Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Novagen Ingenium Inc. | Financial_Report.xls |

| EX-32.2 - CERTIFICATION - Novagen Ingenium Inc. | novz_ex322.htm |

| EX-31.2 - CERTIFICATION - Novagen Ingenium Inc. | novz_ex312.htm |

| EX-32.1 - CERTIFICATION - Novagen Ingenium Inc. | novz_ex321.htm |

| EX-31.1 - CERTIFICATION - Novagen Ingenium Inc. | novz_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

or

|

¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _____________

Commission file # 333-149617

|

NOVAGEN INGENIUM INC |

|

(Exact Name of Registrant as Specified in its Charter) |

|

Nevada |

98-0471927 |

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification number) |

|

|

9120 Double Diamond Pkwy Ste 2227, Reno, Nevada |

89521 |

|

|

(Address of principal executive offices) |

(Zip Code) |

Registrant's telephone number: 310-994-7988

Securities registered under Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.0001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company in Rule 12b-2 of the Act (Check one):

|

Large accelerated filer |

¨ |

Accelerated filer |

¨ |

|

Non-accelerated filer |

¨ |

Smaller reporting company |

x |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $833,165.

As of September 8, 2014 the Registrant had 48,510,901 shares of its Common Stock outstanding.

FORWARD LOOKING STATEMENTS

Certain statements made in this Annual Report are “forward-looking statements” (within the meaning of the Private Securities Litigation Reform Act of 1995) regarding the plans and objectives of management for future operations. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking statements made in this Report are based on current expectations that involve numerous risks and uncertainties. The Company’s plans and objectives are based, in part, on assumptions involving the growth and expansion of business. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of the Company. Although the Company believes that its assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate and, therefore, there can be no assurance that the forward-looking statements made in this Report will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements made in this Report, the inclusion of such information should not be regarded as a representation by the Company or any other person that the objectives and plans of the Company will be achieved.

As used herein, the terms “we”, “us”, “our” and “the Company” refer to Novagen Ingenium Inc and the term “Novagen Group” refers to the Company and its five wholly-owned subsidiaries, unless the context indicates otherwise.

|

2

|

PART I

Item 1. Business

Overview

Novagen Ingenium Inc. is engaged in the development and commercialization of low carbon emission engines and other engineering technology solutions. Our head office is located at 9120 Double Diamond Pkwy Suite 2227, Reno, Nevada 89521 (Telephone: 310 994 7988 Email: corporate@novagenenergy.com).

The Company was incorporated in the State of Nevada, on June 22, 2005, as Pickford Minerals, Inc. The Company was originally engaged in the exploration of mineral deposits in Labrador, Newfoundland, but was unable to implement its exploration program. In April 2009, the Company began to pursue business opportunities relating to photovoltaic solar energy. On May 12, 2009, the Company changed its name to Novagen Solar Inc.

On December 7, 2011, there was a change in control of the Company when Twenty Second Trust, a trust organized under the laws of the State of Queensland, Australia, acquired control of the Company by purchasing 67% of the issued and outstanding shares of the Company’s common stock from shareholders of the Company. Following the change in control, the Company’s board of directors determined that the Company should expand its business to include the development of environmentally sustainable energy solutions through innovative and eco-friendly products and technologies.

Following a change in control and management in December 2011, we moved our operations to Queensland, Australia, to focus on engine development, and entered into a new development stage for accounting purposes effective January 1, 2012.

On January 3, 2012, the Company formed Novagen Pty Ltd., under the laws of Australia, to engage in the manufacture and distribution of products related to solar energy and other clean technologies, including low carbon emission engines. On June 30 2013 the Company divested all of its interest in Novagen Pty Ltd. and abandoned its pursuit of solar energy and other clean technologies to concentrate on the development of low carbon emission engines.

On January 17, 2012, the Company formed Novagen Precision Engineering Pty Ltd. (formerly Novagen Productions Pty Ltd) under the laws of Australia, as a wholly owned operating subsidiary.

On March 2, 2012, the Company formed Novagen Finance Pty Ltd under the laws of Australia as a wholly owned operating subsidiary. Novagen Finance Pty Ltd operates as an internal finance company for the Novagen Group.

Effective June 14, 2012, we acquired Y Engine Developments Pty. Ltd., an Australian corporation, as a wholly-owned subsidiary. Y Engine Developments Pty Ltd. is in the business of developing the Novagen Y Engine and other new engine designs and geometrical engine operating configurations that challenge the existing internal combustion engine market.

Effective June 25, 2012, we acquired Renegade Engine Company Pty. Ltd. (formerly Renegade Streetwear Pty Ltd.), an Australian corporation, as a wholly owned subsidiary (“Renegade”). Renegade is in the business of design, manufacture and distribution of V-twin engines, custom motorcycles and related urban clothing under the Renegade brand. As an original equipment manufacturer, Renegade has developed and manufactured several V-twin motorcycle engines.

Engine Development

The reciprocating internal combustion engine has been in commercial operation for more than a century with many advances in technical operation resulting in numerous differentiated designs, including two stroke, four stroke, rotary, turbine, radial, in-line, v block, boxer, side valve and overhead engines. Over the past century, in-line and V-block engines have become the dominant configurations in non-aircraft commercial applications. Novagen intends to develop engines based on innovative designs and technology that can be powered by gasoline, diesoline, biofuels, liquid petroleum gas, steam, permanent magnets and other alternative energy sources.

|

3

|

The Renegade Engine

Prohibitive production costs have limited sales of the Renegade engine to 60 units since Renegade commenced operations on April 12, 2011. Our management intends to combine elements of the Renegade engine with our own engine products, materials and technologies, to produce engines that can be commissioned into industry, aerospace, marine and automotive applications. Novagen plans to utilize economies of scale not formerly available to Renegade to reduce production costs, and achieve profitability within the next 12 months. There is no assurance that we will succeed in developing an engine, or that if we do, that we will ever be able to commercialize it profitably.

The Novagen Y Engine

The Novagen Y Engine (patent pending) under development is a new design engine configuration that utilizes opposing pistons and three angled cylinders with 180 degree crank journals. On October 14, 2012, the Company filed for patent protection of the Novagen Y-Engine with the United States Patent and Trade Mark Office. On November 2, 2012, the Company filed an updated patent application and is currently preparing the utility patent application.

Products and Services

We sell our motor cycle products through our shop front and workshop facilities. Renegade had a number of independent dealers prior to the acquisition by Novagen and these dealers will be contacted to negotiate ongoing involvement in a new dealer network to be established in the near future. Motor cycle products sold by Renegade includes the sales and service of Renegade V-Twin engines, custom motorcycle design manufacture and sales, motorcycle engineering services and spare part sales. Through our shop front and workshop facility at Helensvale?, we have established and serviced a growing customer base of motorcycle owners and enthusiasts.

Design and Development

We believe the combination of established products being delivered to market as original equipment manufacturers and the design and development of new engine technology places the company in a

We are committed to a substantial ongoing design and development program to:

· create and capture new engine intellectual technology;

· develop, produce and improve line items such as Renegade V-Twin engines.

