Attached files

| file | filename |

|---|---|

| EX-23.1 - INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMS CONSENT - AutoGenomics, Inc. | exhibit231.htm |

As filed with the Securities and Exchange Commission on October 30, 2014

Registration No. 333-199197 .

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

Amendment No. 1 to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_____________________

AutoGenomics, Inc.

(Exact name of registrant as specified in its charter)

______________________

Delaware | 3826 | 80-0252299 |

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

2980 Scott Street

Vista, California 92081

(760) 477-2248

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

______________________

Fareed Kureshy

President and Chief Executive Officer

AutoGenomics, Inc.

2980 Scott Street

Vista, California 92081

(760) 477-2248

(Name, address, including zip code and telephone number, including area code, of agent for service)

Todd A. Hentges Bingham McCutchen LLP 600 Anton Boulevard, 18th Floor Costa Mesa, California 92626-7653 (714) 830-0600 | copy to: | Charles S. Kim Sean M. Clayton David Peinsipp Cooley LLP 4401 Eastgate Mall San Diego, California 92121-1909 (858) 550-6000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ¨ | Accelerated filer | ¨ | |

Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED , 2014

PRELIMINARY PROSPECTUS

Shares

Common Stock

$ per share

AutoGenomics, Inc. is offering shares of its common stock. This is our initial public offering, and no public market currently exists for our common stock. We expect the initial public offering price to be between $ and $ per share. We have applied to list our common stock on the NASDAQ Global Market under the symbol "AGMX."

We are an "emerging growth company," as defined under federal securities laws, and have elected to comply with certain reduced public company reporting requirements available to such companies.

Investing in our common stock involves a high degree of risk. Please read "Risk Factors" beginning on page 13.

Per Share | Total | |

Initial public offering price | $ | $ |

Underwriting discounts and commissions (1) | $ | $ |

Proceeds, before expenses, to us | $ | $ |

(1) We refer you to "Underwriting" beginning on page 128 of this prospectus for additional information regarding total underwriting compensation.

Delivery of the shares of common stock is expected to be made on or about , 2014. We have granted the underwriters an option for a period of 30 days to purchase, on the same terms and conditions set forth above, up to an additional shares of our common stock to cover over-allotments. If the underwriters exercise the option in full, the total underwriting discount payable by us will be $ and the total proceeds to us, before expenses, will be $ million.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Stifel | Canaccord Genuity | Cantor Fitzgerald & Co. |

The date of this prospectus is , 2014.

Not all products have received all necessary domestic or international regulatory approvals or clearances for commercial sale. The vast majority of products sold by AutoGenomics are offered for sale to allow for the collection of research data, and may only be used for clinical purposes by laboratories certified under the Clinical Laboratory Improvements Amendments of 1988 and that have incorporated the products into laboratory-developed tests pursuant to guidelines issued by the College of American Pathologists. The U.S. Food and Drug Administration has not adopted these guidelines and AutoGenomics is not permitted to represent these products as in vitro diagnostic products.

TABLE OF CONTENTS

____________________________

Through and including , 2014 (25 days after the date of this prospectus), all dealers that effect transactions in our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

You should rely only on the information contained or incorporated by reference in this prospectus. Neither we nor the underwriters have authorized anyone to provide you with information different from, or in addition to, the information contained in this prospectus. We are offering to sell shares of our common stock and seeking offers to buy shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

In this prospectus "we," "us," "our," "Company" and "AutoGenomics" refer to AutoGenomics, Inc. Unless otherwise indicated, all information in this prospectus assumes no exercise of the underwriters' over-allotment option.

PROSPECTUS SUMMARY

This summary highlights certain information contained in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. For a more complete understanding of the information that you may consider important in making your investment decision, we encourage you to read this entire prospectus. Among the other information in this prospectus, you should carefully consider the information set forth under the heading "Risk Factors" and our financial statements and accompanying notes included elsewhere in this prospectus. Unless the context requires otherwise, the words "we," "us," "our," "Company" and "AutoGenomics" refer to AutoGenomics, Inc.

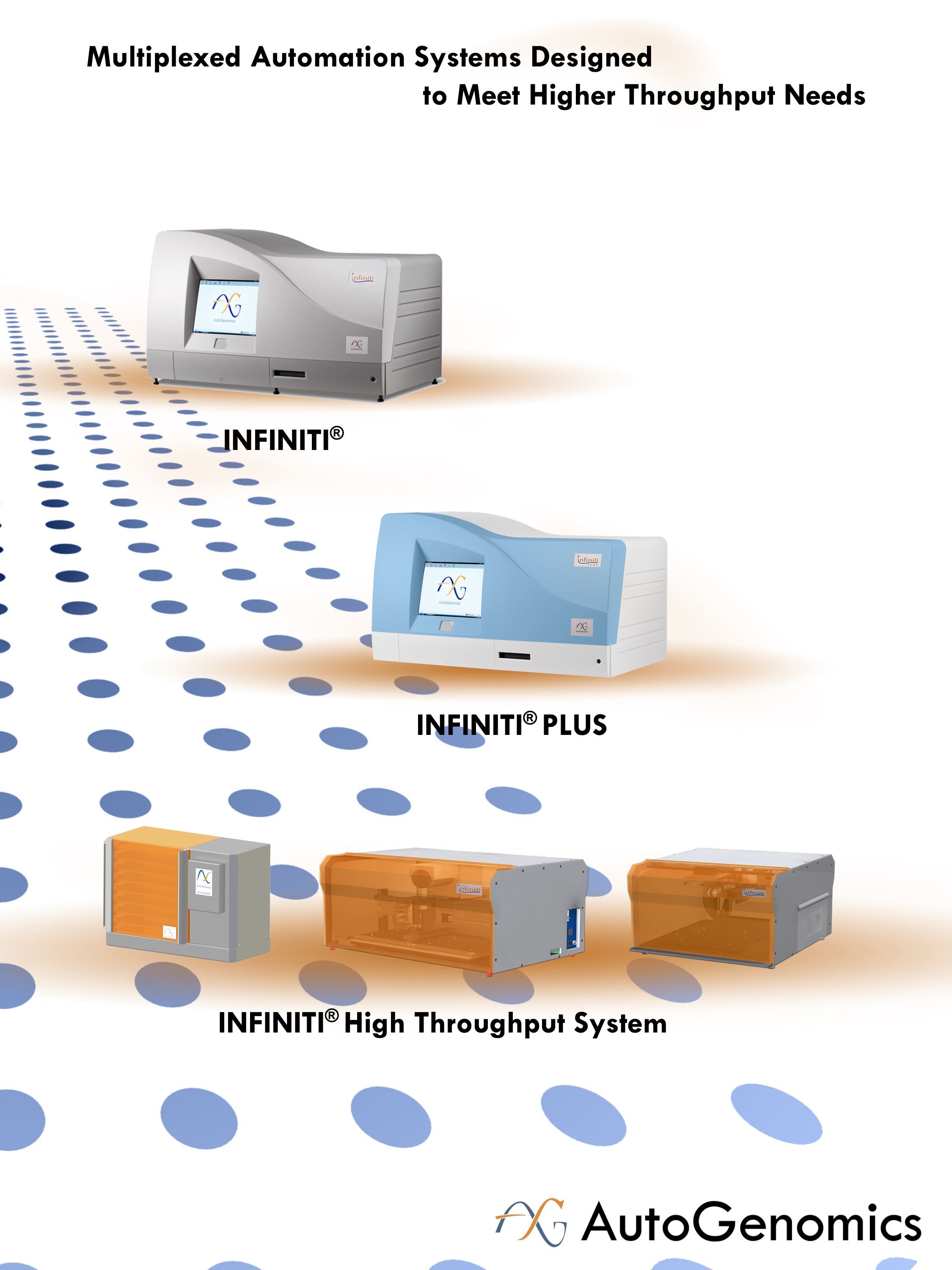

Our Company

We are a commercial stage molecular diagnostics company offering an innovative and proprietary technology platform to clinical reference laboratories, specialty clinics and hospital laboratories. Our platform consists of a family of multiplexing INFINITI analyzers, an extensive and expanding menu of genetic test panels, and proprietary microarrays, reagent modules and other related consumables. Our INFINITI analyzers, which include the INFINITI, the INFINITI PLUS and the recently introduced INFINITI HIGH THROUGHPUT SYSTEM, or INFINITI HTS, are easy to use and automate a number of the discrete processes of genetic analysis with minimal manual intervention, which reduces our customers' need for multiple, specialized instruments, and offer a variety of throughput capabilities together with a demonstrated high level of accuracy and reproducibility. Our genetic test panels are focused on large and growing markets primarily in the areas of personalized medicine, women's health, infectious diseases and genetic disorders. Genetic tests are performed on our INFINITI analyzers using our proprietary BioFilmChip microarrays, related Intellipac Reagent Management Modules and other related consumables.

