Attached files

| file | filename |

|---|---|

| EX-10.13(B) - EX-10.13(B) - Boot Barn Holdings, Inc. | a2221942zex-10_13b.htm |

| EX-10.10 - EX-10.10 - Boot Barn Holdings, Inc. | a2221942zex-10_10.htm |

| EX-23.2 - EX-23.2 - Boot Barn Holdings, Inc. | a2221774zex-23_2.htm |

| EX-10.10(B) - EX-10.10(B) - Boot Barn Holdings, Inc. | a2221942zex-10_10b.htm |

| EX-10.18(B) - EX-10.18(B) - Boot Barn Holdings, Inc. | a2221942zex-10_18b.htm |

Use these links to rapidly review the document

Table of contents

Index to audited consolidated financial statements

As filed with the Securities and Exchange Commission on October 28, 2014.

Registration No. 333-199008

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BOOT BARN HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

5600 (Primary Standard Industrial Classification Code Number) |

90-0776290 (I.R.S. Employer Identification Number) |

15776 Laguna Canyon Road

Irvine, California 92618

(949) 453-4400

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

James G. Conroy

President and Chief Executive Officer

Boot Barn Holdings, Inc.

15776 Laguna Canyon Road

Irvine, California 92618

(949) 453-4400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Richard J. Welch, Esq. Timothy R. Rupp, Esq. Bingham McCutchen LLP 600 Anton Boulevard, 18th Floor Costa Mesa, California 92626 (714) 830-0600 |

William V. Fogg, Esq. Johnny G. Skumpija, Esq. Cravath, Swaine & Moore LLP Worldwide Plaza 825 Eighth Avenue New York, New York 10019 (212) 474-1000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Subject to completion, dated October 28, 2014

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

5,000,000 shares

Common stock

This is the initial public offering of common stock of Boot Barn Holdings, Inc. We are selling 5,000,000 shares of our common stock.

Prior to this offering, there has been no public market for our common stock. We currently expect the initial public offering price to be between $14.00 and $16.00 per share of common stock. Our common stock has been approved for listing on the New York Stock Exchange under the symbol "BOOT".

We have granted the underwriters an option to purchase up to 750,000 additional shares of our common stock at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, and therefore have elected to comply with certain reduced public company reporting requirements. See "Prospectus summary—Implications of being an emerging growth company".

Investing in our common stock involves risks. See "Risk factors" beginning on page 15 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful and complete. Any representation to the contrary is a criminal offense.

| |

Per share |

Total |

|||||

|---|---|---|---|---|---|---|---|

Public offering price |

$ | $ | |||||

Underwriting discount* |

$ | $ | |||||

Proceeds to us, before expenses |

$ | $ | |||||

* We refer you to "Underwriting" beginning on page 122 of this prospectus for additional information regarding underwriting compensation.

The underwriters expect to deliver the shares to purchasers on or about , 2014 through the book-entry facilities of The Depository Trust Company.

| J.P. Morgan | Piper Jaffray | Jefferies |

| Wells Fargo Securities | Baird |

Prospectus dated , 2014.

Through and including , 2014 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission, which we refer to as the SEC. Neither we nor the underwriters have authorized anyone to provide you with additional information or information different from that contained in this prospectus or in any free writing prospectus filed with the SEC. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give to you. We are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any free writing prospectus, or of any sale of our common stock.

For investors outside the U.S.: neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that

i

purpose is required, other than in the U.S. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus outside of the U.S.

Basis of presentation

We operate on a fiscal calendar that results in a 52- or 53-week fiscal year ending on the Saturday closest to March 31. For ease of reference, we identify our fiscal year in this prospectus by reference to the calendar year in which the fiscal year ends. This prospectus contains references to fiscal 2012, fiscal 2013, fiscal 2014 and fiscal 2015, which represent our fiscal years ended March 31, 2012, March 30, 2013, March 29, 2014 and March 28, 2015, respectively, all of which were 52-week periods. This prospectus also contains references to fiscal 2011, which represents our fiscal year ended April 2, 2011 and was a 53-week period. In a 52-week fiscal year, each quarter includes 13 weeks of operations; in a 53-week fiscal year, the first, second and third quarters each include 13 weeks of operations and the fourth quarter includes 14 weeks of operations. Each quarter ends on the last Saturday of the 13-week period (or the 14-week period in a 53-week fiscal year).

The period from April 3, 2011 to December 11, 2011, which is presented separately as the "Predecessor Period" in this prospectus, consisted of approximately 36 weeks. The period from December 12, 2011 to March 31, 2012, which is presented separately as the "Successor Period" in this prospectus, consisted of approximately 16 weeks. See "Prospectus summary—Our sponsor". References in this prospectus to fiscal 2012 represent the sum of the results of the Predecessor Period and Successor Period.

As used in this prospectus, the following terms have the following meanings:

- •

- "CAGR" means compound annual growth rate;

- •

- "GAAP" means U.S. generally accepted accounting principles;

- •

- "net cash investment" means, for a given store, our initial cash investment in that store, which consists of the cost of

the initial inventory (net of accounts payable), pre-opening costs and capital investment (net of tenant improvement allowances); and

- •

- "working capital" means current assets, excluding cash and cash equivalents, minus current liabilities, excluding the current portion of debt under our credit facilities, as determined in accordance with GAAP.

References in this prospectus to our "credit facilities" collectively refer to our term loan credit facility with Golub Capital LLC, which we refer to as our term loan facility, and our revolving credit facility with PNC Bank, N.A., which we refer to as our revolving credit facility.

Amounts presented in this prospectus in millions are approximations of the actual amounts in that they have been rounded to the nearest one decimal place.

Unless the context requires otherwise, references in this prospectus to "Boot Barn", the "Company", "we", "us" and "our" refer to Boot Barn Holdings, Inc. and its consolidated subsidiaries. Except as the context otherwise requires, all information included in this prospectus is presented after giving effect to the reorganization described in "Management's discussion and analysis of financial condition and results of operations—Factors affecting comparability of results of operations—Reorganization".

References in this prospectus to "RCC" refer to RCC Western Stores, Inc., which we acquired in August 2012, and references in this prospectus to "Baskins" refer to Baskins Acquisition Holdings, LLC, which we acquired in May 2013.

ii

Trademarks and trade names

This prospectus includes our trademarks and trade names, such as "Boot Barn" and the names of our private brands, which are protected under applicable intellectual property laws and are our property. This prospectus also contains trademarks, trade names and service marks of other companies, which are the property of their respective owners. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of any applicable licensor to these trademarks, trade names and service marks. We do not intend our use or display of other parties' trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

Industry and market data

Unless otherwise indicated, statements in this prospectus concerning our industry and the markets in which we operate, including our general expectations and competitive position, business opportunity and market size, growth and share, are based on information from independent industry organizations and other third-party sources (including industry publications, surveys and forecasts), data from our internal research and management estimates. Management estimates are derived from publicly available information and the information and data referred to above, and are based on assumptions and calculations made by us based upon our interpretation of such information and data, and on our knowledge of our industry and the categories in which we operate, which we believe to be reasonable. Furthermore, the information and data referred to above are imprecise and may prove to be inaccurate because the information cannot always be verified with complete certainty due to the limitations on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. However, we are responsible for all of the disclosure in this prospectus and believe it to be reasonable. Projections, assumptions, expectations, beliefs and estimates regarding our industry and the categories in which we operate and our future performance are also necessarily subject to risk and change based on various factors, including those discussed under the heading "Risk factors".

