit

Approximately $125m manufacturing fixed cost

–

Ability to produce 115,000* units annually

–

At capacity

Approximately $30m additional fixed cost absorption

Operating costs aligned with targets at increased sales volumes

* Excludes UTILEV and SN Products

48%

31%

33%

25%

0%

20%

40%

60%

80%

100%

2010

2011

2012

2013

2016-2017

Unused Capacity

Unit Volume |

7

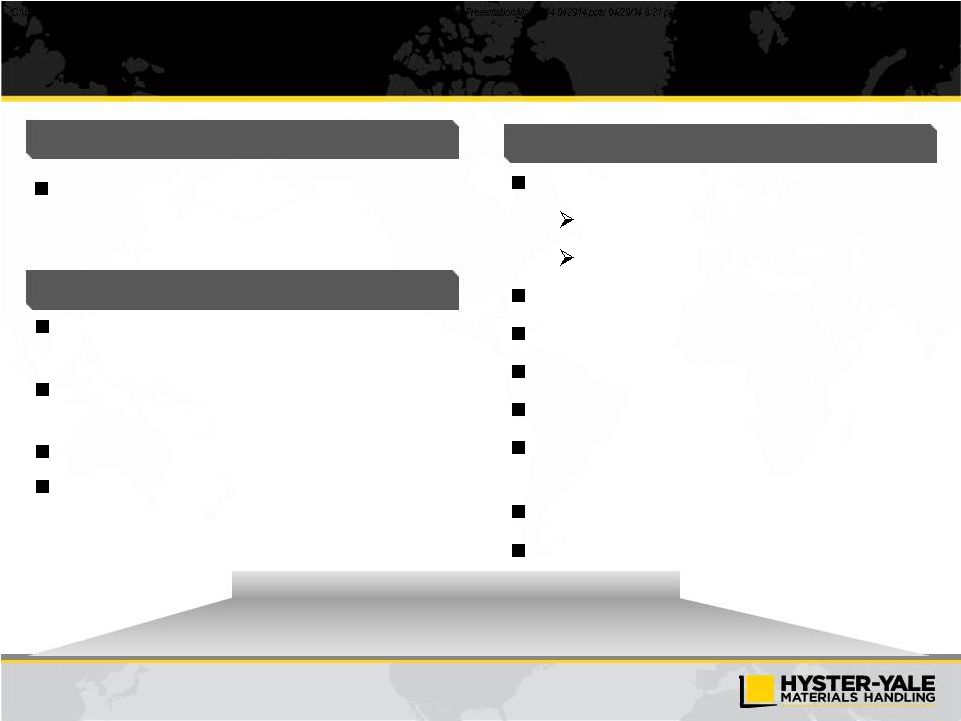

Over the Remainder of this Market Cycle, Target

Volumes Driven by…

Share growth of approx. 2% pts

>

5 Strategic initiatives

Growth of 20-25% by 2018-2019*

Growth of 10-15% by 2016-2017*

Growth of 10-15% by 2017-2018*

* Growth is from 2013 levels.

100

200

300

400

500

2009

2010

2011

2012

2013

EMEA Industry

Actual

Prior Peak

50

100

150

200

2009

2010

2011

2012

2013

Americas Industry

Actual

Prior Peak

150

250

350

450

2009

2010

2011

2012

2013

Asia Industry

Actual

Peak

> 2 Supplemental initiatives

> Share growth is approximately

50% of volume increase required |

8

Key Strategic & Supplemental Initiatives drive the

Economic Engine to Increased Share

Design

Component Commonality

Supply Chain

Manufacturing

Quality

Marketing

Parts

Infrastructure

Capital Requirements

Drivers of long term competitive advantage

Strategic and Supplemental Initiatives are designed to drive

increased share, which in turn increases the lift truck

population, which drives parts and service volumes.