Our genetic tests provide tools to physicians, clinicians and other health care providers to improve detection, treatment and monitoring of a broad spectrum of diseases and conditions. We currently offer 62 test panels for use on our analyzers and have 16 additional test panels in development. In the area of personalized medicine, we offer test panels in pain management, cardiovascular health assessment, oncology and mental health. These test panels offer customers the ability to identify a patient's genetic information, which can assist in improving drug efficacy, identifying non-responders and ultra-, normal- and poor-metabolizers and reducing adverse patient response. In the area of women's health, we offer test panels in cervical cancer, sexually transmitted diseases, or STDs, and vaginal infections. These test panels identify a wide spectrum of specific organisms simultaneously, which can eliminate the need for laboratories to perform multiple tests. The depth and breadth of our menu of test panels, all of which are designed to run on any of our INFINITI analyzers, allows laboratories to utilize laboratory space, labor and capital investment efficiently and conduct genetic tests in less time, thereby improving laboratory economics.

The proprietary design of our platform also allows us to introduce new and enhanced test panels to our menu of genetic tests without modifying our INFINITI analyzers. Based on our own research and customer demand, we intend to continue to increase the number of test panels offered in each of our target market segments, which we believe will further increase the utility of our platform to our customers. For example, we are developing several new test panels to guide the dosing and selection of statin drug therapies, to aid healthcare providers in the treatment of drug addiction and to assess risk and help guide therapy in the treatment of age-related macular degeneration. These test panels are currently in alpha trials and we expect to commercialize these test panels in 2015.

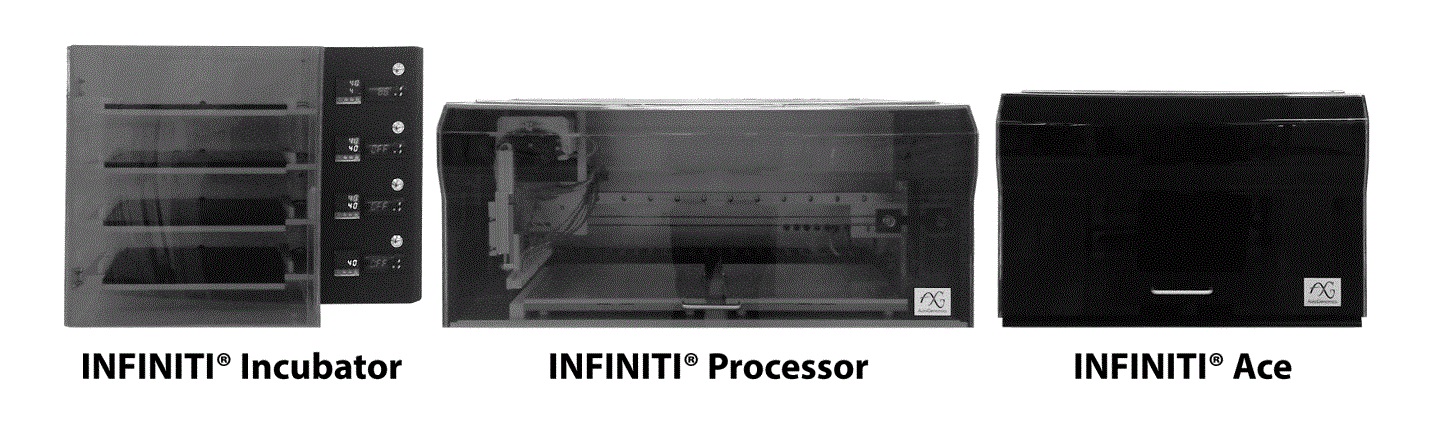

We launched our INFINITI HTS during February 2014 to meet the demand for high test-volume capabilities from our customers, particularly in the areas of personalized medicine and women's health. Our INFINITI HTS is a scalable, automated system comprised of three separate operating modules that provides flexible configuration to maximize workflow efficiency, and has the capacity to process up to 6,912 patient results per day with a single laboratory technician utilizing the same consumables as our other INFINITI analyzers. We believe our INFINITI HTS has the highest processing and throughput capacity of any molecular diagnostics system available in our target markets today. Additionally, for customers who seek a

1

fully automated and integrated solution, and have lower throughput requirements, we offer INFINITI and INFINITI PLUS analyzers designed to operate on a "load and go" basis, in which a technician only needs to load prepared samples along with the test-specific consumables into the analyzer to generate test results.

The following table illustrates the test capabilities of our primary INFINITI analyzers:

Instrument | Capacity per run (1) | Patient results (1) |

INFINITI HTS | 384 samples | up to 6,912 per day |

INFINITI PLUS | 48 samples | up to 192 per day |

INFINITI | 24 samples | up to 96 per day |

(1) Figures assume the use of our four-patient multiple patient array test panel over a 24-hour period.

In late 2013, as we prepared to launch our INFINITI HTS, we began operating our CLIA-certified laboratory to complement and support our efforts to attract customers entering the molecular diagnostics market, and potential INFINITI HTS customers in particular. Our laboratory services allow our customers to more quickly offer new or additional tests during the period when they are awaiting delivery, installation, training and validation of an INFINITI analyzer. Our CLIA-certified laboratory also provides new and existing customers with an alternative source of capacity to assist with their overflow testing needs. In addition, our laboratory enhances our product development efforts and allows us to offer hands-on training opportunities to our customers. Since the launch of our INFINITI HTS, many of these customers have utilized the services of our laboratory to supplement and facilitate sales of medium- and high-volume test products to their physicians, clinicians and healthcare providers.

We commenced sales of our INFINITI HTS in February 2014 through a small direct sales force in the United States. Our net revenue was $18.7 million for the nine months ended September 30, 2014, as compared to $13.3 million for the nine months ended September 30, 2013. Excluding net revenue from one historically large customer, Natural Molecular Testing Corporation, or NMTC, our net revenue for the nine months ended September 30, 2013 was $8.2 million. We had no revenue from NMTC in the nine months ended September 30, 2014. Excluding net revenue from NMTC, our net revenue grew 130% for the nine months ended September 30, 2014 as compared to the same period in 2013. Our net loss was $1.0 million for the nine months ended September 30, 2014, as compared to $6.8 million for the nine months ended September 30, 2013. Our accumulated deficit as of September 30, 2014 was $104.2 million.

For a comparison of our net revenue, including net revenue from NMTC and excluding net revenue from NMTC, by period for the nine months ended September 30, 2014 and 2013, and the years ended December 31, 2013 and 2012, please see "Management's Discussion and Analysis of Financial Condition and Results of Operations - Results of Operations - As Adjusted Financial Information for the Nine Months Ended September 30, 2014 and 2013 and Years Ended December 31, 2013 and 2012 (unaudited)."