Sales and Marketing

We will conduct ongoing marketing activities to promote Novagen and Renegade brands to our customer base and to the general public. Our marketing and promotional efforts will include attending motorcycle trade shows, obtaining publication of articles on our company and its products in industry magazines and other publications available to the general public.

|

4

|

Manufacturing and Suppliers

Our manufacturing operations consist of in-house production of components, parts and custom modifications. Supply of other components, materials and parts are sourced via standard commercial trading terms.

Competition

Engine technology design and development is highly competitive, and our competitors have substantially greater financial, personnel, development, marketing and other resources than us. Our main competitor is Ecomotors International, Inc. which is in an advanced development stage of an opposing piston engine. Other significant competitors range from back yard garage inventors to established market leading engine companies.

The V-Twin motorcycle engine market is highly competitive, and our competitors have substantially greater financial, personnel, development, marketing and other resources than us. Our main competitor is S&S Cycle, Inc. which dominates the after-market V-Twin engine market. Other short run V-Twin after-market engine manufacturers pose direct competition to us. We believe product placement in the original equipment manufacturer contracted supply and joint venture vehicle manufacturing industry will directly impact the future demand for after-market V-Twin motorcycle engines. We cannot assure anyone that we will be able to compete against current or future competitors. Competition faced by us may harm our operations, business and financial position.

Intellectual Property

The proprietary nature of, and protection for, our products, materials, processes and know-how are important to our business. We will seek patent protection in the United States and internationally for our intellectual property where available and when appropriate. In addition, we rely on trade secrets, know-how and continuing innovation to develop and maintain our competitive position.

On October 14, 2012, we filed for patent protection of the Novagen Y-Engine with the United States Patent and Trade Mark Office. On November 2, 2012, we filed an updated patent application and is currently preparing the utility patent application.

Our wholly owned subsidiary, Renegade Engine Company Pty Ltd., holds a registered trademark for the Renegade logo and the Renegade trade name in connection with motorcycles and motorcycle products.

Regulations

Our operations are subject to a variety of national, federal, regional and local laws, rules and regulations relating to worker safety and the use, storage, discharge and disposal of environmentally sensitive materials.

Other than the filing of patent applications with the respective governmental bodies, we are not aware of any approval of our engine and engineering services, materials or processes that may be required from government authorities at this stage in our development. However, once a product is ready to be commercialized, the governmental approval and regulatory process may become substantial.

We believe that we are in compliance in all material respects with all laws, rules, regulations and requirements that affect our business. Further, we believe that compliance with such laws, rules, regulations and requirements does not impose a material impediment on our ability to conduct business.

|

5

|

Facilities

Our principal facilities are located in Queensland, Australia, where we lease approximately 3,300 square feet of commercial space and 2,500 square feet of office space through our subsidiary, Novagen Pty Ltd.

Employees

The Company does not have any employees other than our officers and directors. Our wholly owned subsidiaries, Novagen Pty Ltd. and Renegade Engine Company Pty Ltd. presently employ seven full-time employees and one part-time employee.

Item 1A. Risk Factors

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

Item 1B. Unresolved Staff Comments

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

Item 2. Properties

We do not presently own or have an interest in any real property.

Item 3. Legal Proceedings

Neither the Company nor any of its officers or directors is a party to any material legal proceeding or litigation and such persons know of no material legal proceeding or contemplated or threatened litigation. There are no judgments against the Company or its officers or directors. None of our officers or directors have been convicted of a felony or misdemeanour relating to securities or performance in corporate office.

|

6

|

PART II

Item 5. Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our shares trade under the symbol “NOVZ” on the OTCBB and the OTCQB. Very limited trading activity with our common stock has occurred during the past two years and the subsequent interim period; therefore, only limited historical price information is available. The following table sets forth the high and low bid prices of our common stock for the last two fiscal years, as reported by OTC Markets Group Inc. and represents inter dealer quotations, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions:

|

Quarter Ended |

High | Low | ||||||

|

December 31, 2013 |

$ |

0.070 |

$ |

0.032 |

||||

|

September 30, 2013 |

0.050 |

0.031 |

||||||

|

June 30, 2013 |

0.220 |

0.031 |

||||||

|

March 31, 2013 |

0.540 |

0.018 |

||||||

|

December 31, 2012 |

0.596 |

0.040 |

||||||

|

September 30, 2012 |

0.040 |

0.040 |

||||||

|

June 30, 2012 |

0.040 |

0.040 |

||||||

|

March 31, 2012 |

0.040 |

0.040 |

||||||

Unregistered Sales of Equity Securities and Use of Proceeds

On December 14, 2012, the Company issued 35,000 shares of its common stock to five persons not affiliated with the Company or resident in the United States in exchange for aggregate cash consideration of $17,500. The issuance of our common stock was exempt from registration under Regulation S promulgated under the Securities Act of 1933, as amended.

On November 12, 2012, the Company issued 400,000 shares of its common stock at to a person not resident in the United States in satisfaction of a debt obligation in the amount $100,000 owed by a subsidiary of the Company. The issuance of our common stock was exempt from registration under Regulation S promulgated under the Securities Act of 1933, as amended.

On June 24, 2013, the Company issued 2,000,000 shares of its common stock to related-party creditors in order to convert two promissory notes with an aggregate carrying value of $92,300 at the date of conversion (AU$100,000). The issuance of our common stock was exempt from registration under Regulation S promulgated under the Securities Act of 1933, as amended.

Holders

On July 31, 2014, we had 52 registered holders of our common stock and 50,510,901 shares of common stock issued and 48,510,901 outstanding. The number of record holders was determined from the records of our transfer agent and does not include beneficial owners of shares of common stock whose shares are held in the names of various security brokers, dealers, and registered clearing agencies.

|

7

|

Dividend Policy

We have not declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

Convertible Securities

At December 31, 2013, we had one convertible debt instrument outstanding, the principal of which can be converted into a maximum of 500,000 shares of common stock. As of December 31, 2013, none of the debt had been converted into common stock.

Penny Stock Regulation

Our shares must comply with the Penny Stock Reform Act of 1990, which may potentially decrease our shareholders’ ability to easily transfer their shares. Broker-dealer practices in connection with transactions in "penny stocks" are regulated. Penny stocks generally are equity securities with a price of less than $5.00. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer's account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock, the broker-dealer make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that must comply with the penny stock rules. Since our shares must comply with such penny stock rules, our shareholders will in all likelihood find it more difficult to sell their securities.

Item 6. Selected Financial Data

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our plan of operation should be read in conjunction with the financial statements and the related notes. This discussion contains forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Our actual results and the timing of certain events could differ materially from those anticipated in these forward-looking statements as a result of certain factors.

