Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TRIMAS CORP | trs_093014x8k.htm |

| EX-99.1 - EX-99.1 - TRIMAS CORP | trs_093014xexhibit991.htm |

Third Quarter 2014 Earnings Presentation O c t o b e r 2 8 , 2 0 1 4 NASDAQ • TRS

Forward-Looking Statements Any "forward-looking" statements contained herein, including those relating to market conditions or the Company's financial condition and results, expense reductions, liquidity expectations, business goals and sales growth, involve risks and uncertainties, including, but not limited to, risks and uncertainties with respect to general economic and currency conditions, various conditions specific to the Company's business and industry, the Company’s ability to integrate Allfast and attain the expected synergies, and the acquisition being accretive, the Company's leverage, liabilities imposed by the Company's debt instruments, market demand, competitive factors, supply constraints, material and energy costs, technology factors, litigation, government and regulatory actions, the Company's accounting policies, future trends, and other risks which are detailed in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2013, and in the Company's Quarterly Reports on Form 10-Q. These risks and uncertainties may cause actual results to differ materially from those indicated by the forward-looking statements. All forward-looking statements made herein are based on information currently available, and the Company assumes no obligation to update any forward-looking statements. In this presentation, certain non-GAAP financial measures may be used. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measure may be found at the end of this presentation or in the earnings releases available on the Company’s website. Additional information is available at www.trimascorp.com under the “Investors” section. 2

Agenda • Opening Remarks • Financial Highlights • Segment Highlights • Outlook and Summary • Questions and Answers • Appendix 3

Opening Remarks – Third Quarter Results • Record third quarter sales of approximately $380 million – growth of 7% compared to Q3 2013 – Growth in all six segments – Bolt-on acquisitions and organic growth initiatives adding to top-line • EPS higher than recent expectations • Strong growth and margins in Packaging and Engineered Components • Headwinds continued with supply chain and input costs in Cequent, energy-related end markets, Aerospace inefficiencies, higher level of shares outstanding and tax rate • Intensified projects focused on offsetting internal and external headwinds – progress, so far, is encouraging 4 Focused on driving margin expansion.

Continuous Improvement • Simplify the business ‒ Divest smaller, non-strategic (lower-growth, lower-upside) pieces of business ‒ Continue to implement and train on Lean, Six Sigma and SIOP • Add people/horsepower ‒ Add and upgrade operations talent – significant progress in 2014 ‒ Add and upgrade operating finance talent • Increase visibility via enhanced forecasting/tracking processes ‒ Improvements underway ‒ Focus on additional value-add analysis, speed, and risks and opportunities Evaluating business portfolio, people and processes to achieve Strategic Aspirations. 5

Allfast Acquisition Update • Closed on October 17th • Funding was secured by $275 million incremental Term Loan A facility, cash and additional borrowings on revolving credit facility ‒ Borrowing rate consistent with Credit Agreement • Integration activities underway – but “business as usual” • Customer feedback has been excellent • Pleased with talented, engaged team at Allfast • EPS accretive and strong Free Cash Flow expected in 2015 Addition of Allfast positions TriMas Aerospace for future success. 6

Financial Highlights

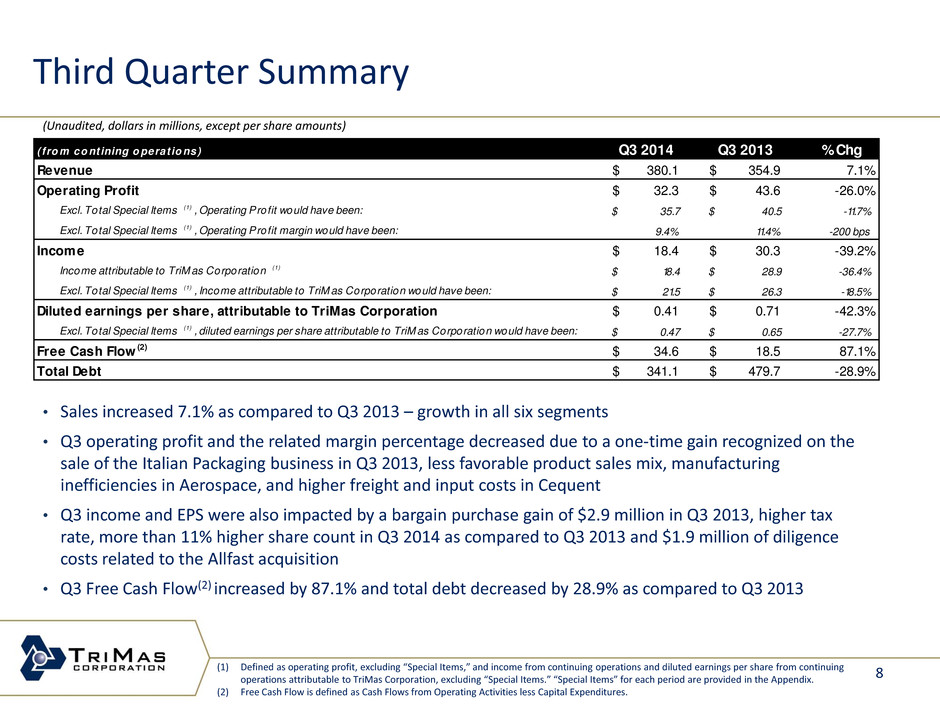

Third Quarter Summary • Sales increased 7.1% as compared to Q3 2013 – growth in all six segments • Q3 operating profit and the related margin percentage decreased due to a one-time gain recognized on the sale of the Italian Packaging business in Q3 2013, less favorable product sales mix, manufacturing inefficiencies in Aerospace, and higher freight and input costs in Cequent • Q3 income and EPS were also impacted by a bargain purchase gain of $2.9 million in Q3 2013, higher tax rate, more than 11% higher share count in Q3 2014 as compared to Q3 2013 and $1.9 million of diligence costs related to the Allfast acquisition • Q3 Free Cash Flow(2) increased by 87.1% and total debt decreased by 28.9% as compared to Q3 2013 8(1) Defined as operating profit, excluding “Special Items,” and income from continuing operations and diluted earnings per share from continuing operations attributable to TriMas Corporation, excluding “Special Items.” “Special Items” for each period are provided in the Appendix. (2) Free Cash Flow is defined as Cash Flows from Operating Activities less Capital Expenditures. (Unaudited, dollars in millions, except per share amounts) ( f ro m co ntining o perat io ns) Q3 2014 Q3 2013 % Chg Revenue 380.1$ 354.9$ 7.1% Operating Profit 32.3$ 43.6$ -26.0% Excl. Total Special Items (1) , Operating Profit would have been: 35.7$ 40.5$ -11.7% Excl. Total Special Items (1) , Operating Profit margin would have been: 9.4% 11.4% -200 bps Inc me 18.4$ 30.3$ -39.2% Income attributable to TriM as Corporation (1) 18.4$ 28.9$ -36.4% Excl. Total Special Items (1) , Income attributable to TriM as Corporation would have been: 21.5$ 26.3$ -18.5% Diluted earnings per share, attributable to TriMas Corporation 0.41$ 0.71$ -42.3% Excl. Total Special Items (1) , diluted earnings per share attributable to TriM as Corporation would have been: 0.47$ 0.65$ -27.7% Free Cash Flow (2) 34.6$ 18.5$ 87.1% Total Debt 341.1$ 479.7$ -28.9%

