Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PILGRIMS PRIDE CORP | a2014_q3xcallslides.htm |

1 Pilgrim’s Pride Corporation Financial Results for Third Quarter Ended September 28, 2014

2 Statements contained in this presentation that share our intentions, beliefs, expectations or predictions for the future, denoted by the words “anticipate,” “believe,” “estimate,” “should,” “expect,” “project,” “plan,” “imply,” “intend,” “foresee” and similar expressions, are forward-looking statements that reflect our current views about future events and are subject to risks, uncertainties and assumptions. Such risks, uncertainties and assumptions include the following matters affecting the chicken industry generally, including fluctuations in the commodity prices of feed ingredients and chicken; actions and decisions of our creditors; our ability to obtain and maintain commercially reasonable terms with vendors and service providers; our ability to maintain contracts that are critical to our operations; our ability to retain management and other key individuals; certain of our reorganization and exit or disposal activities, including selling assets, idling facilities, reducing production and reducing workforce, resulted in reduced capacities and sales volumes and may have a disproportionate impact on our income relative to the cost savings; risk that the amounts of cash from operations together with amounts available under our exit credit facility will not be sufficient to fund our operations; management of our cash resources, particularly in light of our substantial leverage; restrictions imposed by, and as a result of, our substantial leverage; additional outbreaks of avian influenza or other diseases, either in our own flocks or elsewhere, affecting our ability to conduct our operations and/or demand for our poultry products; contamination of our products, which has previously and can in the future lead to product liability claims and product recalls; exposure to risks related to product liability, product recalls, property damage and injuries to persons, for which insurance coverage is expensive, limited and potentially inadequate; changes in laws or regulations affecting our operations or the application thereof; new immigration legislation or increased enforcement efforts in connection with existing immigration legislation that cause our costs of business to increase, cause us to change the way in which we do business or otherwise disrupt our operations; competitive factors and pricing pressures or the loss of one or more of our largest customers; currency exchange rate fluctuations, trade barriers, exchange controls, expropriation and other risks associated with foreign operations; disruptions in international markets and distribution channels; and the impact of uncertainties of litigation as well as other risks described herein and under “Risk Factors” in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”). Actual results could differ materially from those projected in these forward-looking statements as a result of these factors, among others, many of which are beyond our control. In making these statements, we are not undertaking, and specifically decline to undertake, any obligation to address or update each or any factor in future filings or communications regarding our business or results, and we are not undertaking to address how any of these factors may have caused changes to information contained in previous filings or communications. Although we have attempted to list comprehensively these important cautionary risk factors, we must caution investors and others that other factors may in the future prove to be important and affecting our business or results of operations. “EBITDA” is defined as net income (loss) plus interest, income taxes, depreciation and amortization. “Adjusted EBITDA” is defined as the sum of EBITDA plus restructuring charges, reorganization items and loss on early extinguishment of debt less net income attributable to noncontrolling interests. Our method of computation may or may not be comparable to other similarly titled measures used in filings with the SEC by other companies. See the consolidated statements of income and consolidated statements of cash flows included in our financial statements. EBITDA is presented because we believe it provides meaningful additional information concerning a company’s operating results and its ability to service long-term debt and to fund its growth, and we believe it is frequently used by securities analysts, investors and other interested parties, in addition to and not in lieu of results under U.S. Generally Accepted Accounting Principles (GAAP), to compare the performance of companies. We believe investors would be interested in our Adjusted EBITDA because this is how our management analyzes EBITDA. The Company also believes that Adjusted EBITDA, in combination with the Company's financial results calculated in accordance with GAAP, provides investors with additional perspective regarding the impact of certain significant items on EBITDA and facilitates a more direct comparison of its performance with its competitors. EBITDA and Adjusted EBITDA are not measurements of financial performance under GAAP and should not be considered as an alternative to cash flow from operating activities or as a measure of liquidity or an alternative to net income as indicators of our operating performance or any other measures of performance derived in accordance with GAAP. Cautionary Notes and Forward-Looking Statements

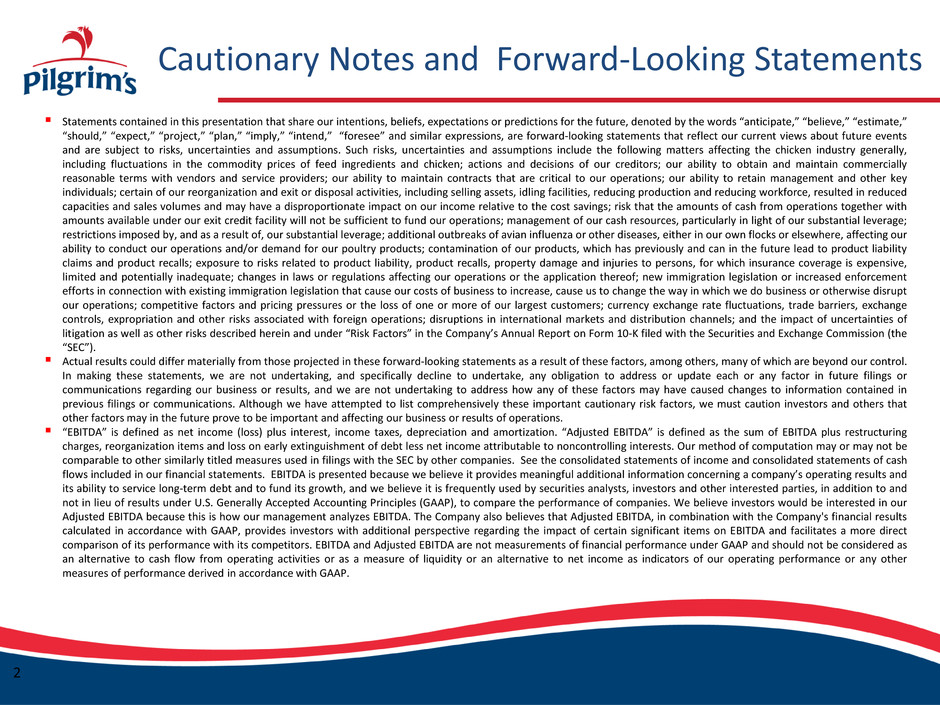

3 Broiler Hatcheries Showing Moderate Increase Source: USDA-WASDE 204,579 186,077 206,918 195,492 170,000 175,000 180,000 185,000 190,000 195,000 200,000 205,000 210,000 215,000 1/ 4 1/ 18 2/ 1 2/ 15 3/ 1 3/ 15 3/ 29 4/ 12 4/ 26 5/ 10 5/ 24 6/ 7 6/ 21 7/ 5 7/ 19 8/ 2 8/ 16 8/ 30 9/ 13 9/ 27 10 /1 1 10 /2 5 11 /8 11 /2 2 12 /6 12 /2 0 Th ou sa nd Eg g United States, Selected 19 Poultry Chicken, broiler Sets '09-'13 Range '12 '13 '14 '14 Est '09-'13 Avg

