Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DIXIE GROUP INC | f8koctinvestorpres.htm |

October 2014 Investor Presentation Contact: Jon Faulkner CFO The Dixie Group Phone: 706-876-5814 jon.faulkner@dixiegroup.com Exhibit 99.1

• Statements in this presentation which relate to the future, are subject to risk factors and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements. Such factors include the levels of demand for the products produced by the Company. Other factors that could affect the Company’s results include, but are not limited to, raw material and transportation costs related to petroleum prices, the cost and availability of capital, and general economic and competitive conditions related to the Company’s business. Issues related to the availability and price of energy may adversely affect the Company’s operations. Additional information regarding these and other factors and uncertainties may be found in the Company’s filings with the Securities and Exchange Commission. • General information set forth in this presentation concerning market conditions, sales data and trends in the U.S. carpet and rug markets are derived from various public and, in some cases, non-public sources. Although we believe such data and information to be accurate, we have not attempted to independently verify such information. 2 Forward Looking Statements The Dixie Group, Inc.

• 1920 Began as Dixie Mercerizing in Chattanooga, TN • 1990’s Transitioned from textiles to floorcovering • 2003 Refined focus on upper- end floorcovering market • 2003 Launched Dixie Home - upper end residential line • 2005 Launched modular tile carpet line – new product category • 2007 Launched wool products in Masland and Fabrica – hi end designs • 2010 Residential “soft products” growth strategy • 2012 New Masland Contract management – performance tile strategy • 2012 Purchased Colormaster dye house – lower cost • 2012 Purchased Crown rugs – wool rugs • 2013 Purchased Robertex - wool carpet mill • 2014 Created Desso Masland Hospitality joint venture • 2014 Purchased Atlas Carpet Mills – high end commercial business • 2014 Purchased Burtco - computerized yarn placement for hospitality 3 Dixie History

Dixie Today • Commitment to brands in the upper- end market with strong growth potential • Diversified between Commercial and Residential markets • Diversified customer base (TTM Basis, excludes Atlas) – Top 10 carpet customers • 15% of sales – Top 20 carpet customers • 18% of sales 4

New and Existing Home Sales Seasonally Adjusted Annual Rate New 1,000 Existing 1,000 Source: National Association of Realtors (existing) and census.gov/const/c25 (new). 5 3,000 3,500 4,000 4,500 5,000 5,500 250 300 350 400 450 500 550 600 Jan '10 July Jan '11 July Jan '12 July Jan '13 Jul Jan '14 • “Low interest rates and price gains holding steady led to September’s healthy increase, even with investor activity remaining on par with last month’s marked decline, • “Traditional buyers are entering a less competitive market with fewer investors searching for available homes, but may also face a slight decline in choices due to the fact that inventory generally falls heading into the winter.” Lawrence Yun, Chief Economist National Association of Realtors October 21, 2014