Certain statements in this prospectus regarding the estimated size and growth of the U.S. western and work wear markets are based on information from a study that we engaged Mōd Advisors LLC, or Mōd, to conduct, which we refer to as the Mōd study. The Mōd study was based, in part, upon industry data obtained from a March 2014 publication by Global Industry Analysts entitled "Workwear: A Global Strategic Business Report". The Mōd study was also based upon information and estimates obtained during interviews that Mōd conducted with executives at several western and work wear manufacturers, as well as an online survey commissioned by Mōd of 2,045 adults and teenagers regarding purchases of western wear products. A broader sampling and different methodologies, among other variables, could have led Mōd to arrive at different results; however, we know of no better methodology for estimation nor do we have any reason to believe that Mōd's consideration of additional or different data would have materially changed its conclusions regarding the size of the U.S. market for the western and work wear categories. We have not independently verified any of the data from the Mōd study, nor have we ascertained the underlying economic assumptions upon which the Mōd study relied. Market research is based on sampling and subjective judgments by both the researchers and the respondents, including judgments about what types of products should be included in the relevant market. As a result, please be aware that the data and statistical information in this prospectus from the Mōd study may differ from information provided by our

iii

competitors or from information found in current or future studies conducted by market research institutes, consultancy firms or independent sources.

Statements in this prospectus regarding our competitive position, business opportunity and market size, growth and share in the U.S. are based on data that may not account for certain retailers. However, we believe that this data is a reasonable approximation of all relevant retailers, and we have no reason to believe that the inclusion of additional retailers in the data collection process would materially change the conclusions that we have drawn from this data. In addition, statements in this prospectus regarding the characteristics and preferences of our customers are based on internal analyses of our customers that have not been independently verified. A broader sampling of our customers and different methodologies, among other variables, could lead to different results; however, we know of no better methodology for estimation, nor do we have any reason to believe that our consideration of additional or different survey data would materially change the conclusions that we have drawn from these surveys.

Same store sales

As used in this prospectus, the term "same store sales" generally refers to net sales from stores that have been open at least 13 full fiscal months as of the end of the current reporting period, although we include or exclude stores from our calculation of same store sales in accordance with the following additional criteria:

- •

- stores that are closed for five or fewer days in any fiscal month are included in same store sales;

- •

- stores that are closed temporarily, but for more than five days in any fiscal month, are excluded from same store sales

beginning in the fiscal month in which the temporary closure begins until the first full month of operation once the store re-opens;

- •

- stores that are closed temporarily and relocated within their respective trade areas are included in same store sales;

- •

- stores that are permanently closed are excluded from same store sales beginning in the month preceding closure; and

- •

- acquired stores are added to same store sales beginning on the later of (a) the first day of the first fiscal month following its applicable acquisition date and (b) the first day of the first fiscal month after the store has been open for at least 13 full fiscal months regardless of whether the store has been operated under our management or predecessor management.

If the criteria described above are met, then all net sales of an acquired store, excluding those net sales before our acquisition of that store, are included for the period presented. However, when an acquired store is included for the period presented, the net sales of such acquired store for periods before its acquisition are included (to the extent relevant) for purposes of calculating "same stores sales growth" and illustrating the comparison between the applicable periods. Pre-acquisition net sales numbers are derived from the books and records of the acquired store, or acquired company in the case of RCC and Baskins, as prepared prior to the acquisition by the acquired store or acquired company and have not been independently verified by us.

In addition to retail store sales, same store sales also includes e-commerce sales, e-commerce shipping and handling revenue and actual retail store or e-commerce sales returns. We exclude gift card escheatment and our provision for sales returns and future award redemptions from our sales in deriving net sales per store.

iv

As used in this prospectus, the term "same store sales growth" refers to the percentage change in our same store sales as compared to the prior comparable period.

We believe that same store sales and same store sales growth provide investors with helpful information about our operating performance. Some of our competitors and other retailers may calculate "same" or "comparable" store sales or "same" or "comparable" store sales growth differently than we do. As a result, data in this prospectus regarding our same store sales and same stores sales growth may not be comparable to similar data made available by our competitors and other retailers. In addition, data regarding same store sales and same store sales growth are not audited or reviewed by our independent registered public accounting firm.

Non-GAAP financial measures

EBITDA and Adjusted EBITDA are financial measures that are not calculated in accordance with GAAP. We define EBITDA as net income (loss) adjusted to exclude income tax expense (benefit), net interest expense and depreciation and intangible asset amortization. We define Adjusted EBITDA as EBITDA adjusted to exclude non-cash stock-based compensation, the non-cash accrual for future award redemptions, recapitalization expenses, acquisition expenses, acquisition-related integration and reorganization costs, amortization of inventory fair value adjustment, loss on disposal of assets and other unusual or non-recurring expenses. In this prospectus, we present these non-GAAP measures together with a reconciliation of EBITDA and Adjusted EBITDA to our net income (loss), the most directly comparable financial measure calculated and presented in accordance with GAAP. See "Prospectus summary—Summary consolidated financial and other data" and "Selected consolidated financial data".

We include EBITDA and Adjusted EBITDA in this prospectus because they are important financial measures that our management, board of directors and lenders use to assess our operating performance. We use EBITDA and Adjusted EBITDA as key performance measures because we believe that they facilitate operating performance comparisons from period to period by excluding potential differences primarily caused by the impact of variations from period to period in tax positions, interest expense and depreciation and amortization, as well as, in the case of Adjusted EBITDA, excluding non-cash expenses, such as non-cash stock-based compensation and the non-cash accrual for future award redemptions, and unusual or non-recurring costs and expenses that are not directly related to our operations, including recapitalization expenses, acquisition expenses, acquisition-related integration and reorganization costs, amortization of inventory fair value adjustment, loss on disposal of assets and other unusual or nonrecurring expenses. Because EBITDA and Adjusted EBITDA facilitate internal comparisons of our historical operating performance on a more consistent basis, we also use EBITDA and Adjusted EBITDA (or some variations thereof) for business planning purposes, in calculating covenant compliance for our credit facilities, in determining incentive compensation for members of our management and in evaluating acquisition opportunities. In addition, we believe that EBITDA and Adjusted EBITDA and similar measures are widely used by investors, securities analysts, ratings agencies and other parties in evaluating companies in our industry as a measure of financial performance and debt-service capabilities.

Our use of EBITDA and Adjusted EBITDA has limitations as an analytical tool. Some of these limitations are:

- •

- neither EBITDA nor Adjusted EBITDA reflects income tax expense or the cash requirements to pay our taxes;

- •

- neither EBITDA nor Adjusted EBITDA reflects our cash expenditures for capital equipment, leasehold improvements or other contractual commitments;

v

- •

- although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be

replaced in the future, and neither EBITDA nor Adjusted EBITDA reflects capital expenditure requirements for such replacements;

- •

- neither EBITDA nor Adjusted EBITDA reflects the interest expense or the cash requirements necessary to service interest or

principal payments under our credit facilities; and

- •

- neither EBITDA nor Adjusted EBITDA reflects changes in, or cash requirements for, our working capital needs.

EBITDA and Adjusted EBITDA should not be considered in isolation or as alternatives to net income or any other measure of financial performance calculated and presented in accordance with GAAP. Given that EBITDA and Adjusted EBITDA are measures not deemed to be in accordance with GAAP and are susceptible to varying calculations, our EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies, including companies in our industry, because other companies may calculate EBITDA and Adjusted EBITDA in a different manner than we calculate these measures.