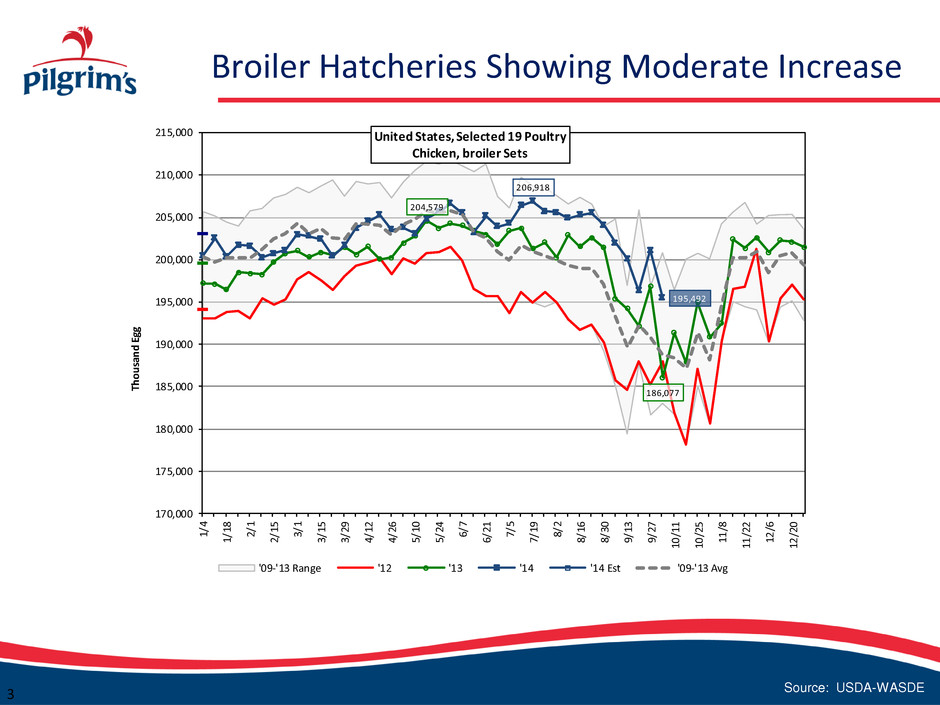

169,196 153,735 162,420 169,708 164,134 140,000 145,000 150,000 155,000 160,000 165,000 170,000 175,000 180,000 1/ 4 1/ 18 2/ 1 2/ 15 3/ 1 3/ 15 3/ 29 4/ 12 4/ 26 5/ 10 5/ 24 6/ 7 6/ 21 7/ 5 7/ 19 8/ 2 8/ 16 8/ 30 9/ 13 9/ 27 10 /1 1 10 /2 5 11 /8 11 /2 2 12 /6 12 /2 0 Th ou sa nd H ea d United States, Selected 19 Poultry Chicken, broiler Placed '09-'13 Range '12 '13 '14 '14 Est '09-'13 Avg Placements Impacted by Low Hatchability

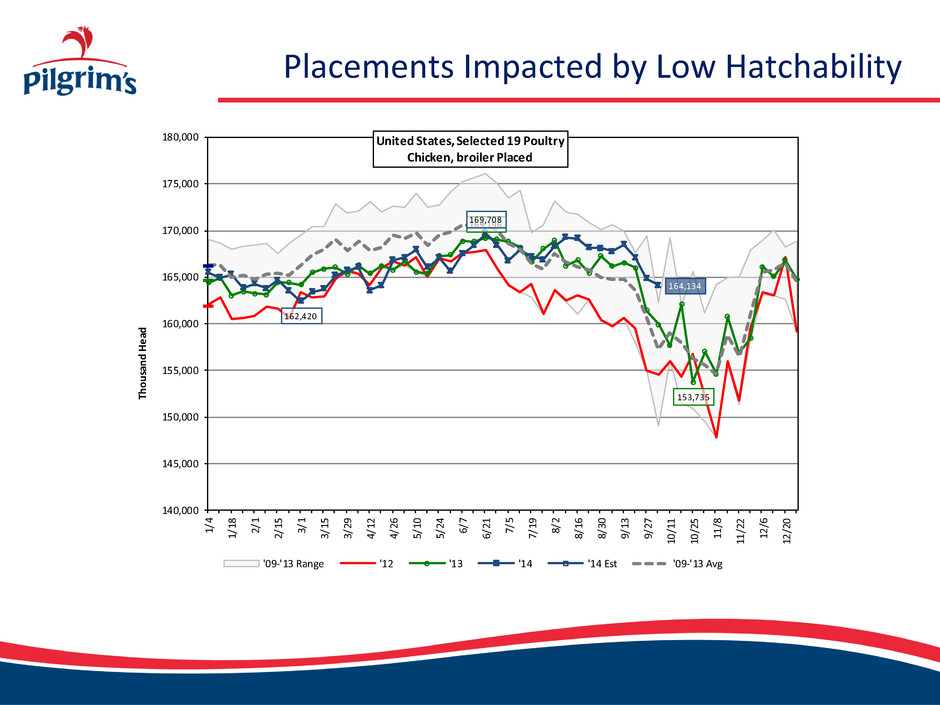

• Hatching layers in Sep are up 2% from 2013 while egg production was unchanged • Sep pullet placements were up 4% and YTD placements are up 2% Hatching Layers Up 2% from 2013

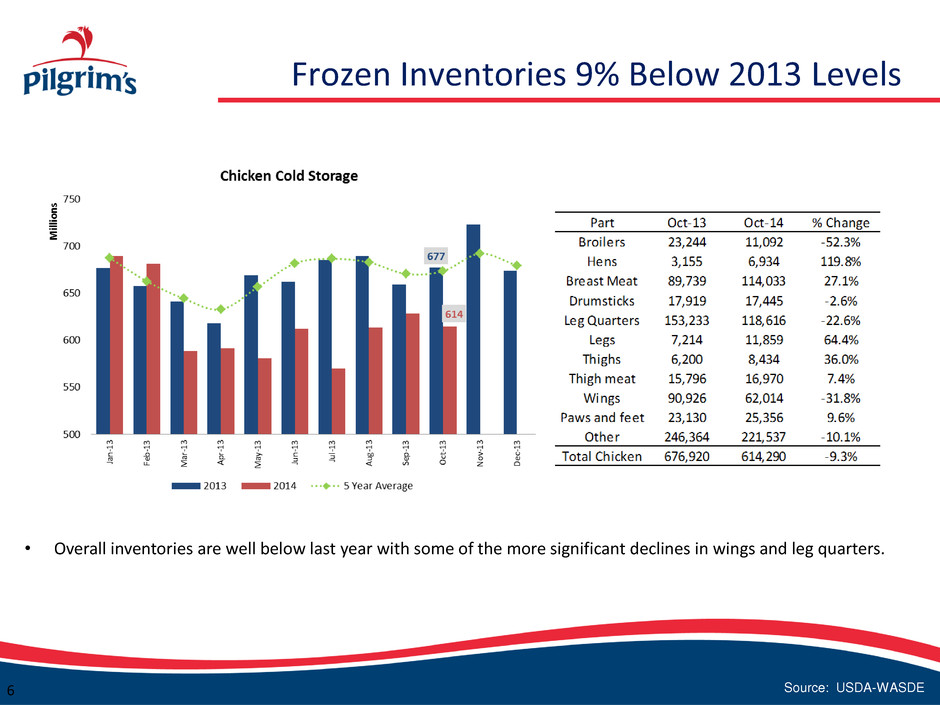

6 Frozen Inventories 9% Below 2013 Levels Source: USDA-WASDE • Overall inventories are well below last year with some of the more significant declines in wings and leg quarters.