YTD 2014 Summary • Sales increased 7.5% as compared to YTD 2013 as a result of acquisitions and organic growth initiatives, offsetting challenges in energy end markets and the Q3 2013 disposition of the Italian rings and levers business • YTD operating profit(1) improved due to increased sales levels, and productivity and cost reduction initiatives, partially offset by the gain on the 2013 disposition, a less favorable product sales mix and inefficiencies in several of the businesses • YTD income(1) and YTD EPS(1) decreased due to a bargain purchase gain of $2.9 million in Q3 2013, a higher tax rate and approximately 13% higher weighted average shares outstanding in YTD 2014 as compared to YTD 2013 • YTD Free Cash Flow(2) ahead of 2013 by $31.0 million 9(1) Defined as operating profit, excluding “Special Items,” and income from continuing operations and diluted earnings per share from continuing operations attributable to TriMas Corporation, excluding “Special Items.” “Special Items” for each period are provided in the Appendix. (2) Free Cash Flow is defined as Cash Flows from Operating Activities less Capital Expenditures. (Unaudited, dollars in millions, except per share amounts) ( f ro m co ntinuing o perat io ns) Q3 YTD 2014 Q3 YTD 2013 % Chg Revenue 1,148.5$ 1,068.4$ 7.5% Operating Profit 109.0$ 109.2$ -0.2% Excl. Total Special Items (1) , Operating Profit would have been: 117.2$ 113.8$ 3.0% Excl. Total Special Items (1) , Operating Profit margin would have been: 10.2% 10.7% -50 bps Inc me 64.1$ 71.5$ -10.4% Income attributable to TriM as Corporation (1) 63.2$ 68.4$ -7.6% Excl. Total Special Items (1) , Income attributable to TriM as Corporation would have been: 70.2$ 71.4$ -1.7% Diluted earnings per share, attributable to TriMas Corporation 1.40$ 1.71$ -18.1% Excl. Total Special Items (1) , diluted earnings per share attributable to TriM as Corporation would have been: 1.55$ 1.78$ -12.9% Free Cash Flow (2) 37.1$ 6.1$ 505.7% Total Debt 341.1$ 479.7$ -28.9%

Segment Highlights

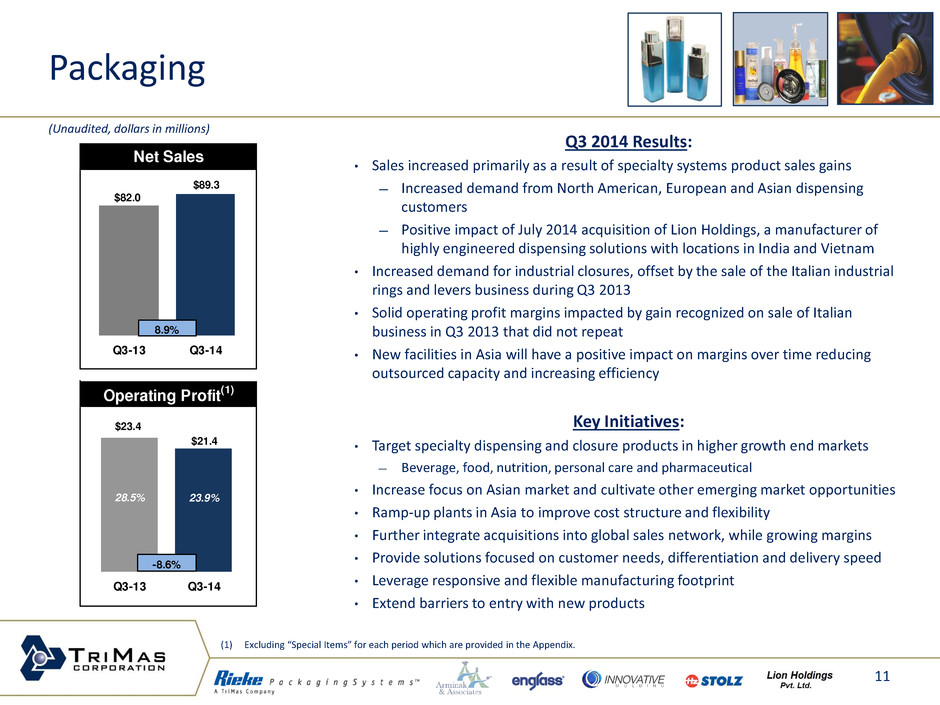

Packaging Q3 2014 Results: • Sales increased primarily as a result of specialty systems product sales gains — Increased demand from North American, European and Asian dispensing customers — Positive impact of July 2014 acquisition of Lion Holdings, a manufacturer of highly engineered dispensing solutions with locations in India and Vietnam • Increased demand for industrial closures, offset by the sale of the Italian industrial rings and levers business during Q3 2013 • Solid operating profit margins impacted by gain recognized on sale of Italian business in Q3 2013 that did not repeat • New facilities in Asia will have a positive impact on margins over time reducing outsourced capacity and increasing efficiency (Unaudited, dollars in millions) Key Initiatives: • Target specialty dispensing and closure products in higher growth end markets — Beverage, food, nutrition, personal care and pharmaceutical • Increase focus on Asian market and cultivate other emerging market opportunities • Ramp-up plants in Asia to improve cost structure and flexibility • Further integrate acquisitions into global sales network, while growing margins • Provide solutions focused on customer needs, differentiation and delivery speed • Leverage responsive and flexible manufacturing footprint • Extend barriers to entry with new products 11 Net Sales Q3-13 Q3-14 $82.0 $89.3 8.9% Operating Profit (1) Q3-13 Q3-14 $23.4 $21.4 28.5% 23.9% -8.6% (1) Excluding “Special Items” for each period which are provided in the Appendix.

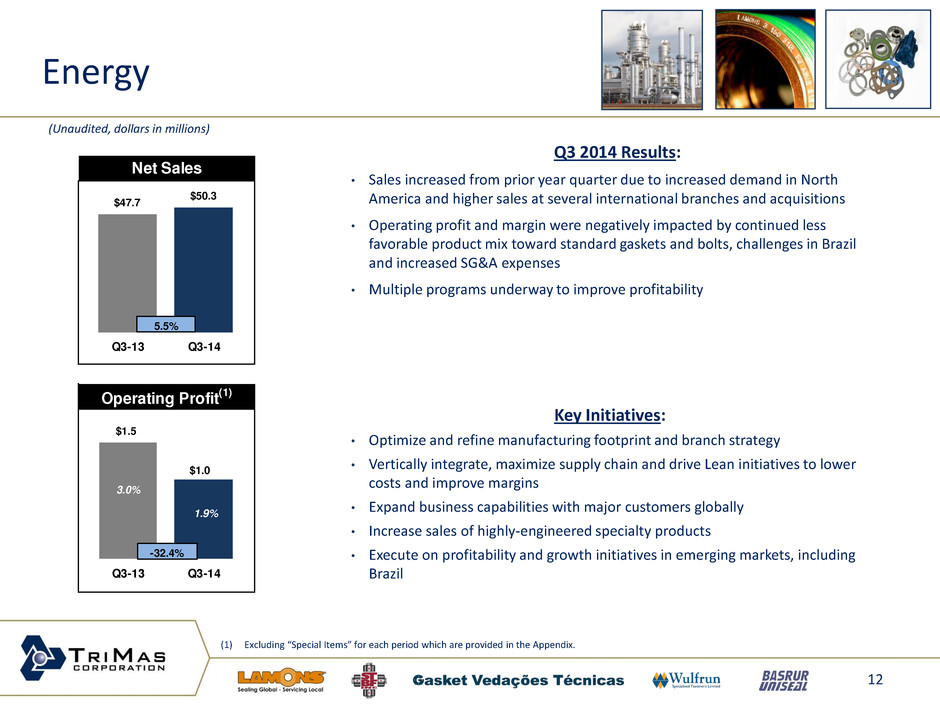

Energy Q3 2014 Results: • Sales increased from prior year quarter due to increased demand in North America and higher sales at several international branches and acquisitions • Operating profit and margin were negatively impacted by continued less favorable product mix toward standard gaskets and bolts, challenges in Brazil and increased SG&A expenses • Multiple programs underway to improve profitability Key Initiatives: • Optimize and refine manufacturing footprint and branch strategy • Vertically integrate, maximize supply chain and drive Lean initiatives to lower costs and improve margins • Expand business capabilities with major customers globally • Increase sales of highly-engineered specialty products • Execute on profitability and growth initiatives in emerging markets, including Brazil 12 (Unaudited, dollars in millions) (1) Excluding “Special Items” for each period which are provided in the Appendix. Net Sales Q3-13 Q3-14 $47.7 $50.3 5.5% Operating Profit (1) Q3-13 Q3-14 -32.4% $1.5 $1.0 3.0% 1.9%

