Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - IBERIABANK CORP | d809008dex991.htm |

| EX-2.1 - EX-2.1 - IBERIABANK CORP | d809008dex21.htm |

| 8-K - 8-K - IBERIABANK CORP | d809008d8k.htm |

Acquisition of Old Florida Bancshares, Inc.

October 27, 2014

Exhibit 99.2 |

| Safe

Harbor And Legend 2

Statements contained in this presentation which are not historical facts and which pertain to

future operating results of IBERIABANK Corporation and its subsidiaries constitute

“forward- looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements involve significant risks and

uncertainties. Actual results may differ materially from the results discussed in these

forward-looking statements. Factors that might cause such a difference include, but are not

limited to, those discussed in IBERIABANK Corporation’s periodic filings with the

SEC.

In connection with the proposed merger, IBERIABANK Corporation will file a Registration

Statement on Form S-4 that will contain a proxy statement / prospectus. INVESTORS AND

SECURITY HOLDERS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT /

PROSPECTUS REGARDING THE PROPOSED TRANSACTION WHEN IT BECOMES AVAILABLE,

BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may

obtain a free copy of the proxy statement / prospectus (when it is available) and other documents

containing information about the transaction with Old Florida Bancshares, Inc., and the pending

merger with Florida Bank Group, Inc. without charge, at the SEC’s website at http://www.sec.gov.

Copies of the proxy statement / prospectus and the SEC filings that will be incorporated by

reference in the proxy statement / prospectus may also be obtained for free from the

IBERIABANK Corporation website, www.iberiabank.com, under the heading “Investor

Information”. This

communication is not a solicitation of any vote or approval, is not an offer to purchase shares

of Old Florida Bancshares, Inc. common stock, nor is it an offer to sell shares of IBERIABANK

Corporation common stock which may be issued in any proposed merger with Old Florida Bancshares,

Inc. The issuance of IBERIABANK Corporation common stock in any proposed merger with Old

Florida Bancshares, Inc. would have to be registered under the Securities Act of 1933, as amended

(the “Act”), and such IBERIABANK Corporation common stock would be offered only by

means of a prospectus complying with the Act. |

Compelling

Strategic

Rationale

Transaction Rationale

•

New market acquisition of an Orlando, Florida-based commercial bank

•

Largest community bank in the Orlando MSA

•

Established and complementary customer profile

•

Strong core deposit franchise with $1.2 billion in low-cost deposits

•

14 bank offices located in Florida –

12 offices in the Orlando area and

two offices approximately 70 miles north of Tampa

•

Emphasis on small to mid-market C&I / owner-occupied CRE with $1.1

billion in gross loans

•

Adds approximately $1.4 billion in total assets

•

Approximately 2% accretive to EPS in 2016 and 3% accretive in 2017

•

Tangible book value dilution of approximately 2% at consummation

•

Tangible book value breakeven, including one-time acquisition and

conversion related costs, in less than four years

•

Transaction has neutral impact on capital ratios

•

Anticipate internal rate of return in excess of 20%

•

Comprehensive due diligence completed, including credit review

•

Strong credit / underwriting culture and excellent asset quality

•

Limited loss content expected (1.2% of gross loans on a par basis)

•

Conversion and integration experience reduces integration risk

Financially

Attractive

Low Risk

3 |

Notes:

(1)

The agreement provides for a fixed exchange ratio with pricing collars that fix the

value received by Old Florida’s shareholders if the weighted average trading price of

IBERIABANK

Corporation’s

common

stock

were

to

decline

below

$57.31

per

share,

or

exceed

$70.05

per

share,

over

a

specified

period

(2)

Assumes

common

and

preferred

converted

shares

and

no

exercise

of

options

outstanding

(3)

Assumes all stock options outstanding are cashed out at consummation

4

4

4

4

4

4

Transaction Overview

•

Tax-free, stock-for-stock exchange

•

Fixed exchange ratio of 0.34 share of IBERIABANK common stock for

each Old Florida Bancshares, Inc. ("Old Florida") share within price

collars

and

floating

exchange

ratios

outside

collars

(1)