In evaluating EBITDA and Adjusted EBITDA, you should be aware that in the future we may or may not incur expenses similar to some of the adjustments in this presentation. Our presentation of EBITDA and Adjusted EBITDA does not imply that our future results will be unaffected by these expenses or any unusual or non-recurring items. When evaluating our performance, you should consider EBITDA and Adjusted EBITDA alongside other financial performance measures, including our net income and other GAAP results, and not rely on any single financial measure.

vi

This summary highlights information contained elsewhere in this prospectus and does not contain all the information that you should consider in making your investment decision. Before investing in our common stock, you should read this entire prospectus carefully, including the sections entitled "Risk factors" and "Management's discussion and analysis of financial condition and results of operations" and our consolidated financial statements, condensed consolidated financial statements and related notes included elsewhere in this prospectus.

Our company

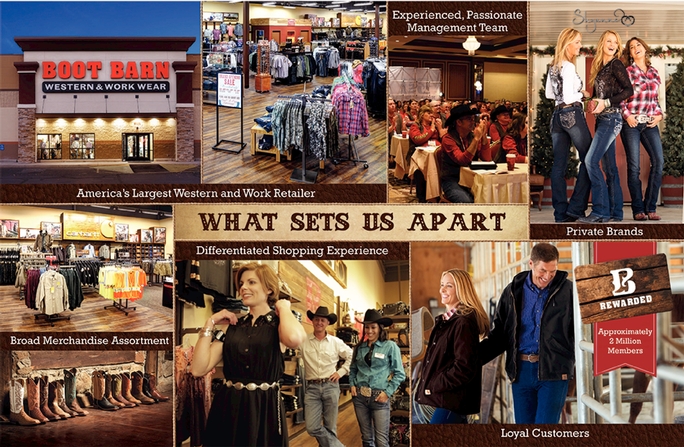

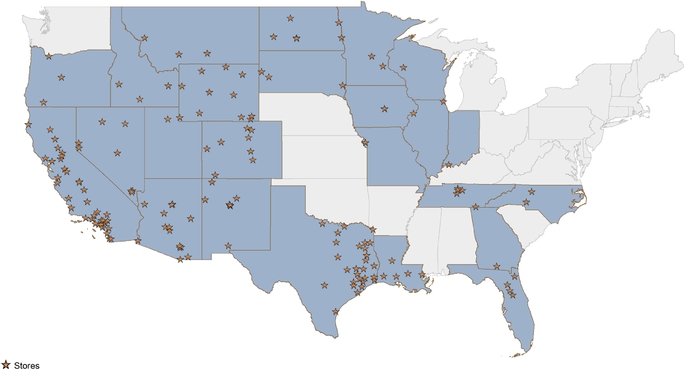

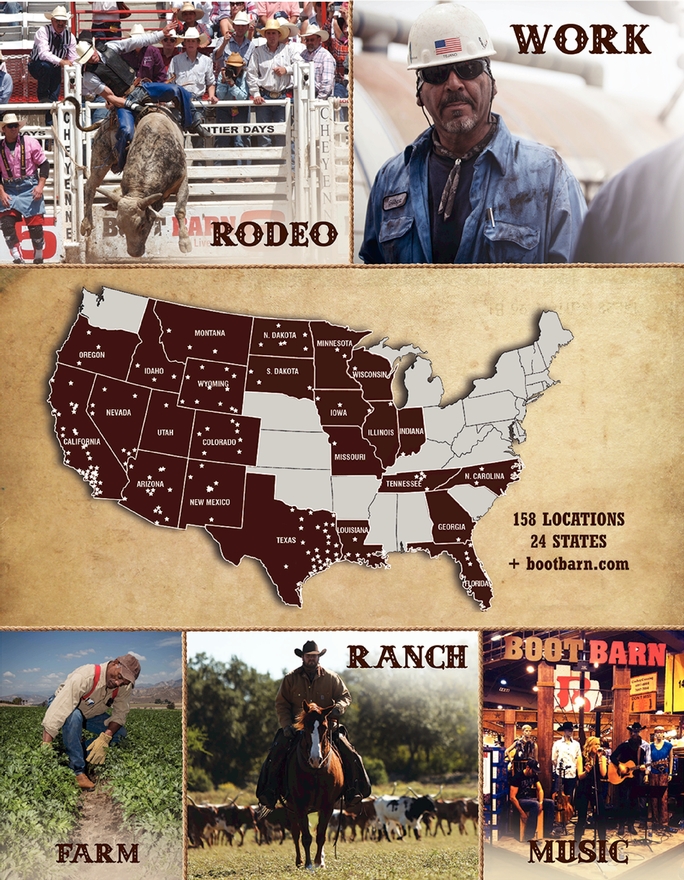

We are the largest and fastest-growing lifestyle retail chain devoted to western and work-related footwear, apparel and accessories in the U.S. With 158 stores in 24 states as of September 27, 2014, we have over twice as many stores as our nearest direct competitor that sells primarily western and work wear, and believe we have the potential to grow our store base to at least 400 domestic locations. Our stores, which are typically freestanding or located in strip centers, average 10,800 square feet and feature a comprehensive assortment of approximately 200 brands and more than 1,500 styles on average, coupled with attentive, knowledgeable store associates. We target a broad and growing demographic, ranging from passionate western and country enthusiasts to workers seeking dependable, high-quality footwear and clothing. We strive to offer an authentic, one-stop shopping experience that fulfills the everyday lifestyle needs of our customers and, as a result, many of our customers make purchases in both the western and work wear sections of our stores. Our store environment, product offering and marketing materials represent the aesthetics of the true American West, country music and rugged, outdoor work. These threads are woven together in our motto, "Be True", which communicates the genuine and enduring spirit of the Boot Barn brand.

Our product offering is anchored by an extensive selection of western and work boots and is complemented by a wide assortment of coordinating apparel and accessories. Many of the items that we offer are basics or necessities for our customers' daily lives and typically represent enduring styles that are not impacted by changing fashion trends. We carry market-leading assortments of boots, denim, western shirts, cowboy hats, belts and belt buckles, western-style jewelry and accessories. Our western assortment includes many of the industry's most sought-after brands, such as Ariat, Dan Post, Justin, Levi Strauss, Lucchese, Miss Me, Montana Silversmiths, Resistol and Wrangler. Our work assortment includes rugged footwear, outerwear, overalls, denim and shirts for the most physically demanding jobs where durability, performance and protection matter, including safety-toe boots and flame-resistant and high-visibility clothing. Among the top work brands sold in our stores are Carhartt, Dickies, Timberland Pro and Wolverine. Our merchandise is also available on our e-commerce website, www.bootbarn.com.

Boot Barn was founded in 1978 and, over the past 36 years, has grown both organically and through successful strategic acquisitions of competing chains. We have rebranded and remerchandised the acquired chains under the Boot Barn banner, resulting in sales and profit increases over their original concepts. We believe that our business model and scale provide us with competitive advantages that have contributed to our consistent and strong financial performance, generating sufficient cash flow to support national growth, as evidenced by:

- •

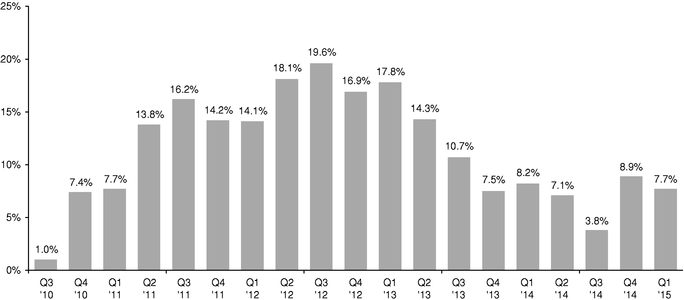

- 19 consecutive quarters of positive same store sales growth averaging 11.3% per quarter (see the diagram below) and same store sales growth of 6.7% in fiscal 2014;

1

- •

- store base expansion to 158 stores as of September 27, 2014 from 86 stores as of March 31, 2012, with

17 new stores resulting from organic growth and 55 new stores resulting from strategic acquisitions;

- •

- net sales of $345.9 million in fiscal 2014, an increase of $177.2 million since fiscal 2012, representing a

CAGR of 43.2%; and

- •

- Adjusted EBITDA of $40.3 million in fiscal 2014, an increase of $18.6 million since fiscal 2012, representing a 36.2% CAGR (see "—Summary consolidated financial and other data" for a discussion and reconciliation of Adjusted EBITDA to net income).