Overview

Our business is in the early stages of development. We have not earned any significant revenues since inception. Our currently available capital and cash flow has been generated through share subscriptions and loans from management and non-affiliated third parties and it is management’s intention that this will continue together with increases in revenue.

|

8

|

Our ultimate success will depend upon our ability to raise capital, including joint venture projects and debt or equity financings. Future financings through equity investments are likely to be dilutive to existing stockholders. Also, the terms of securities we may issue in future capital transactions may be more favorable for our new investors. Newly issued securities may include preferences, superior voting rights, and the issuance of warrants or other derivative securities, which may have additional dilutive effects. Further, we may incur substantial costs in pursuing future capital and financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial condition.

Our ability to obtain needed financing may be impaired by such factors as the capital markets, both generally and specifically in the engine industry, and the fact that we have not been profitable, which could impact the availability or cost of future financings. If the amount of capital we are able to raise from financing activities, together with our revenue from operations, is not sufficient to satisfy our capital needs, even to the extent that we reduce our operations accordingly, we may be required to cease operations.

As a result of the foregoing, our auditors have expressed doubt about our ability to continue as a going concern in our financial statements for the year ended December 31, 2013.

Results of Operations

We recorded a net comprehensive loss of $420,049 for the twelve months ended December 31, 2013, compared with a net loss of $977,735 for the twelve months ended December 31, 2012 (Predecessor net loss $3,658, Post-Acquisition Successor net loss $974,077).

Revenue amounted to $26,890 for the twelve months ended December 31, 2013 versus $16,720 for the previous year (Predecessor $250, Post Acquisition Successor $16,470).

Cost of revenues amounted to $28,176 for the twelve months ended December 31, 2013 compared with $27,232 for the previous year (Predecessor $1,458, Post Acquisition Successor $25,774).

Total SG&A and depreciation amounted to $280,830 for the twelve months ended December 31, 2013 compared with $950,086 for the previous year (Predecessor $2,450, Post Acquisition Successor $947,636). This includes depreciation depletion and amortization of $11,547 for the current year and $5,124 for the previous year. The reduction in the current year versus the previous year is principally due to a reduction in stock-based compensation from $485,000 in the previous year to zero in the current.

Liquidity and Capital Reserves

Our financial statements have been prepared on a going concern basis that contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business.

At December 31, 2013 our total liabilities amounted to $796,150 compared with $636,949 at December 31, 2012.

Item 7a. Quantitative and Qualitative Disclosures about Market Risk.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

|

9

|

Item 8. Financial Statements

FINANCIAL STATEMENTS

NOVAGEN INGENIUM, INC.

CONTENTS

|

Report of Independent Registered Public Accounting Firm |

F-1 |

|

FINANCIAL STATEMENTS |

|

|

Balance Sheets as of December 31, 2013 and 2012 (Predecessor and Successor) |

F-2 |

|

Statements of Operations for the for the year ended December 31, 2013 (Successor) and for the periods from January 1, 2012 to June 25, 2012 (Predecessor) and from June 26, 2012 to December 31, 2012 (Post-Acquisition Successor) |

F-3 |

|

Statement of Changes in Stockholders’ Deficit for the period from June 26, 2012 to December 31, 2013 (Post Acquisition Successor) |

F-4 |

|

Statement of Changes in Members’ Equity for the period from April 12, 2011 through December 31, 2011 and the period from January 1, 2012 through June 25, 2012 (Predecessor) |

F-5 |

|

Statements of Cash Flows for the year ended December 31, 2013 (Successor) and for the periods from January 1, 2012 to June 25, 2012 (Predecessor) and from June 26, 2012 to December 31, 2012 (Post-Acquisition Successor) |

F-7 |

|

10

|

Report of Independent Public Accounting Firm

To the Board of Directors

Novagen Ingenium Inc.

Reno, Nevada

We have audited the accompanying consolidated balance sheets of Novagen Ingenium Inc. and its subsidiaries (collectively, the “Company” or “Successor”) as of December 31, 2013 and 2012 and the related consolidated statements of operations, stockholders' deficit and cash flows for the year ended December 31, 2013 and the period from June 26, 2012 through December 31, 2012. We have also audited the accompanying statements of operations, changes in members’ equity and cash flows of Renegade Streetwear, Pty (“Predecessor”) for the period from January 1, 2012 through June 25, 2012. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of the Successor as of December 31, 2013 and 2012 and the consolidated results of their operations and their cash flows for the year ended December 31, 2013 and the period from June 26, 2012 through December 31, 2012 in conformity with accounting principles generally accepted in the United States of America. Further, in our opinion, the Predecessor financial statements referred to above present fairly, in all material respects, the results of its operations and its cash flows for the period from January 1, 2012 through June 25, 2012 in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, the Company has suffered losses from operations and has a working capital deficit. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regards to these matters are also described in Note 2. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty

/s/ MaloneBailey, LLP

www.malonebailey.com

Houston, Texas

October 27, 2014

|

F-1

|

NOVAGEN INGENIUM INC.

CONSOLIDATED BALANCE SHEETS

| December 31, | |||||||||

|

2013 |

2012 |

|

|||||||

|

ASSETS |

|||||||||

|

Cash and equivalents |

|

$ |

327 |

$ |

1,451 |

|

|||

|

Accounts receivable |

|

- |

7,995 |

|

|||||

|

Other current assets |

|

27 |

13,056 |

|

|||||

|

Investments |

|

- |

18,821 |

|

|||||

|

Total current assets |

|

354 |

41,323 |

|

|||||

|

Property and equipment, net |

|

227,038 |

31,576 |

|

|||||

|

Intangible assets |

|

- |

5,759 |

|

|||||

|

Other non-current assets |

|

18,085 |

- |

|

|||||

|

Total non-current assets |

|

245,123 |

37,335 |

|

|||||

|

TOTAL ASSETS |

|

$ |

245,477 |

$ |

78,658 |

|

|||

|

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) |

|||||||||

|

Accounts payable and accrued liabilities |

|

$ |

159,562 |

$ |

156,413 |

|

|||

|

Notes payable |

|

449,806 |

129,730 |

|

|||||

|

Notes payable, related parties |

|

103,842 |

290,834 |

|

|||||

|

Deferred income |

|

82,940 |

59,972 |

|

|||||

|

Total current liabilities |

|

796,150 |

636,949 |

|

|||||

|

TOTAL LIABILITIES |

|

796,150 |

636,949 |

|

|||||

|

STOCKHOLDERS' DEFICIT |

|||||||||

|

Preferred stock, $0.0001 par value, 50,000,000 shares authorized; no shares issued and outstanding |

|

- |

- |

|

|||||

|

Common stock, $0.0001 par value; 100 million shares authorized, 48,510,901 and 46,510,901 shares issued and outstanding at December 31, 2013 and 2012, respectively |

|

4,852 |

4,652 |

|

|||||

|

Additional paid in capital |

|

1,609,411 |

1,199,494 |

|

|||||

|

Accumulated other comprehensive gain (loss) |

|

64,686 |

(4,233 |

) |

|||||

|

Common stock payable |

|

17,550 |

- |

|

|||||

|

Accumulated deficit |

|

(2,247,172 |

) |

(1,758,204 |

) |

||||

|

TOTAL STOCKHOLDERS' DEFICIT |

|

(550,673 |

) |

(558,291 |

) |

||||

|

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT |

|

$ |

245,477 |

$ |

78,658 |

|

|||

The accompanying notes are an integral part of these consolidated financial statements