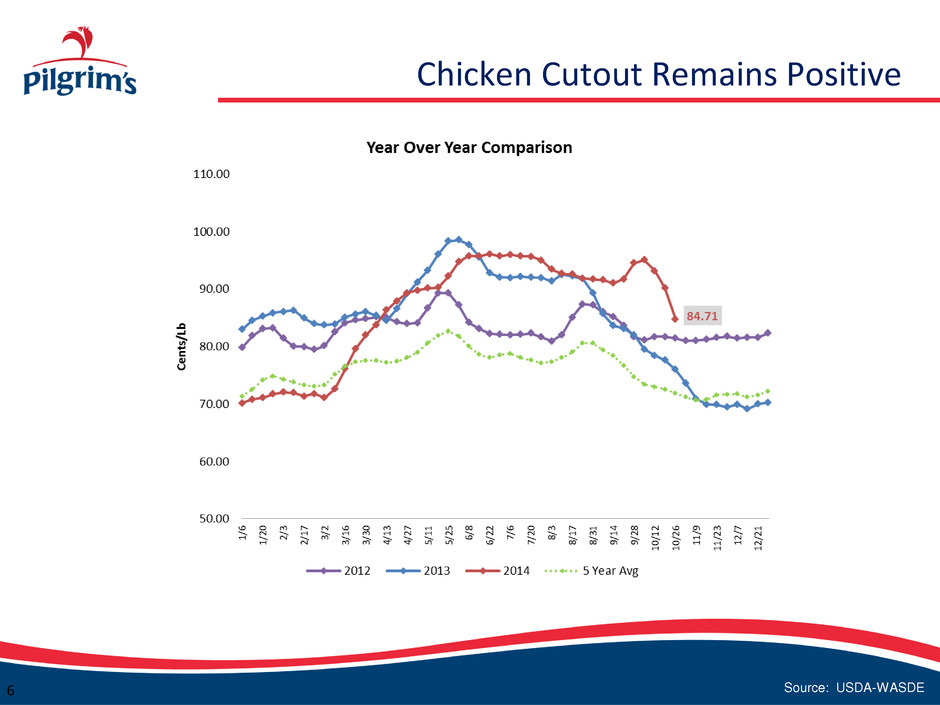

6 Chicken Cutout Remains Positive Source: USDA-WASDE

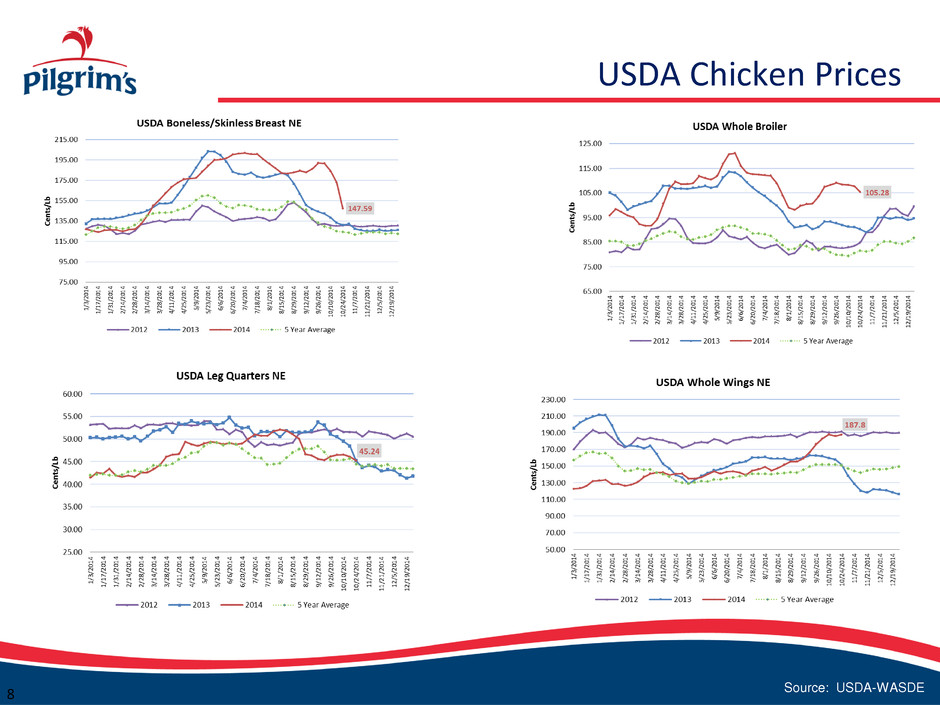

8 USDA Chicken Prices Source: USDA-WASDE

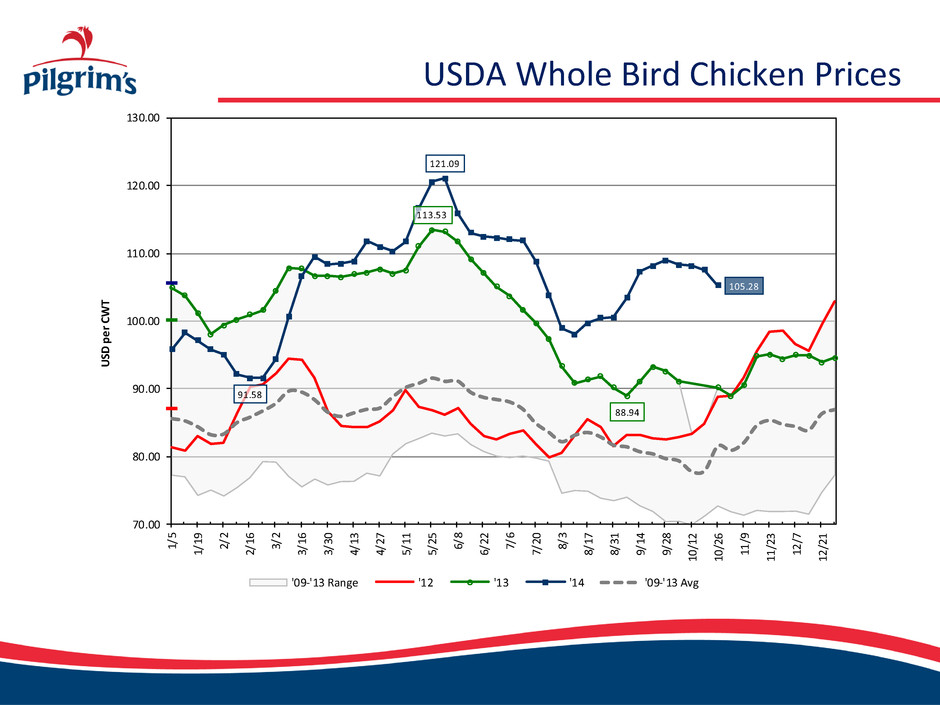

113.53 88.94 91.58 121.09 105.28 70.00 80.00 90.00 100.00 110.00 120.00 130.00 1/ 5 1/ 19 2/ 2 2/ 16 3/ 2 3/ 16 3/ 30 4/ 13 4/ 27 5/ 11 5/ 25 6/ 8 6/ 22 7/ 6 7/ 20 8/ 3 8/ 17 8/ 31 9/ 14 9/ 28 10 /1 2 10 /2 6 11 /9 11 /2 3 12 /7 12 /2 1 US D pe r C W T '09-'13 Range '12 '13 '14 '09-'13 Avg USDA Whole Bird Chicken Prices