6 Residential Remodeling Harvard Study Leading Indicator of Remodeling Activity

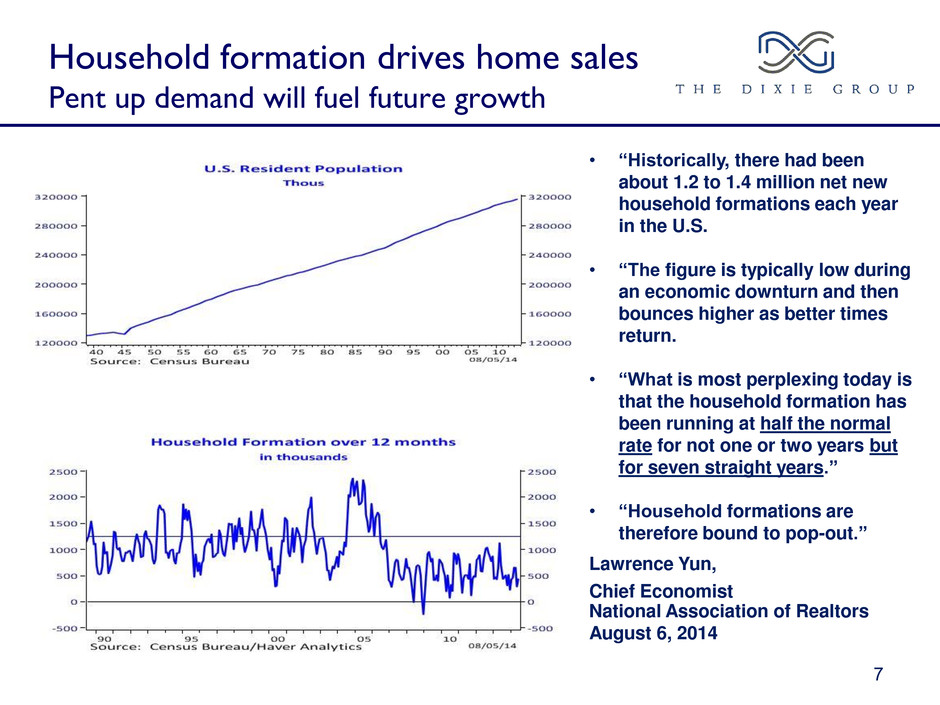

7 Household formation drives home sales Pent up demand will fuel future growth • “Historically, there had been about 1.2 to 1.4 million net new household formations each year in the U.S. • “The figure is typically low during an economic downturn and then bounces higher as better times return. • “What is most perplexing today is that the household formation has been running at half the normal rate for not one or two years but for seven straight years.” • “Household formations are therefore bound to pop-out.” Lawrence Yun, Chief Economist National Association of Realtors August 6, 2014

Residential and Commercial Fixed Investment 8 Rebound in residential activity Rebound in commercial activity 2014 has shown a strong rebound in growth; We expect 2015 to continue this trend

9 Consumer Sentiment Conference Board September 2014: “Consumer confidence retreated in September after four consecutive months of improvement. “A less positive assessment of the current job market …. was the sole reason for the decline in consumers’ assessment of present-day conditions. “All told, consumers expect economic growth to ease in the months ahead.” Lynn Franco, Director of The Conference Board Consumer Research Center 1966 = 100

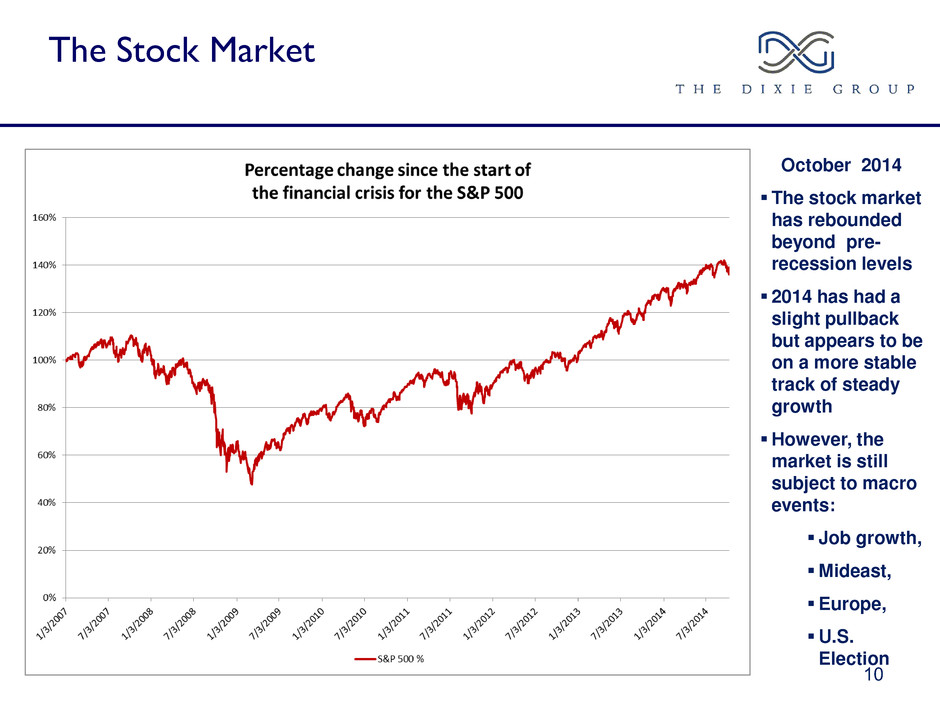

The Stock Market 10 October 2014 The stock market has rebounded beyond pre- recession levels 2014 has had a slight pullback but appears to be on a more stable track of steady growth However, the market is still subject to macro events: Job growth, Mideast, Europe, U.S. Election