|

F-2

|

NOVAGEN INGENIUM INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND OTHER COMPREHENSIVE LOSS

|

|

|

|

|||||||||||

|

Successor Year Ended December 31, 2013 |

Predecessor January 1, 2012 to June 25, 2012 |

Post-Acquisition Successor June 26, 2012 to December 31, 2012 |

|||||||||||

|

REVENUES |

|||||||||||||

|

Sales |

$ |

26,890 |

$ |

250 |

$ |

16,470 |

|||||||

|

Cost of revenues |

28,176 |

1,458 |

12,529 |

||||||||||

|

Gross profit |

(1,286 |

) |

(1,208 |

) |

3,941 |

||||||||

|

OPERATING EXPENSES |

|||||||||||||

|

General and administrative expenses |

269,283 |

2,450 |

331,943 |

||||||||||

|

Impairment of goodwill |

- |

- |

75,938 |

||||||||||

|

Depreciation, depletion and amortization |

11,547 |

- |

- |

||||||||||

|

Total operating expenses |

280,830 |

2,450 |

407,881 |

||||||||||

|

Net loss |

(282,116 |

) |

(3,658 |

) |

(403,940 |

) |

|||||||

|

OTHER INCOME/(EXPENSE) |

|||||||||||||

|

Interest income |

49 |

- |

68 |

||||||||||

|

Interest expense |

(91,947 |

) |

- |

(12,961 |

) |

||||||||

|

Total other expense |

(91,898 |

) |

- |

(12,893 |

) |

||||||||

|

Net income (loss) from continuing operations |

(374,014 |

) |

(3,658 |

) |

(416,833 |

) |

|||||||

|

Discontinued operations |

(114,954 |

) |

- |

(553,011 |

) |

||||||||

|

Net loss |

$ |

(488,968 |

) |

$ |

(3,658 |

) |

$ |

(969,844 |

) |

||||

|

OTHER COMPREHENSIVE INCOME/(LOSS) |

|||||||||||||

|

Currency translation |

68,919 |

- |

(4,233 |

) |

|||||||||

|

Net comprehensive loss |

$ |

(420,049 |

) |

$ |

(3,658 |

) |

$ |

(974,077 |

) |

||||

|

Net loss per share |

|||||||||||||

|

From continuing operations |

(0.01 |

) |

n/a |

(0.02 |

) |

||||||||

|

From discontinued operations |

(0.00 |

) |

(0.01 |

) |

|||||||||

|

Weighted average number of shares outstanding |

47,551,997 |

n/a |

45,737,709 |

||||||||||

The accompanying notes are an integral part of these consolidated financial statements

|

F-3

|

NOVAGEN INGENIUM, INC.

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

Period from June 26, 2012 through December 31, 2013

|

Additional |

Accumulated Other Comprehensive | Common Stock | Accumulated | Total Shareholder | ||||||||||||||||||||||||

|

|

Shares | Par Value | Capital | Gain / (Loss) | Payable | Deficit | Equity | |||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Balance, June 26, 2012 |

44,075,900 |

$ |

4,407 |

$ |

592,290 |

$ |

- |

$ |

- |

$ |

(788,360 |

) |

$ |

(191,663 |

) |

|||||||||||||

|

Shares issued for cash |

435,000 |

45 |

122,404 |

122,449 |

||||||||||||||||||||||||

|

Shares issued for services |

2,000,000 |

200 |

484,800 |

485,000 |

||||||||||||||||||||||||

|

Shares issued for Y Engine Developments |

1 |

- |

- |

- |

- |

- |

||||||||||||||||||||||

|

Unrealized currency gains / (losses) |

(4,233 |

) |

(4,233 |

) |

||||||||||||||||||||||||

|

Net loss |

(969,844 |

) |

(969,844 |

) |

||||||||||||||||||||||||

|

Balance, December 31, 2012 |

46,510,901 |

$ |

4,652 |

$ |

1,199,494 |

$ |

(4,233 |

) |

$ |

- |

$ |

(1,758,204 |

) |

$ |

(558,291 |

) |

||||||||||||

|

Shares issued for conversion of debt |

2,000,000 |

200 |

93,894 |

94,094 |

||||||||||||||||||||||||

|

Beneficial conversion feature of promissory note |

51,273 |

51,273 |

||||||||||||||||||||||||||

|

Gain on sale of subsidiary to related party |

264,750 |

264,750 |

||||||||||||||||||||||||||

|

Unrealized currency gains / (losses) |

68,919 |

68,919 |

||||||||||||||||||||||||||

|

Shares payable in connection with asset purchase |

17,550 |

17,550 |

||||||||||||||||||||||||||

|

Net loss |

(488,968 |

) |

(488,968 |

) |

||||||||||||||||||||||||

|

Balances, December 31, 2013 |

48,510,901 |

$ |

4,852 |

$ |

1,609,411 |

$ |

64,686 |

$ |

17,550 |

$ |

(2,247,172 |

) |

$ |

(550,673 |

) |

|||||||||||||

The accompanying notes are an integral part of these consolidated financial statements

|

F-4

|

NOVAGEN INGENIUM INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

|||||||||||||

|

Successor Year Ended December 31, 2013 |

Predecessor January 1, 2012 to June 25, 2012 |

Post-Acquisition Successor June 26, 2012 to December 31, 2012 |

|

||||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES |

|||||||||||||

|

Net income / (loss) |

|

$ |

(488,968 |

) |

$ |

(3,658 |

) |

$ |

(969,844 |

) |

|||

|

Adjustments to reconcile net loss to net cash used in operating activities: |

|||||||||||||

|

Stock based compensation |

|

- |

- |

485,000 |

|

||||||||

|

Beneficial conversion feature of promissory note |

|

51,273 |

|||||||||||

|

Depreciation |

|

11,547 |

- |

5,124 |

|

||||||||

|

Impairment of goodwill |

|

- |

- |

75,938 |

|

||||||||

|

Change in operating assets and liabilities: |

|

||||||||||||

|

Accounts receivable |

|

7,995 |

(293 |

) |

(7,995 |

) |

|||||||

|

Inventory |

|

- |

3,070 |

- |

|

||||||||

|

Prepaid expense and other current asstes |

|

13,029 |

3,053 |

(6,373 |

) |

||||||||

|

Deferred revenue |

|

22,968 |

- |

59,972 |

|

||||||||

|

Accounts payable and accrued expenses |

|

52,098 |

5,884 |

108,768 |

|

||||||||

|

Other non-current assets |

|

- |

- |

- |

|

||||||||

|

Net cash provided by / (used in) operations |

|

(330,058 |

) |

8,056 |

(249,410 |

) |

|||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES |

|||||||||||||

|

Purchase of investments |

|

- |

- |

(18,821 |

) |

||||||||

|

Cash divested upon sale of subsidiary to a related party |

|

- |

- |

- |

|

||||||||

|

Net cash used in investing activities |

|

- |

- |

(18,821 |

) |

||||||||

|

F-5

|

NOVAGEN INGENIUM INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Continued)