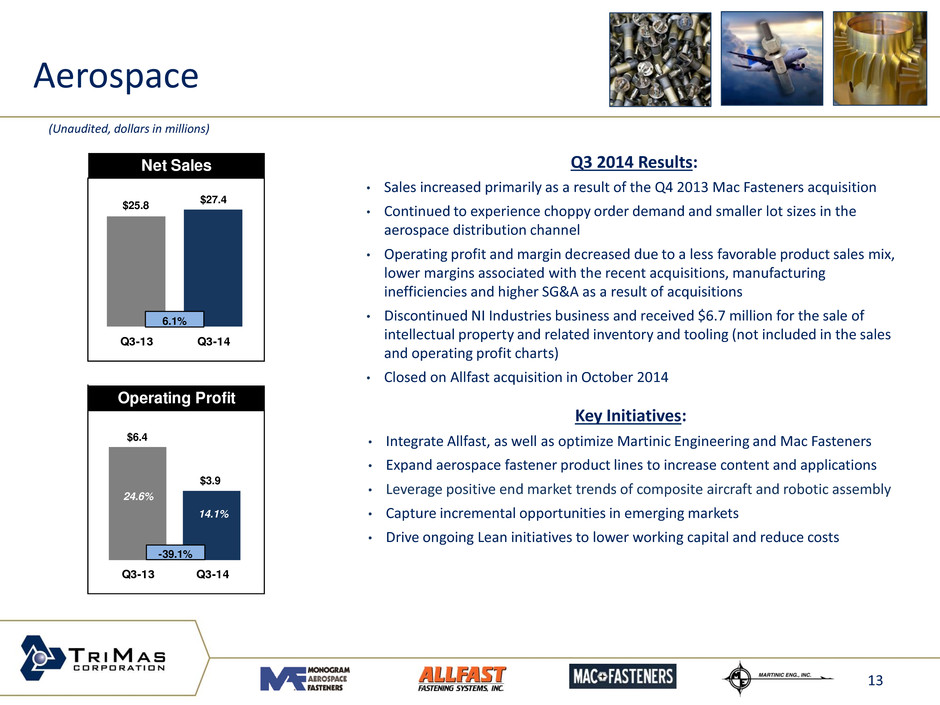

Aerospace Key Initiatives: • Integrate Allfast, as well as optimize Martinic Engineering and Mac Fasteners • Expand aerospace fastener product lines to increase content and applications • Leverage positive end market trends of composite aircraft and robotic assembly • Capture incremental opportunities in emerging markets • Drive ongoing Lean initiatives to lower working capital and reduce costs Q3 2014 Results: • Sales increased primarily as a result of the Q4 2013 Mac Fasteners acquisition • Continued to experience choppy order demand and smaller lot sizes in the aerospace distribution channel • Operating profit and margin decreased due to a less favorable product sales mix, lower margins associated with the recent acquisitions, manufacturing inefficiencies and higher SG&A as a result of acquisitions • Discontinued NI Industries business and received $6.7 million for the sale of intellectual property and related inventory and tooling (not included in the sales and operating profit charts) • Closed on Allfast acquisition in October 2014 13 (Unaudited, dollars in millions) Net Sales Q3-13 Q3-14 $25.8 $27.4 6.1% Operating Profit Q3-13 Q3-14 -39.1% $6.4 $3.9 24.6% 14.1%

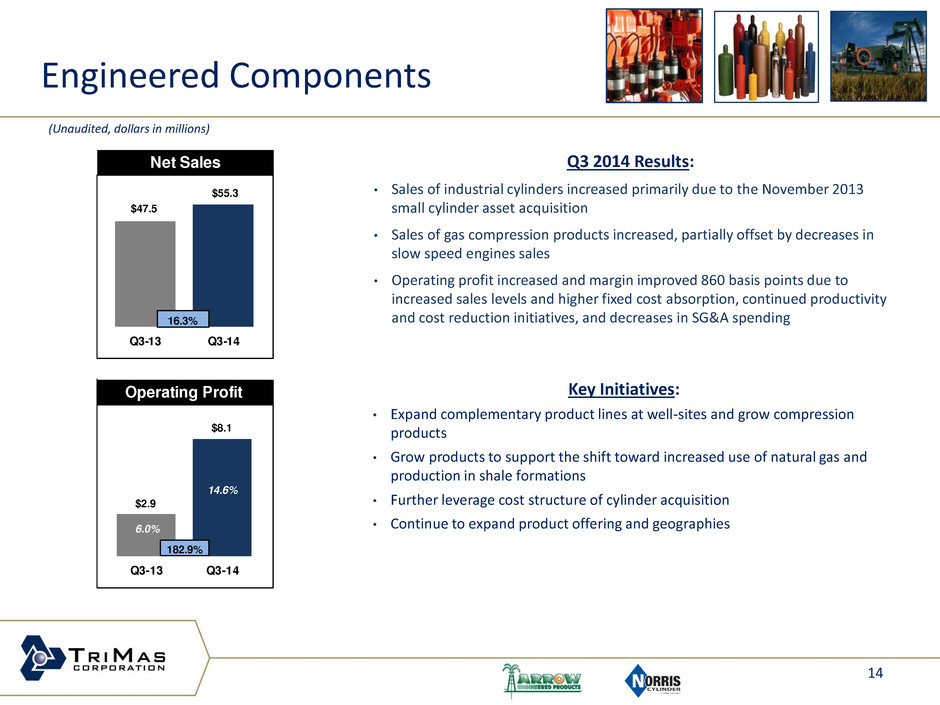

Engineered Components Key Initiatives: • Expand complementary product lines at well-sites and grow compression products • Grow products to support the shift toward increased use of natural gas and production in shale formations • Further leverage cost structure of cylinder acquisition • Continue to expand product offering and geographies Q3 2014 Results: • Sales of industrial cylinders increased primarily due to the November 2013 small cylinder asset acquisition • Sales of gas compression products increased, partially offset by decreases in slow speed engines sales • Operating profit increased and margin improved 860 basis points due to increased sales levels and higher fixed cost absorption, continued productivity and cost reduction initiatives, and decreases in SG&A spending 14 (Unaudited, dollars in millions) Net Sales Q3-13 Q3-14 $47.5 $55.3 16.3% Operating Profit Q3-13 Q3-14 182.9% $2.9 $8.1 6.0% 14.6%

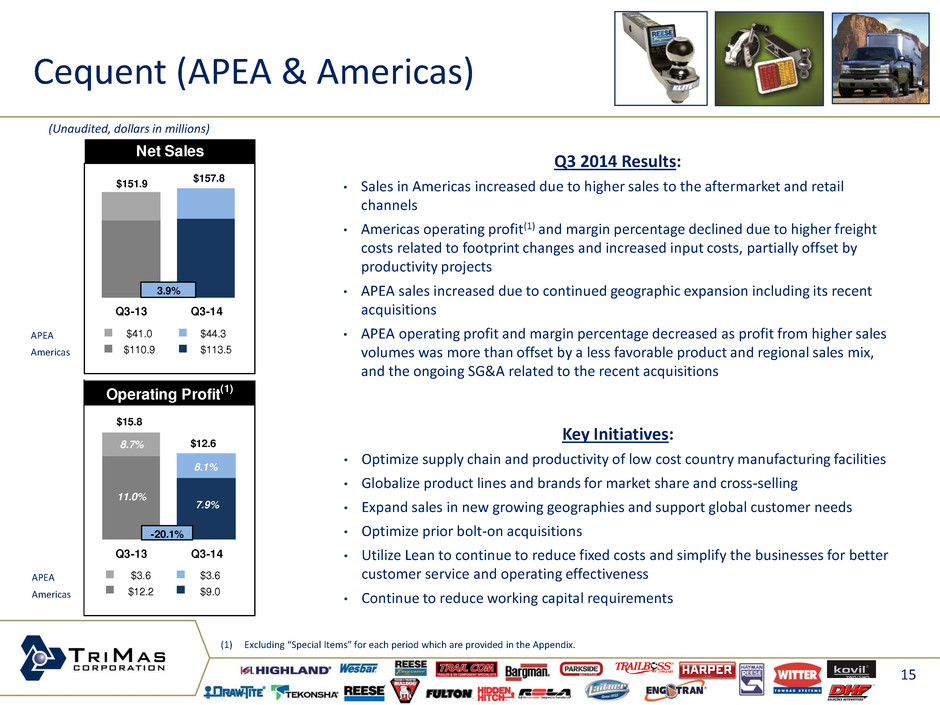

Cequent (APEA & Americas) $46.4 Q3 2014 Results: • Sales in Americas increased due to higher sales to the aftermarket and retail channels • Americas operating profit(1) and margin percentage declined due to higher freight costs related to footprint changes and increased input costs, partially offset by productivity projects • APEA sales increased due to continued geographic expansion including its recent acquisitions • APEA operating profit and margin percentage decreased as profit from higher sales volumes was more than offset by a less favorable product and regional sales mix, and the ongoing SG&A related to the recent acquisitions Key Initiatives: • Optimize supply chain and productivity of low cost country manufacturing facilities • Globalize product lines and brands for market share and cross-selling • Expand sales in new growing geographies and support global customer needs • Optimize prior bolt-on acquisitions • Utilize Lean to continue to reduce fixed costs and simplify the businesses for better customer service and operating effectiveness • Continue to reduce working capital requirements APEA Americas 15 APEA Americas (1) Excluding “Special Items” for each period which are provided in the Appendix. (Unaudited, dollars in millions) $44.3 $113.5 Net Sales $41.0 $110.9 Q3-13 Q3-14 $157.8 $151.9 3.9% $3.6 $9.0 Operating Profit (1) $3.6 $12.2 Q3-13 Q3-14 $12.6 -20.1% $15.8 11.0% 7.9% 8.7% 8.1%

