Attached files

| file | filename |

|---|---|

| 8-K - 8-K - A10 Networks, Inc. | atenq32014pressrelease8kdoc.htm |

| EX-99.1 - EXHIBIT - A10 Networks, Inc. | october302014pressreleaseb.htm |

A10 Networks – Q3 2014 Earnings 10/30/2014 1 | P a g e

A10 Networks – Q3 2014 Earnings 2 | P a g e Maria Thank you all for joining us today. I am pleased to welcome you to A10 Networks third quarter 2014 financial results conference call. This call is being recorded and webcast live and may be accessed for 90 days via the A10 Networks website, www.a10networks.com. Joining me today are A10’s Founder & CEO, Lee Chen; A10’s CFO, Greg Straughn; and our VP of Global Sales, Ray Smets Before we begin, I would like to remind you that shortly after the market closed today, A10 Networks issued a press release announcing its third quarter 2014 financial results. Additionally, A10 published a presentation along with its prepared comments for this call and supplemental trended financial statements. You may access the press release, presentation with prepared comments, and trended financial statements on the investor relations section of the company’s website www.a10networks.com. During the course of today’s call, management will make forward-looking statements, including statements regarding our projections for our fourth quarter operating results, our expectations for future revenue growth and the growth of our business generally. These statements are based on current expectations and beliefs as of today, October 30, 2014. A10 disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events, or otherwise. These forward-looking statements involve a number of risks and uncertainties, some of which are beyond our control that could cause actual results to differ materially. We disclaim any obligation to update these forward-looking statements as a result of future events or otherwise. For a more detailed description of these risks and uncertainties, please refer to our 10-Q filed on August 4th. Please note that with the exception of revenue, financial measures discussed today are on a non-GAAP basis and have been adjusted to exclude certain charges. A reconciliation between GAAP and non-GAAP measures can be found in the press release issued today and on the trended quarterly financial statements posted on the company’s website. We will provide our current expectations for the fourth quarter of 2014 on a non-GAAP basis. However, we will not make available a reconciliation of non-GAAP guidance measures to corresponding GAAP measures on a forward-looking basis due to high variability and low visibility with respect to the charges, which are excluded from these non-GAAP measures. Now I would like to turn the call over to Lee for opening remarks.

A10 Networks – Q3 2014 Earnings 10/30/2014 3 | P a g e

A10 Networks – Q3 2014 Earnings 10/30/2014 4 | P a g e

A10 Networks – Q3 2014 Earnings 10/30/2014 5 | P a g e Lee Chen, Founder & CEO I would like to thank you all for joining our third quarter financial results conference call. Let me start by saying we are very disappointed with our financial results this quarter. We delivered third quarter revenue of 43.4 million dollars, below our initial guidance of 48 million to 50 million dollars. The lower topline performance coupled with a lower gross margin profile, brought our non-GAAP net loss to 8.8 million dollars or a loss of 15 cents per share, significantly off our original guidance of 7 cents to 9 cents per share. Our current level of growth and execution is not at the level we intend to exhibit. We understand that the investment community expects more out of A10, as do we, and we are committed to improving our execution and rebuilding your trust in A10.