|

|

|||||||||||||

|

Successor Year Ended December 31, 2013 |

Predecessor January 1, 2012 to June 25, 2012 |

Post-Acquisition Successor June 26, 2012 to December 31, 2012 |

|

||||||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES |

|||||||||||||

|

Proceeds from notes payable |

|

130,872 |

- |

129,487 |

|

||||||||

|

Proceeds from related-party notes payable |

|

153,859 |

- |

98,715 |

|

||||||||

|

Payments on related-party notes payable |

|

(24,716 |

) |

(10,499 |

) |

(87,773 |

) |

||||||

|

Proceeds from the sale of stock |

|

- |

- |

122,449 |

|

||||||||

|

Net cash provided by/(used in) financing activities |

|

260,015 |

(10,499 |

) |

262,878 |

|

|||||||

|

Foreign exchange effect |

|

68,919 |

- |

6,105 |

|

||||||||

|

Net change in cash and equivalents |

|

(1,124 |

) |

(2,443 |

) |

752 |

|

||||||

|

Cash and equivalents, beginning of period |

|

1,451 |

2,611 |

699 |

|

||||||||

|

Cash and equivalents, end of period |

|

$ |

327 |

$ |

168 |

$ |

1,451 |

|

|||||

|

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION |

|||||||||||||

|

Cash paid for interest |

|

$ |

10,852 |

$ |

- |

11,504 |

|

||||||

|

Cash paid for income taxes |

|

- |

- |

- |

|

||||||||

|

SUPPLEMENTAL DISCLOSURES OF NON-CASH FINANCING ACTIVITIES |

|||||||||||||

|

Debt conversions |

|

$ |

94,094 |

$ |

- |

$ |

- |

|

|||||

|

Shares payable for property, plant and equipment |

|

17,550 |

- |

- |

|

||||||||

|

Sale of subsidiary to related party |

|

264,750 |

- |

- |

|

||||||||

|

Debt issued for property, plant and equipment |

|

239,563 |

- |

- |

|

||||||||

|

Implied Australian General Services Tax |

|

18,085 |

- |

- |

|

||||||||

|

Debt discount |

|

51,273 |

- |

- |

|

||||||||

The accompanying notes are an integral part of these consolidated financial statements

|

F-6

|

NOVAGEN INGENIUM INC.

Notes to Consolidated Financial Statements

Note 1. Organization and Description of Business

Novagen Ingenium Inc. (referred to herein collectively with its subsidiaries as “Novagen” and the “Company”), was incorporated in the State of Nevada, U.S.A., on June 22, 2005 under the name of Pickford Minerals, Inc. The Company’s fiscal year end is December 31. On May 12, 2009, the Company changed its name to Novagen Solar Inc. The Company was originally engaged in the exploration of mineral deposits in Labrador, Newfoundland, but was unable to implement its exploration program. In April 2009, the Company began to pursue business opportunities relating to photovoltaic solar energy.

On December 7, 2011, there was a change in control of the Company when Twenty Second Trust, a trust organized under the laws of the State of Queensland, Australia acquired control of the Company by purchasing 67% of the issued and outstanding shares of the Company’s common stock from shareholders of the Company. Following the change in control, the board of directors determined that the Company should expand its business to include the development of environmentally sustainable energy solutions through innovative and eco-friendly products and technologies.

On January 3, 2012, the Company formed Novagen Pty Ltd under the laws of Australia, as a wholly owned operating subsidiary. On January 17, 2012, the Company formed Novagen Productions Pty Ltd. under the laws of Australia, as a wholly owned operating subsidiary. On March 2, 2012, the Company formed Novagen Finance Pty Ltd under the laws of Australia, as a wholly owned non-operating subsidiary.

On June 25, 2012 the Company acquired Renegade Streetwear Pty Ltd. (“Renegade”), under the laws of Australia as a wholly owned operating subsidiary. Prior to the acquisition of Renegade Streetwear Pty Ltd the Company was a shell company. After acquiring Renegade, the Company’s name was changed to Renegade Engine Company, Pty Ltd. At the time of the acquisition, Renegade was in the business of designing, manufacturing and distributing V-Twin engines, custom motorcycles and related urban clothing under the Renegade brand. Renegade operates from leased premises situated at Helensvale, Queensland for use as a workshop, prototype machine shop and engine assembly shop. In late 2013, Renegade abandoned its custom motorcycle business and now concentrates on development of the Renegade V-Twin engine line as its core business.

Under Securities and Exchange Commission rules, when a registrant succeeds to substantially all of the business of another entity and the registrant’s own operations before the succession appear insignificant relative to the operations assumed or acquired, the registrant is required to present financial information for the acquired entity (the “Predecessor”) for all comparable periods being presented before the acquisition.

We are therefore providing additional information in our financial statements regarding the predecessor business for periods prior to June 25, 2012. Renegade Streetwear Pty Ltd is considered the predecessor company. The financial information in this report that relates to the predecessor company is labeled “Predecessor Business” in the financial statements.

On September 27, 2012, the Company acquired all the issued and outstanding shares of Y Engine Developments Pty Ltd, a development stage Australian company (hereunder “Y Engine Developments”), from Michael Nugent, who is also the President and a director of the Company. The Company issued one common share to Mr. Nugent as the total aggregate consideration for Y Engine Developments.

On April 15, 2013, the Company filed Articles of Merger with the Nevada Secretary of State in order to merge with Novagen Ingenium Inc. (the "Subsidiary"), a wholly-owned subsidiary of the Company that was incorporated on April 2, 2013 under the laws of the State of Nevada (the "Merger"). Effective April 30, 2013, the Subsidiary merged with and into the Company, with the Company being the surviving entity. As a result of the Merger, effective April 30, 2013, the Articles of Incorporation of the Company were amended to change the name of the Registrant to Novagen Ingenium Inc.

|

F-7

|

Summary of Significant Accounting Policies

The financial statements of the Company have been prepared in accordance with the generally accepted accounting principles in the United States of America. Because a precise determination of many assets and liabilities is dependent upon future events, the preparation of financial statements for a period necessarily involves the use of estimates that have been made using careful judgment. The financial statements have, in management’s opinion been properly prepared within reasonable limits of materiality and within the framework of the significant accounting policies summarized below:

Accounting Method

The Company’s financial statements are prepared using the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America and reported in US Dollars.

Revenue Recognition

Revenue from the sale of goods is recognised by the company in accordance with Accounting Standards Codification “(ASC”) 605, when all the following conditions have been satisfied:

1. persuasive evidence of an arrangement exists;

2. product delivery has occurred;

3. title and risk of loss has transferred to the buyer;

4. sales price to the customer is fixed and determinable and;

5. collectability is assured.