Outlook and Summary

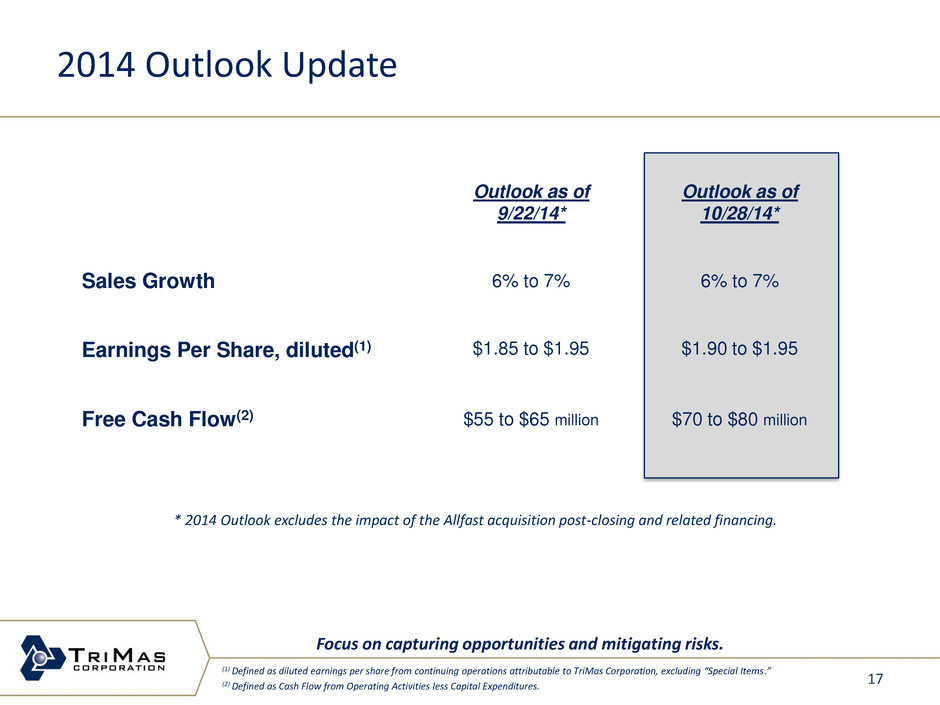

2014 Outlook Update Outlook as of 9/22/14* Outlook as of 10/28/14* Sales Growth 6% to 7% 6% to 7% Earnings Per Share, diluted(1) $1.85 to $1.95 $1.90 to $1.95 Free Cash Flow(2) $55 to $65 million $70 to $80 million (1) Defined as diluted earnings per share from continuing operations attributable to TriMas Corporation, excluding “Special Items.” (2) Defined as Cash Flow from Operating Activities less Capital Expenditures. 17 Focus on capturing opportunities and mitigating risks. * 2014 Outlook excludes the impact of the Allfast acquisition post-closing and related financing.

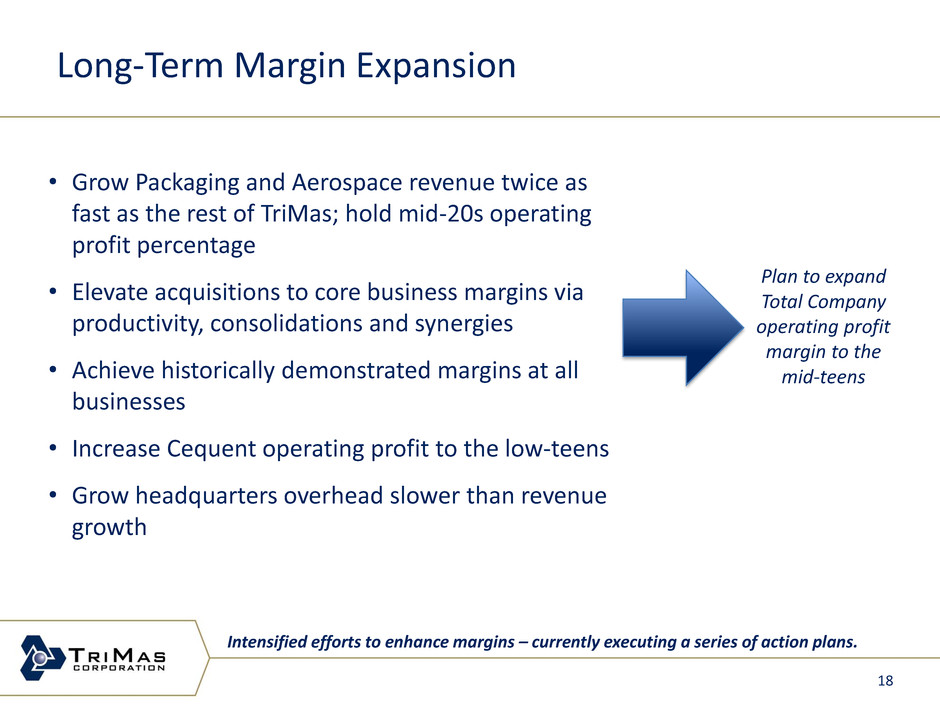

Long-Term Margin Expansion • Grow Packaging and Aerospace revenue twice as fast as the rest of TriMas; hold mid-20s operating profit percentage • Elevate acquisitions to core business margins via productivity, consolidations and synergies • Achieve historically demonstrated margins at all businesses • Increase Cequent operating profit to the low-teens • Grow headquarters overhead slower than revenue growth Plan to expand Total Company operating profit margin to the mid-teens 18 Intensified efforts to enhance margins – currently executing a series of action plans.

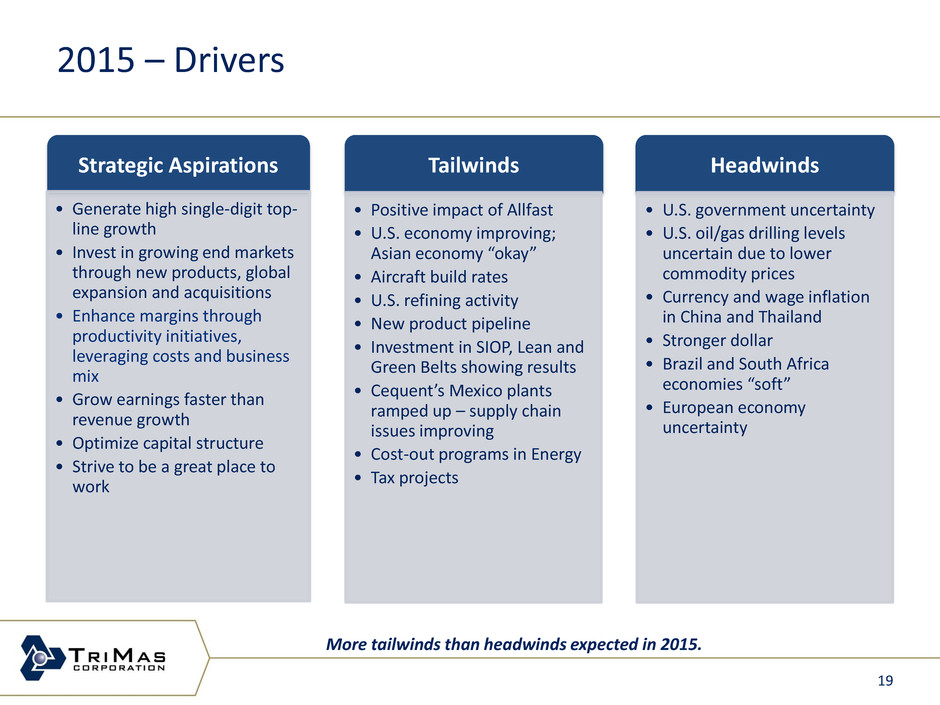

2015 – Drivers Strategic Aspirations • Generate high single-digit top- line growth • Invest in growing end markets through new products, global expansion and acquisitions • Enhance margins through productivity initiatives, leveraging costs and business mix • Grow earnings faster than revenue growth • Optimize capital structure • Strive to be a great place to work Tailwinds • Positive impact of Allfast • U.S. economy improving; Asian economy “okay” • Aircraft build rates • U.S. refining activity • New product pipeline • Investment in SIOP, Lean and Green Belts showing results • Cequent’sMexico plants ramped up – supply chain issues improving • Cost-out programs in Energy • Tax projects Headwinds • U.S. government uncertainty • U.S. oil/gas drilling levels uncertain due to lower commodity prices • Currency and wage inflation in China and Thailand • Stronger dollar • Brazil and South Africa economies “soft” • European economy uncertainty More tailwinds than headwinds expected in 2015. 19