Consideration

Deal Value

Valuation

Multiples

Due Diligence

Required

Approvals

Timing

•

$238

million

for

total

equity

(2)

outstanding

based

on

IBERIABANK

Corporation’s closing price of $64.13 on October 24, 2014

•

$21.80

per

Old

Florida

common

share

outstanding

(2)

•

Estimated $21 million in cash liquidation value of all options

outstanding

(3)

•

Completed comprehensive due diligence

•

Old Florida shareholder approval

•

Customary regulatory approvals

•

Expected closing in first quarter of 2015

Shareholders’ Aggregate Value

Equity

(2)

Including Options

(3)

•

Price

/

Total

Book:

163%

178%

•

Price

/

Tangible

Book:

170%

185% |

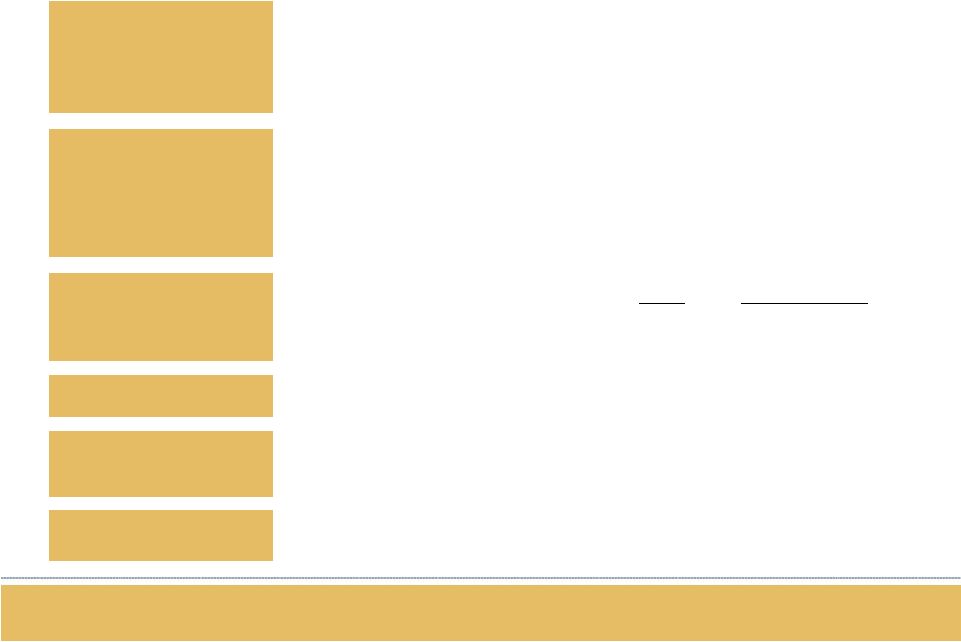

Solidifies our Florida Franchise

IBERIABANK

Old Florida

Florida Bank Group

Pro Forma Diversification (Deposits)

Florida Market Share & Rankings

Rank in Top 6 markets

2014

Rank

Institution

Branch

Deposits

($mm)

Market

Share

Miami

Tampa

Orlando

J'Ville

Sara-

sota

Fort

Myers

1

Bank of America

602

85,310

18.91

2

1

2

1

1

2

2

Wells Fargo

652

71,336

15.81

1

2

3

3

2

1

3

SunTrust

506

43,769

9.70

5

3

1

5

3

3

4

JPMorgan Chase

388

21,621

4.79

4

7

4

23

6

8

5

Regions

363

19,102

4.23

12

4

6

6

7

11

6

BB&T

326

15,773

3.50

7

6

7

7

4

5

7

Citigroup

56

15,201

3.37

3

-

-

34

-

-

8

EverBank

14

13,959

3.09

31

21

-

2

-

15

9

BankUnited

103

10,876

2.41

6

17

31

-

13

14

10

Toronto-Dominion

166

10,355

2.30

10

11

11

8

-

-

16

Pro Forma

IBERIABANK

78

4,248

0.85

41

22

8

26

8

7

21

IBERIABANK

(1)