Cash received prior to the revenue recognition criteria above being met is recorded as deferred revenue until all criteria have been met.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses for the reporting period. The Company reviews its estimates on an ongoing basis. The estimates were based on historical experience and on various other assumptions that the Company believes to be reasonable under the circumstances. Actual results could differ from these estimates. The Company believes the judgments and estimates required in its accounting policies to be critical in the preparation of the Company’s financial statements.

Cash and Cash Equivalents

For purposes of the statement of cash flows, the Company considers all highly liquid investments and short-term debt instruments with original maturities of three months or less to be cash equivalents.

|

F-8

|

Property and Equipment

The Company has property and equipment being depreciated over the period between two to ten years. Depreciation on property and equipment is provided on a straight line basis over their expected useful lives. Generally, these useful lives are: Computer equipment: 2 years; Plant and equipment: 7 years; Motor vehicles: 7 years; Office furniture and equipment: 5 years.

Inventories

Inventories are measured at the lower of cost and net realizable value. The cost of manufactured products includes direct materials, direct labor and an appropriate portion of variable and fixed overheads. Overheads are applied on the basis of normal operating capacity. Costs are assigned on the basis of weighted average costs.

Concentration of Credit Risk

The Company places its cash and cash equivalents with high credit quality financial institutions in uninsured accounts.

Consolidation Policy

In January, March, June and September 2012, the Company incorporated three subsidiaries and acquired two wholly-owned subsidiaries, and as such, the consolidated financial statements include the accounts of Novagen Ingenium Inc. and its wholly-owned subsidiaries. All significant intercompany balances and transactions have been eliminated upon consolidation.

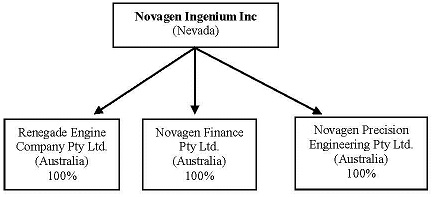

Our Corporate Structure

All of our business operations are conducted through our Australian subsidiaries. The chart below presents our corporate structure.

Reclassifications

Certain financial statement amounts for the prior period have been reclassified to conform to the current period presentation. These reclassifications had no effect on the net loss or accumulated deficit as previously reported.

Foreign Currency Translations

Novagen maintains its accounting records in US Dollars. The Company’s subsidiaries are located and operating outside of the United States of America. They maintain their accounting records in Australian Dollars. For reporting purposes the Company reports its financial information in US Dollars.

Transactions in a currency other than the functional currency are measured in the respective functional currencies of the Company and its subsidiaries and are recorded on initial recognition in the functional currencies at exchange rates approximating those ruling at the transaction dates. Exchange gains and losses are recorded in the statements of income and comprehensive income.

|

F-9

|

Assets and liabilities of the Company and its subsidiaries are translated into the U.S. dollars at exchange rates at the balance sheet date, equity accounts are translated at historical exchange rate and revenues and expenses are translated by using the average exchange rates. Translation adjustments are reported as cumulative translation adjustments and are shown as a separate component of other comprehensive income in the statements of stockholders’ equity.

The following table provides the exchange rates used to translate the balances in the accounts from Australian Dollars to US Dollars:

| Australian Dollar / US Dollar |

|

|||||||||

|

Item |

|

Rate Used |

2013 | 2012 |

|

|||||

|

Assets and liabilities |

|

Year-end |

0.8906 |

1.0370 |

|

|||||

|

Revenues and expenses |

|

Average |

0.9670 |

1.0354 |

|

|||||

Fair Value of Financial Instruments

The Company's financial instruments as defined by Accounting Standards Codification (“ASC”) 825, "Disclosures about Fair Value of Financial Instruments," include accounts payable and accrued liabilities and notes payable. Fair values were assumed to approximate carrying value for these financial instruments, except where noted. Management is of the opinion that the Company is not exposed to significant interest or credit risks arising from these financial instruments. The Company is operating outside the United States of America and has significant exposure to foreign currency risk due to the fluctuation of currency in which the Company operates and U.S. dollars.

Long-lived assets impairment

Long-lived assets of the Company are reviewed for impairment whenever events or circumstances indicate that the carrying amount of assets may not be recoverable, pursuant to guidance established in ASC 360, Accounting for the Impairment or Disposal of Long-Lived Assets.

Management considers assets to be impaired if the carrying value exceeds the future projected cash flows from related operations (undiscounted and without interest charges). If impairment is deemed to exist, the assets will be written down to fair value. Fair value is generally determined using a discounted cash flow analysis.

Stock-Based Compensation

The Company adopted ASC 718, "Share-Based Payment", to account for its stock options and similar equity instruments issued. Accordingly, compensation costs attributable to stock options or similar equity instruments granted are measured at the fair value at the grant date, and expensed over the expected vesting period. ASC 718 requires excess tax benefits be reported as a financing cash inflow rather than as a reduction of taxes paid. The Successor Company did not grant any stock options during the period from June 26, 2012 through December 31, 2013.

Comprehensive Income

The Company adopted ASC 220, "Reporting Comprehensive Income", which establishes standards for reporting and display of comprehensive income, its components and accumulated balances. The Company is disclosing this information on its Statement of Stockholders' Equity and its Statements of Operations and Comprehensive Income. The Company’s comprehensive income consists of net earnings for the period and currency translation adjustments.

Income Taxes

The Company has adopted ASC 740, "Accounting for Income Taxes", which requires the Company to recognize deferred tax liabilities and assets for the expected future tax consequences of events that have been recognized in the Company’s financial statements or tax returns using the liability method. Under this method, deferred tax liabilities and assets are determined based on the temporary differences between the financial statement and tax bases of assets and liabilities using enacted tax rates in effect in the years in which the differences are expected to reverse.

|

F-10

|

Basic and Diluted Loss Per Share

In accordance with ASC 260 – “Earnings Per Share”, the basic loss per common share is computed by dividing net loss available to common stockholders by the weighted average number of common shares outstanding. Diluted loss per common share is computed similar to basic loss per common share except that the denominator is increased to include the number of additional common shares that would be outstanding if the potential common shares had been issued and if the additional common shares were dilutive. At December 31, 2012, the basic loss per share was equal to diluted loss per share as there were no dilutive instruments.

Business Combinations

ASC 805 applies the acquisition method of accounting for business combinations established in ASC 805 to all acquisitions where the acquirer gains a controlling interest, regardless of whether consideration was exchanged. ASC 805 establishes principles and requirements for how the acquirer: a) recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, and any non-controlling interest in the acquiree; b) recognizes and measures the goodwill acquired in the business combination or a gain from a bargain purchase; and c) determines what information to disclose to enable users of the financial statements to evaluate the nature and financial effects of the business combination.

Recently Adopted and Recently Enacted Accounting Pronouncements

Recent accounting pronouncements issued by the FASB (including its EITF), the AICPA, and the SEC did not or are not believed by management to have a material impact on the Company's present or future financial statements.

Note 2. Going Concern

The Company has an accumulated deficit of $2,247,172 for the period from June 26, 2012 (date of acquisition of Renegade Streetwear Pty, Ltd.) through December 31, 2013, and does not have the resources at this time to repay its credit and debt obligations, make any payments in the form of dividends to its shareholders or fully implement its business plan. Without additional capital, the Company will not be able to remain in business.

