Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UNITED STATES STEEL CORP | form8-kxslidesandqaforearn.htm |

| EX-99.2 - EXHIBIT - UNITED STATES STEEL CORP | a3q2014qaoctober298kvers.htm |

Exhibit 99.1 United States Steel Corporation Third Quarter 2014 Earnings Conference Call and Webcast October 29, 2014 © 2011 United States Steel Corporation

2 Forward-looking Statements United States Steel Corporation This presentation contains forward-looking statements with respect to market conditions, operating costs, shipments and prices. Factors that could affect market conditions, costs, shipments and prices for both North American and European operations include: (a) foreign currency fluctuations and related activities; (b) global product demand, prices and mix; (c) global and company steel production levels; (d) plant operating performance; (e) natural gas, electricity, raw materials and transportation prices, usage and availability; (f) international trade developments, including court decisions, legislation and agency decisions on petitions and sunset reviews; (g) the impact of fixed prices in energy and raw materials contracts (many of which have terms of one year or longer) as compared to short-term contract and spot prices of steel products; (h) changes in environmental, tax, pension and other laws; (i) the terms of collective bargaining agreements; (j) employee strikes or other labor issues; and (k) U.S. and global economic performance and political developments. Domestic steel shipments and prices could be affected by import levels and actions taken by the U.S. Government and its agencies, including those related to CO2 emissions, climate change and shale gas development. Economic conditions and political factors in Europe that may affect U. S. Steel Europe's results include, but are not limited to: (l) taxation; (m) nationalization; (n) inflation; (o) fiscal instability; (p) political issues; (q) regulatory actions; and (r) quotas, tariffs, and other protectionist measures. We present adjusted net income (loss), adjusted net income (loss) per diluted share, EBITDA and Adjusted EBITDA, which are non-GAAP measures, as an additional measurement to enhance the understanding of our operating performance and facilitate a comparison with that of our competitors. In accordance with “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, cautionary statements identifying important factors, but not necessarily all factors, that could cause actual results to differ materially from those set forth in the forward-looking statements have been included in U. S. Steel’s Annual Report on Form 10-K for the year ended December 31, 2013, and in subsequent filings for U. S. Steel.

Income from Operations – Reportable Segments and Other Businesses $ Millions Adjusted EBITDA $ Millions Adjusted Diluted EPS $ / Share 3Q 2014 2Q 2014 3Q 2013 3Q 2013 2Q 2014 3Q 2014 Strong operating performance and Carnegie Way progress in the quarter Note: For reconciliation of non-GAAP amounts see Appendix 2Q 2014 3Q 2013 3Q 2014 Adjusted Third Quarter 2014 Results Strong 3 United States Steel Corporation Significant strategic actions announced in September Adjusted Net Income $ Millions 3Q 2013 2Q 2014 3Q 2014 Highest segment income from operations since 3Q 2008

Income from Operations – Reportable Segments and Other Businesses $ Millions Adjusted EBITDA $ Millions Adjusted Diluted EPS $ / Share 9M 2014 9M 2013 9M 2013 9M 2014 Note: For reconciliation of non-GAAP amounts see Appendix 9M 2013 9M 2014 Financial Results – Nine Months Ended 9/30/2014 4 United States Steel Corporation Adjusted Net Income $ Millions 9M 2013 9M 2014 Results for the first nine months of 2014 well above consensus estimates EPS already above full year consensus estimates

Cash from Operations $ Millions 2Q 2014 1Q 2014 4Q 2013 LTM 3Q 2014 Note: Cash from operations in 3Q 2014 includes a reduction in cash of $80 million from the deconsolidation of U. S. Steel Canada, Inc., a voluntary pension contribution of $140 million and a litigation settlement of $58 million Total Estimated Liquidity $ Millions 2Q 2014 1Q 2014 4Q 2013 3Q 2014 Strong cash generation and liquidity position in 2014 Strong Cash Flows and Liquidity 5 United States Steel Corporation Cash and Cash Equivalents $ Millions Net Debt $ Millions Net debt reduced by over $1 billion this year to strengthen balance sheet Cash used in 3Q to build inventory and for voluntary pension contribution

Income from Operations $ Millions Average Realized Prices $ / Ton 3Q 2013 2Q 2014 3Q 2014 Third Quarter 2014 Flat-rolled Segment 3Q 2013 2Q 2014 3Q 2014 Shipments Net tons (Thousands) 3Q 2013 2Q 2014 3Q 2014 Operating income per ton increased $70 from third quarter 2013 Increasing Carnegie Way benefits driving improved results 6 United States Steel Corporation EBITDA $ Millions 3Q 2013 2Q 2014 3Q 2014