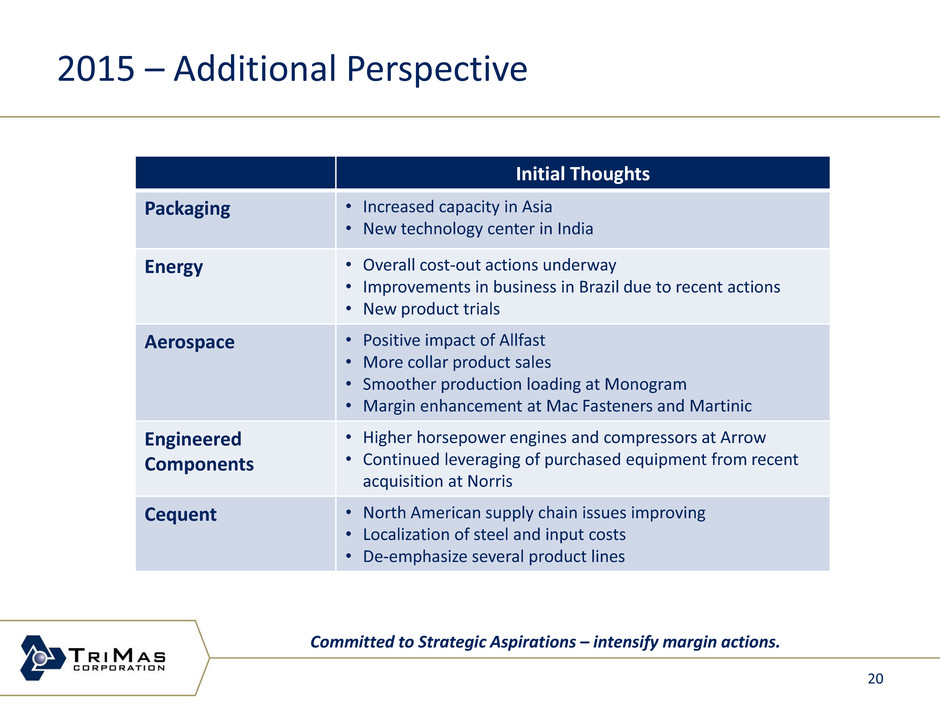

2015 – Additional Perspective 20 Committed to Strategic Aspirations – intensify margin actions. Initial Thoughts Packaging • Increased capacity in Asia • New technology center in India Energy • Overall cost-out actions underway • Improvements in business in Brazil due to recent actions • New product trials Aerospace • Positive impact of Allfast • More collar product sales • Smoother production loading at Monogram • Margin enhancement at Mac Fasteners and Martinic Engineered Components • Higher horsepower engines and compressors at Arrow • Continued leveraging of purchased equipment from recent acquisition at Norris Cequent • North American supply chain issues improving • Localization of steel and input costs • De-emphasize several product lines

Questions and Answers

Appendix

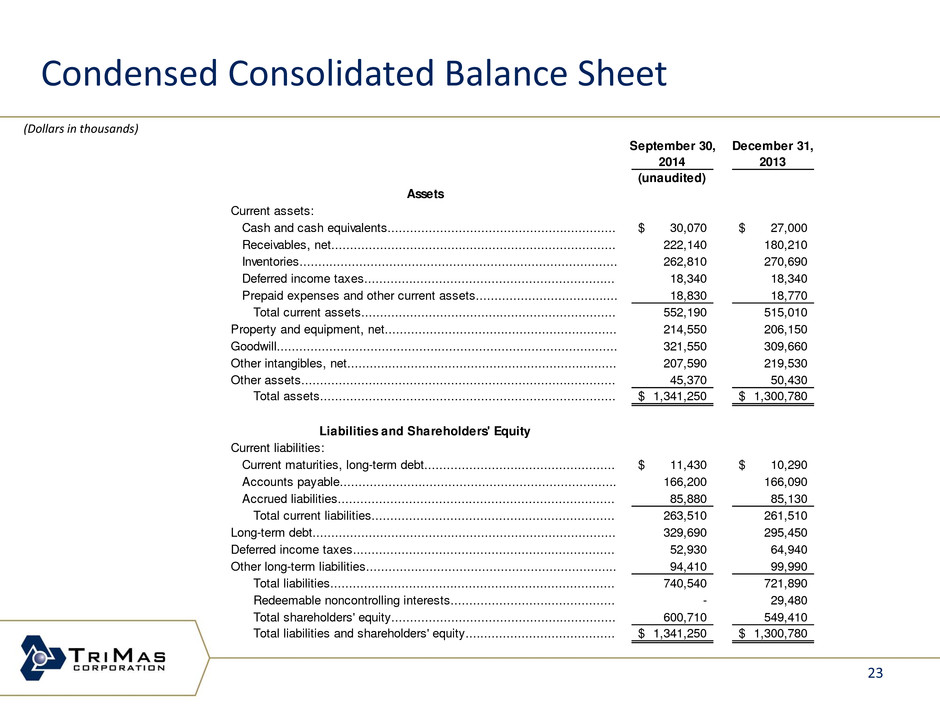

Condensed Consolidated Balance Sheet 23 (Dollars in thousands) September 30, December 31, 2014 2013 (unaudited) Assets Current assets: Cash and cash equivalents............................................................. 30,070$ 27,000$ Receivables, net............................................................................ 222,140 180,210 Inventories..................................................................................... 262,810 270,690 Deferred income taxes................................................................... 18,340 18,340 Prepaid expenses and other current assets...................................... 18,830 18,770 Total current assets.................................................................... 552,190 515,010 Property and equipment, net.............................................................. 214,550 206,150 Goodwill........................................................................................... 321,550 309,660 Other intangibles, net........................................................................ 207,590 219,530 Other assets.................................................................................... 45,370 50,430 Total assets............................................................................... 1,341,250$ 1,300,780$ Liabilities and Shareholders' Equity Current liabilities: Current maturities, long-term debt................................................... 11,430$ 10,290$ Accounts payable.......................................................................... 166,200 166,090 Accrued liabilities.......................................................................... 85,880 85,130 Total current liabilities................................................................. 263,510 261,510 Long-term debt................................................................................. 329,690 295,450 Deferred income taxes...................................................................... 52,930 64,940 Other long-term liabilities................................................................... 94,410 99,990 Total liabilities............................................................................ 740,540 721,890 Redeemable noncontrolling interests............................................ - 29,480 Total shareholders' equity............................................................ 600,710 549,410 Total liabilities and shareholders' equity........................................ 1,341,250$ 1,300,780$