Quarterly same store sales growth

19 consecutive quarters of growth

For a description of the manner in which we calculate same store sales see "Same store sales" at the beginning of this prospectus.

Our competitive strengths

We believe the following strengths differentiate us from our competitors and provide a solid foundation for future growth:

Powerful lifestyle brand. Our deep understanding of the western lifestyle enables us to create long-lasting relationships with our customers. Our brand is highly visible through our sponsorship of western events, which, in fiscal 2014, included 257 local community rodeos, 9 national rodeos and 89 other country and western events. We believe these grassroots marketing efforts make our brand synonymous with the western lifestyle, validate our brand's authenticity and establish Boot Barn as the trusted specialty retailer for all of our customers' everyday needs.

Largest and fastest growing specialty retailer of western and work wear in the U.S. Our broad geographic footprint, which currently spans 24 states, provides us with significant economies of scale, enhanced supplier relationships, the ability to recruit and retain high quality store associates and the ability to reinvest in our business at levels that we believe exceed those of our competition. Over the past two full fiscal years, we have grown our stores at a 32.9% CAGR.

2

Attractive, loyal customer base. Our customers come to us for many aspects of their everyday footwear and clothing needs because of the breadth and availability of our product offering. Our loyalty program, B Rewarded, has grown rapidly since its inception in 2011, and includes approximately 2.2 million members who have purchased merchandise from us as of September 27, 2014. Approximately 90% of our sales in fiscal 2014 were generated by customers who were already in our loyalty program or signed up to participate in our loyalty program at the time of their purchase.

Differentiated shopping experience. We deliver a one-stop shopping experience that engages our customers and, we believe, fulfills their lifestyle needs. Our stores are designed to create an inviting and engaging experience and feature strong in-stock positions across our broad assortment of boots, apparel and accessories. Our knowledgeable store associates are passionate about our merchandise and deliver a high level of service to our customers. These elements help promote customer loyalty and drive repeat visits.

Compelling merchandise assortment and strategy. We believe we offer a diverse merchandise assortment that features the most sought-after western and work wear brands, well-regarded niche brands and exclusive private brands across a range of boots, apparel and accessories. In fiscal 2014, the vast majority of our merchandise sales were at full price, which, we believe, demonstrates the strength of our brand and the less discretionary nature of our product offering.

Portfolio of exclusive private brands. We have leveraged our scale, merchandising experience and customer knowledge to launch a portfolio of private brands exclusive to us, including Shyanne, Cody James, American Worker and BB Ranch. Our private brands offer high-quality western and work boots as well as apparel and accessories for men, ladies and kids and address product and price segments that we believe are underserved by third-party brands.

Versatile store model with compelling unit economics. We have successfully opened and currently operate stores that generate strong cash flow, consistent store-level financial results and an attractive return on investment across a variety of geographies, markets, store sizes and location types. As of the end of fiscal 2014, all of our stores included in same store sales were profitable. Our new store model requires an average net cash investment of approximately $670,000 and targets an average payback period of less than three years.

Highly experienced management team and passionate organization. Our senior management team has extensive experience across all key retail disciplines. With an average of approximately 25 years of experience in their respective functional areas, our senior management team has been instrumental in developing a robust and scalable infrastructure to support our growth. Our senior management team embraces the genuine and enduring qualities of the western lifestyle and has created a positive culture of enthusiasm and entrepreneurial spirit which is shared by team members throughout our entire organization. Our strong company culture is exemplified by the long tenure of our employees at all levels. For example, our district and regional managers have an average of eight years of service with us and our store managers have an average of more than five years of service with us, including the companies acquired by us.

Our growth strategies

We are pursuing several strategies to continue our profitable growth, including:

Expanding our store base. Driven by our compelling store economics and based on an extensive internal analysis, we believe that we have the potential to grow our domestic store base from 158 stores as of

3

September 27, 2014 to at least 400 domestic locations. We currently plan to target new store openings in both existing markets and new, adjacent and underserved markets. Over the past several years, we have made significant investments in personnel, information technology, warehouse infrastructure and an e-commerce platform to support the expansion of our operations. We believe that we can grow our store base in the U.S. by at least 10% annually for the next several years.

Driving same store sales growth. We believe that we can continue to grow our same store sales by increasing our brand awareness, driving additional traffic to our stores and increasing the amount of merchandise purchased by customers while visiting our stores. Our management team has launched several initiatives to accelerate growth, enhance our store associates' selling skills, drive store-level productivity and increase customer engagement through our loyalty program.

Enhancing brand awareness. We intend to enhance our brand awareness and customer loyalty in a number of ways, such as continuing to grow our store base and our online and social media initiatives. We use broadcast media such as radio, television and outdoor advertisements to reach customers in new and existing markets. We also have an effective social media strategy with high customer engagement, as evidenced by our Facebook fan base. According to Internet Retailer, we were ranked number one for having the fastest growing fan base of all merchants covered by their survey released in January 2014.(1) As of September 27, 2014, our Facebook fan base eclipsed 2.1 million fans.

Growing our e-commerce business. We continue to make investments aimed at increasing traffic to our e-commerce website, which reached over 7.5 million visits in fiscal 2014, and increasing the amount of merchandise purchased by customers who visit our website, while improving the shopping experience for our customers. Since re-launching our e-commerce website with a new platform in fiscal 2011, our e-commerce sales have grown at a 38.2% CAGR. Our e-commerce business allows us to reach customers outside our geographic footprint, with 32.7% of our domestic e-commerce sales during fiscal 2014 being made to customers in states where we do not operate stores.

Increasing profitability. Our ability to leverage our infrastructure and drive store-level productivity due to economies of scale is expected to be a primary driver of our improvement in profitability. We intend to continually refine our merchandise mix and increase the penetration of our private brands to help differentiate us from our competitors and achieve higher merchandise margins. We also expect to capitalize on additional economies of scale in purchasing and sourcing as we grow our geographic footprint and online presence.

Our market opportunity

We participate in the large, growing and highly fragmented western and work wear markets of the broader apparel and footwear industry. We offer a variety of boots, apparel and accessories that are basics or necessities for our customers' daily lives. Many of our customers are employed in the agriculture, oil and gas, manufacturing and construction industries, and are often country and western enthusiasts.

The following data regarding these markets is derived from the Mōd study referenced at the beginning of this prospectus. See "Industry and market data". The U.S. western and work wear markets represented approximately $8 billion and $12 billion in retail sales, respectively, in calendar year 2013. The western wear market is composed of footwear, apparel and accessories, which in 2013 represented approximately $3.0 billion, $3.5 billion and $1.5 billion in retail sales, respectively. The work wear market is composed of

(1) Source: Stefany Moore, How Boot Barn uses Facebook to build a national brand, Internet Retailer (January 9, 2014), http://www.internetretailer.com/2014/01/09/how-boot-barn-uses-facebook-build-national-brand.