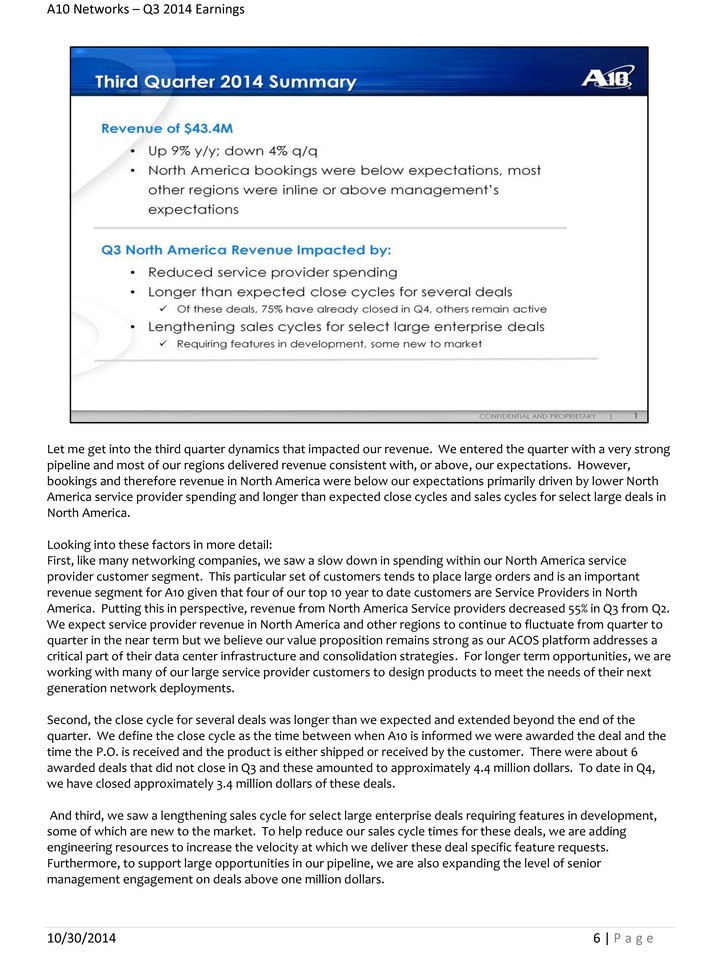

A10 Networks – Q3 2014 Earnings 10/30/2014 6 | P a g e Let me get into the third quarter dynamics that impacted our revenue. We entered the quarter with a very strong pipeline and most of our regions delivered revenue consistent with, or above, our expectations. However, bookings and therefore revenue in North America were below our expectations primarily driven by lower North America service provider spending and longer than expected close cycles and sales cycles for select large deals in North America. Looking into these factors in more detail: First, like many networking companies, we saw a slow down in spending within our North America service provider customer segment. This particular set of customers tends to place large orders and is an important revenue segment for A10 given that four of our top 10 year to date customers are Service Providers in North America. Putting this in perspective, revenue from North America Service providers decreased 55% in Q3 from Q2. We expect service provider revenue in North America and other regions to continue to fluctuate from quarter to quarter in the near term but we believe our value proposition remains strong as our ACOS platform addresses a critical part of their data center infrastructure and consolidation strategies. For longer term opportunities, we are working with many of our large service provider customers to design products to meet the needs of their next generation network deployments. Second, the close cycle for several deals was longer than we expected and extended beyond the end of the quarter. We define the close cycle as the time between when A10 is informed we were awarded the deal and the time the P.O. is received and the product is either shipped or received by the customer. There were about 6 awarded deals that did not close in Q3 and these amounted to approximately 4.4 million dollars. To date in Q4, we have closed approximately 3.4 million dollars of these deals. And third, we saw a lengthening sales cycle for select large enterprise deals requiring features in development, some of which are new to the market. To help reduce our sales cycle times for these deals, we are adding engineering resources to increase the velocity at which we deliver these deal specific feature requests. Furthermore, to support large opportunities in our pipeline, we are also expanding the level of senior management engagement on deals above one million dollars.