64

3,042

0.58

41

22

-

26

8

7

Total for Institutions in

Market

5,441

451,131

•

IBERIABANK Corporation will have a meaningful presence in the

six largest MSAs in the state of Florida

•

Pro

forma

ranks

#16

in

the

state

of

Florida

with

$4.3

billion

in

total

deposits and 78 branches

•

Florida is the fourth largest state in the nation as measured by

both population and gross state product

5

Miami

Tampa

Orlando

Jacksonville

Sarasota

Fort Myers

Source: SNL Financial as of June 30, 2014 Regulatory Data

(1)

IBERIABANK is pro forma for acquisition of Florida Bank Group, Inc. announced in

October 2014 |

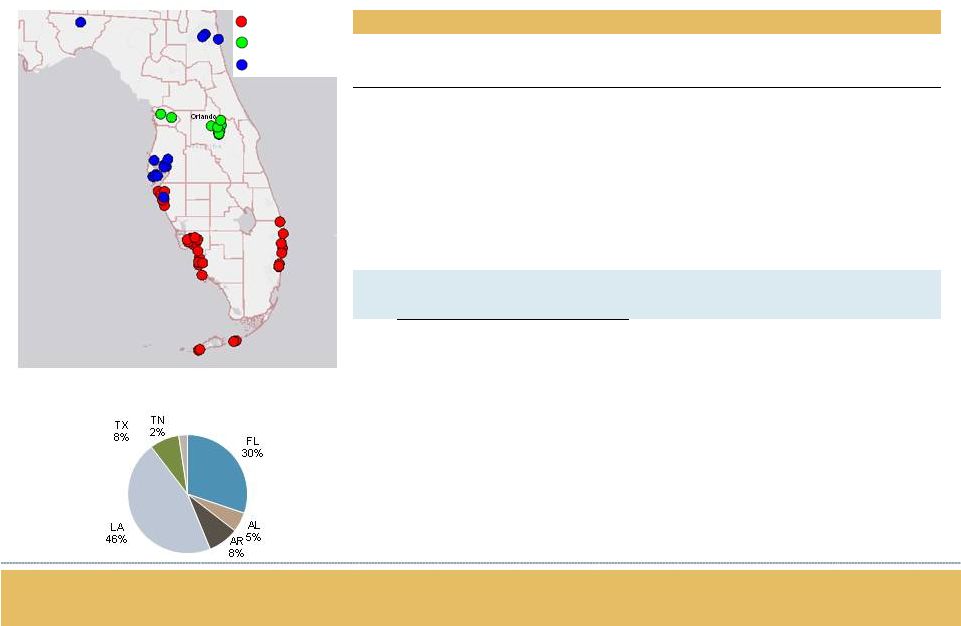

6

6

Orlando Market Highlights

Growing Metro Product with Falling Unemployment

•

Large and stable economy with a favorable growth forecast

•

Orlando MSA has current population of 2.3 million people with projected growth of