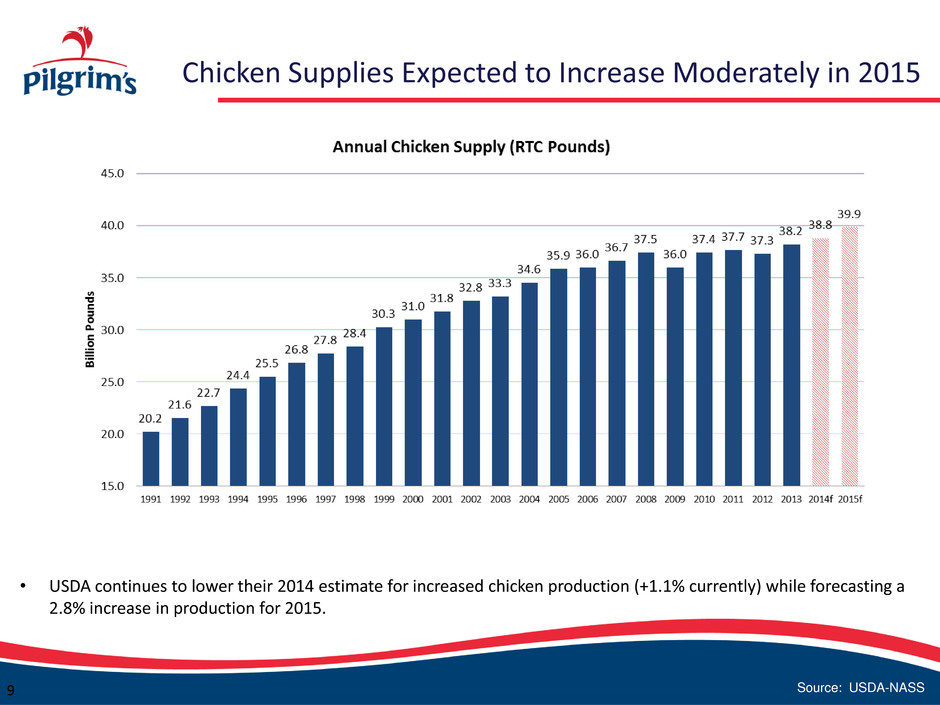

Chicken Supplies Expected to Increase Moderately in 2015 Source: USDA-NASS 9 • USDA continues to lower their 2014 estimate for increased chicken production (+1.1% currently) while forecasting a 2.8% increase in production for 2015.

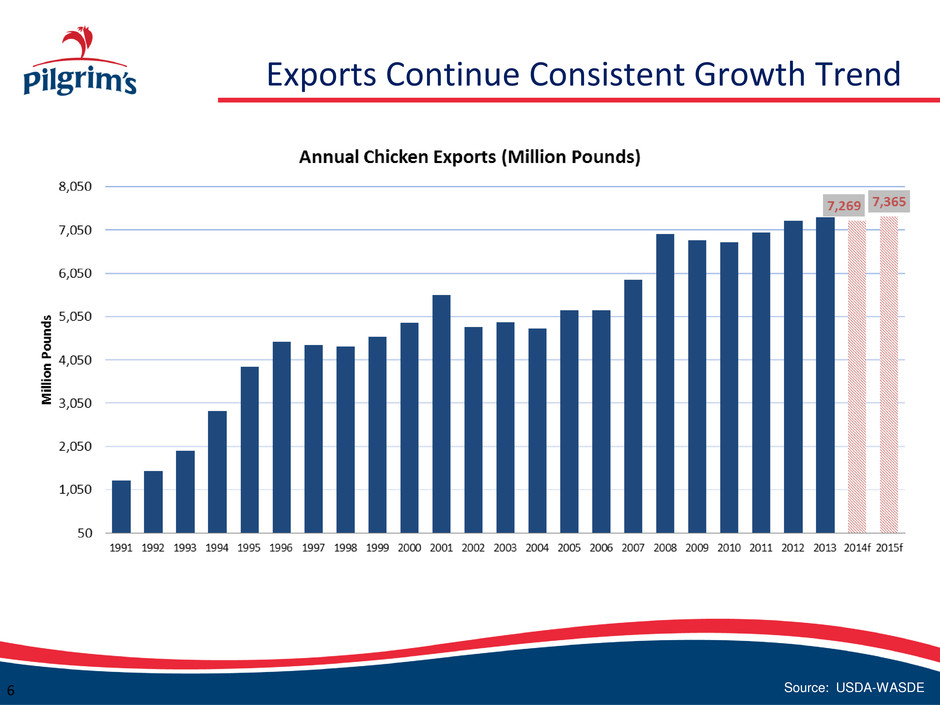

6 Exports Continue Consistent Growth Trend Source: USDA-WASDE

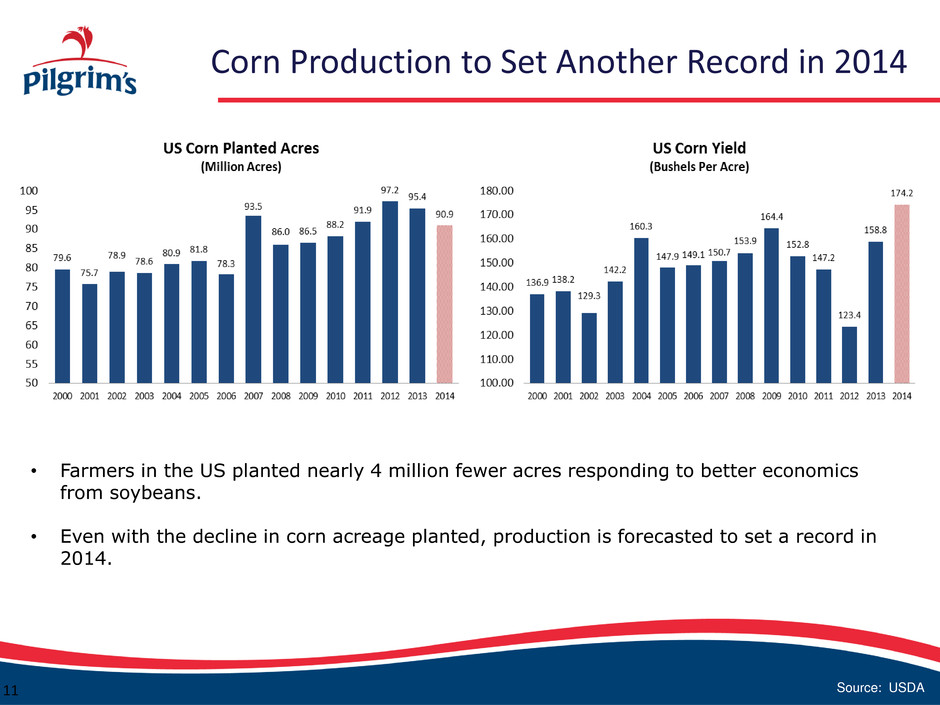

Corn Production to Set Another Record in 2014 Source: USDA 11 • Farmers in the US planted nearly 4 million fewer acres responding to better economics from soybeans. • Even with the decline in corn acreage planted, production is forecasted to set a record in 2014.

