Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DUPONT E I DE NEMOURS & CO | dd1028148-k.htm |

| EX-99.1 - EX-99.1 - DUPONT E I DE NEMOURS & CO | lettertoshareholders1028.htm |

Shareholder Update October 2014 1

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 2 2 Regulation G The attached charts include company information that does not conform with generally accepted accounting principles (GAAP). Management believes the use of these non-GAAP measures are meaningful to investors because they provide insight with respect to operating results of the company and additional metrics for use in comparison to competitors. These measures should not be viewed as an alternative to GAAP measures of performance. Furthermore, these measures may not be consistent with similar measures used by other companies. This data should be read in conjunction with previously published company reports on Forms 10-K, 10-Q, and 8-K. These reports, are available on the Investor Center of www.dupont.com. Reconciliations of non-GAAP measures to GAAP are also included with this presentation. Forward-Looking Statements This document contains forward-looking statements which may be identified by their use of words like “plans,” “expects,” “will,” "believes," “intends,” “estimates,” “anticipates” or other words of similar meaning. All statements that address expectations or projections about the future, including statements about the company's strategy for growth, product development, regulatory approval, market position, anticipated benefits of recent acquisitions, timing of anticipated benefits from restructuring actions, outcome of contingencies, such as litigation and environmental matters, expenditures and financial results, are forward looking statements. Forward-looking statements are not guarantees of future performance and are based on certain assumptions and expectations of future events which may not be realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond the company’s control. Some of the important factors that could cause the company’s actual results to differ materially from those projected in any such forward-looking statements are: fluctuations in energy and raw material prices; failure to develop and market new products and optimally manage product life cycles; significant litigation and environmental matters; failure to appropriately manage process safety and product stewardship issues; changes in laws and regulations or political conditions; global economic and capital markets conditions, such as inflation, interest and currency exchange rates; business or supply disruptions; security threats, such as acts of sabotage, terrorism or war, weather events and natural disasters; ability to protect and enforce the company's intellectual property rights; successful integration of acquired businesses and separation of underperforming or non-strategic assets or businesses and successful completion of the proposed spinoff of the Performance Chemicals segment including ability to fully realize the expected benefits of the proposed spinoff. The company undertakes no duty to update any forward-looking statements as a result of future developments or new information. Developing Markets Total developing markets is comprised of Developing Asia, Developing Europe, Middle East & Africa, and Latin America. A detailed list of all developing countries is available on the Earnings News Release link on the Investor Center website at www.dupont.com.

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 3 DuPont is a Science Company DuPont has a 200-year record of creating value for customers and owners by connecting science to the marketplace to create novel solutions the world needs. Today, DuPont is creating higher growth and higher value for shareholders by leveraging advanced science and technology, market and value chain knowledge, global scale, and disciplined management to drive its next great era of innovation.

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 4 Discussion Agenda III. Management’s Plan Is Aligned With Shareholder Priorities II. Management’s Plan Is Delivering Results I. DuPont Is Executing On A Plan To Deliver Higher Growth, Higher Value

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 5 Share Price Performance 12/31/2008 – 9/30/2014 Capital Returned To Shareholders Total Capital Returned to Shareholders (2009 – 2013)(1) …And Is Positioned To Continue To Do So Management Has A Track Record Of Delivering Shareholder Value… Source: Datastream as of 9/30/2014, Bloomberg, Capital IQ, FactSet Note: S&P Indices are USD market cap-weighted and assume dividends are re-invested at the closing price applicable on the ex-dividend date 1) Total Capital Returned to Shareholders calculated as dividends and share repurchases as a % of average market capitalization; S&P 500 metrics calculated as the average of the median value for all companies in the index in each of the five years (2009 – 2013) $71.76 $55.24 $0 $10 $20 $30 $40 $50 $60 $70 $80 DuPont Share Price S&P 500 (Indexed to DD as of 12/31/2008) Total Shareholder Return DuPont 253% S&P 500 147% $1B $3B $5B $7B $10B $13B 860 880 900 920 940 2009 2010 2011 2012 2013 2014 YTD Numb er of Shares (M M ) Cumulative Dividends Cumulative Buybacks Basic Shares Outstanding 5.0% 4.2% DuPont S&P 500 As of 9/30/14, cumulative dividends exceeded $9B; $5B share repurchase program announced on 1/28/2014

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 6 Discussion Agenda II. Management’s Plan Is Delivering Results I. DuPont Is Executing On A Plan To Deliver Higher Growth, Higher Value III. Management’s Plan Is Aligned With Shareholder Priorities

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 7 Management And Board Remain Focused On Driving Growth And Enhancing Shareholder Value Management’s Plan: What Shareholders Should Expect From Us • Higher growth, higher value through focused strategic priorities • Innovation driven new products and solutions • Accelerated growth in developing markets • Execution and productivity as a way of life • Savings from redesign initiative (“Fresh Start”) • Ongoing portfolio refinements to increase value • Capital structure that supports growth, seasonality and regional needs

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 8 1 These Three Strategic Priorities Position DuPont For The Next Wave Of Innovation And Growth Path to Future Growth Agriculture & Nutrition Extend our leadership across the high-value, science-driven segments of the Agriculture and Food value chain Advanced Materials Strengthen and grow our leading position in differentiated high-value materials and leverage new sciences Bio-Based Industrials Develop world-leading industrial biotechnology capabilities to create transformational new bio-based businesses • Seeds • Agricultural Chemicals • Specialty Food Ingredients • Enzymes • Biofuels • Biomaterials • Advanced Polymers • Protective Materials • Electronic Materials • Alternative Energy DuPont’s Strategy To Build Higher Growth, Higher Value