Our Market Opportunity

Molecular diagnostics, or MDx, refers to the detection of DNA and RNA and their variations and mutations, and the use of such information to determine a patient’s susceptibility to disease, diagnose disease and infection, evaluate response to therapy and drug efficacy, identify non-responders and ultra-, normal- and poor-metabolizers and reduce adverse events. Frost & Sullivan, a market research company, estimated in 2012 that the MDx market will reach $6.2 billion in the United States during 2014 and forecasted a compound annual growth rate for the market in excess of 11%. The Centers for Medicare and Medicaid Services of the Department of Health and Human Services, or CMS, estimated in June 2014 that there were more than 5,900 independent clinical reference laboratories and specialty clinics and more than 8,900 hospital-based laboratories in the United States. We believe that less than 10% of these laboratories are currently performing MDx testing, and that we have an opportunity to expand our customer base by enabling more laboratories to participate in this growing market.

2

Our Target Markets

Personalized medicine

The optimal matching of treatment options to a patient's specific genetic profile has emerged as an important trend in medicine. More targeted and effective pharmacogenomic-based treatments have the potential to improve healthcare outcomes and lower healthcare costs, which we believe will lead to increased use of genetic testing. Many patients do not currently achieve the best possible outcome with the first drug that they are prescribed in treatment. Studies have linked the variation in efficacy of a patient's response to a prescribed drug treatment to patient-specific differences in the genes that code for drug-metabolizing enzymes, drug transporters or drug targets, which can be identified through the use of genetic testing. Our target markets in personalized medicine include:

Pain management. More than 116 million adult Americans suffer from acute or chronic pain each year. Studies have shown that only 58% of patients taking prescription medication reported pain relief. Additionally, approximately 80% of post-operative patients experience adverse events from pain medications. As of October 24, 2014, we offered 11 test panels in the area of pain management, which detect multiple mutations in specific drug-metabolizing genes and can enable physicians to select optimal therapies for pain management.

Cardiovascular health assessment. According to a report from the World Health Organization, or WHO, cardiovascular diseases were responsible for 30% of global deaths in 2008. The WHO estimates that by 2030 23.6 million people will die annually from some form of cardiovascular disease. As of October 24, 2014, we offered 20 test panels in the area of cardiovascular health assessment, five of which have received U.S. Food and Drug Administration, or FDA, 510(k) clearance, including our Plavix responder and Warfarin sensitivity test panels.

Mental health. Drugs associated with mental health, including drugs focused on central nervous system disorders, and treatment of depression and anti-psychotic therapy, represent a major component of overall pharmaceutical sales. According to the Centers for Disease Control and Prevention, or CDC, as much as 11% of the U.S. population is taking antidepressants at a given time. Despite this prevalence, approximately 30 to 40% of patients do not respond to the first medication prescribed. The resulting trial-and-error process delays effective treatment for patients and increases healthcare costs. Genetic testing provides the information to allow physicians to select the most appropriate drug or combination of drugs specific to the patient's genetic makeup. As of October 24, 2014, we offered 12 test panels in the area of mental health, which identify mutations in drug-metabolizing genes that can enable healthcare providers to select optimal therapies.

Women's health

According to the CDC, approximately 79 million Americans are infected with Human papillomavirus, or HPV, and approximately 14 million become infected each year. Current regulations from the U.S. Preventive Services Task Force recommend that MDx HPV tests for women be utilized in conjunction with cytology (Pap test) in standard five year intervals. The CDC estimates that there are nearly 20 million new cases of STDs each year, costing the nation approximately $16 billion in healthcare costs annually. As of October 24, 2014, we offered 19 test panels in the area of women's health. Key tests in this segment include four test panels for HPV testing and nine test panels designed to identify various microorganisms related to STDs and vaginal infections. We believe our women's health test panels are the most comprehensive menu of test panels in the market currently.

Other markets

We also target the markets of: (i) oncology to help manage chemotherapy treatments for breast, colorectal, lung, melanoma and thyroid cancers; (ii) infectious diseases for detection of influenza, nontuberculous mycobacteria, respiratory viruses and tuberculosis; and (iii) genetic disorders including, but not limited to, tests for identification of carriers of gene mutations associated with Bloom disease, Canavan disease, cystic fibrosis and Familial Mediterranean fever.

3

Limitations of Traditional Testing Methods

Traditional testing methods have a number of drawbacks and limitations, including:

• | Throughput limitations. Traditional systems in the market have throughput constraints and typically process a limited number of patient samples simultaneously. |

• | High operating cost per reportable result. Many existing systems require specialized personnel and training, involve time-consuming protocols, require supplementary, discrete instrumentation and result in high labor costs. |

• | Limited testing menu. Many existing MDx systems have limited test menus, leading to a need for a laboratory to purchase many different systems, all which require their own training, use and maintenance, as well as their own laboratory bench space and inventory. |

• | Inability to multiplex. Many existing systems are only able to examine one biomarker at a time, and, in order to make a diagnosis, the laboratory must perform repeated tests on a sample. Serial testing is expensive, time-consuming and requires higher sample volumes. |

• | Limited automation. Many existing systems automate only certain steps in the MDx testing process and do not enable testing of multiple patient samples in a single microarray. |

• | Need for specialized labor. Many existing systems require specialized laboratory technicians and in some cases specialized training, adding to labor costs. |

Our Solution

Our platform has been designed to enable a broad range of clinical reference laboratories, specialty clinics and hospital laboratories to start performing, or to more cost-effectively perform, genetic testing across a wide range of throughput levels, which we believe will drive adoption and use of our platform as well as expand the potential of the MDx testing market. Our platform has a number of key advantages, including:

• | Significantly higher throughput and better workflow. Our broad offering of INFINITI analyzers is designed to address our target customers' varied throughput and workflow requirements. Using one INFINITI HTS, laboratories are capable of producing up to 6,912 patient results per day. |

• | Improved laboratory economics. Our INFINITI and INFINITI PLUS eliminate the need for complex protocols and manual intervention once a test is initiated, which is intended to improve the laboratory's economics by simplifying workflow and reducing the need for highly skilled technicians. Our INFINITI HTS allows individual components to remain active during the workflow process, which can significantly improve throughput time and reduce costs. |

• | Broad menu of tests. We currently offer 62 test panels as part of our platform and have an additional 16 test panels in development. We believe that this represents the broadest available test menu on a single system in the market today. |

• | Multiple patient array technology. Our proprietary multiple patient array, or MPA, technology is designed to test up to eight distinct patient samples on a single microarray. |

• | Ability to multiplex. Many diseases and patient responses to therapy are caused by multiple genetic mutations that necessitate testing for multiple biomarkers to diagnose those diseases or to predict or monitor therapy response. |

• | Increased accuracy of results. By reducing the risk of human error and contamination, we believe that our platform can provide more accurate and more reproducible test results compared to other less automated systems. |

Our Products and Technology

Our platform is comprised of five key technological innovations: (1) our INFINITI analyzers; (2) our multiplexing test format; (3) our BioFilmChip microarrays; (4) our multiple patient array technology; and (5) our Intellipac Reagent Management Modules.

4

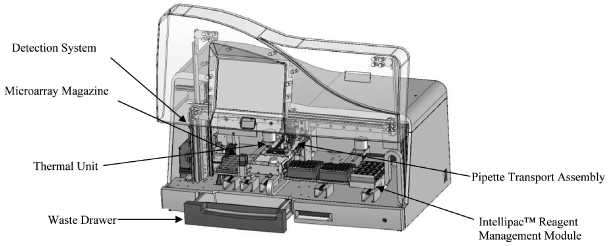

Our INFINITI analyzers

Our platform includes a family of analyzers, each of which is designed to address customer-specific needs based on the customer's workflow and throughput requirements, and automate the discrete processes in genetic analysis. Our INFINITI HTS is a scalable, multiplexing, random access, microarray-based system comprised of three independent operating modules. Our INFINITI and INFINITI PLUS analyzers integrate and automate the discrete processes of sample handling, reagent management, hybridization, detection, results analysis and reporting in a self-contained system. All of our INFINITI analyzers use similar underlying proprietary technology and the same consumables to generate consistent patient results presented in an identical format.