4

footwear and apparel, which in 2013 represented approximately $3.0 billion and $9.0 billion in retail sales, respectively. Between 2009 and 2013, the western and work wear markets experienced estimated annual retail sales growth of approximately 6% to 8% and 1% to 3%, respectively. Over the next three to five years, Mōd estimates that retail sales in the western and work wear markets will grow annually at approximately 3% to 5% and 2% to 4%, respectively. We believe that growth in the western wear market has been and will continue to be driven by the growth of western events, such as rodeos, the popularity of country music and the continued strength and endurance of the western lifestyle. We believe that growth in the work wear market has been and will continue to be driven by increased output and employment in the oil and gas industries, increasing activity in the construction sector and the return of domestic manufacturing. Additionally, government regulations for workplace safety have driven and, we believe, will continue to drive, sales in specific categories, such as safety-toe boots and flame-resistant and high-visibility clothing for various industrial and outdoor occupations.

Risks associated with our business

We believe that our business strategy will continue to offer significant opportunities, but it also presents risks and challenges. These risks and challenges include, but are not limited to, the following:

- •

- there may be a decline in consumer spending or changes in consumer preferences;

- •

- we may not be able to effectively execute on our growth strategy, including our store growth plan;

- •

- we may not be able to maintain and enhance our strong brand image;

- •

- we may not compete effectively;

- •

- we may not be able to maintain good relationships with our key suppliers;

- •

- we may not be able to improve and expand our exclusive product offerings; and

- •

- there may be a substantial increase in product costs or general inflation.

See "Risk factors" for other important factors that could adversely impact our results of operations.

Recent Developments

Preliminary financial information for the thirteen weeks ended September 27, 2014

We are currently finalizing our unaudited interim financial statements as of and for the thirteen weeks ended September 27, 2014, including our results of operations for that period. While financial statements as of and for this period are not yet available, based on the information currently available to management, we preliminarily estimate that for the thirteen weeks ended September 27, 2014, net sales were between $85.9 million and $86.4 million compared to $77.4 million for the thirteen weeks ended September 28, 2013; income from operations was between $3.9 million and $4.4 million compared to a loss from operations of $0.1 million for the thirteen weeks ended September 28, 2013; and same store sales growth was between 7.2% and 7.3% compared to 7.1% for the thirteen weeks ended September 28, 2013.

Our estimated increase in net sales for the thirteen weeks ended September 27, 2014, as compared to the thirteen weeks ended September 28, 2013, was due to an increase in same store sales, plus additional sales from seven net new stores opened since September 28, 2013, including three new stores that opened during the thirteen weeks ended September 27, 2014.

5

Our estimated increase in income from operations for the thirteen weeks ended September 27, 2014 was due primarily to our increase in net sales and gross profit. Included in income from operations for the thirteen weeks ending September 27, 2014 are non-recurring expenses of approximately $0.9 million incurred in connection with our evaluation of an acquisition, which we decided not to pursue. Included in the loss from operations for the thirteen weeks ended September 28, 2013 are non-recurring expenses of approximately $2.0 million incurred in connection with the acquisition and integration of Baskins (which we acquired in May 2013), approximately $0.4 million in amortization of inventory fair value adjustments and approximately $0.3 million from a loss on the disposal of assets in connection with the rebranding of the Baskins stores.

The preliminary financial information above is unaudited and may vary from our actual financial results for the thirteen weeks ended September 27, 2014. The preliminary financial information above reflects estimates based only on preliminary information available to us as of the date of this prospectus, has not been subject to our normal quarterly closing procedures and adjustments, which may be material, and is not a comprehensive statement of our financial results for the thirteen weeks ended September 27, 2014. Accordingly, you should not place undue reliance on these preliminary estimates. The preliminary financial information should not be viewed as a substitute for full interim financial statements prepared in accordance with GAAP. The estimates above are not necessarily indicative of any future period or any full fiscal year and should be read together with "Risk factors", "Special note regarding forward-looking statements", "Management's discussion and analysis of financial condition and results of operations", "Selected consolidated financial data" and our consolidated financial statements, condensed consolidated financial statements and related notes included elsewhere in this prospectus. The preliminary financial information above has been prepared by, and is the responsibility of, our management. Our independent registered public accounting firm has not audited, reviewed, compiled or performed any procedures with respect to this preliminary financial information and does not express an opinion or any other form of assurance with respect thereto.

Stock split

Our board of directors and stockholders have approved a 25-for-1 stock split of our common stock that will be effective prior to this offering. All references in this prospectus to shares of common stock, options to purchase shares of common stock, per share data and related information have been retroactively adjusted, where applicable, to reflect this stock split as if it had occurred at the beginning of the earliest period presented.

Our sponsor

Freeman Spogli & Co. is a private equity firm dedicated exclusively to investing and partnering with management in consumer-related and distribution companies in the U.S. Since its founding in 1983, Freeman Spogli & Co. has invested $3.3 billion of equity in 50 portfolio companies with aggregate transaction values of $20 billion. Freeman Spogli & Co. acquired its shares of our common stock in December 2011 in a transaction that we refer to as the Recapitalization. See "Management's discussion and analysis of financial condition and results of operations—Factors affecting comparability of results of operations—Recapitalization". Following the completion of this offering, Freeman Spogli & Co. will beneficially own approximately 71.2% of our outstanding common stock, or 69.1% if the underwriters fully exercise their option to purchase additional shares. It is possible that the interests of Freeman Spogli & Co. may in some circumstances conflict with our interests and the interests of our other stockholders.

6

Our corporate information

Boot Barn Holdings, Inc. was formed in Delaware on November 17, 2011 as WW Top Investment Corporation to facilitate the Recapitalization. On June 9, 2014, WW Holding Corporation and Boot Barn Holding Corporation were each merged with and into WW Top Investment Corporation. On June 10, 2014, the legal name of WW Top Investment Corporation was changed to Boot Barn Holdings, Inc. Our principal executive offices are located at 15776 Laguna Canyon Road, Irvine, California, 92618 and our telephone number is (949) 453-4400. Our website address is www.bootbarn.com. We do not incorporate the information contained on, or accessible through, our corporate website into this prospectus, and you should not consider it part of this prospectus. We have included our website address only as an inactive textual reference and do not intend it to be an active link to our website.

Implications of being an emerging growth company

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, which we refer to as the JOBS Act. We will remain an emerging growth company until the earlier of (1) the last day of our fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenue of at least $1.0 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeds $700.0 million as of the last business day of our most recently completed second fiscal quarter, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period.

An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

- •

- the option to report only two years of audited financial statements and to present management's discussion and analysis of

financial condition and results of operations for only those two years;

- •

- exemption from the provisions of Section 404(b) of the Sarbanes-Oxley Act of 2002, which we refer to as the

Sarbanes-Oxley Act, requiring that an independent registered public accounting firm provide an attestation report on the effectiveness of our internal controls over financial reporting;

- •

- exemption from the "say on pay" and "say on golden parachute" advisory vote requirements of the Dodd-Frank Wall Street

Reform and Customer Protection Act, which we refer to as the Dodd-Frank Act;

- •

- exemption from certain disclosure requirements of the Dodd-Frank Act relating to compensation of our executive officers

and permission to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Securities Exchange Act of 1934, as amended, which we refer to as the

Exchange Act; and

- •

- permission to provide a reduced level of disclosure concerning executive compensation and exemption from any rules that may be adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotations or a supplement to the auditor's report on the financial statements.

We have not taken advantage of certain of these reduced reporting burdens in this prospectus, although we may choose to do so in future filings. If we do take advantage of any of these exemptions, we cannot predict if investors will find our common stock less attractive, or if taking advantage of these exemptions would result in less active trading or more volatility in the price of our common stock.