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 9 34 Strategic Priorities Delivering Growth Agriculture & Nutrition • Seeds: Extend germplasm leadership and drive biotech pipeline for higher crop yields • Agricultural Chemicals: Commercialize robust pipeline of innovative productivity-enhancing crop protection compounds • Specialty Food Ingredients: Expand nutritional offerings in high-growth emerging and health & wellness markets Bio-Based Industrials • Enzymes: Develop and commercialize enzymes providing faster targeted chemistries in high growth applications • Biofuels: Bring new forms of alternative energy to reality for global adoption and benefit • Biomaterials: Leverage bio-based technologies to develop new offerings across DuPont businesses Advanced Materials • Advanced Polymers: Develop technologies to push the performance boundaries of products in markets including automotive, aerospace, packaging, and construction • Protective Materials: Develop solutions to manage environmental and man-made hazards and risks to safety and health • Electronic Materials: Enable faster, smaller, and more efficient products for consumer electronics to industrial applications • Alternative Energy: Enable more efficient solutions for photovoltaic and energy storage systems Path to Future Growth Leveraging DuPont’s Science, Markets, Customers, And Infrastructure To Execute On Our Strategic Priorities

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 10 1 Path to Future Growth Innovation • Leveraging Multi-disciplinary Science And Technology Platform • Delivering Renewal, Breakthrough and Transformational New Products • Strengthening Our Pipeline Using Our 13 Global Innovation Centers Execution • Delivering Ongoing Productivity Enhancements • Improving Customer Experience • Ensuring Management Accountability Global Reach • Driving Penetration In Fast- growing, Developing Markets • Combining Local Market Knowledge With Leading Science To Deliver Superior Solutions • Developing Globally Diverse, Talented Employees Operational Priorities Our Operational Priorities Advance Our Strategic Priorities

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 11 Our Full Complement Of Capabilities Drives Solutions From Portfolio Renewal To Transformational Innovation Innovation Agriculture Electronics & Communications Industrial Biosciences Nutrition & Health Performance Materials Safety & Protection Ongoing DuPont Solutions Global Market Insights Customer Access Value Chain Knowledge Market Intelligence Technical Capabilities Process Technology Engineering Application Development All Businesses Draw On The Total System Material Science Chemistry Biology Science The DuPont Innovation Platform:

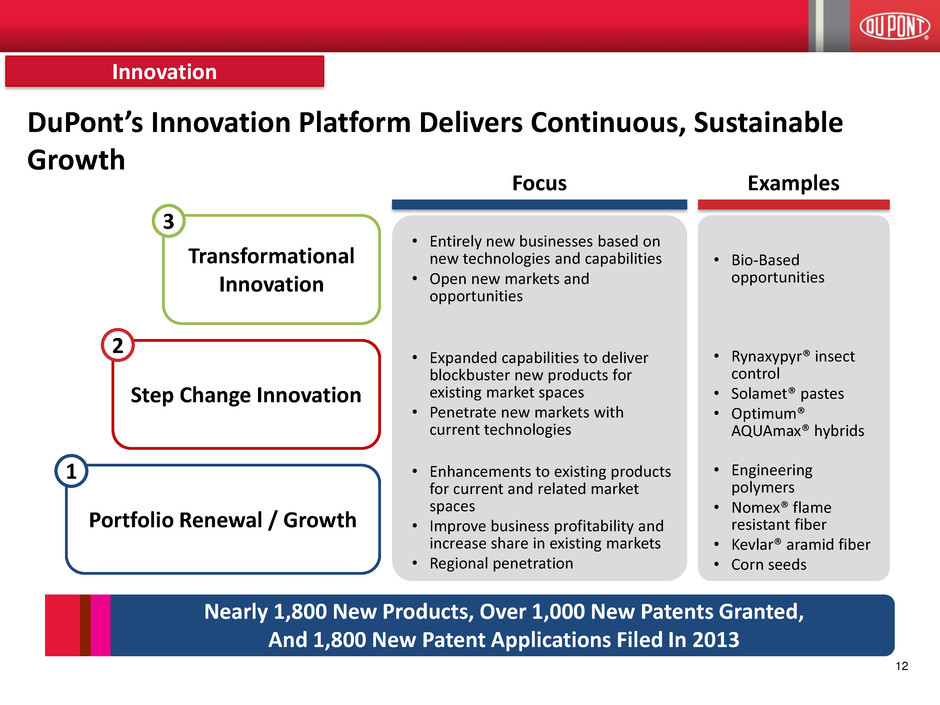

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 12 Innovation Examples Focus DuPont’s Innovation Platform Delivers Continuous, Sustainable Growth • Engineering polymers • Nomex® flame resistant fiber • Kevlar® aramid fiber • Corn seeds • Enhancements to existing products for current and related market spaces • Improve business profitability and increase share in existing markets • Regional penetration Portfolio Renewal / Growth 1 • Rynaxypyr® insect control • Solamet® pastes • Optimum® AQUAmax® hybrids • Expanded capabilities to deliver blockbuster new products for existing market spaces • Penetrate new markets with current technologies Step Change Innovation 2 • Bio-Based opportunities • Entirely new businesses based on new technologies and capabilities • Open new markets and opportunities Transformational Innovation 3 Nearly 1,800 New Products, Over 1,000 New Patents Granted, And 1,800 New Patent Applications Filed In 2013

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 13 Pipeline Of Both Step-Change And Transformational Innovations Significant Growth Initiatives – Selected Examples Innovation Our Innovation Platform Delivers A Strong Pipeline Across The Company Advanced Materials Bio-Based Industrials Agriculture & Nutrition • Cyazypyr® Insecticide • DP4114 Corn • Encirca Services • Food Ingredients • Lumigen™ Seed Treatment • Optimum® GLY™ Canola • Optimum® Leptra™ hybrids • Plenish® Soybeans • Probiotics • Animal Nutrition • Biobutanol • Cellulosic Ethanol • Coldwater Enzymes • Food Enzymes • Home & Personal Care Enzymes • Renewables • Aerospace Innovations • Kevlar® AP • Kevlar® Tire Innovation • New Silver Conductive Pastes • OLEDs • Refinery Technology Systems • Zytel® Next Gen Nylons SM