Our multiplexing test methods and multiple patient microarray

Our multiplexing technology allows our INFINITI analyzers to detect multiple biomarkers across multiple genes at the same time on a single microarray, eliminating the need to process multiple tests separately. For example, our pain management panel can detect multiple mutations associated with six different genes to determine the efficacy, toxicity and dosing of specific drugs. In addition, our test panel for HPV detects and genotypes all 14 high-risk types of HPV simultaneously on a single microarray from a single sample. Our proprietary MPA technology enables our INFINITI analyzers to process multiple patient samples on a single microarray, reducing our costs, increasing our test production capacity, and improving our customers' laboratory economics while increasing their throughput. For example, our MTBC OCTA (drug-resistant tuberculosis test panel) is designed to test up to eight patient samples on a single microarray, increasing throughput for our laboratory customers by up to 700%, while reducing their operating cost per reportable result by up to 87%, as compared to our single patient microarrays.

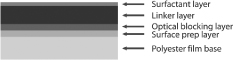

Our BioFilmChip microarrays and Intellipac Reagent Management Modules

Our proprietary BioFilmChip microarrays utilize our proprietary and patented manufacturing processes, and can be printed with up to 1,024 individual features of biochemical sensors, or biomarkers, depending on the requirements of the test. Our assay-specific Intellipac Reagent Management Modules provide the proprietary reagent used to complete our genetic tests. The reagent module is designed to communicate all relevant information about a test to the INFINITI analyzer without any intervention from the operator, saving time by automatically recording all pertinent test details, and reducing the possibility for human errors which could occur in manual systems by eliminating contamination risk.

Sales and Marketing

Our goal is to achieve broad adoption of our INFINITI analyzers in the market, and drive utilization to generate sales of our high-margin testing consumables. Our current sales and marketing strategy is focused on the broad introduction of our INFINITI HTS to customers in high-volume testing market segments, particularly personalized medicine and women's health, and emphasizes the high throughput testing capacity, ease of use, enhanced workflow, increased efficiency, low cost, high quality and consistent results of our platform as well as the potential versatility afforded by our broad menu of genetic test panels.

In the United States, we offer our family of INFINITI analyzers either through direct sales, monthly rental plans or our Reagent Access Plan, or RAP. Under the RAP, an INFINITI analyzer is placed at the customer’s location at no initial cost to the customer, and is subject to contractual minimum consumables purchasing thresholds. We have established a small direct sales force that is regionally deployed and performs market development as well as account management. We plan to significantly expand our sales force within the next 12 months.

Internationally, we market and sell our platform through our network of distributors. We have established 12 distributor relationships to market our platform in 23 countries outside the United States. We plan to expand our distributor network outside the United States to enter new markets and capitalize on growing international demand.

5

Manufacturing and Research and Development

We manufacture our family of INFINITI analyzers, BioFilmChips and Intellipac Reagent Management Modules at our facility in Vista, California. Our facility is registered with the FDA as a Medical Device Manufacturing Establishment. We have established a quality system that is in compliance with the FDA's Quality Systems Regulations and we have obtained ISO 13485:2003 certification for our facility. Our research and development efforts focus on developing additional genetic tests and INFINITI analyzers, improving or enhancing current tests and INFINITI analyzers, and supporting clinical trials for certain genetic tests.

Our Strategy

Our objective is to become a leading provider of genetic tests to clinical reference laboratories, specialty clinics and hospital laboratories in multiple growing market segments. One key element of our strategy is to focus on high-volume customers, particularly in the areas of personalized medicine and women’s health. We plan to continue to expand into other market segments through the development of additional test panels.

To achieve our objectives, we intend to:

• | Increase placements of our recently launched INFINITI HTS analyzer and expand penetration in the highest-volume testing market segments. |

• | Target molecular diagnostics laboratories with high potential utilization of our INFINITI and INFINITI PLUS analyzers. |

• | Develop and launch test panels in new areas and enhance our current test panels. |

• | Significantly expand our domestic sales force, increase marketing expenditures and expand international distribution. |

• | Pursue additional regulatory clearances, approvals and certifications for products and facilities, as necessary. |

• | Utilize our CLIA-certified laboratory to enhance and complement our product offerings. |

Government Regulation

We have received FDA 510(k) clearance for our INFINITI and INFINITI Plus analyzers and five of our genetic test panels: CYP450 2C19, Factor II, Factor V, Factor II/V and Warfarin. Products for which we have received 510(k) clearance accounted for 35%, 18% and 14% of our net revenue for the nine months ended September 30, 2014, and the years ended December 31, 2013 and 2012, respectively. We are currently in clinical trials collecting data to support a submission for 510(k) clearance for our INFINITI HTS, both of our CYP450 2C19 Plus test panels and all three of our CYP450 2D6 test panels. We intend to use a portion of the proceeds of this offering to conduct additional clinical trials for the collection of data, and to submit for 510(k) clearance, for an additional seven of our test panels that, together with our existing and in-process 510(k) cleared test panels, made up approximately 80% of consumables revenue for the nine months ended September 30, 2014. We expect to conduct additional clinical trials for the collection of data, and to submit for 510(k) clearance, for test panels based on a variety of factors, including:

• | the regulatory environment for the use of genetic tests, in particular the FDA's requirements and limitations on marketing RUO tests, which may not be marketed as in vitro diagnostic products; |

• | the demand by our existing and target customers for particular genetic tests that have received regulatory approvals or clearances; |

• | the competitive environment for the use of genetic tests that have received regulatory approvals or clearances versus similar tests that have not; and |

• | the size of the available market for the particular test, given the significant expense and time required to obtain regulatory approvals or clearances. |

6

Internationally, we have obtained a Conformité Européenne, or CE, mark for our INFINITI and INFINITI PLUS analyzers and a total of 24 of our tests. This designation is supported by completed clinical and validation studies that demonstrate the analytical performance of each CE marked test. The CE mark facilitates the marketing and sale of our CE marked analyzers and tests in the European Union and the European Economic Area as well as certain other international markets.

Our test panels that are not 510(k) cleared are offered for sale in the United States under the RUO designation. These RUO tests are labeled "For Research Use Only. Not for use in diagnostic procedures." as required by FDA regulations. Sales of these test panels represented 65%, 82% and 86% of our net revenue for the nine months ended September 30, 2014, and the years ended December 31, 2013 and 2012, respectively.

RUO test panels may only be used in the United States for clinical purposes by laboratories and other facilities certified under CLIA that have incorporated these products into their laboratory developed tests, or LDTs, pursuant to guidelines issued by the College of American Pathologists. We believe that nearly all of our RUO product sales are incorporated into LDTs. In order to develop an LDT utilizing our products, these certified laboratories and other facilities must develop and validate a test protocol that includes specimen collection, DNA extraction, polymerase chain reaction, or PCR, amplification, hybridization and detection, and data analysis, interpretation and reporting. Our products provide components that can be used by these certified laboratories and other facilities for the PCR amplification, hybridization and detection portions of these LDTs. We sell each of these components individually, as ordered by the customer in its discretion, and not as a kit or system. The validation process engaged in by these certified laboratories and other facilities can involve validation of the sample collection and extraction process, establishing limits of detection and analytical sensitivity, testing for specificity and cross-reactivity, including interfering substances, validation for assay accuracy, precision and reproducibility, and establishing reportable ranges of test results for the test system and reference values that will be measured against as controls. This validation process also requires verifying the result from the LDT against known standard samples or the results of a high-standard laboratory testing method such as sequencing, and can involve the testing of a large number of patient samples. This process may take from several weeks to several months or more to complete, and thus requires a significant investment by the customer.