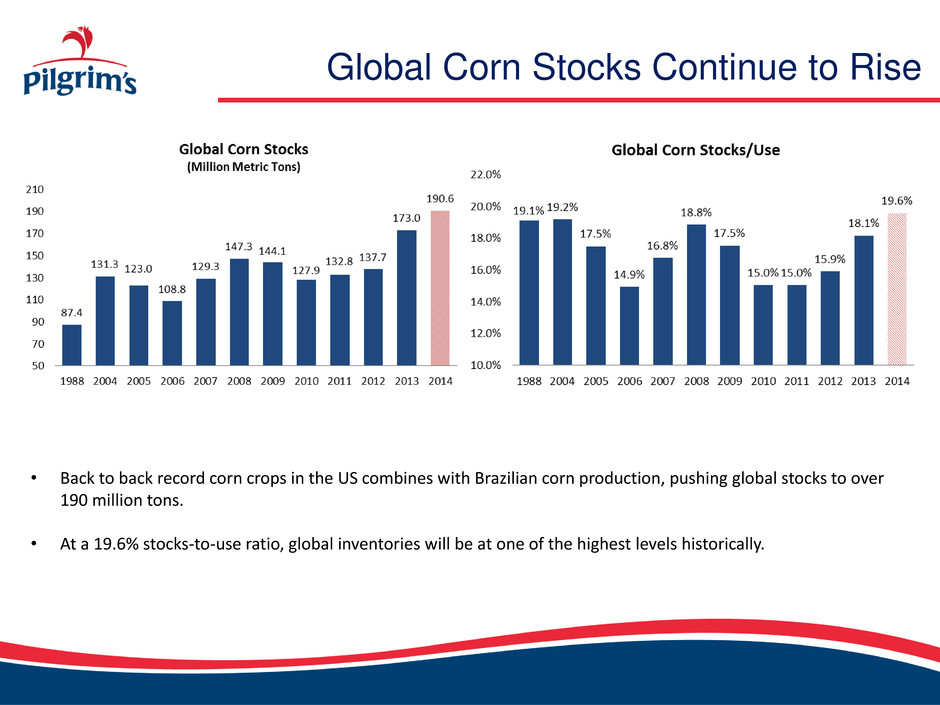

Global Corn Stocks Continue to Rise • Back to back record corn crops in the US combines with Brazilian corn production, pushing global stocks to over 190 million tons. • At a 19.6% stocks-to-use ratio, global inventories will be at one of the highest levels historically.

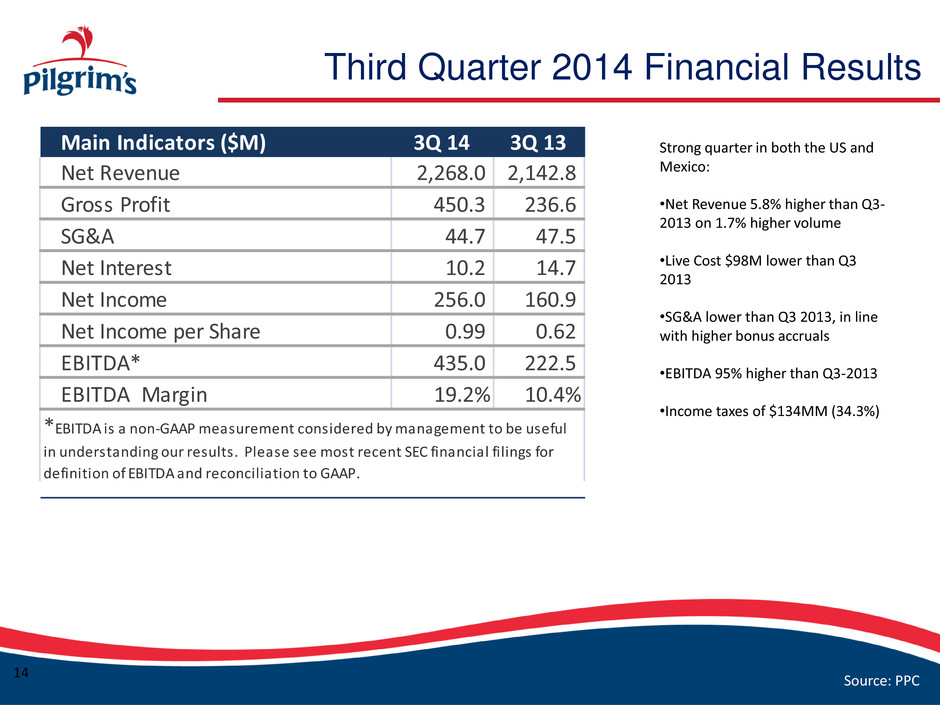

Third Quarter 2014 Financial Results 14 Source: PPC Main Indicators ($M) 3Q 14 3Q 13 Net Revenue 2,268.0 2,142.8 Gross Profit 450.3 236.6 SG&A 44.7 47.5 Net Interest 10.2 14.7 Net Income 256.0 160.9 Net Income per Share 0.99 0.62 EBITDA* 435.0 222.5 EBITDA Margin 19.2% 10.4% *EBITDA is a non-GAAP measurement considered by management to be useful in understanding our results. Please see most recent SEC financial filings for definition of EBITDA and reconciliation to GAAP. Strong quarter in both the US and Mexico: •Net Revenue 5.8% higher than Q3- 2013 on 1.7% higher volume •Live Cost $98M lower than Q3 2013 •SG&A lower than Q3 2013, in line with higher bonus accruals •EBITDA 95% higher than Q3-2013 •Income taxes of $134MM (34.3%)