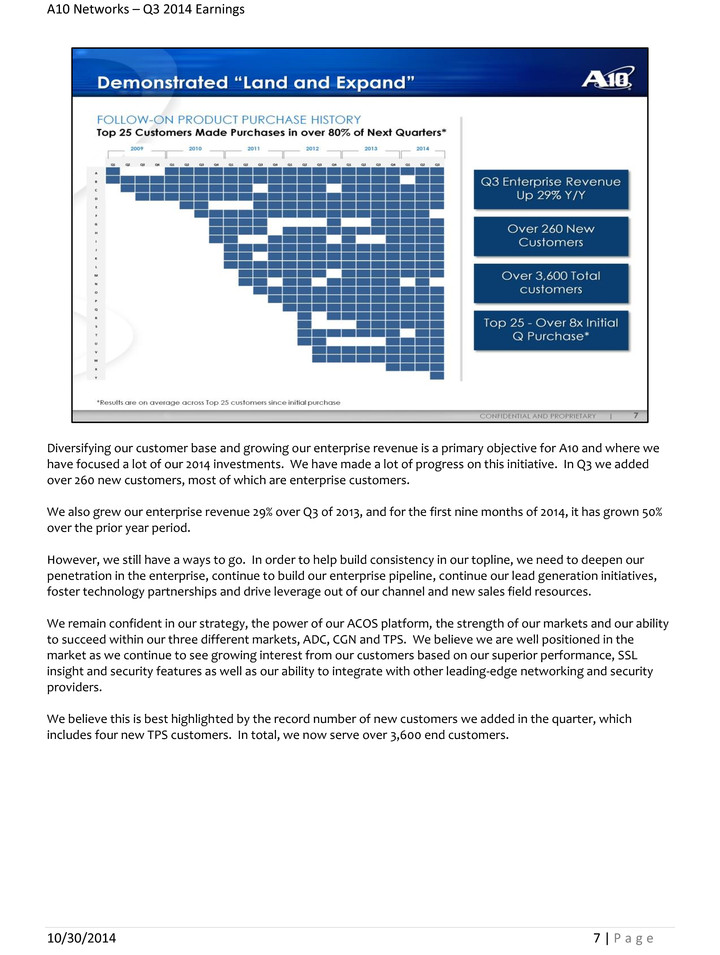

A10 Networks – Q3 2014 Earnings 10/30/2014 7 | P a g e Diversifying our customer base and growing our enterprise revenue is a primary objective for A10 and where we have focused a lot of our 2014 investments. We have made a lot of progress on this initiative. In Q3 we added over 260 new customers, most of which are enterprise customers. We also grew our enterprise revenue 29% over Q3 of 2013, and for the first nine months of 2014, it has grown 50% over the prior year period. However, we still have a ways to go. In order to help build consistency in our topline, we need to deepen our penetration in the enterprise, continue to build our enterprise pipeline, continue our lead generation initiatives, foster technology partnerships and drive leverage out of our channel and new sales field resources. We remain confident in our strategy, the power of our ACOS platform, the strength of our markets and our ability to succeed within our three different markets, ADC, CGN and TPS. We believe we are well positioned in the market as we continue to see growing interest from our customers based on our superior performance, SSL insight and security features as well as our ability to integrate with other leading-edge networking and security providers. We believe this is best highlighted by the record number of new customers we added in the quarter, which includes four new TPS customers. In total, we now serve over 3,600 end customers.

A10 Networks – Q3 2014 Earnings 10/30/2014 8 | P a g e A few third quarter customer engagements I would like to highlight include: Our Thunder ADC was selected by two government agencies, including a large US military department. We were chosen because of our unique ability to process SSL encrypted data packets. Our Thunder CGN solution was chosen by an international carrier that is in the process of deploying one of the largest LTE networks in the world. Lastly, our Thunder TPS solution was selected by two leading gaming companies in North America to help protect their network against the growing number and intensity of DDoS attacks. In both cases, we replaced an incumbent and beat several other security vendors in the bake-off. We also won initial TPS deals in Asia and Europe. These are just a few of the many customer success stories in the quarter that demonstrate the power of our differentiated application networking platform, which we continue to innovate and enhance to meet our customers needs. In August, we added several new security features to our Thunder ADC solution including URL bypass for SSL in an ADC that provides industry leading performance and scalability of SSL insight. We also integrated enhanced SSL offload capabilities, web application firewall enhancements and we broadened our application, access management features that centralize user authentication. In conclusion, while we hit a speed bump and our revenue is not at the level we would like it, we continued to make progress on our initiatives by adding a record number of new customers, continuing to expand our enterprise revenue base, and bringing on four new TPS customers. Our differentiated high performance product suite is gaining a lot of attention in the market and we see significant interest by customers, channel partners, and technology companies in the Thunder portfolio. It is important that we continue to develop our go to market resources and partnerships in order to help drive future revenue and diversify our customer base. To that end, I’m pleased to announce that earlier this month, we launched the A10 Security Alliance, an ecosystem of leading security and networking companies that are working together to help mitigate threats and automate security operations. Our ecosystem provides validated and integrated solutions that help customers architect secure data centers and improve efficiency. Inaugural members of the A10 Security Alliance include leading companies such as RSA, Arista, FireEye, Symantec, IBM Security, Webroot and several more. Additionally, we recently brought on a new VP of Strategic Alliances. Gunter Reiss joins us from Ericsson, and in his new role, he will oversee business development activities, including strategic alliances, technology partnerships, and OEM relationships. We are moving forward and charging ahead and we will remain focused on improving our execution. With that, I’d like to turn the call over to Greg to review the details of our third quarter financial performance and fourth quarter guidance.