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 14 Bio-Based Opportunities DuPont Is Uniquely Positioned To Be At The Forefront Of The Bio-Based Technology Revolution Innovation Bio-Based Technologies Represent A New Wave In Innovation That Draws On All Aspects Of DuPont’s Innovation Platform Agriculture & Nutrition • Pioneer grower network • Participation in entire farm-to-table value chain • Industry collaborations • Agronomy • Plant genetics • Nutritional science • Toxicology • Chemistry • Elite germplasm pool • Regional testing/growing capability • Formulation technology • Chemical synthesis • Trait integration Global Market Insights Technical Capabilities Science Bio-Based Industrials • Industry pioneer • Collaborations in food and consumer goods markets • Biofuels, biomaterials commercial businesses • Enzymology • Synthetic biology • Fermentation science • Chemical engineering • Protein engineering • Hi-throughput screening • Fermentation scale-up • Process piloting facilities Advanced Materials • Leading brands (e.g. Kevlar®, Tedlar®) • Industry partnerships & collaborations • Footprint in 65+ countries • Materials science • Engineering • Chemistry • Polymer science • Application development • Modeling & prototyping • Material & product testing • Global Innovation Centers Seed Coatings / Protection Renewable Materials Biologicals Home & Personal Care Packaging Healthier Oils Cellulosic Value Chains Energy Production & Efficiency

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 15 $0.9 $2.3 $0.0 $2.0 $4.0 2008 2013 Sal es ( $B) China Sales % of Total DuPont 4% 8% Rapidly Growing Developing Market Sales Significant Growth in China 25 Plants 6 R&D/Technical Centers 5 Offices 14 Joint Ventures Jiuquan Beijing Shenyang Laizhou Anyang Zhengzhou Luohe Chengdu Guangzhou Foshan Dongguan Shenzhen Hong Kong Ningbo Shanghai Changshu Zhangjiagang Wuxi Kunshan ~6,000 employees $5.0 $9.7 $0.0 $3.0 $6.0 $9.0 $12.0 2008 2013 Sa le s ($ B ) Developing Market Sales as % of Total DuPont 25% 34% Developing Markets Represent Significant Opportunities For Growth (1) Net sales, excluding Performance Chemicals (1) 43 DuPont’s Global Brand, Agriculture Leadership, And Infrastructure Enhances Its Capability To Access New Markets Global Reach (1)

128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 16 31 73 125 203 21 48 255 159 0 155 187 89 Acquisitions: Technology/Market Access Driven Divestitures: Slower Growth Businesses Enhanced Portfolio For Higher Growth, Higher Value Through Major Transactions Disciplined Portfolio Management Continues To Strengthen The Company Industrial Biosciences Safety & Protection Agriculture Nutrition & Health Electronics & Communications Performance Materials $36.0B 2013 Sales • 7 US seed companies • Solae – full ownership • MECSTM sulfuric acid technology • InnovalightTM liquid silicon inks for PV • Pannar Seed – full ownership • Glass Laminating Solutions/Vinyls • Professional products insecticide assets • Kocide® and ManKocide® fungicides (In Process) • Liquid Packaging Systems • Zenite® liquid crystal polymer resins • Sontara® nonwovens business • Borealis specialty polymers JV Additional Acquisitions Additional Portfolio Changes (1) Segment Sales include transfers (1) Performance Coatings (2013, $5.1B) (2011, $7B) Performance Chemicals (Mid-2015, ~19% of 2013 Sales) Execution

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 17 Committed Focus To Aligning Costs With A Changing Portfolio Execution As part of the plan to separate Performance Chemicals, Management initiated a fresh look at: • Organizational design, business necessities and external benchmarks • Business processes and optimal means to execute • Management structure Optimization of The Ongoing DuPont Re-alignment of functional support around business units • Streamline corporate support, centers-of-excellence and regional support Reduce complexity • Fewer layers of management • Clarity on accountability and staffing to support • Standardized processes Outsourcing of non-strategic support activities “Fresh Start” Initiative A Detailed Play Book Is In Place And Execution Is Ongoing

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 18 “Fresh Start” Will Have A Significant And Sustainable Benefit Result Target Annual Savings ($MM) • Significant complexity reduction with clear accountabilities and performance measurement • Core functions will serve business units at lowest cost • Transactional activities in service centers employing standard business processes • Improved organization agility with spans, layers and levels better than benchmark • Operational improvements will increase plant efficiency and optimize logistics “Fresh Start” Represents Another Step Towards Optimizing Operational Efficiency Execution Cost Reductions Q4 2015 Run Rate Cost Reductions in Final State Costs Eliminated at Performance Chemicals Separation $375 $375 Redesign, Simplify and Standardize Company- Wide Processes $250 $625 Target Annual Savings: ~Two-Thirds of Total Plan $1,000

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 19 Discussion Agenda II. Management’s Plan Is Delivering Results I. DuPont Is Executing On A Plan To Deliver Higher Growth, Higher Value III. Management’s Plan Is Aligned With Shareholder Priorities

128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 20 31 73 125 203 21 48 255 159 0 155 187 89 Management Has A Strong Track Record Of Delivering Results 2 0 0 9 – Cur re n t Clear Strategic Mission… 1. Refine the portfolio to achieve higher growth with less volatility 2. Improve operational performance 3. Reduce costs and improve efficiency 4. Return capital to shareholders Since The Start Of 2009, Management’s Plan Has Delivered Total Shareholder Return Of 253%(1) And Will Continue To Drive Strong Future Growth For DuPont …With Tangible Results Enhanced portfolio Realized innovation successes Strengthened key business lines Streamlined cost structure Achieved strong earnings growth and margin improvement Simplified management Accelerated capital return to shareholders Driven by strong governance and accountability (1) Total Shareholder Return from 12/31/2008 – 9/30/2014