Basic Business Areas

Geographic

and Product

Balance

Worldwide

Distribution

Strength

to

Drive

Market Share

Parts and Service

Volume

Large Lift Truck

Population in Service

Volume

Economies

of Scale

Crack the Code

in Warehouse

Leaders in

Independent

Distribution

Succeed in

Asia

Big Truck

Focus

Enhanced Sales and

Marketing Organization

Low Cost of

Ownership

Understand

Needs of

Customers |

Applications

–

Global industry strategy teams

–

Initial focus on 8 industries

–

Early success in Metals and Trucking industries

–

Leveraging success across geographies

Strategic Objective

Status

Key Elements

Provide the right product and solution to meet

the specific needs of different customers across

multiple industries

Segmentation

–

Segmenting in all classes

–

Expanding Standard and Utility truck ranges

–

Improving the Premium truck ranges

–

Matching products to customer needs

Segmentation of products and industries

Development of Utility, Standard and Premium

products

Range of options to match needs of different

industries

Targeted sales and marketing effort

Enhanced Understanding of Customer

Needs to Drive Tailored Solutions

Win in Targeted Major Accounts and Applications

Outcome:

9 |

10

Status

Key Elements

Masters of the World of Low Cost of Ownership

Deliver lowest cost of ownership for all of our

customers based on their specific application

Customer facing

–

Energy efficient product solutions

–

Factory fitted telematics

–

Enhanced fleet management capabilities

–

Increased lease residuals

–

Service repair costs reduced

–

Automation initiatives

Internal facing

–

Fewer, higher quality suppliers

–

Lean manufacturing

Understand major cost drivers:

Direct (truck price, fuel, service, operator, uptime)

Indirect (safety, litigation, pollution)

Strategic Objective

Competitive Advantage across Product Segments

Outcome:

10 |

Strategic Objective

Status

Key Elements

Expand market penetration throughout Asia

Expanding production in India

Electrics

Big Trucks

Increased foreign brand share in China

Strategic relationship in China

New sales and marketing office in Malaysia

New financing program

Success with Japanese companies throughout

Asia

New dealers appointed

New products introduced

Organic growth through development of

dealer network and direct selling capabilities

Development of long term strategic

partnerships

Development of right products

Development of support infrastructure

Succeed in Asian Markets

Increase Share and Strengthen Distribution at Accelerated Pace

Outcome:

11 |

Strategic Objective

Status

Key Elements

Develop the strongest independent

dealer network

New dealers recruited

Excellence programs enhanced

Enhanced sales specialization

Enhanced sales messaging

Dealer business plan process implemented

globally

New product configurator under

development

Awareness, participation and closure

tracking enhanced

Strengthened account identification and

coverage activities

Develop all dealers

Appoint / convert successful dealers

Expand number of dual line dealers

Enhance dealer value proposition

Combine dealer entrepreneurship with

OEM support

Enhanced Independent Distribution

Best Distribution Channels in the Industry

Outcome:

12 |

Strategic Objective

Status

Key Elements

Strengthen penetration of the growing

warehouse segment

Increased NMHG and dealer sales specialization

Warehouse solutions groups formed

New products launched –

unique to market

Large customer wins

Enhanced selling tools developed

Enhance product ranges

Develop stronger direct sales capabilities

Develop dealer resources and specialization

Enhance marketing services and support

Significantly Improve Warehouse Business Position

Be a Top Tier Global Competitor in Warehouse Equipment

Outcome:

13 |

14

Supplemental Initiatives

Big Truck Focus

–

New products

–

Specialist teams in each region

–

Global team coordination

–

Focus on industry and solutions

–

Success with large port operators

–

Comprehensive Tier 4 offering

Enhanced Sales and Marketing

Organization

–

Greater accountability for results

through smaller sales management

areas

–

Leaders provided with new tools and

enhanced reporting capabilities

–

Solutions Groups to develop product

specific expertise for customer clusters

–

Major focus on account identification

and coverage |

15

Positive Environment for Hyster-Yale to Gain Share

and Margin Performance Over Next 3-5 Years

Product gaps filled to position Hyster-Yale in most application segments and

improve margins

Low-cost manufacturing base relative to German-centric and Japanese-centric

competitors

Second-tier competitors in the ICE segment more vulnerable due to their

weakened economy of scale position

Key warehouse segment competitors are regional

Key Big Truck segment competitors are niche

Over the longer-term, as key initiatives are executed and mature, share gains are