A10 Networks – Q3 2014 Earnings 10/30/2014 9 | P a g e

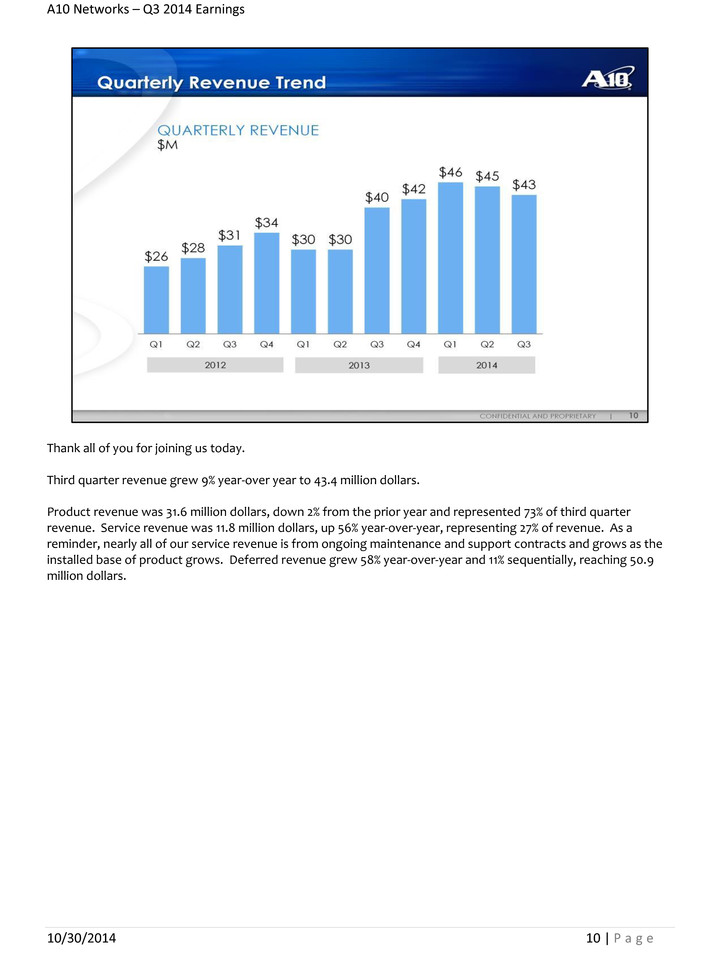

A10 Networks – Q3 2014 Earnings 10/30/2014 10 | P a g e Thank all of you for joining us today. Third quarter revenue grew 9% year-over year to 43.4 million dollars. Product revenue was 31.6 million dollars, down 2% from the prior year and represented 73% of third quarter revenue. Service revenue was 11.8 million dollars, up 56% year-over-year, representing 27% of revenue. As a reminder, nearly all of our service revenue is from ongoing maintenance and support contracts and grows as the installed base of product grows. Deferred revenue grew 58% year-over-year and 11% sequentially, reaching 50.9 million dollars.