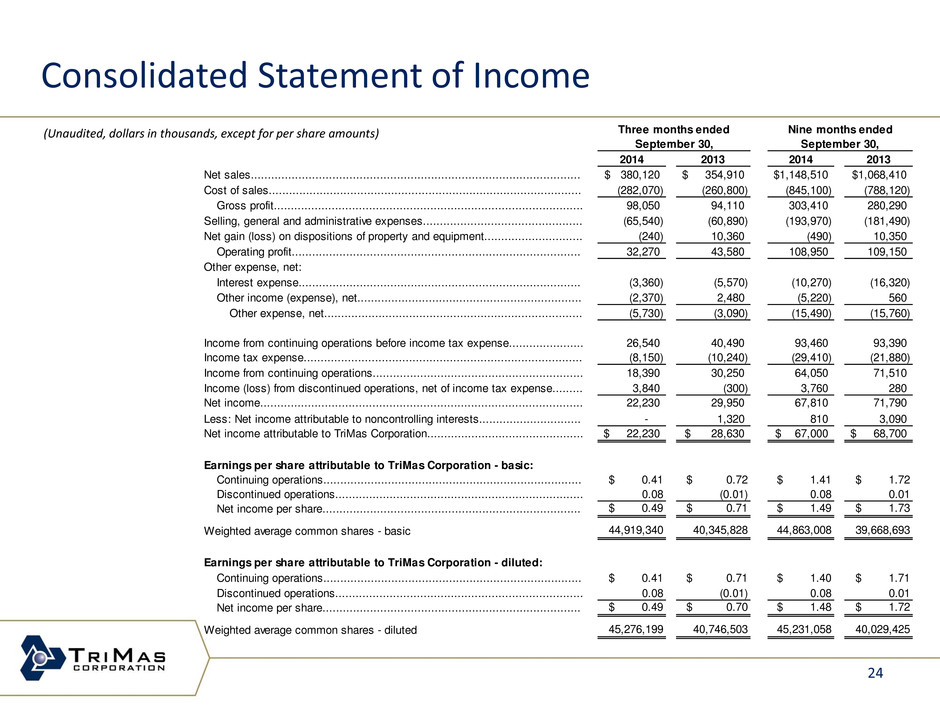

Consolidated Statement of Income 24 Three months ended Nine months ended 2014 2013 2014 2013 Net sales................................................................................................. 380,120$ 354,910$ 1,148,510$ 1,068,410$ Cost of sales............................................................................................ (282,070) (260,800) (845,100) (788,120) Gross profit........................................................................................... 98,050 94,110 303,410 280,290 Selling, general and administrative expenses............................................... (65,540) (60,890) (193,970) (181,490) Net gain (loss) on dispositions of property and equipment............................. (240) 10,360 (490) 10,350 Operating profit..................................................................................... 32,270 43,580 108,950 109,150 Other expense, net: Interest expense................................................................................... (3,360) (5,570) (10,270) (16,320) Other income (expense), net.................................................................. (2,370) 2,480 (5,220) 560 Other expense, net............................................................................ (5,730) (3,090) (15,490) (15,760) Income from continuing operations before income tax expense...................... 26,540 40,490 93,460 93,390 Income tax expense.................................................................................. (8,150) (10,240) (29,410) (21,880) Income from continuing operations.............................................................. 18,390 30,250 64,050 71,510 Income (loss) from discontinued operations, net of income tax expense......... 3,840 (300) 3,760 280 Net income............................................................................................... 22,230 29,950 67,810 71,790 Less: Net income attributable to noncontrolling interests.............................. - 1,320 810 3,090 Net income attributable to TriMas Corporation.............................................. 22,230$ 28,630$ 67,000$ 68,700$ Earnings per share attributable to TriMas Corporation - basic: Continuing operations............................................................................ $ 0.41 $ 0.72 $ 1.41 $ 1.72 Discontinued operations......................................................................... 0.08 (0.01) 0.08 0.01 Net income per share............................................................................ $ 0.49 $ 0.71 $ 1.49 $ 1.73 Weighted average common shares - basic 44,919,340 40,345,828 44,863,008 39,668,693 E r ings per share attributable to TriMas Corporation - diluted: Continuing operations............................................................................ $ 0.41 $ 0.71 $ 1.40 $ 1.71 Discontinued operations......................................................................... 0.08 (0.01) 0.08 0.01 Net income per share............................................................................ $ 0.49 $ 0.70 $ 1.48 $ 1.72 Weighted average common shares - diluted 45,276,199 40,746,503 45,231,058 40,029,425 September 30, September 30, (Unaudited, dollars in thousands, except for per share amounts)

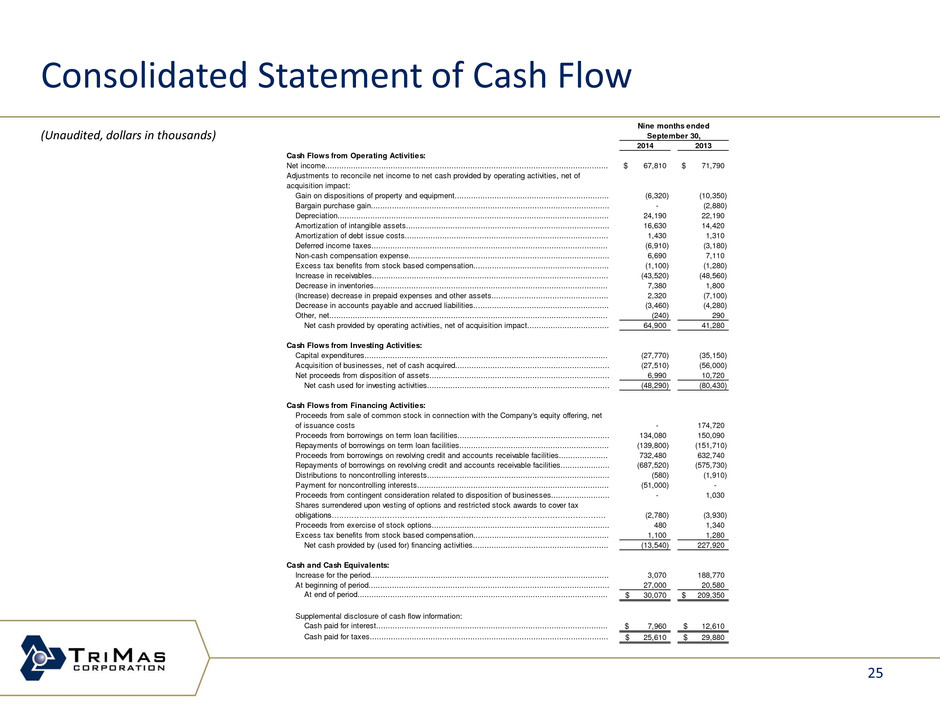

Consolidated Statement of Cash Flow (Unaudited, dollars in thousands) 25 2014 2013 Cash Flows from Operating Activities: Net income......................................................................................................................... 67,810$ 71,790$ Adjustments to reconcile net income to net cash provided by operating activities, net of acquisition impact: Gain on dispositions of property and equipment.................................................................. (6,320) (10,350) Bargain purchase gain...................................................................................................... - (2,880) Depreciation.................................................................................................................... 24,190 22,190 Amortization of intangible assets....................................................................................... 16,630 14,420 Amortization of debt issue costs....................................................................................... 1,430 1,310 Deferred income taxes..................................................................................................... (6,910) (3,180) Non-cash compensation expense...................................................................................... 6,690 7,110 Excess tax benefits from stock based compensation.......................................................... (1,100) (1,280) Increase in receivables..................................................................................................... (43,520) (48,560) Decrease in inventories.................................................................................................... 7,380 1,800 (Increase) decrease in prepaid expenses and other assets.................................................. 2,320 (7,100) Decrease in accounts payable and accrued liabilities.......................................................... (3,460) (4,280) Other, net....................................................................................................................... (240) 290 Net cash provided by operating activities, net of acquisition impact................................... 64,900 41,280 Cash Flows from Investing Activities: Capital expenditures........................................................................................................ (27,770) (35,150) Acquisition of businesses, net of cash acquired.................................................................. (27,510) (56,000) Net proceeds from disposition of assets............................................................................. 6,990 10,720 Net cash used for investing activities.............................................................................. (48,290) (80,430) Cash Flows from Financing Activities: Proceeds from sale of common stock in connection with the Company's equity offering, net of issuance costs - 174,720 Proceeds from borrowings on term loan facilities................................................................. 134,080 150,090 Repayments of borrowings on term loan facilities................................................................ (139,800) (151,710) Proceeds from borrowings on revolving credit and accounts receivable facilities..................... 732,480 632,740 Repayments of borrowings on revolving credit and accounts receivable facilities..................... (687,520) (575,730) Distributions to noncontrolling interests.............................................................................. (580) (1,910) Payment for noncontrolling interests.................................................................................. (51,000) - Proceeds from contingent consideration related to disposition of businesses......................... - 1,030 Shares surrendered upon vesting of options and restricted stock awards to cover tax obligations…...………………………………………………………………………………………… (2,780) (3,930) Proceeds from exercise of stock options............................................................................ 480 1,340 Excess tax benefits from stock based compensation.......................................................... 1,100 1,280 Net cash provided by (used for) financing activities.......................................................... (13,540) 227,920 Cash and Cash Equivalents: Increase for the period...................................................................................................... 3,070 188,770 At beginning of period....................................................................................................... 27,000 20,580 At end of period........................................................................................................... 30,070$ 209,350$ Supplemental disclosure of cash flow information: Cash paid for interest................................................................................................... 7,960$ 12,610$ Cash paid for taxes...................................................................................................... 25,610$ 29,880$ Nine months ended September 30,