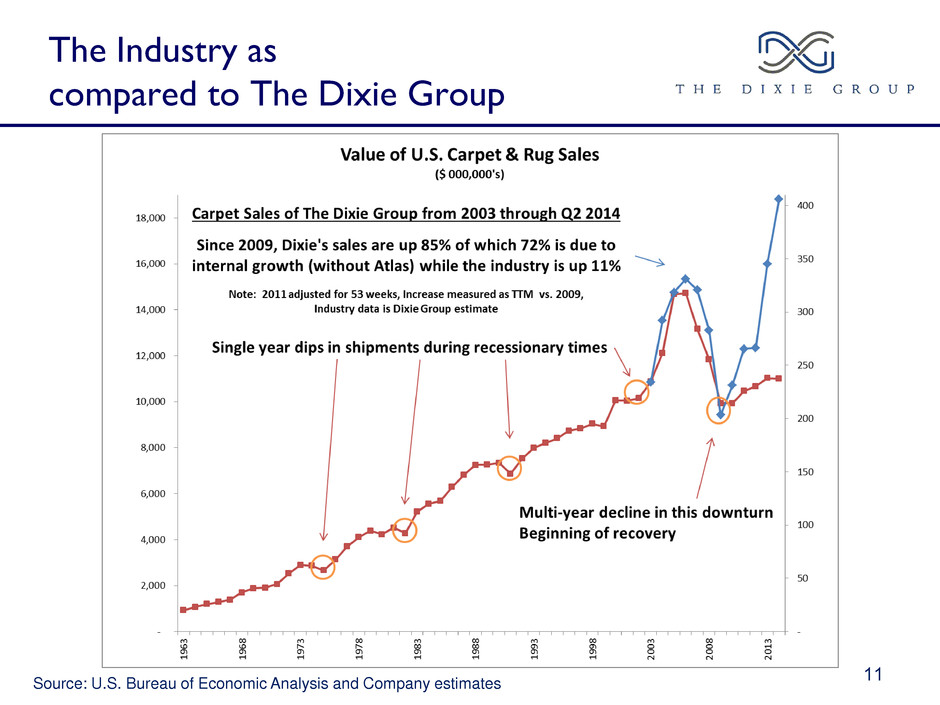

The Industry as compared to The Dixie Group 11 Source: U.S. Bureau of Economic Analysis and Company estimates

2013 U.S. Carpet & Rug Manufacturers 12 Source: Floor Focus – includes carpet as broadloom and modular tile, and rug sales Carpet Leaders Dollars in Millions % Total Shaw (Berkshire Hathaway) $ 3,110 27.7% Residential & Commercial Mohawk (MHK) $ 2,521 22.4% Residential & Commercial Beaulieu (Private) $ 625 5.6% Residential & Commercial Interface (TILE) $ 459 4.1% Commercial Only Engineered Floors (Private) $ 385 3.4% Residential Only Dixie (DXYN) $ 342 3.0% Residential & Commercial Other $ 3,806 33.8% Residential & Commercial Market $ 11,248 100.0%

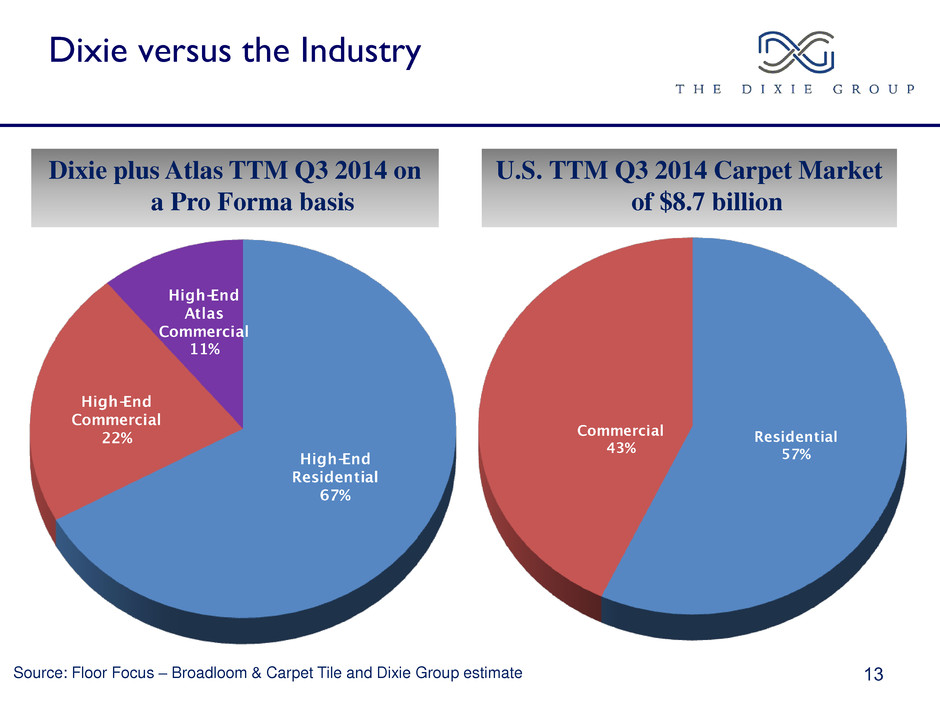

U.S. TTM Q3 2014 Carpet Market of $8.7 billion 13 Source: Floor Focus – Broadloom & Carpet Tile and Dixie Group estimate Dixie versus the Industry Dixie plus Atlas TTM Q3 2014 on a Pro Forma basis