7

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, which we refer to as the Securities Act, for complying with new or revised accounting standards. However, we are choosing to "opt out" of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

8

| Common stock offered by us | 5,000,000 shares (or 5,750,000 shares if the underwriters exercise in full their option to purchase additional shares) | |

Common stock outstanding after this offering |

24,929,350 shares (or 25,679,350 shares if the underwriters exercise in full their option to purchase additional shares) |

|

The number of shares of our common stock outstanding after this offering is based on the assumptions outlined below. |

||

Use of proceeds |

We estimate that we will receive net proceeds from the sale of the shares of our common stock in this offering of approximately $66.9 million (or $77.3 million if the underwriters exercise in full their option to purchase additional shares), assuming an initial public offering price of $15.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

|

We intend to use the net proceeds of this offering to repay a portion of our existing term loan facility, including applicable prepayment penalties and fees. See "Use of proceeds". |

||

Risk factors |

See "Risk factors" on page 15 and the other information in this prospectus for a discussion of factors you should carefully consider before you decide to invest in our common stock. |

|

Dividend policy |

We anticipate that we will retain all of our available funds to repay existing indebtedness and for use in the operation and expansion of our business for the foreseeable future. Any future determination as to the payment of cash dividends on our common stock will be at the discretion of our board of directors and will depend on our financial condition, operating results, current and anticipated cash needs, plans for expansion, legal requirements and other factors that our board of directors considers to be relevant. In addition, financial and other covenants in our credit facilities and in any credit facilities, debt instruments or other agreements that we enter into in the future may restrict our ability to pay cash dividends on our common stock. See "Dividend policy". |

|

Listing and symbol |

Our common stock has been approved for listing on the New York Stock Exchange, or NYSE, under the symbol "BOOT". |

Unless otherwise indicated, information in this prospectus:

- •

- assumes an initial public offering price of $15.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus;

9

- •

- assumes the underwriters have not exercised their option to purchase additional shares in this offering; and

- •

- gives effect to the 25-for-1 stock split of our common stock that will be effective prior to this offering.

The number of shares outstanding immediately after this offering is based on 19,929,350 shares of common stock outstanding as of September 27, 2014 and excludes:

- •

- 2,720,250 shares of our common stock issuable upon the exercise of options outstanding under our 2011 Equity

Incentive Plan at a weighted average exercise price of $6.41;

- •

- 32,250 shares of our common stock issuable upon the exercise of options outstanding under our 2007 Stock Incentive Plan at

a weighted average exercise price of $0.00;

- •

- an additional 1,600,000 shares of our common stock currently reserved for future issuance under our 2014 Equity Incentive

Plan (including 99,650 shares issuable upon the exercise of an option that we intend to grant under this plan to our Chief Executive Officer, 3,333 shares that we intend to issue under this plan to

one of our non-employee directors and 29,000 shares that we intend to issue to employees other than executive officers, in each case immediately prior to the execution of the underwriting agreement

for this offering and, in the case of each of the share issuances, assuming an initial public offering price of $15.00 per share, which is the midpoint of the price range set forth on the cover page

of this prospectus), see "Executive and director compensation"; and

- •

- an additional 1,029,750 shares of our common stock reserved for future issuance under our 2011 Equity Incentive Plan, see "Executive and director compensation".

10

Summary consolidated financial and other data

The following tables summarize our consolidated financial and other data as of and for the periods indicated, as well as certain "as adjusted" financial data. We have derived the summary consolidated statement of operations data for the years ended March 29, 2014 and March 30, 2013, the Successor Period and the Predecessor Period and the consolidated balance sheet data as of March 29, 2014 and March 30, 2013 from the audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated statements of operations data for the thirteen weeks ended June 28, 2014 and June 29, 2013 and the consolidated balance sheet data as of June 28, 2014 have been derived from our unaudited interim condensed consolidated financial statements included elsewhere in this prospectus. The unaudited interim condensed consolidated financial statements were prepared on the same basis as our audited consolidated financial statements. In our opinion, such financial statements reflect all adjustments that are of a normal and recurring nature necessary to fairly present our financial position and results of operations in all material respects as of the dates and for the periods presented. The results of operations presented in the unaudited interim condensed consolidated financial statements are not necessarily indicative of the results that may be expected for a full fiscal year or in any future period.

The as adjusted consolidated balance sheet data as of June 28, 2014 is presented after giving effect to the offering contemplated by this prospectus and the application of the net proceeds received by us in the offering to repay outstanding indebtedness as described under "Use of proceeds", as though this offering and the application of net proceeds had occurred as of such date. The unaudited as adjusted financial data does not purport to represent what our results will be in future periods.

The consolidated statement of operations data and consolidated balance sheet data include the financial position, results of operations and cash flows of RCC and Baskins since their respective dates of acquisition in August 2012 and May 2013.

You should read the following summary consolidated financial and other data together with the sections of this prospectus titled "Use of proceeds", "Capitalization", "Selected consolidated financial data" and "Management's discussion and analysis of financial condition and results of operations" and the consolidated financial statements, condensed consolidated financial statements and related notes included elsewhere in this prospectus.

11

| |

Fiscal year ended(1) | Period(1) | Thirteen weeks ended | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands, except per share data) |

March 29, 2014 |

March 30, 2013 |

(Successor) December 12, 2011 to March 31, 2012 |

(Predecessor) April 3, 2011 to December 11, 2011 |

June 28, 2014 |

June 29, 2013 |

|||||||||||||

Consolidated statement of operations data: |

|||||||||||||||||||

Net sales |

$ | 345,868 | $ | 233,203 | $ | 58,267 | $ | 110,429 | $ | 82,497 | $ | 64,574 | |||||||

Cost of goods sold |

231,796 | 151,357 | 37,313 | 72,129 | 55,607 | 42,146 | |||||||||||||

Amortization of inventory fair value adjustment |

867 | 9,199 | 9,369 | — | — | 145 | |||||||||||||

Total cost of goods sold |

232,663 | 160,556 | 46,682 | 72,129 | 55,607 | 42,291 | |||||||||||||

Gross profit |

113,205 | 72,647 | 11,585 | 38,300 | 26,890 | 22,283 | |||||||||||||

Operating expenses: |

|||||||||||||||||||

Selling, general and administrative expenses |

91,998 | 62,609 | 12,769 | 28,145 | 21,497 | 18,845 | |||||||||||||

Acquisition-related expenses(2) |

671 | 1,138 | 3,027 | 7,336 | — | 671 | |||||||||||||

Total operating expenses |

92,669 | 63,747 | 15,796 | 35,481 | 21,497 | 19,516 | |||||||||||||

Income (loss) from operations |

20,536 | 8,900 | (4,211 | ) | 2,819 | 5,393 | 2,767 | ||||||||||||

Interest expense, net |

11,594 | 7,415 | 1,442 | 3,684 | 2,757 | 5,078 | |||||||||||||

Other income, net |

39 | 21 | 5 | 70 | 18 | 8 | |||||||||||||

Income (loss) before income taxes |

8,981 | 1,506 | (5,648 | ) | (795 | ) | 2,654 | (2,303 | ) | ||||||||||

Income tax expense (benefit) |

3,321 | 826 | (1,047 | ) | (135 | ) | 1,241 | (858 | ) | ||||||||||

Net income (loss) |

5,660 | 680 | (4,601 | ) | (660 | ) | 1,413 | (1,445 | ) | ||||||||||

Net income (loss) attributed to non-controlling interest |

283 | 34 | (230 | ) | — | 4 | (72 | ) | |||||||||||

Net income (loss) attributed to Boot Barn Holdings, Inc. |

$ | 5,377 | $ | 646 | $ | (4,371 | ) | $ | (660 | ) | $ | 1,409 | $ | (1,373 | ) | ||||