We believe that all sales of our RUO products in the United States are to customers that are either certified in the manner described above and have incorporated our products into their LDTs, or that use such products for research only. We are not permitted to represent our RUO products as in vitro diagnostic products. We therefore train our personnel to only market these products to laboratories for research or investigational use in the collection of research data, and to not promote any off-label uses of our products.

We believe that we are in compliance with existing FDA rules and regulations governing our business, including those governing the marketing and sale of RUO tests; however, a significant change in existing laws, or their enforcement, may require us to change our business model or our business practices to maintain compliance with these laws. For instance, in June 2011, the FDA issued a Draft Guidance entitled "Commercially Distributed In Vitro Diagnostic Products Labeled for Research Use Only or Investigational Use Only: Frequently Asked Questions," and in November 2013 issued a guidance document entitled "Distribution of In Vitro Diagnostic Products Labeled for Research Use Only or Investigational Use Only," or the RUO Guidance, which highlights the FDA's interpretation that distribution of RUO products with any labeling, advertising or promotion that suggests that clinical laboratories can validate the test through their own procedures and subsequently offer it for clinical diagnostic use as an LDT is in conflict with RUO status. The RUO Guidance further articulates the FDA's position that any assistance offered in performing clinical validation or verification, or similar specialized technical support, to clinical laboratories, is in conflict with RUO status. The FDA has generally exercised its enforcement discretion to not enforce applicable regulations with respect to LDTs. However, the FDA has repeatedly indicated since 2010 that it intends to reconsider its policy regarding enforcement and to begin drafting an oversight framework for such tests, and most recently, on July 31, 2014, the FDA notified the U.S. Congress of the FDA's intent to modify its enforcement discretion approach to LDTs in a risk-based manner. If the RUO Guidance were to be enforced, it would limit our marketing of RUO test panels to general discovery laboratories and require us to seek FDA clearance for

7

our RUO test panels, which may require significant time and investment on our part and may reduce our revenues or increase our costs and adversely affect our business, prospects, results of operations or financial condition.

Risks Affecting Us

Our business is subject to numerous risks, as more fully described in the section entitled "Risk Factors" elsewhere in this prospectus, including the following:

• | Financial risks. We have a history of net losses and negative cash flows with an accumulated deficit of $104.2 million as of September 30, 2014, and may not be able to achieve or maintain profitability in the current fiscal year or in future fiscal periods. |

• | Business risks. There is limited information available to evaluate our business, particularly with respect to our recently launched INFINITI HTS, and we face significant competition. |

• | Product and customer risks. Our financial results depend on commercial acceptance of our platform and tests and the development of additional tests. |

• | Regulatory risks. The majority of our net revenue is derived from the sale of products designated for research use only, or RUO; the FDA announced July 31, 2014 its intention to modify its enforcement discretion approach to laboratory developed tests, which may adversely affect our ability to sell our RUOs; violations of these regulations by us could significantly limit our ability to sell our products to our target customers, or otherwise require us to obtain regulatory approvals for our products at considerable time and expense. |

• | Legal risks. Our success depends in part on our ability to operate without infringing or misappropriating the proprietary rights of others, our ability to own or license patents that are adequate to reduce competition and our ability to license intellectual property from third parties for certain tests and manufacturing processes needed for our business. |

Company Information

We were incorporated as Neuron Technologies, Incorporated in California in April 1999, and changed our name to AutoGenomics, Incorporated in August 2000. We subsequently changed our name to AutoGenomics, Inc. in October 2002. We reincorporated in Delaware in November 2008. Our principal executive offices are located at 2980 Scott Street, Vista, California 92081. Our telephone number is (760) 477-2248. Our website address is www.autogenomics.com. Information contained in or that can be accessed through our website is not incorporated by reference into this prospectus and should not be considered to be part of this prospectus.

INFINITI, BioFilmChip, Intellipac and QMatic are our trademarks. All other service marks, trademarks and trade names referred to in this prospectus are the property of their respective owners. Some of our trademarks are referred to in this prospectus from time to time, solely for convenience, without their associated ® and ™ symbols. We retain, however, our rights to these trademarks notwithstanding such presentation, and we will assert, to the fullest extent under applicable law, our rights to our trademarks.

8

Implications of Being an Emerging Growth Company

We are an "emerging growth company," as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we are eligible to comply with less stringent disclosure requirements than those applicable to larger, more established companies. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenue of at least $1.0 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeds $700.0 million as of the prior June 30th, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

So long as we qualify as an emerging growth company, we will, among other things, be exempted from (i) the auditor attestation requirement in the assessment of internal controls over financial reporting of Section 404(b) of the Sarbanes-Oxley Act; (ii) various existing and forthcoming executive compensation related disclosures, for example: "say-on-pay," "pay-for-performance" and "CEO pay ratio;" (iii) any rules that might be adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or supplemental auditor discussion and analysis reporting; and (iv) having to solicit advisory say-on-pay, say-on-frequency and say-on golden-parachute shareholder votes on executive compensation under Section 14A of the Securities Exchange Act of 1934, as amended, and will be permitted to comply with the SEC's detailed executive compensation disclosure requirements on the same basis as a smaller reporting company.

In addition, under Section 107(b) of the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

9

The Offering

Common stock to be offered by us | shares |

Common shares to be outstanding immediately after this offering | shares |

Over-allotment option | We have granted the underwriters an option for 30 days from the date of this prospectus to purchase up to additional shares of our common stock at the initial public offering price to cover over-allotments. |

Use of proceeds | We anticipate that we will use the net proceeds from this offering as follows: (i) to fund capital expenditures for expansion of manufacturing capabilities, (ii) to expand our sales and marketing efforts, (iii) to fund research and development, including regulatory efforts, (iv) to satisfy all of our outstanding notes payable and certain of our accounts payable and (v) the balance for working capital and general corporate purposes. |

NASDAQ Global Market listing | We have applied to list our common stock on the NASDAQ Global Market under the symbol "AGMX." |

Risk factors | Investing in our common stock involves a high degree of risk. You should carefully read and consider the information set forth under the heading "Risk Factors" and all other information set forth in this prospectus before deciding to invest in our common stock. |

The number of shares of common stock outstanding after this offering is based on 11,722,251 shares of common stock outstanding as of October 24, 2014, after giving effect to the conversion of our convertible preferred stock into 7,974,932 shares of common stock immediately prior to the completion of this offering and excludes the following:

• | 1,469,055 shares of common stock issuable upon exercise of options outstanding at a weighted average exercise price of $6.25 per share; |

• | 282,221 and 82,500 shares of common stock reserved for future issuance under our 2008 Equity Incentive Award Plan and 2008 Employee Stock Purchase Plan, respectively; and |

• | warrants to purchase 3,892,249 shares of common stock at a weighted average exercise price of $6.04 per share. |

Unless otherwise indicated, all information in this prospectus assumes an initial public offering price of $ per share. The conversion into common stock of our Series C, Series E and Series NC Convertible Preferred Stock is predicated on the offering referred to in this prospectus resulting in net proceeds to us of $25 million or more.

Except as otherwise indicated, all information in this prospectus assumes:

• | no issuance of any options under our 2008 Equity Incentive Award Plan and no exercise of any outstanding warrants or options, in each case after the respective dates as of which information is presented; and |

• | no exercise by the underwriters of their over-allotment option. |

10

Summary Financial Data

The following tables summarize our financial data as of the periods indicated below. We have derived the following summary statement of operations data for the years ended December 31, 2013 and 2012 from our audited financial statements included elsewhere in this prospectus, which have been prepared in accordance with U.S. generally accepted accounting principles. The statements of operations data for the nine months ended September 30, 2014 and 2013, and the balance sheet data as of September 30, 2014, are derived from our unaudited financial statements included elsewhere in this prospectus. We have prepared unaudited financial information on the same basis as the audited financial statements and have included, in our opinion, all adjustments, consisting only of normal recurring adjustments, that we consider necessary for a fair presentation of the financial information set forth in those statements.