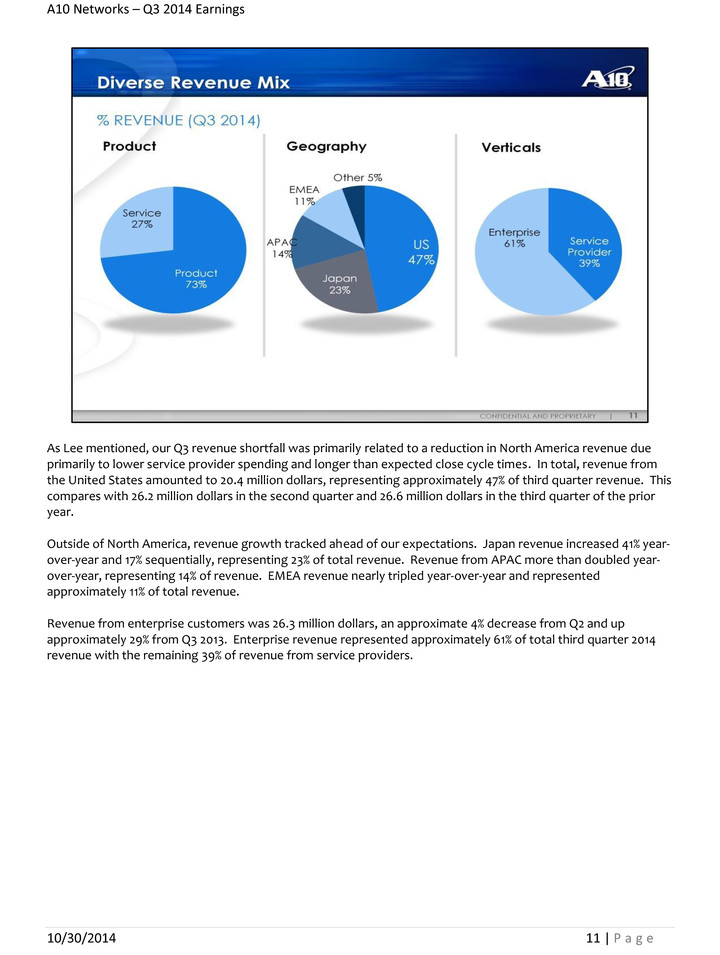

A10 Networks – Q3 2014 Earnings 10/30/2014 11 | P a g e As Lee mentioned, our Q3 revenue shortfall was primarily related to a reduction in North America revenue due primarily to lower service provider spending and longer than expected close cycle times. In total, revenue from the United States amounted to 20.4 million dollars, representing approximately 47% of third quarter revenue. This compares with 26.2 million dollars in the second quarter and 26.6 million dollars in the third quarter of the prior year. Outside of North America, revenue growth tracked ahead of our expectations. Japan revenue increased 41% year- over-year and 17% sequentially, representing 23% of total revenue. Revenue from APAC more than doubled year- over-year, representing 14% of revenue. EMEA revenue nearly tripled year-over-year and represented approximately 11% of total revenue. Revenue from enterprise customers was 26.3 million dollars, an approximate 4% decrease from Q2 and up approximately 29% from Q3 2013. Enterprise revenue represented approximately 61% of total third quarter 2014 revenue with the remaining 39% of revenue from service providers.