Income from Operations $ Millions Average Realized Prices $ / Ton 3Q 2014 2Q 2014 3Q 2013 xxx Third Quarter 2014 Tubular Segment 3Q 2014 2Q 2014 3Q 2013 Shipments Net tons (Thousands) 3Q 2014 2Q 2014 3Q 2013 Strong energy tubular market led by onshore horizontal oil drilling 7 United States Steel Corporation Operating income per ton increased $54 from third quarter 2013 EBITDA $ Millions 3Q 2013 2Q 2014 3Q 2014

Income from Operations $ Millions Average Realized Prices $ / Ton 3Q 2013 2Q 2014 3Q 2014 Third Quarter 2014 U. S. Steel Europe Segment 3Q 2013 2Q 2014 3Q 2014 Shipments Net tons (Thousands) 3Q 2013 2Q 2014 3Q 2014 Operating income per ton increased $67 from third quarter 2013 Increasing Carnegie Way benefits driving improved results 8 United States Steel Corporation EBITDA $ Millions 3Q 2013 2Q 2014 3Q 2014

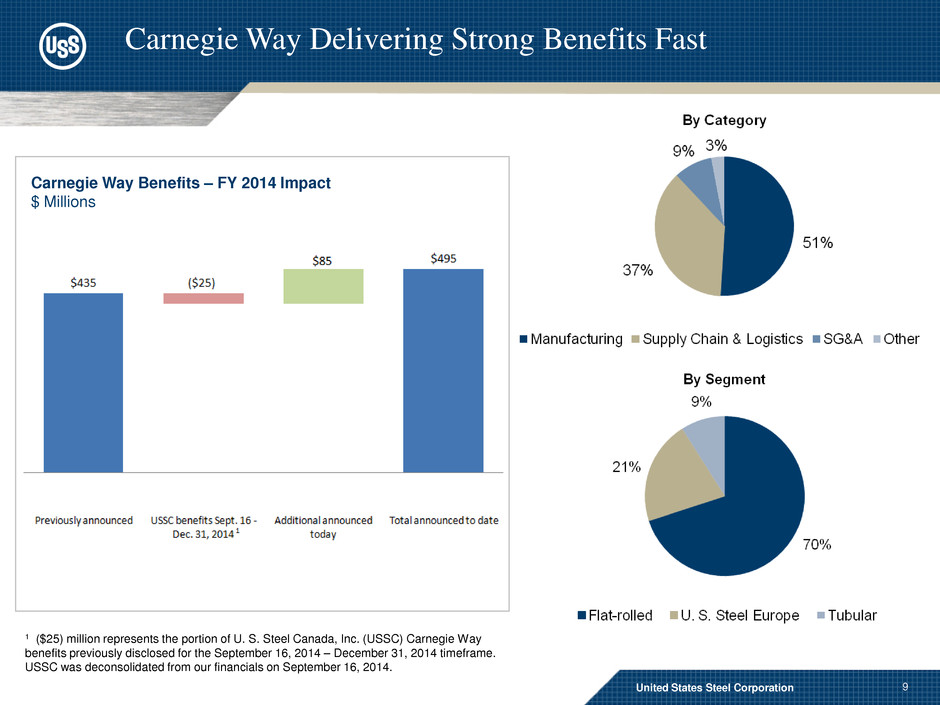

Carnegie Way Benefits – FY 2014 Impact $ Millions 9 Carnegie Way Delivering Strong Benefits Fast 55% 12% United States Steel Corporation 1 ($25) million represents the portion of U. S. Steel Canada, Inc. (USSC) Carnegie Way benefits previously disclosed for the September 16, 2014 – December 31, 2014 timeframe. USSC was deconsolidated from our financials on September 16, 2014.