Our historical results are not necessarily indicative of the results that may be expected in the future, and our interim results are not necessarily indicative of the results expected for the full fiscal year. The summary historical financial data should be read together with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the financial statements included elsewhere in this prospectus.

Nine Months Ended September 30, | Years Ended December 31, | ||||||||||||||

2014 | 2013 | 2013 | 2012 | ||||||||||||

(in thousands, except share and per share data) | |||||||||||||||

(unaudited) | |||||||||||||||

Statements of Operations Data: | |||||||||||||||

Net revenue | $ | 18,725 | $ | 13,273 | $ | 18,083 | $ | 18,409 | |||||||

Cost of sales and services | 6,645 | 5,799 | 7,758 | 7,147 | |||||||||||

Gross profit | 12,080 | 7,474 | 10,325 | 11,262 | |||||||||||

Operating expenses: | |||||||||||||||

Research and development | 1,540 | 1,715 | 2,306 | 2,355 | |||||||||||

General and administrative | 3,308 | 7,210 | 8,302 | 4,715 | |||||||||||

Sales and marketing | 5,334 | 1,898 | 2,998 | 2,269 | |||||||||||

Total operating expenses | 10,182 | 10,823 | 13,606 | 9,339 | |||||||||||

Income/(loss) from operations | 1,898 | (3,349 | ) | (3,281 | ) | 1,923 | |||||||||

Interest expense, net | (1,361 | ) | (1,186 | ) | (1,820 | ) | (2,602 | ) | |||||||

Gains/(loss) on extinguishment of debt | (1,872 | ) | (140 | ) | (140 | ) | (1,996 | ) | |||||||

Other income/(expense), net | (5 | ) | (2,095 | ) | (1,877 | ) | 5 | ||||||||

Change in the fair value of stock warrant liabilities | 375 | 5 | 46 | 163 | |||||||||||

Net loss | $ | (965 | ) | $ | (6,765 | ) | $ | (7,072 | ) | $ | (2,507 | ) | |||

Net loss from continuing operations per common share, basic and diluted | $ | (0.26 | ) | $ | (2.22 | ) | $ | (2.21 | ) | $ | (0.95 | ) | |||

Weighted average shares used in per share amounts | 3,743,084 | 3,042,029 | 3,200,286 | 2,652,275 | |||||||||||

11

As of September 30, 2014 | ||||||||||

Actual | Pro forma (1) | Pro forma as adjusted (2) | ||||||||

(unaudited and in thousands) | ||||||||||

Balance Sheet Data: | ||||||||||

Cash and cash equivalents | $ | 556 | $ | 556 | ||||||

Current assets | 12,719 | 12,719 | ||||||||

Total assets | 15,372 | 15,372 | ||||||||

Total debt (3) | 18,491 | 18,491 | — | |||||||

Convertible preferred stock (4) | 53,165 | — | — | |||||||

Total stockholders' equity/(deficit) | (75,995 | ) | (22,830 | ) | ||||||

(1) | On a pro forma basis after giving effect to the conversion of all outstanding shares of convertible preferred stock into common stock, which will occur immediately prior to the completion of this offering. |

(2) | On a pro forma as adjusted basis after giving effect to (i) the conversion of all outstanding shares of convertible preferred stock into common stock, which will occur immediately prior to the completion of this offering, (ii) the sale of shares of our common stock in this offering at an assumed initial offering price of $ per share, the midpoint of the range on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and our estimated offering expenses and (iii) the application of $21.2 million of the net proceeds of this offering to repay the principal and accrued interest as of September 30, 2014 under our outstanding promissory notes. A $1.00 increase or decrease in the assumed initial public offering price of $ per share would increase or decrease, as applicable, the net proceeds to us from this offering by approximately $ million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and our estimated offering expenses. |

(3) | Amounts include principal only of promissory notes payable as of September 30, 2014. |

(4) | Our convertible preferred stock has been classified as temporary equity on our balance sheets instead of in stockholders' equity/(deficit) due to the possibility of the occurrence of certain change in control events that are outside of our control, including our sale or transfer of control, which trigger the rights of holders of the convertible preferred stock to force redemption. Accordingly, these shares are considered contingently redeemable. We have adjusted the carrying values of the convertible preferred stock to their liquidation values at each period end. |

As Adjusted Financial Information for the Nine Months Ended September 30, 2014 and 2013 and Years Ended December 31, 2013 and 2012 (unaudited)

The unaudited as adjusted financial data below sets forth the net revenue for the nine-month periods ended September 30, 2014 and 2013 and the years ended December 31, 2013 and 2012, excluding all revenue attributable to NMTC (in thousands).

Nine Months Ended September 30, | Years Ended December 31, | ||||||||||||||||||||||

2014 | 2013 | Change | 2013 | 2012 | Change | ||||||||||||||||||

Net revenue (as reported) | $ | 18,725 | $ | 13,273 | $ | 5,452 | $ | 18,083 | $ | 18,409 | $ | (326 | ) | ||||||||||

Net revenue from NMTC | — | 5,116 | (5,116 | ) | 5,116 | 7,749 | (2,633 | ) | |||||||||||||||

As adjusted net revenue | $ | 18,725 | $ | 8,157 | $ | 10,568 | $ | 12,967 | $ | 10,660 | $ | 2,307 | |||||||||||

12

RISK FACTORS

Before deciding to invest in our common stock, you should carefully consider each of the following risk factors and all of the other information set forth in this prospectus. The following risks and the risks described elsewhere in this prospectus, including in the section entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations," could materially harm our business, financial condition, future results and cash flow. If that occurs, the trading price of our common stock could decline, and you could lose all or part of your investment. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business.

Financial Risks

We have a history of operating losses and negative cash flows and may not be able to achieve or maintain profitability.

We have incurred substantial costs to develop our technology since our inception in 1999. As of September 30, 2014, we had an accumulated deficit of $104.2 million. We expect to continue to spend substantial financial and other resources on introducing new products, expanding our sales and marketing activities, further developing our technology and manufacturing capabilities, engaging in laboratory testing, manufacturing new products and seeking regulatory approvals. As a result, we will need to continue to generate additional revenue in order to achieve and maintain profitability. Our ability to generate additional revenue will depend on our ability to successfully implement our business strategies and address the risks and uncertainties facing us, and we cannot assure you that we will be successful in these efforts. Even if we do address these risks successfully and implement our business strategies, we may not generate sufficient revenue to maintain profitability. We cannot assure you that we would be able to increase profitability on a quarterly or annual basis in the future, or at all.

We may not be able to meet our cash requirements without obtaining additional capital from external sources, and if we are unable to do so, we may have to curtail or cease operations.