Carpet Dollar Sales Indexed to 2009 (includes Atlas Carpet Mills from date of acquisition) 14

Carpet Unit Sales Indexed to 2009 (includes Atlas Carpet Mills from date of acquisition) 15

Industry Positioning The Dixie Group 16 • Strategically our residential and commercial businesses are driven by our relationship to the upper-end consumer and the design community • This leads us to: – Have a sales force that is attuned to design and customer solutions – Be a “product driven company” with emphasis on the most beautiful and up to date styling and design – Be quality focused with excellent reputation for building excellent products and standing behind what we make – And, unlike much of the industry, not manufacturing driven

Residential Market Positioning The Dixie Group 17 BROADLOOM RESIDENTIAL SALES = $7.0 Billion (2012 $’s) T O T A L M A R K E T : S QUA R E Y A R DS OR S AL E S DO L L A R S ESTIMATED TOTAL WHOLESALE MARKET FOR CARPETS AND RUGS: VOLUME AND PRICE POINTS Positioning of Dixie Brands by Price Point Segment (Over $20 per SQ YD) Dixie Home Fabrica INDUSTRY AVERAGE PRICE/ SQ YD $0 $14 $21 $28 $35 $42 $49 Note: Industry average price is based on sales reported through industry sources. Excerpt from KSA Study dated May 2004, Titled "KSA Assessment of Dixie's Residential and Contract Carpet Businesses", commissioned by The Dixie Group, Inc. $8 Masland LARGEST NATIONAL SUPPLIER IN THE UPPER END OF THE SOFT FLOOR COVERING MARKET

Dixie Group High-End Residential Sales All Brands 18 Sales by Brand for TTM Q3 2014

Dixie Group High-End Residential Sales All Brands 19 Sales by Channel for TTM Q3 2014

• Well-styled moderate to upper priced residential broadloom line – Known for differentiated pattern and color selection • Dixie provides a “full line” to retailers – Sells Specialty and Mass Merchant retailers • Growth initiatives – Stainmaster® Tru Soft TM Fiber Technology – Stainmaster® SolarMax ® Fiber Technology – Durasilk Polyester 20

• Leading high-end brand with reputation for innovative styling, design and color • High-end retail / designer driven – Approximately 27% of sales directly involve a designer • Hand crafted and imported rugs • Growth initiative – Stainmaster® TruSoft™ Fiber Technology – Wool products in both tufted and woven constructions 21

• Premium high-end brand – “Quality without Compromise” • Designer focused – Approximately 39% of sales directly involve a designer • Hand crafted and imported rugs • Growth initiatives – Stainmaster® TruSoft™ Fiber Technology – Fabrica Permaset dyeing process “unlimited color selection in wool” 22

Commercial Market Positioning The Dixie Group 23 • We focus on the “high end specified soft floorcovering contract market” – Our Masland Contract brand • Broad product line for diverse commercial markets – Our Atlas brand • Designer driven focused on the fashion oriented market space – Our Avant brand • Corporate focus using a multi- line sales agent based model – Our Masland Residential sales force • Sells “main street commercial” through retailers

• Premium brand in the specified commercial marketplace – Corporate, End User, Store Planning, Hospitality, Health Care, Government and Education markets • Designer focused • Strong national account base – Delta Air Lines, Best Buy, Club Corp • Growth initiative – SPEAK and FIT collections – Desso Air Master product line – Desso Masland Hospitality joint venture 24

25 Sales by Channel for TTM Q3 2014 Channels: Interior Design Specifier and Commercial End User

• Atlas is our newest brand • Dedicated to servicing the architect and designer for finer goods • Focus is on the corporate market through high fashion broadloom and modular carpet tile offerings • With state-of-the-art tufting machines Atlas can quickly manufacture custom running line products 26

• Avant is a forward thinking brand that has an Artisan’s theme • Dedicated to servicing the designer through the multi-line interior finishes sales agent • Focus is on the corporate market through high fashion broadloom and modular carpet tile offerings 27