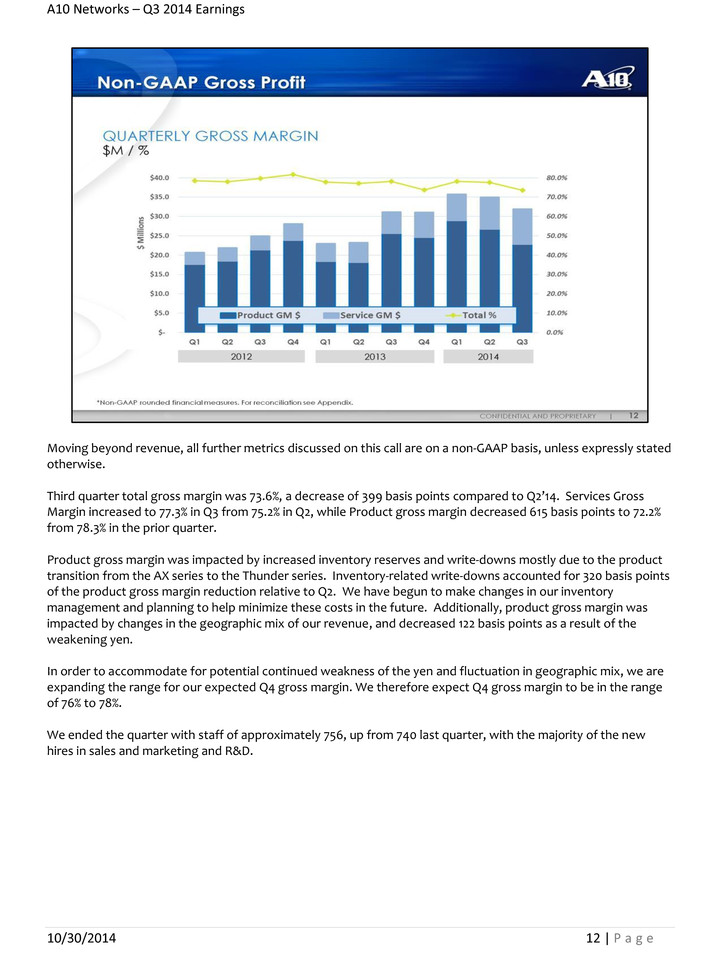

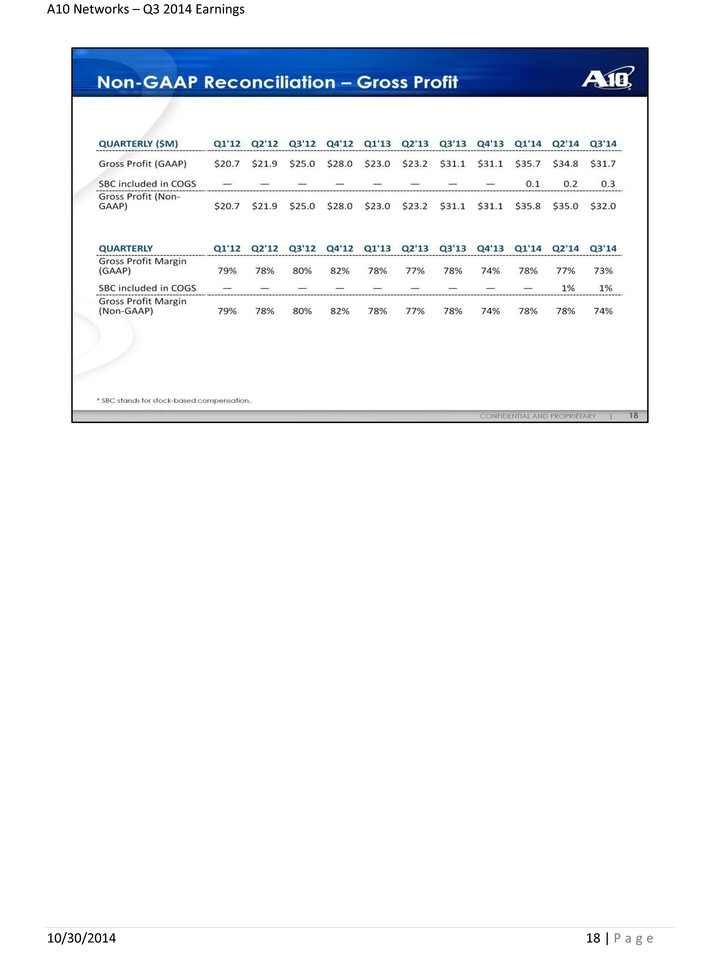

A10 Networks – Q3 2014 Earnings 10/30/2014 12 | P a g e Moving beyond revenue, all further metrics discussed on this call are on a non-GAAP basis, unless expressly stated otherwise. Third quarter total gross margin was 73.6%, a decrease of 399 basis points compared to Q2’14. Services Gross Margin increased to 77.3% in Q3 from 75.2% in Q2, while Product gross margin decreased 615 basis points to 72.2% from 78.3% in the prior quarter. Product gross margin was impacted by increased inventory reserves and write-downs mostly due to the product transition from the AX series to the Thunder series. Inventory-related write-downs accounted for 320 basis points of the product gross margin reduction relative to Q2. We have begun to make changes in our inventory management and planning to help minimize these costs in the future. Additionally, product gross margin was impacted by changes in the geographic mix of our revenue, and decreased 122 basis points as a result of the weakening yen. In order to accommodate for potential continued weakness of the yen and fluctuation in geographic mix, we are expanding the range for our expected Q4 gross margin. We therefore expect Q4 gross margin to be in the range of 76% to 78%. We ended the quarter with staff of approximately 756, up from 740 last quarter, with the majority of the new hires in sales and marketing and R&D.