expected to occur. |

16

Share Gain Expected to Take Place Over Time as

Momentum is Gained in All Key Areas of Business

New Program

Developing

Achieved Momentum

Product Improvement

Supply Chain

Manufacturing

Quality

Pricing

Dealer Structure and Excellence

Account Identification/Coverage

Warehouse and Counterbalanced Solutions

Aftermarket

Fleet

Area Sales Management

|

17

Substantial Cash being returned to Stockholders

Stockholder returns

Quarterly dividend established in November 2012

$50 million stock repurchase program announced in December 2012

Annual Dividends

2013

Annual

dividend

-

$1.00

per

share

or

$16.7

million

2014

Annual

dividend

–

10%

increase

in

May

2014

to

an

annualized

rate

of

$1.10

per

share

2014

Total

dividends

paid

-

$13.4

million

Share Buyback Activity

2012/2013

Share

buyback

–

103,619

shares

of

Class

A

common

stock

for

$5.2

million

2014

Share

buyback

–

431,357

shares

of

Class

A

common

stock

for

$33.3

million |

18

Q3

2014

Highlights

Significantly lower estimated incentive compensation, as well as

expected improvements in unit and parts volumes and a shift in sales

mix to higher-margin units expected to be substantially offset by pricing

pressures, higher manufacturing costs and continued investments in the

strategic initiatives, resulting in a moderate improvement in operating

profit in the fourth quarter of 2014.

The Brazil market and currency fluctuations continue to be headwinds to

2014 results.

($ in millions)

Close gap to 7% target economics at mid-cycle and 7% at the peak of

the current market cycle

33%+ unit volume growth

•

Industry recovery

•

Share growth

Unit margin enhancement

•

Product segmentation

•

Low cost of ownership

_____________________

(1)

LTM Operating profit, net income and EBITDA include $17.7 million pre-tax gain on

sale from the Brazil land and facility (2)

EBITDA is a non-GAAP measure and should not be considered in isolation or as a

substitute for GAAP measures. For discussion of

non-GAAP

items

and

the

related

reconciliations

to

GAAP

measures,

see

pages

starting

on

20.

Revenue

$695.8

100.0%

$2,774.4

100.0%

Operating

Profit

(1)

36.3

5.2%

150.6

5.4%

Net Income

28.4

4.1%

109.1

3.9%

EBITDA

(2)

$41.2

5.9%

$183.1

6.6%

Debt

$38.3

Cash

$97.9

Net Cash

$59.6

2014 Third Quarter

9/30/14 LTM

(1)

8.1% growth in Q3 2014 revenue on a 16% increase in operating profit.

Revenue growth from a shift in sales to higher-priced lift trucks, an

increase in unit and parts volumes and favorable foreign currency

translation.

Q3 2014 Results

Hyster-Yale

Outlook

–

Longer-

term

Hyster-Yale Outlook –

Short Term

Growth rates for global lift truck market expected to decelerate during the remainder of

2014, with growth generally concentrated in Western Europe, Middle East

and Africa markets, with smaller growth in Asia-Pacific.

Americas market expected to slow in Q4 2014.

Backlog of 26,800 units, or approximately $710m at 9/30/14 represents

>16 weeks of production and supports 4th quarter 2014 production plan. Operating profit and net income up substantially, primarily as a result of lower incentive

compensation estimates, but gross profit declined. Benefits from higher unit and

parts volumes were more than offset by unfavorable foreign currency movements,

lower earnings on the remarketing of used trucks and increased warranty

expense. Modest declines in unit pricing were fully offset by lower

material costs. |

Appendix

30 |

20

Non-GAAP Disclosure

EBITDA and return on total capital employed are not measurements under U.S. GAAP,

should not be considered in isolation or as a substitute for GAAP measures, and

are not necessarily comparable with similarly titled measures of other companies.