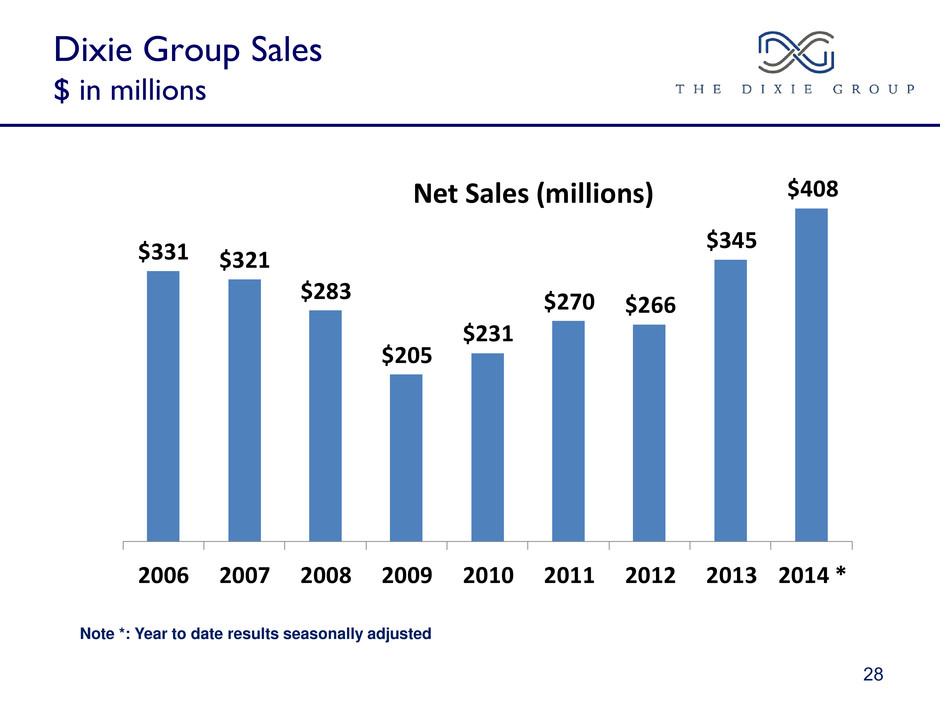

$331 $321 $283 $205 $231 $270 $266 $345 $408 2006 2007 2008 2009 2010 2011 2012 2013 2014 * Net Sales (millions) 28 Dixie Group Sales $ in millions Note *: Year to date results seasonally adjusted

Sales & Operating Income $ in millions 29 Note: Non-GAAP reconciliation starting on slide 34 Y 2007 Y 2008 Y 2009 Y 2010 Y 2011 Y 2012 Y 2013 YTD 2014 Net Sales 320.8 283 203 231 270 266 345 303 Net Income (Loss) 6.2 (31.5) (42.2) (4.7) 1.0 (0.9) 5.3 3.6 Non-GAAP Adjusted Op. Income 16.7 (28.5) (45.4) (2.6) 5.7 3.5 16.1 4.6 Non-GAAP Adjusted EBITDA 29.7 15.5 5.3 10.3 14.5 13.2 26.3 14.3 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Net Sales 71.1 75.4 83.6 90.2 95.8 85.3 108.2 109.4 Net Income (Loss) (0.4) 0.6 1.6 1.4 1.6 4.4 (0.6) (0.2) Non-GAAP Adjusted Op. Income 1.3 3.1 4.7 4.6 3.7 (1.1) 2.7 3.1 Non-GAAP Adjusted EBITDA 3.5 5.7 7.2 7.3 6.1 1.9 6.0 6.5 Change Year overe Year Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Net Sales 5.8 12.6 17.1 24.4 24.7 9.9 24.6 19.1 Net Sales % Change 9% 20% 26% 37% 35% 13% 29% 21%

- Operationally we continue to create advantages for the future: - Our sales growth residentially significantly exceeded the marketplace - We are well along in the integration of Atlas Carpet Mills - Purchased Burtco enhancing our position in the hospitality market - We are implementing our restructuring projects - The Adairsville distribution center is over 75% transitioned - The Atlas dye house has been shut down and sold - The Susan Street dye house is installing additional dye equipment - We shut down Atmore yarn & carpet dye houses and moved production to other facilities and suppliers - We shut down our Atmore yarn dye house in August • Commercial product sales increased 1.0% versus prior year, ex. Atlas • Residential product sales increased 9.8% versus prior year 30 Current Business Conditions Third quarter 2014 activity