128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 21 31 73 125 203 21 48 255 159 0 155 187 89 DuPont Performance Chemicals Upcoming Performance Chemicals Separation Is Another Key Repositioning Step 43 Creating Two Highly Competitive Companies With Distinct Value Creation Strategies • Leading technologies • Science leverage across businesses • Strong applications development • Targets secular driven growth • Innovative products; robust pipeline • Global reach and productivity • Leading businesses • Customer focused applications development • Low cost production • Capital productivity • Sustainable operator • Regulatory leadership and advocacy Mission: Growth Differentiated innovation platform Mission: Cash Generation Industry leadership and productivity Enhanced Portfolio

128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 22 31 73 125 203 21 48 255 159 0 155 187 89 New Products Delivered More Than $10 Billion(1) (28%) Of Revenue In 2013 $ 5.8B new product revenue $ 0.4B new product revenue $ 3.9B new product revenue Agriculture & Nutrition Bio-Based Industrials Advanced Materials • Seeds • Agricultural Chemicals • Specialty Food Ingredients • Enzymes • Biofuels • Biomaterials • Advanced Polymers • Protective Materials • Electronic Materials • Alternative Energy Realized Innovation Successes (1) 2013 revenue from products introduced in the last four years Our Innovation Platform Has Proven Successful

128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 23 31 73 125 203 21 48 255 159 0 155 187 89 $0 $1 $2 $3 $4 $5 $6 $7 2008 2011 2013 Se gm en t A d ju st ed O p er ating Ea rn in gs ($ B ) Agriculture Electronics & Communications Industrial Biosciences Nutrition & Health Performance Materials Safety & Protection Performance Chemicals Performance Coatings $0 $10 $20 $30 $40 2008 2011 2013 Se gm en t Sa les ($B ) Agriculture Electronics & Communications Industrial Biosciences Nutrition & Health Performance Materials Safety & Protection Performance Chemicals Performance Coatings Source: Company Data (1) Segment sales include transfers. CAGR is calculated excluding Performance Coatings, Performance Chemicals and Other (2) Segment adjusted operating earnings are calculated using segment pre-tax operating income (GAAP) less significant items; calculations included certain corporate expenses and excluded adjusted operating earnings of Performance Coatings, Performance Chemicals, Pharma and Other. See non-GAAP reconciliations included within this presentation Segment Sales (1) Segment Adjusted Operating Earnings (2) - Strategic And Operational Actions Have Resulted In Strong Performance DuPont’s Ongoing Portfolio Is Well Positioned To Drive Further Growth Through Greater Emerging Market Penetration, Continued Innovation Success, And Operational Improvements Strengthened Key Business Lines

128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 24 31 73 125 203 21 48 255 159 0 155 187 89 DuPont’s Businesses Are Competitively Well-Positioned Key Margin Drivers 2013 EBITDA Margin Note: DuPont’s adjusted segment EBITDA margins are calculated using segment pre-tax operating income (GAAP), less significant items; calculations include certain corporate expenses; see non-GAAP reconciliations included within this presentation Peer EBITDA margins calendarized to December where possible) exclude non-recurring expenses/income where applicable and a corporate overhead allocated based on gross segment revenue contribution (1) Using comparable industry segment when applicable Strengthened Key Business Lines Peer Universe (1) DuPont Improvement (Since 2008) Competitive with peers; well-positioned for future growth due to industry leading R&D pipeline and leading market positions globally BASF, Bayer, Dow, FMC, Monsanto, Syngenta +360bps 15.6% 17.2% Electronics & Communications Peer Average Meaningful solar market exposure; competitive despite precious metal pass-through pricing Air Products, Asahi Kasei, Dow, Hitachi, Toray +210bps 18.8% 31.0% Industrial Biosciences Peer Average Diverse portfolio of enzymes plus early stage biomaterials; only potential peer has narrow portfolio of specialty enzymes Novozymes N/A 14.8% 21.0% Nutrition & Health Peer Average Broadest portfolio and leader in each product line; negatively impacted by guar price fluctuations in 2013; continued improvement expected Chr. Hansen, FMC, Ingredion, Kerry, Royal DSM, Tate & Lyle +600bps 21.3% 18.2% Safety & Protection Peer Average Leading brands and technology 3M, Honeywell, Kimberly- Clark, Owens Corning, Royal DSM, Teijin +80bps 21.5% 12.8% Performance Materials Peer Average Focus on differentiated, value-added products BASF, Celanese, Dow, Eastman, Lanxess, Royal DSM +1360bps 16.7% 7.4% Performance Chemicals Peer Average Industry-leading margins in cyclical end markets; advantaged cost structure Arkema, Daikin, Huntsman, Kronos, Solvay, Tronox +320bps 22.6% 22.3% Agriculture Peer Average

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 25 Cost Management Is Always A Priority Cost Reductions $0B $1B $2B $3B $4B 2009 2010 2011 2012 2013 • Days Payable Outstanding (DPO) increased by 23% • Days Sales Outstanding (DSO) decreased by 5% Streamlined Cost Structure 2009 – 2013 Cost Saving Initiatives Over $2B cumulative fixed cost savings achieved (exceeded target of $1B(1)), driving segment operating margin improvement Over $3B in cumulative working capital reductions achieved (exceeded target of $1B(1)), funding business growth ~$230MM of stranded costs eliminated after Performance Coatings divestiture $130MM of cost synergies realized from Danisco acquisition Working Capital Savings $0B $1B $2B $3B 2009 2010 2011 2012 2013 (1) Based on 3-year targets set in 2009

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 26 Cost Saving Initiatives Will Further Enhance Already Competitive Overhead Costs And Increase DuPont’s Cost Advantage Streamlined Cost Structure Proxy Peers A ve ra ge S G & A as a % o f N et Sal es ( C Y200 9 – C Y201 3 ) 10.4% 31.5% 31.1% 27.5% 22.7% 22.6% 22.2% 20.7% 19.6% 18.5% 18.0% 16.7% 14.1% 11.0% 10.4% 10.4% 9.8% 5.1% 4.9% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% J&J P&G Merck Sygenta Emerson Baxter 3M Ingersoll- Rand Kimberly- Clark Monsanto DuPont Honeywell United Technologies Air Products Johnson Controls Caterpillar Dow Boeing Peer Median: 18.5% Source: Company Filings (excludes Performance Coatings) (1) 10.4% represents SG&A as reported; 16.7% represents reported SG&A plus certain costs included in Other Operating Charges on the income statement; these costs include functional and management expenses supporting the business segments (1)