Net income (loss) per share:(3)(5) |

|||||||||||||||||||

Basic shares |

$ | 0.28 | $ | 0.03 | $ | (0.23 | ) | $ | (3.82 | ) | $ | (0.00 | ) | $ | (0.07 | ) | |||

Diluted shares |

$ | 0.28 | $ | 0.03 | $ | (0.23 | ) | $ | (3.82 | ) | $ | (0.00 | ) | $ | (0.07 | ) | |||

Weighted average shares outstanding:(5) |

|||||||||||||||||||

Basic shares |

18,929 | 18,757 | 18,633 | 173 | 19,149 | 18,929 | |||||||||||||

Diluted shares |

19,175 | 18,757 | 18,633 | 173 | 19,149 | 18,929 | |||||||||||||

As adjusted net income (loss) per share:(4)(5) |

|||||||||||||||||||

Basic shares |

$ | (0.06 | ) | ||||||||||||||||

Diluted shares |

$ | (0.06 | ) | ||||||||||||||||

As adjusted weighted average shares outstanding:(5) |

|||||||||||||||||||

Basic shares |

19,204 | ||||||||||||||||||

Diluted shares |

19,204 | ||||||||||||||||||

12

| |

Fiscal year ended(1) | Period(1) | Thirteen weeks ended | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands, except selected store data) |

March 29, 2014 |

March 30, 2013 |

(Successor) December 12, 2011 to March 31, 2012 |

(Predecessor) April 3, 2011 to December 11, 2011 |

June 28, 2014 |

June 29, 2013 |

|||||||||||||

Other financial data (unaudited): |

|||||||||||||||||||

EBITDA(6) |

$ | 28,704 | $ | 14,509 | $ | (3,111 | ) | $ | 4,107 | $ | 7,469 | $ | 4,355 | ||||||

Adjusted EBITDA(6) |

$ | 40,271 | $ | 28,933 | $ | 9,785 | $ | 11,917 | $ | 7,789 | $ | 5,900 | |||||||

Capital expenditures |

$ | 11,400 | $ | 3,848 | $ | 698 | $ | 2,055 | $ | 1,803 | $ | 1,909 | |||||||

Selected store data (unaudited): |

|||||||||||||||||||

Same store sales growth |

6.7% | 11.9% | 17.5% | 17.5% | 7.7% | 8.2% | |||||||||||||

Stores operating at end of period |

152 | 117 | 86 | 85 | 155 | 149 | |||||||||||||

Total retail store square footage, end of period (in thousands) |

1,642 | 1,082 | 814 | 804 | 1,676 | 1,591 | |||||||||||||

Average store square footage, end of period |

10,801 | 9,251 | 9,466 | 9,456 | 10,811 | 10,676 | |||||||||||||

Average net sales per store (in thousands)(7) |

$ | 2,162 | $ | 1,861 | $ | 644 | $ | 1,210 | $ | 511 | $ | 419 | |||||||

| |

As of | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands) |

March 29, 2014 |

March 30, 2013 |

June 28, 2014 |

As adjusted June 28, 2014(8) |

|||||||||

Consolidated balance sheet data: |

|||||||||||||

Cash and cash equivalents |

$ | 1,118 | $ | 1,190 | $ | 1,115 | $ | 2,529 | |||||

Working capital |

56,786 | 37,174 | 61,814 | 60,835 | |||||||||

Total assets |

291,863 | 224,282 | 301,339 | 299,951 | |||||||||

Total debt |

128,124 | 88,410 | 172,594 | 106,201 | |||||||||

Stockholders' equity |

84,575 | 77,624 | 45,130 | 110,874 | |||||||||

(1) We operate on a fiscal calendar that results in a 52- or 53-week fiscal year ending on the Saturday closest to March 31. In a 52-week fiscal year, each quarter includes 13 weeks of operations; in a 53-week fiscal year, the first, second and third quarters each include 13 weeks of operations and the fourth quarter includes 14 weeks of operations. The data presented contains references to fiscal 2014, fiscal 2013, the Successor Period and the Predecessor Period, which represent our fiscal years ended March 29, 2014 and March 30, 2013, and our fiscal periods from December 12, 2011 to March 31, 2012 and from April 3, 2011 to December 11, 2011, respectively. Fiscal 2014 and fiscal 2013 were each 52-week periods, the Successor Period consisted of approximately 16 weeks and the Predecessor Period consisted of approximately 36 weeks. Same store sales growth presented for each of the Predecessor Period and the Successor Period was calculated by comparing same store sales for such period against same store sales for the corresponding period in fiscal 2011. The data includes the activities of RCC from August 2012 and Baskins from May 2013, their respective dates of acquisition.

(2) Represents costs incurred in connection with the acquisitions of RCC and Baskins, as well as the Recapitalization.

(3) Net loss per share for the thirteen weeks ended June 28, 2014 reflects the deduction from net income, for purposes of determining the net income available to common stockholders, of the cash payment of $1.4 million made in April 2014 to holders of vested stock options. See "Management's discussion and analysis of financial condition and results of operations—Liquidity and capital resources—Financing activities".

(4) As adjusted per share data gives effect to (i) the sale by us of 5,000,000 shares of our common stock in this offering, assuming an initial public offering price of $15.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, and (ii) the application of the net proceeds of this offering as described under "Use of proceeds", in each case assuming such events occurred on June 28, 2014. Basic and diluted as adjusted net income per share consists of as adjusted net income divided by the basic and diluted as adjusted weighted average number of shares of common stock outstanding. As adjusted net income per share reflects the increase in interest expense, net of income taxes, of $1.1 million resulting from the incurrence of prepayment penalties and fees and the write-off of prepaid loan fees in connection with our intended repayment of debt under our credit facilities as described in "Use of proceeds".

(5) The indicated data, other than data for the Predecessor Period, gives effect to the 25-for-1 stock split of our common stock that will be effective prior to this offering.

(6) EBITDA and Adjusted EBITDA are financial measures that are not calculated in accordance with GAAP. We define EBITDA as net income (loss) adjusted to exclude income tax expense (benefit), net interest expense and depreciation and intangible asset amortization. We define Adjusted EBITDA as EBITDA adjusted to exclude non-cash stock-based compensation, the non-cash accrual for future award redemptions,

13

recapitalization expenses, acquisition expenses, acquisition-related integration and reorganization costs, amortization of inventory fair value adjustment, loss on disposal of assets and other unusual or non-recurring expenses. We include EBITDA and Adjusted EBITDA in this prospectus because they are important financial measures which our management, board of directors and lenders use to assess our operating performance. EBITDA and Adjusted EBITDA should not be considered in isolation or as alternatives to net income or any other measure of financial performance calculated and presented in accordance with GAAP. Given that EBITDA and Adjusted EBITDA are measures not deemed to be in accordance with GAAP and are susceptible to varying calculations, our EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies, including companies in our industry, because other companies may calculate EBITDA and Adjusted EBITDA in a different manner than we calculate these measures. See "Non-GAAP financial measures" at the beginning of this prospectus. The following table presents a reconciliation of EBITDA and Adjusted EBITDA to our net income, the most directly comparable financial measure calculated and presented in accordance with GAAP, for each of the periods indicated:

| |

Fiscal year ended(1) | Period(1) | Thirteen weeks ended | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands) |