10 Carnegie Way transformation Phase 1: Earning the right to grow in search of: • Economic profits • Customer satisfaction and loyalty • Process improvements and focused investment Phase 2: Driving profitable growth with: • Advanced high strength steel • Premium connections • Operational flexibility • Targeted M&A Strategic Approach United States Steel Corporation

11 United States Steel Corporation Strategic Actions Recent strategic actions announced • Keetac iron ore expansion project will not be pursued • Development of carbon alloy facilities at Gary Works terminated • U. S. Steel Canada, Inc. filed for protection under the Companies’ Creditors Arrangement Act in Canada

12 United States Steel Corporation Flat-rolled September 2014 U.S. light vehicle sales SAAR was 1 million units higher than September 2013 Recent OEM forecasts reflect improving appliance market in 2014 Construction indices continue to indicate growth in 2014 Service center shipments continue to trend higher versus 2013 U. S. Steel Europe V4* car production expected to outpace the average EU in 2014 Appliance growth in Central Europe expected to outperform average EU growth EU construction output expected to grow slightly in 2014, primarily driven by the residential sector Tubular Imports remain challenging Oil directed rig counts near highest level in decades Natural gas directed rig counts increased 2% in 3Q, and are currently above the 3Q average Natural gas storage levels at end of withdrawal season are below both last year’s levels and the five year average Market Updates Major industry summary and market fundamentals * Visegrad Group – Czech Republic, Hungary, Poland and Slovakia

13 United States Steel Corporation Fourth Quarter 2014 Outlook Segment outlook Flat-rolled Operating results expected to decrease significantly, but expected to exceed $100 million Shipments, which no longer include U. S. Steel Canada, Inc., are expected to decline by as much as 10% from the 3.2 million tons shipped by our U.S. plants in the third quarter Average realized prices expected to decrease Repair and maintenance cost expected to increase by approximately $150 million for planned outages U. S. Steel Europe Operating results expected to increase slightly as compared to the third quarter Higher shipments resulting from maintenance outages being completed in the third quarter Average realized prices expected to decrease due to shift in product mix Lower repair and maintenance costs Tubular Operating results expected to increase slightly as compared to the third quarter Lower shipments due to the indefinite idling of Bellville and McKeesport facilities Average realized prices expected to increase due to higher market prices and improved product mix

United States Steel Corporation Third Quarter 2014 Earnings Conference Call and Webcast Q & A October 29, 2014 © 2011 United States Steel Corporation United States Steel Corporation 14

© 2011 United States Steel Corporation Appendix 15 United States Steel Corporation

16 Major industry summary North American Flat-rolled Segment Sources: Wards / Customer Financial Reports / AISI / CMI / Economic Planning Assoc / AHAM / US Census Bureau / AIA / AEM / MSCI Automotive September U.S. light vehicle sales came in at 16.34M units SAAR. While on the lower end of expectations following a better than expected August, the pace remains 1 million units over September 2013 pace. Days supply of light vehicles generally followed seasonal patterns, ending three days above pre-recession average at 64. Production remains strong in anticipation of a strong year-end finish, but specific underperforming models are seeing some schedule reductions. Industrial Equipment Agricultural and Mining equipment sales expected to drop at least 10% in 2014. Construction equipment projected to be the lone bright spot. Railcar deliveries forecast for 2014 up 25% vs 2013. Tin Plate YTD metal can shipments through Sept. are down 2%. AISI apparent consumption of tin mill products through July down 1%. Domestic shipments down 7%; imports up 19% through July. Appliance August 2014 U.S. factory unit shipments up 1% y-o-y; YTD 2014 up 3%. FY14 industry shipment forecasts are for 4% to 5% growth over FY13. Pipe and Tube Structural tubing demand and line pipe project inquiry activity remains good. Large project pricing increasingly aggressive. OCTG demand is good, but inventories & imports remain high, despite ITC case ruling. Construction August Dodge contracts for non-res showed continued growth, increasing 10% y-o-y and 7% m-o-m; residential came in slightly lower vs 2013 (down 1%) and vs. July (down 2%); 2014 YTD continues to trend higher (up 6%) compared with 2013. Service Center September average daily shipments moderated m-o-m but YTD shipments continue to trend higher vs. 2013. End of month inventory registered both m-o-m (up 4%) and y-o-y (up 19%) increases; months' supply up slightly to 2.4 weeks. United States Steel Corporation

17 Market Fundamentals Sources: Baker Hughes, Energy Information Administration, Preston Publishing, Raymond James, Internal Oil Directed Rig Count The oil directed rig count averaged 1,577 during 3Q, an increase of 3% over 2Q. There are currently 1,595 active oil rigs. Gas Directed Rig Count The natural gas directed rig count averaged 324 during 3Q, an increase of 2% over 2Q. There are currently 332 active natural gas rigs. Natural Gas Storage Level Currently 3.4 Tcf, 9% below last year and the five year average. Inventories projected to end refill season (end of October) above 3.5 Tcf, 7% below last year. Oil Price The West Texas Intermediate oil price averaged $98 per barrel during 3Q, down $5.57 or 5% from 2Q. Raymond James forecasts an average 4Q price of $84 per barrel. Natural Gas Price The Henry Hub natural gas price averaged $3.96 per MMBtu during 3Q, down $0.65 or 14% from 2Q. The U.S. Energy Information Administration forecasts an average 4Q natural gas price of $4.01 per MMBtu. Imports During 3Q, import share of OCTG apparent market demand averaged roughly 51%. OCTG Inventory September 2014 OCTG inventory is estimated to be about 2.8 million tons, approximately 4-1/2 months of supply. Tubular Segment United States Steel Corporation