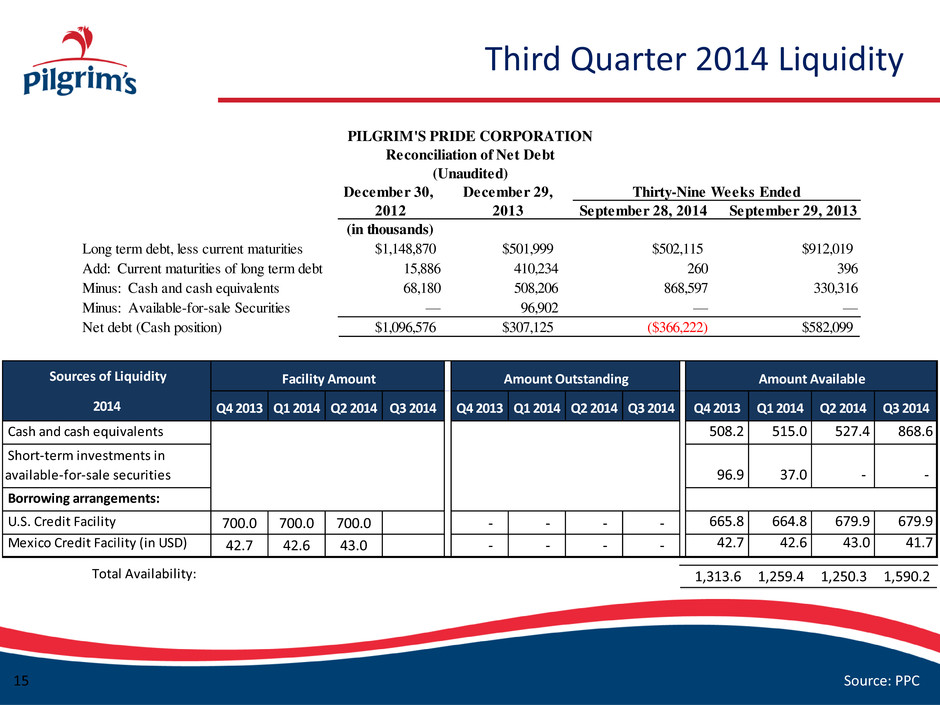

15 Third Quarter 2014 Liquidity Source: PPC Sources of Liquidity 2014 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Cash and cash equivalents 508.2 515.0 527.4 868.6 Short-term investments in available-for-sale securities 96.9 37.0 - - Borrowing arrangements: U.S. Credit Facility 700.0 700.0 700.0 - - - - 665.8 664.8 679.9 679.9 Mexico Credit Facility (in USD) 42.7 42.6 43.0 - - - - 42.7 42.6 43.0 41.7 Total Availability: 1,313.6 1,259.4 1,250.3 1,590.2 Facility Amount Amount Outstanding Amount Available December 30, December 29, 2012 2013 September 28, 2014 September 29, 2013 (in thousands) Long term debt, less current maturities $1,148,87 $501,999 $502,115 $912,019 Add: Current maturities of long term debt 15,886 410,234 260 396 Minus: Cash and cash equivalents 68,180 508,206 868,597 330,316 Minus: Available-for-sale Securities — 96,902 — — Net debt (Cash position) $1,096,576 $307,125 ($366,222) $582,099 Thirty-Nine Weeks Ended PILGRIM'S PRIDE CORPORATION Reconciliation of Net Debt (Unaudited)

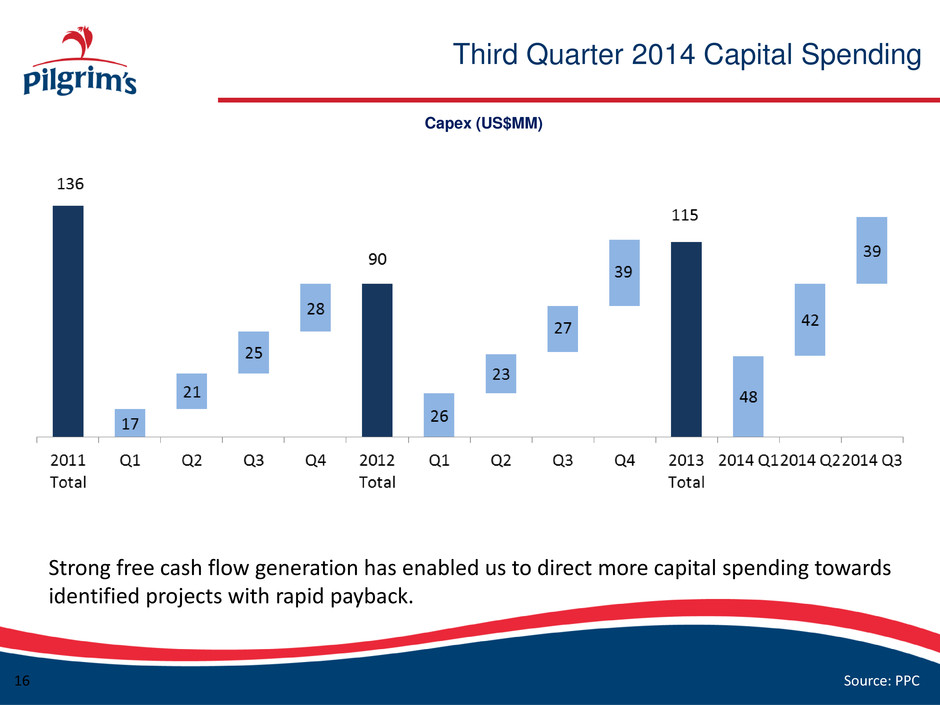

16 Third Quarter 2014 Capital Spending Capex (US$MM) Source: PPC Strong free cash flow generation has enabled us to direct more capital spending towards identified projects with rapid payback.

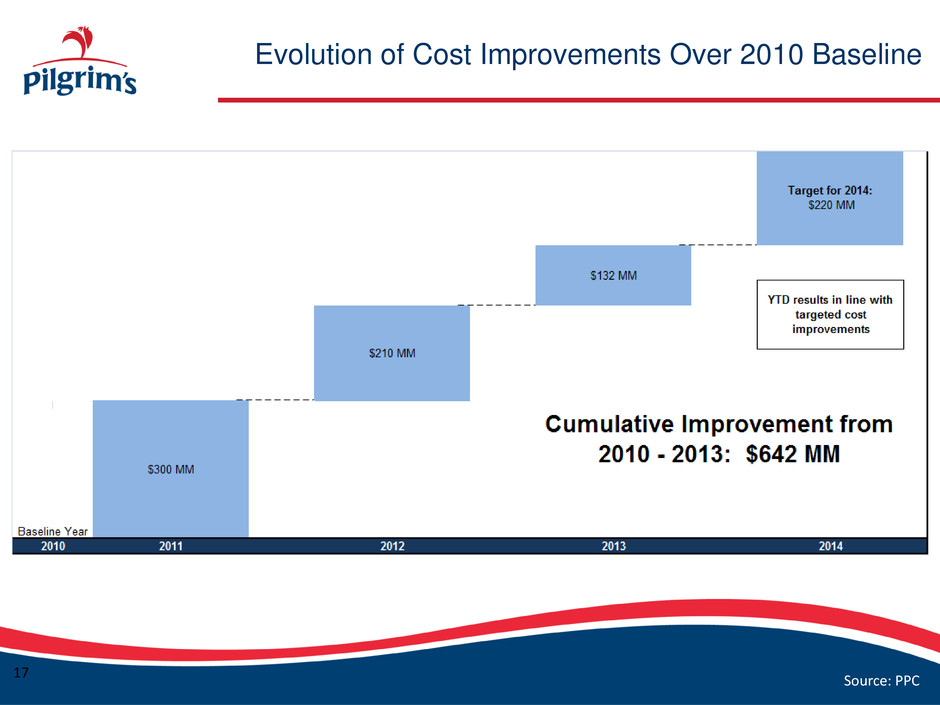

Evolution of Cost Improvements Over 2010 Baseline 17 Source: PPC

Investor Relations Contact 18 Investor Relations: E-mail: IRPPC@pilgrims.com Address: 1770 Promontory Circle Greeley, CO 80634 USA Website: www.pilgrims.com