Hyster-Yale defines each as the following:

EBITDA is defined as income before income taxes and non-controlling interest

income (loss) plus net interest expense and depreciation and amortization

expense; Return on total capital employed (“ROTCE”) is defined as net income before

interest expense, after tax, divided by average capital employed.

Average capital employed is defined as average stockholder’s

equity plus average debt less average cash.

For reconciliations from GAAP measurements to non-GAAP measurements, see pages 21

and 22. |

21

Non-GAAP Reconciliation

Year Ended December 31

Qtr.

Trailing 12

Months

2009

2010

2011

2012

2013

9/30/14

9/30/14

Reconciliation of EBITDA

Net income (loss) attributable to stockholders

($43.1)

$32.4

$82.6

$98.0

$110.0

$28.4

$109.1

Noncontrolling interest income (loss)

(0.1)

(0.1)

–

0.1

0.2

0.1

0.3

Income taxes provision (benefit)

(3.6)

1.8

18.9

7.0

17.2

8.4

39.8

Interest expense

19.0

16.6

15.8

12.4

9.0

1.6

5.1

Interest income

(2.8)

(2.3)

(1.8)

(1.5)

(1.8)

(0.4)

(1.4)

Depreciation and amortization expense

36.2

33.9

31.3

28.0

30.2

7.5

30.2

EBITDA

$5.6

$82.3

$146.8

$144.0

$164.8

$45.6

$183.1

($ in millions)

(1)

Note: EBITDA in this investor presentation is provided solely as a supplemental

disclosure with respect to operating results. EBITDA does not represent net income, as defined by U.S. GAAP and

should not be considered as a substitute for net income or net loss, or as an indicator of operating

performance. The Company defines EBITDA as income before income taxes and non-controlling

interest income (loss) plus net interest expense and depreciation and amortization expense. EBITDA is

not a measurement under U.S. GAAP and is not necessarily comparable with similarly titled

measures of other companies.

(1) EBITDA for the LTM 9/30/14 includes a $17.7 million gain on the sale of the

Brazil land and facility.

_____________________ |

22

Non-GAAP Reconciliation (continued)

($ in millions)

Reconciliation of Return on Total Capital Employed (ROTCE)

9/30/14 LTM

LTM Average Stockholders' Equity (9/30/14, 6/30/14, 3/31/14, 12/31/13 and

9/30/13) $460.8

LTM Average Debt (9/30/14, 6/30/14, 3/31/14, 12/31/13 and 9/30/13)

60.9

LTM Average Cash (9/30/14, 6/30/14, 3/31/14, 12/31/13 and 9/30/13)

(132.8)

LTM average capital employed

$388.9

LTM Net income

$109.1

Plus: LTM Interest expense, net

3.7

Less: Income taxes on interest expense, net at 38%

(1.4)

Actual return on capital employed = actual net income before interest expense, net, after

tax $111.4

Actual return on capital employed percentage

28.6%

_____________________

Note: Return on capital employed is provided solely as a supplemental disclosure with

respect to income generation because management believes it provides useful information with respect to earnings in a form that is comparable to the Company’s cost of capital

employed,

which

includes

both

equity

and

debt

securities,

net

of

cash. |

23

Cash Flow before Financing Calculation

($ in millions)

Year Ended December 31

Trailing 12

Months

2009

2010

2011

2012

2013

9/30/14

Reconciliation of Cash Flow before Financing

Net cash provided by operations

$115.9

$47.5

$54.6

$128.7

$152.9

$105.3

Net cash provided by (used) for investing activities

5.8

(8.5)

(15.9)

(19.5)

(26.1)

(36.8)

Cash Flow before Financing

$121.7

$39.0

$38.7

$109.2

$126.8

$68.5

|