128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 27 31 73 125 203 21 48 255 159 0 155 187 89 Adjusted Operating Margins Have Significantly Improved 9.5% 14.1% 16.0% 2008 2011 2013 20 +650 bps 2008–2013 Change in Adjusted Operating Margin(1) Strong Operating Performance (1) Segment adjusted operating earnings and margins are calculated using segment pre-tax operating income (GAAP) less significant items; calculations included certain corporate expenses and excluded adjusted operating earnings and margins of Performance Coatings, Performance Chemicals, Pharma and Other. See non-GAAP reconciliations included within this presentation +190 bps 2011–2013 Change in Adjusted Operating Margin(1)

128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 28 31 73 125 203 21 48 255 159 0 155 187 89 5.9% 2.8% 9.3% 14.1% 17.1% 3.4% 29.1% DuPont Proxy Peers S&P Chemicals S&P 500 S&P Materials $1.0B $2.8B $1.2B $0.8B $2.2B $3.6B 2008 2013 Adjusted Operating Earnings After-Tax(1) EPS CAGR(2) (CY2008 – CY2013) (3) (4) (5) Ex Non-Op Pension and OPEB Ex Performance Chemicals & Pharma GAAP (6) Source for peer and market data: Datastream as of 9/30/2014, Bloomberg, Capital IQ, FactSet (1) Adjusted operating earnings after-tax is defined as income from continuing operations after-tax (GAAP) excluding non-operating pension/OPEB costs and significant items. Reconciliations of non-GAAP measures to GAAP are included with this presentation (2) EPS defined as diluted earnings per share from continuing operations. “CAGR” defined as compound annual growth rate (3) Refer to non-GAAP reconciliations included within this presentation (4) Proxy Peers consists of 3M, Air Products, Baxter Intl, Boeing, Caterpillar, Dow, Emerson, Honeywell, Johnson Controls, Johnson and Johnson, Kimberly Clark, Merck, Monsanto, Procter and Gamble, Syngenta AG, and United Technologies; Median EPS CAGR used; Proxy Peer Ingersoll Rand excluded because CAGR is non-meaningful (5) S&P Chemicals in 2014 consists of Airgas, Air Products, CF Industries, Dow, DuPont, Eastman Chemical, Ecolab, FMC, IFF, LyondellBasell, Monsanto, Mosaic, PPG, Praxair, Sherwin-Williams, and Sigma-Aldrich (6) S&P Materials in 2014 consists of Air Products, Airgas, Alcoa, Allegheny Technologies, Avery Dennison, Ball, Bemis, CF Industries, Dow Chemical, DuPont, Eastman Chemical, Ecolab, FMC, Freeport-McMoRan, IFF, International Paper, LyondellBasell, Martin Marietta Materials, MeadWestvaco, Monsanto, Mosaic, Newmont Mining, Nucor, Owens Illinois, PPG, Praxair, Sealed Air, Sherwin-Williams, Sigma-Aldrich, and Vulcan Materials Strong Operating Performance Adjusted Operating Earnings Have More Than Doubled And EPS Growth Has Significantly Outperformed Both Peers And The Market Adjusted Operating Earnings After-Tax (ex. Perf. Coatings, Perf. Chem. & Pharma) Perf. Chem. & Pharma Operating Earnings After-Tax GAAP

128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 29 31 73 125 203 21 48 255 159 0 155 187 89 • Short-term incentives include: • Revenue growth • Operating EPS growth • Cash flow from operations versus budget • Individual performance versus goals • 80% of business presidents’ short-term incentives tied to performance of their Business Units • Senior leadership long-term incentives (PSUs)(1) include: • 3 year revenue growth vs. Proxy Peers • 3 year Total Shareholder Return vs. Proxy Peers Quality of Management Improved Compensation Aligned With Performance (1) “PSUs” defined as performance-based restricted stock units 24 • Consolidated 23 Business Units into 12 • Reduced senior leadership by >20% • Eliminated a layer of leadership • 19% of current senior leadership new to their roles • Created specific top and bottom line goals by Business Unit • Established new corporate culture/behaviors • Speed and agility • Accountability • Collaboration • Enhanced transparency – including external reporting DuPont Has Taken Numerous Actions To Strengthen Management Accountability And Align Incentives Simplified Management Management’s Interests Are Directly Aligned With Shareholder Value Creation