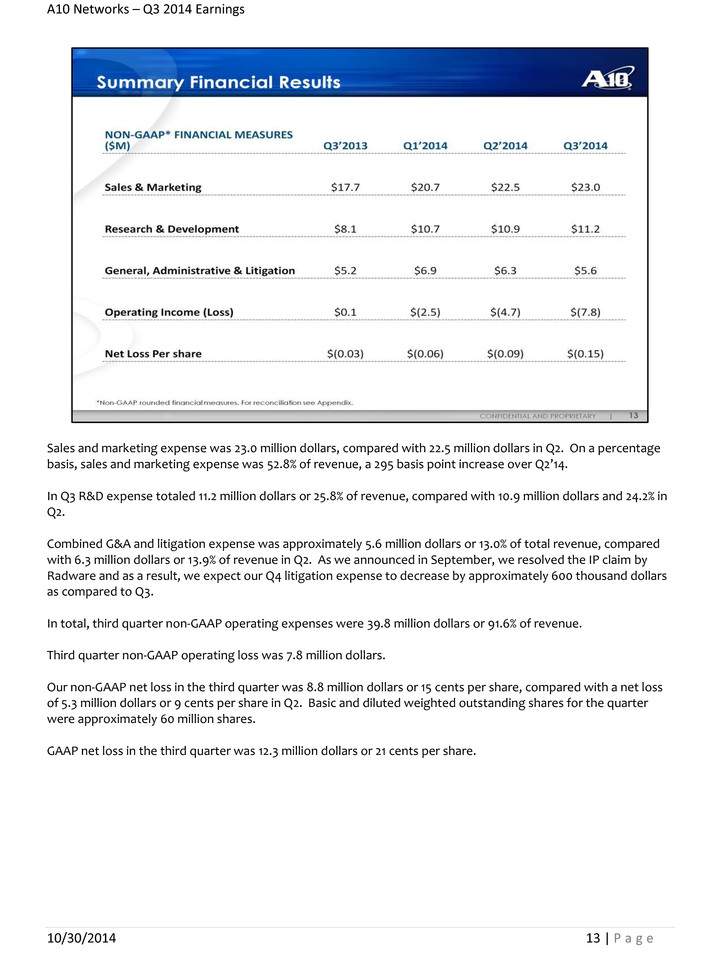

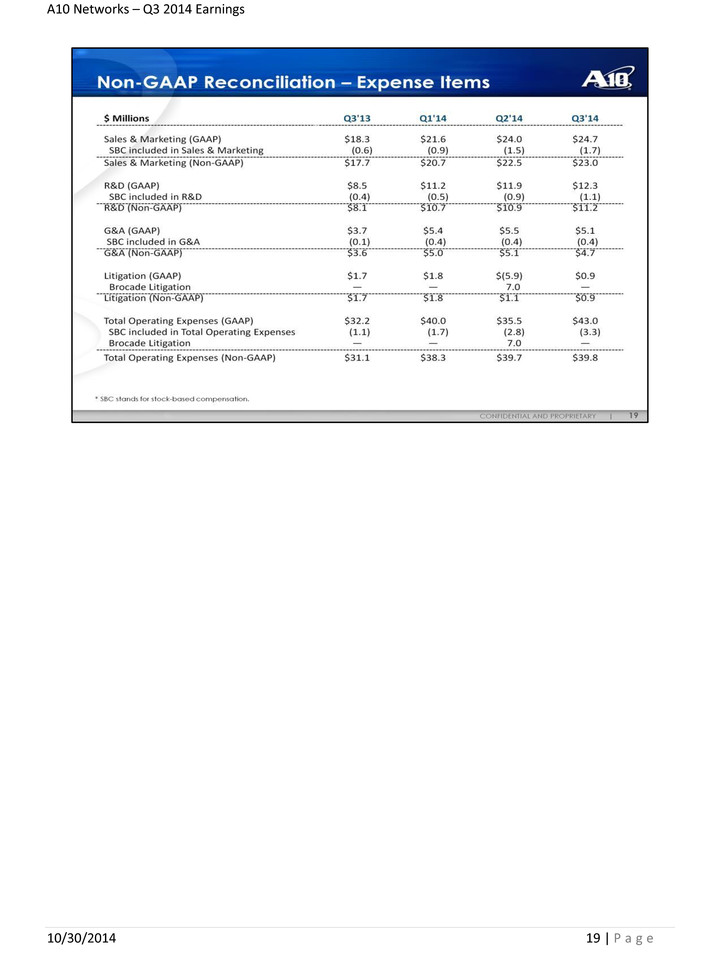

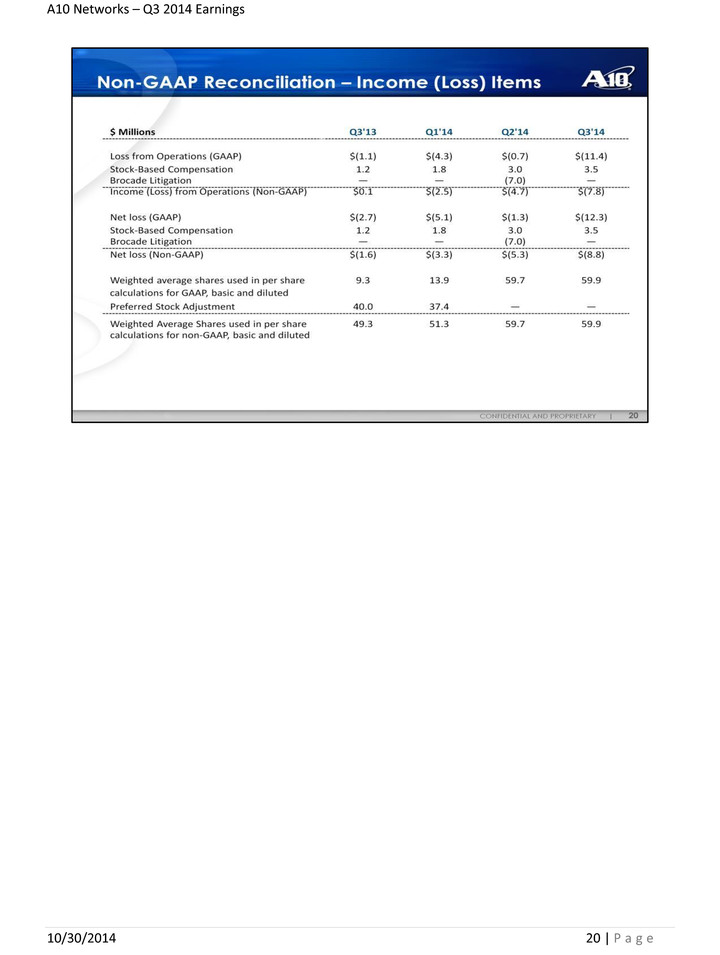

A10 Networks – Q3 2014 Earnings 10/30/2014 13 | P a g e Sales and marketing expense was 23.0 million dollars, compared with 22.5 million dollars in Q2. On a percentage basis, sales and marketing expense was 52.8% of revenue, a 295 basis point increase over Q2’14. In Q3 R&D expense totaled 11.2 million dollars or 25.8% of revenue, compared with 10.9 million dollars and 24.2% in Q2. Combined G&A and litigation expense was approximately 5.6 million dollars or 13.0% of total revenue, compared with 6.3 million dollars or 13.9% of revenue in Q2. As we announced in September, we resolved the IP claim by Radware and as a result, we expect our Q4 litigation expense to decrease by approximately 600 thousand dollars as compared to Q3. In total, third quarter non-GAAP operating expenses were 39.8 million dollars or 91.6% of revenue. Third quarter non-GAAP operating loss was 7.8 million dollars. Our non-GAAP net loss in the third quarter was 8.8 million dollars or 15 cents per share, compared with