7.5% over the next five years

•

Strong job creation has led to net migration into the area, while keeping the

unemployment rate below 6% in 2014

•

New home permit issuance at 1.6% of the existing housing stock, about twice the

national average •

Deep and sophisticated C&I client base across a diversified array of

industries Diversified Economy

Source: SNL Financial as of June 30, 2014; Moody's Analytics indexed to 100 in

2009 |

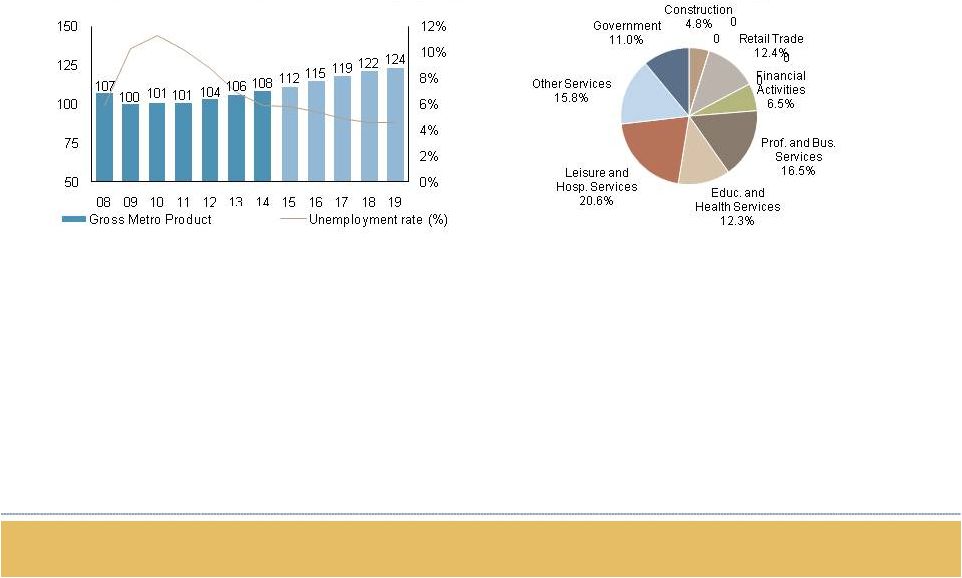

7

7

Franchise Highlights

Medical District -

South Orlando

–

918 South Orange Ave

Orlando, $111.7 mm

Lake Mary –

7090 CR 46A

Lake Mary, $40.0 mm

Apopka –

1420 W Orange Blossom Trail

Apopka, $36.9 mm

Source: SNL Financial as of June 30, 2014

(1)

SNL ranking $500 million to $5 billion in assets in 2013

•

In a market dominated by money center banks and

super-regionals, Old Florida is the largest local player

in terms of branches and deposit share

•

Old Florida's main office and 11 bank branches

in the Orlando area

•

Two branches in Citrus County, Florida,

expanding from the Tampa footprint

•

Strong core deposit franchise concentrated in

Orlando market

•

Total deposits of $1.1 billion in market

•

Average deposits per branch of $94 million

•

Cost of deposits of approximately 0.29%

•

High quality, experienced management team and

board of directors with strong local connectivity

•

Favorable commercial lending platforms, including

attractive niche specialty finance businesses

•

Top 100 best performing bank in the nation, two

years

in

a

row

(1) |

8

8

Specialty Businesses

•

Mercantile Capital Corporation established in

2002

•

Acquired by Old Florida Bancshares, Inc. in

2010 and is a wholly-owned subsidiary of the

bank.

•

Provides structuring, SBA qualification,

underwriting and closing services to

borrowers

•

Provides short-term, interim first and second

mortgage loans that are typically paid off by

permanent first mortgage lender and SBA

debenture funding

•

Focus is on 504 lending and not 7(a) financing

•

30% of loans are in Florida

•

Approximately $45 million in book balances

•

In the 12 years of existence, MCC had only

one troubled loan

•

63% of portfolio is in Florida, 21% in Georgia,

6% in South Carolina, 3% in Mississippi, and

7% in other states

•

Entire portfolio is made up of loans (does not

provide lease financing)

•

Focus is on heavy, income producing

equipment –

where a rental value or specific

value in fulfilling a contract can be calculated

•

Industry concentration on logging and

excavation equipment

•

Loan portfolio is approximately $78 million

•

Typical deal size is less than $500,000 and

the maximum loan term is five years

SBA 504 Lending

Equipment Finance Business |

9

9

Presence in Florida's Six-Largest MSAs

Source: SNL Financial as of June 30, 2014 Regulatory Data

IBERIABANK pro forma for pending acquisition of Florida Bank Group, Inc. and Old

Florida Bancshares, Inc. Miami –

Fort Lauderdale –

West Palm Beach

Rank

Institution

Branches

Deposits ($mm)