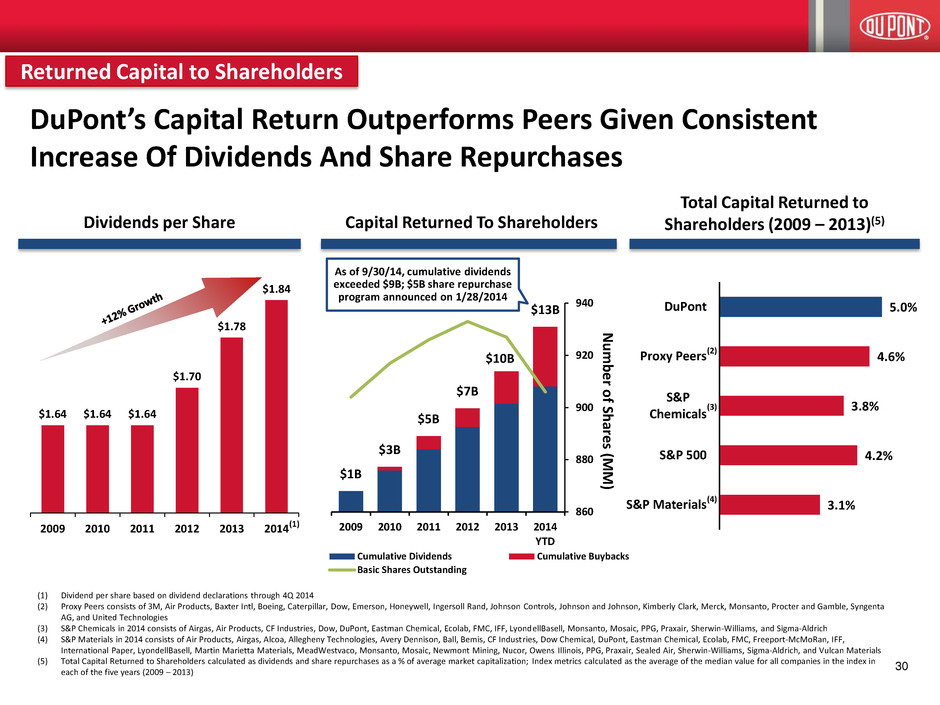

128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 30 31 73 125 203 21 48 255 159 0 155 187 89 $1B $3B $5B $7B $10B $13B 860 880 900 920 940 2009 2010 2011 2012 2013 2014 YTD N u m b e r o f Sh a re s (M M ) Cumulative Dividends Cumulative Buybacks Basic Shares Outstanding Dividends per Share 48 $1.64 $1.64 $1.64 $1.70 $1.78 $1.84 2009 2010 2011 2012 2013 2014 Capital Returned To Shareholders Returned Capital to Shareholders DuPont’s Capital Return Outperforms Peers Given Consistent Increase Of Dividends And Share Repurchases (1) Dividend per share based on dividend declarations through 4Q 2014 (2) Proxy Peers consists of 3M, Air Products, Baxter Intl, Boeing, Caterpillar, Dow, Emerson, Honeywell, Ingersoll Rand, Johnson Controls, Johnson and Johnson, Kimberly Clark, Merck, Monsanto, Procter and Gamble, Syngenta AG, and United Technologies (3) S&P Chemicals in 2014 consists of Airgas, Air Products, CF Industries, Dow, DuPont, Eastman Chemical, Ecolab, FMC, IFF, LyondellBasell, Monsanto, Mosaic, PPG, Praxair, Sherwin-Williams, and Sigma-Aldrich (4) S&P Materials in 2014 consists of Air Products, Airgas, Alcoa, Allegheny Technologies, Avery Dennison, Ball, Bemis, CF Industries, Dow Chemical, DuPont, Eastman Chemical, Ecolab, FMC, Freeport-McMoRan, IFF, International Paper, LyondellBasell, Martin Marietta Materials, MeadWestvaco, Monsanto, Mosaic, Newmont Mining, Nucor, Owens Illinois, PPG, Praxair, Sealed Air, Sherwin-Williams, Sigma-Aldrich, and Vulcan Materials (5) Total Capital Returned to Shareholders calculated as dividends and share repurchases as a % of average market capitalization; Index metrics calculated as the average of the median value for all companies in the index in each of the five years (2009 – 2013) (1) Total Capital Returned to Shareholders (2009 – 2013)(5) 5.0% 4.6% 3.8% 4.2% 3.1% DuPont Proxy Peers S&P Chemicals S&P 500 S&P Materials (2) (3) (4) As of 9/30/14, cumulative dividends exceeded $9B; $5B share repurchase program announced on 1/28/2014

128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 31 31 73 125 203 21 48 255 159 0 155 187 89 Source: Datastream as of 9/30/2014, Bloomberg, Capital IQ, FactSet (1) Proxy Peers and S&P Indices are USD market cap-weighted and assume dividends are re-invested at the closing price applicable on the ex-dividend date (2) Proxy Peers consists of 3M, Air Products, Baxter Intl, Boeing, Caterpillar, Dow, Emerson, Honeywell, Ingersoll Rand, Johnson Controls, Johnson and Johnson, Kimberly Clark, Merck, Monsanto, Procter and Gamble, Syngenta AG, and United Technologies (3) S&P Chemicals in 2014 consists of Airgas, Air Products, CF Industries, Dow, DuPont, Eastman Chemical, Ecolab, FMC, IFF, LyondellBasell, Monsanto, Mosaic, PPG, Praxair, Sherwin-Williams, and Sigma-Aldrich (4) S&P Materials in 2014 consists of Air Products, Airgas, Alcoa, Allegheny Technologies, Avery Dennison, Ball, Bemis, CF Industries, Dow Chemical, DuPont, Eastman Chemical, Ecolab, FMC, Freeport-McMoRan, IFF, International Paper, LyondellBasell, Martin Marietta Materials, MeadWestvaco, Monsanto, Mosaic, Newmont Mining, Nucor, Owens Illinois, PPG, Praxair, Sealed Air, Sherwin-Williams, Sigma-Aldrich, and Vulcan Materials 6 Total Shareholder Return (12/31/08 – 9/30/14)(1) (2) (3) (4) DuPont Has Outperformed Peers And The Market In Total Shareholder Return 253% 125% 217% 147% 158% DuPont Proxy Peers S&P Chemicals S&P 500 S&P Materials Delivered Shareholder Value

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 32 DuPont’s Effective Governance Practices Contribute To Value Creation DuPont Has Actively Supported And Adopted Best Practices In Corporate Governance Accountability and Oversight Effective Board Leadership and Independent Oversight • 12 of 13 directors are independent • 4 new directors added in the last three years, and 10 directors added in the last nine years • Executive sessions of independent directors at every board meeting • No director sits on more than 2 other public company boards Enhanced Shareholder Rights • Annual election of directors • Majority vote standard • Shareholder ability to call special meetings (25%) or act by written consent • Simple majority vote standard for bylaw/charter and M&A • No poison pill in place Sustainability Efforts and Shareholder Engagement • Comprehensive sustainability program and annual reporting • Strong track record of shareholder dialogue • Responsive to shareholder feedback Strong Experience • Impressive leadership experience in corporate, government, and scientific roles • Track record of successfully evaluating and implementing major transformations at DuPont