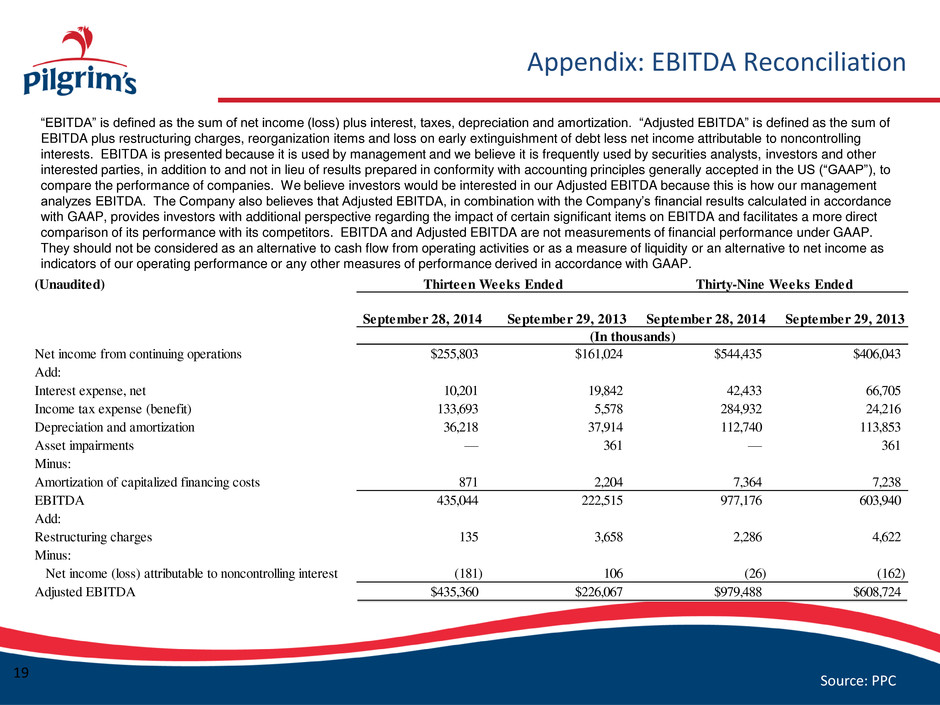

Appendix: EBITDA Reconciliation 19 “EBITDA” is defined as the sum of net income (loss) plus interest, taxes, depreciation and amortization. “Adjusted EBITDA” is defined as the sum of EBITDA plus restructuring charges, reorganization items and loss on early extinguishment of debt less net income attributable to noncontrolling interests. EBITDA is presented because it is used by management and we believe it is frequently used by securities analysts, investors and other interested parties, in addition to and not in lieu of results prepared in conformity with accounting principles generally accepted in the US (“GAAP”), to compare the performance of companies. We believe investors would be interested in our Adjusted EBITDA because this is how our management analyzes EBITDA. The Company also believes that Adjusted EBITDA, in combination with the Company’s financial results calculated in accordance with GAAP, provides investors with additional perspective regarding the impact of certain significant items on EBITDA and facilitates a more direct comparison of its performance with its competitors. EBITDA and Adjusted EBITDA are not measurements of financial performance under GAAP. They should not be considered as an alternative to cash flow from operating activities or as a measure of liquidity or an alternative to net income as indicators of our operating performance or any other measures of performance derived in accordance with GAAP. Source: PPC (Unaudited) September 28, 2014 September 29, 2013 September 28, 2014 September 29, 2013 Net income from continuing operations $255,803 $161,024 $544,435 $406,043 Add: Interest expense, net 10,201 19,842 42,433 66,705 Income tax expense (benefit) 133,693 5,578 284,932 24,216 Depreciation and amortization 36,218 37,914 112,740 113,853 Asset impairments — 361 — 361 Minus: tizatio f capitalized financing costs 871 2,204 7,364 7,238 EBIT A 435,044 222,515 977,176 603,940 Add: Restructuring charges 135 3,658 2,286 4,622 Minus: Net income (loss) attributable to noncontrolling interest (181) 106 (26) (162) Adjusted EBITDA $435,360 $226,067 $979,488 $608,724 Thirty-Nine Weeks Ended (In thousands) Thirteen Weeks Ended

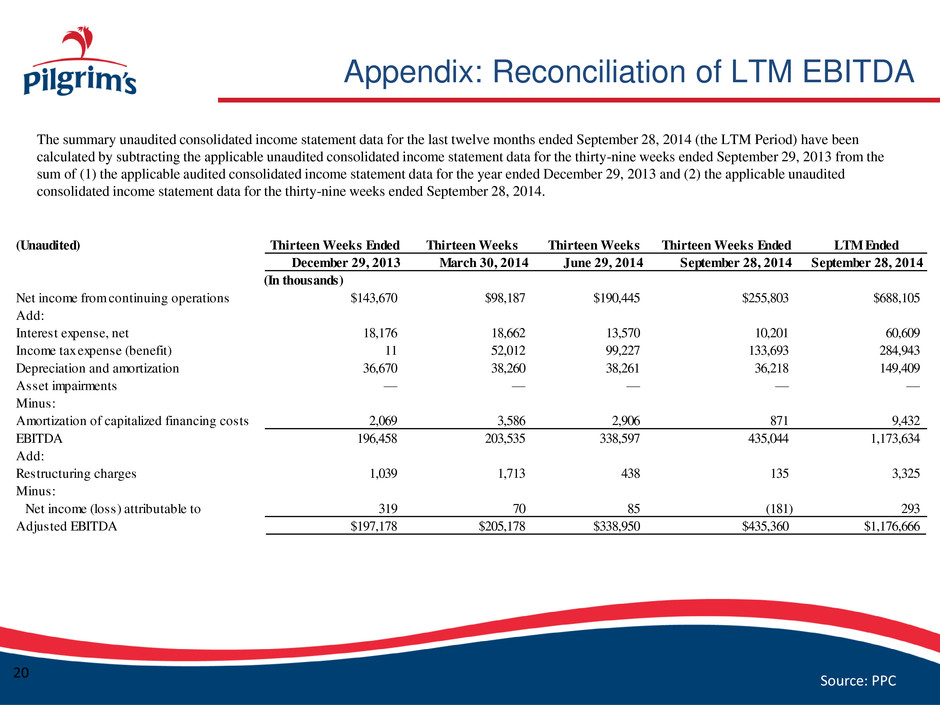

Appendix: Reconciliation of LTM EBITDA 20 Source: PPC The summary unaudited consolidated income statement data for the last twelve months ended September 28, 2014 (the LTM Period) have been calculated by subtracting the applicable unaudited consolidated income statement data for the thirty-nine weeks ended September 29, 2013 from the sum of (1) the applicable audited consolidated income statement data for the year ended December 29, 2013 and (2) the applicable unaudited consolidated income statement data for the thirty-nine weeks ended September 28, 2014. (Unaudited) Thirteen Weeks Ended Thirteen Weeks Thirteen Weeks Thirteen Weeks Ended LTM Ended December 29, 2013 March 30, 2014 June 29, 2014 September 28, 2014 September 28, 2014 (In thousands) Net income from continuing operations $143,670 $98,187 $190,445 $255,803 $688,105 Add: Interest expense, net 18,176 18,662 13,570 10,201 60,609 Income tax expense (benefit) 11 52,012 99,227 133,693 284,943 Depreciation and amortization 36,670 38,260 38,261 36,218 149,409 Asset impa rments — — — — — M u : A o tization of capitalized financing costs 2,069 3,586 2,906 871 9,432 EBITDA 196,458 203,535 338,597 435,044 1,173,634 Add: Restructuring charges 1,039 1,713 438 135 3,325 Minus: Net income (loss) attributable to 319 70 85 (181) 293 Adjusted EBITDA $197,178 $205,178 $338,950 $435,360 $1,176,666