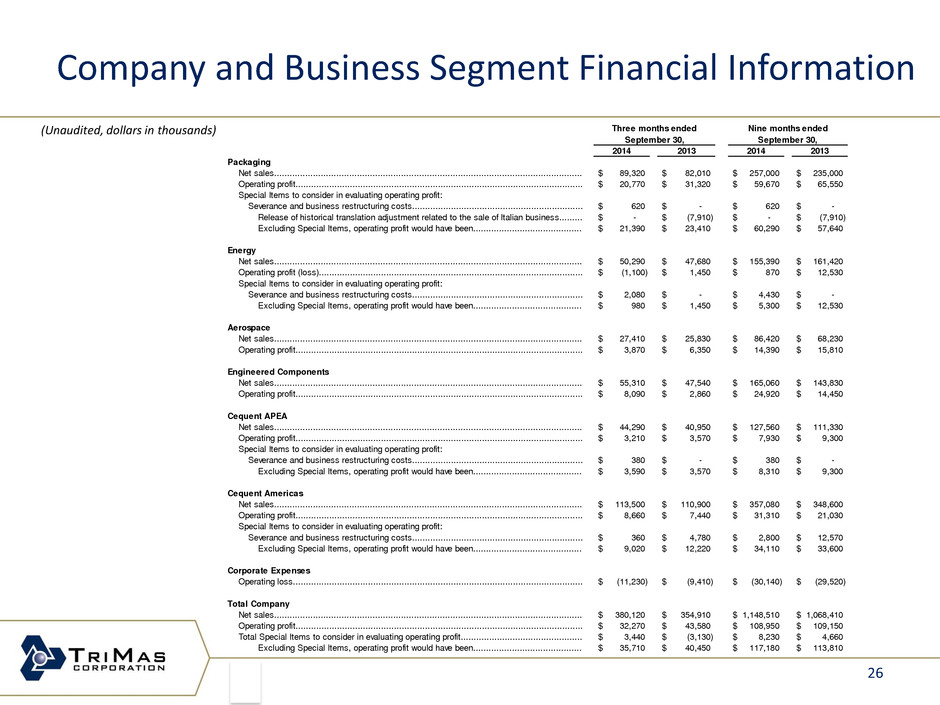

Company and Business Segment Financial Information 26 (Unaudited, dollars in thousands) Three months ended 2014 2013 2014 2013 Packaging Net sales....................................................................................................................... 89,320$ 82,010$ 257,000$ 235,000$ Operating profit............................................................................................................... 20,770$ 31,320$ 59,670$ 65,550$ Special Items to consider in evaluating operating profit: Severance and business restructuring costs.................................................................. 620$ -$ 620$ -$ Release of historical translation adjustment related to the sale of Italian business......... -$ (7,910)$ -$ (7,910)$ Excluding Special Items, operating profit would have been.......................................... 21,390$ 23,410$ 60,290$ 57,640$ Energy Net sales....................................................................................................................... 50,290$ 47,680$ 155,390$ 161,420$ Operating profit (loss)...................................................................................................... (1,100)$ 1,450$ 870$ 12,530$ Special Items to consider in evaluating operating profit: Severance and business restructuring costs.................................................................. 2,080$ -$ 4,430$ -$ Excluding Special Items, operating profit would have been.......................................... 980$ 1,450$ 5,300$ 12,530$ Aerospace Net sales....................................................................................................................... 27,410$ 25,830$ 86,420$ 68,230$ Operating profit............................................................................................................... 3,870$ 6,350$ 14,390$ 15,810$ Engineered Components Net sales....................................................................................................................... 55,310$ 47,540$ 165,060$ 143,830$ Operating profit............................................................................................................... 8,090$ 2,860$ 24,920$ 14,450$ Cequent APEA Net sales....................................................................................................................... 44,290$ 40,950$ 127,560$ 111,330$ Operating profit............................................................................................................... 3,210$ 3,570$ 7,930$ 9,300$ Special Items to consider in evaluating operating profit: Severance and business restructuring costs.................................................................. 380$ -$ 380$ -$ Excluding Special Items, operating profit would have been.......................................... 3,590$ 3,570$ 8,310$ 9,300$ Cequent Americas Net sales....................................................................................................................... 113,500$ 110,900$ 357,080$ 348,600$ Operating profit............................................................................................................... 8,660$ 7,440$ 31,310$ 21,030$ Special Items to consider in evaluating operating profit: Severance and business restructuring costs.................................................................. 360$ 4,780$ 2,800$ 12,570$ Excluding Special Items, operating profit would have been.......................................... 9,020$ 12,220$ 34,110$ 33,600$ Corporate Expenses Operating loss................................................................................................................ (11,230)$ (9,410)$ (30,140)$ (29,520)$ Total Company Net sales....................................................................................................................... 380,120$ 354,910$ 1,148,510$ 1,068,410$ Operating profit............................................................................................................... 32,270$ 43,580$ 108,950$ 109,150$ Total Special Items to consider in evaluating operating profit............................................... 3,440$ (3,130)$ 8,230$ 4,660$ Excluding Special Items, operating profit would have been.......................................... 35,710$ 40,450$ 117,180$ 113,810$ September 30, September 30, Nine months ended