Market Share

1

Wells Fargo

204

31,326

16.76

2

Bank of America

199

28,896

15.46

3

Citigroup

55

15,184

8.12

4

JPMorgan Chase

185

14,143

7.56

5

SunTrust

102

11,317

6.05

6

BankUnited

69

8,837

4.73

7

BB&T

114

6,248

3.34

8

Mercantil Servicios

16

5,677

3.04

9

HSBC

17

5,309

2.84

10

Toronto

-

Dominion

71

5,301

2.84

41

IBERIABANK

8

404

0.22

Total in Market

1,665

175,835

North Port –

Sarasota –

Bradenton

Rank

Institution

Branches

Deposits ($mm)

Market Share

1

Bank of America

35

3,223

18.88

2

Wells Fargo

30

2,586

15.15

3

SunTrust

31

1,959

11.47

4

BB&T

20

1,189

6.97

5

Fifth Third

16

787

4.61

6

JPMorgan Chase

19

775

4.54

7

Regions

16

513

3.01

8

IBERIABANK

9

480

2.81

9

Bank of Montreal

11

480

2.81

10

PNC

10

372

2.18

Total in Market

300

17,072

Orlando –

Kissimmee -

Sanford

Rank

Institution

Branches

Deposits ($mm)

Market Share

1

SunTrust

64

9,490

23.34

2

Bank of America

63

8,381

20.61

3

Wells Fargo

55

6,817

16.76

4

JPMorgan Chase

53

2,589

6.37

5

Fifth Third

40

1,668

4.1

6

Regions

47

1,660

4.08

7

BB&T

40

1,578

3.88

8

IBERIABANK

12

1,129

2.78

9

PNC

23

628

1.54

10

Three Shores

4

547

1.35

Total in Market

579

40,664

Tampa –

St. Petersburg –

Clearwater

Rank

Institution

Branches

Deposits ($mm)

Market Share

1

Bank of America

93

10,855

19.64

2

Wells Fargo

87

9,715

17.57

3

SunTrust

95

7,725

13.97

4

Regions

79

5,878

10.63

5

Fifth Third

44

2,795

5.06

6

BB&T

48

2,539

4.59

7

JPMorgan Chase

55

1,650

2.98

8

USAmeriBancorp

13

1,547

2.8

9

Tampa Bay

10

1,210

2.19

10

TFS Financial

5

1,080

1.95

22

IBERIABANK

8

289

0.52

Total in Market

764

55,282

Cape Coral –

Fort Myers

Rank

Institution

Branches

Deposits ($mm)

Market Share

1

Wells Fargo

34

2,123

16.59

2

Bank of America

28

1,854

14.48

3

SunTrust

24

1,715

13.4

4

Fifth Third

18

1,114

8.7

5

BB&T

20

844

6.59

6

FineMark

3

520

4.06

7

IBERIABANK

10

439

3.43

8

JPMorgan Chase

11

373

2.91

9

Northern Trust

3

351

2.74

10

FCB

4

328

2.56

Total in Market

224

12,800

Jacksonville

Rank

Institution

Branches

Deposits ($mm)