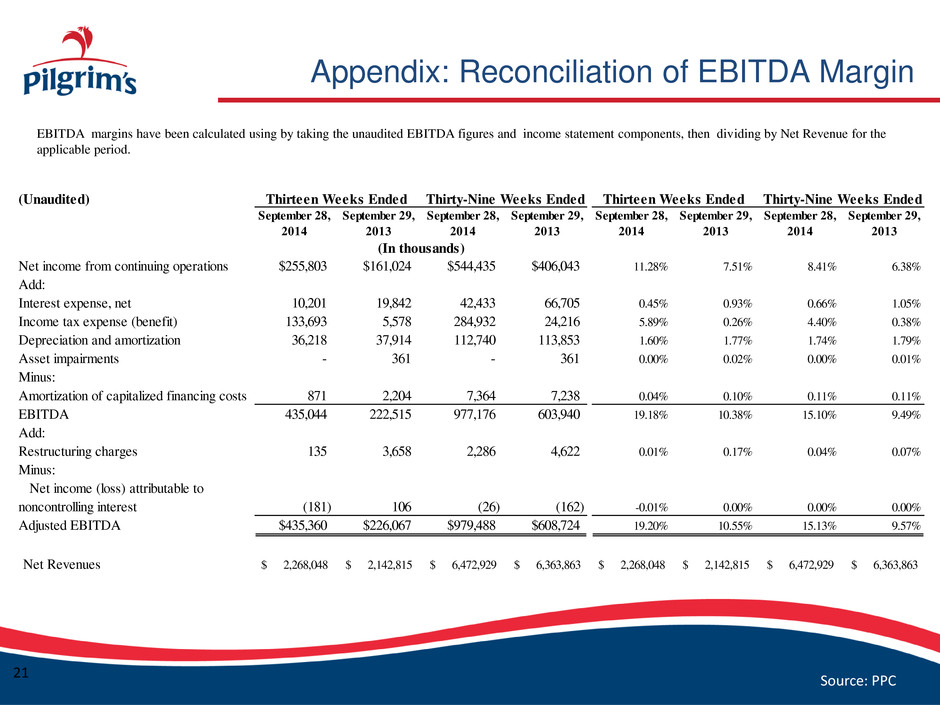

Appendix: Reconciliation of EBITDA Margin 21 Source: PPC EBITDA margins have been calculated using by taking the unaudited EBITDA figures and income statement components, then dividing by Net Revenue for the applicable period. (Unaudited) September 28, September 29, September 28, September 29, September 28, September 29, September 28, September 29, 2014 2013 2014 2013 2014 2013 2014 2013 Net income from continuing operations $255,803 $161,024 $544,435 $406,043 11.28% 7.51% 8.41% 6.38% Add: Interest expense, net 10,201 19,842 42,433 66,705 0.45% 0.93% 0.66% 1.05% Income tax expense (benefit) 133,693 5,578 284,932 24,216 5.89% 0.26% 4.40% 0.38% Depreciation and amortization 36,218 37,914 112,740 113,853 1.60% 1.77% 1.74% 1.79% Asset impairments - 361 - 361 0.00% 0.02% 0.00% 0.01% Minus: Amortization of capitalized financing costs 871 2,204 7,364 7,238 0.04% 0.10% 0.11% 0.11% EBITDA 435,044 222,515 977,176 603,940 19.18% 10.38% 15.10% 9.49% Add: Restructuring charges 135 3,658 2,286 4,622 0.01% 0.17% 0.04% 0.07% Mi s: Net income (loss) attributable to noncontrolling interest (181) 106 (26) (162) -0.01% 0.00% 0.00% 0.00% Adjusted EBITDA $435,360 $226,067 $979,488 $608,724 19.20% 10.55% 15.13% 9.57% Net Revenues 2,268,048$ 2,142,815$ 6,472,929$ 6,363,863$ 2,268,048$ 2,142,815$ 6,472,929$ 6,363,863$ Thirty-Nine Weeks EndedThirty-Nine Weeks EndedThirteen Weeks Ended Thirteen Weeks Ended (In thousands)

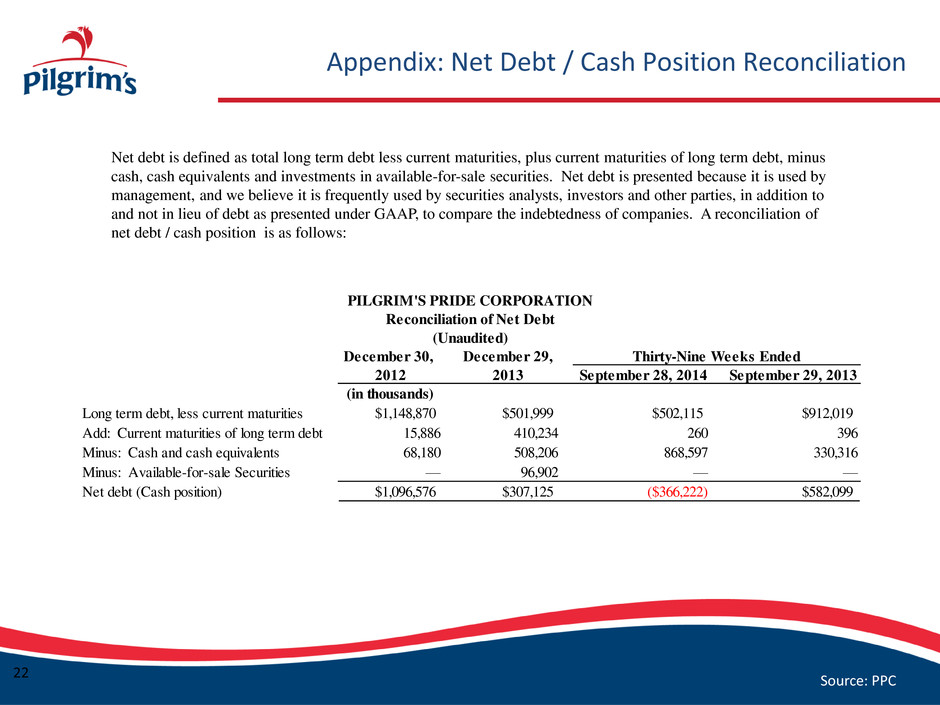

Appendix: Net Debt / Cash Position Reconciliation 22 Source: PPC Net debt is defined as total long term debt less current maturities, plus current maturities of long term debt, minus cash, cash equivalents and investments in available-for-sale securities. Net debt is presented because it is used by management, and we believe it is frequently used by securities analysts, investors and other parties, in addition to and not in lieu of debt as presented under GAAP, to compare the indebtedness of companies. A reconciliation of net debt / cash position is as follows: December 30, December 29, 2012 2013 September 28, 2014 September 29, 2013 (in thousands) Long term debt, less current maturities $1,148,870 $501,999 $502,115 $912,019 Add: Current maturities of long term debt 15,886 410,234 260 396 Minus: Cash and cash equivalents 68,180 508,206 868,597 330,316 Minus: Available-for-sale Securities — 96,902 — — Net debt (Cash position) $1,096,576 $307,125 ($366,222) $582,099 Thirty-Nine Weeks Ended PILGRIM'S PRIDE CORPORATION Reconciliation of Net Debt (Unaudited)