These factors raise substantial doubt about the Company’s ability to continue as a going concern.

In addition to operational expenses, as the Company executes its business plan, it is incurring expenses related to complying with its public reporting requirements. In order to finance these expenditures, the Company has raised capital in the form of debt, which will have to be repaid, as discussed in detail below.

The Company has depended on loans from private investors and related parties for much of its operating capital. The Company will need to raise capital or have positive cash flows from operations in the next twelve months in order to remain in business.

Management anticipates that significant dilution will occur as a result of any future sales of the Company’s common stock and this will reduce the value of its outstanding shares. The Company cannot project the future level of dilution that will be experienced by investors as a result of its future financings, but it will significantly affect the value of its shares.

The accompanying financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that may result from the possible inability of the Company to continue as a going concern.

|

F-11

|

Note 3. Property and Equipment

The Company has property and equipment being depreciated over period between two to ten years. Depreciation on property and equipment is provided on a straight line basis over their expected useful lives.

On October 11, 2013, the Company acquired certain plant and equipment in exchange for AU$270,000 (approximately US$239,563) plus 270,000 shares of the Company common stock. An independent valuation of the fair value of the equipment was performed in Australia and determined that its fair value, before considering the Australian Goods and Services Tax (“GST”), was AU$203,060 (or approximately US$180,169). 10% of the amount was considered to be GST tax and not allocated to the purchase price, but held as future input GST payments. We valued the shares promised as consideration at their fair values on the date of the acquisition and added US$17,550 to the total amount of consideration given. Therefore, the total amount of consideration given, including cash and promised stock, was US$257,113 and US$18,085 was allocated to input GST to be applied against future tax payments.

The following table breaks down property and equipment by category:

| December 31, | ||||||||

| 2013 | 2012 | |||||||

|

Property and improvements |

|

$ |

- |

$ |

3,572 |

|

||

|

Plant and equipment |

|

237,118 |

14,119 |

|

||||

|

Office furniture and equipment |

|

- |

18,570 |

|

||||

|

Total property and equipment, at cost |

|

237,118 |

36,261 |

|

||||

|

Less: accumulated depreciation |

|

(10,080 |

) |

(4,685 |

) |

|||

|

Property and equipment, net |

|

$ |

227,038 |

$ |

31,576 |

|

||

For the years ended December 31, 2013 depreciation, depletion and amortization was $11,547. For the period from January 1, 2012 to June 25, 2012, the date of acquisition of Renegade Engine Company Pty. Ltd. (formerly Renegade Streetwear Pty Ltd.), depreciation, depletion and amortization was $15,702 (Predecessor). For the period from June 26, 2012 to December 31, 2012 (the Post-Acquisition Successor), depreciation, depletion and amortization was $608.

Note 4. Notes Payable

Borrowings from related parties

The Company has four promissory notes payable to related parties, being Rubyden Pty Ltd., Jennifer Mewett Pty Ltd., Loadstone Motor Corporation Pty Ltd. and Micheal Nugent, respectively. All the related party notes are unsecured, payable on demand, and accrue interest at the rate of 5% per annum on un-matured amounts and 10% on matured, unpaid amounts. As at December 31, 2012, the total unpaid principal on all the promissory notes was $290,834 (AUD $280,365) and unpaid interest was $9,181 (AUD $8,850). As demand notes these promissory notes are considered current liabilities.

|

F-12

|

During the year ended December 31, 2013, the Company borrowed an additional $153,859 from related parties, made principal payments of $24,716 and converted the above-mentioned Rubyden and Jennifer Mewett debt of AU$100,000 (about US$94,094 at the time of conversion). In addition, $194,700 (AU$219,437) was extinguished upon the sale of Novagen Pty Ltd. to a related party. This activity resulted in an ending balance of $103,842 in related party debt.

Borrowings from third parties

On September 17, 2012, we issued a promissory note to an unrelated party in the amount of $129,730 (AUD $125,000). The note is payable on demand and bears interest at 10%. As of December 31, 2012, total unpaid interest on this note was US$3,268 (AUD $3,151).

During the year ended December 31, 2013, we borrowed an additional $130,872 from unrelated parties, and extinguished $24,400 (AU$27,500) upon the sale of Novagen Pty Ltd to a related party. This activity resulted in an ending balance owed to unrelated parties of $449,806 (AU$505,060).

Of the amounts due to third parties at December 31, 2013, one promissory note for AU$50,000 (US$44,530) can be converted into common stock at the rate of AU$0.10. We valued this beneficial conversion feature at the number of shares convertible (500,000) times the closing price of our common stock on February 27, 2013 which resulted in a value greater than the present value of the underlying promissory note. We therefore capped the value at the nominal value of promissory note and included $51,273 in interest expense for the year ended December 31, 2013.

Note 5. Capital Stock

Preferred stock

The Company has 50,000,000 shares of preferred stock authorized and none issued.

Common stock

The Company has 100,000,000 shares of common stock authorized. During the period from June 26, 2012 to December 31, 2012, we, the Successor Company, had the following stock transactions:

|

· |

During November, 2012, we issued an aggregate of 435,000 shares of common stock and received cash proceeds of US$122,449. |

|

|

|

||

|

· |

On July 17, 2012, we issued 1,500,000 shares of common stock to a consulting company for services. We valued the shares at their fair value on the grant date and charged general and administrative expenses with $285,000. |

|

|

|

||

|

· |

On October 12, 2012, we issued 500,000 shares of common stock to a consulting company for services. We valued the shares at their fair value on the grant date and charged general and administrative expenses with $200,000. |

|

|

|

||

|

· |

On September 27, 2012, the Company acquired all the issued and outstanding shares of Y Engine Developments Pty Ltd, a development stage Australian company (hereunder “Y Engine Developments”), from Michael Nugent, who is also the President and a director of the Company. The Company issued one common share to Mr. Nugent as the total aggregate consideration for Y Engine Developments. |

During the year ended December 31, 2013, we issued 1 million shares each to Rubyden Pty Ltd., and Jennifer Mewett Pty Ltd. to convert their debt balances to equity. We valued the shares at their grant date fair value of $94,094.

|

F-13

|

Note 6. Related Party Transactions

On September 27, 2012, the Company acquired all the issued and outstanding shares of Y Engine Developments Pty Ltd, a development stage Australian company (hereunder “Y Engine Developments”), from Michael Nugent, who is also the President and a director of the Company. The Company issued one common share to Mr. Nugent as the total aggregate consideration for Y Engine Developments. Y Engine Developments had no assets, liabilities or operations prior to the acquisition.

During the year ended December 31, 2012, we had net borrowings from our Chief Executive Officer and President, Micheal Nugent, of US$110,285 (AU$106,315). Gross proceeds from Mr. Nugent to the company amounted to US$198,223 (AU$191,087) and repayments of US$87,938 (AU$84,772). At December 31, 2012, the company is indebted to Mr. Nugent in the amount of US $110,285 (AU$106,315).