18 Major industry summary Sources: Eurofer, USSK Marketing, EASSC, LMC, Euroconstruct, ESTA, ACEA United States Steel Corporation Automotive In 4Q 2014, EU 28 car production is expected to amount to 4.1 million units, an increase of 1.3% y-o- y. Total EU 2014 car production is forecasted to grow by 4.7% to roughly 16.7million units. V4 car production is anticipated to decrease by 7% y-o-y in 4Q 2014 and for full year 2014 we expect growth of 5.5% y-o-y with 2.92 million produced units. Significant growth is expected mainly in Audi Hungary and Mercedes Hungary. Appliance In 4Q 2014, the EU appliance sector is projected to grow by 3.7% q-o-q. (2% y-o-y). The V4 market is anticipated to grow by 5% q-o-q. (6% y-o-y). The appliance sector 2014 is expected to rise in the EU by 0.3% y-o-y and by 4% y-o-y in V4. Tin Plate After high demand in 3Q, the usual seasonal decline is expected in 4Q. Overall, tin demand in 2014 will be higher by roughly 3% compared to 2013, mostly driven by the food segment. Construction The outlook for 4Q 2014 (+0.4% y-o-y) does not provide any indication of better market fundamentals. Output in EU construction remains driven by the residential sector, particularly in Germany, the UK and Sweden. In Poland and Hungary activity in the civil engineering output is gathering strength due to infrastructure investment. Total output of the construction sector in 2014 is expected to grow by 2% y-o-y. Service Centers 4Q 2014 flat product stocks are predicted to remain relatively well-balanced with the expected activity of ex-stocks sales. Sales activity is expected to be similar to 3Q 2014 levels in most markets. U. S. Steel Europe Segment

U. S. Steel Commercial – Contract vs. Spot Contract vs spot mix by segment – twelve months ended September 30, 2014 Firm 28% Market Based Quarterly * 20% Flat-rolled ** Market Based Monthly * 10% Tubular U. S. Steel Europe Spot 31% Cost Based 11% Contract: 69% Spot: 31% Firm 38% Market Based Quarterly 1% Spot 50% Cost Based 1% Program 53% Contract: 50% Spot: 50% Market Based Monthly 10% Spot 47% Program: 53% Spot: 47% United States Steel Corporation 19 Market Based Semi-annual * <1% *Annual contract volume commitments with price adjustments in stated time frame ** Excludes shipments for U. S. Steel Canada, Inc.

20 United States Steel Corporation Other Items Capital Spending Third quarter actual $96 million, 2014 estimate $500 million Depreciation, Depletion and Amortization Third quarter actual $158 million, 2014 estimate $628 million Pension and Other Benefits Costs Third quarter actual $85 million, 2014 estimate $311 million Pension and Other Benefits Cash Payments (excluding any voluntary pension contributions) Third quarter actual $150 million, 2014 estimate $500 million

21 Days Away From Work Injury Rate (Frequency Rates per 200,000 Hours Worked) Global Safety Performance Safety Performance United States Steel Corporation

22 United States Steel Corporation Adjusted Results ($ millions) 9M 2014 3Q 2014 2Q 2014 9M 2013 3Q 2013 Reported net income (loss) ($173) ($207) ($18) ($1,942) ($1,791) Loss on deconsolidation of U. S. Steel Canada and other charges $384 384 ─ ─ ─ Impairment of carbon alloy facilities at Gary Works 163 163 ─ ─ ─ Write-off of pre-engineering costs at Keetac 30 30 ─ ─ ─ Gain on sale of real estate assets (45) (45) ─ ─ ─ Litigation reserves 46 ─ 46 ─ ─ Loss on assets held for sale 9 ─ 9 ─ ─ Curtailment gain (12) ─ (12) ─ ─ Impairment of goodwill ─ ─ ─ $1,771 1,771 Charge related to the repurchase of 2014 Convertible Notes ─ ─ ─ $22 ─ Adjusted net income (loss) $402 $325 $25 ($149) ($20) Reconciliation of reported and adjusted net income