a net loss of 5.3 million dollars or 9 cents per share in Q2. Basic and diluted weighted outstanding shares for the quarter were approximately 60 million shares. GAAP net loss in the third quarter was 12.3 million dollars or 21 cents per share.

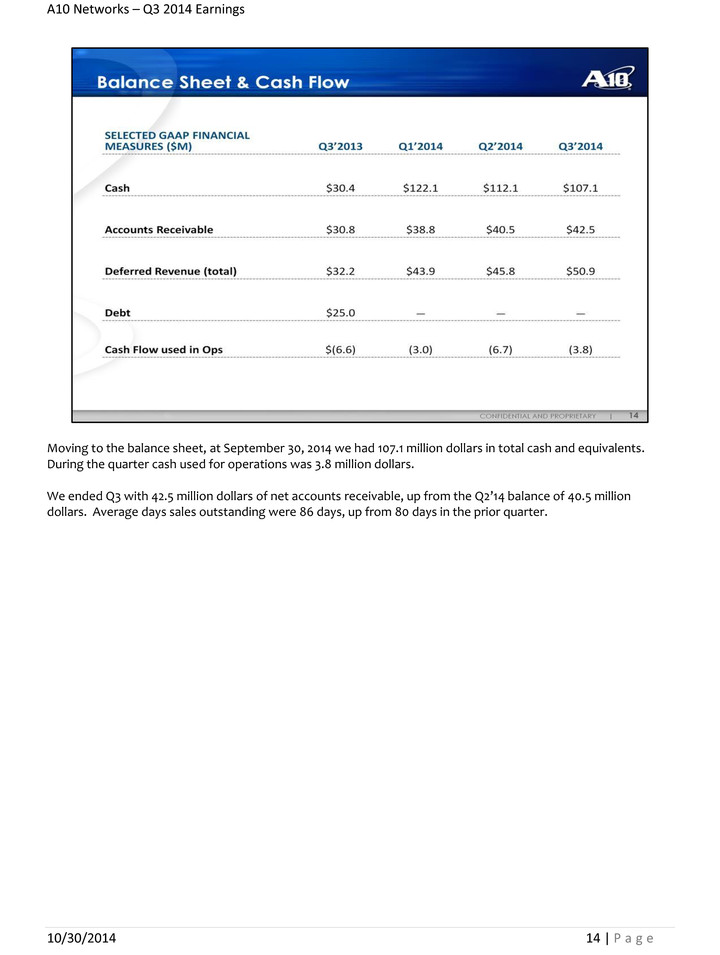

A10 Networks – Q3 2014 Earnings 10/30/2014 14 | P a g e Moving to the balance sheet, at September 30, 2014 we had 107.1 million dollars in total cash and equivalents. During the quarter cash used for operations was 3.8 million dollars. We ended Q3 with 42.5 million dollars of net accounts receivable, up from the Q2’14 balance of 40.5 million dollars. Average days sales outstanding were 86 days, up from 80 days in the prior quarter.

A10 Networks – Q3 2014 Earnings 10/30/2014 15 | P a g e

A10 Networks – Q3 2014 Earnings 10/30/2014 16 | P a g e

A10 Networks – Q3 2014 Earnings 10/30/2014 17 | P a g e

A10 Networks – Q3 2014 Earnings 10/30/2014 18 | P a g e

A10 Networks – Q3 2014 Earnings 10/30/2014 19 | P a g e

A10 Networks – Q3 2014 Earnings 10/30/2014 20 | P a g e

A10 Networks – Q3 2014 Earnings 10/30/2014 21 | P a g e