31 Current Business Conditions 2014 Initiatives • We are consolidating our east coast distribution facilities and dyeing operations in 2014 & 15 to expand capacity, lower costs and reduce excess freight and waste • We are consolidating our west coast dye houses in 2014 to lower cost and improve utilization • We have launched the Desso collection of health and welfare product collections to the U.S. market under an exclusive distribution agreement • We have launched a joint venture with Desso to service the hospitality marketplace with a combined woven / CYP / tufted offering • We acquired Atlas Carpet Mills, a premium supplier to the specified commercial marketplace • We purchased Burtco to offer custom computerized yarn placement (CYP) product offering to the hospitality market

Outlook for 2014 and 2015 The housing & commercial markets are still growing: • Our upper-end residential market is continuing its momentum Masland and Fabrica Wool growth opportunities New Stainmaster® PetProtect™ and TruSoft™ products Stainmaster ® partnership to expand retail coverage • Commercial market is forecasted to improve (AIA forecast) Hospitality is an area of particular strength over the coming years Desso Masland hospitality joint has built sales momentum for 2015 Positive reception to our hospitality CYP offering from Burtco Atlas introducing products using new technology to drive growth Masland Contract expanded modular tile collections • Expanding and leveraging our residential and commercial sales forces • Internal operations will soon reap the benefits of our restructuring 32