We anticipate that our current cash and cash equivalents and cash provided by this offering and our operating activities will be sufficient to meet our currently estimated cash requirements for at least the next 12 months; however, we expect capital outlays and operating expenditures to increase over the next several years as we expand our infrastructure, test panel commercialization, training and support, manufacturing and research and development activities. We operate in a market that makes our prospects difficult to evaluate, and we may need additional financing to execute on our current or future business strategies. The amount of additional capital we may need to raise depends on many factors, including:

• | the level of research and development investment required to maintain and improve our technology, including efforts to expand our menu of test panels, invest in the development of new products and to seek regulatory approval for new products; |

• | the amount of future cash provided by or used in operating activities, including expansion of our sales force and marketing activities; |

• | our need or decision to acquire or license complementary technologies or acquire complementary businesses; |

• | changes in regulatory policies or laws that affect our operations; and |

• | the costs of filing, prosecuting, defending and enforcing patent claims and other intellectual property rights. |

We cannot be certain that additional capital will be available when and as needed or that our actual cash requirements will not be greater than anticipated. If we require additional capital at a time when investment in diagnostics companies, or in the marketplace in general, is limited due to the then-prevailing market or other conditions, we may not be able to raise such funds at the time that we desire or any time thereafter. If we are unable to raise additional capital, we may be required to curtail some or all of our operations, including commercialization and research and development efforts, and forced to forego otherwise valuable business opportunities. Any failure to raise additional capital when needed could have an adverse effect on us. In addition, if we raise additional funds through the issuance of common stock, preferred stock or convertible securities, the percentage ownership of our stockholders could be significantly diluted, and any preferred stock or convertible securities may have rights, preferences or privileges senior to those of common stockholders. If we obtain additional debt financing, a substantial portion of our operating cash flow or other cash resources may be dedicated to the payment of principal

13

and interest on such indebtedness, and the terms of the debt securities issued could impose significant restrictions on our operations. If we raise additional funds through collaborations and licensing arrangements, we may be required to relinquish significant rights to our technologies or products, or grant licenses on terms that are not favorable to us.

Our ability to use our net operating loss and research and development credit carryforwards may be subject to limitations.

As of September 30, 2014, we had approximately $72.4 million of net operating loss carryforwards and $1.2 million of research and development credit carryforwards for U.S. federal tax purposes. Realization of any tax benefit from our carryforwards is dependent on our ability to generate future taxable income and the absence of certain "ownership changes" of our common stock. An "ownership change," as defined in the applicable federal income tax rules, could place significant limitations, on an annual basis, on the amount of our future taxable income that may be offset by our carryforwards. Such limitations, in conjunction with the net operating loss expiration provisions, could effectively eliminate our ability to utilize a substantial portion of our carryforwards.

Although we have not conducted a study to make this determination, it is possible that we have incurred one or more "ownership changes" in the past, in which case our ability to use our carryforwards may be limited. In addition, the issuance of shares of our common stock (including due to this offering) could cause an "ownership change" which could also limit our ability to use our carryforwards. Other issuances of shares of our common stock which could cause an "ownership change" include the issuance of shares of common stock upon future conversion or exercise of outstanding options and warrants.

Business Risks

There is limited information available to evaluate our business, products and strategy.

We are a commercial stage company in the rapidly evolving market for molecular diagnostics, or MDx, and we face numerous risks and uncertainties. We recently launched our INFINITI HTS and we cannot predict the challenges, expenses, difficulties, complications and delays frequently encountered in the launch of a new product. Further, our operations are subject to many of the risks inherent in the growth of a business. We cannot assure you that we will be successful in continuing to place our INFINITI analyzers and targeting high-volume users of genetic tests, achieving anticipated revenue growth or achieving and maintaining profitability. Our failure to meet any of these goals could have an adverse effect on us and may force us to reduce or cease our operations.

Our operating results may be variable and unpredictable.

Due to the nature of the molecular diagnostics testing market and facets of our business, our revenue and operating results may be difficult to predict and may vary significantly from period to period. The sales cycles for our analyzers is generally between three and six months, which makes it difficult for us to accurately forecast revenue in a given period. Specifically, initial sales of our consumables are often dependent on completing customer validation processes that may be time-consuming and unique to each customer. In addition to its length, the sales cycle associated with our products is subject to a number of significant risks, including the budgetary constraints of our customers, their inventory management practices and possibly internal acceptance reviews and the timing of U.S. Food and Drug Administration, or FDA, approval and review, all of which are beyond our control. Sales of our products also involve the purchasing decisions of clinical reference laboratories, specialty clinics and hospital laboratories, which can require many levels of pre-approvals, further lengthening sales time. These purchasing decisions are subject to a number of significant risk factors beyond their and our control and are difficult for us to predict. For example, clinical reference laboratories, specialty clinics and hospital laboratories may purchase fewer of our consumables due to a decline in the volumes of tests needed at these facilities. As a result, we may expend considerable resources on unsuccessful sales efforts or we may not be able to complete sales as anticipated. Our manufacturing, installation and training cycles for our INFINITI analyzers also typically involve a significant investment of working capital by us before we begin to receive revenue from our customers, and can be dependent in part on our inventory levels and the availability of our working capital. As a result, we may incur inventory-carrying and other working capital expenses that may vary over time and that may make our operating results difficult to forecast.

Our revenue and operating results are also variable and difficult to predict due to differences in revenue recognition when our customers purchase, versus rent or lease, our INFINITI analyzers. Changes in any of these

14

relative mixes can have an impact on the timing of our recognition of revenue, as instrument sales result in revenue to us upon the delivery of the instrument and instrument leases or rentals involve the recapture of instrument costs through the sale of consumables, or on our gross margin, as consumable sales typically have significantly higher margins than those of instrument sales.

Further, our revenue and operating results are variable and difficult to predict because many of our test panels have been launched relatively recently. As a result, we do not have sufficient history with these new test panels to reliably predict revenue for those tests. Any period-to-period variations in our revenue and operating results may cause our stock price to fluctuate significantly in the future.

Our inability to pay our indebtedness and trade payables could adversely affect our reputation and business prospects.

In the past, we have been in default on indebtedness owed to various persons due to our inability to repay our debts by their applicable maturity dates. We have also periodically been unable to timely pay various trade payables, including amounts owed to our suppliers, service providers and landlord. We currently are behind on making timely payments to some of our suppliers and service providers. These events have had a negative impact on our reputation and perceived creditworthiness, and may make it more difficult for us to maintain existing relationships and enter into new relationships with suppliers and service providers, or to obtain future financing, particularly debt financing. In addition, concerns about our long-term ability to continue operations may deter potential customers from investing the time and resources necessary to install and train on our analyzers and use our platform to conduct genetic testing. Our reputation has been harmed from our past failure to timely pay our debt and trade payables, and it may take us some time to repair our reputation. In the meantime, we may receive less favorable terms from our suppliers and service providers, find it more difficult to obtain financing, and face challenges convincing customers to invest in the long-term use of our platform.

We face significant competition from large competitors that are well capitalized and from alternative technologies and products.

We face, and will continue to face, significant competition from organizations such as large in vitro diagnostics companies and large reference laboratories that compete directly or indirectly with us in the general molecular diagnostics market. We compete in an industry characterized by: (i) rapid technological change, (ii) evolving industry standards and regulatory requirements, (iii) emerging competition and (iv) new product introductions. Our competitors may develop and commercialize products and technologies that may mitigate any advantages our products may currently have and that may compete successfully with our products and technologies. Since several potentially competing companies and institutions have greater financial resources, more established brand names and larger existing customer bases than we do, they may be able to: (a) provide broader services and product lines, (b) make greater investments in research and development, (c) undertake more extensive sales efforts and marketing campaigns and (d) adopt more aggressive pricing policies than we are able. Some of our competitors are also our suppliers, and there can be no assurance that these suppliers will continue to provide us products at competitive prices or at all. Many of our competitors have also been able to enter into long-term, exclusive agreements with major potential customers, often by offering favorable pricing and other terms. Until these agreements expire, our ability to place our analyzers with and sell our testing consumables to these customers will be limited. Even after exclusive agreements expire, we may not be able to compete with the terms offered by our competitors in their efforts to extend exclusive relationships with these major potential customers. In addition, we compete against companies on the basis of the relative regulatory status of their and our products. Some of our competitors may have already received regulatory approval and conducted extensive clinical trials for tests we seek to sell. Any tests that we offer on a research use only, or RUO, basis may be at a competitive disadvantage to similar tests offered by others that have received FDA clearances or approvals, particularly as the FDA has announced its intention to modify its enforcement discretion approach to laboratory developed tests, or LDTs, which may have an adverse effect on sales of our RUO products even in advance of final regulations taking effect.