During the year ended December 31, 2013, we had net borrowings of $41,617 (AU$43,038) from Mr. Nugent and extinguishment of Mr. Nugent’s debt of $115,496 (AU$119,437) upon the sale of Novagen Pty Ltd. to a related party.

During the year ended December 31, 2012, other related parties loaned the Company an aggregate of US$180,549 (AU$174,050). These notes are demand notes with no guarantee, no stated maturity date bearing 5% annual interest on un-matured amounts and 10% on matured, unpaid amounts. As demand notes these notes are considered current liabilities.

During the year ended December 31, 2013, we had net borrowings from related parties other than Mr. Nugent of $87,526 (AU$98,626), debt converted into common stock of $94,094 (AU$100,000), and extinguished $96,700 (AU$100,000) of related-party debt when we sold Novagen Pty Ltd. to a related party.

Note 7. Business Combinations and Dispositions

On June 25, 2012, the Company acquired all of the issued and outstanding shares of Renegade Streetwear Pty Ltd., an Australian company (“Renegade”), for consideration of 400,000 shares of common stock in Novagen Ingenium Inc. As a result of the acquisition, Renegade is a wholly owned operating subsidiary of the Company. The estimation of fair value of the assets and liabilities obtained as a result of the acquisition is as follows:

| US$ Fair Value |

|

|||

|

Purchase consideration |

|

|||

|

400,000 shares of common stock |

|

$ |

76,000 |

|

|

Fair value of assets and liabilities obtained |

|

|||

|

Cash and cash equivalents |

|

168 |

|

|

|

Accounts receivable |

|

293 |

|

|

|

Accounts payable |

|

(399 |

) |

|

|

Identifiable assets and liabilities acquired |

|

$ |

62 |

|

|

Goodwill |

|

$ |

75,938 |

|

|

F-14

|

As of December 31, 2012, the Company analyzed the goodwill recognized from the Renegade acquisition for impairment under ASC 350-20. The Company used a discounted cash flow approach to determine the fair value of the Renegade reporting unit. As the fair value of the reporting unit was less than the carrying value of the reporting unit including goodwill, the Company impaired the goodwill down to its implied value. As a result of this analysis, the Company determined to recognize an impairment charge of $75,938.

On September 27, 2012, the Company acquired all of the issued and outstanding shares of Y Engine Developments Pty Ltd from Micheal Nugent, our Chief Executive Officer, in exchange for one share of its common stock. Y Engine Developments had no assets, liabilities or operations prior to the acquisition.

The Company has property and equipment being depreciated over period between two to ten years. Depreciation on property and equipment is provided on a straight line basis over their expected useful lives.

On October 11, 2013, the Company acquired certain plant and equipment in exchange for AU$270,000 (approximately US$239,563) plus 270,000 shares of the Company common stock (see Note 5).

Sale of Novagen Pty Ltd.

On July 1, 2013, we sold our subsidiary, Novagen Pty Ltd. to a related party for AU$100 (about US$92). The effect on the financial statements was to reduce assets by US$51,394, reduce liabilities by US$307,900, reduce stockholders’ equity by $22,700, increase the foreign exchange effect by $14,456, and to record a gain of $264,750 on the sale as follows:

|

Financial Statement Item |

|

Financial Effect |

|

|

|

Assets |

|

|||

|

Cash and equivalents |

|

$ |

(3,365 |

) |

|

Other current assets |

|

(6 |

) |

|

|

Investments |

|

(16,747 |

) |

|

|

Property, plant and equipment |

|

(35,946 |

) |

|

|

Accumulated depreciation |

|

6,981 |

|

|

|

Intangible assets |

|

(2,309 |

) |

|

|

Total assets |

|

(51,394 |

) |

|

|

Liabilities |

|

|||

|

Accounts payable and accrued liabilities |

|

42,432 |

|

|

|

Notes payable |

|

25,383 |

|

|

|

Notes payable, related parties |

|

240,085 |

|

|

|

Deferred income |

|

- |

|

|

|

Total current liabilities |

|

307,900 |

|

|

|

Stockholders' Deficit |

|

|||

|

Additional paid in capital |

|

6,745 |

|

|

|

Accumulated loss |

|

15,955 |

|

|

|

Total stockholders' deficit |

|

22,700 |

|

|

|

Foreign exchange effect |

|

(14,456 |

) |

|

|

Gain on sale of Novagen Pty Ltd to related party |

|

$ |

264,750 |

|

Because the sale was to a related party, we included the gain in Additional Paid in Capital.

|

F-15

|

Acquisition of assets from Misal Technologies Pty Ltd.

On March 7, 2013, the Company entered into a written agreement to acquire certain assets, including an aircraft computerized hydraulic test station and associated intellectual property, from Misal Technologies Pty Ltd. of Victoria, Australia. Under the terms and subject to the conditions set forth in the agreement, Novagen was to pay a cash purchase price of AU$2,000,000 (USD$2,046,706) for the assets.

This acquisition has not closed and is still pending.

Note 8. Income Taxes

At December 31, 2013 and 2012, the Company had deferred tax assets of approximately $529,000 and 437,000, respectively, principally arising from net operating loss carryforwards for income tax purposes. As our management cannot determine that it is more likely than not that we will realize the benefit of the deferred tax asset, a valuation allowance equal to the deferred tax asset has been established at December 31, 2013 and 2012. The significant component of the deferred tax asset at December 31, 2013 and 2012 was as follows:

| December 31, | ||||||||

| 2013 | 2012 |

|

||||||

|

Deferred tax asset at 30% |

|

$ |

529,000 |

437,000 |

|

|||

|

Valuation allowance |

|

(529,000 |

) |

(437,000 |

) |

|||

|

Net deferred tax asset |

|

$ |

- |

$ |

- |

|

||

At December 31, 2013 and 2012, the Company had net operating loss carry forwards of approximately $1,762,000 and $1,250,000 which will begin to expire in the year 2026.

|

F-16

|

Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

In connection with the preparation of this annual report on Form 10-K, an evaluation was carried out by our management, with the participation of the Chief Executive Officer and the Chief Financial Officer, of the effectiveness of the Company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934 (“Exchange Act”)) as of December 31, 2013. Disclosure controls and procedures are designed to ensure that information required to be disclosed in reports filed or submitted under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the SEC rules and forms and that such information is accumulated and communicated to management, including the Chief Executive Officer and the Chief Financial Officer, to allow timely decisions regarding required disclosures.

Based on that evaluation, the Company’s management concluded, as of the end of the period covered by this report, that the Company’s disclosure controls and procedures were not effective. Management intends to improve the adequacy of its disclosure controls and procedures during the course of 2014, subject to available resources.

Management’s Report on Internal Control over Financial Reporting

The Company’s management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is defined in Rule 13a-15(f) and Rule 15d-15(f) promulgated under the Exchange Act as a process designed by, or under the supervision of, the Company’s principal executive and principal financial officers, or persons performing similar functions, and effected by the Company’s board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. The Company’s internal control over financial reporting includes those policies and procedures that: