Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DIGITAL REALTY TRUST, INC. | a8-kshellearningsdeck093014.htm |

28 October 2014 October 28, 2014 Going the Distance

The Way Forward Top Priorities Progress Report 2 • Improved ROIC ~ 30 bps year-over-year • Rolled out new sales comp plan in January 2014 • Leased 5.7 MW of finished inventory in 3Q14 • Commenced capital recycling program • Began marketing first phase of asset sales • Closed a Joint Venture with Griffin (GCEAR) seeded with a Turn-Key Flex data center • Announced Global Alliances Program • Established partnerships with Carpathia and VMware • Expanding Global Cloud Marketplace with ~ 80 additional cloud service providers in 4Q14 • Committed capital to signed leases • Active Data Center Construction is 86% leased • ROIC on signed leases at 11% as of 9/30/14 • Continue to unleash intellectual capital • Expanded Bernard Geoghegan’s mandate to include APAC in addition to EMEA • Lease-up existing inventory and improve ROIC • Align our leasing efforts and sales incentive program to bring inventory back into equilibrium • Recycle capital to focus on the core • Sell non-strategic assets to refine our portfolio focus, improve ROIC and fund future capital requirements • Explore additional joint venture opportunities • Improve asset utilization and deliver innovative product offerings • Focus on mid-market and colocation, Open IX and ecosystem initiatives • Transition to Just-in-Time Inventory • Know returns with certainty before building • Commit capital only for projects that meet return thresholds • Unleash the intellectual capital and creative energies of the Digital Realty team WE SAID… WE DID…

Macro Dashboard Relatively Benign Outlook 3 1) IMF World Economic Outlook - October 2014 2) Bloomberg 3) Nate Silver FiveThirtyEight.com – October 2014 4) Citi Research 5) Gartner: IT Spending Worldwide, 3Q14 – September 2014 6) Gartner: Servers Forecast Worldwide – September 2014 7) Cisco Global Cloud Index: Forecast and Methodology, 2012-2017 - October 2013 2Q14 Call Current July 29,2014 October 27, 2014 Global GDP Growth Forecast (1) 2014E: 3.4% 2014E: 3.3% 3.8% n/a U.S. GDP Growth Forecast (2) 2014E: 1.7% 2014E: 2.2% 3.1% n/a U.S. Unemployment Rate (2) 6.2% 6.1% 5.6% 5.4% Inflation Rate - U.S. Annual CPI Index (2) 2.1% 1.7% 2.0% 2.2% Control of White House, Senate and House of Representatives (3) D,D,R D,D,R D,R,R n/a One-Month Libor (USD) (2) 0.16% 0.15% 0.5% 1.4% 10-Year U.S. Treasury Yield (2) 2.5% 2.3% 3.4% n/a S&P 500 (2) 1,970 / YTD 6.6% 1,962 / YTD 6.1% P/E 17.8x 17.5x NASDAQ (2) 4,443 / YTD 6.4% 4,486 / YTD 7.4% P/E 45.2x 69.4x RMZ (2) 1,047 / YTD 17.3% 1,066 / YTD 19.5% n/a Avg FFO multiple (4) 16.8x 17.0x IT Spending Growth Worldwide (5) 2014E: 2.8% 2014E: 3.2% 3.8% 3.3% Server Shipment Growth Worldwide (6) 2014E: 4.3% 2014E: 3.6% 4.0% 3.2% 26% 26% CAGR '12-'17E CAGR '12-'17E 35% 35% CAGR '12-'17E CAGR '12-'17E 22.1x 18.1x 15.9x Change 2015E 2016E 16.3x 14.9x CAGR '12-'17E 35% CAGR '12-'17E 26% M ac ro ec o n o m ic In te re st R at es Global Cloud IP Traffic (7) Global Data Center to Data Center IP traffic (7)In d u st ry E q u ity M ar ke ts

Value-Creating Joint Venture Contribution Establishes Attractive Valuation for Turn-Key Properties 1) Represents GAAP NOI adjusted for above/below market rent, deferred rental income and allocated landlord overhead. For a description of NOI and cash NOI and a reconciliation to net income, please see the Appendix. 2) The cash cap rate is calculated by dividing anticipated forward 12-month cash net operating income by the purchase price (including assumed debt). Cash net operating income represents rental revenue and tenant reimbursement revenue from in-place leases less rental property operating and maintenance expenses, property taxes and insurance expenses and is not a financial measure calculated in accordance with GAAP. Partner • Griffin Capital Essential Asset REIT, Inc. (“GCEAR”) Market • Ashburn, VA Property Type • Turn-Key Flex data center JV Contribution Date • September 9, 2014 Ownership • Digital Realty 20% / GCEAR 80% Property Valuation Price • $185.5 million / $1,402 per square foot / $20,611 per kW Size • 132,280 rentable square feet (approx.) Occupancy • 100% Tenants • Financial Services and Social Media Term • Long-term hold (10 years or longer expected) Levered Cash on Cash Yield to Digital Realty • Mid-teens levered cash-on-cash yield, expected to increase over a 10-year period 2014 Cash NOI – Estimated • $13.1 million(1) Cap Rate • 7.05%(2) Benefits • Attractive alternative source of equity for Digital Realty • Establishes long-term relationship with a partner who has appetite for future Turn-Key Flex transactions, including potential Build-to-Suits • Healthy yield on Digital Realty retained equity interest • Establishes strong market cap rate for Turn-Key Flex products 4

Turn-Key Flex® 148,612 $140 $20.8 million Powered Base Building® 22,000 $46 $1.0 million Custom Solutions 15,195 $238 $3.6 million Colocation 23,082 $229 $5.3 million Non-Technical 15,939 $32 $0.5 million Total 224,828 $139 $31.3 million Type of Space Total s.f. Signed (1) Annualized GAAP Annualized GAAP Base Rent / s.f. (2) Base Rent (2) $ $20 $40 $60 1Q 07 3Q 07 1Q 08 3Q 08 1Q 09 3Q 09 1Q 10 3Q 10 1Q 11 3Q 11 1Q 12 3Q 12 1Q 13 3Q 13 1Q 14 3Q 14 Sustained Leasing Momentum Consistent Execution in Absorbing Inventory 1) Includes signings for new and re-leased space. 2) GAAP rental revenues include total rent for new leases and expansion. The timing between lease signing and lease commencement (and receipt of rents) may be significant. 3) Represents $12 million direct lease with a former sub-tenant at a Powered Base Building in Santa Clara. Historical Signings – Annualized GAAP Base Rent (2) $ in millions 5 (3)

Annualized GAAP Base Rent (1) Lease Momentum Driven by Cloud Providers Cloud Demand is the Fastest Growing Segment $ in millions 6 1) GAAP rental revenues include total rent for new leases and expansion. The timing between lease signing and lease commencement (and receipt of rents) may be significant $0 $20 $40 $60 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 All Other Social, Mobile, Analytics, Cloud & Content

Healthy Renewal Economics (1) Peak-Rate Expirations Weigh on Otherwise Solid Results 7 5% -9% 66% 22% 10% -6% -15% 0% 15% 30% 45% 60% 75% GAAP Rent Change Cash Rent Change TKF PBB Total Datacenter 1) Represents Turn-Key Flex and Powered Base Building product types signed in 3Q14. ® ® ■ Signed renewal leases representing $42 million of annualized GAAP rental revenue ■ Rental rates on renewals increased by 10% on a GAAP basis and decreased by 6% on a cash basis for total data center space ■ Renewed 107,000 square feet of Powered Base Building data centers at a rental rate increase of 66% on a GAAP basis and 22% on a cash basis ■ Renewed 234,000 square feet of Turn-Key Flex data centers at a rental rate increase of 5% on a GAAP basis and decrease of 9% on a cash basis

Steady Velocity & Pricing Early Innings of Rate Trend Improvement 1) GAAP rental revenues include total rent for new leases and expansion. The timing between lease signing and lease commencement (and receipt of rents) may be significant. 2) As of September 30, 2014. 8

Expected Commencement Quarter Expected Commencement Quarter Lag Has Stabilized in the ~ Six-Month Range (1) Sign-to-Commencement Gap is Healthy 1) Expected commencement quarter at time of signing. 2) On a weighted-average basis. Note: Amounts shown represent GAAP annualized base rent from signed but not commenced leases and are based on current estimates of future lease commencement timing. Actual results may vary from current estimates. Amounts shown include signed but not commenced leasing at unconsolidated JV’s at 100%. Expected Commencement Quarter months S ig ni ng Q ua rt er $ in millions S ig ni ng Q ua rt er 9 • Average sign-to-commence gap in 3Q14 is 5.5 months (2) • 79% of leases signed in 3Q14 commence within 12 months (2) $ in millions $ in millions (2) (2) (1) 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 2016+ Pre 1Q13 $67.4 $19.3 $13.7 $8.3 $2.6 $3.8 $1.2 $1.6 $.0 $.0 $.0 $6.0 $2.3 $8.6 1Q13 $43.7 $7.8 $5.8 $7.0 $4.1 $2.9 $.3 $.0 $.0 $2.9 $1.3 $.0 $.0 $11.6 2Q13 $16.0 $.0 $5.1 $1.5 $3.2 $3.2 $.0 $.0 $.0 $.0 $.0 $.0 $.0 $3.1 3Q13 $47.3 $.0 $.0 $15.3 $13.1 $5.0 $8.1 $4.1 $.0 $.0 $.0 $.4 $.0 $.0 4Q13 $50.1 $.0 $.0 $.0 $12.8 $15.6 $6.0 $5.9 $1.8 $2.0 $1.8 $4.1 $.0 $.2 1Q14 $46.6 $.0 $.0 $.0 $.0 $7.4 $4.0 $2.8 $27.7 $2.0 $.0 $2.7 $.0 $.0 2Q14 $35.2 $.0 $.0 $.0 $.0 $.0 $9.3 $9.7 $2.9 $2.3 $1.0 $7.8 $.2 $2.0 3Q14 $31.2 $.0 $.0 $.0 $.0 $.0 $.0 $11.1 $7.7 $8.4 $.0 $.1 $.0 $4.0 $337.5 $27.0 $24.6 $32.1 $35.8 $38.0 $28.9 $24.1 $40.1 $17.6 $4.1 $21.1 $2.5 $29.5 Backlog: $114.9 5 5 6 4 18 12 5 5 6 7 6 - 5 10 15 20 $0 $20 $40 $60 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 Custom Solutions TKF All Other Types Sign to Commence Gap (Months)Current Q CQ+1 CQ+2 CQ+3 +4Q 1Q13 $43.7 $7.8 $5.8 $7.0 $4.1 $19.1 2Q13 $16.0 $5.1 $1.5 $3.2 $3.2 $3.1 3Q13 $45.9 $15.3 $13.1 $5.0 $8.1 $4.5 4Q13 $50.1 $12.8 $15.6 $6.0 $5.9 $9.9 1Q14 $46.6 $7.4 $4.0 $2.8 $27.7 $4.7 2Q14 $35.2 $9.3 $9.7 $2.9 $2.3 $11.0 3Q14 $31.2 $11.1 $7.7 $8.4 $.0 $4.0 $268.7 $68.7 $57.4 $35.2 $51.3 $56.3 Percent Commenced 26% 21% 13% 19% 21% (2)

Significant Absorption of Finished Inventory(1) Steady Progress Since Investor Day in megawatts 10 - 3 6 9 12 Phoenix Silicon Valley Dallas Boston Houston NY Metro N. Virginia Chicago Investor Day Nov. 12, 2013 As of Sept. 30, 2014 1) Finished inventory represents space ready for immediate leasing and is a subset of available inventory.

Data Center Retention is Solid Tenants are Sticky Given Their Capital Investment 1) Represents trailing 12-month average. Retention on Rentable Square Feet (1) 11 40% 60% 80% 100% 1Q10 3Q10 1Q11 3Q11 1Q12 3Q12 1Q13 3Q13 1Q14 3Q14 Data Center Non-Data Center Historical Average = 84% Historical Average = 52%

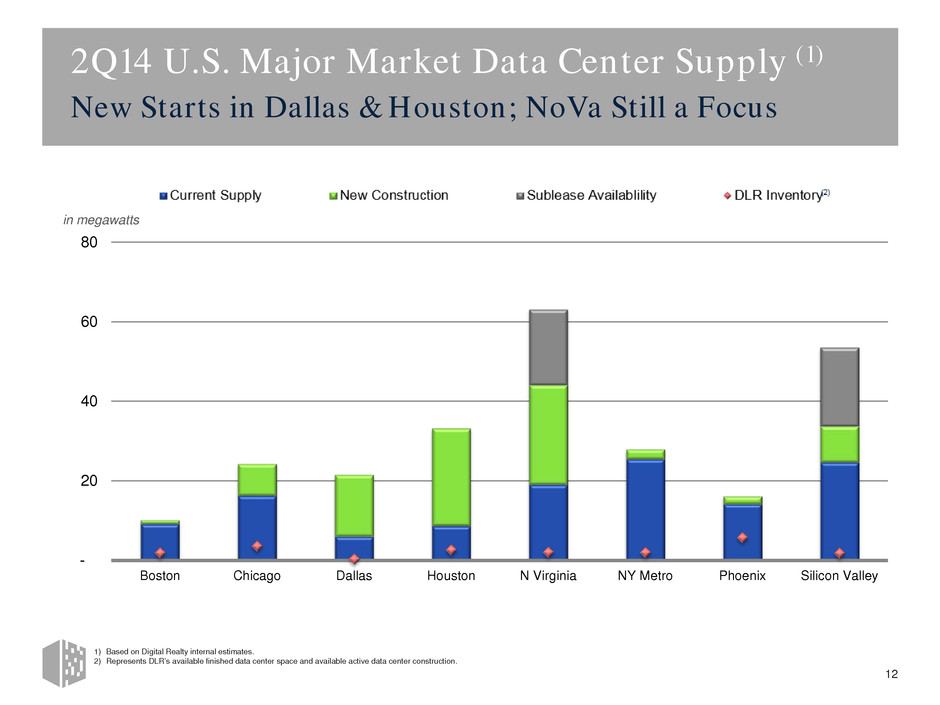

2Q14 U.S. Major Market Data Center Supply (1) New Starts in Dallas & Houston; NoVa Still a Focus 1) Based on Digital Realty internal estimates. 2) Represents DLR’s available finished data center space and available active data center construction. 12 in megawatts - 20 40 60 80 Boston Chicago Dallas Houston N Virginia NY Metro Phoenix Silicon Valley (2)

3Q14 U.S. Major Market Data Center Supply (1) Positive Momentum in NoVA & Silicon Valley 1) Based on Digital Realty internal estimates. 2) Represents DLR’s available finished data center space and available active data center construction. 13 in megawatts - 20 40 60 80 Boston Chicago Dallas Houston N Virginia NY Metro Phoenix Silicon Valley Current Supply New Construction Sublease Availablility DLR Inventory(2)

4.4x 4.3x 3.8x 3.7x 3.6x 3.2x 2.9x 0.0x 2.0x 4.0x 6.0x DLR AVB FRT SPG KIM EQR BXP 4.3x 3.8x 3.7x 3.2x 3.1x 2.9x 2.8x 0.0x 2.0x 4.0x 6.0x AVB FRT SPG EQR DLR KIM BXP 7.1x 6.9x 6.6x 6.2x 5.5x 5.5x 5.3x 0.0x 2.0x 4.0x 6.0x 8.0x KIM BXP EQR DLR AVB SPG FRT 6.7x 6.6x 5.9x 5.5x 5.5x 5.3x 5.0x 0.0x 2.0x 4.0x 6.0x 8.0x BXP EQR KIM AVB SPG FRT DLR Credit Metrics Compare Favorably to REIT Peers Committed to a Conservative Capital Structure Source: Company calculation based on 3Q14 data, unless otherwise indicated, derived from public filings by FactSet and SNL Financial Data. Peers may calculate these or similar metrics differently. 1) Adjusted EBITDA is a non-GAAP financial measure. For a description of Adjusted EBITDA, see the Appendix. 2) For these companies, the data is based on 2Q14 numbers which are the most current results available at this time. 3) Based on GAAP interest expense plus capitalized interest. Interest Coverage (3) Net Debt + Preferred / LQA Adjusted EBITDA (1) Net Debt / LQA Adjusted EBITDA (1) Fixed Charge Coverage (3) 14 (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2)

Credit Spreads Have Tightened Nicely Digital Realty Notes due 2022 vs. REIT BBB 10 Year 15 Basis points - 20 40 60 80 100 Jan-13 Apr-13 Jul-13 Oct-13 Jan-14 Apr-14 Jul-14 Oct-14

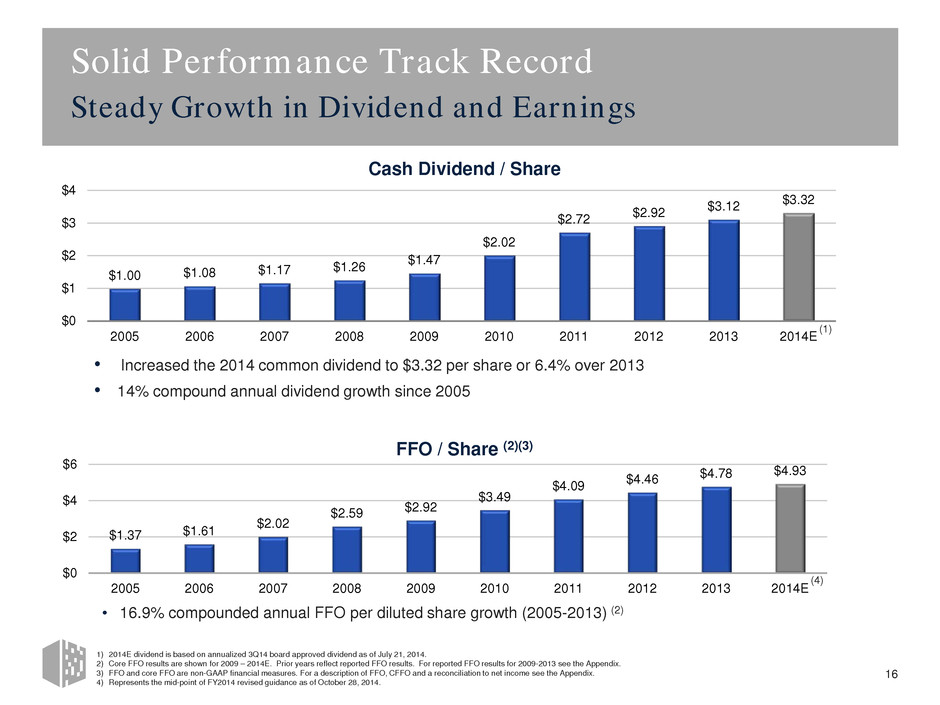

$1.00 $1.08 $1.17 $1.26 $1.47 $2.02 $2.72 $2.92 $3.12 $3.32 $0 $1 $2 $3 $4 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014E Solid Performance Track Record Steady Growth in Dividend and Earnings 16 1) 2014E dividend is based on annualized 3Q14 board approved dividend as of July 21, 2014. 2) Core FFO results are shown for 2009 – 2014E. Prior years reflect reported FFO results. For reported FFO results for 2009-2013 see the Appendix. 3) FFO and core FFO are non-GAAP financial measures. For a description of FFO, CFFO and a reconciliation to net income see the Appendix. 4) Represents the mid-point of FY2014 revised guidance as of October 28, 2014. Cash Dividend / Share FFO / Share (2)(3) • Increased the 2014 common dividend to $3.32 per share or 6.4% over 2013 • 14% compound annual dividend growth since 2005 (1) $1.37 $1.61 $2.02 $2.59 $2.92 $3.49 $4.09 $4.46 $4.78 $4.93 $0 $2 $4 $6 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014E • 16.9% compounded annual FFO per diluted share growth (2005-2013) (2) (4)

Consistent Execution on Strategic Vision Third Quarter in Review Signed $31 million of new leasing ̵ Including a $5.3 million mid-market contribution Leased 5.7 megawatts of finished inventory ̵ One megawatt of positive net absorption Occupancy ticked up another 20 bps sequentially Same-capital cash NOI growth of 5.9% (1) ̵ Raised guidance for full-year same-capital cash NOI growth by 50 bps to 4.5% - 5.5% Commenced capital-recycling program ̵ Crystallized ~$100 million of taxable gains year-to-date Beat consensus analyst estimates by two cents Raised the low end of the guidance range by five cents 17 1) The same-capital pool includes properties owns as of December 31, 2013 with less than 5% of total rentable square feet under development. It also excludes properties that were undergoing, or were expected to undergo development activities in 2013-2014. NOI is a non-GAAP financial measurement. For a description of NOI and reconciliation to operating income, see the Appendix.

Appendix 18

Definitions of Non-GAAP Financial Measures 19 The information included in this presentation contains certain non-GAAP financial measures that management believes are helpful in understanding our business, as further described below. Our definition and calculation of non-GAAP financial measures may differ from those of other REITs, and, therefore, may not be comparable. The non-GAAP financial measures should not be considered an alternative to net income or any other GAAP measurement of performance and should not be considered an alternative to cash flows from operating, investing or financing activities as a measure of liquidity. FUNDS FROM OPERATIONS (FFO) We calculate Funds from Operations, or FFO, in accordance with the standards established by the National Association of Real Estate Investment Trusts, or NAREIT. FFO represents net income (loss) (computed in accordance with GAAP), excluding gains (or losses) from sales of property, impairment charges, real estate related depreciation and amortization (excluding amortization of deferred financing costs) and after adjustments for unconsolidated partnerships and joint ventures. Management uses FFO as a supplemental performance measure because, in excluding real estate related depreciation and amortization and gains and losses from property dispositions, it provides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates and operating costs. We also believe that, as a widely recognized measure of the performance of REITs, FFO will be used by investors as a basis to compare our operating performance with that of other REITs. However, because FFO excludes depreciation and amortization and captures neither the changes in the value of our properties that result from use or market conditions, nor the level of capital expenditures and capitalized leasing commissions necessary to maintain the operating performance of our properties, all of which have real economic effect and could materially impact our financial condition and results from operations, the utility of FFO as a measure of our performance is limited. Other REITs may not calculate FFO in accordance with the NAREIT definition and, accordingly, our FFO may not be comparable to such other REITs’ FFO. Accordingly, FFO should be considered only as a supplement to net income computed in accordance with GAAP as a measure of our performance. CORE FUNDS FROM OPERATATIONS (CFFO) We present core funds from operations, or CFFO, as a supplemental operating measure because, in excluding certain items that do not reflect core revenue or expense streams, it provides a performance measure that, when compared year over year, captures trends in our core business operating performance. We calculate CFFO by adding to or subtracting from FFO (i) termination fees and other non-core revenues, (ii) significant transaction expenses, (iii) loss from early extinguishment of debt, (iv) costs on redemption of preferred stock, (v) significant property tax adjustments, net, (vi) change in fair value of contingent consideration and (vii) other non-core expense adjustments. Because certain of these adjustments have a real economic impact on our financial condition and results from operations, the utility of CFFO as a measure of our performance is limited. Other REITs may not calculate CFFO in a consistent manner. Accordingly, our CFFO may not be comparable to other REITs’ CFFO. CFFO should be considered only as a supplement to net income computed in accordance with GAAP as a measure of our performance. NET OPERATING INCOME (NOI) AND CASH NOI NOI represents rental revenue and tenant reimbursement revenue less rental property operating and maintenance expenses, property taxes and insurance expenses (as reflected in statement of operations). NOI is commonly used by stockholders, company management and industry analysts as a measurement of operating performance of the company’s rental portfolio. Cash NOI is NOI less straight-line rents and above and below market rent amortization. Cash NOI is commonly used by stockholders, company management and industry analysts as a measure of property operating performance on a cash basis. However, because NOI and cash NOI exclude depreciation and amortization and capture neither the changes in the value of our properties that result from use or market conditions, nor the level of capital expenditures and capitalized leasing commissions necessary to maintain the operating performance of our properties, all of which have real economic effect and could materially impact our results from operations, the utility of NOI and cash NOI as measures of our performance is limited. Other REITs may not calculate NOI and cash NOI in the same manner we do and, accordingly, our NOI and cash NOI may not be comparable to such other REITs’ NOI and cash NOI. Accordingly, NOI and cash NOI should be considered only as supplements to net income computed in accordance with GAAP as measures of our performance.

Definitions of Non-GAAP Financial Measures 20 EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION (EBITDA) AND ADJUSTED EBITDA We believe that earnings before interest expense, income taxes, depreciation and amortization, or EBITDA, and Adjusted EBITDA (as defined below), are useful supplemental performance measures because they allow investors to view our performance without the impact of non-cash depreciation and amortization or the cost of debt and, with respect to Adjusted EBITDA, straight-line rent expense adjustment attributable to prior periods, change in fair value of contingent consideration, severance accrual and equity acceleration, impairment charges, gain on sale of property, gain on contribution of properties to unconsolidated joint venture, non-controlling interests, and preferred stock dividends. Adjusted EBITDA is EBITDA excluding straight-line rent expense adjustment attributable to prior periods, change in fair value of contingent consideration, severance accrual and equity acceleration, impairment charges, gain on sale of property, gain on contribution of properties to unconsolidated joint venture, non-controlling interests, and preferred stock dividends. In addition, we believe EBITDA and Adjusted EBITDA are frequently used by securities analysts, investors and other interested parties in the evaluation of REITs. Because EBITDA and Adjusted EBITDA are calculated before recurring cash charges including interest expense and income taxes, exclude capitalized costs, such as leasing commissions, and are not adjusted for capital expenditures or other recurring cash requirements of our business, their utility as a measure of our performance is limited. Other REITs may calculate EBITDA and Adjusted EBITDA differently than we do; accordingly, our EBITDA and Adjusted EBITDA may not be comparable to such other REITs’ EBITDA and Adjusted EBITDA. Accordingly, EBITDA and Adjusted EBITDA should be considered only as supplements to net income computed in accordance with GAAP as a measure of our financial performance.

Reconciliation of Non-GAAP Items To Their Closest GAAP Equivalent 21 Three Months Ended September 30, 2014 FFO available to common stockholders and unitholders $ 168,811 Add: 5.50% exchangeable senior debentures interest expense - FFO available to common stockholders and unitholders -- diluted $ 168,811 Weighted average common stock and units outstanding 138,308 Add: Effect of dilutive securities (excluding series D convertible preferred stock and 5.50% exchangeable senior debentures) 454 Add: Effect of dilutive series D convertible preferred stock - Add: Effect of dilutive 5.50% exchangeable senior debentures - Weighted average common stock and units outstanding -- diluted 138,762 Digital Realty Trust, Inc. and Subsidiaries Reconciliation of Funds From Operations (FFO) to Core Funds From Operations (CFFO) (in thousands, except per share and unit data) (unaudited) Three Months Ended September 30, 2014 FFO available to common stockholders and unitholders -- diluted $ 168,811 Termination fees and other non-core revenues (3) (165) Gain on insurance settlement - Significant transaction expenses 144 Loss from early extinguishment of debt 195 Straight-line rent expense adjustment attributable to prior periods - Change in fair value of contingent consideration (4) (1,465) Equity in earnings adjustment for non-core items - Severance accrual and equity acceleration (5) - Other non-core expense adjustments (6) 1,588 CFFO available to common stockholders and unitholders -- diluted $ 169,108 Diluted CFFO per share and unit $ 1.22 (3) Includes one-time fees, proceeds and certain other adjustments that are not core to our business. (4) Relates to earn-out contingency in connection with Sentrum Portfolio acquisition. (5) Relates to severance charges related to the departure of the company’s former Chief Executive Officer. (6) Includes reversal of accruals and certain other adjustments that are not core to our business. Digital Realty Trust, Inc. and Subsidiaries Reconciliation of Net Income Available to Common Stockholders to Funds From Operations (FFO) (in thousands, except per share and unit data) (unaudited) Three Months Ended September 30, 2014 Net income available to common stockholders $ 109,314 Adjustments: Noncontrolling interests in operating partnership 2,272 Real estate related depreciation and amortization (1) 136,289 Real estate related depreciation and amortization related to investment in unconsolidated joint ventures 1,934 Impairment of investments in real estate 12,500 Gain on sale of property - Gain on contribution of properties to unconsolidated joint ventures (93,498) FFO available to common stockholders and unitholders (2) $ 168,811 Basic FFO per share and unit $ 1.22 Diluted FFO per share and unit (2) $ 1.22 Weighted average common stock and units outstanding Basic 138,308 Diluted (2) 138,762 (1) Real estate related depreciation and amortization was computed as follows: Depreciation and amortization per income statement 137,474 Non-real estate depreciation (1,185) $ 136,289 (2) At September 30, 2013, we had no series D convertible preferred shares outstanding, as a result of the conversion of all remaining shares on February 26, 2013, which calculates into 629 common shares on a weighted average basis for the nine months ended September 30, 2013. For all periods presented, we have excluded the effect of dilutive series E, series F, series G and series H preferred stock, as applicable, that may be converted upon the occurrence of specified change in control transactions as described in the articles supplementary governing the series E, series F, series G and series H preferred stock, as applicable, which we consider highly improbable. In addition, we had a balance of $0, $0 and $266,400 of 5.50% exchangeable senior debentures due 2029 that were exchangeable for 0, 1,122 and 6,684 common shares on a weighted average basis for the three months ended September 30, 2014, June 30, 2014 and September 30, 2013, respectively, and were exchangeable for 2,618 and 6,628 common shares on a weighted average basis for the nine months ended September 30, 2014 and September 30, 2013, respectively. See below for calculations of diluted FFO available to common stockholders and unitholders and weighted average common stock and units outstanding.

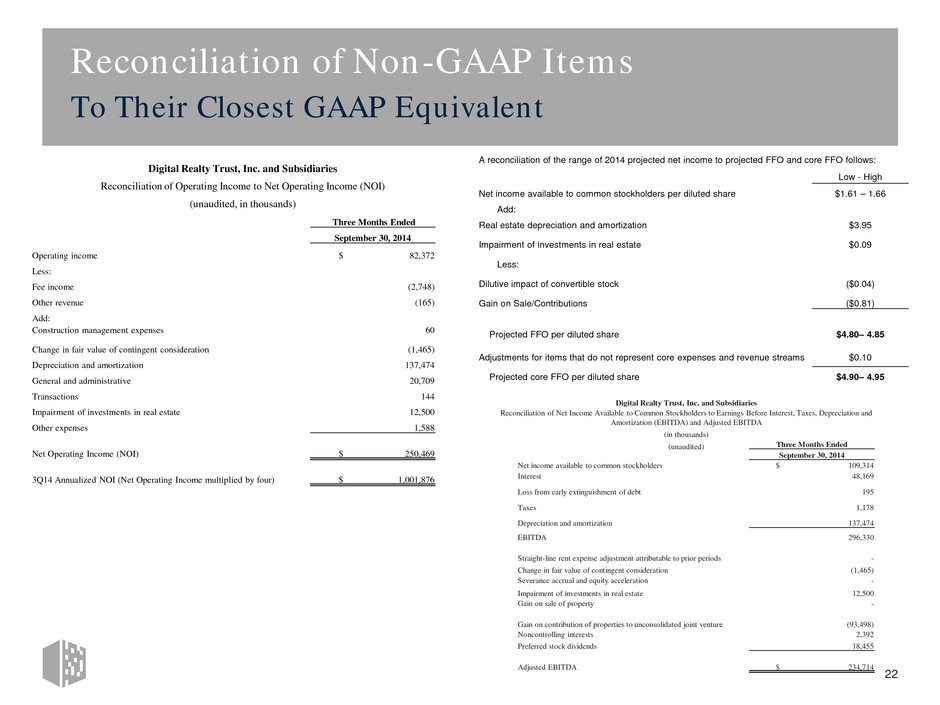

Reconciliation of Non-GAAP Items To Their Closest GAAP Equivalent 22 Digital Realty Trust, Inc. and Subsidiaries Reconciliation of Operating Income to Net Operating Income (NOI) (unaudited, in thousands) Digital Realty Trust, Inc. and Subsidiaries Reconciliation of Net Income Available to Common Stockholders to Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) and Adjusted EBITDA (in thousands) (unaudited) Three Months Ended September 30, 2014 Operating income $ 82,372 Less: Fee income (2,748) Other revenue (165) Add: Construction management expenses 60 Change in fair value of contingent consideration (1,465) Depreciation and amortization 137,474 General and administrative 20,709 Transactions 144 Impairment of investments in real estate 12,500 Other expenses 1,588 Net Operating Income (NOI) $ 250,469 3Q14 Annualized NOI (Net Operating Income multiplied by four) $ 1,001,876 Three Months Ended September 30, 2014 Net income available to common stockholders $ 109,314 Interest 48,169 Loss from early extinguishment of debt 195 Taxes 1,178 Depreciation and amortization 137,474 EBITDA 296,330 Straight-line rent expense adjustment attributable to prior periods - Change in fair value of contingent consideration (1,465) Severance accrual and equity acceleration - Impairment of investments in real estate 12,500 Gain on sale of property - Gain on contribution of properties to unconsolidated joint venture (93,498) Noncontrolling interests 2,392 Preferred stock dividends 18,455 Adjusted EBITDA $ 234,714 A reconciliation of the range of 2014 projected net income to projected FFO and core FFO follows: Low - High Net income available to common stockholders per diluted share $1.61 – 1.66 Add: Real estate depreciation and amortization $3.95 Impairment of investments in real estate $0.09 Less: Dilutive impact of convertible stock ($0.04) Gain on Sale/Contributions ($0.81) Projected FFO per diluted share $4.80– 4.85 Adjustments for items that do not represent core expenses and revenue streams $0.10 Projected core FFO per diluted share $4.90– 4.95

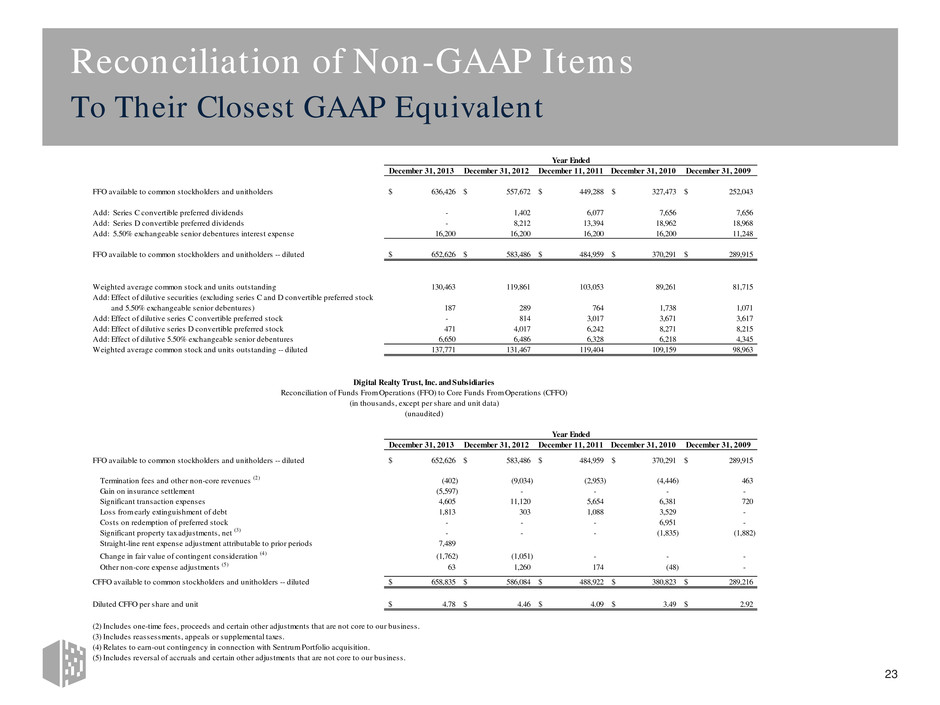

Reconciliation of Non-GAAP Items To Their Closest GAAP Equivalent 23 December 31, 2013 December 31, 2012 December 11, 2011 December 31, 2010 December 31, 2009 FFO available to common stockholders and unitholders 636,426$ 557,672$ 449,288$ 327,473$ 252,043$ Add: Series C convertible preferred dividends - 1,402 6,077 7,656 7,656 Add: Series D convertible preferred dividends - 8,212 13,394 18,962 18,968 Add: 5.50% exchangeable senior debentures interest expense 16,200 16,200 16,200 16,200 11,248 FFO available to common stockholders and unitholders -- diluted 652,626$ 583,486$ 484,959$ 370,291$ 289,915$ Weighted average common stock and units outstanding 130,463 119,861 103,053 89,261 81,715 Add: Effect of dilutive securities (excluding series C and D convertible preferred stock and 5.50% exchangeable senior debentures) 187 289 764 1,738 1,071 Add: Effect of dilutive series C convertible preferred stock - 814 3,017 3,671 3,617 Add: Effect of dilutive series D convertible preferred stock 471 4,017 6,242 8,271 8,215 Add: Effect of dilutive 5.50% exchangeable senior debentures 6,650 6,486 6,328 6,218 4,345 Weighted average common stock and units outstanding -- diluted 137,771 131,467 119,404 109,159 98,963 December 31, 2013 December 31, 2012 December 11, 2011 December 31, 2010 December 31, 2009 FFO available to common stockholders and unitholders -- diluted 652,626$ 583,486$ 484,959$ 370,291$ 289,915$ Termination fees and other non-core revenues (2) (402) (9,034) (2,953) (4,446) 463 Gain on insurance settlement (5,597) - - - - Significant transaction expenses 4,605 11,120 5,654 6,381 720 Loss from early extinguishment of debt 1,813 303 1,088 3,529 - Costs on redemption of preferred stock - - - 6,951 - Significant property tax adjustments, net (3) - - - (1,835) (1,882) Straight-line rent expense adjustment attributable to prior periods 7,489 Change in fair value of contingent consideration (4) (1,762) (1,051) - - - Other non-core expense adjustments (5) 63 1,260 174 (48) - CFFO available to common stockholders and unitholders -- diluted 658,835$ 586,084$ 488,922$ 380,823$ 289,216$ Diluted CFFO per share and unit 4.78$ 4.46$ 4.09$ 3.49$ 2.92$ (2) Includes one-time fees, proceeds and certain other adjustments that are not core to our business. (3) Includes reassessments, appeals or supplemental taxes. (4) Relates to earn-out contingency in connection with Sentrum Portfolio acquisition. (5) Includes reversal of accruals and certain other adjustments that are not core to our business. Year Ended (unaudited) Year Ended Digital Realty Trust, Inc. and Subsidiaries Reconciliation of Funds From Operations (FFO) to Core Funds From Operations (CFFO) (in thousands, except per share and unit data)

Reconciliation of Non-GAAP Items To Their Closest GAAP Equivalent 24 Funds from operations (1) Q214 Q114 FY2014 Q413 Q313 Q213 Q113 FY2013 FY2012 FY2011 FY2010 FY2009 FY2008 FY2007 FY2006 FY2005 Net income (loss) available to common stockholders $41,510 $34,186 $75,696 $42,977 $ 138,872 $ 47,077 $ 42,657 $ 271,583 $ 171,662 $ 130,868 $ 58,339 $ 47,258 $ 26,690 $18,907 $16,950 $6,087 Noncontrolling interests in operating partnership 873 693 1,566 849 2,757 936 824 5,366 6,157 6,185 3,406 3,432 2,329 3,753 12,570 8,268 Real estate related depreciation and amortization (2) 135,938 129,496 265,434 125,671 120,006 114,913 110,690 471,280 378,970 308,547 262,485 196,971 171,657 134,265 90,932 62,171 Real estate related depreciation and amortization related to investment in unconsolidated joint venture 1,802 1,628 3,430 1,387 788 797 833 3,805 3,208 3,688 3,243 4,382 2,339 3,934 796 - Gain on contribution of properties to unconsolidated joint venture - (1,906) (1,906) (555) (115,054) - - (115,609) - - - - - - - - Gain on sale of property (15,945) - (15,945) - - - - - (2,325) - - - - (18,049) (18,096) - Funds from operations (FFO) $ 164,178 $ 164,097 $ 328,275 $ 170,329 $ 147,369 $ 163,723 $ 155,004 $ 636,425 $ 557,672 $ 449,288 $ 327,473 $ 252,043 $ 203,015 $ 142,810 $ 103,152 $ 76,526 Funds from operations (FFO) per diluted share $1.20 $1.22 $2.45 $1.26 $ 1.10 $ 1.22 $ 1.16 $ 4.74 $ 4.44 $ 4.06 $ 3.39 $ 2.93 $ 2.59 $ 2.02 $ 1.61 $ 1.37 Net income (loss) per diluted share available to common stockholders $0.31 $0.26 $0.58 $0.33 $ 1.06 $ 0.37 $ 0.34 $ 2.12 $ 1.48 $ 1.32 $ 0.68 $ 0.61 $ 0.41 $ 0.36 $ 0.47 $ 0.25 Funds from operations (FFO) $ 164,178 $ 164,097 $ 328,275 $ 170,329 $ 147,369 $ 163,723 $ 155,004 $ 636,425 $ 557,672 $ 449,288 $ 327,473 $ 252,043 $ 203,015 $ 142,810 $ 103,152 $ 76,526 Non real estate depreciation 1,154 1,124 2,278 1,105 1,192 954 933 4,184 3,583 1,878 1,418 1,081 721 533 511 61 Amortization of deferred financing costs 2,402 2,085 4,487 2,925 2,831 2,471 2,431 10,658 8,700 9,455 10,460 7,926 5,932 5,541 3,763 2,965 Amortization of debt discount 359 357 716 338 418 418 605 1,779 1,097 2,232 3,821 3,933 3,677 3,437 1,235 - Non cash compensation 3,656 3,153 6,809 2,183 2,877 3,580 2,888 11,528 12,632 13,429 11,162 8,108 7,639 3,580 1,787 481 Deferred compensation related to equity acceleration - 5,832 5,832 - - - - - - - - - - - - - Loss from early extinguishment of debt 293 292 585 608 704 501 - 1,813 303 1,088 3,529 - 182 - 528 1,021 Straight line rents, net (19,099) (20,471) (39,570) (21,858) (19,661) (19,892) (21,169) (82,580) (75,776) (56,309) (45,468) (45,341) (36,007) (25,388) (17,742) (13,023) Non-cash straight-line rent expense adjustment - - - - 9,988 - - 9,988 - - - - - - - - Above and below market rent amortization (2,553) (2,787) (5,340) (2,887) (2,746) (3,041) (3,045) (11,719) (10,262) (7,937) (8,318) (8,040) (9,262) (10,224) (7,012) (1,717) Change in fair value of contingent consideration 766 (3,403) (2,637) (1,749) (943) (370) 1,300 (1,762) (1,051) - - - - - - - Capitalized leasing compensation (6,894) (6,891) (13,785) (4,214) (4,924) (4,786) (5,053) (18,977) (15,102) (10,508) (7,603) (6,570) (4,036) (1,066) (2,054) (781) Recurring capital expenditures and tenant improvements - - - - - - - - - (12,969) (5,604) (13,648) (11,328) (4,259) (4,160) (2,897) Capitalized leasing commissions - - - - - - - - - (21,266) (15,744) (12,611) (13,303) (8,369) (7,186) (3,051) Recurring capital expenditures (only disclosed for 2012 - 2014) (11,355) (8,685) (20,040) (17,025) (12,895) (13,429) (9,860) (53,209) (41,430) - - - - - - - Internal leasing commissions (only disclosed for 2012 - 2014) (4,829) (4,670) (9,499) (4,435) (2,077) (3,331) (2,025) (11,868) (7,301) - - - - - - - Costs on redemption of preferred stock - - - - - - - - - - 6,951 - - - - - Adjusted funds from operations (1) $ 128,078 $ 130,033 $ 258,111 $ 125,320 $ 122,133 $ 126,798 $ 122,009 $ 496,260 $ 433,065 $ 368,381 $ 282,077 $ 186,881 $ 147,230 $ 106,595 $ 72,822 $ 59,585 (1) Funds from operations and Adjusted funds from operations for all periods presented above include the results of properties sold in 2006 and 2007 — 7979 East Tufts Avenue (July 2006), 100 Technology Center Drive (March 2007) and 4055 Valley View Lane (March 2007). (2) Real estate related depreciation and amortization was computed as follows: Q214 Q114 FY2014 Q413 Q313 Q213 Q113 FY2013 FY2012 FY2011 FY2010 FY2009 FY2008 FY2007 FY2006 FY2005 Depreciation and amortization per income statement $ 137,092 $ 130,620 $ 267,712 $ 126,776 $ 121,198 $ 115,867 $ 111,623 $ 475,464 $ 382,553 $ 310,425 $ 263,903 $ 198,052 $ 172,378 $ 134,419 $ 86,129 $ 55,701 Depreciation and amortization of discontinued operations - - - - - - - - - - - - - 379 5,314 6,531 Non real estate depreciation (1,154) (1,124) (2,278) (1,105) (1,192) (954) (933) (4,184) (3,583) (1,878) (1,418) (1,081) (721) (533) (511) (61) $ 135,938 $ 129,496 $ 265,434 $ 125,671 $ 120,006 $ 114,913 $ 110,690 $ 471,280 $ 378,970 $ 308,547 $ 262,485 $ 196,971 $ 171,657 $ 134,265 $ 90,932 $ 62,171 Weighted-average shares and units outstanding - diluted 137,912 138,162 137,979 137,891 137,851 137,787 137,680 137,771 131,467 103,817 89,058 82,786 76,766 70,806 63,870 55,761

Forward-Looking Statements The information included in this presentation contains forward-looking statements. Such statements are based on management’s beliefs and assumptions made based on information currently available to management. Such forward-looking statements include statements relating to our economic outlook; opportunities and strategies, including ROIC, recycling assets and capital, and sources of growth; our joint venture with GCEAR, our expected yield, future cash NOI, expected term and expected benefits from the joint venture; business drivers; sources and uses; our expected development plans and completions, including timing, total square footage, IT capacity and raised floor space upon completion; expected availability for leasing efforts, sales incentive program, mid-market and colocation initiatives; organizational initiatives; joint venture opportunities; occupancy and total investment; our expected investment in our properties; our estimated time to stabilization and targeted returns at stabilization of our properties; our expected future acquisitions; acquisitions strategy; available inventory and development strategy; the signing and commencement of leases, and related rental revenue; lag between signing and commencement of leases; our expected same store portfolio growth; our expected growth and stabilization of development completions and acquisitions; our expected mark-to-market rates on lease expirations, lease rollovers and expected rental rate changes; our expected yields on investments; our expectations with respect to capital investments at lease expiration on existing Turn-Key Flex space; barriers to entry; competition; debt maturities; lease maturities; our expected returns on invested capital; estimated absorption rates; our other expected future financial and other results, and the assumptions underlying such results; our top investment markets and market opportunities; our ability to access the capital markets; expected time and cost savings to our customers; our customers’ capital investments; our plans and intentions; future data center utilization, utilization rates, growth rates, trends, supply and demand, and demand drivers; datacenter outsourcing trends; datacenter expansion plans; estimated kW/MW requirements; growth in the overall Internet infrastructure sector and segments thereof; the market effects of regulatory requirements; the replacement cost of our assets; the development costs of our buildings, and lead times; estimated costs for customers to deploy or migrate to a new data center; capital expenditures; the effect new leases and increases in rental rates will have on our rental revenues and results of operations; lease expiration rates; our ability to borrow funds under our credit facilities; estimates of the value of our development portfolio; our ability to meet our liquidity needs, including the ability to raise additional capital; credit ratings; capitalization rates, or cap rates, potential new markets; dividend payments and our dividend policy; projected financial information and covenant metrics; annualized, projected and run-rate NOI; other forward-looking financial data; leasing expectations; Digital Realty Ecosystem, our connectivity initiative; Digital Open Internet Exchange; and the sufficiency of our capital to fund future requirements. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “pro forma,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and discussions which do not relate solely to historical matters. Such statements are subject to risks, uncertainties and assumptions, are not guarantees of future performance and may be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control that may cause actual results to vary materially. Some of the risks and uncertainties include, among others, the following: the impact of current global economic, credit and market conditions; current local economic conditions in our geographic markets; decreases in information technology spending, including as a result of economic slowdowns or recession; adverse economic or real estate developments in our industry or the industry sectors that we sell to (including risks relating to decreasing real estate valuations and impairment charges); our dependence upon significant tenants; bankruptcy or insolvency of a major tenant or a significant number of smaller tenants; defaults on or non-renewal of leases by tenants; our failure to obtain necessary debt and equity financing; risks associated with using debt to fund our business activities, including re-financing and interest rate risks, our failure to repay debt when due, adverse changes in our credit ratings or our breach of covenants or other terms contained in our loan facilities and agreements; financial market fluctuations; changes in foreign currency exchange rates; our inability to manage our growth effectively; difficulty acquiring or operating properties in foreign jurisdictions; our failure to successfully integrate and operate acquired or developed properties or businesses; the suitability for our properties and data center infrastructure, delays or disruptions in connectivity, failure of our physical infrastructure or services or availability of power; risks related to joint venture investments, including as a result of our lack of control of such investments; delays or unexpected costs in development of properties; decreased rental rates, increased operating costs or increased vacancy rates; increased competition or available supply of data center space; our inability to successfully develop and lease new properties and development space; difficulties in identifying properties to acquire and completing acquisitions; our inability to acquire off-market properties; our inability to comply with the rules and regulations applicable to reporting companies; our failure to maintain our status as a REIT; possible adverse changes to tax laws; restrictions on our ability to engage in certain business activities; environmental uncertainties and risks related to natural disasters; losses in excess of our insurance coverage; changes in foreign laws and regulations, including those related to taxation and real estate ownership and operation; and changes in local, state and federal regulatory requirements, including changes in real estate and zoning laws and increases in real property tax rates. The risks described above are not exhaustive, and additional factors could adversely affect our business and financial performance, including those discussed in our annual report on Form 10-K for the year ended December 31, 2013, as amended, and subsequent filings with the Securities and Exchange Commission. We expressly disclaim any responsibility to update forward-looking statements, whether as a result of new information, future events or otherwise. 25