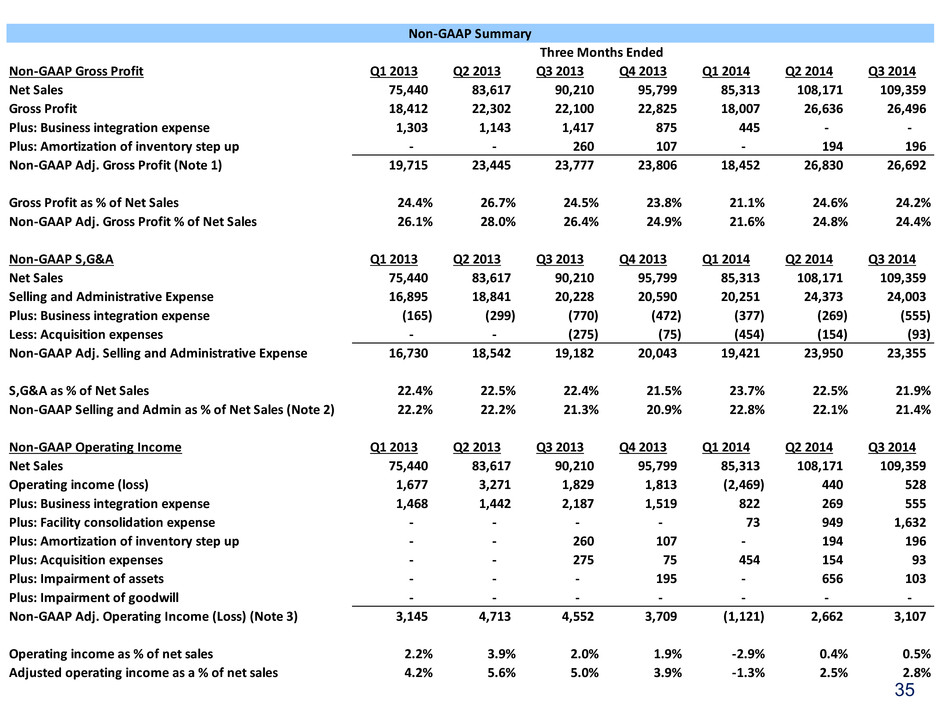

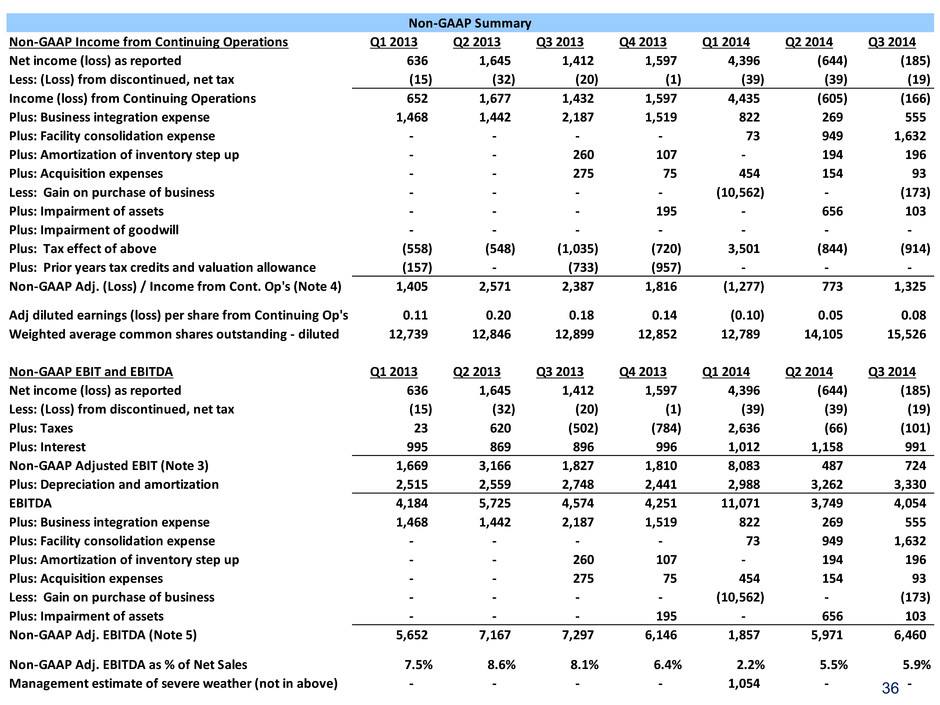

Non-GAAP Information 34 The Company believes that non-GAAP performance measures, which management uses in evaluating the Company's business, may provide users of the Company's financial information with additional meaningful bases for comparing the Company's current results and results in a prior period, as these measures reflect factors that are unique to one period relative to the comparable period. However, the non-GAAP performance measures should be viewed in addition to, not as an alternative for, the Company's reported results under accounting principles generally accepted in the United States. In considering our supplemental financial measures, investors should bear in mind that other companies that report or describe similarly titled financial measures may calculate them differently. Accordingly, investors should exercise appropriate caution in comparing our supplemental financial measures to similarly titled financial measures report by other companies. The Company defines Adjusted Gross Profit as Gross Profit plus manufacturing integration expenses of new or expanded operations, plus acquisition expense related to the fair value write-up of inventories, plus one-time items so defined. (Note 1) The Company defines Adjusted S,G&A as S,G&A less manufacturing integration expenses and direct acquisition expenses included in S,G&A, less one-time items so defined. (Note 2) The Company defines Adjusted Operating Income (Loss) as Operating Income (Loss) plus manufacturing integration expenses of new or expanded operations, plus acquisition expense related to the fair value write-up of inventories, plus facility consolidation and severance expenses, plus direct acquisition expenses, plus impairment of assets, plus impairment of goodwill, plus one-time items so defined. (Note 3) The Company defines Adjusted Income (Loss) from Continuing Operations as Net Income (Loss) plus loss from discontinued operations net of tax, plus manufacturing integration expenses of new or expanded operations, plus facility consolidation and severance expenses, plus acquisition expense related to the fair value write-up of inventories, plus direct acquisition expenses, plus impairment of assets, plus impairment of goodwill, plus one-time items so defined, all tax effected. (Note 4) The Company defines Adjusted EBIT as Net Income (Loss) plus taxes and plus interest. The Company defines Adjusted EBITDA as Adjusted EBIT plus depreciation and amortization, plus manufacturing in integration expenses of new or expanded operations, plus facility consolidation and severance expenses, plus acquisition expense related to the fair value write-up of inventories, plus direct acquisition expenses, plus impairment of assets, plus impairment of goodwill, plus one-time items so defined. (Note 5)

Non-GAAP Gross Profit Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Net Sales 75,440 83,617 90,210 95,799 85,313 108,171 109,359 Gross Profit 18,412 22,302 22,100 22,825 18,007 26,636 26,496 Plus: Business integration expense 1,303 1,143 1,417 875 445 - - Plus: Amortization of inventory step up - - 260 107 - 194 196 Non-GAAP Adj. Gross Profit (Note 1) 19,715 23,445 23,777 23,806 18,452 26,830 26,692 Gross Profit as % of Net Sales 24.4% 26.7% 24.5% 23.8% 21.1% 24.6% 24.2% Non-GAAP Adj. Gross Profit % of Net Sales 26.1% 28.0% 26.4% 24.9% 21.6% 24.8% 24.4% Non-GAAP S,G&A Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Net Sales 75,440 83,617 90,210 95,799 85,313 108,171 109,359 Selling and Administrative Expense 16,895 18,841 20,228 20,590 20,251 24,373 24,003 Plus: Business integration expense (165) (299) (770) (472) (377) (269) (555) Less: Acquisition expenses - - (275) (75) (454) (154) (93) Non-GAAP Adj. Selling and Administrative Expense 16,730 18,542 19,182 20,043 19,421 23,950 23,355 S,G&A as % of Net Sales 22.4% 22.5% 22.4% 21.5% 23.7% 22.5% 21.9% Non-GAAP Selling and Admin as % of Net Sales (Note 2) 22.2% 22.2% 21.3% 20.9% 22.8% 22.1% 21.4% Non-GAAP Operating Income Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Net Sales 75,440 83,617 90,210 95,799 85,313 108,171 109,359 Operating income (loss) 1,677 3,271 1,829 1,813 (2,469) 440 528 Plus: Business integration expense 1,468 1,442 2,187 1,519 822 269 555 Plus: Facility consolidation expense - - - - 73 949 1,632 Plus: Amortization of inventory step up - - 260 107 - 194 196 Plus: Acquisition expenses - - 275 75 454 154 93 Plus: Impairment of assets - - - 195 - 656 103 Plus: Impairment of goodwill - - - - - - - Non-GAAP Adj. Operating Income (Loss) (Note 3) 3,145 4,713 4,552 3,709 (1,121) 2,662 3,107 Operating income as % of net sales 2.2% 3.9% 2.0% 1.9% -2.9% 0.4% 0.5% Adjusted operating income as a % of net sales 4.2% 5.6% 5.0% 3.9% -1.3% 2.5% 2.8% Three Months Ended Non-GAAP Summary 35

36 Non-GAAP Income from Continuing Operations Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Net income (loss) as reported 636 1,645 1,412 1,597 4,396 (644) (185) Less: (Loss) from discontinued, net tax (15) (32) (20) (1) (39) (39) (19) Income (loss) from Continuing Operations 652 1,677 1,432 1,597 4,435 (605) (166) Plus: Business integration expense 1,468 1,442 2,187 1,519 822 269 555 Plus: Facility consolidation expense - - - - 73 949 1,632 Plus: Amortization of inventory step up - - 260 107 - 194 196 Plus: Acquisition expenses - - 275 75 454 154 93 Less: Gain on purchase of business - - - - (10,562) - (173) Plus: Impairment of assets - - - 195 - 656 103 Plus: Impairment of goodwill - - - - - - - Plus: Tax effect of above (558) (548) (1,035) (720) 3,501 (844) (914) Plus: Prior years tax credits and valuation allowance (157) - (733) (957) - - - Non-GAAP Adj. (Loss) / Income from Cont. Op's (Note 4) 1,405 2,571 2,387 1,816 (1,277) 773 1,325 Adj diluted earnings (loss) per share from Continuing Op's 0.11 0.20 0.18 0.14 (0.10) 0.05 0.08 Weighted average common shares outstanding - diluted 12,739 12,846 12,899 12,852 12,789 14,105 15,526 Non-GAAP EBIT and EBITDA Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Net income (loss) as reported 636 1,645 1,412 1,597 4,396 (644) (185) Less: (Loss) from discontinued, net tax (15) (32) (20) (1) (39) (39) (19) Plus: Taxes 23 620 (502) (784) 2,636 (66) (101) Plus: Interest 995 869 896 996 1,012 1,158 991 Non-GAAP Adjusted EBIT (Note 3) 1,669 3,166 1,827 1,810 8,083 487 724 Plus: Depreciation and amortization 2,515 2,559 2,748 2,441 2,988 3,262 3,330 EBITDA 4,184 5,725 4,574 4,251 11,071 3,749 4,054 Plus: Business integration expense 1,468 1,442 2,187 1,519 822 269 555 Plus: Facility consolidation expense - - - - 73 949 1,632 Plus: Amortization of inventory step up - - 260 107 - 194 196 Plus: Acquisition expenses - - 275 75 454 154 93 Less: Gain on purchase of business - - - - (10,562) - (173) Plus: Impairment of assets - - - 195 - 656 103 Non-GAAP Adj. EBITDA (Note 5) 5,652 7,167 7,297 6,146 1,857 5,971 6,460 Non-GAAP Adj. EBITDA as % of Net Sales 7.5% 8.6% 8.1% 6.4% 2.2% 5.5% 5.9% Management estimate of severe weather (not in above) - - - - 1,054 - - Non-GAAP Summary

37 Facility Consolidation Information Facility Consolidation Plan Summary Q1 2014 Q2 2014 Q3 2014 Q4 2014 Est 2014 Est 2015 Est Total East Coast Facility consolidation - 384 1,279 2,011 3,674 789 4,463 East Coast Asset write off - 656 103 (90) 669 - 669 West Coast Facility consolidation 73 565 353 425 1,416 268 1,683 Total facility consolidation and asset write off's 73 1,605 1,735 2,345 5,759 1,057 6,816