Market Share

1

Bank of America

35

20,751

42.05

2

EverBank

6

12,303

24.93

3

Wells Fargo

63

5,973

12.1

4

BBVA

25

1,934

3.92

5

SunTrust

27

1,811

3.67

6

Regions

24

1,246

2.53

7

BB&T

14

557

1.13

8

Toronto

-Dominion

7

544

1.1

9

Ameris

10

470

0.95

10

Jacksonville

9

423

0.86

26

IBERIABANK

3

72

0.14

Total in Market

321

49,353 |

10

10

10

10

10

10

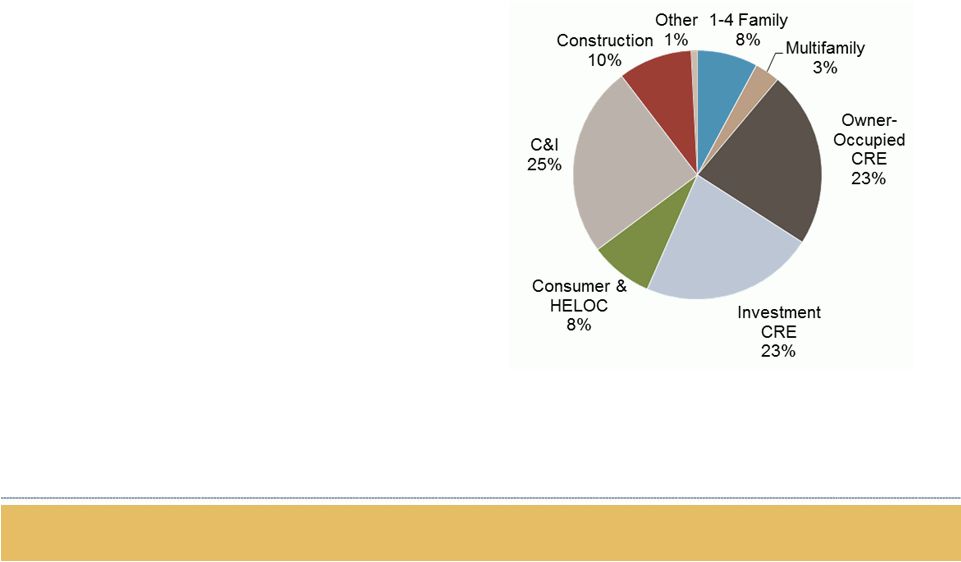

•

Approximately 80 people involved in due

diligence process; credit team included 27

associates performing both on-site credit file and

off-site credit portfolio reviews

•

Reviewed 98% of outstanding loan balances

and nearly 98% of total number of loans

•

Approximately 60% of outstanding loan

balances were reviewed on-site with the

remainder analyzed by off-site portfolio review

Total Loans: $1.1 billion

Yield on Loans:

5.17%

Credit Summary

Diligence Scope

Loan Portfolio Comments

Loan Portfolio Composition

Source: Financial data as of September 30, 2014

•

Majority are in-market loans

•

Primarily focused on commercial lending

•

Good asset quality metrics:

•

Non-performing assets /Assets = 0.98%

•

Non-performing loans/Loans = 0.74%

•

Credit mark of approximately $13.1 million on a

pre-tax par basis ($5.6 million on a pre-tax book

basis)

•

Allowance for loan losses of $10.0 million |

11

11

11

11

11

11

Merger Considerations

•

No corporate or bank board seats

•

Old Florida board members

invited to form the nucleus of

IBERIABANK Corporation’s

Central Florida Advisory Board

•

Two employment contracts

•

Savings equate to approximately

30% compared to Old Florida’s

total expenses

•

No office consolidations

anticipated

Approximately $22 million in pre-tax

costs:

•

$3.6 million in change of control contracts

•

$3.6 million in severance/retention payments

•

$3.2 million in contract terminations

•

$2.8 million in lease terminations

•

$1.3 million in system conversions

•

$0.6 million in marketing/communications

•

$6.5 million in other merger-related expense

Costs & Synergies

Merger-Related Costs |

12

12

12

12

12

12

Conservative

Financial

Assumptions

Cost Savings:

Merger Related Costs:

•

Gross loss estimate of $13.1 million on a pre-tax par

basis, or $5.6 million on a pre-tax book basis

•

Current allowance for loan losses of $10.0 million

•

Approximately $22 million on a pre-tax basis

Credit Mark:

Other Marks:

•

Aggregate negative $3.0 in other marks including

securities portfolio, loan rate, OREO, fixed assets

Financial Assumptions & Impact

Attractive

Financial

Impact

Notes:

(1)