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 33 Discussion Agenda II. Management’s Plan Is Delivering Results I. DuPont Is Executing On A Plan To Deliver Higher Growth, Higher Value III. Management’s Plan Is Aligned With Shareholder Priorities

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 34 Management Actively Engages With Shareholders To Understand Priorities And Discuss Improvements Management’s Plan Shareholder Priorities Separation of Non-Core Businesses Aggressive and proactive portfolio management Latest step – Performance Chemicals – in process Business aligned around key technology and market themes Differential Management Based on Business Maturity Long time DuPont strategy to fund growth with mature business cash flow Cost Reduction and Business Simplification Tangible plan with identified actions being executed Proven track record of cost productivity and delayering Shareholder Friendly Capital Allocation Capital returns are large and accelerating Capital structure that supports growth Management Accountability Management compensation directly aligned with shareholders’ interests Management's Plan Is Aligned With Shareholder Interests And Is Positioned To Deliver Significant Value

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 35 DuPont’s Plan Will Continue to Create Value For Shareholders Observations On Proposal For Further Break-Up (1) Consists of debt breakage costs, separation charges, additional working capital, cash repatriation tax, tax leakage from legal separation, upfront pension contributions, and financing fees (2) Consists of duplicative overhead, increase in tax rate, and additional interest costs • Trian Fund Management has proposed the further separation of DuPont into two entities – a company focused on our Agriculture & Nutrition businesses and a company focused on our Materials businesses – with substantial additional leverage • Members of DuPont’s Board and Management team met with Trian a number of times and, assisted by independent advisors, have reviewed their proposal • Observations about their proposal include: ‒ Significantly underestimates upfront separation costs(1) and ongoing dis-synergies(2) ‒ Has no basis for annual cost savings of $2-4B ‒ Creates negative impact of lower credit rating on supplier terms and reduces financial flexibility necessary for seasonal and regional cash flow management ‒ Assumptions overestimate cash flow generation and returns to shareholders ‒ Assumes DuPont trades at a sum of the parts discount

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 36 Conclusion

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 37 DuPont’s Plan Has Delivered Strong Results Management Has A Proven Track Record Of Success Results Of Management Actions Key Areas Returns Outperformance in TSR and total capital returned to shareholders versus peers Targets Track record of exceeding performance targets; Management has exceeded 3-year targets set in 2009 and long-term targets set in 2010(1) Margins Significant improvement in adjusted operating earnings margins Growth Strong adjusted operating EPS growth Ability to leverage operational priorities to drive new product sales across the company Portfolio Proven focus on enhancing DuPont’s business portfolio Efficiency Priority focus on cost reduction and an efficient capital strategy (1) Targets based on results excluding significant items

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 38 Management And Board Remain Focused On Driving Growth And Enhancing Shareholder Value Management’s Plan: What Shareholders Should Expect From Us • Higher growth, higher value through focused strategic priorities • Innovation driven new products and solutions • Accelerated growth in developing markets • Execution and productivity as a way of life • Savings from redesign initiative (“Fresh Start”) • Ongoing portfolio refinements to increase value • Capital structure that supports growth, seasonality and regional needs