March 29, 2014 |

March 30, 2013 |

(Successor) December 12, 2011 to March 31, 2012 |

(Predecessor) April 3, 2011 to December 11, 2011 |

June 28, 2014 |

June 29, 2013 |

|||||||||||||

EBITDA reconciliation: |

|||||||||||||||||||

Net income (loss) |

$ | 5,660 | $ | 680 | $ | (4,601 | ) | $ | (660 | ) | $ | 1,413 | $ | (1,445 | ) | ||||

Income tax expense (benefit) |

3,321 | 826 | (1,047 | ) | (135 | ) | 1,241 | (858 | ) | ||||||||||

Interest expense, net |

11,594 | 7,415 | 1,442 | 3,684 | 2,757 | 5,078 | |||||||||||||

Depreciation and intangible asset amortization |

8,129 | 5,588 | 1,095 | 1,218 | 2,058 | 1,580 | |||||||||||||

EBITDA |

28,704 | 14,509 | (3,111 | ) | 4,107 | 7,469 | 4,355 | ||||||||||||

Non-cash stock-based compensation(a) |

1,291 | 787 | 99 | — | 442 | 210 | |||||||||||||

Non-cash accrual for future award redemptions(b) |

591 | 219 | 384 | 470 | (184 | ) | 180 | ||||||||||||

Recapitalization expenses(c) |

— | — | 3,027 | 7,336 | — | — | |||||||||||||

Acquisition expenses(d) |

671 | 1,138 | — | — | — | 667 | |||||||||||||

Acquisition-related integration and reorganization costs(e) |

6,167 | 2,061 | — | — | — | 343 | |||||||||||||

Amortization of inventory fair value adjustment(f) |

867 | 9,199 | 9,369 | — | — | 145 | |||||||||||||

Loss on disposal of assets(g) |

1,980 | 322 | 17 | 4 | 62 | — | |||||||||||||

Other unusual or non-recurring expenses(h) |

— | 698 | — | — | — | — | |||||||||||||

Adjusted EBITDA |

$ | 40,271 | $ | 28,933 | $ | 9,785 | $ | 11,917 | $ | 7,789 | $ | 5,900 | |||||||

(a) Represents non-cash compensation expenses related to stock options granted to certain of our employees.

(b) Represents non-cash accrual for future award redemptions in connection with our customer loyalty program.

(c) Represents non-capitalized costs associated with the Recapitalization.

(d) Represents direct costs and fees related to the acquisitions of RCC and Baskins, which we acquired in August 2012 and May 2013, respectively.

(e) Represents certain store integration, remerchandising and corporate consolidation costs incurred in connection with the integrations of RCC and Baskins, which we acquired in August 2012 and May 2013, respectively.

(f) Represents the amortization of purchase-accounting adjustments that increased the value of inventory acquired to its fair value.

(g) Represents loss on disposal of assets in connection with the rebranding of RCC and Baskins acquired stores and store closures, as well as other costs.

(h) Represents professional fees and expenses incurred in connection with other acquisition activity.

(7) Average net sales per store is calculated by dividing net sales for the applicable period by the number of stores operating at the end of the period. For the purpose of calculating net sales per store, e-commerce sales and certain other revenues are excluded from net sales.

(8) As adjusted balance sheet data as of June 28, 2014 gives effect to (i) the sale by us of 5,000,000 shares of our common stock in this offering, assuming an initial public offering price of $15.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us and (ii) the application of the net proceeds of this offering as described under "Use of proceeds". The as adjusted June 28, 2014 cash and cash equivalents balance adjusts for $1.4 million of offering expenses previously paid by us.

14

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus, including our consolidated financial statements, condensed consolidated financial statements and related notes included elsewhere in this prospectus, before deciding whether to purchase shares of our common stock. If any of the following risks are realized, our business, operating results and prospects could be materially and adversely affected. In that event, the price of our common stock could decline, and you could lose part or all of your investment.

Risks related to our business

Our sales could be severely impacted by declines in consumer confidence and decreases in consumer spending or by changes in consumer preferences.

We depend upon consumers feeling confident about spending discretionary income on our products to drive our sales. Consumer spending may be adversely impacted by economic conditions, such as consumer confidence in future economic conditions, interest and tax rates, employment levels, salary and wage levels, general business conditions, the availability of consumer credit and the level of housing, energy and food costs. These risks may be exacerbated for retailers like us who focus on specialty footwear, apparel and accessories. Our financial performance is particularly susceptible to economic and other conditions in California and other western states where we have a significant number of stores. Our financial performance may also be susceptible to economic and other conditions relating to output and employment in the oil and gas industries, the construction sector, domestic manufacturing and the transportation and warehouse sectors because we believe that growth in these industries and sectors have driven the growth of our work wear business. In addition, our financial performance may be negatively affected if the popularity of the western and country lifestyle subsides, or if there is a general trend in consumer preferences away from boots and other western or country products in favor of another general category of footwear or attire. If this were to occur or if periods of decreased consumer spending persist, our sales could decrease, which could have a material adverse effect on our financial condition and results of operations.

Our continued growth depends upon successfully opening a significant number of new stores as well as integrating any acquired stores, and our failure to successfully open new stores or integrate acquired stores could negatively affect our business and stock price.

We have grown our store count rapidly in recent years, both organically and through strategic acquisitions of competing chains. However, we must continue to open and operate new stores to help maintain our revenue and profit growth. Our ability to successfully open and operate new stores is subject to a variety of risks and uncertainties, such as:

- •

- identifying suitable store locations, the availability of which is beyond our control;

- •

- obtaining acceptable lease terms;

- •

- sourcing sufficient levels of inventory;

- •

- selecting the appropriate merchandise to appeal to our customers;

- •

- hiring, training and retaining store employees;

- •

- assimilating new store employees into our corporate culture;

- •

- marketing the new stores' locations and product offerings effectively;

- •

- avoiding construction delays and cost overruns in connection with the build out of new stores;

- •

- managing and expanding our infrastructure to accommodate growth; and

- •

- integrating the new stores with our existing buying, distribution and other support operations.

15

Our failure to successfully address these challenges could have a material adverse effect on our financial condition and results of operations. We opened six stores during the 26 weeks ended September 27, 2014, nine stores in fiscal 2014 and four stores in fiscal 2013. As of September 27, 2014, we plan to open at least 11 new stores during the remainder of fiscal 2015. However, there can be no assurance that we will open the planned number of new stores in fiscal 2015 or thereafter, or that any such stores will be profitable. This expansion will place increased demands on our operational, managerial and administrative resources. These increased demands could cause us to operate our existing business less effectively, which in turn could cause the financial performance of our existing stores to deteriorate. In addition, we currently plan to open some new stores within existing markets. Some of these new stores may open close enough to our existing stores that a segment of customers will stop shopping at our existing stores and instead shop at the new stores, causing sales and profitability at those existing stores to decline. If this were to occur with a number of our stores, this could have a material adverse effect on our financial condition and results of operations.

In addition to opening new stores, we may acquire stores. Acquiring and integrating stores involves additional risks that could adversely affect our growth and results of operation. Newly acquired stores may be unprofitable and we may incur significant costs and expenses in connection with any acquisition including in remerchandising and rebranding the acquired stores. Integrating newly acquired stores may divert our senior management's attention from our core business. Our ability to integrate newly acquired stores will depend on the successful expansion of our existing financial controls, distribution model, information systems, management and human resources and on attracting, training and retaining qualified employees.

Our business largely depends on a strong brand image, and if we are unable to maintain and enhance our brand image, particularly in new markets where we have limited brand recognition, we may be unable to increase or maintain our level of sales.