Pro forma capital ratios include pending Florida Bank Group, Inc. transaction

•

Approximately 2% accretive to EPS in 2016 and 3% accretive in 2017

•

Tangible book value dilution of approximately 2% at consummation

•

Tangible book value breakeven, including one-time acquisition and

conversion related costs, of under four years

•

Strong pro forma capital ratios

(1)

:

•

Tangible common equity ratio = 8.5%

•

Total risk based capital ratio = 12.3%

•

Internal rate of return over 20%; well in excess of our cost of capital

Annual run-rate cost savings of approximately $9

million on a pre-tax basis

Represents approximately of 30% of Old Florida’s

run-rate 2014 non-interest expenses

Expect run-rate savings to be achieved within

six months of closing |

Appendix |

14

14

14

14

14

14

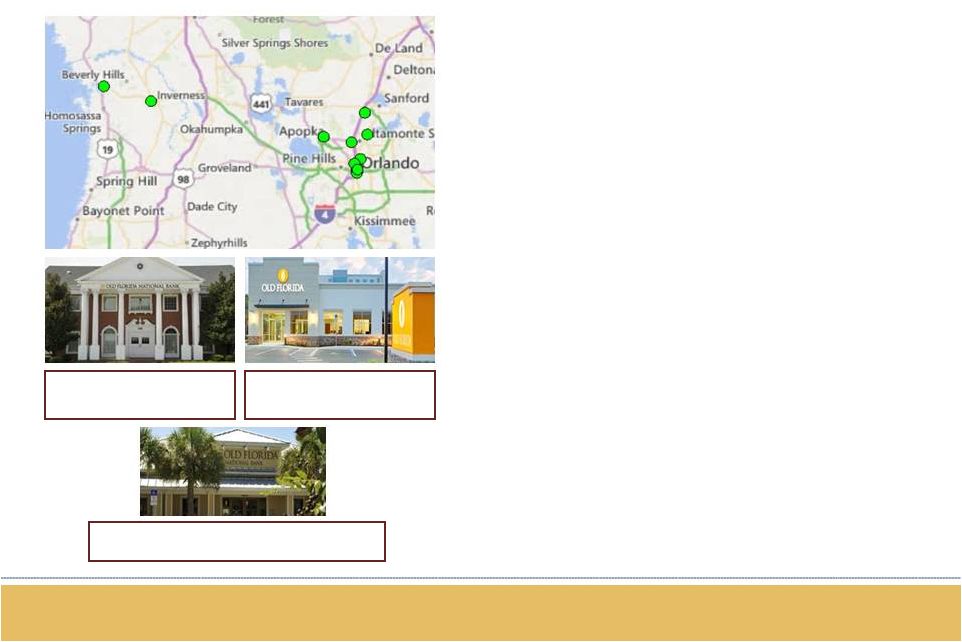

Orlando Marketplace

2008

2009

2010

2011

2012

2013

INDICATORS

2014

2015

2016

2017

2018

2019

107.2

100.4

100.6

101.1

103.5

106.0

Gross metro product

108.3

111.8

115.3

118.7

121.5

123.9

(2.3)

(6.4)

0.2

0.6

2.3

2.4

% change

2.2

3.2

3.2

2.9

2.4

2.0

1,064.7

997.5

992.3

1,005.6

1,031.9

1,065.0

Total employment (000s)

1,099.6

1,133.3

1,173.5

1,208.2

1,233.5

1,256.3

(1.7)

(6.3)

(0.5)

1.3

2.6

3.2

%change

3.2

3.1

3.6

3.0

2.1

1.8

5.9

10.3

11.3

10.2

8.7

6.9

Unemployment rate (%)

5.9

5.8

5.4

4.9

4.6

4.6

1.2

(5.1)

3.9

4.7

5.0

3.3

Personal income growth (%)

5.9

7.9

8.1

7.4

6.3

5.6

50.6

47.1

46.6

46.1

46.8

47.9

Median household income ($000s)

49.3

51.2

53.2

55.1

56.8

58.2

2,087.5

2,111.9

2,139.4

2,174.2

2,223.5

2,267.8

Population (000s)