23 United States Steel Corporation Adjusted Results ($ per share) 9M 2014 3Q 2014 2Q 2014 9M 2013 3Q 2013 Reported EPS (LPS) ($1.19) ($1.42) ($0.12) ($13.44) ($12.38) Loss on deconsolidation of U. S. Steel Canada and other charges 2.54 2.54 ─ ─ ─ Impairment of carbon alloy facilities at Gary Works 1.08 1.08 ─ ─ ─ Write-off of pre-engineering costs at Keetac 0.21 0.21 ─ ─ ─ Gain on sale of real estate assets (0.30) (0.30) ─ ─ ─ Litigation reserves 0.31 ─ 0.31 ─ ─ Loss on assets held for sale 0.06 ─ 0.06 ─ ─ Curtailment gain (0.08) ─ (0.08) ─ ─ Additional dilutive effects of securities 0.05 0.05 ─ ─ ─ Impairment of goodwill ─ ─ ─ 12.24 12.24 Charge related to the repurchase of 2014 Convertible Notes ─ ─ ─ 0.16 ─ Adjusted EPS (LPS) $2.68 $2.16 $0.17 ($1.04) ($0.14) Reconciliation of reported and adjusted EPS

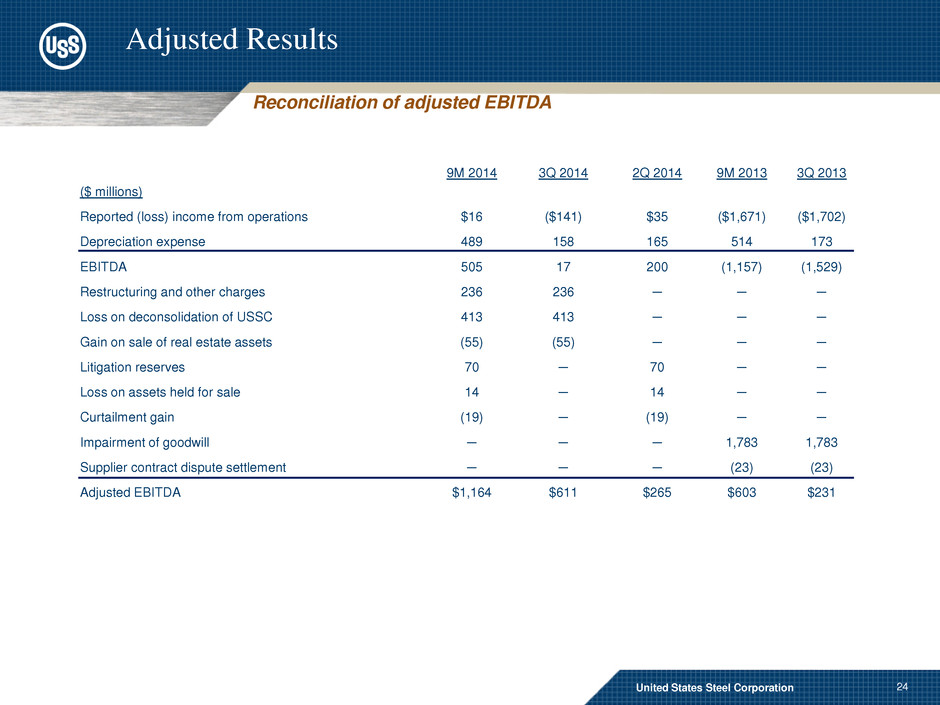

24 United States Steel Corporation Adjusted Results ($ millions) 9M 2014 3Q 2014 2Q 2014 9M 2013 3Q 2013 Reported (loss) income from operations $16 ($141) $35 ($1,671) ($1,702) Depreciation expense 489 158 165 514 173 EBITDA 505 17 200 (1,157) (1,529) Restructuring and other charges 236 236 ─ ─ ─ Loss on deconsolidation of USSC 413 413 ─ ─ ─ Gain on sale of real estate assets (55) (55) ─ ─ ─ Litigation reserves 70 ─ 70 ─ ─ Loss on assets held for sale 14 ─ 14 ─ ─ Curtailment gain (19) ─ (19) ─ ─ Impairment of goodwill ─ ─ ─ 1,783 1,783 Supplier contract dispute settlement ─ ─ ─ (23) (23) Adjusted EBITDA $1,164 $611 $265 $603 $231 Reconciliation of adjusted EBITDA