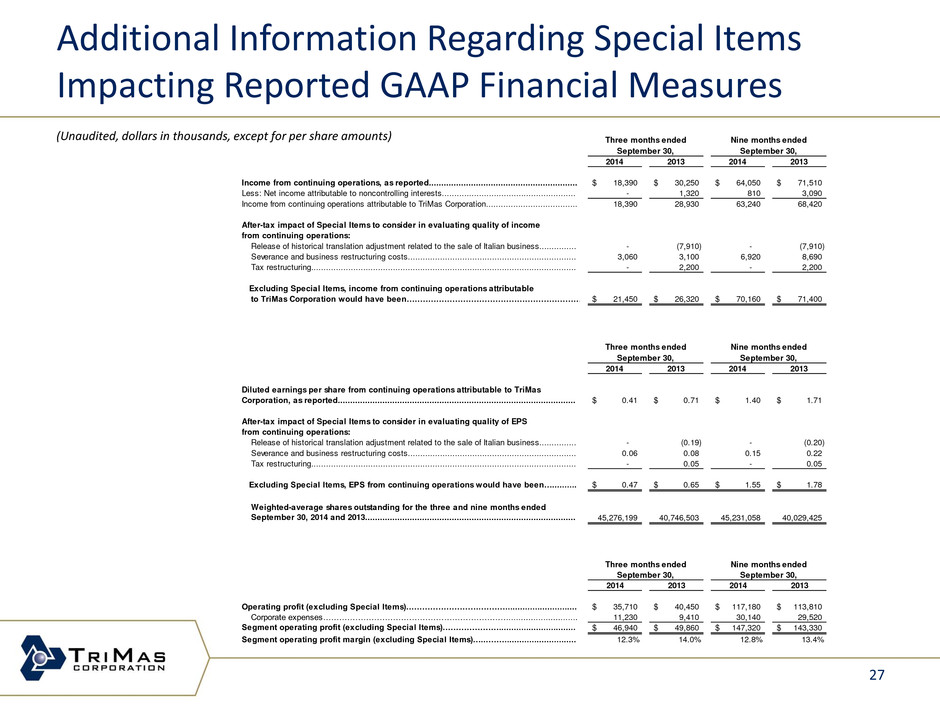

Additional Information Regarding Special Items Impacting Reported GAAP Financial Measures 27 Three months ended Nine months ended September 30, September 30, 2014 2013 2014 2013 Income from continuing operations, as reported............................................................ 18,390$ 30,250$ 64,050$ 71,510$ Less: Net income attributable to noncontrolling interests...................................................... - 1,320 810 3,090 Income from continuing operations attributable to TriMas Corporation..................................... 18,390 28,930 63,240 68,420 After-tax impact of Special Items to consider in evaluating quality of income from continuing operations: Release of historical translation adjustment related to the sale of Italian business............... - (7,910) - (7,910) Severance and business restructuring costs.................................................................... 3,060 3,100 6,920 8,690 Tax restructuring........................................................................................................... - 2,200 - 2,200 Excluding Special Items, income from continuing operations attributable to TriMas Corporation would have been………………………………………………………………………………. 21,450$ 26,320$ 70,160$ 71,400$ Three months ended Nine months ended September 30, September 30, 2014 2013 2014 2013 Diluted earnings per share from continuing operations attributable to TriMas Corporation, as reported................................................................................................ 0.41$ 0.71$ 1.40$ 1.71$ After-tax impact of Special Items to consider in evaluating quality of EPS from continuing operations: Release of historical translation adjustment related to the sale of Italian business............... - (0.19) - (0.20) Severance and business restructuring costs.................................................................... 0.06 0.08 0.15 0.22 Tax restructuring........................................................................................................... - 0.05 - 0.05 Excluding Special Items, EPS from continuing operations would have been….......... 0.47$ 0.65$ 1.55$ 1.78$ Weighted-average shares outstanding for the three and nine months ended September 30, 2014 and 2013..................................................................................... 45,276,199 40,746,503 45,231,058 40,029,425 2014 2013 2014 2013 Operating profit (excluding Special Items)……………………….………............................. 35,710$ 40,450$ 117,180$ 113,810$ Corporate expenses……………………………………………………………............................ 11,230 9,410 30,140 29,520 Segment operating profit (excluding Special Items)…………………............................... 46,940$ 49,860$ 147,320$ 143,330$ Segment operating profit margin (excluding Special Items)…...……............................. 12.3% 14.0% 12.8% 13.4% September 30, September 30, Three months ended Nine months ended (Unaudited, dollars in thousands, except for per share amounts)

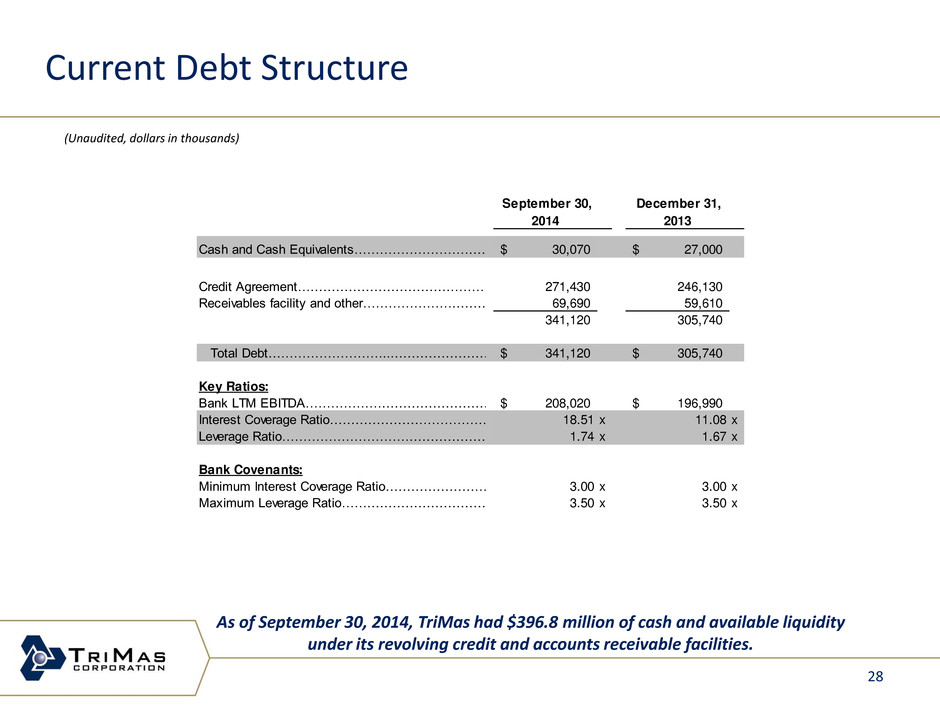

Current Debt Structure 28 (Unaudited, dollars in thousands) As of September 30, 2014, TriMas had $396.8 million of cash and available liquidity under its revolving credit and accounts receivable facilities. September 30, December 31, 2014 2013 Cash and Cash Equivalents……………………………..………………… 30,070$ 27,000$ Credit Agreement……………………………………….. 271,430 246,130 Receivables facility and other……………………………….. 69,690 59,610 341,120 305,740 Total Debt………………………...………………………...………………………… 341,120$ 305,740$ Key Ratios: Bank LTM EBITDA……………………………………………………………………………….……………………………………… 208,020$ 196,990$ Interest Coverage Ratio………………………………………………………………… 18.51 x 11.08 x Leverage Ratio…………………………………………………………………... 1.74 x 1.67 x Bank Covenants: Minimum Interest Coverage Ratio………………………………………………………………… 3.00 x 3.00 x Maximum Leverage Ratio………………………………………………………………………………… 3.50 x 3.50 x

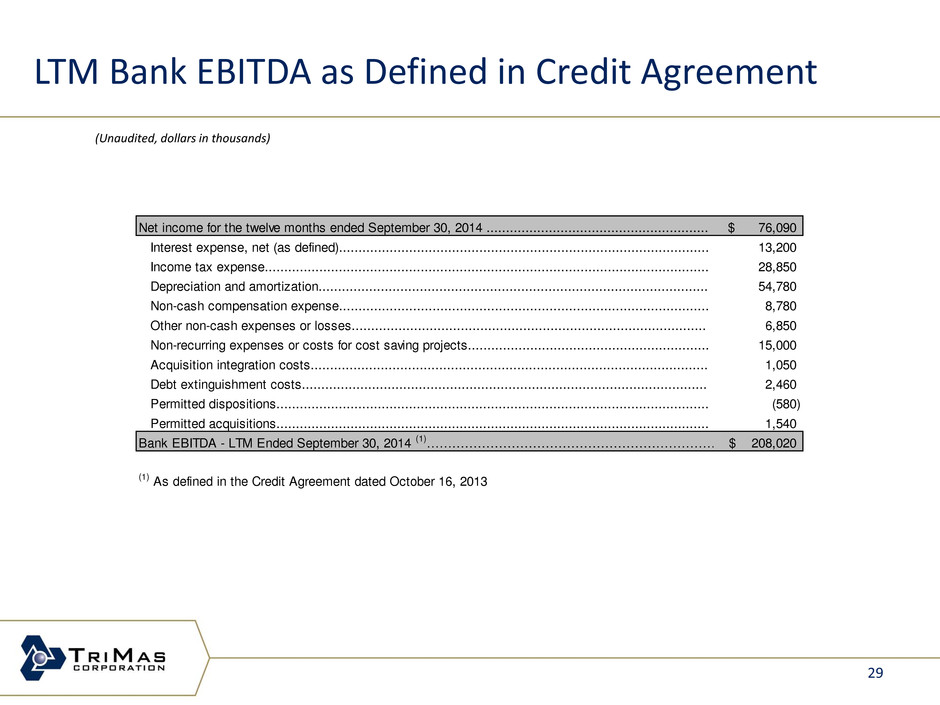

LTM Bank EBITDA as Defined in Credit Agreement 29 (Unaudited, dollars in thousands) 76,090$ Interest expense, net (as defined)............................................................................................... 13,200 Income tax expense.................................................................................................................. 28,850 Depreciation and amortization.................................................................................................... 54,780 Non-cash compensation expense............................................................................................... 8,780 Other non-cash expenses or losses........................................................................................... 6,850 Non-recurri g expenses or costs for cost saving projects.............................................................. 15,000 Acquisition integration costs...................................................................................................... 1,050 Debt extinguishment costs........................................................................................................ 2,460 Permitted dispositions............................................................................................................... (580) Permitted acquisitions............................................................................................................... 1,540 208,020$ (1) As defined in the Credit Agreement dated October 16, 2013 Net income for the twelve months ended September 30, 2014 ......................................................... Bank EBITDA - LTM Ended September 30, 2014 (1)…………………………………………………………………