2,314.6

2,368.6

2,429.5

2,496.6

2,566.5

2,638.1

1.4

1.2

7.3

7.6

2.3

2.0

% change

2.1

2.3

2.6

2.8

2.8

2.8

14.6

10.0

14.5

23.3

37.2

32.0

Net migration (000s)

35.0

42.2

49.0

55.1

57.9

59.5

5,280

3,707

4,221

4.533

7,322

9.222

Single-family permits (#)

8,539

13,607

19,681

21,088

19,968

19,565

4,953

780

1,033

1,972

4,684

6,341

Multifamily permits (#)

7,565

9,417

11.217

10,549

10,141

10,161

211.2

150.4

134.6

125.3

133.7

161.2

Existing-home price ($000s)

181.3

188.3

194.1

197.1

200.4

205.8

One of the fastest-growing mature economies in the nation, forecasted to well

outpace the US average The area provides abundant jobs for both skilled and

unskilled labor, moderate living cost, strong housing demand and thriving

industries including healthcare and tourism Source: Moody’s Analytics as

of June 2014 |

15

15

15

15

15

15

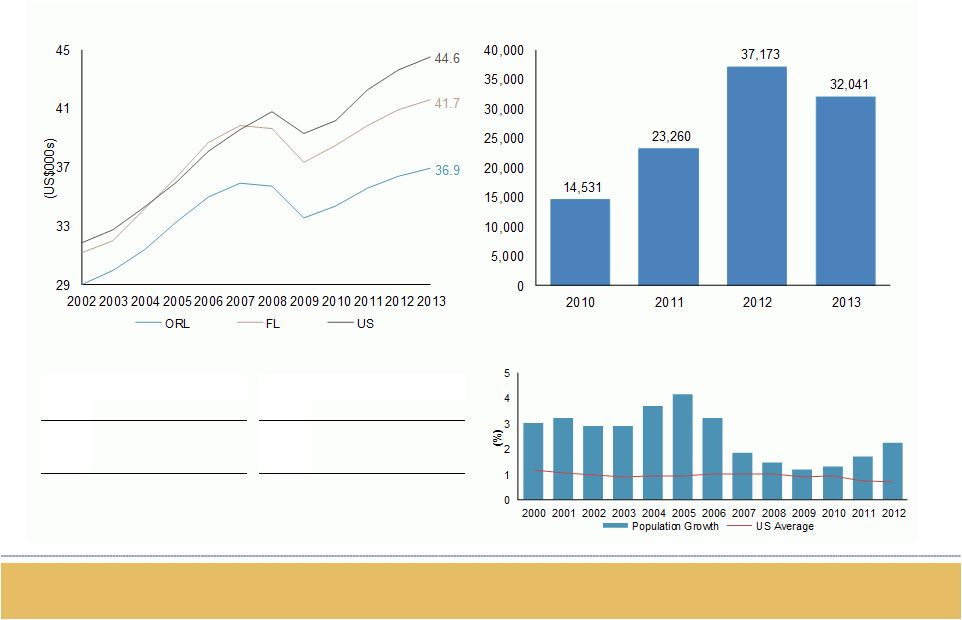

Orlando Demographics

Per Capita Income

High-Tech Employment

(000s)

% of Total

ORL

44.5

4.2

US

6,431.1

4.7

Housing-Related Employment

(000s)

% of Total

ORL

120.3

11.3

US

12,401.4

9.1

Job Specialization

Net Migration

Population Growth

Source:

Moody's

Analytics

as

of

June

2014;

Local

Market

Monitor

for

the

Orlando

MSA

as

of

October

2014 |

16

16

16

16

16

16

Orlando Housing Market

•

House values expected to increase by 12% over the next year, above the national

average of 7.2% •

Historical foreclosures from the housing bubble still pull down house prices, as

those are sold further potential for increase in prices

Actual and Equilibrium Home Prices

Housing Permits

Home Price Change

Monthly Rent

Source: Local Market Monitor as of October 2014 |

|