We also expect to continue to face competition from enhanced or alternative technologies and products. One or more of our competitors could develop a product that is superior to a product we offer or intend to offer or our technology and products may be rendered obsolete or uneconomical by advances in existing technologies. At least

15

one of our competitors currently offer on a commercial basis self-contained, integrated systems for molecular diagnostics testing that are similar in many ways to our products. If we are unable to keep pace with technological advances in the molecular diagnostics market, our business, financial condition and results of operations may suffer.

Our business may be adversely affected if we fail to capture a share of the rapidly growing molecular diagnostics testing market.

There are barriers to the adoption of widespread genetic testing, including the need to increase physician education on molecular research use and diagnostic testing and to keep physicians up-to-date on new and emerging technologies, as well as overcoming coverage denials from insurance companies. We cannot assure you that we will be successful in capturing a significant share of the MDx market by expanding the sale of our products at the prices we currently project. In the event that the market in general, or our market share in particular, does not grow as we expect, our business may be adversely affected.

Growth in our business could strain our managerial, operational, manufacturing, customer support, sales, financial and information systems resources.

The anticipated future growth necessary to expand our operations will place a significant strain on our managerial, operational, manufacturing, sales, financial and information systems resources. These increased demands could cause us to operate our business less effectively, which in turn could cause deterioration in the financial performance of our business. To increase revenue and achieve growth, we will need to expand our sales efforts and continue to improve and develop our products. The future growth of our business will also require us to expand our customer support resources, including adding additional personnel for customer training and technical product support. If our customer support infrastructure does not keep pace with future growth of our customer base, we may lose customers and our reputation and future sales potential may be harmed. In addition, we will need to improve our financial and managerial controls, reporting systems and procedures, and will also need to expand, train and manage our workforce. We may be unable to hire, train and retain a sufficient number of qualified personnel or successfully manage our growth. This growth may also place increased burdens on our international distributors, increase the complexities we face related to international sales and increase our inventory-related risk. Future growth will also make it difficult for us to adequately predict the expenditures we will need to make in the future. If we do not make the necessary capital or other expenditures to accommodate our anticipated growth, or if we are unable to manage our growth effectively, our business, financial condition and results of operations will suffer. We cannot anticipate all of the demands that our expanding operations will impose on our business, controls and procedures, personnel and systems, and our failure to appropriately address such demands could have an adverse effect on us.

The loss of the services of one or more of our key personnel or failure to attract and retain other highly qualified personnel in the future could adversely affect operations and result in a loss of revenue.

We are dependent on the continued services and performance of senior management and educated, technically-trained personnel. We currently do not have employment or severance agreements with any of these persons other than Fareed Kureshy, our President and Chief Executive Officer. Certain of the members of our senior management, including certain of our named executive officers, are at, close to or past traditional retirement age in the United States. Our business depends and will depend in the future on the ability to identify, attract, hire, train, retain and motivate senior management and other highly skilled technical, managerial, marketing and customer service personnel. Competition for such personnel is intense, and we cannot assure you that we will be able to successfully attract and retain sufficiently qualified personnel in the future. While we do not currently expect any of our senior management or other technically-trained personnel to retire or otherwise cease employment with us in the near-term, we will need to effectively plan for management succession to maintain effective leadership and continuity in our business. The failure to attract and retain necessary senior management and technically-trained personnel and to successfully plan for management succession could adversely affect our business and result in a loss of revenue.

16

We rely on the innovation and resources of larger industry participants and public programs to advance genetic research, establish the medical relevance of biomarkers and educate physicians and clinicians on molecular diagnostics.

The link between the genetic variations that our products detect and the underlying disease states, or responses to medications, is not always fully medically validated, and our current and future products may involve biomarkers whose medical relevance is unproven. Additionally, the availability of validated biomarkers is dependent on significant investment in genetic research, often funded through public programs for which there are no assurances of ongoing support. The adoption of molecular diagnostics is dependent to a great extent on the education and training of physicians and clinicians. We do not have the resources to undertake such training, and we are relying on larger industry participants and professional medical colleges to establish, communicate and educate physicians and clinicians regarding the use and application of molecular diagnostics. The genetic test results produced by our platform (including as used by our in-house laboratory) are reported to our customers in a format that also indicates potential options for treatment and dosing based on the specific test result. These presented options are based on publicly available information and open-source data repositories. We do not independently verify this information. If this information were to be incorrect, or if in the future similar information for genetic tests that we develop were not publicly available, we would be required to develop or obtain such information through our own or private resources, which could be expensive and time-consuming and which would in turn adversely affect our business and results of operations.

We may be unsuccessful in our long-term goal of expanding our product offerings outside the United States.

For the nine months ended September 30, 2014, and the years ended December 31, 2013 and 2012, 14%, 14% and 9%, respectively, of our revenue was from customers in countries outside the United States, including countries in Europe, Asia, the Middle East and South America. We are dependent on third-party distributor relationships in these countries to market, sell and provide customer and technical support for our products. Distributors may not commit the necessary resources to market, sell and support our products to the level of our expectations. If distributors do not perform adequately, or we are unable to locate distributors in particular geographic areas, our ability to realize long-term international revenue growth would be adversely affected. Furthermore, there are risks inherent in doing business internationally, including:

• | imposition of governmental controls and changes in laws, regulations or policies; |

• | political and economic instability; |

• | changes in U.S. and other national government trade policies affecting the markets for our products; |

• | changes in regulatory practices, tariffs and taxes; and |

• | currency exchange rate fluctuations, devaluations and other conversion restrictions. |

Any of these factors could have an adverse effect on our business, results of operations or financial condition.

Manufacturing risks, shortages and inefficiencies may adversely affect our production ability.

We must manufacture or engage third parties to manufacture components of our products in sufficient quantities and on a timely basis, while maintaining product quality and acceptable manufacturing costs and complying with regulatory requirements. In determining the required quantities of our products and the manufacturing schedule, we must make significant judgments and estimates based on historical experience, inventory levels, current market trends and other related factors. Because of the inherent nature of estimates, there could be significant differences between our estimates and the actual amounts of products we require. We generally manufacture our INFINITI analyzers only when ordered by our customers, and a significant influx of instrument orders could result in significant backlogs. In such a situation our ability to manufacture our INFINITI analyzers could be adversely impacted if we do not have sufficient working capital or labor on hand to support the purchasing of components, and the assembly of the same, necessary for the manufacture of our analyzers. For example, from February 2014 through September 30, 2014, we received a higher number of orders for our INFINITI HTS than anticipated, and our ability to fulfill all of these orders has been delayed due to manufacturing lead time, influenced by parts availability and supplier availability. In the future, our inability to timely fulfill analyzer orders could have an adverse impact on our revenue and results of operations.

17

We may also experience unforeseen technical complications in the processes we use to develop, manufacture, customize or receive orders for our products. Such complications could materially delay or limit the use of products we attempt to commercialize, substantially increase the anticipated cost of our products or prevent us from implementing our processes at appropriate quality and scale levels, thereby causing our business to suffer.

We have relationships with suppliers who are sources of raw materials and components for our product offerings. We do not have long-term agreements with our suppliers and have not arranged for alternate suppliers. It may be difficult to find alternate suppliers in a timely manner or on terms acceptable to us. Additionally, the availability of some components of the INFINITI analyzers may be limited as only a few outside vendors produce them. In the event that we become subject to a shortage of components or raw materials, our business, financial condition and results of operations could be adversely affected.

We will incur increased costs as a result of being a public company, and our management will be required to devote substantial time to new compliance matters.