Reconciliation of Non-GAAP Measures 1

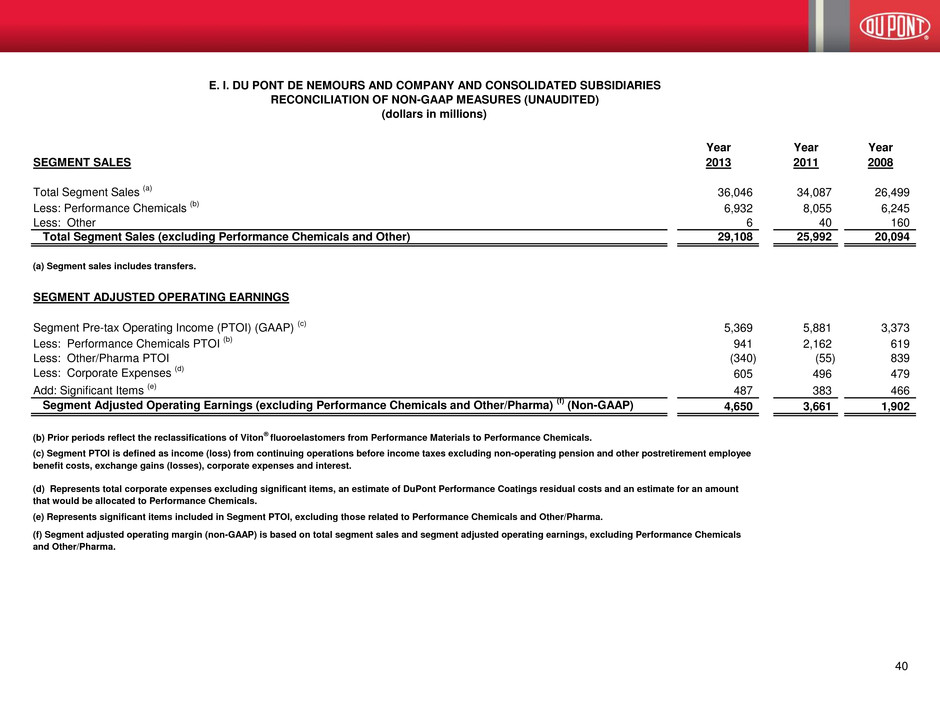

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 40 Year Year Year 2013 2011 2008 Total Segment Sales (a) 36,046 34,087 26,499 Less: Performance Chemicals (b) 6,932 8,055 6,245 Less: Other 6 40 160 Total Segment Sales (excluding Performance Chemicals and Other) 29,108 25,992 20,094 (a) Segment sales includes transfers. SEGMENT ADJUSTED OPERATING EARNINGS Segment Pre-tax Operating Income (PTOI) (GAAP) (c) 5,369 5,881 3,373 Less: Performance Chemicals PTOI (b) 941 2,162 619 Less: Other/Pharma PTOI (340) (55) 839 Less: Corporate Expenses (d) 605 496 479 Add: Significant Items (e) 487 383 466 Segment Adjusted Operating Earnings (excluding Performance Chemicals and Other/Pharma) (f) (Non-GAAP) 4,650 3,661 1,902 (b) Prior periods reflect the reclassifications of Viton ® fluoroelastomers from Performance Materials to Performance Chemicals. (e) Represents significant items included in Segment PTOI, excluding those related to Performance Chemicals and Other/Pharma. E. I. DU PONT DE NEMOURS AND COMPANY AND CONSOLIDATED SUBSIDIARIES RECONCILIATION OF NON-GAAP MEASURES (UNAUDITED) (d) Represents total corporate expenses excluding significant items, an estimate of DuPont Performance Coatings residual costs and an estimate for an amount that would be allocated to Performance Chemicals. (f) Segment adjusted operating margin (non-GAAP) is based on total segment sales and segment adjusted operating earnings, excluding Performance Chemicals and Other/Pharma. (dollars in millions) SEGMENT SALES (c) Segment PTOI is defined as income (loss) from continuing operations before income taxes excluding non-operating pension and other postretirement employee benefit costs, exchange gains (losses), corporate expenses and interest.

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 41 RECONCILIATION OF SEGMENT PRE-TAX OPERATING INCOME (PTOI) TO ADJUSTED EBITDA Year Ended December 31, 2013 Agriculture Electronics & Communications Nutrition & Health Safety & Protection Performance Materials (c) Performance Chemicals (c) Industrial Biosciences Segment PTOI (GAAP) (a) 2,132 203 305 694 1,264 941 170 Add: Significant Items Charge/(Benefit) included in Segment PTOI 351 131 (6) (4) 16 74 (1) Add: Segment depreciation and amortization 358 105 271 198 162 253 81 Less: Corporate Allocations (b) 188 41 56 62 100 111 20 Adjusted Segment EBITDA (Non-GAAP) 2,653 398 514 826 1,342 1,157 230 Segment Sales 11,739 2,549 3,473 3,884 6,239 6,932 1,224 22.6% 15.6% 14.8% 21.3% 21.5% 16.7% 18.8% Year Ended December 31, 2008 Agriculture Electronics & Communications Nutrition & Health Safety & Protection Performance Materials (c) Performance Chemicals (c) Segment PTOI (GAAP) (a) 1,006 211 18 601 79 619 Add: Significant Items Charge/(Benefit) included in Segment PTOI 5 37 17 97 310 56 Add: Segment depreciation and amortization 346 86 114 130 206 274 Less: Corporate Allocations (b) 113 38 25 64 107 108 Adjusted Segment EBITDA (Non-GAAP) 1,244 296 124 764 488 841 Segment Sales 6,549 2,194 1,403 3,733 6,215 6,245 19.0% 13.5% 8.8% 20.5% 7.9% 13.5% (c) Prior periods reflect the reclassifications of Viton ® fluoroelastomers from Performance Materials to Performance Chemicals. E. I. DU PONT DE NEMOURS AND COMPANY AND CONSOLIDATED SUBSIDIARIES RECONCILIATION OF NON-GAAP MEASURES (UNAUDITED) (b) Represents total corporate expenses plus unallocated depreciation and amortization, excluding significant items and an estimate of DuPont Performance Coatings residual costs. Adjusted Segment EBITDA Margin (Non-GAAP) Adjusted Segment EBITDA Margin (Non-GAAP) (dollars in millions) (a) Segment PTOI is defined as income (loss) from continuing operations before income taxes excluding non-operating pension and other postretirement employee benefit costs, exchange gains (losses), corporate expenses and interest.

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 42 Year Year 2013 2008 Income From Continuing Operations After Income Taxes (GAAP) 2,863 2,083 Add: Significant Items Charge - After-tax 423 378 Add: Non-Operating Pension & OPEB Costs / (Credit) - After-tax 360 (250) Less: Net Income Attributable to Noncontrolling Interests 14 4 Less: Pharma Operating Earnings - After-tax (a) 21 666 Less: Performance Chemicals Operating Earnings - After-tax (b), (c) 804 537 Adjusted Operating Earnings - After-tax (excluding Performance Chemicals and Pharma) (Non-GAAP) 2,807 1,004 RECONCILIATION OF DILUTED EPS GAAP EPS from continuing operations 3.04 2.28 Less: Performance Chemicals (b),(c) 0.80 0.54 Less: Pharma (a) 0.02 0.73 Add: Non-Operating Pension & OPEB Costs / (Credits) 0.39 (0.28) EPS (excluding Pharma and Non-Operating Pension & OPEB Costs) (Non-GAAP) 2.61 0.73 (a) Pharma operating earnings assumes a 35% tax rate. E. I. DU PONT DE NEMOURS AND COMPANY AND CONSOLIDATED SUBSIDIARIES RECONCILIATION OF NON-GAAP MEASURES (UNAUDITED) (dollars in millions, except per share) (b) Performance Chemicals operating earnings assumes a base income tax rate from continuing operations of 20.8% and 20.4% for 2013 and 2008, respectively. ADJUSTED OPERATING EARNINGS AFTER INCOME TAXES (c) Prior periods reflect the reclassifications of Viton ® fluoroelastomers from Performance Materials to Performance Chemicals.

203 21 48 155 187 89 255 159 0 31 73 125 128 100 162 219 219 219 242 242 242 Template Theme Colors Secondary + Chart Colors 203 21 48 65 152 175 113 88 143 192 192 192 31 73 125 255 255 153 226 140 0 137 165 78 43 Copyright © 2014 DuPont. All rights reserved. The DuPont Oval Logo, DuPontTM, The miracles of scienceTM, and all products denoted with ® or M are trademarks or registered trademarks of E. I. du Pont de Nemours and Company.